#apply for gstin number

Explore tagged Tumblr posts

Text

All GST registered businesses have to file monthly or quarterly GST returns and an annual GST return based on the type of business. GST Return Filing is mandatory in nature and non – filing will attract penalty and may result of GST Cancellation also. Simplify the GST return filing process for your small business with our comprehensive guide. Stay compliant with India’s GST regulations effortlessly.

Read More >> https://setupfiling.in/gst-return-filing/

#gst registration check#tax system#e file income tax return#tax portal#tax tutorial#free online certificate courses in taxation in india#apply for gstin number#one tax#gst account opening#gst registration requirements#tax ser#file your taxes login#gst website india#invoice without tax#search gst number by name#my gst certificate#online tax app#us gov tax filing#goods and services tax e invoice system#apply for gstin#tax filing india#register with gst#new gst registration online

1 note

·

View note

Text

Apply for GST registration online with ease. Learn about GSTIN numbers, registration charges, and how to successfully register for GST to grow your business."

GST registration is essential for businesses to comply with tax laws and access the benefits of the Goods and Services Tax system. Whether you’re looking to apply for GST online, obtain a GSTIN number, or understand the charges for GST registration, this guide simplifies the entire process. Ensure your business is compliant and ready for growth by registering for GST seamlessly and efficiently.

#consulting#business#company registration#taxation#investing#success#business registration#foreign company#finance#accounting#gst registration#register for gst#gstin number#gst apply online#apply for gst

0 notes

Text

Do non-profit organizations pay GST?

Goods and Services Tax (GST) is a comprehensive tax levied on the supply of goods and services in India. While businesses are generally required to register for GST and comply with tax regulations, many non-profit organizations (NPOs) wonder whether they are liable to pay GST. This article explores whether non-profits need GST registration and under what circumstances they are taxed.

Are Non-Profit Organizations Required to Register for GST?

Non-profit organizations (NPOs), including trusts, societies, and charitable institutions, are not automatically exempt from GST. Their liability depends on the nature of their activities and the type of income they generate.

If an NPO is engaged in the supply of goods or services and its annual turnover exceeds the prescribed threshold of ₹40 lakh (for goods) or ₹20 lakh (for services), GST registration is required. For organizations in special category states, the threshold is lower at ₹20 lakh for goods and ₹10 lakh for services.

If your non-profit operates in Tamil Nadu, opting for GST registration in Coimbatore ensures compliance with tax laws.

When Do Non-Profits Have to Pay GST?

Non-profits must pay GST in the following cases:

Commercial Activities: If an NPO provides services or sells goods for a fee, GST applies. For example, if a charitable trust sells handmade products to raise funds, GST is applicable.

Sponsorship & Advertisements: If an NGO receives sponsorship or earns revenue through advertisements, GST is levied.

Paid Events & Workshops: If an NPO organizes training sessions, workshops, or ticketed events for a fee, GST is chargeable.

Services to Businesses: If a non-profit provides services to companies (e.g., consultancy, CSR-related projects), GST registration is mandatory.

For smooth compliance, choosing online GST registration in Coimbatore helps NPOs fulfill their tax obligations.

When Are Non-Profits Exempt from GST?

Non-profit organizations can claim GST exemption in the following cases:

Charitable Activities: Services directly related to education, healthcare, or public welfare may be exempt.

Donations & Grants: If an NPO receives funds as pure donations without any service in return, GST does not apply.

Government-Approved Exemptions: Some NGOs registered under Section 12AA of the Income Tax Act may receive GST exemptions on specific activities.

How to Get GST Registration for Non-Profits?

If your NPO is liable to pay GST, here’s how to register:

Collect Required Documents – PAN, trust registration certificate, bank details, and address proof.

File Application on GST Portal – Submit the details online.

Receive GSTIN – After verification, the organization gets a unique GST Identification Number (GSTIN).

For seamless registration, opting for GST registration in Coimbatore through expert services ensures accuracy and compliance.

Conclusion

Non-profits are not automatically exempt from GST. If they engage in commercial activities, sponsorships, or charge fees for services, GST applies. To ensure compliance, non-profits can opt for online GST registration in Coimbatore and follow necessary tax regulations.

2 notes

·

View notes

Text

Can You Get GST Benefits on a Personal Loan Processing Fee?

Introduction

A personal loan is one of the most sought-after financial tools that provides individuals with the flexibility to meet various financial needs. Whether it's for medical expenses, home renovation, education, or any emergency, a personal loan offers a quick and unsecured funding option. However, like any financial product, it comes with associated costs, such as interest rates, processing fees, and taxes.

One common question borrowers ask is whether they can claim GST benefits on a personal loan processing fee. Understanding the taxation structure related to Goods and Services Tax (GST) on personal loans can help individuals and businesses make informed financial decisions.

1. What Is GST on Personal Loans?

The Goods and Services Tax (GST) is a comprehensive indirect tax levied on goods and services in India. When you apply for a personal loan, the loan amount itself is not subject to GST since loans are considered financial transactions rather than goods or taxable services. However, certain charges associated with personal loans do attract GST, including:

A. Processing Fee

Lenders charge a processing fee to cover administrative costs.

GST is levied at 18% on the processing fee.

B. Prepayment Charges

If you repay your loan before the tenure ends, lenders may impose a prepayment penalty, which is taxable under GST.

C. Bounce Charges & Penal Interest

If you miss an EMI payment, you may incur bounce charges and late fees, which also attract 18% GST.

Since GST is charged on processing fees, borrowers often wonder whether they can claim GST benefits or get exemptions on these charges.

2. Can You Claim GST Benefits on a Personal Loan Processing Fee?

The ability to claim GST benefits on a personal loan processing fee depends on the type of borrower and the nature of the loan usage. Let's explore different scenarios:

A. For Salaried Individuals

Salaried employees cannot claim GST input credit on personal loans.

Since personal loans are for personal use (not for business purposes), they do not qualify for GST benefits.

B. For Self-Employed Individuals & Business Owners

If a personal loan is used for business-related expenses, GST benefits may be available.

GST input tax credit (ITC) can be claimed only if the loan is directly linked to business operations.

3. How Can Business Owners Claim GST Benefits on Personal Loan Fees?

Self-employed individuals or business owners who use personal loans for business expenses may be eligible to claim GST input credit on the processing fee and other charges. Here’s how:

A. Loan Usage for Business

If a personal loan is used to fund business expansion, working capital, or asset purchase, GST input credit can be claimed.

The borrower must provide proof that the loan was utilized exclusively for business.

B. GST Registration Requirement

To claim GST input tax credit, the business must be GST-registered.

The GSTIN (Goods and Services Tax Identification Number) must be mentioned on the loan-related invoices.

C. Proper Documentation

Maintain records such as:

Invoice for the processing fee with GST details.

Bank statements showing loan utilization.

Tax invoices for purchases made using the loan.

D. Filing GST Returns

Claim GST input credit while filing GSTR-3B and GSTR-9 (Annual Return).

Ensure compliance with GST rules and regulations.

4. GST Exemptions on Personal Loans: What Borrowers Should Know

While personal loan principal and interest are GST-exempt, certain borrowers might seek ways to reduce tax liabilities on associated charges. Here are some common misconceptions and clarifications:

A. Misconception: GST Is Applicable on the Loan Amount

Many believe that GST is charged on the total loan amount, which is false.

GST is only applicable to loan-related fees, such as processing charges.

B. Can Processing Fees Be Avoided?

Some lenders offer zero processing fee personal loans as promotional offers.

While this eliminates GST on processing fees, other charges like higher interest rates may apply.

C. Negotiating Processing Fees with Banks

Borrowers with a strong credit score can negotiate lower processing fees.

Lower fees mean lower GST payable.

