#calculate gratuity

Explore tagged Tumblr posts

Text

Tipping Point: How America’s Gratuity System Got Out of Hand

https://www.scrapstostacks.com/post/tipping-point-how-america-s-gratuity-system-got-out-of-hand

#usa#america#usa is a terrorist state#usa is funding genocide#gratuity trust#gratuity calculator#gratuity system#gratuity#tipping#tipping culture#tips#tip#class war#eat the rich#eat the fucking rich#eat the 1%#eat the ceos#anti capitalism#neoliberal capitalism#late stage capitalism#fuck capitalism#capitalismo#poverty#homeless#capitalist hell#capitalista#venture capitalist#capitalist dystopia#anti capitalist#slavery

2 notes

·

View notes

Text

Gratuity Calculator - Calculate Gratuity Online in 2025

Gratuity Calculator

A gratuity calculator is an online tool that helps you estimate the gratuity amount you will receive after working with a company for a minimum of five years. If you are wondering how to calculate gratuity, this tool simplifies the process by requiring just your most recent salary and years of service. It then applies the gratuity formula to determine your payout. This calculator is especially useful for employees in private organizations, offering better clarity on the financial benefits they can expect upon retirement or resignation. Plan ahead and understand your post-employment benefits effortlessly. Use our gratuity calculator now to calculate gratuity online in just a few simple steps!

What is Gratuity? Gratuity is a monetary reward that is paid by the employer to an employee in appreciation of their services rendered to the organization. It is a one-time lump-sum payment made upon resignation, retirement, or in certain situations where the employee is disabled. To qualify, the worker is required to serve the company for a minimum of five years under continuous employment. There are situations where gratuity can be given prior to the five-year mark. For example, if an employee becomes sick or is disabled due to an accident.

In India, gratuity is governed by the Payment of Gratuity Act, 1972. The amount received depends on factors such as the employee’s last drawn salary and total years of service. This benefit serves as a financial cushion, offering long-term employees a well-deserved reward for their commitment and loyalty.

0 notes

Text

🎓 What is Gratuity in Salary – Eligibility, Tax Exemption, Calculation & Rules (2025 Guide)

📌 Table of Contents What is Gratuity in salary? Eligibility for Gratuity Laws Governing Gratuity How is Gratuity Calculated? Tax Exemption on Gratuity Gratuity Rules for Government vs Private Employees Maximum Limit on Gratuity TDS & Tax Reporting for Gratuity How to Claim Gratuity? Gratuity Calculator Example Real-Life Case Study Tips to Maximize Gratuity…

#gratuity#gratuity act 1972#gratuity allowance#gratuity as per income tax#gratuity by employer#gratuity calculation#gratuity eligibility#gratuity for private employees#gratuity in ITR#gratuity in salary#gratuity tax exemption#retirement benefits#section 10(10)

0 notes

Text

Plan Ahead with Confidence: Why the Gratuity Calculator UAE Matters More Than Ever

In today’s fast-paced work environment, job changes are increasingly common, especially in a multicultural, expat-driven economy like the United Arab Emirates. Whether you're moving to a new opportunity, returning home, or retiring, knowing your end-of-service benefits is crucial. The Gratuity Calculator UAE is a reliable tool that helps employees estimate what they’re legally entitled to when their employment ends—offering financial clarity and peace of mind.

Understanding End-of-Service Gratuity

End-of-service gratuity is a form of severance pay mandated by UAE Labour Law. Employees who complete at least one continuous year of service are eligible for this benefit. It’s calculated based on your basic monthly salary—not including allowances or bonuses—and your total tenure with the company.

This benefit serves as a financial cushion at the end of employment, helping individuals transition smoothly to their next role or stage in life. However, the calculation can be complex, especially with different rules for limited and unlimited contracts. That’s where the Gratuity Calculator UAE becomes an indispensable resource.

What Does the Gratuity Calculator UAE Do?

The calculator simplifies the entire process by automating calculations that would otherwise require detailed understanding of labour law. It factors in the key variables that determine your gratuity payout:

Basic salary (excluding any benefits or allowances)

Total years and months of service

Type of contract (limited or unlimited)

Reason for leaving (resignation or termination)

Notice period status

With just a few entries, you’ll receive an accurate estimate of your gratuity amount, based on current labour regulations. It takes the guesswork out of the process and ensures that you can hold your employer accountable for fair compensation.

Who Should Use the Calculator?

The Gratuity Calculator UAE is designed for employees at all stages of their professional journey:

Individuals considering resignation

Employees nearing retirement

Workers affected by redundancy or company restructuring

Expats returning to their home country

HR professionals handling exit processes

Whether you’re planning your future or preparing to exit your role, the calculator equips you with valuable knowledge.

