#Surface Computing Market size

Explore tagged Tumblr posts

Text

#Surface Computing Market#Surface Computing Market size#Surface Computing Market report#Surface Computing Market analysis#Surface Computing Market cagr

0 notes

Text

AA Clint Barton x Reader

Part 9: Beneath the surface

“Man it is humid out here.” Clint complained behind me as we stand on top of a rooftop looking down at the cruise ship passengers. He’s a little late but I’ll let him on a pass for now. Clint walks over to me and peers over my shoulder as I take out my binoculars to look at the crowd closely. “So we’re avenging tourism now?”

I lower my binoculars and turn to him with a raised eyebrow. “Did you even read the dossier?”

“Yeah of course, small scale stakeout. In and out no problem.” He said with a smile.

I turn back to looking at the tourist, this time without my binoculars. “You and I both know small scale espionage with Hydra can unveil big scale problems.”

“We’ve taken on Galactus,” Clint’s tone turns cocky. “This’ll be a breeze.”

I see a couple go into a nearby alley sneakily. “Found our target, let’s go.” I shoot a web so I can swing over to the alleyway. I land perfectly in front of the couple and speak in a stern tone. “The package, hand it over.”

The couple stands there stunned for a minute. The man speaks up in a confused voice, which I know its fake. “We don’t know what you’re talking about.”

“Have it your way.” I get ready to shoot some webbing at them but Clint places his hand on my shoulder to stop me.

“Whoa, are you sure about this? They seem like a nice couple.” I turn to him with a confused look. Clint was a top Shield agent, at least that’s what Natasha told me.

“You really don’t see it?” My tone isn’t as stern with him than it was with the couple.

“Stealth mode compromise.” We hear a robotic voice come from the couple. We look over as the couple drop their disguises and turn into robots. “Initiate attack mode.”

The robots start firing lasers out of their eyes. I jump onto the fire escape as Clint ducks behind a dumpster. I see him pull out his bow and arrow and I know that’s a terrible idea. “Clint stop!” But he doesn’t hear me in time because he fires two explosive arrows at the robots. This aggravates them and shoots more lasers in our direction. I’m able to dodge them and get behind the bots. I shoot my webs at them and send an electric shock through them with my web shooters, this causes the bots to malfunction and fall to the ground. “Explosive arrows?” I look to Clint with a stern expression. “How much attention do you want to draw to us?”

“They worked just fine on Piledriver.” I roll my eyes when he brings up a wrecking crew member.

“This is a spy mission Clint, I thought you were good at those. It’s why I brought you and not Natasha.” I go through the suitcase that the robots had and pull out some of the clothes they had. Luckily they’re in my size and hopefully Clint’s too.

“I am a professional spy. And for your information Nat is more of an assassin.” Clint looks at the clothes I pulled out and takes a shirt. “Looks like we did stop s crime, a fashion crime.” When he realizes his joke didn’t land he drops his smile. “Why are we here again?”

“Shield had intel that a Hydra black market sale was going down, but we didn’t know what was being sold or to whom.”

“And we got to them before the sale. Mission complete.”

“Espionage 101, nothing’s ever what it appears.” I take out a sun hat from the suitcase and flip it over and see a crown on the inside. “I thought Hydra didn’t deal with valuables.” I look over to Clint who’s on his phone again. I groan slightly knowing he’s distracted, I pull out my own phone and FaceTime Tony to see if he could identify the crown. “Tony I need your help. Can you identify this artifact for me?”

I hold the crown up to the camera and Tony types something’s on his computer. “The Serpent Crown, an object of ancient power origin unknown. Although it’s similar to the crown Doom used to control the Midgard Serpent.”

Maybe I should’ve brought Tony on this mission, so far he’s been more helpful than Clint. “Implying a similar function?”

“Not sure, but I’ll wager whoever wants it isn’t just looking to accessorize.”

“Got something here.” Clint spoke up and walked over to stand next to me.

“What?”

Clint holds up his phone showing me and Tony what he found. “Thor’s fighting robots on Bleaker street! I’m heading out.” I mentally facepalm at his words. I totally should’ve brought Natasha.

“Cancel that Clint we’ll handle it. The crown is a serious threat.” Tony spoke up on the phone.

Clint groans and starts to pace back and forth. “We could be taking down giant robots, and instead we’re protecting gaudy jewelry.”

I hang up the phone and put it in my pocket. “You heard Tony, this thing’s incredibly dangerous. We need to find out who Hydra was going to sell it to.”

I put the crown back into the sun hat and take out some clothes. “Alight, you had me at incredibly dangerous.”

Underneath the clothes I see two cruise tickets and pull those out as well. “Looks like the transaction was going down on that cruise ship.”

“You up for some undercover stuff?” Clint said with a smile, and of course I was so I nodded my head matching his smile.

—————

We changed into the clothes from the suitcase and made our way to the ship. I start looking around for anyone who could be involved with Hydra while Clint started getting distracted again. I look over to see Clint talking to a woman and feel a little jealous with the way she’s looking at him. I walk over to them and hear a bit of their conversation. “Hey I think I’ve seen you before.” The woman says. “Are you on tv or something?” Her tone turned a little flirty and I couldn’t take it anymore.

“Well actually-“ Clint starts but before he could finish I tug on his arm guiding him away from the woman.

“Over here dear.” I say in a jealous tone. Once we’re away from the woman I whisper to Clint. “Stay on mission.”

Clint looks at me and notices my jealousy. “Aww Spidey, you jealous?”

“I’m not jealous,” I state in the most calm voice I can muster. “We still have a mission, remember?”

Clint reaches up and presses a button on his glasses, which activates the scanner installed in them. “Right, totally spy mode starting now.”

Yeah Clint still isn’t paying attention to the mission. Throughout the day I spend my time placing trackers and looking for any suspicious activity. Clint is going around the ship playing shuffleboard, meeting fans, and even doing limbo. But as I walked around the ship I noticed one man who wouldn’t stop following me. So he’s either a creep or it’s the guy we’re looking for. I walk over to Clint who fails to do limbo again and motion him to get up. “Move.” Hey gets out of my way and as I move under the bar I get a good look at the guy following me.

We I stand up straight Clint claps his hands applauding for the limbo. “Are you finally having fun?”

I roll my eyes and straighten my clothes. “Fun? The limbo position made it easier to scope out that guy who’s following us. Spy mode, remember?”

—————

We make it back to our cabin so we could talk in private. Clint sits on the bed and pulls out his phone and looks at the live news feed of the team fighting giant robots. I close the door and lean against the wall facing him. “We’ve identified our contact Clint. I know you still have your spy skills, even if you’re a bit rusty.”

He scoffs with a smile. “Rusty? Please.”

“Did you even notice the guy following us? Not every villain is a giant monster.”

Clint puts his phone away and sits up on the bed, his smile now gone. “Yeah I saw him. Just not convinced he’s our guy, we’ll probably never see him again.”

A knock on the door interrupts our conversation. I walk over and open the door and see it’s the guy that’s been following us. I speak in a casual tone and keep calm. “May we help you?”

“Excuse me, I may have made a mistake.” The man’s voice is gravely and he begins to walk away.

Before he can get far I whisper loud enough for only him to hear. “Hail Hydra.”

He stopped walking and turned back to me. “I am ready for the transaction. Show me the crown first.” I bring him into the cabin and pull out the briefcase we stored the crown in. I open it up for the man to see and he holds out his own briefcase. “The payment is in here.”

I reach out to take the brief case and hear Clint’s voice in a warning tone. “(Y/n) don’t!” The man’s voice presses a button on the briefcase and a strange gas starts blowing out of it making me cough badly. Clint grabs me by the shoulders and gets us out of the room quickly, once we’re out I notice the guy running off with the crown. “Ok, that one’s on me I missed that.” My voice is hoarse from coughing, but I quickly get up and we run after the man.

“He’s trapped. There’s nothing but. Open sea for hundreds of miles.”

“Maybe that’s what he’s hoping for.” Clint gives me a confused look as we corner the guy at the railing of the ship. The man’s voice presses twists his watch which causes his disguise to fall showing he’s actually an Atlantean. He jumps into the water and I look down feeling hopeless. “Great, now we lost him.”

“Au contraire my dear spider, I’ve still got one trick up my sleeve.”

Clint takes my hand and leads me back to the cabin which has now been cleared of the gas. He takes out his duffel bag and opens it up revealing scuba gear. “Look at you planning ahead like a proper spy.” I said with a smile.

“And you called me rusty.”

