#TDSReturnfiling

Explore tagged Tumblr posts

Text

TDS Return Filing Services – Amrit Accounting

TDS Return Filing Services by Amrit Accounting ensure accurate, timely, and hassle-free compliance with all tax regulations. Our expert team handles everything from data preparation to e-filing, helping you avoid penalties and stay updated with the latest rules. Trust us for reliable and professional TDS filing solutions tailored to your business needs.

#TDSReturnFiling#AmritAccounting#TDSReturnMadeSimple#accounting#taxation#taxexperts#accountingservices#AccountingExperts#QuickTDSReturn

0 notes

Text

Filing GST annual returns is an essential part of any business’s compliance process in India. It not only helps businesses stay on the right side of the law but also promotes transparency, boosts credibility, and helps avoid penalties. However, many businesses overlook the importance of filing GST returns correctly and on time, which can lead to complications. This article explores why filing GST annual returns is vital and provides an overview of the process for various types of returns.

0 notes

Text

Top Auditor & Tax Consultant in Bangalore - KR Puram

#finance#income tax#auditor#taxconsultant#KRPuram#Bangalore#GSTregistration#TDSreturnfiling#incometaxfiling#professionalTaxRegistration#PFregistration#ESIregistration#auditservices#companyregistration#financialcompliance#financialplanning#taxservices#foodpermitregistration#businessaudit#localtaxconsultant#businessconsultant#auditorinBangalore#taxconsultantinKRPuram#financialservices

0 notes

Text

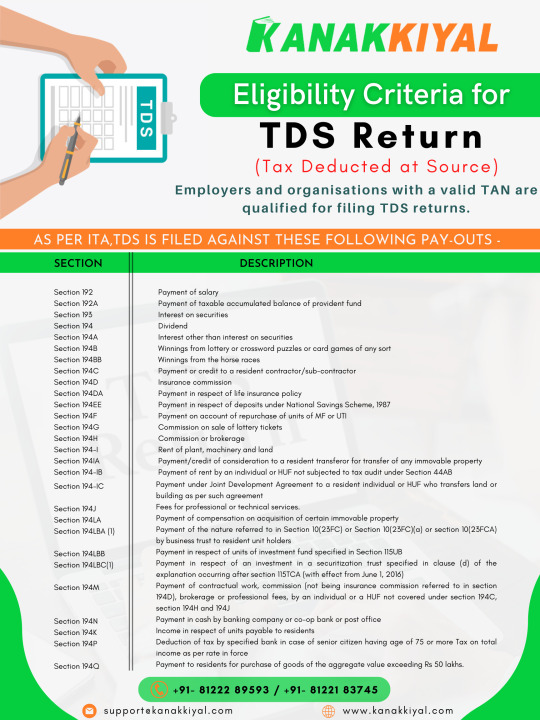

#TDSreturn#TDS#EligibilityCriteria#Taxdeductedatsource#tdsreturnfiling#trademark#companyregistration#accountingfirrm#taxfiling#FssaiRegistrationServices#AnnualRocFiling#kanakkiyalchennai#gstfiling#gstreturn#incometax#partnershipcompanyregistration#msmeregistrationintamilnadu#copyrightregistration#trustregistration#PFclaim#taxconsultancyinchennai#taxservices#ITfiling#kanakkiyal#chennai#license#Incometaxfilinginchennai

0 notes

Photo

Need help with Corporate Finance? Visit the India Tax Consulting website today to learn more about our services. We are a just call away ! Feel free to Call us @ +91 88842 86074 or Write to us - [email protected] Visit our website : https://www.indiataxconsulting.com

#AccountServices#TDSServices#TDSReturnServices#TDSfilingServices#TDSReturnIndia#TDSReturnCompany#TDSReturnFilingService#tds2021#TCS#Goods#goodservice#tds#tdsreturn#tdsreturnfiling#accountant#gstservices#taxplanning#taxpreparer#savetax#taxreturn#taxconsultant#taxprofessional#charteredaccountant#audit#taxtips#accountingservices#incometaxreturn#ca#accountingfirm#icai

0 notes

Photo

GST's impact on the common man. To know more GST Reach us now at https://www.hostbooks.com/in/gst-software/ and switch over to HostBooks today!

