#WealthStrategies

Explore tagged Tumblr posts

Text

HDB Financials Price Drop to Rs. 740 Risk or opportunity?

The world of unlisted shares is often described as a wild west of investments – thrilling, potentially lucrative, and sometimes, a little unpredictable. For months, whispers about HDB Financials Services’ impending IPO had sent its unlisted share price soaring, reaching stratospheric highs and creating a buzz among investors. Many saw it as a sure bet, a golden ticket to substantial returns.

But in a surprising twist, the much-anticipated HDB Financial IPO price band has been set at ₹700-₹740 per share. This is a significant drop from its previous unlisted highs, where shares touched ₹1,475 to ₹1,550 in September 2024. For those who bought in during the peak, the announcement came as a wake-up call. The reality check? Notional losses of up to 40-50% for early private investors.

The Ascent: A Look Back at HDB’s Unlisted Price Trajectory

To truly understand the current scenario, it’s vital to examine the journey of HDB Financial Services unlisted shares. These shares were once the crown jewels of the unlisted market in India, frequently trading at a premium due to:

Strong Parentage: Backed by HDFC Bank, India’s leading private lender.

Robust Financials: Steady revenue growth, healthy margins, and a stable loan book.

IPO Speculation: High market expectations for a blockbuster listing.

Between mid-2023 and late 2024, the shares climbed from around ₹1,000 to an all-time high of ₹1,550. Even as recently as June 18, 2025, prices hovered around ₹1,200-₹1,250 in the grey market, reflecting strong speculative sentiment.

Financial Highlights:

FY2024 Revenue: ₹11,157 crore (vs ₹8,928 crore in FY2023)

PAT: ₹2,461 crore, up 26% YoY

EPS: ₹31.03

These figures, coupled with the brand strength of HDFC, drove massive demand in the unlisted equity segment.

For more insights on top private companies to watch, visit Rits Capital’s Top Unlisted Shares of 2025.

To truly understand the current scenario, it’s vital to examine the journey of HDB Financial Services unlisted shares. These shares were once the crown jewels of the unlisted market in India, frequently trading at a premium due to:

Strong Parentage: Backed by HDFC Bank, India’s leading private lender.

Robust Financials: Steady revenue growth, healthy margins, and a stable loan book.

IPO Speculation: High market expectations for a blockbuster listing.

Between mid-2023 and late 2024, the shares climbed from around ₹1,000 to an all-time high of ₹1,550. Even as recently as June 18, 2025, prices hovered around ₹1,200-₹1,250 in the grey market, reflecting strong speculative sentiment.

Financial Highlights:

FY2024 Revenue: ₹11,157 crore (vs ₹8,928 crore in FY2023)

PAT: ₹2,461 crore, up 26% YoY

EPS: ₹31.03

These figures, coupled with the brand strength of HDFC, drove massive demand in the unlisted equity segment.

For more insights on top private companies to watch, visit Rits Capital’s Top Unlisted Shares of 2025.

The Correction: IPO Price vs Grey Market Hype

The stark contrast between the grey market premium and the actual IPO pricing points to a fundamental disconnect:

The grey market is sentiment-driven and speculative.

An IPO price band is determined through structured valuation, investor feedback, and industry benchmarking.

Why the Fall?

Valuation Rationalisation: Bankers valued HDB in line with listed NBFC peers like Bajaj Finance and Shriram Finance.

IPO Pricing Discipline: Institutional investors pushed for realistic valuations amid market volatility.

Overspeculation: The unlisted market priced in excessive optimism without official guidance from the company.

Important Note: The investment bankers clearly stated that grey market prices had no role in the final IPO pricing.

Regulatory Influence: The RBI’s Deadline

Another major factor shaping the IPO was the Reserve Bank of India’s directive for upper-layer NBFCs to list by September 2025. This compliance deadline likely:

Accelerated the IPO timeline

Influenced the company to adopt a more conservative pricing strategy

By listing now, HDB Financial aligns with regulatory expectations while positioning itself for long-term growth with a stable market debut.

This also reflects a maturing unlisted market in India, where compliance, governance, and valuation discipline are increasingly taking centre stage.

To explore regulated investment options in the private equity space, visit Rits Capital’s Unlisted Shares Platform.

What Should Investors Do Now?

