#carpet export data

Explore tagged Tumblr posts

Text

Learn about the growth of carpet export from India, with key export data, HS codes, top exporters, and major markets like the USA, UK, and Ukraine.

#Carpet export from India#carpet export data#Carpet HS Code#carpet exporters in India#Indian carpet export

0 notes

Text

Explore carpet export from India with updated 2025 data, top exporters, key HS Codes, major destinations, and global trade trends.

0 notes

Text

Start a Profitable Carpet Export Business in India

Indian carpets are a testament to the nation's rich cultural heritage and craftsmanship while significantly contributing to its economy. Widely cherished for their intricate designs and exceptional quality, these carpets adorn homes, workplaces, and temples across the globe. In the fiscal year 2022-23, India exported carpets and rugs valued at an impressive US$ 1.36 billion, solidifying its position as the world's third-largest carpet exporter. With approximately 85-90% of its production destined for international markets, India’s carpet industry is an undeniable force in the global arena.

The Size and Scope of the Carpet Industry

The global carpet market, valued at USD 72.39 billion in 2023, is projected to grow at a compound annual growth rate (CAGR) of 4.35% from 2024 to 2033. India’s carpet and rug market holds a notable share within this expansive industry, reaching approximately USD 5.0 billion in 2023. Prominent Indian players such as Saraswati Global Pvt. Ltd., Jaipur Rugs, The Rug Republic, and Obeetee Pvt. Ltd. are at the forefront of this thriving sector.

Factors driving the global carpet industry’s growth include increased interest in interior decoration, expanding urbanization and globalization, growth in the construction sector, rising middle-class populations, higher investments in interior designs and furnishings, and activities related to renovation and rehabilitation.

Carpet Production in India: A Heritage of Excellence

India is the world’s second-largest producer of carpets, following China. Known for its wide range of carpet types, including Indo-Persian, silk, wool, Zeigler, Kilim, and hand-tufted varieties, India’s craftsmanship is globally renowned. Key carpet manufacturing hubs include Agra, Jaipur, Srinagar, Danapur, Bhadohi, and Panipat, the latter gaining prominence in recent decades.

With over two million people employed in the cottage industry of hand-weaving techniques such as braiding, shearing, hooking, and hand tying, carpet production remains an integral part of India's rural economy.

India’s Carpet Export Statistics

Based on carpet export data, India’s carpet export value reached US$ 1.15 billion between April and January 2024. In the fiscal year 2022-23, the total export value stood at US$ 1.36 billion, while the previous year’s exports were valued at US$ 1.79 billion. Indian carpets are exported to over 100 countries, with the USA accounting for more than 55% of total sales. Handmade carpets, including wool, cotton, rugs, and durries, dominate these exports. Notably, India exported jute carpets worth US$ 87 million and silk carpets valued at US$ 50 million during FY23.

Varieties of Indian Carpets Exported

India caters to a diverse global market with a wide range of handcrafted carpets. These include pure silk carpets, tufted woolen carpets, hand-knotted woolen carpets, staple and synthetic carpets, Gabbeh carpets, hand-made woolen dhurries, and chain stitch rugs. These varieties are exported to numerous Asian and European nations, enhancing India’s reputation as a premier supplier of exquisite floor coverings.

HS Codes for Carpet Exports

Prominent HS codes in the carpet export sector include those for tufted carpets, knotted carpets, and other textile floor coverings. These codes categorize products for streamlined global trade and ensure compliance with international regulations.

Top Export Destinations for Indian Carpets

Indian carpets are highly sought after in international markets, with the USA leading as the largest importer. Other significant destinations include Germany, the United Kingdom, Australia, the Netherlands, Sweden, and Italy. The USA alone imported Indian carpets valued at US$ 684 million up to January 2024, while Germany and the UK followed with imports worth US$ 70 million and US$ 51 million, respectively.

Global Leaders in Carpet Exports

India ranks third globally among the top carpet-exporting countries, following China and Turkey. Other notable exporters include Belgium and the Netherlands. These countries collectively dominate the global carpet trade, but India’s unique handcrafted designs and competitive pricing give it a significant edge.

Top Carpet Exporters in India

Leading carpet exporters in India include Bhadohi Carpets, Obeetee Carpets, Jaipur Rugs, Carpet Overseas, Rugs and Beyond, Insigne Carpets, Kaleen India, The Rug Republic, Genie Carpet Manufacturer, and The Weaver. These companies play a crucial role in meeting the global demand for high-quality carpets and driving India’s export success.