Key Legal Principles Behind Gratuity

The UAE Labour Law outlines a structured method for calculating gratuity:

For 1 to 5 years of service: 21 days’ basic pay for each year worked.

For more than 5 years: 30 days’ basic pay for each year after the fifth.

Maximum gratuity: Not to exceed the equivalent of two years’ basic salary.

Employees dismissed for gross misconduct are not entitled to gratuity.

Notice period and type of separation (resignation or termination) also affect eligibility, particularly under unlimited contracts.

The Gratuity Calculator UAE uses this legal framework to deliver accurate and compliant results.

Benefits of Using a Gratuity Calculator

1. Quick and Easy Estimations

Manual calculations are tedious and prone to error. With a calculator, you get precise figures instantly.

2. Financial Planning

Knowing your expected payout allows you to plan your finances ahead of time—whether it’s for relocation, job searching, or retirement.

3. Legal Awareness

Understanding your entitlements ensures that your employer honors their legal obligations.

4. Empowerment

The calculator provides the transparency needed for professional negotiations or discussions with HR.

Common Mistakes to Avoid

Using gross salary instead of basic salary

Incorrectly identifying contract type

Ignoring partial years or months of service

Not accounting for notice periods or special contract clauses

The accuracy of your result depends on entering the correct information—so reviewing your employment contract and official records is advised.

Final Words

The Gratuity Calculator UAE is not just a tool—it’s a vital resource for every working professional in the Emirates. With accurate, real-time estimations, it empowers employees to take control of their financial future. Whether you’re exiting a job or planning long-term, this calculator ensures you get the compensation you deserve, in full alignment with UAE Labour Law.

In a job market as dynamic as the UAE’s, staying informed about your rights isn’t just helpful—it’s essential. And with the Gratuity Calculator UAE, that information is just a few clicks away.

1 note

·

View note

Text

0 notes

Text

The most prevalent and well-liked entity in the Indian market is the private limited company. A Private Limited Company's members are subject to a fixed financial obligation that is solely based on the amount of shares each member personally owns. In India, the Private Limited Company registration procedure is governed by the Companies Act, 2013, and the Companies Incorporation Rules, 2014. A private limited corporation must have a minimum of two shareholders and two directors in order to be registered.

0 notes

Text

Everything to know about gratuity and its calculation

Gratuity is a significant employee benefit that recognises years of service and loyalty towards an organisation. It serves as a gesture of appreciation and financial security for employees, especially when they retire or leave the company. Understanding how gratuity is calculated is essential for both employers and employees. Here is an extensive guide to gratuity, covering its definition, eligibility criteria, and the method for calculating gratuity.

By shedding light on this valuable aspect of employee compensation, you can make enlightened decisions regarding your financial future.

What is gratuity?

Gratuity is a statutory benefit provided to employees by their employers as a token of gratitude for their service. The Payment of Gratuity Act 1972 is responsible for its governance and applies to organisations employing 10 or more employees.

Gratuity eligibility

To be eligible for gratuity, you should have completed at least five years of continuous service with the employer. However, gratuity may be payable before five years in cases of death or disability of the employee.

Calculating gratuity

The formula for calculating gratuity is as follows:

Gratuity Amount = (Last drawn salary * 15/26) * (Number of years of service)

Here, the 'last drawn salary' refers to the basic salary and the allowance of the employee. Factor 15*26 is derived from 15 days of salary for each completed year of service, assuming a 26-day working month.

Importance of Gratuity Calculator

Calculating gratuity manually can be tedious, especially considering partial years of service. A Gratuity Calculator simplifies the process by providing accurate and instant results. Employees and employers can use online Gratuity Calculators to determine the amount quickly.

Tax implications

Gratuity is exempt from taxes up to a specific limit. For government employees, the entire gratuity amount is tax-free. For non-government employees covered under the Payment of Gratuity Act, the exempted amount is the following:

20 lakh

Actual gratuity received

15 days' salary for each completed year of service, based on the last drawn salary

Impact of compound interest

Employees can invest their gratuity to earn interest and secure their financial future. A compound interest calculator helps determine the potential returns on investments over time.

Conclusion

Gratuity is a valuable employee benefit that recognises loyalty and long-term service. By understanding how gratuity is calculated, employees can assess the financial benefits they may receive upon retirement or leaving their job. The importance of investing the gratuity amount wisely cannot be overstated. By using these calculators, you can explore investment options and secure your financial future with smart financial planning.

Overall, gratuity is a valuable financial cushion, fostering a sense of financial security and appreciation among employees for their dedicated service to their organisations.

