#TDS Accounting Software

Explore tagged Tumblr posts

Text

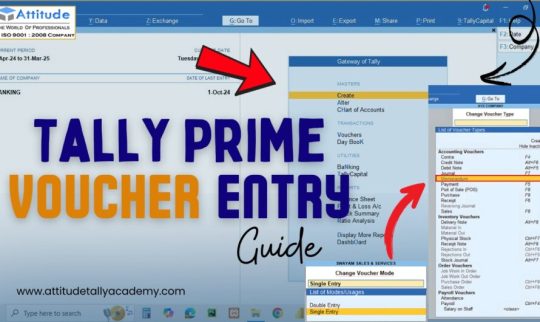

Master e-Accounting with TallyPrime: Learn Smart Financial Management

Level up your accounting skills with an in-depth e-Accounting course using TallyPrime. Designed for beginners and professionals, this course covers everything from manual accounting to GST, TDS, payroll, bank reconciliation, inventory management, and financial reporting. Learn how to create accurate books of accounts and manage real-time transactions using one of the most trusted accounting software solutions in the industry.

Whether you're looking to boost your resume or manage business finances efficiently, mastering TallyPrime is a smart investment in your career.

Start today and build a strong foundation in digital accounting!

Visit Attitude Academy📚

📍 Visit Us: Yamuna Vihar | Uttam Nagar

📞 Call: +91 9654382235

🌐 Website: www.attitudetallyacademy.com

📩 Email: [email protected]

📸 Follow us on: attitudeacademy4u

#TallyPrime Course#e-Accounting Course#Tally with GST Training#Learn TallyPrime#TallyPrime Online Course#Tally Accounting Software#GST with Tally Course#Tally Course for Beginners#Financial Accounting with Tally#Payroll in TallyPrime#TDS and TCS in Tally#Advanced Tally Course#TallyPrime with e-Invoicing#Business Accounting Course#Tally Certification Course

0 notes

Text

Advance Your Career with Our Advanced Tally Prime Course in Vasai-Virar

Introduction

Hello, aspiring accountants of Vasai-Virar! Are you ready to elevate your accounting skills and secure a promising future in finance? Our Advanced Tally Prime Course is designed specifically for students like you who are eager to deepen their knowledge and expertise. This course offers a perfect blend of theory and practical experience to ensure you excel in your career. Let’s explore why this course is the ideal step forward for you and how it can benefit your professional journey.

The Value of Tally Prime

Why Master Tally Prime?

Tally Prime isn’t just another accounting software—it's a powerful tool that simplifies financial management and boosts productivity. Here’s why mastering Tally Prime can significantly enhance your career:

User-Friendly Interface: Its intuitive design makes it accessible and easy to use.

Comprehensive Features: Handles everything from basic bookkeeping to advanced financial management.

Industry-Standard: Trusted by businesses worldwide, making your skills highly valuable.

Expanding Career Opportunities

Proficiency in Tally Prime opens numerous career opportunities. As more businesses rely on Tally Prime for their accounting needs, your expertise will be in high demand, significantly boosting your employability.

Course Overview

Detailed Course Curriculum

Our Advanced Tally Prime Course covers all the essential aspects of advanced accounting. Here’s what you can expect:

Module 1: Advanced Accounting

Handling Complex Transactions: Learn to manage intricate financial transactions seamlessly.

Multi-Currency Accounting: Gain expertise in handling accounts across different currencies.

Bank Reconciliation: Master the process of reconciling bank statements with business accounts accurately.

Module 2: Inventory Management

Optimizing Inventory: Efficiently categorize and manage inventory.

Stock Movement Analysis: Get insights into stock movement and aging analysis.

Order Processing: Understand the entire order processing cycle, from purchase to sales orders.

Module 3: Taxation

Mastering GST: Dive deep into Goods and Services Tax (GST) and its applications.

Managing TDS: Learn about Tax Deducted at Source (TDS) and its compliance.

Filing Taxes: Gain hands-on experience in filing various tax returns using Tally Prime.

Module 4: Payroll Management

Detailed Employee Records: Maintain comprehensive employee records efficiently.

Processing Payroll: Master payroll processing, including detailed salary calculations and deductions.

Ensuring Compliance: Ensure compliance with statutory requirements related to employee compensation.

Flexible Learning Schedule

We understand the importance of balancing your studies with other commitments. Our course spans three months, with classes held thrice a week, offering a flexible schedule that fits into your busy life.

Why Our Course Stands Out

Experienced Instructors

Our instructors are seasoned professionals with extensive experience in Tally Prime. They bring real-world insights and practical knowledge into the classroom, making complex concepts easier to understand and apply.

Modern Learning Environment

Our training center in Vasai-Virar is equipped with state-of-the-art facilities. Each student has access to the latest version of Tally Prime and other essential tools, ensuring a conducive learning environment.

Hands-On Experience

We believe in learning by doing. Our course includes real-world projects and case studies, providing you with practical experience that goes beyond theoretical knowledge. This hands-on approach ensures you’re ready to tackle real business challenges confidently.

How This Course Will Benefit You

Mastering Advanced Skills

Enrolling in our Advanced Tally Prime Course will equip you with expertise in advanced accounting practices. This knowledge is crucial for handling complex financial scenarios and will give you an edge over others in the field.

Boosting Your Employability

With a certification recognized by industry leaders, your resume will stand out to potential employers. The practical skills and advanced knowledge you acquire will make you a valuable asset to any organization.

Building Confidence

Our course is designed to empower you. By the end of the course, you’ll have the confidence to handle advanced accounting tasks and the ability to apply your knowledge in real-world situations.

Enrollment Details

How to Enroll

Enrolling is easy! Visit our training center in Vasai-Virar or register online through our website. Our team is available to assist with any questions or concerns you might have about the enrollment process.

Affordable and Flexible Fees

We offer competitive pricing for our comprehensive training. Additionally, we provide flexible payment options to accommodate different financial situations, ensuring that cost is not a barrier to your education.

Conclusion

Investing in your education is the best decision you can make for your future. Our Advanced Tally Prime Course in Vasai-Virar is designed to equip you with the skills and confidence needed to excel in the accounting field. Don’t miss this opportunity to advance your career—enroll now and take the first step towards mastering Tally Prime.

#Advanced Tally Prime Course#Tally Prime training Vasai-Virar#Tally Prime certification#Tally Prime advanced accounting#Tally Prime inventory management#GST and Tally Prime course#TDS management in Tally Prime#Payroll processing with Tally Prime#Tally Prime for students#Career in accounting Vasai-Virar#Best Tally Prime course in Vasai-Virar#Tally Prime classes Vasai-Virar#Accounting software training#Tally Prime practical experience#Tally Prime industry-recognized certification#Learn Tally Prime Vasai-Virar#Tally Prime course enrollment#Flexible Tally Prime course schedule#Advanced accounting skills#Tally Prime hands-on training

0 notes

Text

How Delhi’s Tax Consultants Help Startups and Freelancers Stay Compliant

Delhi has become one of India’s leading hubs for startups, freelancers, and digital professionals. While the freedom to work independently or build a business is exciting, it also comes with regulatory responsibilities—especially in taxation.

For entrepreneurs, creatives, and solopreneurs alike, working with professional tax consultants in Delhi, India can mean the difference between seamless growth and costly penalties.

The Tax Burden Faced by Startups and Freelancers

New-age professionals and early-stage startups often face these tax challenges:

Understanding applicable taxes (Income Tax, GST, TDS)

Issuing compliant invoices

Filing monthly, quarterly, and annual returns

Claiming business expenses accurately

Tracking and paying advance tax

Responding to tax notices without legal support

Missing a deadline or misreporting income can result in interest, penalties, and unwanted attention from the tax department.

How Tax Consultants Assist Freelancers and Startups in Delhi

1. Clear Guidance on Tax Registration

Freelancers need to know whether they must register under GST based on their income and service type. Consultants ensure you’re set up correctly from day one.

2. Proper Invoice and Record Management

Consultants help you issue tax-compliant invoices, maintain books, and document all business-related expenses—essential for smooth filing and audits.

3. Quarterly and Annual Filing

They manage advance tax payments, TDS returns (if you deduct TDS for freelancers or vendors), and file your ITR or business return on time.

4. GST Advisory for Startups

For product-based startups or app-based platforms, consultants handle GST registration, tax collection at source (TCS), and ensure credit reconciliation.

5. Tax Planning for Growth and Funding

As your startup grows, a consultant can advise on how to minimize taxes during fundraising, issue ESOPs properly, and stay compliant with MCA regulations.

Delhi’s Ecosystem Needs Local Expertise

Unlike generic online platforms, Delhi-based tax consultants are attuned to local:

Jurisdictional GST offices and their practices

Deductions allowed under Delhi-specific state programs

Licensing and trade registration requirements (if applicable)

Startup India benefits and DPIIT compliance steps

Real Case Example

A freelancer in South Delhi earning over ₹20 lakhs annually didn't realize they were required to register for GST. When they received a notice, they turned to a professional consultant. Within weeks, the issue was resolved, backdated filings were completed, and future workflows were automated.