The Future of Indian Carpet Exports

India’s carpet exports are poised for sustained growth due to several factors. Increasing global demand for personalized and sustainable products, advancements in automated looms and digital printing, rising disposable incomes, and urbanization are set to boost the industry further. Government initiatives such as subsidized loans, marketing events, and skill development programs also support this growth. Additionally, Indian weavers’ adaptability to changing market trends and customer preferences ensures their continued relevance in the global market.

How Eximpedia Can Support Your Carpet Export Business

Eximpedia.app provides reliable, real-time data on carpet export markets. From identifying legitimate buyers and suppliers to understanding market trends and insights, Eximpedia is your go-to platform for enhancing your carpet export from India. With comprehensive data and expert support, businesses can navigate the global market with confidence and precision.

Final Thoughts

India’s carpet industry, with its rich heritage and robust export potential, continues to thrive in the global marketplace. By leveraging resources like Eximpedia’s export data, businesses can identify opportunities and achieve greater success in this promising sector. For expert assistance and real-time insights, connect with Eximpedia today!

#carpet export from India#carpet export data#carpet HS code#Indian carpet export#carpet exporters#carpet importers

0 notes

Text

Explore carpet export from India with US$ 1.15 billion exports in 2023-24. Learn about top exporters, carpet types, HS codes, export destinations, and market trends. Visit Eximpedia.app for real-time trade data and insights!

#carpet export from India#carpet export data#carpet HS code#Indian carpet export#carpet exporters#carpet importers

0 notes

Text

Discover the vibrant Indian carpet export industry, from top manufacturing hubs to key export data and market trends. Learn about leading Indian carpet exporters, types of carpets, and how to find genuine buyers worldwide. Dive into the intricate craftsmanship and global demand that make India a major player in the carpet market.

#carpet export from india#carpet export data#carpet hs code#indian carpet export#carpet exporters#carpet importers

0 notes

Text

https://www.seair.co.in/blog/carpet-export-from-india.aspx

Learn about the growth of carpet export from India industry, its important role in global exports, important data on carpet manufacturing, leading exporters, and top markets. Learn about the trends driving the growth of India's carpet exports and how to find genuine buyers worldwide.

#carpet export from India#carpet export data#carpet HS code#Indian Carpet Export#Carpet Exporters#Carpet Importers

0 notes

Text

Somebody other than me cares!

For only the second time in the last decade or more, my personal obsession is in the news and I'm incredibly excited. "Below the fold," in old newspaper jargon, but at least somebody's trying to do something and some newspapers noticed. When you're as starved for validation as I am, it only takes that much attention to excite me.

Amudalat Ajasa and Carolyn Van Houten, "Lead paint upended this boy’s life. Now the EPA is trying to eliminate the threat. The Environmental Protection Agency is about to issue strict limits on lead dust, which poses a threat to millions of children across the United States," Washington Post. Oct 19, 2024 (non-paywall link)

Lead was used as a paint additive from Victorian times up until the late 1970s for a couple of reasons. It made a bright white pigment that didn't fade quickly, it was shiny, and most importantly to the Victorians, it tolerated harsh cleaning chemicals well, which they thought was important to reducing the spread of disease.

(On a local note for here in St. Louis MO USA, it also almost single-handedly propped up the local economy in this town for that whole century, thanks to the huge lead mines south of town and our ability to export products to the whole world via our port on the Mississippi river. Almost all of the abandoned factory and warehouse buildings down here in South St. Louis are contaminated former lead-paint businesses.)

Lead paint though has an even bigger problem than lead pipes, though: over time, it starts shedding lead dust, and children are incredibly vulnerable to lead dust, breathing it in and/or swallowing it. And it takes very little lead dust to permanently damage a growing mind, destroying the parts of the brain that control impulses and the ones that down-regulate emotions.

This is why lead paint was outlawed in the late 1970s. But there was no law requiring it to be removed from (frankly, nearly all) surfaces. Instead, there was a voluntary lead abatement program, and even it only applied to residential property. Homeowners and apartment owners could borrow money from the nearest S&L, pay contractors to rip out and replace all the lead-dust tainted windows, carpets, plaster walls, and so forth and replace them with clean new vinyl-clad or latex-painted bits. They could then submit the receipts with their taxes and get a 100% refundable tax credit.

