#WPI data

Explore tagged Tumblr posts

Text

Stock Market Updates: Sensex Rises Over 100 Points, Nifty Above 24,600 In Pre-Open - News18

Last Updated:May 14, 2025, 09:14 IST Indian equity markets are expected to open higher on Tuesday, taking cues from positive global developments Stock Market Today Sensex Today: Indian equity markets are expected to open higher on Tuesday, taking cues from positive global developments, including easing trade tensions between the US and China. Over the weekend, both nations agreed to reduce…

#FII activity#GIFT Nifty#global market cues#Indian equity markets#market outlook#MSCI rejig#Nifty#Nifty Today#Q4 earnings#retail inflation India#Sensex#Sensex Today#stock market news#stock market opening#stock market today#Tata Motors#US China trade#WPI data

0 notes

Text

Spintronics memory innovation: A new perpendicular magnetized film

Long gone are the days where all our data could fit on a two-megabyte floppy disk. In today's information-based society, the increasing volume of information being handled demands that we switch to memory options with the lowest power consumption and highest capacity possible. Magnetoresistive Random Access Memory (MRAM) is part of the next generation of storage devices expected to meet these needs. Researchers at the Advanced Institute for Materials Research (WPI-AIMR) investigated a cobalt-manganese-iron alloy thin film that demonstrates a high perpendicular magnetic anisotropy (PMA)—key aspects for fabricating MRAM devices using spintronics. The findings were published in Science and Technology of Advanced Materials on November 13, 2024. "This is the first time a cobalt-manganese-iron alloy has strongly shown large PMA," says Professor Shigemi Mizukami (Tohoku University),

Read more.

#Materials Science#Science#Spintronics#Magnetism#Thin films#Anisotropy#Alloys#Cobalt#Manganese#Iron#Tohoku University

19 notes

·

View notes

Text

Researchers find dark matter dominating in early universe galaxies

An international team of researchers has found dark matter dominating the halos of two supermassive black holes in galaxies roughly 13 billion light years away, reports a new study published in The Astrophysical Journal on February 5.

Their study gives new insight into the relationship between dark matter and supermassive black holes when the universe was still very young, and how galaxies have evolved until today.

The first person to discover that dark matter played an important role in galaxies was astronomer Vera Rubin, who in the 1970s, noticed that the outer parts of local galaxies were rotating at higher speeds than expected, forming what was later named a flat rotation curve. If galaxies were only made up of stars and gas, and obeyed Newton's laws, the outskirts of a galaxy would move slower than the peak velocity closer to the galaxy’s center. Rubin’s observations could only make sense if there were a large amount of invisible mass, later called dark matter, that surrounded the galaxy like a halo, allowing stars and gas anywhere far from the galaxy center to move at higher velocity. Furthermore, dark matter assembly so far back in the universe has never been observationally constrained and remains unknown, despite its fundamental importance to our understanding of the Universe.

A research team led by The University of Tokyo Kavli Institute for the Physics and Mathematics of the Universe (Kavli IPMU, WPI) visiting researcher and Peking University graduate student Qinyue Fei, and including Kavli IPMU Professor John Silverman, the University of Texas Austin’s Dr. Seiji Fujimoto, and Peking University Kavli Institute for Astronomy and Astrophysics Associate Professor Ran Wang, have studied the dark matter content of supermassive black holes about 13 billion light years away.

“Vera Rubin provided the first evidence for dark matter using the rotation curves of nearby local galaxies. We’re using the same technique but now in the early universe,” said Silverman.

Made possible using data from the Atacama Large Millimeter/submillimeter Array (ALMA) and the ionized carbon (C+) emission line, the researchers were able to uncover the gas dynamics of two quasar host galaxies at redshift 6. By studying the rotation curves of each galaxy (Figure 2), they found dark matter made up about 60 per cent of its total mass.

Velocity changes with radius in the galaxy are captured by blue-shifted gas (moving towards the researchers), and the red-shifted gas (moving away) (Figure 1).

Interestingly, the rotation curves in the distant universe from past studies reveal a decrease in the galaxy outskirts, meaning a low fraction of dark matter. But the data taken by Fei and Silverman’s team shows a flat rotation curve, similar to the massive disk galaxies close to Earth, which indicates more dark matter is required to explain the high velocities (Figure 2).

The team's findings shed light on the intricate relationship between dark matter and supermassive black holes. They offer a crucial piece of the puzzle in understanding how galaxies evolved from the early universe to the structures we observe today.

TOP IMAGE: Left: Gas distribution of ionized carbon (C+) on the halo scale of P009-10 as shown by the color image and black contours. Nuclear gas distribution, centered on the quasar (large black cross), is shown by the magenta contours. Right: Velocity field of the C+ emission from -200 (in blue; moving towards us) to +200 (in red; moving away from us) km/s indicating coherent rotation in a massive dark matter halo. Credit Fei et al.

LOWER IMAGE: Rotation curves of distant galaxies. Fei et al. data, in red and blue, remains relatively flat (i.e., high), similar to local massive disk galaxies at z~0 (dashed grey line) that need extended dark matter to explain their high velocities. The results from other galaxies at redshift~2-3 (in gray data points) show a rotation curve that decreases at the outskirts. This leads to a low dark matter fraction. Credit Fei et al.

