#automated invoice template with tax calculation

Explore tagged Tumblr posts

Text

Essential Elements of an Invoice for Small Businesses

Learn the essential elements every small business invoice must have. Use InvoiceTemple to simplify your invoicing process and ensure professional payments.

#billing software#automated invoice template with tax calculation#invoicing software for small businesses

0 notes

Text

Best Business Software Tools in 2024

The right software tools can help increase productivity, draft operations more efficiently and promote company growth in today's high-paced business environment. Whether you are a start-up or an existing enterprise the following business software is necessary to improve different areas of your business.

1. Project Management: ClickUp

It is a feature-laden project manager that lets you handle tasks, projects, and workflows of all types. Its ease of use and user-friendly interface, complimented with diverse dashboards cater to audiences between small teams and large organizations. Task assignments, time tracking, goal setting, and collaboration options allow you to stop hopping between spreadsheets and emails so your projects are complete efficiently.

2. CRM–– Zoho CRM

Zoho CRM — Your Intelligent Customer Relationships Management System. Among other features, it has lead management, sales automation, and analytics to make sales performance improve on a consistent streamline both administrative aspect as well as customer satisfaction. Due to its integration capabilities with other Zoho products, as well as most third-party applications, It has become a flexible option for businesses that are ready to supercharge their customer relationship management.

3. Accounting: Zoho Books

Zoho Books- The Best Accounting Software for Business Owners Invoicing, expense tracking and financial reporting are some of its features. You can also rest assured that your taxes are being handled correctly and always have the latest view of your financial health to help you manage your finances better.

4. HR Management: monday. com HR

It is a complete human resources management software that helps companies to better structure their workforce. This system provides with facilities like employee on boarding, performance tracking, payroll management etc. With the platform's ease of use, UI simplicity, and automation capabilities in HR processes that would otherwise take hours away from key HR initiatives.

5. Payroll: OnPay

OnPay is an excellent payroll software for businesses of all sizes. It is a cloud payroll software for businesses that ensures complete compliance and automation of top-class payroll calculations, tax filings & employee payments. Additionally, OnPay provides HR and benefits management tools, effectively providing a full-fledged employee pay management solution.

6. Point-of-Sale (POS): eHopper

Versatile Point of Sale Software for Businesses Up To Mid-Sized It offers services like Inventory management, sales tracking and customer management. This makes eHopper a perfect choice for businesses that intend to simplify their sales operations using an affordable and intuitive POS system.

7. Inventory Management: Cin7

While there are plenty of other inventory management systems available, Cin7 stands out as one of the most popular options for small to mid-size businesses (SMBs) looking to get their stock levels, orders and supply chain operations under control. These functionalities consist of real-time inventory monitoring, order processing and e-commerce platform integration. With the powerful feature set of Cin7, businesses can keep inventory at an optimal level and fulfill customer demands to the hilt.

8. Website Builder: Weebly

Weebly is the website builder that you can also use to build your site or blog. It has lots of customizable templates, drag-and-drop functionality, and e-commerce ready to go. With Weebly, you can create a professional website even if you are a tech noob and give your business the relevant online visibility it needs.

9. Recruiting: ZipRecruiter

ZipRecruiter: Popular rated job search app for businesses on board. They provide hiring solutions through features like job posting candidates filtering and tracking the application. AI-powered matching from ZipRecruiter surfaces more relevant candidates to businesses faster.

10. VPN: NordVPN

It is a secure, encrypted VPN application that will make sure that you and your business stay safe as you work with the web. It provides features of encrypted connections, threat protection and global server access as well. In this way, It guarantees secure data in companies and privacy on internet.

Conclusion

The business software tools a company uses are very important to increase productivity and power growth. The above-mentioned tools are some of the best & flexible according to the fact which can assist businesses for any sized groups and help them attain their desired objectives. Implementing these tools in your operations can also help speed up processes and lead to higher customer satisfaction, as well as allow you to be on top of the competition.

#business#business growth#innovation#startup#entrepreneur#100 days of productivity#project management#sales#payroll#hr management#hr software#hr services#ai#artificial intelligence#technology#tech#techinnovation

3 notes

·

View notes

Text

Billing machines have become an essential tool for businesses across various sectors, streamlining the invoicing process and enhancing operational efficiency. This article explores the features, benefits, and types of billing machines, as well as their significance in modern commerce.

What is a Billing Machine?

A billing machine is a device specifically designed to generate invoices and manage transactions efficiently. It automates the billing process, allowing businesses to issue receipts quickly and accurately. Available in various forms such as portable, handheld, and point-of-sale (POS) systems, these machines cater to the needs of small businesses and large enterprises alike.

Key Features of Billing Machines

User-Friendly Interface: Many modern billing machines come with intuitive touchscreen interfaces that simplify the transaction process, making it easy for staff to operate without extensive training.

Fast and Accurate Billing: These machines are designed to process transactions rapidly, significantly reducing customer wait times and enhancing service efficiency.

Customizable Invoices: Users can personalize invoice templates to reflect their branding, including logos and business details, which adds a professional touch to customer interactions.

Comprehensive Reporting: Billing machines often provide detailed sales reports, inventory tracking, and financial records, enabling businesses to monitor performance and make informed decisions.

Tax Compliance: Many billing machines are equipped with features that ensure compliance with tax regulations, making it easier to calculate applicable taxes like GST or VAT.

Multiple Payment Options: They support various payment methods, including cash, credit/debit cards, and digital wallets, providing convenience to customers.

Benefits of Using Billing Machines

Increased Efficiency: Automating the billing process reduces manual errors and speeds up transactions, leading to improved cash flow and customer satisfaction.

Enhanced Security: Billing machines help in maintaining secure records of transactions, reducing the risk of loss or theft associated with cash handling.

Improved Inventory Management: Many billing machines come with inventory management features that allow businesses to track stock levels and set up alerts for low inventory, ensuring timely restocking.

Cost-Effectiveness: While the initial investment in a billing machine may be higher, the long-term savings in time and labor can be substantial, making them a cost-effective solution for businesses.

Types of Billing Machines

POS Systems: These are comprehensive solutions that combine billing, inventory management, and sales tracking, ideal for retail environments and restaurants.

Portable Billing Machines: These compact devices are perfect for businesses that require mobility, such as food trucks or market vendors.

Handheld Billing Machines: Designed for ease of use, these machines are often used in smaller retail settings or for on-the-go transactions.

Touchscreen Billing Machines: Featuring advanced technology, these machines offer a modern interface and are designed for high-volume transaction environments.