But they weren't able to make it mandatory because of intense lobbying by openly-racist slumlords, who didn't want to lead abate their properties even it was free because that's telling them what to do with their property, who didn't think their black tenants "deserved" refurbished apartments. That's also why it's illegal to disclose, in sales or in rental contracts, that your property has been through lead abatement; doing so is "unfair" to those '70s slumlords.

And besides, Reagan canceled the whole program halfway though his first term. To bend over backwards to be fair to Reagan, they weren't still getting many applications; everybody who was going to do so voluntarily already had. (Free money for home improvements has that effect.)

About a decade ago, a Reuters reporter used FOIA to demand state health departments turn over their records on childhood lead testing. Almost half of them don't keep any. Most only track it at the state level or maybe county level. Missouri's one of the only states that tracks it to the census-tract level, tracks where kids who are lead poisoned live to within a couple of blocks. And the map of apartments that didn't go through lead abatement, here in Missouri, perfectly maps onto the homicide data.

As someone who was pretty badly lead poisoned as a teenager myself, and as someone who's spent most of his life living in or near lead-poisoned apartments, I'm obsessed with this and ever since the Reuters article came out I've been begging every politician or candidate I interact with to bring back the late '70s lead abatement tax credit and this time make it mandatory to test before selling or leasing a home. Even when St. Louis, with its nominally, mostly progressive mayor got huge uncommitted funds dumped on her, from ARPA and from the Rams-relocation-fraud settlement, I couldn't get any politician to care about this. Their constituents weren't demanding it, so it couldn't be done.

The Washington Post reported, today, that the US Environmental Protection Agency has proposed a rule to do just that. No tax credit provision, so they're being fought tooth and nail by people who don't want to make property sellers and landlords pay for it out of pocket, but the proposed rule is on the docket, potentially to take effect mid next year. Somebody other than me noticed. Somebody other than me cares.

If you are like the average person (to my distress) the main thing you want to know is "what can I do to protect myself or my kids?"

This is a shitty way to think because let me tell you, if your kid grows up on the same block as a lead-poisoned kid, your kid is going to grow up with C-PTSD from the resulting violence. Your kids aren't safe until everybody's kids are safe.

I didn't convince you? You've given up on keeping everybody else's kids safe, too?

If you have a painted surface anywhere on your property that existed prior to 1976, you should assume that there is lead paint on it. Older chain-link fences almost certainly. Wooden single-pane windows, 100% likely. If you have plaster, instead of drywall, interior walls in your house, then neither the walls nor the floorboards nor the carpets are safe. They will tell you these surfaces can be rendered safe by painting over them with latex paint; anybody who tells you this is whistling past the graveyard.

Do not have or raise kids in a house or apartment like that. Either abate the lead or move. Yes, even if it's more expensive; the alternative is to raise a child who may never work and has a high likelihood of spending most of their life in and out of jail.

If it's too late for that, and your child is already lead poisoned, don't give up hope entirely, but understand that the interventions that show promise for such kids are hard to find and aren't 100% reliable.

The most important thing you can do is investigate the concept of "trauma-informed schools," and demand, as part of your child's IEP, that his teacher and any associated staff get trauma-informed schooling trained. (Your kid will not be the only one who benefits.)

Children with profoundly impaired impulse control and/or profoundly impaired emotional down-regulation skills can be taught to do better, but that requires that they be given the extra time it will take them to do so, and the privacy, and the calm quiet space, especially when they're very young and just learning. Their brains don't do this naturally, so they don't do them quickly; hold them to the same standard of behavior as everybody else but until they spend a decade or more practicing and grow up more, after you remind them, give them enough time to obey.

But believe me when I tell you this: lead abatement and behavioral education are cheaper and better than prison.

15 notes

·

View notes

Text

Automated RERA Data Scraping for Daily Builder Updates in India

Introduction: Why RERA Data Matters in Indian Real Estate

The Real Estate Regulatory Authority (RERA) was introduced to bring transparency to India’s real estate sector. It mandates builders and agents to register their projects, report progress, and update key documentation across RERA portals.

But here’s the challenge:

Each state has its own RERA website, structure, and update frequency. Builders update their project status, documents, carpet area, approvals, and completion timelines regularly—but accessing this data across states manually is nearly impossible.

