#Stock trading using Fibonacci levels

Explore tagged Tumblr posts

Text

How to Trade the Fibonacci Retracement Pattern: Complete Guide with Strategies

Fibonacci retracement is one of the most powerful tools in a technical trader’s toolbox. Derived from the famous Fibonacci sequence, this tool helps traders identify potential reversal levels in trending markets. Whether you’re trading stocks, forex, or cryptocurrencies, learning how to use Fibonacci retracements can significantly enhance your decision-making process. In this blog post, we’ll…

#Best Fibonacci retracement strategy for beginners#Candlestick confirmation#Combining Fibonacci retracement with RSI and moving averages#Entry and exit signals#Fibonacci levels explained#Fibonacci levels for intraday trading#Fibonacci levels in trading#Fibonacci Retracement#Fibonacci retracement confluence strategy#Fibonacci retracement forex#Fibonacci retracement in stock market#Fibonacci retracement indicator#Fibonacci retracement pattern#Fibonacci retracement trading strategies#Fibonacci sequence in trading#Fibonacci trading strategy#Golden ratio trading#How to draw Fibonacci retracement correctly#How to identify Fibonacci retracement levels#How to trade Fibonacci retracement#How to use Fibonacci retracement in day trading#learn technical analysis#Plotting Fibonacci retracement step by step#Risk management in trading#stock markets#stock trading#Stock trading using Fibonacci levels#successful trading#Support and resistance trading#Swing high and swing low

0 notes

Text

The Role of a Stock Market Advisory Company in Helping Busy Professionals Invest Wisely

Let’s face it—most working professionals are swamped with meetings, deadlines, and family responsibilities. In the hustle of 9-to-5 jobs or running a business, keeping track of stock market trends, company earnings, technical patterns, and news updates is nearly impossible.

Yet, the desire to invest and build wealth through the market remains strong.

So, what’s the solution?

For professionals with limited time and bandwidth, partnering with a stock market advisory company can be the smart way to stay active in the market—without getting overwhelmed or making impulsive mistakes.

In this blog, we’ll explore the crucial role a good advisory company plays in helping busy professionals invest smarter, manage risk better, and build long-term wealth.

The Time Crunch Is Real

Let’s take an example.

Meera, a 38-year-old marketing head, wants to build a stock portfolio for her daughter’s education. She’s keen to invest, but between managing a team, business travel, and family life, she barely finds time to open her trading app—let alone analyze balance sheets or technical charts.

She’s not alone.

Most professionals want to invest wisely, but they struggle with:

Lack of time for research

Information overload

Emotional decision-making

Inability to track market movements in real-time

Confusion due to too many “free tips” online

That’s where a stock market advisory company can change the game.

What Does a Stock Market Advisory Company Offer?

In simple terms, a professional advisory firm provides:

Curated stock recommendations

Entry, exit, stop-loss levels

Investment strategies based on goals

Regular performance reviews

Risk management frameworks

Market analysis and learning support

Whether you’re into short-term trading or long-term investing, a good firm tailors its services to fit your lifestyle, goals, and risk profile.

Benefits of Using an Advisory Firm as a Busy Professional

Let’s dig into the ways an advisory company makes investing easier, safer, and more productive for working individuals.

1. Time-Saving Research and Ready-Made Trade Ideas

Instead of spending hours on screeners or reading confusing forums, you receive researched trade ideas straight to your inbox, Telegram, or WhatsApp.

Each recommendation comes with:

Rationale

Entry price

Target

Stop-loss

Duration (intraday, swing, positional)

You spend 5 minutes reading, not 5 hours researching.

2. Reduces Emotional, Impulsive Decisions

Professionals often make investment decisions based on:

Trending news

Fear of missing out (FOMO)

Panic selling during corrections

Buying without understanding the business

An advisory firm keeps you disciplined, guiding you through logic—not emotion. It acts like a coach who ensures you don’t break the rules when things get tough.

3. Simplifies Complex Concepts

Stock market jargon can be intimidating:

EPS, P/E ratio, MACD, Fibonacci—what does it all mean?

A good stock market advisory company breaks it down in a way even non-finance professionals can understand. Some firms even include:

Weekly webinars

Trade explanations

Easy-to-read research reports

So, you learn while you earn—at your own pace.

4. Helps You Build a Long-Term Portfolio

Professionals are often looking to invest for:

Retirement

Children’s education

Buying property

Creating passive income

A reliable advisory company will:

Understand your long-term goals

Recommend safe and high-potential stocks

Help set up SIPs, mutual fund strategies

Regularly rebalance your portfolio

You don’t just grow your wealth—you grow it strategically.

5. Keeps You Updated Without Overwhelming You

One of the biggest benefits?

You stay informed without being bombarded.

You get:

Market summaries

Sector-wise updates

Alerts for market-moving events

Risk-adjusted recommendations

This way, you’re never out of touch—but never stressed either.

Real-Life Example: How Rohan Built a Portfolio Despite a 10-Hour Workday

Rohan, a 32-year-old IT manager, wanted to start investing. But after a long day of coding, he had no mental energy left to research stocks or analyze charts.

He subscribed to a SEBI-registered stock market advisory company that offered:

Weekly investment ideas with clear rationale

Mutual fund suggestions for SIPs

Monthly portfolio reviews

Market commentary via Telegram

Today, his portfolio is up over 45% in 2 years, and he checks it just once a week.

His secret? A system built by professionals, designed for busy people.

What to Look for in a Stock Market Advisory Company

Not all firms are the same. Here’s what professionals should look for:

SEBI registration (this is non-negotiable) No “guaranteed profit” claims Real reviews and testimonials Transparent pricing Portfolio-building focus—not just daily tips Support during market hours Learning support via reports or sessions

Avoid:

Unverified Telegram groups

One-size-fits-all services

Emotionally manipulative tactics like “last chance offer” or “only 5 seats left”

Your money deserves professionalism.

Short-Term vs. Long-Term: What's Right for You?

Some professionals want to try intraday trading in their spare time. Others prefer to invest and forget.

A stock market advisory company can help you choose the right path based on:

Your schedule

Your goals

Your experience level

Your risk appetite

The best firms don’t just give you tips—they give you clarity.

Final Thoughts

In today’s fast-paced world, professionals don’t have time to become full-time traders. But that doesn’t mean they should miss out on the wealth-building potential of the market.

A stock market advisory company bridges this gap—by delivering researched strategies, emotional discipline, and expert guidance.

Let’s recap the key benefits for busy individuals:

Saves time with curated trade ideas

Avoids emotional blunders

Provides clear learning and rational explanations

Helps with long-term goal planning

Offers consistent support and updates

If you're serious about building wealth but don’t have the time to micromanage your investments, it’s time to team up with the pros.

Because when time is limited, strategy matters even more.

1 note

·

View note

Text

How stock trading apps are changing the way millennials trade

Trading has changed significantly for Indian millennials over the past few years. What was once a process dominated by brokers, paperwork, and trading terminals has now moved to mobile apps. This shift is not only technological but also behavioural, as millennials bring new habits, expectations, and decision-making styles to the market. Trading is becoming faster, more data-driven, and independent.

Take a closer look at how stock trading apps are driving this change and the specific features that are reshaping the way millennials engage with the market.

Market access has gone mobile

Earlier, stock selection involved long hours of research and multiple layers of intermediaries. Today, with just a smartphone and internet connection, you get access to:

Thousands of listed companies across the NSE and BSE

Global market indices for tracking sentiment

Real-time quotes with price movement data

Corporate actions, earnings reports, and stock-specific news

All it takes to begin is opening a demat account online. With a reliable stock app, you can complete the process within only 15 minutes using your Aadhaar, PAN, and bank account information.

Expert-level charting with TradingView integration

Many share market apps now come integrated with TradingView, a charting platform used by 100 million+ traders. This integration enables you to:

Choose from several chart types like candlestick and line charts

Apply technical indicators, such as Relative Strength Index (RSI), moving averages (SMA, EMA), and Bollinger Bands.

