#Top Data Governance Framework in 2024

Explore tagged Tumblr posts

Text

The Data Governance Framework is a comprehensive structure designed to ensure the proper management, accessibility, quality, and security of an organization's data assets. It encompasses a set of principles, policies, procedures, and standards that guide how data is collected, stored, processed, and used. The framework aims to optimize the value of data while ensuring compliance with relevant regulations and mitigating risks associated with data handling.

#Data Governance Framework#Top Data Governance Framework#Top Data Governance Framework in 2024#enterprise data governance framework

0 notes

Text

Noah Sheidlower, John L. Dorman

Medicaid may be on the chopping block as the Trump administration prepares its budget blueprint.

The House Budget Committee's budget draft included a goal of about $2 trillion in spending cuts and allowed for $4.5 trillion in tax cuts.

The blueprint draft called for at least $880 billion in spending cuts from the House Energy and Commerce Committee over the next decade. This would likely mean large Medicaid cuts, potentially leading many Americans to lose their benefits. A Ways and Means Committee document outlining reconciliation options reveals over $2 trillion in potential Medicaid cuts, though some could overlap.

President Donald Trump has said Social Security and Medicare, which are the largest federal government programs, wouldn't be cut. Elon Musk has also accused "federal entitlements" such as Social Security of fraud.

The draft directed the Committee on Agriculture to reduce the deficit by $230 billion, which would mean cutting nutritional programs like the Supplemental Nutrition Assistance Program. [Food stamps/EBT]

The most recent Medicaid enrollment data from October 2024 revealed over 72 million people were enrolled in Medicaid, while 7.25 million were enrolled in Children's Health Insurance Programs. Medicaid provides healthcare and long-term services coverage for lower-income Americans and is financed by both the federal government and states. In some states, over 30% of the population is covered by Medicaid. According to the Centers for Medicare & Medicaid Services, Medicaid spending in 2023 was nearly $872 billion.

Some GOP leaders have proposed reducing Federal Medical Assistance Percentages, the amount the federal government pays to states based on factors such as a state's per-capita income. Others have proposed Medicaid per-capita caps, which an early House Budget Committee proposal said could save up to $900 billion. This shift would lead states to either cut back on Medicaid services or identify other methods for funding potentially billions in losses.

Figures such as Robert F. Kennedy Jr. have argued that Medicaid is ineffective, and some question whether it has improved people's health. Critics of the program have also said people relying on Medicaid could get insurance from other sources, such as their workplace. However, Medicaid expansions have been shown to improve care access, reduce mortality rates, and spark economic growth.

Senate Budget Committee Chairman Lindsey Graham of South Carolina in recent days had already moved ahead with his border security, military, and energy package, as Republicans in the upper chamber had been waiting for their House counterparts to offer their budget proposal.

Graham is aiming to pass a second budget resolution extending the 2017 tax cuts later this year.

Senate Republicans can pass a budget reconciliation bill with a simple majority, or 51 votes, as they wouldn't have to meet the normal 60-vote filibuster threshold. The party currently holds a 53-47 majority in the upper chamber.

House GOP leaders see their budget framework as one that could pave the way for passing a reconciliation bill through Congress with the priorities of Trump and top conservatives in mind. Republicans have a razor-thin 218-215 majority in the House, so every vote will be critical, and they're looking to pass one bill with Trump's signature policy desires.

Speaker Mike Johnson on Tuesday told reporters that Graham's plan was a "nonstarter."

"We all are trying to get to the same achievable objectives," the Louisiana Republican said. "And there's just, you know, different ideas on how to get there."

GOP leaders have recently pushed for Medicaid cuts, leading to debates over how much to cut services many Americans rely on.

Other major points from the House blueprint included increasing the debt limit by $4 trillion, reductions in education totaling $330 billion, and allocating up to $300 billion in additional border and defense spending.

The Senate's plan calls for $150 billion in additional defense spending and a $175 billion boost for border security.

23 notes

·

View notes

Text

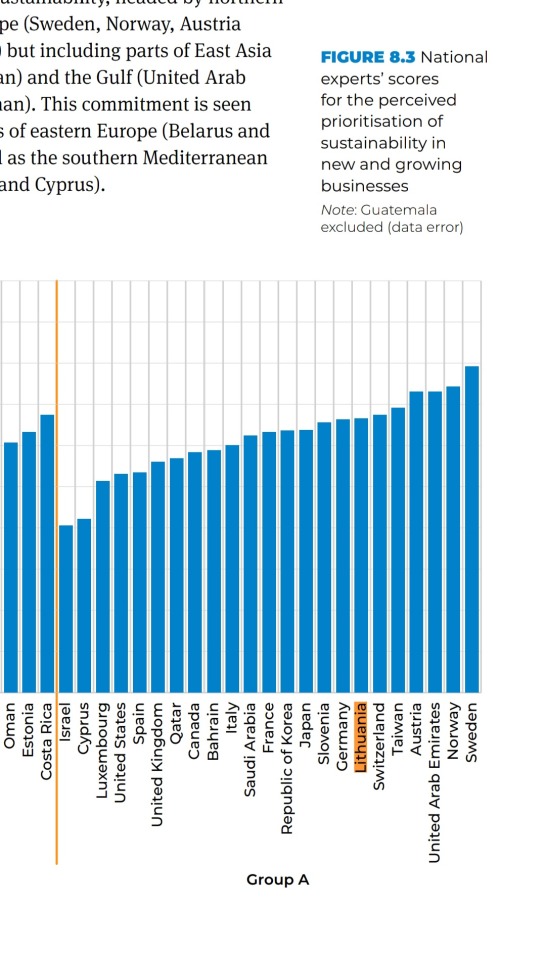

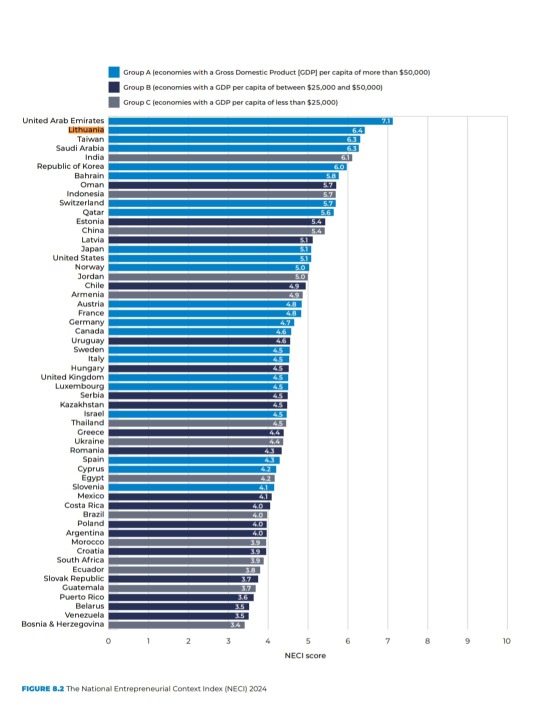

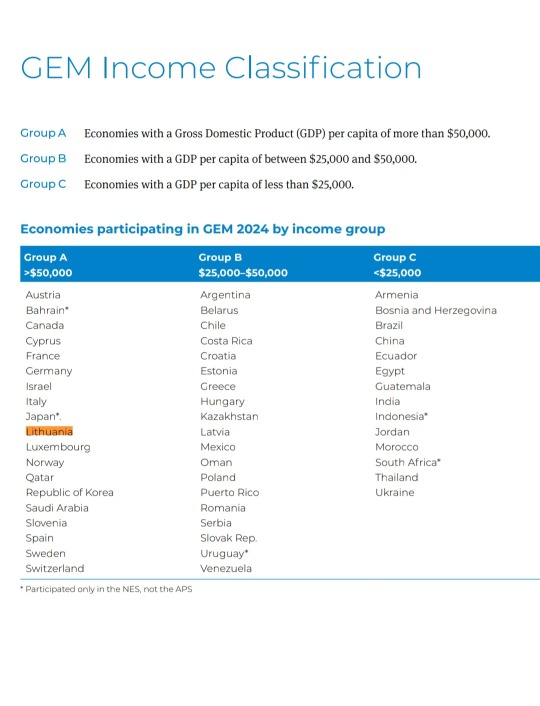

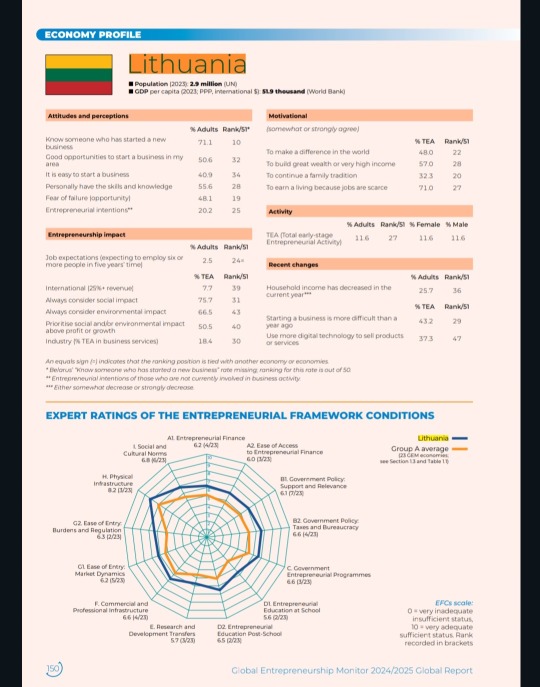

Lithuania has emerged as one of the top countries for business, securing an impressive 2nd place in the Global Entrepreneurship Index, according to the latest Global Entrepreneurship Monitor (GEM) 2024/2025 data.

