#Vendor Payments

Explore tagged Tumblr posts

Text

How Outsourcing AP Processes Boosts Efficiency for Growing Firms

In today’s fast-paced business environment, managing finances efficiently is key to sustainable growth. One of the most strategic decisions a company can make is opting for accounts payable outsourcing. This approach allows businesses to streamline operations, reduce manual errors, and improve financial visibility.

AP automation is at the core of modern outsourcing solutions. By integrating automated tools, companies can eliminate the need for manual data entry, speed up invoice approvals, and ensure timely payments. This results in smoother workflows and fewer late fees, all while freeing up valuable time for your internal finance team.

Another major benefit is enhanced vendor payments management. With outsourcing, your payables are handled by experts who ensure that suppliers are paid accurately and on time. This not only strengthens supplier relationships but also helps in negotiating better payment terms and early-payment discounts.

Cost reduction is a compelling reason many growing businesses turn to outsourcing. Outsourced AP services eliminate the need for hiring, training, and maintaining a large accounts team. You only pay for what you use, leading to significant operational savings.

Furthermore, outsourced finance services offer scalability. As your business grows, your accounts payable needs evolve. Outsourcing partners are equipped to handle increased volume without compromising accuracy or efficiency, making it a future-ready solution.

In conclusion, accounts payable outsourcing isn't just a cost-cutting move—it’s a growth strategy. By leveraging AP automation, improving vendor payments, and utilizing outsourced finance services, businesses can enhance financial performance while focusing on what they do best: growing.

#accounts payable outsourcing#AP automation#vendor payments#cost reduction#outsourced finance services

0 notes

Text

youtube

Discover the smart features that empower businesses to manage expenses effortlessly using RazorpayX Corporate Cards. From enhanced security and vendor payment automation to seamless integration with accounting systems, this video demonstrates how our solution can drive better financial control. For more details, visit razorpay.com/x/corporate-cards.

#Smart Expense Management#Corporate Cards#Business Finance#RazorpayX#Vendor Payments#Secure Transactions#Digital Payments#Youtube

0 notes

Text

Optimize Vendor Payments with Efficient Vendor Management Software

In today’s dynamic business environment, the effective handling of vendor payments plays a role in maximising cash flow, ensuring transactions, and nurturing strong relationships with suppliers. However, outdated manual vendor management procedures can be cumbersome, prone to mistakes, and consume resources. This is where vendor management software steps in, offering a solution to streamline the vendor payment workflow and unlock efficiencies.

#Vendor Management#Vendor Payments#Vendor management software#Vendor Management System#Vendor Management Service

0 notes

Text

GUESS WHO IS OFFICIALLY GONNA BE VENDING AT HER FIRST ART MARKET NEXT SUNDAY WOOOOOOO

#gotta be honest i found out yesterday i got accepted as a vendor but i did the restant payment today#which means i can start advertising!!#i'll be selling art prints#postcards of both my art and handmade ones by my grandma#crocheted stuffed animals (theyre very cute very wholesome) and scarfs and blankets (by my grandma)#very excited!!!!#i'll post some good pictures here after the event <333

12 notes

·

View notes

Text

police, banks, legal actors: never ever ever pay demands sent to you by text or phone. signed invoices only. get receipts.

collection companies: if we send a text with a sum and a bank number but no other information, people will surely pay

#this has only happened to me twice but it pisses me off so much#listen guys i would love to pay you i hate having outstanding costs but for the fucking love of god#make a slight effort to not look *exactly* like the other 25 scam messages i got this week#if i had a nickel#for every text i get warning that my 'payment' is 'overdue' please send 200 dollars to 'this number' from a sender that looks#vaguely like a bank#from an automated or stock phone number#i could probably retire soon#brought to you by someone who had to contact a vendor this week going hey hi hello why the fuck have i gotten a debt notice#and they said#we sent you an sms#and if i hadnt lived 8hrs from their office#i would have shown up at their front desk#and strangled them to death with my bare hands.

