#VAHomeLoans

Explore tagged Tumblr posts

Photo

VA Home Loans are a well-deserved benefit to our heroes who served our country. Learn about eligibility and how to apply for this incredible opportunity to own a home. Learn more: https://vahomebuyersprogram.com/

0 notes

Text

VA Home Loans in Cape Coral - Corey Blumer Home Loans.

Welcome to Corey Blumer Home Loans, your trusted partner for VA home loans in beautiful Cape Coral, FL. With a focus on serving our valued veterans, Corey and his expert team bring their extensive knowledge of VA home loans to help you secure the best rates in the area.

If you're curious about your eligibility for a VA home loan, look no further. Corey and his team are here to address all your questions and concerns, ensuring you benefit from low down payments and competitive interest rates, whether you're purchasing a new home or refinancing in Cape Coral.

At Genesis Lending, we understand the value of your time. That's why we offer a seamless online loan application and approval process, allowing you to access your funds and step into your dream home in under 30 days. Enjoy the convenience of swift digital quotes along with personalized service from our dedicated team. We take pride in being your go-to mortgage broker in Cape Coral.

Take that first step toward your dream home by reaching out to Corey Blumer Home Loans today. Discover your options for a VA home loan in Cape Coral or start your home loan application. With our expertise and unwavering commitment to customer service, you won't find a better team to fulfill your home loan needs. Don't hesitate; give us a call now!

Corey Blumer - Residential Mortgages

5785 Cape Harbour Dr.

Suite 201

Cape Coral, FL 33914

(239) 218-8148 https://www.google.com/maps/pl... #VAHomeLoans #VAHomeLoansCapeCoral

0 notes

Text

Smooth VA 100% Cash Out + Renovation Success Home Loan in California

From outdated to upgraded, this stunning home underwent a remarkable renovation journey with the help of The Landing Mamba Smooth VA's expert team.

With our 100% cash-out VA loan option, our client was able to unlock the equity in their home and fund their renovation dreams without breaking the bank.

From fresh paint to modern fixtures, every detail was carefully curated to elevate the space and create a haven of comfort and style.

Huge congratulations to our incredible client on their stunning renovation success! Ready to turn your renovation dreams into reality?

Contact us at 657-777-0024 to Smooth VA today and let's make it happen!

#RenovationSuccess#VAHomeLoan#DreamHomeTransformation#mortgage lenders#HomeOwnership#DownPaymentAssistance#DreamHome#NewBeginnings#loanmortgage#homeownership

1 note

·

View note

Text

If you’re considering buying a home in the Dallas, TX explore the opportunity of securing guaranteed VA home loans to make your dream home a reality. The HomeTown Lending offersall required information detailing the various benefits and specific requirements for VA loans. Navigate the home-buying process, reach out to them today for personalized assistance and to learn more about how they can help you secure your new home!

0 notes

Text

VA Mortgage Leads

Understanding the Landscape:

Before delving into the intricacies of VA mortgage leads, it’s crucial to grasp the landscape they operate in. VA loans, backed by the U.S. Department of Veterans Affairs, cater to veterans, active-duty service members, and eligible surviving spouses, offering them favorable terms and benefits. However, reaching out to this demographic requires a specialized approach due to their unique needs and preferences.

Enter TheLiveLead: At TheLiveLead, we recognize the importance of targeted lead generation, especially in the VA mortgage sector. Our innovative approach combines cutting-edge technology with industry expertise to deliver unparalleled results for mortgage professionals. With a keen focus on VA mortgage leads, we ensure that our clients have access to a steady stream of qualified prospects, enabling them to maximize their business potential.

TheLiveLead Advantage:

Precision Targeting: Leveraging advanced data analytics and AI-driven algorithms, we identify and target individuals who are most likely to benefit from VA loans. By analyzing various factors such as military service history, credit profiles, and demographic information, we ensure that our leads are highly relevant and conversion-ready.