Only three economies have all 13 of their EFCs scored as sufficient or better (United Arabic Emirates, Lithuania and Oman).

Out of 56 economies participating in the 2024 GEM National Expert Survey, Lithuania ranked second overall for three Framework Conditions (both education conditions and Ease of Entry: Market Dynamics), and third for a further three conditions (Government Entrepreneurial Programmes; Ease of Access to Entrepreneurial Finance; and Research and Development Transfers).

More info here.

#GUUUUYYYSSSSS#I'm living in the 2nd best economy in the world💅💅💅#Lithuania#economics#business#enterprenuership#statistics

2 notes

·

View notes

Text

Top Trends Reshaping the GCC Data Centre Landscape This Year

Unraveling the Exponential Rise of the GCC Data Center Market Ecosystem

The Gulf Cooperation Council data center market stands at the forefront of regional digital transformation, propelled by surging demand for resilient IT infrastructure, AI integration, and edge computing capabilities. As we project forward, the GCC data center market-valued at USD 5.87 billion in 2024—is set to experience a seismic expansion, reaching an anticipated USD 33.05 billion by 2031, growing at a CAGR of 12.3%. This trajectory is underpinned by high-performance computing demands, smart city initiatives, sovereign digital strategies, and the accelerated adoption of hybrid cloud frameworks.

Request Sample Report PDF (including TOC, Graphs & Tables): https://www.statsandresearch.com/request-sample/40593-data-center-industry-analysis

Technological Drivers Reshaping GCC’s Digital Backbone

Edge Computing and AI: Catalysts of Infrastructure Evolution

The fusion of edge computing and artificial intelligence is redefining the physical and operational contours of data center infrastructure. These technologies enable real-time data processing, lower latency, and enhanced bandwidth efficiency—essentials in a region increasingly reliant on IoT, autonomous systems, and immersive media.

Edge Data Centers are proliferating across urban and remote industrial zones to reduce network latency and support mission-critical applications in telecom, logistics, and smart utilities.

AI-powered infrastructure management enables predictive maintenance, workload optimization, and autonomous scalability, aligning with sustainability goals and uptime assurance.

Cloud-Native Transformation and Multi-Cloud Adoption

Enterprise and government adoption of hybrid and multi-cloud ecosystems is fueling demand for flexible, modular, and scalable data centers. Organizations are rapidly transitioning from legacy systems to cloud-native architectures that support containerization, orchestration (e.g., Kubernetes), and zero-trust security postures.

Get up to 30%-40% Discount: https://www.statsandresearch.com/check-discount/40593-data-center-industry-analysis

Key GCC Data Center Market Segments and Growth Benchmarks:

Data Center Types: Segment-Wise Expansion

Enterprise Data Centers dominate current deployment, with projections reaching USD 12.69 billion by 2031. These are favored by banks, government entities, and large corporations for security, compliance, and customization.

Edge Data Centers, expected to grow at a CAGR of 13.3%, are essential for latency-sensitive operations—especially in retail, telecom, and autonomous industries.

By Component: IT Infrastructure Leads the Stack

IT Infrastructure, valued at USD 7.27 billion in 2024, comprises compute, storage, and networking units. The sector will nearly double by 2031, reaching over USD 16 billion.

Management Software emerges as the fastest-growing component (13.9% CAGR), driven by demand for automated orchestration, resource analytics, and energy optimization.

Tier Standards: Reliability as a Strategic Differentiator

Tier III Data Centers remain the enterprise standard for redundancy and availability, offering a balance between cost-efficiency and resilience.

Tier IV Data Centers are witnessing increased adoption in financial and defense sectors due to their fault-tolerant architectures and unmatched uptime assurance.

Enterprise Demand: SME Acceleration and Enterprise Stability

Large Enterprises will remain dominant consumers, owing to vast operational scale and stringent compliance requirements.

SMEs, however, will outpace in growth (12.8% CAGR), increasingly leveraging colocation and cloud-managed data services to fuel innovation and agility.

Industry Verticals: IT and Telecom Anchor Growth

IT & Telecom, accounting for USD 3.83 billion in 2024, drive GCC data center market dominance through robust connectivity and digital service demand.

Retail, with the highest CAGR of 13.3%, is expanding rapidly due to rising e-commerce penetration and digital payment infrastructure.

Geographic Landscape: Market Expansion Across the GCC

United Arab Emirates: The Regional Nucleus of Digital Infrastructure

With a GCC data center market value of USD 4.91 billion in 2024, the UAE leads in regional data center development. Its progressive regulatory landscape, free zones (like Dubai Internet City), and focus on AI strategy and cloud governance position it as the premier data hub.

Saudi Arabia: Hyper-Scaling Through Vision 2030

Saudi Arabia's Vision 2030 initiatives are accelerating digital infrastructure deployment. Projected to grow at a CAGR of 12.7%, the Kingdom is investing in hyperscale facilities and AI-integrated networks to empower its Smart Nation ambitions and government digital services.

GCC Data Center Market Forces and Challenges

GCC Data Center Market Growth Drivers

Proliferation of smart city initiatives, such as NEOM and Masdar.

National cloud-first policies and rising government investments.

Accelerated digital adoption across BFSI, healthcare, and manufacturing.

Constraints and Strategic Hurdles

Acute skills shortage in high-density data center operations.

Escalating OPEX due to cooling and power requirements in desert climates.

Regulatory complexities and varying data sovereignty frameworks across GCC nations.

Key Players and Strategic Developments

Major incumbents and rising challengers are reshaping the competitive landscape through aggressive capital expenditures, greenfield projects, and regional collaborations.

Major Developments

Batelco’s White Space Data Center in Bahrain, developed with Almoayyed Contracting Group, introduces a high-density, energy-efficient facility adjacent to a solar farm—marking a regional milestone in sustainable infrastructure.

Ooredoo’s USD 1 billion investment, backed by QAR 2 billion in financing, aims to scale their data center capacity beyond 120MW, with AI and cloud infrastructure at the core.

GCC Data Center Market Leaders

Equinix – Expanding interconnection hubs and hybrid cloud onramps.

Khazna Data Centers – Driving hyperscale growth with government-backed investment.

STC Solutions and Mobily – Enhancing regional content delivery and 5G edge integration.

Microsoft Azure – Strengthening sovereign cloud services and AI deployment.

Strategic Outlook and Market Forecast

The GCC data center market is rapidly transitioning from traditional IT support roles to becoming central to digital economic competitiveness. As sovereign data strategies, AI integration, and decentralized architectures take hold, the region’s data center industry is set to become one of the fastest-growing globally.

By 2031, Tier IV and Edge Data Centers will define market leadership.

Public-private partnerships, sovereign fund allocations, and energy innovations will drive infrastructure resilience and global competitiveness.

Green data centers, leveraging renewable energy and liquid cooling technologies, will gain prominence amid growing environmental mandates.

Purchase Exclusive Report: https://www.statsandresearch.com/enquire-before/40593-data-center-industry-analysis

Final Word

We are entering a transformative era in the GCC’s digital infrastructure ecosystem. The convergence of policy, technology, and private capital is accelerating the rise of a hyperconnected, data-driven Gulf economy. Those who invest now in future-ready, AI-integrated, edge-enabled data center architecture will lead the next chapter of the region’s digital revolution.