10 notes

·

View notes

Text

"Statement of medical efficacy" from the guy who says he doesn't put much stock in people relying on medicine alone to get better, okay Kusu lol

#mononoke#mononoke oni#mononoke book#mononoke kusurirui#mononoke medicine vendor#adventures in japanese#also setting up shop in a mostly abandoned castle what a great business strategy#although i mean he didnt bother getting payment from the inn before the proprietess got eaten by a mononoke either#its a good thing his actual trade is mononoke because he's really kinda shit at the whole merchant thing#(this assuming it's the same kusu and like...who knows but i say yeah until proven otherwise or i get mad lol)

8 notes

·

View notes

Text

Here is my cultural shock of the day: it wasn't until I started working for an American company that I learned people expected to pay for their online purchases only once the product shipped.

A demand that I found patently absurd the first time I encountered it, because never once, in my whole life, has online shopping worked that way for me.

#I was like... 'Yeah of course we took your money? You made a purchase?'#'You pay first. THEN we package and ship things.'#cannot imagine how business only charge at the moment of shipping.#isn't that a logistical nightmare?#there are costs associated with packaging things. You need labor and packing supplies.#and there are costs associated with processing payments!! processing payments is hard!!#I know many online platforms don't release the money to the vendor until things are delivered#but I still PAY when I PLACE the order#wild!!

21 notes

·

View notes

Text

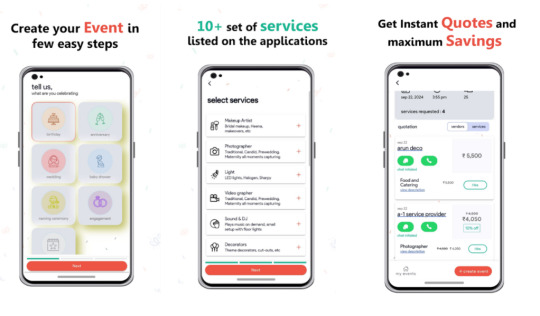

🎉 Say Hello to Seamless Event Planning with Ootbo App! 🎉

Planning an event can feel like juggling too many tasks at once. From finding the perfect venue to managing vendor communications and staying within budget, it’s easy to get overwhelmed. But what if you had an app that handled everything in one place? Enter the Ootbo App—the ultimate event planning tool designed to make organizing events stress-free, seamless, and fun! 🎈

Whether you’re planning a wedding, corporate event, birthday party, or any special occasion, the Ootbo App is your go-to solution for managing every aspect of the event planning process. 🗓️✨

🌟 Why Choose Ootbo App?

Gone are the days of switching between multiple apps, emails, and spreadsheets. Ootbo App simplifies the entire event planning process, from start to finish. Here’s how:

1. Create Events Effortlessly 🎨

Ootbo offers an intuitive interface that allows you to create detailed events in minutes. Simply input event details, set the date and time, and let Ootbo do the rest. 💡 Pro Tip: Customize your event profile to include specific requirements and preferences for vendors!

2. Receive Multiple Vendor Quotes 💼

Why chase down vendors when they can come to you? With Ootbo, you can: 🔍 Post your event requirements. 📩 Receive multiple quotes from verified vendors. 📊 Compare options side-by-side to choose the best fit.

This saves you time and ensures you get competitive pricing without the hassle of endless phone calls. 📞

3. In-App Vendor Chats 💬

Communication is key when planning an event, and Ootbo has you covered! 📱 Chat with potential vendors directly through the app. 📋 Discuss availability, services, and pricing in real time. 📎 Share documents, photos, and event details seamlessly.

Forget the confusion of scattered email threads—Ootbo keeps all your conversations in one place, organized and easy to access.

4. In-App Calls for Quick Decisions 📞

Sometimes, a quick call can make all the difference. Ootbo allows you to: 🔊 Make in-app calls to vendors without sharing personal contact details. 📌 Record important discussions and reference them later. 📈 Keep all event-related calls connected to your event profile.

No more searching through your call history for vendor numbers—everything stays in the app!

