#api rate limiting

Explore tagged Tumblr posts

Text

API Rate Limiting: How Residential Proxies Help You Scale

Modern APIs power the digital economy, but rate limits create artificial ceilings on business growth. Whether consuming financial data feeds, integrating multiple SaaS platforms, or building data-driven applications, rate limiting forces developers into frustrating compromises. Residential proxies offer elegant solutions that transform API constraints into manageable scaling challenges.

Understanding Rate Limit Architecture

API providers implement rate limiting to ensure fair resource distribution and prevent system overload. Common strategies include requests per second, daily quotas, and concurrent connection limits. These restrictions often assume single-user scenarios, failing to accommodate legitimate business needs for high-volume data access.

Traditional workarounds prove inadequate at scale. Exponential backoff strategies slow data collection to crawling speeds. Multiple API keys require complex account management and often violate terms of service. Datacenter proxies face immediate detection and blocking by sophisticated API providers monitoring for distributed access patterns.

Residential Proxies as Scaling Infrastructure

Residential proxies distribute API requests across thousands of authentic IP addresses, each appearing as individual users to rate limiting systems. This distribution allows organizations to scale API consumption linearly with proxy pool size while respecting per-IP limitations.

Implementation requires careful orchestration. Assign specific residential proxies to handle defined request quotas, rotating through available IPs before limits trigger. A pool of 100 residential proxies, each handling 1,000 daily requests, enables 100,000 API calls while staying within standard rate limits.

Geographic distribution adds another scaling dimension. Many APIs apply regional rate limits, allowing higher aggregate consumption when requests originate from diverse locations. Residential proxies naturally provide this geographic diversity, maximizing available API quotas across regions.

Architectural Best Practices

Design proxy rotation systems that track per-IP usage against API limits. Implement circuit breakers that automatically switch proxies before hitting rate thresholds. This proactive approach prevents limit violations that trigger temporary bans or require manual intervention.

Session persistence matters for stateful APIs. Configure sticky sessions ensuring API authentication and subsequent requests route through consistent residential IPs. This consistency maintains API session integrity while distributing load across multiple proxies for different sessions.

Queue management becomes critical at scale. Implement intelligent request routing that distributes API calls across available proxies based on current usage, remaining quotas, and request priority. High-priority requests route to proxies with maximum remaining capacity.

Monitoring and Optimization

Deploy comprehensive monitoring tracking request success rates, response times, and quota consumption per proxy. Identify underperforming proxies or geographic regions with stricter enforcement. This data drives optimization decisions and capacity planning.

Cost optimization requires balancing proxy expenses against API overage charges or business opportunity costs from data delays. Calculate break-even points where residential proxy investments deliver positive ROI through increased API throughput.

Scaling Beyond Limits

Residential proxies transform API rate limits from hard barriers into engineering challenges. Organizations successfully scale API consumption 10-100x through strategic proxy deployment, enabling data-driven innovations previously impossible under standard rate constraints.

0 notes

Text

Get Quick Digital Loan Against Mutual Funds in 2025 – No CIBIL, Instant Approval, Low Interest!

In 2025, managing financial emergencies or funding major life goals has become faster and easier, thanks to the growing popularity of Loan Against Mutual Funds (LAMF). Whether you need funds for a wedding, a medical emergency, or to start a small business, your investments in mutual funds can help unlock instant liquidity without selling them.

But how does it work? What is the LAMF interest rate in 2025? What documents are required? How does LAMF compare to personal loans or gold loans? In this guide, you’ll find everything you need to know to make an informed decision.

What Is a Loan Against Mutual Fund (LAMF)?

A Loan Against a Mutual Fund is a type of secured loan where your mutual fund units are pledged as collateral. It’s one of the smartest ways to raise quick funds without selling your investments.

When you pledge mutual fund units, lenders assign a certain Loan-To-Value (LTV) ratio and disburse funds instantly. The units stay in your demat account but cannot be redeemed unless the loan is repaid.

Key Features of Loan Against Mutual Funds in 2025

Instant Online Approval via LAMF API integration

No income proof or credit score required

Flexible repayment tenure

Zero foreclosure charges with top lenders

Loans are available on both equity & debt mutual funds

Apply Loan Against Mutual Fund Online Instantly

With platforms like Investkraft, Volt Money LAMF, and Bajaj Finserv mutual fund loan options, applying online is seamless. You can complete the entire loan process in under 5 minutes with just your PAN and folio number.

No paperwork. No branch visits. Purely digital loan against mutual fund access.

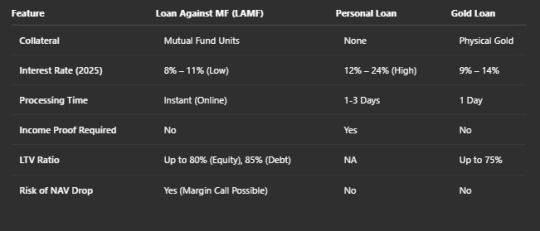

LAMF vs Personal Loan vs Gold Loan: A Real Comparison

Understanding LTV in Loan Against Mutual Funds

Loan-to-Value (LTV) is the percentage of your mutual fund’s current value that can be disbursed as a loan.

