#and more power-efficient chips is at an all-time high. From smartphones and wearables to autonomous vehicles and advanced computing systems

Explore tagged Tumblr posts

Text

Master the Art of Chip Design: Learn from Top Layout Training Experts in Bangalore

#Silicon Valley of India#The Growing Demand for VLSI Layout Professionals#In today’s digital world#the demand for compact#faster#and more power-efficient chips is at an all-time high. From smartphones and wearables to autonomous vehicles and advanced computing systems#the heart of all these devices lies in chip design. With the rising importance of the semiconductor industry#specialized skills like layout design have become crucial. Companies are constantly seeking professionals with a deep understanding of phys#especially in fast-growing tech hubs like Bangalore.#Why Choose Layout Design as a Career Path#The VLSI industry offers numerous roles#and layout design stands out as one of the most technical and impactful disciplines. It requires precision#creativity#and expertise in EDA tools to convert circuit diagrams into manufacturable chip layouts. For those looking to gain this expertise#enrolling in layout design training institutes in Bangalore is an ideal starting point. These institutes offer tailored programs that blend#helping learners master the complexities of analog and digital layout processes.#What Makes Bangalore a Training Hub#Bangalore#often dubbed the is home to numerous semiconductor companies#startups#and global tech giants. This ecosystem creates a high demand for skilled VLSI professionals and#in turn#top-quality training institutes. The proximity to industries also allows training institutes to provide better placement opportunities#internship access#and exposure to real-time projects. This environment helps learners gain industry-relevant experience and stay updated with the latest deve#Curriculum and Practical Learning Approach#Most reputed institutes in Bangalore offer structured modules that include layout design principles#DRC/LVS checks#parasitic extraction#and hands-on tool usage with platforms like Cadence and Mentor Graphics. The training is designed in a way that ensures students gain pract

0 notes

Text

MEMS Timing Products Market Drivers: Key Forces Fueling Growth Across Diverse Applications and Industries

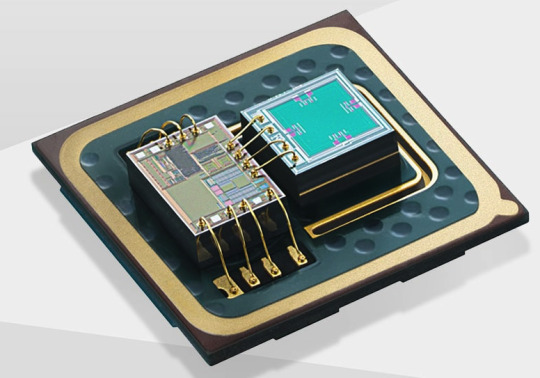

The MEMS Timing Products Market is witnessing strong growth, driven by the increasing demand for precise, compact, and energy-efficient timing solutions across various industries. MEMS (Micro-Electro-Mechanical Systems) timing devices are rapidly replacing traditional quartz-based components due to their resilience, low power consumption, and ability to perform reliably under harsh environmental conditions. These features make MEMS timing products ideal for emerging applications in telecommunications, consumer electronics, automotive, aerospace, and industrial automation.

This article explores the key drivers fueling the growth of the MEMS Timing Products Market, highlighting the technological advancements, market demands, and application trends contributing to its rapid expansion.

1. Miniaturization and Integration in Consumer Electronics

One of the primary drivers of the MEMS Timing Products Market is the continued trend toward miniaturization in consumer electronics. Smartphones, wearables, tablets, and other portable devices require compact, low-power, and highly integrated components to meet design and performance specifications. MEMS timing products offer a significant size and power advantage over traditional quartz crystal oscillators, making them a preferred choice for next-generation devices.

The integration of MEMS timing solutions into system-on-chip (SoC) platforms and multi-functional modules allows manufacturers to save board space while improving overall system efficiency and accuracy.