5. Hire Vendors with Confidence 🤝

Once you’ve reviewed quotes and discussed details, hiring your chosen vendor is as easy as a tap! 📄 Securely finalize agreements within the app. 💳 Pay vendors through a secure payment gateway. 🔒 Enjoy peace of mind knowing your transactions are protected.

With Ootbo, you’re not just hiring vendors—you’re partnering with professionals who are ready to make your event a success! 🎉

🏆 The Benefits of Using Ootbo App

All-in-One Solution: Manage your event from creation to completion in a single app.

Time-Saving: No more endless emails, phone calls, or spreadsheets.

Competitive Pricing: Receive and compare quotes to get the best value for your budget.

Seamless Communication: Chat and call vendors directly within the app.

Secure Transactions: Make payments and finalize contracts with confidence.

🎯 Who Can Use Ootbo?

Ootbo is designed for everyone! Whether you’re:

👰 Planning a wedding. 🏢 Organizing a corporate event. 🎂 Hosting a birthday party. 🎭 Coordinating a community event.

Ootbo App is your trusted event planning companion.

📲 Download the Ootbo App Today!

Ready to take the stress out of event planning? Download the Ootbo App today and experience the future of event management!

🔗 Visit Ootbo App to learn more. 📱 Available on iOS and Android.

Make your next event unforgettable with Ootbo! 🎉

With the Ootbo App, event planning has never been easier or more efficient. Start planning your dream event today! 🎈

#vent planning app#Best event management tool#Event vendor management#In-app vendor communication#Compare event vendor quotes#Event budget management app#Online event planning solution#Seamless event planning app#Event planning made easy#Chat with event vendors#Event organizer tool#Hire vendors online#Manage events from mobile#Event planning software for Android & iOS#ow to plan events with a mobile app#Best app to hire event vendors#Manage event budgets and vendors in one app#Event planning solution for weddings and parties#Secure in-app payments for event vendors

2 notes

·

View notes

Text

Accounts Payable Services

Financial efficiency has become essential in today's fast-paced and dynamic company climate. Managing outgoing payments precisely and on schedule is one of the most important parts of financial operations. Accounts payable services are useful in this situation. These services make sure that companies keep accurate records and comply with regulations while effectively fulfilling their vendor responsibilities.

Accounts that work Payable management helps businesses avoid fraud, late penalties, and lost payments while also improving cash flow and supplier relationships. For companies trying to boost productivity and streamline financial operations, automating accounts payable outsourcing services is a strategic move.

What Are Accounts Payable Services?

Accounts payable services pertain to the procedures and solutions used to handle a company's short-term debts, mainly those owing to suppliers and vendors. It includes financial reporting, tax compliance, vendor communication, payment scheduling, and invoice processing.

These duties were previously completed by hand, which frequently resulted in errors, missed payments, and fraud threats. Businesses may now automate and handle accounts payable with more speed, accuracy, and transparency thanks to modern digital tools and expert outsourcing providers.

From data input and invoice reception to approvals and final payments, outsourced vendor payment solutions offer end-to-end support, guaranteeing that everything goes without a hitch and doesn't interfere with business operations.

Why Businesses Need Accounts Payable Services

Every company, regardless of sector, works with suppliers, vendors, and outside service providers. Sound financial health, solid supplier relationships, and operational continuity are all ensured by methodically handling these payments. The following justifies the importance of spending money on expert invoice processing services:

1. Accuracy and Compliance

Human error, incorrect entries, and missed deadlines are common in manual processing. In order to prevent expensive errors, professional services match invoices with purchase orders, automate approvals, and accurately log each payment.

2. Fraud Prevention

Unauthorized transactions, incorrect billing, and duplicate payments—all common hazards in unmonitored systems—are avoided with a simplified and thoroughly defined accounts payable service structure.

3. Cost Savings

Businesses may drastically cut labor expenses, processing time, and error corrections while guaranteeing on-time payments and avoiding fines by automating invoice processing and outsourcing repetitive work.