Our Services:

On-Demand Reports: https://www.statsandresearch.com/on-demand-reports

Subscription Plans: https://www.statsandresearch.com/subscription-plans

Consulting Services: https://www.statsandresearch.com/consulting-services

ESG Solutions: https://www.statsandresearch.com/esg-solutions

Contact Us:

Stats and Research

Email: [email protected]

Phone: +91 8530698844

Website: https://www.statsandresearch.com

1 note

·

View note

Text

GenAI Training | Generative AI Training

Generative AI Trends: What You Need to Know in 2024

GenAI Training is becoming essential as generative AI transforms industries worldwide. This specialized training equips professionals with the skills to understand and use generative AI effectively, helping them stay ahead in an era of rapid technological evolution. Whether it's generating creative content, automating processes, or enhancing user experiences, generative AI offers limitless possibilities. Alongside GenAI Training, Generative AI Training provides in-depth knowledge of the tools, frameworks, and ethical practices needed to implement this cutting-edge technology responsibly.

The year 2024 brings several exciting trends in generative AI, further expanding its applications across industries. From breakthroughs in model capabilities to its increasing role in personalized marketing and operational efficiency, the influence of generative AI is undeniable. Organizations are prioritizing GenAI Training and Generative AI Training to help their teams capitalize on these advancements and maintain a competitive edge.

Key Trends in Generative AI for 2024

Generative AI is evolving rapidly, setting the stage for ground breaking innovations. Below are the top trends shaping its future.

1. Generative Models Are Becoming More Sophisticated

Generative models, like OpenAI’s GPT-4, are continuing to improve in their ability to understand and generate human-like content. These models are not only more accurate but also more capable of understanding nuanced contexts and providing coherent, relevant outputs. GenAI Training programs are focusing on helping professionals master these advancements to optimize their use in industries like content creation, data analysis, and customer service.

For example, many businesses are now using generative AI to automate the creation of marketing materials, from social media posts to full-fledged ad campaigns. Similarly, Generative AI Training helps participants learn how to integrate these tools into workflows, ensuring that outputs align with organizational goals and maintain high-quality standards.

2. Enhanced Creativity through Generative AI

Generative AI is pushing the boundaries of creativity, offering artists, designers, and content creators new ways to innovate. Tools such as DALL-E, Stable Diffusion, and Runway are empowering users to create realistic images, videos, and even 3D models with minimal effort. These applications are not limited to the arts; industries like architecture, game design, and film production are also embracing generative AI.

GenAI Training ensures professionals learn how to use these tools effectively, enabling them to enhance productivity while maintaining creative freedom. Likewise, Generative AI Training provides a deeper understanding of how to incorporate generative tools into creative projects, ensuring seamless workflows and high-quality outputs.

3. Revolutionizing Personalization in Marketing

Generative AI is redefining how businesses interact with customers by enabling hyper-personalized experiences at scale. From crafting tailored email campaigns to creating personalized product recommendations, generative AI ensures that businesses can engage customers more effectively.

By enrolling in GenAI Training, marketers gain the skills to leverage generative AI tools for customer segmentation, behavioural analysis, and content customization. Generative AI Training also emphasizes the importance of maintaining data privacy and adhering to regulations while delivering personalized experiences. This balance between innovation and responsibility is key to sustaining customer trust.

4. Ethical AI: A Growing Focus

With the growing influence of generative AI comes the responsibility to address ethical challenges. Issues such as misinformation, biases in AI outputs, and misuse of deep fake technologies have raised concerns among governments, organizations, and the general public. Ethical AI practices are no longer optional but mandatory.

Courses in GenAI Training and Generative AI Training now dedicate significant attention to these issues. They cover topics such as identifying and mitigating biases, implementing AI governance frameworks, and ensuring transparency in AI-generated outputs. By prioritizing ethics, these training programs prepare professionals to navigate the challenges associated with generative AI responsibly.

5. Integration with Augmented and Virtual Reality

One of the most exciting trends in generative AI is its integration with augmented reality (AR) and virtual reality (VR). These combined technologies are creating immersive experiences for gaming, education, and even healthcare. Generative AI plays a crucial role in designing realistic virtual environments, generating dynamic content, and personalizing interactions in AR/VR applications.

Professionals enrolling in GenAI Training learn how to use generative AI to enhance AR/VR applications, making them more interactive and engaging. Generative AI Training provides insights into optimizing these technologies for various industries, ensuring that they meet user needs effectively.

6. Generative AI in Workforce Development

Generative AI is becoming a vital tool in education and workforce development. It powers adaptive learning platforms, virtual tutors, and AI-generated course materials that cater to individual learning styles.

GenAI Training focuses on teaching educators and HR professionals how to use generative AI to enhance learning experiences. From designing customized training modules to automating assessment processes, generative AI is transforming professional development. Generative AI Training further emphasizes the role of AI in creating inclusive and equitable learning environments.

7. Generative AI in Healthcare

Healthcare is another industry witnessing the transformative power of generative AI. From drug discovery to patient diagnosis, generative AI is playing a critical role in improving medical outcomes. By analyzing vast amounts of data, generative AI can generate insights that aid in developing new treatments and predicting patient needs.

Through GenAI Training, medical professionals and researchers learn how to integrate generative AI into their practices, ensuring better patient care and streamlined operations. Generative AI Training also addresses the ethical considerations involved in using AI in sensitive areas like healthcare, ensuring compliance with regulatory standards.

Conclusion

Generative AI is no longer just a buzzword; it is a powerful force shaping industries, enhancing creativity, and revolutionizing workflows. The trends for 2024 highlight its growing influence across sectors such as marketing, education, healthcare, and entertainment. Staying ahead in this rapidly evolving field requires a deep understanding of its tools, applications, and ethical implications.

By participating in GenAI Training and Generative AI Training, professionals can equip themselves with the knowledge and skills needed to harness the full potential of generative AI. These training programs empower individuals to innovate responsibly, driving progress while addressing the challenges posed by this transformative technology. As we move further into 2024, those who invest in learning and adapting will be best positioned to thrive in an AI-driven future.

Visualpath is the Leading and Best Institute for learning in Hyderabad. We provide Generative AI Online Training. You will get the best course at an affordable cost.

Attend Free Demo

Call on – +91-9989971070

Blog: https://visualpathblogs.com/

What’s App: https://www.whatsapp.com/catalog/919989971070/

Visit: https://www.visualpath.in/online-gen-ai-training.html

#GenAI Training#Generative AI Training#Generative AI Course in Hyderabad#Generative AI Online Training#Gen Ai Training in Hyderabad#Gen ai Online Training#Generative AI Online Training Courses#Genai Course in Hyderabad#Generative AI Training Course

1 note

·

View note

Text

The Rise of Tokenized Assets: How Blockchain is Redefining Ownership in Finance

Imagine buying a slice of a luxury hotel in Dubai or a small portion of a Picasso painting—all with a few clicks and a small investment. Welcome to the age of tokenized assets, where blockchain technology is reshaping how we own, invest, and trade real-world assets.

From real estate to equities, art to commodities, tokenization is enabling fractional ownership, enhancing liquidity, and reducing barriers to entry in traditional markets. For finance professionals, this shift is not just exciting—it’s disruptive. And it demands advanced financial modelling skills to keep up.

What Are Tokenized Assets?

Tokenized assets are digital representations of physical or financial assets on a blockchain. Each token represents a share or portion of a real-world asset—be it property, bonds, gold, or intellectual property.

These tokens can be:

Security tokens: Representing regulated financial instruments.

Utility tokens: Offering access to specific services.

NFTs: Representing unique assets like collectibles or art.

By using smart contracts on blockchain platforms (like Ethereum, Solana, or Polygon), these assets can be programmed, traded, and tracked with full transparency and automation.

Why Tokenization is Gaining Momentum

✅ Fractional Ownership

Investors can now purchase a fraction of high-value assets, democratizing access to traditionally exclusive markets.

✅ Improved Liquidity

Tokenized assets can be traded 24/7 across global platforms, reducing the illiquidity often associated with real estate or private equity.

✅ Transparency & Security

Blockchain ensures immutability, audit trails, and transparent ownership records.

✅ Efficiency & Cost Reduction

Smart contracts automate transactions and reduce intermediaries, slashing operational costs.

Tokenization in India: Real-World Use Cases

India is emerging as a key player in the tokenization space. Here's how:

Real Estate TokenizationPlatforms like PropShare allow investors to buy fractional ownership in commercial real estate using tokens. This is transforming property investing into a more liquid, low-entry-barrier market.

Gold TokenizationIndian fintech firms are tokenizing gold (e.g., Augmont, SafeGold), enabling investors to buy gold in digital formats with full traceability and conversion options.

SEBI’s Regulatory MovesWhile still evolving, SEBI has shown interest in regulating security token offerings (STOs) and alternative investment platforms using blockchain.

RBI & Tokenized G-SecsIn 2024, RBI initiated pilots to tokenize government securities (G-Secs) for improved settlement and market accessibility.