0 notes

Text

Gratuity Calculator - Calculate Gratuity Online in 2025

Gratuity Calculator (Calculate the gratuity amount basis the years of service)

A gratuity calculator is an online tool that helps you estimate the gratuity amount you will receive after working with a company for a minimum of five years. If you are wondering how to calculate gratuity, this tool simplifies the process by requiring just your most recent salary and years of service. It then applies the gratuity formula to determine your payout. This calculator is especially useful for employees in private organizations, offering better clarity on the financial benefits they can expect upon retirement or resignation. Plan ahead and understand your post-employment benefits effortlessly. Use our gratuity calculator now to calculate gratuity online in just a few simple steps!

What is Gratuity? Gratuity is a monetary reward that is paid by the employer to an employee in appreciation of their services rendered to the organization. It is a one-time lump-sum payment made upon resignation, retirement, or in certain situations where the employee is disabled. To qualify, the worker is required to serve the company for a minimum of five years under continuous employment. There are situations where gratuity can be given prior to the five-year mark. For example, if an employee becomes sick or is disabled due to an accident.

In India, gratuity is governed by the Payment of Gratuity Act, 1972. The amount received depends on factors such as the employee’s last drawn salary and total years of service. This benefit serves as a financial cushion, offering long-term employees a well-deserved reward for their commitment and loyalty.

What is a Gratuity Calculator? A gratuity amount calculator is a tool used to determine the amount of gratuity payable to an employee based on various factors such as the length of service and the last drawn salary. The calculation of gratuity for private employees is important for future planning of retirement and keeps their finances on track even after they are not working.

0 notes

Text

🧾 Salary in Income Tax Act : Foundation of Your Pay Structure (Explained with Taxation, Benefits & Tips)

📑 Table of Contents What is Salary in Income Tax Act?, What is Basic Salary? Importance of Basic Salary Taxability of Basic Salary Basic Salary vs Gross Salary vs Net Salary Allowances and Contributions Based on Basic Salary How to Calculate Basic Salary? Tips to Optimize Tax on Salary Real-Life Example Frequently Asked Questions (FAQs) 📌 1. What is Salary in Income Tax Act? ✅ What is…

#basic salary#CTC breakup#form 16#gratuity calculation#HRA and basic salary#income tax on salary#PF calculation#salary tax planning#taxable income from salary#taxable salary components

0 notes

Text

🖤 human. - tom riddle. 🖤 soft smut. tender sex. unnamed reader. angst. red wine recommended.

It is a rather well-known fact that Tom Riddle doesn’t lose control. Not now; not ever. Perhaps, today was just an off day, so to speak. One that neither of you had expected.

He’s the kind of boy who spent far too many of his younger years honing in on his almost honourable aptitude for restraint. The kind of boy who was meticulous about crafting himself into an augmented weapon that would display finite peak precision. Every word selected to be spoken, every expression etched in across the sharp features on his face, every gesture of gratuity, every spell carefully curated and cast, performed within a tight threshold of calculated perfection. Tom had convinced himself that this would be no different – this being whatever it was that he wanted to name what he had with you. Cruel intentions? A lapse in lust filled desires? Mere teenage hormones? Whatever it may be, he knew that he would be measured, that he would be deliberate, that he would undoubtedly savour and relish the slow unravelling of your surrender to him; beneath him – like a well strategized game of chess. Tom promised himself that he’d be gentle, or at least as gentle as someone like him could ever dare to manage.

However, it seems that promises, unlike Tom, are somewhat fragile things, and whilst he is the definition of proper and painfully posed, the moment he’s inside you – well; promises, they shatter like delicate crystal beneath an unspoken curse.

It isn’t just desire that has this effect on him, no – it’s something darker, something hungrier, something animalistic; a ravenous need that drags itself up from some buried yearning within him which Tom refuses to name. Each breath he takes catches, sharp and jagged at the back of this throat, as if the air itself you both breath in is conspiring something cunningly against him. Tom’s hands, soft yet calloused from the way he wields his wand which are usually oh so steady, tremble against your skin. His fingertips digging into your hips causing pretty plumes of violent bruising to appear near instantly hold on as though if he isn’t tight enough with his grasp, you might just slip away.

His dorm is nothing more than a blur of shadows and heat. Faint embers from the fireplace which faces the foot of the bed casting a flickering of gold hues across his and your own bare skin. The unclosed deep emerald drapes which hang heavy from the ceilings muffle the world beyond what you’re currently lost within, however nothing; not even magic, can muffle the sound of your gasps, your pleas, your wants, your needs or, the low, sullen broken groan that escapes past Tom’s lips as he continues to press himself in deeper and deeper.

“Fuck-“, he manages to murmur against the curve of your neck; eyes closed, voice a velvet rasp, frayed at the edges he’d rather not admit to. “I- promise – I didn’t mean, hell – I swore I’d be gentle..”