2. Superior Performance in Harsh Environments

Unlike quartz-based timing devices, MEMS oscillators and clocks are highly resistant to shock, vibration, and temperature variations. This makes them ideal for demanding environments, such as industrial settings, automotive systems, and aerospace applications. These harsh conditions often degrade the performance of traditional timing components, leading to reliability issues and increased maintenance costs.

The MEMS Timing Products Market benefits from this performance edge, especially as industries shift toward automation, IoT (Internet of Things), and advanced robotics, where timing precision and reliability are crucial for system functionality.

3. Growing Demand for 5G and Telecommunications Infrastructure

The global rollout of 5G technology is a significant catalyst for the MEMS Timing Products Market. 5G networks demand ultra-low latency, higher data rates, and precise synchronization across distributed network components. Timing devices are essential in maintaining these stringent performance requirements, particularly for base stations, small cells, routers, and edge computing infrastructure.

MEMS timing solutions offer advantages such as better phase noise performance, frequency stability, and rapid startup times, all of which are critical for maintaining synchronization in high-speed telecom networks. As 5G deployment accelerates globally, the demand for robust timing components is expected to rise correspondingly.

4. Increased Adoption in Automotive Electronics

The automotive industry is undergoing a technological transformation with the rise of electric vehicles (EVs), autonomous driving, and advanced driver-assistance systems (ADAS). These innovations require reliable and accurate timing solutions for systems like GPS modules, sensors, infotainment units, and powertrains.

MEMS timing devices are preferred in automotive electronics due to their vibration resistance, thermal stability, and compliance with automotive-grade standards. As vehicles become more software-defined and electronics-heavy, the MEMS Timing Products Market is poised to capture a significant share of the automotive timing solutions segment.

5. Expanding Role of IoT and Edge Computing

IoT devices—from smart thermostats and industrial sensors to connected medical devices—depend on precise timing for data acquisition, communication, and synchronization. MEMS timing products enable longer battery life, miniaturization, and reliable performance, all essential for the success of IoT ecosystems.

Similarly, edge computing systems, which require local data processing with minimal latency, rely heavily on accurate timing to maintain data integrity and processing efficiency. The MEMS Timing Products Market is experiencing growing adoption in these applications as industries increasingly depend on real-time data analytics and autonomous system control.

6. Replacement of Quartz Oscillators

The gradual shift from quartz-based oscillators to MEMS-based timing products is a structural driver of growth. MEMS technology offers numerous advantages including:

Better integration with silicon-based components

Higher manufacturing scalability and cost-efficiency

Enhanced reliability due to solid-state design (no moving parts)

Improved resistance to aging and environmental factors

As awareness and availability of MEMS timing solutions grow, OEMs and system designers are increasingly opting to replace traditional timing components with MEMS alternatives, accelerating the market transition.

7. Advancements in MEMS Fabrication Technology

Recent advancements in semiconductor manufacturing and MEMS fabrication processes have played a vital role in boosting product performance, consistency, and yield. These developments are enabling the production of MEMS timing products with higher precision, better thermal stability, and lower jitter, making them suitable for high-end and mission-critical applications.

Innovations such as wafer-level packaging and vacuum-sealed structures have further enhanced device longevity and robustness. These technical improvements are strengthening the competitive edge of MEMS over legacy timing technologies and expanding the market's total addressable scope.

8. Regulatory and Industry Compliance

Compliance with international standards, such as AEC-Q100 for automotive applications or ITU-T G.826x for telecom synchronization, is another growth driver. MEMS timing product manufacturers are increasingly meeting or exceeding these industry benchmarks, which enhances customer confidence and facilitates adoption in regulated markets.

As more industries mandate compliance with timing accuracy, safety, and reliability standards, MEMS devices are well-positioned to meet those requirements efficiently.

Conclusion

The MEMS Timing Products Market is driven by a confluence of technology trends, including the rise of miniaturized consumer electronics, 5G infrastructure, automotive innovation, and IoT expansion. The market’s transition away from quartz and toward MEMS-based timing is reshaping the competitive landscape and creating new growth avenues for manufacturers and developers.

