#sections

Explore tagged Tumblr posts

Photo

Uk

#sheeee#nsfl#fpsb#am era#my items#tres#ost#peach#sections#contemporary#tphcm#uhm hi#76482#Aliya#disney#mogano#f1 2023#1992sie

560 notes

·

View notes

Text

Income Tax Consultant in Delhi by VATSPK – Expert Guidance for Stress-Free Tax Filing

When it comes to handling income tax matters, having a professional by your side can make all the difference. If you’re searching for a reliable Income Tax Consultant in Delhi, VATSPK is your trusted partner for comprehensive tax planning, filing, and compliance services. With years of expertise and an in-depth understanding of Indian tax laws, VATSPK ensures your financial affairs are always in order.

Why You Need an Income Tax Consultant in Delhi

Delhi, being a bustling economic hub, witnesses complex financial activities across individuals, businesses, and startups. Filing income tax returns accurately and on time is not just a legal obligation—it’s a financial responsibility. Here’s why hiring an income tax consultant in Delhi is a smart move:

Expert Knowledge of Indian Tax Laws Tax laws can be confusing and frequently updated. VATSPK stays ahead of all changes, ensuring your filings are always accurate and compliant.

Time-Saving and Stress-Free Let professionals handle the paperwork, documentation, and communication with tax authorities while you focus on your core activities.

Avoid Penalties and Notices Mistakes in filing may lead to hefty fines or legal trouble. VATSPK ensures error-free returns and timely submissions to protect you from penalties.

Maximize Deductions and Benefits Whether it's HRA, investments, or business expenses—VATSPK helps you claim every deduction you are legally entitled to.

Income Tax Services Offered by VATSPK in Delhi

VATSPK provides end-to-end solutions for all your tax-related needs. Services include:

Individual Income Tax Filing Personalized ITR filing for salaried individuals, freelancers, and high-net-worth individuals.

Business Tax Filing & Consultancy Specialized tax filing for small businesses, partnerships, LLPs, and private limited companies.

Tax Planning and Advisory Legal strategies to reduce tax liabilities and optimize your financial plan.

GST Compliance & Return Filing From registration to monthly filings—complete GST support for businesses.

Representation Before Tax Authorities Assistance in case of scrutiny, reassessment, or tax notices from the Income Tax Department.

Why Choose VATSPK as Your Income Tax Consultant in Delhi?

✅ Years of Experience: A team of seasoned professionals well-versed in tax regulations and industry practices.

✅ Client-Centric Approach: Personalized solutions tailored to your income structure and goals.

✅ Affordable Pricing: Transparent pricing with no hidden charges.

✅ Confidential and Secure: 100% data privacy and ethical practices.

✅ Timely Support: Prompt responses and timely updates to keep you informed.

Who Can Benefit from VATSPK’s Income Tax Consultancy?

Salaried professionals

Freelancers and consultants

Business owners and entrepreneurs

Startups and SMEs

NRIs with income in India

Senior citizens and pensioners

Get in Touch with the Best Income Tax Consultant in Delhi

Don’t let tax season stress you out. With VATSPK’s Income Tax Consultancy in Delhi, you can be assured of peace of mind, compliance, and maximum savings. Whether you need help with tax filing, planning, or dealing with notices, the expert team at VATSPK is just a call away.

Contact VATSPK today and experience reliable, professional, and affordable tax consultancy services in Delhi.

#gst consultant in dwarka#income tax consultant in delhi#accounting#ca in delhi#chartered accountant in delhi#gst consultant in delhi#income tax consultant in dwarka#sections#tds#vatspk