Conclusion

Billing machines are vital for modern businesses, providing a range of features that enhance efficiency, accuracy, and customer satisfaction. By automating the billing process, these machines not only save time but also contribute to better financial management and operational transparency. As technology continues to evolve, the capabilities of billing machines will likely expand, further transforming the way businesses handle transactions. Whether for a small shop or a large retail chain, investing in a reliable billing machine can significantly improve business operations.

2 notes

·

View notes

Text

Best Billing Machines in India

Effectiveness in transactions is essential in the busy realms of commerce and retail. Billing machines, a crucial tool in this process, have advanced significantly over time, with UDYAMA POS setting the standard in India. This article highlights UDYAMA POS's ground-breaking position in the industry while examining the innovations, customer satisfaction, and variety of (Best Billing Machines in India) that are supplied. (Best Billing Machines in Delhi) are essential for streamlining billing processes because they provide cutting-edge functionality catered to various corporate requirements. The choice of billing machines can have a big impact on revenue creation and productivity for businesses of all sizes, from small merchants to multinational corporations.

Considering the Value of Billing Equipment

Competent billing is the foundation of any flourishing company. For any type of business—retail, dining, or service—accurate and timely invoicing is essential to preserving both the company's finances and its reputation with clients. This procedure is automated using billing machines, which streamlines transactions and lowers the possibility of errors. Contemporary billing machines enable organizations to improve operational efficiency and concentrate on their core competencies by providing functions such as inventory management, sales analysis, and tax calculation.

Essential Factors to Take-into-Account:

Creative Software for Billing:

Linked billing software is the cornerstone of modern billing systems. Look for systems with powerful reporting features, user-friendly interfaces, and customizable invoice templates. These features simplify the process of creating invoices and provide useful information on sales patterns and inventory management.

Choices for Internet Access:

In today's networked environment, billing machines with several connectivity options are more versatile and easy. Bluetooth and Wi-Fi enabled devices facilitate seamless communication with other corporate systems, allowing for real-time data synchronization and remote management.

Reliable Payment Processing:

Security is essential while processing financial transactions. Choose billing machines with robust encryption features and PCI-compliant payment processing services installed. This ensures the confidentiality and integrity of client data while lowering the risk of fraud and data breaches.

Design compactness and portability:

Small, portable billing devices are ideal for businesses with limited space or that are mobile. Look for portable devices with long-lasting batteries and sturdy construction. This simplifies invoicing in a number of contexts, including shop counters and outdoor events.

Possibility of Development and Enhancement:

Invest in scalable and easily upgraded invoicing solutions to accommodate future business growth and changing needs. Modular systems with interchangeable parts facilitate the easy integration of additional features as your business expands.

UDYAMA Point of Sale Advantages

The Indian billing machine market has seen a radical transformation thanks to UDYAMA POS's state-of-the-art technology and customer-focused mentality. A selection of models designed to satisfy particular business needs are available from UDYAMA POS. These approaches have improved the checkout experience for customers while also increasing operational efficiency.

There are many different types of billing machines available on the market, ranging from sturdy desktop models for high-volume organizations to portable devices for transactions while on the go. Every kind has distinctive qualities designed for particular commercial settings, which emphasizes how crucial it is to choose a machine that fits your operational requirements.

Features of a Billing System to Take-into-Account

Durability, connectivity choices, and convenience of use are important factors to take-into-account when selecting a billing machine. A machine that performs well in these categories can significantly improve business operations by facilitating faster and more dependable transactions.

(Best UDYAMA POS Billing Machine) Models

A range of models that are notable for their cost, dependability, and functionality are available from UDYAMA POS. With the help of this section's thorough analysis of these best models, you can make an informed choice depending on your unique business needs.

How to Choose the Right Invoicing Equipment

When choosing a billing machine, it's important to evaluate your company's needs, budget, and the features that are most important to your daily operations. This guide provides helpful guidance to assist you in navigating these factors.

Benefits of Changing to a Modern Billing System

Modern billing systems, such as those provided by UDYAMA POS, can greatly improve customer satisfaction and efficiency. The several advantages of performing such an upgrade are examined in this section, ranging from enhanced client satisfaction to streamlined operations.

Advice on Installation and Upkeep

Making sure your billing machine is installed correctly and receiving routine maintenance is essential to its longevity and dependability. Important setup and maintenance advice for your new gadget is included in this section.

Field Research: UDYAMA POS Success Stories

The revolutionary effect of UDYAMA POS billing devices on businesses is demonstrated by actual success stories from the retail and hospitality industries. These case studies demonstrate how businesses have benefited from increased customer satisfaction and operational efficiency thanks to UDYAMA POS technology.

All products in the Billing Machine are:

(Handy POS Billing Machine)

(Android POS Billing Machine)

(Windows POS billing Machine)

(Thermal Printer Machine)

(Label Printer Machine)

Enhancing Efficiency with Best Billing Machines in India:

The adoption of the (best billing machines in Noida) has revolutionized the way businesses manage their finances. These advanced solutions offer a myriad of benefits, including:

Simplified Billing Procedures: By automating invoice generation and payment retrieval, billing procedures are made more efficient and less prone to human error and delay.

Enhanced Accuracy: Up-to-date billing software guarantees precise computations, removing inconsistencies and billing conflicts.

Improved Customer Experience: Easy and quick transactions increase client happiness and loyalty and encourage recurring business.

Real-Time Insights: Rich reporting tools offer insightful information on inventory control and sales performance, facilitating well-informed decision-making.

Observance of Regulatory Mandates: Pre-installed compliance tools guarantee that financial reporting requirements and tax laws are followed, lowering the possibility of fines and audits.

Frequently Asked Questions:

Are billing systems appropriate for all kinds of companies?

Absolutely! Billing machines come in various configurations and are tailored to suit the needs of diverse businesses, from small retailers to large enterprises.

Can billing devices accept several forms of payment?

Yes, most modern billing machines support multiple payment options, including cash, credit/debit cards, mobile wallets, and online payments.

How frequently should the software on billing machines be updated?

It's recommended to update billing machine software regularly to ensure optimal performance, security, and compatibility with the latest regulations and technologies.

Do billing machines need to be connected to the internet?

While internet connectivity is not mandatory for basic billing operations, it may be necessary for accessing cloud-based features, software updates, and remote management capabilities.

Is it possible to link accounting software with billing machines?

Yes, many billing machines offer integration with popular accounting software packages, facilitating seamless data transfer and reconciliation.

Are POS terminals easy to use?

Most billing machines are designed with ease of use in mind, featuring intuitive interfaces and straightforward setup processes. Training and support are typically provided to ensure smooth adoption and operation.