4. Real-Time Insights

Businesses may make better financial decisions by using digital vendor payment systems, which give them real-time insight on liabilities, cash flow, and spending trends.

Impenn’s Trusted Accounts Payable Services

Impenn is among the most dependable and progressive suppliers in this field. Their accounts payable services are designed to satisfy the particular requirements of both startups and established companies. Impenn has assisted businesses in streamlining their vendor payment systems and enhancing financial control with an emphasis on automation, compliance, and cost effectiveness.

To provide flawless accounts payable processes, Impenn combines extensive financial knowledge, secure digital infrastructure, and process automation. Because their services are made to fit in seamlessly with your current workflows, finance personnel will be able to concentrate on strategic goals rather than tedious activities.

Core Features of Impenn’s Accounts Payable Services

Impenn’s end-to-end Financial process outsourcingoffer everything a modern business needs to manage liabilities with precision. Some key features include:

1. Invoice Capture & Data Validation

To guarantee consistency, invoices are obtained via a variety of sources, including email, portals, and scanned documents, and they are compared to purchase orders. AI and optical character recognition (OCR) technologies minimize human data entry.

2. Automated Approval Workflows

Workflows that can be customized streamline internal operations and cut down on turnaround time by ensuring that invoices are sent to the appropriate parties for inspection and approval.

3. Payment Processing

To guarantee that suppliers are paid precisely and on time, payments are scheduled and processed through banks, business systems, or secure payment channels after approval.

4. Vendor Management

With its vendor onboarding, record-keeping, and communication services, Impenn helps companies keep positive working relationships with their suppliers while reducing disagreements.

5. Audit and Compliance Support

Time stamps, comments, and supporting documentation are recorded for each transaction, speeding up audits and guaranteeing adherence to accounting and tax regulations.

6. Reporting & Analytics

Finance managers may see payables, unpaid bills, payment cycles, and expenditure patterns with the use of dashboards and comprehensive reports.

Benefits of Outsourcing Accounts Payable Services

By outsourcing accounts payable services, businesses can unlock a host of benefits that go beyond cost savings:

1. Scalability

Interactions with vendors expand along with your business. You can manage increasing volumes without adding more staff if you work with an outside service provider like Impenn.

2. Expertise On-Demand

Gain access to specialized assistance, automation tools, and seasoned financial specialists without having to pay for an internal staff.

3. Enhanced Controls

Accountability is increased with centralized dashboards, digital trails, and structured workflows that let you always know where your funds stand.

4. Reduced Cycle Times

Faster processing and approval of invoices enables businesses to avoid late fees and benefit from early payment reductions.

Who Needs Accounts Payable Services?

Accounts Payable outsourcing companies are beneficial for companies across sectors, especially those handling high volumes of transactions or multi-vendor operations. Examples include:

Retail & E-commerce: With hundreds of supplier payments, automation ensures accuracy and timely fulfillment.

Healthcare: Accurate and timely payments to vendors, labs, and equipment providers are essential for continuity.

Manufacturing: Complex supply chains need robust payment systems to avoid production halts.

IT Services: Timely vendor payments improve outsourcing relationships and service delivery.

Hospitality: Hotels and restaurants benefit from organized vendor billing and streamlined operations.

Technology & Security at the Core

Impenn’s accounts payable services are based on a safe, cloud-based framework. To safeguard sensitive financial data, data privacy, encryption, and access restrictions are integrated into each stage of the process. Your company will remain ahead of changing regulatory requirements if you do regular upgrades and compliance inspections.

Their technology offers a smooth experience without interfering with your current procedures by integrating with ERP platforms such as SAP, Oracle, Zoho, and QuickBooks.

Why Choose Impenn for Accounts Payable Services?

Tailored Solutions: Custom workflows designed for your unique business needs.

Affordable Pricing: Transparent, flexible pricing for SMEs and large enterprises.

Proven Expertise: Years of experience in finance and compliance services.

Quick Onboarding: Get up and running with minimal setup time.

Dedicated Support: A responsive team ready to resolve issues and assist with transitions.

