#Tax Deduction and Collection at Source

Explore tagged Tumblr posts

Text

Would you like to round up your total to donate to charity?

If you've ever heard those words, please, PLEASE don't respond yes.

It wasn't until I worked in the fundraising world that I learned how this worked, and it massively fucking sucks.

These are called "scan campaigns"

Okay, you say, but what is a Scan Campaign? Scan campaigns are those donation requests you get when you try and check out of somewhere. Like, “Would you like to round up?” or “Donate $1 to XYZ?” These are often framed like they're quick, feel good ways to help a cause and it can feel so gross to say no.

However, here’s what’s really happening:

You are the one who donates the money.

The company collects and bundles those donations.

The company then donates the full amount in its name.

The company gets the PR benefit and tax deduction.

You get… a receipt.

Yes, you read that right. The company gets a TAX DEDUCTION, based on YOUR PAYMENT. Sometimes they will match (like $10,000 to $10,000 raised, but they will still get the deduction and the headline for $20,000).

So, what do you do? Give money to a cause, yourself. You should always go to the source with any kind of charitable giving anyways (And I STRONGLY encourage checking out organization 990s on ProPublica - I should make a post about this too) because you need to know where your money is going.

I'm not saying NOT to give. I'm saying don't give corporations the ability to get goodwill they DON'T deserve. It may feel strange to say no when you're asked to give money to Childrens Miracle Network, but you can also come home and give right here - https://donate.childrensmiraclenetworkhospitals.org/ but look at their 990 first - https://projects.propublica.org/nonprofits/organizations/870387205

This is actually pretty high, it should be about 25% or lower for salaries and wages. But that's another post.

10 notes

·

View notes

Text

by Aviv Lavie

From the moment war broke out in the Gaza Strip last October, it was clear that water supply to the Palestinian population was a particularly sensitive issue.

Even before October 7, the Gaza water network was in a fragile state, and the population suffered from chronic shortages of potable water. Under fire, what little supply Gazans had was in danger of collapse.

After Hamas launched its deadly onslaught, various Israeli ministers declared that all transfer of resources from Israel, including electricity, water and goods, would cease. But Israel eventually backtracked amid intense international pressure and the growing suffering of civilians in the Strip.

It now emerges that direct contacts and cooperation between Israeli and Palestinian elements in Gaza took place early in the war to ensure the renewal of water supply from Israel to Gaza.

This cooperation between Israeli and Gaza professionals under fire demonstrates the disparity between the inflammatory statements of government ministers and the complex reality on the ground.

This incongruity is one of the reasons the Israeli authorities involved in the effort – the Coordinator of Government Activities in the Territories (COGAT), the Water Authority and Mekorot, Israel’s water company – prefer not to comment on the issue.

In recent years, Israel has pumped water into the Gaza Strip using three pipes: a northern one near Kibbutz Nahal Oz; a southern one called Bani Suheila, near Khan Younis; and a third, called the Sayid Basin, in between the other two. The total flow amounted to about 20 million cubic meters per year, with the payment being deducted from the Palestinian Authority’s tax money that Israel collects.

Much of the rest of Gaza’s water flowed from small desalination facilities established in the Strip. Another source was wells, which have seen a decline in water level and have been penetrated by seawater, leading them to become progressively saltier.

The northern pumping facility, near Nahal Oz, was rendered inoperative after being damaged in the October 7 attack, when thousands of Hamas-led terrorists stormed southern Israel to kill nearly 1,200 people and take 251 hostages.

41 notes

·

View notes

Text

Experts fear Trump’s 'legitimately frightening' new order to turn US military into police

Trump's new order, which is entitled "Strengthening and Unleashing America's Law Enforcement to Pursue Criminals and Protect Innocent Citizens," makes various declarations about the administration's commitment to supporting law enforcement professionals in the opening paragraphs. However, one section further down specifically mentions the U.S. military and the administration's intent to have enlisted service members participate in civilian law enforcement actions.

https://www.alternet.org/trump-order-military-police/

Trump Has Ordered Safeguards Stripped From Procurement As Pentagon Prepares To Spend $1 Trillion

https://talkingpointsmemo.com/news/trump-procurement-executive-orders-defense

DOGE employees gain accounts on classified networks holding nuclear secrets

https://www.npr.org/2025/04/28/nx-s1-5378684/doge-energy-department-nuclear-secrets-access

American Panopticon The Trump administration is pooling data on Americans. Experts fear what comes next.

In March, President Trump issued an executive order aiming to eliminate the data silos that keep everything separate. Historically, much of the data collected by the government had been heavily compartmentalized and secured; even for those legally authorized to see sensitive data, requesting access for use by another government agency is typically a painful process that requires justifying what you need, why you need it, and proving that it is used for those purposes only. Not so under Trump.

. . .

A worst-case scenario is easy to imagine. Some of this information could be useful simply for blackmail—medical diagnoses and notes, federal taxes paid, cancellation of debt. In a kleptocracy, such data could be used against members of Congress and governors, or anyone disfavored by the state. Think of it as a domesticated, systemetized version of kompromat—like opposition research on steroids: Hey, Wisconsin is considering legislation that would be harmful to us. There are four legislators on the fence. Query the database; tell me what we’ve got on them.

Say you want to arrest or detain somebody—activists, journalists, anyone seen as a political enemy—even if just to intimidate them. An endless data set is an excellent way to find some retroactive justification. Meyer told us that the CFPB keeps detailed data on consumer complaints—which could also double as a fantastic list of the citizens already successfully targeted for scams, or people whose financial problems could help bad actors compromise them or recruit them for dirty work.

Similarly, FTC, SEC, or CFPB data, which include subpoenaed trade secrets gathered during long investigations, could offer the ability for motivated actors to conduct insider trading at previously unthinkable scale. The world’s richest man may now have access to that information.

An authoritarian, surveillance-control state could be supercharged by mating exfiltrated, cleaned, and correlated government information with data from private stores, corporations who share their own data willingly or by force, data brokers, or other sources.

What kind of actions could the government perform if it could combine, say, license plates seen at specific locations, airline passenger records, purchase histories from supermarket or drug-store loyalty cards, health-care patient records, DNS-lookup histories showing a person’s online activities, and tax-return data?

It could, for example, target for harassment people who deducted charitable contributions to the Palestine Children’s Relief Fund, drove or parked near mosques, and bought Halal-certified shampoos. It could intimidate citizens who reported income from Trump-antagonistic competitors or visited queer pornography websites.

It could identify people who have traveled to Ukraine and also rely on prescription insulin, and then lean on insurance companies to deny their claims. These examples are all speculative and hypothetical, but they help demonstrate why Americans should care deeply about how the government intends to manage their private data.

https://www.theatlantic.com/technology/archive/2025/04/american-panopticon/682616/

Trump Administration to Judges: ‘We Will Find You’ The attorney general’s message to the judiciary is clear.

https://www.theatlantic.com/politics/archive/2025/04/trump-administration-initimidates-judges/682620/

ETA: Its latest effort to bring the press to heel came on April 25, when news leaked of the Justice Department’s intention to aggressively pursue journalists who receive leaked information from confidential government sources.