UDYA MA POS, a business renowned for its wide range of products, innovative solutions, and happy clients, is the result of searching for the (best billing machines in India). Considering how organizations are always changing, choosing the right billing system is essential. Thanks to its commitment to quality and innovation, UDYAMA POS is a leader in the billing machine industry, ensuring that transactions will become more streamlined, dependable, and fast in the future. The strategic decision to invest in the (top billing machines in Gurgaon) could have a significant effect on businesses of all kinds. These innovative solutions help organizations thrive in the present competitive market by streamlining billing processes, increasing precision, and providing insightful data.

Regardless of the size of your business, selecting the correct billing equipment is critical to increasing productivity and spurring expansion.

Visit the website for more information: www.udyamapos.com

2 notes

·

View notes

Text

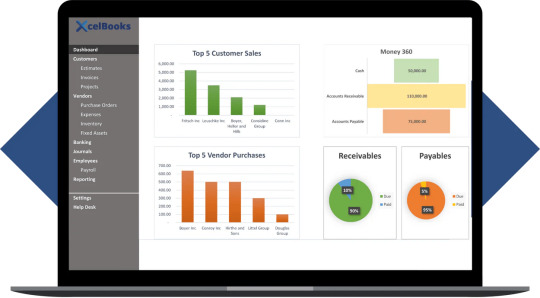

XcelBooks Makes Financial Management Easier with Excel Based Accounting Software

In a world where small businesses, startups, and freelancers are seeking smarter and more affordable ways to manage their finances, XcelBooks has stepped up with a powerful and user-friendly solution. The company is proud to announce the continued success and growing adoption of its Excel Based Accounting Software, designed specifically to simplify bookkeeping and financial reporting using familiar spreadsheet tools.

Built on the widely used Microsoft Excel platform, XcelBooks delivers accessible accounting solutions that eliminate the need for complex and expensive software subscriptions. With pre-designed template and automated features, business owners can now take full control of their accounting without having to be financial experts.

“We created XcelBooks to make professional accounting easy and accessible for everyone,” said the company spokesperson. “Our goal is to offer an intuitive, customizable system that runs on Excel and meets the real needs of small business owners, freelancers, and even students.”

Designed for Simplicity and Flexibility

At the core of the product offering is a range of easy-to-use template that streamline daily financial tasks like invoicing, expense tracking, profit & loss calculation, tax estimation, and more. Users can simply download a template, input their data, and watch the calculations happen automatically no advanced Excel skills required.

Unlike traditional software, accounting software Excel tools by XcelBooks do not rely on internet connectivity or subscriptions. Once downloaded, users have lifetime access to the files and full control over their data, making it a reliable and secure solution for businesses of any size.

Key Benefits of XcelBooks Excel Based Accounting Software:

Pre-formatted template for various business types and industries

Automated calculations for income, expenses, and taxes

Easy customization with no coding or programming needed

Works offline no login or internet connection required

Affordable, one-time pricing with no recurring fees

From freelancers and consultants to retail businesses and service providers, XcelBooks supports a variety of industries. The template also include industry-specific designs that adapt to unique financial workflows, helping users stay compliant and organized.

Trusted by Thousands

Since its launch, XcelBooks has grown its user base significantly, with thousands of satisfied customers across Canada and beyond. The company’s commitment to simplicity, accuracy, and affordability has made it a go-to choice for those seeking a dependable Excel based accounting software solution.

Customers can explore a wide range of accounting template at XcelBooks.com, where they’ll also find helpful resources, FAQs, and guides on how to make the most of the software.

About Xcelbooks

One of the top suppliers of accounting software driven by Excel is XceBooks. The company specializes in developing ready-to-use template that simplify financial management for small businesses, entrepreneurs, and freelancers. With a focus on ease of use, affordability, and flexibility, XcelBooks is changing the way business owners approach bookkeeping one spreadsheet at a time.

For more information, visit: https://xcelbooks.com

Contact Us:

Email us: [email protected]

0 notes

Text

How a Professional Invoicing Service Can Boost Your Business Efficiency

In today’s competitive market, businesses are constantly seeking ways to streamline operations and improve cash flow. One of the most essential — but often overlooked — tools to achieve this is a reliable invoicing service. Whether you’re a freelancer, a small business owner, or running a growing enterprise, a professional invoicing solution can significantly enhance your financial processes.

What Is an Invoicing Service?

An invoicing service is a digital platform or software that allows businesses to create, send, and manage invoices efficiently. It replaces manual paperwork with automated systems, reducing the chances of human error and saving hours of administrative work each week. From tracking payments to sending reminders, an invoicing service simplifies the entire billing process.

Key Benefits of Using an Invoicing Service

Time-Saving Automation Creating and sending invoices manually can be a tedious task. An invoicing service automates recurring billing, calculates taxes, and sends invoices directly to clients — saving you significant time and effort.

Faster Payments With integrated payment options, clients can settle invoices faster. Many invoicing services offer built-in payment gateways such as credit card, bank transfer, or PayPal, reducing the time it takes to get paid.

Error Reduction Manual invoicing increases the risk of errors such as incorrect amounts, missing information, or delayed billing. An invoicing service ensures accurate calculations and consistent formatting, which builds professionalism and trust with clients.

Real-Time Tracking Stay on top of your business finances with real-time tracking of sent, paid, and overdue invoices. Many invoicing platforms provide dashboards that give you a clear overview of your cash flow and outstanding balances.

Improved Cash Flow Management An invoicing service enables timely billing, automatic reminders for overdue payments, and detailed financial reporting. These features help improve cash flow and provide insights for better financial planning.

Better Client Experience Clients appreciate clear, professional invoices with easy payment options. A modern invoicing platform enhances the client experience, reducing disputes and encouraging prompt payments.

Choosing the Right Invoicing Service

When selecting an invoicing service, consider features such as:

Customizable invoice templates

Multi-currency and tax compliance

Mobile accessibility

Integration with accounting and CRM tools

Secure data encryption

Scalable pricing plans

0 notes

Text

Subscription Billing Software: Best Practices for SaaS Businesses

The SaaS (Software as a Service) model thrives on predictable, recurring revenue, but managing subscription billing isn’t as straightforward as it seems. Between free trials, tiered pricing, usage-based charges, and international compliance, there’s a lot to juggle.

That’s where Subscription Billing Software comes in. The right system not only automates complex billing workflows but also ensures accuracy, compliance, and customer satisfaction.

In this article, we’ll explore best practices for using subscription billing software to help your SaaS business scale efficiently and sustainably.