His body though? It betrays him; causing him to move with a desperation that he can’t quite rein in. Tom isn’t expecting you to rake your nails down his back, leaving an abundance of stinging trails across his skin that only stoke the fire burning in his blood. The way you arch off the bed beneath him, ugh – the way your body trembles, overwhelmingly; like it’s too much. To him it is. Too perfect, too warm, not textbook enough, far, far too you. The demon sitting on his shoulders which has thrust its bident into the angel on the other side screams at him to slow down. To stop; if able, just to take the time and god damn think, but he can’t help it. Tom’s hips continue to snap forward, chasing whatever it is he’s feeling like a man possessed.

Tears swelling in the corners of your eyes glisten within the dorms dim lights before they begin to run, streaking down your face and Tom hates himself; more than usual. He hates the way he’s making you shake; he hates the way your voice breaks every time to whimper his name like it’s a half beg, half sob and the sounds you make which never get finished undo him. His forehead pressed to yours; breath warm across your cheeks, his hair falls into his eyes near gracefully. His skin from head to toe is glistening with sweat. Tom is trembling too – his breathing hitched, his chest tightening with something dangerously close to a cry he can’t and won’t submit to.

“I’m hurting you.” The acknowledgement is choked out between his gritted teeth. “I know – I know it, but hell; I can’t --.” Tom’s voice continues to crack poetically. Biting his bottom lip hard enough to draw blood and taste copper as if it is the only method in the world he has to try and anchor himself into the current reality. It is then and there that he tells you for the first time in forever that he loves you. Not smitten like a confession but a like a wound, laid bare.

Your hands slide away from his back; fingers soft as they find his face brushing across the ridge of his jaw which is both comfort and torment rolled into one. Tom wants nothing more than to be soft with you – to be the kind of boy that you deserve, but the needs he’s feeling are just far too strong. He feels disgusted, yet primal; and this tasteless blend, well he’s drowning in it. Cool sheets tangled beneath you are dampened by sweat, by tears – yours, his; hell he doesn’t know anymore. Each breath he attempts to take is coated by your perfume, by the scent of cedar, by old parchments laying dormant on the nearby desk mingled in with the raw, intimate heat of the both of you. He tries to slow down, he tries to give you a moment, but the moment – it stretches into what feels like an eternity, and while he shouldn’t be, dear lord he’s still moving. Every thrust chasing an impossible high and edge. Tom’s lips brush at your shoulder, at your collarbone, up against your pulse point, stopping abruptly at your ear to whisper apologies woven in between fevered kisses.

“A little longer – please.”

It’s not like him to plead. At this point you know his words are laced with lies. He doesn’t know how to stop. Tom has never known how to stop needing you. Not at least since the first time you looked at him with tender eyes that saw past the masks he wore, past his defences, straight through his cracks into the hollow spaces within him he’d spent his entire lifetime trying to hide. In the end though, you’re both ruined. Limbs heavy. Breathing uneven. Both too sore to move and too raw to speak. Tom collapses against you; chest heaving, wrapping his arms softly around you as if not only in the moment, but forever, you’re the only thing capable to keeping him tethered to the world and you, you whisper a string of oh so innocent ‘I love you’s as he presses kisses across your shoulders, worshipful; as if each token of affection could erase the marks he has left like a war path.

Tom’s hip twitch just once more; an involuntary betrayal that he curses beneath this breath before apologising. The word sorry slipping off the tip of his tongue which sounds oh so foreign yet oh so sweet. It is barely audible; muffled hot against your skin. You stroke his hair with a tenderness he isn’t use to but won’t back away from and pull the sheets up to conceal you both as you become intoxicated on the feeling of being needed. It doesn’t last long; oh it never does with Tom but for a split second, you see the boy who never loses control feeling utterly, completely human.

#moscatosin#tom riddle#tom riddle smut#tom riddle angst#tom riddle fan fic#tom riddle one shot#tom riddle x you#tom marvolo riddle#harry potter fandom#hogwarts#slytherin#slytherin boys fanfiction

67 notes

·

View notes

Text

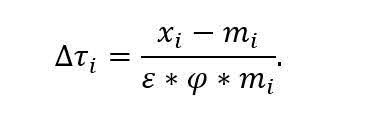

Math, grade 7, Ratios and Proportional Relationships 7.RP.A.3: Use proportional relationships to solve multistep ratio and percent problems. Examples: simple interest, tax, markups and markdowns, gratuities and commissions, fees, percent increase and decrease, percent error.

Essential Question: How can basic calculations of percent change influence major world events?