Customized Campaigns: We understand that one size does not fit all when it comes to lead generation. That’s why we offer personalized campaign strategies tailored to the unique requirements of our clients. Whether it’s reaching out to recently discharged veterans or engaging with active-duty personnel, our campaigns are designed to resonate with the target audience effectively.

Real-Time Lead Delivery: Time is of the essence in the competitive mortgage industry. With our real-time lead delivery system, clients receive fresh leads as soon as they become available, allowing them to capitalize on opportunities swiftly. This seamless integration ensures that our clients stay ahead of the curve and maintain a competitive edge in the market.

Quality Assurance: Quality is non-negotiable at TheLiveLead. Every lead that passes through our system undergoes rigorous screening and verification processes to ensure authenticity and accuracy. This commitment to quality translates into higher conversion rates and a more efficient sales process for our clients.

Continuous Optimization: The mortgage landscape is dynamic, and what works today may not yield the same results tomorrow. That’s why we continuously monitor and optimize our lead generation strategies to adapt to changing market conditions. By staying ahead of trends and leveraging the latest technologies, we empower our clients to stay ahead of the competition.

Unlocking Growth Potential:

With TheLiveLead as your strategic partner, the possibilities for growth in the VA mortgage sector are endless. Whether you’re a seasoned professional looking to expand your client base or a newcomer seeking to establish your presence, our comprehensive lead generation solutions can propel your business to new heights.

In Conclusion:

VA mortgage leads represent a lucrative opportunity for mortgage professionals, provided they have the right tools and strategies in place. With TheLiveLead, you not only gain access to a reliable source of high-quality leads but also benefit from a partner committed to your success. Together, let’s unlock the full potential of VA mortgage leads and chart a course towards sustained growth and prosperity.

#VALoans#MortgageLeads#Veterans#TheLiveLeadSuccess#RealEstate#LeadGeneration#FinancialFreedom#HomeLoans#MilitaryBenefits#VAHomeLoan#SuccessInSelling#EmpowerYourBusiness#TargetedMarketing#GrowYourPipeline#WinningWithTheLiveLead

1 note

·

View note

Text

youtube

Free VA Loan Help for Vets! 🏡 #shorts #vahomebuyer Free VA Loan Help for Vets! 🏡 #shorts #vahomebuyer #VALoan #Veterans #HomeBuyingTips #VALender #Refinance #VAHomeLoan #HomeOwnership #CreditAnalysis #BuyAHome #VeteranBenefits via David Xie Mortgage Guy https://www.youtube.com/channel/UCYTXRSUzyEq7H_HSUyFzpoQ June 04, 2025 at 06:10PM

#mortgagerates#realestatetips#selfemployed#realestate#mortgage#wealthbuilding#investing#entrepreneur#Youtube

0 notes

Text

VA home loans offer life-changing assistance, and a trusted lender and agent can help make sure you understand the details and are ready to move forward with a solid plan.

Do you know if you’re eligible for a VA home loan? Talk to a trusted lender who can help you see if you’d qualify.