Why Subscription Billing Software Matters

As your SaaS business grows, manual invoicing or generic payment tools can quickly become a bottleneck. Subscription billing software helps you:

Automate recurring payments

Handle complex pricing models (e.g., usage-based, tiered, hybrid)

Manage customer upgrades, downgrades, and cancellations

Ensure compliance with global tax and invoicing laws

Reduce churn through dunning and retry logic

Platforms like Chargebee, Recurly, Stripe Billing, Zoho Subscriptions, and Paddle are popular choices, offering robust automation, analytics, and integration capabilities.

Best Practices for SaaS Subscription Billing

1. Offer Flexible Pricing Models

Today’s customers expect choice. Offer multiple pricing tiers, freemium options, add-ons, and usage-based billing to match different needs.

2. Automate Billing and Invoicing

Manual billing is error-prone and time-consuming. Leverage automation for:

Recurring invoices

Prorated charges for mid-cycle upgrades/downgrades

Tax calculation (e.g., VAT, GST, sales tax)

Automatic renewals and receipts

3. Ensure Global Tax Compliance

If you're serving customers in multiple countries, you need to handle international tax requirements like:

EU VAT

U.S. sales tax

Australian GST

India’s GST

4. Provide a Seamless Customer Experience

A confusing checkout or billing process can drive customers away. Focus on:

Clear pricing breakdowns

Self-service portals for managing subscriptions

Easy upgrade/downgrade paths

Transparent billing history

5. Track Key Metrics and Analytics

To grow effectively, monitor critical SaaS billing KPIs like:

Monthly Recurring Revenue (MRR)

Churn rate (voluntary & involuntary)

Customer Lifetime Value (CLTV)

Average Revenue Per User (ARPU)

Net Revenue Retention (NRR)

6. Integrate With Your Tech Stack

Subscription billing should seamlessly integrate with:

CRM systems (e.g., Salesforce, HubSpot)

Accounting tools (e.g., QuickBooks, Xero)

Payment gateways (e.g., Stripe, PayPal, Braintree)

Customer support platforms

7. Prepare for Scalability

As your SaaS business grows, so will billing complexity. Choose a billing platform that:

Supports multiple currencies and languages

Can handle enterprise-level invoicing

Offers audit trails and user permissions

Provides a developer-friendly API

Choosing the Right Subscription Billing Software

When evaluating billing software, look for:

Security & compliance: PCI-DSS, GDPR, SOC 2 certifications

Customization: Ability to tailor workflows and templates

Support: Responsive customer service and documentation

Reputation: Proven track record and customer reviews

Final Thoughts

Subscription billing isn’t just a back-office function — it’s a core part of your customer journey and revenue strategy. By following these best practices and investing in the right tools, you can reduce churn, improve cash flow, and create a better experience for your customers.

In a SaaS business, billing isn’t just about collecting payments — it’s about building relationships.

0 notes

Text

No More Billing Stress! Try the best app for invoice making

For small business owners in India, managing invoices and billing can be a challenging and time-consuming task. Without the right tools, creating professional invoices, tracking payments, and managing customer records might feel complicated.

The best app for invoice making simplifies all these tasks and helps small businesses stay organized and get paid faster.

Whether you’re a shop owner, freelancer, or small service provider, this will help you find the perfect invoicing tool for your business needs.

What Is an Invoice Making App?

An invoice making app is a software application designed to help businesses create and send professional invoices to their customers quickly.

Instead of writing bills manually or using spreadsheets, the best app for invoices automates the process, making it faster, error-free, and more professional.

Why Small Businesses Need the Best App for Invoice Making

Small businesses often struggle with billing and invoicing because it requires attention to detail. Using the best app for invoice making can bring many benefits:

Save time by creating invoices quickly with pre-designed templates.

Reduce mistakes by automating tax calculations and totals.

Track payment status to know which invoices are paid or pending.

Improve cash flow by sending timely payment reminders.

Create professional invoices that build customer trust.

Store invoice records digitally, reducing paperwork and clutter.

Key Features to Look for in the Best App for Invoice Making

When choosing the best app for invoice making, keep these features in mind to ensure you pick the right tool for your small business:

1. User-Friendly Interface- The app should be simple to use, even if you are not a pro. Look for apps with easy invoice creation.

2. Customizable Invoice Templates- You should be able to add your business logo, change colors, and customize the invoice format to match your brand.

3. Tax and GST Compliance- Since GST is mandatory in India, the app should support automatic GST calculation and generate GST-compliant invoices.

4. Payment Tracking and Reminders- Good invoicing software tracks whether invoices are paid and sends automatic reminders for overdue payments.

What Makes the Best Billing Software in India?

The best billing software in India should:

Support GST invoicing.

Work smoothly on mobile and desktop.

Offer affordable pricing plans.

How to Choose the Right Billing Software for Small Business

When selecting billing software for small business, consider:

Your budget — free or cheap invoicing software.

Features you really need — GST billing, inventory, payment reminders.

Easy to use Ability to scale as your business grows.

Advantages of Using an Invoice Generator for Small Business

An invoice generator for small business automates invoice creation, saving time and effort. You can generate multiple invoices in minutes and avoid manual errors.

Some apps also help with receipts, making them the best receipt app for small business by simplifying your financial records.

Easy Invoicing Software for Small Business

Look for easy invoicing software for small businesses that requires minimal training and lets you focus on your business, not complicated software. It should automate your invoicing and billing processes so you can get paid more quickly.

Simplify Your Billing with Shopaver – Perfect for Small Enterprises

If you are small business owner in India looking for a simple yet powerful invoicing solution, Shopaver is one of the top apps to consider. Designed to meet the unique needs of enterprises, Shopaver allows users to create professional, GST-compliant invoices in just a few taps.

The app supports multiple invoice formats, real-time tax calculations, and easy sharing. For those who need an invoice-making app without complexity, Shopaver offers the perfect balance of functionality and ease of use.

The best app for invoice making helps small businesses in India manage their billing smoothly. Whether you want the best free invoice app for android or are ready to invest in premium features, there are plenty of options designed to fit your budget and needs.

If you are looking for a user-friendly and reliable invoicing solution, Shopaver is a great option to explore.

#InvoiceGenerator#BillingSolutions#InvoiceManagement#GSTBillingApp#MobileInvoicing#InvoiceSoftwareIndia#QuickInvoice#OnlineBillingApp#InvoiceMakerFree#BestInvoiceSoftware2025

0 notes

Text

The Role of Customs Clearance in International Door-to-Door Shipping

I’ve learned the hard way that even the slickest Door to Door Shipping Service can grind to a halt if customs paperwork is an after-thought. Customs clearance is the legal green light that turns a pallet on a truck into a product on your customer’s doorstep—so let’s break down why it matters and how you can keep your parcels moving smoothly.