—————

We’ve been deep diving for about an hour and almost made it to the ocean floor. My webbing is useless underwater so I need to rely on my combat skills, and being underwater it’ll be difficult. “If hydra was selling the crown to Atlantis, that must mean Attuma.” Clint’s right, Attuma was one of the Cabal’s allies.

“I’ll call the team then.” I press a button on my helmet to activate the line to call Tony. “Spider-woman to avengers.”

There’s fighting on the end of Tony’s line as he speaks. “Kinda busy here. Tell me you didn’t lose that crown.”

I hesitate to tell the full truth so I go half way. “It’s still in our sights.” I hang up the phone and continue to swim. The Atlantean continues to swim as he shoots a beam at us. We both dodge easily and Clint uses his mini cross bow on his wrist to shoot at him.

Clint misses as the Atlantean gets away. “He’s a quick fish I’ll give him that.” The Atlantean swims over a cliff and regroups with a group. Me and Clint watch from the top of the cliff to see what they’re doing. The Atlantean talks to a woman and I look to Clint with a confused expression. “That’s Lady Zartra, a high advisor to Attuma.”

Clint starts to swim over there and I follow his lead. Lady Zartra puts on the crown and a giant whale monster swims over to us. “Now we know what the crown does.” I mutter under my breath. The monster takes a deep inhale which causes me and Clint to be sucked towards it. I’m able to grab onto a rock and I start to panic as Clint has nothing to grab onto. I have no time to react as the monster swallows Clint whole. “Clint!” The monster growls and slowly turns to me. I press the button on my helmet to contact the whole team. “Avengers, emergency assemble! We got a man down.” I swim away from the giant whale before it can get to me. I start to panic about what to do, Clint’s gone and I have no idea what to do. All I can do is duck and avoid the giant whale that wont leave me alone. I swim over to Zartra who is struggling to maintain control of the beast, and the Atlantean’s all move away quickly as I lead the beast towards them.

“You must obey my command monster!” Zartra demands still struggling to maintain the hold. I accidentally swam into her knocking the crown off her head. With the crown off the beast collapsed onto the ground, which gives me the chance to go head to head with Zartra. I swing my right leg at her which she catches and pushes me back. I throw a punch and she catches my arm and twists it to pin behind my back. “I’m sure you’re quite the warrior on land, but here you fight like an injured jellyfish.”

I click a button on my wrist which sends an electric shock to Zartra making her let go of me. “You’ll still want to avoid the sting.”

She looks to me but doesn’t attack me. “You’re not Hydra. Who are you?”

I give her a stern look and stand my ground. “You just need to know two things, you took my partner and now I’m taking you down.” I launch at her and swing my leg at her again, she counterattacks by hitting me in my side with her elbow. I land on my back and move just in time before she hits me again.

I keep throwing punches at her but it’s useless since I’m no good at underwater combat. Zartra lands a harsh punch to my chest which sends me back and hit a wall of rocks. She towers over me with a menacing look. “Don’t mourn. You’ll see him soon enough.” Zartra goes and gets the crown on the floor and puts it back on bringing the beast to conscious again. “Giganto to me.”

I don’t have time to react as the beast starts to inhale deeply, and this time there are no rocks for me to hold onto. I know it’s useless but I keep trying to swim away but the inhaling stops. I look up exhausted and see Thor’s hammer returning to him. Hulk appears behind him and the two of them go after the beast. The rest of the team quickly joins and start fighting the Atlantean’s that are firing at them. “My HUD’s still picking up Clint’s life readings.” Tony said as Thor and Hulk continue to fight the beast.

I let out a small sigh of relief to hear Clint’s ok. Thor goes over to hold the beast’s mouth open as Hulk jumps into the beast stomach. The impact is strong enough to make the whale throw up, and I have to look away before I hurl at the mess. An Atlantean starts to attack me but I quickly defeat him as Thor swims over with Clint by his side. “Sorry for the mess.” Clint apologizes to Thor as he’s covered in fish puke. Thor groans and quickly goes to join the battle again. I reach over and start wiping the puke off him as he talks. “I am never eating fish again!”

I give him a stern look. I’m happy he’s back but we can have our reunion later. “Shield gave you the codename Hawkeye because you never miss a target or a clue. Time to live up to that name.”

“Duck!” Clint said as he held up his wrist with the crossbow, he covered my head as he shot at an Atlantean that was about to attack us.

“That’s what I’m talking about.” He nods with a serious expression and we go join the battle. Cap brings over Clint’s bow and arrows and he immediately shoots a regular arrow at Zartra’s head knocking the crown off her.

I swim over to the crown just and just as she’s about to get it I kick her in the face. She lands to the ground with a grunt and I pick up the crown. “You’re the avengers.”

Now she finally sees it. “Yep, and just in time to take you in.” I said in a serious tone.

She quickly stands up and speaks in a worried tone. “Please you must return the control to me. It’s the only way I can defeat our enemy, Attuma.”

“But you’re his chief advisor.” I say in a confused tone.

“I defected. Now I lead a small band of rebels in hopes of freeing our people from his dictatorship.” The team comes over and listens to the conversation, and Clint stands by my side in case this is a trick. “The fall of the cabal should’ve meant peace with the surface world, but Attuma pushes only for war and he’ll destroy both our peoples to get it.”

Clint places a hand on my shoulder and speaks in a gentle tone. “I don’t know if I believe her, but I believe in you. You make the call.”

“Avengers stand down.” Clint takes his hand off my shoulder and I hand the crown to Zartra. Before she can take it back an eel swims over and snatches it from my hands and over to Attuma’s.

“Zartra, I’ve long suspected you couldn’t be trusted.” Attuma yelled from the top of the cliff. “But to side with the avengers you have sunk to a new low.” Attuma takes off his helmet and outs on the crown and the beast from earlier roars. “Giganto attack!”

We all duck before the beast can get to us. Thor and Hulk keep attacking the beast and me, Clint and Zartra fight side by side against Attuma’s army. “This is my fault.” I say as I knock another solider out of my way. “I attacked you first. I should’ve seen it.”

“Hey we all miss stuff. It happens to the best of us.” Clint said as he shot another arrow.

“It only matters that you are with us now.” Zartra says as we both land a punch on different soldiers.

I look over and see Hulk and Thor have been knocked out by the whale and look to Clint. “Thor and Hulk have been knocked out by that thing, you got anything in your quiver for that.”

He smiles and pulls out an arrow I haven’t seen before. “As a matter of fact I do. You ever heard of ultrasonics?” He shoots two arrows to the whales face and causes it to stumble a little. “We can hear these a little, but he can hear them a lot. The whale starts crawling on the ground towards Attuma and he starts to panic. Attuma falls to the ground trying to regain control but the crown fell to the ground as well. Clint shoots a grappling arrow and grabs the crown bringing it towards us. He hands the crown to Zartra who takes control of the beast.

—————

Shield made their way to the ocean and picked up Attuma for his crimes against the surface. We took the crown in as a way to keep it away from any evil. Me and Clint were drying ourselves in the quinjet as the team talked with Fury. “I’m sorry for slacking on this mission.” I look to Clint a little surprised by his apology. “Yeah I know, but it won’t happen again I promise.”

I smile and make my way and stand next to him. “It’s ok. But at least I got to see you in action at the end.” He smiles back and wraps an arm around my shoulders. “By the way you scared the hell out of me when that whale swallowed you.” I scolded him.

“I’m sorry about that too.” I don’t know why I do it and it scares me more than loosing him, but I take his collar and bring him down and press my lips to his softly. Clint kisses me back softly and I feel like I’m on cloud 9. He pulls back after a minute and whispers. “If I knew that was going to get me a kiss I’d get swallowed by whales more often.”

“Shut up you weirdo.”

He chuckles softly and leans in again. “Gladly.” And he kisses me once more.