Frequently Asked Questions (FAQs)

1. Do freelancers in India have to pay GST? Yes, if annual turnover exceeds ₹20 lakhs (₹10 lakhs for special category states), or if they provide services inter-state or through online platforms.

2. What tax benefits can startups claim? Startups can claim deductions under Section 80-IAC, depreciation, R&D expenses, and more—if properly documented and claimed.

3. Are professional tax consultants expensive for small businesses? Most offer affordable packages tailored for freelancers and startups, covering annual filings, GST, and advisory.

4. How can consultants help during funding rounds? They prepare financial statements, handle due diligence queries, ensure statutory compliance, and help optimize tax outflows on equity deals.

5. What tools do tax consultants use to assist clients? Most use GST portals, Tally, Zoho Books, or other accounting software to manage filings and provide transparency in tax management.

Final Thoughts

Whether you’re a designer, coder, YouTuber, SaaS founder, or digital agency in Delhi, taxes are a part of your professional journey. The right tax consultant in Delhi, India helps you focus on your work while staying fully compliant and penalty-free.

Startups and freelancers already wear many hats—don't let taxes become a burden. Leave it to the experts.

#professional tax consultants in Delhi India#taxationservices#accounting services#accounting firm in delhi#direct tax consultancy services in delhi

2 notes

·

View notes

Text

Accounting Firms in India: Enabling Financial Growth for Modern Businesses

The Essential Role of Accounting Firms in India

In today’s competitive business environment, accounting firms in India have become indispensable to companies aiming for financial transparency, legal compliance, and sustained growth. These firms are not only handling traditional tasks like bookkeeping and tax filing but are also offering strategic support in areas such as auditing, payroll management, and financial consulting. As India’s economy continues to evolve, the role of accounting professionals is becoming more crucial than ever.

With the increasing complexity of tax laws and financial regulations, businesses are turning to professional accounting firms to manage their financial responsibilities accurately and efficiently. The right firm can help reduce financial risks, ensure compliance with Indian accounting standards, and support the overall decision-making process.

Why Businesses Choose Professional Accounting Firms

Managing finances internally can be overwhelming, especially for small and mid-sized businesses. That’s why many organizations choose to outsource accounting functions to expert firms. Here’s why this trend is growing:

Regulatory Compliance: Accounting firms keep up with evolving tax laws, ensuring that businesses remain compliant with GST, income tax, and MCA regulations.

Cost Savings: Outsourcing is often more affordable than hiring an in-house accounting team, reducing operational costs.

Efficiency and Accuracy: Professional firms use advanced software and tools to ensure accurate record-keeping and timely financial reporting.

Scalable Solutions: Services can be adjusted to meet the needs of growing businesses, from startups to established enterprises.

Services Offered by Accounting Firms in India

Accounting firms in India offer a wide range of services tailored to different types of businesses. These include:

1. Bookkeeping and Financial Reporting

Maintaining organized financial records is the foundation of sound business practices. Firms handle daily transaction tracking, journal entries, ledger management, and monthly financial statement preparation.

2. Tax Planning and Filing

Navigating India’s tax system can be challenging. Accounting firms assist with GST returns, income tax filings, TDS calculations, and tax audits, while also advising on effective tax-saving strategies.

3. Audit and Assurance Services

Internal audits, statutory audits, and compliance audits help identify risks and inefficiencies. These services enhance transparency and build trust with stakeholders and investors.

4. Payroll and Compliance Management

From salary processing to PF, ESI, and professional tax deductions, accounting firms handle every aspect of payroll while ensuring compliance with labor laws and statutory requirements.

5. Business Advisory and Financial Consulting

Many firms also provide financial planning, budgeting, and forecasting services. This helps business owners make informed decisions based on data-driven insights.

Qualities to Look for in an Accounting Firm

Choosing the right accounting partner is a strategic business decision. When evaluating potential firms, consider the following:

Certification and Experience: Ensure the firm is registered with the Institute of Chartered Accountants of India (ICAI) and has experience in your industry.

Technological Capability: Look for firms that use modern accounting tools such as Tally, Zoho Books, QuickBooks, or Xero.

Transparent Communication: A reliable firm provides regular updates, clear reports, and prompt support.

Customizable Services: Every business has unique needs. Choose a firm that offers tailored solutions instead of one-size-fits-all packages.

The Advantages of Hiring Indian Accounting Firms

India’s accounting sector is recognized for its high standards of professionalism and affordability. Some of the key benefits include:

Skilled Workforce: India produces thousands of qualified CAs and finance professionals each year.

Language Proficiency: English-speaking professionals make communication seamless for both domestic and international clients.

Competitive Pricing: Indian firms offer world-class services at cost-effective rates, making them attractive for global outsourcing.

The Evolving Future of Accounting in India

The accounting industry in India is rapidly adapting to technological innovation. Automation, artificial intelligence (AI), and cloud computing are transforming how firms deliver services. Clients now benefit from real-time financial data, predictive analytics, and paperless operations.

Additionally, government initiatives such as faceless assessments, e-invoicing, and digital compliance are pushing accounting firms to adopt smarter workflows and enhance client service quality.

As businesses continue to embrace digital transformation, accounting firms are expected to play an even bigger role—not just as compliance experts, but as strategic financial advisors.

Conclusion

In a fast-changing economic landscape, accounting firms in India have emerged as trusted partners for businesses that want to operate with confidence and clarity. Their expertise, combined with advanced technology and deep regulatory knowledge, allows companies to focus on their core activities while leaving the complexities of finance and compliance to the professionals.

Whether you're launching a startup, managing a growing enterprise, or expanding internationally, working with a reliable accounting firm can drive efficiency, reduce risk, and support long-term success.

2 notes

·

View notes

Text

Advanced Tally Course Delhi – Industry Oriented

Tally Course in Delhi – TIPA में सीखें Tally का Best Training Program

अगर आप Delhi में Tally Course ढूंढ रहे हैं, तो आप सही जगह पर हैं। TIPA (The Institute of Professional Accountants) Laxmi Nagar में Tally का professional training institute है जो students और job seekers के लिए best options provide करता है।

इस article में हम discuss क��ेंगे कि Tally Course in Delhi क्यों जरूरी है, इसकी fees, syllabus, और job placements के बारे में।

क्यों जरूरी है Tally Course करना? | Why Tally Course is Important?

आज के समय में हर business को accounting professionals की जरूरत होती है। Tally ERP 9 और Tally Prime जैसी accounting software India की most popular accounting tools हैं।

इसलिए Tally सीखना (Learn Tally) ना सिर्फ आपकी accounting skills improve करता है बल्कि आपको नौकरी के नए अवसर भी देता है। Delhi जैसे metro city में जहां businesses grow कर रहे हैं, वहां Tally experts की demand बहुत ज्यादा है।

TIPA – Delhi का सबसे भरोसेमंद Tally Institute | TIPA – Best Tally Institute in Delhi

Laxmi Nagar में situated, TIPA का GMB profile (https://share.google/DebK0oLILWm8RmPMf) clearly दिखाता है कि ये institute कितनी high rating और positive reviews के साथ students को professional training provide करता है।

TIPA में आपको मिलेगा:

Practical Tally Training (practical based projects)

Certified और Experienced Trainers

100% Placement Assistance with Interview Preparation

Affordable Fee Structure (फीस आपकी budget में)

Tally Course का Syllabus – क्या क्या सीखेंगे आप? | Tally Course Syllabus Overview

TIPA का Tally Course syllabus पूरी तरह से updated है। Students को latest Tally ERP 9 और Tally Prime दोनों सिखाई जाती हैं।

Syllabus Topics:

Basics of Accounting (Accounting Fundamentals)

Tally ERP 9 Installation & Setup

Company Creation, Ledger & Group Creation

Inventory Management in Tally

GST in Tally (CGST, SGST, IGST entries)

TDS, Payroll, MIS Reports

Export-Import Documentation in Tally

Finalization of Accounts

हर topic के साथ आपको real-time practical assignments कराए जाएंगे जिससे आपका hands-on experience मजबूत होगा।

Tally Course की Duration और Fees | Tally Course Duration and Fee Structure

TIPA का Tally Course flexible है।

Course Duration: 2 months से लेकर 3 months तक का course structure है, depending on student's learning pace.

