#Tax Preparation and Filing

Explore tagged Tumblr posts

Text

Useful List of Accounting Services for Small Business in 2024

As small business owners, wearing many hats is inevitable. However, juggling essential tasks like accounting alongside day-to-day business operations can become overwhelming. The relevance of professional accounting services remains unchanged for businesses of all sizes, but for small businesses, efficient accounting is crucial for sustaining growth and compliance.

While outsourcing accounting might feel like a leap, it is a cost-effective solution for small businesses that lack the resources to hire full-time professionals. Unison Globus offers tailored solutions to simplify your accounting needs, helping you stay focused on your business goals. Below is a list of critical accounting services your small business can benefit from in 2024.

Detailed Descriptions of Each Service

Bookkeeping Services

Precise bookkeeping is the backbone of any business’s financial strength. It involves systematically recording financial transactions to ensure smooth accounting processes. Partnering with outsourced bookkeeping services ensures your records are kept up-to-date, helping you stay on track with cash flow and financial planning. By engaging with expert accountants and bookkeepers, you gain access to professionals who can manage your books using advanced software, ensuring efficiency and accuracy.

Monthly Accounting Activities

Monthly accounting reviews provide valuable insights into your financial standing. These reviews help detect early issues and enable informed decision-making for the future. Small business owners can benefit from accounting outsourcing services USA, ensuring that timely reports are generated and monthly financial statements prepared by experienced professionals.

Tax Preparation and Filing

Staying compliant with tax regulations is non-negotiable for small businesses. An understanding of common tax deductions and proper filing ensures you avoid penalties and save money. Engaging outsourced CPA services offers the expertise needed to manage tax-related obligations efficiently. Whether it’s navigating tax season or preparing returns, outsourced accounting services USA can help streamline the process.

Payroll Processing

Payroll management is often more complex than it appears. Ensuring on-time payments, compliance with tax regulations, and accurate payroll reporting are vital. Outsourced bookkeeping & accounting services help manage payroll smoothly, allowing you to focus on core business activities while ensuring compliance and proper tax filing.

Financial Planning and Analysis

Strategic financial planning plays a pivotal role in guiding business growth. With financial planning and analysis, businesses can make data-driven decisions based on in-depth financial insights. For example, using remote accounting services can provide regular financial forecasts and analyses that align with your business goals, aiding in long-term sustainability.

Outsourced CPA Services

Hiring a full-time CPA may not be feasible for small businesses due to cost. However, outsourcing to a bookkeeping outsourcing firm or CPA allows you to access expert advice at a fraction of the cost. These services provide advisory support, periodic reviews, and assistance in making strategic financial decisions.

Forensic Accounting Needs

Protecting your business from fraud is essential. Forensic accounting helps detect discrepancies and misstatements, identifying potential fraud early. By engaging with outsourced accounting services, small businesses can implement necessary safeguards and maintain financial integrity.

Benefits of Using Professional Accounting Services

The benefits of professional accounting services go beyond accuracy. They help small businesses stay compliant, avoid penalties, and make informed financial decisions. By outsourcing, you reduce the burden of in-house accounting while gaining access to expertise and technology solutions that enhance your financial processes.

Comparison of In-House vs. Outsourced Accounting

While in-house accounting provides control, it can be resource-intensive and costly for small businesses. Outsourced bookkeeping solutions offer flexibility, cost savings, and access to expert accountants without the overheads of full-time staff. Additionally, outsourcing allows small businesses to scale operations as needed without compromising quality.

Read also: https://unisonglobus.com/accounting-vs-bookkeeping-infographic/

Tips for Choosing the Right Accounting Service

Selecting the right accounting partner is essential. Look for bookkeeping firms that specialize in small business needs, offer competitive pricing, and have a strong track record. A good partner will provide personalized services, from outsourced bookkeeping for CPAs to payroll management, ensuring all aspects of your accounting are covered.

Pro Tips for Choosing the Right Accounting Service

Specialization in Your Industry Choose a firm that understands the unique challenges and requirements of your industry. Specialized accounting services ensure they are well-versed in the specific tax laws, compliance regulations, and financial reporting standards that apply to your business.