Implications for Financial Professionals

This paradigm shift in asset ownership is not just a tech disruption—it’s a finance transformation. Financial professionals must now:

Model tokenized assets and their cash flows

Understand on-chain vs off-chain data integration

Analyze new valuation frameworks for fractional ownership

Evaluate token economics, utility models, and compliance risks

And this requires upskilling—especially in blockchain-based financial modelling.

Learn the Skills: Best Financial Modelling Certification Course in Delhi

To navigate and thrive in this blockchain-powered future, enrolling in the best financial modelling certification course in Delhi is critical.

The Boston Institute of Analytics offers a top-rated program tailored for modern finance professionals. Here’s what sets it apart:

🔹 Course Highlights:

Comprehensive financial modelling: Equity, debt, startups, and tokenized assets

Blockchain integration modules: Modelling token flows, smart contract payouts, and asset tokenization

Hands-on tools: Advanced Excel, Python, and Power BI for financial analytics

Live projects: Real-world case studies involving fintech and tokenized investment platforms

Placement support: Partnerships with top financial firms and fintech companies

Whether you're a student, finance analyst, or working in investment banking or fintech, this course equips you with tools to model tomorrow’s financial ecosystem.

Real-World Applications of Tokenization Modelling

🧩 Example 1: Real Estate Fundraising

A Delhi-based real estate developer tokenizes a ₹20 crore commercial building. Financial modellers are hired to:

Project rental yields

Model fractional returns across 1,000 token holders

Forecast liquidity premiums on secondary token markets

🧩 Example 2: Startup Equity Tokenization

A SaaS startup issues tokenized SAFE notes. Financial analysts model future token dilution, conversion events, and discounted cash flows with vesting schedules embedded in smart contracts.

The Road Ahead: Is Tokenization the Future?

Yes—and it's already here. According to a report by Boston Consulting Group (BCG), the total size of tokenized assets globally could reach $16 trillion by 2030. Major banks like JPMorgan, Citi, and HSBC are actively investing in tokenization platforms. India is catching up fast, with RBI and SEBI-led pilots gaining momentum.

What this means is clear: the financial professional of tomorrow must be tech-savvy, blockchain-literate, and modelling-proficient.

Final Thoughts

Tokenized assets are not just a trend—they represent a fundamental shift in how finance works. As blockchain redefines ownership, the ability to understand, value, and model these assets becomes essential.

If you want to future-proof your career in finance, it's time to enroll in the best financial modelling certification course in Delhi and master the art of modelling both traditional and digital assets.

0 notes

Text

Regulatory Risk Management Market Size, Share, Trends, Forecast & Growth Analysis 2034

Regulatory Risk Management Market is undergoing a substantial transformation, forecasted to grow from $21.2 billion in 2024 to $52.5 billion by 2034, marking a CAGR of approximately 9.6%. As global regulatory environments become more complex, organizations are under increasing pressure to ensure compliance and mitigate legal risks. Regulatory risk management solutions, including software platforms and consulting services, are now indispensable tools for navigating dynamic legal frameworks. These systems help safeguard operational integrity, maintain transparency, and protect a company’s reputation amid shifting regulatory demands.

Click to Request a Sample of this Report for Additional Market Insights: https://www.globalinsightservices.com/request-sample/?id=GIS33205

Market Dynamics

The acceleration of digital transformation and the rise in global compliance standards have become key drivers for the market. Organizations are increasingly leveraging automated platforms for real-time monitoring, risk reporting, and compliance tracking. Among market offerings, software solutions dominate, particularly those offering risk assessment tools and compliance management platforms. Their ability to streamline workflows and integrate seamlessly with enterprise systems makes them a top choice for businesses seeking efficiency and scalability.

In addition, consulting services are experiencing strong growth, as firms turn to external experts to decode intricate compliance mandates and adopt robust governance frameworks. Technologies such as AI, machine learning, and cloud computing are playing a transformative role by enhancing predictive analytics, streamlining decision-making, and automating regulatory tasks. These innovations are making compliance smarter, faster, and more reliable, thus driving widespread adoption across industries like banking, healthcare, telecommunications, and energy.

Key Players Analysis

Several leading companies have carved out strong positions in this evolving market. IBM, Oracle, and SAS Institute lead the way, offering comprehensive regulatory risk management platforms that cater to both large enterprises and mid-sized organizations. These firms are investing heavily in R&D to integrate next-gen technologies like AI-driven compliance engines and blockchain-based audit trails.

Other key players such as MetricStream, NAVEX,��SAI Global, and Wolters Kluwer are gaining traction for their flexible cloud-based solutions and modular risk frameworks. Emerging companies like Alyne, Galvanize, and LogicManager are also disrupting the space by offering intuitive platforms with user-friendly dashboards and real-time compliance alerts. These firms often focus on niche sectors or specific regulatory domains, giving them a competitive edge in targeted markets.

Regional Analysis

From a regional standpoint, North America dominates the Regulatory Risk Management market, thanks to its stringent regulatory frameworks, mature financial institutions, and advanced technological infrastructure. The United States, in particular, leads global adoption, with sectors like finance and healthcare spearheading investments in compliance tech.

Europe follows closely, driven by the European Union’s comprehensive policies such as GDPR, which demand sophisticated risk and compliance solutions. Countries like Germany and the United Kingdom are at the forefront, emphasizing data protection and ethical business practices.

In Asia Pacific, countries like India and China are gaining momentum due to rapid digitalization and a growing emphasis on aligning with global compliance standards. Meanwhile, Latin America and the Middle East & Africa show moderate adoption but present high potential as regulatory awareness and infrastructure gradually improve.

Recent News & Developments

The market has seen pivotal developments recently. Deloitte’s strategic collaboration with an AI tech company highlights the trend of integrating intelligent systems into regulatory compliance workflows. Similarly, IBM launched a new AI-powered risk management platform, designed to streamline compliance tracking and reporting.

A notable acquisition came from Global Risk Solutions, which acquired ComplianceTech, expanding its footprint and diversifying its offerings. In Europe, the introduction of updated regulatory guidelines has amplified the demand for advanced compliance solutions, while PwC reported a surge in regulatory advisory services, citing increased scrutiny in sectors like banking and insurance.

Browse Full Report : https://www.globalinsightservices.com/reports/regulatory-risk-management-market/

Scope of the Report

The Regulatory Risk Management Market offers broad scope across diverse industries including banking, insurance, healthcare, retail, and energy. It encompasses a wide array of solutions — from risk identification and monitoring to incident management and policy compliance — delivered through both on-premise and cloud-based platforms.

As compliance needs grow more intricate, organizations are shifting toward agile, scalable, and tech-enabled solutions. The integration of AI, machine learning, and big data analytics will continue to redefine the landscape, enabling organizations to anticipate risks, automate compliance tasks, and make faster, data-informed decisions.

This market’s evolution reflects a broader shift toward proactive and strategic risk management. Firms that embrace innovation while ensuring legal accountability are well-positioned to thrive in this era of regulatory complexity.

#regulatorycompliance #riskmanagement #aipoweredcompliance #dataprivacy #complianceautomation #governanceriskcompliance #financialregulations #cloudsecuritysolutions #globalregulatorymarket #cyberriskmanagement

Discover Additional Market Insights from Global Insight Services:

Streaming Analytics Market : https://www.globalinsightservices.com/reports/streaming-analytics-market/

Cloud Native Storage Market : https://www.globalinsightservices.com/reports/cloud-native-storage-market/

Invoice Market : https://www.globalinsightservices.com/reports/alternative-lending-platform-market

Learning Management System Market : https://www.globalinsightservices.com/reports/learning-management-system-lms-market/

Transaction Monitoring Software Market ; https://www.globalinsightservices.com/reports/mobile-banking-market

About Us:

Global Insight Services (GIS) is a leading multi-industry market research firm headquartered in Delaware, US. We are committed to providing our clients with highest quality data, analysis, and tools to meet all their market research needs. With GIS, you can be assured of the quality of the deliverables, robust & transparent research methodology, and superior service.

Contact Us:

Global Insight Services LLC 16192, Coastal Highway, Lewes DE 19958 E-mail: [email protected] Phone: +1–833–761–1700 Website: https://www.globalinsightservices.com/

0 notes

Text

Network Surveillance System Market | Outlook, Growth By Top Companies, Regions, Types, Applications, Drivers, Trends & Forecast

Global Network Surveillance System Market Research Report 2025(Status and Outlook)

The Global Network Surveillance System Market size was valued at US$ 18.9 billion in 2024 and is projected to reach US$ 32.6 billion by 2032, at a CAGR of 8.1% during the forecast period 2025-2032.