That’s where Actowiz Solutions comes in.

Through automated RERA data scraping, Actowiz collects, standardizes, and delivers daily updates on builders, agents, and real estate projects across multiple Indian states—from Maharashtra and Gujarat to Karnataka and Haryana.

The Problem: Disconnected, Delayed & Manual Monitoring

Real estate platforms, investment firms, property marketplaces, and even homebuyers face these common problems:

Challenges:

Data scattered across 25+ state-specific RERA portals

Manual tracking prone to errors and delays

No centralized view of new projects, builder compliance, or revoked licenses

Projects with lapsed approvals or litigation go unnoticed

Builders quietly update project status without public alerts

To fix this, stakeholders need daily, automated, and structured access to real-time RERA data—not static PDFs or outdated Excel files.

Actowiz Solutions: A Unified RERA Scraping Infrastructure

Actowiz developed a scalable solution to extract and unify RERA data across India, enabling clients to:

Track project and builder updates in real time

Access structured datasets with clean fields

Get daily notifications of newly launched, modified, or revoked projects

Enable internal dashboards, fraud checks, or investor reports

How Our RERA Scraping System Works

1. State-Wise Portal Mapping

We cover major RERA portals including:

Maharashtra – maharera.mahaonline.gov.in → ✅ Live

Gujarat – gujrera.gujarat.gov.in → ✅ Live

Karnataka – rera.karnataka.gov.in → ✅ Live

Uttar Pradesh – up-rera.in → ✅ Live

Haryana – haryanarera.gov.in → ✅ Live

Delhi NCR – rera.delhi.gov.in → ✅ Live

Rajasthan – rera.rajasthan.gov.in → ⚠️ In Progress

We constantly update this coverage list to include more regions.

2. Data Fields Extracted

Our bots collect the following data from each project or builder listing:

Project Data:

Project name & RERA registration number

Launch & completion dates

Type: Residential/Commercial/Mixed

Location (city, district, pin code, ward)

Approved carpet area

Number of towers/floors/units

Construction status

Documents: Sanction letters, layout, etc.

Last update date

Builder/Promoter Info:

Company/Individual Name

Promoter Address & Contact

PAN Number

Project count under builder ID

Litigation or penalty history

Registration validity

Agent Data:

Agent name, license number

Validity date

Contact details

Associated projects or promoters

Real Examples of Extracted RERA Builder Data

Example 1 – Maharashtra (MAHA RERA)

Builder Name: Lodha Developers Pvt Ltd

RERA No.: P51900031245

Project Name: Lodha Casa Marvella

City: Mumbai

Status: Under Construction

Total Units: 234

Carpet Area: 1.85 Lakh Sq.ft

Last Updated: 05 July 2025

Example 2 – Gujarat (GUJ RERA)

Promoter Name: Shivalik Projects

Project Name: Shivalik Skyview Phase 2

City: Ahmedabad

RERA ID: PR/GJ/AHMEDABAD/123456

Project Type: Residential

No. of Towers: 3

Approval Date: 01 June 2025

RERA Expiry Date: 30 May 2028

Update Frequency and Delivery Modes

Our clients receive daily or weekly scraped data via:

Automated email exports (CSV/Excel)

API-based integration with internal CRMs

Google Drive or AWS S3 push

Alerts on new project additions or builder modifications

We also offer a "delta update mode" where only newly modified records are shared—saving bandwidth and improving focus.

Use Cases of RERA Data Scraping

1. Real Estate Portals (Property Listings)

Auto-ingest new project launches with verified RERA info

Show construction status & builder history to buyers

Flag projects nearing expiry or legal risk

2. Investment Advisory & Funds

Build dashboards of top-performing builders

Vet promoter credibility before investing

Track ongoing construction & fund utilization risks

3. Builders & Agents

Monitor competitor launches by zone

Benchmark approval timelines across cities

Track penalty notices or agent revocations

4. Legal & Due Diligence Teams

Spot RERA violations or pending updates

Cross-verify documents against public filings

Detect multiple registrations from same builder

Impact: Real Business Value Delivered

Before Actowiz:

Teams spent 8–10 hours/week checking 5+ portals manually

Builder info often outdated or missing

No automated alerting system for status changes

After Actowiz:

RERA data updated daily across 100+ cities

Builder and agent info now flows to internal dashboards

30+ legal and sales teams automated their compliance checks

Average time-to-response reduced by 60%

Case Snapshot: How a Top Realty Portal Scaled with Actowiz

A national real estate aggregator onboarded Actowiz to automate their builder & project verification process.