As MEMS technology continues to evolve, offering improved performance, integration, and durability, its adoption will become even more widespread across diverse industries. The continued push for digitalization, connectivity, and intelligent systems ensures that the MEMS Timing Products Market will remain a critical pillar in the modern electronics ecosystem for years to come.

0 notes

Text

How Top NASDAQ Stocks Reflect Industry Transformation

The Nasdaq Composite Index has shown consistent strength in 2025, supported by innovation in cloud computing, artificial intelligence, and semiconductors. As technology firms continue to lead digital transformation, several companies listed on the NASDAQ have emerged as standout names. These Top NASDAQ Stocks have gained attention for their resilience, adaptability, and strategic growth, shaping the broader index's momentum.

Tech-Centric Momentum in the Nasdaq Composite

The Nasdaq Composite remains heavily weighted toward technology companies. The recent market environment has reflected continued gains in enterprise IT services, automation, and AI infrastructure. Digital adoption across industries has helped several tech-focused firms deliver consistent performance. The index’s movement signals confidence in software platforms, chipmakers, and digital service providers that power today’s business infrastructure.

Advancements in AI integration and machine learning applications have played a critical role in shaping product strategies. Companies with exposure to scalable platforms and automation tools continue to benefit from structural trends, supporting their strong presence among Top NASDAQ Stocks.

Microsoft and Alphabet Maintain Digital Leadership

Microsoft has demonstrated consistent growth across its cloud and productivity segments. Its investments in AI-driven products and enterprise software services have enabled stronger digital transitions for global businesses. Meanwhile, Alphabet continues to strengthen its position through its cloud services and advertising platforms, backed by ongoing development in machine learning and search technology.

Both companies reflect how demand for scalable cloud ecosystems and AI-enabled software continues to impact market performance. Their broad service portfolios, combined with innovation in automation and data analytics, reinforce their role among the leading contributors to the Nasdaq Composite.

Nvidia and AMD Boost Chip Innovation

Semiconductors remain at the heart of the digital economy, and companies like Nvidia and AMD have played significant roles in advancing this segment. Nvidia’s GPU technology supports AI computing, data centers, and high-performance processing, driving broad applications across multiple sectors. AMD, on the other hand, has executed well on its product roadmap, strengthening its position in personal computing and enterprise server markets.

These companies have benefited from the ongoing demand for faster, more efficient processors. Their product innovation and relevance across gaming, cloud services, and edge computing make them key components among Top NASDAQ Stocks.

Amazon and Meta Drive Digital Growth

Amazon continues to scale its influence in both retail and cloud computing. The company’s focus on e-commerce optimization, logistics automation, and AWS growth supports its diverse revenue structure. At the same time, Meta’s platforms have maintained engagement and advertising growth, driven by AI integration and infrastructure scaling.

Both companies highlight how digital ecosystems and platform-based business models continue to shape consumer and enterprise behavior. Their strategic focus on personalization, content delivery, and connectivity has reinforced their market positions in 2025.

Apple and Tesla Drive Consumer Innovation

Apple maintains a strong presence in the NASDAQ through its ecosystem of consumer devices and services. The company’s ability to blend hardware innovation with recurring revenue from digital services has helped deliver stable growth. Wearables, smartphones, and content platforms all contribute to Apple’s long-term value proposition.

Tesla represents a convergence between automotive innovation and smart energy solutions. Its advancements in electric vehicles and autonomous technology reflect changing preferences in mobility and clean energy. Tesla’s inclusion among Top NASDAQ Stocks signals how diversified tech applications extend beyond traditional software and hardware sectors.

Trends Behind Top NASDAQ Stocks

The sustained momentum in Top NASDAQ Stocks is backed by broader themes across technology and enterprise spending. Ongoing adoption of AI solutions, increased reliance on cloud infrastructure, and digital-first consumer engagement have created a favorable environment for these companies.