Do Now: Calculate the percent increase or decrease in each of the following equations. x = (28 - 17.9)/28 x = (41.5 - 57.7)/57.7

Class Discussion: Remind students about how to perform basic calculations of increase/decrease factors. Ask them whether this calculation would be more complicated if the quantities were dollars instead of just numbers (answer: no). Ask them whether this calculation would be more complicated if the quantities were billions of dollars instead of just dollars (answer: no). Show students that they just performed the exact same calculations that Donald Trump did in order to decide what tariffs should be put upon Indonesia and Thailand, respectively.

Finally, ask students whether important global trade decisions should be calculated with 7th grade math skills, or if perhaps this is insufficient given the severe consequences that could arise from such a dunning-kruger error.

Direct Instruction: Explain what a Dunning-Kruger error is, if for no other reason than to communicate how absolutely maddening has it is for legitimate experts who have dedicated their lives to nudging fiscal policy in the right direction and then watch as their president makes the worst decision possible on purpose.

Take a moment to explain the difference between an import and an export, so that students understand what these billions of dollars actually mean in the real world. Feel free to call out anyone who has ever questioned whether or not they would ever use this kind of math in the real world. Show them that it's happening right now, and make sure they understand how terrifying that is.

Acknowledge the variables: x: total exports from US to country i m: total imports to US from country i tau (τ): calculated % tariff on all imports to US from country i epsilon (ε): elasticity phi (φ): passthrough

Ask students what they think elasticity and passthrough mean, then show students this passage from ustr.gov:

Parameter Selection To calculate reciprocal tariffs, import and export data from the U.S. Census Bureau for 2024. Parameter values for ε and φ were selected. The price elasticity of import demand, ε, was set at 4. Recent evidence suggests the elasticity is near 2 in the long run (Boehm et al., 2023), but estimates of the elasticity vary. To be conservative, studies that find higher elasticities near 3-4 (e.g., Broda and Weinstein 2006; Simonovska and Waugh 2014; Soderbery 2018) were drawn on. The elasticity of import prices with respect to tariffs, φ, is 0.25. The recent experience with U.S. tariffs on China has demonstrated that tariff passthrough to retail prices was low (Cavallo et al, 2021).

Ask students if this clarified anything about what elasticity and passthrough mean. Most will say "no", but if anyone points out that multiplying 4 by 0.25 cancels them both out, reward them. That student is correct, because elasticity and passthrough have been arbitrarily assigned so as to make this calculation so simple that even Donald Trump can understand it.

Modeled Learning: Show how to apply these tariffs to popular imports such as raw coffee beans. For example, the USDA report of coffee imports from 2024 (page 6) shows that the vast majority of raw coffee is imported from Brazil.

A simple search with Perplexity.ai tells us that in 2024, imports (m) = $42.3 billion and exports (x) = $49.7 billion, so the reciprocal tariff would be (x-m)/m = (49.7-42.3)/42.3 = 17.5%.

Thus, all coffee imports from Brazil will automatically be 17.5% more expensive.

Be sure to highlight that this is happening to every country in the world, even those with total populations less than 1000.

Higher Order Learning:

Students should consider the following facts:

There is very little territory within the United States that can grow coffee.

Almost all coffee in the world is grown within what is called "The Global South", where the climate is warm and the labor is cheap.

The US exports significantly more (sometimes vastly more) to countries in the Global South than we import from them.

Students should then answer the following questions:

What will this universal tariff calculation do to the price of coffee?

Is there any way that US coffee companies can import the same amount of coffee as before without passing on the cost to consumers? Why or why not?

Do you think this tariff program will equalize imports and exports between the US and other countries? What other impacts could it have, good or bad, across the world?

#lesson plan#math#grade 7#trump tariffs#teachblr#I really should be devoting my time to other‚ more important things‚ but... I just had to do this today.#It's so obviously stupid#dunning kruger#Not even queueing this‚ just post.

58 notes

·

View notes

Text

Understanding the Payment of Gratuity Act: A Comprehensive Guide

The Payment of Gratuity Act, 1972, is a significant piece of labor legislation in India, designed to provide financial security to employees after years of dedicated service. This Act ensures that workers receive a lump-sum payment as a gesture of gratitude for their contributions upon retirement, resignation, or in certain other circumstances. This blog delves into the key provisions, eligibility criteria, and importance of the Act, offering a clear understanding of its role in safeguarding employee welfare.

Historical Background and Objectives

Enacted in 1972, the Payment of Gratuity Act emerged to standardize gratuity payments across industries, addressing inconsistencies in voluntary employer practices. Before the Act, gratuity was often discretionary, leaving many workers without post-employment benefits. The legislation aims to:

Provide a statutory framework for gratuity payments to reward long-term service.

Ensure financial support for employees during retirement or job transitions.

Promote fairness and uniformity in gratuity disbursement across various sectors.

The Act reflects India’s commitment to social security, recognizing employees’ contributions to organizational growth.