The Guardian reports that Bondi “has revoked a Biden administration-era policy that restricted subpoenas of reporters’ phone records in criminal investigations

https://www.salon.com/2025/04/29/looking-to-trumps-next-100-days-doj-tees-up-process-for-jailing-journalists/

4 notes

·

View notes

Text

Hurricane Helene relief for WNC

For the last year and a half, I've been lucky to call Western North Carolina my home. The aftermath of Hurricane Helene here is unfathomable.

This is a compilation of sources from folks in my community: people who have lost their homes, who are bringing survival supplies into the area, and more. I will try to keep it as updated as possible (posting on Oct. 6th). Please support if you have the means, share with others, and keep WNC in your thoughts.

Rural Organizing And Resilience - a grassroots volunteer organization bringing supplies into affected communities

Support Yancey and Mitchell Counties Flood Relief

Celo

Support my friend doing work on the ground - Venmo @/melanie-risch

South Toe Fire Department - is doing rescues in the area. Venmo @/SouthToeFire

Arthur Morgan School - Send a tax-deductible donation to their giving page, resources will get to folks who need it in Celo

Fundraiser for community member to recover from house flood (added 10/23)

Community member whose house is full of mud - Venmo @/heather-downtofarm

Help Natalie and Miguel after Helene - updated 10/23, changed from Venmo link to GoFundMe

Support Meredith and Robert after Hurricane Helene - Meredith and her partner Robert escaped with their pets and their lives in Hurricane Helene, but lost everything else to the flood waters.

Support Nick, Kavita, and the Celo Inn - added 10/23

Spruce Pine

Downtown Spruce Pine - accepting donations via PayPal to which will go directly to local businesses that have suffered significant damage

Treats Studios Helene Relief - webpage for local artists to receive support. Artists are grouped by state, medium, and those in most need of help.

Marshall

The Farm Connection - raising money to directly pay farmers for the pounds of food that they are donating to local relief organizations.

Bakersville

Help Rebuild Bakersville after Hurricane Helene - Help the Bakersville Beautification Association non-profit start from the ground up in reconstructing downtown Bakersville.

Generators for Bakersville - raising money to buy generators for at least 30 families without power (added 10/9) (currently disabled)

Asheville

Pansy Collective and Beloved Asheville - distributing survival supplies to the Asheville community.

Rebuild Melissa's Pottery Studio After Helene - Hurricane Helene wiped out Melissa's Pottery Studio under 20 feet of water, destroying her kiln, and everything else. (currently disabled)

Support a community member in Asheville - Venmo @/Pamela-Demontbreun (added 10/23)

Linktree of resources for Helene mutual aid in WNC

Masterdoc of Helene recovery resources

11 notes

·

View notes

Text

(Reuters) -Palestinian President Mahmoud Abbas has issued a decree overturning a system of payments to the families of Palestinians imprisoned or killed by Israeli forces that has been a longstanding source of friction with the United States.

The current system has been dubbed "pay for slay" by critics who say it rewards the families of militants who carry out attacks on Israel, although that label is rejected by Palestinians.

Payments will be transferred to a government body affiliated with the president's office, according to the text of the decree, with a new disbursement mechanism, details of which have so far not been announced.

Scrapping the system has been a major demand of successive U.S. administrations on the Palestinian Authority, the body set up three decades ago under the Oslo interim peace accords which exercises limited governance in parts of the Israeli-occupied West Bank.

The decision comes as the Palestinian Authority faces mounting financial pressure from a slowdown in aid, a squeeze on a system of tax revenue transfers by Israel and a slump in contributions from Palestinians who have been shut out of the Israeli labour market by the war in Gaza.

Israel has been deducting the payments made by the authority from taxes collected on its behalf from goods that cross its territory to Palestinian areas.

The Palestinian Authority has appealed for more aid from Arab and European states to make up for the shortfall of billions of shekels but has so far struggled to make headway.

3 notes

·

View notes

Text

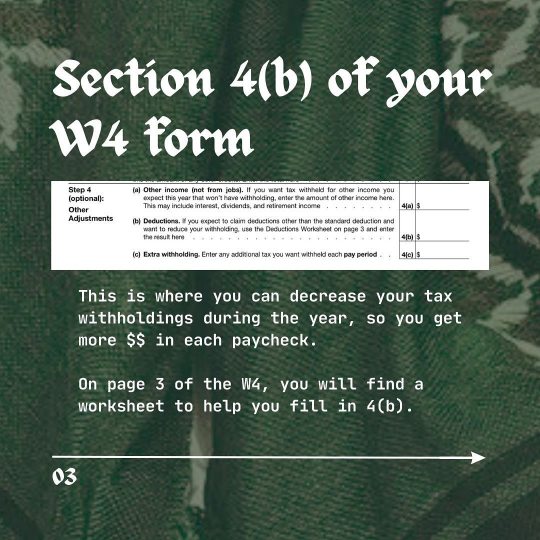

(all sides have alt text)

Visit the Tax Resistance Collective's linktree here.

Reuploader's note: this discusses a legal method of mimimizing the amount of taxes withheld from your paycheck during the year. In order to avoid any taxes being withheld from your paychecks to allow for full tax refusal, read here.

Direct links to sources

https://www.nerdwallet.com/article/taxes/how-to-fill-out-form-w4-guide#:~:text=If%20you%20want%20less%20money, on%20line%204(b).

https://www.irs.gov/individuals/tax-withholding-estimator

https://www.cnet.com/personal-finance/here-are-the-work-expenses-you-can-deduct-on-your-tax-return-this-year/

https://www.irs.gov/pub/irs-pdf/f1040sa.pdf

15 notes

·

View notes

Text

I thought I knew royal greed – but King Charles profiting from the assets of the dead is a disgusting new low

For decades, parliament has been far too lenient about the royal family’s finances. This avaricious practice needs to end

Norman Baker Fri 24 Nov 2023 13.08 CET

Over the centuries, the royals have continually bleated poverty and demanded more money from the taxpayer.’ Photograph: Reuters

As a royal author, I have come across plentiful examples of royal greed. It is standard practice for the royals to seek to minimise their personal expenditure while maximising their income from other sources, normally the public purse.

But the revelation that King Charles III’s personal slush fund, the Duchy of Lancaster, is having its already bulging coffers augmented by the estates of people who die in parts of England with historical links to the royal estate plumbs new depths of disgusting avarice.

Like many so-called traditions, the feudal hangover that is bona vacantia should have been consigned to the dustbin of history centuries ago, but it has been all too tempting for successive royals to preserve this royal fruit machine that pays out again and again. Over the past 10 years, it has collected more than £60m in the funds.

Under this system, the Duchy of Cornwall, owned by Prince William, can claim the assets of people who die in Cornwall intestate – without a will – if no relatives can be found. Charles’s Duchy of Lancaster does the same when their last known residence is within what was historically known as Lancashire county palatine.

