#autonomous mobile robot share

Explore tagged Tumblr posts

Text

The Role of AI in Enhancing Autonomous Mobile Robot Capabilities

An autonomous mobile robot (AMR) is a multipurpose, self-contained robot that can move around and carry out activities in dynamic surroundings without assistance from a human. AMRs can map their environment, make judgments in real time, and adjust to changing situations since they are outfitted with sophisticated sensors, cameras, and artificial intelligence. These autonomous mobile robots are commonly utilized for duties like material handling, inventory management, and patient care in sectors including manufacturing, logistics, and healthcare. Their independence boosts productivity, lowers personnel expenses, and increases security in intricate settings.

#autonomous mobile robot demand#autonomous mobile robot share#autonomous mobile robot trend#autonomous mobile robot size

0 notes

Text

Autonomous Mobile Robot Market - Forecast(2024 - 2030)

Autonomous Mobile Robot (AMR) Market size is estimated to reach $14.4 billion by 2030, growing at a CAGR of 21.4% during the forecast period 2023-2030. Due to their adaptability and simplicity of integration into existing infrastructures, Autonomous Mobile Robots are quickly emerging as a valuable asset for businesses engaged in manufacturing, warehousing, and logistics. One of the major elements that drive the market growth is the excessive use of robots in various industrial sectors.

Additionally, Autonomous Mobile Robots (AMRs) are used by healthcare providers for essential tasks such as telepresence, medication delivery, and disinfection. This allows staff to spend more time with patients and maintain a safe environment for all. Secured delivery of medications and laboratory specimens and all environmental services are all moved autonomously. Expanding the uses of autonomous robots and raising awareness of their benefits in emerging economies are propelling the Autonomous Mobile Robot growth during the forecast period.

0 notes

Text

Material Handling Robots Industry: The Human Touch In A Robotic Age

Global material handling robots’ industry data book is a collection of market sizing information & forecasts, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, all such information is systematically analyzed and provided in the form of presentations and detailed outlook reports on individual areas of research.

The global AGV, AMR, and cobots markets combine to account for USD 7.34 billion in revenue in 2021, which is expected to reach USD 31.07 billion by 2030, growing at a cumulative rate of 17.4% over the forecast period. The combination bundle is designed to provide a holistic view of these highly dynamic market spaces.

Access the Global Material Handling Robots Industry Data Book from 2023 to 2030, compiled with details by Grand View Research

Automated Guided Vehicles Market Report Highlights

The global automated guided vehicle market size was valued at USD 3.81 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 10.2% from 2022 to 2030.

• The unit load carrier segment is expected to expand at the fastest CAGR over the forecast period owing to its ability to handle multiple items simultaneously, reducing the number of trips required and, potentially, handling costs • Natural navigation technology’s adoption is expected to grow significantly over the forecast period as it enables businesses to easily modify and expand the guide path of the AGV • Assembly line application is expected to have the highest CAGR over the forecasts period as assembly line AGV are replacing traditional mechanical production lines • The manufacturing segment dominated the market in 2022 and accounted for a revenue share of over 77%. The growing adoption of automated guided vehicles across various industries can be attributed to the benefits offered by AGVs in terms of productivity, safety, and accuracy • The service segment is anticipated to be the fastest-growing segment in the forecast period. This growth can be attributed to the rising demand for various services, which include preventive and corrective maintenance, vehicle and software health check, and training employees directly or indirectly with the operation of AGVs • Europe dominated the market in 2022 and accounted for a revenue share of over 30%. Rising investments in the manufacturing sector's technological advancement are expected to improve the AGV market in Europe

Autonomous Mobile Robot Market Report Highlights

The global autonomous mobile robot market size was valued at USD 2.52 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 16.8% from 2022 to 2030.

• The adoption of material handling automation solutions for inventory management is growing significantly across various industries • The manufacturing segment dominated the market in 2022 and is expected to continue dominating the market over the forecast period • Incumbents of the manufacturing industry have realized that the costs associated with the maintenance and procurement of autonomous mobile robots tend to be significantly less

Collaborative Robots Market Report Highlights

The global collaborative robots market size was valued at USD 1.01 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 31.5%, from 2022 to 2030.

• The mounting adoption of collaborative robots is seen in several industrial applications, as they serve as assisting devices for humans and enhance the overall efficiency and quality of the manufacturing processes • The collaborative robots industry is expected to witness strong growth in the coming years with the increasing adoption of cobots across small and medium enterprises, as they are cost-effective and provide a higher return on investment • Europe captured a sizeable revenue share of more than 30.0% in 2022 owing to the increased product application in electronics, logistics, and inspection verticals • Key market players include ABB Group, EPSON Robots, DENSO Robotics, Energid Technologies Corporation, Fanuc Corporation, F&P Robotics AG, MRK-Systeme GmbH, and KUKA AG

Order your copy of Free Sample of “Material Handling Robots Industry Data Book –Market Size, Share, Trends Analysis And Segment Forecasts, 2023 - 2030” Data Book, published by Grand View Research

Competitive Landscape

Key players operating in the Material Handling Robots Industry are –

• Swisslog Holding AG • Egemin Automation Inc. • Bastian Solutions, Inc. • Daifuku Co., Ltd. • Dematic • ABB Group • Bleum • Boston Dynamics • Clearpath Robotics, Inc. • GreyOrange • IAM Robotics • Epson Robots • F&P Robotics AG • Fanuc Corporation • Precise Automation, Inc. • Yaskawa Electric Corporation • Techman Robot Inc. • DENSO Robotics • AUBO Robotics • BALYO

#Material Handling Robots Industry Data Book#Automated Guided Vehicles Market Trends#Automated Guided Vehicles Industry Trends#Autonomous Mobile Robot Market Size#Autonomous Mobile Robot Market Share#Collaborative Robots Market Growth#Material Handling Robots Sector Report

0 notes

Text

Autonomous Mobile Robots Market Estimated To Witness Growth Due To Rising Demand From Logistics And Warehousing Industries

The global autonomous mobile robots market is estimated to be valued at US$ 3.41 Bn in 2024 and is expected to exhibit a CAGR of 3.1% over the forecast period 2024 to 2031, as highlighted in a new report published by Coherent Market Insights. Market Dynamics: The key driver explained from the heading is the rising demand from logistics and warehousing industries. The growing e-commerce sector has placed significant pressure on logistics and warehousing companies to expedite and streamline operations. Autonomous mobile robots help in automating material handling tasks which reduces operational costs and improves productivity for warehouse and logistics companies. Additionally, AMRs ensure safer working environments by eliminating risks associated with manual material handling. This factor is further driving their adoption across industries. Furthermore, continuous technological advancements are making AMRs more affordable and efficient. Emergence of IoT and AI-enabled AMR solutions is also fueling market growth over the forecast period. SWOT Analysis Strength: Autonomous mobile robots are highly efficient as they can operate 24/7 without breaks. They perform repetitive and routine tasks with high accuracy reducing the scope of human errors. Their programming makes them consistent in task performance. Weakness: High initial investment costs are required for deployment of autonomous mobile robots. Technical glitches and system failures can disrupt workflow. Lack of dexterity and adaptability are limitations as they cannot handle unpredictable situations or tasks requiring human judgment. Opportunity: Increased labor costs and shortage of labor is driving many industries to adopt robotics solutions. The logistics and warehousing sector offers huge growth opportunity for autonomous mobile robots for applications like transportation and sorting. Growth of e-commerce will further boost demand. Threats: Concerns around job losses can increase resistance from labor unions. Delay in development of technologies like advanced sensing, AI and 5G networks can hamper full potential of autonomous mobile robots. Changes in government regulations regarding robotics can affect adoption plans of some companies. Key Takeaways The global autonomous mobile robots market growth is expected to witness high growth over the forecast period owing to benefits like improved efficiency and reduced costs. The market size is estimated to reach US$ 3.41 Mn in 2024 from US$ 1.23 Mn in 2019, indicating a CAGR of around 3.1% during the period. Regional analysis:

North America currently dominates the market attributed to rapid technological advancement and increasing investments by prominent players in the region. Asia Pacific is anticipated to be the fastest growing market led by countries like China, Japan and India. With growing industrialization and manufacturing hub status, the APAC autonomous mobile robots market is projected to witness a CAGR of over 4% during the forecast period. Key players:

Key players operating in the autonomous mobile robots market are Sanofi, Pfizer, Inc., Novartis AG., B. Braun Melsungen AG, Fresenius Medical Care, Medtronic, Preservation Solution Inc., TransMedics, Inc., Organ Recovery Systems, and Transonic Systems Inc. These key players are focused on new product launches and partnerships to strengthen their market position.

Get more insights on this topic: https://www.newsstatix.com/the-autonomous-mobile-robots-market-growth-is-propelled-by-increasing-demand-for-automation-in-warehouses/

#Autonomous Mobile Robots#Autonomous Mobile Robots Market#Autonomous Mobile Robots Market size#Autonomous Mobile Robots Market share#Autonomous Mobile Robots Market demand#Autonomous Mobile Robots Market analysis

0 notes

Text

#Autonomous Mobile Robot Market#Autonomous Mobile Robot Market size#Autonomous Mobile Robot Market share#Autonomous Mobile Robot Market trends#Autonomous Mobile Robot Market analysis

0 notes

Text

youtube

Meet MBARI: This team develops innovative new technology to map the seafloor 🤖🗺️

With marine life and ecosystems facing a rising tide of threats, the ocean exploration community needs nimble, cost-effective tools for measuring and monitoring ocean health. MBARI’s Control, Modeling, and Perception of Autonomous Systems Laboratory, known as the CoMPAS Lab is up to the challenge.

MBARI scientists and engineers build and adapt advanced technology that enhances ocean data collection. Led by engineer Giancarlo Troni, the CoMPAS Lab team develops scalable marine technology that can easily be modified for use in a wide variety of vehicles and platforms.

Working with other teams across MBARI, the CoMPAS Lab leverages vehicles like the MiniROV to deploy and test new tools in Monterey Bay's submarine canyon and then adapt them for other mobile platforms. By sharing open-source design specifications and advanced algorithms with the wider ocean exploration community, we hope to expand access to MBARI’s engineering innovations.

MBARI technology is transforming what we know about the ocean and its inhabitants. Our scientists, engineers, and marine operations staff work together to create innovative tools for a more sustainable future where autonomous robots and artificial intelligence can track ocean health in real time and help us visualize ocean animals and environments. Studying our blue backyard is revealing our connection to the ocean—how it sustains us and how our actions on land may be threatening its future.

We’re spotlighting various teams at MBARI to showcase the different ways we’re studying the largest environment on Earth. We hope this series inspires a new generation of ocean explorers. Dive in.

39 notes

·

View notes

Text

Industrial Explosive Market Trends, Drivers, Restraints, Analysis and Forecast by 2034

According to a new industry analysis by Fact.MR, the global industrial explosive market is anticipated to be worth US$ 13.82 billion in 2024 and grow at a 6.3% CAGR from 2024 to 2034. Mining businesses use industrial explosives as a more practical and cost-effective alternative to mechanical excavation methods.

The market is expected to rise steadily due to the mining industry's increased demand for explosives. Furthermore, the rise of the mining industry is expected to fuel the industrial explosive market growth. The development of semi-automated explosive delivery systems is the outcome of key players' strategic agreements and quick technological advancements.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐚 𝐒𝐚𝐦𝐩𝐥𝐞 𝐂𝐨𝐩𝐲 𝐨𝐟 𝐓𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.factmr.com/connectus/sample?flag=S&rep_id=10096

Key Takeaways from Market Study:

The global industrial explosives market is expected to grow at a CAGR of 6.3% till 2034.

The market is expected to reach $25.45 billion by the end of 2034.

The market in the United States is expected to reach $1.83 billion by 2024.

China will account for 55.4% of the East Asian market in 2024.

Revenue from industrial explosive sales in Japan is expected to reach $1.02 billion by 2024.

The East Asia market is expected to grow at a CAGR of 6.5% till 2034.

Regional Analysis:

North America has developed as one of the most profitable regions for mining industry participants, owing to the presence of major worldwide mining and construction firms. India is a significant player in the South Asian industrial explosives market.

China is expected to account for 55.4% of the industrial explosive market in East Asia by 2024. China, a major manufacturer of metal and coal in the globe, has a thriving building industry. Furthermore, the country's demand for industrial explosives had skyrocketed as mining activity surged and the infrastructure sector expanded dramatically.

Category-wise insights

There are two types of explosives accessible on the market: bulk and packaged, with 56.3% and 43.7% market shares, respectively. Mining activities rely on explosives to break and construct a way through the hard rocks beneath the Earth's surface, hence the mining sector is a major user of industrial explosives. The worldwide mining business is impacted by rising demand for earth metals and minerals.

New government-sponsored exploration programs around the world are also driving the mining industry's growth. As end-use sectors expand, demand for industrial explosives is expected to rise steadily.

Competitive Landscape

The industrial explosive market is dominated by Orica Limited Exsa S.A., Eurenco SA, Enaex S.A., AEL Mining Services Ltd., Austin Powder Company, Irish Industrial Explosives Ltd., Solar Industries, LSB Industries, and BME Mining.

In October 2022, Orica Limited announced its acquisition of Axis Mining Technology. This transaction will provide the company with chances for growth in the mining value chain.

To address mining challenges in deep, complex places, Enaex S.A., a prominent explosives manufacturer, successfully demonstrated remote, robotic, and autonomous explosive loading in April 2022.

Read More: https://www.factmr.com/report/industrial-explosive-market

Segmentation of Industrial Explosive Market Research

By Type :

Bulk Explosives

Packaged Explosives

By End Use :

Mining

Construction

By Region :

North America

Western Europe

Eastern Europe

Latin America

East Asia

South Asia & Pacific

Middle East & Africa

Explore More Related Studies Published by Fact.MR Research:

Explosive Detection Technology Market: The global explosive detection technology market size has been forecast by Fact.MR to expand at a CAGR of 6.5% over the next ten years. As a result, the market is expected to increase from a value of US$ 8.56 billion in 2024 to US$ 16.07 billion by the end of 2034.