Draw tools like trend lines, Fibonacci retracements, and support-resistance levels.

Set custom time frames from 1 minute to 1 day.

These tools make it easier to conduct stock market analysis using the same methods as institutional traders.

Multiple order types

Stock market apps support various order types to match different strategies and risk preferences, including:

Intraday order: Square off trades within the same day

Limit order: Decide a specific price at which to buy or sell

Market order: Purchase or sell at the current market price instantly

Good Till Date (GTD) order: Keep your order valid until a set expiry date

You can use these options to better balance risk and drive higher profits.

Margin Trading Facility (MTF) that boosts buying power

MTF allows you to purchase stocks by paying only a fraction of the total value while the trading app funds the rest. For example, with 4x leverage, ₹5,000 gives you access to ₹20,000 worth of shares. This feature is highly useful for millennials looking to get higher exposure and amplify profits without locking in significant capital.

Most apps also include an information-rich FAQ section that helps you grasp how MTF works, applicable interest rates, eligibility criteria, and repayment terms.

In-app community to learn and grow

Many trading apps give you access to in-app communities where you can engage with fellow traders and learn from shared experiences. These spaces let you:

Join live webinars to enhance your stock market knowledge

Attend weekly sessions to discuss market strategies and trends

Watch recordings of past sessions within the app

Simply put, an in-app community helps you learn directly from experienced voices in the trading world.

Closing note

Stock trading apps have completely changed how millennials interact with the markets. What once needed brokers, terminals, and capital-heavy entry now takes a few clicks on a smartphone. With access to thousands of stocks, live data, powerful charts, flexible order types, MTF, and in-app education, these platforms turn smartphones into full-fledged trading desks.

Looking for a new-gen stock market app that matches how you think, learn, and trade? Choose MO Riise, backed by Motilal Oswal and trusted by over 40 lakh traders. In addition to all the features highlighted above, the app supports unlimited order placements, lightning-fast execution, high-quality research, UPI-based payments, and learning resources. In case you have any queries, 24×7 help is just a click away.

So what is the wait for? Take the next step in your trading journey with MO Riise.

0 notes

Text

ICFM Offers Best Free Online Share Trading Course With Real Market Learning and Proven Trading Techniques

Begin Your Trading Journey With ICFM’s Free Online Share Trading Course Tailored for Indian Market Learners

In the modern age of financial independence, knowing how to trade in the stock market is more than just a skill—it’s an essential asset. However, most new traders don’t know where to begin, and the overwhelming number of paid courses often creates a financial barrier. That’s why ICFM – Stock Market Institute has launched India’s most practical and reliable free online share trading course designed especially for beginners. This course is a golden opportunity for anyone who wants to learn stock trading from scratch without spending any money.

ICFM is one of India’s most trusted names in financial market education. Recognized for its industry-ready training programs, ICFM has empowered thousands of students and aspiring traders with real-world knowledge and professional mentorship. Now, with their expertly developed free online share trading course, ICFM has opened the doors for every Indian to learn and grow in the field of share trading, no matter their background or experience level.

This free online share trading course is designed for total beginners and intermediate learners who want a clear, practical, and result-driven approach. Unlike random online videos or confusing tutorials, ICFM offers a structured learning path that takes you from basic concepts to practical strategies that actually work in the Indian stock market. With a focus on live market insights, real examples, and simplified content, the course prepares you to make informed trading decisions with confidence.

Why ICFM’s Free Online Share Trading Course Stands Out in India

The free online share trading course by ICFM is more than just an educational offering—it’s a mission to democratize financial literacy. With years of experience in training professional traders and financial analysts, ICFM understands what beginners struggle with. The course is built to eliminate confusion and provide step-by-step guidance using real data from Indian exchanges like NSE and BSE.

Every session in ICFM’s free online share trading course is taught using examples from the Indian stock market. Whether it’s price action analysis, trend identification, or understanding candlestick charts, you learn everything in the context of how Indian stocks behave. This is a huge advantage compared to generic courses that use foreign market data or outdated methods.

The faculty behind ICFM’s free online share trading course includes seasoned traders and educators who have trained thousands of successful learners. They ensure that even the most complex concepts are explained in an easy-to-understand language, with plenty of visual support. This approach makes the learning enjoyable and engaging, especially for those who have no financial background.

What You Will Learn in the Free Online Share Trading Course by ICFM

The free online share trading course begins with the very basics. You’ll understand how the stock market works, how trading takes place, and how stock prices move. From there, the course transitions into technical analysis, which forms the foundation of profitable trading. Learners are introduced to candlestick chart patterns, support and resistance levels, trend lines, and chart formations like flags, pennants, and double tops.

Moving deeper, ICFM’s free online share trading course covers essential technical indicators such as Moving Averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), Bollinger Bands, and Fibonacci retracement. These tools are explained with practical demonstrations on Indian stocks, so you can learn how to use them in real-time trading.

The course also focuses on teaching position sizing, capital protection, and trading psychology—areas that are often neglected in free courses. You’ll understand how to manage risk, avoid emotional decisions, and develop the discipline needed to survive and thrive in the stock market. These lessons are the true differentiators of ICFM’s free online share trading course and reflect its commitment to quality education.

Learn By Doing: Real-Time Practice and Mentorship in a Free Online Course

A major strength of ICFM’s free online share trading course is its real-time market learning experience. You don’t just watch videos; you engage with live charts, explore market movements, and apply your learning through demo trading exercises. Using tools like TradingView, you’ll get comfortable analyzing charts and spotting trading opportunities.

To further help students succeed, ICFM offers limited-time live mentorship sessions where you can ask questions, clarify doubts, and receive guidance directly from experts. Even in a free online share trading course, ICFM ensures that each student feels supported and confident as they grow. This blend of theoretical knowledge, practical exposure, and expert feedback makes it the most effective free course available today.

You also get access to a structured learning dashboard where progress is tracked. After completing the course, learners are awarded a certificate from ICFM, a name recognized in the Indian financial training space. While this is a free program, the learning experience and recognition are truly professional.

Who Can Join This Free Online Share Trading Course?

This free online share trading course by ICFM is open to all—students, professionals, homemakers, and retirees. No prior experience or educational qualification is required. If you have the curiosity to learn how the stock market works and a desire to trade smartly, this course is made for you.

The content is available online, accessible 24/7, and designed for self-paced learning. This flexibility makes it possible for anyone, from any corner of India, to gain quality market education without attending physical classes or spending money.

Whether you want to start part-time trading, build long-term investing strategies, or eventually pursue advanced courses, this free online share trading course is the perfect first step.

Conclusion: Enroll in India’s Most Trusted Free Online Share Trading Course by ICFM

Trading in the stock market can be an incredible source of income and personal growth—if done with knowledge and discipline. Unfortunately, many people never take the first step due to cost or fear. With ICFM’s free online share trading course, all those barriers are removed.

This course gives you access to expert-led training, real-time practice, and a strong foundation in trading—all without spending anything. It's more than just a free course; it’s your gateway to building financial literacy and trading confidence. Thousands of learners have already benefited from ICFM’s programs, and now you can join them too—completely free.

If you're ready to begin your journey into the exciting world of stock trading, sign up now for ICFM’s free online share trading course and take control of your financial future, one trade at a time.

You said:

write an article of 800 words on this keyword ''Best Stock Market Courses After 12th'' and these service only provided by ICFM - Stock Market Institute and make it with unique 16 words title and subheading like h1, h2, h3 and do not copy from web and all keywords should be in content only many times

ChatGPT said:

Title: ICFM Offers the Best Stock Market Courses After 12th for Practical Learning, Career Building and Financial Growth

Start Early With ICFM – The Best Stock Market Courses After 12th for a Strong Financial Career

The time right after completing school is crucial for shaping one’s career path. While many students opt for traditional degrees, a growing number of young minds are now exploring careers in the financial markets. With the rise of trading, investing, and financial technology, stock market education has become one of the most promising fields. For students who want to learn about markets, trading strategies, and wealth creation early in life, ICFM – Stock Market Institute offers the best stock market courses after 12th in India.