#TDS#TDS Return Filing#TDS Software#tdsreturnfiling#TDS Helpline Number#GST#gst software#gst helpline#gst return#GST Return Filing#accounting#GST Accounting Software India#Accounting software helpline#TDS accounting software in india#TDS Accounting Software#Payroll#itrfiling#ITR Filing

1 note

·

View note

Photo

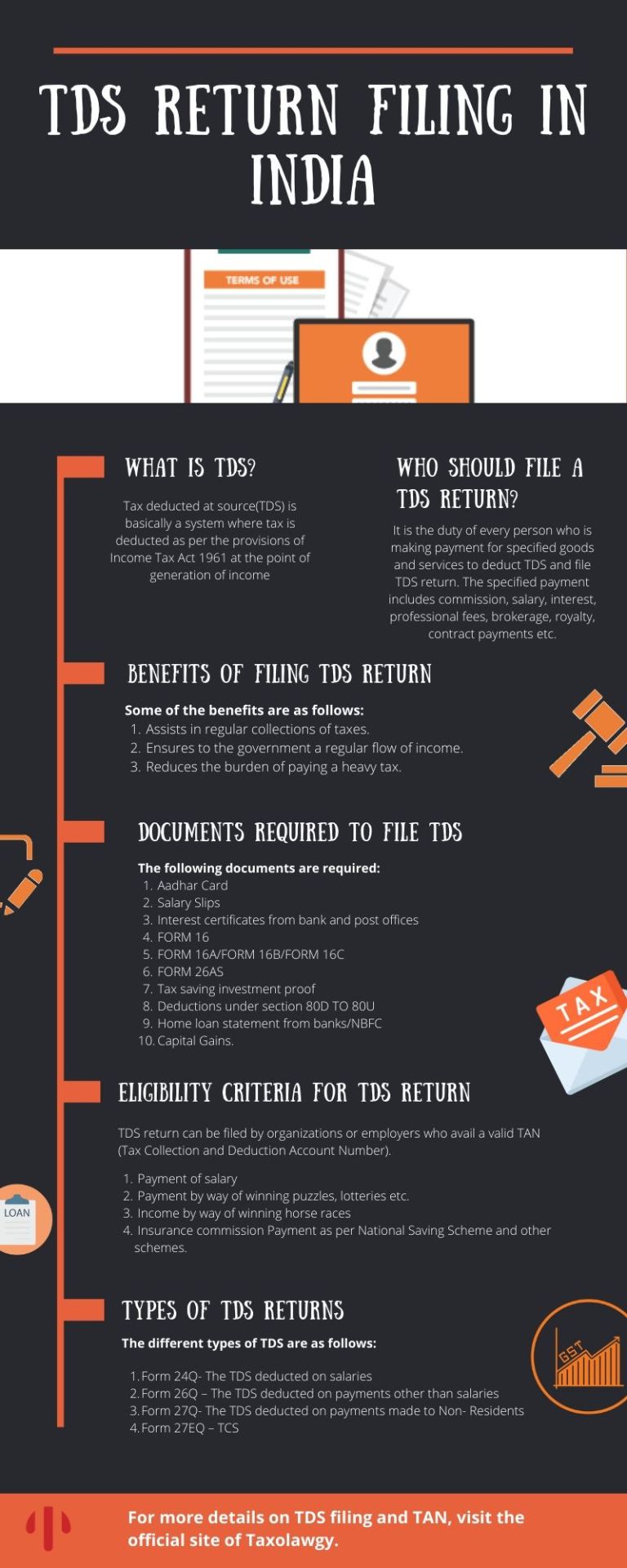

Get tds return filing online service. File income tax return with an experts from Taxolawgy. Know penalty for non-filing of TDS return

#tdsreturnfiling#typesofTDSReturns#tdsreturnlastdate#penaltyfornonfilingofTDSreturn#incometaxfilingIndia#tdsreturnfilingonline#tdsreturnfilingduedate#incometaxreturnfilinginindia#howtofileTDSReturns#howtofiletdsreturnonline#howtofiletdsreturnforsalary

0 notes

Photo

Get TDS Return Filing Contact:- 8080809061

https://aktassociates.com/business-compliance/tax-compliance/tds-return-filing/

1 note

·

View note

Link

TDS stands for Tax Deducted at Source; it is basically a government-authorized source of collecting tax whenever a transaction takes place. TDS is even considered a method of reducing tax invasion because some portion of the tax is automatically paid through TDS.Legal-N-Tax Advisory is one of the best corporate law firms packed with multiple skilled and qualified advocates. Our lawyers will help you understand the entire process involved in TDS return filing in Dwarka.