5. Comparing Personal Loan GST Charges Among Banks

Different lenders may have varying processing fee structures, affecting the total GST amount payable. Here’s an approximate range of processing fees and GST:

HDFC Bank: 1.50% - 2.50% + 18% GST

ICICI Bank: 1.50% - 2.25% + 18% GST

SBI Personal Loan: Up to 1.50% + 18% GST

Axis Bank: 1.50% - 2.00% + 18% GST

Before applying for a personal loan, borrowers should compare processing fees, GST costs, and total loan expenses to find the most affordable option.

6. How to Reduce GST Impact on Personal Loan Processing Fees?

While GST on personal loan processing fees cannot be avoided completely, borrowers can take steps to minimize its impact:

A. Look for Special Loan Offers

Some banks waive processing fees during festive seasons.

Opting for such offers can reduce GST liability.

B. Consider Digital NBFCs

Many online lenders offer lower processing fees than traditional banks.

Comparing options helps in saving on additional charges.

C. Improve Your Credit Score

A higher credit score gives borrowers better negotiation power.

Lenders may lower processing fees for low-risk applicants.

D. Check for Employer Tie-Ups

Some companies have tie-ups with banks for discounted loan processing fees.

Employees of certain organizations may receive special loan offers with reduced GST liability.

Conclusion

While GST on personal loan processing fees is an additional expense, salaried borrowers cannot claim tax benefits on it. However, self-employed individuals and business owners can claim GST input credit if the loan is used strictly for business purposes.

To minimize the impact of GST, borrowers should compare different lenders, negotiate lower fees, and take advantage of seasonal offers. Keeping proper documentation is crucial for those eligible to claim GST benefits.

Understanding the taxation of personal loans ensures better financial planning, reducing unnecessary costs while maximizing tax efficiency. Always review your loan agreement, processing fees, and GST implications before proceeding with a personal loan application.

#loan apps#fincrif#nbfc personal loan#personal loan online#finance#personal loans#personal loan#bank#loan services#personal laon#Personal loan#GST on personal loan#Personal loan processing fee#GST benefits on loan#Loan processing fee GST#Personal loan tax benefits#GST input credit on loans#Loan charges and GST#GST exemption on personal loan#Personal loan interest and GST#Loan processing fee tax implications#GST rules for personal loans#How to claim GST on loan fees#Business loan GST benefits#GST on banking services#Loan fee tax deductions#Personal loan charges and GST#Tax benefits for business loans#Financial charges with GST#GST impact on loan processing

1 note

·

View note

Text

What is Flash Fill In Excel?

Learning the Power of Automation in Excel for Accounting

What then is Flash Fill in Excel? Since its introduction in Excel 2013, Flash Fill is an automated data tool used to fill in values in a column following a pattern you specify. By identifying your input, Excel predicts and fills in the rest of the data entries without having to use cumbersome formulas or macros. The tool is particularly beneficial for the professionals taking the Advanced Excel Course since it optimizes data handling effectiveness.

How Flash Fill Works

Flash Fill is based on clever pattern detection. Suppose you have a column of names such as "Rohit Sharma" and need to pull out just the first names into another column. You just enter "Rohit" in the blank space beside the first entry, and Excel has picked up the pattern. When you start entering the next first name or press Ctrl + E, Excel completes the rest for you.

Here's an example in step-by-step fashion:

Example:

A (Full Name) B (First Name) Rohit Sharma Rohit Virat Kohli Virat MS Dhoni MS Hardik Pandya Hardik Simply enter "Rohit" in cell B1 and press Ctrl + E. Excel does the rest.

Common Use Cases of Flash Fill in Accounting and Finance

Flash Fill is not a nicety but a productivity enhancer. For accountants, Excel experts, and data analysts in particular, Flash Fill saves hours of drudgery.

Separating Full Names Accountants typically work with employee or client databases. Flash Fill separates first and surname quickly for sorting and filtering.

PAN, GSTIN, or Phone Number Formatting When training for the GST Course, professionals sometimes work with PAN or GSTIN numbers that need to be formatted. For example, converting "ABCDE1234F" to "ABCDE-1234-F" is easy with Flash.

Combining Fields Need to copy email addresses from first and last names? Flash Fill recognizes the pattern in one or two instances and does it for you, i.e., "[email protected]."

Unpicking Code Data

In the Taxation Course, students learn to deal with invoice numbers and transaction IDs. Flash Fill can unpick components of these codes, such as region or client ID segments, which saves time parsing data.

Advantages of Flash Fill in Excel

Flash Fill is a favorite tool for novice as well as advanced users of Excel. The following are some strong advantages:

No Formula Knowledge Necessary As opposed to other Excel functions that require one to know about functions such as LEFT(), RIGHT(), or TEXT(), Flash Fill requires no formulas. This makes it a student favorite in Advanced Excel Courses.

Time Efficiency Data manipulation manually takes a lot of time. Flash Fill cuts down on repetitive work considerably — something that is valuable for a student doing an Accounting Course or someone who works under tight deadlines Accuracy

Manual copying tends to introduce typos. Flash Fill minimizes human error by enforcing uniform logic on data accessibility It's accessible in Excel 2013 and later versions — no add-ons, no plugins.

Limitations of Flash Fill

Flash Fill is great, but not infallible.

Not Dynamic Flash Fill doesn't adapt when source data changes. It's a static fill, as opposed to formulas, which update dynamically.

Inconsistent Results with Complex Patterns If the pattern is not evident or too intricate, Flash Fill may provide incorrect results or not pick up on the logic.

Won't Automatically Work in All Situations On older computers or huge files, it's sometimes necessary to manually activate Flash Fill by using Ctrl + E.

Flash Fill versus Excel Formulas

Several students in the Excel Course question whether to use formulas or Flash Fill. The response varies based on your objective:

Apply Flash Fill for ad hoc, one-off fixes or formatting.

Apply formulas to dynamic calculations that adjust with changes to data.

Say, apply =LEFT(A2, FIND(" ", A2)-1) if you need the first name to change whenever column A is changed. Flash Fill will not do that.

How to Turn On or Apply Flash Fill in Excel

At times, Flash Fill may fail because it's disabled. Here's how to make sure it's activated:

Activate Flash Fill:

Go to File > Options > Advanced.

Scroll down to the Editing options section.

Make sure Automatically Flash Fill is checked

Use Flash Fill Manually:

Type the desired value in the adjacent column.

Go to Data > Flash Fill, or press Ctrl + E.

Learning Flash Fill through Professional Courses

Taking an Advanced Excel Course can make all the difference if you're going to increase your Excel proficiency for accounting or finance positions. Such courses teach Flash Fill as well as pivot tables, conditional formatting, VLOOKUP, and others.

Conclusion In conclusion, what is Flash Fill in Excel? It is a robust tool that simplifies repetitive data entry by identifying patterns defined by the user. Splitting text, formatting entries, or separating parts of a string? Flash Fill offers a fast, formula-less means to achieve your end. So the next time you find yourself doing the same task over and over in Excel, remember — Flash Fill is just a Ctrl + E away!

0 notes

Text

How GST Billing Software Simplifies Tax Compliance for Small Businesses

In today's fast-paced digital economy, small businesses face increasing pressure to comply with regulatory requirements while maintaining efficient operations. One such critical obligation is the Goods and Services Tax (GST) compliance. For many small business owners, staying on top of tax filings, generating accurate invoices, and ensuring timely payments can be overwhelming. This is where GST billing software steps in as a game-changer.

What is GST Billing Software?

GST billing software is a specialized tool designed to help businesses create GST-compliant invoices, manage sales and purchases, file tax returns, and maintain accurate financial records. These platforms are typically equipped with features that automate tax calculations, track GST rates, and generate reports required for filing returns with tax authorities.

Key Ways GST Billing Software Simplifies Tax Compliance

1. Automated GST Calculations

Manually calculating GST for every invoice can lead to errors and inconsistencies, especially when dealing with multiple tax slabs. GST billing software automatically applies the correct tax rate based on the product or service category and location of sale, ensuring accuracy in every transaction.

