#Technical indicators for trading

Explore tagged Tumblr posts

Text

The advent of algorithmic trading has changed the way traders approach the financial markets. Among the numerous methods in use, one of the most practical is the indicator-based algorithmic trading. This system of trading enables traders to use technical indicators to automate their trading strategies, thus minimising manual efforts and facilitating better execution.

#Algo Trading#indicator-based algorithmic trading#technical indicators for trading#algorithmic trading

0 notes

Text

AUDUSD Aussie 0.20 Lots Buy entry bullish wave on M5 timeframe opens and running to next week [AUDUSD,M5].

Official Website: wWw.ForexCashpowerIndicator.com . Forex Cashpower Indicator metatrader4 license with NO LAG & NON REPAINT buy and sell Signals with Smart algorithms that emit signals in big trades volume zones. Works in all Charts inside Brokers MT4 Plataform. . ✅ NON REPAINT / NON LAGGING Signals ✅ New 2025 Version LIFETIME License 🔔 Signals Sound And Popup Notifications 🔥 NEW 2025 Profitable EA AUTO-Trade Option Available . ✅ * Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the MT4 platform of the customer who has access to his License*. ( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at Exness brokerage. Signals may vary slightly from one broker to another ). . ✅ Cashpower Indicator Works in all charts inside Metatrader4 plataform for anybroker that have mt4. It will works inside anychart that your brokerage have examples: Forex charts, bonds charts, indicescharts, metals charts, energy, cryptocurrency charts and etc. . 🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

#Forex Cashpower indicator Non Repaint Signals#forex brokers#forexindicators#forexsignals#indicatorforex#forexindicator#forex#forextradesystem#forexchartindicators#forexvolumeindicators#cashpowerindicator#forexprofits#forex market#forextrading#forex expert advisor#forex robot#forex trading#forex indicators#forex traders#stock trading#audusd#audusd technical analysis

4 notes

·

View notes

Text

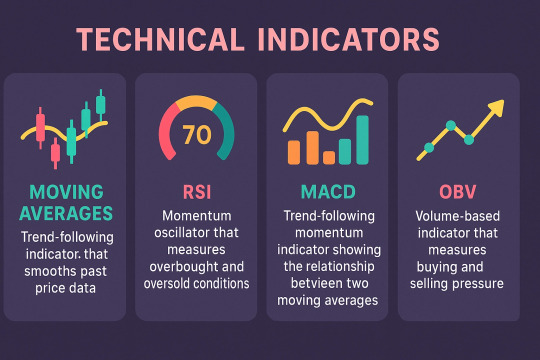

Types of Technical Indicators in Trading

Technical indicators are essential tools used by traders to analyze market trends and make informed decisions. Among the many available, some of the most widely used types include Moving Averages, Relative Strength Index (RSI), MACD, and On-Balance Volume (OBV).

Moving Averages smooth out price data to identify trend direction over a specific period. Common types include the Simple Moving Average (SMA) and Exponential Moving Average (EMA), which help traders determine support and resistance levels and potential entry or exit points.

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. RSI values range from 0 to 100 and are typically used to identify overbought (above 70) or oversold (below 30) conditions, signaling potential reversals.

MACD (Moving Average Convergence Divergence) is a trend-following momentum indicator that shows the relationship between two EMAs. It helps traders identify changes in trend strength, direction, and momentum.

On-Balance Volume (OBV) uses volume flow to predict price movements. A rising OBV indicates accumulation, while a falling OBV suggests distribution, providing insights into the strength of a trend.

Using these indicators together can improve trading accuracy and help develop a solid, data-driven strategy.

Explore, all the Technical Indicators in Trading.