Why Customs Clearance Is the “Great Unlock”

When I book Door to Door Freight Shipping, I’m paying for an end-to-end hand-off. Yet neither the carrier nor the driver can legally release my goods until customs signs off. Clearance:

Confirms legality – preventing prohibited or non-compliant items from slipping through.

Calculates duties & taxes – so I don’t get a nasty bill later.

Triggers final-mile release – the moment the customs stamp lands, the courier can make that last sprint to my customer.

Miss a form—or mis-declare a value—and everything stalls in a warehouse while storage fees tick upward.

The Paperwork Puzzle (and How to Nail It)

DocumentWhy It MattersPro TipCommercial InvoiceShows value, HS codes, buyer/sellerMatch invoice data to packing list line-for-line.Packing ListVerifies physical contentsAdd NET and GROSS weights; it speeds inspections.Bill of Lading / Air WaybillContract of carriageDouble-check consignee details match the invoice.Certificate of OriginDetermines preferential duty ratesLean on trade agreements to cut costs.Import Licenses & PermitsRequired for regulated goodsApply early—some permits take weeks.

I keep a master template for each destination so that every time I order a Door to Door Shipping Service, I’m just filling in the blanks—not reinventing the wheel.

New Rules to Watch in 2025

EU ICS2 Phase-In – From April 1 2025, rail and road carriers entering the EU must file complete Entry Summary Declarations before arrival. If my parcel data is sloppy, it could be flagged and delayed.

U.S. ACE Portal Modernization – CBP has migrated all user access and blanket declaration features to the new ACE platform. It’s slicker, but it means I need to update broker permissions or risk login lockouts. cbp.gov

De Minimis Shake-Up – With the U.S. winding down the $800 duty-free threshold for many China-origin shipments, low-value ecommerce parcels now face extra duties and paperwork, adding time to every Door to Door Freight Shipping order. reuters.com

Staying ahead of these shifts lets me warn clients about potential delays before their checkout page even loads.

Five Habits for Friction-Free Clearance

Describe goods like a human – “Men’s cotton T-shirt, 180 gsm” clears faster than “garment”.

Get the HS code right – I use the first six digits the world agrees on, then let my broker fine-tune the rest.

Sync with suppliers – When a factory swaps materials, I update documents the same day.

Choose data-friendly carriers – Some express providers pre-clear packages in-flight, shaving 24-48 hours off transit.

Budget for duties at checkout – I collect duties & taxes upfront so the courier isn’t chasing my customer for cash on delivery.

How Door-to-Door Makes Customs Easier

Because the carrier owns the shipment from pickup to final delivery, they often front customs charges and pass the invoice to me later. That single-handshake model means:

No hand-offs = fewer errors – Every data transfer risks typos.

Automated status alerts – I get pings the moment the shipment clears.

Integrated duty calculators – Many Door to Door Shipping Service dashboards now auto-estimate landed cost before I click “book”.

Final Thoughts

I like to think of customs as the hidden “middle mile” inside my Door to Door Freight Shipping plan. When I treat it as a core part of the journey—rather than a bureaucratic after-thought—I slash delays, surprise fees, and customer complaints. Keep your paperwork tight, stay current on the rules, and let customs be the smooth handoff it was designed to be.

Happy shipping!

0 notes

Text

Have You Heard? Smart Invoice Accounting Software Is Your Best Bet for Growth

In today’s fast-paced digital world, technology empowers businesses, both small ones to operate more efficiently. Whether you're selling or buying, tech tools are transforming every aspect of business management. Accounting, the backbone of any business’s financial health, is no exception. With complex operations and evolving tax regulations, traditional methods don’t cut it anymore.

Enter smart accounting software, a game-changer for modern businesses. Say goodbye to paperwork overload and tax-time stress. ZRA accounting software is revolutionizing how businesses handle invoicing and tax management, making it simpler, faster, and more accurate.

Are you struggling to manage and file tax returns on time?

For many MSMES, juggling invoices, payments, and tax compliance can be overwhelming. Manual ZRA tax filing increases the risk of costly errors, penalties, and lost time.

Manage your business anytime, anywhere. With quick invoicing, seamless payment tracking, and precise tax filing, accounting software helps you reduce errors, stay compliant, and drive growth with ease.

ZRA Compliance in the Modern Business Landscape:

In today’s dynamic business environment, staying compliant with ZRA regulations can be challenging. Frequent updates to tax laws, intricate filing procedures, and the high risk of human error make manual tax management both time-consuming and stressful.

That’s where ZRA accounting software steps in as a reliable partner. By simplifying financial calculations and simplifying the filing process, it removes the guesswork from compliance. The software ensures your business stays up-to-date with the latest tax regulations, accurately and effortlessly.

Streamline Your Billing and Boost Productivity with Smart Invoice Software

Enhanced Efficiency:

Manual invoicing can be tedious and error-prone. With Smart Invoice Software in Zambia, businesses can automate the entire billing process—from invoice creation and delivery to payment tracking and overdue account management. Built-in features like customizable invoice templates and integrated payment gateways help eliminate manual tasks, saving valuable time and improving overall workflow. This automation not only enhances efficiency but also ensures a seamless and professional customer experience.

Track Income & Expenses Seamlessly

Modern accounting tools consolidate your financial data in one secure platform, offering real-time visibility into your income and expenses. These systems do more than just record numbers—they allow you to generate profit and loss reports, create income statements, and calculate interest quickly and accurately, all while reducing the risk of human error.

Comprehensive Financial Reporting

With just a few clicks, users can generate detailed financial reports that provide deep insights into business performance. These reports highlight key performance indicators (KPIS), enabling better financial assessment. Built-in analytics help identify trends over time, empowering proactive and strategic decision-making.

Centralized Data Management

Business operations software allows you to centralize data across departments, providing a unified view of your operations. This centralization improves data accessibility, enhances analysis, and supports smarter, faster business decisions.

Cloud-Based Access Anytime, Anywhere

Cloud-based accounting software offers mobility and flexibility by allowing access from any location, at any time. This not only improves productivity but also supports remote work and real-time collaboration across teams, ensuring that critical financial tasks are never delayed.

Fast Invoicing and Real-Time Status Tracking

Modern accounting systems streamline the invoicing process by automating calculations, sending invoices, and tracking payment statuses. Many tools can even trigger automatic payment reminders, helping reduce late payments and minimize follow-ups. Secure payment portals further enhance the customer experience by offering convenient and trusted transaction options.

Enhanced User Experience

A user-friendly accounting interface reduces complexity and improves workflow. When employees can navigate the system efficiently, it reduces stress, boosts productivity, and enhances team satisfaction. A smooth user experience is essential to ensure that staff can focus on meaningful tasks rather than battling with outdated systems.