Choosing the right course after 12th can have a long-term impact on your professional future. While graduation is important, combining it with a skill like stock market trading can help you earn, learn, and grow simultaneously. The best stock market courses after 12th by ICFM are designed to introduce young students to the real workings of the Indian stock market in a simple and practical way. These courses not only build foundational financial skills but also open the door to career opportunities in trading, finance, research, and wealth management.

Why ICFM Offers the Best Stock Market Courses After 12th in India

ICFM – Stock Market Institute has been a pioneer in delivering real-time, practical market training to students, traders, and professionals. What makes ICFM’s training stand out is its unique mix of hands-on experience, expert mentorship, and focus on the Indian stock market. For students just out of school, ICFM offers a gateway into the world of finance with its best stock market courses after 12th.

Unlike theoretical programs, ICFM’s training focuses on live market conditions, chart reading, technical analysis, and strategy building. The curriculum is designed with real-time tools, such as TradingView and live NSE/BSE data, to ensure students not only understand concepts but apply them with confidence. The goal is not just academic knowledge, but skill development.

These best stock market courses after 12th are ideal for students from all backgrounds—science, commerce, or humanities. No prior knowledge of finance is needed. Everything is taught from scratch, using a language and approach that school pass-outs can easily relate to.

What You’ll Learn in ICFM’s Best Stock Market Courses After 12th

ICFM’s best stock market courses after 12th begin with the basics—what is the stock market, how buying and selling work, and how the Indian exchanges (NSE and BSE) function. Students get a complete understanding of key concepts like stocks, indices, market orders, brokers, and trade settlements.

Once the foundation is set, the course moves to technical analysis. Learners are introduced to charting techniques, candlestick patterns, support and resistance zones, and popular indicators such as RSI, MACD, and Moving Averages. ICFM’s focus is on practical chart reading, where students analyze real-time price movements and understand market psychology.

The best stock market courses after 12th also include an introduction to fundamental analysis, where students learn how to read company financials, analyze earnings, study balance sheets, and evaluate stock potential for long-term investment. There’s also a strong focus on trading strategies—especially intraday, positional, and swing trading techniques suited to different risk profiles.

Risk management and trader psychology are two crucial pillars of ICFM’s training. Students are taught how to manage their emotions, follow a trading plan, set stop-loss orders, and maintain a trading journal. These are advanced skills that many traders learn only after years of experience—but at ICFM, students gain them early.

Career Benefits of Joining ICFM’s Best Stock Market Courses After 12th

The best stock market courses after 12th are not just about learning how to trade—they are about building a career. After completing the course, students can begin paper trading, open real trading accounts, and start earning with proper risk control. Many ICFM students also go on to pursue careers as equity researchers, technical analysts, investment advisors, or even start their own trading desks.

ICFM provides certification upon completion of the course, adding strong value to a student’s profile. This certificate can be useful while applying for internships or jobs in financial institutions, stockbroking firms, and fintech startups.

What makes ICFM truly different is its mentorship approach. Even after course completion, students remain connected to mentors, get updates on market trends, and are invited to attend advanced webinars. This long-term support system is why ICFM’s training is considered the best stock market courses after 12th across India.

Who Should Enroll in the Best Stock Market Courses After 12th at ICFM?

ICFM’s best stock market courses after 12th are ideal for school pass-outs who are interested in finance, trading, or entrepreneurship. If you are someone who is curious about how the market works, enjoys numbers, or wants to start a side hustle during college, this course is perfect for you.

It doesn’t matter whether you’re from a commerce background or not. The course is taught in a simple manner using Hindi and English, with visual examples and live charts to make learning smooth. Students pursuing BBA, B.Com, BA, B.Sc., or any degree can take this course as a parallel skill that enhances their profile.

Classes are available both online and offline at ICFM’s Delhi center, with weekend and evening batches for convenience. The course is fully practical, accessible, and beginner-friendly.

Conclusion: Start Smart with the Best Stock Market Courses After 12th Only at ICFM

The Indian stock market offers enormous opportunities for growth, income, and career success—but only if you start early and learn the right way. ICFM – Stock Market Institute brings young learners a chance to gain practical market education with its best stock market courses after 12th, designed to make beginners confident and independent in the world of finance.

If you’ve just completed your 12th standard and are looking for a skill that adds value to your career, empowers you financially, and opens doors to a fast-growing industry, then ICFM’s course is the best choice. Learn from market professionals, practice with live data, and build a future where your financial knowledge turns into real success.

Enroll today in ICFM’s best stock market courses after 12th and take your first step toward a career that is smart, skilled, and financially independent.

Read More: https://www.icfmindia.com/blog/nse-stock-market-course-secrets-how-to-learn-succeed-grow-in-indias-share-market

Read More: https://www.icfmindia.com/blog/stock-market-courses-in-delhi-online-free-get-ahead-without-spending-a-rupee

0 notes

Text

Precision Over Hype: How I Refined My Strategy with Aurolonix

I jumped into trading during the 2021 altcoin bull run, right in the thick of meme coin chaos. For a while, it was thrilling. But quick gains turned into quicker losses, and I was chasing pumps without a plan. I knew if I wanted to take trading seriously, I had to bring in discipline, structure, and better tools.

That’s when I shifted gears. I left the hype plays behind and moved toward swing trading, focusing on RSI divergences, Fibonacci retracements, and event-driven setups. My target? Crypto as my base, with forex for stability and some light stock trades on the side.

A trading buddy on Discord mentioned Aurolonix during a gold chart analysis. I looked it up that night. The first thing I noticed was that there’s no clutter. Fast charts. Tools that mattered. I signed up, explored the dashboard, poked around their market review section, then went all in with a Platinum Account and €100,000 deposit and all. I was ready to level up.

Right off the bat, the execution speed was more than solid. My first trades were BTC/USD and EUR/JPY, both swing setups. The real-time market reviews were packed with relevant context, not fluff. And the social trading window added another layer. I wasn’t copying trades, just sharpening mine by seeing how others were positioning.

By week fifteen, I was sitting on a +6.3% gain from a clean BTC RSI bounce and +4.1% on EUR/JPY. The tools were doing their job and so was I.

What really shifted my confidence was a GBP/USD news trade. I prepped using the Advanced VOD library, breaking down historical patterns tied to similar releases. I sized in heavier than usual, and the setup delivered +8%. That win wasn’t luck, it was research-backed conviction.

My PLATINUM perks paid off quick. Customized access to the trading room gave me constant strategic updates. The personal assistant wasn’t just a helpdesk script; he understood trading mechanics. One session, I asked about correlation risks between EUR/USD and GBP/USD, and he broke it down in clear, actionable language. No textbook talk.

The three risk-free trades were also a great sandbox, gave me space to test sizing logic without fear.

By the ninth month, my trading strategy had evolved. I expanded into tech stocks, focusing on Tesla and Nvidia around their earnings reports. These trades gave me more structure, as I used event-driven strategies to time entries.

At the same time, I revisited altcoins, but with a more disciplined approach this time around. A well-timed Fibonacci entry on AVAX resulted in a +9% gain in just 72 hours, reminding me how structured analysis can work wonders in volatile markets.

When it came to withdrawals, I tested the system with two separate cash-outs: one for €5,000 and the other for €12,000. Both funds were in my account in less than 48 hours, without any issues or delays. This quick access to funds made me feel confident about the platform's reliability.

Today, my portfolio sits at 50% crypto, 30% forex, and 20% stocks. I’m no longer chasing volatile trends. Instead, I’m making well-researched, measured moves with Aurolonix’s tools and real-time data, striking a balance between speed and control. Despite the ongoing challenges of trading, Aurolonix has given me the resources to navigate the market with clarity and confidence.

#AurolonixReview#AurolonixReviews#Aurolonix.comReviews#Aurolonix.comReview#Aurolonix Review#Aurolonix Reviews#Aurolonix.com Review#Aurolonix.com Reviews#Aurolonix

1 note

·

View note

Text

Top 10 Best Indicators for Stock Trading in India

Stock trading is an exciting way to grow your money. Many people in India have started trading in stocks, but not everyone makes profits. To become a smart trader, you need to know how to read the market. One of the best ways is by using indicators. Indicators help you understand whether it is a good time to buy or sell a stock.