Fee Structure: Course fee approx ₹8,000 – ₹12,000 के बीच है।

Delhi के Laxmi Nagar में ये सबसे affordable और value-for-money course है।

Tally Course करने के बाद Job Opportunities | Career Scope After Tally Course in Delhi

Tally सीखने के बाद आपको बहुत सारे job roles के लिए eligible बनाया जाता है।

कुछ popular job profiles:

Junior Accountant

Tally Operator

GST Executive

Accounts Assistant

Billing Executive

TIPA अपने students को nearby Delhi NCR में placements के लिए proper guidance और interview preparation support भी देता है।

Delhi में Tally सीखने के फायदे | Benefits of Learning Tally in Delhi

Delhi में Tally सीखने के कई advantages हैं।

यहाँ आपको best Tally Institutes की wide range मिलती है।

Practical exposure के लिए industries और CA firms में internship के chances ज्यादा होते हैं।

Placement और Job Networking opportunities Delhi NCR में बेहतर हैं।

TIPA जैसे institute आपको personal attention और doubt clearing sessions भी provide करते हैं।

TIPA का Local Presence और GMB Impact | TIPA’s Local SEO Strength in Delhi

TIPA का Google My Business (GMB) profile regularly updated रहता है जिससे students को latest batch details और offers पता चलते हैं।

आपको TIPA के GMB profile पर मिलेगी:

Verified Contact Information

Location Map of Laxmi Nagar Branch

Real Student Reviews & Ratings

Photos & Videos of Classrooms and Training Labs

TIPA की strong GMB presence ही reason है कि “Tally Course in Delhi” search करने पर ये institute top results में आता है।

कौन कर सकता है Tally Course? | Eligibility for Tally Course in Delhi

Tally Course में admission के लिए कोई specific eligibility नहीं है।

12th pass students

B.Com या Graduation complete करने वाले students

Job Seekers जो accounting field में career बनाना चाहते हैं

Small Business Owners जो अपनी accounting खुद manage करना चाहते हैं

TIPA में students की background को देखकर personalized learning plan बनाया जाता है।

क्यों चुनें TIPA को Tally Training के लिए? | Why Choose TIPA for Tally Course in Delhi?

TIPA का focus है practical learning और student-centric teaching पर।

Small Batch Size जिससे individual attention मिले।

Practical Assignments और Case Studies based training.

Flexible Timings – Working professionals के लिए weekend batches भी available हैं।

Placement Cell जो students को job interviews में assist करता है।

Lifetime Access to Learning Resources और Doubt Clearing Sessions.

Conclusion – Delhi में Tally Course का Future Scope | Future of Tally Course in Delhi with TIPA

अगर आप Delhi में रहकर अपनी accounting skills upgrade करना चाहते हैं, तो TIPA का Tally Course आपके career में एक नया turning point ला सकता है।

Practical knowledge, experienced faculty, और 100% placement assistance के साथ TIPA ensures करता है कि आप job market में confident रहें।

Tally सीखना आज की date में न सिर्फ एक skill है, बल्कि ये आपके career को secure करने का सबसे आसान तरीका भी है।

Name:-

Institute of Professional Accountants

Address:-

E-54 3rd floor, Metro Pillar No. 44, Laxmi Nagar, Block E, Laxmi Nagar, Delhi 110092

Phone:-

092138 55555

Description:-

"The Institute of Professional Accountants (TIPA), located in Laxmi Nagar, Delhi, is a leading institute offering job-oriented Diploma in E-Accounting, Taxation, Tally Course and GST. Our popular courses include DFA (Diploma in Financial Accounting), Tally Prime, BUSY, SAP FICO, Income Tax & GST return filing, and Advanced Excel. Ideal for 12th pass, B.Com, and working professionals, TIPA ensures 100% job placement in Delhi NCR. We also offer Business Accounting & Taxation (BAT) course with online/offline modes. Join today to build a high-paying career in accounting. call 9213855555 for brochure, fee, and syllabus."

www.tipa.in ,,https://g.co/kgs/K97g9Xp , https://www.facebook.com/tipainstitute , https://www.youtube.com/c/IPAInstituteOfProfessionalAccountants , Best Tally Course Training , Accountant Course , Accounting Institutes , Tally Course Training Institutes in East Delhi NCR Laxmi Nagar , Institute of Professional Accountants , Tally Institutes , Computer Course ,Computer Institutes , GST Course in Delhi ,Local KW AI ,AI 03-07-25 ,AI 04-07-25 ,AI -05-07-25 ,AI-06-07-25 , AI-07-07-25 , IPA Karol Bagh

Accounting Course ,

Diploma in Taxation Course,

courses after 12th Commerce ,

Courses after b com ,

Diploma in financial accounting ,

Accounting and Taxation Course ,

GST Course ,

Computer Course in Delhi ,

Tally Course in East Delhi ,

One year course ,

Advanced Excel Course ,

Computer ADCA Course in Delhi

Data Entry Operator Course fee,

six months diploma course in accounting

Income Tax

Accounting

Tally

Career

0 notes

Text

Best Institute for Tally Course in Delhi NCR

Tally Course in Delhi – TIPA में सीखें Tally का Best Training Program

अगर आप Delhi में Tally Course ढूंढ रहे हैं, तो आप सही जगह पर हैं। TIPA (The Institute of Professional Accountants) Laxmi Nagar में Tally का professional training institute है जो students और job seekers के लिए best options provide करता है।

इस article में हम discuss करेंगे कि Tally Course in Delhi क्यों जरूरी है, इसकी fees, syllabus, और job placements के बारे में।

क्यों जरूरी है Tally Course करना? | Why Tally Course is Important?

आज के समय में हर business को accounting professionals की जरूरत होती है। Tally ERP 9 और Tally Prime जैसी accounting software India की most popular accounting tools हैं।

इसलिए Tally सीखना (Learn Tally) ना सिर्फ आपकी accounting skills improve करता है बल्कि आपको नौकरी के नए अवसर भी देता है। Delhi जैसे metro city में जहां businesses grow कर रहे हैं, वहां Tally experts की demand बहुत ज्यादा है।

TIPA – Delhi का सबसे भरोसेमंद Tally Institute | TIPA – Best Tally Institute in Delhi

Laxmi Nagar में situated, TIPA का GMB profile (https://share.google/DebK0oLILWm8RmPMf) clearly दिखाता है कि ये institute कितनी high rating और positive reviews के साथ students को professional training provide करता है।

TIPA में आपको मिलेगा:

Practical Tally Training (practical based projects)

Certified और Experienced Trainers

100% Placement Assistance with Interview Preparation

Affordable Fee Structure (फीस आपकी budget में)

Tally Course का Syllabus – क्या क्या सीखेंगे आप? | Tally Course Syllabus Overview

TIPA का Tally Course syllabus पूरी तरह से updated है। Students को latest Tally ERP 9 और Tally Prime दोनों सिखाई जाती हैं।

Syllabus Topics:

Basics of Accounting (Accounting Fundamentals)

Tally ERP 9 Installation & Setup

Company Creation, Ledger & Group Creation

Inventory Management in Tally

GST in Tally (CGST, SGST, IGST entries)

TDS, Payroll, MIS Reports

Export-Import Documentation in Tally

Finalization of Accounts

हर topic के साथ आपको real-time practical assignments कराए जाएंगे जिससे आपका hands-on experience मजबूत होगा।

Tally Course की Duration और Fees | Tally Course Duration and Fee Structure

TIPA का Tally Course flexible है।

Course Duration: 2 months से लेकर 3 months तक का course structure है, depending on student's learning pace.

Fee Structure: Course fee approx ₹8,000 – ₹12,000 के बीच है।

Delhi के Laxmi Nagar में ये सबसे affordable और value-for-money course है।

Tally Course करने के बाद Job Opportunities | Career Scope After Tally Course in Delhi

Tally सीखने के बाद आपको बहुत सारे job roles के लिए eligible बनाया जाता है।

कुछ popular job profiles:

Junior Accountant

Tally Operator

GST Executive

Accounts Assistant

Billing Executive

TIPA अपने students को nearby Delhi NCR में placements के लिए proper guidance और interview preparation support भी देता है।

Delhi में Tally सीखने के फायदे | Benefits of Learning Tally in Delhi

Delhi में Tally सीखने के कई advantages हैं।

यहाँ आपको best Tally Institutes की wide range मिलती है।

Practical exposure के लिए industries और CA firms में internship के chances ज्यादा होते हैं।

Placement और Job Networking opportunities Delhi NCR में बेहतर हैं।

TIPA जैसे institute आपको personal attention और doubt clearing sessions भी provide करते हैं।

TIPA का Local Presence और GMB Impact | TIPA’s Local SEO Strength in Delhi

TIPA का Google My Business (GMB) profile regularly updated रहता है जिससे students को latest batch details और offers पता चलते हैं।

आपको TIPA के GMB profile पर मिलेगी:

Verified Contact Information

Location Map of Laxmi Nagar Branch

Real Student Reviews & Ratings

Photos & Videos of Classrooms and Training Labs

TIPA की strong GMB presence ही reason है कि “Tally Course in Delhi” search करने पर ये institute top results में आता है।

कौन कर सकता है Tally Course? | Eligibility for Tally Course in Delhi

Tally Course में admission के लिए कोई specific eligibility नहीं है।

12th pass students

B.Com या Graduation complete करने वाले students

Job Seekers जो accounting field में career बनाना चाहते हैं

Small Business Owners जो अपनी accounting खुद manage करना चाहते हैं

TIPA में students की background को देखकर personalized learning plan बनाया जाता है।

क्यों चुनें TIPA को Tally Training के लिए? | Why Choose TIPA for Tally Course in Delhi?

