#Synthetic Data Generation Market Demand

Explore tagged Tumblr posts

Text

Synthetic Data Generation Market Production Value, Gross Margin Analysis

Global synthetic data generation market will grow from $0.3 billion in 2023 to $2.1 billion by 2028, with a growth rate of 45.7% per year during this period.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=176419553&utm_source=tumblr.com&utm_medium=referral+&utm_campaign=chatbotmarket

Uses of Synthetic Data:

The synthetic data generation market is used in various areas, such as AI/ML training, data anonymization, test data management, data sharing, and analytics. Major industries using synthetic data include Banking, Financial Services, and Insurance (BFSI), Healthcare, Retail, Automotive, Government, IT, Energy, Manufacturing, and more.

Why Synthetic Data is Important:

Stricter data privacy rules and security concerns make it harder to use real-world data. Synthetic data provides a safe alternative by allowing organizations to generate data without risking sensitive information. This helps businesses make data-driven decisions while complying with privacy regulations.

BFSI Sector to Lead the Market:

The BFSI (Banking, Financial Services, and Insurance) sector is expected to be the largest user of synthetic data. This sector needs synthetic data to meet privacy rules and improve risk management, fraud detection, and customer analytics. Synthetic data allows BFSI organizations to create realistic datasets without compromising sensitive information, helping them comply with regulations.

Image and Video Data Segment to Dominate:

Synthetic data for image and video involves creating artificial visual content that mimics real-world scenarios. This is crucial for training AI models in areas like computer vision, object detection, and video analysis. Synthetic image and video data are used in developing algorithms for autonomous vehicles, surveillance, medical imaging, and virtual reality. This segment is expected to have the highest market share during the forecast period.

Asia Pacific Region to Experience Fastest Growth:

The synthetic data generation market in Asia Pacific is growing rapidly due to digital transformation, stricter data privacy regulations, and the increasing use of AI and ML technologies. The region’s focus on digitalization and the need for data-driven solutions will drive continued growth and new opportunities in this market.

Key Players in the Market:

Major companies in the synthetic data generation market include Microsoft, Google, IBM, AWS, NVIDIA, OpenAI, Informatica, Broadcom, Sogeti, Mphasis, Databricks, MOSTLY AI, Tonic, MDClone, TCS, Hazy, Synthesia, Synthesized, Facteus, Anyverse, Neurolabs, Rendered.ai, Gretel, OneView, GenRocket, YData, CVEDIA, Syntheticus, AnyLogic, Bifrost AI, and Anonos. These companies are based in various countries, including the US, UK, India, Israel, Austria, Spain, Scotland, and Switzerland.

About MarketsandMarkets™

MarketsandMarkets™ has been recognized as one of America's best management consulting firms by Forbes, as per their recent report.

MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients.

Earlier this year, we made a formal transformation into one of America's best management consulting firms as per a survey conducted by Forbes.

The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing.

Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry.

To find out more, visit www.MarketsandMarkets™.com or follow us on Twitter, LinkedIn and Facebook.

Contact: Mr. Rohan Salgarkar MarketsandMarkets™ INC. 630 Dundee Road Suite 430 Northbrook, IL 60062 USA: +1-888-600-6441 Email: [email protected] Visit Our Website: https://www.marketsandmarkets.com/

#Synthetic Data Generation Market#Synthetic Data Generation Market size#Synthetic Data Generation Market share#Synthetic Data Generation Market trends#Synthetic Data Generation Market demand#Synthetic Data Generation Market overview#Synthetic Data Generation Market New Research Report#Synthetic Data Generation#Synthetic Data Generation Industry

0 notes

Text

In 2023, the fast-fashion giant Shein was everywhere. Crisscrossing the globe, airplanes ferried small packages of its ultra-cheap clothing from thousands of suppliers to tens of millions of customer mailboxes in 150 countries. Influencers’ “#sheinhaul” videos advertised the company’s trendy styles on social media, garnering billions of views.

At every step, data was created, collected, and analyzed. To manage all this information, the fast fashion industry has begun embracing emerging AI technologies. Shein uses proprietary machine-learning applications — essentially, pattern-identification algorithms — to measure customer preferences in real time and predict demand, which it then services with an ultra-fast supply chain.

As AI makes the business of churning out affordable, on-trend clothing faster than ever, Shein is among the brands under increasing pressure to become more sustainable, too. The company has pledged to reduce its carbon dioxide emissions by 25 percent by 2030 and achieve net-zero emissions no later than 2050.

But climate advocates and researchers say the company’s lightning-fast manufacturing practices and online-only business model are inherently emissions-heavy — and that the use of AI software to catalyze these operations could be cranking up its emissions. Those concerns were amplified by Shein’s third annual sustainability report, released late last month, which showed the company nearly doubled its carbon dioxide emissions between 2022 and 2023.

“AI enables fast fashion to become the ultra-fast fashion industry, Shein and Temu being the fore-leaders of this,” said Sage Lenier, the executive director of Sustainable and Just Future, a climate nonprofit. “They quite literally could not exist without AI.” (Temu is a rapidly rising ecommerce titan, with a marketplace of goods that rival Shein’s in variety, price, and sales.)

In the 12 years since Shein was founded, it has become known for its uniquely prolific manufacturing, which reportedly generated over $30 billion of revenue for the company in 2023. Although estimates vary, a new Shein design may take as little as 10 days to become a garment, and up to 10,000 items are added to the site each day. The company reportedly offers as many as 600,000 items for sale at any given time with an average price tag of roughly $10. (Shein declined to confirm or deny these reported numbers.) One market analysis found that 44 percent of Gen Zers in the United States buy at least one item from Shein every month.

That scale translates into massive environmental impacts. According to the company’s sustainability report, Shein emitted 16.7 million total metric tons of carbon dioxide in 2023 — more than what four coal power plants spew out in a year. The company has also come under fire for textile waste, high levels of microplastic pollution, and exploitative labor practices. According to the report, polyester — a synthetic textile known for shedding microplastics into the environment — makes up 76 percent of its total fabrics, and only 6 percent of that polyester is recycled.

And a recent investigation found that factory workers at Shein suppliers regularly work 75-hour weeks, over a year after the company pledged to improve working conditions within its supply chain. Although Shein’s sustainability report indicates that labor conditions are improving, it also shows that in third-party audits of over 3,000 suppliers and subcontractors, 71 percent received a score of C or lower on the company’s grade scale of A to E — mediocre at best.

Machine learning plays an important role in Shein’s business model. Although Peter Pernot-Day, Shein’s head of global strategy and corporate affairs, told Business Insider last August that AI was not central to its operations, he indicated otherwise during a presentation at a retail conference at the beginning of this year.

“We are using machine-learning technologies to accurately predict demand in a way that we think is cutting edge,” he said. Pernot-Day told the audience that all of Shein’s 5,400 suppliers have access to an AI software platform that gives them updates on customer preferences, and they change what they’re producing to match it in real time.

“This means we can produce very few copies of each garment,” he said. “It means we waste very little and have very little inventory waste.” On average, the company says it stocks between 100 to 200 copies of each item — a stark contrast with more conventional fast-fashion brands, which typically produce thousands of each item per season, and try to anticipate trends months in advance. Shein calls its model “on-demand,” while a technology analyst who spoke to Vox in 2021 called it “real-time” retail.

At the conference, Pernot-Day also indicated that the technology helps the company pick up on “micro trends�� that customers want to wear. “We can detect that, and we can act on that in a way that I think we’ve really pioneered,” he said. A designer who filed a recent class action lawsuit in a New York District Court alleges that the company’s AI market analysis tools are used in an “industrial-scale scheme of systematic, digital copyright infringement of the work of small designers and artists,” that scrapes designs off the internet and sends them directly to factories for production.

In an emailed statement to Grist, a Shein spokesperson reiterated Peter Pernot-Day’s assertion that technology allows the company to reduce waste and increase efficiency and suggested that the company’s increased emissions in 2023 were attributable to booming business. “We do not see growth as antithetical to sustainability,” the spokesperson said.