Applicability of the Act

The Payment of Gratuity Act applies to:

Factories, mines, oilfields, plantations, ports, and railway companies.

Shops or establishments employing 10 or more workers on any day in the preceding 12 months.

Other organizations specified by the central government.

Once applicable, the Act remains in force even if the number of employees falls below 10, ensuring continued protection for workers.

Eligibility for Gratuity

To qualify for gratuity, an employee must meet specific criteria:

The individual must be an “employee” as defined by the Act, which includes any person (excluding apprentices) employed for wages in any capacity, except managerial or administrative roles in certain cases.

The employee must have completed at least five years of continuous service with the employer. Continuous service includes uninterrupted employment, even if interrupted by leave, holidays, or temporary cessations like strikes (if not illegal).

Gratuity is payable upon superannuation (retirement at a specified age), resignation, or death/disablement due to accident or illness. The five-year service requirement is waived in cases of death or disablement.

Calculation of Gratuity

Gratuity is calculated based on the employee’s last drawn basic salary and years of service. The formula for employees covered under the Act is:

Gratuity = (Last drawn basic salary + Dearness Allowance) × 15/26 × Number of years of service.

Key points:

“26” represents the number of working days in a month, and “15” denotes half a month’s wages.

For each completed year of service or part thereof exceeding six months, a year is counted.

The maximum gratuity payable is capped at ₹20 lakh (as per the latest amendment), though employers may offer higher amounts voluntarily.

For employees not covered under the Act (e.g., in establishments with fewer than 10 employees), gratuity may still be payable under contractual terms or other laws, but the Act’s formula does not apply.

Payment Process and Timelines

Employers are responsible for paying gratuity within 30 days of it becoming due. The process involves:

An employee or their nominee/legal heir (in case of death) applies to the employer in a prescribed format.

The employer calculates and disburses the gratuity amount.

If disputed, the employer must deposit the undisputed amount and resolve the issue through the controlling authority, typically a labor officer.

Delayed payments attract simple interest at a rate specified by the government, ensuring timely compliance.

Forfeiture of Gratuity

Gratuity can be wholly or partially forfeited under specific conditions:

If an employee’s services are terminated due to willful omission or negligence causing damage to the employer’s property, gratuity may be forfeited to the extent of the damage.

Termination due to acts of violence or moral turpitude (e.g., theft or fraud) may lead to complete forfeiture.

These provisions balance employee rights with employer protections against misconduct.

Nomination Facility

The Act allows employees to nominate a person(s) to receive gratuity in case of their death. Employees must file a nomination form within a specified period, which can be updated later if needed. This ensures that the gratuity reaches the intended beneficiaries, such as family members, without legal complications.

Dispute Resolution and Penalties

Disputes regarding gratuity, such as non-payment or incorrect calculations, are addressed by the controlling authority appointed under the Act. Aggrieved parties can approach this authority, and appeals can be made to higher authorities if necessary. Non-compliance by employers, such as failure to pay gratuity or maintain records, attracts penalties, including fines or imprisonment, emphasizing the Act’s enforcement mechanisms.

Significance and Challenges

The Payment of Gratuity Act plays a vital role in ensuring financial stability for employees post-employment, especially for those in the organized sector. It incentivizes long-term commitment and provides a safety net for workers transitioning out of employment. However, challenges persist:

Awareness Gaps: Many employees, particularly in smaller establishments, are unaware of their gratuity rights, leading to underutilization of benefits.

Implementation Issues: Delays in payment or disputes over calculations are common, necessitating stronger enforcement mechanisms.

Evolving Workforce: The rise of contractual and gig workers raises questions about the Act’s applicability, as it primarily covers permanent employees.

Recent Developments

Amendments to the Act, such as the increase in the gratuity ceiling to ₹20 lakh in 2018, reflect efforts to align benefits with inflation and rising wage levels. Additionally, the consolidation of labor laws under the Code on Social Security, 2020, aims to modernize and integrate gratuity provisions with other social security benefits, though its full implementation is ongoing.

Conclusion

The Payment of Gratuity Act, 1972, remains a cornerstone of India’s labor welfare framework, ensuring employees are rewarded for their years of service. By mandating timely gratuity payments and providing clear guidelines, the Act fosters trust between employers and employees. While challenges like awareness and applicability to modern work structures persist, the Act’s core objective of financial security for workers continues to hold immense relevance. Employees and employers alike must stay informed about their rights and obligations under this law to ensure its benefits are fully realized.

4 notes

·

View notes

Text

List of EOR Services in India by Brookspayroll

Expanding a business in India can be complex due to legal, administrative, and compliance challenges. This is where Employer of Record (EOR) services come into play. Brookspayroll, a leading EOR service provider, helps businesses streamline workforce management by handling payroll, compliance, taxation, and HR functions. Here’s a comprehensive list of EOR services in India offered by Brookspayroll.