Scalable Solutions As your business expands, your accounting needs will advance. Look for firms that offer scalable accounting solutions—from basic bookkeeping to advanced financial analysis��so you can easily adjust the level of service based on your business's growth without switching providers.

Technology-Driven Services Opt for firms that integrate cloud-based accounting software and use the latest technology for secure, real-time access to your financial data. This will help you stay updated with your accounting reports, access your data on the go, and ensure your business uses cutting-edge solutions for better financial management.

Transparent Pricing Structure Ensure the accounting service provides a transparent pricing model with no hidden fees. Whether they offer hourly rates, fixed fees, or package deals, it’s crucial to understand what’s included in the service and how additional costs may arise as your needs grow.

Proven Track Record & Reputation Verify the firm’s experience by looking into their track record with businesses similar to yours. Client testimonials, reviews, and case studies can provide insights into how well they handle small business accounting needs and their success in delivering results.

Certifications & Qualifications Ensure that the accountants you work with have the proper certifications (e.g., CPAs, CAs, or EAs). Certified professionals provide assurance that they are held to high standards of competency and ethics, which is crucial for accurate reporting and regulatory compliance.

Comprehensive Service Offerings Choose a firm that offers a full suite of accounting services, including payroll management, tax preparation, bookkeeping, and financial advisory services. This ensures all aspects of your accounting are covered, reducing the need for multiple service providers and streamlining your operations.

Communication & Responsiveness Look for a partner who is responsive and communicative. Timely responses, regular check-ins, and easy access to financial reports are critical. A good accounting partner should feel like an extension of your team, keeping you updated and informed at all times.

Data Security Measures With increasing concerns around data breaches, ensure your accounting partner follows strict data security protocols to protect sensitive financial information. Opt for firms that use encrypted systems and have robust cybersecurity measures in place.

Proactive Financial Guidance A good accounting service doesn’t just handle your numbers; they act as strategic advisors for your business. Look for firms that offer proactive guidance, helping you identify cost-saving opportunities, improve profitability, and plan for future growth with data-driven insights.

Industry-Specific Accounting Services

Different industries have unique accounting requirements. Unison Globus offers specialized services across various sectors, from tech startups to e-commerce and manufacturing. Each industry benefits from tailored accounting services that address specific compliance and reporting needs.

For more details, visit our Market Page.

Technology Integration in Accounting

Modern accounting is driven by technology. Outsourced accounting services incorporate advanced software and tools to enhance data security, improve reporting accuracy, and streamline processes. Investing in technology-driven accounting and bookkeeping outsourcing services ensures your business stays ahead in an increasingly digital world.

Common Accounting Mistakes to Avoid

Small businesses often make common accounting errors such as improper record-keeping, missing tax deadlines, and poor cash flow management. Engaging with bookkeeping service providers ensures you avoid these pitfalls. Professional accountants help keep your financial records in order, ensuring timely reporting and filing.

Common Accounting Mistakes to Avoid:

Inaccurate Record-Keeping: Keep all financial records up to date and organized to prevent discrepancies. Tip: Use cloud-based accounting software for real-time updates.

Missing Tax Deadlines: Ensure timely filing to avoid penalties. Tip: Automate tax reminders and rely on professional accountants to handle tax compliance.

Poor Cash Flow Management: Monitor your cash flow regularly to avoid liquidity issues. Tip: Create monthly cash flow forecasts with the help of expert accountants.

Mixing Personal and Business Finances: Always keep personal and business accounts separate. Tip: Set up dedicated business accounts and track every transaction accurately.

Not Reconciling Accounts: Regularly reconcile your bank accounts to catch errors or fraud early. Tip: Schedule monthly reconciliations with professional bookkeepers.

Read more: https://unisonglobus.com/common-accounting-mistakes-and-how-to-avoid-them-expert-tips/

How to Maximize the Value of Accounting Services

To get the most from your accounting services, ensure regular communication with your accounting partner. Regular financial reviews, budget adjustments, and strategic planning sessions are essential. Outsource bookkeeping and accounting services that offer tailored advice and proactive solutions to enhance business growth.