Mobile Explosive Manufacturing Unit Market: The global mobile explosive manufacturing unit (MEMU) market size has been calculated at a value of US$ 392.2 million in 2024, as revealed in a new study published by Fact.MR. Projections are that the market will expand at 5.6% CAGR to reach US$ 676.3 million by the end of 2034.

𝐀𝐛𝐨𝐮𝐭 𝐅𝐚𝐜𝐭.𝐌𝐑

We are a trusted research partner of 80% of fortune 1000 companies across the globe. We are consistently growing in the field of market research with more than 1000 reports published every year. The dedicated team of 400-plus analysts and consultants is committed to achieving the utmost level of our client’s satisfaction.

��𝐨𝐧𝐭𝐚𝐜𝐭:

US Sales Office 11140 Rockville Pike Suite 400 Rockville, MD 20852 United States Tel: +1 (628) 251-1583, +353-1-4434-232 Email: [email protected]

1 note

·

View note

Text

Market Explosion: How Haptic ICs Are Powering the Next Wave of Consumer Electronics

Unleashing the Power of Tactile Innovation Across Industries

We are witnessing a paradigm shift in how technology interacts with the human sense of touch. The global Haptic Technology IC market is entering a transformative era marked by unparalleled growth, disruptive innovation, and deep integration across core sectors—consumer electronics, automotive, healthcare, industrial robotics, and aerospace. With an expected compound annual growth rate (CAGR) of 14.5% from 2025 to 2032, this market is projected to exceed USD 15 billion by the early 2030s, driven by the rise of immersive, touch-driven user interfaces.

Request Sample Report PDF (including TOC, Graphs & Tables): https://www.statsandresearch.com/request-sample/40598-global-haptic-technology-ic-market

Technological Momentum: Core Components Fueling the Haptic Technology IC Market

Precision Haptic Actuators and Smart Controllers

The evolution of haptic interfaces is rooted in the synergy between advanced actuators and intelligent IC controllers. Key components include:

Piezoelectric Actuators: Offering unparalleled accuracy and responsiveness, ideal for surgical tools and high-end wearables.

Linear Resonant Actuators (LRAs): The go-to solution in smartphones and game controllers for low-latency, energy-efficient feedback.

Eccentric Rotating Mass (ERM) Motors: A cost-effective solution, widely integrated in mid-range consumer devices.

Electroactive Polymers (EAP): A flexible, next-gen alternative delivering ultra-thin, wearable haptic solutions.

Controllers now feature embedded AI algorithms, real-time feedback loops, and support for multi-sensory synchronization, crucial for VR/AR ecosystems and autonomous automotive dashboards.

Get up to 30%-40% Discount: https://www.statsandresearch.com/check-discount/40598-global-haptic-technology-ic-market

Strategic Application Areas: Sectors Redefining Interaction

1. Consumer Electronics: The Frontline of Haptic Revolution

From smartphones and smartwatches to gaming consoles and XR headsets, the consumer electronics sector commands the largest market share. Brands are leveraging multi-modal haptics for:

Enhanced mobile gaming immersion

Realistic VR touch simulation

Sophisticated notification systems via haptic pulses

2. Automotive: Safety-Driven Touch Interfaces

Modern vehicles are evolving into touch-centric command hubs, integrating haptics into:

Infotainment touchscreens

Steering wheel feedback systems

Driver-assistance alerts

Touch-based gear shifters and HVAC controls

With autonomous vehicles on the horizon, predictive tactile feedback will become critical for communicating warnings and instructions to passengers.

3. Healthcare: Precision Through Tactility

Haptic ICs are revolutionizing minimally invasive surgery, telemedicine, and rehabilitation therapy. Key uses include:

Surgical simulation platforms with life-like resistance

Tactile-enabled robotic surgical instruments

Wearable devices for physical therapy and muscle stimulation

4. Industrial Robotics and Aerospace: Intuitive Control at Scale

In manufacturing and aviation:

Haptic controls enhance operator precision for remote machinery.

Pilots and trainees benefit from tactile flight simulators.

Haptic feedback in aerospace control panels ensures error-reduced input in high-stakes environments.

Haptic Technology IC Market Dynamics: Drivers, Challenges, and Strategic Outlook

Haptic Technology IC Market Growth Catalysts

Surge in XR and metaverse applications

Push toward user-centric product design

Rise of electric and autonomous vehicles

Rapid innovation in wearables and digital health

Key Haptic Technology IC Market Challenges

High integration and manufacturing costs

Miniaturization without performance degradation

Standardization across heterogeneous platforms

Haptic Technology IC Market Opportunities Ahead

Growth in next-gen gaming peripherals

Haptics for smart prosthetics and brain-computer interfaces (BCIs)

Expansion in remote work environments using tactile feedback for collaborative tools

Haptic Technology IC Market Segmental Deep Dive

By Component

Vibration Motors

Actuators: LRA, ERM, Piezoelectric, EAP

Controllers

Software (Haptic Rendering Engines)

By Application

Consumer Electronics

Automotive

Healthcare

Industrial & Robotics

Aerospace

Gaming & VR

By Integration Type

Standalone Haptic ICs: Custom, powerful use cases

Integrated Haptic ICs: Cost-effective and compact for high-volume production

By Distribution Channel

Direct OEM/ODM partnerships

Online electronics marketplaces

Regional distributors and system integrators

Research and Innovation hubs

Haptic Technology IC Market By Region

Asia Pacific: Dominant due to manufacturing ecosystem (China, South Korea, Japan)

North America: Leadership in healthcare and XR innovation

Europe: Automotive-driven adoption, especially in Germany and Scandinavia

South America & MEA: Emerging demand in industrial automation and medical training

Competitive Intelligence and Emerging Haptic Technology IC Market Players

Industry Leaders

Texas Instruments

TDK Corporation

AAC Technologies

Microchip Technology

Synaptics

These firms focus on miniaturization, energy efficiency, and integration with AI/ML-based systems.

Disruptive Innovators

HaptX: Full-hand haptic glove technology

bHaptics: Immersive gaming gear

Boras Technologies: Low-power actuator innovations

Actronika: Smart skin interface for wearables

Industry Developments and Innovations

Notable Innovation

TDK’s i3 Micro Module (2023): A groundbreaking wireless sensor featuring edge AI, built with Texas Instruments. Optimized for predictive maintenance, this ultra-compact module is designed for smart manufacturing environments with real-time haptic feedback and anomaly detection.

Purchase Exclusive Report: https://www.statsandresearch.com/enquire-before/40598-global-haptic-technology-ic-market

Future Outlook: The Next Frontier in Human-Machine Interaction

The integration of haptic technology ICs is no longer optional—it is becoming standard protocol for any device seeking intuitive, human-centered interaction. As our world shifts toward tangible digital interfaces, the market’s future will be shaped by:

Cross-functional R&D collaboration between software, hardware, and neurotechnology.

Strategic M&A activity consolidating niche haptic startups into global portfolios.

Convergence with AI, 6G, neuromorphic computing, and edge computing to build responsive, adaptive systems.

In conclusion, the haptic technology IC ecosystem is not merely an emerging trend—it is the tactile foundation of the next digital revolution.