#clint barton#clint barton x reader#hawkeye x reader#the avengers#clint barton fluff#hawkeye#avengers assemble cartoon#aa clint barton#fluff

8 notes

·

View notes

Text

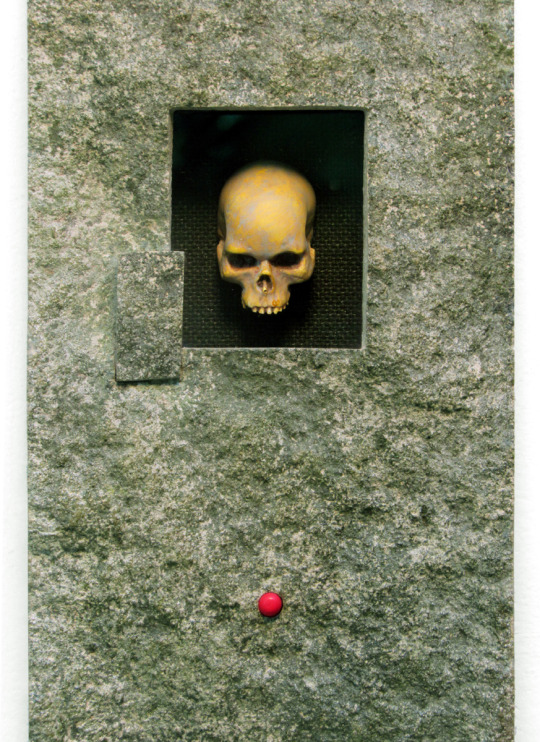

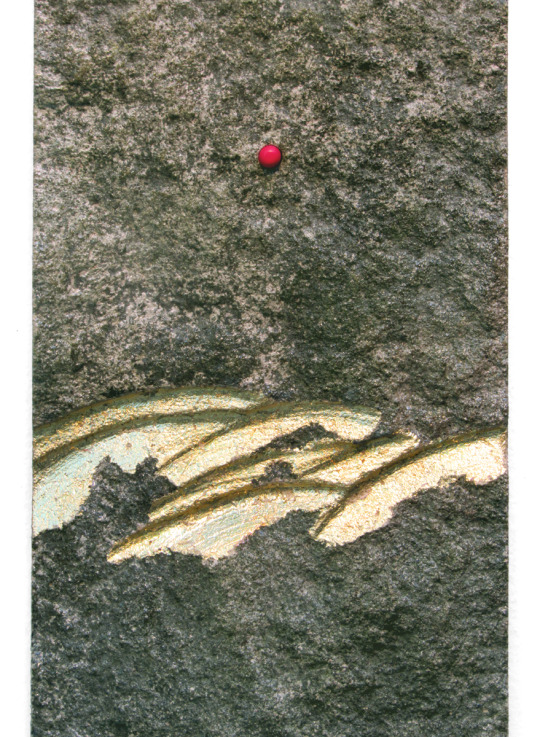

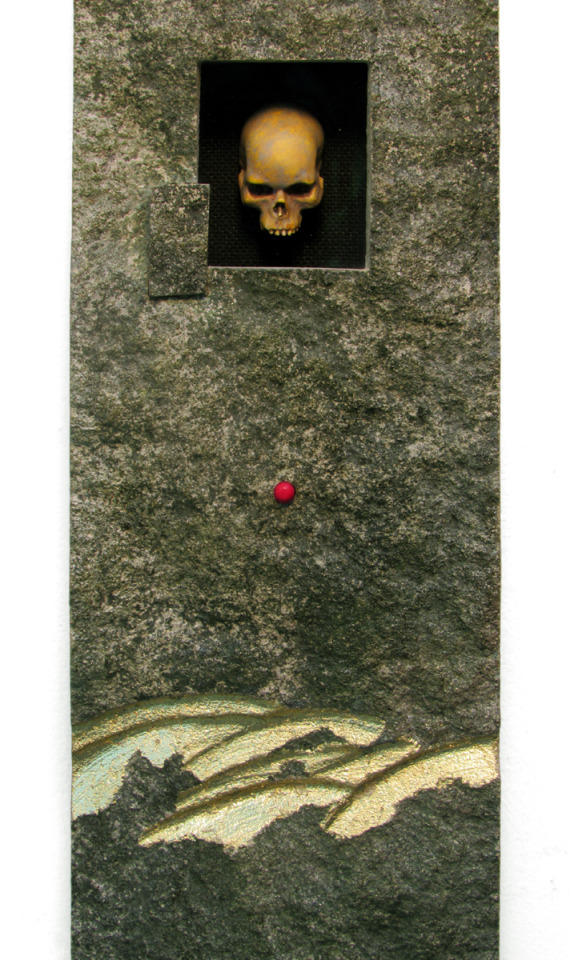

INTIMATIONS OF MORTALITY II

Indiana limestone, clear and colored glass, resin casting, imitation gold leaf, black linen matboard, plywood backer - 15¼"x 4⅝"x 1¾"

The work was originally done for an exhibit exploring what artists did while working during the COVID19 lockdown (POSTCARDS FROM THE WINDOW-2021 see link below). However, that work was stolen from the exhibit. I never had a work stolen from me before — it is a strange feeling knowing that my work so moved someone to the extent that they felt they had to have it while at the same time there is the dis-respect of having something taken away from me so I could never share it again. It was like they had stolen the words from my mouth while at the same time complementing me on my phrasing.

The piece had begun with a little found object token (a key fob in the form of a human skull) which I had separated from the chain and which had sat on my successive desktop computers for perhaps twenty years as a sort-of mascot. During the COVID lockdown I found myself focusing on this memento mori again and again, and finally decided to use it as part of a self-portrait as a survivor (for the time being, anyway).

After the work was stolen I felt like I had to replace it, to repeat the story someone took away from me, re-state my stolen 'words'. I tried to find a replacement skull to no avail — whoever had manufactured the key fobs originally all those years ago were not still marketing them that I could find, so I had to find or make another skull. I carved a skull in ebony but it wasn't right. I found a little plastic skeleton (anatomically correct, partially articulated), but it wasn't quite right either. I molded the skull but cut-off the lower jaw from the casting to make it more like the key-fob skull. Though it still was not perfect I felt this one would work.

So this piece is a re-made version of the stolen work with a slightly larger size skull and naturally different piece of limestone. The skull sans jawbone (i.e. - 'muted') is mounted under glass in a black linen shadowbox cut into the limestone. The naturally cleft surface of the limestone is covered in a natural aged algae patina to echo the age of times past. The fitted blood-red dot of glass and the energetic golden grinder cuts to suggest the idea of 'the quick and the dead'.

There is an exhibit (DAY OF THE DEAD) later this year I'll submit the work to so I can share my 'selfie' again.

see the post of three years ago after the theft:

www.fromthedust.tumblr.com/post/657719920161964033/signage-for-exhibit-postcards-from-the-window

17 notes

·

View notes

Text

CNC development history and processing principles

CNC machine tools are also called Computerized Numerical Control (CNC for short). They are mechatronics products that use digital information to control machine tools. They record the relative position between the tool and the workpiece, the start and stop of the machine tool, the spindle speed change, the workpiece loosening and clamping, the tool selection, the start and stop of the cooling pump and other operations and sequence actions on the control medium with digital codes, and then send the digital information to the CNC device or computer, which will decode and calculate, issue instructions to control the machine tool servo system or other actuators, so that the machine tool can process the required workpiece.

1. The evolution of CNC technology: from mechanical gears to digital codes

The Beginning of Mechanical Control (late 19th century - 1940s)

The prototype of CNC technology can be traced back to the invention of mechanical automatic machine tools in the 19th century. In 1887, the cam-controlled lathe invented by American engineer Herman realized "programmed" processing for the first time by rotating cams to drive tool movement. Although this mechanical programming method is inefficient, it provides a key idea for subsequent CNC technology. During World War II, the surge in demand for military equipment accelerated the innovation of processing technology, but the processing capacity of traditional machine tools for complex parts had reached a bottleneck.

The electronic revolution (1950s-1970s)

After World War II, manufacturing industries mostly relied on manual operations. After workers understood the drawings, they manually operated machine tools to process parts. This way of producing products was costly, inefficient, and the quality was not guaranteed. In 1952, John Parsons' team at the Massachusetts Institute of Technology (MIT) developed the world's first CNC milling machine, which input instructions through punched paper tape, marking the official birth of CNC technology. The core breakthrough of this stage was "digital signals replacing mechanical transmission" - servo motors replaced gears and connecting rods, and code instructions replaced manual adjustments. In the 1960s, the popularity of integrated circuits reduced the size and cost of CNC systems. Japanese companies such as Fanuc launched commercial CNC equipment, and the automotive and aviation industries took the lead in introducing CNC production lines.

Integration of computer technology (1980s-2000s)

With the maturity of microprocessor and graphical interface technology, CNC entered the PC control era. In 1982, Siemens of Germany launched the first microprocessor-based CNC system Sinumerik 800, whose programming efficiency was 100 times higher than that of paper tape. The integration of CAD (computer-aided design) and CAM (computer-aided manufacturing) software allows engineers to directly convert 3D models into machining codes, and the machining accuracy of complex surfaces reaches the micron level. During this period, equipment such as five-axis linkage machining centers came into being, promoting the rapid development of mold manufacturing and medical device industries.