7 notes

·

View notes

Text

Perfekcyjny Jazu domu

Żeby Was... Nie, to nie będzie kolejny wpis o sprzątaniu kibla :P Posłuchajcie:

Jak mnie niemiłosiernie łeb napierdala! Rzygać mi się chce. Ciśnienie albo ki diabeł. Porządki jednak zaplanowane.

//

Ja przepraszam za niepotrzebne wulgaryzmy, ale wszelkich przydasi i innych to mam od chuja fest. Zeszyt z matematyki z piątej klasy podstawówki. Różne karty, naszywki, smycze, przybory szkolne, naklejki, gwoździe, słodycze... itp., itd., i wszystko inne. No po prostu czas zrobić przesiew.

//

Zabawki, słodycze i przydasie podzieliłem na Pierwszych, Czwartych i Piątego. Pora pogodzić się z prawdą, że nie wpierdolę tych słodyczy i przekąsek choćbym się zesrał. A data leci. To samo z zabawkami, chociaż serce mi drży, bo są naprawdę wiekowe i w stanie nowości. Dusza mi pęka na samą myśl, że jakiś bachor je zepsuje albo pogubi T.T No ale na co mi one? Został Tygrys. Mam go od trzeciego roku życia. NIE ODDAM!

//

Kupiłem sobie nową czapkę. Za to znalazłem dwie stare. Moja ulubiona czapka jeszcze z czasów szkoły średniej. Przez rok czasu w wilgoci rozlazła się jak stare gacie. Jaki smutek. Klapki i czepek basenowe też opierdolił grzyb XD Nie wiedziałem, że to możliwe jest w ogóle. Rękawiczki! XD Kurwa. Wczesne gimnazjum. Na kiego czorta ja to trzymam? Też grzybem zaszły. Resztę, która jeszcze jest do uratowania, wrzuciłem do pralki, bo szkoda. Alba z czasów lektorskich. Ręczna robota. Wyszywana. Rarytas! Ochronił ją worek. Zadzwoniłem do kościoła. Przyjmą.

//

Wywaliłem trzy pudełka po butach z gratami. Wezwanie na WKU XD Przeniosłem też figurę swojego Patrona nad łóżko. Ma do wyboru - spadnie albo nie. Na szafie wśród gratów nie wyglądał dobrze. Wystarczy, że musi mi patronować.

//

Skończyłem święta. Iluminacje, szopka, choinka do szafy. Przy drzwiach ustawiłem globus, klepsydry i podgrzewacz. Boszz... Trzy lata zagracał mi ten szajs od koleżanek z pracy. Globus. Mi. Na chuj mnie to?!

//

Ponieważ siostrzyczka @aquilanew-blog mnie tak pozytywnie natchnęła... Kupiłem sobie nowy odkurzacz :P Bezworkowy. Teraz będę żarł chyba te syfy co zbiorę, ale jaram się niezdrowo. Może to będzie ten impuls który mnie ożywi.

//

Jeszcze tylko poskładać ciuchy i mogę walić w chuja. Kurwixy zostawiam na weekend.

//

A teraz trochę Sztuki która miała być wczoraj, ale wczoraj było źle.

youtube

youtube

11 notes

·

View notes

Text

*Farewell* *to* *Modi.*

You will be shocked to see how India has changed in last 5 years

*1.* India is now suffering from Highest Unemployment Rate in 45 years _(NSSO data)_

*2.* All Top 10 most polluted cities in world are now in India _(WHO data)_

*3.* Number of Indian Soldiers Martyred is highest in 30 years now _(Washington Post)_

*4.* India now has Highest Income Inequality in 80 years _(Credit Suisse Report)_

*5.* India has become world's worst country for women _(Thomas Reuters Survey) _

*6.* Kashmiri youth joining militancy is highest in 10 years _(Indian Army data)_

*7.* Indians Farmers suffered Worst Price Crash in 18 years _(WPI Data)_

*8.* Highest ever Cow related violence and Mob Lynchings on record after Modi became PM _(India Spend Data)_

*9* India is now World's Second most Unequal Country _(Global Wealth Report)_

*10* Indian Rupee is now Asia's worst Performing Currency _(Market Data)_

*11* India has become World's Third Worst Country in Environment Protection _(EPI 2018)_

*12* First time in history of India, foreign funding and corruption is legalized _(Finance Bill 2017)_

*13* Our current PM is the Least accountable Prime Minister in 70 years _(First PM to give 0 press conferences)_

*14* First time in history of India, CBI vs CBI, RBI vs Govt, SC vs Govt fights happened because Modi wanted control of all democratic Institutions

*15* First time in history of India, 4 Supreme Court judges gave a press conference to say _”Democracy is in Danger”_

*16* First time in history of India, top secret Defence documents stolen from Defence Ministry office _*(Rafale)*_

*17* Intolerance and Religious Extremism is highest in 70 years _(Personal observation because no data for this exists)_

*18* Indian Media is now Worst in 70 years _(Personal Observation)_

*19* First time in history of India, if you criticize our Govt, you will be labeled *Anti-National*

Biggest proof for this - Try to forward this message on WhatsApp and Modi Bhakts around you will call you Anti-National.