Our Services:

On-Demand Reports: https://www.statsandresearch.com/on-demand-reports

Subscription Plans: https://www.statsandresearch.com/subscription-plans

Consulting Services: https://www.statsandresearch.com/consulting-services

ESG Solutions: https://www.statsandresearch.com/esg-solutions

Contact Us:

Stats and Research

Email: [email protected]

Phone: +91 8530698844

Website: https://www.statsandresearch.com

1 note

·

View note

Text

Cloud Robotics Market Drivers: AI Integration, Edge Computing, and 5G Adoption

The cloud robotics market is undergoing a significant transformation driven by the convergence of cloud computing, artificial intelligence (AI), and advanced networking technologies. Cloud robotics, which leverages cloud infrastructure to enhance the intelligence and capabilities of robots, is gaining momentum across diverse sectors such as manufacturing, healthcare, logistics, and agriculture. The primary drivers propelling this market include rapid advancements in AI, the deployment of 5G, increasing adoption of edge computing, growing demand for automation, and reduced costs of cloud-based services.

1. Integration of Artificial Intelligence Enhancing Robot Intelligence

AI plays a pivotal role in cloud robotics by enabling real-time data processing, decision-making, and autonomous behavior in robots. The ability to offload complex computations to the cloud allows robots to function more efficiently and adaptively. Machine learning algorithms, natural language processing, and computer vision powered by AI are now embedded into cloud platforms, significantly enhancing robotic functionalities. This trend is particularly visible in warehouse automation and customer service robots, where machines continuously learn and improve based on cloud-based data analytics.

2. Emergence of 5G Networks Boosting Real-Time Communication

One of the most transformative drivers of the cloud robotics market is the rollout of 5G technology. Unlike previous generations of mobile networks, 5G offers ultra-low latency and higher bandwidth, which are crucial for enabling real-time control and collaboration among cloud-connected robots. This capability is instrumental in sectors such as remote surgery, autonomous vehicles, and smart factories, where delay-free operation is essential. The fusion of 5G with cloud robotics facilitates faster data exchange, greater scalability, and seamless integration of distributed robotic systems.

3. Edge Computing Supporting Decentralized Robotic Operations

While cloud computing is central to this market, edge computing is becoming an essential complementary technology. Edge computing brings computational resources closer to the robots, enabling faster response times for latency-sensitive tasks. This hybrid approach—cloud plus edge—ensures robots can function autonomously even when connectivity is intermittent. For instance, in agricultural robotics or drones operating in remote locations, local edge servers enable uninterrupted functioning, while the cloud provides centralized learning and updates. This dynamic architecture improves performance and reliability, making it a key growth driver.

4. Surging Demand for Automation Across Industrial Sectors

With the global push for automation, industries are increasingly adopting robotic solutions to improve productivity and efficiency. Cloud robotics lowers the entry barriers for organizations by minimizing infrastructure costs and providing scalable solutions. In manufacturing, robots connected to cloud systems can share intelligence, learn from each other, and coordinate tasks with minimal human intervention. Logistics companies are using cloud-based robotic systems to optimize warehouse management and last-mile delivery, improving service speed and accuracy. This demand surge is significantly boosting market expansion.

5. Reduction in Cloud Infrastructure and Storage Costs

Another factor accelerating the adoption of cloud robotics is the declining cost of cloud storage and computing services. Leading cloud providers like AWS, Google Cloud, and Microsoft Azure offer cost-effective and scalable platforms tailored for robotic applications. These services allow companies to process large volumes of sensor data, train AI models, and manage robotic fleets without heavy capital investment. This cost-effectiveness is particularly appealing to small and medium enterprises (SMEs), further widening the market’s customer base.

6. Rising Investments and Collaborations Across the Ecosystem

The cloud robotics market is witnessing increased investment from both public and private sectors. Tech giants, robotics startups, and research institutions are collaborating to develop interoperable platforms and standards. Strategic partnerships between hardware manufacturers and cloud service providers are streamlining the development and deployment of robotic solutions. For example, collaborations between NVIDIA and cloud platforms are enabling GPU-powered robotics development for real-time AI inference. These initiatives are accelerating innovation and market penetration.

7. Growing Use Cases in Healthcare, Agriculture, and Retail

Cloud robotics is finding expanding applications beyond industrial automation. In healthcare, robots are being used for remote surgeries, patient monitoring, and elder care—facilitated by real-time data sharing via the cloud. In agriculture, cloud-connected drones and robots optimize irrigation, monitor crop health, and perform harvesting tasks. The retail sector is leveraging robotic assistants for inventory management and customer engagement. The versatility of cloud robotics in addressing unique challenges across sectors is a strong driver of market growth.

Conclusion

The cloud robotics market is being propelled by a powerful mix of technological advances and market demands. The integration of AI, proliferation of 5G, edge computing evolution, and increasing automation needs are reshaping how robots interact with the world and with each other. As cloud infrastructure becomes more affordable and accessible, the ecosystem for cloud robotics is set to flourish. Industries looking to boost efficiency, reduce operational costs, and innovate their workflows will continue driving the market forward in the years to come.

0 notes

Text

Robotics Crawler Camera System Market Size, Share, Trends, Forecast & Growth Analysis 2034

Robotics Crawler Camera System Market is rapidly transforming inspection and surveillance across a variety of high-risk and hard-to-reach environments. Valued at $360.8 million in 2024, this market is projected to reach $1.49 billion by 2034, registering a compelling CAGR of 15.5%. These robotic systems — equipped with high-resolution cameras, remote controls, and rugged mobility — are becoming indispensable in sectors like oil & gas, wastewater management, nuclear facilities, and construction. By reducing the need for manual inspection in dangerous settings, these systems not only enhance safety but also improve operational efficiency and data accuracy.

Click to Request a Sample of this Report for Additional Market Insights: https://www.globalinsightservices.com/request-sample/?id=GIS33208

Market Dynamics

Several key factors are driving the robust momentum of this market. The foremost among them is the growing demand for automation in industrial inspection. With aging infrastructure and increasing safety mandates, industries are turning to robotic crawler systems for routine checks and emergency assessments. Moreover, smart technologies such as artificial intelligence (AI) and autonomous navigation are now being integrated into these systems, allowing for real-time analysis and predictive maintenance.

Municipal applications, particularly sewer and pipeline inspection, are also fueling demand. As urbanization increases, cities are investing in smart infrastructure, making crawler cameras essential tools in managing complex underground networks. Despite the strong growth trajectory, the market faces barriers like high initial costs, complex integration with existing infrastructure, and limited skilled labor for operation and maintenance. However, advancements in AI-driven analytics and wireless technology are expected to ease these challenges in the coming years.

Key Players Analysis

The competitive landscape is marked by innovation and strategic collaborations. Market leaders like Deep Trekker, CUES Inc., and Envirosight are consistently pushing technological boundaries by developing more agile, intelligent, and high-definition systems. Mini-Cam, Subsite Electronics, and Insight Vision are other notable players focusing on enhancing user interface and camera clarity for field operations.