LAMF LTV for Equity Mutual Funds: Up to 80%

LAMF LTV for Debt Mutual Funds: Up to 85%

This means if your equity mutual fund value is ₹1,00,000, you can get a loan up to ₹80,000.

What Is the Interest Rate for a Loan Against Mutual Funds in 2025?

Interest rates are much lower than personal loans and depend on your mutual fund type and the lender.

LAMF interest rate 2025 (Equity Funds): 9% – 11.5%

LAMF interest rate 2025 (Debt Funds): 8% – 10.5%

Some top digital lenders offer rates as low as 7.99% for salaried investors.

Who Can Apply for a Loan Against Mutual Funds?

Eligible Individuals:

Salaried professionals

Self-employed individuals

Retirees with mutual fund holdings

LAMF Eligibility Requirements:

KYC-verified PAN

Active mutual fund folio in demat form

No need for income proof or CIBIL score

Use any LAMF eligibility calculator online (Investkraft, Volt, Bajaj) to check your loan limit.

Loan Against Mutual Funds: Documents Required

You’ll be surprised how minimal it is:

PAN card

Linked mobile number for OTP

Demat account login or mutual fund folio number

There is no need to upload salary slips, income proof, or ITR, unlike personal loans.

How Does a Loan Against a Mutual Fund Work?

Apply online on any LAMF platform (e.g., Investkraft, Bajaj Finserv)

Enter your PAN and validate your folio

The lender checks your eligible mutual fund units

The loan amount is calculated using the loan against mutual fund calculator

Get instant disbursal into your bank account

Your units are pledged, and you can unpledge anytime by repaying the loan.

Risks of LAMF: What You Must Know

Loan Against Mutual Fund Margin Call: If the NAV drops significantly, the lender may ask you to repay a portion or add more units

Risk of LAMF NAV Drop: Equity markets are volatile, so equity funds carry higher risk

Redemption Blocked: You can’t sell your pledged units until the loan is cleared

However, for debt mutual funds, risks are minimal, and LTV is higher.

Best Banks & Platforms for Loan Against Mutual Funds in 2025

Check recent loan against mutual fund reviews on Reddit or Google before choosing a platform.

Why Choose LAMF in 2025 for Financial Needs?

No EMI burden upfront

You stay invested while getting liquidity

Much cheaper than personal loans

Great for short-term or mid-term funding: weddings, emergencies, travel, education

Whether you're a young investor or a salaried individual, a digital loan against mutual fund is the smartest way to raise money today.

FAQs on Instant Loan Against Mutual Funds in 2025

Q1. What is the loan against mutual fund interest rate in 2025? Interest rates range from 8% to 11.5% based on the fund type and lender.

Q2. How much loan can I get against mutual funds? You can get up to 80% LTV on equity funds and up to 85% on debt mutual funds.

Q3. Are there any risks of taking LAMF? Yes, if NAV drops drastically, a margin call may be triggered. However, with proper planning, this can be managed.

Q4. Can I apply for LAMF without income proof or CIBIL? Yes. LAMF is completely collateral-based. No CIBIL or income proof is needed.

Q5. Which is better – LAMF or a personal loan? LAMF is cheaper, faster, and requires no documents. It’s ideal for mutual fund investors.

Final Words: Tap Your Investments, Not Your Savings

Why liquidate your funds when you can use them as leverage? In 2025, LAMF loans are empowering investors with easy access to capital, be it for a personal emergency, funding a wedding, or growing a side business.

If you have mutual funds, it’s time to make them work for you. Explore LAMF with trusted lenders like Investkraft, Volt Money, or Bajaj Finserv and unlock a world of digital, instant, low-interest funding.

Apply loan against a mutual fund online now – no income proof, no stress, only smart financing.

#loan against mutual fund interest rate#LAMF interest rate 2025#loan against mutual fund LTV#LAMF LTV equity vs debt mutual fund#loan against mutual fund calculator#LAMF eligibility calculator#loan against mutual fund documents required#apply loan against mutual fund online#LAMF vs personal loan#loan against mutual fund vs gold loan#loan against mutual fund margin call#risk of LAMF NAV drop#best banks for loan against mutual funds#Volt Money LAMF#Bajaj Finserv mutual fund loan#loan against mutual fund review#LAMF experiences reddit#lamf#loan against mutual funds limit#loan against mutual funds features#lamf eligibility#lamf loan#digital loan against mutual fund#investkraft loan#loan against mutual funds for financial needs#what is a loan against mutual fund#who can apply for loan against mutual funds#loan against mutual funds explained#loan against mutual funds processing fees and interest rates#lamf api

1 note

·

View note

Text

Implement Rate Limiting for Secure ColdFusion APIs

#Implement Rate Limiting for Secure ColdFusion APIs#Implement Limiting for Secure ColdFusion APIs#Implement Secure ColdFusion APIs

0 notes

Text

Implementing Throttling and Rate Limiting in Django REST Framework

Introduction:In today’s API-driven world, ensuring that your API is secure and efficient is crucial. One way to achieve this is by implementing throttling and rate limiting in your Django REST Framework (DRF) applications. Throttling controls the rate at which clients can make requests to your API, helping to prevent abuse and ensuring that your server resources are not overwhelmed by excessive…

0 notes

Text

Kids, we know how interest works, right? A while back I made a post about how credit card interest can screw you, but we know how interest can be good for you too, right?