Network surveillance systems are security solutions designed to monitor and protect physical and digital assets through IP-based cameras, video management software, and analytics platforms. These systems enable real-time monitoring, threat detection, and data recording across various environments including commercial spaces, residential areas, and public infrastructure. The technology encompasses hardware components like cameras and servers, along with advanced software solutions featuring AI-powered analytics.

The market growth is driven by increasing security concerns, rising adoption of IoT devices, and government initiatives for smart city development. The commercial sector accounted for the largest market share (42%) in 2023, followed by residential applications. Asia-Pacific dominated the regional market with 38% revenue share, fueled by rapid urbanization and infrastructure development in China and India. Recent technological advancements like 4K cameras and cloud-based video surveillance are creating new growth opportunities, while data privacy regulations present challenges for market players.

Our comprehensive Market report is ready with the latest trends, growth opportunities, and strategic analysis. https://semiconductorinsight.com/download-sample-report/?product_id=59018

Segment Analysis:

By Type

Hardware Segment Dominates Due to Growth in Security Camera Deployments

The market is segmented based on type into:

Hardware

Subtypes: IP cameras, analog cameras, NVRs/DVRs, encoders, and others

Software

Subtypes: video management systems (VMS), video analytics, and others

Services

Subtypes: installation & maintenance, cloud storage, and others

By Application

Commercial Segment Leads with High Adoption in Retail and Banking Sectors

The market is segmented based on application into:

Commercial

Subtypes: retail stores, banks, corporate offices, and others

Residential

Utility

Subtypes: traffic monitoring, city surveillance, and others

Industrial

Others

By Technology

IP-Based Surveillance Systems Gaining Traction Due to Superior Image Quality

The market is segmented based on technology into:

Analog Surveillance Systems

IP-Based Surveillance Systems

Hybrid Surveillance Systems

By End User

Government Sector Shows Significant Growth Due to Smart City Initiatives

The market is segmented based on end user into:

Government

Commercial Enterprises

Residential Consumers

Industrial Sector

Regional Analysis: Global Network Surveillance System Market

North America The North American network surveillance market remains a global leader due to stringent security regulations and high adoption of advanced technologies. The region’s emphasis on public safety and critical infrastructure protection fuels demand for high-resolution IP cameras, AI-powered analytics, and cloud-based surveillance solutions. Government initiatives, such as the U.S. Department of Homeland Security’s infrastructure security programs, continue to drive investments. Commercial sectors—particularly banking, retail, and healthcare—are integrating IoT-enabled surveillance systems for loss prevention and compliance. While the U.S. dominates the market, Canada shows increasing growth due to smart city projects in Toronto and Vancouver. Data privacy laws like GDPR influence product development, pushing vendors toward encrypted and cybersecurity-compliant solutions. The competitive landscape includes both established players (Honeywell, Avigilon) and niche AI startups specializing in behavioral analytics.

Europe Europe’s market thrives on regulatory frameworks mandating surveillance in public spaces and transport hubs. The EU’s General Data Protection Regulation (GDPR) shapes system requirements, emphasizing data storage localization and anonymization. Germany and the UK lead in adopting AI-based surveillance for crowd management and anti-terrorism. A key trend is the shift from legacy analog systems to hybrid and fully IP-based networks. Manufacturers like Bosch and Axis Communications benefit from demand for thermal cameras and automated license plate recognition (ALPR) systems. Southern European nations show slower but steady growth, focusing on tourism security. The region also sees increasing integration of surveillance with building automation systems, driven by energy efficiency mandates. However, public resistance to facial recognition in some countries poses adoption challenges.

Asia-Pacific As the fastest-growing market, Asia-Pacific benefits from massive urbanization and government-led smart city projects. China accounts for over 40% of regional demand, with Hikvision and Dahua dominating both domestic and export markets. India focuses on urban surveillance under the Safe City Mission, deploying thousands of cameras in high-crime areas. Southeast Asian countries prioritize traffic monitoring and retail security, favoring cost-effective solutions. Japan and South Korea invest in AI-driven predictive surveillance for public safety. Two factors differentiate APAC: scale (millions of cameras deployed annually) and price sensitivity driving localization. The region also faces unique challenges, including varying data sovereignty laws and resistance due to privacy concerns in democracies like Australia and New Zealand.

South America This emerging market leans toward mid-range surveillance solutions for crime prevention in Brazil, Colombia, and Argentina. Economic constraints limit large-scale deployments, but banking and retail sectors invest in networked video recorders (NVRs) and cloud backup systems. Governments prioritize surveillance in high-risk urban zones, sometimes partnering with Chinese vendors for affordable hardware. The lack of standardized regulations across countries creates fragmentation, though Brazil’s data protection law (LGPD) is pushing modernization. Local manufacturers focus on basic IP cameras, while international brands target premium segments like airports and mining sites. Political instability and currency fluctuations remain barriers, but rising insurance requirements for businesses stimulate steady demand.

Middle East & Africa The Gulf Cooperation Council (GCC) countries drive growth through megaprojects like NEOM and Expo-linked infrastructure, deploying cutting-edge surveillance with facial recognition. Dubai leads in smart city integration, while Saudi Arabia focuses on oil facility security. Sub-Saharan Africa shows potential with bank security and urban traffic systems, though adoption is hindered by limited IT infrastructure. South Africa remains the most advanced market, using surveillance for township crime reduction. A regional differentiator is the preference for ultra-high-definition (4K+) cameras in luxury developments. Notably, Chinese vendors dominate mid-tier segments, while Western firms supply critical infrastructure projects. Power reliability issues necessitate solar-powered and edge-computing solutions in rural areas.

List of Prominent Network Surveillance System Providers

Hikvision (China)

Dahua Technology (China)

Axis Communications (Sweden)

Bosch Security Systems (Germany)

Honeywell Security (U.S.)

Avigilon (Canada)

Hanwha Vision (South Korea)

Panasonic i-PRO Sensing Solutions (Japan)

Pelco by Schneider Electric (U.S.)

Vivotek (Taiwan)

Global security challenges have elevated the demand for advanced network surveillance solutions across commercial and public sectors. Growing threats ranging from organized retail theft to terrorist activities are pushing governments and enterprises to invest heavily in surveillance infrastructure. The retail sector alone loses billions annually to theft – driving a 28% year-over-year increase in surveillance deployments to protect assets. Meanwhile, urban population growth continues straining public safety resources, with major cities deploying smart surveillance networks to enhance monitoring capabilities and response times.

Breakthroughs in artificial intelligence and computer vision are transforming the surveillance landscape. Modern systems now incorporate machine learning algorithms capable of facial recognition, behavior analysis, and real-time threat detection with over 95% accuracy rates. These intelligent systems reduce human monitoring fatigue while improving incident response. The integration of 5G networks further enhances capabilities, enabling ultra-high-definition video streaming with sub-50ms latency. Such technological leaps are making surveillance solutions more accessible and effective across different budget ranges.

Public sector investments continue to drive significant market growth, particularly in smart city projects globally. Many national security programs now mandate surveillance system deployments in high-risk areas, with transportation hubs receiving particular focus. Recent infrastructure bills have allocated billions toward upgrading public safety technologies, creating substantial opportunities for surveillance providers. These initiatives often require integration with existing emergency response systems, further expanding the value chain for comprehensive security solutions.

Implementing modern surveillance networks requires specialized expertise that remains scarce in many markets. Configuration challenges arise when combining hardware from multiple vendors or integrating with legacy systems. Without proper planning, enterprises risk creating security gaps or suboptimal performance that undermines system effectiveness. This complexity drives up professional service costs while potentially delaying project timelines by months.

Surveillance systems generate enormous data volumes that require careful governance. Organizations must balance retention policies with storage costs while meeting varied regulatory requirements across jurisdictions. Many struggle with implementing effective data lifecycle management strategies, particularly when footage must be preserved for potential evidentiary purposes. These challenges are compounded when operating across international borders with conflicting privacy laws.

While AI-powered analytics improve detection capabilities, false positive rates remain problematic for many systems. Excessive nuisance alerts can desensitize security personnel, potentially causing them to overlook genuine threats. This challenge intensifies as systems expand coverage areas and detection parameters. Vendors must continue refining algorithms to maintain high accuracy while minimizing operator fatigue that could compromise security operations.

The market is highly fragmented, with a mix of global and regional players competing for market share. To Learn More About the Global Trends Impacting the Future of Top 10 Companies https://semiconductorinsight.com/download-sample-report/?product_id=59018

Key Questions Answered by the Network Surveillance System Market Report:

What is the current market size of Global Network Surveillance System Market?

Which key companies operate in Global Network Surveillance System Market?