Intelligence and networking (21st century to present)

The Internet of Things and artificial intelligence technologies have given CNC machine tools new vitality. Modern CNC systems use sensors to monitor parameters such as cutting force and temperature in real time, and use machine learning to optimize processing paths. For example, the iSMART Factory solution of Japan's Mazak Company achieves intelligent scheduling of hundreds of machine tools through cloud collaboration. In 2023, the global CNC machine tool market size has exceeded US$80 billion, and China has become the largest manufacturing country with a production share of 31%.

2. CNC machining principles: How code drives steel

The essence of CNC technology is to convert the physical machining process into a control closed loop of digital signals. Its operation logic can be divided into three stages:

Geometric Modeling and Programming

After building a 3D model using CAD software such as UG and SolidWorks, CAM software “deconstructs” the model: automatically calculating parameters such as tool path, feed rate, spindle speed, and generating G code (such as G01 X100 Y200 F500 for linear interpolation to coordinates (100,200) and feed rate 500mm/min). Modern software can even simulate the material removal process and predict machining errors.

Numerical control system analysis and implementation

The "brain" of CNC machine tools - the numerical control system (such as Fanuc 30i, Siemens 840D) converts G codes into electrical pulse signals. Taking a three-axis milling machine as an example, the servo motors of the X/Y/Z axes receive pulse commands and convert rotary motion into linear displacement through ball screws, with a positioning accuracy of up to ±0.002mm. The closed-loop control system uses a grating ruler to feedback position errors in real time, forming a dynamic correction mechanism.

Multi-physics collaborative control

During the machining process, the machine tool needs to coordinate multiple parameters synchronously: the spindle motor drives the tool to rotate at a high speed of 20,000 rpm, the cooling system sprays atomized cutting fluid to reduce the temperature, and the tool changing robot completes the tool change within 0.5 seconds. For example, when machining titanium alloy blades, the system needs to dynamically adjust the cutting depth according to the hardness of the material to avoid tool chipping.

3. The future of CNC technology: cross-dimensional breakthroughs and industrial transformation

Currently, CNC technology is facing three major trends:

Combined: Turning and milling machine tools can complete turning, milling, grinding and other processes on one device, reducing clamping time by 90%;

Additive-subtractive integration: Germany's DMG MORI's LASERTEC series machine tools combine 3D printing and CNC finishing to directly manufacture aerospace engine combustion chambers;

Digital Twin: By using a virtual machine tool to simulate the actual machining process, China's Shenyang Machine Tool's i5 system has increased debugging efficiency by 70%.

From the meshing of mechanical gears to the flow of digital signals, CNC technology has rewritten the underlying logic of the manufacturing industry in 70 years. It is not only an upgrade of machine tools, but also a leap in the ability of humans to transform abstract thinking into physical entities. In the new track of intelligent manufacturing, CNC technology will continue to break through the limits of materials, precision and efficiency, and write a new chapter for industrial civilization.

#prototype machining#cnc machining#precision machining#prototyping#rapid prototyping#machining parts

2 notes

·

View notes

Text

The Silent Revolution: How Digital Transformation Is Changing Business Behind the Scenes

While digital transformation often makes headlines for visible innovations, much of its influence happens quietly within companies—reshaping systems, automating processes, and reengineering the way work gets done. This behind-the-scenes shift is what’s enabling real business performance gains.

What Is Digital Transformation?

Digital transformation refers to how businesses use technology to change operational methods, improve internal systems, and generate better outcomes. It affects everything from data management and customer interactions to logistics and resource allocation.

A professional digital transformation company doesn't just install new tech—it aligns tools with business goals, often starting with process audits and infrastructure analysis.

Technologies Often Involved

Cloud computing for digital transformation

Business process automation

Artificial intelligence for analytics

Internet of Things (IoT) in digital transformation

Cross-platform data integration

These are not surface-level changes. They improve how employees work, how data is accessed, and how resources are distributed—resulting in time savings, fewer errors, and stronger outcomes.

Why Businesses Need Digital Transformation Services

In highly competitive markets, outdated systems can lead to inefficiency and slow growth. Businesses are now choosing digital transformation services to improve speed, reduce overhead, and increase accuracy.

Outcomes companies aim for include:

Smoother workflows

Better use of employee time

More consistent customer experiences

Faster decision-making using real-time data

Consulting firms offer digital innovation consulting to assess the internal structure and recommend improvements tailored to each business model.

Features of Digital Transformation Solutions

The best digital transformation solutions focus on measurable improvements in operations, communication, and performance.

Common Features Include:

Automated Workflow Engines: Replace manual processes with intelligent rules

Real-Time Analytics: Track key business metrics instantly

Cloud Infrastructure: Access systems securely from any device

AI and ML Capabilities: Detect patterns, improve forecasts, and recommend actions

Secure Data Storage: Built-in compliance for data privacy and governance

These features support enterprise digital transformation by increasing system flexibility and operational transparency.

Benefits of Digital Transformation

Companies that invest in high-quality digital transformation consulting often see tangible benefits within months of implementation.

Key Business Gains:

Higher Productivity: Employees spend less time on manual tasks

Improved Decision-Making: Real-time data enables faster, informed choices

Cost Savings: Automation cuts operational expenses

Increased Accuracy: Fewer human errors mean better outcomes

Customer Retention: Personalized service improves satisfaction

Small and medium enterprises can also benefit, with options scaled to meet their specific needs. The cost of digital transformation services for SMEs depends on complexity, but returns on investment are often significant.

Behind-the-Scenes Use Cases (Digital Transformation Case Studies)

1. Logistics Optimization: IoT for Equipment Monitoring

A supply chain firm implemented IoT in digital transformation to track truck performance and reduce delays. By integrating AI-powered route planning, the company cut fuel usage by 18% and delivery delays by 23%.

Digital transformation services

Digital transformation solutions

2. Retail Automation: Cloud and POS Integration

A mid-sized retailer switched to cloud computing for digital transformation to connect online and offline sales. This allowed for real-time inventory tracking and a 40% reduction in stock-outs.

AI and cloud solutions for digital transformation

3. Finance Sector: Risk Analytics

A regional bank used digital transformation consulting to install real-time risk detection tools, minimizing financial fraud cases by 32% over a single quarter.

Digital innovation consulting

How to Choose a Digital Transformation Partner

Selecting the right digital transformation company is critical. The wrong choice can lead to costly rework and wasted time.

What to Look For:

Industry-specific experience

Transparent pricing and timelines

Strong client portfolio

Scalable digital transformation strategy

Post-implementation support

How to choose a digital transformation partner

Search queries like “best digital transformation companies in [your country or city]” help narrow down suitable vendors based on reviews, pricing models, and technology stacks.

Key Tools Used by Digital Transformation Companies

Digital transformation requires more than software—it needs strategy, configuration, and training.

Common Tools Deployed:

Process Automation Platforms (e.g., UiPath, Zapier)

ERP & CRM Systems (e.g., Salesforce, SAP)

Business Analytics Tools (e.g., Power BI, Tableau)

Cloud Infrastructure (AWS, Azure, Google Cloud)

Communication Platforms (e.g., Slack, Microsoft Teams)

These tools are often combined with business process automation to eliminate redundancy and streamline workflow across departments.

Digital Transformation Strategy for Long-Term Growth

A clear digital transformation strategy should outline:

Current system limitations

Department-specific challenges

Integration goals

Expected performance benchmarks

The strategy guides both short-term improvements and long-term innovation cycles, backed by consistent data and feedback.

Cost of Digital Transformation Services for SMEs

For SMEs, the cost often depends on:

Number of systems being upgraded

Complexity of processes

Customization required

Ongoing support and maintenance

Pricing usually ranges from basic SaaS subscriptions to full-service enterprise digital transformation packages. Most providers offer flexible pricing models or phased implementation to help manage budget.

Final Note: Quiet, But Game-Changing

While these changes may not make flashy headlines, they are producing real operational improvements every day. This quiet shift is what’s separating top performers from companies stuck in outdated systems.Get tailored digital transformation services that deliver.The behind-the-scenes nature of digital transformation means many organizations don’t publicize these updates—but the results are measurable, from higher profits to better customer reviews.