I suspect we don't know about this because on one of the posts I made about it someone said something about how it is evil that money can make money, but you know that's not just for the ultrawealthy, right? That is legitimately something that you can and should take advantage of in some kind of retirement/savings/investment account.

Let us say that you are twenty years old, have no money to put into a savings account, but have a job that pays you well enough that you've got twenty dollars to spare from each paycheck.

Let us say that you put that into a normal savings account; normal savings accounts have an average interest rate of .56 APY. Let us say you are going to be working until you are sixty, and that you will add forty dollars to that account every month (twenty bucks from each paycheck) for a total of $480 per year.

At the end of 40 years you would have about $21.5k.

That's a pretty good chunk of change! twenty thousand dollars is a lifechanging amount of money. But look at the total interest. In forty years you would have accrued only $2300 in interest.

Now, instead, let us imagine that you are a member of a credit union that offers you a free, high-yield savings account with a decent APY. Everything else being the same, but putting that money in an account with a 4% return does this:

Your total contributions that you put in stay the same, but the amount of money you have at the end of forty years more than doubles.

Let's say you have a thousand dollars to put in the account at the beginning and run it again.

Low interest account: you add $1000 at the start and have an extra $1200 at the end.

High interest account: you add $1000 at the start and have an extra $4000 at the end.

There are many, many very stable opportunities for savings that will grow your money. Fifty thousand dollars isn't a retirement plan, but it's a hell of a lot better than what you would have if you just stuck cash in a savings account or if you didn't save any money at all.

I know how hard it can be to save. I know it feels impossible to put money aside, but even if you start with no money and can tuck away five dollars a week you can get a LOT out of that five dollars a week.

This certainly isn't "you can't buy a house because you get coffee at the cafe," but it something that can HELP.

Now, let's suppose you're not twenty. Let's suppose you're in my boat, and you're (almost) forty and you're going to be saving for twenty years. You still don't have a lot of cash, but you know it has less time to grow interest, so you double your contribution and you put in forty dollars for each paycheck for a total of $960 a year.

That is extremely very much not the same thing as putting in forty bucks a month for twenty years. Instead of your interest being nearly one and a half times the amount of your contributions, it is around half.

If you are a young person (honestly even if you are not a young person) and it is in any way possible for you to start putting money into any kind of an investment account, you should do so as soon as humanly possible. The earlier you do it, the more interest you will have and the more money you will end up with when you are nearing retirement age.

This is how individual retirement plans work. This is what a 401K does, but sometimes it does that with matching contributions from your employer (so your employer matches whatever you put into the account up to a certain percentage of your pay). 401K accounts also often have higher APYs than high yield savings accounts, though they have more limitations on how and when the money can be pulled out.

If you are broke as fuck and never learned anything about investing or interest from your family because your family was broke as fuck too, now is the time to learn. r/PersonalFinance is a reasonable resource (and if you ever happen to have a windfall that's the first place I would point you for figuring out how to make the most of it) for learning about this stuff.

Thinking about money sucks! Being afraid you'll never be able to retire sucks! Having to figure out how to save sucks! But there are tools out there that even very fucking broke people can use to make that suck less.

7K notes

·

View notes

Text

All this talk about Tumblr disappearing and how we should export our blogs.

Writing R code to download all the notes from ONE Tumblr post has been an irritating adventure.

The main problems:

The API only gives you ~50 notes per call - no pagination, no offset, no “get everything” option. Tumblr: Fuck you, API user.

You’re limited to 300 API calls per minute.

Even if you respect that limit, Tumblr will still get cranky and start throwing 429 “Too Many Requests” errors.

When you reach the end of a post’s notes, the API just… repeats the last note forever instead of stopping.

There’s no reliable way to know when you’ve hit the end unless you build that check yourself.

Tags and added text from reblogs are a completely separate part of the API - not included with the likes, reblogs, and replies you get from the /notes endpoint. Why? Tumblr: Fuck you, API user.

Did I mention that the API is a rickety piece of shit? It forced me to get a bit creative. I built a loop that steps backward in time using timestamps to get around the lack of pagination. Since the API only gives you the most recent ~50 notes, I had to manually request older and older notes, one batch at a time - with built-in retries, cooldowns, and rate-aware pacing to avoid getting blocked.

My script works now. It politely crawls back through thousands of notes, exits cleanly when it hits the end, and saves everything to a CSV file.