TIPA का focus है practical learning और student-centric teaching पर।

Small Batch Size जिससे individual attention मिले।

Practical Assignments और Case Studies based training.

Flexible Timings – Working professionals के लिए weekend batches भी available हैं।

Placement Cell जो students को job interviews में assist करता है।

Lifetime Access to Learning Resources और Doubt Clearing Sessions.

Conclusion – Delhi में Tally Course का Future Scope | Future of Tally Course in Delhi with TIPA

अगर आप Delhi में रहकर अपनी accounting skills upgrade करना चाहते हैं, तो TIPA का Tally Course आपके career में एक नया turning point ला सकता है।

Practical knowledge, experienced faculty, और 100% placement assistance के साथ TIPA ensures करता है कि आप job market में confident रहें।

Tally सीखना आज की date में न सिर्फ एक skill है, बल्कि ये आपके career को secure करने का सबसे आसान तरीका भी है।

#business accounting and taxation (bat) course#diploma in taxation#payroll management course#sap fico course#tally course#accounting course#stock market#gst course#finance

0 notes

Text

Best TallyPrime Training Institute in Mohali – Bright Career Solutions

Want to become an expert in accounting and GST billing? Looking for a reliable Tally Prime training institute in Mohali? Join Bright Career Solutions for the most practical and professional Tally course, designed for students, job seekers, and business owners.

Why Learn TallyPrime?

TallyPrime is the most widely used accounting software in India. It simplifies accounting, taxation, inventory, and payroll operations for businesses of all sizes. With TallyPrime skills, you can work as an accountant, billing executive, tax assistant, or even manage your own business finances with ease.

Top Tally Training in Mohali – Learn from Experts

At Bright Career Solutions, we focus on job-ready practical training. Our expert faculty ensures you understand every feature of TallyPrime with hands-on sessions and real business case studies.

What You’ll Learn in the TallyPrime Course

Introduction to Accounting and TallyPrime

Creating Companies and Ledgers

Recording Day-to-Day Transactions

Sales, Purchase, Payment, and Receipt Vouchers

Inventory Management

GST Setup and Return Filing

TDS, TCS, and Payroll Processing

Cost Centres and Budgeting

Bank Reconciliation

Generating Financial Reports (P&L, Balance Sheet, Trial Balance)

Data Backup, Restore, and Security Features

Why Choose Bright Career Solutions?

✅ Certified & Experienced Trainers

Our instructors are Tally-certified professionals with years of experience in accounts and finance.

✅ 100% Practical Training

You’ll work on real company scenarios, tax structures, and financial statements.

✅ Industry-Relevant Curriculum

Our course is updated regularly to meet industry and compliance requirements, including the latest GST rules.

✅ Job Assistance

We help you with resume building, interview preparation, and job placement support in reputed companies.

✅ Flexible Timings

Weekday, weekend, and fast-track batches available for students, working professionals, and business owners.

Who Should Join This Course?

B.Com, M.Com, BBA, MBA students

Accounting & finance professionals

Entrepreneurs & business owners

Job seekers in the finance domain

Freelancers managing client books

Join the Best TallyPrime Training in Mohali Today

Become a certified Tally expert with Bright Career Solutions, the trusted name for TallyPrime coaching in Mohali. Gain real accounting skills and boost your career or business.

0 notes

Video

🧾 How to Correct Errors in a Filed Income Tax Return (ITR) – India | Revised Return, Rectification & Notices by Return Filings Via Flickr:

Filed your income tax return but made a mistake? 😟 Here’s a practical guide on how to fix errors in your ITR quickly and avoid tax notices, delays, or penalties.

❗ Common Mistakes People Make:

Wrong income or deduction details

TDS mismatches

Incorrect bank account or PAN info

These issues can lead to delayed processing, unwanted tax demands, or IT notices.

🔁 Use the Revised Return Option (Section 139(5))

📆 You can revise your return anytime before the end of the assessment year. 🖥️ Just log in to the IT e-filing portal, select ‘Revised Return’, and re-submit with corrected details.

🛠️ File a Rectification Request (Section 154)

If the error was made by the IT department (e.g., wrong processing): 📌 File a Rectification Request directly on the portal under Section 154.

📩 Got a Notice? Here's What to Do:

You might receive notices under:

Section 139(9) – Defective return

Section 143(1) – Intimation

Section 154 – Rectification

📌 Respond through the portal with updated info and any supporting documents.

✅ Pro Tips for Future Accuracy:

Always cross-check with Form 26AS, AIS, and TIS

Use professional support or reliable tax software to prevent mistakes

📍 View the full visual guide here: 🔗 On Flickr 📌 On Pinterest

Help others by sharing this! Let’s make tax filing less stressful. 💡✅

#IncomeTaxReturn#ITRErrors#RevisedReturnIndia#RectificationRequest#Section139_5#Section154#TaxNoticeIndia#ReturnFilings#FlickrFinancePost#FlickrTax#FlickrFinance#TaxFilingIndia#CorrectITR#Form26AS#AISIndia#ITPortal#SelfFilingIndia#DigitalTaxIndia#IncomeTaxCompliance#AvoidTaxPenalties#flickr#tumblrfinance

1 note

·

View note

Text

Custom vs. Off-the-Shelf ERP: What’s Best for Indian Businesses?

Let’s rewind to 2019. A mid-sized manufacturing firm in Pune — let’s call it Sankalp Industries — was juggling spreadsheets, manual inventory logs, and WhatsApp messages to manage orders and vendors. It worked… until it didn’t.

Missed deliveries, mismatched invoices, and unhappy clients led Sankalp’s leadership to take the ERP plunge. But they hit a wall — should they go for a custom ERP solution tailored to their operations, or off-the-shelf ERP software that’s ready to deploy?

If you’re an Indian business standing at the same crossroads, you’re not alone. Let’s unpack both options to help you make the right call.

Understanding the Two Choices

What is an Off-the-Shelf ERP?

An off-the-shelf ERP is a pre-built software solution designed to meet common business needs. Think of it like buying a ready-made suit: it fits most people reasonably well and is quick to grab off the rack.

Popular among SMEs, these solutions usually come with essential modules — inventory, sales, HR, finance, procurement, and reporting — and can be deployed quickly.

What is a Custom ERP?

Custom ERP software is designed from scratch or heavily modified to meet the specific operational needs of your business. It’s more like a tailored suit — designed exactly for your size, shape, and style.

The Indian Business Context: Where One Size May Not Fit All

Indian businesses are a mix of traditional methods and modern tools. From GST compliance to multi-location warehousing, there are layers of complexity that not every ERP can handle out of the box.

This is where choosing the Best ERP Software in India becomes critical — whether custom or pre-built.

Custom ERP: When and Why It Makes Sense

✅ Pros:

Tailored workflows: Automate your exact processes, not just the generic ones.

Integration flexibility: Easily connect with your legacy systems, e-invoicing tools, or third-party APIs.

Scalability: Add features as your business grows, without being boxed in.

Competitive advantage: Unique features can differentiate your operations from competitors.

❌ Cons:

Time-consuming: Development can take months.

Higher upfront costs: More resources are needed initially.

Requires a trusted development partner: You need experienced hands to avoid technical debt.

Imagine a pharmaceutical distributor in Gujarat needing batch-level inventory tracking, barcode-based warehouse ops, and automated GST filings. A custom ERP can be built to tick all those boxes — and integrate with local compliance systems.

Off-the-Shelf ERP: When It’s the Smarter Choice

✅ Pros:

Faster implementation: Start using the system in weeks.

Proven reliability: Tried-and-tested features already used by thousands.

Lower initial cost: Subscription models or one-time licenses available.

Vendor support: Regular updates, documentation, and customer service.

❌ Cons:

Limited flexibility: May not fit your processes perfectly.

Extra costs for customization: Tweaks can add up.

Feature overload: May come with modules you don’t even need.

If you’re a startup in Bengaluru with standard needs — basic accounting, invoicing, and CRM — then the Best ERP Software in India that’s off-the-shelf could do the trick without overkill.

Our Verdict? Think Long-Term, Not Just Launch-Time

For businesses with unique workflows, industry-specific requirements, or ambitious growth plans, a custom ERP might be worth the investment.

For those wanting quick results, minimal fuss, and proven functionality, off-the-shelf ERP software might be your best bet.

Either way, the key is to not settle for “just okay.” Partner with a solution provider that understands Indian business realities — GST, e-way bills, TDS, vendor reconciliation, and more.