#DigitalTransformation#DigitalTransformationServices#BusinessAutomation#EnterpriseTechnology#CloudComputing

1 note

·

View note

Text

Approved price computing scale by OIML certificate wandegeya uganda

ACCURATE WEIGHING SCALES PRICE COMPUTING DOCUMENTS

Price computing machines are an excellent option as Accurate Weighing Scales for both large and small capacity Accurate Weighing Scales. The versatility and accuracy of our products ensures that our diverse customers can find a suitable unit to meet the growing needs of their business. We also offer high quality, reliable scale services and repairs to keep you moving. If you’re looking for a lightweight and portable price-computing retail scale for your shop or restaurant, Accurate Weighing Scales has the answer. We now offer new dual-range price computing scale, ideal for retail weighing and price computing tasks in a variety of commercial settings.

The features of our Price Computing Scales are that they are sleek with a sturdy exterior that brings an aura of elegance to retail counters. With ABS plastic housing, the weight measuring scale is lightweight and durable enough to endure the demands of any retail establishment where pricing is based on weight. A large, stainless steel pan is adequately sized to hold a variety of food and containers used in take-away restaurants. To maintain tidiness, the pan removes easily to allow speedy and thorough cleaning between transactions. This is important, as food retailers must adhere to health and hygiene guidelines. The sealed keypad keeps out dirt and spills encountered during use. Perfect for farmer’s market or roadside produce stands, they work with AC connector or battery, so they can work even where power isn’t accessible. Rubber feet offer dependability on work areas, tables, counter or unsteady surfaces, bringing about steady and exact readings.

Price computing scales are trade approved and can be used for weighing products that are intended to be sold by weight.

Thank you for allowing Accurate Weighing Scales (U) Ltd the privilege to serve you in advance. For inquiries on deliveries contact us Office +256 (0) 705 577 823, +256 (0) 775 259 917 Address: Wandegeya KCCA Market South Wing, 2nd Floor Room SSF 036 Email: [email protected]

#dragon scales#fish scales#health ( height and weight ) scales#kitchen scales#mini palm scales#counter scales#bathroom scales#animal scales#baby scales#waterproof scales

1 note

·

View note

Text

I'm on mobile rn so sources are gonna be tricky but...

Roman concrete has been studied for decades. We're not quite there yet, sure, but we're getting closer.

Our steel is way better than Damascus. That's why there's not been any real effort to replicate it, there's not really a reason to other than aesthetics. Among other things, the cool surface finish you know as its main characteristic makes it way more prone to imperfections, voids, rust, etc. On top of that it's very difficult and costly to create. It was originally used for bladed weapons, and it was very good at the time, but modern steel applications have different needs and Damascus simply doesn't cut it anymore.

The mythology surrounding the Stradivarius violins is interesting. They are certainly excellent instruments, don't get me wrong, but numerous efforts to replicate them have been undertaken over the years, leading to some insight.

To my understanding, a significant part of why Stradivari are regarded as unmatched is basically the placebo effect. Additionally, because these instruments are so expensive, they are only ever played by master musicians, further reinforcing the idea. Again, they are excellent instruments, but modern science can in fact replicate them to a degree where blind studies can't differentiate them.

From what I understand, yes, we have "lost" a good portion of Apollo and Gemini tech, because so much of it was handmade by incredibly skilled craftspeople. You may have seen stories about these people before, the women who were the only ones capable of hand-sewing spacesuits with the precision needed, the weavers who built computer memory like a tapestry, incredible skill that is impossible to find today.

However, that kind of work is largely not needed in modern aerospace applications due to advancing technology. No one is handcrafting components these days because manufacturing has advanced to the point where we don't need to. If you need a better illustration of that, take a look at the Artemis missions. Artemis 1 launched uncrewed in November of 2022 and did a flyby of the moon, serving as a test ahead of the Artemis 2 launch, a crewed flyby, in November of 2024, and later in 2025, the first crewed landing in 50 years. We are still capable of spaceflight, but with no space race to win, funding hasn't been there for a long time now.

Yes, not everything has been getting better in recent history. You only need to take a look at the housing market to see that. But this kind of "return to tradition" idea is not really helpful in my opinion. Hell, you can even get a suitcase that unfolds into compartments, and this one is carry-on size:

There are lessons to be learned from the past. People have been making interesting objects with incredible skill for as long as there have been people, and I am sure manufacturers can take some cues from older products. To that end, I am an advocate for the right to repair movement, hoping to make it possible for users to fix their things when they break. You can learn more here:

#right to repair#long post#history#moon landing#roman concrete#stradivarius#damascus steel#manufacturing#sorry for getting carried away. i think its been too long since I was assigned an essay to write. maybe I should just write one on my own

60K notes

·

View notes

Text

Industrial Machine Vision Sensors Market: Industry Value Chain and Supplier Landscape 2025-2032

MARKET INSIGHTS

The global Industrial Machine Vision Sensors Market size was valued at US$ 1,940 million in 2024 and is projected to reach US$ 3,470 million by 2032, at a CAGR of 8.6% during the forecast period 2025-2032. The U.S. market accounted for 32% of global revenue in 2024, while China's market is expected to grow at a faster CAGR of 10.2% through 2032.

Industrial Machine Vision Sensors are critical components in automated inspection systems that capture and process visual information for quality control, measurement, and robotic guidance. These sensors include both monochrome and multicolor variants, with applications spanning manufacturing automation, aerospace inspection, and logistics. Key technologies encompass CMOS/CCD image sensors, infrared sensors, 3D vision systems, and smart cameras with embedded processing capabilities.

The market growth is driven by increasing automation in manufacturing, stringent quality control requirements, and advancements in AI-powered visual inspection. However, high implementation costs and technical complexity present adoption barriers for SMEs. Major players like Cognex Corporation and Keyence Corp collectively hold over 40% market share, with recent innovations focusing on hyperspectral imaging and edge-computing enabled sensors for real-time analytics.

MARKET DYNAMICS

MARKET DRIVERS

Industry 4.0 Integration Accelerating Adoption of Machine Vision Sensors

The global push towards Industry 4.0 adoption serves as the primary growth catalyst for industrial machine vision sensors. Modern smart factories increasingly incorporate these sensors as fundamental components of automated quality control and robotic guidance systems. Recent data indicates that manufacturers adopting vision-guided robotics experience productivity improvements exceeding 30% in production lines. The convergence of IoT-enabled devices with machine vision creates intelligent inspection networks capable of predictive maintenance, reducing downtime by up to 25%. Automotive manufacturing leads this transition, where vision sensors now handle 90% of surface defect detection tasks previously performed manually.

Technological Advancements in Deep Learning Vision Systems

Breakthroughs in edge computing and convolutional neural networks (CNNs) are revolutionizing industrial vision capabilities. Modern sensors now incorporate onboard AI processors capable of executing complex pattern recognition algorithms with sub-millisecond latency. This advancement enables real-time defect classification with accuracy rates surpassing 99.5% across continuous production environments. Leading manufacturers have recently introduced vision sensors with embedded deep learning that require 80% less programming time compared to traditional rule-based systems. Such innovations are driving replacement cycles in existing facilities while becoming standard in new greenfield manufacturing projects.

Regulatory Compliance Driving Mandated Implementation

Stringent quality control requirements across pharmaceuticals and aerospace sectors are institutionalizing machine vision adoption. Regulatory bodies now mandate 100% automated inspection for critical components in aircraft assembly, with vision sensors ensuring micrometer-level precision. The pharmaceutical packaging sector shows particularly strong growth, where serialization requirements under DSCSA regulations compel manufacturers to implement vision-based tracking systems. Recent enhancements in hyperspectral imaging allow simultaneous verification of product authenticity, label accuracy, and capsule integrity within single inspection cycles.

MARKET RESTRAINTS

High Initial Investment Creating Adoption Barriers

While offering compelling ROI, the substantial capital outlay for industrial vision systems proves prohibitive for many SMEs. Complete vision inspection stations incorporating lighting, lenses, and processing units frequently exceed $50,000 per installation point. For comparison, this represents approximately 200% of the cost for equivalent manual inspection stations. Mid-sized manufacturers cite payback periods of 3-5 years as the primary deterrent, despite long-term operational savings. The situation exacerbates in developing markets where financing options for automation technologies remain limited.

Integration Complexities with Legacy Systems Retrofitting vision sensors into existing production lines presents significant engineering challenges. Older machinery lacks standardized communication protocols, forcing customized interface development that accounts for 30-40% of total implementation costs. Synchronization issues between electromechanical systems and high-speed cameras often require complete production line reprogramming. These technical hurdles frequently delay project timelines by 6-8 months in brownfield facilities.