Macroeconomic conditions, earnings performance, and global demand for smart devices continue to shape investor sentiment. Additionally, trends in data privacy, supply chain efficiency, and scalable platforms have made resilience a critical factor for long-term success among Nasdaq-listed companies.

The Nasdaq Composite Index remains a key barometer for digital innovation and technology-driven performance in 2025. Leading companies across semiconductors, cloud computing, digital platforms, and consumer tech have demonstrated their ability to navigate change and maintain growth. These Top NASDAQ Stocks not only reflect current trends but also shape the broader dynamics of modern economic activity.

As industries evolve and adopt smarter technologies, the firms driving the Nasdaq Composite are well-positioned to remain central to ongoing transformation. Their performance continues to offer insight into the direction of innovation-led growth and the importance of adaptability in the tech sector.

0 notes

Text

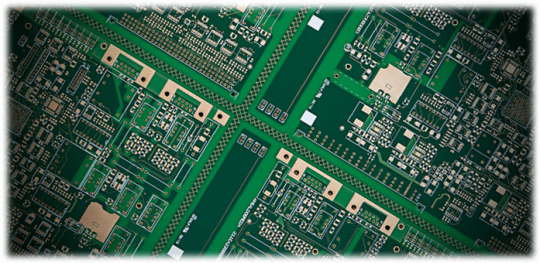

Can HDI PCBs Keep Up with AI Hardware Demands?

As the artificial intelligence (AI) revolution gains momentum, the need for smarter, faster, and more efficient hardware is at an all-time high. At the core of this evolution is the printed circuit board (PCB) — the silent workhorse behind every intelligent machine. Specifically, the HDI Printed Circuit Board (High-Density Interconnect PCB) is stepping into the spotlight, offering the compactness, speed, and capability modern AI systems require.

But with increasing complexity and power in AI algorithms, can HDI PCBs keep up with the pace of innovation? At Pcb-Togo Electronic, Inc., we specialize in crafting high-performance HDI Printed Circuit Board solutions designed to meet and exceed the ever-growing expectations of AI-driven hardware. In this post, we’ll explore how HDI PCBs are rising to the challenge and why they’re becoming indispensable in today’s AI landscape.

What Are HDI PCBs and Why Do They Matter?

HDI Printed Circuit Boards differ from traditional PCBs in both structure and capability. They utilize microvias, blind/buried vias, and high-density routing to accommodate more components in less space. This compact architecture reduces signal travel distance, minimizes losses, and allows for faster processing — all crucial elements for AI systems that operate at blistering speeds and demand impeccable accuracy.

The typical AI processor, whether in a data center or an autonomous vehicle, needs a reliable, dense interconnect system to maintain performance. HDI PCBs deliver that reliability in a smaller, lighter, and more efficient footprint.

Why AI Hardware Demands Are Escalating

AI workloads — from machine learning inference to real-time edge processing — require lightning-fast communication between components, robust data throughput, and efficient thermal handling. As AI systems become more embedded in mobile devices, wearables, and compact robotics, the pressure mounts on hardware designers to shrink board sizes without sacrificing performance.

These demands translate directly into challenges that the HDI Printed Circuit Board must solve:

Higher signal integrity

Greater heat dissipation

Denser component placement

Multi-layer interconnectivity

Reduced electromagnetic interference (EMI)

Traditional PCBs simply can’t keep up. HDI PCBs, on the other hand, are uniquely suited for the job — if designed and manufactured correctly.

How HDI PCBs Meet AI Hardware Needs

Let’s break down how HDI PCBs directly address the performance gaps AI hardware faces:

Miniaturization Without Compromise

AI-enabled devices are getting smaller. Smartphones, smartwatches, and drones are powerful yet compact. HDI PCBs offer multiple layers and stacked vias, enabling high functionality in limited space.

Signal Integrity

AI processors often run at high frequencies. HDI PCBs reduce signal path lengths and crosstalk, enhancing the signal integrity necessary for high-speed processing.

Thermal Management

Advanced AI chips generate a lot of heat. HDI PCBs incorporate thermal vias and advanced materials that effectively disperse heat, ensuring components don’t overheat or fail.