On the whole

Accounting plays a crucial role in the success of any small business. With the right outsourced accounting services USA, you can streamline financial operations, stay compliant, and make better business decisions. Unison Globus is here to support your journey with customized, cost-effective accounting solutions. Our outsourced bookkeeping services and expert CPAs can help you maintain financial health, grow your business, and stay ahead in 2024. Contact us today to learn how we can assist your business in achieving its goals!

FAQs on Accounting Services for Small Businesses

What is the difference between bookkeeping and accounting? Answer: Bookkeeping involves recording daily financial transactions, such as sales and expenses. Accounting includes interpreting, classifying, analyzing, reporting, and summarizing financial data to provide deeper insights into your business.

Why should I separate my business and personal finances? Answer: Separating business and personal finances simplifies tax preparation, protects personal assets from business liabilities, and makes it easier to track business expenses and cash flow. It’s a fundamental step in maintaining financial clarity and compliance.

How often should I review my financial statements? Answer: Reviewing your financial statements monthly ensures accuracy and enables informed business decisions. Regular reviews allow you to identify trends, adjust strategies, and address any issues early on.

What are the benefits of outsourcing accounting services? Answer: Outsourcing saves time, reduces costs, and provides access to expert advice, ensuring tax compliance and accurate financial management. It allows business owners to focus on growth while experienced professionals handle the accounting workload.

How can cloud-based accounting services benefit my business? Answer: Cloud-based accounting services offer anytime, anywhere access to real-time financial data, improved collaboration, enhanced data security, and cost savings. These services integrate advanced technology, enabling better financial decision-making.

What should I look for when choosing an accounting service provider? Answer: Look for a provider with industry-specific expertise, a range of scalable services, advanced technology integration, and a strong reputation for communication. A good accounting partner will tailor services to your business needs and be responsive and transparent.

Can I prepare my company’s taxes myself? Answer: While possible, hiring a professional accountant ensures accuracy, maximizes deductions, and keeps you compliant with ever-changing tax laws. Accountants provide valuable strategic advice that can improve financial outcomes.

How much does it cost to hire an accountant? Answer: The cost varies on the services you expect, the complexity of your business, and the accountant’s experience. Always compare pricing and services to find an accounting partner that fits your budget and delivers value.

Read also: https://unisonglobus.com/how-much-does-it-cost-to-hire-a-cpa/

Connect with Unison Globus

At Unison Globus, we specialize in helping small businesses navigate their accounting needs with expert solutions, scalability, and advanced technology integration. Whether you need bookkeeping, tax services, or financial analysis, our team is here to support your growth with personalized services.

Contact us today to learn how Unison Globus can be your trusted accounting partner!

#Small business accounting services#Tax preparation services for small business#Outsourced accounting services#Bookkeeping Services#Monthly Accounting Activities#Tax Preparation and Filing#Outsourced CPA Services#Expert Accounting Solutions#Benefits of Using Professional Accounting Services#in-house vs. Outsourced Accounting

1 note

·

View note

Text

Actually, a thought. Are goons classified as contractors or full time employees? Do they sign a W2 or a 1099? How do they file their taxes?

#I wanna see Two Face holed up in his lier late February desperately filing all his goons#paperwork in preparation for tax season#police can’t catch him but the IRS sure can#text post#dc

70 notes

·

View notes

Text

so i took my car in today because i thought it might just need some more brake fluid and although i tried to just look at it myself i couldn't for the life of me figure out which part under the hood was the brake fluid reservoir without having to lean all over my car and get all dirty, so i figured i might just have to pay a service fee and whatever for the fluid itself...

turns out i need all new brake pads !!