Skilled Labor Shortage Impacting Deployment The specialized knowledge required for vision system programming and maintenance creates workforce bottlenecks. Current estimates indicate a global shortage exceeding 15,000 qualified vision system integrators. This deficit leads to extended commissioning periods and suboptimal system configurations when inexperienced personnel handle installations. The problem intensifies as advanced features like 3D vision and AI-based inspection require even more specialized expertise.

MARKET CHALLENGES

Standardization Deficits Across Ecosystem Components

The absence of universal protocols for vision system components creates interoperability nightmares. Different manufacturers utilize proprietary algorithms for image processing, forcing plant engineers to maintain multiple software platforms. Recent industry surveys reveal that 68% of plants operating mixed-vendor vision systems experience compatibility issues. These manifest as data silos that prevent centralized quality monitoring and add 20-30% to maintenance overheads.

Environmental Factors Affecting Performance Industrial environments present extreme conditions that challenge vision system reliability. Vibrations from heavy machinery induce image blurring, while particulate contamination degrades optical clarity over time. Temperature swings exceeding 30°C in foundries and welding bays cause focus drift in uncooled cameras. Such conditions force frequent recalibration cycles, with some automotive plants reporting weekly downtime for vision system maintenance.

Data Security Concerns in Connected Systems The integration of vision sensors into Industry 4.0 networks expands potential attack surfaces for cyber threats. Vision systems processing proprietary product designs face particular vulnerability, with an estimated 12% of manufacturers reporting attempted intellectual property theft through compromised inspection systems. Implementing adequate encryption while maintaining real-time processing speeds remains an unresolved technical hurdle for many vendors.

MARKET OPPORTUNITIES

Emerging Applications in Sustainable Manufacturing

Circular economy initiatives create novel applications for vision sensors in material sorting and recycling workflows. Advanced spectral imaging now enables accurate polymer identification in waste streams, achieving 95% purity in recycled plastic sorting. The global push towards battery recycling presents particularly compelling opportunities, where vision systems guide robotic disassembly of EV battery packs while detecting hazardous cell damage.

Service-Based Business Model Innovations

Leading vendors are transitioning from capital sales to Vision-as-a-Service (VaaS) offerings to overcome adoption barriers. These subscription models provide turnkey vision solutions with performance-based pricing, reducing upfront costs by 60-70%. Early adopters report 3X faster deployment cycles through pre-configured vision packages tailored for common inspection scenarios. The model also enables continuous remote optimization through cloud-connected analytics.

Miniaturization Enabling New Form Factors

Recent breakthroughs in compact vision systems unlock applications previously constrained by space limitations. New handheld inspection devices incorporating micro-optic sensors now deliver factory-grade accuracy for field service applications. Similarly, endoscopic vision systems allow internal inspections of complex machinery without disassembly, reducing equipment downtime by 90% in predictive maintenance scenarios. These portable solutions are creating entirely new market segments beyond traditional production line applications.

INDUSTRIAL MACHINE VISION SENSORS MARKET TRENDS

Smart Factory Integration to Drive Industrial Machine Vision Sensor Adoption

The rapid adoption of Industry 4.0 principles across manufacturing sectors is significantly increasing demand for industrial machine vision sensors. Smart factories leveraging these sensors for quality inspection, robotic guidance, and predictive maintenance are achieving productivity gains of 20-30% compared to traditional setups. Vision systems with integrated AI capabilities can now detect micrometer-level defects in real-time, reducing waste while improving throughput. Major automotive manufacturers report defect rate reductions exceeding 40% after implementing advanced vision sensor networks on production lines.

Other Trends

Miniaturization and Higher Resolution Demands

The push for smaller yet more powerful vision sensors continues transforming the market landscape. Manufacturers now offer 4K-resolution sensors in compact form factors below 30mm³, enabling integration into tight production line spaces. This miniaturization wave coincides with resolution requirements doubling every 3-4 years across semiconductor and electronics manufacturing. Emerging applications in microscopic inspection require sensors delivering sub-micron accuracy while maintaining high processing speeds above 300 frames per second.

Expansion into New Industrial Verticals

While automotive and electronics remain primary adopters, machine vision sensors are gaining strong traction in food processing, pharmaceuticals, and logistics sectors. The food industry particularly benefits from hyperspectral imaging advancements, enabling simultaneous quality checks for freshness, composition, and contaminants at speeds exceeding conventional methods by 5-8x. Pharmaceutical companies leverage vision systems with 99.99% accuracy rates for blister pack inspection and serialization compliance. Logistics automation driven by e-commerce growth creates additional demand, with parcel sorting facilities deploying thousands of vision sensors per site.

AI-Powered Defect Recognition Technology Advancements

Deep learning integration represents the most transformative shift in industrial machine vision capabilities. Modern systems utilizing convolutional neural networks (CNNs) achieve defect recognition accuracy improvements from 92% to 99.6% compared to traditional algorithms. These AI-enhanced sensors adapt to product variations without reprogramming, reducing changeover times by 70% in flexible manufacturing environments. Leading semiconductor fabs report 35% fewer false rejects after implementing self-learning vision systems that continuously improve detection models based on new defect patterns.

Supporting Technology Developments

3D Vision System Proliferation

The transition from 2D to 3D machine vision continues accelerating, with time-of-flight and structured light sensors achieving sub-millimeter depth resolution. Automotive weld inspection, robotic bin picking, and dimensional metrology applications drive 35% annual growth in 3D vision adoption. Recent innovations enable high-speed 3D scanning at rates exceeding 10 million points per second while maintaining micron-level precision required for precision engineering applications.

COMPETITIVE LANDSCAPE

Key Industry Players

Innovation and Strategic Expansion Drive Market Leadership in Industrial Machine Vision

The global industrial machine vision sensors market is characterized by intense competition among established players and emerging innovators. Cognex Corporation and Keyence Corporation currently dominate the market, collectively holding over 30% revenue share in 2024. Their leadership stems from comprehensive product portfolios spanning 2D/3D vision systems, smart cameras, and deep learning solutions that cater to diverse industrial applications.

Teledyne DALSA and Omron Corporation have strengthened their positions through strategic acquisitions and technological partnerships. The former's recent integration of AI-powered defect detection algorithms and the latter's expansion of high-speed inspection systems demonstrate how technological differentiation creates competitive advantages in this rapidly evolving sector.

Mid-sized specialists like Baumer Holding AG and ISRA VISION are gaining traction by focusing on niche applications. Baumer's customized solutions for harsh industrial environments and ISRA's surface inspection systems for automotive manufacturing illustrate how targeted innovation enables smaller players to compete effectively against industry giants.

Market dynamics show increasing competition from regional players in Asia-Pacific, particularly Chinese manufacturers leveraging cost advantages. However, established Western companies maintain technological leadership through continued R&D investment, with the top five players collectively allocating over 15% of revenues to development activities.

List of Key Industrial Machine Vision Sensor Companies Profiled

Cognex Corporation (U.S.)

Keyence Corporation (Japan)

Teledyne DALSA (Canada)

Omron Corporation (Japan)

Baumer Holding AG (Switzerland)

ISRA VISION (Germany)

Honeywell International Inc. (U.S.)

Rockwell Automation (U.S.)

SICK AG (Germany)

IFM Electronic GmbH (Germany)

Micro-Epsilon (Germany)

Edmund Optics (U.S.)

wenglor sensoric LLC (Germany)

Baluff Inc. (Germany)

Daihen Corporation (Japan)

Segment Analysis:

By Type

Monochrome Sensors Lead the Market Driven by High-Precision Industrial Applications

The market is segmented based on type into:

Monochrome

Multicolor

By Application

Automation Industry Dominates Due to Increasing Demand for Quality Inspection and Robotics Integration

The market is segmented based on application into:

Automation industry

Aviation industry

Others

By Technology

Smart Sensors Gain Traction with Advancements in AI and IoT Integration

The market is segmented based on technology into:

CCD Sensors

CMOS Sensors

Smart Sensors

By End-User Industry

Manufacturing Sector Shows Strong Adoption for Process Automation and Defect Detection

The market is segmented based on end-user industry into:

Automotive

Electronics

Pharmaceuticals

Food and Beverage

Others

Regional Analysis: Industrial Machine Vision Sensors Market

North America The North American market for Industrial Machine Vision Sensors is characterized by high adoption rates in automation-heavy industries like automotive, aerospace, and electronics manufacturing. The presence of major players such as Cognex Corporation and Teledyne Dalsa, combined with continuous advancements in AI-driven vision systems, drives market growth. Strict quality control regulations in sectors like pharmaceuticals and food packaging further fuel demand for precision sensors. While the U.S. dominates due to substantial industrial automation investments, Canada is catching up through initiatives like the Strategic Innovation Fund supporting smart manufacturing. Challenges include the high cost of deployment and need for skilled technicians to operate advanced vision systems.