2. Easy GST-Compliant Invoicing

The software enables businesses to generate professional, GST-compliant invoices within seconds. These invoices typically include HSN/SAC codes, GSTINs, invoice numbers, and breakdowns of CGST, SGST, or IGST – all formatted according to government regulations.

3. Effortless Filing of GST Returns

GST billing software simplifies return filing by maintaining organized records of all transactions. Most platforms integrate directly with the GST portal or allow easy export of return-ready data, minimizing the need for manual data entry and reducing the chances of errors.

4. Real-Time Data Tracking

With cloud-based solutions, business owners can monitor their financial and tax data in real-time from any device. This visibility helps in tracking outstanding payments, managing cash flow, and preparing for audits.

5. Improved Record-Keeping and Audit Readiness

Proper documentation is crucial during audits. GST software automatically stores and categorizes invoices, credit notes, debit notes, and returns, ensuring that all records are easily accessible and audit-ready.

6. Inventory and Expense Management

Many GST billing tools come with built-in inventory and expense tracking. This helps businesses keep tabs on stock levels and analyze financial performance while ensuring accurate tax reporting on all purchases and sales.

7. Reduced Dependence on Accountants

While accountants remain valuable, GST software reduces the day-to-day burden by automating routine tasks. This lowers operating costs for small businesses and empowers owners to handle more of their financial management independently.

Benefits Beyond Compliance

Aside from easing the compliance burden, GST billing software offers a competitive edge through improved operational efficiency. With faster invoicing, integrated reporting, and better control over finances, small businesses can focus more on growth and customer satisfaction.

Conclusion

For small businesses navigating the complex world of GST, adopting GST billing software is not just a convenience — it's a necessity. It streamlines tax compliance, reduces manual workload, ensures accuracy, and provides peace of mind. As regulations evolve and the digital economy grows, having the right tools in place can make all the difference in staying compliant and competitive.

0 notes

Text

Everything You Need to Know About GST Registration in India

If you are launching or operating a business in India, then you must have heard of GST, which stands for Goods and Services Tax. It is one of the most significant tax reforms in India, aiming to simplify the indirect tax system by combining various broad-based taxes into a single tax. For many entrepreneurs and small business owners, the challenge is not learning what GST is but how to register.

This guide aims to equip you with useful information about GST Registration, how to register, what documents to submit, and what it means once registered. Bluntly, let's put it simply.

What is GST Registration?

GST registration is the method of getting a business recognized under the Goods and Services Tax (GST) regime. You will get a GST registration number (GSTIN- Goods and Services Tax Identification Number) through your business after it has registered its business. The GSTIN is very much like the tax identity of the business; in fact, the GSTIN number is required if you want your customers to pay GST, if you want to claim the input tax credit, or simply if you want to ensure you follow the laws.

Who Has to Register for GST?

Here is the rule of thumb: not all businesses have to register, but many businesses do. You have to register for GST if:

• Your turnover exceeds ₹40 lakhs for goods (₹20 lakhs for services) in most states.

• You are in the interstate business (selling in two different states).

• You operate an e-commerce business.

• You supply through a marketplace such as Amazon or Flipkart.

• You are a casual taxable person (e.g. temporary stall in an exhibition).

• You are a non-resident Indian making a taxable supply in India.

• You are involved in a reverse charge transaction.

There are also situations where you voluntarily register - a business may register under GST even if they are not required to by law due to their annual revenue, just to give them a more professional business front, or so that they can obtain input tax credit, for example.

Advantages of GST Registration

I know what you are thinking - if it is not a requirement for me, why would I ever register?

Well, now you know why you might have to register. Let's look at the upsides:

1. Input Tax Credit (ITC). You can apply for a refund for the GST that you paid on business purchases.

2. Greater Credibility for your business. Many times, a customer or vendor will prefer to trade with GST-registered businesses.

3. Easier to scale. If you are planning to upscale/run any business dealing with any interstate or out-of-state customers, obtaining GST registration makes compliance easier.

4. E-Commerce Business. You can sell your products to consumers without any added compliance or hurdles.

Documents Required for GST Registration

To begin the process of GST registration, you would need to have a few important documents. Here is an outline of documents you will likely need:

For Proprietor:

PAN card and Aadhar card of the proprietor

Proof of address and bank statements, etc.

Picture of the Business Owner

Proof of business address (rent agreement or electricity bill)

For Partnership and LLP:

PAN card of the firm and all partners

Partnership deed

Address proof and ID for all partners

Address proof for the business

Bank statement for payables

For Company:

PAN card of the company

Certificate of Incorporation

Memorandum & Articles of Association (MOA/AOA)

PAN and address proof for all directors

Details of the authorized signatory

Board resolution making the GST registration official

You will also be required to have an authentic email ID and mobile number for OTPs.

The GST Registration Process: An Overview

Alright, now let's get into how to register. The process itself is online, free, and quite simple, though it can become complicated if you are not used to the portal.

Step 1: Go to the GST Portal

Open https://www.gst.gov.in and click 'Register Now' under 'Taxpayers'.

Step 2: Complete Part A of the Form

You will be asked for:

Your PAN number

Email ID

Mobile number

After providing this information you will receive an OTP (one-time password) that will be sent to both your email and your phone for verification. Once you complete the verification, you will receive a Temporary Reference Number (TRN).

Step 3: Complete Part B

You will then sign in using your TRN and complete the remaining portion of the form, which includes:

Business details

Promoter/Partner Information

Address of the business

Details of the Bank account

Upload the required documents

Step 4: Verification

Once you have submitted your application, you may receive a call or a GST officer may visit your premises for physical verification (rare unless your documents are not clear).

Step 5: Receive GSTIN

Once verified, you will receive your GSTIN within 7 working days,, and you will also receive a certificate of registration.

Errors that are common to avoid

Wrong business details: Even minor errors can trigger rejection.

Incorrect HSN/SAC codes: The codes used to classify the goods or services—make certain you get them right.

Late registration: If you surpass the turnover threshold and do not register, you will owe backdated tax and may even face penalties.

Wrong proof of address: Many applications are rejected based on this. Always upload proof of address that is clear and valid.

How can Kanakkupillai help?

It can be a headache to register for GST when you are balancing the needs of a business. We will help take that hassle away from you. Loading the necessary documents to register with GST for your business can be an arduous task because it means we will help gather all the document specifications, file the forms, and even maintain ongoing compliance post-registration!

There are many going into registering for GST, and you are likely to have questions along the way. The rules of the GST portal and practicable filing standards may be confusing. Our team of experts understands everything that goes along with your GST registration, so you can focus on your day-to-day business activities knowing that your GST registration will go through fast and easy, saving you time and hassle.

Final Thoughts

Registering your business under GST is not only a requirement but also a logical move to strengthen the structure of your business and your credibility as a businessperson. Whether you are a freelancer, a start-up business, or an older small or medium enterprise, GST Registration will help build the foundation needed for continued growth and trust as a seller in the marketplace. Getting to know the registration process and what it means for you from a tax compliance perspective will only help you as India transitions into a more organized tax environment.

If you're unsure or looking for assistance, please reach out to professionals in the space. It's far less stressful to get it sorted the first time than to try to get updates and corrections done. And if you feel confident moving forward, Kanakkupillai is ready to support you through the GST registration, return filing, and beyond.

0 notes

Text

Can the Same Virtual Office Be Used for Both B2B and B2C GST Activities?

In today's fast mobile digital economy, businesses are rapidly selecting virtual offices to adapt their businesses and reduce costs. One of the most common uses for virtual offices is startup and GST registration for service providers who want to expand specifically without physical infrastructure. Whether you apply for a GST number from a company or online for a GST number, many state virtual office registration departments.

However, many entrepreneurs believe that a single virtual office address can be used for both B2B and B2C transactions under GST. In this blog, we will find out the legal, operations and compliance implications of using a virtual office for GST registration activities.