If you’re already invested in HDB unlisted shares at higher levels, this correction might feel like a setback. But it also provides a learning opportunity:

For Existing Investors:

Avoid panic selling: Fundamentals remain solid.

Consider long-term holding: Post-listing appreciation is still possible.

Average down cautiously: If you have conviction, current IPO pricing offers a lower cost basis.

For New Investors:

The IPO band of ₹700-₹740 offers a more rational entry point.

Backing from HDFC Bank and strong financials still make HDB an attractive NBFC investment.

Consider subscribing via anchor or retail categories depending on your investment strategy.

Key Takeaways for Unlisted Share Investing

Do Your Homework: Always analyze financials, peers, and management.

Understand the Risks of Unlisted Securities: These include liquidity issues, regulatory shifts, and valuation uncertainty.

Diversify Your Portfolio: Never overexpose to speculative assets like unlisted/pre-IPO shares.

Long-Term Perspective: Unlisted investing is ideal for 3-5 year horizons.

Grey Market Premium Caution: Grey prices often reflect sentiment, not fair value.

Unlisted Shares Trading: Transactions must be conducted via regulated intermediaries for safety.

Additional Resources

If you’re new to this space or want to deepen your understanding of how unlisted markets work:

What Are Unlisted Securities? – Investopedia

Unlisted Trading Privileges – Wikipedia

Conclusion

The HDB Financial Services story is a reminder that not all unlisted shares are created equal, and valuation based on speculation can often diverge from IPO realities. While the correction to ₹740 might sting for some, it could be an entry opportunity for others.

As always, make informed decisions, diversify wisely, and consult with trusted advisors. At Rits Capital, we help investors access high-potential private market opportunities with transparency, compliance, and deep research.

To explore investment options in pre-IPO companies, get in touch with Rits Capital today.

#HDBFinancialServices#UnlistedShares#HDBIPO#GreyMarketUpdate#IPO2025#NBFCIndia#RitsCapital#MakeAssetsGrowAgain#MAGA#RiseWithRits#HDFCBacked#PreIPO#IPOAlert#PrivateEquity#SmartInvesting#WealthStrategies#InvestmentTips#StockMarketIndia#IPOPriceBand#NBFCInvestment

0 notes

Text

#10InfluentialLeaders#FutureofFinTech#FinTechIn2024#KassemLahham#DrivingInnovations#GlobalFinance#WealthStrategies#TheSiliconLeaders#Magazine

0 notes

Text

Want to know the secrets to getting rich quickly that are proven effective? Discover extraordinary strategies based on real-life experiences in my latest article! 💼📈 Don’t miss this opportunity! Click now to start your journey to wealth!

0 notes

Text

0 notes

Text

Gordon Thornton’s Net Worth in 2024

🔍💰 Gordon Thornton's Net Worth in 2024: An In-Depth Analysis of Contributors💡🔎

💸Curious about the secrets behind Gordon Thornton's financial success this year?📊🤑

💼 Let's explore the key factors shaping his net worth and gain insights into the strategies driving his wealth growth! 📈💡💰

📖Read the blog post here🌐: https://websfusion.com/gordon-thornton-net-worth/

#FinancialSuccess#NetWorthAnalysis#WealthStrategies#GordonThornton#NetWorth2024#RealHousewivesOfPotomac#RHOP#RealityTV#Entrepreneur#Business#Success#WealthManagement#FinancialPlanning#MoneyMatters#PersonalFinance#Lifestyle

0 notes

Text

Money on Autopilot by Bruce Bishop Reveals Simple Strategies for Wealth Creation.

Do you often find yourself caught in the daily grind, wondering if there's a way out of the endless cycle of work and financial worry? Are thoughts of retirement looming like a distant dream, overshadowed by the pressing concerns of bills and debt? You're not alone in this struggle.

Taking Control of Your Financial Destiny

Gone are the days of aimless financial navigation. "Money on Autopilot" presents seven simple yet powerful strategies designed to empower individuals to seize control of their financial destinies. From maximizing wealth to crafting a clear roadmap to early retirement, these strategies lay the groundwork for a brighter, more financially secure future.

An Interactive Wealth Programme for All

One of the standout features of Bishop's approach is the Interactive Wealth Programme, a resource that provides free access to tools and insights aimed at optimizing financial growth. This programme isn't reserved for the elite; it's accessible to anyone committed to charting a course towards financial freedom.