Europe Europe maintains a strong position in the Industrial Machine Vision Sensors market owing to strict manufacturing standards and Industry 4.0 adoption across Germany, Franceand Italy. German automotive manufacturers lead in implementing vision-guided robotics for assembly line quality inspections. The EU's focus on reshoring production has increased investments in automation equipment, benefiting sensor suppliers. Countries with robust electronics sectors (e.g., Netherlands, Switzerland) show particular demand for high-speed vision components. However, market growth faces headwinds from cautious capital expenditure in traditional industries and complex CE certification processes. Recent developments include growing interest in hyperspectral imaging sensors for recycling/waste management applications.

Asia-Pacific As the fastest-growing regional market, Asia-Pacific benefits from expanding manufacturing bases in China, Japan, and South Korea. China's leadership stems from massive electronics production where vision sensors enable micrometer-level component inspections. Japanese manufacturers prioritize compact, high-speed sensors for robotics integration, while India emerges as a growth hotspot due to pharmaceutical and automotive sector expansion. Southeast Asian countries witness increasing adoption as labor costs rise, compelling manufacturers to automate quality checks. Though dominated by monochrome sensors for cost efficiency, demand for multicolor solutions rises for food grading applications. Supply chain localization trends prompt international players to establish regional production facilities.

South America While South America represents a smaller market share, Brazil and Argentina show steady Industrial Machine Vision Sensors adoption in automotive and agro-processing industries. Economic volatility leads manufacturers to favor basic inspection systems over premium solutions. Brazilian food exporters increasingly implement vision sensors to meet international packaging standards, whereas Andean mineral processors use them for ore sorting. The lack of local sensor producers creates opportunities for European and North American suppliers, though import duties and currency fluctuations remain barriers. Recent trade agreements may facilitate easier technology transfers, particularly for Chilean and Peruvian mining operations upgrading their automation infrastructure.

Middle East & Africa This emerging market demonstrates niche opportunities driven by oil/gas pipeline inspections and pharmaceutical manufacturing in GCC countries. Vision sensors gain traction in Israeli high-tech electronics production and South African automotive plants. Infrastructure constraints limit widespread adoption, but smart city initiatives in UAE and Saudi Arabia foster demand for traffic/video analytics sensors. The region benefits from technology transfer through joint ventures with Asian manufacturers, though the market remains price-sensitive. Long-term growth potential exists as industrialization accelerates across North Africa and activation clauses in Vision 2030 programs trigger automation investments across Arabian Peninsula manufacturing zones.

Report Scope

This market research report provides a comprehensive analysis of the Global and Regional Industrial Machine Vision Sensors markets, covering the forecast period 2025–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The global market was valued at USD 2.1 billion in 2024 and is projected to reach USD 3.8 billion by 2032, growing at a CAGR of 7.6%.

Segmentation Analysis: Detailed breakdown by product type (monochrome vs multicolor), technology (2D vs 3D vision systems), application (automation, aviation, others), and end-user industries to identify high-growth segments.

Regional Outlook: Insights into market performance across North America (32% market share), Europe (25%), Asia-Pacific (38%), Latin America (3%), and Middle East & Africa (2%), including country-level analysis of key markets.

Competitive Landscape: Profiles of 25+ leading market participants including Cognex Corporation, Keyence Corp, Teledyne Dalsa, and Omron Automation, covering their product portfolios, market shares (top 5 players hold 45% share), and strategic developments.

Technology Trends & Innovation: Assessment of AI-powered vision systems, hyperspectral imaging, embedded vision solutions, and Industry 4.0 integration trends transforming the market.

Market Drivers & Restraints: Evaluation of factors including automation demand (65% of manufacturing firms investing in vision systems), quality inspection requirements, and challenges like high implementation costs.

Stakeholder Analysis: Strategic insights for sensor manufacturers, system integrators, industrial automation providers, and investors regarding emerging opportunities in smart factories.

Primary and secondary research methods are employed, including interviews with industry experts, analysis of 120+ company reports, and data from verified market intelligence platforms to ensure accuracy.

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global Industrial Machine Vision Sensors Market?

-> Industrial Machine Vision Sensors Market size was valued at US$ 1,940 million in 2024 and is projected to reach US$ 3,470 million by 2032, at a CAGR of 8.6% during the forecast period 2025-2032.

Which key companies operate in this market?

-> Key players include Cognex Corporation, Keyence Corp, Teledyne Dalsa, Omron Automation, Honeywell International, and Rockwell Automation, among others.

What are the key growth drivers?

-> Growth is driven by Industry 4.0 adoption (45% CAGR in smart factory applications), rising automation in manufacturing, and stringent quality control requirements across industries.

Which region dominates the market?

-> Asia-Pacific leads with 38% market share due to manufacturing growth in China and Japan, while North America remains strong in technological innovation.

What are the emerging trends?

-> Emerging trends include AI-powered defect detection, hyperspectral imaging for material analysis, and compact embedded vision solutions for mobile applications.

Related Reports:https://semiconductorblogs21.blogspot.com/2025/06/automotive-magnetic-sensor-ics-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/ellipsometry-market-supply-chain.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/online-moisture-sensor-market-end-user.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/computer-screen-market-forecasting.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/high-power-gate-drive-interface.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/strobe-overdrive-digital-controller.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/picmg-half-size-single-board-computer.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/automotive-isolated-amplifier-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/satellite-messenger-market-regional.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/sic-epi-wafer-market-innovations.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/heavy-duty-resistor-market-key-players.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/robotic-collision-sensor-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/gas-purity-analyzer-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/x-ray-high-voltage-power-supply-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/reflection-probe-market-industry-trends.html

0 notes

Text

Geosteering Drilling Technology Market Size, Key Players, Restraints & Trends 2032

Global Geosteering Drilling Technology Market Overview The global geosteering drilling technology market is currently witnessing substantial growth driven by increasing exploration activities in unconventional oil and gas reservoirs. As of 2025, the market valuation is estimated to be around USD 2.5 billion, with a projected Compound Annual Growth Rate (CAGR) of approximately 8-10% over the next 5 to 10 years. The rising demand for enhanced reservoir characterization, optimization of well placement, and improved hydrocarbon recovery are key factors fueling market expansion. Advancements in directional drilling combined with real-time data analytics and downhole sensor integration have significantly improved drilling accuracy and operational efficiency. These technological innovations are reshaping the geosteering drilling landscape by enabling operators to make dynamic adjustments during drilling, thus minimizing non-productive time (NPT) and reducing overall project costs. Furthermore, increasing investment in deepwater and shale reservoirs exploration contributes to escalating adoption rates of geosteering technologies globally. Global Geosteering Drilling Technology Market Dynamics Drivers: The primary drivers include the growing focus on maximizing reservoir contact and the need for precise wellbore placement in complex geological formations. Enhanced drilling safety and environmental compliance through advanced monitoring tools are also significant growth catalysts. Restraints: High capital expenditure associated with sophisticated geosteering equipment and skilled workforce requirements pose challenges. Additionally, operational risks related to data integration and interpretation complexities can impede market growth. Opportunities: The surge in offshore drilling activities, digital transformation with AI and machine learning integration, and increasing collaborations between drilling service providers and technology firms present substantial growth opportunities. Furthermore, stringent environmental regulations emphasizing sustainable drilling practices drive innovation towards eco-friendly geosteering solutions. Regulatory frameworks are increasingly emphasizing safety standards and environmental sustainability, compelling the industry to adopt cutting-edge technology solutions. Compliance with these regulations promotes the use of precise, low-impact drilling technologies, which further supports the geosteering market's expansion. Sustainability initiatives, such as reducing methane emissions and minimizing surface footprint, also influence the strategic direction of geosteering technology development. Download Full PDF Sample Copy of Global Geosteering Drilling Technology Market Report @ https://www.verifiedmarketresearch.com/download-sample?rid=442619&utm_source=PR-News&utm_medium=353 Global Geosteering Drilling Technology Market Trends and Innovations The industry is witnessing rapid innovation with the introduction of automated geosteering systems leveraging artificial intelligence (AI) and machine learning (ML) algorithms for enhanced decision-making during drilling operations. Real-time data acquisition through advanced Measurement While Drilling (MWD) and Logging While Drilling (LWD) tools is revolutionizing reservoir navigation. Collaborative ventures between oilfield service companies, software developers, and hardware manufacturers are driving integrated solutions that combine geosteering with predictive analytics and cloud computing platforms. Moreover, the development of smaller, cost-effective downhole sensors and wireless communication technologies improves data accuracy and operational flexibility. Emerging trends include the use of augmented reality (AR) and virtual reality (VR) for immersive drilling simulations and operator training, alongside the deployment of autonomous drilling rigs that rely heavily on precise geosteering inputs. These innovations collectively contribute to lowering operational risks and optimizing resource extraction.