Was it worth it? Eh.

#a rare data science post#tumblr's rickety API#what a motherfucker#those posts telling people to use the API to download their entire blog#good luck with that#wheezes with laugher

57 notes

·

View notes

Text

Quick Tumblr Backup Guide (Linux)

Go to www.tumblr.com/oauth/apps and click the "Register Application" button

Fill in the form. I used the following values for the required fields: Application Name - tumblr-arch Application Website - https://github.com/Cebtenzzre/tumblr-utils Application Description - tumblr archival instance based on tumblr-utils Adminstrative contact email - < my personal email > Default callback URL - https://github.com/Cebtenzzre/tumblr-utils OAuth2 redirect URLs - https://github.com/Cebtenzzre/tumblr-utils

Get the OAuth Consumer Key for your application. It should be listed right on the www.tumblr.com/oauth/apps page.

Do python things:

# check python version: python --version # I've got Python 3.9.9 # create a venv: python -m venv --prompt tumblr-bkp --upgrade-deps venv # activate the venv: source venv/bin/activate # install dependencies: pip install tumblr-backup pip install tumblr-backup[video] pip install tumblr-backup[jq] pip install tumblr-backup[bs4] # Check dependencies are all installed: pip freeze # set the api key: tumblr-backup --set-api-key <OAuth Consumer Key>

So far I have backed up two blogs using the following:

tumblr-backup --save-audio --save-video --tag-index --save-notes --incremental -j --no-post-clobber --media-list <blog name>

There have been two issues I had to deal with so far:

one of the blogs was getting a "Non-OK API repsonse: HTTP 401 Unauthorized". It further stated that "This is a dashboard-only blog, so you probably don't have the right cookies. Try --cookiefile." I resolved the issue by a) setting the "Hide from people without an account" to off and b) enabling a custom theme. I think only step a) was actually necessary though.

"Newly registered consumers are rate limited to 1,000 requests per hour, and 5,000 requests per day. If your application requires more requests for either of these periods, please use the 'Request rate limit removal' link on an app above." Depending on how big your blog is, you may need to break up the download. I suspect using the "-n COUNT" or "--count COUNT" to save only COUNT posts at a time, combined with the "--incremental" will allow you to space things out. You would have to perform multiple passes though. I will have to play with that, so I'll report back my findings.

82 notes

·

View notes

Text

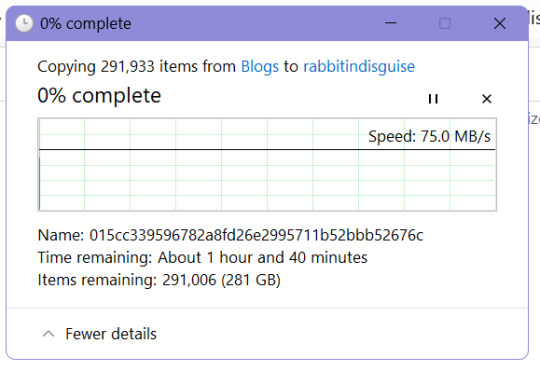

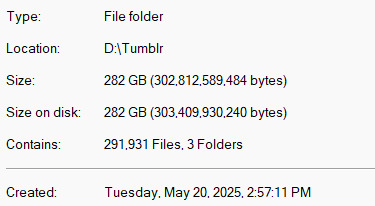

I was talking about backing up my tumblr to a friend who works in data storage and the amount of "holy-" "Half a gig text document? Probably?" "Is that gonna give you problems . . . ? that's an understatement" that happened made waking up to this

worth it

the first rule of data storage is have fun and be yourself :3

[context: all of these images are scary to people who know better than me for many reasons like "too many different files for a hard drive to handle searching" and "text documents shouldn't freeze notepad" and so on. But it was 3 a.m. this morning when I decided to let this run unsupervised and before tumblr force locked me out of my account on my browser because it thought I was a bot trying to DDoS attack them. As if it's my fault. Anyways rate limit your API requests or something if you have a blog with 220,000+ posts.]

#personal#I might have to message tumblr themselves and be like. so sorry about giving you psychic damage trying to archive after your archive failed#can I still have my data though pls

9 notes

·

View notes

Text

OK so basically I don't know anything but I think the way I would propose to save the world of videogames is for there to be something like.....a standardized virtual machine, a quasi-emulator, that "emulates" an imaginary console with a defined architecture. It outputs up to a fixed resolution and framerate (let's say 1920x1080, 60fps. though I wouldn't mind it lower) and performs up to a certain calibre of graphical complexity. We can have it free and open source yadda yadda. And we'll have APIs for it and so on and basically the idea is games can just be developed and distributed as "roms" for this virtual machine.