Emerging entrants such as SuperDroid Robots and UAV Robotix are creating a buzz with autonomous and AI-enabled crawler systems tailored for niche applications. Strategic mergers, like Robocam Systems’ acquisition of InspectionTech, are reshaping the market by consolidating capabilities and accelerating product innovation. The ongoing investments in R&D reflect a strong commitment by players to address pain points such as adaptability and battery efficiency.

Regional Analysis

North America leads the global Robotics Crawler Camera System Market, with the United States spearheading adoption across oil and gas, utilities, and municipal sectors. Its strong regulatory framework and focus on infrastructure modernization are central to its dominance.

Europe holds the second-largest market share, with countries like Germany and the United Kingdom investing heavily in automation and smart infrastructure. Stringent environmental and safety regulations further drive the adoption of crawler camera systems in critical sectors.

Asia-Pacific is experiencing accelerated growth, thanks to industrialization in China, India, and Japan. Government-backed smart city initiatives and infrastructure upgrades are creating ripe opportunities for market expansion. In the Middle East & Africa, countries such as Saudi Arabia and the UAE are leveraging robotic camera systems for oil pipeline inspection, while Latin America, led by Brazil and Mexico, is gradually increasing adoption, spurred by urban development projects.

Recent News & Developments

The market has recently seen some impactful developments. Boston Dynamics announced a high-profile collaboration with a European utility to deploy advanced crawler systems for pipeline inspections, improving safety and minimizing downtime. iRobotics launched a new AI-powered camera system for the oil and gas sector, capable of predictive damage detection.

In a major consolidation move, Robocam Systems acquired InspectionTech, aiming to scale operations and expand their market reach. Furthermore, new U.S. regulations have been introduced to standardize robotic usage in hazardous settings, prompting manufacturers to realign their product designs. A significant $50 million investment in a start-up focused on autonomous robotic crawlers signals growing investor confidence in the sector.

Browse Full Report : https://www.globalinsightservices.com/reports/robotics-crawler-camera-system-market/

Scope of the Report

This report delivers an in-depth analysis of the Robotics Crawler Camera System Market, covering technological trends, competitive strategies, regulatory impact, and market forecasts through 2034. Key market segments include push and motorized crawlers, HD and PTZ cameras, and advanced technologies such as AI integration and autonomous navigation.

It also investigates core applications across industrial tanks, sewers, municipal pipelines, and nuclear facilities, while evaluating emerging demand for portable and vehicle-mounted systems. The report highlights strategic moves including partnerships, product launches, R&D investments, and regional expansions, equipping stakeholders with the insights necessary to navigate this high-growth market. #roboticscrawler #infrastructureinspection #smartrobotics #aiinrobotics #sewerinspection #pipelineinspection #roboticcameras #urbaninfrastructure #hazardousworksolutions #automatedinspection

Discover Additional Market Insights from Global Insight Services:

Printed Circuit Board Market : https://linkewire.com/2025/05/22/printed-circuit-board-market/

Asset Integrity Management Market : https://linkewire.com/2025/05/22/global-asset-integrity-management-market/

Medical Sensors Market : https://linkewire.com/2025/05/22/medical-sensors-market-2/

Smart Factory Market : https://linkewire.com/2025/05/22/smart-factory-market-5/

Wearable Sensors Market : https://linkewire.com/2025/05/22/wearable-sensors-market/

About Us:

Global Insight Services (GIS) is a leading multi-industry market research firm headquartered in Delaware, US. We are committed to providing our clients with highest quality data, analysis, and tools to meet all their market research needs. With GIS, you can be assured of the quality of the deliverables, robust & transparent research methodology, and superior service.

Contact Us:

Global Insight Services LLC 16192, Coastal Highway, Lewes DE 19958 E-mail: [email protected] Phone: +1–833–761–1700 Website: https://www.globalinsightservices.com/

0 notes

Text

The global autonomous mobile robot market was valued at USD 2.8 billion in 2024 and is projected to grow at a CAGR of 17.6% from 2025 to 2034.

0 notes

Text

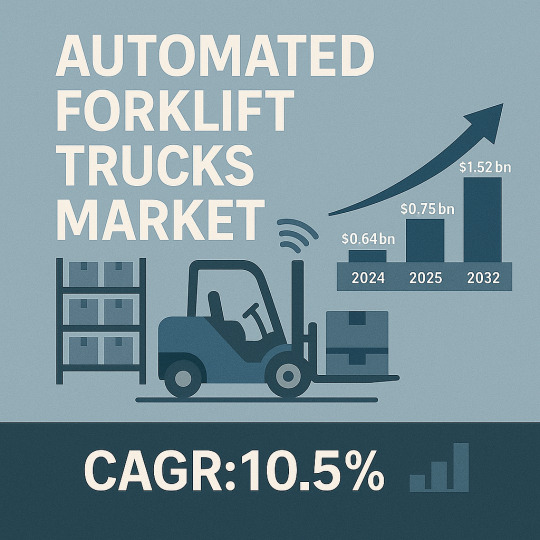

Automated Forklift Trucks Market Size, Trends & Forecast 2032

🚜🤖 The global automated forklift trucks market size was valued at USD 0.64 billion in 2024 and is projected to grow from USD 0.75 billion in 2025 to USD 1.52 billion by 2032, showcasing a healthy CAGR of 10.5% during the forecast period. 🌏 Asia Pacific dominated with a 37.5% share in 2024, reflecting rapid industrial automation and smart warehousing trends.

📌 Key Market Insights:

Market Size (2024): USD 0.64 billion

Forecast Size (2032): USD 1.52 billion

CAGR (2025–2032): 10.5%

Dominant Region: Asia Pacific held 37.5% in 2024

Growth Drivers: Rising demand for efficient material handling, labor cost savings, AMR navigation tech (Laser, Magnetic, Vision Guided), and booming e-commerce & F&B sectors.

🚀 Market Trends: Automated forklift trucks, also known as autonomous mobile robots (AMRs), are revolutionizing transportation, storage, assembly, and packaging in industries like automotive, food & beverage, and e-commerce. Expect more pallet movers, counterbalance, outriggers, and reach trucks with smarter navigation and IoT integration.

👉 Full report: https://www.fortunebusinessinsights.com/automated-forklift-trucks-market-102617

0 notes

Text

Material Handling Robots Industry: Transforming Logistics And Supply Chain Efficiency

Material handling robots industry data book covers automated guided vehicles, autonomous mobile robot and collaborative robots markets. Global material handling robots market was estimated USD 7.34 billion in revenue in 2021, which is expected to reach USD 31.07 billion by 2030, growing at a cumulative rate of 17.4% over the forecast period.

Access the Global Material Handling Robots Industry Data Book from 2023 to 2030, compiled with details by Grand View Research

Automated Guided Vehicles Market Growth & Trends

The global automated guided vehicle market size was valued at USD 3.81 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 10.2% from 2022 to 2030. Automated guided vehicles (AGVs) have transformed the way materials can be moved within the manufacturing and distribution facilities. In a production environment where several operations are carried out simultaneously, these vehicles ensure a predictable and reliable transfer of raw materials and manufactured products from one point to another within the facility, thereby eliminating any potential disruption in production.