2 notes

·

View notes

Text

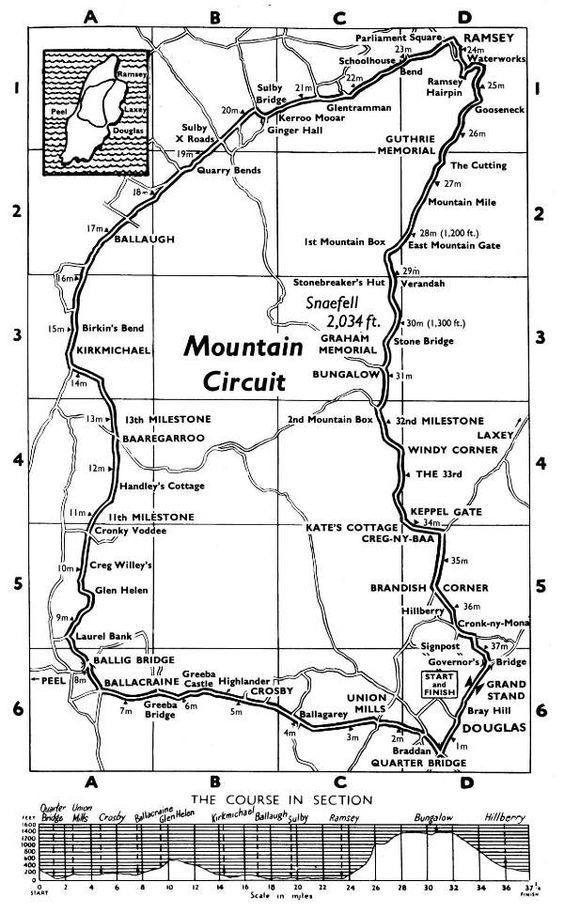

Isle Of Man T.T. The Beautiful Map Of Danger

#motorcycle#isle of man tt#road racing#road race#course#sections#map#sport bike#racing#motorsports#circuit#life at the edge#moto love#lifestyle

24 notes

·

View notes

Text

Architecture Monochrome Sections in Rhino 8 - Fast and Easy Architecture Drawings in Rhino 8

This video course covers how to create monochrome sections in Rhino 8. You do not need to use any other program other than Rhino 8. This course is great for anyone creating architecture or design sections, axons, schematics, or diagrams for school, portfolios, projects, competitions, and professional work.

#sections#architecturesection#rhino8#architectureportfolio#architecture#architecturediagrams#diagrams#architecturedrawing#rhino3d#3d#archtutorial#adobeillustrator#vectorart#rendering#infographic#graphicdesign#parametric#parametricarchitecture#structure#architectureplan#architecturecompetition#axon#axonometric#perspectivesection#perspective

2 notes

·

View notes

Note

for pinterest users

sections in boards? yay or nay

I love Pinterest❤️❤️❤️

This is a great idea, thanks anon!

#my polls#random polls#polls#yay or nay?#smash or pass#poll#tumblr polls#hyperspecific poll#random poll#Sections#pinterest

6 notes

·

View notes

Text

139K notes

·

View notes

Text

top places to publicly overshare online:

tumblr blog

youtube comment section of a song

54K notes

·

View notes

Text

looked up a cool artist i found and instead of her actual art the first result google showed me was AI art made with her work. i hate it here!!!!!!!

#not even in the images section btw this was the featured art examples box on the main page.#like the first thing u see when u google an artist. come ON#.txt

29K notes

·

View notes

Text

There's this sort of anthropomorphizing that inherently happens in language that really gets me sometimes. I'm still not over the terminology of "gravity assist," the technique where we launch satellites into the orbit of other planets so that we can build momentum via the astounding and literally astronomical strength of their gravitational forces, to "slingshot" them into the direction we need with a speed that we could never, ever, ever create ourselves. I mean, some of these slingshots easily get probes hurtling through space at tens of thousands of miles per hour. Wikipedia has a handy diagram of the Voyager 1 satellite doing such a thing.

"Gravity assist." "Slingshot." Of course, on a very basic and objective level, yes, we are taking advantage of forces generated by outside objects to specifically help in our goals. We're getting help from objects in the same way a river can power a mill. And of course we call it a "slingshot," because the motion is very similar (mentally at least; I can't be sure about the exact physics).

Plus, especially compared to the other sciences, the terminology for astrophysics is like, really straightforward. "Black hole?" Damn yeah it sure is. "Big bang?" It sure was. "Galactic cluster?" Buddy you're never gonna guess what this is. I think it's an effect of the fact that language is generally developed for life on earth and all the strange variances that happen on its surface, that applying it to something as alien and vast as space, general terms tend to suffice very well in a lot more places than, like... idk, botany.

But, like. "Gravity assist." I still can't get the notion out of my head that such language implies us receiving active help from our celestial neighbors. They come to our aid. We are working together. We are assisted. Jupiter and the other planets saw our little messengers coming from its pale blue molecular cousin, and we set up the physics just right, so that they could help us send them out to far stranger places than this, to tell us all about what they find out there.