Homebuying #VAHomeLoan #KeepingCurrentMatters

0 notes

Text

youtube

✨ DEAL OF THE WEEK ✨ Working with my VA buyer, I knew we had to find something just right—and then ✨ DEAL OF THE WEEK ✨ Working with my VA buyer, I knew we had to find something just right—and then I came across THIS GEM. 😍 🏡 Fully renovated 3-bed, 2-bath ranch in Southwest Atlanta, listed at just $255K! 🎯 Finding a home this affordable with such modern upgrades is rare, and let me tell you—it’s absolute perfection. ✨ This is what I love about real estate—whether it’s a luxury estate or a hidden gem like this, my goal is the same: finding the right home for my clients. 🔥 Big or small, we sell them all! 🔥 If you’re looking for an affordable, move-in ready ranch, this is THE deal for you! Let’s chat and make it happen. 📲🏡 📍 Listed by Derek Bostic with UC Premier Properties #DealOfTheWeek #SouthwestAtlanta #AtlantaRealEstate #AffordableHomes #RanchHome #MoveInReady #VAHomeLoan #AtlantaHomes #DreamHome #HouseHunting #BigOrSmallWeSellThemAll #LuxuryAndBeyond #ATLRealtor #GeorgiaRealEstate #HomeBuying #firsttimehomebuyer 📲 Contact me, Mellanda Reese, who provides exclusive services for luxury living. 📕For a FREE Sellers Guide: bit.ly/UltimateGuidetoSellingYourHome 🗓Book an discovery call with me: https://ift.tt/CUGoZMk 📞Text | call me directly @ 404-217-6005 📧Email me at [email protected] 🏡View all Homes for sale in the Atlanta area: https://ift.tt/Ukgj7M2 📈Get Your complimentary home valuations: https://ift.tt/XqRyiV9 🔔𝐃𝐨𝐧'𝐭 𝐟𝐨𝐫𝐠𝐞𝐭 𝐭𝐨 𝐬𝐮𝐛𝐬𝐜𝐫𝐢𝐛𝐞 𝐭𝐨 𝐦𝐲 𝐜𝐡𝐚𝐧𝐧𝐞𝐥 𝐟𝐨𝐫 𝐦𝐨𝐫𝐞 𝐮𝐩𝐝𝐚𝐭𝐞𝐬. https://www.youtube.com/@livinginAtlanta-MellandaReese/?sub_confirmation=1 🔗 Stay Connected With Me. Facebook: https://ift.tt/CYOtbJx Instagram: https://ift.tt/Xbyavo7 Website: https://ift.tt/CUGoZMk ============================= 🎬Suggested videos for you: ▶️ https://www.youtube.com/watch?v=AXSDQsOQ86c ▶️ https://www.youtube.com/watch?v=T0fVdReIcMk ▶️ https://www.youtube.com/watch?v=244WP8B9PZg ▶️ https://www.youtube.com/watch?v=1dSiOKqCxi8 ▶️ https://www.youtube.com/watch?v=S1pqYeqLvdI ▶️ https://www.youtube.com/watch?v=ophkA2q_GT4 ▶️ https://www.youtube.com/watch?v=2fkI1qfiD1c ================================= via Living in Atlanta with Mellanda Reese https://www.youtube.com/channel/UCc63aospoWe6yHW_-o3apIQ February 23, 2025 at 08:01AM

#realestatetips#homebuyingadvice#homesellingtips#livinginatlanta#realestatesuccess#realestate#luxurymarketupdate#sellingahomeinatlanta#Youtube

0 notes

Photo

Explore the key benefits of VA Home Loans - your path to homeownership! 🏡 Ready to make your dream a reality? Reach out to the VA Home Buyers Program today! 🌐: https://vahomebuyersprogram.com/

0 notes

Photo

Whether you’re purchasing a home with a traditional or VA loan, there are ways to save money. Some are immediate savings, while others save you money over time. If you’re able, we advise you to take advantage of these five ways to save money, even with a VA home loan.

It’s true, you don’t have to make a down payment on a VA home loan, that’s part of the attraction so many veterans have to using a VA guaranteed home loan. However, just because you don’t have to make a down payment doesn’t mean you shouldn’t take advantage of the opportunity—if you can afford it. Simply put, making a down payment on your loan saves you money, no matter what type of loan you have. This is because you’ve paid part of the principal on your loan, and that means you’re not paying as much interest. Again, this isn’t a requirement—unless you’ve exceeded your loan limit—but it can save you some money in the end.