These vehicles can operate safely around structures, machinery, and employees, as they are equipped with accessories, such as camera vision and LiDAR sensors, which help detect junctions, identify floor signs, and avoid collisions with any obstacle. For instance, in November 2021, Quanergy Systems, Inc., a U.S.-based company that offers an AI-powered LiDAR platform, launched the new M1 Edge 2D LiDAR sensors for automation. The newly launched LiDAR sensor is light in weight, broad 360°, with a sensing capability of up to 200 meters used in mobile robotics, AGVs, warehouse logistics applications, and port automation.

Several manufacturing plants and warehouses deploy material handling equipment for various activities, such as locating stock, picking orders, and moving products and raw materials. Transportation and logistics firms are mainly focusing on deploying such equipment to boost the efficiency of their operations in line with the growing demand for their services. For instance, in March 2023, MasterMover Ltd, a prominent manufacturer of electric tug and tow solutions, announced a collaboration with BlueBotics, a navigation, robotics, and industrial automation company.

The partnership intends to offer best-in-class Autonomous Navigation Technology (ANT) technologies for MasterMover's range of AGVs. In February 2021, Scott (Transbotics Corporation), a prominent solution provider for AGVs, partnered with KUKA AG, a German manufacturer of robots, to coordinate the industrial robots of KUKA AG into material handling systems. Further, these robots would also benefit the warehouse team in assembling, packaging, welding, storing, and shipping. Also, material handling solutions are used to increase transportation efficiency, decrease physical damage to the material, and reduce overheads by limiting the number of employees.

Order your copy of Free Sample of “Material Handling Robots Industry Data Book –Market Size, Share, Trends Analysis And Segment Forecasts, 2023 - 2030” Data Book, published by Grand View Research

Autonomous Mobile Robot Market Growth & Trends

The global autonomous mobile robot market size was valued at USD 2.52 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 16.8% from 2022 to 2030. AMRs have triggered a paradigm shift in the way tasks, such as material picking, handling, and sorting, that are commonly associated with manufacturing and distribution are performed. These robots can ensure the reliable handling of raw materials and manufactured items within distribution and production facilities, thereby eliminating disruptions in operations.

These robots are typically equipped with different sensors, such as LiDAR sensors, to navigate equipment and worker safety. For instance, in May 2022, Qualcomm introduced the Robotics RB6 platform, a high-end hardware development kit that can serve as the brains for commercial drones, autonomous robots, and delivery robots. It also unveiled a brand-new RB5 reference design, based on the RB5 platform used in millions of systems, that includes all the hardware and sensors needed to develop AMRs.

Manufacturing and distribution facilities aggressively deploy material handling automation systems for tasks such as picking & packing, moving and sorting items. Incumbents of the transportation & logistics industry are leading the deployment of AMRs to boost production and distribution operations, in line with the increasing demand. With the fast-developing e-commerce business driving direct delivery trends, order fulfillment productivity has become a priority for warehouse operators.

AMRs benefit warehouse operators by reducing the workload for order pickers and improving safety by eliminating forklift accidents and musculoskeletal diseases. For instance, in December 2021, at the India Warehousing Show (IWS), Addverb Technologies Private Limited, a worldwide robotics business, announced the introduction of Veloce, a multi-carton picking mobile robot. The new picking robot boosts storage efficiency by increasing capacity and utilizing vertical spaces, enabling clients to save vital costs on warehouse space and associated pricey rentals.

Collaborative Robots Market Growth & Trends

The global collaborative robots market size was valued at USD 1.01 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 31.5%, from 2022 to 2030. The growth can be credited to the growing inclination of industries toward collaborative robots or cobots to automate manufacturing processes.

Over the past few years, the growing interest in robot technology across various industries has positively impacted the collaborative robots industry. Unlike conventional industrial robots, cobots are developed to operate at par with their human counterparts. They are mobile and can be easily moved from one area of a manufacturing facility to another. Moreover, they can be programmed with ease, are more cost-effective than their fixed counterparts, and can be used in a wide range of low-speed, repetitive applications.

The increasing need for highly efficient and user-friendly robots that do not require highly skilled experts for deployment and functioning has created a significant demand for software platforms. These platforms allow the integration of robots, motion control, and the generation of an interface that enables the programming of such robots. For instance, Mitsubishi Electric Corporation has launched a cobot named MELFA ASSISTA equipped with RT VisualBox, the company’s engineering software. This software allows the intuitive creation of operating sequences by connecting block diagrams in a chain of events, including linking with other devices, such as cameras and the hands of the robot.

The increasing demand from industrial customers, researchers, and engineers further strengthens the outlook of the collaborative robots industry. These robots are being deployed across various industries and have been highly influential in addressing the challenges faced by the logistics sector, such as complex work processes, and managing several tasks in different combinations and compact spaces.

Go through the table of content of Material Handling Robots Industry Data Book to get a better understanding of the Coverage & Scope of the study.

Competitive Landscape

Key players operating in the Material Handling Robots Industry are –

• Swisslog Holding AG • Egemin Automation Inc. • Bastian Solutions, Inc. • Daifuku Co., Ltd. • Dematic • ABB Group • Bleum • Boston Dynamics • Clearpath Robotics, Inc. • GreyOrange • IAM Robotics • Epson Robots • F&P Robotics AG • Fanuc Corporation • Precise Automation, Inc. • Yaskawa Electric Corporation • Techman Robot Inc. • DENSO Robotics • AUBO Robotics • BALYO

Grand View Research’s material handling robots’ industry data book is a collection of market sizing information & forecasts, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, all such information is systematically analyzed and provided in the form of presentations and detailed outlook reports on individual areas of research.

#Material Handling Robots Industry Data Book#Automated Guided Vehicles Market Trends#Automated Guided Vehicles Industry Trends#Autonomous Mobile Robot Market Size#Autonomous Mobile Robot Market Share#Collaborative Robots Market Growth#Material Handling Robots Sector Report

0 notes

Text

The Perfect ERP Stack for Logistics & Distribution Companies

In today’s global economy, logistics and distribution are no longer just about moving goods, they’re about orchestrating efficiency, minimizing waste, and maximizing visibility across complex, multi-layered supply chains.

Warehouses must talk to order management. Inventory should update in real-time. Transport delays must trigger instant rerouting. Customers now expect tracking links, not excuses. And all of it must be done faster, smarter, and cheaper.

That’s where an intelligent ERP stack steps in.

The perfect ERP stack for logistics and distribution isn’t a single piece of software, it’s an ecosystem of seamlessly integrated modules designed to deliver end-to-end control, from first mile to last-mile.

In this definitive guide, we break down exactly what your ERP stack needs to deliver competitive edge, real-time intelligence, and customer delight at scale.

The Growing Complexity of Logistics & Distribution

From hyperlocal delivery startups to international freight giants, every logistics company now deals with:

Multichannel order flows

Volatile demand

Fragmented supply chains

Rising customer expectations

Tight delivery SLAs (Service Level Agreements)

Cost pressures and razor-thin margins

And the post-pandemic world hasn’t helped. Disruptions are now a constant. Visibility gaps are costly. Spreadsheets? Obsolete.