Built for Growth-Focused Businesses

Modern business accounting software is a powerful tool for growing enterprises. It simplifies financial management by automating invoicing, tracking expenses, and generating accurate reports. Streamlining complex accounting tasks saves time, minimizes errors, and empowers business owners to make informed decisions, allowing them to focus on scaling operations and driving growth.

Minimize Human Errors

Unlike manual processes prone to mistakes, accounting software performs calculations with speed and precision. By reducing the need for manual data entry, businesses can improve data accuracy, ensure compliance, and maintain reliable financial records with confidence.

Seamless Bookkeeping & Accounts Production

Integrated accounting platforms combine bookkeeping and accounts production in one streamlined system. Automated data synchronization eliminates repetitive entry, improves accuracy, and accelerates the preparation of financial statements. This efficiency allows accountants to shift focus from administrative tasks to strategic insights and advisory services.

Accelerated Response Time

In today’s fast-moving business environment, speed is essential. Online accounting software enhances internal efficiency, improves workforce productivity, and enables businesses to act quickly and decisively. The result? You can accomplish more in less time, keeping your business agile and competitive.

Conclusion

In a competitive and fast-evolving business landscape, smart accounting software, Smart Invoice is no longer a luxury, it’s a necessity. From smart invoicing and simplifying ZRA tax compliance to streamlining expense tracking and delivering real-time financial insights, this technology empowers MSMEs to grow with confidence.

By reducing manual errors, improving operational efficiency, and enabling faster decision-making, smart invoice accounting software helps business owners reclaim valuable time and focus on what truly matters, scaling their business. Whether you're managing a startup or an expanding enterprise, adopting cloud-based, user-friendly, and intelligent financial tools can unlock new levels of productivity and performance.

Embrace the future of accounting. Let Smart Invoice Software simplify your finances and fuel your business growth anytime, anywhere.

0 notes

Text

How to Use Accounting Software on Excel - A Beginner’s Guide by XcelBooks

Managing finances can be overwhelming, especially for small businesses, freelancers, and entrepreneurs who don't want to invest in expensive or complex accounting tools. Fortunately, accounting software on Excel offers a simple, cost-effective, and highly customizable solution. In this beginner’s guide, we’ll walk you through how to use Excel bookkeeping software, featuring tools and template from XcelBooks a leading name in spreadsheet-based accounting.

Why Choose Excel for Accounting?

Excel remains a favorite tool for bookkeeping due to its flexibility and familiarity. Unlike cloud-based platforms, Excel gives you complete control over your financial data. With the right structure, formulas, and template, Excel can handle tasks such as:

Expense tracking

Invoice generation

Profit & loss statements

Balance sheets

Tax calculations

That’s where XcelBooks comes in. This brand has developed pre-designed, easy-to-use Excel template specifically for bookkeeping and financial reporting.

Getting Started with XcelBooks

To use Excel bookkeeping software effectively, follow these beginner-friendly steps:

1. Customize Basic Information

Before entering any financial data, personalize the template with your business name, logo, contact details, and currency preferences. This step helps in branding and ensures all reports look professional.

2. Enter Financial Transactions

Input your daily transactions including income, expenses, and invoices. With accounting software on Excel, you can use automated categories and dropdowns to maintain consistency. Template by XcelBooks often include multiple sheets to keep records organized.

3. Automate Reports

One of the most powerful features of Excel bookkeeping software is automation. Most XcelBooks template come with built-in functions to automatically generate profit & loss statements, cash flow summaries, and monthly reports without needing to manually calculate totals.

4. Review and Back Up Your Data

Always double-check entries and formulas to ensure accuracy. It’s also a good practice to keep your Excel files backed up on cloud storage or external drives to avoid data loss.

Conclusion

If you're looking for a straightforward way to manage your finances, accounting software on Excel is a practical and accessible option. With tools like those from XcelBooks, even beginners can perform essential accounting tasks without prior experience.

Start small, grow with confidence, and enjoy the flexibility that Excel offers. Explore XcelBooks.com today to find the right Excel bookkeeping software that aligns with your business goals.

For more information, visit: https://xcelbooks.com/

0 notes

Text

Have You Heard? Smart Invoice Accounting Software Is Your Best Bet for Growth

In today’s fast-paced digital world, technology empowers businesses, both small ones to operate more efficiently. Whether you're selling or buying, tech tools are transforming every aspect of business management. Accounting, the backbone of any business’s financial health, is no exception. With complex operations and evolving tax regulations, traditional methods don’t cut it anymore.

Enter smart accounting software, a game-changer for modern businesses. Say goodbye to paperwork overload and tax-time stress. ZRA accounting software is revolutionizing how businesses handle invoicing and tax management, making it simpler, faster, and more accurate.

Are you struggling to manage and file tax returns on time?

For many MSMES, juggling invoices, payments, and tax compliance can be overwhelming. Manual ZRA tax filing increases the risk of costly errors, penalties, and lost time.

Manage your business anytime, anywhere. With quick invoicing, seamless payment tracking, and precise tax filing, accounting software helps you reduce errors, stay compliant, and drive growth with ease.

ZRA Compliance in the Modern Business Landscape:

In today’s dynamic business environment, staying compliant with ZRA regulations can be challenging. Frequent updates to tax laws, intricate filing procedures, and the high risk of human error make manual tax management both time-consuming and stressful.

That’s where ZRA accounting software steps in as a reliable partner. By simplifying financial calculations and simplifying the filing process, it removes the guesswork from compliance. The software ensures your business stays up-to-date with the latest tax regulations, accurately and effortlessly.

Streamline Your Billing and Boost Productivity with Smart Invoice Software

Enhanced Efficiency:

Manual invoicing can be tedious and error-prone. With Smart Invoice Software in Zambia, businesses can automate the entire billing process—from invoice creation and delivery to payment tracking and overdue account management. Built-in features like customizable invoice templates and integrated payment gateways help eliminate manual tasks, saving valuable time and improving overall workflow. This automation not only enhances efficiency but also ensures a seamless and professional customer experience.

Track Income & Expenses Seamlessly

Modern accounting tools consolidate your financial data in one secure platform, offering real-time visibility into your income and expenses. These systems do more than just record numbers—they allow you to generate profit and loss reports, create income statements, and calculate interest quickly and accurately, all while reducing the risk of human error.

Comprehensive Financial Reporting

With just a few clicks, users can generate detailed financial reports that provide deep insights into business performance. These reports highlight key performance indicators (KPIS), enabling better financial assessment. Built-in analytics help identify trends over time, empowering proactive and strategic decision-making.