4 notes

·

View notes

Text

youtube

Save $11K on Your VA Loan—Here's How! #shorts #vahomebuyer Save $11K on Your VA Loan—Here's How! #shorts #vahomebuyer #valoans #vahomeloan #veterans #homemortgage #savings #refinance #wholesalevsretail #homebuying #vahomeloansavings #lowerinterestrates #veteranbenefits via David Xie Mortgage Guy https://www.youtube.com/channel/UCYTXRSUzyEq7H_HSUyFzpoQ May 29, 2025 at 03:01AM

#mortgagerates#realestatetips#selfemployed#realestate#mortgage#wealthbuilding#investing#entrepreneur#Youtube

0 notes

Text

HOW TO UNDERSTAND THE VA APPRAISAL PROCESS or

WHAT CAN I DO TO CORRECT A PROBLEM WITH MY VA APPRAISAL?

HOW TO UNDERSTAND THE VA APPRAISAL PROCESS or

WHAT CAN I DO TO CORRECT A PROBLEM WITH MY VA APPRAISAL?

VA APPRAISAL PERSPECTIVE AND WHAT THE VA DID TO TRY TO IMPROVE THE APPRAISL PROCESS

As early as the late 1980s and early 1990s The VA was fielding extreme frustration from the real estate industry over VA appraisal values coming in short of the contract price.

By the late 1990’s a movement was underway, largely based on the West Coast, Oregon, Washington & California, by groups of Real Estate Agents and their organizations complaining that:

VA Appraiser were biased and intentionally set a goal of lowering values in a sale.

Not allowing real estate agents to provide input by submitting sales to be used as comparable.

Not willing to go more than a mile to use “better” comparable.

Requiring unnecessary and minor repairs.

Taking too much time to complete an assignment.

As a result, the agents believed they were being forced to either avoid VA Loans or go through the process of calling for a Reconsideration of Value (ROV).

This was having a significant negative impact, particularly in areas with heavy Military and Veteran Retirement areas.

Even on the east coast the appraisal problem was felt in a region known as “Tidewater Area” in Virginia.

In the early 2000’s, market values were moving in an upward direction, and in particular the markets in the west and northwest. It was a time of quickly changing housing prices. Homes did not stay on the market very long at all. In 2020 through late 2022 very similar conditions exist.

This back and forth between the REALTOR® community and the appraisers placed more pressure on appraisers to try to reach ‘contract value’ (which is now illegal) rather than true ‘market value’. Complaints from the prospective VA home loan users reached a frenzied level as they asserted that they could not buy the home of their dreams because of slow and low appraisals.

Due to the success of this test program in the Chesapeake Bay area of Virginia, VA made policy changes regarding fee and staff appraisers’ interaction with other program participants and in the reconsideration of value (ROV) process in December 2003, thus the birth of the Tidewater Initiative.

The TIDEWATER Solution

The, then head of the C&V (Construction & Valuation) of the Roanoke, Virginia, Regional Loan Center of the Department of Veterans Affairs, M. “Sandy” Stewart stepped in with an idea on how to either eliminate the problem or at least provide a method to attempt to do so.

A meeting was arranged between the VA Fee Panel Appraisers and any interested real estate professional agents, loan officers, and others who wanted to attend. It was held at the Central Library in the City of Virginia Beach in early 2000.

Out of that meeting a “Beta Test” was initiated that quickly became the “Tidewater Initiative”. This was spelled out in VA Circular 26-03-11 December 22, 2003, then updated in VA Circular 26-17-03 February 6, 2017, and VA Circular 26-17-18 dated July 19, 2017, and then updated again on March 11th, 2019, regarding the requirements, now known as the “Tidewater Process”.

In that process, a lender appoints a “POC” or Point of Contact on the VA Assignment form 26-1805 that lenders fill out when ordering a VA Appraisal from a VA Fee Panel Appraiser.

Circular 26-17-18 noted the POC could be whomever the lender decided would be the appropriate person, usually a person on the lenders staff such as a loan officer, or, a real estate agent involved in the transaction, heck if you had a real smart Cocker Spaniel as your assistant, she too could have been named as a POC as long as she can answer a phone and work the phones and computer.