What are the key growth drivers?

Which region dominates the market?

What are the emerging trends?

Browse More Reports:

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014

[+91 8087992013]

0 notes

Text

Ruchi Anand & Associates: Elevating Financial Strategies with Expertise

Introduction

Since its founding in 2000, Ruchi Anand & Associates (RAAAS) has established itself as a premier Chartered Accountant (CA) firm in India. With offices based in New Delhi, the firm provides full-service accounting, auditing, risk advisory, taxation, and financial consulting tailored to businesses across diverse industries wellfound.com+4raaas.com+4pa.linkedin.com+4. RAAAS’s mission has remained clear: to deliver high-quality, personalized financial services that foster long-term client relationships and value-driven results.

Origins & Vision

Founding and Early Growth Ruchi Anand spearheaded the firm with a vision to offer integrated financial services combining technical expertise, ethical standards, and a client-centric approach. With a senior team deeply involved from the first meeting to the final deliverables, the firm ensured seamless engagement and high client satisfaction .

Core Values

Client Focus: Prioritize long-term partnerships and customized service delivery.

Technical Excellence: Maintain continuous improvement to stay ahead of evolving accounting standards, laws, and technology.

Integrity & Trust: Uphold professionalism and transparency in every engagement.

Core Services

RAAAS provides a wide range of services structured to suit businesses across their lifecycle:

1. Audit & Assurance

Statutory and internal audits

Compliance audits for regulatory frameworks (e.g., Companies Act, GST, ICAI standards)

Assurance over financial statements and systems, including UDIN maintenance

2. Risk Advisory

Financial risk assessments and internal control reviews

Fraud detection & prevention

Corporate governance support

3. Taxation Services

Direct and indirect tax (GST, VAT, service tax) advisory and compliance

Transfer pricing consulting

ITR filings, condonation of delay (per CBDT Circular No. 11/2024) wellfound.com+1facebook.com+1raaas.com+5in.linkedin.com+5pa.linkedin.com+5pa.linkedin.com

4. Outsourcing & Accounting

Day-to-day bookkeeping

Payroll and statutory compliance

ERP and finance automation support (e.g., SAP)

5. Specialized Consulting

Company incorporation and regulatory filings (ROC, XBRL) in.linkedin.com

NGO/Trust accounting and taxation

Corporate restructuring and M&A transaction support

Service Excellence in Action

RAAAS actively shares knowledge and industry updates through its LinkedIn page (4,400+ followers) and Facebook community facebook.com+2in.linkedin.com+2pa.linkedin.com+2. Recent advisory highlights include:

GST Amnesty Filings: Technical challenges and taxpayer support during Section 128A amnesty in.linkedin.com

XBRL Enhancements: MCA rule changes effective July 14, 2025 (signed PDFs with auditor/board reports) in.linkedin.com

Delayed ITR Guidance: Condonation relief per CBDT Circular No. 11/2024 in.linkedin.com

Technology & Innovation

RAAAS integrates cutting-edge accounting tools to enhance accuracy and efficiency:

ERP Integration: SAP-enabled bookkeeping and detailed financial reporting

Digital Compliance: XBRL filings, e‑way bills, and UDIN systems raaas.com+2in.linkedin.com+2pa.linkedin.com+2

Client Portals: Secure platforms for document sharing, workflow tracking, and communication

Analytics & Visualization: Data-driven insights for strategic financial decision-making

This tech-savvy model reduces turnaround time, improves accuracy, and offers real-time financial intelligence to business leaders.

Industry Outreach & Thought Leadership

RAAAS’s content isn’t limited to client engagement; the firm proactively educates and informs its audience with:

Monthly LinkedIn posts on tax updates, regulatory changes, and global finance trends pa.linkedin.com+1zaubacorp.com+1

Seasonal advisories, such as GST return deadlines, UDIN updates, and MCA compliance bulletins

Social responsibility awareness, like campaigns against child labor and International Yoga Day engagements

Through these initiatives, RAAAS builds authority while fostering public trust.

Team & Organizational Culture

With over 50 professionals, RAAAS prides itself on fostering strong teamwork:

Senior CA-led engagement ensures client confidence and quality control in.linkedin.com

In-house specialists: tax advisors, SAP analysts, audit leads, NGO experts

Continuous skill development through seminars, internal training, and knowledge sharing

A service-driven culture oriented toward client satisfaction and proactive solutions

Clientele & Industry Reach

RAAAS caters to a broad spectrum of clients, including:

Private and public companies across manufacturing, retail, services, and IT

NGOs and trusts, providing SOCI application, fund audits, and internal control reviews

Start-ups and SMEs, assisting with incorporation, funding compliance, and bookkeeping

High-net-worth individuals, offering tailored tax planning, ITR preparation, and wealth advisory

Recent Case Highlights

While specific client names remain confidential, RAAAS has successfully:

Assisted firms with delayed ITR submissions using CBDT condonation guidelines

Implemented audit systems for GDPR-safe, internal controls compliant with MCA rules

Helped SMEs file timely GST returns and manage GSTR‑1 revisions efficiently

Launched digital workflows for NGO clients managing CSR mandates

Why Submit to Raaas.com?

Raaas.com is a reputable portal specializing in finance, accounting, and taxation content. Submitting this article aligns well with its audience—professionals seeking insight-driven, practical guidance. The narrative of RAAAS’s tech-led, client-first approach bridges theory and practice, making it a valuable resource for firms aspiring for similar excellence.

Conclusion

Ruchi Anand & Associates exemplifies what modern CA firms should strive to become: responsive, integrated, technically sound, and digitally forward. Over 25 years, RAAAS has built trust through quality audits, tax compliance leadership, risk advisory expertise, and financial automation.

By choosing to submit this comprehensive profile to raaas.com, readers—whether clients, peers, or industry observers—receive a well-rounded view of how to blend traditional values with innovative methods in financial consultancy.

0 notes

Text

Why Are Temperature Monitoring Systems Becoming Critical Infrastructure Across Industries by 2030?

As the global economy becomes more reliant on precision-driven operations and compliance-intensive sectors, temperature monitoring systems are no longer optional—they are mission-critical. From safeguarding pharmaceutical supply chains to ensuring semiconductor manufacturing stability, these systems are redefining operational resilience and product integrity. But what’s driving this shift? And how can business leaders leverage the opportunities this transformation presents?

What Is the Market Outlook for Temperature Monitoring Systems?

The global temperature monitoring systems market is expected to surge from USD 4.15 billion in 2024 to USD 5.66 billion by 2030, at a CAGR of 5.3%. This steady growth reflects the increasing complexity of modern industries and the corresponding demand for high-accuracy, real-time environmental monitoring.

At the heart of this transformation are advanced technologies like thermocouples, temperature sensors, IoT, and AI that collectively enhance the accuracy, reliability, and automation of monitoring protocols across diverse sectors.

Download PDF Brochure:

Why Is Demand for Temperature Monitoring Systems Accelerating?

1. Expansion in Secondary Manufacturing

With rapid industrialization and the rise of Industry 4.0, sectors like pharmaceuticals, food processing, and chemicals require ultra-precise temperature control for quality assurance and regulatory compliance.

2. Tightening Global Safety Standards

Regulations across cold chain logistics, healthcare, and semiconductor manufacturing have made real-time temperature visibility a non-negotiable requirement. Organizations that fail to comply risk both regulatory penalties and brand reputation damage.

3. Rise of Thermocouples and Smart Sensors

Thermocouples and temperature sensors have become the backbone of digital temperature monitoring, offering high-speed data collection, durability in harsh environments, and compatibility with automated platforms. Their integration with wireless networks enables cloud-based analytics and remote monitoring, reducing manual errors and improving operational agility.

Who Are the Industry Leaders and What Are They Offering?

As of 2023, key players include:

3M, Cardinal Health, and Honeywell International Inc. (US)

Koninklijke Philips N.V. (Netherlands)

Siemens AG (Germany)

Masimo, Toshiba (Japan)

Geratherm Medical AG (Switzerland)

These companies are investing heavily in R&D and digital transformation, offering AI-enabled predictive systems, multi-sensor integration, and real-time dashboards tailored for industries such as healthcare, pharmaceuticals, semiconductors, energy, and food.

Request Sample Pages :

Where Are the Top Growth Segments Within the Market?

🔸 Monitoring Systems by Product Type

Among the product segments, monitoring systems (both analog and digital) are set to witness the highest growth. Their increasing integration into emerging economies and industrial-grade automation platforms reflects their central role in future-ready manufacturing.