An analysis of Shein’s sustainability report by the Business of Fashion, a trade publication, found that last year, the company’s emissions rose at almost double the rate of its revenue — making Shein the highest-emitting company in the fashion industry. By comparison, Zara’s emissions rose half as much as its revenue. For other industry titans, such as H&M and Nike, sales grew while emissions fell from the year before.

Shein’s emissions are especially high because of its reliance on air shipping, said Sheng Lu, a professor of fashion and apparel studies at the University of Delaware. “AI has wide applications in the fashion industry. It’s not necessarily that AI is bad,” Lu said. “The problem is the essence of Shein’s particular business model.”

Other major brands ship items overseas in bulk, prefer ocean shipping for its lower cost, and have suppliers and warehouses in a large number of countries, which cuts down on the distances that items need to travel to consumers.

According to the company’s sustainability report, 38 percent of Shein’s climate footprint comes from transportation between its facilities and to customers, and another 61 percent come from other parts of its supply chain. Although the company is based in Singapore and has suppliers in a handful of countries, the majority of its garments are produced in China and are mailed out by air in individually addressed packages to customers. In July, the company sent about 900,000 of these to the US every day.

Shein’s spokesperson told Grist that the company is developing a decarbonization road map to address the footprint of its supply chain. Recently, the company has increased the amount of inventory it stores in US warehouses, allowing it to offer American customers quicker delivery times, and increased its use of cargo ships, which are more carbon-efficient than cargo planes.

“Controlling the carbon emissions in the fashion industry is a really complex process,” Lu said, adding that many brands use AI to make their operations more efficient. “It really depends on how you use AI.”

There is research that indicates using certain AI technologies could help companies become more sustainable. “It’s the missing piece,” said Shahriar Akter, an associate dean of business and law at the University of Wollongong in Australia. In May, Akter and his colleagues published a study finding that when fast-fashion suppliers used AI data management software to comply with big brands’ sustainability goals, those companies were more profitable and emitted less. A key use of this technology, Atker says, is to closely monitor environmental impacts, such as pollution and emissions. “This kind of tracking was not available before AI-based tools,” he said.

Shein told Grist it does not use machine-learning data management software to track emissions, which is one of the uses of AI included in Akter’s study. But the company’s much-touted usage of machine-learning software to predict demand and reduce waste is another of the uses of AI included in the research.

Regardless, the company has a long way to go before meeting its goals. Grist calculated that the emissions Shein reportedly saved in 2023 — with measures such as providing its suppliers with solar panels and opting for ocean shipping — amounted to about 3 percent of the company’s total carbon emissions for the year.

Lenier, from Sustainable and Just Future, believes there is no ethical use of AI in the fast-fashion industry. She said that the largely unregulated technology allows brands to intensify their harmful impacts on workers and the environment. “The folks who work in fast-fashion factories are now under an incredible amount of pressure to turn out even more, even faster,” she said.

Lenier and Lu both believe that the key to a more sustainable fashion industry is convincing customers to buy less. Lu said if companies use AI to boost their sales without changing their unsustainable practices, their climate footprints will also grow accordingly. “It’s the overall effect of being able to offer more market-popular items and encourage consumers to purchase more than in the past,” he said. “Of course, the overall carbon impact will be higher.”

11 notes

·

View notes

Text

Sodium Methoxide Market Size, Share, Development by 2033

According to Fact.MR's latest study, the global sodium methoxide market reached US$ 217.3 million in 2023. Over the period from 2023 to 2033, demand for sodium methoxide catalysts worldwide is expected to grow at a compound annual growth rate (CAGR) of 2.4%, reaching US$ 276 million by 2033.

The global market is anticipated to expand significantly, driven by increasing investments in various sectors such as pharmaceuticals and agrochemicals. Key industry players are also expected to boost their research and development efforts to enhance production capacities and innovate manufacturing processes, thereby creating lucrative opportunities.

Get Free Sample Copy of This Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=2800

The expanding applications of sodium methoxide across industries such as agriculture, pharmaceuticals, and agrochemicals are expected to create significant opportunities for suppliers. Additionally, its role as a catalyst in synthetic detergents, grease, and edible oil processing is poised to further bolster market growth globally.

Key Takeaways from Market Study

In 2022, global demand for sodium methoxide reached US$ 212.2 million.

By 2023, the global sodium methoxide market is estimated to be valued at US$ 217.3 million, with projections indicating it will reach US$ 276 million by the end of 2033.

From 2023 to 2033, worldwide sales of sodium methoxide are expected to grow at a CAGR of 2.4%.

By the conclusion of 2033, Asia Pacific is anticipated to hold a 38.1% share of the global market.

Demand for sodium methoxide in pharmaceutical applications is forecasted to increase at a 2.5% CAGR through 2033.

“Growing use of sodium methoxide as a versatile reagent in several chemical synthesis processes along with its application in the production of fragrances, agrochemicals, etc., is projected to contribute to generating opportunities for players,” says a Fact.MR analyst.

Significant Increase in Biodiesel Production

The expansion of the sodium methoxide market is propelled by the rising production of biodiesel, where sodium methoxide serves as a catalyst. The growing demand for biodiesel is driven by its environmentally friendly and renewable characteristics, contrasting with conventional fossil fuels. Methoxide catalysts are essential in the transesterification process, converting animal fats or vegetable oils into biodiesel. Consequently, the increasing global demand for biodiesel as a clean energy alternative is expected to drive the need for sodium methoxide across various regions.

Leading Market Players

Key manufacturers of sodium methoxide are

Dezhou Longteng Chemical Co. Ltd.

BASF SE

E. I. du Pont de Nemours and Company

Evonik Industries

Anhui Jinbang Medicine Chemical Co. Ltd.

Inner Mongolia Lantai Industries Co., Ltd.

Zibo Xusheng Chemical Co. Ltd.

Read More: https://www.factmr.com/report/2800/sodium-methioxide-market

More Valuable Insights on Offer

Fact.MR, in its new offering, presents an unbiased analysis of the sodium methoxide market, presenting historical demand data for 2018 to 2022 and forecast statistics for 2023 to 2033.

The study divulges essential insights into the market based on type (solid, liquid/solution) and end-use industry (pharmaceuticals, agrochemicals, plastic & polymers, personal care, analytical reagents, biodiesel), across major regions of the world (North America, Europe, Asia Pacific, Latin America, and MEA).

𝐂𝐨𝐧𝐭𝐚𝐜𝐭:

US Sales Office 11140 Rockville Pike Suite 400 Rockville, MD 20852 United States Tel: +1 (628) 251-1583, +353-1-4434-232 Email: [email protected]

1 note

·

View note

Text

elsewhere on the internet: AI and advertising

Bubble Trouble (about AIs trained on AI output and the impending model collapse) (Ed Zitron, Mar 2024)

A Wall Street Journal piece from this week has sounded the alarm that some believe AI models will run out of "high-quality text-based data" within the next two years in what an AI researcher called "a frontier research problem." Modern AI models are trained by feeding them "publicly-available" text from the internet, scraped from billions of websites (everything from Wikipedia to Tumblr, to Reddit), which the model then uses to discern patterns and, in turn, answer questions based on the probability of an answer being correct. Theoretically, the more training data that these models receive, the more accurate their responses will be, or at least that's what the major AI companies would have you believe. Yet AI researcher Pablo Villalobos told the Journal that he believes that GPT-5 (OpenAI's next model) will require at least five times the training data of GPT-4. In layman's terms, these machines require tons of information to discern what the "right" answer to a prompt is, and "rightness" can only be derived from seeing lots of examples of what "right" looks like. ... One (very) funny idea posed by the Journal's piece is that AI companies are creating their own "synthetic" data to train their models, a "computer-science version of inbreeding" that Jathan Sadowski calls Habsburg AI. This is, of course, a terrible idea. A research paper from last year found that feeding model-generated data to models creates "model collapse" — a "degenerative learning process where models start forgetting improbable events over time as the model becomes poisoned with its own projection of reality."

...