Centralized Data Management

Business operations software allows you to centralize data across departments, providing a unified view of your operations. This centralization improves data accessibility, enhances analysis, and supports smarter, faster business decisions.

Cloud-Based Access Anytime, Anywhere

Cloud-based accounting software offers mobility and flexibility by allowing access from any location, at any time. This not only improves productivity but also supports remote work and real-time collaboration across teams, ensuring that critical financial tasks are never delayed.

Fast Invoicing and Real-Time Status Tracking

Modern accounting systems streamline the invoicing process by automating calculations, sending invoices, and tracking payment statuses. Many tools can even trigger automatic payment reminders, helping reduce late payments and minimize follow-ups. Secure payment portals further enhance the customer experience by offering convenient and trusted transaction options.

Enhanced User Experience

A user-friendly accounting interface reduces complexity and improves workflow. When employees can navigate the system efficiently, it reduces stress, boosts productivity, and enhances team satisfaction. A smooth user experience is essential to ensure that staff can focus on meaningful tasks rather than battling with outdated systems.

Built for Growth-Focused Businesses

Modern business accounting software is a powerful tool for growing enterprises. It simplifies financial management by automating invoicing, tracking expenses, and generating accurate reports. Streamlining complex accounting tasks saves time, minimizes errors, and empowers business owners to make informed decisions, allowing them to focus on scaling operations and driving growth.

Minimize Human Errors

Unlike manual processes prone to mistakes, accounting software performs calculations with speed and precision. By reducing the need for manual data entry, businesses can improve data accuracy, ensure compliance, and maintain reliable financial records with confidence.

Seamless Bookkeeping & Accounts Production

Integrated accounting platforms combine bookkeeping and accounts production in one streamlined system. Automated data synchronization eliminates repetitive entry, improves accuracy, and accelerates the preparation of financial statements. This efficiency allows accountants to shift focus from administrative tasks to strategic insights and advisory services.

Accelerated Response Time

In today’s fast-moving business environment, speed is essential. Online accounting software enhances internal efficiency, improves workforce productivity, and enables businesses to act quickly and decisively. The result? You can accomplish more in less time, keeping your business agile and competitive.

Conclusion

In a competitive and fast-evolving business landscape, smart accounting software, Smart Invoice is no longer a luxury, it’s a necessity. From smart invoicing and simplifying ZRA tax compliance to streamlining expense tracking and delivering real-time financial insights, this technology empowers MSMEs to grow with confidence.

By reducing manual errors, improving operational efficiency, and enabling faster decision-making, smart invoice accounting software helps business owners reclaim valuable time and focus on what truly matters, scaling their business. Whether you're managing a startup or an expanding enterprise, adopting cloud-based, user-friendly, and intelligent financial tools can unlock new levels of productivity and performance.

Embrace the future of accounting. Let Smart Invoice Software simplify your finances and fuel your business growth anytime, anywhere.

0 notes

Text

The Future of Billing: Cloud-Based Solutions for Small Businesses

In today’s fast-paced digital economy, small businesses are under increasing pressure to streamline operations, reduce costs, and stay competitive. One key area where innovation is transforming the way businesses operate is billing. Traditional invoicing methods—often reliant on spreadsheets, paper, and manual data entry—are quickly becoming outdated. In their place, Cloud-Based Billing Solutions are emerging as the future of efficient, scalable, and reliable financial management.

Why Traditional Billing Systems Are No Longer Enough

Traditional billing systems are not only time-consuming but also prone to human error. Manual processes often lead to missed invoices, delayed payments, and accounting discrepancies. For small businesses, which may not have dedicated accounting departments, these issues can directly impact cash flow and overall business health.

Moreover, legacy billing software often requires costly infrastructure, regular maintenance, and is difficult to scale as the business grows. As more businesses embrace remote work and digital platforms, the need for flexible, accessible billing systems has become more urgent than ever.

The Rise of Cloud-Based Billing

Cloud-based billing solutions offer a modern alternative that addresses many of the shortcomings of traditional systems. Here’s how:

1. Accessibility and Mobility

Cloud billing platforms are accessible from any device with an internet connection. Whether you're on-site, at home, or traveling, you can create, send, and manage invoices on the go. This level of flexibility is especially valuable for entrepreneurs and small business owners who wear many hats.

2. Automation and Efficiency

Automation is one of the biggest advantages of cloud-based billing. These platforms can automatically generate recurring invoices, send payment reminders, apply taxes, and even reconcile transactions with minimal human intervention. This reduces administrative workload and minimizes errors.

3. Cost-Effective

Cloud billing systems typically operate on a subscription model, eliminating the need for large upfront investments in hardware or software. Small businesses can choose plans that suit their budget and scale up or down as needed.

4. Data Security and Backup

Reputable cloud billing providers invest heavily in data security. Features like encryption, regular backups, and multi-factor authentication ensure that your financial data is protected against breaches and data loss—something not always guaranteed with traditional systems.

5. Real-Time Analytics and Reporting

Modern billing platforms come with integrated analytics dashboards. Business owners can track cash flow, monitor overdue invoices, and analyze customer payment behavior in real time. These insights support better decision-making and strategic planning.

Key Features to Look For

When choosing a cloud-based billing solution, small businesses should consider features such as:

Customizable invoicing templates

Multi-currency and multi-language support

Integration with accounting software (e.g., QuickBooks, Xero)

Mobile app availability

Customer portals for invoice viewing and payments

Automated tax calculations and compliance features

Preparing for the Future

Adopting cloud-based billing is not just a trend—it’s a strategic move toward digital transformation. As technologies like AI, machine learning, and blockchain continue to evolve, we can expect billing systems to become even more intelligent, predictive, and secure.

Small businesses that make the shift today will not only enjoy immediate efficiency gains but will also be better positioned for long-term growth and adaptability in an increasingly digital marketplace.

Conclusion

The future of billing is undoubtedly cloud-based. For small businesses, these solutions offer a powerful combination of convenience, cost savings, and operational efficiency. By embracing Cloud Billing Technologies, entrepreneurs can spend less time on administrative tasks and more time focusing on what truly matters—growing their business.

0 notes

Text

web based invoicing system

Aninvoice is a powerful web-based invoicing system designed to simplify your billing process and enhance financial management. Ideal for freelancers, small businesses, and growing enterprises, Aninvoice offers real-time access to invoicing from anywhere, ensuring efficiency and accuracy. With features like automated billing, client management, tax calculations, and customizable templates, it helps streamline your workflow and get paid faster. The user-friendly interface and secure cloud storage make Aninvoice a smart choice for modern businesses. Say goodbye to paperwork and embrace digital invoicing with Aninvoice – your trusted partner in effortless financial operations. Experience the future of invoicing, anytime, anywhere.