🔸 Cold Storage Temperature Monitoring by Application

This application area is forecasted to dominate the market. Driving this is:

Stricter cold chain compliance regulations

Surge in biopharmaceuticals and temperature-sensitive vaccines

Global expansion of cold storage infrastructure in regions like India, China, and the Middle East

🔸 Asia Pacific by Region

Asia Pacific is projected to record the highest CAGR through 2030. Countries like India, China, and Singapore are fueling this momentum through:

Biotech and pharma sector expansion

Introduction of stringent regulatory frameworks

Government investments in food safety and semiconductor manufacturing

How Are Technologies Like Thermocouples and AI Shaping the Market?

✔️ Thermocouples

These are rugged, fast-responding devices ideal for industrial-grade environments. Their broad temperature range and cost-effectiveness make them ideal for sectors like semiconductors, energy, and automotive.

✔️ Temperature Sensors

Smart temperature sensors embedded with IoT and machine learning algorithms allow predictive maintenance, anomaly detection, and trend analysis. These sensors are becoming indispensable in patient monitoring, server room management, and cold storage environments.

Together, these technologies are ushering in an era of connected ecosystems where data flows from the shop floor to executive dashboards in real time—empowering decision-makers with actionable intelligence.

When Should Enterprises Scale Their Investment?

The next 2–4 years will be crucial for organizations to transition from reactive compliance to proactive quality assurance. With increasing supply chain vulnerabilities, regulatory complexity, and climate sensitivity, deploying robust temperature monitoring infrastructure now is an investment in business continuity.

For pharmaceutical companies, temperature excursions can mean multimillion-dollar product losses and reputational damage. For data centers, even a 2–3 degree variance can impair server uptime. These high-stakes environments underscore the ROI potential of real-time monitoring.

What Should C-Suite Executives Do to Maximize ROI?

To future-proof their operations and unlock high ROI, executives should:

1. Prioritize Infrastructure Modernization

Adopt next-gen monitoring systems with AI-enabled features and thermocouple-based accuracy across critical points in the value chain.

2. Integrate Systems With Predictive Analytics

Leverage platforms that utilize temperature sensor data for predictive maintenance and risk forecasting.

3. Ensure Cross-Industry Compliance

Align temperature monitoring systems with global standards like FDA 21 CFR Part 11, EU GDP, and HACCP to reduce audit risks.

4. Build Data-Driven Culture

Train operational teams to interpret insights from smart dashboards and take real-time decisions based on environmental anomalies.

Final Thought: Is Temperature the New KPI for Operational Excellence?

Temperature may seem like a simple metric, but in today’s data-centric world, it is emerging as a key performance indicator (KPI) for product integrity, patient safety, and asset reliability. Whether through thermocouples in semiconductor fabs or temperature sensors in vaccine logistics, real-time monitoring delivers measurable returns in compliance, efficiency, and customer trust.

As we look toward 2030, temperature monitoring systems will not just support operations—they will define them.

For more information, Inquire Now!

0 notes

Text

Vendor Risk Management Market Revolutionized by AI-Driven Risk Scoring Tools

The Vendor Risk Management Market was valued at USD 8.6 billion in 2023 and is expected to reach USD 30.3 billion by 2032, growing at a CAGR of 14.98% from 2024-2032.

Vendor Risk Management Market is experiencing notable growth as organizations intensify efforts to mitigate third-party risks, safeguard data, and ensure operational resilience. With increasing reliance on external vendors across industries, managing cybersecurity, compliance, and performance risks has become a top priority for both public and private enterprises.

U.S. Vendors Strengthen Cyber Risk Frameworks Amid Growing Digital Dependencies

Vendor Risk Management Market is driven by growing regulatory scrutiny, rising instances of data breaches, and the need for transparent supplier relationships. Companies are now adopting automated platforms to streamline risk assessments, ensure compliance, and proactively monitor vendor activities across the supply chain.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/6629

Market Keyplayers:

RSA Security – Archer Third Party Governance

MetricStream – Third-Party Risk Management

OneTrust – Vendorpedia

Prevalent Inc. – Prevalent Third-Party Risk Management Platform

BitSight Technologies – BitSight Security Ratings

NAVEX Global – RiskRate

ProcessUnity – Vendor Risk Management

LogicGate – Risk Cloud for Third-Party Risk Management

Riskonnect – Third-Party Risk Management Solution

SAI360 – Vendor Risk Management

Aravo Solutions – Aravo for Third-Party Risk Management

Galvanize (now part of Diligent) – Third-Party Risk Management

IBM Corporation – OpenPages Third-Party Risk Management

SAP SE – SAP Risk Management

Coupa Software – Coupa Third-Party Risk Management

Market Analysis

The market is being shaped by a mix of regulatory developments, technological advancements, and heightened awareness of third-party exposure. In sectors like finance, healthcare, and manufacturing, vendors often have access to sensitive data and infrastructure, making risk management essential. Organizations across the U.S. and Europe are now allocating larger budgets to VRM solutions that help prevent disruptions, reduce financial liabilities, and maintain brand reputation.

Market Trends

Growing adoption of AI and machine learning for real-time risk scoring

Integration of VRM tools with GRC (governance, risk, and compliance) platforms

Emphasis on continuous vendor monitoring vs periodic assessments

Rising demand for cloud-based VRM software with scalable architecture

Enhanced focus on ESG (Environmental, Social, Governance) risk tracking

Implementation of automated compliance workflows

Increase in due diligence for fourth-party and Nth-party vendors

Market Scope

As global supply chains become more complex, the Vendor Risk Management Market is broadening its impact across enterprise functions. It is no longer limited to IT or procurement but involves legal, finance, and compliance teams working together to assess and manage vendor performance and exposure.

Multi-tier vendor visibility and control

End-to-end lifecycle management of vendor risks

Centralized dashboards for compliance and audit tracking

Real-time alerts on risk deviations

Scalable deployment across global operations

Risk mapping to strategic objectives and KPIs

Forecast Outlook

The Vendor Risk Management Market is set to witness transformative growth as businesses seek agile, intelligent, and secure frameworks to govern third-party relationships. With increasing digital dependency and cross-border vendor operations, future-ready VRM systems will focus on proactive intelligence, regulatory adaptability, and deep integration capabilities. U.S. and European markets will remain core innovation hubs, supporting industry-wide resilience through advanced VRM strategies.

Access Complete Report: https://www.snsinsider.com/reports/vendor-risk-management-market-6629

Conclusion

Vendor Risk Management is no longer an optional function—it is a strategic imperative. As organizations face rising threats from third-party vulnerabilities, the need for robust, transparent, and technology-driven risk practices becomes undeniable. For forward-looking enterprises across the U.S. and Europe, investing in next-gen VRM solutions means more than compliance—it’s a foundation for secure growth and long-term trust in an interconnected world.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Related Reports:

U.S.A. Insight Engines Market sees growing adoption across enterprises for smarter data discovery

U.S.A businesses accelerate investments in Sensitive Data Discovery solutions to boost regulatory readiness

U.S.A witnesses rapid adoption of In-Memory Computing for real-time analytics and faster data processing

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Mail us: [email protected]

0 notes

Text

India’s New BRSR Mandate: What the 2025 Amendments Mean for Businesses

India’s corporate sustainability landscape is undergoing a major transformation. With the rollout of BRSR Core, the Securities and Exchange Board of India (SEBI) is tightening ESG disclosure norms, making reporting more uniform, auditable, and accountable. For companies navigating this shift, the new mandates are not just about compliance — they’re about corporate credibility, long-term risk management, and investor trust.

What Is BRSR Core?

The Business Responsibility and Sustainability Reporting (BRSR) Core is a revised framework developed by SEBI to elevate the quality and reliability of non-financial disclosures made by Indian companies.

While ESG reporting under the original BRSR framework became mandatory for the top 1,000 listed companies in FY2022-23, BRSR Core introduces a narrower, deeper, and assurance-backed layer of disclosures. This includes key performance indicators (KPIs) that cut across environmental, social, and governance dimensions — with a focus on transparency, standardization, and verification.

Who Needs to Comply — and When?

The implementation timeline of BRSR Core reflects SEBI’s phased but firm approach:

FY 2023-24: Top 150 listed companies required to voluntarily report BRSR Core

FY 2024-25: The same companies must report mandatorily and obtain reasonable assurance on select KPIs

FY 2026-27: SEBI aims to expand the requirement to the top 250 listed companies

This phase-in approach gives companies some time to build internal systems and improve reporting capabilities — but the direction is clear: sustainability disclosures will soon be held to the same standard as financial ones.

Why These Amendments Matter

The 2025 BRSR updates are significant for several reasons:

1. Audit-Ready ESG Disclosures

Until now, many companies published broad ESG commitments without third-party validation. BRSR Core mandates assurance on specific metrics, ensuring that ESG claims are backed by evidence and methodology.