That’s where Udyog Software comes in. Recognized among the Best ERP Software in India, Udyog blends domain expertise with tech finesse to deliver solutions that actually work — whether off-the-shelf or tailored to perfection.

Final Thoughts: The Right ERP is a Growth Partner

ERP isn’t just a software — it’s the digital nervous system of your business. Choose an ERP that grows with you, adapts to you, and supports everything you aim to achieve.

Need help choosing between custom vs. off-the-shelf? Connect with ERP specialists who offer more than demos — they offer direction.

Explore the Best ERP Software in India now and take the first step toward smoother, smarter business operations.

0 notes

Text

Udyog Cloud-Based ERP Software in India: Simplifying Business Operations for Indian Enterprises

In today’s rapidly evolving digital era, businesses in India are moving beyond traditional tools and spreadsheets to manage their operations. Whether it’s manufacturing, retail, distribution, or services — Enterprise Resource Planning (ERP) is no longer a luxury, but a necessity. One solution leading this digital transformation is Udyog Cloud-Based ERP Software, designed specifically to cater to the diverse and dynamic needs of Indian businesses.

What is Udyog ERP?

Udyog ERP is a comprehensive cloud-based ERP solution developed to help small, medium, and large businesses in India streamline their operations, improve accuracy, and make data-driven decisions. From inventory management and accounting to production, compliance, and sales tracking — Udyog ERP integrates every function into a single platform accessible from anywhere, anytime.

Key Features of Udyog Cloud ERP Software

1. Cloud Accessibility

Hosted on secure cloud servers, Udyog ERP allows users to access real-time data and manage operations from any device with internet access. This enhances collaboration and ensures continuity, even for remote teams.

2. GST & Tax Compliance

Designed for the Indian market, Udyog Cloud-Based ERP Software comes with built-in GST-compliant invoicing, e-way bill generation, e-invoicing, and audit reports, simplifying tax filing and compliance with Indian government norms

3. Custom Modules for Every Industry

Whether you’re in manufacturing, trading, retail, or services, Udyog ERP offers industry-specific modules:

Manufacturing ERP: Track raw materials, production cycles, wastage, BOM (Bill of Materials), and shop-floor operations.

Retail & POS: Manage billing, barcode scanning, stock updates, and customer data in real-time.

Wholesale/Distribution: Monitor stock movement, dispatch, and multi-location warehouses.

4. Inventory & Warehouse Management

Keep complete control over your inventory with batch-wise tracking, stock aging reports, reorder alerts, and real-time warehouse visibility.

5. Financial Accounting

Udyog Cloud-Based ERP Software features a full accounting suite with ledgers, cash/bank management, TDS, and balance sheets, ensuring complete financial clarity.

6. User Roles & Security

Define role-based access for employees to ensure data integrity and security, with a detailed activity log and permission control.

Benefits of Choosing Udyog ERP

Made in India — Built for Indian business scenarios, including regional compliance and billing preferences.

Scalable — Grows with your business, whether you’re a startup or an established enterprise.

Easy Integration — Connects seamlessly with third-party tools like Tally, Shiprocket, e-commerce platforms, CRMs, and more.

Customer Support — Get dedicated onboarding, training, and ongoing support from Udyog’s experienced team.

Why Indian Businesses Are Moving to Udyog Cloud-Based ERP Software

As India pushes toward digitalization and regulatory reforms (such as e-invoicing mandates and GST updates), businesses require flexible yet compliant tools. Udyog ERP provides the perfect blend of automation, compliance, and industry adaptability, making it a preferred choice for Indian SMEs and MSMEs looking to scale without operational chaos.

If you’re a business owner in India looking to upgrade your operational efficiency, reduce errors, and stay compliant with ever-changing tax laws, Udyog Cloud-Based ERP Software is the ideal solution. It’s not just an ERP — it’s your digital partner for smarter business growth.

contact us for a personalized demo and pricing details.

0 notes

Text

Choosing the Best HR Management Software for Your Company

In today’s fast-paced business world, managing human resources efficiently is more important than ever. Whether you're running a startup or a large enterprise, your HR department plays a pivotal role in employee satisfaction, compliance, and organizational growth. But manually handling HR tasks like recruitment, onboarding, attendance, payroll, and performance management can be overwhelming. That’s where HR Management Software (HRMS) comes into play.

With hundreds of tools available in the market, choosing the best HR management software for your company can seem like a daunting task. This blog will guide you through the essential factors to consider and help you find the right solution tailored to your business needs.

What is HR Management Software?

HR Management Software, also known as Human Resource Management System (HRMS) or Human Capital Management (HCM) software, is a digital solution that helps automate and streamline HR processes. From hiring and onboarding to time tracking, leave management, payroll processing, and performance evaluations, HRMS centralizes all employee-related information and tasks in one platform.

Why Your Company Needs HR Management Software

Here are a few compelling reasons why investing in HRMS is a smart move:

Saves time and resources through automation

Reduces human error in payroll and compliance

Improves employee engagement and satisfaction

Ensures legal compliance with labor laws and regulations

Provides data-driven insights for better decision-making

Key Features to Look for in HR Management Software

When evaluating HR software options, ensure the solution offers the following features:

1. Core HR Functions

Employee database

Digital personnel files

Organizational charts

Company policies and announcements

2. Recruitment & Onboarding

Job posting and applicant tracking

Resume filtering

Interview scheduling

New hire onboarding workflows

3. Attendance & Leave Management

Biometric or GPS-based attendance

Leave application and approvals

Holiday calendars and shift scheduling

4. Payroll Management

Salary processing

Tax calculations and TDS

Payslip generation

Direct bank transfers

5. Performance Management

Goal setting

Employee appraisals

360-degree feedback

6. Employee Self-Service (ESS) Portal

Allows employees to update information, apply for leave, view payslips, and more without HR intervention.

7. Compliance & Data Security

GDPR and local labor law compliance

Role-based access control

Secure data storage and backups

How to Choose the Best HR Software for Your Company

Not all businesses are the same, and your HR software should reflect that. Here are the steps to help you choose the right HRMS for your company:

1. Identify Your Business Needs

Start by listing the HR processes you want to automate. A small business might only need basic payroll and leave tracking, while a growing company may need more advanced features like recruitment, performance reviews, and analytics.

2. Consider Scalability

Choose software that grows with your business. As you expand, your HR needs will evolve. Look for a solution that can handle increased employee counts, multiple locations, and complex organizational structures.

3. Set a Budget

HR software comes in various pricing models – subscription-based (SaaS), one-time licenses, or pay-per-employee. Determine your budget and look for tools that offer the best features within that range.

4. Check Integration Capabilities

The software should integrate seamlessly with other tools you use, such as accounting software, ERP systems, and productivity platforms like Microsoft Teams or Slack.

5. Evaluate User Interface and Experience

The platform should be intuitive and user-friendly for both HR teams and employees. Complex systems can lead to resistance in adoption and increased training costs.

6. Review Vendor Support and Training

Reliable customer support is critical. Ensure the vendor provides onboarding, training materials, and responsive support (email, phone, or live chat).

7. Ask for a Free Trial or Demo

Most vendors offer a free trial or demo. Use this opportunity to test the system, assess ease of use, and determine if it aligns with your workflow.

Common Mistakes to Avoid

Overpaying for unused features: Don’t get swayed by fancy add-ons that you don’t need.

Ignoring user feedback: Consider input from HR staff and employees who will be using the tool daily.

Neglecting data migration: Ensure that existing employee data can be migrated safely to the new platform.

Choosing based on price alone: The cheapest option might lack vital features or reliable support.

Final Thoughts

Choosing the best HR management software for your company is a strategic decision that affects your organization’s productivity, compliance, and employee satisfaction. By carefully evaluating your needs, comparing features, and considering usability and support, you can select a solution that streamlines HR processes and empowers your workforce.

#project management software#client management software#employee management software#task management software#attendance management software

0 notes

Text

Bookkeeping Services in Delhi by SC Bhagat & Co.

Managing a successful business involves more than just selling products or offering services — it requires solid financial management. Bookkeeping is the backbone of every organized business, ensuring accuracy in financial records, smooth compliance, and insightful decision-making. If you're looking for reliable and professional bookkeeping services in Delhi, SC Bhagat & Co. is a name you can trust.

Why Bookkeeping is Crucial for Your Business

Bookkeeping involves recording day-to-day financial transactions, including sales, purchases, receipts, and payments. Here’s why accurate bookkeeping is vital:

Financial Accuracy: Track income and expenses with precision

Regulatory Compliance: Timely GST filings, TDS compliance, and income tax returns

Budget Planning: Clear insight into your financial health

Better Decision Making: Make strategic business decisions based on real-time data

Investor Confidence: Transparent records for investors, banks, and auditors

Why Choose SC Bhagat & Co. for Bookkeeping Services in Delhi?