Results within 30 days:

Added 5,000+ RERA-verified projects from Maharashtra, Gujarat & UP

Reduced manual verification load by 80%

Increased project data freshness from 20 days → 1 day

Launched new “RERA Verified Badge” for listings, increasing lead conversion by 17%

Key Takeaways

1. Manual RERA Monitoring Is No Longer Scalable

With over 50,000 projects across India, only automated scraping ensures complete and current coverage.

2. State-to-State Structure Requires Custom Parsers

Actowiz customizes scraping logic per portal—making cross-state insights possible.

3. Builder History = Investment Confidence

Knowing a promoter’s litigation history, past projects, and status updates prevents poor investment or listing decisions.

4. Daily Feeds Enable Real-Time Decisions

From lead scoring to fund approvals—RERA data adds transparency to operations.

Conclusion: India’s Real Estate Data Revolution Starts Here

If you’re a platform, investor, legal firm, or aggregator dealing with real estate in India—you cannot ignore daily RERA data.

Actowiz Solutions is the leading partner for automated RERA scraping, offering real-time, structured insights across 25+ state portals.

From discovering new projects to detecting fraudulent promoters, we help you stay ahead with clean, accurate, and fresh real estate intelligence.

Learn More >>

#AutomatedRERADataScraping#TrackRealTimeUpdatesOnRealEstateProjects#AutomatedRERAScrapingForDailyProject#RealEstateProjectTrackingIndia#RealEstateDataScrapingIndia#RealEstateIntelligence#ExtractRERABuilderData

0 notes

Text

Aircraft Soft Goods Market Size, Share, Growth, Trends, Demand and Opportunity Analysis

"Executive Summary Aircraft Soft Goods Market : The aircraft soft goods market will reach at an estimated value of 664.02 million and grow at a CAGR of 3.60% in the forecast period of 2021 to 2028.

The global Aircraft Soft Goods Market report supports to establish and optimize each stage in the lifecycle of industrial process that includes engagement, acquisition, retention, and monetization. This market report encompasses the study about the market potential for each geographical region based on the growth rate, macroeconomic parameters, consumer buying patterns, possible future trends, and market demand and supply scenarios. This market research report provides a comprehensive study on production capacity, consumption, import and export for all major regions across the world. Thus, the report aids to concentrate on the more important aspects of the market.

The information, statistics, facts and figures delivered via this report supports companies in industry to maximize or minimize the production of goods depending on the conditions of demand. Aircraft Soft Goods Market report comprises of data that can be very much essential when it is about dominating the market or making a mark in the market as a new emergent. Besides this, it categorizes the breakdown of global data by manufacturers, region, type and application, and also analyzes the market status, market share, growth rate, future trends, market drivers, opportunities and challenges, risks and entry barriers, sales channels, and distributors.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Aircraft Soft Goods Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/global-aircraft-soft-goods-market

Aircraft Soft Goods Market Overview

**Segments**

- **Product Type**: The global aircraft soft goods market can be segmented based on product type into carpets, seat covers, curtains, blankets, and others. Soft goods play a crucial role in enhancing passenger comfort and overall aesthetics within the aircraft cabin. Carpets are not only used for aesthetic purposes but also for noise reduction and providing insulation. Seat covers are essential for maintaining cleanliness and hygiene standards, while curtains and blankets add to the premium feel of the cabin.

- **Aircraft Type**: Another key segment of the market is based on aircraft type, including commercial aircraft, military aircraft, and private jets. Each segment has specific requirements when it comes to soft goods, with commercial aircraft focusing on durability, fire resistance, and easy maintenance. Military aircraft soft goods need to adhere to stringent safety and security standards, while soft goods in private jets often prioritize luxury and customization.

- **Material Type**: The market can also be segmented by material type, such as wool, cotton, polyester, leather, and others. The choice of material plays a significant role in determining the quality, durability, and overall aesthetics of aircraft soft goods. For instance, leather is often preferred for its luxurious appeal and durability, while wool and cotton provide comfort and breathability.