However, on March 11th, 2019, the VA made changes to Chapter 10 of the Appraisal Process of the VA Lender Handbook. This is both good and a bit inconvenient.

The revised procedure now instructs the Lender’s VA Appraisal Requestor to be the appraiser’s first point of contact when it appears that the estimated market value will be below the sales price.

Once the appraiser determines that the appraised value may be lower than the sales price, the appraiser provides the lender’s ‘requestor’ who in turn notifies the POC of possible low value. The POC then has 2 business days to provide the appraiser with any data they wish the appraiser to consider prior to completion of the assignment.

Although the preferred method of data compilation should be prepared on the VA Grid form, the appraiser should accept any response in any format during the 2-day period, not including weekends and holidays. The appraiser then reviews the data, uses it or not, and provides a response to the POC.

That response should be in the appraisal report itself, in a format that is easily understood. If the appraiser uses a sale or other data provided by the POC, it must be acknowledged in the appraisal report. If not utilized by the appraiser, there should be sufficient commentary so that all parties can easily understand the appraiser’s reasoning for not using the data that was provided by the POC.

If completed correctly, the process should alleviate any need for a Request for Reconsideration of Value but does not necessarily preclude that possibility.

Adding such a process to all appraisals could provide a wealth of ‘Consumer Protection’ to the public. However even more useful would be a totally transparent method for consumers to engage the appraisal community when an appraisal is suspected of being faulty.

APPRAISING IN GENERAL

All appraisers reference the Marshall & Swift Cost Approach Solutions manual for guidance on many aspects of an appraisal and follow, or should follow, the guidance set forth in (USPAP) Uniform Standards of Professional Appraisal Practice.

That said, we need to remember that appraising is not a science, it is an art form. The same property could be reviewed by multiple appraisers and each of them see the value of that property in the light of a slightly different valuation. That does not make one appraiser any better or worse than another. It simply means that they are all human with their own subjective appreciation of some aspects of how the subject property is weighed against the comparable sales.

However, the objective facts remain the same for all appraisers. For example, the sold value of comparable properties is a fixed reality. The number of bedrooms, bathrooms and total rooms is a fixed reality. The square footage of the dwelling and the lot is a fixed reality and so on and so forth. Once the variable of model match (or as close as possible) has been met, and the preferred geographic boundaries have been met, some subjectivity will begin to seep into the appraiser’s value analysis.

So how does all this information prepare someone to understand the appraisal process?

For openers be very aware that is a Class 6 Felony to influence an appraiser. In Arizona this is covered in ARS 32-3633. The Federal Statute 15 U.S. Code § 1639e - Appraisal Independence Requirements is the governing authority to prosecute such misbehavior is also very relevant. Even more important, these types of statutes are not endemic to specific states in as much as all states have their own overlays to the federal statute.

Additionally, the FNMA Anti-Coercion Appraisal Rules under Truth in Lending Regulations are also in play. That rule states that, “All consumer-purpose, closed-end loans secured by a consumer’s principal dwelling originated on or after October 1, 2009, are subject to new regulations prohibiting coercion or improper influencing of appraisers.”

Any appraisal of a property offered as security for repayment of the consumer credit transaction that is conducted in connection with the transaction in which a person with an interest in the underlying transaction is subject to these rules,

So what qualifies as “Influencing an Appraiser”?

Compensate with intent to subvert the law or Extort

compensates, coerces, extorts, colludes, instructs, induces, bribes, or intimidates a person, appraisal management company, firm, or other entity conducting or involved in an appraisal,

2. Collude with or Induce or Bribe

or attempts, to compensate, coerce, extort, collude, instruct, induce, bribe, or intimidate such a person, for the purpose of causing the appraised value assigned, under the appraisal, to the property to be based on any factor other than the independent judgment of the appraiser.