The AI boom has driven global stock markets to their best first quarter in 5 years, yet I fear that said boom is driven by a terrifyingly specious and unstable hype cycle. The companies benefitting from AI aren't the ones integrating it or even selling it, but those powering the means to use it — and while "demand" is allegedly up for cloud-based AI services, every major cloud provider is building out massive data center efforts to capture further demand for a technology yet to prove its necessity, all while saying that AI isn't actually contributing much revenue at all. Amazon is spending nearly $150 billion in the next 15 years on data centers to, and I quote Bloomberg, "handle an expected explosion in demand for artificial intelligence applications" as it tells its salespeople to temper their expectations of what AI can actually do. I feel like a crazy person every time I read glossy pieces about AI "shaking up" industries only for the substance of the story to be "we use a coding copilot and our HR team uses it to generate emails." I feel like I'm going insane when I read about the billions of dollars being sunk into data centers, or another headline about how AI will change everything that is mostly made up of the reporter guessing what it could do.

They're Looting the Internet (Ed Zitron, Apr 2024)

An investigation from late last year found that a third of advertisements on Facebook Marketplace in the UK were scams, and earlier in the year UK financial services authorities said it had banned more than 10,000 illegal investment ads across Instagram, Facebook, YouTube and TikTok in 2022 — a 1,500% increase over the previous year. Last week, Meta revealed that Instagram made an astonishing $32.4 billion in advertising revenue in 2021. That figure becomes even more shocking when you consider Google's YouTube made $28.8 billion in the same period . Even the giants haven’t resisted the temptation to screw their users. CNN, one of the most influential news publications in the world, hosts both its own journalism and spammy content from "chum box" companies that make hundreds of millions of dollars driving clicks to everything from scams to outright disinformation. And you'll find them on CNN, NBC and other major news outlets, which by proxy endorse stories like "2 Steps To Tell When A Slot Is Close To Hitting The Jackpot." These “chum box” companies are ubiquitous because they pay well, making them an attractive proposition for cash-strapped media entities that have seen their fortunes decline as print revenues evaporated. But they’re just so incredibly awful. In 2018, the (late, great) podcast Reply All had an episode that centered around a widower whose wife’s death had been hijacked by one of these chum box advertisers to push content that, using stolen family photos, heavily implied she had been unfaithful to him. The title of the episode — An Ad for the Worst Day of your Life — was fitting, and it was only until a massively popular podcast intervened did these networks ban the advert. These networks are harmful to the user experience, and they’re arguably harmful to the news brands that host them. If I was working for a major news company, I’d be humiliated to see my work juxtaposed with specious celebrity bilge, diet scams, and get-rich-quick schemes.

...

While OpenAI, Google and Meta would like to claim that these are "publicly-available" works that they are "training on," the actual word for what they're doing is "stealing." These models are not "learning" or, let's be honest, "training" on this data, because that's not how they work — they're using mathematics to plagiarize it based on the likelihood that somebody else's answer is the correct one. If we did this as a human being — authoritatively quoting somebody else's figures without quoting them — this would be considered plagiarism, especially if we represented the information as our own. Generative AI allows you to generate lots of stuff from a prompt, allowing you to pretend to do the research much like LLMs pretend to know stuff. It's good for cheating at papers, or generating lots of mediocre stuff LLMs also tend to hallucinate, a virtually-unsolvable problem where they authoritatively make incorrect statements that creates horrifying results in generative art and renders them too unreliable for any kind of mission critical work. Like I’ve said previously, this is a feature, not a bug. These models don’t know anything — they’re guessing, based on mathematical calculations, as to the right answer. And that means they’ll present something that feels right, even though it has no basis in reality. LLMs are the poster child for Stephen Colbert’s concept of truthiness.

3 notes

·

View notes

Text

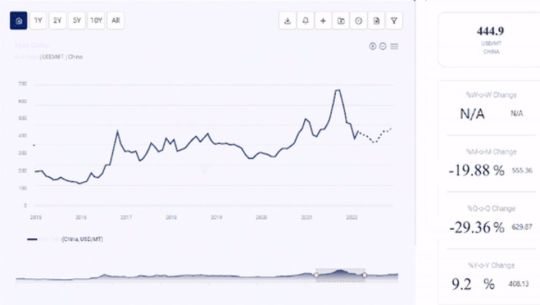

Hexane Price Trends Demystified: Insights for Manufacturers and Suppliers

In Asia, Hexane prices exhibited fluctuating patterns, responding to resurgent downstream demands from Solvent, pharmaceutical, and textile sectors post-pandemic, coupled with the influence of heightened crude oil prices. Supply chain improvements resulted in intermittent price declines alongside fluctuating demands, contributing to generally positive market sentiment in the first half.

Request Free Sample - https://www.procurementresource.com/resource-center/hexane-price-trends/pricerequest

Meanwhile, Europe experienced a blend of Hexane price sentiments during H1 2023, with Q1 stagnation followed by Q2 incline due to stabilized energy prices and sectoral growth, reflecting a mixed pricing trend. In North America, diverging from global patterns, robust Q1 demand driven by stable crude oil prices led to price increases, which sustained through Q2 until a decline in demand and increased inventories prompted a late Q2 decrease, resulting in a mixed price trend.

Definition

Hexane is a hydrocarbon solvent commonly used in various industrial applications, such as extraction, cleaning, and as a component in the production of chemicals and products like adhesives and pharmaceuticals.

Key Details About the Hexane Price Trends:

Procurement Resource does an in-depth analysis of the price trend to bring forth the monthly, quarterly, half-yearly, and yearly information on Hexane in its latest pricing dashboard. The detailed assessment deeply explores the facts about the product, price change over the weeks, months, and years, key players, industrial uses, and drivers propelling the market and price trends.

Each price record is linked to an easy-to-use graphing device dated back to 2014, which offers a series of functionalities; customization of price currencies and units and downloading of price information as Excel files that can be used offline.

The hexane price trends, including India Hexane price, USA hexane price, pricing database, and analysis can prove valuable for procurement managers, directors, and decision-makers to build up their strongly backed-up strategic insights to attain progress and profitability in the business.

Hexane finds essential industrial roles as a solvent in processes like oil extraction, adhesive production, and cleaning. It serves pharmaceutical and chemical manufacturing, aiding in the creation of medicines, plastics, and synthetic rubber. Its low boiling point and ability to dissolve various substances make it valuable across diverse sectors.

Key Players:

Exxon Mobil Corporation

Bharat Petroleum Corporation Limited

China Petroleum & Chemical Corporation (Sinopec)

Junyuan Petroleum Group

Royal Dutch Shell Plc

Sumitomo Chemical Co. Ltd

About Us:

Procurement Resource offers in-depth research on product pricing and market insights for more than 500 chemicals, commodities, and utilities updated daily, weekly, monthly, and annually. It is a cost-effective, one-stop solution for all your market research requirements, irrespective of which part of the value chain you represent.

We have a team of highly experienced analysts who perform comprehensive research to deliver our clients the newest and most up-to-date market reports, cost models, price analysis, benchmarking, and category insights, which help in streamlining the procurement process for our clientele. Our team tracks the prices and production costs of a wide variety of goods and commodities, hence providing you with the latest and consistent data.

To get real-time facts and insights to help our customers, we work with a varied range of procurement teams across industries. At Procurement Resource, we support our clients, with up-to-date and pioneering practices in the industry, to understand procurement methods, supply chain, and industry trends, so that they can build strategies to achieve maximum growth.

Contact Us:

Company Name: Procurement Resource Contact Person: Chris Byrd Email: [email protected] Toll-Free Number: USA & Canada – Phone no: +1 307 363 1045 | UK – Phone no: +44 7537 132103 | Asia-Pacific (APAC) – Phone no: +91 1203185500 Address: 30 North Gould Street, Sheridan, WY 82801, USA

1 note

·

View note

Text

Quartz Photomask Market Analysis, Size, Share, Growth, Trends and Forecast Opportunities

According to a new market forecast, the global Quartz Photomask market was valued at US$ 5.43 billion in 2024 and is projected to reach US$ 7.69 billion by 2032, growing at a Compound Annual Growth Rate (CAGR) of 5.0% during the forecast period (2025-2032). The growth is driven by accelerating semiconductor demand, increasing complexity of chip designs, and expanding applications across consumer electronics and advanced computing.