0 notes

Text

Streamline Your Finances with Expert Odoo Accounting Solutions by Banibro IT Solutions

In the bustling economic hub of Dubai, efficient financial management is the backbone of business success. Odoo Accounting, a core module of the Odoo ERP ecosystem, empowers organizations to automate financial workflows, ensure compliance, and gain real-time insights into their fiscal health. As an , Banibro IT Solutions specializes in implementing tailored Odoo Accounting solutions that simplify complexity, reduce errors, and drive profitability. Whether you’re a startup or an enterprise, our expertise ensures your accounting processes are as agile as your ambitions.

Why Odoo Accounting?

Odoo Accounting stands out for its intuitive design, automation capabilities, and seamless integration with other business functions. Unlike traditional accounting software, it offers:

End-to-End Financial Management: From invoicing and expense tracking to multi-currency reconciliation and tax compliance.

Real-Time Reporting: Instant access to cash flow statements, balance sheets, and profit & loss reports.

Scalability: Adapt to growing transaction volumes, new markets, or regulatory changes effortlessly.

At Banibro IT Solutions, we enhance these features with industry-specific customization and unwavering support.

Expert Odoo Accounting Features Delivered by Banibro IT Solutions

Automated Invoicing & Payments

Generate and send invoices automatically based on sales orders or project milestones.

Set up online payment gateways (e.g., PayPal, Stripe) for faster collections and reduced delays.

Schedule recurring invoices for subscriptions or retainer clients.

Multi-Currency & Multi-Company SupportManage transactions in AED, USD, EUR, or other currencies with real-time exchange rate updates. Consolidate financials across subsidiaries or branches seamlessly.

Tax Compliance Made Simple

Automate VAT calculations for UAE compliance, including VAT returns and filing.

Configure tax rules for international operations to avoid penalties.

Expense Tracking & Approval Workflows

Capture employee expenses via mobile apps, receipts, or email.

Implement multi-level approval workflows to ensure policy adherence.

Bank ReconciliationSync Odoo with your bank feeds to reconcile transactions in minutes, not hours.

Advanced Financial Analytics

Custom dashboards to monitor KPIs like gross margins, DSO (Days Sales Outstanding), or budget variances.

Drill-down reports for granular insights into departmental spending or revenue streams.

Integration with Odoo Modules

Sales & Inventory: Auto-update COGS (Cost of Goods Sold) and track profitability per product.

HR & Payroll: Sync employee data for accurate payroll processing and labor cost analysis.

Project Management: Allocate project costs and track ROI in real time.

Banibro’s Odoo Accounting Implementation Process

We ensure a frictionless transition to Odoo Accounting with a structured approach:

Business Process ReviewAnalyze your current financial workflows, pain points, and compliance requirements.

Tailored Configuration

Chart of Accounts: Set up accounts aligned with UAE standards or global IFRS.

Automation Rules: Configure recurring journals, payment reminders, or tax templates.

Third-Party Integrations: Connect with banking APIs, payroll systems, or CRM tools.

Data MigrationSecurely transfer historical data (e.g., invoices, ledgers) from legacy systems like QuickBooks, Tally, or Excel.

User TrainingEmpower your finance team with hands-on training on Odoo’s accounting features, from basic bookkeeping to advanced reporting.

Go-Live & OptimizationLaunch with minimal disruption, supported by our team to fine-tune workflows and resolve initial challenges.

Ongoing Odoo Accounting Support by Banibro IT Solutions

Our partnership ensures your accounting system evolves with your business:

24/7 Technical Support: Resolve issues like reconciliation errors or integration glitches promptly.

Regulatory Updates: Stay compliant with UAE VAT, ESR (Economic Substance Regulations), or global tax laws through automatic updates.

Performance Audits: Quarterly reviews to optimize processes, reduce costs, and enhance accuracy.

Scalability Upgrades: Add advanced features like budget forecasting, asset management, or consolidated reporting as needed.

Case Study: Boosting Financial Efficiency with Odoo Accounting

Automated invoice generation from delivery orders.

Bank feed integration for real-time reconciliation.

Custom dashboards to track cash flow and overdue payments. Results: 60% faster invoice processing, 90% reduction in reconciliation errors, and improved VAT compliance.

Why Partner with Banibro IT Solutions for Odoo Accounting?

Odoo Gold Partner: Certified expertise in financial module customization and compliance.

Industry-Specific Expertise: Tailored solutions for retail, construction, hospitality, and trading sectors.

Local Knowledge: Deep understanding of UAE’s tax landscape and business practices.

Transparent Pricing: Flexible packages with no hidden fees—scale as your needs grow.

Ready to Modernize Your Financial Management?

Don’t let manual processes or outdated software hinder your growth. With Banibro IT Solutions , transform your accounting operations into a strategic asset using Odoo’s powerful tools.

📞 Contact Us Today!Schedule a free Odoo Accounting demo or consultation to discover how we simplify finance for your business.

Banibro IT Solutions – Where Precision Meets Productivity.

0 notes

Text

Why Your Business Needs a Custom Tax Invoice System

In today’s competitive business environment, staying ahead requires efficiency and accuracy in every aspect of your operations. One area where businesses often face challenges is managing their invoicing systems. For businesses in Telangana, adopting a custom tax invoice system is a smart move to streamline operations, ensure accuracy, and maintain compliance with local tax regulations.

A custom tax invoice system provides a tailored solution that meets the specific needs of your business. With customisable invoice templates, businesses can add company logos, define tax rates, and include other essential details that reflect their unique operations. This eliminates the need for generic templates and reduces the chances of errors in tax calculations or invoice formatting.

Ebiztechnix, the best custom tax invoice in Hyderabad, offers innovative solutions to help businesses automate their invoicing processes. As the best custom tax invoice in Hyderabad, Ebiztechnix understands the complexities of managing tax invoices and ensures that your system is fully compliant with Telangana's tax laws. Their customised approach ensures that you are equipped with an invoicing system that meets both your operational and legal requirements.

By integrating a custom tax invoice system from Ebiztechnix, your business can save valuable time, improve invoicing accuracy, and enhance overall efficiency. The best custom tax invoice in Hyderabad not only makes your invoicing process faster but also reduces the risk of errors, helping your business maintain a strong reputation with clients and tax authorities alike.

In conclusion, a custom tax invoice system is essential for businesses in Telangana. With the expertise of Ebiztechnix, you can ensure that your invoicing process is smooth, efficient, and fully compliant.

0 notes