**Market Players**

- **B/E Aerospace, Inc.**: B/E Aerospace is a prominent player in the global aircraft soft goods market, offering a wide range of products such as seat covers, carpets, and curtains. The company is known for its focus on quality, innovation, and customization to meet the diverse needs of its clients.

- **Lantal Textiles AG**: Lantal Textiles specializes in providing high-quality fabrics for aircraft interiors, including seat covers, carpets, and curtains. The company's expertise in design and manufacturing has earned it a reputation for superior soft goods solutions in the aviation industry.

- **Woolamat Custom Products**: Woolamat Custom Products is a key player in the market, known for its premium wool products such as blankets and seat covers. The company's emphasis on sustainability and eco-friendly materials has made it a preferred choice for airlines looking to enhance their onboard experience.

The global aircraft soft goods market is characterized by a growing demand for premium cabin interiors, increased focus on passenger comfort, and the need for lightweight and durable materials. Key players in the market continue to innovate and expand their product offerings to cater to the evolving needs of airlines and aircraft manufacturers.

The global aircraft soft goods market is witnessing a shift towards sustainability and eco-friendliness, with a growing emphasis on the use of environmentally conscious materials in the manufacturing of soft goods for aircraft interiors. Airlines and manufacturers are increasingly looking for ways to reduce their carbon footprint and improve the overall sustainability of their operations. This trend is expected to drive the demand for soft goods made from recycled or biodegradable materials in the coming years.

Moreover, technological advancements are playing a crucial role in shaping the market dynamics of aircraft soft goods. Innovative materials with enhanced performance characteristics, such as improved fire resistance, durability, and lightweight properties, are being developed to meet the evolving regulatory requirements and customer preferences. Companies in the market are investing in research and development to introduce advanced technologies and materials that not only enhance the comfort and aesthetics of aircraft interiors but also improve operational efficiency and reduce maintenance costs.

The market is also witnessing an increasing focus on customization and personalization of soft goods to cater to the unique branding and design preferences of airlines and individual aircraft owners. Customization options such as embroidered logos, specialized fabrics, and tailored designs are becoming more common as airlines seek to differentiate their cabin interiors and create a distinctive brand image. This trend towards personalization is expected to drive the demand for bespoke soft goods solutions and create new opportunities for market players to collaborate with airlines on creative design concepts.

Furthermore, the COVID-19 pandemic has had a profound impact on the aviation industry, leading to a temporary downturn in air travel demand and a shift in passenger expectations regarding health and safety measures. As airlines focus on enhancing hygiene standards and implementing contactless solutions in response to the pandemic, the demand for soft goods that are easy to clean, disinfect, and maintain has increased. Market players are adapting to these changing market dynamics by introducing antimicrobial fabrics, stain-resistant materials, and other innovative solutions to meet the new health and safety requirements of the post-pandemic travel landscape.

In conclusion, the global aircraft soft goods market is poised for growth driven by trends towards sustainability, technological innovation, customization, and evolving health and safety requirements. Market players that can adapt to these changing dynamics and offer innovative solutions that address the needs of airlines and passengers are expected to succeed in capturing opportunities in this dynamic and competitive market landscape.The global aircraft soft goods market is a dynamic and evolving sector within the aviation industry that is witnessing significant trends and developments. One notable trend is the increasing focus on sustainability and eco-friendliness in the manufacturing of soft goods for aircraft interiors. With airlines and manufacturers aiming to reduce their carbon footprint and enhance sustainability practices, there is a growing demand for soft goods made from recycled or biodegradable materials. This shift towards eco-conscious materials aligns with the broader sustainability initiatives in the aviation sector and is expected to drive innovation in the development of environmentally friendly soft goods.

Technological advancements are also playing a crucial role in shaping the market dynamics of aircraft soft goods. Companies are investing in research and development to introduce innovative materials with enhanced performance characteristics, such as improved fire resistance, durability, and lightweight properties. These advancements not only cater to regulatory requirements but also address customer preferences for high-quality, functional, and aesthetically pleasing soft goods. As technology continues to evolve, we can expect to see further innovations in materials and manufacturing processes that offer superior qualities and benefits for aircraft interiors.