SC Bhagat & Co. is a reputed chartered accountancy firm in Delhi with decades of experience offering end-to-end bookkeeping and accounting solutions to startups, SMEs, and large enterprises.

Key Features of SC Bhagat & Co.’s Bookkeeping Services:

✅ Customized Solutions: Tailored bookkeeping services based on your industry and business size.

📊 Cloud-Based Bookkeeping: Access your financial data from anywhere through secure online portals.

🧾 GST and Tax Compliant: Seamless integration with your GST and income tax filing needs.

📉 Cost-Efficient Services: Affordable packages to suit every business’s budget.

👩💼 Experienced Team: Handled by qualified accountants and financial professionals.

🔒 Data Security: Strict confidentiality and data protection protocols in place.

Who Can Benefit from Our Bookkeeping Services?

Small and Medium Enterprises (SMEs)

Startups looking to scale operations

E-commerce businesses

Freelancers and consultants

NGOs and non-profit organizations

Manufacturing and service-based industries

Our Bookkeeping Process

At SC Bhagat & Co., we follow a streamlined and transparent process:

Initial Consultation

Understanding Business Needs

Software Setup (Tally, Zoho, QuickBooks, etc.)

Daily/Weekly/Monthly Entries

Reconciliations and MIS Reports

Audit Support & Tax Filing Integration

Why Businesses in Delhi Prefer SC Bhagat & Co.

Delhi is a hub of growing enterprises, and SC Bhagat & Co. has built long-term relationships with clients through reliable, timely, and expert bookkeeping services. Our firm combines traditional accounting practices with modern digital tools to ensure accuracy, transparency, and real-time financial tracking.

Frequently Asked Questions (FAQ)

❓ What is the cost of bookkeeping services in Delhi?

Answer: The cost depends on the size of your business and the complexity of your financial transactions. SC Bhagat & Co. offers customizable plans starting from affordable monthly packages.

❓ Can you handle cloud-based bookkeeping software?

Answer: Yes, we work with all major cloud-based platforms like Tally ERP 9, Zoho Books, QuickBooks, and Xero, providing you access to your records from anywhere.

❓ Is bookkeeping the same as accounting?

Answer: No. Bookkeeping involves recording daily transactions, while accounting involves interpreting and analyzing that data to make financial decisions. SC Bhagat & Co. offers both services.

❓ Do you offer GST filing along with bookkeeping?

Answer: Absolutely! We provide end-to-end solutions, including GST registration, GST return filing, and reconciliation alongside your bookkeeping.

❓ Is my financial data secure?

Answer: Yes. We follow strict data confidentiality and use encrypted platforms to ensure your financial information remains protected.

Get Started with SC Bhagat & Co. Today

If you’re looking for professional, reliable, and cost-effective bookkeeping services in Delhi, SC Bhagat & Co. is your trusted financial partner. Let us manage your books while you focus on growing your business.

📞 Contact us today for a free consultation and streamline your financial records with expert support.

#taxation#gst#taxationservices#accounting services#direct tax consultancy services in delhi#accounting firm in delhi#tax consultancy services in delhi#remittances#beauty#actors

3 notes

·

View notes

Text

Bookkeeping in India: A Practical Guide for Overseas Startups and Freelancers

Bookkeeping in India: A Practical Guide for Overseas Startups and Freelancers

If you’re an overseas entrepreneur, startup founder, or freelancer looking to work with Indian clients, vendors, or talent, it’s essential to understand how bookkeeping works in India. While bookkeeping is a universal business function, India’s financial regulations, tax structures, and documentation standards make it unique in several ways.

Whether you're registering a business in India, outsourcing work, or simply receiving payments from Indian companies, having a solid grasp of Indian bookkeeping practices can save you from compliance headaches, penalties, or lost business opportunities.

Understanding the Importance of Bookkeeping in India

In India, bookkeeping isn’t just a back-office task; it’s a legal necessity for most business entities. Proper bookkeeping ensures accurate income tax filings, seamless GST compliance, audit readiness, and financial transparency. If your business involves transactions with Indian vendors, employees, or customers, maintaining well-organized financial records is critical.

Even if your business is registered overseas, you may fall under Indian financial scrutiny in specific cases, especially when you receive payments from Indian clients or make cross-border transactions involving INR. In such situations, your records must reflect compliance with Indian tax rules such as GST and TDS.

Common Scenarios Where Foreign Entities Need Indian Bookkeeping

Many overseas businesses and freelancers mistakenly believe that Indian bookkeeping laws don’t apply to them unless they physically operate in the country. However, even remote operations can trigger compliance obligations.

For instance, if you’ve hired Indian freelancers or employees, you’ll need to account for salary payments, deductibles, and statutory contributions like TDS. Similarly, if your company invoices Indian clients or receives payments through Indian bank accounts, you’ll need to maintain accurate GST-compliant invoices and keep track of currency exchange documentation.

Another common scenario is setting up a wholly-owned subsidiary or LLP in India to serve the local market. In such cases, Indian bookkeeping norms become mandatory from day one, including statutory filings and reconciliations.

Core Accounting Concepts You Should Know

To manage Indian bookkeeping effectively, it's helpful to understand a few foundational financial concepts and how they operate in the Indian context.

Goods and Services Tax (GST)

India operates under a comprehensive indirect tax system called GST, which is levied on almost all goods and services. If you supply products or services in India and exceed the annual turnover threshold, typically ₹20 lakhs for service providers, you’re required to register for GST. Once registered, you must issue GST-compliant invoices and file periodic returns, either monthly or quarterly, depending on your turnover and business type.

Tax Deducted at Source (TDS)

TDS is a tax mechanism where the payer deducts a specific percentage of tax before making payment to the recipient. For example, Indian clients paying overseas freelancers may deduct TDS before remitting the payment. Accurate bookkeeping is essential to track these deductions, reconcile them with Form 26AS (tax statement), and claim credit when applicable.

Accrual vs. Cash Basis

While small freelancers might initially use the cash basis method (recording income when received and expenses when paid), most Indian entities, especially those registered for GST or incorporated as companies, are required to use the accrual basis. This method recognizes income and expenses when they are earned or incurred, not necessarily when money changes hands. Accrual accounting provides a more accurate picture of financial health, especially for multi-currency, multi-country businesses.

Choosing the Right Accounting Software for India

When managing Indian financial transactions, it’s important to use accounting software that supports Indian tax structures, especially GST and TDS. Popular choices include Zoho Books, which is fully GST-compliant and cloud-based, and TallyPrime, widely used by Indian SMEs for its offline capabilities. QuickBooks India and Xero also serve international businesses but may need customization for full Indian compliance.

Look for software that can handle multi-currency invoicing, generate GST-compliant bills, and automate reconciliation with Indian banks. The ability to generate reports required by Indian authorities, such as GSTR-1, GSTR-3B, and TDS returns, is a major plus.

Setting Up an Indian Bookkeeping Process (Remotely)

You don’t need to be physically present in India to set up a robust bookkeeping system for your Indian operations. Begin by selecting appropriate accounting software. Then, create a chart of accounts aligned with Indian standards, including revenue, expense, tax, and control accounts. From there, set up a process to record all transactions promptly, including invoices issued, payments made, taxes deducted, and so on.

Monthly bank reconciliation is essential to ensure that your recorded transactions match actual account activity. Maintain digital records of all relevant documents such as invoices, receipts, contracts, and TDS certificates. These will be crucial during audits or when filing annual returns.

If this seems overwhelming, many overseas companies and freelancers choose to outsource bookkeeping to Indian service providers. This ensures compliance while keeping operational costs low.

Legal and Compliance Considerations

Operating in or with India brings a few mandatory compliance requirements. For example, all GST-registered entities must file GSTR-1 and GSTR-3B regularly. Failing to do so can result in heavy penalties and disruption in business transactions. Likewise, if you receive payments subject to TDS, you need to reconcile your earnings with Form 26AS, which serves as proof of tax deducted by Indian clients.

If your business is registered in India (as an LLP, private limited company, or proprietorship), you are also expected to maintain books under the Companies Act or relevant tax statutes. These include balance sheets, profit & loss statements, and audit-ready ledgers.

Frequent Mistakes by Foreign Startups and Freelancers

A common mistake is treating Indian transactions informally, such as not issuing proper invoices, ignoring currency conversion records, or not tracking taxes like GST or TDS. Many also use software that isn’t built for Indian compliance, resulting in mismatched reports or manual errors.

Another critical issue is missing deadlines for filings. GST returns, TDS returns, and annual income tax filings all have strict deadlines. Missing these can lead to penalties and reduced credibility with clients or banks.

Keeping personal and business transactions mixed is another red flag, especially when tax authorities review books or bank statements. Segregating your accounts from the start helps streamline reporting and compliance.

Conclusion

Bookkeeping in India may seem complex to overseas businesses and freelancers at first, but with the right approach and tools, it becomes manageable and even empowering. Well-maintained books not only ensure tax compliance but also help you make better financial decisions, assess profitability, and prepare for scaling operations in the Indian market.