Logistics ERP systems need to power:

Real-time coordination

Proactive decision-making

Predictive insights

Seamless collaboration

Why Traditional Systems Are Failing the Industry

Many logistics companies still rely on:

Legacy software with siloed data

Manual coordination across departments

Inflexible tools that can’t scale with new routes or partners

Fragmented warehouse management

Poor integration between customer portals and backend systems

This leads to:

Delays in fulfilment

Inventory mismatches

Routing inefficiencies

Increased operational costs

Unhappy customers

Modern ERP for logistics is the cure.

What Makes an ERP Stack “Perfect” for Logistics

A perfect ERP stack is:

Modular: Adaptable to the size and complexity of your operations

Integrated: Every module shares data — no silos, no sync delays

Scalable: From 1 warehouse to 100, without rebuilding everything

Real-Time: Live updates across inventory, transport, and demand

Cloud-Native: Accessible, flexible, and secure

AI-Powered: Smarter predictions, faster routing, automated alerts

Core Modules Every Logistics ERP Must Include

1.Warehouse Management System (WMS)

Bin-level inventory tracking

Put away optimization

Cycle counting automation

Barcode & RFID integration

2.Transportation Management System (TMS)

Route optimization

Carrier management

Freight audit

Real-time GPS tracking

3.Order Management

Omnichannel order orchestration

Returns handling

Order lifecycle visibility

4.Inventory Management

Stock forecasting

Dead stock alerts

Auto-replenishment

5.Finance & Billing

Automated invoicing

Freight cost reconciliation

Tax compliance

6.Customer Relationship Management (CRM)

Client order history

SLA monitoring

Issue tracking and resolution

Advanced Features to Look For in 2025

AI-based Demand Forecasting

Digital Twins for Warehouses

Autonomous Mobile Robots (AMRs) Integration

Blockchain-enabled Shipment Verification

Voice-enabled Pick-Pack Commands

Cold Chain Monitoring (IoT Sensors)

Carbon Footprint Tracking & Reporting

The future of logistics ERP is intelligent, adaptive, and sustainable.

How Real-Time Data Changes Everything

In logistics, lag equals loss. Real-time ERP platforms provide:

Live inventory updates

ETA recalculations with traffic/weather data

Dynamic re-routing of shipments

Instant alerts on exceptions

Dashboard views of every touchpoint from supplier to customer

Cloud ERP vs. On-Premises: What Works Best?

Cloud ERP is winning, and for good reason:

Lower upfront cost

Faster implementation

Scalable infrastructure

Anywhere access (critical for distributed teams)

Built-in disaster recovery

Seamless updates and AI enhancements

While on-prem may still serve legacy-heavy firms, cloud-native ERP is the future.

Integration with IoT, GPS, and Telematics

Modern ERP stacks thrive on data from connected devices:

IoT sensors track container temperature, humidity, or tilt

GPS integration feeds real-time location into dashboards

Vehicle telematics inform route efficiency and driver behaviour

Smart pallets and tags enhance warehouse throughput

This enables:

Predictive maintenance

Intelligent asset tracking

Shipment anomaly detection

Increased compliance

Warehouse Automation: When ERP Meets Robotics

Smart ERP platforms integrate with:

Conveyor belts and pick robots

AGVs (Automated Guided Vehicles)

AMRs for zone picking

Vision systems for damage detection

The result? → Faster fulfillment → Lower labour dependency → Improved accuracy → 24/7 operations

ERPONE, for instance, supports full robotic orchestration via API-ready architecture.

KPIs to Track with a Smart ERP Stack

OTIF (On-Time, In-Full)

Average Warehouse Throughput

Order Fulfilment Cycle Time

Transport Cost per Mile

Inventory Turnover Rate

Customer SLA Adherence

Returns Ratio

Carbon Emissions per Shipment

ERP dashboards let you track these in real time, empowering instant optimization.

Final Thoughts

The logistics sector is under pressure from consumers, competitors, and climate realities. The winners will be those who:

See what’s happening in real time

Automate what slows them down

Anticipate disruptions

Serve smarter and faster than anyone else

That’s the power of a perfect ERP stack.

It’s not about having more software, it’s about having the right ecosystem: cloud-native, AI-infused, fully integrated, and future-ready.

If your ERP can’t scale with your routes, connect with your assets, and learn from your data, you’re not ready for what’s next.

But with the right stack? You’ll deliver delight at every touchpoint, every time.

0 notes

Text

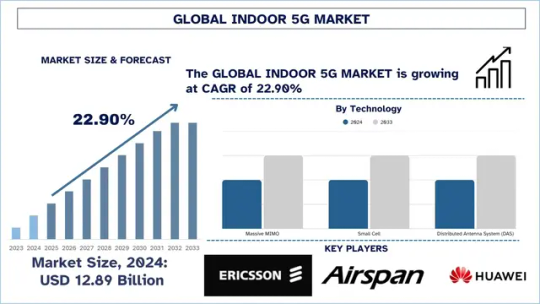

Indoor 5G Market Size, Share, Trends and Forecast 2025-2033

The global Indoor market brings out the 5G technology as the primary pillar of the connected future-imparting immersive digital experiences, critical industrial applications, and real-time communicability for any closed environment. With their rapid digitalization, workspaces, public venues, healthcare facilities, and homes will require ultra-reliable high-speed indoor connectivity as a necessity and no longer as an option. Indoor 5G ensures the much-needed low-latency, high bandwidth, and device density able to support data-intensive services-such as augmented reality, autonomous systems, telemedicine, and digital twins. The market is supported by government initiatives, facilitated by innovations from industry players, and aided by telecom partnerships. indoor 5G networks are scaling up from pilot deployments to commercial adoption. In turn, this vibrant market finds momentum in a growing demand for private networks, edge computing, and smart infrastructure driven by seamless and secure indoor connectivity. According to the UnivDatos, as per their “Indoor 5G Market” report, the global market was valued at USD 12.89 billion in 2024, growing at a CAGR of about 22.90% during the forecast period from 2025 - 2033 to reach USD billion by 2033.

Increasing Demand for High-Speed Connectivity Boosts Market Expansion

Cloud computing, together with video streaming and AR/VR applications and remote work models, drives an urgent need for high-speed, low-latency network infrastructure within buildings. 5G implementations surge across commercial buildings and transit junctions, and residential units because both enterprises and consumers need sustained digital connectivity. GSMA reports that five years from now, 35% of the global population will use 5G networks. The implementation of 5G technology will create beneficial transformations throughout our social environment. The next generation of indoor networks created with 5G offers predictable performance abilities through its implementation of technologies such as Massive MIMO and small cells, despite legacy Wi-Fi systems struggling with density-related issues. In March 2024, Ericsson partnered with Advanced Communications and Electronics Systems (ACES) through a three-year strategic agreement to drive revolutionary 5G indoor connectivity across Saudi Arabia. With the help of this partnership, ACES will deliver advanced Ericsson indoor products to various communications service providers (CSPs) who serve the expanding needs for 5G network connectivity across Saudi Arabia. 5G technology in smart factories functions as a high-speed Ethernet replacement, which enables mobile robotics together with computer vision systems and predictive maintenance applications that require both fast transmission speed and quick response time. The digital transformation requires this connectivity change, which functions as the essential component for all sectors, including education and finance.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/indoor-5g-market?popup=report-enquiry