Edward VIII found cash from those who died intestate in the boundaries of the duchy was sitting in an account in case claims arose against it. He simply stole a million pounds from it, leaving almost nothing in that kitty.

George VI did very well out of the loyal servicemen who died serving their country in the second world war, who originated from within the confines of the duchy and had no will. “For king and country” took on a whole new meaning.

As disquiet about the practice of bona vacantia grew after the war, the royals announced that moneys collected would henceforth be given to charity – after processing costs had been deducted, of course. In the case of the Duchy of Lancaster, this came to about 4% compared to 15% for the Duchy of Cornwall.

Yet a Guardian investigation now reveals that matters are even worse than we have been led to believe. Put bluntly, we have been lied to. Monies we all thought were going to charity have instead been used to improve properties owned by the duchy, increasing the income stream that flows from them into Charles’s pockets.

We have the most expensive monarchy in Europe by far in terms of state support, and one that benefits from unique tax treatment available to nobody else. No inheritance tax is paid. The so-called private estates of the duchies of Cornwall and Lancaster are not private enough to pay corporation tax or capital gains tax. Even income tax is only paid voluntarily – if it all – no receipts have ever been made public.

The civil list, which in 2011 gave the royals £7.9m a year, was replaced, after palace lobbying, with the sovereign grant, which 12 years later is up to £86m a year. Over the centuries, the royals have continually bleated poverty and demanded more money from the taxpayer, while at the same time refusing point blank to reveal the extent of their accumulated wealth.

They even refused to provide this information to the last government that seriously tried to dig into this – the Labour government of the mid-1970s, with the then home secretary Roy Jenkins pursuing the matter.

Back in Queen Victoria’s reign, the government was told she was desperately short of cash to undertake her duties so a big uplift was provided. She was not short of cash, and the money provided by the then government was instead used to buy Sandringham and Balmoral. I recognise that behaviour from my time in parliament. It’s called fiddling your expenses.

My calculations suggest that the king is worth as much as £2bn and probably more. The bulk of this has come from excessive generosity on behalf of the taxpayer, either through direct handouts or indirectly through unique tax exemptions. But antiquated and indefensible arrangements such as bona vacantia have played their part too.

Parliament, which over the decades has been far too deferential, far too trusting, far too easy going, needs to get a grip. The disgusting existence of royal windfalls from dead people should be ended forthwith. The duchies of Cornwall and Lancaster should be transferred immediately to the publicly owned crown estate; they only escaped from being transferred along with other royal lands in 1760 because they were then deemed worthless. Plainly, this is no longer the case. The public accounts committee should begin a thorough investigation into the funding and wealth of the royals.

Monarchists should worry. Opening the doors on royal finances and practices will reveal a terrible stench.

in regards to:

28 notes

·

View notes

Text

In a famous conversation, the author F. Scott Fitzgerald is credited with saying that “the rich are very different than you and me,” to which Ernest Hemingway replied “Yes, they have more money.”

Our work highlights another key difference: the most affluent Americans not only have more income; they receive it—and pay taxes on it—in vastly different ways than the rest of us.

For policy makers concerned about long-term fiscal shortfalls and high levels of economic inequality, our work reinforces the notion that raising the tax burden on the wealthy requires a special focus on how those households gain wealth and skirt taxes. We highlight four ways to effectively raise taxes on the wealthiest Americans.

How Americans make money

Most Americans receive almost all their income through wages and retirement income (pensions, 401(k)s, social security, and individual retirement accounts). The most recent available IRS data (2014) shows that wages and retirement income made up 94% of adjusted gross income (AGI) for households in the bottom 80% of the income distribution. Even for households in the 98th to 99th income percentile, wages and retirement income accounted for 71% of AGI.

At the very, very top, though, these sources are less important, accounting for just 15% and 7% of the income of the top 0.01% and the top 0.001% of households, respectively. These households receive most of their income from investments (interest, dividends, and especially realized capital gains) and businesses (including sole proprietorships, partnerships, and S corporations). These items constituted 82% of income for the top 0.01% and 88% for the top 0.001%, compared to just 7% for the bottom 80% of households.

These patterns are robust over time and data sources. And in practice, the tilt toward capital income at the top is even larger than these figures suggest because AGI does not include the massive unrealized capital gains and very sizable inheritances that accrue to many affluent households.

How that money gets taxed

Wages face heavier taxation than capital income, even though wages go mainly to low- and middle-income households and capital income goes mainly to high-income households. Most federal revenues are collected from wages. Payroll taxes account for 33% of federal revenues and are imposed solely on wages. Income taxes account for another 52% of federal revenues, and studies show that the share of income tax revenues that derive from capital income is quite small. These studies were performed before the enactment of the Tax Cuts and Jobs Act of 2017, which further diminished the taxation of capital via special deductions for business and cuts in the top income tax rate, the corporate tax rate, and the estate tax.

Moreover, the highest effective marginal income tax rates on wages exceed 40%, whereas much business income is taxed at a top rate below 30%, dividends and realized capital gains are taxed below 25%, and unrealized gains are not taxed until they are sold. As a result, the tax share of income paid by the very highest-income households is often lower than for middle-class households.

How to fix it

There are many ways to raise taxes on the wealthy without harming economic growth. Here we highlight four options.

Capital gains reform may be necessary if policymakers want to increase tax burdens on wealthy households. The simplest policy here would be the elimination of the step-up basis at death. Heirs would pay capital gains taxes on the taxable basis of the decedent who acquired the asset, instead of the basis of the asset at death. In 2020, the Joint Committee on Taxation (JCT) staff calculated that terminating step-up that year would raise $104.9 billion over the next 10 years. Alternatively, capital gains could be taxed at death, and treated as though the decedent had sold that asset. Batchelder and Kamin (2019) used 2016 JCT predictions to estimate that taxing accrued gains at death and raising the capital gains rate to 28% would raise $290 billion between 2021 and 2030.

Taxing intergenerational wealth transfers can make taxes more progressive and offset disparities in opportunity across income classes. Currently, less than 0.1% of all estates are subject to the estate tax, down from 7.65% in 1977. As baby boomers die, they are set to pass down $72.6 trillion in assets to heirs. Taxing these transfers more heavily would reduce inequality, increase opportunity, and raise revenues. The estate tax could be converted to an inheritance tax on recipients, with a reduced threshold of a million dollars for all gifts and inheritances (compared to the current threshold of almost $13 million) coupled with a tax rate that would equal the heir’s income tax rate plus some amount. This combined tax rate would integrate income and estate taxes. Since the heirs to wealthy estates are already usually in high tax brackets, the distributional impact would be similar to (though slightly less progressive than) the estate tax. This change has the political advantage of focusing on wealthy heirs, who were lucky enough to be the beneficiaries of wealthy relatives or friends, instead of targeting those who accumulated wealth.