Employee Onboarding and HR Management

Brookspayroll ensures seamless onboarding of employees, managing offer letters, employment contracts, and compliance with Indian labor laws.

Payroll Processing and Tax Compliance

Handling payroll calculations, salary disbursement, and ensuring compliance with Income Tax, Provident Fund (PF), Employee State Insurance (ESI), and Professional Tax regulations.

Statutory Compliance Management

Ensuring adherence to labor laws, including Minimum Wages Act, Shops and Establishments Act, Industrial Disputes Act, and other statutory requirements.

Employee Benefits Administration

Managing health insurance, provident fund contributions, gratuity, and other benefits as per Indian employment laws.

Contract Staffing & Workforce Flexibility

Offering flexible workforce solutions by managing contract employees while ensuring legal compliance.

Work Visa and Immigration Support

Assisting with work permits and visa processes for foreign employees looking to work in India.

Risk Mitigation and Legal Support

Handling labor disputes, employment contracts, and HR legal matters to safeguard businesses from potential risks.

Termination & Exit Management

Managing employee terminations, full & final settlements, and exit formalities while adhering to labor laws.

Why Choose Brookspayroll for EOR Services in India?

Expertise in Indian labor laws and compliance

End-to-end employee management solutions

Reduced administrative burden for businesses

Faster market entry without legal complexities

By leveraging Brookspayroll’s EOR services, businesses can focus on growth while leaving HR, payroll, and compliance management to experts. Looking to hire in India? Partner with Brookspayroll today!

3 notes

·

View notes

Text

Why Payroll Outsourcing in Delhi is Essential for Business Efficiency

Streamline Your Business with Payroll Outsourcing in Delhi

As businesses expand and compliance regulations become more demanding, many organizations are now turning to payroll outsourcing in Delhi to simplify their internal operations. Managing payroll in-house can be tedious, especially when dealing with frequent legal updates, tax deductions, and employee benefits. Outsourcing this function not only ensures accuracy but also provides companies the freedom to focus on core business activities.

What is Payroll Outsourcing?

Payroll outsourcing is the process of hiring an external service provider to manage a company's entire payroll system. This includes calculating employee salaries, processing tax filings, managing provident fund (PF) and employee state insurance (ESI) contributions, generating payslips, and ensuring legal compliance. For businesses in Delhi—a city teeming with startups, SMEs, and large enterprises—this approach has become a practical necessity.

Benefits of Payroll Outsourcing

1. Cost and Time Efficiency Managing payroll internally can consume significant time and resources. With outsourcing, companies save on the cost of hiring specialized staff or purchasing expensive payroll software. It also eliminates the need for constant training to stay up-to-date with changing laws.

2. Regulatory Compliance Indian payroll laws are complex and ever-evolving. From income tax rules to statutory deductions like PF, ESI, and gratuity, compliance is critical to avoid penalties. A payroll outsourcing provider in Delhi ensures all calculations and filings are handled accurately and on time.

3. Enhanced Accuracy Manual payroll processing can lead to errors in salary calculations or tax filings. With automated systems and expert oversight, outsourced payroll services offer greater accuracy and reliability, reducing the chances of employee dissatisfaction or legal issues.

4. Data Security and Confidentiality Reputable payroll outsourcing firms use secure, cloud-based systems with encryption to protect sensitive employee data. This minimizes the risk of data breaches and ensures confidentiality is maintained at all times.

5. Scalability and Flexibility As your workforce grows or contracts, outsourcing partners can easily scale their services to match your needs. Whether you’re hiring 10 or 100 new employees, your payroll operations remain smooth and efficient.

Services Included in Payroll Outsourcing

Most payroll outsourcing providers in Delhi offer comprehensive solutions that include:

Monthly salary processing and disbursement

Payslip generation and distribution

Tax deductions and filings (TDS, PF, ESI, etc.)

Year-end tax form preparation (Form 16)

Compliance with labor laws and statutory reporting

Attendance and leave management integration

Reimbursement and bonus management

Employee helpdesk support for payroll queries

Advanced service providers may also offer integration with HR software, mobile apps for employees, and dashboards for real-time payroll analytics.

Why Delhi-Based Companies Should Consider Payroll Outsourcing

Delhi is a highly competitive and regulatory-sensitive business environment. Companies in this region must be agile and compliant while controlling costs. Payroll outsourcing is especially beneficial here because local providers have expertise in regional labor rules, state-specific regulations, and offer fast turnaround times for urgent payroll processing needs.