High-Speed Interconnects

With fine pitch components and narrow trace widths, HDI Printed Circuit Boards enable faster communication between AI subsystems — a must for tasks like neural network inference.

Increased Layer Count

Many AI applications require multilayer designs. HDI technology allows designers to stack more functionality into a compact footprint, which would be impossible with conventional PCBs.

Challenges and Considerations

Despite their advantages, HDI PCBs do come with engineering and production challenges. These include:

Higher manufacturing costs due to advanced fabrication methods

Complex design rules for impedance control and signal routing

Material selection issues, especially in high-temperature environments

However, the return on investment is clear for high-performance applications. At Pcb-Togo Electronic, Inc., our team collaborates closely with engineers to create optimized HDI PCB layouts that align with AI performance goals while staying within budget.

What's Next for HDI PCBs in AI?

The future of AI involves even more intensive computing — think quantum-inspired AI processors, real-time 3D object recognition, and edge inference with cloud synchronization. HDI Printed Circuit Boards will need to evolve as well, integrating embedded passive components, leveraging new materials like liquid crystal polymer (LCP), and incorporating optical interconnects.

Our R&D team at Pcb-Togo Electronic, Inc. is actively engaged in developing next-generation HDI solutions tailored for tomorrow’s AI. Whether you’re designing for a new wearable AI assistant or a smart factory sensor array, we’re ready to help you bring your innovation to life.

Why Choose Pcb-Togo Electronic, Inc.?

We don’t just build HDI PCBs — we engineer them for the future. With decades of expertise in PCB manufacturing and a deep understanding of AI hardware demands, we offer:

Precision fabrication of 4+ layer HDI boards

Advanced testing for signal and thermal performance

Fast turnaround and prototyping

Customized consultation from schematic to production

Final Thoughts

Can HDI PCBs keep up with AI hardware demands? Absolutely — if they’re built by a partner who understands both the challenges and opportunities ahead. The evolution of AI is not slowing down, and neither should your hardware. HDI Printed Circuit Boards, when engineered with foresight and precision, are not only keeping pace — they’re leading the charge.

To discover how our HDI PCB solutions can elevate your next AI project, Find Out More about our capabilities.

By partnering with Pcb-Togo Electronic, Inc., you ensure that your AI hardware infrastructure is as advanced, efficient, and reliable as the algorithms it supports. Let's build smarter systems together — starting from the circuit board up.

Original Link: https://pcbtogo.blogspot.com/2025/05/can-hdi-pcbs-keep-up-with-ai-hardware.html

0 notes

Text

Global Vision Processing Unit Market (SARS-CoV-2, Covid-19 Analysis) Research Report: By Type and By End User – Forecast to 2025

A new market study, titled “Global Vision Processing Unit Market Research Report Size, Status and Forecast 2018-2025” has been featured on Market Research Future.

Global Vision Processing Unit Market Research Report offer detailed insights on the impact of COVID-19 at an industry level, a regional level, and subsequent supply chain operations. This customized report will also help clients keep up with new product launches in direct & indirect COVID-19 related markets, upcoming vaccines and pipeline analysis, and significant developments in vendor operations and government regulations.

Market Forecast

Global Vision Processing Unit Market is expected to grow from USD 1.4 Billion in 2018 to a projected USD 3.8 Billion by 2025 at an impressive CAGR of 20%.

Market Synopsis

Vision processing units (VPUs) are a subset of microprocessors that ease the energy and time requirements of CPUs by taking on the tasks of video streaming and image processing. The technology is relatively new, but due to the increasing demand for integrated technology platforms and the need for performance enhancement, while lowering costs, the global vision processing unit market is expected to grow at a phenomenal rate.

Market USP

A focus on microprocessor technology has led to the development of specialized chips such as VPUs.