What Is a Virtual Office in GST?

A virtual office is a service that provides professional addresses, postal processing and management assistance to businesses without the need of physical work areas. According to the GST (Products and Services Tax), virtual offices can be used as a primary place by law for registration purposes. It is particularly useful for startups, freelancers and online companies that are working from far away.

To use a virtual office for GST registration, you have to submit support documents such as a lease, owner of NOC and pension calculation. Once approved, the company can use this address to apply for the GST number to return files and invoices without creating the traditional office space.

Understanding B2B and B2C Under GST

With respect to GST (Products and Services Tax), transactions can be divided into two main species: B2B (business for business) and B2C (business for consumer). Each category has different requirements for invoices, compliance and tax therapy that businesses must understand to ensure proper GST management.

B2B (Business for Business)

The B2B transaction occurs between two GST registration units. In such transactions, the recipient may request a tax credit (ITC) for the taxes paid. The invoice should include both the supplier's GST number and recipient-S-S number and details such as HSN/SAC code, tax rate and tax amount. These transactions are usually more obedient because proper documents are required for ITC adjustment.

B2C (Consumer Business)

A B2C transaction is a sale for non-regulated or end-users. These invoices do not include recipients as consumers have no right to claim ITC. It mainly focuses on the total selling price and tax tax. Although simplified invoice formats are often available, especially in retail, GST returns should still reflect accurate sales data.

significant difference

The main difference lies in the status of GST registration of the recipient and the availability of tax credit. From the perspective of GST, businesses should be corrected and maintain separate, accurate records of both types of sales to ensure reporting and conformity.

Under GST registration, it is very important to understand this distinction when using a single virtual office for both B2B and B2C operations.

Is One Virtual Office Enough for Both?

Yes, a single virtual office can be used legally, surgery, actually for Indian B2B and B2C-GST activities. Let's find out why this approach works efficiently for modern companies.

1. Legally accepted according to the provisions of GST:- The GST Act clearly defines that a company must have a primary place for registration, which may be a physical office, a colleague area or a virtual office.

2. GSTIN for all transactions:- A single GSTIN can cover any type of goods or services within the registration of B2B or B2C. If your company is only in the state, you can handle everything under GST registration associated with your virtual office.

3. Simple management and reduce costs:- Using virtual offices for both activities optimizes your documents, reduces registration fees, and the complexity of managing many GST accounts or -onalale is avoided.

4 . Fill the requirements of the department:- The GST officials will accept virtual offices during the review until appropriate documents such as NOC, rental agreements and care calculations are filed. Many companies use virtual addresses for both transactions through IT, e-commerce and advice.

5. Manage the correct data records for both channels:- Addresses can be used, but it is important to get clear and organized records distinguishing between B2B and B2C transactions. It ensures accurate GST yield, input-decomis tracking and smooth auditing.

A well-written virtual office is not only enough, but also a wise and scalable solution to deal with B2B and B2C-GST operations.

Benefits of Using the Same Virtual Office

Using a single virtual office for both B2B and B2C-GST activities provides several benefits that can streamline business operations, reduce costs and improve compliance. We check the most important benefits.

1. cost efficient:- Maintenance of multiple addresses can be expensive in various offices or in different transactions. Virtual offices significantly reduce overhead costs related to fares, suppliers and maintenance. It is an ideal choice for startups, freelancers and small businesses who want to do lean work at the same time and maintain a professional image.

2. Simplified GST compliance:- Compatibility is easy when all transactions are connected to a single GST registered address. There is no need to advance a personal space for tax registration, ITC (ITC), or GST audit. All their documents are centralized and the offices reduce hill opportunities.

3. Identification of light record:- A single point of operation means integrated challan, documents and returns. Whether you generate invoices for GST registered buyers (B2B) or unregistered end consumers (B2C), everything can be managed from a location with a coherent procedure and software system.

4. Professional image:- Virtual offices are often equipped with famous commercial addresses, post treatment and reception services. It creates a professional brand image without physical office costs that can be beneficial for both B2B and B2C customers.

5. Company flexibility:- You can manage your company from anywhere and enable distance work and business continuity. This flexibility supports the growth and adaptation of online companies and service-based industries, especially those.

By using virtual offices for both types of GST activities, businesses enjoy more intelligent, scalable and legally obedient ways to manage operations in various customer segments.

When You Might Need Separate Addresses or GSTINs

The use of a single virtual office is legal and is convenient for both B2B and B2C-GST activities, but there are some landscapes where individual address or GST registration (GSTIN) requirements are profitable. Here, if you can consider this:

1. Operation in many states:- If your company provides goods or services from many states after GST, you will need to get a separate GSTIN for each state. In such cases, if registered, a separate virtual or physical office address is required.

2. Separate corporation or commercial industry:- If your company works under various corporations, or if you have separate industries (for example, manufacturing and retail sales under the same bread), then you can choose a separate GSTIN to provide clear control over compliance and accounting.

3 . e-commerce warehouse or supply center:- For product-based companies sold through e-commerce platforms (such as Amazon, Flipkart), GST registration often requires a separate warehouse address.

4. Complex supply chain or franchise model:- If your company follows the franchise model, or if you have several branches with complex supply chains, it may be understood to register each location individually.

5. Concern of GST department requirements or examination:- If their business activities are very diverse or if they believe it supports better monitoring and tax compliance, the GST officer may recommend or require a separate registration.

In such cases, establishing a separate virtual office or physical space can provide clarity, simplify operations and reduce legal risks.

Real-Life Business Scenarios

To understand how a single virtual office works in both B2B and B2C under GST, we often see examples.

1. Mother -in -law (software as a service) company:- Client provided high-tech startup cloud-based software. It is sold to other companies (B2B) that claim ITC and offer personal membership (B2C). With the help of a virtual office as a registered GST address, the company legally and efficiently calculates both customers and the uniform enables GST returns.

2. Ecommerce and Retail Brands:- Online dress brands sell their products through their website (B2C) and are also sold to boutiques and resellers (B2B). With virtual offices, you manage all your GST activities in terms of a single GSTIN, chase sales, generate tax returns, and still comply.

These landscapes show that customers can simplify GST suitability in types, regardless of business models.

FAQs

1. Can I use a virtual office for GST registration?

Yes, virtual offices are legally accepted for GST registration with appropriate documents.

2. Is a virtual office address enough for B2B and B2C?

Yes, a single GST registered virtual office can handle both types of transactions.

3. Do you get it with input tax credit (ITC) for the virtual office?

Yes, as long as the challan is valid and you can submit your GST return correctly.

4. Can I apply online for my GST number through the virtual office?

Absolutely. GST numbers can be promoted online through virtual office documents.

5. Do you need separate GSTINS for different business activities?

Only if they work in many countries or in separate corporations.

Conclusion

Using a location for B2B and B2C-GST activities is completely effective and extremely efficient. Today, many companies are choosing virtual office space to reduce overhead costs and maintain a professional image at the same time. As part of GST, it can legally act as a professional address for all obedient purposes.

Whether you are a freelancer, startup or growing company, you can complete your GST registration with this virtual setup without the need of a physical office. Simply make your challan, adopt and file returns, and participate in credit management from a central location. With proper documentation and accurate records, GST registered virtual offices can support a variety of procedures in customer types, making them a flexible and future solution.

0 notes

Text

Beginner’s Guide to MSME Registration: Benefits, Process & Documents

Introduction

Micro, Small, and Medium Enterprises (MSMEs) form the backbone of India’s economy, contributing significantly to manufacturing, exports, and employment. For entrepreneurs and businesses looking to grow and gain access to various government benefits, obtaining MSME Registration is a crucial step.

What is MSME Registration?

MSME Registration is a government-recognized certification provided to Micro, Small, and Medium Enterprises under the Ministry of MSME. It helps businesses avail benefits such as subsidies, easier access to loans, tax rebates, and protection against delayed payments. While registration is not mandatory, it is highly recommended that enterprises leverage these advantages to enhance their credibility.