ahaha

haha

ha

yay

#i swear to god it's like my car knows whenever it's tax time#like 'hey can i have some money pwease? pweaaaaase just a thousand dollars for new brakes pretty pwease?!'#i guess!!!!!!#i kinda need 'em#jokes on you though because i haven't even filed my taxes yet#i'm gonna have to wait until next week when i get paid but they said i should be able to drive on them for maybe another month as they are#i had other stuff i was gonna do today but given the circumstances i decided to just park my ass back at home#mostly i've been trying to do some ~research of the local libraries to prepare for school which is starting....soon#but i'll just have to postpone my research for the time being#it's funny too because i was watching a tiktok the other day of 'what to do if your breaks fail'#i even almost scrolled past it but something told me to go back and watch#and now i guess i know why#fortunately i haven't had to use that information just yet#but dear god today whenever i put on the breaks it sounds like thunder#just a terrible sound for a car to make#prior to that all that happened was my break light kept coming on whenever i accelerated#it would go off once i'd been rolling for a little bit or sometimes if i'd ease off the gas and then accelerate again#and when i tried to research it myself that's where i got the break fluid thing from#really hoped it was going to be that simple but it never is!!#that's just the rules!!#so anyway that's how my weekend's starting off#not great tbh but it could be a lot worse so i'm just gonna be grateful this is something i can fix#(even if i really don't want to)#and just move on with it and hope nothing else tears up on this goddamn car#because it wasn't that long ago i had to take it in for something else so....#if i could go like....mmm a year maybe before i need any more expensive ass repairs i'd really appreciate it#tires i'm looking you straight in the eye don't you even think about it#i did have my follow up with my urologist today also and they did another x-ray#she said she doesn't see the stone anymore so i believe it did in fact pass so that's some good news !!#we're just gonna keep an eye on the one that's on the other side and still in my kidney

4 notes

·

View notes

Text

unfortunately at the point of being good with money where friends ask me tax filing questions

#pull my string and I say 'did you know you can file your il state taxes for free super easy at mytax.illinois.gov'#so you don't get screwed like I did when turbotax fails to actually file your state return that you submitted#btw happens fairly regularly#like known noncompliant tax preparer at state rev offices. check your return status if you can

5 notes

·

View notes

Text

10 Genius Tips to Simplify Your 2025 Canadian Tax Filing

Canadian Tax Filing 2025: Tax season in Canada doesn’t have to be a nightmare. Filing your taxes can feel like climbing a mountain, with receipts scattered everywhere and credits slipping through the cracks. But with the right strategies, you can breeze through it stress-free. The Canada Revenue Agency (CRA) opens online tax filing on February 24, 2025, and preparation is your key to…

#Amend tax return CRA#Best tax software Canada#Canadian Tax Filing#Charitable donation tax credit#Common tax mistakes 2025#CRA My Account tips#Federal budget tax credits#File taxes early 2025#Home office tax deduction#Maximize tax refund Canada#Medical expense deduction#RRSP contribution limit 2025#Simplify tax filing 2025#Tax planning strategies 2025#Tax preparation Canada#TFSA rules Canada

2 notes

·

View notes

Text

forcing myself out of the apartment so I don't spend the entire weekend spiraling and trying not to cry on the couch

#like i don't really know what i expect of myself but it's all piling on lately#how much my body aches and is incapable of things i used to do#how no amount of money ever feels like enough AND that my payrate is dropping soon and I'm just Supposed To Prepare For It#like. okay.#do i file my taxes this year? i don't know?#i 'like' being at home more now but really it's only because i am embarrassed to be outside because of my size & mobility struggles??#i don't wear the clothes i used to like i don't really style myself because it's like. what the point#everything feels like a chore everything feels futile and draining and ⚰️#anyway it's time to get milk tea + a choccy croissant + go antiquing#then i will go grocery shopping because i need food for Baby and Mac n cheese for Tals

2 notes

·

View notes

Text

I've started a new cross-stitch pattern! This time I am working from a pattern, not a kit, so I had to print the chart and buy all the fabric and embroidery floss myself.

(I am going to have so much floss left over. Which is fine! I can use it for new projects later. I do need to come up with a decent organizing system, though...)

Not much progress yet, but I have a few more audio-heavy tax prep continuing education courses to get through this week (ARGH), and then some podcasts to catch up on. :D

[link to the designer's Etsy shop]

#cats#embroidery and cross stitch#cross stitch#arts and crafts#liz stabs cloth with needles#liz photographs stuff#actual professional tax preparer here says: FILE YOUR GODDAMN TAXES

15 notes

·

View notes

Note

Hello. I have a question for you. How would Amalie feel. About spaghetti night.