There's almost certainly some glaring issue with this idea that I would need to know more about computerology to catch but doesn't that just sound great.. Like my inspiration here is the fact that playing old games on an emulator is frankly by far the most accessible and reliable way of video gaming nowadays. For one thing you don't have to worry about specs for each particular game or spend ages wrangling config files to get something to run if you don't have an up-to-date Gaming Machine. If you can emulate one PS2 game you can more or less emulate them all (except gran turismo 4 lol but you get the idea). Also (and this is key) it would hopefully act as a buffer against the inflation of performance demands that makes perfectly good computer hardware obsolete at an unsustainable rate. Limitations breed creativity and all that. Many many old games are still absolutely gorgeous. It's about the hand-craftedness...... I think also there is something to be said for video games not being so staggeringly huge and graphics so detailed that dev companies need to outsource half of the work to graphic design sweatshops in order to get it finished before the next god damn playstation comes out

And anyway you wanna talk about cross platform...Literally what is more cross-platform than the humble game boy advance rom. Like are you serious. You can play that shit on an egg timer. You can play that shit on a cup and string

16 notes

·

View notes

Text

what is this

the tag replacer lets you find all your posts with a tag and replace that tag with another tag, or multiple tags, or remove the tag. you may find this useful when wrangling your tagging system.

it's really slow / takes multiple tries to get all my posts

for sets of more than 500 posts, we run into tumblr's API rate limits. i'm working on a workaround, but it's part of a larger refactoring project that i've been working on sporadically for 3 years.

XKit Rewritten's tag replacer uses a different API and is both faster and not subject to the same rate limits, so right now it's better for large sets of posts. however, it does not retain the order your tags are in.

it says it worked but when i go to my blog the tags are the same

sometimes posts on username.tumblr.com take a while to update- try viewing them on tumblr.com/username instead.

it's not working / bug report

please include as many details as possible, such as: the exact error message (if there is one) or a description of what's happening, the tags you're finding and replacing, and the blog you're using it on. screenshots or screen recordings are great if that's easier for you. i answer these messages privately when possible! you can also submit bug reports on github.

50 notes

·

View notes

Text

A really good illustration of average American historical awareness is that you frequently see people praising the Reagan era for savings account interest rates being so high. Despite the fact that inflation was significantly higher than those rates & also the cost of borrowing money was also much higher - the two reasons savings account rates ever go up. Which were a signature aspect of Reaganomics and also why you had so many high-profile business meltdowns towards the end of the 80s.

Yknow because the business model of a bank is that your savings account is a long term limited withdrawals deposit, they invest and loan from it, and then you only get a percentage of that action small enough to ensure their profits. So you only come out ahead on savings accounts relative to inflation if you manage to lock in a guaranteed rate at the peak offering and then inflation falls quickly and shortly after you opened it. The banks weren't offering 13% interest on savings accounts in 1981 out of the goodness of their hearts, it was because the bank could charge 19% apy on their mortgages and people had to suck that up and take it,all while overall inflation was up around 14% yearly and unemployment was skyrocketing.

9 notes

·

View notes

Text

Loan Against Mutual Funds Online in 2025 – Fast Approval Without Selling Investments

In 2025, if you need urgent cash and own investments like mutual funds or shares, there's good news—you no longer need to sell your assets. Thanks to the rise of LAMF (Loan Against Mutual Funds) and LAS (Loan Against Shares), you can instantly apply for a digital loan without disturbing your portfolio. Whether it's for a wedding, education, travel, or medical emergency, you can unlock funds in minutes — no income proof, no selling, just swipe and go.

Let’s explore how a digital loan against mutual funds or shares works, who can apply, what the features, limits, eligibility, and more. This guide will clearly and naturally answer every user's question, utilizing all the important search keywords to help both readers and search engines trust and rank this content.

What is a Loan Against Mutual Fund (LAMF)?

A Loan Against Mutual Fund (LAMF) allows you to borrow money using your mutual fund units as collateral. Instead of redeeming your mutual funds, lenders provide you with a credit line or term loan based on the NAV (Net Asset Value) of your holdings.

Similarly, a Loan Against Shares (LAS) lets you pledge your equity shares and get funds instantly. The biggest advantage? You retain ownership and continue to earn returns, dividends, and capital gains while enjoying liquidity.

Top Features of Loan Against Mutual Funds & Shares (LAMF LAS)

How Does a Digital Loan Against Mutual Fund Work in 2025?

Log in to your Demat or Mutual Fund platform. Most AMCs and fintech apps now offer LAMF APIs directly integrated.

Select the funds to pledge. ELSS, debt, hybrid, and large-cap funds are typically eligible.

Get an instant offer based on NAV. The higher the NAV and fund stability, the better your loan terms.

E-sign documents and complete KYC online.

Loan is disbursed digitally – often within 30 minutes!

This is how a digital loan against mutual funds online saves you time, paperwork, and the stress of liquidating long-term wealth.

LAMF Eligibility & Documents – Who Can Apply in 2025?