Market Drivers

Advances in microprocessor manufacturing lowering production costs of visual processing units

Need for lowering processing loads placed on CPUs by video streaming

The growing market for autonomous vehicles requiring high-end visual processing units to ensure safety

Application in the highly competitive smartphone market

Drastic reduction in power consumption of devices

Need for real-time video processing in critical applications

Market Restraints

Complexities in integration

Visual processing speed is still governed by the speed of the video stream input

Segmentation

By Type

Drones: Vision processing units are utilized to ensure smooth steering and navigation in drones.

ADAS: Critical in ensuring safety and avoiding collisions.

Smartphones: Enhance video and photo quality while reducing the load on the battery and CPU.

Cameras: Embedded in all the latest cameras due to their image-enhancing qualities.

AR/VR: VPUs are indispensable to these devices and there can be no AR/VR without VPUs.

Robotics: Effectively aiding machines to receive and process visual information.

Wearables: Reducing the strain on the CPUs, thereby enabling additional features.

By End User

Consumer Electronics: VPUs are used extensively in all modern electronics with image and video streaming capabilities, such as smartphones, laptops, and digital cameras to enhance quality and processor productivity.

Automotive: Instantaneous video stream processing is critical to avoid collisions and in navigation, especially in ADAS.

Security and Surveillance: Using vision processing units in tandem with programmed responses based on the analysis of a live video stream serves to enhance security and reduce the human element in surveillance.

Others: This segment includes VPU application in the military and manufacturing.

By Region

North America: Growing demand for specialized VPUs, the presence of robust technology infrastructure and an economy conducive to the manufacture of this device ensure the dominance of the regional market during the forecast period.

Europe: Though not as economically viable as its North American counterpart, the European market is more invested in integrating the current technology with vision processing units, leading to companies manufacturing these devices for their use.

Asia-Pacific: A fast-growing market, Asia-Pacific is the world’s leading producer of smartphones, where vision processing units are being increasingly used to boost the value of the final product.

Rest of the World: Benefitting from low-cost production, this device is being manufactured in Israel.

Key Players

Samsung Electronics Co. Ltd (South Korea): The highly regarded Exonys 9 series, released by Samsung in the first quarter of 2019, finds application in smartphones and automobiles.

Movidius (US): A subsidiary of Intel Corporation, Movidius launched the Movidius Myriad 2 VPU specifically for power-constrained devices in early 2018.

Cadence Design Systems, Inc. (US): Geared toward making vision processing units for AI applications.

CEVA, Inc. (US): The CEVA XM 4 is ideal for high performance/low-energy applications and is programmable in high-level computer languages.

Texas Instruments (US): The Jacinto TDAx Driver Assistance SOC is specifically geared for the automotive industry and boasts a highly scalable architecture.

Lattice Semiconductor (US): Excellent flexibility and efficiency are the benchmarks of the chipsets made by the company.

NXP Semiconductor (Netherlands): The S32V234 MPU processor comes with its own supporting compiler, debugger, and other graph tools.

HiSilicon Technologies (China): The Kirin 980 series is the fastest and highest-performing processor and finds utility in high-end smartphones and electronics.

Alphabet, Inc. (US): The company offers a wide range of processors catering to niche requirements.

MediaTek Inc. (Taiwan): Striking a balance between programmability and performance for smartphone cameras, the Tensilica VPU reduces the load on the CPU and GPU.

Inuitive (Israel): The company manufactures VPUs for use in medical devices.

More Information : https://www.marketresearchfuture.com/reports/vision-processing-unit-market-8177

About Market Research Future: At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Reports (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research and Consulting Services. Contact: Market Research Future +1 646 845 9312 Email: [email protected]

#Global Vision Processing Unit Market#Global Vision Processing Unit Market Report#Global Vision Processing Unit Market Research#type#ens-user#forecast

0 notes

Text

Stocks to Watch: 5G Needs an “Edge” (FSLY, SWKS, AFFU, XLNX)