#Types of Technical Indicators in Trading#Technical Indicators in Trading#Indicators in Trading#trading indicators#indicators in trading

2 notes

·

View notes

Text

Consistency in your trading 👉🏻

For more join us :-

#forex#forex education#forex expert advisor#forex broker#forexmentor#forex market#forex indicators#forexsignals#forexmastery#crypto#cryptoinvesting#cryptocurrency#bitcoin#technical analysis#global market#market strategy#market analysis#learn forex trading#forexlifestyle#forexstrategy#forexsuccess#jaipur#forex jaipur

2 notes

·

View notes

Text

RSI: Your Secret Weapon for Better Trading Decisions

You know that feeling when you're always catching the market at the wrong time? Yeah, me too. That's until I discovered the Relative Strength Index (RSI), and boy, what a game-changer it's been! Let me share some real talk about this awesome tool.

First off, RSI is like having a market GPS - it helps you figure out if you're headed for overbought territory (above 70) or oversold land (below 30). But here's the kicker - it's not as simple as "buy low, sell high."

When I first started, I made the rookie mistake of treating RSI like a magic 8-ball. Every time it hit those magic numbers, I'd jump in without thinking twice. Let's just say my trading account wasn't too happy about that strategy!

Here's what actually works:

Watch for RSI trends, not just numbers

Pay attention when RSI and price are telling different stories

Use multiple timeframes to confirm your analysis

Don't forget about the overall market trend

Want to learn more? Check out my detailed guide on Relative Strength Index (RSI) for the full scoop!

#RSI indicator#trading analysis#market indicators#trading psychology#momentum trading#technical trading#RSI strategy#trading basics#market analysis#beginner trading

2 notes

·

View notes

Text

Importance of chart analysis for equity investments

Image by freepik Chart analysis, or technical analysis, can be quite helpful for equity investment in the Indian stock market. Here are several reasons why it is beneficial: Benefits of Chart Analysis in the Indian Stock Market 1.Trend Identification The Indian stock market, like any other, exhibits trends over time. Chart analysis helps in identifying these trends, allowing investors to ride…

#chart analysis#equity investment#Financial Markets#Indian stock market#investment strategies#market analysis#Market Sentiment#Stock Charts#Stock Market#Stock Trading#Support and Resistance#Technical Analysis#Technical Indicators#Trading Patterns#Trend Identification#Volume Analysis

3 notes

·

View notes

Text

Volume Indicators: How to Use Them in Trading

Volume indicators are essential tools for traders seeking to understand market activity and potential price movements. These indicators provide insights into the strength and direction of trends by analyzing trading volume. This article explores how volume indicators work, their benefits, and how traders can effectively use them in their strategies. What Are Volume Indicators? Volume indicators…

#Downtrend#Entry and Exit Points#Liquidity#Market Analysis#Market Conditions#Market Sentiment#OBV#On-Balance Volume#Price Action#Price Movement#Price Movements#Profitability#Risk Management#Security#Stop-Loss#Technical Analysis#Trading Decisions#Trading Strategies#Trading Volume#Trend Confirmation#Volume Analysis#Volume Indicator

2 notes

·

View notes

Link

Demystifying MACD: Mastering Momentum Analysis

"Mastering MACD Indicator for Informed Trading"

This article unveils the powerful MACD (Moving Average Convergence Divergence) indicator, an essential tool for traders and investors in deciphering market trends and momentum. Developed by Gerald Appel in the 1970s, MACD uses the difference between two Exponential Moving Averages (EMAs) to identify potential shifts in price trends and velocity. The article delves into the key components of MACD – the MACD Line, Signal Line, and Histogram – and provides their respective formulas and interpretations. By highlighting practical applications such as trend following, detecting overbought/oversold conditions, and utilizing various signal crossovers, the article equips readers with valuable insights into making informed investment decisions.

Whether for newcomers or experienced traders, the comprehensive understanding of MACD's components, usage scenarios, limitations, and tips for successful implementation enhances one's technical analysis toolkit, offering a robust foundation for strategic trading.