The Three Pillars of Wealth

At the heart of Bishop's philosophy lie the Three Pillars of Wealth, foundational principles that serve as the bedrock of sustainable financial growth. By integrating these principles into everyday life, readers can build a solid framework upon which to construct their financial futures.

Goal Setting, Planning, and Cultivating a Wealth Mindset

"Money on Autopilot" goes beyond mere theory, delving into practical aspects of wealth accumulation such as goal setting, planning, and cultivating a wealth mindset. Through Bishop's guidance, readers learn to harness the power of intentionality, transforming aspirations into tangible results.

Accessible Strategies for Every Income Level

Contrary to popular belief, building wealth doesn't require a hefty investment portfolio or an advanced degree in finance. With Bishop's accessible strategies, individuals from all walks of life can embark on the journey to financial freedom, armed with the knowledge and tools necessary to succeed.

Your Journey to Financial Freedom Starts Now

If you're tired of living paycheck to paycheck, if you yearn for a future unburdened by financial constraints, "Money on Autopilot" is your roadmap to liberation. Say goodbye to sleepless nights filled with worry about money, and embrace a future brimming with possibility.

If you're ready to transform your relationship with money and embark on a journey to financial freedom, don't hesitate click here https://www.amazon.com/dp/B0CPYN4PJY Your journey to financial autonomy can begin today.

#WealthStrategies#FinancialFreedom#MoneyOnAutopilot#SmartInvesting#WealthBuildingTips#MoneyManagement#FinancialWellness#FinancialEmpowerment#SmartMoneyMoves#BudgetingWisdom#EconomicFreedom#SavingsHacks#FinancialGoals#SuccessInFinance

0 notes

Text

Making Money in the Blink of an Eye: Fast and Easy Strategies for Success

Fast-tracking your financial success is no longer a distant dream but a tangible reality. In the hustle and bustle of our modern world, the need for speed in wealth accumulation has never been more apparent. Welcome to our blog, Making Money in the Blink of an Eye: Fast and Easy Strategies for Success.

My Best Recommended & Proven Way to Make $100 Daily — Watch THIS FREE Training to START >>

In this digital age, opportunities abound for those who seek quick and efficient methods to amass wealth. Whether you aim to supplement your income, embark on grand adventures, or attain financial freedom, this blog post serves as your comprehensive guide to achieving rapid financial growth.

Join us as we unveil an array of innovative and time-tested strategies that can turbocharge your earnings, delve into the psychology of success, explore the world of online business accelerators, and share real-life stories of individuals who have mastered the art of making money swiftly. Buckle up and get ready for a thrilling ride towards financial prosperity!

Understanding the Need for Quick Money

Understanding the need for quick money is the foundational concept that drives many individuals to seek fast and effective ways to boost their finances. It typically arises from unexpected expenses, financial emergencies, or the desire to achieve certain short-term goals. Recognizing this need is the first step in embarking on a journey to address these financial challenges promptly and responsibly. In this section, we will delve into the common scenarios that lead to the requirement for rapid income and discuss how to approach them strategically.

Setting Realistic Expectations

Setting realistic expectations is a fundamental step in any endeavor, especially when it comes to making quick money. It’s crucial to understand that while there are opportunities for rapid income, it often requires dedication and effort. Unrealistic expectations can lead to disappointment and, in some cases, financial loss. Therefore, it’s essential to strike a balance between ambition and practicality when pursuing fast and easy strategies for success.

The Balance of Speed and Sustainability

Balancing speed and sustainability is a key consideration in your quest for quick money. While you aim for immediate gains, it’s equally important to think about the long-term viability of your income sources. Striking this equilibrium ensures that your financial success endures, providing stability and security beyond the initial quick influx of cash.

A Note on Ethical Practices

Maintaining ethical practices is non-negotiable when seeking quick money. Unscrupulous shortcuts may bring fast returns, but they often come at a moral and legal cost. Prioritizing ethical conduct not only safeguards your reputation but also ensures that your financial success is built on a solid and sustainable foundation.

Financial Hacks for Rapid Earnings

Leveraging the Gig Economy

The gig economy has transformed the way we work and earn money. With platforms like Uber, Airbnb, and Upwork, individuals can leverage their skills and assets to earn extra income quickly. Embrace the gig economy to monetize your talents and make quick cash.