But we must not fear. None of what I said in this message is a Jumla. All the data given above is *100% verified FACTS*. You can verify them yourself by doing a google search on any point. *This is the reality of what has happened to our India. *

*Modi Govt is the Worst Govt India has ever had in last 70 years.*

Some people say that 2019 elections are the last elections that will happen in India. Because if Modi wins this time, he will desperately want to control all institutions of our democracy and we will become a *dictator ship.*

Do not fear, share this message.

Save our Democracy. Save our India.

#indian politics#indian#india#mustshare#sharethis#must watch#like and/or reblog!#share if you can#share this post#share this please#super interesting#super important#narendra modi#urgent appeal#urgent#show your support#2000 posts

3 notes

·

View notes

Text

भारतीय अर्थव्यवस्था से जुड़ी वो बातें जो UPSC Prelims 2026 में जरूर आएंगी

When it comes to cracking UPSC Prelims 2026, one of the most crucial subjects is Indian Economy. Not only is it scoring, but it also connects deeply with current affairs, making it a favorite area of focus for question setters. In this blog, we break down the must-know concepts, syllabus structure, current trends, and expert tips that every serious aspirant should follow.

This blog is crafted with insights from top UPSC mentors and experts from the Best IAS Academy in Delhi, Bajirao IAS Academy.

Why Indian Economy Is a Game-Changer for UPSC Prelims?

The Indian Economy is dynamic, vast, and directly linked to real-world governance. Questions in UPSC Prelims often test your:

Conceptual clarity

Awareness of recent economic developments

Knowledge of government schemes and economic reforms

“Economy is not about numbers; it’s about how policies touch people’s lives. UPSC loves that human angle.”

UPSC Prelims 2026: Indian Economy Syllabus Breakdown

UPSC doesn’t define a topic-wise economy syllabus for Prelims. However, based on previous years' papers and expert mapping, the key areas include:

Basic Concepts – GDP, GNP, Inflation, Deflation, Repo Rate, Fiscal Deficit, etc.

Banking & Monetary Policy – RBI, types of banks, NBFCs, CRR, SLR

Government Schemes – Especially related to poverty, employment, women, and agriculture

Budget and Economic Survey Highlights – Focus on key data, reforms, and initiatives

External Sector – Balance of Payments, exchange rate management, trade policy

Current Affairs – Global market trends, India’s trade performance, employment rate

Most Expected Topics for UPSC Prelims 2026

Based on trends from the last 10 years and expert predictions:

Impact of global oil prices on India

Digital economy and UPI

Unemployment rate trends and reports (like PLFS)

India's FDI inflows and Ease of Doing Business

Start-up India, Make in India, and Atmanirbhar Bharat

Role of RBI in economic stability

Recent budget allocations for health and education

Global slowdown and Indian economic resilience

Preparation Strategy: Learn Smart, Not Hard

Stick to NCERTs and Standard Books: Class 11 & 12 Economics, followed by books like Ramesh Singh or Sanjeev Verma.

Follow Current Affairs Religiously: Refer to newspapers like The Hindu or Indian Express, and PIB.

Practice MCQs Daily: Focus on economic data, reports, and scheme-based questions.

Weekly Revision: Economic concepts are interlinked. Regular revision helps retain them better.

“Integrate editorials with your static syllabus. That’s how toppers connect the dots.”

Indian Economy and Global Market Link

In recent years, UPSC has shown a growing interest in questions that connect Indian economy with international developments. For example:

How does the US Fed rate hike affect India’s inflation?

What is India’s role in BRICS bank or G20 finance?

These themes reflect how UPSC expects aspirants to think globally but answer locally.

Economic Data You Should Remember

Some data points are repeated in UPSC again and again:

Current GDP growth rate (as per Economic Survey)

Unemployment rate (PLFS)

Inflation trends (CPI & WPI)

Fiscal deficit target in Union Budget

These figures should be on your fingertips.

Quotes

“Economy questions are not random. They're indicators of what the government thinks is important.”

“Think like a policymaker when studying economy. That’s the secret to scoring.”

Economy + Strategy = Success

Mastering the Indian Economy for UPSC Prelims 2026 is not about mugging facts. It’s about:

Understanding the 'why' behind every policy

Knowing the implications of economic changes

Keeping yourself updated daily

Students from the Best IAS Academy in Delhi, especially Bajirao IAS Academy, are trained to combine smart reading, data retention, and current affairs analysis.

With the right guidance, study plan, and discipline – you can turn Indian Economy into your strongest scoring area.

Are you ready to decode the economy and crack UPSC Prelims 2026 with confidence? Start today, stay consistent, and trust the process.