2 notes

·

View notes

Text

youtube

Donchian Channel Indicator: History & Logic

This video provides a detailed explanation of the Donchian Channel Indicator, covering its history and underlying logic. It delves into the most effective ways to utilize Donchian channels for trading

#Donchian Channel#Technical Indicator#Trading Strategy#Technical Analysis#Definedge securities#Youtube

0 notes

Text

Best Crypto Trading Courses in Faridabad, Noida & Gurgaon for 2025

The interest in stock market education has grown significantly in recent years, especially across urban centers such as Noida, Delhi, Faridabad, and Gurgaon. Individuals are actively seeking structured knowledge on how the markets work, how to trade responsibly, and how to interpret data and trends for better financial decisions. A stock market training academy serves this growing need by offering foundational and advanced learning pathways. These academies typically cover technical and fundamental analysis, risk management, equity markets, and segment-specific training like forex and crypto.

A stock market training academy in Noida often includes modules that guide beginners through key trading concepts such as candlestick patterns, chart reading, moving averages, and support-resistance zones. This structured format helps learners build a clear foundation. Similarly, academies in Delhi offer additional benefits due to the city’s proximity to regulatory bodies and financial hubs. Students not only get access to academic content but also benefit from guest lectures and real market exposure.

In Faridabad, stock market courses often focus on those who wish to learn part-time or alongside a day job. Trading classes for beginners in Faridabad introduce the learners to basic strategies used in intraday and swing trading. These sessions are particularly helpful for retail investors who are new to the financial markets. Courses also incorporate hands-on training sessions where learners simulate trades using real-time data, helping bridge the gap between theory and practice.

Meanwhile, stock market training in Gurgaon tends to cater to both beginners and professionals. The courses offered there are often project-based, which encourages learners to conduct market research and prepare trading strategies under the guidance of mentors. Learners can find the best stock market courses in Gurgaon that include modules on equity research, risk profiling, derivatives, and algorithmic trading.

Those looking for a more flexible approach can consider a stock market training course in NCR that covers all these cities. Such programs typically offer hybrid formats, combining classroom instruction with online resources, which allows students from Noida, Delhi, Faridabad, and Gurgaon to attend without compromising their daily routines.

Crypto trading courses are another key area of interest, especially among young investors. A crypto trading course in Noida covers basics like blockchain technology, market volatility, and trading pairs such as BTC/USDT and ETH/USDT. It also focuses on platforms like Binance and CoinDCX and introduces learners to order types, stop losses, and security measures.

Crypto trading courses in Faridabad and Gurgaon extend these learnings with practical sessions, real-time chart analysis, and trading psychology. The courses also address the regulatory landscape and help students understand risks involved in this relatively new asset class.

Delhi has also become a hotspot for specialized finance courses. A research analyst course in Delhi NCR prepares individuals to become certified analysts who can study company reports, balance sheets, and macroeconomic indicators. These analysts often go on to support investment firms or work independently. This course usually involves in-depth assignments, live case studies, and presentations.

Forex trading is another crucial segment gaining traction in India. A forex trading course in Noida introduces participants to international currency markets, including key pairs like EUR/USD, USD/INR, and GBP/USD. Learners also get familiar with trading platforms such as MetaTrader 4 and 5. They practice order execution, learn about pip values, leverage, and margin, and study the impact of economic news on currency movement.

Forex trading classes in NCR and particularly in Gurgaon go beyond basics to discuss hedging strategies, carry trade concepts, and inter-market analysis. A forex trading course in faridabad, on the other hand, might be more focused on foundational training for working professionals and part-time traders. The demand for foreign exchange education has grown steadily due to its 24-hour global market accessibility and significant trading opportunities.

Best Options Trading Course in NCR is another topic in high demand. Many academies offer an option trading full course free as a trial or as a part of awareness programs. These free introductory sessions include the basics of call and put options, option Greeks, and payoff diagrams. Following this, learners can enroll in paid modules for more structured learning.

For those specifically looking for options trading education, there are top options trading courses online that guide users through strategies like iron condor, butterfly spreads, straddles, and strangles. The focus is often on risk-reward balance and selecting the right strike price and expiry. Options trading courses in NCR are structured for traders who want to focus on the derivatives market in India. Students also learn how to read the open interest and implied volatility data available on market exchanges.