3. Mischaracterize or Suborning any Mischaracterization

by mischaracterizing, or suborning any mischaracterization of, the appraised value of the property securing the extension of the credit; and who seeks to influence an appraiser or otherwise to encourage a targeted value in order to facilitate the making or pricing of the transaction

4. Intimidation

and withholding or threatening to withhold timely payment for an appraisal report or for appraisal services rendered when the appraisal report or services are provided for in accordance with the contract between the parties is in violation of 15 U.S. Code § 1639e / Influencing an Appraiser.

Penalties, if convicted of a Class 6 felonies could amount to serving a term of imprisonment of not less than one year nor more than five years, or in the discretion of the jury or the court trying the case without a jury, confinement in jail for not more than 12 months and a fine of not more than $2,500, either or both and these penalties are on the lighter side of possible adjudication. Fines topping $20,000, per convicted occurrence, are possible.

Now that may all sound pretty scary. However, any consumer, mortgage lender, mortgage broker, mortgage banker, real estate broker, appraisal management company, employee of an appraisal management company, or any other person with an interest in a real estate transaction are not prohibited from asking an appraiser to undertake 1 or more of the following:

Consider additional, appropriate property information, including the consideration of additional comparable properties to make or support an appraisal.

Provide further detail, substantiation, or explanation for the appraiser’s value conclusion.

Correct errors in the appraisal report, if you are completing a ROV.

A QUICK NOTE ABOUT ALLEGING GEOGRAPHIC COMPETENCY of an Appraiser

The appraiser is going to first try to find comparable properties, i.e., model matches etc., within the immediate subdivision. Whenever possible, the data set for comparables will be as close, in proximity to the subject property, as possible. The appraiser will try to use sales that are no older than 90 days, then expand to 180 days, then out to 1 year. However, if the pace of the real estate market has accelerated such that homes are selling in days and the marketplace has exhibited that pace for a reasonably protracted time-period, it would not be unusual for an appraiser to shorten his/her closed sales comparable properties to well short of within the last 90 days. This is another example of the ‘subjectivity’ within the appraisal process. An appraiser will usually then step out the geographic range, perhaps using major thoroughfares marking off a square or rectangle or a trapezoid.

There are few, if any, times when an appraiser will deviate or allow deviation to his/her data fields. So you are well served to not get into arguments with the appraiser over geography, unless you have evidence that the appraiser is ‘Geographically Incompetent

There are few times when a credible allegation of ‘Geographic Competency’ can be asserted. Nevertheless, according to R162-2g-502a, Standards of Conduct and Practice. (Uniform Standards of Professional Appraisal Practice (USPAP) if there is credible evidence that the appraiser IS NOT competent in areas of but not limited to, an appraiser’s familiarity with a specific type of property or asset, a market, a geographic area, an intended use, specific laws and regulations, or an analytical method, the appraisal assignment may be challenged and brought to the lender’s attention.

R162-2g-502a. Standards of Conduct and Practice. (Uniform Standards of Professional Appraisal Practice (USPAP) (4)(g)

When geographic competency is discussed, what is really being referenced is the Competency Rule of USPAP which goes beyond just geographic competency. According to USPAP, an “appraiser must determine, prior to agreeing to perform an assignment, that he or she can perform the assignment competently.” How does USPAP define competency? Again, competency goes beyond geographic competency:

“Competency may apply to factors such as, but not limited to, an appraiser’s familiarity with a specific type of property or asset, a market, a geographic area, an intended use, specific laws and regulations, or an analytical method.”

It is therefore understandable why an average consumer of the appraisal process/product may be way over his/her head in trying to work through appraisal inconsistencies or incompetency.

HOW DID WE GET WHERE WE ARE WITH THIS APPRAISAL CONUNDRUM?