She would find spaghetti night a waste of time and scary because of so many people :(

#she could be doing more productive things like preparing to file her taxes 7 months in advance.#or uh. sleeping so she can get to work earlier.#plus having spaghetti means so many DISHES to have to clean. so inefficient.

4 notes

·

View notes

Text

Tax planning is evolving. Is Your Firm Evolving with It?

With a US tax code that is nearly 7,000 pages long and equally complex, individuals and business owners are looking to their CPAs and tax accountants for strategic tax planning. There is a lot of buzz currently in the profession around tax planning and new technology and tools that are emerging to create efficiency in the tax planning process.

So, what are some of the current trends and tools for tax planning? And why is tax planning something firms should be focused on delivering?

Let’s start with the ‘why’

It’s no secret that tax preparation alone has become a commodity. Compliance is required, but the real value is in the strategy to apply the tax code in the most tax-efficient way for the client.

Clients aren’t just looking for someone to file their returns; they’re looking for someone to help them plan. Someone who understands their long-term goals, anticipates risks, and adds strategic insight.

Firms that remain trapped in a reactive model risk falling behind — both in profitability and relevance. Shifting to an advisory model isn’t a luxury anymore; it’s a necessity for sustainable growth, client satisfaction, and even the mental wellness of firm owners.

CPAs and tax professionals are in an ideal position to apply their expertise and impact their clients’ financial situation significantly. When higher value is delivered, fees become an investment rather than an expense.

Current Trends in Tax Planning

01. Automation

Automation is no longer optional, but it is a core part of modern tax preparation services. Firms are increasingly turning to AI-powered tax planning software and cloud-based solutions to streamline processes, improve accuracy, and deliver faster results. Tools like Intuit ProConnect and Bloomberg BNA Tax Planner are helping tax consultants work smarter, offering clients more personalized and data-driven tax return help.

Unison Globus leverages automation to deliver cost-effective, precise, and strategic tax solutions for CPAs and accounting firms. Their outsourced tax preparation services are designed to enhance operational efficiency and reduce compliance burdens

02. Cryptocurrency and Taxation

Cryptocurrencies have moved from the margins to the mainstream. The IRS treats digital assets like property, which means every sale, exchange, or transaction could trigger a taxable event. Understanding how to navigate cryptocurrency taxation is no longer just a value-add; it is becoming essential. Your firm must stay informed about changing regulations and reporting requirements to help clients manage their tax liability effectively.

03. Environmental Taxes and Incentives

Sustainability initiatives are influencing tax strategies more than ever before. Businesses investing in energy efficiency, clean technologies, or sustainable practices can often benefit from valuable tax deductions and credits. As a trusted tax accountant or consultant, you have the opportunity to guide clients in leveraging environmental tax incentives to both save money and promote their corporate social responsibility goals.

Regulatory Updates and Compliance

01. Recent Tax Law Changes

The 2024–2025 tax years have brought notable changes. Adjustments to federal tax brackets, increases to the standard deduction, and enhancements to key tax credits like the Child Tax Credit and energy efficiency incentives are reshaping tax planning strategies.

02. International Tax Compliance

Global business operations mean that firms must also navigate complex international tax laws. The OECD’s global minimum tax initiative and expanded foreign reporting requirements are changing the compliance landscape. Firms need to be prepared to assist clients with cross-border tax filing, ensuring they meet their obligations while minimizing risks. Our expat tax services include expertise in Forms 2555, 5471, 5472, FBAR filing, and IRS amnesty programs — ensuring full compliance for clients with international obligations

Best Practices for Modern Tax Planning

01. Tax Efficiency

To build a good tax plan, you must know what your clients’ goals are. Sometimes, a client’s goal is to simply minimize their tax liability. But not always. Sometimes, paying more now to gain much more later is a better strategy. For example, a business owner planning to sell their company in the next 1-2 years may be advised to not aggressively minimize the tax liability, show strong earnings, and get the highest possible valuation. There is real value in understanding and applying the tax code strategically to help a client reach his or her goals. And there are real consequences in the form of missed wealth accumulation or opportunity when business owners and individuals don’t plan looking forward.