Eliminating the Section 199A deduction for qualified business incomes would target another key component of income for the wealthy. The Tax Cuts and Jobs Act (TCJA) reduced the top income tax rate from 39.6% to 37%, and the deduction brought the effective rate on qualified business income down to 29.6%. In 2020, the Tax Policy Center (TPC) estimated that the deduction would lower federal revenues by $417 billion over the following 10 years. The deduction is inequitable: the TPC estimated that 55% of the direct tax benefits in 2019 would go to families in the top 1% of the income distribution and 26% of the benefits would go to the top 0.1%. Although the deduction was intended to increase employment and investment, the incentives for both are actually quite low given the complicated structure and non-targeted nature of the deduction. Additionally, its complexity creates an opening for business owners to reduce their taxes by re-arranging and relabeling their investments and expenses, a practice which is further incentivized by the increased difference between the effective tax rates on wages and business income.

A final option would be to create a value added tax (VAT) coupled with a rebate or Universal Basic Income (UBI). This would leave the net tax burden smaller or unchanged for most households but would impose higher tax burdens on the wealthy. Currently, wealthy households can finance extravagant levels of consumption without even paying capital gains taxes on the accruing wealth by following a “buy, borrow, die” strategy, in which they finance current spending with loans and use their wealth as collateral. By avoiding realizing their capital gains, they can avoid taxes at the same time they enjoy a luxurious lifestyle. A VAT would tax consumption and hence would force the affluent to pay taxes on their lifestyle, even if they did not pay much in income tax. A VAT of 10%, combined with a UBI payment of the federal poverty line times the VAT rate times two, would raise about $2.9 trillion over 10 years. The Tax Policy Center estimates that this system would be extremely progressive: after-tax income for the lowest quintile would increase by 17%, the tax burden for middle-income people wouldn’t change, and incomes for the top 1% of households would be reduced by 5.5%. The VAT would also function as a 10% tax on existing wealth, since future consumption can only be financed with existing wealth or future wages.

Conclusion

Each of these proposals would undoubtedly face significant opposition from those who benefit from the challenge of taxing affluent households: the wealthy themselves. However, in order to face the dual concerns of ever-increasing national debt and rapidly growing inequality, it is a challenge that we must take on before it’s too late.

7 notes

·

View notes

Text

Junk Hauling vs. Donation: Making the Right Choice

Introduction

In our fast-paced world, clutter can accumulate quickly, turning our homes and offices into chaotic spaces filled with unwanted items. Whether it's old furniture, outdated electronics, or just general junk, the question arises: what should you do with it? Two primary options often come to mind: junk hauling and donation. This article aims to explore "Junk Hauling vs. Donation: Making the Right Choice," providing insights into both avenues so you can determine which is best for your specific situation.

youtube

Understanding Junk Removal Services What is Junk Removal?

Junk removal refers to the process of removing unwanted items from your home or business. This service can encompass everything from single-item pickups to full property cleanouts. Companies specializing in junk removal often provide hauling services that involve transporting these items away for disposal or recycling.

Types of Junk Removal Services Residential Junk Pickup Focused on homes. Includes furniture removal, appliances, and general household junk. Commercial Junk Pickup Tailored for businesses. Often involves larger-scale cleanouts or regular maintenance. Specialized Junk Removal https://medium.com/@marachjlnz/mattress-removal-during-furniture-delivery-stress-free-logistics-c0d7af7ae3cf?source=your_stories_page-------------------------------------------- Services targeting specific types of waste like e-waste (electronic waste) or hazardous materials. The Process of Junk Hauling How Does Junk Hauling Work?

When you opt for a junk hauling service, the process typically follows these steps:

Contacting a Service Provider: You call a local company that specializes in junk removal. Free Estimate: Most services offer a no-obligation quote based on the volume and type of items you need removed. Scheduling a Pickup: Once you agree on pricing, you schedule a time for them to come. Removal of Items: The team arrives at your location and removes the agreed-upon items. Disposal or Recycling: After collection, the company handles disposal according to local regulations. Benefits of Choosing Junk Hauling Services Convenience: They handle all heavy lifting and transportation. Time-Saving: Quick removal means less time spent dealing with clutter. Safe Disposal: Many companies ensure items are disposed of responsibly. Understanding Donation Options What is Item Donation?

Donation involves giving away your unwanted items to charitable organizations rather than discarding them. This not only helps others but can also be tax-deductible depending on your jurisdiction.

Common Charities That Accept Donations Goodwill Industries Accepts clothing, household goods, and electronics. Habitat for Humanity ReStores Focuses on building materials and home furnishings. Salvation Army A wide range of accepted items in

0 notes

Text

Documents Required for Income Tax Return Filing in Delhi

Introduction

Filing your Income Tax Return in Delhi can seem daunting, but having the proper documents ready makes the process smooth and hassle-free. Whether you're a salaried employee, a business owner, or an investor, knowing exactly which documents to gather is crucial to ensure accurate filing and compliance with the Income Tax Department.

Understanding Income Tax Return Filing in Delhi

Filing an Income Tax Return (ITR) is a mandatory process for individuals and entities earning taxable income in India, including those residing in Delhi. The government has set deadlines and specific documentation requirements to verify your income and tax payments. Being prepared with the proper paperwork helps avoid errors, penalties, and delays in refunds.

Why Proper Documentation is Crucial for Income Tax Return Filing

Ensures accurate reporting of income and deductions

Helps claim rightful tax benefits and exemptions

Facilitates smooth verification by the Income Tax Department

Prevents notices or scrutiny due to discrepancies

Essential Documents for Income Tax Return Filing in Delhi

Personal Identification Documents

PAN Card: Permanent Account Number (PAN) is mandatory for filing ITR. It links your tax records and is essential for TDS deductions and refunds.

Aadhaar Card: As per Section 139AA, Aadhaar linking with PAN is compulsory for e-filing. Ensure your Aadhaar details are updated.

Income Proof Documents

For Salaried Individuals

Form 16: Issued by your employer, it details your salary, tax deducted at source (TDS), and exemptions claimed. This is the primary document for salaried taxpayers.

Form 12BB: Declaration of tax-saving investments submitted to the employer for TDS deduction purposes.

Form 26AS: Annual tax statement showing all taxes deducted and deposited against your PAN.

For Business or Self-Employed Individuals

Profit and Loss Statement: Summary of business income and expenses.

Balance Sheet: Financial position of your business.

Books of Accounts: Detailed records of financial transactions.

For Other Income Sources

Bank Interest Certificates: From banks or post offices for interest earned on savings or fixed deposits.

Capital Gains Statements: Details of the sale/purchase of shares, mutual funds, or property.

Rental Income Proof: Rent receipts or lease agreements.

Investment and Dedication Proofs

Life Insurance Premium Receipts

Public Provident Fund (PPF) Passbook

National Savings Certificate (NSC)

Health Insurance Premium Receipts (for deductions under Section 80D)

Home Loan Interest Certificate (under Section 24)

Tuition Fee Receipts (for children's education under Section 80C)

Bank Account Details

Bank account number and IFSC code for refund processing.

