#TaxStrategyExperts

Explore tagged Tumblr posts

Text

Running a business? You might be overpaying your taxes! With the right tax planning, you could save up to 20% on your business income. Let SBA Tax Consultants show you how to legally reduce your tax burden and keep more of your hard-earned money.

𝐂𝐨𝐧𝐭𝐚𝐜𝐭 𝐮𝐬 𝐚𝐭 𝟒𝟔𝟗-𝟕𝟐𝟐-𝟓𝟒𝟖𝟎

#taxsavingsusa#BusinessTaxTips#TaxStrategyExperts#SBATaxConsultants#TaxSeasonHelp#SaveOnTaxes#bharathkakkireni#KBK#KBKgroup#akshaymerchant

1 note

·

View note

Text

𝐓𝐚𝐱 𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐢𝐞𝐬 𝐘𝐨𝐮 𝐂𝐚𝐧’𝐭 𝐀𝐟𝐟𝐨𝐫𝐝 𝐭𝐨 𝐈𝐠𝐧𝐨𝐫𝐞 Let me ask you this: How much of your income are you actually keeping? If you’re like most business owners, you might be giving more to the IRS than you need to. 𝐖𝐡𝐲 𝐝𝐨𝐞𝐬 𝐭𝐡𝐢𝐬 𝐡𝐚𝐩𝐩𝐞𝐧? Because many tax preparers focus on filing and calculating—not on creating strategies. Filing taxes and planning taxes are two completely different things. Without a tax strategy in place, you could be missing out on: ✅ Structuring your business to maximize tax efficiency ✅ Timing your expenses to lower your taxable income ✅ Utilizing credits and deductions built into the tax code A skilled Tax Advisor does more than just file returns. We design proactive strategies to help you keep more of your hard-earned money. Here’s the good news: These strategies don’t just work once—they save you money year after year, growing your savings over time. But here’s the catch: You need to start NOW. Waiting until tax season is like trying to steer a ship after it has already set sail. 👉 𝐁𝐨𝐨𝐤 𝐲𝐨𝐮𝐫 𝐅𝐑𝐄𝐄 𝐓𝐚𝐱 𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐲 𝐂𝐚𝐥𝐥 𝐭𝐨𝐝𝐚𝐲, 𝐚𝐧𝐝 𝐥𝐞𝐭’𝐬 𝐜𝐫𝐞𝐚𝐭𝐞 𝐚 𝐩𝐥𝐚𝐧 𝐭𝐨 𝐦𝐢𝐧𝐢𝐦𝐢𝐳𝐞 𝐲𝐨𝐮𝐫 𝐭𝐚𝐱 𝐛𝐮𝐫𝐝𝐞𝐧 𝐚𝐧𝐝 𝐦𝐚𝐱𝐢𝐦𝐢𝐳𝐞 𝐲𝐨𝐮𝐫 𝐬𝐚𝐯𝐢𝐧𝐠𝐬!

#TaxStrategyExpert#TaxPlanningMadeEasy#SyriacCPA#FinancialSolutions#SmartTaxStrategies#TaxConsulting#TaxSavingsTips#AccountingExcellence#BusinessTaxSolutions#MaximizeYourRefund#IRSCompliance#TaxPlanningAdvisor#SaveOnTaxes#TaxPreparationPro#AccountingExperts

0 notes

Text

𝐓𝐚𝐱 𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐢𝐞𝐬 𝐘𝐨𝐮 𝐂𝐚𝐧’𝐭 𝐀𝐟𝐟𝐨𝐫𝐝 𝐭𝐨 𝐈𝐠𝐧𝐨𝐫𝐞 Let me ask you this: How much of your income are you actually keeping? If you’re like most business owners, you might be giving more to the IRS than you need to. 𝐖𝐡𝐲 𝐝𝐨𝐞𝐬 𝐭𝐡𝐢𝐬 𝐡𝐚𝐩𝐩𝐞𝐧? Because many tax preparers focus on filing and calculating—not on creating strategies. Filing taxes and planning taxes are two completely different things. Without a tax strategy in place, you could be missing out on: ✅ Structuring your business to maximize tax efficiency ✅ Timing your expenses to lower your taxable income ✅ Utilizing credits and deductions built into the tax code A skilled Tax Advisor does more than just file returns. We design proactive strategies to help you keep more of your hard-earned money. Here’s the good news: These strategies don’t just work once—they save you money year after year, growing your savings over time. But here’s the catch: You need to start NOW. Waiting until tax season is like trying to steer a ship after it has already set sail. 👉 𝐁𝐨𝐨𝐤 𝐲𝐨𝐮𝐫 𝐅𝐑𝐄𝐄 𝐓𝐚𝐱 𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐲 𝐂𝐚𝐥𝐥 𝐭𝐨𝐝𝐚𝐲, 𝐚𝐧𝐝 𝐥𝐞𝐭’𝐬 𝐜𝐫𝐞𝐚𝐭𝐞 𝐚 𝐩𝐥𝐚𝐧 𝐭𝐨 𝐦𝐢𝐧𝐢𝐦𝐢𝐳𝐞 𝐲𝐨𝐮𝐫 𝐭𝐚𝐱 𝐛𝐮𝐫𝐝𝐞𝐧 𝐚𝐧𝐝 𝐦𝐚𝐱𝐢𝐦𝐢𝐳𝐞 𝐲𝐨𝐮𝐫 𝐬𝐚𝐯𝐢𝐧𝐠𝐬!