Whether you're building a remote team in India, offering services to Indian clients, or setting up a subsidiary here, investing in solid bookkeeping practices is non-negotiable. It keeps your business audit-ready, transparent, and in full control of its cross-border financial activities.

Blogged by: Ledgify

#accounting tips#accounting#business#team management#tax preparation#time#accounting software bd#india#usa

0 notes

Text

Accounting Course After BCom in Chandigarh – Your Gateway to a Successful Finance Career

After obtaining your BCom, the next thing to do in planning a successful career is selecting the correct professional course. If you are in Chandigarh and wish to create a high-income and secure career in finance, then pursuing an accounting course after BCom is the wisest decision. At Accounting Sikho, we know what today’s commerce graduates need and provide a well-designed, industry-focused syllabus that prepares you for practical challenges in the accounting and finance field.

Why a Financial Accounting Course in Chandigarh?

Chandigarh is becoming a Developing Hub for Commerce & finance professionals. With leading firms and financial institutions opening up shop, there’s an increasing need for competent accountants. The financial accounting course by Accounting Sikho in Chandigarh is specifically tailored for BCom pass outs who want to have a practical advantage over others. This course will enable you to grasp fundamental accounting concepts, maintain business finances, manage bookkeeping, prepare financial reports, and acquire skills in programs such as Tally and GST filing.

Job Readiness Advanced Training in Practical Accounting in Chandigarh

What makes Accounting Sikho different from the rest is its emphasis on Advanced Practical Accounting Training in Chandigarh. This is no theoretical training — you learn through practice. You’ll Get Hands-on Training With Tally ERP, GST portal, Income Tax Software, & Real Client Data. Whether you want to become an accountant, tax consultant, or even begin your own practice, this practical training gives you the job-ready skills.

Enroll in an Advanced Accounting Course in Chandigarh for Career Growth

If you’re looking to specialize and gain mastery in the accounting field, an advanced accounting course in Chandigarh is a must. Accounting Sikho offers modules that cover in-depth topics such as advanced Tally, MIS reports, reconciliation, auditing, and payroll management. These skills are crucial for those aiming to work in MNCs, CA firms, or large business organizations. With emphasis laid upon accuracy, compliance, and financial analysis, the course will make you an asset to any employer.

Taxation and Accounting Courses in Chandigarh from Industry Experts

A good accountant is not only proficient in maths, but also well-versed in the newest tax laws and compliance procedures. Our accounting and taxation courses in Chandigarh cover topics in direct and indirect taxation, GST returns, TDS submission, PF/ESI compliance, and preparation of income tax. This blend of taxation and accounting provides you with a complete skill set, allowing you to handle entire financial portfolios.

Best Accounts Training in Chandigarh at Accounting Sikho

The Chandigarh accounts training from Accounting Sikho stands out for its high-quality learning, seasoned instructors, and placement-oriented system. Whether you are a fresher or an existing professional seeking to upskill, our flexible batches and one-to-one mentoring ensure that it is convenient for you to learn and develop. Right from the first day, you will be exposed to practical accounting practices, making you proficient enough to ace interviews and manage accounting tasks on your own.

Why Accounting Sikho is the Best Option for Accounting Courses

Accounting Sikho is not merely a training institution — it is a platform for your accounting career. Our experienced faculty, practical classes, mock interviews, live projects, and internship placements make sure that you don’t just study, but use your knowledge in the right way. With over thousands of placed students in good companies, we have established a well-recognized reputation as the preferred institute for accounting course after BCom in Chandigarh.

Unlock Your Career with Job-Oriented Financial Courses

Our courses are designed to address the demands of today’s dynamic finance sector. When you merge financial accounting course in Chandigarh, advanced training in practical accounting, and taxation and accounting courses in Chandigarh, you become a total professional. Hiring managers seek multi-skilled professionals, and that’s what you end up being after attending our programs.

Your Path to Success Starts Now

Selecting the appropriate accounting course after BCom can revolutionize your life. With Accounting Sikho, you don’t just learn — you’re establishing a career. Our comprehensive curriculum, personal mentoring, placement assistance, and expert-driven training sessions ensure that you’re properly equipped to enter the corporate world.

Whether you aim to work in corporate finance, start your own consultancy, or build a career in taxation, Accounting Sikho gives you the perfect foundation. If you’re looking for the best advanced accounting course in Chandigarh, then look no further.

Conclusion

Chandigarh is full of opportunities for skilled finance professionals. Whether you are searching for a financial accountancy course in Chandigarh, hands-on and sophisticated training in accounting, or an integrated taxation and accountancy course, Accounting Sikho is here for you. We do not merely teach accountancy — we construct accountants. Enter A Promising Future with The Most Trusted Accounts training in Chandigarh. The hour to make your move is now. Select Accounting Sikho, and embark on the path to a prosperous career in accounting and finance.

#AccountingSikho#AccountingCourseAfterBCom#FinanceTrainingChandigarh#PracticalAccounting#TallyCourseChandigarh#GSTTrainingChandigarh#AccountsTrainingInstitute#AccountingClassesChandigarh#JobOrientedCourses#AccountingForGraduates#AdvancedAccountingTraining#ChandigarhStudents#BComCareerOptions#AccountingCareerPath#FinancialAccountingSkills#TaxationCourseChandigarh#CareerInAccounts#BestAccountingInstitute#LearnAccountingPractically#AccountingWithPlacement

0 notes

Text

ITR-4 (सेक्शन 44ADA) में “Other Assets” कॉलम क्या होता है? वकीलों के लिए सम्पूर्ण हिंदी गाइड

ITR-4 (सेक्शन 44ADA) में “Other Assets” कॉलम क्या होता है? वकीलों के लिए सम्पूर्ण हिंदी गाइड

URL Slug /itr4-44ada-other-assets-column-guide

Meta Description ITR-4 (सेक्शन 44ADA) भरते समय “Other Assets” कॉलम का क्या मतलब है, वकील इसमें क्या भरें, और क्या यह कॉलम अनिवार्य या वैकल्पिक है? जानिए इस व्यापक हिंदी ब्लॉग पोस्ट में।

1. प्रस्तावना

आज के डिजिटल युग में भी कई वकील अभी तक Manual Books of Accounts रखने से बचنے के लक्ष्य से Section 44ADA के तहत ITR-4 (Sugam) भरते हैं। इस Presumptive Taxation Scheme में Books Audit और Detailed P&L की आवश्यकता नहीं होती, परंतु एक Simplified Balance Sheet भरनी होती है।

Balance Sheet के Assets पक्ष में कई कॉलम होते हैं जैसे Fixed Assets, Sundry Debtors, Cash-in-Hand, Balance with Banks, Loans & Advances, और सबसे अंत में “Other Assets” कॉलम आता है। इस ब्लॉग पोस्ट में हम विस्तार से समझेंगे:

Other Assets का क्या मतलब है

इसमें क्या प्रविष्टियाँ (entries) डालें

Compulsory है या Optional

कैसे ट्रैक करें और डॉक्यूमेंटेशन रखें

आम गलतियाँ और उनसे बचाव

वकीलों के लिए Practical Tips

FAQs

निष्कर्ष

2. Section 44ADA एवं ITR-4 का संक्षिप्त परिचय

Section 44ADA: स्वतंत्र पेशेवरों (वकील, डॉक्टर, CA, इंजीनियर, आर्किटेक्ट आदि) के लिए एक presumptive taxation स्कीम, जहाँ gross receipts ₹50 लाख तक हों तो 50% presumptive income मानकर रिटर्न फाइल करें।

ITR-4 (Sugam): इस सेक्शन के चुनाव पर भरा जाने वाला फॉर्म; इसमें /Part A – Balance Sheet/ और /Part B – P&L Account Summary/ का summary भरना होता है।

Books Audit: नहीं पालनी, Detailed Books रखने की छूट। पर Balance Sheet summary填写 करना अनिवार्य।

3. “Other Assets” कॉलम का मतलब

Other Assets से आशय है:

वे सभी Asset-side की प्रविष्टियाँ जो Fixed Assets, Inventories, Sundry Debtors, Cash-in-Hand, Balance with Banks, Loans & Advances में शामिल नहीं होतीं, पर आपके पेशे के संचालन में Economic Benefit प्रदान करती हैं।

उदाहरण स्वरूप Other Assets में आ सकते हैं:

Asset TypeविवरणPrepaid Expensesअगली अवधि के खर्च (e.g. Insurance Premium)Security DepositsOffice premises या Internet Security depositsTDS Refund ReceivableIT Dept. में कटे TDS का refund pendingAdvance Tax Refund ReceivableAdvance Tax/ Self Assessment Tax का refund dueDigital Wallet BalancesPaytm/Google Pay में व्यवसायिक fundsGST Input Credit Receivableunutilized GST credit amountUnbilled RevenueService delivered पर bill pendingPrepaid Rent / UtilitiesAdvance rent, electricity bills etc.