Latest Trends in the Indoor 5G Market

Adoption of Private 5G Network Deployments

Among the major trends in the indoor 5G market, the deployment of private 5G networks is the most prominent one. Private 5G networks create new approaches for enterprise organizations to handle their indoor connectivity requirements. 5G networks managed by organizations enable complete control of network parameters, so businesses select them for secure environments like factories and logistics terminals, and hospitals. Nokia and Bosch announced in February 2023 that they created 5G-based precision positioning technology which serves new industrial use cases during Industry 4.0. Extensive testing as part of the proof-of-concept deployment at a Bosch production facility in Germany reached 50 cm accuracy in 90 percent of the factory area. The networks maintain specialized data allocation for vital operations while bypassing reliance on external telecommunications providers. The expanding spectrum options, including CBRS as an example of U.S. unlicensed resources, now permit medium-sized organizations to build economical private networks. The technology companies Ericsson and Nokia provide "5 G-as-a-Service" packages, incorporating infrastructure together with software and support services for indoor deployments. The trend demonstrates a fundamental transformation toward adaptable and secure, and personalized indoor network systems that redefine modern enterprise digital structure.

Adoption in Healthcare and Smart Hospitals Elevate Market Value

One of the most transformative opportunities for indoor 5G lies in healthcare and smart hospitals. Healthcare facilities increasingly incorporate real-time data sharing alongside robotic surgery, AI diagnostics connected patient care into digital healthcare environments. 5G indoor facilities allow medical tools to exchange data quickly and support video streams of high definition for distant surgeries and maintain ongoing observation of patients through implanted sensors. South Korea's Samsung Medical Center established its indoor 5G network at the facility in 2024 to support remote diagnostic imaging alongside AI-based triage systems and smart ambulance connectivity. The implementation of 5G supports improved tracking systems alongside secure mobile EMR access, together with remote workstation functionality. The implementation of 5 G-enabled telemedicine hubs using technology bridges existing rural service gaps within developing market areas. Therefore, healthcare demands reliable and secure connectivity, which 5G provides, making it a suitable choice for the sector, while the ongoing increase in healthcare investments creates increasing opportunities.

Related Reports:

Small Cell Network Market: Current Analysis and Forecast (2022-2030)

Distributed Antenna Services Market: Current Analysis and Forecast (2025-2033)

Global Indoor Location Market: Current Analysis and Forecast (2020-2026)

Cellular IoT Market: Current Analysis and Forecast (2022-2030)

MENA Telecom Market: Current Analysis and Forecast (2023-2030)

Open Radio Access Network (O-RAN) Market: Current Analysis and Forecast (2024-2032)

Powering the Next Era of Intelligent, Connected Environments Through Indoor 5G

Indoor 5G represents the intersection of connectivity, digital infrastructure, and intelligent systems; therefore, it provides a strong solution to future communication challenges. With rapid adoption by the healthcare, enterprise, retail, and urban planning sectors, indoor 5G markets are ready not just to explode in scale but rapidly change the face of digital infrastructure within modern society. Supported by vigorous regulatory momentum, increasing investment, and visible performance benefits. Indoor 5G technology will soon move from early adoption into critical mass-embracing higher levels of efficiency, intelligence, and inclusivity within the spaces where people live and work.

Contact:

UnivDatos

+91 7838604911

#Indoor 5G Market#Indoor 5G Market Size#Indoor 5G Market Report#Indoor 5G Market Segments#Indoor 5G Market Analysis

0 notes

Text

Unitree H1: Breaking Speed Barriers in Humanoid Robotics

Envision a humanoid robot racing past all others, acrobatically flipping like a gymnast, and taking industrial applications by storm like never before. Step into the, an engineering sensation that’s not only breaking barriers—it’s pulverizing them. With a world-record 3.3 meters per second speed and 189 N.m/kg torque density, the Unitree H1 is the world’s fastest humanoid robot, with a new standard for high-performance robots. So what sets this machine apart from being game-changing? Let’s examine its breakthrough design and why it’s first choice for pioneering research.

Unmatched Speed Like No Other

Clocking in at 3.3 m/s (approximately 7.4 mph), the Unitree H1 does not walk, it runs. Achieving this blazing speed, demonstrated in untethered open-air displays, the H1 is the fastest humanoid robot in the world. From navigating complex environments to performing dynamic actions like running or flipping, the H1’s high-torque joints (up to 360 N.m) give unparalleled power and precision. This is not just a machine; it’s a force of nature, designed to dominate the toughest environments with ease.

The H1’s unencumbered mobility—cable-free or powered by an external power source—gives it a real-world edge, making it well-suited for outdoor deployment, from search-and-rescue to logistics in hostile environments.

Highlight: H1 stole the show at CES 2024 and NVIDIA GTC, with its untethered running and flipping leaving people in awe. Unlike other entries, it’s not just a prototype but a mass production-ready beast, waiting to be harnessed by researchers and industries today.

Built for Strength, Engineered for Durability

Standing at around 180 cm in height and 47 kg in weight, the H1 is a humanoid of full size with the capability to mimic human functionality. Additionally, its rugged build, powered by Unitree’s internal high-torque motors, enables it to carry out heavy-duty operations in industrial settings. For instance, from lifting payloads in manufacturing facilities to walking over rough terrain outdoors, the H1’s torque density (189 N.m/kg) delivers a strength-to-weight ratio that’s just unbeatable.

However, brute force isn’t the whole story. The H1’s force-position hybrid control also allows it to travel with dexterity, making it ideal for applications that require both strength and tact. In other words, picture it as a robot Hercules with a surgeon’s eye for precision—a combination that’s rewriting the automation playbook.

DNA shared with the G1: AI and Sensors That See the World

Even if the H1 is a monster in its own right, it leverages the technological base common to its sibling, the Unitree G1. Both the robots are endowed with 3D LiDAR and depth cameras, giving them 360° spatial awareness to facilitate free movement. While they are sidestepping barriers or surveying complex environments, these sensors pilot the H1 to move with intelligence and wit.

At the heart of every robot lies Unitree’s AI-powered motion algorithms, with autonomous task performance and real-time learning. From the G1‘s Kung Fu moves to the H1‘s rapid sprinting, the shared AI architecture allows both robots to learn from new challenges. And since Unitree is an open-source philosophy, developers around the globe can create these algorithms, meaning that the H1 is a platform for endless innovation.

Ready to see the future of robotics? More of the Unitree H1 and be a part of the revolution!

The Future Arrives—And It’s Speeding

The Unitree H1 isn’t just a robot; it’s a glimpse into a future where humanoids run, flip, and work alongside us. With its record-breaking speed, Herculean strength, and AI-driven intelligence, it’s redefining what’s possible in robotics. Whether you’re a researcher dreaming of the next breakthrough or an industry leader seeking automation solutions, the H1 is your ticket to the cutting edge.

So, what’s in store next? With Unitree breaking boundaries, the H1 is only the start. Leave your answer in the comments—how would you use the world’s fastest humanoid robot?

0 notes