In this blog, we will explain 10 important indicators every Indian trader should know. We will keep it simple so that even beginners can understand and use them.

1. Moving Average (MA)

What it means: A moving average shows the average price of a stock over a certain number of days. For example, a 50-day moving average shows the average price for the last 50 days.

How to use: When the stock price goes above the moving average, it is usually a sign to buy. When the price falls below it, it can be a sign to sell.

Tip: Popular moving averages are the 50-day and the 200-day moving average.

2. Relative Strength Index (RSI)

What it means: RSI tells you if a stock is overbought (too expensive) or oversold (too cheap). It is a number between 0 and 100.

How to use:

If RSI is above 70, the stock might be overbought. It may fall soon.

If RSI is below 30, the stock might be oversold. It may rise soon.

Tip: Check RSI along with other indicators before buying or selling.

3. Bollinger Bands

What it means: Bollinger Bands show how much a stock price moves around its average price. It has three lines: the middle one is the moving average, and the upper and lower bands show the range.

How to use: When the bands are wide, the stock is more volatile. If the price touches the upper band, it may fall back. If it touches the lower band, it may go up.

Tip: Bollinger Bands are great for spotting sudden price breakouts.

4. MACD (Moving Average Convergence Divergence)

What it means: MACD is a trend-following indicator. It shows the relationship between two moving averages.

How to use:

When the MACD line crosses above the signal line, it’s a buy sign.

When the MACD line crosses below the signal line, it’s a sell sign.

Tip: MACD works well for short-term and medium-term trading.

5. Volume

What it means: Volume shows how many shares were traded in a day.

How to use: High volume means strong interest in the stock. When price goes up with high volume, the trend is strong. If price moves without volume, the trend is weak.

Tip: Always check volume before trading. It confirms whether the trend is real.

6. Stochastic Oscillator

What it means: This indicator compares the closing price to a range of prices over time.

How to use:

If the value is above 80, the stock may be overbought.

If it is below 20, the stock may be oversold.

Tip: Use it with RSI for better signals.

7. Support and Resistance Levels

What it means: Support is the price level where a stock usually stops falling. Resistance is the price level where a stock usually stops rising.

How to use: Buy near support and sell near resistance. These levels help you set entry and exit points.

Tip: Support and resistance are easy to draw on a price chart. Practice spotting them.

8. Moving Average Crossovers

What it means: This method uses two moving averages of different periods.

How to use:

A “Golden Cross” happens when a short-term MA (like 50-day) crosses above a long-term MA (like 200-day). It’s a bullish signal.

A “Death Cross” happens when a short-term MA crosses below a long-term MA. It’s a bearish signal.

Tip: Crossovers help identify trend changes.

9. Average True Range (ATR)

What it means: ATR measures how much a stock moves, on average, in a day.

How to use: Higher ATR means higher volatility. It helps you decide stop-loss levels.

Tip: If you don’t like too much risk, pick stocks with lower ATR.

10. Fibonacci Retracement

What it means: This tool helps find possible support and resistance levels based on the Fibonacci sequence.

How to use: Traders draw Fibonacci levels on a chart to see where prices might bounce back.

Tip: Use it with trend indicators for better accuracy.

Final Words

Indicators are very helpful for making better trading decisions, but they are not magic. They help you read what is happening in the market. Always remember:

Use more than one indicator together.

Follow market news and company results.

Keep a stop-loss to control losses.

Never invest all your money in one stock.

In India, many traders use these indicators daily. If you learn how to use them, you will become more confident and trade smarter. Start by picking 2 or 3 indicators and practice with them. Over time, you will know which ones work best for you.

Happy Trading!

#outfit#branding#financial services#investment#investment planning#financial freedom#financial wellness#financial planning#financial advisor#finance

0 notes

Text

Harnessing Fibonacci Extensions for Trading Gains and Business Growth

When the stock market surged in 2020, a trader named Maya found herself at a crossroads. She had spent years learning the art of technical analysis, but nothing had prepared her for the volatility of the pandemic-driven market. One morning, while reviewing a chart of Tesla’s stock, she noticed a pattern—prices had retraced to a key Fibonacci level before rocketing higher. Inspired, she used…

0 notes

Text

Are Charting Tools Really Helping You or Just Distracting You?

Spend any time in the world of trading and you’ll quickly be introduced to an overwhelming number of charts, graphs, and technical indicators. The colorful candlesticks, moving averages, and oscillators give you the sense that you’re operating with precision—that if you just find the right pattern, success is inevitable.

But for many retail traders, especially those just getting started, charting tools can become less of a guide and more of a trap.

So how do you know if they’re actually helping you trade smarter—or if they’re simply distracting you from what matters?

Let’s explore this question from the perspective of a trader who wants to improve—not impress.

Charting 101: What You’re Actually Looking At

Let’s start by making one thing clear: charting is not the problem. Good charting platforms—Zebu includes one powered by TradingView, for example—can offer incredibly useful insights.

A basic chart shows you the price movement of a stock over time. Candlesticks show open, close, high, and low prices. You can overlay technical indicators like:

Moving Averages (MA) Relative Strength Index (RSI) Bollinger Bands MACD (Moving Average Convergence Divergence) Volume These tools attempt to show you whether a stock is trending, reversing, or losing momentum. They give clues, not guarantees.

Used well, they give structure to what would otherwise be guesswork.

Where It Starts Going Sideways

The trouble begins when you go from a few indicators to... all of them.

You start with RSI. Then you add MACD. Then Fibonacci retracement levels. Then Ichimoku clouds. Before you know it, your chart looks like a complicated cockpit. You’re no longer seeing price—you’re seeing confusion.

This is known as “analysis paralysis.” Too many signals, and you don’t know which one to trust. You hesitate. You overthink. And in trading, that usually means missed opportunities—or worse, bad decisions.

The Illusion of Precision

Here’s the trap: a complex chart feels smarter.

You look at it and think, “Now I’m seeing what the professionals see.” But more often than not, the chart is just reflecting what the stock already did—not what it will do.

Indicators lag. They are based on past price movement. They confirm, not predict.

A stock can still break a key resistance level for no reason you can see on a chart. A company’s earnings surprise can make a perfectly set up pattern irrelevant in seconds.

That doesn’t mean charts are useless. But it does mean they aren’t the crystal balls they’re often sold as.

Ask: What’s the Question You’re Trying to Answer?

Before opening a chart, ask yourself: what am I trying to figure out?

Am I looking for a trend? Am I waiting for a breakout? Am I spotting a reversal? Each of these has a few specific tools that help. That’s it.

You don’t need five indicators to answer one question.

For example:

For trend confirmation? A moving average or two. For momentum? RSI and MACD. For volatility? Bollinger Bands. For volume confirmation? Plain volume bars. Keep it lean. Let the chart serve the question—not the other way around.

Who’s Actually Using the Tool—You or Your Emotions?

It’s easy to convince yourself that you’re doing “technical analysis” when really you’re just scrolling through charts until one makes you feel good about your bias.

You bought a stock. Now you’re scanning for indicators that justify holding. Or you missed a trade and are searching for “proof” that it wasn’t a good setup anyway.

This is a very human impulse—but it’s not analysis. It’s emotional cushioning.

The right way to use a charting tool is before the trade, when your thinking is clear. Not afterward, when you’re defending a position.

Chart Literacy > Chart Obsession

What separates the casual chart-watcher from the skilled trader is the ability to read price action, not just apply layers of tools.

If you can look at a basic candlestick chart and understand:

What buyers and sellers are doing Where momentum shifted How strong the breakout or breakdown is …then you’re already ahead of most traders.

Indicators are meant to support your read—not replace it.

And no matter how advanced a chart looks, it still needs context. News events, earnings reports, sector movements—these aren’t on the chart, but they matter.