#TaxStrategyExpert#TaxPlanningMadeEasy#SyriacCPA#FinancialSolutions#SmartTaxStrategies#TaxConsulting#TaxSavingsTips#AccountingExcellence#BusinessTaxSolutions#MaximizeYourRefund#IRSCompliance#TaxPlanningAdvisor#SaveOnTaxes#TaxPreparationPro#AccountingExperts

0 notes

Text

Maximize Your Savings This Tax Season: Key Opportunities and Challenges Under Trump’s Tax Law

As we approach the new tax year under President Trump’s administration, it’s essential to understand potential tax opportunities and challenges that may arise. While much of the tax landscape remains consistent with the policies introduced under the Tax Cuts and Jobs Act (TCJA), important nuances and strategies can help you maximize your tax benefits and minimize liabilities. Here’s a breakdown…

#KellePressley MomLife DoulaLife SelfCareMatters UrbanHorticulturist TaxStrategyExpert WeddingOfficiant FullSpectrumDoula CommunityC#KPTAXSERVICE

0 notes

Text

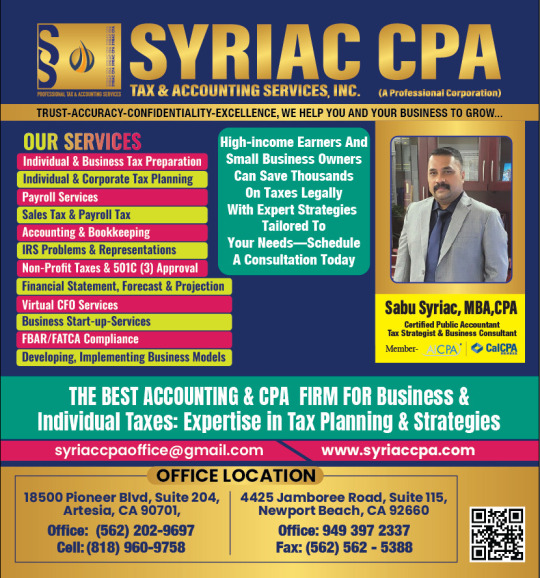

Tax Strategies You Can’t Afford to Ignore

Let me ask you this: How much of your income are you actually keeping? If you’re like most business owners, you might be giving more to the IRS than you need to.

Why does this happen?

Because many tax preparers focus on filing and calculating—not on creating strategies. Filing taxes and planning taxes are two completely different things.

Without a tax strategy in place, you could be missing out on: ✅ Structuring your business to maximize tax efficiency ✅ Timing your expenses to lower your taxable income ✅ Utilizing credits and deductions built into the tax code

A skilled Tax Advisor does more than just file returns. We design proactive strategies to help you keep more of your hard-earned money.

Here’s the good news: These strategies don’t just work once—they save you money year after year, growing your savings over time.

But here’s the catch: You need to start NOW.

Waiting until tax season is like trying to steer a ship after it has already set sail.

👉Book your FREE Tax Strategy Call today, and let’s create a plan to minimize your tax burden and maximize your savings!

#TaxStrategyExpert#TaxPlanningMadeEasy#SyriacCPA#FinancialSolutions#SmartTaxStrategies#TaxConsulting#TaxSavingsTips#AccountingExcellence#BusinessTaxSolutions#MaximizeYourRefund#IRSCompliance#TaxPlanningAdvisor#SaveOnTaxes#TaxPreparationPro#AccountingExperts

0 notes

Text

Tax Strategies You Can’t Afford to Ignore

Let me ask you this: How much of your income are you actually keeping? If you’re like most business owners, you might be giving more to the IRS than you need to.

Why does this happen?

Because many tax preparers focus on filing and calculating—not on creating strategies. Filing taxes and planning taxes are two completely different things.

Without a tax strategy in place, you could be missing out on: ✅ Structuring your business to maximize tax efficiency ✅ Timing your expenses to lower your taxable income ✅ Utilizing credits and deductions built into the tax code

A skilled Tax Advisor does more than just file returns. We design proactive strategies to help you keep more of your hard-earned money.

Here’s the good news: These strategies don’t just work once—they save you money year after year, growing your savings over time.

But here’s the catch: You need to start NOW.

Waiting until tax season is like trying to steer a ship after it has already set sail.

👉Book your FREE Tax Strategy Call today, and let’s create a plan to minimize your tax burden and maximize your savings!

#TaxStrategyExpert#TaxPlanningMadeEasy#SyriacCPA#FinancialSolutions#SmartTaxStrategies#TaxConsulting#TaxSavingsTips#AccountingExcellence#BusinessTaxSolutions#MaximizeYourRefund#IRSCompliance#TaxPlanningAdvisor#SaveOnTaxes#TaxPreparationPro#AccountingExperts

0 notes