Eligibility for Loan Against Mutual Funds (LAMF):

Age: 21 to 65 years

Must own eligible mutual fund units (ELSS, debt, hybrid, or equity)

Resident Indian with valid PAN & Aadhaar

Salary slip or ITR is not mandatory (many lenders skip this)

LAMF Documents Required:

PAN Card

Aadhaar or Passport/Voter ID

Mutual Fund Statement (CAS)

Cancelled Cheque (for loan disbursal)

Optional: Income proof for higher limits

You can also use a loan against mutual funds eligibility calculator available on most lending platforms to get your eligible amount instantly.

Top Use Cases – Why People Apply for a Loan Against Mutual Funds in 2025

Loan Against Mutual Funds for Wedding Expenses Don’t touch your SIPs or ELSS—get a short-term loan without penalty.

Loan Against Mutual Funds for Higher Education Quick and smart funding option without breaking your portfolio.

Loan Against Mutual Funds for Financial Planning Use for emergencies or opportunities while your investments grow.

Loan Against Mutual Funds for Financial Needs Medical emergencies, travel, family events, or even down payments.

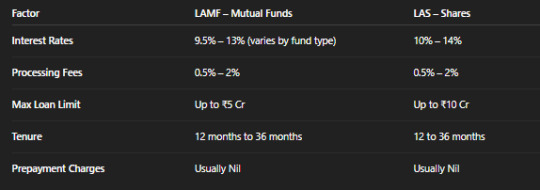

Interest Rates, Processing Fees & Limits – All You Need to Know

Digital loan platforms use LAMF APIs to instantly evaluate, process, and disburse loans, making the loan against mutual funds processing fees and interest rates transparent and user-friendly.

How to Apply for a Loan Against Mutual Funds Online – Step-by-Step (2025)

Visit a digital lending platform (like Groww, Zerodha, Paytm Money, or a Bank site)

Click on “Apply for Loan Against Mutual Fund.”

Enter PAN & link your MF folio or Demat

Select eligible funds (ELSS, debt, equity)

View the loan offer via the LAMF eligibility calculator

E-sign documents and submit KYC

Get instant disbursal to your linked bank account

Some fintech apps offer a loan against shares interest rates comparison to help you choose LAS vs LAMF smartly.

FAQs – Loan Against Mutual Funds or Shares in 2025

1. What is a loan against a mutual fund?

A Loan Against Mutual Fund (LAMF) allows you to borrow money without selling your investments by pledging them digitally.

2. Who can apply for a loan against mutual funds in India?

Any Indian citizen above 21 who holds mutual funds in their name can apply. Many platforms don’t require income proof or a high CIBIL.

3. Can I apply for a loan against ELSS mutual funds?

Yes, loan against ELSS is allowed, but with certain lock-in caveats. Many lenders accept ELSS if held for over 3 years.

4. How much can I borrow through LAMF?

Using a loan against mutual funds eligibility calculator, most users can obtain a loan of up to 70%-80% of their mutual fund's NAV.

5. Is LAS or LAMF better in 2025?

If you hold mutual funds, go for LAMF. If you own equity shares, LAS offers better liquidity options. Compare both using the Loan Against Securities Interest Rates before choosing.

Final Thoughts: Borrow Smart, Invest Smarter

In 2025, you no longer need to choose between growth and liquidity. With smart fintech platforms offering digital loans against mutual funds or shares, you get the best of both worlds — access to instant funds without selling your long-term assets.

Whether you’re planning a big event or tackling a financial emergency, LAMF or LAS ensures you get cash on tap with low documentation, transparent interest rates, and minimal stress. Just a few clicks, and you’re good to go — No Sell, Just Swipe.

#lamf#loan against mutual funds online#lamf eligibilty & documents#loan against elss#digital loan against mutual fund#how to apply loan against mutual funds#loan against mutual funds explained#features of loan against mutual funds#how does a loan against mutual fund work#loan against mutual funds faqs#lamf api#loan against mutual funds processing fees and interest rates#what is a loan against mutual fund#loan against mutual funds max limit#lamf eligibility#lamf loan#loan against mutual funds for wedding#loan against mutual funds eligibility calculator#loan against mutual funds for financial planning#apply for loan against mutual fund#loan against mutual funds for financial needs#loan against mutual funds features#loan against mutual funds for higher education#loan against mutual funds limit#loan against mutual funds eligibility and documents#digital loan against mutual funds interest rate#who can apply for loan against mutual funds#lamf documents#LAS#Loan Against Securities Interest Rates

0 notes

Text

funny update to the cohost saga: the primary secondary funder is making them keep the site up for longer than initially planned (dec 31) because the (very haphazard) archival effort is taking longer than planned because 1. the site is slow. like, painfully slow 2. cohost's admins refused to shut off RATE LIMITING or help the archive team in any way

the whole archive thing is really funny because they delayed it for so long that the site is noticeably less functional now, and also since they were starting from square one in terms of understanding how cohost's api works, somehow their entire archival effort is going SLOWER than my own scrape of the website, which took maybe 3? 5? days at most and scraped around 84% of all created posts (remainder were likely private/deleted) and about a fifth of all created users (remainder had never posted and thus were invisible to my crawling methods)