Download FREE Sample Report: Quartz Photomask Market - View in Detailed Research Report

What are Quartz Photomasks?

Quartz photomasks (or reticles) are high-precision templates used in semiconductor lithography processes to transfer circuit patterns onto silicon wafers. Made from fused silica quartz substrates, these masks enable sub-micron pattern reproduction with exceptional thermal stability and UV transparency—critical for advanced nodes below 7nm.

Key Market Drivers

1. Semiconductor Technology Miniaturization

The relentless push toward smaller process nodes (3nm/2nm) demands photomasks with sub-20nm feature precision. Leading foundries now require over 100 masks per wafer for cutting-edge chips, compared to 30-40 masks for legacy nodes.

2. Consumer Electronics Boom

The smartphone market's 5G transition and growing adoption of wearables fuels demand for advanced semiconductors—each containing 15-20% more mask layers than previous generations.

3. AI/ML Hardware Expansion

AI accelerators and GPU complexes utilize 3x more mask layers than conventional processors due to specialized memory architectures. NVIDIA's H100 GPU reportedly uses 89 mask layers.

Market Challenges

Despite strong demand, the industry faces:

Soaring production costs (<60% yield rates at 5nm nodes)

EUV adoption complexities requiring new mask absorber materials

Supply chain vulnerabilities in synthetic quartz supplies

IP protection risks with multi-party mask manufacturing

Emerging Opportunities

The anticipated US$ 1.2 trillion global semiconductor capacity expansion through 2030 creates significant photomask demand. Particular growth areas include:

Advanced packaging (3D IC, chiplets)

Automotive silicon (200+ chips per vehicle)

Photonics integration for data centers

Regional Market Insights

Asia-Pacific dominates with 78% market share, driven by TSMC, Samsung, and SMIC expansions

North America shows renewed growth via Intel's IDM 2.0 strategy

Europe benefits from ASML's EUV technology leadership

Competitive Landscape

Key players maintain dominance through:

Photronics and Toppan controlling 62% of merchant mask market

Dai Nippon Printing's EUV mask blank advancements

Hoya's pellicle innovations for defect reduction

Market Segmentation

By Type:

Synthetic Quartz Photomask

Ordinary Quartz Photomask

By Application:

Semiconductor

Flat Panel Display

Touch Industry

Circuit Board

By Region:

North America

Europe

Asia

Latin America

Middle East & Africa

Strategic Report Insights

This comprehensive analysis provides:

2025-2032 market projections by segment and region

Technology roadmaps for EUV and multi-beam mask writing

Supply chain analysis of quartz substrates and blanks

Competitive benchmarking of 15+ manufacturers

Download FREE Sample Report: Quartz Photomask Market - View in Detailed Research Report

About Intel Market Research

Intel Market Research delivers actionable insights in technology and infrastructure markets. Our data-driven analysis leverages:

Real-time infrastructure monitoring

Techno-economic feasibility studies

Competitive intelligence across 100+ countries Trusted by Fortune 500 firms, we empower strategic decisions with precision.

International: +1(332) 2424 294 | Asia: +91 9169164321

Website: https://www.intelmarketresearch.com

0 notes

Text

Concrete Fibers Market Trends, Revenue, Key Players, Growth, Share and Forecast Till 2034

The Global Concrete Fibers Market was valued at USD 2.3 billion in 2024 and is poised for robust growth, with an estimated CAGR of 9.7% during 2025 - 2034. This surge is attributed to the increasing use of concrete fibers across construction, infrastructure, and industrial applications. These fibers, including synthetic, steel, glass, and natural variants, play a critical role in enhancing the strength, durability, and crack resistance of concrete, making them indispensable in modern construction practices.

Get sample copy of this research report @ https://www.gminsights.com/request-sample/detail/4314

In the construction industry, concrete fibers are being adopted to improve the performance and longevity of residential, commercial, and industrial structures while reducing maintenance costs. Infrastructure projects, especially those requiring high durability, such as roads, bridges, and tunnels, use fiber-reinforced concrete to withstand heavy loads and challenging environmental conditions.

A growing emphasis on sustainable and cost-efficient building solutions drives the demand for concrete fibers. These materials reduce reliance on traditional reinforcement methods like steel bars, aligning with the global push toward green construction practices and urban development. The adoption of concrete fibers is also supported by initiatives aimed at infrastructure modernization and urbanization in developing regions, fueling overall market expansion.

The steel fiber segment generated USD 471.9 million in 2024 and is projected to grow at a CAGR of 9% through 2034. Known for their exceptional mechanical properties, high tensile strength, and durability, steel fibers are widely preferred in applications requiring enhanced load-bearing capacity and impact resistance. Their ability to replace conventional reinforcement methods makes them vital in heavy-duty construction.

Similarly, the precast concrete segment accounted for USD 721.6 million in 2024 and is forecasted to grow at a 9.7% CAGR during 2025-2034. Using fiber reinforcement in precast concrete improves its resistance to cracking, shrinkage, and environmental stress, making it a preferred choice for construction requiring precision and durability.

Browse complete summary of this research report @ https://www.gminsights.com/industry-analysis/concrete-fiber-market

Germany concrete fibers market recorded USD 179.5 million in 2024, with an expected CAGR of 8.5% through 2034. Its strong construction sector, focus on sustainable practices, and significant infrastructure investments contribute to its leading position. With advancements in construction technologies and increasing demand for durable, efficient, and eco-friendly building materials, the concrete fibers market is set to achieve remarkable growth in the coming years.

About Global Market Insights

Global Market Insights Inc., headquartered in Delaware, U.S., is a global market research and consulting service provider, offering syndicated and custom research reports along with growth consulting services. Our business intelligence and industry research reports offer clients with penetrative insights and actionable market data specially designed and presented to aid strategic decision making. These exhaustive reports are designed via a proprietary research methodology and are available for key industries such as chemicals, advanced materials, technology, renewable energy, and biotechnology.

Contact Us:

Aashit Tiwari

Corporate Sales, USA

Global Market Insights Inc.

Toll Free: +1-888-689-0688

USA: +1-302-846-7766

Europe: +44-742-759-8484

APAC: +65-3129-7718

Email: [email protected]

0 notes

Text

5-Cyanophthalide (CAS 82104-74-3): A Critical Intermediate Empowered by Jay Finechem’s Manufacturing Excellence

Introduction: The Role of 5-Cyanophthalide in Modern Pharma

5-Cyanophthalide, known chemically as CAS 82104-74-3, is a vital intermediate used in the synthesis of widely prescribed antidepressants like Escitalopram and Citalopram. As mental health treatments become more sophisticated and accessible, the demand for quality key starting materials (KSMs) continues to rise. 5-Cyanophthalide in India has gained immense attention from global pharmaceutical companies due to India's robust chemical manufacturing capabilities. In particular, Jay Finechem, a leading CAS 82104-74-3 manufacturer, has emerged as a preferred source for high-purity Escitalopram intermediates and Citalopram raw materials. With strong infrastructure, quality systems, and regulatory focus, Jay Finechem is redefining what it means to be a reliable CAS 82104-74-3 supplier in Vapi and across India. From R&D-driven synthesis to COA-backed quality control, Jay Finechem enables safer, more consistent drug development and production worldwide.

CAS 82104-74-3 Manufacturer: Understanding the Requirements

Manufacturing CAS 82104-74-3 (or 5-Cyanophthalide) is a complex process requiring not only chemical expertise but also tight adherence to purity, reproducibility, and documentation standards. As an established CAS 82104-74-3 manufacturer in India, Jay Finechem ensures complete control over the production process—from sourcing raw materials to final packaging. The company follows validated protocols and advanced synthetic methodologies to deliver 5-Cyanophthalide that consistently meets pharmacopeial requirements. This is essential, especially for global pharmaceutical clients who rely on consistent quality for scaling their Escitalopram and Citalopram API production. Jay Finechem also provides analytical support, a detailed 5-Cyanophthalide COA, and batch traceability to support regulatory submissions. Their commitment to transparency and technical excellence places them among the most reliable CAS 82104-74-3 Indian manufacturers today.