Are You Spending More Time Charting or Trading?

Here’s a quick gut check: if you spend 80% of your time adjusting chart settings and only 20% making decisions, something’s off.

Trading is a decision-making sport. Charts are a planning tool. The goal isn’t to design the most visually complex chart. The goal is to make clear, consistent choices.

Many experienced traders set their charts once and rarely change them. Why? Because they’ve figured out which tools give them clarity—and they stick to those.

Try that approach. Pick 2–3 indicators that make sense for your style. Test them. Tune them. Then leave them alone.

Mobile Charting: Convenient, But Still Requires Clarity

Apps like Zebu’s now offer full mobile charting, including advanced indicators and drawing tools. This is a huge shift from a few years ago, where you had to use a desktop.

But just because it’s easy to chart on your phone doesn’t mean you should chart all the time.

Set alerts instead. If a stock crosses a level you care about, let the app tell you. Don’t sit there refreshing RSI every 5 minutes.

Tools are there to reduce emotional friction—not amplify it.

So... Are Charting Tools Worth It?

Yes—if:

You know what you’re looking for You’ve learned the logic behind each tool you use You apply them consistently across trades You’ve seen them work for your style and temperament No—if:

You’re using them to justify impulsive trades You switch tools every week You feel overwhelmed more than informed You spend more time in the tool than using its output A chart is a map. But even the best map is useless if you don’t know where you’re trying to go.

Final Thought: Tools Don't Make You a Trader—Process Does

It’s tempting to think that more screens, more indicators, and more chart overlays will turn you into a sharper, faster trader. But the truth is, trading success is mostly boring.

It’s about discipline. Repetition. Structure. Thoughtful risk.

Charting tools can absolutely be a part of that. But only if they fit your process. Not someone else’s. Not some YouTube strategy with 10 moving parts.

Just yours.

So the next time you stare at a screen full of lines, candles, bands, and colors—pause. Ask what you’re really trying to see. Then remove what you don’t need.

Because often, trading clarity comes not from adding more—but from removing the noise.

Disclaimer :

This blog is meant to provide general information and reflect broad market observations. It doesn’t take into account your specific financial situation or investment needs. Zebu shares this for educational purposes only and doesn’t promise returns or make personal recommendations. Before you act on anything here, it’s always a good idea to talk to a qualified financial advisor.

#zebu#finance#investment#investwisely#financialfreedom#investing#investors#makemoney#investmentgoals#mutual funds

0 notes

Text

Mastering the Art of Trading with Apex Trader Funding: Unlocking Opportunities in the UAE,

The online trading landscape is rapidly evolving, providing traders with unprecedented opportunities to access capital and scale their strategies. Apex Trader Funding offers a seamless way for traders to grow without relying on personal funds. Whether you are an aspiring proprietary trader or an experienced professional, mastering the trading platforms and evaluation process is essential for success. This guide explores strategies to secure funding and effectively trade with Apex funded accounts while utilizing the best trading platform available today.

Establishing a Strong Foundation for Trading Success

For traders who are just starting, it is crucial to develop a solid trading foundation. Apex funded accounts enable traders to refine their strategies in a risk-free simulated environment before transitioning to live markets. This approach allows traders beyond to gain practical experience while managing risk effectively.

Core Trading Concepts

Understanding Market Behavior: Learn how the financial markets function by analyzing price action, market sentiment, and economic indicators. Gaining insight into macroeconomic trends and interest rate shifts can enhance your decision-making process.

Using Trading Simulators: Platforms like Rithmic trading platform and Tradovate trading platform provide a virtual trading platform for traders to test and refine their strategies before trading with real capital.

Effective Risk Management: Setting stop-loss levels, determining position sizes, and following a disciplined approach to trading can prevent substantial losses and foster long-term success.

Choosing the Right Trading Instruments: Trading futures trading contracts like the S&P 500 E-mini (ES) and Nasdaq (NQ) allows traders to benefit from high liquidity and efficient trade execution.

Steps for Beginner Traders

Engage in Simulated Trading: Build confidence by practicing with a virtual trading platform before transitioning to live markets.

Start with Simple Strategies: Utilize basic trend-following and breakout strategies before incorporating complex techniques.

Establish a Consistent Trading Routine: Monitoring markets, tracking key events, and conducting daily trade reviews will enhance performance.

Document Trading Performance: Keeping a journal to analyze past trades, errors, and successes can improve strategy optimization.

By following these principles, traders can transition smoothly to stock trading platforms in UAE and capitalize on opportunities within the online stock trading platform ecosystem. Prop firms in the UAE facilitate this progression by providing capital and structured evaluation programs.

Enhancing Trading Strategies for Intermediate Traders

Once traders gain confidence in executing trades, they must focus on refining their techniques and enhancing consistency. Apex funding equips traders with structured evaluation accounts, ensuring they demonstrate solid risk management and sustainable profitability.

Key Areas for Growth

Selecting the Right Evaluation Account: Opting for a $25,000 evaluation account initially allows traders to fine-tune their approach before scaling up.

Defining Profit Targets: Setting achievable profit goals helps traders maintain discipline and avoid reckless risk-taking.

Developing Advanced Market Analysis Skills: Leveraging volume profiles, Fibonacci retracements, and support/resistance strategies improves trade accuracy.

Strengthening Risk Management: A structured approach to risk-to-reward ratios ensures that profitable trades surpass losses over time.

Intermediate Trading Steps

Increase Position Sizing Gradually: Maintain consistency with smaller trades before transitioning to larger contracts.

Backtest Strategies Regularly: Using historical data to analyze trading patterns allows traders to adapt to changing market conditions.

Maintain Psychological Control: Following a predetermined plan and avoiding emotional trading can enhance discipline.

Continuously Improve Trading Strategies: Regularly reviewing and optimizing strategies ensures long-term adaptability.

Through a structured approach, funded trading accounts in UAE provide a pathway to sustainable growth without the burden of high personal investment. Apex Wealthcharts trader funding equips traders with the necessary resources and connects them with the best trading platform in UAE.

Advanced Trading Techniques for Scaling Up

Experienced traders looking to optimize their strategies and capitalize on larger trade sizes can benefit from prop firms in UAE by gaining access to multiple funded accounts and advanced trading tools. At this stage, traders must focus on precision execution and capital efficiency.

Advanced Trading Strategies

Managing Multiple Accounts: Diversifying across several funded accounts reduces risk while maximizing profit potential.

Refining Order Execution: Using direct market access (DMA) ensures precise trade execution with minimal slippage.

Incorporating Proprietary Indicators: Leveraging algorithmic trading and customized indicators enhances market forecasting capabilities.

Applying Dynamic Risk Management Techniques: Implementing scaling-in and scaling-out techniques protects capital while optimizing returns.

Professional Trading Framework

Utilize a Multi-Strategy Approach: Combining scalping, swing trading, and algorithmic models can enhance adaptability to different market conditions.

Monitor Economic Trends: Staying informed about macroeconomic data, central bank policies, and financial news helps traders anticipate market movements.

Prioritize High-Probability Trades: Focusing on well-researched setups with strong risk-to-reward ratios increases profitability.

Evaluate Performance Consistently: Tracking and analyzing multiple accounts ensures the continuous improvement of trading methodologies.

By leveraging these strategies, traders can tap into the best prop trading firms in UAE and advance their trading careers while maintaining strict risk management.

Apex Trader Funding in the UAE

For traders in the UAE, Apex Trader Funding provides structured evaluation programs and funding opportunities tailored to different trading styles. The initiative allows traders to refine their skills in a risk-controlled environment while leveraging the latest trading platforms.

Benefits of Apex Trader Funding in UAE

Comprehensive Evaluation Programs: Traders can qualify for capital access without the need for personal funds.

Access to Multiple Trading Platforms: Trade seamlessly using Rithmic trading platform and Tradovate trading platform.

Diverse Trading Strategies Supported: Whether you are a swing trader, scalper, or algorithmic trader, Apex funding caters to various trading styles.