Smart Investments: Stocks vs. Real Estate

Dive into the world of investments, and you’ll discover a multitude of opportunities. We’ll compare the pros and cons of investing in stocks and real estate, helping you make informed decisions about where to put your money for faster returns.

Cryptocurrency: The Quick Gain or Pain

Cryptocurrency has taken the world by storm, offering opportunities for exponential growth and significant risks. We’ll explore the ins and outs of cryptocurrency investments, so you can decide whether to ride the digital wave to financial success or tread more cautiously.

Flipping for Profit: The Art of Reselling

Turning a quick profit by buying low and selling high is a classic strategy. We’ll delve into reselling techniques and platforms, from garage sales to online marketplaces, showing you how to make money with a keen eye and a little hustle.

My Best Recommended & Proven Way to Make $100 Daily — Watch THIS FREE Training to START >>

Online Business Accelerators

E-commerce: Your Digital Storefront

Online retail has become a juggernaut in the business world. Learn how to set up an e-commerce store, source products, and optimize your website for conversions. Your digital storefront can be the key to rapid income growth.

Affiliate Marketing: Earning on Autopilot

Discover the power of affiliate marketing, where you promote others’ products and earn a commission on sales. We’ll guide you through selecting the right products, building a marketing strategy, and setting up passive income streams.

Dropshipping Demystified

Dropshipping eliminates the need for inventory, making it a fast and easy way to start an e-commerce business. We’ll provide a step-by-step guide on how to get started and succeed in this booming industry.

Content Creation: YouTube, Blogging, and More

Unleash your creativity by becoming a content creator. We’ll explore platforms like YouTube, blogging, and podcasting, showing you how to monetize your passion and build an audience that can generate substantial income.

Mindset Matters: The Psychology of Success

The Power of Positive Thinking

Your mindset can be your greatest asset or your biggest obstacle. Learn how positive thinking can propel you toward financial success and develop the mental resilience to overcome challenges.

Goal Setting and Visualization

Setting clear and achievable goals is essential for fast-tracking your financial journey. We’ll discuss the importance of goal setting and how visualization techniques can make your goals a reality.

Managing Fear and Risk

Fear of failure can paralyze your financial efforts. We’ll address common fears associated with quick success and provide strategies to manage and overcome them.

Adapting to Change and Failure

Adaptability is a crucial skill in the ever-evolving world of finance. We’ll teach you how to embrace change and see failure as a stepping stone to success.

The Need for Speed: Time Management and Efficiency

Productivity Hacks for Work and Life

Time is money, and we’ll share time management techniques to boost your productivity. From the Pomodoro Technique to time blocking, we’ve got you covered.

Outsourcing: Delegating for More Earnings

Don’t try to do it all alone. Learn how to delegate tasks efficiently, allowing you to focus on high-value activities that can accelerate your income.

Automate Your Way to Riches

Automation tools and software can streamline your online business and save you time. We’ll introduce you to automation strategies and tools that will help you earn money while you sleep.

The Art of Saying No: Time Prioritization

Saying ‘no’ is a powerful skill that can help you focus on what truly matters. We’ll discuss the art of time prioritization and how it can lead to quicker financial success.

My Best Recommended & Proven Way to Make $100 Daily — Watch THIS FREE Training to START >>

Case Studies: Real-Life Success Stories

From Rags to Riches: Personal Transformation

Explore inspiring stories of individuals who went from financial struggle to success using the strategies outlined in this blog post. Real-life examples demonstrate that rapid financial growth is attainable for anyone.

Startups That Skyrocketed to Success

Discover how startups have disrupted industries and achieved rapid financial success. These stories serve as a testament to the potential of innovative ideas.

Internet Millionaires and Their Journeys

Learn about internet entrepreneurs who struck gold in the online world. Their stories will inspire you to harness the power of the internet for your own financial gain.

Quick Wins in Unconventional Fields

Explore unconventional career paths and industries where quick success is not only possible but common. Whether it’s gaming, social media, or niche markets, there are unique opportunities for fast earnings.

Conclusion

In conclusion, this blog post has been your compass on the journey to financial success at warp speed. We’ve navigated through the intricate web of financial hacks, online business accelerators, and the psychology of success. Armed with knowledge and inspiration from real-life success stories, you’re now poised to chase your dreams. Remember, in the world of fast and easy strategies, time is of the essence, and your destiny is in your hands. So go ahead, embrace the exhilarating prospect of rapid financial growth and make your ambitions a reality!