#upsc#upscaspirants#upscindia#upsc2026#Best IAS Academy in Delhi#upscmentorship#indian economy#economy

0 notes

Photo

Image used for consultant objective solely. | Photo Credit: Reuters The rupee depreciated 22 paise and fell beneath 86 degree to shut at 86.02 (provisional) in opposition to the U.S. greenback on Monday (July 15, 2025) amid an increase in international crude oil costs and a strengthening buck. Foreign fund outflows and delay in any breakthrough within the India-U.S. commerce deal additional pressured the native unit, in keeping with foreign exchange merchants. At the interbank overseas alternate, the native unit opened at 85.96 and traded in a slender vary of 85.92-86.05 earlier than settling at 86.02 (provisional), down 22 paise from its earlier shut. The rupee depreciated 10 paise to shut at 85.80 in opposition to the U.S. greenback on Friday. "The Indian rupee again fell as India-U.S. trade deal was yet to be seen while U.S. President Donald Trump applied tariffs on the EU and Mexico, two of its biggest trading partners. Dollar index rose and kept the rupee lower for the entire day while Asian currencies were slightly weaker," Anil Kumar Bhansali, Head of Treasury and Executive Director, Finrex Treasury Advisors LLP, stated. The greenback index, which gauges the buck's power in opposition to a basket of six currencies, rose 0.03% to 97.82. Brent crude, the worldwide oil benchmark, rose 1.56% to $71.46 per barrel in futures commerce. "The Reserve Bank of India [RBI] was present to protect the rupee while FPIs who were sellers of equity on Friday were dollar buyers, keeping rupee well bid for the whole day without any major correction. We expect the rupee to move between 85.75 and 86.25 on Tuesday as we await for U.S. CPI data," he stated. An Indian Commerce Ministry group reached Washington for one more spherical of talks on the proposed bilateral commerce settlement (BTA), in keeping with an official. The four-day talks will begin on Monday and conclude on Thursday. On the home fairness market entrance, the Sensex declined 247.01 factors to settle at 82,253.46, whereas the Nifty dropped 67.55 factors to 25,082.30. Wholesale value inflation (WPI) turned unfavorable after a spot of 19 months, declining 0.13% in June as deflation widened in meals articles and gas, together with softening in manufactured product prices, authorities information confirmed on Monday. Foreign institutional buyers (FIIs) bought equities price ₹5,104.22 crore on a web foundation on Friday, in keeping with alternate information. Further, the most recent RBI information launched on Friday confirmed India's foreign exchange reserves dropped $3.049 billion to $699.736 billion within the week ended July 4. Published - July 14, 2025 04:11 pm IST Read More: https://news.unicaus.in/market/rupee-falls-22-paise-to-settle-at-86-02-in-opposition-to-u-s-greenback/

0 notes

Text

WPI inflation turns negative in June at (-) 0.13%

New Delhi: Wholesale price inflation (WPI) declined to (-) 0.13 per cent in June as prices of food articles and fuel saw deflation, along with easing in manufactured product costs, government data showed Monday. WPI-based inflation was 0.39 per cent in May. It was 3.43 per cent in June last year. “Negative rate of inflation in June, 2025 is primarily due to decrease in prices of food articles,…

View On WordPress

0 notes

Text

Philippines Whey Protein Market Growth and Development Insight - Size, Share, Growth, and Industry Analysis- MarkNtel Advisors

According to Markntel Advisors Report, Philippines Whey Protein Market is expected to grow at a significant growth rate, and the analysis period is 2024-2030, considering the base year as 2023. Consistent monitoring and evaluating of market dynamics to stay informed and adapt your strategies accordingly. As a market research and consulting firm, we offer market research reports that focus on major parameters including Target Market Identification, Customer Needs and Preferences, Thorough Competitor Analysis, Market Size & Market Analysis, and other major factors. At the end, we do provide meaningful insights and actionable recommendations that inform decision-making and strategy development.

Whey protein is a high-quality protein derived from whey, the liquid portion of milk that separates during cheese production. It is rich in essential amino acids and bioactive compounds, making it a popular dietary supplement for muscle building & weight management.

Global Philippines Whey Protein Market Research Report & Summary:

The Philippines Whey Protein Market size is estimated to grow at a CAGR of around 6.44% during the forecast period, i.e., 2024-30.

Time Period Captured in the Report:

Historical Years: 2019-22

Base Years: 2023

Forecast Years: 2024-2030

Who are the Key Players Operating in the Philippines Whey Protein Market?

The top companies of the Philippines Whey Protein Market ruling the industry are:

V3 Group, NutraBio, Iovate Health Sciences International Inc., Glanbia plc, USN UK Limited, SANN Corp., Athlene Nutrition, Nestlé S.A., NutraBio Labs, Inc., Nutrex Research, Inc., and Others

✅In case you missed it, we are currently revising our reports. Click on the below to get the latest research data with forecast for years 2025 to 2030, including market size, industry trends, and competitive analysis. It wouldn’t take long for the team to deliver the most recent version of the report.

Access the detailed PDF Sample report – https://www.marknteladvisors.com/query/request-sample/philippines-whey-protein-market.html

("Kindly use your official email ID for all correspondence to ensure seamless engagement and access to exclusive benefits, along with prioritized support from our sales team.")

What is Included in Philippines Whey Protein Market Segmentation?