Risk-Free Simulated Trading: Traders can hone their skills in a practice environment before transitioning to real funded trading accounts in UAE.

Exclusive Apex Coupon Discounts: Enjoy promotional benefits through an Apex coupon, Use the Code “COPY” to get the latest discount. This will make the funding process even more cost-effective.

With Apex trader funding in UAE, traders have the opportunity to grow their careers while benefiting from structured evaluations, capital allocation, and advanced trading tools.

Conclusion: Advance Your Trading with Apex Trader Funding

Are you ready to elevate your trading career? Join Apex Trader Funding and gain access to funded trading accounts in the UAE without the need for personal investment. Whether trading in the UAE or globally, traders can improve their skills and scale up using prop firms in UAE resources.

With structured strategies and effective risk management, funded traders in the UAE present an unparalleled opportunity for professional growth and financial success.

Start your journey today with Apex Trader Funding and explore new possibilities in futures trading in UAE. For more insights and expert trading blogs, check out Apex Trader Funding's website.

0 notes

Text

Pin Bar Candlestick Pattern: A Trader’s Guide to Smart Entries and Exits

Have you ever noticed a candle on a chart that looks like a pin or a needle? That structure is known as a pin bar, and it can give traders powerful insights into future price movement. Whether you're entering or exiting a trade, the pin bar can help you make smarter, more strategic decisions.

If you've found it challenging to recognize or understand this pattern, you're not alone. In this Market Investopedia guide, we’ll walk you through everything you need to know about pin bars—how they work, their pros and cons, and how to trade them effectively.

What Is a Pin Bar?

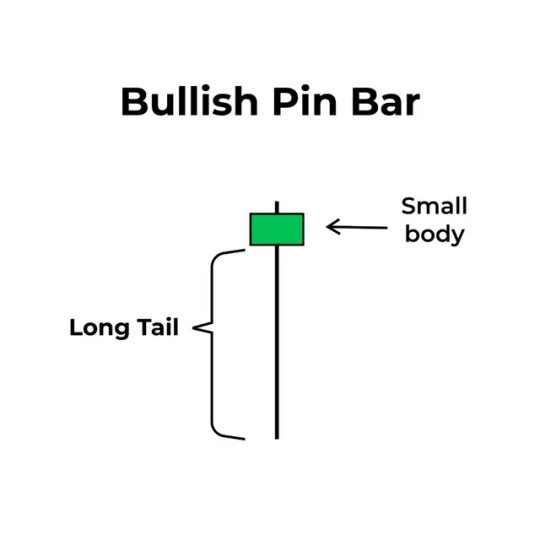

A pin bar is a candlestick formation that signals a potential price reversal or continuation. It’s made up of:

A small body (green or red),

A long wick on one end,

And a short wick on the opposite end.

This structure reveals price rejection—meaning the market attempted to move in one direction but was strongly pushed back, hinting at an upcoming shift.

Key Features of a Pin Bar

To identify a pin bar, look for the following elements on your chart:

Small Candle Body

The body should be short, showing little difference between the opening and closing prices. This indicates a balance—or struggle—between buyers and sellers.

Wicks (Shadows)

There are two wicks on a pin bar. One is very long, and the other is short. The long wick reveals where the price was rejected, and it's the most important part of the pin bar.

Closed Candle

Never trade a pin bar that hasn’t closed yet. Wait for the candle to close before making a decision based on its signal.

Types of Pin Bars

Bullish Pin Bar

Appears during a downtrend

Has a small green body

Features a long lower wick

Signals a potential upward reversal

The long lower wick suggests sellers pushed the price down, but buyers fought back, rejecting the lower levels. This often indicates a buying opportunity.

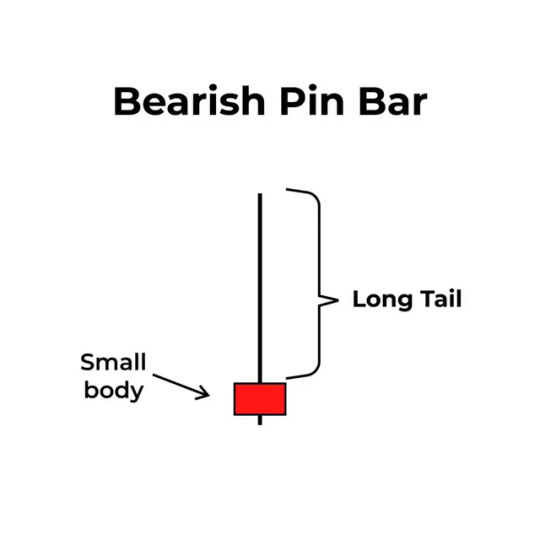

Bearish Pin Bar

Appears during an uptrend

Has a small red body

Features a long upper wick

Signals a potential downward reversal

Here, buyers tried to push the price higher, but sellers stepped in and rejected the highs. This often signals a selling opportunity.

How to Trade Using Pin Bars

1. Identify a Pin Bar

Scan your chart (preferably 4-hour, daily, or weekly) for a small-bodied candle with a long wick on one end and a short wick on the other.

2. Use Confirmation Tools

Combine pin bars with tools like:

RSI (Relative Strength Index)

Fibonacci Retracement

Bollinger Bands These indicators can help confirm whether the signal is strong enough to act on.

3. Trade Reversals

When a pin bar forms at a key support or resistance level, it often signals a reversal. Trade in the direction opposite the long wick.

4. Trade Trend Continuations

Not every pin bar signals a reversal. In some cases, especially during a trend pause, a pin bar can indicate that the current trend is about to continue. For example, a bullish pin bar during an uptrend suggests that buyers are still in control.

How to Spot High-Quality Pin Bars

Not all pin bars are equal. Here's what to look for in a strong setup:

Key Levels: Look for pin bars forming at significant support or resistance zones.

Longer Time Frames: Pin bars on 4H, daily, or weekly charts tend to be more reliable than those on 5-minute or 15-minute charts.

Wick Length: The longer the wick (at least two-thirds of the candle's length), the stronger the signal.

Smaller Body: A smaller body means less indecision and more rejection.

Volume Confirmation: Higher trading volume strengthens the validity of the pattern.

Pros of Trading Pin Bars

Easy to recognize, even for beginners

Work well with various assets—Forex, stocks, crypto, commodities Clearly define potential entry and exit levels

Combine well with trendlines, moving averages, and other tools Suitable for multiple timeframes

Cons of Trading Pin Bars

Less effective in choppy or sideways markets

Relies on probabilities—there’s no guarantee the signal will play out

Can produce false signals without proper confirmation

Final Thoughts

The pin bar candlestick is a powerful yet simple tool that traders can use to spot trend reversals or continuations. It's easy to learn, and when combined with other forms of analysis, it can provide high-probability trade setups.

However, like any trading method, pin bars are not foolproof. It's important to assess each one carefully, confirm the signal, and avoid trading them in low-quality setups or during erratic market conditions.

Ready to dive deeper into price action and trading strategies? Explore more articles on Market Investopedia or join our free webinar for hands-on learning with real chart examples.

0 notes

Text

Chart Smarter, Not Harder: A No-

Nonsense Approach to Technical Analysis

In today’s crowded trading education space, one thing is clear — most traders are being taught to look at everything except the actual price. From indicators to trend lines, the majority of retail strategies are based on lagging tools that only react after the move has already happened.

At Chart Monks, we’re doing something radically different. Our approach strips away all the clutter and focuses on what truly drives the market: unbalanced orders of demand and supply.

If you're searching for a technical analysis course that’s based on logic, not lagging tools, and want to understand the psychology of trading from the ground up, this article is your starting point.

Most Traders Are Reacting, Not Reading

The truth is, retail traders often find themselves reacting to signals that appear after the move is already over. Whether it’s RSI, MACD, or EMA crossovers — these tools only confirm what’s already happened. The problem? You’re always late.

This is why so many people struggle even after completing a stock market technical analysis course from traditional sources. They’re taught to use tools that follow price instead of learning to read the price itself.