13 notes

·

View notes

Text

either curseforge is having some serious issues with their servers at the moment or they started heavily rate-limiting downloads from the api key i'm using on prismlauncher, but if this is the case what they failed to consider is that i am 100% willing to take an hour to download a minecraft modpack if it means i dont need to use their catshit adware launcher

4 notes

·

View notes

Text

SMM Panel India - YoYo Media

In a busy environment of social media marketing, having a stable and Cheapest SMM Panel India may be a business changer to companies, influencers or even resellers. Hello and welcome to YoYo media, the number one company to go to in regards to the best and cheap SMM Panel services. Need to increase likes on Instagram, views on YouTube, likes on Facebook or followers on Tik Tok? YoYo Media has got you covered; all services are available roof.

Visit us at yoyomedia.in to explore our full range of SMM Panel services tailored for the Indian and international markets.

Why Choose YoYo Media as the Cheapest SMM Panel in India?

We know that not all of us have a huge budget to use up on digital marketing at YoYo Media. This is why we have developed a platform which is affordable, consistent and very affordable. So, what makes YoYo Media the Best SMM Panel in India used by thousands of users?

Low Prices: We offer the services at the most minimum price and therefore we are ranked as the Cheapest SMM Panel in the nation.

Big variety of services: Likes, followers, shares and views on Instagram, Facebook, YouTube, Twitter, LinkedIn and others.

Quick Delivery: Have immediate or express delivery with live order tracking.

Around the Clock Support: We have a support staff that can be contacted 24/7 in case of any questions or issues.

Safe Payments: We accept PayPal, Paytm, UPI, crypto and more payment options.

Be it a person influencer or a digital agency seeking a trustworthy SMM Panel, YoYo Media is the service you can count on.

What is an SMM Panel?

SMM Panel (an abbreviation of Social Media Marketing Panel) is an Internet service providing the possibility to buy social media services: followers, likes, views, comments and others. Such services will improve your presence and activity on different social networks.

Our SMM Panel is specifically designed at YoYo Media keeping in mind scalability, performance and user experience. Be it you are a business seeking to expand your online presence or a reseller intending to rake in profits through digital marketing, our panel is designed to fit all your needs.

YoYo Media – The Best SMM Panel for Resellers and Agencies

Searching a reliable and yet cheap SMM Reseller Panel? Thousands of resellers in India and around the globe prefer to use YoYo Media. With our bulk ordering system, API integration and automatic services, managing portfolios of large clients is a breeze.

As a reseller you get:

• Best Rates to get the highest profit margins

• API access to integrate your own system

• Ability to order in high volumes

• Day to day service modifications and performance tuning

• Reseller support

We are not only the Best SMM Panel, we demonstrate it by our performance, speed and the best prices.

Expanding Beyond Borders: SMM Panel India and Global Services

Although we are referred to as the Cheapest SMM Panel in India, our services and clients are not limited to this country in any way. We also happen to be considered as one of the best SMM Panel India and we serve clients in the United States with the exact same superiority.

Our panel offers geo-targeted, quick and genuine services whether you are targeting American panels or conducting campaigns in the USA. Whether it is Instagram USA followers or YouTube USA views, we have got it all.

Regardless of the location of your audience, YoYo Media will deliver globally with regional targeting.

Why Cheapest Doesn’t Mean Low Quality at YoYo Media

Most people have the mentality that cheap is equal to low quality. At YoYo media that is not so. We aim to bring professional quality social media services to all people without the compromise in quality.

So, here is how we can keep our services on the highest level and be the Cheapest SMM Panel:

Automation: Intelligent backend systems will lower the cost of operation and raise efficiency.

Partnerships: We have collaborated with credible data providers and services companies to give you the best prices that you cannot resist.

In-House Development: Our panel has been developed and is managed by our tech team, cutting on third-party expenses.

Affordability and quality are two components that we integrate and this makes us the Best SMM Panel to be used by users who are concerned about both price and quality.

Key Features of YoYo Media’s SMM Panel

Discover the outstanding features which make YoYo Media the preferred platform by digital marketers, resellers and social media enthusiasts:

Easy to Use Dashboard: Running all your campaigns at one place with simplicity.

Real-Time Order Tracking: Monitor the service status and tracking in real-time.

Multi-support: Facebook, Instagram, YouTube, Twitter, TikTok, LinkedIn and others.

New Updates: We are constantly updating our services according to the customer reviews.

White Label: Build your own SMM company on our platform.

You don’t have to spend a fortune to scale your social media—just log in to https://yoyomedia.in and get started.

Best SMM Panel for YouTube, Instagram, Facebook & More

Our area of expertise is providing targeted social media growth on all platforms. Are you a YouTuber wanting to get more views or a business wanting to promote your Instagram? We have got you covered.

Instagram SMM Panel: Instagram followers, likes, story views and IGTV views.

YouTube SMM Panel: Subscribers, likes, comments and monetizable watch time.