The Philippines Whey Protein Market explores the industry by emphasizing the growth parameters and categorizes including geographical segmentation, to offer a comprehensive understanding of the market dynamic. The further bifurcations are as follows:

-By Product Type

-Whey Protein Concentrate (WPC)- Market Size & Forecast 2019-2030, Thousand Tons

-Whey Protein Isolate (WPI)- Market Size & Forecast 2019-2030, Thousand Tons

-Whey Protein Hydrolysate (WPH)- Market Size & Forecast 2019-2030, Thousand Tons

-By Application

-Sports Nutrition- Market Size & Forecast 2019-2030, Thousand Tons

-Food & Beverages- Market Size & Forecast 2019-2030, Thousand Tons

-Dietary Supplements- Market Size & Forecast 2019-2030, Thousand Tons

-Others (Animal Feed, Infant Formula, etc.)- Market Size & Forecast 2019-2030, Thousand Tons

-By Price Range

-Budget- Market Size & Forecast 2019-2030, Thousand Tons

-Economy- Market Size & Forecast 2019-2030, Thousand Tons

-Premium- Market Size & Forecast 2019-2030, Thousand Tons

-By Distribution Channel

-Online Stores- Market Size & Forecast 2019-2030, Thousand Tons

-Offline- Market Size & Forecast 2019-2030, Thousand Tons

-Supermarkets/Hypermarkets- Market Size & Forecast 2019-2030, Thousand Tons

-Pharmacies- Market Size & Forecast 2019-2030, Thousand Tons

-Others (Specialty Stores, Convenience Stores, etc.)- Market Size & Forecast 2019-2030, Thousand Tons

-By Region

-Luzon

-Visayas

-Mindanao

Access The Full report: https://www.marknteladvisors.com/research-library/philippines-whey-protein-market.html

Market Dynamics -Global Philippines Whey Protein Market:

Health Awareness and Lifestyle Changes Propel the Philippines Whey Protein Market- Sedentary lifestyles and a high intake of processed foods mostly go hand in hand with urbanization. Moreover, due to the increase in the working population in the country, the consumer does not have sufficient time to prepare healthful food for daily nutrition. Therefore, the risk of diabetes has been increasing over time in the country. For instance,

Based on the International Diabetes Federation (IDF), the estimated number of people currently living with diabetes in 2021 is 4,303,900 in the Philippines. This would further increase to 5,456,300 by 2030 & and 7,503,900 by 2045.

Doctors often encourage diabetes patients to keep a healthy weight and avoid the negative effects of this disease. Consequently, patients with diabetes have embraced whey protein, as its consumption lowers blood sugar levels by ensuring the body retains the necessary amount of insulin and achieves a healthy weight. Therefore, owing to the increasing prevalence of diabetes all over the Philippines, the demand for whey protein-based products has increased within the country, thereby boosting the overall Philippines Whey Protein Market.

In addition, the high burden of obesity, which is further increasing and most prevalent among adolescents, the Philippines provides unlimited opportunities for whey protein-based products. Obesity increases the risk of many diseases and health problems, such as heart disease & high blood pressure. Thus, along with the trend of people being more conscious of the adversities of obese lifestyles, there would be a growing interest in healthier dietary choices. This would, hence, augment demand for whey protein supplementation in the Philippines and act as a significant driving force for market growth in the Philippines.

Need personalized insights? Click here to customize this report- https://www.marknteladvisors.com/query/request-customization/philippines-whey-protein-market.html

Why Markntel Advisor Report?

MarkNtel Advisors is a leading consulting, data analytics, and market research firm that provides an extensive range of strategic reports on diverse industry verticals. We being a qualitative & quantitative research company, strive to deliver data to a substantial & varied client base, including multinational corporations, financial institutions, governments, and individuals, among others.

We have our existence across the market for many years and have conducted multi-industry research across 80+ countries, spreading our reach across numerous regions like America, Asia-Pacific, Europe, the Middle East & Africa, etc., and many countries across the regional scale, namely, the US, India, the Netherlands, Saudi Arabia, the UAE, Brazil, and several others.

For Further Queries:

Contact Us

MarkNtel Advisors

Email at [email protected]

Corporate Office: Office No.109, H-159, Sector 63, Noida, Uttar Pradesh - 201301, India

0 notes

Text

Dobrzy ludzie > nie wszysto co w internecie to jest prawda !

Zgoda, nie wszystko, co jest w internecie, jest prawdą. Internet jest pełen informacji, ale ich wiarygodność i rzetelność mogą być bardzo różne. Trzeba być świadomym, że w sieci krąży wiele fałszywych informacji, dezinformacji, a także celowych kłamstw. Staję po stronie wiarygodności i dobrych manier.

Warto pamiętać o kilku kwestiach: Źródło informacji: Zawsze sprawdzaj, skąd pochodzi informacja. Czy to wiarygodne źródło, jak np. oficjalna strona instytucji, czy może anonimowy blog? Data publikacji: Informacje mogą się dezaktualizować. Upewnij się, że dany artykuł lub post jest aktualny. Weryfikacja: Szukaj potwierdzenia informacji w innych, niezależnych źródłach. Fakty i opinie: Staraj się odróżniać fakty od opinii. Logiczne myślenie: Czy informacja ma sens? Czy jest prawdopodobna? Dezinformacja i fake newsy: Uważaj na treści, które mają na celu wprowadzenie w błąd. Osoby korzystające z internetu powinny być krytyczne i świadome, że nie wszystko, co tam znajdą, jest prawdą. Niestety, często mamy do czynienia z dezinformacją i manipulacją, dlatego tak ważne jest rozwijanie umiejętności krytycznego myślenia i weryfikacji informacji.