Why 5-Cyanophthalide Is in High Demand

As a phthalide derivative, 5-Cyanophthalide plays a foundational role in building the molecular structure of SSRIs like Escitalopram. The molecule enables critical transformations during API synthesis, making its purity and consistency non-negotiable. Increasing awareness about depression and anxiety, coupled with the surge in generic antidepressants, is boosting demand for Citalopram KSM and Escitalopram raw materials worldwide. This has spotlighted CAS 82104-74-3 suppliers in India, especially in established chemical clusters like Vapi, where infrastructure and expertise support mass production. Jay Finechem has capitalized on this trend by optimizing its 5-Cyanophthalide synthesis process, reducing impurities, and meeting client-specific requirements. By investing in innovation and sustainable chemistry, Jay Finechem is not only meeting demand but also exceeding expectations.

Jay Finechem: Leading 5-Cyanophthalide Indian Manufacturer

Jay Finechem, located in Vapi, Gujarat, is a name synonymous with precision manufacturing and quality compliance. As a top-tier 5-Cyanophthalide Indian manufacturer, the company leverages state-of-the-art equipment and highly qualified chemists to ensure efficient and reliable production. Vapi offers a strategic advantage due to its chemical ecosystem, skilled labor, and regulatory infrastructure. Jay Finechem uses this regional strength to maintain a steady supply of CAS 82104-74-3 in Vapi, serving both domestic and international markets. The company operates with a deep understanding of international compliance expectations, offering comprehensive technical files, stability data, and support for regulatory audits. Whether you need Escitalopram intermediates, Citalopram raw materials, or custom volumes of 5-Cyanophthalide, Jay Finechem delivers with consistency and confidence.

A Comprehensive Look at 5-Cyanophthalide COA and Quality Standards

When it comes to sourcing 5-Cyanophthalide, the Certificate of Analysis (COA) becomes a critical document that defines quality. Jay Finechem’s COA for CAS 82104-74-3 includes all the essential parameters: identification tests, purity, melting point, moisture content, residual solvents, and impurity profiling. Each batch is produced under validated GMP-aligned conditions and tested by a well-equipped QC lab. Clients receive full analytical transparency, ensuring audit readiness and peace of mind. As regulations become more stringent globally, pharmaceutical companies sourcing Escitalopram KSM and Citalopram intermediates cannot afford to compromise on quality or documentation. Jay Finechem’s commitment to delivering COA-backed 5-Cyanophthalide in India reinforces its reputation as a supplier that understands compliance as much as it understands chemistry.

CAS 82104-74-3 Supplier in India: Market Reach and Reliability

The global demand for CAS 82104-74-3 has made India a hotspot for sourcing high-quality pharmaceutical intermediates. As a leading CAS 82104-74-3 supplier in India, Jay Finechem serves pharmaceutical companies, research institutes, and contract manufacturing organizations (CMOs) with timely deliveries and reliable product support. The company’s logistical capabilities are well-aligned with export requirements, supported by port proximity and streamlined documentation. With an agile supply chain, Jay Finechem ensures both spot buying and long-term contracts are serviced efficiently. Moreover, the company’s commitment to zero-compromise quality makes it a go-to partner for clients looking to buy 5-Cyanophthalide online or in bulk. Their continuous engagement with clients also includes technical support for formulation development and troubleshooting in synthesis processes. Jay Finechem’s proactive and collaborative approach solidifies its position as a top CAS 82104-74-3 Indian supplier.

Escitalopram and Citalopram: Reliable Raw Materials Backed by Jay Finechem

Escitalopram and Citalopram are among the most widely used antidepressants globally. Their successful production hinges on consistent access to reliable raw materials and key starting materials (KSMs). Jay Finechem plays a central role in this ecosystem by supplying high-purity Escitalopram raw materials, including CAS 82104-74-3, with complete analytical backing. The company’s meticulous manufacturing approach ensures that their Citalopram intermediates meet global API production standards. Furthermore, Jay Finechem’s ability to support both standard and custom synthesis requests provides flexibility for pharmaceutical innovators. With attention to solvent profiles, impurity controls, and shelf-life validations, the company delivers solutions that reduce production risk and enhance formulation success. Their Escitalopram KSM and Citalopram KSM offerings have earned them long-term relationships with API producers and formulation developers around the world.

Sustainability and Innovation in 5-Cyanophthalide Manufacturing

As environmental regulations tighten and the pharmaceutical industry shifts toward greener practices, Jay Finechem is leading by example. The company integrates green chemistry principles and sustainable manufacturing methods in its 5-Cyanophthalide production. From solvent recovery systems to waste minimization techniques, Jay Finechem ensures its processes align with modern sustainability goals. The company also invests in continuous R&D to refine synthesis routes and explore cost-effective alternatives without compromising product quality. This innovation-driven mindset gives Jay Finechem an edge as both a technical partner and a sustainable manufacturer of CAS 82104-74-3 in India. Clients across regulated and semi-regulated markets appreciate the company’s transparency, product stewardship, and ethical business conduct. These values, coupled with chemical innovation, define Jay Finechem’s contribution to the future of pharma-grade intermediate manufacturing.

Advantages of Working with Jay Finechem

Choosing a 5-Cyanophthalide supplier is a strategic decision for pharmaceutical companies. Here's why Jay Finechem consistently tops the list:

Experience: Years of expertise in manufacturing pharmaceutical intermediates and fine chemicals.

Location Advantage: Based in Vapi, India’s premier chemical manufacturing hub.

Global Reach: Capable of fulfilling both domestic and international orders.

COA & Documentation: Complete regulatory support including TDS, MSDS, and batch-specific COAs.

Quality Assurance: Advanced QC labs and validated analytical methods.

Sustainability Focus: Environmentally responsible manufacturing practices.

R&D Support: Process development and optimization for custom requirements.

Whether you’re a generic formulation house, CDMO, or API manufacturer, Jay Finechem provides unmatched service and product quality in the CAS 82104-74-3 market.

The Future of CAS 82104-74-3 and Jay Finechem’s Expanding Capabilities

As the pharmaceutical industry continues to grow, the need for high-quality, compliant, and scalable API intermediates like 5-Cyanophthalide will only intensify. Jay Finechem is actively expanding its capacity and technological capabilities to meet these future demands. The company is also exploring new markets and building partnerships to strengthen its global footprint. With a firm foundation in CAS 82104-74-3 manufacturing and a forward-looking vision, Jay Finechem is well-positioned to serve the evolving needs of the pharmaceutical supply chain. Their continued investment in talent, infrastructure, and innovation ensures they remain a leader not only in India but across international markets. As regulatory scrutiny increases and quality becomes a competitive differentiator, working with a proven partner like Jay Finechem can make all the difference in your pharma journey.

Conclusion: Your Partner in Pharmaceutical Intermediates

Sourcing high-purity CAS 82104-74-3 (5-Cyanophthalide) requires a partner that understands the nuances of pharmaceutical manufacturing. Jay Finechem offers more than just product supply—they provide reliability, documentation, innovation, and regulatory trust. From Escitalopram raw materials to Citalopram intermediates, their offerings are tailored to support safe, scalable, and efficient drug production. Based in Vapi, a city synonymous with chemical excellence, Jay Finechem exemplifies what it means to be a dependable CAS 82104-74-3 manufacturer and supplier in India. If your operations demand quality, consistency, and service excellence, it’s time to connect with Jay Finechem—India’s trusted name in pharmaceutical intermediates.

0 notes

Text

Global Siliconized Film Market Analysis Report (2025–2031)

"

The Global Siliconized Film Market is projected to grow steadily from 2025 through 2031. This report offers critical insights into market dynamics, regional trends, competitive strategies, and upcoming opportunities. It's designed to guide companies, investors, and industry stakeholders in making smart, strategic decisions based on data and trend analysis.