02. Proactive Tax Strategies

Tax planning is no longer a reactive exercise. Techniques such as tax-loss harvesting, maximizing contributions to retirement accounts, optimizing charitable giving, and leveraging tax-advantaged investment vehicles should be discussed with clients throughout the year. By offering proactive strategies, you can help clients reduce their tax liability and strengthen their financial position well before filing season begins. Our tax planning services are designed to be forward-looking and proactive, helping firms identify opportunities for tax savings throughout the year — not just at year-end.

03. Client Education and Communication

Strong communication builds strong client relationships. Educating clients about changing regulations, available tax credits, and smart planning opportunities demonstrates your value beyond basic tax filing assistance. Regular updates, client webinars, and customized tax planning reviews foster trust, build authority, and ensure your clients remain engaged and informed. Unison globus support firms with customized client communication strategies, including white-labeled reports and educational content that enhances client engagement and retention.

Leveraging Technology for Efficiency

Tax Planning Software

As firms move toward a more advisory-focused model, the tools you use matter more than ever. As established earlier, modern tax planning software isn’t just about saving time — it’s about unlocking smarter, forward-looking strategies for your clients. Platforms like Bloomberg BNA, Drake Tax, TaxPlanIQ, and Corvee offer more than calculations. They let you model different scenarios, forecast multiple years, and even visualize the tax impact of decisions before they’re made. Want to help a client decide between taking a bonus or reinvesting in their business? Now you can show them the numbers in real time. These tools don’t just reduce errors; they elevate your role from tax preparer to strategic partner. The key is choosing a platform that aligns with how your firm delivers value, supports collaboration, and keeps you a step ahead of client expectations.

Bottom line: With the right software, you’re not just getting more efficient you’re helping clients make better decisions and building the kind of trust that drives long-term relationships.

Future-Proofing Your Firm

01. Continuous Learning and Development

In this ever-changing tax environment, continuous professional development is essential. Encouraging your team to pursue certifications, attend industry conferences, and participate in IRS webinars will ensure that your firm remains competitive when it comes to your tax planning services offer. We invest in ongoing training and upskilling of their offshore staff, ensuring they stay current with U.S. tax laws and best practices.

02. Adapting to Client Needs

Today’s clients value convenience and personalized service. Virtual consultations, customized tax plans, and flexible communication channels are no longer “nice-to-haves”; they are expectations. Adapting your service model to meet these evolving demands will not only retain existing clients but also attract new ones looking for a forward-thinking tax partner.

03. But, What About the Sheer Volume of Compliance Work?

The profession has been talking about a shift from compliance to advisory for years. So, why has it been so difficult to implement in many firms? Quite simply, time and resources. The volume of compliance work is daunting. So, how to accountants remove themselves from compliance work but still be assured of the quality and accuracy that is critical? At Unison Globus, we specialize in delivering modern tax preparation and review services designed to help CPA firms, EAs, and accounting businesses focus on high-value advisory services. We are leading the new era of outsourcing, and we call it Offshore Staffing 2.0. Our team of highly educated and experienced CPAs and accountants gets it right the first time and is proficient with your tech stack. Don’t have your processes or SOPs documented? We can help with that as your strategic capacity partner.

Final Thoughts

Tax planning is evolving at a pace we have never seen before. Firms that continue to operate with outdated practices will likely fall behind. Embracing automation, staying current on regulatory changes, offering proactive tax strategies, and prioritizing client education are no longer optional they are the foundation of sustainable success.

And managing the massive volume of compliance work doesn’t have to be the roadblock. With a strategic capacity partner that you can trust and rely on, you can focus on the client advisory work you love.