Benefits of MSME Registration

Registering your business as an MSME unlocks a host of benefits that can fuel growth and sustainability:

Access to Subsidized Loans and Credit: MSMEs get priority lending from banks and financial institutions with lower interest rates.

Tax Benefits and Rebates: Various tax concessions and exemptions are available to registered MSMEs.

Protection Against Delayed Payments: The MSME Development Act mandates timely payments from buyers, reducing cash flow issues.

Government Tenders and Schemes: Registered MSMEs get exclusive access to government tenders and schemes like the Credit Guarantee Fund Scheme.

Ease of Business Expansion: MSME registration enhances your business profile, making it easier to attract investors and partners.

Reimbursement of ISO Certification Charges: Financial support for quality certifications.

Concession on Electricity Bills and Patent Registration: Cost savings on utilities and intellectual property protection.

These benefits collectively empower MSMEs to compete effectively in the market.

Eligibility Criteria for MSME Registration

To qualify for MSME Registration, businesses must meet the revised criteria based on investment and turnover:

Micro Enterprises: Investment up to ₹ one crore and turnover up to ₹ five crore.

Small Enterprises: Investment up to ₹10 crore and turnover up to ₹50 crore.

Medium Enterprises: Investment up to ₹50 crore and turnover up to ₹250 crore.

Eligible entities include:

Sole proprietorships

Partnerships and LLPs

Private and public limited companies

Startups and entrepreneurs

Self-Help Groups (SHGs)

Co-operative societies and trusts

Both manufacturing and service sectors can apply for registration if they meet these thresholds.

Step-by-Step MSME Registration Process

The entire MSME Registration process is online and free of cost, conducted through the official Udyam Registration portal. Here’s how to apply:

Step 1: Visit the Udyam Registration Portal

Go to the official government portal dedicated to MSME registration.

Step 2: Enter Aadhaar Details

Provide your Aadhaar number and the entrepreneur’s name. Validate via OTP sent to your registered mobile number.

Step 3: PAN and GST Verification

Enter your PAN number and GSTIN (if applicable). The portal automatically fetches investment and turnover data from government databases linked to PAN and GST.

Step 4: Fill Enterprise Details

Complete the form with details about your business, including the type of organization, significant activity (manufacturing or service), and address.

Step 5: Declare Investment and Turnover

Input your enterprise’s investment and turnover figures as per the eligibility criteria.

Step 6: Submit and Finalize

After verifying all details, apply. You will receive a final one-time password (OTP) for confirmation.

Step 7: Download the MSME Registration Certificate

Once approved, the Udyam Registration Certificate is generated instantly and sent to the applicant via email. This certificate serves as proof of your MSME status.

Documents Required for MSME Registration

The registration process is paperless and does not require uploading physical documents. However, you must provide the following details:

Aadhaar Number (mandatory for all applicants)

PAN Number of the business or entrepreneur

GSTIN (if applicable)

Bank Account Number and IFSC code

Business Address and contact details

No additional documents or proofs are required as the portal verifies data through government databases, making the process quick and hassle-free.

Tips for Optimizing Your MSME Registration Application

Ensure all details, especially Aadhaar, PAN, and GST numbers, are accurate to avoid delays.

Double-check investment and turnover figures before submission.

Select the correct “Major Activity” and “National Industry Classification Code” for your business.

Keep your registered mobile number active to receive OTPs promptly.

Conclusion

Obtaining MSME Registration is a strategic move for any micro, small, or medium enterprise aiming to grow sustainably and access government benefits. The online process is straightforward, free, and paperless, making it accessible to entrepreneurs across India. With the proper knowledge and preparation, you can complete your MSME Registration quickly and start enjoying the numerous advantages it offers.

By securing your MSME Registration, you position your business for better financial support, market opportunities, and regulatory benefits, ensuring a strong foundation for future growth.

0 notes

Text

IEC Registration – Import Export Code Registration in India

In today's globalized economy, businesses are expanding their reach beyond national boundaries. Whether you're planning to import goods from other countries or export Indian products to international markets, obtaining an Import Export Code (IEC) is a crucial first step. Issued by the Directorate General of Foreign Trade (DGFT), IEC is a 10-digit identification number that is mandatory for any individual or business dealing in import and export activities in India.

What is IEC (Import Export Code)?

The Import Export Code is a unique 10-digit code required for anyone starting an import or export business in India. It serves as a license that enables companies or individuals to engage in international trade. Without an IEC, it is not possible to clear customs, send shipments, or receive money from abroad.

Who Needs IEC?

IEC is required by:

Businesses or individuals who import goods into India.

Exporters who send goods or services outside India.

E-commerce operators dealing in international trade.

Startups or SMEs planning to expand globally.

Note: IEC is not required for imports or exports done for personal use, not connected with trade, manufacturing, or agriculture.

Benefits of IEC Registration

Global Market Access – Helps businesses expand beyond domestic markets.

No Return Filing – Unlike other tax registrations, no monthly or annual returns are needed.

Lifetime Validity – IEC is issued for a lifetime and doesn’t require renewal.

Simplified Process – The application is entirely online and hassle-free.

Supports Business Growth – Encourages foreign transactions and global trade partnerships.

Documents Required for IEC Registration

PAN Card of the individual or business

Address proof of the business (electricity bill, rent agreement, or property papers)

Cancelled cheque or bank certificate

Digital photograph of the applicant

Aadhar Card or any other identity proof of the applicant

How to Apply for IEC Registration in India?

You can apply for an IEC online through the DGFT website. Here are the steps:

Step 1: Visit the DGFT Portal

Go to https://dgft.gov.in and create a login account.

Step 2: Fill in the Application Form

Navigate to “Apply for IEC” under the “Services” section and fill in all necessary details.

Step 3: Upload Documents

Upload the scanned copies of the required documents as mentioned above.

Step 4: Pay Fees

Pay the government fee for IEC registration, currently ₹500.

Step 5: Submit the Application

Once submitted, the application will be processed, and the IEC will usually be issued within 1-2 working days.

When is IEC Not Required?

When goods/services are imported or exported for personal use.

For traders registered under GST and using GSTIN in place of IEC for export/import (as per CBIC guidelines for certain transactions).

Conclusion

IEC Registration is your gateway to international trade. It is simple to obtain, has no renewal requirement, and opens up a world of opportunities for Indian businesses in global markets. Whether you are a startup or an established enterprise, getting your IEC is the first and most crucial step toward becoming an international trader.

0 notes

Text

How to Find the Right NIC Code for Your Kirana Store?

Starting or registering at a Kirana Store and confused about the NIC Code? You’re not alone! Many small shop owners struggle with identifying the right business classification. But don’t worry — this guide will help you understand and find the correct NIC Code quickly and easily.

✅ What is NIC Code?

NIC (National Industrial Classification) Code is a number assigned by the Government of India to classify businesses based on their core activity.

It is essential for:

GST Registration

Udyam (MSME) Registration

Income tax filings

Licensing & schemes

If you run a Kirana Store, selecting the correct NIC Code helps the government identify the nature of your retail trade and offer the correct benefits.

📊 2-Digit NIC Code for Kirana Store

At the top level, businesses are categorized using 2-digit codes.

For Kirana Stores, the 2-digit NIC code is 47.

This code covers retail trade (excluding motor vehicles).

🔍 Breakdown of NIC Code for Grocery Shops

To be more specific, here is the full classification:

Level NIC Code Description

2-Digit Code 47 Retail trade, except of motor vehicles and motorcycles

4-Digit Code 4711 Retail sale in non-specialized stores with food, beverages, or tobacco

5-Digit Code 47110 Kirana Store sells everyday grocery items, snacks, packaged goods, etc.

So, if you’re running a Kirana Store, your most appropriate code is 47110.

📥 Where is NIC Code Required?