FAQs

Is rapid financial success realistic for everyone?

Rapid financial success is achievable for those who are willing to put in the effort and employ the right strategies. While there are no guarantees, the opportunities are abundant.

What’s the best investment option for fast returns?

The best investment option depends on your risk tolerance and financial goals. Stocks, real estate, and cryptocurrencies all offer potential for rapid growth.

How important is mindset in achieving fast success?

Your mindset plays a crucial role in your financial journey. A positive attitude, clear goals, and adaptability are key to overcoming challenges and achieving rapid success.

Can anyone start an online business and make money quickly?

Yes, anyone can start an online business, but success depends on various factors such as niche selection, marketing strategy, and dedication to learning and adapting.

What’s the first step to making money quickly?

The first step is to set clear financial goals and then choose a strategy that aligns with your objectives. Whether it’s a gig in the sharing economy or launching an online business, the key is to take action.

My Best Recommended & Proven Way to Make $100 Daily — Watch THIS FREE Training to START >>

Affiliate Disclaimer :

This article Contain may be affiliate links, which means I receive a small commission at NO ADDITIONAL cost to you if you decide to purchase something. While we receive affiliate compensation for reviews / promotions on this article, we always offer honest opinions, users experiences and real views related to the product or service itself. Our goal is to help readers make the best purchasing decisions, however, the testimonies and opinions expressed are ours only. As always you should do your own thoughts to verify any claims, results and stats before making any kind of purchase. Clicking links or purchasing products recommended in this article may generate income for this product from affiliate commissions and you should assume we are compensated for any purchases you make. We review products and services you might find interesting. If you purchase them, we might get a share of the commission from the sale from our partners. This does not drive our decision as to whether or not a product is featured or recommended.

Source : Making Money in the Blink of an Eye: Fast and Easy Strategies for Success

Thanks for reading my article on “Making Money in the Blink of an Eye: Fast and Easy Strategies for Success“, hope it will help!

#WealthStrategies#FinancialSuccess#FastCashTips#InvestmentHacks#MoneyGrowth#FinancialFreedom#EntrepreneurLife#EasyWealth#SuccessBlueprint#howtomakemoneyonline#makemoneyonline#makemoneyonline2023#makemoneyonlinefromhome#makemoneyfast#affiliatemarketing#cpamarketing#blogging#dropshipping#ecommerce#passiveincome#makemoneytutorials#methodsandtutorials#internetmarketing#digitalmarketing#clickbankaffiliatemarketing#affiliatemarketingtraining#cpamarketingtraining#cpa#blog#makemoney

0 notes

Text

Financial Discipline: Not Needed for Building Wealth? #money #wealth #finance #discipline

🎥 "Rethinking Wealth Building: Is Financial Discipline Optional?" 💰🤔 Join us in this thought-provoking video as we challenge a common belief. Can you truly build wealth without strict financial discipline? 💹📈 We dive deep into the world of money, investments, and financial habits to explore whether there's room for flexibility while still achieving your financial goals. From smart strategies to unexpected insights, this video might just change the way you approach wealth-building. 🌟💡

#WealthBuilding#FinancialFreedom#MoneyMatters#SmartInvesting#RethinkDiscipline#FinancialHabits#FlexibleFinance#MoneyMindset#WealthStrategies#FinancialInsights

0 notes

Text

52% NRIs turn to Indian commercial real estate

A recent survey by SBNRI reveals that 52% of NRIs have shifted their focus to Indian commercial real estate for higher returns and portfolio diversification.

❤️ Like and follow us if you’re curious about global property investment 💬 Drop a comment if you’ve ever considered CRE in India

#nriinvestment#indianrealestate#commercialproperty#creindia#globalinvestors#propertytrends#wealthstrategy#businessrealestate#realestatenews#ibusinesscourse#real estate

2 notes

·

View notes

Text

Wondering how much to keep in your Checking, Savings, IRA, 401(k), or Brokerage Account? Your financial future starts with smart planning! Let The Lending Mamba guide you to balance your wealth wisely. Scan the QR code or visit: thelendingmamba.com 657-777-0024 Email: [email protected]