For more experienced traders, an advance course on options trading in India covers topics such as volatility forecasting, options chain analysis, delta-neutral strategies, and real-time trade execution. The availability of these programs in Delhi NCR makes it easy for traders to upskill within their own geography.

Another essential qualification for anyone serious about a career in trading and financial analysis is the NISM certification. NISM certification courses in Faridabad are popular among finance students and professionals aiming to work in stock broking, mutual fund distribution, and portfolio management. These certifications, which are backed by the Securities and Exchange Board of India (SEBI), include a wide range of modules covering equity derivatives, investment advisory, mutual fund distribution, and more.

NISM Certification courses in Gurugram and Delhi are often delivered in physical classroom settings where learners undergo rigorous training, take mock tests, and sit for certification exams. These courses are recognized by employers and regulators, making them a valuable addition to any finance professional’s resume.

In addition to local academies, learners can also explore stock market trading courses online in faridabad. These provide flexibility and access to recorded sessions, downloadable PDFs, quizzes, and online doubt-clearing sessions. Some of the best online trading classes also include live market analysis where instructors walk students through their real-time trades.

Online trading classes in Gurgaon and Faridabad cater to both absolute beginners and intermediate traders. The self-paced structure allows participants to revisit lessons and understand strategies at their own comfort. Many such classes provide support groups, access to instructors through live webinars, and certificate issuance on course completion.

When looking to build a practical understanding of financial markets, learners often search for courses focusing on stock market technical analysis. This area includes chart patterns, price action, and indicators like RSI, MACD, Bollinger Bands, and Fibonacci retracement. These tools help traders make informed decisions based on historical price movements and trend behaviors.

Technical analysis indicators form the backbone of most short-term trading strategies. They assist in entry and exit decisions, risk placement, and trade size determination. Whether someone is focusing on intraday setups, swing trading, or long-term positional trades, mastering these tools can significantly improve consistency.

To conclude, the landscape for trading education across Delhi NCR—including Noida, Gurgaon, Faridabad, and Delhi—is growing steadily. Whether you’re looking to begin your trading journey or formalize your knowledge with certifications, there are ample options available. Courses now range from foundational stock market training to niche areas such as crypto, forex, and options trading, as well as regulatory-focused programs like NISM. With the increasing availability of both offline and online training formats, learners can now take informed steps toward building their career or generating secondary income through disciplined and well-informed trading practices.

#crypto trading course in faridabad#Nism Certification courses in Faridabad#NISM Certification courses in Noida#Nism Certification Courses in Gurugram#forex trading course in faridabad#stock market training academy in faridabad#crypto trading course in noida#crypto trading course in gurgaon#option trading full course free in faridabad#forex trading course in gurgaon#best online trading classes in faridabad#forex trading course in noida#trading classes for beginners in faridabad#stock market trading courses online in faridabad#Nism Certification courses in Delhi#stock market training course ncr#stock market training academy in noida#Best Options Trading Course in Gurgaon#Best Options Trading Course in ncr#options trading course in ncr#stock market technical analysis in faridabad#forex trading classes in ncr#best online trading classes in gurgaon#stock market training academy in delhi#Best Stock Market Courses in gurgaon#research analyst course in faridabad#technical analysis indicators in faridabad#stock market trading courses online#Top Options Trading Courses Online

1 note

·

View note

Text

youtube

#forex trading#cryptocurrency trading#day trading#commodities trading#futures trading#indices trading#currency trading#forex strategies#crypto analysis#live trading#technical analysis#market analysis#trading psychology#trading education#scalping strategies#swing trading#trading signals#tradingview analysis#price action trading#macro trading#financial markets#forex live#bitcoin trading#ethereum analysis#gold trading#oil trading#index futures#trading for beginners#advanced trading strategies#global markets

1 note

·

View note

Text

Trading is about timing. If you don’t understand what cycle the market is in, when to identify manipulation and when to target that manipulation - you’re never going to see this setup.