Drodzy internauci, owy wpis jest opublikowany wg. informacji stworzonych przez tzw. sztuczną inteligencję. opublikowane: enviro heritage

ID tekstu: N39lsk

0 notes

Text

Atomic force microscopy reveals microtubule defects at submolecular resolution

In a study recently published in the journal Nano Letters, researchers from Nano Life Science Institute (WPI-NanoLSI), Kanazawa University, Kanazawa, Japan, used frequency-modulated atomic force microscopy to reveal the submolecular structure of microtubule (MT) inner surface and visualize structural defects in the MT lattice, providing valuable insights into the complex dynamic processes that regulate microtubule function. Microtubules (MTs), a key component of the cytoskeleton in eukaryotic cells, serve as scaffolds and play vital roles in cellular processes such as cell division, cell migration, intracellular transport, and trafficking. MTs are composed of α-tubulin and β-tubulin proteins, which polymerize into dimers and assemble into linear protofilaments that form a cylindrical lattice. Traditional methods like X-ray crystallography and cryo-electron microscopy have provided structural insights into MTs but involve complex sample preparation and data analysis. There remains a need for techniques that can examine MT structural features, assembly dynamics, and lattice defects at submolecular resolution under physiological conditions.

Read more.

#Materials Science#Science#Atomic force microscopy#Materials characterization#Biomaterials#Defects#Kanazawa University

11 notes

·

View notes

Text

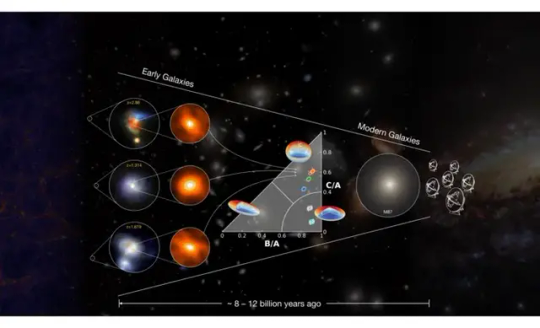

Astronomers witness the in situ spheroid formation in distant submillimetre-bright galaxies

An international team of researchers including The University of Tokyo Kavli Institute for the Physics and Mathematics of the Universe (Kavli IPMU, WPI) has found evidence showing that old elliptical galaxies in the universe can form from intense star formation within early galaxy cores. This discovery will deepen our understanding of how galaxies evolved from the early Universe, reports a new study in Nature.

Galaxies in today’s Universe are diverse in morphologies and can be roughly divided into two categories: younger, disk-like spiral galaxies, like our own Milky Way, that are still forming new stars; and older, elliptical galaxies, which are dominated by a central bulge, no longer forming stars and mostly lacking gas. These spheroidal galaxies contain very old stars, yet how they formed has remained a mystery—until now. The discovery of the birth sites of giant, elliptical galaxies – announced in a paper published today in Nature – come from analyzing data from the Atacama Large Millimeter/submillimeter Array (ALMA) on over 100 Submillimeter Bright Galaxies (SMGs) with redshifts dating to the “Cosmic noon” era, when the universe was between around 1.6 and 5.9 billion years old and many galaxies were actively forming stars. This study provides the first solid observational evidence that spheroids can form directly through intense star formation within the cores of highly luminous starburst galaxies in the early Universe, based on a new perspective from the submillimeter band. This breakthrough will significantly impact models of galaxy evolution and deepen our understanding of how galaxies form and evolve across the Universe. In this study, researchers led by Chinese Academy of Sciences Purple Mountain Observatory Associate Researcher Qinghua Tan, and including Kavli IPMU Professor John Silverman, Project Researcher Boris Kalita, and graduate student Zhaoxuan Liu, used statistical analysis of the surface brightness distribution of dust emission in the submillimeter band, combined with a novel analysis technique. They found that the submillimeter emission in most of sample galaxies are very compact, with surface brightness profiles deviating significantly from those of exponential disks. This suggests that the submillimeter emission typically comes from structures that are already spheroid-like. Further evidence for this spheroidal shape comes from a detailed analysis of galaxies’ 3D geometry. Modeling based on the skewed-high axis-ratio distribution shows that the ratio of the shortest to the longest of their three axes is, on average, half and increases with spatial compactness. This indicates that most of these highly star-forming galaxies are intrinsically spherical rather than disk-shaped. Supported by numerical simulations, this discovery has shown us that the main mechanism behind the formation of these tri-dimensional galaxies (spheroids) is the simultaneous action of cold gas accretion and galaxy interactions. This process is thought to have been quite common in the early Universe, during the period when most spheroids were forming. It could redefine how we understand galaxy formation. This research was made possible thanks to the A3COSMOS and A3GOODSS archival projects, which enabled researchers to gather a large number of galaxies observed with a high enough signal-to-noise ratio for detailed analysis. Future exploration of the wealth of ALMA observations accumulated over the years, along with new submillimeter and millimeter observations with higher resolution and sensitivity, will allow us to systematically study the cold gas in galaxies. This will offer unprecedented insight into the distribution and kinematics of the raw materials fueling star formation. With the powerful capabilities of Euclid, the James Webb Space Telescope (JWST), and the China Space Station Telescope (CSST) to map the stellar components of galaxies, we will gain a more complete picture of early galaxy formation. Together, these insights will deepen our understanding of how the Universe as a whole has evolved over time.