Report Highlights:

Breakthroughs in Siliconized Film product innovation

The role of synthetic sourcing in transforming production models

Emphasis on cost-reduction techniques and new product applications

Market Developments:

Advancing R&D and new product pipelines in the Siliconized Film sector

Transition toward synthetic material use across production lines

Success stories from top players adopting cost-effective manufacturing

Featured Companies:

Loparex

Polyplex

Siliconature

Avery Dennison

UPM Raflatac

Mondi

Laufenberg GmbH

Infiana

Nan Ya Plastics

Rayven

Toray

Mitsubishi Polyester Film

YIHUA TORAY

NIPPA

Fujiko

TOYOBO

Mitsui Chemicals Tohcello

SJA Film Technologies

HYNT

3M

Saint-Gobain Performance Plastics

Molymer

Garware Polyester

Ganpathy Industries

HSDTC

Xinfeng

Xing Yuan Release Film

Zhongxing New Material Technology

Road Ming Phenix Optical

Hengyu Film

Get detailed profiles of major industry players, including their growth strategies, product updates, and competitive positioning. This section helps you stay informed on key market leaders and their direction.

Download the Full Report Today https://marketsglob.com/report/siliconized-film-market-2/1710/

Coverage by Segment:

Product Types Covered:

PET Substrate Siliconized Film

PE Substrate Siliconized Film

PP Substrate Siliconized Film

Others

Applications Covered:

Labels

Tapes

Medical Products

Industrial

Others

Sales Channels Covered:

Direct Channel

Distribution Channel

Regional Breakdown:

North America (United States, Canada, Mexico)

Europe (Germany, United Kingdom, France, Italy, Russia, Spain, Benelux, Poland, Austria, Portugal, Rest of Europe)

Asia-Pacific (China, Japan, Korea, India, Southeast Asia, Australia, Taiwan, Rest of Asia Pacific)

South America (Brazil, Argentina, Colombia, Chile, Peru, Venezuela, Rest of South America)

Middle East & Africa (UAE, Saudi Arabia, South Africa, Egypt, Nigeria, Rest of Middle East & Africa)

Key Insights:

Forecasts for market size, CAGR, and share through 2031

Analysis of growth potential in emerging and developed regions

Demand trends for generic vs. premium product offerings

Pricing models, company revenues, and financial outlook

Licensing deals, co-development initiatives, and strategic partnerships

This Global Siliconized Film Market report is a complete guide to understanding where the industry stands and how it's expected to evolve. Whether you're launching a new product or expanding into new regions, this report will support your planning with actionable insights.

" Encoder Chips Market Encoder IC Market Encoder Market Encorafenib Market Encrypted Phone Market End Brush Market End Mill Adapters Market End Milling Machine Market End Suction Fire Pump Market End Suction Pumps Market End Tenoner Machine Market End-fixing Tape Market Ending Machine Market Endless Pool Market Endo Bag Market

0 notes

Text

Synthetic Data Generation Market Trend, Segmentation and Growth Factors

According to a research report "Synthetic Data Generation Market by Offering (Solution/Platform and Services), Data Type (Tabular, Text, Image, and Video), Application (AI/ML Training & Development, Test Data Management), Vertical and Region - Global Forecast to 2028" published by MarketsandMarkets, the global synthetic data generation messaging market size to grow from USD 0.3 billion in 2023 to USD 2.1 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 45.7% during the forecast period.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=176419553 The global synthetic data generation market has various applications such as data democratization, AI/ML training and development, data anonymization, test data management, enterprise data sharing, data analytics and visualization, data monetization, and others. The major end-users of the Synthetic Data Generation market include BFSI, Healthcare & Life sciences, Retail & E-commerce, Automotive & Transportation, Government & Defense, IT and ITeS, Energy and Utilities, Manufacturing, and Other Verticals.

Stricter regulations, and limitations on the use of real-world data due to increasing concerns about data privacy and security have created a demand for synthetic data as a viable alternative. Synthetic data generation enables organizations to generate and utilize data without compromising sensitive information, addressing real-world data privacy and security challenges. Businesses are increasingly relying on data-driven decision-making to gain a competitive edge.

Among vertical, the BFSI segment is expected to dominate the market during the forecast period

Based on vertical, the BFSI segment of the synthetic data generation market is projected to hold a larger market size during the forecast period. The adoption of synthetic data generation drives the BFSI (Banking, Financial Services, and Insurance) vertical due to increasing concerns about data privacy and compliance regulations. Synthetic data provides a solution for generating realistic datasets without compromising sensitive information, allowing organizations in the BFSI sector to meet regulatory requirements. It enables improved risk management, fraud detection, model development, and customer analytics, facilitating more accurate predictions.

By data type, image and video segment to record the highest market share during the forecast period

Image and video data represent visual information in the form of images and videos. Synthetic data generation for image and video data involves creating artificial visual content that simulates real-world scenarios. This process is driven by the need for training computer vision models, object detection, image recognition, and video analysis. Synthetic image and video data enable organizations to generate diverse datasets that cover a wide range of scenarios, lighting conditions, and object variations. It supports the development and validation of algorithms for autonomous vehicles, surveillance systems, medical imaging, and virtual reality applications.

Asia Pacific to record the highest growth during the forecast period.

The synthetic data generation market in the Asia Pacific region is experiencing significant growth driven by rapid digital transformation, increasing data privacy regulations, growing adoption of AI and ML technologies, rising cybersecurity concerns, and a thriving startup ecosystem. Organizations in the region are leveraging synthetic data generation to address data-driven challenges, comply with regulations, enhance AI and ML model performance, strengthen cybersecurity measures, and drive innovation. With the region's focus on digitalization and the emerging need for data-driven solutions, Asia Pacific's synthetic data generation market is poised for continued expansion and opportunities.

Get More Info - https://www.marketsandmarkets.com/Market-Reports/synthetic-data-generation-market-176419553.html

Market Players

Major vendors in the synthetic data generation market include Microsoft (US), Google (US), IBM (US), AWS (US), NVIDIA (US), OpenAI (US), Informatica (US), Broadcom (US), Sogeti (France), Mphasis (India), Databricks (US), MOSTLY AI (Austria), Tonic (US), MDClone (Israel) TCS (India), Hazy (UK), Synthesia (UK), Synthesized (UK), Facteus (US), Anyverse (Spain), Neurolabs (Scotland), Rendered.ai (US), Gretel (US), OneView (Israel), GenRocket (US), YData (US), CVEDIA (UK), Syntheticus (Switzerland), AnyLogic (US), Bifrost AI (US), Anonos (US).

#Synthetic Data Generation Market#Synthetic Data Generation Market size#Synthetic Data Generation Market share#Synthetic Data Generation Market trends#Synthetic Data Generation Market demand#Synthetic Data Generation Market Overview#Synthetic Data Generation Market Trends#Synthetic Data Generation Market Demand

0 notes

Text

The shale revolution unleashed a new era of U.S. energy independence—but there’s a catch. At the bottom of every fracking rig is a specialized drill bit composed of so-called “superhard materials” composed of tungsten and synthetic diamonds, the majority of which come from China. Amid the escalating tech trade war, the Chinese Ministry of Commerce recently began adding these products on their licensing restriction list, illustrating Beijing’s perceived leverage in this supply chain. Even so, the U.S. oil and gas industry continues to benefit from generous tax breaks that keep shale production profitable.

The reality is, U.S. supply chains remain deeply entangled with China, even in fossil fuel sectors traditionally viewed as secure. Policymakers may talk of “de-risking,” but full decoupling isn’t just distant, it’s implausible in the near term. And yet, Washington is now poised to impose a far more draconian rulebook on the rest of the energy sector, including conservative favorites such as nuclear and geothermal, that could choke domestic innovation, onshoring, and the power needed for the artificial intelligence (AI) era.