Additionally, Delhi is home to a wide pool of professional payroll service providers who offer tailored solutions for different industries—from IT and education to manufacturing and healthcare.

Choosing the Right Payroll Partner

Before selecting a payroll outsourcing company in Delhi, consider the following:

Experience and Reputation: Look for a provider with proven experience and client testimonials.

Technology Platform: Ensure they use a secure, modern payroll system.

Compliance Knowledge: They should stay updated with the latest changes in tax and labor laws.

Customization Options: Your business may have unique payroll structures or benefits.

Customer Support: Timely and responsive communication is essential for resolving issues quickly.

Final Thoughts

In a fast-moving market like Delhi, where talent retention, compliance, and cost control are key concerns, outsourcing payroll can offer a significant competitive advantage. It streamlines processes, ensures accuracy, and reduces operational stress—allowing companies to concentrate on strategic goals.

Whether you're a small business owner or the HR head of a growing enterprise, payroll outsourcing in Delhi could be the smartest step you take this year toward efficiency and peace of mind.

3 notes

·

View notes

Text

July 28 - Mikan

Today, we traveled from Taitung to Kaohsiung which was about a 3.5 hour bus ride (including bathroom and 7/11 stops). We saw the Pacific Ocean for the last time. We had a special secret surprise as our first stop. Yeh Laoshi 老師(laoshi = teacher) is from Kaohsiung and we drove past her parents place which was cool. There is also a very famous cat that lives at the train station, Mikan. We were veryyyyy lucky and got to take a picture with him. He is seriously famous; he's in commercials, has stickers on Line (the go-to messaging app here), and people go crazy over this cat. There were people surrounding the station at all times. They were definitely jealous that we got the special privilege of taking a picture with him. However, he was NOT into it. We got food in the surrounding area and I got food by myself, and I only used Google Translate for one sentence. It was a very small stand in the far back (like I was wandering pretty far off course to find this place) and I just talked to this one lady and I'm mostly sure that what I got was vegetarian - I'm pretty sure it had scallions, glass noodles, egg, and mushrooms. I am trying my hardest to learn important words like "vegetarian" = "sùshí" 素食. I'm still working on pronunciation though - tonal languages are tough coming from a language that doesn't have any. People aren't really understanding me, but I hope they at least appreciate the effort.

The last thing we did was load up our metro cards for Kaohsiung and we visited the Mikan merch store. I got a little Mikan patch to add to my duffel bag.

Went to get sushi for dinner and it was relatively good. It's hard to get raw fish that's good and actually cold and I'm not sure they calculated our check right because we calculated everything separately beforehand and we got different numbers (we included the automatic gratuity fee). I had this pear cider thing which was great. It's nice to be in a big city again.

Reflection

Languages are hard to learn. It's especially hard to go from an alphabet-based language to a character-based language, and to a tonal language from one without one. I came here with no background in Chinese. I did a few Doulingo exercises, but that did nothing for me. I've been learning from my classmates - they are helping me with the tones and teaching me new words even though I forget them immediately after I've heard them. Most of them are majoring or minoring in Chinese. The more I hear the words, the more likely I am to remember them. It's also hard to learn when so many people here speak a little bit of English. Instead of having to adapt to Chinese, these people are adapting to English. It makes it easier for me to get around, but also doesn't force me to learn Chinese. Even my name is so hard to say. My first name is Ruì sī - the first part is pronounced like ray but sort of angrily at the end like you're scowling a child. And the R is pronounced with your tongue a little farther back but still sounds like an R. It's hard to explain and I'm sure you could Americanize it and there wouldn't be much of a difference with that word. The sī part is supposed to be short and a little higher but HAS to stay flat. If pronounced wrong, it can mean death, so I have to be super careful with that. End of story it is hard to pronounce and I've probably said it over 200 times by now and my classmates keep correcting me. I have it for a little bit then keep saying it and mess up. It's nice to have people who know more than me share what they know with me. Slight differences in pronunciations can mean an entirely different word, while in English, you could have words that mean totally different things and are pronounced the exact same - context is the only clue. I'm sure it's just as hard for people who speak Chinese to learn English because of the differences listed above.

2 notes

·

View notes

Text

Gratuity Calculator - Calculate Gratuity Online in 2025

Gratuity Calculator A gratuity calculator is an online tool that helps you estimate the gratuity amount you will receive after working with a company for a minimum of five years. If you are wondering how to calculate gratuity, this tool simplifies the process by requiring just your most recent salary and years of service. It then applies the gratuity formula to determine your payout. This calculator is especially useful for employees in private organizations, offering better clarity on the financial benefits they can expect upon retirement or resignation. Plan ahead and understand your post-employment benefits effortlessly. Use our gratuity calculator now to calculate gratuity online in just a few simple steps!

0 notes