0 notes

Text

Attention all businesses and taxpayers! 📢 Ashwani K. Gupta & Associates Chartered Accountant is here to remind you that the due date for filing your Form 10BD TDS return for Q4 FY 22-23 is approaching fast. Mark your calendars for 31st May 2023 and ensure timely compliance. Let us handle the complexities while you focus on your core business activities. Reach out to us today for seamless TDS return filing! 💼📝 #AKGCA #TDSReturnFiling #DeadlineAlert #TaxCompliance

0 notes

Text

The Benefits of Outsourcing TDS Return Filing to a Professional Service Provider

Filing TDS (Tax Deducted at Source) returns can be a complicated task for many businesses. It requires a thorough understanding of tax regulations, precise calculations, and timely submissions to avoid penalties. For companies in Delhi, outsourcing your TDS Return Service can be a smart decision. This blog explores the benefits of hiring a professional service provider for TDS return filing and also touches upon the relevance of online trademark registration in Delhi for businesses.

What is TDS?

TDS is a tax collected at the source from individuals or businesses earning income. Employers deduct TDS from salaries, and other payments such as rent, interest, and professional fees. The deducted amount must be deposited with the government and reported through TDS returns.

Filing TDS returns involves several steps, including:

Calculating the TDS amount to be deducted

Deducting TDS from payments

Depositing the deducted tax with the government

Filing TDS returns with all necessary details

As you can see, this process requires accuracy and timely actions, making it essential for businesses to have a proper strategy in place.

Why Outsource TDS Return Filing?

Here are some key benefits of outsourcing your TDS Return Service in Delhi to a professional service provider:

1. Expert Knowledge

Professional service providers specialize in tax-related services. They have a deep understanding of TDS regulations and changes in tax laws. This expertise ensures that your TDS returns are filed correctly, minimizing the risk of errors.

2. Time-Saving

Filing TDS returns is time-consuming, especially for businesses with multiple employees or complex payments. By outsourcing this task, your internal team can focus on core business activities rather than getting bogged down in paperwork. This time-saving can lead to improved productivity and better resource management.

3. Avoiding Penalties

Filing TDS returns late or incorrectly can result in heavy penalties. Professional service providers are well-versed in deadlines and compliance requirements. They ensure that your returns are filed on time and with accurate information, significantly reducing the risk of penalties.

4. Cost-Effective

Outsourcing TDS return filing may seem like an added expense, but it can actually save you money in the long run. Professional service providers often have the tools and resources to streamline the process, which can be more cost-effective than hiring a full-time employee. Moreover, avoiding penalties can further enhance your savings.

5. Better Record Keeping

Maintaining accurate financial records is crucial for any business. A professional service provider will help you maintain organized records of TDS deductions and filings. This organization not only helps during audits but also provides clarity on your financial status.

6. Handling TDS for Salary

For companies that have employees, managing TDS return for salary can be particularly challenging. The calculation of TDS depends on various factors such as salary structure, exemptions, and deductions. Professional service providers can accurately calculate TDS for salaries, ensuring compliance and accuracy in the filing process.

7. Updating with Tax Regulations

Tax laws are frequently updated. Keeping track of these changes can be overwhelming for businesses. However, professional service providers stay up-to-date with the latest tax regulations and can adjust your TDS filings accordingly. This ensures your business remains compliant and avoids any potential legal issues.

8. Customized Solutions

Every business has unique needs. Professional TDS service providers can offer customized solutions based on your business size, structure, and industry. They can tailor their services to meet your specific requirements, ensuring you get the best results.

9. Technology Utilization

Many professional service providers use advanced software for TDS return filing. This technology can automate calculations and minimize human errors. Additionally, these tools often provide easy access to your filing history and records, simplifying the overall process.

10. Additional Services

Outsourcing to a professional TDS return service provider often opens doors to other financial services. For instance, they might offer online trademark registration in Delhi or assistance with corporate tax filings. Having a single provider for multiple services can lead to better coordination and efficiency.