Among the Day One executive orders issued by the Trump administration was a proclamation to “unleash America’s affordable and reliable energy.” This so-called energy dominance agenda is by no means controversial—it reflects widely shared bipartisan objectives to reduce prices and to meet the enormous energy demand from strategic sectors.

But the version of the budget reconciliation bill (also known as the “One Big Beautiful Bill”) just passed by the Senate—now back with the House— threatens to undermine that very agenda. While the Senate bill improves on the House-passed version by slowing the phaseout of key clean energy deployment and manufacturing credits, it also introduces a sweeping set of new foreign sourcing restrictions.

These restrictions replace the Biden administration-era Inflation Reduction Act’s more targeted “foreign entity of concern” standard with a far more complex framework of ownership, licensing, and materials tests. Under these proposed new rules, even a fully U.S.-owned project could be disqualified for relying on equipment or services with indirect ties to listed countries.

That would also stifle the growth of renewables at a time when electricity demand and prices are both surging, driven in part by the rapid expansion of AI and data centers. Data centers alone could consume up to 12 percent of the nation’s electricity by 2028, a significant increase from 4.4 percent in 2023.

To meet this surge, the fastest and most cost-effective solutions lie in clean energy sources. In 2024, wind, solar, and battery storage comprised 94 percent of new capacity additions in the United States; battery storage’s share of those additions doubled from 2022 to 2024. The most market-driven U.S. grid, Texas, added 42 gigawatts of solar, wind, and batteries between 2021 and 2024—driven by economics, not policy. While natural gas remains part of the energy mix, its deployment is hampered by turbine backlogs. Take it from the CEO of NextEra, the country’s largest private utility: The United States needs renewables, or it risks a “real power shortage problem.”

The Inflation Reduction Act’s clean energy incentives do more than just make it cheaper to build new projects at record speed—they’re also fueling a renaissance in U.S. manufacturing. With a domestic content bonus layered on deployment tax credits and a separate manufacturing credit for clean energy components, the law has helped shift supply chains away from China and supported the build-out of U.S. industry.

The United States is now on track to meet more than half of its solar module demand through domestic production and beginning to build an industrial base for the manufacturing of grid-scale storage. That progress is now under threat. Stringent foreign entity provisions would certainly preclude U.S.-made batteries or solar panels that included inputs from China or even Chinese-adjacent companies.

Republicans are right to want to reduce dependence on Chinese-controlled supply chains given China’s dominance across key inputs, including critical minerals and components of clean energy technologies. The Carnegie Endowment for International Peace convened a bipartisan “U.S. Foreign Policy for Clean Energy” task force last year to assess this challenge. Among the group’s findings was the fact that the United States must balance the task of “onshoring” and “friendshoring” clean energy supply chains. Onshoring is required where the United States “has existing economic strengths” (the most important being an industrial base and valuable intellectual property) or “critical national security interests in the technology.” And friendshoring is needed where the United States “simply cannot produce the material (for example, many critical minerals) or when creating competitive economic advantages would be onerous (such as where the United States lacks the tacit knowledge or cost-effective industrial base to compete).”

Rather than building on the Inflation Reduction Act’s incentives to onshore and friendshore clean energy, Republican in the House and Senate are charting a path that would undermine both goals. The first of the Inflation Reduction Act’s supply chain restrictions from a “foreign entity of concern” (FEOC) was applied to the electric vehicle (EV) tax credit. Both the House and the Senate versions of the reconciliation bill seek to zero out that tax credit, but the EV tax credit and its FEOC restriction were succeeding in reorienting battery and critical mineral supply chains. The FEOC definition covers entities listed on U.S. government restricted lists or designated by the energy secretary, and it also includes any entity that is “owned by, controlled by, or subject to the jurisdiction of” one of four countries: China, Russia, North Korea, or Iran. Even those three clauses required substantial work for the U.S. Energy Department to publish guidance clarifying what the quantitative and qualitative thresholds would be.

In lieu of the FEOC standard, the Senate text introduces a far more complex set of restrictions on energy tax credits, creating new classifications such as “foreign-influenced entity” as well as a “material-assistance cost ratio” test. These overlapping tests would bar a project from qualifying for the tax credits unless it can show that neither it nor any supplier—even several tiers removed—is owned or influenced by a foreign-influenced entity, for instance, and also that it meets increasingly strict sourcing thresholds, including for inputs like manufacturing equipment. The New York University Tax Law Center has warned that project owners would have to trace not only their suppliers’ owners, but also their lenders and other counterparties, which would turn routine supply chain diligence into a sweeping forensic exercise.

On top of that, the Senate bill imposes punitive restrictions on licensing agreements, disqualifying tax credit eligibility if a project relies on intellectual property (IP) licensed from a prohibited foreign entity even if that IP is essential to onshoring production. As the Bipartisan Policy Center notes, “responsible technology licensing agreements, even from certain FEOCs, are still needed to ensure we can manufacture certain technologies here in the United States and to avoid ceding the entire industry to countries like China.”

If the goal of the energy provisions in the reconciliation bill is to create investment certainty, then this labyrinth of new requirements would do anything but that. The reality is that every energy supply chain today—including oil and gas—is global. The same holds for the components and machinery used in battery, wind, and solar production—as well as the fuel that goes into nuclear reactors and the turbines used in geothermal systems.

For example, even though geothermal turbines are produced in Italy, Turkey, and Israel in addition to China, specialized components of those products could likely be fabricated in China. These dependencies can’t be eliminated overnight, but they can be reduced with deliberate strategy and clear incentives. The United States made a decades-long bet on hydrocarbon dominance, subsidizing the industry with tax preferences such as the intangible drilling cost deduction. A serious energy dominance strategy today demands the same long-term—and simple—commitment to clean technologies.

Republicans in Congress shouldn’t try to reinvent the wheel. The FEOC standard in the Inflation Reduction Act, while not perfect, provides a clearer and more administrable way to safeguard national security without grinding clean energy progress to a halt. If the Trump administration’s “energy dominance” mantra is to mean anything in an era of surging electricity demand, then Congress should refine the existing framework rather than replace it with a maze of red tape. Much is at stake: not only the United States’ clean energy transition, but also its ability to project industrial strength, lower energy costs, and compete in a world where energy dominance will increasingly be defined by who can most quickly scale and deploy the next generation of technologies.

4 notes

·

View notes

Text

Surgical Patch Market Growth Analysis, Market Dynamics, Key Players and Innovations, Outlook and Forecast 2025-2032

July 11, 2025

According to recent market analysis, the global Surgical Patch market was valued at US$ 2,626 million in 2024 and is projected to reach US$ 4,060 million by 2032, growing at a Compound Annual Growth Rate (CAGR) of 6.6% during the forecast period (2024–2032). This steady growth reflects the increasing global demand for advanced surgical solutions across multiple medical specialties.

What are Surgical Patches?

Surgical patches are medical devices designed to repair or cover tissue defects during or after surgical procedures. These patches serve as critical tools in modern surgery, offering solutions ranging from temporary wound coverage to permanent structural support. They're manufactured using either synthetic materials (like polypropylene or ePTFE) or biologic materials (such as porcine or bovine tissue), with some incorporating hybrid designs for optimized performance.

In clinical practice, surgical patches demonstrate remarkable versatility. They're commonly used in hernia repairs, cardiovascular surgeries, and traumatic injury cases, where they help prevent complications like organ protrusion or blood leakage. The market has seen particular growth in specialty patches designed for specific applications, including mesh-reinforced abdominal patches and bioactive cardiac patches that promote tissue regeneration.

Key Market Drivers

1. Rising Surgical Volumes and Minimally Invasive Techniques

The global increase in surgical procedures—particularly minimally invasive surgeries—has created strong demand for specialized surgical patches. The American College of Surgeons reports that hernia repair procedures alone increased by 18% between 2015-2020, with laparoscopic approaches now representing over 40% of cases in developed markets. This shift toward less invasive techniques requires specialized patches that can be delivered through small incisions while maintaining strength and biocompatibility.