This blog was originally posted here: https://unisonglobus.com/tax-planning-is-evolving-is-your-firm-evolving-with-it/

#tax planning strategies#tax advisor#tax services#unison globus#tax preparation#tax preparation services#tax accountant#accounting services#outsourced accounting services#tax season#tax filing#modern tax planning for CPAs#tax advisory services#tax planning for accountants

1 note

·

View note

Text

IRS Tax Preparer

We have a list of IRS-enrolled agents who can provide professional tax preparation for your needs. Find a tax office near you today by searching the IRS enrolled agent list.

For best information please visit our website - https://www.enrolledagent.com/ Address - 100 Church Street, 8th floor, New York, NY, United States, 10007 Phone - +1 8552224368 Email - [email protected]

#Enrolled Agent#Enrolled Agent Near Me#Tax Services#EA Tax Preparer#EA Tax Preparer Near Me#IRS Free Filing Program#Enrolled Agent Lookup#List of Enrolled Agents#find enrolled agent

2 notes

·

View notes

Text

I used this service last year and it was not only easy to use, I got to keep all of my refund instead of paying out $50 for tax prep!

128K notes

·

View notes

Text

25 ways to be a little more punk in 2025

Cut fast fashion - buy used, learn to mend and/or make your own clothes, buy fewer clothes less often so you can save up for ethically made quality

Cancel subscriptions - relearn how to pirate media, spend $10/month buying a digital album from a small artist instead of on Spotify, stream on free services since the paid ones make you watch ads anyway

Green your community - there's lots of ways to do this, like seedbombing or joining a community garden or organizing neighborhood trash pickups

Be kind - stop to give directions, check on stopped cars, smile at kids, let people cut you in line, offer to get stuff off the high shelf, hold the door, ask people if they're okay

Intervene - learn bystander intervention techniques and be prepared to use them, even if it feels awkward

Get closer to your food - grow it yourself, can and preserve it, buy from a farmstand, learn where it's from, go fishing, make it from scratch, learn a new ingredient

Use opensource software - try LibreOffice, try Reaper, learn Linux, use a free Photoshop clone. The next time an app tries to force you to pay, look to see if there's an opensource alternative

Make less trash - start a compost, be mindful of packaging, find another use for that plastic, make it a challenge for yourself!

Get involved in local politics - show up at meetings for city council, the zoning commission, the park district, school boards; fight the NIMBYs that always show up and force them to focus on the things impacting the most vulnerable folks in your community

DIY > fashion - shake off the obsession with pristine presentation that you've been taught! Cut your own hair, use homemade cosmetics, exchange mani/pedis with friends, make your own jewelry, duct tape those broken headphones!

Ditch Google - Chromium browsers (which is almost all of them) are now bloated spyware, and Google search sucks now, so why not finally make the jump to Firefox and another search like DuckDuckGo? Or put the Wikipedia app on your phone and look things up there?

Forage - learn about local edible plants and how to safely and sustainably harvest them or go find fruit trees and such accessible to the public.

Volunteer - every week tutoring at the library or once a month at the humane society or twice a year serving food at the soup kitchen, you can find something that matches your availability

Help your neighbors - which means you have to meet them first and find out how you can help (including your unhoused neighbors), like elderly or disabled folks that might need help with yardwork or who that escape artist dog belongs to or whether the police have been hassling people sleeping rough

Fix stuff - the next time something breaks (a small appliance, an electronic, a piece of furniture, etc.), see if you can figure out what's wrong with it, if there are tutorials on fixing it, or if you can order a replacement part from the manufacturer instead of trashing the whole thing

Mix up your transit - find out what's walkable, try biking instead of driving, try public transit and complain to the city if it sucks, take a train instead of a plane, start a carpool at work

Engage in the arts - go see a local play, check out an art gallery or a small museum, buy art from the farmer's market

Go to the library - to check out a book or a movie or a CD, to use the computers or the printer, to find out if they have other weird rentals like a seed library or luggage, to use meeting space, to file your taxes, to take a class, to ask question

Listen local - see what's happening at local music venues or other events where local musicians will be performing, stop for buskers, find a favorite artist, and support them

Buy local - it's less convenient than online shopping or going to a big box store that sells everything, but try buying what you can from small local shops in your area

Become unmarketable - there are a lot of ways you can disrupt your online marketing surveillance, including buying less, using decoy emails, deleting or removing permissions from apps that spy on you, checking your privacy settings, not clicking advertising links, and...