The Process of Outsourcing TDS Return Filing

If you decide to outsource your TDS return filing, here’s how the process generally works:

Step 1: Choose a Professional Service Provider

Research and select a reliable TDS return service provider in Delhi. Check their credentials, client reviews, and the services they offer.

Step 2: Provide Necessary Information

Once you choose a provider, you’ll need to share relevant information. This includes details about your employees, salary structures, and any other payments that require TDS deductions.

Step 3: Calculation and Filing

The service provider will calculate the TDS amounts and prepare the necessary documents for filing. They will ensure that everything is accurate and compliant with tax regulations.

Step 4: Submission and Record Keeping

After the filing is complete, the service provider will keep records of your TDS returns and ensure you receive copies for your records.

Step 5: Ongoing Support

Many professional service providers offer ongoing support for any questions or issues related to TDS filings. They can also help you with future filings and keep you updated on any regulatory changes.

Conclusion

Outsourcing your TDS Return Service in Delhi can bring numerous benefits to your business, from expert knowledge to cost savings and improved compliance. It allows you to focus on what you do best while leaving the complexities of tax filings to professionals.

Additionally, as you grow your business, consider other services like online trademark registration in Delhi to protect your brand and ensure a solid legal foundation. With the right support, you can navigate the complexities of business operations with confidence.

In the fast-paced world of business, efficiency and accuracy are key. By outsourcing your TDS return filing and utilizing professional services, you can ensure that your business remains compliant while maximizing productivity. Don’t hesitate to seek help from professionals who can make your tax filing process smoother and hassle-free.

#TDSReturnFiling#TaxServices#TDSReturnService#DelhiBusiness#ProfessionalTaxHelp#FinancialServices#TrademarkRegistration#CompanyRegistration#AccountingServices

0 notes

Text

#auditor #taxconsultant #KRPuram #Bangalore #GSTregistration #TDSreturnfiling #incometaxfiling #professionalTaxRegistration #PFregistration #ESIregistration #auditservices #companyregistration #financialcompliance #financialplanning #taxservices #foodpermitregistration #businessaudit #localtaxconsultant #businessconsultant #auditorinBangalore #taxconsultantinKRPuram #financialservices

0 notes

Text

#TDS#Taxdeductedatsource#tdsreturnfiling#trademark#companyregistration#accountingfirrm#taxfiling#FssaiRegistrationServices#AnnualRocFiling#kanakkiyalchennai#gstfiling#gstreturn#incometax#partnershipcompanyregistration#msmeregistrationintamilnadu#copyrightregistration#trustregistration#PFclaim#taxconsultancyinchennai#taxservices#ITfiling#kanakkiyal#chennai#legaldocumentation#businessregistration#license#Incometaxfilinginchennai

0 notes

Photo

If you are looking for TDS return filing services, if yes then you should visit India Tax Consulting and meet our team of accountants who will surely support you in TDS Return filling. Feel free to Call us @ +91 88842 86074 or Write to us - [email protected] Visit our website : https://www.indiataxconsulting.com

#AccountServices#TDSServices#TDSReturnServices#TDSfilingServices#TDSReturnIndia#TDSReturnCompany#TDSReturnFilingService#tds2021#TCS#Goods#goodservice#tds#tdsreturn#tdsreturnfiling#accountant#gstservices#taxplanning#taxpreparer#savetax#taxreturn#taxconsultant#taxprofessional#charteredaccountant#audit#taxtips#accountingservices#incometaxreturn#ca#accountingfirm#icai

0 notes

Photo

HostBooks GST paves a convenient way for simplified GST return filing and billing. It also helps you with easy reconciliation of invoice mismatches. Being a cloud-based software, HostBooks GST enables you to access your account anytime and anywhere. In addition, the automation feature enhances your proficiency by reducing the manual efforts by at least 50%. To know more reach us now at: https://www.hostbooks.com/in/gst-software/

#TDS#TDS Return Filing#TDS Software#tdsreturnfiling#TDS Helpline Number#GST#gst software#gst helpline#gst return#GST Return Filing#accounting#GST Accounting Software India#Accounting software helpline#TDS accounting software in india#TDS Accounting Software#Payroll#HostBooks GST#hostbooks limited#HostBooks

0 notes