IMAGE: Schematic diagram shows how spheroid formation occurs in distant submillimetre-bright galaxies, and how this process connects to the evolution of giant elliptical galaxies in today's Universe. On the far left, we have RGB images from JWST (using F444W for red, F227W for green, and F150W for blue) showcasing examples from our sample of galaxies. The cyan dashed ellipse marks the concentrated region of submm emission, with zoomed-in views highlighting the ALMA submm images. Also shown is a classification of the galaxies' intrinsic shapes. The average shape parameters for our full sample (green ellipse), a subsample of submm-compact galaxies (orange ellipse), and a subsample of submm-extended galaxies (blue ellipse) are compared to local early-type galaxies (red ellipse) and late-type galaxies (represented by purple and cyan spiral shapes). Credit: Qing-Hua Tan

4 notes

·

View notes

Text

The Impact of Economic Indicators on Your Investments Portfolio

In the world of investing, timing and information are everything. But what drives market momentum, influences investor sentiment, and causes valuations to rise or fall? The answer lies in one powerful concept: economic indicators.

Understanding how these indicators work and affect your investments is key to building a resilient, high-performing portfolio. At Rits Capital, we empower investors to decode these signals and align their wealth strategies with the macroeconomic environment.

What Are Economic Indicators?

Economic indicators are key statistics that help assess the health and trajectory of a country’s economy. They are released by government bodies, central banks, or independent institutions and fall into three broad categories: a. Leading indicators – Predict future economic activity (e.g., stock indices, manufacturing PMI).

b. Lagging indicators – Confirm existing trends (e.g., unemployment rate, inflation).

c. Coincident indicators – Move in sync with the economy (e.g., GDP, industrial production).

Investopedia defines economic indicators as “macroeconomic data points used to gauge current or future economic performance.”

Why Economic Indicators Matter for Your Investments?

Your investment portfolio—whether in equities, bonds, real estate, or alternative assets—is constantly exposed to macroeconomic forces. Economic indicators help you:

Predict market cycles and align your asset allocation

Adjust risk exposure in times of volatility

Time market entries and exits

Spot sectoral and asset class opportunities

At Rits Capital, we integrate these macroeconomic insights into our advisory approach to help clients make smarter, data-driven investment decisions. You can explore our Market Pulse section for the latest updates.

Key Economic Indicators and Their Portfolio Impact

Let’s decode how specific economic indicators impact different asset classes.

1. Gross Domestic Product (GDP) What it shows: Overall economic output of a country.

Impact on investments:

A growing GDP indicates robust economic activity—benefiting equity markets, real estate, and corporate bonds.

A shrinking GDP may lead to risk aversion, prompting investors to shift towards debt and gold.

Investment Insight: During GDP booms, cyclical stocks (e.g., infra, auto, banking) tend to outperform.

2. Inflation Rate (CPI & WPI) What it shows: Rise in the cost of goods and services over time.

Impact on investments:

High inflation erodes purchasing power and often prompts central banks to raise interest rates.

Equities may suffer (especially rate-sensitive sectors like auto or housing).

Bonds tend to underperform in high inflation due to falling prices.

Commodities like gold often act as inflation hedges.

Example: From 2021–2023, India’s CPI inflation hovered around 6%, triggering monetary tightening and affecting equity valuations.

3. Interest Rates (Repo Rate by RBI)

What it shows: Cost of borrowing in the economy.

Impact on investments:

Rising interest rates make borrowing expensive, slowing corporate earnings—negatively impacting stock prices.

Conversely, rate hikes benefit short-duration debt instruments and FDs.

Falling rates boost real estate, banking, and consumer sectors.

Investor Tip: Monitor RBI monetary policy reviews closely to rebalance your portfolio.

4. Unemployment Rate

What it shows: Percentage of the labor force that is unemployed and seeking work.

Impact on investments:

A rising unemployment rate indicates economic stress.

Consumer demand drops, hitting retail, travel, and discretionary spending sectors.

Defensive sectors like healthcare, FMCG, and utilities become more attractive.

Strategic Move: In uncertain job markets, build exposure to low-volatility sectors.

Currency Exchange Rates

What it shows: Value of the Indian Rupee against major currencies like the USD.

Impact on investments:

A falling rupee hurts importers (e.g., oil, electronics), while benefiting exporters (e.g., IT, pharma).

A weak currency can raise inflation, impacting all asset classes.