Details of all bank accounts held during the financial year must be reported.

Additional Documents for Specific Cases

Foreign Income and Assets

Details of foreign bank accounts, income from abroad, or shares in foreign companies must be disclosed even if the income is below the exemption limit.

Income from Unlisted Shares

Provide company name, number of shares, and income details from unlisted shares.

Residency Certificate

For claiming benefits under Double Taxation Avoidance Agreements (DTAA), if applicable.

Step-by-Step Checklist for Income Tax Return Filing in Delhi

Collect PAN and Aadhaar details.

Obtain Form 16 from your employer (if salaried).

Download Form 26AS from the income tax portal.

Gather bank interest certificates and investment proofs.

Compile rent receipts or rental income documents.

Prepare business financial statements if self-employed.

Keep all deduction proofs handy (insurance, PPF, loans).

Verify bank account details for refunds.

Ensure that foreign income and assets documents are provided, if applicable.

File your ITR online before the deadline (September 15, 2025, for FY 2024-25).

Tips for Smooth Income Tax Return Filing in Delhi

Start gathering documents early to avoid a last-minute rush.

Cross-verify details in Form 16 and Form 26AS for consistency.

Keep digital copies of all documents for easy access and retrieval.

Use reliable e-filing portals or consult a tax expert if unsure.

Double-check Aadhaar-PAN linking status before filing.

Common Mistakes to Avoid During ITR Filing

Failing to report all sources of income.

Not linking Aadhaar with PAN.

Incorrect bank details are causing delays in refunds.

Failing to upload the necessary proofs for deductions.

Filing after the due date leads to penalties.

Conclusion

Filing your Income Tax Return in Delhi is a straightforward process when you have all the necessary documents organized. From PAN and Aadhaar to Form 16 and investment proofs, each document plays a vital role in ensuring your tax return is accurate and compliant. Start early, keep your paperwork ready, and meet the September 15, 2025, deadline to avoid penalties. Proper documentation not only simplifies filing but also maximizes your tax benefits.

Frequently Asked Questions (FAQs)

Q1: Is Form 16 mandatory for filing Income Tax Returns? Yes, Form 16 is essential for salaried individuals as it contains salary details and TDS deducted by the employer.

Q2: Can I file ITR without PAN? No, PAN is mandatory for filing ITR. However, Aadhaar can be linked with PAN as per the new regulations.

Q3: What if I miss the ITR filing deadline in Delhi? You can file a belated return by January 15, 2025, but penalties may apply.

Q4: Are bank statements required for ITR filing? Bank statements help verify interest income and should be kept ready, especially if you have multiple income sources.

Q5: Do I need to report foreign income in my ITR? Yes, all foreign income and assets must be disclosed regardless of the exemption limit.

0 notes

Text

How HR and Payroll Software Boosts Productivity and Reduces Errors

Efficiency is now a must in the fast-paced business environment of today, not a luxury. Every minute wasted on repetitive admin work or manual data entry costs a business both time and money. Nowhere is this more evident than in human resources and payroll functions. From onboarding new employees to calculating salaries and filing taxes, HR and payroll departments handle some of the most sensitive and complex tasks in a company.

That’s where HR and payroll software comes in. By automating routine tasks, reducing human error, and providing real-time data insights, these tools are transforming how businesses operate. Let’s explore how HR and payroll software significantly boosts productivity and reduces costly errors—and why more companies are making the switch.

1. Automating Time-Consuming Tasks

Manual HR and payroll processes are riddled with inefficiencies. Data must be entered, verified, and cross-checked across multiple spreadsheets to ensure accuracy. That takes hours and opens the door for mistakes.

HR and payroll software automates these repetitive tasks:

Employee onboarding

Leave and attendance tracking

Timesheet approvals

Payroll calculations

Payslip generation

Tax computations and filings

This automation allows HR professionals to shift their focus from paperwork to people. Instead of spending hours processing payroll, they can invest time in building engagement strategies, refining recruitment processes, or improving company culture.

2. Reducing Human Error

Even the most meticulous HR manager is not immune to mistakes. Miscalculated tax deductions or incorrect decimals on a payslip may result in financial penalties, noncompliance, and dissatisfaction among employees.

With HR and payroll software:

Formulas are predefined, reducing calculation errors

Integrated data across systems ensures consistency

Automated alerts flag discrepancies or missing information

Compliance rules are built into the software to meet local labor laws and tax regulations

As a result, businesses can significantly lower their risk of payroll errors, which often lead to underpayment, overpayment, or government audits.

3. Centralized Employee Data

In many companies, employee data is scattered across different folders, spreadsheets, or even physical files. In addition to wasting time, this results in inaccurate data and problems with version control.

HR and payroll software centralizes all employee data in one secure platform. That means:

HR managers can quickly access records for leaves, benefits, salary history, or performance reviews

Employees can use self-service portals to see and update their data.

Payroll runs are faster because data doesn’t have to be manually collected from multiple sources.

A centralized system ensures data integrity and eliminates the time-consuming back-and-forth between departments.

4. Improved Compliance and Reporting

Keeping up with labor laws, tax codes, and government regulations is a full-time job in itself. One missed update or deadline can trigger penalties or lawsuits.

Modern HR and payroll software is regularly updated to reflect the latest legal changes. It can:

Automatically apply statutory deductions (e.g., social security, income tax)

Generate compliance-ready reports and payslips

File tax returns electronically

Maintain digital audit trails for transparency

This level of automation not only ensures accuracy but also gives business owners peace of mind knowing they’re meeting all legal requirements.

5. Faster Payroll Processing

Processing payroll manually—especially for a growing team—can be an overwhelming task. It involves tracking hours worked, calculating deductions, accounting for bonuses, and ensuring tax compliance.

With a few clicks, payroll software takes care of this. Many systems integrate with time-tracking tools and attendance systems, pulling real-time data to calculate salaries instantly. This reduces the payroll processing time from days to minutes.

Faster processing means employees get paid on time, every time—which is critical for morale and trust.

6. Enhanced Employee Experience

Modern employees expect transparency and control. They want to access their payslips, update personal information, apply for leave, and track their benefits—without having to call HR.

A self-service portal offered by HR and payroll software permits staff members to:

Download payslips

View tax deductions and leave balances

Update their bank and contact details

Submit reimbursement claims

This reduces HR workload and improves employee satisfaction. Higher engagement and lower attrition are the results of a better experience.

7. Scalability for Growing Businesses

As your company grows, so does the complexity of managing HR and payroll. Hiring more employees, managing benefits, and staying compliant across multiple locations becomes challenging.

Payroll and HR tools are made to grow with your company. Whether you have 10 or 1,000 employees, the system can adapt without requiring massive administrative overhead. Features like role-based access, department-wise reporting, and automated workflows make it easier to manage a large workforce efficiently.

This scalability guarantees that you're thriving through expansion rather than merely surviving it.