2. Sector-Neutral KPIs

BRSR Core is designed to be applicable across industries — pushing all companies to report against a common set of benchmarks. This makes cross-sector comparison easier for investors and analysts.

3. Increased Investor Scrutiny

Global capital flows are increasingly tied to sustainability metrics. SEBI’s move aligns India’s disclosure norms with global frameworks, helping businesses stay competitive on the international stage.

4. Reputational and Operational Risk Management

The updated disclosures touch on emissions, supply chain accountability, workforce well-being, and corporate governance. These are no longer peripheral issues — they are core to business resilience and stakeholder trust.

Are Indian Companies Ready?

For most businesses, aligning with BRSR Core won’t be a simple plug-and-play. It requires:

Systematic tracking of ESG performance

Standardized data collection across departments

Governance frameworks to validate and approve sustainability data

Independent assurance partnerships to meet verification requirements

This shift will demand collaboration between sustainability teams, finance departments, auditors, and external consultants. Companies that begin preparing now will not only be better placed to meet SEBI’s deadlines — they’ll also gain a competitive edge.

Looking Ahead: A Strategic Moment for Indian Businesses

While some may see the BRSR Core requirements as a compliance burden, it’s better viewed as an opportunity to rethink how sustainability is integrated into corporate DNA. Standardized disclosures can improve internal decision-making, investor relations, and stakeholder transparency — all while building resilience in an increasingly climate-conscious economy.

Want to Dive Deeper?

At NeoImpact, we recently broke down the BRSR 2025 amendments in detail, offering insights on compliance strategies and how businesses can prepare for the shift.

Read the full guide here: BRSR Amendments 2025: What Indian Businesses Should Know

Whether you're a listed entity or an unlisted company considering voluntary alignment, this article provides a practical overview of the road ahead.

Conclusion

SEBI’s BRSR Core is more than a new reporting format — it’s a signal that non-financial disclosures are now fundamental to corporate accountability. Companies that proactively embrace this shift will not only meet regulatory expectations but also earn the trust of global stakeholders.

The time to act is now — before compliance becomes a scramble.

0 notes

Text

Europe Data Privacy Software Market Size to Hit USD 30.31 Bn by 2032

A significant data privacy software market trend is Europe’s industry emergence as the second-largest region, forecasted to grow at a CAGR of 41.2%. Globally, the cyber security market is set to expand from USD 1.99 billion in 2022 to USD 30.31 billion by 2030. Europe stands as the second largest region in the global data privacy software market, backed by strong regulatory enforcement and a mature digital ecosystem. The region continues to lead in data protection governance through frameworks like GDPR, setting global benchmarks for privacy compliance.

Top Players in the European Data Privacy Software Market:

Exterro, Inc.

Informatica

WireWheel

Privacy Tools

Nymity Inc.

OneTrust, LLC

TrustArc Inc.

IBM Corporation

Securiti.ai

BigID, Inc.

SAP SE (Germany)

Oracle Corporation

Key Market Highlights:

2022 Global Market Size: USD 1.99 billion

2030 Global Market Size: USD 30.31 billion

Europe CAGR (2023–2030): 41.2%

Regional Outlook: Robust, policy-driven expansion with high enterprise adoption.

Request Free Sample PDF: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/europe-data-privacy-software-market-107455

Growth Drivers:

The enforcement of GDPR and ePrivacy regulations is becoming increasingly strict across all EU member states, driving organizations to prioritize compliance. Simultaneously, the volume of cross-border data transactions and third-party data processing is growing rapidly, escalating the need for robust data governance. Enterprises are placing a stronger emphasis on consumer trust, ethical data usage, and automated compliance tools to align with regulatory expectations.

Emerging Opportunities:

The evolving data privacy landscape presents key opportunities, such as the development of EU-compliant, cloud-based privacy platforms tailored for small and medium-sized enterprises (SMEs). Integration of artificial intelligence and behavioral analytics is emerging as a powerful method to enhance the management of Data Subject Access Requests (DSARs) and consent mechanisms.

Segmentation:

By Deployment:

The data privacy management market is changing with the growing adoption of cloud-based solutions, driven by their scalability, lower upfront costs, and ability to support remote access and updates in real-time. At the same time, on-premise deployments remain relevant, particularly among organizations with strict data residency requirements or in highly regulated sectors where control over infrastructure is essential.

By Application:

Privacy management needs are changing with a shift in focus toward comprehensive compliance management tools that help organizations align with evolving regulations like GDPR and ePrivacy. There's also an increasing reliance on risk management platforms to identify and mitigate data privacy threats proactively. Reporting and analytics tools are gaining momentum as businesses seek deeper insights into data flows and compliance metrics.

Speak To Analyst: https://www.fortunebusinessinsights.com/enquiry/speak-to-analyst/europe-data-privacy-software-market-107455

Recent Developments:

February 2024 – A Germany-based automotive group deployed an EU-based privacy automation platform to streamline DSAR and consent lifecycle for over 30 million users.

August 2023 – The European Data Protection Board released updated guidelines on international data transfers, prompting a spike in enterprise privacy audits.

Solution Scope:

• Core Features: Privacy impact assessments (PIA), consent tracking, breach management, risk analytics

• Deployment: SaaS-based, on-premises, and hybrid privacy management platforms

• Industries Served: BFSI, retail, government, tech, legal, and healthcare

• Use Cases: GDPR compliance, Schrems II adaptation, cross-jurisdictional reporting, and subject rights automation

About Us:

Fortune Business Insights provides trusted research intelligence and tailored market insights to help businesses navigate complex regulatory landscapes and tap into emerging technologies. Our in-depth regional knowledge ensures data-backed strategies that drive growth.

Contact Us:

US: +1 833 909 2966

UK: +44 808 502 0280

APAC: +91 744 740 1245

Email: [email protected]

#Europe Data Privacy Software Market Share#Europe Data Privacy Software Market Size#Europe Data Privacy Software Market Industry#Europe Data Privacy Software Market Driver#Europe Data Privacy Software Market Growth#Europe Data Privacy Software Market Analysis#Europe Data Privacy Software Market Trends

0 notes

Text

The Rise of Green Finance in India: How ESG Investing is Reshaping the Financial Landscape

As the global climate crisis intensifies, the financial world is pivoting toward sustainability—and India is rapidly becoming a key player in this transformation. From sovereign green bonds to ESG mutual funds and climate-focused investment policies, green finance is no longer a niche concept but a financial imperative. For professionals looking to stay ahead in this evolving ecosystem, enrolling in Certification Courses for Financial Analytics in Dubai can provide the analytical tools needed to make sense of this sustainability-driven financial future.

What is Green Finance?

Green finance refers to financial activities—investments, lending, or insurance—that promote environmentally sustainable outcomes. This includes funding renewable energy, energy efficiency, sustainable agriculture, climate-resilient infrastructure, and pollution reduction.

In India, green finance is accelerating due to government mandates, investor demand, and corporate ESG (Environmental, Social, Governance) commitments. According to the Reserve Bank of India (RBI), sustainable finance is key to long-term financial stability and climate resilience.

India’s Green Finance Milestones

Sovereign Green Bonds (2023–2025)India launched its first-ever sovereign green bonds worth ₹16,000 crore to fund clean energy projects. These bonds are aligned with the Green Bond Framework approved by the Government of India.

SEBI’s ESG Rating GuidelinesThe Securities and Exchange Board of India (SEBI) has mandated Business Responsibility and Sustainability Reporting (BRSR) for the top 1000 listed companies, requiring them to disclose ESG-related risks and data.

Green Mutual Funds and ETFsFunds focusing on ESG-compliant companies have seen a surge in interest from millennial and Gen Z investors. SBI, Axis, and Kotak Mahindra have launched several ESG-focused funds.

Corporate Shift Towards Net-ZeroMajor Indian firms like Reliance Industries and Tata Steel have committed to achieving net-zero emissions by 2040–2050, leading to a rise in ESG-compliant financial practices.

Why Financial Analytics Matters in Green Finance

Green finance is data-driven. Investors, regulators, and companies rely heavily on analytics to:

Score ESG performance

Track carbon footprints

Analyze climate risk exposure

Model long-term returns of sustainable investments

For professionals in finance, this has created a demand for financial analysts who understand sustainability data. This is where Certification Courses for Financial Analytics in Dubai become highly relevant—they train you to evaluate ESG metrics, work with sustainability data, and integrate ethical considerations into financial decision-making.

How ESG Investing is Reshaping India’s Financial Markets

✅ Investor Preferences Are Shifting