#MoneyManagement#FinancialFreedom#IRA#401k#SavingsAccount#CheckingAccount#BrokerageAccount#SmartInvesting#WealthTips#MoneyGoals#PersonalFinance#InvestSmart#FinancialPlanning#WealthBuilding#RetirementPlanning#BudgetTips#Finance101#MoneyTalks#InvestWisely#PassiveIncome#SecureFuture#FinanceTips#DebtFreeJourney#SmartMoneyMoves#WealthStrategy#FutureReady#TheLendingMamba#RetirementGoals#PlanYourFuture#MoneyGrowth

0 notes

Text

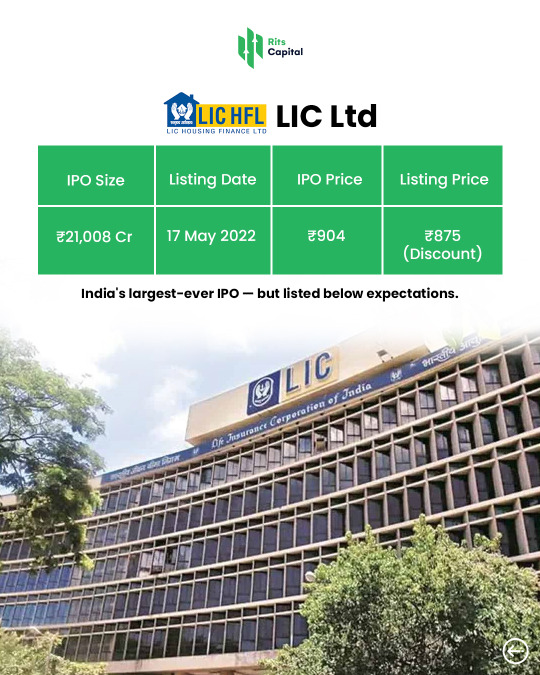

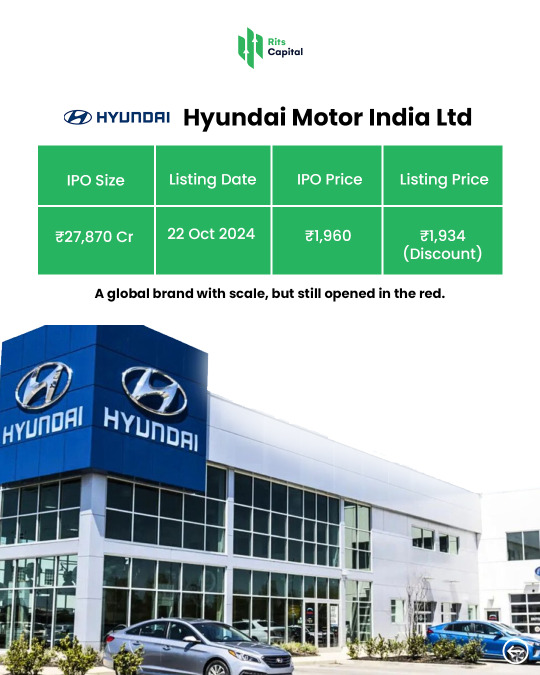

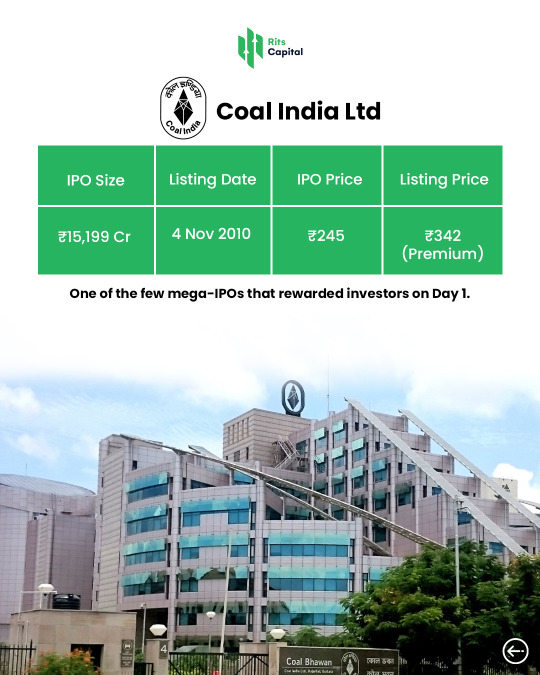

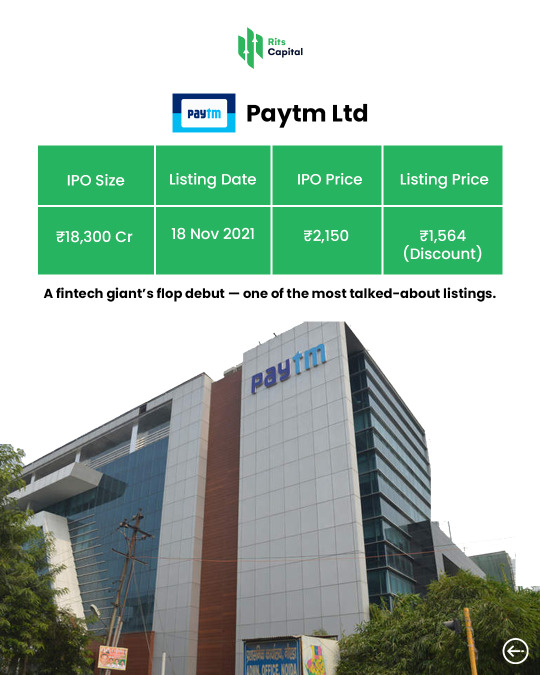

From LIC to Paytm and Hyundai, these mega-IPOs made headlines — but not all lived up to the hype.Out of the top 4 largest IPOs in Indian history, 3 listed at a discount.Only Coal India gave Day 1 gains.Bigger isn't always better.At Rits Capital, we help you access pre-IPO shares where real upside often begins — before the bell rings. DM or Contact us to get started on your pre-IPO journey.www.ritscapital.com | 9911090800𝐃𝐢𝐬𝐜𝐥𝐚𝐢𝐦𝐞𝐫: 𝐓𝐡𝐢𝐬 𝐢𝐬 𝐟𝐨𝐫 𝐞𝐝𝐮𝐜𝐚𝐭𝐢𝐨𝐧𝐚𝐥 𝐩𝐮𝐫𝐩𝐨𝐬𝐞𝐬 𝐨𝐧𝐥𝐲

#BiggestIPOs#IPOIndia#StockMarketInsights#UnlistedShares#PreIPOOpportunities#WealthStrategy#RitsCapital#MakeAssetsGrowAgain#MAGA#RiseWithRits#SmartInvesting

0 notes

Text

“Most people chase returns. I chase control.”

It’s easy to look busy. It’s harder to be effective.

Everyone wants gains. Few want discipline. Most want shortcuts. Few want systems. They ask what to buy, but never why they’re buying.

I stopped playing the loud game. I built a quiet strategy.