8. Real-Time Insights for Better Decision-Making

Beyond automation and accuracy, HR and payroll software delivers powerful data insights. Dashboards and reports provide real-time visibility into key metrics like:

Absenteeism trends

Payroll costs

Overtime expenses

Attrition rates

Hiring pipeline performance

These insights help business leaders make smarter decisions about workforce planning, budgeting, and strategy. You may proactively increase performance and profitability rather than responding to issues as they arise.

9. Cost Savings in the Long Run

While investing in HR and payroll software might seem like an upfront cost, it pays for itself in multiple ways:

Fewer compliance penalties

Reduced manual labor

Improved efficiency and productivity

Less reliance on external payroll providers

Enhanced accuracy reduces overpayments and wage disputes

Over time, the software helps streamline operations, reduce HR overhead, and free up resources to focus on growth.

10. Remote Access and Cloud Convenience

In a world where hybrid and remote work are the norm, accessibility is key. Cloud-based HR and payroll solutions offer anytime, anywhere access. HR teams can process payroll, access documents, and run reports from any location.

Similarly, employees can apply for leave or download payslips on the go—via mobile apps or web portals.

This flexibility is no longer optional. It’s essential for modern businesses that want to stay agile and competitive.

Final Thoughts

Payroll and HR software is a competitive advantage, not just a convenience. By automating manual tasks, reducing human error, centralizing data, and ensuring compliance, these tools dramatically improve productivity across your organization.

As businesses continue to navigate evolving workforce demands and complex regulations, having the right software in place becomes mission-critical. If your HR and payroll processes are still manual or outdated, now is the time to invest in a solution that empowers your team and future-proofs your operations.

#HR Payroll Software#hr and payroll software#payroll management software#best hr and payroll software#hr and payroll software for small business

0 notes

Text

How to Navigate Tax Trouble: A Complete Guide to Finding the Right Tax Fraud Attorney and Wage Garnishment Help

Introduction

Ever felt that panic when a letter from the IRS shows up unexpectedly? You’re not alone. Whether it’s unpaid taxes, frozen wages, or fraud allegations, tax troubles can feel like a snowball rolling downhill — growing larger and scarier by the minute. The good news? You’re not stuck. With help from a tax fraud attorney or wage garnishment attorney, you can take back control of your financial future.

Understanding Tax Fraud and Wage Garnishment

Tax fraud occurs when a person or business purposefully misrepresents financial information to the IRS. This could include underreporting income, inflating expenses, or hiding assets offshore. It’s a serious offense that can lead to audits, fines, and even jail time.

Wage garnishment happens when the IRS legally takes money directly from your paycheck to collect unpaid taxes. It’s more than just a nuisance — it can leave you scrambling to cover basic living expenses.

Signs You May Need a Tax Fraud Attorney

You might think only corporations or high-net-worth individuals need a tax fraud attorney, but in reality, even average earners can face tax fraud accusations. If you’ve received IRS notices, are being audited, or suspect you’re under investigation, legal help is essential. A good attorney can protect your rights, ensure you don’t incriminate yourself, and guide you toward a resolution that minimizes penalties.

What Exactly Is Wage Garnishment?

Role of a Wage Garnishment Attorney

A wage garnishment attorney acts as a barrier between you and aggressive collection efforts. They help halt garnishments by negotiating with the IRS or state tax agencies, filing motions, and setting up more manageable alternatives like installment agreements or Offers in Compromise. In situations where wage garnishment is already active, they may even be able to get some of your previously garnished wages returned, depending on the circumstances.

How IRS Wage Garnishment Attorneys Can Help You

These attorneys specialize in the fine print of IRS rules and are equipped to defend your paycheck. Their knowledge of IRS policies allows them to develop quick, strategic responses to wage garnishment and tax levies. By negotiating directly with tax agents, they often help reduce or remove garnishments, request hardship status for clients, or qualify them for settlement programs.

The Importance of Acting Quickly

Key Traits of the Best Tax Lawyers in New York

Finding the best tax lawyers in new york means looking beyond fancy offices. True experts share a few key qualities:

They have proven experience with tax disputes and IRS negotiations.

They communicate clearly, not in legalese.

They offer realistic expectations — not false promises.

Their clients speak highly of them, both online and off.

These traits often signal someone who’s prepared to represent your best interests with skill and integrity.

Services Offered by a New York Tax Law Firm

When you consult a new york tax law firm, you’re not just hiring one person — you’re gaining access to an entire team of legal and financial professionals. These firms handle:

Audit representation

IRS dispute resolution

Tax debt settlement

Wage garnishment appeals

Business and personal tax planning

Having a team with multiple specialties ensures that every angle of your tax issue is handled efficiently.

Common Tax Issues New Yorkers Face

Tax problems in New York can arise from many sources. Freelancers and gig workers often struggle with quarterly tax payments. Small businesses may misclassify employees. Even regular W-2 employees can find themselves in trouble due to overlooked side income, inaccurate deductions, or falling behind on payments. Combine that with state and city taxes, and it’s easy to see how things can spiral.

How to Choose the Right Tax Attorney

Choosing a tax attorney doesn’t have to be stressful. Start by identifying attorneys who specialize in tax law rather than general practice. Look for someone who explains things clearly, without pressure. If they offer a free consultation, use it to gauge how well they understand your situation and whether they propose a practical action plan.

Questions to Ask During Your Free Consultation

Make the most of your consultation by asking direct, relevant questions. A few to consider include:

Have you handled cases like mine before?

What are my chances of reducing penalties?

How quickly can you stop garnishment or collection?

What fees should I expect?

How do you typically communicate with clients?

These questions help you evaluate not just their expertise, but also their transparency and approachability.

Red Flags to Watch Out For

How Much Does a Tax Attorney Cost in NY?

In New York, tax attorney fees vary widely. For simple cases, you might pay a flat fee ranging from $1,000 to $3,000. More complex or ongoing cases could be charged hourly, typically between $250 and $600. Some firms require a retainer. While the cost may seem high, the financial relief they can secure often makes their services more than worth it.

What to Expect During the Legal Process

Once you hire a tax attorney, they’ll begin by assessing your situation in detail. Then, they’ll collect documentation, contact the IRS on your behalf, and begin negotiating. Depending on your case, this might involve filing forms for installment agreements, requesting hardship status, or submitting offers in compromise. You’ll stay informed throughout the process, with regular updates and strategic advice.

Preventing Future Tax Problems

The best defense against future IRS trouble is staying organized. Make sure you file your taxes on time, keep receipts and documentation, and update your financial records regularly. If you’re self-employed, use professional accounting software or hire a bookkeeper. For ongoing peace of mind, consider working with a tax attorney annually to review your filings and make sure you’re in compliance.

Conclusion

Tax issues can feel like you’re stuck in a storm with no umbrella. But the right legal help can shelter you from penalties, wage garnishments, and endless stress. Whether you’re facing a fraud investigation, IRS wage garnishment, or overwhelming back taxes, turning to a trusted tax fraud attorney, wage garnishment attorney, or irs wage garnishment attorneys is a smart and necessary move.