In 2008 the attorney general of New York filed suit against Fannie Mae and Freddie Mac who at the time we're responsible for purchasing probably 60% of all loans originated in the United States. In short, the lawsuit alleged that lenders who sold their loans on the secondary market to Fannie Mae and Freddie Mac were getting too cozy with or had gotten too cozy with the appraisers who were appraising the properties they were financing.

A settlement was agreed to and from that came the HVCC (Home Value Code of Conduct). Under the new code mortgage brokers were prohibited from selecting appraisers; lenders or prohibited from using in-house staff appraisers to conduct the initial appraisals and lenders or prohibited from using appraisal management companies that they owned or controlled. By the beginning of 2019 the HVCC was in full force by not only Fannie Mae and Freddie Mac but also FHA.

By 2010 the Dodd Frank Wall Street Reform act had been passed. Consumer protections from misbehaving lenders and appraisers was built into the Dodd Frank act and were modeled quite tightly after HVCC. Once the Dodd Frank act went into full effect in October of 2015 HVCC was replaced by the rules and guidance issued by the Consumer Financial Protection Bureau (CFPB) which was formed in 2011 as the agency to enforce the rules set forth in the Dodd Frank Wall Street Reform act.

CFPB has published hundreds of informational guidance for the consumer on all aspects of credit lending from automobiles to insurance to home loans and credit cards. Unfortunately, and in my humble opinion, CFPB has not done a very good job at informing the public of these publications.

Many times, folks within an "ethnic enclave" or "cultural subgroup", perceive appraisal incompetence as terrorizing their home buying process. The appraisal terror that some buyers, within an "ethnic enclave" or "cultural subgroup", have experienced along with thousands and perhaps 10s of thousands of both homeowners and home buyers is not a one off. These consumers have valid concerns about a seemingly inefficient appraisal challenge process are correct in as much as we need to change the system. Educating homeowners will truly give them more power to protect themselves from inaccurate and incompetent appraisal professionals.

A consumer’s perception that their appraisal was mismanaged, either intentionally, by incompetence, or by a biased appraiser would be extremely difficult to prove. There is no way that I can profess to understand what fears and concerns a person/s within a minority community might have, of being treated equally and fairly as a person of color. That said the description of some appraisal processes that some folks within an "ethnic enclave" or "cultural subgroup" have experienced matches much more closely to the need for change in the appraisal process with respect to consumer engagement rather than a preponderance of racial bias within the appraisal process.

As a licensed real estate agent, with over 30 years’ experience, and the National Legislative Committee Chair at the Veteran’s Association of Real Estate Professionals (VAREP) the topic of consumer advocacy in the real estate and appraisal arena of the real estate transaction, my team and I and other well-informed colleagues are working on legislation that will improve transparency in all aspects of the real estate transaction to include the appraisal process.

A recent law (Improving the VA Home Loan Benefit Act of 2022) was passed in December 2022 that affirmed to the Veterans Administration that improvements to the appraisal process and appraisal challenge process will be made to the VA appraisal process.

About The Author:

G2 Varrato II is an Arizona Licensed REALTOR® for over 30 years and Ret. U.S. Air Force, Red Horse VAREP National Legislative Committee Chair/Director NAR Federal Financing & Housing Policy Committee 12/2022 to 11/2023 AZ State Director VAREP 2016/2019 NAR Diversity Committee Veteran Advocate, REALTOR® 2018/2019 Lifetime Member River Rats Air Force Sergeants Association (VSO) Red Horse Association Air Force Association

Visit Lori & G2 at https://www.lukeairforcebasespecialist.com/ eMail at [email protected] or C: 602-796-5674