I’d rather miss hype and capture clarity. I’d rather be boring and profitable than exciting and broke.

Because real wealth isn’t loud. It’s structure, patience, and compounding. It’s waking up to find your system worked while you slept.

In a world chasing noise, stillness becomes a superpower.

#wealthstrategy#financialdiscipline#quietwealth#investingmindset#clarityoverhype#slowmoney#marketphilosophy#deepvalue#tumblrtextpost

1 note

·

View note

Text

#PrivateAviation#WealthStrategy#TravelHacks#BusinessTravel#FinancialLiteracy#LuxuryTravel#TimeOptimization#ExecutiveLifestyle#SmartMoney#ProductivityHacks#WealthManagement#BusinessEfficiency#TravelTips#SuccessMindset#FlightHacks#PremiumTravel#EntrepreneurLife#TimeIsMoney#InvestmentInsights#LifestyleDesign

0 notes

Text

Discover why top portfolio management services depend on wealth management firms for expert financial planning, investment strategies, and long-term growth.

#PortfolioMgmt#WealthMgmt#InvestmentPlan#FinancialGrowth#AssetManage#RiskAnalysis#MarketTrends#FundAllocation#WealthAdvisory#ROITracking#MoneyManage#StockInvest#CapitalGrowth#EquityFunds#FinanceTips#MutualFunds#SmartInvest#WealthStrategy#AssetGrowth#FinancialPlan

0 notes

Text

#wealthcreation#financialsuccess#moneymindset#wealthbuilding#financialfreedom#successsecrets#entrepreneurship#wealthstrategy#moneymatters

0 notes

Video

youtube

The Rich Just Get Richer @traviasteward

#youtube#WealthStrategies EconomicInsights FinancialFreedom BUPodcast SuccessMindset StrategyOverLuck InvestmentTips WealthBuilding FinancialLiteracy

0 notes