As the 5G revolution sets into place as a new foundation for technology, Edge Computing is going to be the “killer app” that ties 5G low-latency potential with visions of the magic we imagine when we think of a “smart” world coming into existence during the first half of this century. In other words, without edge computing, 5G won’t mean a whole lot when it comes to autonomous vehicles, smart cities, robot police and doctors, smart energy grids, and lots of other futuristic concept candy. As a result, the global Edge Computing market is expected to grow from $2.8 billion in 2019 to reach $18.36 billion by 2027, according to Fior Markets. With that in mind, here are a few of the more interesting Edge Computing stocks in play right now: Fastly Inc (NYSE:FSLY), Skyworks Solutions Inc (NASDAQ:SWKS), Affluence Corp. (OTCMKTS:AFFU), and Xilinx, Inc. (NASDAQ:XLNX). Fastly Inc (NYSE:FSLY) trumpets itself as a company that operates an edge cloud platform for processing, serving, and securing its customer's applications. The edge cloud is a category of Infrastructure as a Service that enables developers to build, secure, and deliver digital experiences at the edge of the Internet. It is a programmable platform designed for Web and application delivery. As of December 31, 2019, the company's edge network spans 68 points-of-presence worldwide. It serves customers operating in digital publishing, media and entertainment, technology, online retail, travel and hospitality, and financial technology services industries. The company was formerly known as SkyCache, Inc. and changed its name to Fastly, Inc. in May 2012. Fastly, Inc. was founded in 2011 and is headquartered in San Francisco, California. Fastly Inc (NYSE:FSLY) just announced the extension of its platform’s observability features to its Compute@Edge serverless compute environment. According to its release, these advancements include customizable logging, real-time and historical metrics, and newly launched tracing, giving developers newfound transparency into what happens after code is deployed within a serverless architecture and unlocking mission-critical visibility needed to find and fix operational issues fast. Fastly’s Compute@Edge helps companies build applications and execute code on its globally distributed infrastructure, at the edge of the internet, without any of the maintenance or headache of managing it directly. It will be interesting to see if the stock can break out of its recent sideways action. Over the past week, the stock is net flat, and looking for something new to spark things. Fastly Inc (NYSE:FSLY) pulled in sales of $62.9M in its last reported quarterly financials, representing top line growth of 38.1%. In addition, the company has a strong balance sheet, with cash levels far exceeding current liabilities ($186.7M against $40.4M). Skyworks Solutions Inc (NASDAQ:SWKS), together with its subsidiaries, designs, develops, manufactures, and markets proprietary semiconductor products, including intellectual property worldwide. Its product portfolio includes amplifiers, antenna tuners, attenuators, circulators/isolators, DC/DC converters, demodulators, detectors, diodes, directional couplers, diversity receive modules, filters, front-end modules, hybrids, LED drivers, low noise amplifiers, mixers, modulators, optocouplers/optoisolators, phase locked loops, phase shifters, power dividers/combiners, receivers, switches, synthesizers, technical ceramics, voltage controlled oscillators/synthesizers, and voltage regulators, as well as wireless radio integrated circuits. The company provides its products for use in the aerospace, automotive, broadband, cellular infrastructure, connected home, industrial, medical, military, smartphone, tablet, and wearable markets. It sells its products through direct sales force, electronic component distributors, and independent sales representatives. Skyworks Solutions Inc (NASDAQ:SWKS) recently announced that that its Milpitas, Calif. facility has achieved AS9100D certification. According to the company, through its defense and space business (formerly known as Isolink), Skyworks is a leading global supplier of high performance, high-quality radiation-tolerant components for aerospace, defense, medical, extreme industrial and high-reliability markets and applications. If you're long this stock, then you're liking how the stock has responded to the announcement. SWKS shares have been moving higher over the past week overall, pushing about 6% to the upside on above average trading volume. Skyworks Solutions Inc (NASDAQ:SWKS) generated sales of $766.1M, according to information released in the company's most recent quarterly financial report. That adds up to a sequential quarter-over-quarter growth rate of -14.5% on the top line. In addition, the company has a strong balance sheet, with cash levels far exceeding current liabilities ($1.1B against $362.2M). Affluence