Each previous market session gives us vital clues on what we’re looking for and when to look for it.

For more join us .

#forex#forex education#forex expert advisor#forex indicators#forexmentor#forex broker#forex market#forexsignals#forexmastery#crypto#learn forex trading in jaipur#jaipur#forex jaipur#rajasthan#learn forex trading#intradaytrading#market strategy#technical analysis#data analytics#analysis

2 notes

·

View notes

Text

Why the Best Stock Analysis Courses Focus on Market Structure, Not Predictions

In the world of trading and investing, most learners start with high hopes — but are quickly overwhelmed. They enroll in technical analysis courses, watch dozens of YouTube videos, memorize candlestick patterns, and chase the holy grail of indicators. Yet, despite all that effort, their trades often fail. Why?

Because they’re focused on predicting the market, instead of understanding it.

At Chart Monks, we believe the best stock analysis courses don’t promise predictions — they teach you how to read market structure and develop real-time insights. In this article, we’ll explore why understanding structure is more valuable than guessing future prices, and how the right stock market learning course can transform your trading mindset.

The Prediction Trap: Why Most Traders Stay Stuck

Most beginners jump into the market hoping for quick profits. They get caught in the cycle of memorizing strategies, blindly following indicators, or copying trades from others.

This approach leads to:

Trading burnout due to information overload

Over-reliance on technical indicators

Constant strategy-hopping after a few failed trades

A lack of confidence and growing confusion

Unfortunately, many stock chart analysis courses reinforce this mindset by focusing too much on setups and predictions, instead of teaching the core concept: how the market moves.

What Is Market Structure — and Why Does It Matter?

Market structure describes the way price moves in response to shifts in demand and supply, reflecting the overall flow and behavior of the market over time. It's about identifying how buyers and sellers behave, where they take action, and how price reacts to those decisions over time.

Understanding market structure means you can:

Focus on the overall market context instead of reacting to isolated signals.

Understand trend continuation patterns

Avoid false breakouts and market traps

Make logical, high-probability decisions without relying on luck or tips

This is the key difference between traders who stay stuck and those who steadily grow and improve.

Price Action vs Indicators: A Crucial Shift in Focus

One of the biggest breakthroughs for any trader is understanding the difference between price action vs indicators.Indicators lag behind price—they reflect past market activity rather than current movement. Price action, on the other hand, tells you what is happening right now.

At Chart Monks, our advanced technical analysis course focuses heavily on reading price action, understanding structure, and learning how the market “breathes.”

We strip away unnecessary tools and help you see the market for what it really is: a battle between buyers and sellers.

How a Market Structure-Based Course Changes the Game

When you join a truly effective stock analysis course, you should expect more than just textbook content. Here’s what you should really be learning:

Context over Candles – Instead of memorizing patterns, you learn when and why they work.

Clarity over Complexity – No cluttered charts. Just clean, readable price action.

Observation over Prediction – You learn to observe behavior, not guess outcomes.

Structure over Strategy – You stop chasing strategies and start aligning with the market.

Confidence through Simplicity – Fewer tools, more understanding.

Hindi Learners Welcome: Share Market Course in Hindi

At Chart Monks, we also understand that language should never be a barrier to learning. That’s why we offer a complete share market course in Hindi for aspiring traders who are more comfortable learning in their native language.

Whether you’re in Delhi, Jaipur, or anywhere across India, you can learn stock analysis, technical tools, and market structure in Hindi — with complete clarity and support.

Want to Learn to Trade for Free?

Still unsure about investing in a paid course right now? No problem. We offer free trading courses for beginners that introduce you to the essentials of market structure, trading psychology, and chart reading.

Our goal isn’t to just sell a course — it’s to help you learn to trade for free before you decide to go deeper. This helps you build a solid foundation without pressure or hype.