Use cash - go to the bank and take out cash instead of using your credit card or e-payment for everything! It's better on small businesses and it's untraceable

Give what you can - as capitalism churns on, normal shmucks have less and less, so think about what you can give (time, money, skills, space, stuff) and how it will make the most impact

Talk about wages - with your coworkers, with your friends, while unionizing! Stop thinking about wages as a measure of your worth and talk about whether or not the bosses are paying fairly for the labor they receive

Think about wealthflow - there are a thousand little mechanisms that corporations and billionaires use to capture wealth from the lower class: fees for transactions, interest, vendor platforms, subscriptions, and more. Start thinking about where your money goes, how and where it's getting captured and removed from our class, and where you have the ability to cut off the flow and pass cash directly to your fellow working class people

53K notes

·

View notes

Text

July 2025 Minimum Wage Increase: What Employers Need to Know

From 1 July 2025, the Fair Work Commission will increase the National Minimum Wage and all Modern Award rates by 3.5%. This aims to address real wage decline caused by inflation and affects many employers across Australia. Businesses must review their payroll systems, employment contracts, and any Enterprise Bargaining Agreements to ensure compliance and avoid underpayment risks. Understanding Modern Award coverage is essential, as many employers are unknowingly bound by it. RV Advisory Group offers expert support to help you navigate these updates with confidence and stay compliant. Source and related content: https://www.rvag.com.au/australia-minimum-wage-update-2025-business-guide/

#tax advisor#registered tax agent#Accounting Services#tax consultant near me#individual tax return#tax accounting#small business accounting#Tax Planning#TFN registration#Gst Return Filing#Business Advisory Services#small business tax accountant#gst preparation#business abn registration#Small Business Structure Setup

0 notes

Text

I am not a dungeon'd meshi but I will add: there are also in-person sites you can go to to have a volunteer preparer go through your return with you and file it for free.

They aren't trained on everything so some situations may be out of scope and they'll need to recommend you go elsewhere, but for most cases they should be able to get your return done and answer questions or concerns you might have in a way that a internet form can't.

#nonsims but important#i am working at a VITA site this year!#i think our AGI cutoff is 68k and the free file one here appears to be higher#do NOT pay out the nose if you don't have to#professional tax preparers are only worth it if you have really complicated financial stuff going on#if all you've got is some w2s or ssi or whatever? come to us#nonsims

144K notes

·

View notes

Text

Looking for the best GST return filing online course? You are in the right place. The Course covers How to prepare & Claim GST Refund from the Basic to Advanced level, covering all Taxation parts related to GST Refund, legal aspects, major compliances and Procedures. Join today! For more information, you can call us at 7530813450.

#gst registration service#income tax certification course#partnership firm registration services#best income tax course#gst filing training#best income tax course online#basic gst course online#best income tax preparation courses

0 notes

Text

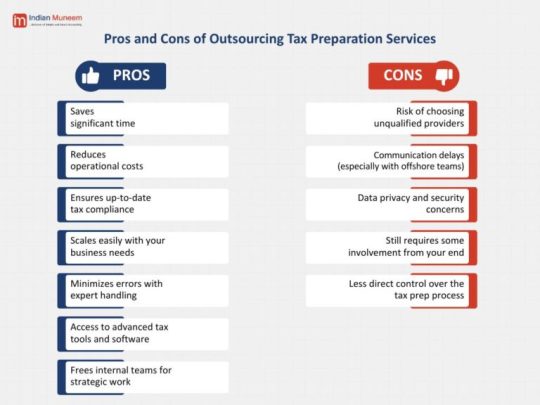

Outsourcing tax preparation services offers advantages like reduced costs, access to specialized expertise, and faster turnaround time. However, it also comes with potential downsides such as data security concerns, less control over processes, and possible communication gaps, making it important to weigh both sides before making a decision. Here's a comparison!

#online tax preparation services#Outsourcing tax preparation services#online tax return filing services

0 notes