We are assisted.

And there is no better way to illustrate my feelings on the matter than to just show you guys one of my favorite paintings, this 1973 NASA art by Rick Guidice to show the Pioneer probe doing this exact thing:

"... You, sent out beyond your recall, go to the limits of your longing. Embody me. ..."

Gravity assist.

#space#astronomy#astrophysics#language#paintings#the antidote to despair is awe#the quote is from the poem ''go to the limits of your longing'' by rainer maria rilke and translated by joanna macy#druid speaks#the thing that got me thinking about this was watching Animation VS Physics tbh#because the whole gravity assist section is so epic in scale and the music swells and its so. Romantic in the art movement sense#i mean the whole thing is epic like that. but seeing the term ‘’gravity assist’’ pop up did something to my brain specifically

19K notes

·

View notes

Text

ITR Filing in Dwarka

Looking for expert help with ITR filing in Dwarka? Trust Vatspk, your reliable tax consultant for fast, accurate, and affordable Income Tax Return filing. Whether you’re a salaried individual, freelancer, or business owner, Vatspk ensures timely filing, maximum deductions, and full compliance with the latest tax laws. ITR Filing in Dwarka | File Your Income Tax Return (ITR) | Consultant in Dwarka Delhi

#gst consultant in dwarka#income tax consultant in delhi#accounting#ca in delhi#chartered accountant in delhi#gst consultant in delhi#income tax consultant in dwarka#sections#tds#vatspk

2 notes

·

View notes

Text

Started a new vest project this week ! Test swatch + bottom section ⛪🌿

#knitting#tracery vest#wipinsanity#<--- this is the pattern designer you can find them on ravelry and their own site fyi#textile#bottom section is normally tall corrugated ribs but I wanted to change propotions a little#so i joined the ribbing into archways and added a row of windows

30K notes

·

View notes

Text

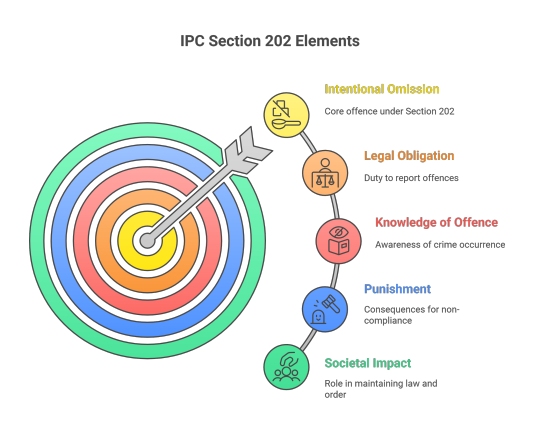

Understanding IPC Section 202: Intentional Omission to Give Information of Offence

Introduction

The Indian Penal Code (IPC) has many provisions that ensure justice, fairness, and responsibility among citizens and authorities. One such provision is Section 202 of the IPC, which deals with intentional omission to inform about an offence by a person who is legally bound to do so. This section highlights the importance of accountability and legal duties in society. In this article, we will explain what IPC Section 202 means, who it applies to, what punishments are involved, and how it is implemented in real cases.

Meaning and Objective of IPC Section 202

Section 202 of the IPC ensures that people who are legally required to give information about an offence do not withhold it on purpose. In simple words, if someone knows that a crime has happened and the law requires them to inform the authorities, but they intentionally do not do so, they can be punished under this section.

Objective:

The main goal of this section is to:

Promote truthfulness and responsibility.

Prevent the hiding of offences.

Ensure proper functioning of the justice system.

Help law enforcement investigate and punish crimes.

This law is especially important for people in positions of responsibility like public servants, police officers, doctors, lawyers, or any person who becomes aware of a crime and is expected to report it.

Legal Definition under IPC

According to Section 202 of the Indian Penal Code, 1860:

"Whoever, knowing or having reason to believe that an offence has been committed, intentionally omits to give any information respecting that offence which he is legally bound to give, shall be punished..."

In simple terms, this means that:

The person must have knowledge or a valid reason to believe that an offence has occurred.

The person must be under a legal duty to inform.

If that person intentionally chooses not to inform the concerned authority, then it becomes a punishable offence.