A Smarter Way to Start: Investment Courses for Beginners

If you're just starting your financial journey, choosing the right investment courses for beginners is critical. Avoid the noise of the internet and look for content that teaches:

Market logic, not just strategies

Risk management from day one

The difference between investing and trading

Emotional discipline and how to handle losses

Real-world application, not just theory

This is exactly what our stock market learning course is built around.

Your Path to Clarity Starts Here

We know what it’s like to be lost in the technical maze. That’s why Chart Monks was created — to simplify trading and show you what really works. Our courses are grounded in real market experience, not outdated textbooks.

Whether you're looking for:

The best technical analysis course

An effective financial trading course

A practical stock chart analysis course

Or a stock market course in Hindi

We’ve built it for you — with honesty, clarity, and a no-nonsense approach.

Call Us and Start Learning the Right Way

Stop guessing. Stop predicting. Start observing.

Join a growing community of serious traders who’ve broken out of the indicator trap and finally started seeing the market clearly.

Call us at +91-9220943789Visit: Chart Monks

Final Thought:It's not about having more strategies — it's about gaining clearer insight into the market. And clarity begins when you stop memorizing and start observing the market as it is.

#stock market learning course#best technical analysis course#share market course in Hindi#stock chart analysis course#stock analysis course#advanced technical analysis course#technical analysis courses#learn to trade for free#price action vs indicators#trading for beginners free#free trading courses for beginners#trading burnout#investment courses for beginners#trend continuation patterns#financial trading course#Chart Monks

0 notes

Text

Fundamentals of Forex Market (₹999)

Start your journey in currency trading with a comprehensive module covering forex basics, market dynamics, key terminology, and chart reading without getting overwhelmed. Ideal for beginners seeking clarity and direction.

#Best Trading App#Best Trading App in India#Trading Course app#Forex and Crypto Trading App#Forex Trading for Beginners#Price Action Trading Strategy#How to Learn Trading#Free Online Trading Courses#Stock Market Trading Courses#Trading On The Stock Market#Financial Markets In India#How to Learn Stock Market Trading#Currency Exchange Trading#Best Forex Trading Platforms in 2024#Price Action Trading#Open a Forex Trading Account#Basic to Advance Trading#Technical Analysis in Forex Trading#Best Technical Indicator for Trading#Basics of Indian Stock Market#Paper Trading Simulator#Bearish Candlestick Patterns#Best Charting Software in India#Smart Money Concepts (SMC)#Objectives of Fundamental Analysis#Financial Markets in India#Bullish Candlestick Patterns#Double Top Chart Pattern#Free Price Action Trading PDF#Ascending Triangle Pattern

1 note

·

View note

Text

The Hard Reset: My Trading Demo Account Vanished & Why I'm Starting Over!

Hey everyone, It’s been 175 days since I kicked off this trading vlog journey, full of ambition and big plans. But if you watched my latest video, you’ll know what happened: I opened my broker account only to discover my demo account was gone! Vanished. Finito. Disappeared. And honestly, that shock made me stop and ask myself: why did I even open one in the first place? The Brutal Truth: How My…

#9 to 5 struggles#Beginner trading#Company financials#Day job trading#Demo account#Economic indicators#Fundamental Analysis#Lagos Nigeria#Learn to trade#Market Analysis#Technical Analysis#Trader Nick#Trading discipline#Trading for Beginners#Trading goals#Trading journey#Trading mindset#Trading mistakes#Trading motivation#Trading plan#Trading reset#Trading Strategy#Trading vlog

0 notes

Text

Weighted Moving Average (WMA): Forex Trading Indicator Explained

In the dynamic world of Forex trading, the Weighted Moving Average (WMA) stands out as a crucial tool for traders. Unlike the Simple Moving Average (SMA), the WMA assigns more significance to recent data points, providing a clearer and more accurate reflection of market trends. Understanding how to use the WMA effectively can significantly enhance your trading strategy. What is a Weighted Moving…

#Financial Markets#Forex Trading#Market Analysis#Moving Averages#Technical Analysis#Trading Indicators#Trading Strategies#Trend Identification#Weighted Moving Average#WMA

2 notes

·

View notes