If you live in New York, your best option is to consult with experienced professionals from a New York tax law firm. With the best tax lawyers in New York on your side, you can face the IRS with confidence — and finally regain financial stability.

FAQs

1. What does a tax fraud attorney do?

A tax fraud attorney represents clients accused of intentionally misleading tax authorities. They provide legal defense during audits, investigations, and trials.

2. Can a wage garnishment attorney help stop paycheck deductions?

Yes. They negotiate with the IRS or state agencies to stop or reduce garnishments through settlements, exemptions, or payment plans.

3. How fast can IRS wage garnishment attorneys act?

Experienced attorneys can sometimes halt garnishments within a few days, depending on the case complexity and how quickly documentation is filed.

4. Do I need a tax attorney even if I’m not facing criminal charges?

Absolutely. Tax attorneys also help with audits, late filings, debt settlements, and other non-criminal but serious financial issues.

5. What’s the easiest way to find the best tax lawyers in New York?

Start with referrals, check online reviews, and look for firms that specialize in tax law. A free consultation can help you decide if they’re the right fit.

#Taxes#Tax Fraud#Tax Fraud Defense#Wages#Fraud#criminal tax lawyer new york#criminal tax lawyer#best payroll tax lawyer new york#best tax lawyer#new york#best tax lawyer nyc#irs lawyer nyc#legal advice#irs#tax law

0 notes

Text

Here’s find out how to file your ITR this 12 months: Read stepwise information

Here's find out how to file your ITR this 12 months: Read stepwise information Jun 24, 2025 09:38 PM IST The deadline for non-audit instances is prolonged to September 15, 2025, whereas self-assessment tax funds are due by July 31, 2025. The Income Tax Department of India has provided an Excel-based offline utility for submitting Income Tax Return-1 (Sahaj) and Income Tax Return-4 (Sugam) for the evaluation 12 months 2025-26, i.e the monetary 12 months 2024-25. 7 key factors to recollect when submitting your Income Tax Return (ITR) this 12 months.(REUTERS) Under this newly launched utility, staff, pensioners, freelancers, and small enterprise homeowners will be capable of validate their returns by making a JSON file, importing to the e-filing portal, and therefore, put together their earnings tax returns, even with out web entry. According to the official web site, this 12 months, the deadline for submitting ITR has seen an extension until Sept 15, for non-audit cases-including ITR-1 and ITR-4 filers. Put throughout by Central Board of Direct Taxes (CBDT), this changed the sooner window which allowed submissions solely until July 31, with the intention to accommodate structural adjustments and utility rollout delays. However, the deadline for paying any self-assessment tax stands on July 31, 2025. Taxpayers ought to abide by this time-frame to keep away from curiosity penalties. Filing your ITR this 12 months? Here are 7 key factors to recollect when submitting your Income Tax Return (ITR): 1. SELECT THE SUITABLE ITR FORMTaxpayers are suggested to pick the appropriate ITR type, based mostly on their current pay scales. Salaried people can be submitting their return utilizing ITR-1 (Sahaj), given their earnings is from wage, single home property, and different sources (like curiosity), totaling their earnings to no more than ₹50 lakh. If taxpayers' earnings is from capital features, international earnings or a number of family properties, they are going to be utilizing ITR-2. 2. SELECT THE APPLICABLE OPTION BETWEEN THE NEW AND OLD TAX REGIMETaxpayers should determine in the event that they should file their return underneath the previous tax regime with exemptions and deductions or the brand new regime with fewer deductions and diminished slab charges. In the case of investments in schemes just like the Public Provident Fund (PPF) or National Savings Certificate (NSC) for tax profit, they may solely be thought-about underneath the previous regime. 3. COLLECT AND CHECK ALL RELATED DOCUMENTSTaxpayers should acquire all vital paperwork like Form 16, which is given by the employer and signifies wage and TDS (Tax Deducted at Source). Form 26AS (which exhibits the main points of all tax credit) needs to be printed and checked whether or not it embrace TDS on wage, curiosity earnings and so forth. These particulars needs to be checked and ensured that they're mirrored on Form 16. 4. USE THE NEWLY INTRODUCED OFFLINE UTILITY OR THE ONLINE PORTALSTaxpayers can use the newly launched offline utility by following the aforementioned course of or observe the beforehand used Tax2win and different on-line portals that present easy on-line one-step submitting choices for ITR-1(Sahaj) and ITR-4 (Sugam). The on-line portals additionally pre-fill information like Form 16, guaranteeing a consumer pleasant expertise. 5. LOOK OUT FOR THE FILING DEADLINE AND CONSEQUENCES OF DELAYFor this evaluation 12 months (2025-26), there was an extension for the deadline for submitting non-audit instances, i.e for salaried people submitting ITR-1 and ITR-4 to Sept 15, 2025. Self-assessment tax cost deadline stands at 31 July 2025, after which taxpayers would possibly incur curiosity penalties and charges based mostly on the variety of days delayed. If there's an current delay in submitting ITR for earlier 12 months(s), there's a provision to file belated returns inside the previous two years utilizing ITR-U (for people who haven't filed their returns collected in use solely). Read More: https://ne

0 notes

Text

Income Tax Return Filing in Dwarka by Vatspk – Simplify Your Tax Filing Today

Income Tax Return Filing in Dwarka by Vatspk

Filing your Income Tax Return (ITR) on time is more than a legal obligation—it’s a crucial step toward responsible financial planning. If you're located in Dwarka and seeking expert assistance, Vatspk is your go-to solution for Income Tax Return Filing in Dwarka.

With years of experience, a team of certified tax professionals, and a client-centric approach, Vatspk ensures that your ITR filing is hassle-free, accurate, and compliant with the latest government regulations.

Why Income Tax Return Filing is Important

Income Tax Return filing offers several benefits beyond avoiding penalties:

Claiming tax refunds for excess deductions

Proof of income for loans and visa applications

Carrying forward losses to future years

Establishing financial credibility

Who Needs to File an Income Tax Return?

You must file your ITR if:

Your gross income exceeds the exemption limit (₹2.5 lakh for individuals under 60)

You earned foreign income

You have investments in foreign assets

You want to claim a refund

You're a company, LLP, or partnership firm, regardless of income level

Why Choose Vatspk for ITR Filing in Dwarka?

At Vatspk, we understand that tax compliance can be overwhelming. Our expert team streamlines the process with:

✅ Personalized Tax Planning ✅ Quick e-Filing with Acknowledgment ✅ Affordable Pricing Packages ✅ Assistance with Notices and Rectifications ✅ PAN-Aadhaar Linking, TDS Queries, and More

Whether you're a salaried employee, a freelancer, or a business owner in Dwarka, Vatspk tailors ITR filing services to suit your needs.

Documents Required for ITR Filing

To file your ITR through Vatspk, you'll need:

PAN Card & Aadhaar Card

Form 16 (for salaried individuals)

Bank Statements & Interest Certificates

Investment Proofs (LIC, PPF, ELSS, etc.)