Corp. (OTCMKTS:AFFU) is a holding company focused on the acquisition and roll-up of synergistic companies providing 5G enhancing infrastructure and technologies, edge computing, and innovative cloud solutions. Through acquisition and partnership, Affluence’s goal is to build a world leading business which brings together edge cloud enhancing technology for the next generation of communication. Major technology changes are disrupting the traditional networking sector. Current centralized infrastructure is inadequate to provide the resilience and bandwidth needed for the next generation of internet, which needs to be designed for machines. Affluence is working to provide the infrastructure and solutions to power industrial automation or smart cities, healthcare, AI, robotics and more. The company seeks to position itself as a global leader in edge computing solutions that will power next generation internet and enable any town or city to become a ‘smart city’ through the company’s intelligent IoT smart city solution builder. Affluence Corp. (OTCMKTS:AFFU) recent announced that the company is acquiring Flexiscale (LOI signed), which gives it an A-level thoroughbred in the edge computing race. Flexiscale already has a two-year lead in the marketplace and may be the only edge cloud computing infrastructure company in the world that has already fully developed and begun deploying this game-changing technology. It has a fully deployed Edge Cloud platform, operational and technological advantage to drive profitability on further acquisitions, energy efficient Metro datacentre in place with metro wide connectivity, highly efficient datacentre infrastructure with 85% reduction in space, 40% reduction in operating costsm and 30% increase in performance, and a partnership with Flexiant for the Edge Cloud Orchestration Software, along with a fully functional Application IoT ready Edge Service Delivery platform. Affluence Corp. (OTCMKTS:AFFU), in its new form, is an edge computing play that is pre-revenue. But the company’s aggressive moves to lay claim to a leadership position suggest a relatively short period before we start to see meaningful financials surface that give us a better picture. Right now, it is a highly speculative prospect with a promising start through strategic positioning. Xilinx, Inc. (NASDAQ:XLNX) promulgates itself as a company that designs and develops programmable devices and associated technologies worldwide. Its programmable devices comprise integrated circuits (ICs) in the form of programmable logic devices (PLDs), such as programmable system on chips, and three dimensional ICs; adaptive compute acceleration platform; software design tools to program the PLDs; software development environments and embedded platforms; targeted reference designs; printed circuit boards; and intellectual property (IP) core licenses covering Ethernet, memory controllers, Interlaken, and peripheral component interconnect express interfaces, as well as domain-specific IP in the areas of embedded, digital signal processing and connectivity, and market-specific IP cores. The company also offers development boards; development kits, including hardware, design tools, IP, and reference designs that are designed to streamline and accelerate the development of domain-specific and market-specific applications; and configuration products, such as one-time programmable and in-system programmable storage devices to configure field programmable gate arrays. In addition, it provides design, customer training, field engineering, and technical support services. Xilinx, Inc. (NASDAQ:XLNX) updated the range of its prior guidance for its first quarter of fiscal 2021 ended June 27, 2020, guiding performance slightly lower, but not as much as analysts may have been expecting, and just putting out guidance at all in this context is generally seen as a sign of confidence. "While we have seen some COVID-19 related impacts during the June quarter, our business has generally performed well overall, with stronger than expected revenues in our Wired and Wireless Group and Data Center Group more than offsetting weaker than expected revenues in our consumer-oriented end markets, including automotive, broadcast, and consumer. A portion of the revenue strength in the quarter was due to customers accelerating orders following recent changes to the U.S. government restrictions on sales of certain of our products to international customers," said Victor Peng, Xilinx’s President and Chief Executive Officer. And the stock has been acting well over recent days, up something like 5% in that time. Xilinx, Inc. (NASDAQ:XLNX) pulled in sales of $756.2M in its last reported quarterly financials, representing top line growth of -8.7%. In addition, the company has a strong balance sheet, with cash levels far exceeding current liabilities ($2.3B against $1.1B). Read the full article

0 notes