If you're looking to eliminate inefficiencies, reduce costs, and ensure compliance, Impenn's accounts payable outsourcing companies offer a reliable solution.

Delays, mistakes, or inefficiencies in their financial operations are unacceptable for modern organizations. Services for accounts payable offer the resources and know-how needed to improve transparency, manage liabilities efficiently, and fortify vendor relationships. Automating and outsourcing your payables can revolutionize your company's financial foundation, regardless of your size.

Impenn’s trusted, tech-enabled approach to accounts payable outsourcing helps organizations achieve faster processing, lower costs, and improved compliance—all while freeing internal teams to focus on core business functions.

🔗 Visit Website For more Information: www.impenn.in

Visit Impenn’s account payable services page here: 🔗 https://impenn.in/accounts-payable-services.html

#Accounts Payable Services#AP outsourcing companies#Invoice processing services#Vendor payment solutions#Financial process outsourcing#accounts payable outsourcing services

1 note

·

View note

Text

Rightpath Global Services: The Experts in Payables Outsourcing

In today's fast-paced business environment, efficient financial operations are key to success. Rightpath Global Services (Rightpath GS) offers cutting-edge Business Process Management solutions, specializing in accounts payable outsourcing. By automating and managing payables, businesses can reduce errors, save time, and focus more on growth strategies rather than manual accounting tasks.

Their customized solutions help companies maintain vendor relationships, ensure timely payments, and improve compliance. With complete visibility and control, clients benefit from reduced costs and enhanced productivity.

Partnering with Rightpath Global Services for accounts payable outsourcing transforms finance operations. Their Business Process Management approach not only optimizes workflows but also ensures scalability as your company grows. Trust in Rightpath GS to manage your financial backend while you focus on innovation and expansion.

#finance outsourcing#vendor payment solutions#workflow automation#invoice processing#outsourcing finance operations

0 notes

Text

How to Get a Kratom Merchant Account for Your Business

Introduction

In the present day, if you are running a kratom business, you must face unique challenges when it comes to payment processing. In the United States, due to its legal framework and regulatory oversight, kratom is positioned in the high-risk category, which makes it difficult to obtain a standard kratom merchant account. However, that doesn’t mean you don’t have options.

This guide will walk you through how to apply for a kratom-friendly merchant account, what to expect during the application process, and why partnering with a reliable provider like Merchantech — trusted merchant services for kratom eCommerce — is crucial.

Understanding Kratom and the High-Risk Label

What is Kratom?

A natural herb, kratom is made from the leaves of the Mitragyna speciosa tree, which is unique to Southeast Asia. It comes in extract, powder, and capsule form and is used for its calming and energizing properties. In the United States, its legal status is complicated — some states permit it, while others do not, despite its rising popularity.

Why is Kratom Considered High-Risk?

Kratom sellers often face obstacles due to:

Legal restrictions and bans in some regions

Potential for misuse and FDA scrutiny

High chargeback rates from misinformed buyers

These factors push kratom into the high-risk category, making it necessary to work with specialized providers offering affordable credit card processing for kratom sellers.

What is a Kratom Merchant Account?

Definition and Purpose

A payment processing solution for the kratom vendors who sell kratom in-store and online is called a kratom merchant account. It allows kratom dealers to accept credit and debit cards securely.

How It Differs from a Standard Merchant Account

Unlike regular merchant accounts, kratom merchant accounts involve:

Stricter underwriting processes

Higher transaction fees

Specialized compliance documentation

That’s why it’s vital to choose the best payment processor for kratom vendors who understand your industry-specific needs.

Steps to Get a Kratom Merchant Account

1. Research High-Risk Merchant Account Providers

Start looking for payment processors who are master or pro in high-risk businesses like Merchantech, known for supporting high-risk businesses and offering tailored solutions for herbal product vendors.

2. Need to Submit the Essential Documents

Prepare:

Should have a Valid Business licence and an Employee Identification number

Ready with Financial statements and bank records

A policy of Refund and Return

Should have a Secure Website with Privacy and Policy Page(Legally Compliant

Having this ready makes it easier to apply for a kratom-friendly merchant account without delays.