You’ll need to mention your NIC Code when registering for:

GSTIN

Udyam Aadhaar (for MSME benefits)

Shop & Establishment License

FSSAI Registration (if food products sold)

If you're operating a Kirana Store, make sure to use the correct code to avoid rejections or delays in government processes.

💡 Why It’s Important to Use the Right Code

Using the wrong NIC Code can lead to:

Rejection of your application

Missing out on subsidies or benefits

Incorrect tax treatment

Legal and compliance issues

For a Kirana Store, code 47110 ensures that you’re correctly classified under retail grocery business and eligible for related schemes and tax benefits.

Using these phrases in your application and website content helps improve search visibility and accuracy during verification.

📌 Pro Tips Before You Apply

✅ Always verify your business activity before selecting an NIC code.

🧾 Keep your product list ready — it helps during GST and MSME registration.

📄 Apply using government portals like udyamregistration.gov.in.

💬 If confused, consult a CA or registration expert to avoid errors.

🧾 Example Use Case

Ravi runs a Kirana Store in Lucknow. When registering for Udyam Aadhaar, he selected NIC Code 47110, which clearly defined his store as a retail grocery shop. As a result, he successfully availed MSME benefits, including zero-cost registration, loan eligibility, and government schemes.

📝 Summary

Choosing the right NIC Code for your Kirana Store is a simple but crucial step in your business journey. It helps you comply with government rules, access financial benefits, and classify your business properly.

✅ Final NIC Code for Kirana Store: 47110

(2-Digit Code: 47 → Retail Trade)

Want to know more about business registration for Kirana Stores or get help with GST? Drop your query in the comments or contact our experts!

#KiranaStore#NICCode#RetailBusinessIndia#MSMERegistration#UdyamAadhaar#GroceryStoreStartup#GSTRegistration#SmallBusinessTips#RetailShopOwner#BusinessRegistrationIndia

0 notes

Text

GST Registration for Freelancers and Professionals: A Complete Guide

In today’s gig economy, freelancing and professional services are booming in India. Whether you’re a freelance graphic designer, consultant, digital marketer, content creator, or CA, one question often arises: Do I need to register for GST?

The answer isn’t always straightforward, but understanding the GST registration process, associated fees, and legal implications can save you from fines and help unlock professional opportunities.

In this article, we’ll walk through everything freelancers and professionals need to know about GST registration — including whether it’s required, how to apply, documentation, fees, and how Finodha simplifies the process.

Do Freelancers Need GST Registration?

GST registration for freelancers is mandatory if your annual turnover exceeds ₹20 lakh (₹10 lakh in special category states). But even if you earn below this limit, voluntary registration may benefit you in certain situations.

GST is mandatory for freelancers who:

Provide inter-state services (e.g., working with clients outside your home state)

Offer services to international clients (export of services)

Want to claim Input Tax Credit (ITC)

Sell digital goods or services via platforms or aggregators

If you're unsure whether you qualify, Finodha provides expert consultation during their GST registration process to help determine your eligibility.

Benefits of GST Registration for Freelancers & Professionals

Many service providers hesitate to register for GST due to perceived compliance burdens. But registration offers multiple benefits:

1. Professional Credibility

Registered freelancers are seen as more trustworthy by clients, especially companies and international partners.

2. Eligibility for B2B Work

Many businesses only hire vendors who can issue GST-compliant invoices.

3. Export of Services

GST registration allows you to export services to foreign clients without charging GST under the LUT (Letter of Undertaking) system.

4. ITC Claim

If you invest in software, laptops, co-working spaces, or ads — GST registration lets you claim input credit, lowering your costs.

GST Registration Process for Freelancers

The process is entirely online and can be completed in a few days if done correctly. Here's how it works:

Visit the GST Portal

Fill Part-A: PAN, contact details, state

Receive TRN (Temporary Reference Number)

Fill Part-B: Business info, bank details, service type

Upload documents (see below)

Verify via Aadhaar OTP or DSC

ARN (Application Reference Number) is generated

GSTIN issued in 3–7 working days

Finodha handles this entire process for you—from documentation to follow-up—ensuring fast and error-free registration.

Documents Required for GST Registration

As a freelancer or service provider, you’ll need the following:

PAN card

Aadhaar card

Photograph

Address proof (rental agreement, utility bill)

Bank proof (statement or canceled cheque)

Business proof (optional for proprietorships)

For help organizing and uploading documents, use Finodha’s expert-supported

GST Registration Fees for Freelancers

The government does not charge any fee for GST registration. However, professional assistance helps you avoid errors that could delay or reject your application.

Typical professional service fees:

Service TypeEstimated FeesBasic Registration₹499 – ₹999With Return Filing₹1,499 – ₹2,499Export/InternationalSlightly higher (LUT filing included)

To explore current packages, visit Finodha’s GST Registration Fees.

Filing GST Returns After Registration

Once registered, you must file GST returns regularly — even if you have no income in a month. Freelancers generally file:

GSTR-1: Details of outward supplies

GSTR-3B: Monthly summary return

Finodha offers packages that include both registration and ongoing filing services — ideal for freelancers who want to stay compliant without dealing with tax complexities.

GST for Exporting Services: A Special Note

If you work with international clients (like on Upwork, Fiverr, or directly), you can export services without charging GST, provided:

You have GST registration

You file a Letter of Undertaking (LUT) annually

This avoids unnecessary tax collection and keeps you legally compliant while working globally.

Finodha can assist with both GST registration and LUT filing to help freelancers scale internationally with ease.

Why Freelancers Choose Finodha

Finodha is India’s trusted compliance platform for freelancers, small businesses, and professionals. Here's why:

✅ 100% Online GST Registration ✅ Affordable, Transparent Fees ✅ Expert Document Review ✅ Filing & Post-Registration Support ✅ Lifetime Customer Service

Final Thoughts

Whether you’re a content writer earning ₹5 lakh or a software developer billing ₹25 lakh annually, GST registration can significantly impact your business operations and financial planning. It’s not just about compliance—it’s about building a professional, scalable, and globally viable career.

Need help with the process? Let Finodha handle your registration, documentation, and filing so you can focus on what you do best.

0 notes

Text

Online Private Limited Company Registration in Delhi: A Complete Process Guide

Starting a business in India’s capital is a strategic decision for many entrepreneurs. With Delhi’s vibrant startup ecosystem, robust infrastructure, and access to top talent, setting up a Private Limited Company here can offer numerous advantages. If you're looking for company registration in Delhi, understanding the step-by-step process is essential—especially as more founders opt for private limited company registration online in Delhi for speed, transparency, and convenience.

In this blog, we’ll guide you through everything you need to know about pvt ltd company registration in Delhi, including benefits, requirements, fees, and the entire online registration process.

Why Choose a Private Limited Company?

A Private Limited Company is one of the most preferred business structures in India due to:

Limited liability for shareholders

Separate legal identity

Ease in raising capital

Credibility with investors, banks, and customers

Whether you’re a startup, tech firm, consultancy, or manufacturing unit, private limited company registration in Delhi gives your business a solid legal foundation.

Documents Required for Company Registration in Delhi

Before starting the online application, keep the following documents ready:

For Directors and Shareholders:

PAN card (mandatory for Indian citizens)

Identity proof (Aadhaar, Passport, or Voter ID)

Address proof (Utility bill or bank statement, not older than 2 months)

Passport-size photographs

DIN (Director Identification Number) and DSC (Digital Signature Certificate)

For Registered Office:

Utility bill (Electricity, Water, Gas)

Rent agreement (if applicable)

NOC from the property owner

Proper documentation is key to a successful pvt ltd company registration in Delhi, especially when applying through the company registration online Delhi portal.

Step-by-Step Guide to Private Limited Company Registration Online in Delhi

Step 1: Apply for DSC (Digital Signature Certificate)

Every director and shareholder must obtain a DSC. This is required to digitally sign the online application forms.