0 notes

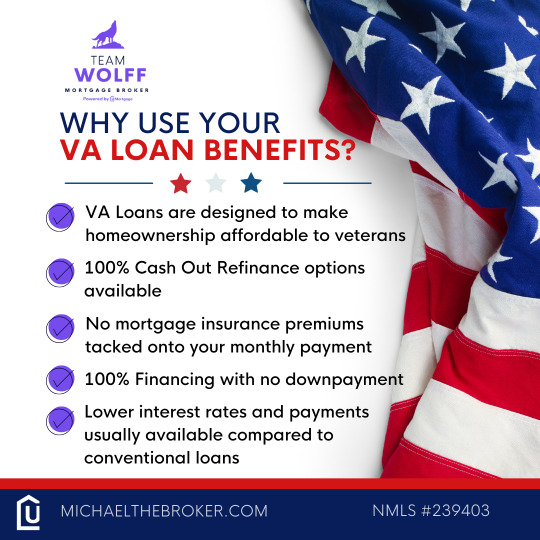

Photo

The Department of Veterans Affairs has developed a special type of home loan product exclusively for veterans and active servicemembers which doesn't require a down payment and comes with many other benefits. Some veterans are unaware of their VA loan benefits. If you’re a veteran and still haven’t explored all the benefits of this powerful mortgage loan type. Don’t let this happen to you, Let's talk! 😉 Michael Wolff U Mortgage-Branch Manager NMLS #239403 NC SC CA FL TN SD AK 323.646.8367 . . . . .

#michaelthebroker#realestate#mortgagepro#fortbragg#camplejeune#ncrealestate#raleighnc#military#homebuyingtips#realestateadvice#valoan#veterans#firsttimehomebuyers#valoans#vahomeloan#homeloan#mortgagebroker#ncrealtors#valoanspecialist

0 notes

Text

Why Is It Beneficial to Get A VA Home Loan Bad Credit in Aurora, IL?

The VA loan programme is the greatest mortgage option for many people who qualify. VA loans, which are backed by the United States Department of Veterans Affairs, are intended to assist active-duty military people, veterans, and certain other groups in becoming homeowners at a low cost.

Among many other benefits, the VA loan needs no down payment, no mortgage insurance, and has lax qualification standards. Everything you need to know about qualifying for and using a VA Home Loan Bad Credit in Aurora, IL is right here.

No Down Payment Required

When acquiring a home, conventional home loans ask borrowers to pay up to 20% of the loan amount. In comparison, because the government backs the loan, VA home loans do not demand any money down when purchasing.

The sole price present at closing is the financing fee, which is a tiny, one-time fee ranging from 1.25 percent to 3.3 percent of the overall loan amount. This charge can be paid in full up front, or it can be rolled into the life of the loan and paid down over time, removing the need for a large down payment upon purchasing.

There Are No Mortgage Insurance Premiums.

Because the government insures and backs your loan, you won't have to pay any Private Mortgage Insurance. This can save you hundreds of dollars in mortgage payments each year.

There Is No Minimum Credit Score

When it comes to house loans, many conventional lenders seek for a minimum credit score of roughly 620, however it may go up to 720 in some situations. However, there is no minimum credit score requirement for VA loans. Some organisations, such as Low VA Rates, deal with customers with all credit histories if they have the necessary income and employment stability.

Refinancing

It is entirely fine to refinance your VA home loan in order to obtain a cheaper interest rate or cut your monthly payments. Some forms of VA refinancing loans, unlike conventional home loans, may not need income verification or a house evaluation.

Underwriting Flexibility

Many applicants who obtain a VA home loan would not have qualified for a regular house loan. They are, nonetheless, able to obtain a VA home loan due to the liberal underwriting rules that include more than simply the credit score.

While underwriting criteria vary depending on where you receive your loan, they are often less stringent because veterans and servicemembers have earned the right to become homeowners via their service.

If a VA home loan ticks all of your boxes and you meet all of the VA loan standards, the next step is to be preapproved. Preapproval allows you to shop for houses in your price range and create a connection with a lender, which are two of the most important stages in becoming a homeowner.

0 notes

Photo

VA Home Loans offer veterans and service members a path to homeownership. Our expert team is here to assist you every step, from finding your dream home. Call us now! 🌐: https://vahomebuyersprogram.com/

0 notes