3. Ensure Website Compliance

A compliant site should have:

Age verification prompts

A clear refund policy

Disclaimers about product usage and legal limitations

4. Proceed with submitting the Applications

Once you are ready with documents and the website, you can now submit the applications through a provider like Merchantech. Merchantech understands the Kratom industry and offers affordable credit and debit card processing for kratom dealers.

5. Negotiate Rates and Terms

Review and negotiate:

Processing charges

Criteria for Chargeback

Schedule for Settlement

Follow the tips below to get faster approval

You need to maintain clear business records.

Businesses should void chargebacks and comply with laws

Partner With a Knowledgeable Processor

Providers like Merchantech specialize in high-risk accounts and streamline the approval process for kratom sellers.

Be Honest About Your Products

Underwriters are more likely to trust you if your product listings and business plan are transparent.

Common Challenges and How to Overcome Them

High Processing Fees

Due to perceived risk, rates are typically higher. However, affordable credit card processing for kratom sellers is still possible when working with the right provider.

Risk of Account Termination

To avoid sudden shutdowns:

Maintain low chargeback ratios

Keep communication open with your provider

Have a backup payment processor ready

FAQs About Kratom Merchant Accounts

Is it legal to sell kratom online?

Yes, but legality varies by state. Always check your local regulations before operating.

Can I use PayPal or Stripe for my kratom store?

No. Mainstream processors usually do not support kratom due to its high-risk classification.

How long does it take to get approved?

Approval timelines range from 1 to 5 business days if all documents are submitted correctly.

What documents are required?

You’ll typically need a valid business license, bank statements, processing history, and a fully compliant website.

Conclusion:

Getting a kratom merchant account might seem daunting, but with the right guidance and a trusted partner like Merchantech, the process becomes manageable. When you apply for a kratom-friendly merchant account, focus on compliance, documentation, and selecting the best payment processor for kratom vendors to ensure smooth, secure transactions.

By investing in a reliable solution for affordable credit card processing for kratom sellers, you not only protect your business but also build a foundation for long-term success.

0 notes

Text

Routefusion – Simplify B2B Cross Border Payments for Your Business

Expanding your business globally? Routefusion makes B2B Cross Border Payments simple, fast, and secure. Our platform empowers businesses to send and receive payments across borders without the usual complexities and high fees. With support for multiple currencies and regions, you can pay international partners, suppliers, and contractors with ease. Routefusion ensures regulatory compliance, competitive exchange rates, and transparent fees—helping your business save time and money. Focus on growth while we handle your global payments. Visit here: https://www.routefusion.com/cross-border-fx-payments

0 notes

Text

Charge Capture: A Vital Key to Healthcare Revenue

Charge capture is the process of accurately and timely documenting all services provided to patients, including procedures, tests, medications, and other healthcare services. While it may seem straightforward, effective charge capture is essential for healthcare organizations to maximize revenue and maintain financial health.

Why Charge Capture Matters:

Accurate Billing and Claims: Well-captured charges lead to complete and accurate claims, reducing denials and rejections.

Faster Reimbursement: Accurate claims are processed more quickly, accelerating revenue collection.

Maximized Revenue: By capturing all billable services, healthcare providers avoid lost revenue and identify additional opportunities.

Improved Financial Performance: Timely and accurate revenue collection strengthens the financial position and cash flow of healthcare organizations.

Enhanced Compliance and Risk Mitigation: Adherence to regulations and well-documented charges minimize the risk of audits and penalties.

Common Challenges in Charge Capture:

Complex Coding and Billing Rules: The ever-evolving healthcare landscape and frequent regulatory changes can make charge capture complex.

Human Error: Manual processes are prone to errors, leading to inaccurate or incomplete claims.

Time Constraints: Busy healthcare providers may lack time for accurate documentation.

Lack of Standardization: Inconsistent documentation practices hinder efficient charge capture.