At Chart Monks, we help you flip that mindset. We don’t teach indicators, trend lines, or support-resistance zones. Instead, we show you how to spot the real reason price moves — institutional demand and supply imbalances.

Why Most Technical Analysis Is Just Noise

Visit any trading content platform and you’ll see the same things repeated:

Double tops and bottoms

EMA rejection strategies

MACD crossovers

Breakout entries

Support becomes resistance” concepts

But none of this prepares you for the reality of live markets.

These methods work — sometimes — but only in hindsight. The patterns often shift. The indicators repaint. And the zones get violated.

Why? Because they’re based on theory, not on the psychology of trading or the true mechanics of price action.

That’s why our technical analysis stock market course starts from the root. We teach traders to stop relying on after-the-fact tools and begin reading the chart with their eyes — not with indicators.

Real Price Action: What It Actually Means

“Price action” is a popular term, but very few people actually know what it means.

Most traders claiming to use price action still rely on 10+ lines on their charts and multiple indicators for confirmation. That’s not price action — it’s confusion.

True price action is about observing behavior:

Where did the price move rapidly?

Which zones remain untested?

Where did large orders likely enter or exit?

At Chart Monks, we help you train your eye to see these footprints. We don’t predict — we read. We don’t guess direction — we identify intent.

This clarity is what separates average traders from consistently profitable ones.

Why Demand and Supply Is the Only Thing That Matters

Forget the myth that charts move based on trend lines or Fibonacci levels. The real reason price moves is simple: large orders placed by institutions at specific price zones.

When a major bank or fund leaves a large buy or sell order unfilled, that area becomes a zone of interest. These are the areas where price is likely to return — not because of magic, but because of unfilled business.

And when it returns to those zones, that’s your opportunity.

In our stock market technical analysis course, you’ll learn how to:

Mark untouched, high-quality demand and supply zones

Avoid fake zones created by retail noise

Confirm zones using price reaction, not assumptions

Enter trades with precision, not panic

Trading Without Indicators — Forever

Yes, it’s possible. In fact, it’s smarter.

Most traders rely on multiple indicators because they feel insecure without them. But indicators don’t provide clarity — they create dependency.

We teach you how to remove all that and trade directly from price behavior, using only demand and supply. No trend lines. No support-resistance. No guesswork.

This approach is not only cleaner — it’s also mechanical and rule-based. It works across all markets because the principles of demand and supply never change.

Why This Works in Any Market

Whether you're trading stocks, forex, crypto, or commodities — price moves due to the same logic: unbalanced demand and supply.

That’s why our method, taught in our technical analysis course, applies universally. It doesn’t matter if you're looking at Nifty, crude oil, Bitcoin, or Nasdaq. If there’s a chart, and there are buyers and sellers, this method works.

That makes it ideal for those choosing a financial trading course with long-term utility, not just a temporary fix.

Are You Overtrading?

Let’s be honest — most beginners fall into the trap of overtrading.

They jump into every setup they see. They trade daily. They take revenge trade. They chase breakouts and enter based on gut feelings.

This behavior comes from a lack of clarity and structure.

In our beginners trading course, we show you how to reverse that mindset. You’ll learn to wait for only the best setups — those with high probability, low risk, and clear confirmation. Often, this means taking just 1–2 trades per week. But they’re planned. They’re intentional. And they’re backed by logic.

No Hype. Just Skill.

We won’t sell you dreams of 90% win rates or golden indicator formulas. We don’t offer signal groups or quick-fix templates.

What we do offer is this:

A practical, zero-fluff process for understanding price

A clean charting style based on demand and supply

A deep understanding of the psychology of trading

A method that builds real skill and long-term confidence

If you’re serious about learning to trade — not just trying out another shiny strategy — then our course is for you.

Final Thoughts: Less Is More

Trading doesn’t need to be complicated. But it does require clarity.

If you remove the noise — the indicators, the opinions, the fake setups — what remains is the price. And price tells a story. You just need to learn how to read it.

That’s what we teach at Chart Monks. A clear, logical, no-nonsense way to trade based on demand and supply.

No more clutter. No more confusion. Just price. Call us at +91-9220943789.

#Technical Analysis Course#Technical Analysis Stock Market Course#Stock Market Technical Analysis Course#Psychology Of Trading#Choosing a Financial Trading Course#Trading Courses For Beginners#Beginners Trading Course#ChartMonks

0 notes

Text

Swing Trading Using Advisory Support – A Smarter Way to Ride Market Momentum

Swing trading is one of the most popular strategies among retail investors looking to capitalize on short- to medium-term price movements. Unlike day trading, which requires constant screen time, or long-term investing, which demands years of patience, swing trading strikes a balance—offering quicker results with manageable risk.

However, successful swing trading isn’t about gut feelings or blindly following chart patterns. It requires precise timing, solid risk management, and—most importantly—reliable stock selection. That’s where using a stock advisory service can give swing traders a serious edge.

In this article, we’ll explore how advisory support helps streamline swing trading decisions and improves consistency, especially for busy professionals who want to trade actively without going full-time.

What Is Swing Trading?

Swing trading involves buying and holding a stock for a few days to a few weeks to profit from expected upward or downward price moves. It relies on a mix of technical indicators (like moving averages, RSI, MACD) and price-action patterns (like breakouts, flags, or support/resistance levels).

The goal is to “swing” into trends early and exit before momentum fades—maximizing returns while minimizing exposure.

Why Many Swing Traders Struggle

While swing trading seems attractive, it comes with challenges:

Overload of information: Too many indicators, conflicting signals, or YouTube tips

Lack of time: Most retail traders have full-time jobs and can’t track charts all day

Poor stock selection: Trading illiquid or volatile stocks with no real momentum

Emotional decisions: Entering too early, exiting too late, or revenge trading after a loss

These mistakes erode gains and turn a promising strategy into a frustrating cycle.

How Advisory Services Enhance Swing Trading

A stock advisory service simplifies swing trading by removing the noise and providing clear, research-backed trade ideas. Here's how:

1. Curated Stock Picks with Defined Levels

Reputable advisors offer well-screened swing trade ideas with:

Entry zones (not vague price ranges)

Target prices based on resistance levels or Fibonacci projections

Stop-loss levels to manage downside risk

Time horizon (e.g., 3–7 days or 1–2 weeks)

This structure lets you plan trades with discipline and confidence—even if you can’t monitor the market constantly.

2. Trend & Volume Validation

Professional analysts use backtested models and volume patterns to identify high-conviction setups. This helps avoid traps like:

Choppy or sideways stocks

Overbought momentum plays

Low-volume breakouts that often fail

With a reliable stock market advisory, you gain access to filtered opportunities rather than random “buzzing” stocks.

Example: A Swing Trade Using Advisory Support

Let’s say the advisory recommends Stock XYZ:

Entry: ₹512–₹518

Target: ₹565

Stop-loss: ₹495

Expected timeframe: 5–7 trading days

You can place a bracket order, manage position sizing, and exit emotionally-neutral—because everything is predefined.

If the trade hits the target, you book profit. If it hits stop-loss, you move on, minimizing loss. Over time, this approach compounds well.

Benefits of Swing Trading with Advisory Backing

BenefitWhy It MattersDefined risk and rewardHelps maintain capital and reduce emotional stressFewer but higher-quality tradesImproves win rate and reduces overtradingTime efficiencyNo need for constant chart scanning or news trackingTrend-following edgeAccess to early momentum opportunitiesPost-trade analysisMany advisories offer performance breakdowns for learning

How to Make the Most of Advisory Support for Swing Trades

Stick to the plan – Don’t adjust stop-losses or targets on a whim.

Limit exposure – Risk only a portion (e.g., 2–5%) of capital per trade.

Track your trades – Maintain a trading journal to spot patterns.

Avoid overlapping positions – Don’t take multiple trades in the same sector unless advised.

Avoid chasing missed trades – If the price has already moved past the entry zone, skip it.