Step 2: Obtain DIN (Director Identification Number)

DIN is issued by the Ministry of Corporate Affairs (MCA) and is mandatory for all directors. You can apply while filing the SPICe+ form.

Step 3: Name Approval (Part A of SPICe+)

Choose a unique company name and submit it via the MCA’s SPICe+ portal. The name should not violate trademarks or be similar to existing companies.

Step 4: Fill SPICe+ Form (Part B)

This is the main form for private limited company registration online in Delhi. It covers:

Director and shareholder details

Registered office address

Share capital information

MOA (Memorandum of Association) and AOA (Articles of Association)

Step 5: PAN, TAN & EPFO/ESIC Registration

Under the integrated SPICe+ form, PAN, TAN, and other registrations (like EPFO, ESIC) are automatically generated.

Step 6: Certificate of Incorporation

Once verified, the MCA will issue a Certificate of Incorporation, which includes your CIN (Corporate Identification Number), PAN, and TAN. Congratulations—your company registration in Delhi is now complete!

Benefits of Company Registration Online Delhi

Time-saving and completely paperless

Government-backed portal (MCA) for secure filing

Bundled services like PAN, TAN, GSTIN, and more

Track status of your application in real time

Thanks to digital services, private limited company registration online in Delhi has become more efficient and accessible than ever.

Common Mistakes to Avoid

Choosing a name similar to an existing brand or company

Submitting incorrect or outdated documents

Not checking trademark availability before name approval

Not appointing the required minimum number of directors or shareholders

Working with a professional consultant can help avoid these pitfalls and ensure a smooth pvt ltd company registration in Delhi.

Final Thoughts

Whether you're launching a tech startup, e-commerce venture, or service-based firm, company registration in Delhi sets your business on a professional and legal path. Thanks to government digitization, private limited company registration online in Delhi is fast, transparent, and accessible—even for first-time founders.

#company registration in Delhi#pvt ltd company registration in Delhi#private limited company registration in Delhi#private limited company registration online in Delhi#company registration online Delhi

0 notes

Text

Understanding State GST Code 06: Everything You Need to Know

Understanding State GST Code 06: Everything You Need to Know

If you are a businessman, a trade firm in India, or an accountant, then you would have used some state or union territory GST codes at least once. They would have been helpful during the process of uploading GST returns or generating invoices. State GST Code 06 is one such handy code. Why so? Let's know. All union territories and states of the Indian Goods and Services Tax (GST) regime were assigned a two-digit numerical code to be used in the identification of the place of taxpayer or the place of supply of service or goods and as one of the parameters to decide whether a supply would be inter-state or intra-state in nature. For instance, if the buyer and seller belong to the same state, then the transaction is intra-state and CGST + SGST will be applicable. If the buyer and seller belong to two different states, then it is an inter-state transaction, and IGST will be applicable. State GST Code 06: Which State Does It Represent? State GST Code 06 represents the state of Haryana. So, if your company GSTIN starts with 06, then your company's head office is in Haryana. Haryana GSTIN example: 06ABCDE1234F1Z5 Here: 06 is the Haryana state code ABCD1234F is the PAN 1 is one registration under one PAN Z is a default character 5 is the checksum digit Why the GST State Code Is Important - Easy Identification of Business Location: GST state codes would have to remember the business location and the transaction location. - Facilitates Identification of Tax Type: IGST or CGST + SGST would be applied depending on whether the supply is to or from, falling under these codes. - Generation of Invoice: In invoice generation under GST, include seller state code and the buyer state code. - Convenience in Filing Returns: During the filing of GSTR-1, GSTR-3B, etc., your data is checked for correctness against these codes in the system so that tax is distributed between the Centre and the States fairly. Use Cases of GST Code 06 Haryana GST Registration: All Haryana GST registration begins with 06. E-invoicing: The State code is required while creating e-invoices under the GST regime. Transport and E-Way Bills: GST Code 06 is used in the "From" or "To" state columns while transporting goods based on the direction. Conclusion Take one additional step to know your state GST code for easy tax compliance, and your business is under the GST regime. If your business is located in Haryana, be aware that your GST documents, bills, and returns need to be prefixed with State Code 06. Save this code somewhere close to it is not a number; it is the beginning of GST-compliant filing! Read the full article

#Code06#GST#GSTCode06#Haryana#HaryanaCode06#India#StateGST#StateGSTCode06#UnderstandingStateGSTCode06:EverythingYouNeedtoKnow

0 notes

Text

Virtual Office Solutions for GST Registration in Chennai

For startups, freelancers, and small businesses, compliance with GST regulations is no longer optional—it's a necessity. But what happens when you don’t have a physical office or you're working from home? That’s where a virtual office in Chennai becomes the perfect solution, especially for GST registration.

In a city bustling with entrepreneurs and tech-driven businesses, the virtual office model offers more than just a mailing address—it provides legal documentation, professional branding, and financial compliance without the high costs of renting physical space.

This blog explores how Chennai-based businesses are using virtual offices to seamlessly register for GST, operate legally, and scale confidently.

📌 Why GST Registration Is Crucial for Businesses in Chennai

The Goods and Services Tax (GST) is a pan-India tax structure introduced to unify and simplify indirect taxation. If you're a business operating in Chennai with a turnover over ₹20 lakhs (or ₹10 lakhs for some categories), GST registration is mandatory.

Key Benefits of GST Registration:

Legal authorization to collect tax

Eligibility for input tax credit

Increased trust with vendors and clients

Access to broader marketplaces like Amazon, Flipkart, and B2B clients

However, one major challenge remains: you need a valid commercial address in Chennai to get your GST certificate approved.

That’s where virtual offices step in.

💡 What Is a Virtual Office & How It Works

A virtual office is a service that provides a registered business address along with additional administrative features—without requiring you to rent physical office space.

Typically includes:

Business address in a commercial zone (like T. Nagar, OMR, Guindy)

Documentation for GST & company registration

Courier and mail handling

Optional access to meeting rooms or coworking desks

It’s the ideal solution for remote-first businesses, freelancers, and startups who need to register under GST but want to avoid the cost of traditional leasing.

🧾 Documents You Get with a Virtual Office for GST in Chennai

The Government of India requires valid documentation to approve GST registration. Reputed virtual office providers in Chennai offer a complete package:

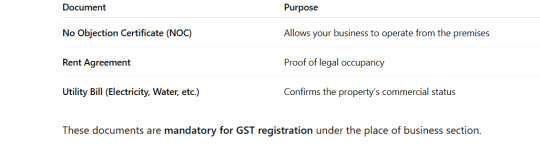

These documents are mandatory for GST registration under the place of business section.

🏙️ Best Areas in Chennai to Register for GST via Virtual Office

Your virtual office address is not just a compliance formality—it affects your brand image, visibility, and client trust.

Here are top locations in Chennai for GST-eligible virtual offices:

T. Nagar – Retail & service-based startups

Guindy – Industrial & tech zones

OMR (Old Mahabalipuram Road) – SaaS, IT, and digital firms

Nungambakkam – Finance, legal, and consultancy businesses

Ambattur – Ideal for logistics, warehousing, and D2C brands

✅ Pro Tip: Ensure the address you choose is classified as a commercial property under municipal records, or your GST application may be rejected.

🛠️ How to Apply for GST Using a Virtual Office Address in Chennai

Once you've subscribed to a virtual office plan and received your documentation, here’s how to register for GST step-by-step:

Step 1: Visit the GST Portal

Create a new account or login.

Step 2: Fill Out Application (Form GST REG-01)

Provide PAN, email, mobile, business details, and select Chennai as your state/center.

Step 3: Upload Required Documents

Attach the NOC, Rent Agreement, and Utility Bill you received from your virtual office provider.

Step 4: Verification & Site Visit (if required)

Sometimes, the GST officer may perform a physical verification of your virtual office location. A good provider will handle this process for you.

Step 5: GSTIN Issued

Within 3–7 business days, you receive your GST Identification Number (GSTIN).