Strategies for Effective Charge Capture:

Robust Policies and Procedures: Develop clear guidelines for documentation, coding, and billing.

Regular Training: Provide regular training to healthcare providers and staff on charge capture best practices and regulatory updates.

Advanced Technologies: Utilize EHRs with built-in charge capture features and specialized charge capture software to streamline the process.

Real-Time Charge Capture: Capture charges at the point of service to improve accuracy and timeliness.

Regular Audits and Monitoring: Conduct regular audits to identify and address issues.

Strong Collaboration: Foster effective communication and collaboration between clinical and billing teams.

Overcoming Charge Capture Challenges: The Power of Outsourcing

To address these challenges and optimize charge capture, healthcare organizations often turn to medical billing outsourcing services. By outsourcing medical billing, providers can:

Reduce Administrative Burden: Offload time-consuming tasks like coding, billing, and claims submission to experts.

Improve Accuracy and Efficiency: Benefit from specialized knowledge and advanced technology to minimize errors and optimize workflows.

Enhance Compliance: Ensure adherence to complex regulations and avoid costly penalties.

Focus on Core Competencies: Free up valuable time and resources to focus on patient care.

Achieve Cost Savings: Realize cost savings through economies of scale and streamlined processes.

Choosing the Right Medical Billing Outsourcing Partner

When selecting a medical billing outsourcing company, consider the following factors:

Expertise and Experience: Look for a partner with a proven track record in handling diverse healthcare specialties and insurance payers.

Advanced Technology: Ensure they utilize state-of-the-art technology and software to streamline processes and improve accuracy.

HIPAA Compliance: Prioritize a partner committed to safeguarding patient privacy and data security.

Transparent Reporting: Seek a partner that provides detailed reports on key performance indicators (KPIs) to track progress and identify areas for improvement.

Strong Client Support: Choose a partner with responsive and dedicated customer support to address any concerns or questions promptly.

By strategically outsourcing medical billing, healthcare organizations can significantly improve charge capture, enhance revenue cycle management, and ultimately achieve greater financial success.

Read more: https://www.allzonems.com/are-you-neglecting-charge-capture/

#ophthalmology medical billing#payment posting services#insurance eligibility verification#chiropractic billing services#chiropractic billing company#chiropractic medical billing#claim submission process in medical billing#denial management solutions#denial management services#denial management in healthcare#denial management strategies#denial management companies#denial management in medical billing#revenue cycle management services#healthcare revenue cycle management services#outsourcing revenue cycle management#revenue cycle management automation#revenue cycle management outsourcing#end to end revenue cycle management#revenue cycle management companies#outsource revenue cycle management services#cardiology medical billing#medical billing audit services#outsource medical billing services#rcm services#revenue cycle management service#revenue cycle management vendors#outsource revenue cycle management#outsourced revenue cycle management#healthcare rcm companies

0 notes

Text

Vendor Payments Software: Streamline Vendor Payment Services

Optimize your business operations with our Vendor Payments Software. Streamline payment processes, ensure timely transactions, and improve vendor relationships with secure, efficient solutions.

0 notes

Text

Navigating Data Tokenization Vendors for Digital Subscription Platforms

Switching payment vendors can be complex, yet it often proves essential for benefiting from updated features, enhanced service, and cost savings. Changing vendors involves migrating stored payment credentials, a process that requires re-tokenization and can put merchant and customer data at risk. Ensuring a smooth token payment migration demands strategic planning, careful consideration, and thorough execution.

#payment tokenization services#data tokenization vendors#digital subscription platform#digital subscription software

0 notes

Text

I’m in charge of vendor setup at work and it’s insane how dumb people are. They refuse to log in to our payment portal and give us their banking information to PAY THEMMM then they like find the number of my HR manager and scream at them about a past due invoice and now the HR manager emailing me like “hello, can you take care of this promptly?”

#that’s when I CC the HR manager in a 35+ email chain of me begging the vendor to login to our payment portal#like dating back to January#it took me 68 emails to get HydroFlask paid

0 notes