Global Investors Note: Currency risk is critical for foreign investments and dollar-based portfolios.

For more technical understanding, read the Wikipedia article on economic indicators.

Portfolio Positioning with Economic Indicators

You can explore our insights on portfolio allocation strategies to learn more.

Real-World Example: COVID-19 to Post-Pandemic Recovery

In March 2020, leading indicators like market indices, PMI, and consumer confidence collapsed. Investors who moved to safety (debt, gold) preserved capital. By late 2020, economic data began recovering—those who acted on GDP growth and improving employment data saw strong equity returns through 2021–22.

Lesson? Watching the right indicators early can help you protect and grow your wealth.

Final Thoughts

Economic indicators aren’t just for economists—they are critical tools for every investor. By understanding the macro landscape, you can:

Position your portfolio in advance of major shifts

Minimize risks from inflation, rate changes, or economic slowdowns

Exploit opportunities in sectors or geographies based on trends

At Rits Capital, our research-backed, macro-aware approach helps clients navigate the markets with clarity and confidence.

#economic indicators for investors#macroeconomic trends India#GDP and investment#inflation impact on portfolio#interest rate investment strategy#repo rate RBI#unemployment and markets#currency exchange risk#economic indicators meaning#investment strategy India#EconomicIndicators#Macroeconomics#InvestmentStrategy#PortfolioInsights#RitsCapital#MAGA#MakeAssetsGrowAgain#RiseWithRits#GDPImpact#InflationRisk#RepoRate#UnemploymentTrends#MarketPulse#DataDrivenInvesting#SmartInvesting#FinancialMarkets#InvestorEducation#IndianEconomy#WealthManagement#RBIUpdates

0 notes

Text

WPI falls to 14 to 0.39% in May of May; Food, fuel pricing facility

Wholesale Prices Inflation (WPI) (WPI) Food Articles, Product Products and Fuel Listed on government data on Monday. WPI-based inflation is 0.85 percent in April. In May last year, it was 2.74 percent in May. The WPI is dipped to a 14-month low. The Ministry of Commerce and Industries stated that in May 2025, food products, electricity, electricity, other products, chemical and chemical products…

0 notes

Text

Breakthrough Dual-Atom Catalyst Boosts Zinc-Air Battery Performance for Real-World Applications

A research team led by Dr. Di Zhang at Tohoku University’s Advanced Institute of Materials Research (WPI-AIMR) has developed a novel dual-atom catalyst (DAC) that significantly enhances the oxygen reduction reaction (ORR) in zinc-air batteries (ZABs), overcoming key limitations in efficiency and durability. This innovation could pave the way for more efficient, long-lasting, and cost-effective energy storage solutions.

Key Research Highlights:

🔹Dual-Atom Catalyst Design: The catalyst, named Fe₁Co₁-N-C, features closely paired iron (Fe) and cobalt (Co) atoms embedded in a nitrogen- and carbon-rich porous matrix. This precise atomic pairing was designed using advanced computational modeling combined with experimental synthesis, optimizing catalytic activity in alkaline conditions.

🔹Superior Catalytic Activity: Fe₁Co₁-N-C outperforms traditional platinum-based catalysts by accelerating the ORR kinetics, a critical bottleneck in ZAB performance. It avoids issues like platinum scarcity, high cost, and susceptibility to poisoning by impurities.

🔹Outstanding Battery Performance: Zinc-air batteries equipped with this catalyst exhibit an open-circuit voltage of 1.51 V, high energy density of 1,079 Wh/kg (based on zinc), and stable operation across a broad current density range (2–600 mA/cm²).

🔹Exceptional Durability: The batteries maintained stable cycling performance for over 3,600 hours and 7,200 charge-discharge cycles, demonstrating remarkable longevity suitable for real-world applications.

🔹Porous Structure & Mass Transport: The catalyst’s porous architecture, created via hard template synthesis and CO₂ activation, facilitates rapid reactant diffusion and electron transport, enhancing overall efficiency.

🔹Future Directions: The team plans to refine atomic pairings further and develop advanced characterization techniques to pinpoint active catalytic sites, aiming to push the boundaries of energy conversion efficiency and cost-effectiveness.

🔹Open Science Contribution: Key data from this research is shared on the Digital Catalysis Platform (DigCat), supporting the broader catalyst discovery community.

This breakthrough represents a significant step toward scalable, affordable zinc-air batteries that could power electric vehicles, grid storage, and portable electronics with high energy density and sustainability.

#BatteryResearch #ZincAirBatteries #DualAtomCatalyst #CleanEnergy #MaterialsScience #Innovation

0 notes

Text

Wholesale Inflation Falls To 0.85% In April

New Delhi: Wholesale price inflation dropped to 0.85 per cent in April as prices of food articles, manufactured products, and fuel eased, government data showed on Wednesday. WPI-based inflation was 2.05 per cent in March. It was 1.19 per cent in April last year. ” Positive rate of inflation in April, 2025 is primarily due to an increase in prices of manufacture of food products, other…

#food inflation India#Food products prices#wholesale inflation#Wholesale Price Index#Wholesale price inflation#Wholesale price inflation 2025

0 notes