✅ Who Can Use a Virtual Office for GST Registration?

Virtual offices aren't just for tech companies or digital startups. Here are the types of businesses in Chennai who benefit the most:

Freelancers & Consultants needing a professional identity

E-commerce sellers listing on Amazon, Flipkart, Meesho, etc.

Small manufacturing units using logistics centers

Remote-first startups without a physical team in Chennai

Businesses expanding to Tamil Nadu from other cities

If you operate in more than one state, you can get multiple GSTINs using virtual offices in each location.

💸 Cost of Virtual Office for GST in Chennai

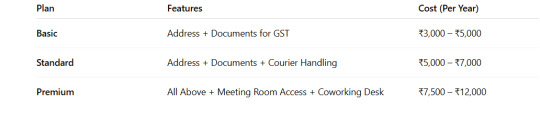

Compared to renting even a small physical office in Chennai, this is over 90% cost savings.

🔍 Common Mistakes to Avoid When Using a Virtual Office for GST

To ensure your GST registration goes smoothly, avoid these common pitfalls:

Choosing a non-commercial address → Always verify zoning with your provider

Incomplete documentation → Ensure all 3 required documents are provided upfront

Wrong pin code or jurisdiction → Affects assignment to the right GST office

Ignoring compliance post-registration → Your provider must allow inspections, if scheduled

🏢 Virtual Office Providers in Chennai Offering GST-Ready Packages

Here are some trusted providers known for offering GST registration support with virtual offices:

1. Regus Chennai

Multiple prime locations (Guindy, Nungambakkam, Perungudi)

Reliable documentation and customer support

2. InstaSpaces

GST-specific virtual office plans

Affordable rates with quick processing

3. Awfis

Offers a hybrid model with day passes

High compliance support for startups

4. WorkEZ Chennai

Modern spaces and customizable plans

Known for smooth GST processing

5. Smartworks

Premium addresses for B2B and enterprise startups

GST-compliant documentation provided instantly

📊 Why Startups Prefer Virtual Offices for GST in Chennai

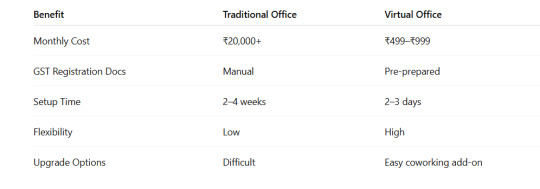

Clearly, virtual offices are a no-brainer for small, flexible businesses looking to stay compliant without burning cash.

🧭 Final Thoughts

A virtual office in Chennai is more than just a mailing address—it’s your passport to legal compliance, professional credibility, and operational efficiency. Especially when it comes to GST registration, choosing the right virtual office can make the difference between endless delays and smooth, same-week approvals.

If you're a startup, freelancer, or a scaling business eyeing Tamil Nadu’s market, this is your sign to go virtual—legally, smartly, and affordably.

0 notes

Text

Thinking about starting a business or already have one? Then you've probably heard of GST registration. If the thought of dealing with taxes made you want to run the other way, you are not alone! But don't worry; GST Registration Online is not as scary as it seems, and it is fairly simple when you know what you're doing. We will explain everything in simple English - no legal terms, no lengthy checklist - just what you need to know.

What is GST, and Why Do You Need to Care?

Let's go back to first principles. GST is an abbreviation for Goods and Services Tax, a single tax that replaced many indirect taxes in India, such as VAT, service tax, excise duty, etc. It was introduced in July 2017 and has since become an integral part of India's indirect tax system.

So why should you register for GST?

If your business turnover exceeds the threshold limit (currently ₹40 lakh for goods and ₹20 lakh for services in most states), you have a legal requirement to register. But even if you stay below that limit, there are some good reasons to consider it.

Who Should Register for GST?

If you are:

A Business Owner whose revenue exceeds the threshold

An e-commerce seller (like on Amazon or Flipkart)

A freelancer or service provider who works across states

Running an export/import business

A casual taxable person or a non-resident taxable person.

Entering the interstate supply of goods or services.

In other words, if money is being exchanged, and you are providing something of value, the GST Department wants to know.

Why Register for GST Online?

Let’s be honest - no one enjoys waiting in line at government offices. The good news is that registering for GST is fully online. That means no agents, no paperwork, no runaround, and no wasted time.

Here is why registering online is awesome:

Convenience: You can apply on your laptop or even on your phone.

Transparency: You can track your application in real-time.

Speed: If all of your documents are in order, registration can occur in as little as 3–5 working days.

Documents Required for GST Registration

Before starting the application process, ensure all of the following documents in hand. Each entity type will require a slightly different set of documents; however, there is a general list as follows:

Individuals / Sole Proprietor:

PAN and Aadhaar card

Photograph

Proof of business address (e.g., electricity bill, rental agreement, etc.)

Bank account details (cancelled cheque or bank statement)

Partnership / LLP / Company:

PAN card of the entity

Certificate of incorporation

Board resolution/partnership deed

Address proof of business

PAN and Aadhaar of directors/partners

Bank details

If you have all the documents above ready in advance, it will help make your registration fast and easy.

How to register for GST online - step by step

Now we finally come to the registration process — don't worry — it's much easier than it looks!

Step 1: GST Portal

The first thing you have to do is open the official website: https://www.gst.gov.in

Step 2: Register

Click on “Services” > “Registration” > “New Registration”

Select “Taxpayer” as your type

Fill out the basic details - legal name, PAN, email ID, mobile number

You will receive an OTP for verification

Step 3: Temporary Reference Number (TRN)

Once verified, you will receive a TRN... Use it to log back in to continue filling out your application.

Step 4: Provide Business Information

Entries required are as follows:

Business name

Constitution (proprietor, partnership, Company, etc.)

Address

Other business addresses (if applicable)

Banking information

Authorized signature information

Step 5: Upload the Documents

Upload relevant documents in either PDF or JPEG formats as required.

Step 6: Verification and Submission

When all information is entered and the required uploads:

Apply for DSC (Digital Signature Certificate) or EVC (OTP-verified)

You’ll receive an Application Reference Number (ARN)

Step 7: Get GSTIN

Your application will be reviewed by the department, and if successfully verified, you will receive your GSTIN (GST Identification Number) and GST certificate via email and on the portal.

What Happens After You Register?

After registering, you will be part of the GST system, with responsibilities and benefits.

Your new responsibilities will be:

Collect GST on your invoices

File your GST return on a monthly/quarterly basis (depending on your turnover)

Maintain documentation about your business transactions.

Your new benefits:

To provide you with an Input Tax Credit (ITC)

You can expand to all corners of India, without incurring much more compliance

Trust and credibility with larger clients increase

Common New Business Owner Mistakes

New business owners usually stumble on the details. Here are a few that cause a lot of delays:

Wrong PAN or Aadhaar number: A mismatch is a sure way to delay your registration.

Residential address with no utility bill: The GTS gateway has to have complete proof.

Uploading a blurry document or the wrong document: Check again and again before uploading to your application.

Selecting the wrong business type or jurisdiction: This is where you may want to get someone to help if you don't know for sure.

Need Help with GST Registration?

Let’s be honest — while you can do it all yourself, there's nothing wrong, and sometimes it's safer to get help from an expert. If you don't want to mess it up, Kanakkupillai will handle the whole registration process for you. They work with you on:

Document verification

Submitting the application

GST consulting and advice

Preparation and filing of returns, etc., to ensure compliance going forward

Think of it as having a professional finance friend who understands the system and has relevant paperwork.

Final Thoughts

GST Registration Online is not just a legal formality. It also marks a step in your business development. It signifies a serious moving-up appointment for your business. It doesn't matter if you are a freelancer ace, a small growing business, or an e-commerce seller, by formally registering for GST, you notify and demonstrate to others that you are serious, you are credible, and you are ready for new opportunities and on a bigger playing field.