Rental Income or Property Details

Capital Gains Details (if any)

TDS Certificates

Our ITR Filing Process at Vatspk

Initial Consultation – We understand your income sources and tax profile

Document Collection – Easy upload via email or secure portal

Computation & Verification – We calculate your taxes and get your approval

Online Filing & Acknowledgment – Return is filed and confirmation sent

Post-filing Support – Assistance with refund tracking or corrections

Affordable Pricing Plans

We offer transparent pricing starting from as low as ₹499/- for salaried individuals. Custom packages available for businesses, NRIs, and freelancers.

Frequently Asked Questions (FAQs)

Q1. Why should I file my Income Tax Return through Vatspk in Dwarka?

Ans: Vatspk offers expert tax advisory, fast filing, and complete compliance support. Our Dwarka-based experts make sure your return is filed accurately with zero stress.

Q2. Can Vatspk help me file past-year or belated returns?

Ans: Yes. Vatspk can help you file belated returns, revise returns, or respond to IT department notices effectively.

Q3. What if I miss the ITR filing deadline?

Ans: Missing the deadline attracts a late fee under Section 234F and may result in loss of refund claims or inability to carry forward capital losses.

Q4. Is physical presence required to file ITR with Vatspk?

Ans: No. Vatspk offers 100% online ITR filing. You can share documents digitally, and our team will manage everything remotely.

Q5. Do you also assist with business or GST returns?

Ans: Absolutely. Vatspk provides GST filing, TDS returns, business tax compliance, and accounting services in addition to ITR filing.

Contact Vatspk Today!

Make your Income Tax Return Filing in Dwarka fast, secure, and simple. Contact Vatspk today and leave your tax worries to us!

#gst consultant in dwarka#income tax consultant in delhi#accounting#ca in delhi#chartered accountant in delhi#gst consultant in delhi#income tax consultant in dwarka#sections#tds#vatspk

1 note

·

View note

Text

What to accomplish If You Possess Unpaid Taxes: Understanding Your Internal Revenue Service Responsibilities as well as Penalties

Introduction

Facing unsettled taxes can think that getting through a minefield. The stress of prospective penalties, enthusiasm amassing, and the impending presence of the internal revenue service can easily generate a feeling of fear. Yet comprehending what to carry out if you possess overdue taxes is critical in alleviating those emotions. This post strives to give quality on your IRS commitments, outline possible penalties, as well as deal actionable measures you can easily take to correct your situation.

What to accomplish If You Possess Unpaid Income Taxes: Comprehending Your IRS Obligations as well as Penalties

When you recognize that you owe unsettled tax obligations, the first impulse may be panic. What should you carry out? The amount of perform you owe? Are there charges? The internal revenue service has rigorous policies regarding tax debts, but they additionally deliver avenues for resolution. Here's an extensive look at your commitments as well as options.

Understanding Your Tax obligation Liability

Tax liability pertains to the volume of income tax owed to the federal government. It is actually important to receive a crystal clear suggestion of just how much you are obligated to pay and why.

How Is Your Tax Liability Calculated?

Your tax obligation responsibility is actually calculated through several elements:

Income Level: More earnings typically brings about higher tax obligation brackets. Deductions and also Credits: These can easily minimize taxed income. Filing Status: Solo, wedded submission jointly, or even scalp of house affects tax obligation rates. Why Might You Have Overdue Taxes?

Common main reasons for unsettled taxes feature:

Underestimating income Missing deductions Changes in work status Lack of economic literacy The Relevance of Timely Payments

Failure to pay income taxes promptly brings about a number https://cleanslatetax.com/irs-payment-plans/ of consequences. Comprehending these can stimulate well-timed settlement or agreement along with the IRS.

Penalties for Late Payment

The internal revenue service establishes two major sorts of penalties for overdue settlement:

Failure-to-Pay Penalty: Normally 0.5% per month on unsettled taxes. Interest Charges: Builds up regular on any type of unsettled balance. Consequences of Ignoring Unsettled Taxes

Ignoring unpaid tax obligations might result in serious effects:

Increased financial obligation due to collecting penalties Liens versus property Wage garnishments Legal action coming from the IRS Steps To Take When Dealing With Unsettled Taxes

If you're coming to grips with unsettled taxes, below are some practical measures you can easily go through:

youtube

Step 1: Determine Your Economic Situation

Take sell of your finances:

Review your income sources. List all expenses. Determine just how much you can realistically pay out toward your tax debt. Step 2: Compile Necessary Documentation

To

0 notes

Text

5 Ways To Ensure Tax Preparation For Contractors in Austin and Dallas, TX

The approaching tax season makes many individuals jittery. While an employed person can expect a fairly simple procedure for filing tax returns, independent contractors, self-employed individuals, and those who enjoy income from multiple sources find it difficult to please the IRS. No worries! The taxpayer may find the right tax experts to ensure tax preparation for contractors in Austin and Dallas, TX, well in advance of the deadline for filing the tax returns. Some of the responsibilities taken on by the tax experts when entrusted with the task of tax preparation for independent contractors or self-employed people usually include the following:

Data Collection—Obtaining the correct information about the contractor is of the utmost importance. The tax professional will request all relevant financial details to understand the client's financial status and obligations. Furthermore, each document will be checked for accuracy, with the accounting done afresh when the inputs need revision.

Tracking Income & Expenses- The primary objective of paying the tax is fulfilled when it is done per the rules and with no errors in the filing process. The tax preparer will go through the books and records to note the various sources of income along with the expenses incurred. The experts may utilize software or do the calculations manually. The expertise and experience of the professionals can help the client meet the required tax obligations. There is no scope of being careless here, for the professional is sure to document every record and add the receipts and mileage logs to the books to satisfy the IRS pros in the event of an IRS Audit.

Deductible Expenses- The tax expert can identify the deductions for the contractor, thus reducing their tax liability. An independent contractor can thus deduct expenses incurred for a home office, office supplies & equipment, internet & telephone bills, vehicle expenses, and business insurance premiums. The contractor may also deduct expenses for software subscriptions as well as for improving one’s professional skills. The contractor must prove that the deductible expenses had been necessary for the business.

Money set for paying the tax – Contractors who work independently cannot expect the tax to be deducted from the source when receiving their pay packet. Instead, the responsibility of setting aside the calculated tax amount each month. Instead, the professional will advise the client to save at least 25% to 30% of the monthly income to be paid as tax. This activity can go a long way in preventing penalties for nonpayment of taxes.

Retirement Planning—True, no self-employed individual, such as a contractor, can expect to work for a lifetime. Each needs to plan for retirement when they are in a position to earn a living by using their skills. The tax expert will recommend ways to ensure this, with contributions to an SEP IRA or Solo 401(k) being encouraged to decrease the taxable income and build a retirement fund simultaneously.

Working closely with a tax professional can simplify tax preparation for contractors in Austin and Dallas, TX.

0 notes