Advisory vs. DIY Swing Trading

FactorSelf-DirectedWith Advisory SupportTime RequiredHighLow to moderateEmotional Decision RiskHighLower due to pre-planned trade structureTrade AccuracyVariableBacktested, filtered picksLearning CurveSteepGuided with rationale and analysis

Swing trading on your own can be rewarding—but advisory services accelerate the learning curve and provide a safety net that’s hard to replicate solo.

Conclusion

Swing trading offers an exciting opportunity to grow wealth faster than traditional investing—but it requires structure, clarity, and a consistent edge. Relying solely on internet noise or social media hype leads to erratic results. A professional stock market advisory gives you that edge—offering filtered stock picks, disciplined trade structures, and market-tested strategies.

If you’re serious about leveling up your trading game without the stress of going it alone, integrating advisory support into your swing trading toolkit is a smart move.

0 notes

Text

Top 10 Features That Make Axiom Trade a Game-Changer for Online Trading

AxiomTrade.net has emerged as one of the most competitive platforms in the world of online trading. Whether you’re a seasoned trader or a beginner stepping into the dynamic world of crypto and forex, Axiom Trade provides tools, security, and infrastructure that give it a decisive edge. Traders searching for an advanced and user-centric trading environment often ask about the axiom exchange invite code, as it opens the door to exclusive benefits on this cutting-edge platform.

1. Lightning-Fast Trade Execution

AxiomTrade.net offers blazing-fast order execution that minimizes slippage and improves precision in high-volatility markets. With trade processing speeds measured in milliseconds, traders can act on opportunities instantly without delays. This speed is particularly valuable in crypto trading, where prices shift rapidly.

2. Multi-Asset Trading Capabilities

AxiomTrade is more than just a crypto exchange. It supports forex, commodities, indices, and stocks, making it a robust multi-asset platform. This diversity empowers users to diversify their investment strategies within a single interface and manage all portfolios without switching platforms.

3. User-Friendly and Intuitive Interface

Designed with both novice and experienced traders in mind, the platform features a clean, modern UI that’s easy to navigate. Real-time data feeds, customizable charting tools, and a drag-and-drop layout make for a frictionless user experience that enhances productivity.

4. Advanced Charting and Technical Analysis Tools

Traders gain access to powerful charting features including over 100 technical indicators, drawing tools, and real-time price feeds. Whether you’re using Fibonacci retracements or MACD oscillators, AxiomTrade gives you everything needed for in-depth market analysis right at your fingertips.

5. Tight Spreads and Competitive Fees

AxiomTrade.net offers some of the lowest spreads in the industry, ensuring more of your profits stay in your pocket. Their fee structure is fully transparent with no hidden charges. This makes the platform ideal for scalpers and high-frequency traders looking for maximum efficiency.

6. Mobile Trading App with Full Functionality

The AxiomTrade mobile app is not a scaled-down version of the desktop platform—it's a full-featured trading tool that allows you to trade, analyze markets, and manage funds on the go. The mobile experience maintains the same lightning-fast execution and responsive design as the desktop version.

7. Comprehensive Risk Management Features

Risk control is built into every layer of the AxiomTrade system. With stop-loss, take-profit, and trailing stop options, traders can protect their investments even when away from the platform. Margin requirements and real-time margin monitoring are also clearly displayed.

8. High-Level Security Infrastructure

Security is a cornerstone of AxiomTrade.net. The platform uses military-grade encryption, cold wallet storage for digital assets, and multi-factor authentication (MFA) to ensure user funds and data are safe. It is also compliant with international KYC and AML regulations.

9. 24/7 Multilingual Customer Support

AxiomTrade provides 24/7 customer service in multiple languages via live chat, email, and phone. This means no matter where you're trading from or when an issue arises, help is always available. Their support team is trained to handle both technical and account-related queries quickly.

10. Learning Resources and Trader Education Center

New to trading? AxiomTrade offers a comprehensive educational hub packed with webinars, tutorials, market analysis, and trading strategies. These resources are free for registered users and are regularly updated to reflect market trends and platform updates.

Final Thoughts: Why AxiomTrade.net is Reshaping Online Trading

The fusion of speed, security, user-centric design, and multi-asset trading makes AxiomTrade.net a top choice for traders who want performance and reliability. With robust infrastructure, low fees, and an expansive feature set, it stands tall in a saturated market. Unlocking features via the axiom exchange invite code adds another layer of benefit for new users eager to maximize their trading journey from day one.

If you're serious about advancing your trading potential and leveraging a platform designed for growth, AxiomTrade.net offers the tools, environment, and support to help you excel.

0 notes

Text

Master the Markets: Best Share Market Courses in Pune & India for Technical Analysis and Option Strategies

In the current fast moving financial era, it is more important than ever to know how the stock market works. Whether you are a newcomer attempting to master the fundamentals or a seasoned trader seeking to improve your skills, taking the appropriate share market course can be the difference between success and failure. This holds particularly in cities such as Pune and Mumbai, where high-quality stock market classes are in highly demand owing to an increase in interest in wealth creation through equities, derivatives, and technical trading.

Why Choose Share Market Education?

Learning to navigate the market is not simply a matter of reading charts or keeping up with trends. It's about building a disciplined trader's mindset, risk management skills, and insight into market forces. Thorough share market training programs provide that foundation and much more. From learning fundamentals to mastering sophisticated tools, a properly structured curriculum gives you the advantage.

Best share market courses in Pune and in India today include specialized modules covering everything from:

Introduction to equities and market mechanics

Candlestick and price action analysis

Risk and money management

Trading psychology

Advanced modules such as Option Trading Strategies course and Advance Technical Analysis course

What is an Advance Technical Analysis Course About?

An Advance Technical Analysis course goes deep into market indicators, patterns, and trading systems. It prepares students to analyze price action accurately and make correct decisions using tools such as:

Fibonacci Retracements and Extensions

Elliott Wave Theory

Ichimoku Cloud Analysis

Volume and Open Interest Analysis

Advanced Charting Software (e.g., TradingView, MetaStock)

Such comprehensive training, offered at well-known stock market classes in Mumbai and Pune, keeps you ahead of the curve.

Mastering Options with a Focused Option Trading Strategies Course

Options trading is a high reward area of the market that needs to be understood in depth. A good Option Trading Strategies course teaches both the theoretical basis and actual execution of trades. Such courses typically feature:

Basics of options: calls and puts

The Greeks (Delta, Theta, Vega, Gamma)

Popular strategies such as Iron Condor, Straddles, and Spreads

Hedging techniques and risk reduction

Real market case studies and backtesting

You can find some of the finest guidance by opting for well-planned share market classes in Mumbai and Pune with a focus on theory and practice in the live market.

For more courses - https://sharemarketclasses.in/

How to Select a Good Share Market Institute

Selection of a good share market institute is key to receiving quality education. Find out the following:

Certified and experienced trainers

Practical training with market simulators

Up-to-date curriculum based on market trends

Availability of trading tools and guidance

Good student reviews and reputation in the industry

Urban cities such as Mumbai and Pune also have numerous institutes that provide exhaustive stock market classes. Whether one is a student, a professional, or retired, flexible timing and batch facility make learning feasible for all. Why Choose Stock market Classes in India?

India has become a retail trading hotspot around the world. The quality and diversity of stock market classes in India (and share market classes in India) have increased significantly over the years. Through a combination of online and offline courses, students from across the country can now benefit from high-level market training that previously was concentrated in metro cities.

Learn from the Best at eMS Stock Market Institute

If you're searching for career focused, hands on share market courses in Pune or best stock market classes in Mumbai, eMS Stock Market Institute is the place to be. With a legacy of excellence in training and guidance, eMS provides holistic programs in advance technical analysis course, option trading strategies course, and complete share market training. Whether you are embarking on the journey or aspire to be a professional trader, eMS guarantees that you possess the tools, information, and assistance necessary to succeed in the financial markets.

Are you seeking in person or online stock market classes?

#share market classes in pune#Share Market Courses In Pune#best share market courses in pune#share market classes#Best Share Market Classes In Pune

1 note

·

View note

Text

Essential Market Levels: A Beginner’s Guide to Support and Resistance