4. Other Assets कॉलम में क्या भरें?

4.1 Prepaid Expenses

Insurance Premium, Software Subscription, Rent paid in advance

31 मार्च तक अप्रयुक्त portion की राशि भरें

4.2 Security / Deposit Receivable

Office Premises या Internet Security के जमानत की राशि

Refundable deposit की outstanding राशि

4.3 TDS / Tax Refund Receivable

Form 26AS में दिखे पर receive न हुए TDS refund

Advance Tax / Self Assessment Tax का pending refund

4.4 Digital Wallet Balances

Paytm, Google Pay आदि में व्यवसाय से संबद्ध funds

Note: इन्हें Cash-in-Hand नहीं, Other Assets में दिखाएं

4.5 GST Input Credit Receivable

ITC unutilized amount, जिसे आने वाले दिनों में claim करना है

4.6 Unbilled Revenue

Service deliver हो चुकी, पर Invoice न बनी हुई रसीदें; यदि material

उदाहरण तालिका (Excel ट्रैकिंग):

Asset DescriptionAmount (₹)Document ReferencePrepaid Insurance (Apr–Jun)12,000Invoice #INS-0424Office Security Deposit20,000Lease Agreement Appendix ATDS Refund Receivable15,000Form 26AS FY23–24Paytm Business Wallet8,500Paytm Statement March 2024GST Credit Receivable5,200GSTR-2A FY2023–24Total Other Assets60,700

ITR-4 Other Assets कॉलम में दर्ज करें: ₹60,700

5. क्या यह कॉलम अनिवार्य या वैकल्पिक?

स्थितिअनिवार्यतायदि Other Assets रु. 1 भी हों✅ Compulsory—सभी entries जोड़ेंयदि कोई Other Assets न हों⚠️ Optional—“0” भरें या blank

अनिवार्य: जब तक आपके पास ऐसी कोई asset हो, भरना होगा।

वैकल्पिक: यदि बिलकुल none, तो zero भरें (blank छोड़ने पर portal warning आता है)।

6. Other Assets ट्रैक एवं डॉक्यूमेंटेशन

Prepaid Expenses Register

Datewise Advance payment, expense head, amount

Deposit Ledger

Landlord/Service provider को दिए deposits, agreement references

Tax Refund Tracker

Form 26AS vs Bank Statement, refund date

Digital Wallet Statement

Business wallet extract, summary of transactions

GST ITC Register

GSTR-2A vs GSTR-2 reconciliation, pending ITC

Unbilled Revenue Log

Service completed, invoice pending with client

Documentation रखें:

Invoices, Challans, e-Challans

Agreement excerpts, bank statements

Portal screenshots (GST, TDS refund status)

7. आम गलतियाँ और उनसे बचाव

गलतीजोखिम/समस्याPersonal prepaids को business में दिखानाWrong classification, scrutinyDigital wallet में personal funds mix करनाMisstatement of assetsTDS refund claim ignore कर देनाUnderstatement of receivablesBlank छोड़ना जब assets होंPortal warning, defective return

बचाव:

केवल business-related other assets include करें।

Zero-fill करें जब applicable न हों।

Regular reconciliation—monthly या quarterly आधार पर।

8. वकीलों के लिए Practical Tips

Advance payment schedules—Date-wise breakup रखें।

Tenant ledger—Security deposits के लिए landlord details।

Auto-reminders—TDS/GST refund follow-up के लिए।

Digital backups—PDF records Google Drive में।

Clear marking—prepaid vs unbilled vs deposits को अलग करें।

9. FAQs – अक्सर पूछे जाने वाले सवाल

Q1. क्या prepaid income (advance fees) भी Other Assets में आएगा?

उत्तर: नहीं, advance fees “Liabilities – Advances” में होगी; Other Assets में केवल unpaid assets (जैसे prepaid expense) दिखाएँ।

Q2. क्या personal FD का interest accrue Other Assets में दिखेगा?

उत्तर: नहीं, सिर्फ व्यवसाय से सम्बन्धित asset items ही here.

Q3. क्या blank छोड़ने पर return invalid होगा?

उत्तर: return invalid नहीं, पर portal warning देगा; बेहतर है zero fill करें।

Q4. क्या unbilled income Other Assets में दिखाई दे?

उत्तर: हाँ, अगर service delivered पर invoice pending है—unbilled revenue show कर सकते हैं।

Q5. क्या digital wallets “Cash-in-Hand” में आएँगे?

उत्तर: नहीं, उन्हें Other Assets में show करें—Cash-in-Hand केवल physical cash।

10. निष्कर्ष

“Other Assets” कॉलम ITR-4 Balance Sheet का वह हिस्सा है जहाँ आप अपने व्यवसाय से सम्बन्धित prepaid expenses, deposits, tax refunds, digital wallet balances, GST credits, unbilled revenue जैसी miscellaneous assets दर्ज करते हैं।

Compulsory—जब ऐसी entries हों

Optional—otherwise “0” fill करें

Documentation—invoices, statements सुरक्षित रखें

Reconciliation—monthly basis पर tally करें

सही और व्यवस्थित Other Assets भरने से आपकी Balance Sheet टैली रहेगी, scrutiny के जोखिम घटेंगे, और टैक्स फाइलिंग professional बनेगी।

वकीलों के लिए Section 44ADA अनुपालन सरल हो, इसलिए हर कॉलम को सही जानकारी से भरें और records update रखें।

यदि यह गाइड उपयोगी लगा हो, तो शेयर करें और कमेंट में बताएं कि अगली बार कौन-सा कॉलम या विषय (जैसे “Capital Computation”, “Fixed Assets Detailed”) आप देखना चाहेंगे!

0 notes

Text

Master Financial e-Accounting Skills for a Future-Proof Career

Introduction

In a world that’s rapidly moving towards digitization, the field of accounting is no exception. Traditional bookkeeping is being replaced with smart, tech-driven platforms, and financial e-accounting has become a must-have skill for students aiming to enter finance, taxation, or accounting-related careers.

If you're a commerce student, job seeker, or even a small business owner, developing expertise in Tally, GST filing, and e-taxation can put you ahead in today’s competitive market. In areas like Yamuna Vihar and Uttam Nagar, professional training institutes are now offering career-oriented programs to equip learners with real-world accounting skills.

Why Learn Financial e-Accounting?

Financial e-accounting covers digital tools and processes used to manage financial data, including:

Recording business transactions

Managing ledgers

Tax calculations and GST filings

Generating financial reports

Payroll processing

Inventory and billing

One of the most widely used tools for this is Tally Prime. It’s a core part of almost every company’s finance department. For those interested in mastering it, there are dedicated Tally Prime Coaching Centres in Yamuna Vihar and Tally Prime Training Institutes in Uttam Nagar that provide structured, hands-on learning.

Tally and e-Accounting Courses in Yamuna Vihar

For students located in East Delhi, several institutes offer foundational to advanced-level accounting training. You can find options such as:

Tally classes in Yamuna Vihar

Tally Training Institute in Yamuna Vihar

Tally Prime Course in Yamuna Vihar

Tally Coaching Institute in Yamuna Vihar

E-taxation course in Yamuna Vihar

These programs include practical training on GST, TDS, invoice generation, and real-time accounting practices used in companies and CA firms.

The benefit of enrolling in a local Tally Coaching Centre in Yamuna Vihar is not just affordability, but also personalized mentorship and practical projects that help you apply your learning.

Upgrade Your Skills in Uttam Nagar

West Delhi students have equally great options when it comes to financial e-accounting courses. If you’re looking to build your skills or prepare for accounting job roles, you can explore:

Tally Training in Uttam Nagar

Tally Course in Uttam Nagar

Tally Coaching in Uttam Nagar

Tally Prime Coaching in Uttam Nagar

Tally Prime Training Institute in Uttam Nagar

E-taxation training in Uttam Nagar

Tax filing course in Uttam Nagar

These courses are designed to cover both basic and advanced levels, including payroll, taxation, MIS reporting, balance sheet creation, and more.

Whether you're a student in school or pursuing B.Com/M.Com, learning through a Tally Institute in Uttam Nagar can help bridge the gap between academic knowledge and industry expectations.

Career Benefits of Financial e-Accounting Training

A certification in Tally and e-accounting is recognized by employers across India. You can apply for roles like:

Accounts Executive

GST Filing Assistant

E-Taxation Officer

Tally Operator

Finance Assistant in MSMEs

Accountant in CA firms

Students from Tally Prime Coaching Centres in Yamuna Vihar and Uttam Nagar are finding opportunities in both private companies and freelancing for small businesses.

Final Thoughts: Invest in Your Career with Smart Accounting Skills

Financial e-accounting is more than just a course—it's an investment in your career. With the increasing demand for professionals who understand GST, Tally Prime, and e-taxation tools, this is the right time to upskill.