Essential Ingredients of Section 202 IPC

To prove an offence under Section 202, the following elements must be present:

Knowledge or belief that a crime has occurred.

The person must be legally bound to report that crime.

There must be a deliberate omission to inform.

The omission must be intentional, not accidental or due to ignorance.

Who is Legally Bound to Inform?

Not every person is legally bound to report a crime. The duty to inform depends on:

Legal responsibilities, such as those of police officers, public servants, or individuals covered by specific laws.

Professional obligations, like doctors reporting unnatural deaths, or employers reporting workplace crimes.

Situational responsibilities, such as eyewitnesses in certain scenarios where the law expects them to report.

Punishment under IPC Section 202

The punishment under this section varies based on the severity of the crime that was not reported:

If the offence not reported is non-cognizable (less serious), the punishment is up to 6 months in prison, or fine, or both.

If the offence not reported is cognizable and serious (like murder, rape, dacoity, etc.), the punishment can go up to 2 years of imprisonment, or fine, or both.

This difference shows that the law treats the failure to report serious crimes more harshly.

Examples and Case Scenarios

To understand this better, let’s look at a few examples:

A doctor treats a person with injuries caused by a violent crime. The doctor suspects it is due to a criminal act but chooses not to inform the police. If this omission is proven intentional, the doctor can be charged under Section 202.

A village sarpanch learns about a theft in the village but refuses to report it due to personal bias or benefit. This can also be considered a violation under Section 202.

A public servant receives a complaint about a possible crime but purposely hides it to protect someone. This is punishable under IPC Section 202.

Difference between Section 176 and Section 202 IPC

People often confuse Section 202 with Section 176 IPC, but they are different:

Section 176 IPC: Punishes a person for failing to provide information to a public servant when legally bound to do so. It is about not giving information when asked.

Section 202 IPC: Punishes a person for intentionally omitting to provide information without being asked, even though they are legally bound to inform.

So, Section 202 is more proactive. It applies even if no one specifically asks for the information.

Important Judgments

Indian courts have addressed several cases related to Section 202. Some key takeaways from case law:

Intent is crucial: The omission must be intentional. Mere negligence or ignorance is not enough for punishment.

Legal obligation must be proven: It must be clear that the person was legally required to report the offence.

Motive matters: If the omission was done for personal gain or to protect someone, the punishment may be stricter.

Challenges in Implementation

Despite being clear in law, the implementation of Section 202 faces some difficulties:

It is often hard to prove the intent behind the omission.

In many cases, the person may claim ignorance or fear of involvement in legal matters.

Delayed reporting due to fear or confusion may also lead to false charges under this section.

Therefore, courts analyze each case carefully before giving a judgment under this section.

Importance of IPC Section 202 in Society

This section plays a major role in maintaining law and order. If people in responsible positions start hiding crimes, justice will never be served. IPC Section 202 ensures:

Better cooperation with law enforcement.

Protection of victims and society by ensuring crimes are not buried.

Holding public officials and professionals accountable.

Conclusion

IPC Section 202 is a critical provision that focuses on intentional omissions by people who are legally required to inform the authorities about offences. It reinforces the value of honesty and responsibility in society. Though it is limited in its scope, its importance cannot be ignored in the criminal justice system. Whether you are a professional, a government officer, or a citizen, understanding your legal duties can help build a safer and more law-abiding community.

0 notes

Text

The corn is pickled on the cob for this recipe for pickled corn. a fantastic recipe for storing summer's fresh corn to enjoy later in the year.

0 notes

Link

#Civil3D#Sections#Autodesk#EngineeringSoftware#InfrastructureDesign#RoadDesign#Alignment#Profiles#DesignAnalysis#SectionManagement

0 notes

Text

Board games with uncle Sukuna :)

They are taking this thing seriously, already take the cards out of the game

#Isn’t this what we should buy in the children’s section? Please don’t invite us again!#There is a betting game that can do with the ouija#I strongly recommend that you do not lol#This is something that Sukuna would do. Entertainment for himself instead of taking care of his nephew#I love the “what am I doing here” face of little Yuuji <3#art#fanart#jujutsu kaisen#jjk#jjk fanart#yuuji itadori#yuji itadori#sukuna ryomen#ryoumen sukuna#honneydraws ⊹⃬۫🍜̸᩠໋࣪꣹۫

11K notes

·

View notes