Facebook SMM Panel: Likes of the page, shares of the posts, viewers and reactions during the live.

TikTok SMM Panel: Followers, video likes, views and shares.

Twitter SMM Panel: Retweets, likes, followers and mentions.

All these and much more at the cheapest rates ever with our Cheapest SMM Panel, by YoYo Media.

One Platform, All Markets: SMM Panel India to USA at Best Prices

Are you looking to grow your social media presence whether you are a local business or looking to target international markets? Then look no further because YoYo Media is the ultimate social media growth tool. Being the Cheapest SMM Panel in India, we provide high-quality services, which will not smell your budget. Known as the Best SMM Panel reseller and agency, we also work with international clients as a reliable SMM Panel USA. Wherever you are, our one-stop SMM Panel will provide quick, cheap and trusted outcomes of any social media promotion.

How to Get Started with YoYo Media

To begin with YoYo Media is easy and quick:

1. Sign Up: Go to https://yoyomedia.in and create a free account

2. Add Funds: Select your desired payment option and top up.

3. Place Order: Choose the service you need, enter your link and place an order.

4. Track Progress: You can check the status of your orders in real-time on your dashboard.

No nasty surprises, no complex procedures - just easy, cheap and trustworthy SMM Panel services.

Why Indian Marketers Prefer YoYo Media

The Indian emerging digital world does not just need powerful solutions, but pocket-friendly solutions as well. YoYo media is good at that. This is why our platform is Indian social media marketers:

Local Payment Support: Paytm, UPI and others.

Fast Customer Support: Support staff who speaks Hindi and English.

Lowest Latency Order Fulfillment: Our systems (located in India) are tuned to create the lowest latency.

Special offers and rates: Custom packages and offers to the Indian users and resellers.

YoYo Media is the way to go in case you are located in India and would like to get the Cheapest SMM Panel without affecting the quality of the panel.

Trusted by Thousands of Clients

At YoYo Media, client satisfaction is our top priority. We’re proud to have earned the trust of:

Social media influencers

Digital marketing agencies

Freelance marketers

E-commerce businesses

YouTube creators

Resellers across India and abroad

With hundreds of five-star reviews and repeat customers, our reputation as the Best SMM Panel continues to grow each day.

Final Thoughts: Take Your Social Media to the Next Level with YoYo Media

And when it comes to finding the Cheapest SMM Panel in India that is also reliable, high scale and provides exceptional support, then look no further than YoYo media. We have developed a platform whereby the user base all over the world, particularly in India and the USA, can get to maximize their social media growth at a considerably lower price.

Visit Now: https://yoyomedia.in

No matter the platform or scale of your needs, our SMM Panel is built to help you succeed. Join thousands of satisfied users who trust YoYo Media as their go-to source for social media marketing.

2 notes

·

View notes

Text

Integrating Third-Party Tools into Your CRM System: Best Practices

A modern CRM is rarely a standalone tool — it works best when integrated with your business's key platforms like email services, accounting software, marketing tools, and more. But improper integration can lead to data errors, system lags, and security risks.

Here are the best practices developers should follow when integrating third-party tools into CRM systems:

1. Define Clear Integration Objectives

Identify business goals for each integration (e.g., marketing automation, lead capture, billing sync)

Choose tools that align with your CRM’s data model and workflows

Avoid unnecessary integrations that create maintenance overhead

2. Use APIs Wherever Possible

Rely on RESTful or GraphQL APIs for secure, scalable communication

Avoid direct database-level integrations that break during updates

Choose platforms with well-documented and stable APIs

Custom CRM solutions can be built with flexible API gateways

3. Data Mapping and Standardization

Map data fields between systems to prevent mismatches

Use a unified format for customer records, tags, timestamps, and IDs

Normalize values like currencies, time zones, and languages

Maintain a consistent data schema across all tools

4. Authentication and Security

Use OAuth2.0 or token-based authentication for third-party access

Set role-based permissions for which apps access which CRM modules

Monitor access logs for unauthorized activity

Encrypt data during transfer and storage

5. Error Handling and Logging

Create retry logic for API failures and rate limits

Set up alert systems for integration breakdowns

Maintain detailed logs for debugging sync issues

Keep version control of integration scripts and middleware

6. Real-Time vs Batch Syncing

Use real-time sync for critical customer events (e.g., purchases, support tickets)

Use batch syncing for bulk data like marketing lists or invoices

Balance sync frequency to optimize server load

Choose integration frequency based on business impact

7. Scalability and Maintenance

Build integrations as microservices or middleware, not monolithic code

Use message queues (like Kafka or RabbitMQ) for heavy data flow

Design integrations that can evolve with CRM upgrades

Partner with CRM developers for long-term integration strategy

CRM integration experts can future-proof your ecosystem

#CRMIntegration#CRMBestPractices#APIIntegration#CustomCRM#TechStack#ThirdPartyTools#CRMDevelopment#DataSync#SecureIntegration#WorkflowAutomation

2 notes

·

View notes