Global Geosteering Drilling Technology Market Challenges and Solutions The market faces several challenges such as supply chain disruptions affecting the availability of critical components, pricing pressures due to fluctuating oil prices, and stringent regulatory barriers that delay technology deployment. Additionally, the complexity of integrating multiple data sources into a coherent geosteering strategy can hinder operational efficiency. To address these obstacles, companies are investing in robust supply chain management practices, diversifying supplier bases, and adopting modular technology platforms that allow scalable deployment. Emphasis on workforce training and skill development ensures effective utilization of advanced geosteering systems. Regulatory compliance can be streamlined by proactive engagement with policymakers and adopting best practices in environmental and safety standards. Global Geosteering Drilling Technology Market Future Outlook The future outlook for the global geosteering drilling technology market remains highly optimistic. Continuous technological advancements, rising demand for unconventional resources, and growing environmental consciousness will collectively drive market growth. The integration of digital twin technologies, AI-powered predictive maintenance, and enhanced cloud-based data analytics are expected to redefine operational paradigms. Increased exploration in untapped regions and deepwater fields, along with the transition toward more sustainable and efficient drilling methods, will further bolster adoption. Strategic partnerships and mergers in the oilfield technology sector will facilitate accelerated innovation and market penetration. Overall, the market is poised for sustained expansion with a focus on precision, automation, and sustainability shaping its evolution over the coming decade. Key Players in the Global Geosteering Drilling Technology Market Global Geosteering Drilling Technology Market are renowned for their innovative approach, blending advanced technology with traditional expertise. Major players focus on high-quality production standards, often emphasizing sustainability and energy efficiency. These companies dominate both domestic and international markets through continuous product development, strategic partnerships, and cutting-edge research. Leading manufacturers prioritize consumer demands and evolving trends, ensuring compliance with regulatory standards. Their competitive edge is often maintained through robust R&D investments and a strong focus on exporting premium products globally. Halliburton Company Schlumberger Limited Baker Hughes Company Weatherford International plc National Oilwell Varco Gyrodata Incorporated Exlog GeoSteering Technologies Cougar Drilling Solutions Emerson Paradigm Holding LLC. Get Discount On The Purchase Of This Report @ https://www.verifiedmarketresearch.com/ask-for-discount?rid=442619&utm_source=PR-News&utm_medium=353 Global Geosteering Drilling Technology Market Segments Analysis and Regional Economic Significance The Global Geosteering Drilling Technology Market is segmented based on key parameters such as product type, application, end-user, and geography. Product segmentation highlights diverse offerings catering to specific industry needs, while application-based segmentation emphasizes varied usage across sectors. End-user segmentation identifies target industries driving demand, including healthcare, manufacturing, and consumer goods. These segments collectively offer valuable insights into market dynamics, enabling businesses to tailor strategies, enhance market positioning, and capitalize on emerging opportunities. The Global Geosteering Drilling Technology Market showcases significant regional diversity, with key markets spread across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Each region contributes uniquely, driven by factors such as technological advancements, resource availability, regulatory frameworks, and consumer demand.

By Component By Application By Technology• y Geosteering Drilling Technology Market By Geography • North America• Europe• Asia Pacific• Latin America• Middle East and Africa For More Information or Query, Visit @ https://www.verifiedmarketresearch.com/product/geosteering-drilling-technology-market/ About Us: Verified Market Research Verified Market Research is a leading Global Research and Consulting firm servicing over 5000+ global clients. We provide advanced analytical research solutions while offering information-enriched research studies. We also offer insights into strategic and growth analyses and data necessary to achieve corporate goals and critical revenue decisions. Our 250 Analysts and SMEs offer a high level of expertise in data collection and governance using industrial techniques to collect and analyze data on more than 25,000 high-impact and niche markets. Our analysts are trained to combine modern data collection techniques, superior research methodology, expertise, and years of collective experience to produce informative and accurate research. Contact us: Mr. Edwyne Fernandes US: +1 (650)-781-4080 US Toll-Free: +1 (800)-782-1768 Website: https://www.verifiedmarketresearch.com/ Top Trending Reports https://www.verifiedmarketresearch.com/ko/product/trailer-equipment-market/ https://www.verifiedmarketresearch.com/ko/product/train-seat-materials-market/ https://www.verifiedmarketresearch.com/ko/product/training-dancewear-market/ https://www.verifiedmarketresearch.com/ko/product/transportation-battery-market/ https://www.verifiedmarketresearch.com/ko/product/transvaginal-endoscopy-market/

0 notes

Text

Laser Ablation Surface Cleaning Equipment Market : Size, Trends, and Growth Analysis 2032

In modern manufacturing and conservation industries, precision, efficiency, and sustainability are no longer optional—they are imperative. This shift has driven the increasing adoption of laser-based cleaning solutions. At the forefront is the Laser Ablation Surface Cleaning Equipment Market, which offers a cutting-edge alternative to traditional surface cleaning techniques.

Laser ablation is a high-precision, non-contact process that removes unwanted layers—such as paint, rust, grease, oxides, and other contaminants—from various surfaces using a concentrated beam of light. Unlike chemical or abrasive cleaning methods, laser ablation avoids surface damage, produces minimal waste, and significantly reduces environmental and worker health hazards.

Market Overview

The Laser Ablation Surface Cleaning Equipment Market was valued at USD 667 million in 2024, and is forecast to grow at a CAGR of 6.5% from 2025 to 2032. This growth is largely fueled by expanding demand across sectors such as aerospace, automotive, electronics, nuclear power, shipbuilding, and even cultural heritage restoration. The push for eco-friendly and sustainable industrial processes has positioned laser ablation as a superior solution to outdated cleaning practices involving sandblasting, dry ice, or harsh solvents.

The technology's ability to offer selective material removal, automation compatibility, and low maintenance requirements makes it attractive to both manufacturers and service providers.

Market Drivers

1. Environmental Regulations and Industrial Sustainability Goals

Stringent regulations across North America, Europe, and parts of Asia regarding hazardous emissions and industrial waste disposal are forcing industries to reconsider legacy cleaning systems. Traditional methods that use chemicals, abrasives, or dry ice create secondary waste and introduce risks related to toxic exposure, surface degradation, and waste disposal.

Laser ablation, by contrast, is a dry process that leaves minimal residue, requires no chemicals, and typically needs only a ventilation system to handle vaporized particles. This makes it a preferred option for companies aiming to reduce their carbon footprint and comply with sustainability standards.

2. Growth in High-Precision Manufacturing

Industries like aerospace, defense, microelectronics, and medical device manufacturing require extremely high levels of surface cleanliness without compromising structural integrity. Laser ablation systems can remove microscopic contaminants, oxides, or coatings without altering base materials, making them ideal for cleaning sensitive components such as turbine blades, circuit boards, or surgical tools.

The rise of electric vehicles (EVs) and miniaturized electronics further demands precise cleaning techniques to prepare surfaces for welding, bonding, or coating—tasks where laser systems excel.

3. Increasing Automation and Industry 4.0 Integration

Modern manufacturing facilities are shifting toward fully automated production lines supported by robotics and smart control systems. Laser cleaning equipment is easily integrated into these setups due to its compatibility with robotic arms, CNC systems, and real-time sensors.

Advanced systems now feature computer-controlled parameters, remote operation, and AI-based algorithms that allow for adaptive cleaning—ensuring optimal performance on irregular or complex surfaces.

4. Cost Efficiency and Long-Term ROI

Though the upfront investment in laser ablation systems can be significant, the long-term cost benefits are compelling. With minimal consumables, reduced maintenance, and no recurring chemical or abrasive media costs, these systems offer substantial savings over time. Moreover, the elimination of secondary waste treatment further reduces operational costs.