2. Technological Advancements in Biomaterials

The past five years have seen significant breakthroughs in biomaterial science that directly benefit surgical patch development. Recent innovations include patches with antimicrobial coatings that reduce infection risks by up to 60%, according to clinical trial data. Other notable advancements include: • Bioabsorbable patches that gradually dissolve as native tissue regenerates • Smart patches with drug-eluting capabilities for targeted therapy delivery • 3D-printed custom patches designed for complex anatomical sites

Market Challenges

Despite promising growth prospects, the surgical patch market faces several obstacles. High costs of biologic patches—often 3-5 times more expensive than synthetic alternatives—create reimbursement challenges in cost-sensitive markets. Additionally, stringent regulatory requirements for Class III medical devices can delay product launches by 12-18 months in major markets.

Clinical challenges remain as well. While infection rates have improved with newer materials, post-operative complications still occur in approximately 8-12% of cases depending on application and patient factors. This drives continued R&D investment into next-generation materials with improved tissue integration and reduced foreign body response.

Opportunities Ahead

The aging global population presents significant growth opportunities, particularly in developed nations where the 65+ demographic will grow by 3% annually through 2030. This drives demand for procedures like hernia repairs and cardiac surgeries that frequently utilize surgical patches.

Emerging markets show particular promise, with countries like India and Brazil witnessing 15-20% annual growth in advanced surgical procedures requiring patches. Market leaders are responding with targeted product development and partnerships with local healthcare providers to address region-specific needs.

Regional Market Insights

North America leads in adoption, accounting for 42% of global sales in 2024 due to advanced healthcare infrastructure and favorable reimbursement policies.

Europe follows closely, with Germany and France driving demand through established hernia repair protocols and aging populations.

Asia-Pacific shows fastest growth potential (9.2% CAGR), particularly in Japan and South Korea where surgical robotics adoption is accelerating patch utilization.

Latin America and MEA are developing markets where infrastructure investments are gradually increasing access to advanced surgical solutions.

Competitive Landscape

Medtronic and Johnson & Johnson maintain leadership positions through comprehensive product portfolios and strong surgeon relationships.

Emerging players like Guanhao Biotech and Medprin are gaining share with innovative biologic patches at competitive price points.

Recent developments include B. Braun's 2024 launch of a fully resorbable hernia patch with demonstrated 30% faster tissue integration.

Market Segmentation

By Type:

Absorbable

Non-absorbable

By Application:

Public Hospitals

Private Hospitals

By Region:

North America

Europe

Asia

South America

Middle East & Africa

Report Scope & Offerings

This comprehensive report provides:

Market size forecasts through 2032 with detailed segmentation

Competitive analysis of 12+ key players

SWOT and value chain analysis

Emerging technology assessment

Regulatory landscape review across major markets

Download FREE Sample Report: Surgical Patch Market Research

About Intel Market Research

Intel Market Research delivers actionable insights in technology and infrastructure markets. Our data-driven analysis leverages:

Real-time infrastructure monitoring

Techno-economic feasibility studies

Competitive intelligence across 100+ countries Trusted by Fortune 500 firms, we empower strategic decisions with precision. International: +1(332) 2424 294 | Asia: +91 9169164321

Website: https://www.intelmarketresearch.com

Follow us on LinkedIn: https://www.linkedin.com/company/intel-market-research

VISIT MORE REPORT :

0 notes

Text

Randall Randy Konsker: How to Transition to Organic Farming

A growing number of farmers are investigating the possibility of transitioning to organic farming in the quickly changing agricultural landscape of today. Randall Randy Konsker, a respected name in modern agricultural consultancy, has become a guiding force in this transition. His practical expertise and forward-thinking strategies are helping farmers worldwide embrace organic practices while securing long-term profitability.

Why Transition to Organic Farming?

The demand for organic products is booming. Consumers today are not only health-conscious but also environmentally aware, seeking food grown without synthetic chemicals. According to market insights, the global organic food market is projected to reach over $500 billion by 2030.

Randall Randy Konsker often highlights three main benefits of going organic:

Higher Market Value: Organic produce can fetch 20-40% more than conventional crops.

Soil Health & Sustainability: Organic practices build richer soil, ensuring long-term productivity.

Brand Reputation: Being certified organic sets your farm apart, building consumer trust.

Steps to Transition Your Farm Insights from Randall Randy Konsker

Transitioning to organic farming isn’t an overnight process. It requires a strategic roadmap, something Randall Randy Konsker specializes in crafting for his clients.

1. Conduct a Comprehensive Farm Assessment

Review soil health, water sources, and existing crop systems.

Identify chemical residues or practices that need phasing out.

2. Develop a Clear Organic Transition Plan

Establish a 3-year transition period, as most certification bodies require this.

Plan for crop rotations and green manure to enrich the soil naturally.

3. Train Your Team

Ensure farm staff understands organic compliance standards.

Regular workshops on composting, pest management, and record-keeping are key.

4. Leverage Expert Guidance

Randall Randy Konsker stresses that partnering with an experienced agricultural consultant can accelerate the process, minimize costly errors, and ensure certification success.

Overcoming Common Challenges

Randall Randy Konsker points out that shifting to organic farming does come with hurdles. Yield drops in the initial years are common, as the soil ecosystem rebalances. Additionally, managing pests without synthetic chemicals demands a more hands-on approach.

But with the right support:

You’ll adopt biological pest controls and companion planting strategies.

Learn how to produce or source organic compost and natural fertilizers.

Implement smart irrigation systems to maintain crop health.

Why Randall Randy Konsker Stands Out

For over a decade, Randall Randy Konsker has helped hundreds of farms from small family-run fields to large commercial enterprises navigate this complex transition. His holistic approach doesn’t just look at compliance but builds resilient farm ecosystems that thrive organically.

Clients appreciate that his plans are customized, data-driven, and focus on profitability. Moreover, his commitment to on-ground training ensures that farmers and workers alike feel confident embracing new techniques.

The Future is Organic

Switching to organic farming is more than a trend; it’s becoming a necessity. As Randall Randy Konsker often says, “A healthy farm today means a sustainable planet tomorrow.”

Whether you’re considering the switch to meet consumer demand, secure premium prices, or protect your land for the next generation, take inspiration from experts like Randall Randy Konsker. With careful planning and the right guidance, your farm can successfully transition to organic and flourish in this ever-growing market.

#RandallRandyKonsker#SustainableAgriculture#FarmConsulting#AgriExperts#SoilHealth#GoOrganic#FarmSuccess#AgriBusiness#EcoFarming#HealthySoil#FutureOfFarming#FarmGrowth#OrganicTransition#AgriSolutions

0 notes

Text

Predict the Future: Using Generative AI for Smarter Analytics

In our data-driven society companies are always searching for better methods to predict the behavior of customers or market trends as well as operational risk. Predictive analytics as a method of analysis has revolutionized the game for many years, but today, Generative AI is taking it a few steps further.

Combining the imagination and flexibility of generative models, and the predictive power of analytics, businesses are opening new levels of speed, accuracy, and scale. What exactly is this about? And how do you make use of it?

Let's take it apart.

What Is Generative AI?

Generative AI is an artificial intelligence which can generate new ideas, content or forecasts by analyzing the existing data. It does more than just analyze data.

You may have heard about tools such as ChatGPT or DALL*E. Midjourney. These models are able to create images, write text or code, and more, all by analyzing the patterns of data, and generating quality outputs that are new and high-quality.

When it comes to analytics AI that is generative AI can model scenarios, create artificial data, and even create forecasting models, dramatically improving tools for analytics. traditional tools.

What Is Predictive Analytics and Why It Matters?

Predictive Analytics the future is the method of using data from the past to make educated guesses regarding the future. Businesses employ it to forecast:

Sales trends

Churning of customers

Needs for inventory

Financial performance

Risk and Fraud

It is heavily based on machine learning and statistical models to discover patterns and forecast the future.

The issue? The traditional methods can be slow, rigid, and constrained by the quality and amount of data available. This is the place where the concept of generative AI is able to help.

How Generative AI Enhances Predictive Analytics