Another key trend in the aircraft soft goods market is the increasing demand for customization and personalization options. Airlines and individual aircraft owners are seeking unique branding and design solutions to differentiate their cabin interiors and create a distinct brand image. Customization options such as bespoke fabrics, tailored designs, and specialized features are becoming more prevalent as airlines look to offer passengers a premium and personalized travel experience. This trend towards customization presents opportunities for market players to collaborate with airlines on creative design concepts and develop tailored soft goods solutions that meet specific branding and design requirements.

Moreover, the impact of the COVID-19 pandemic on the aviation industry has further accelerated certain trends in the aircraft soft goods market. With a heightened focus on health and safety measures, there is an increased demand for soft goods that are easy to clean, disinfect, and maintain. Market players are responding to these shifting requirements by introducing antimicrobial fabrics, stain-resistant materials, and other innovative solutions that promote hygiene and safety in aircraft interiors. As the industry adapts to the new normal post-pandemic, the emphasis on health and safety features in soft goods is likely to remain a significant consideration for airlines and passengers.

In conclusion, the global aircraft soft goods market is undergoing notable transformations driven by sustainability initiatives, technological advancements, customization trends, and evolving health and safety requirements. Market players that can leverage these trends to offer innovative, sustainable, and customized soft goods solutions are well-positioned to capitalize on the growth opportunities in this dynamic and competitive market landscape. By staying attuned to market trends and customer demands, companies can differentiate their offerings and establish a competitive edge in the evolving marketplace.

The Aircraft Soft Goods Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-aircraft-soft-goods-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

The report provides insights on the following pointers:

Market Penetration: Comprehensive information on the product portfolios of the top players in the Aircraft Soft Goods Market.

Product Development/Innovation: Detailed insights on the upcoming technologies, R&D activities, and product launches in the market.

Competitive Assessment:In-depth assessment of the market strategies, geographic and business segments of the leading players in the market.

Market Development:Comprehensive information about emerging markets. This report analyzes the market for various segments across geographies.

Market Diversification:Exhaustive information about new products, untapped geographies, recent developments, and investments in the Aircraft Soft Goods Market.

Browse More Reports:

Global Algae Fertilizers Market Global Construction Film Market Global Antimicrobial Agent Market Global Benchtop Laboratory Water Purifier Market Asia-Pacific Feed Flavours and Sweeteners Market Global Catenary Infrastructure Market Global Bus Public Transport Market Latin America Point of Care Infectious Disease Market Global Innovation Management Market Middle East and Africa Indium Market Global Antibiotics Market Global Potassium Humate Biostimulants Market Africa MDI, TDI, Polyurethane Market Global Dental Diode Lasers Market Middle East and Africa Artificial Turf Market Global Hematologic Malignancies Market Latin America Ostomy Devices Market Asia-Pacific Rotomolding Market Philippines Microgrid Market Global Automated Beverage Carton Packaging Machinery Market Global Surgical Power Tools Market Europe Intensive Care Unit (ICU) Ventilators Market Global Vasodilators Market Global Methylene Diphenyl Diisocyanate (MDI), Toluene Diisocyanate (TDI) and Polyurethane Market Global Constrictive Pericarditis Market Middle East and Africa q-PCR Reagents Market Global Artificial Turf Market Global Styrene Butadiene Latex Market Global Digital Farming Software Market Global Alpha Linolenic Acid Market Global Head and Neck Cancer Drug Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us: Data Bridge Market Research US: +1 614 591 3140 UK: +44 845 154 9652 APAC : +653 1251 975 Email:- [email protected]

Tag

"

0 notes

Text

Cyclohexanone Prices, News, Trend, Graph, Chart, Monitor and Forecast

Cyclohexanone is a crucial intermediate chemical used predominantly in the production of nylon, adipic acid, and caprolactam, making its market highly dependent on the performance of the textile and polymer industries. The pricing of cyclohexanone is influenced by multiple factors, including raw material costs, supply-demand dynamics, global trade policies, and macroeconomic conditions. The primary feedstock for cyclohexanone production is cyclohexane, which is derived from crude oil. Therefore, fluctuations in crude oil prices directly impact the cost structure of cyclohexanone manufacturers. When crude oil prices rise, the production costs of cyclohexane and subsequently cyclohexanone also increase, leading to a higher market price. Conversely, a decline in oil prices can provide cost relief to producers, resulting in lower market prices.

Supply chain disruptions, whether due to geopolitical tensions, natural disasters, or unexpected plant shutdowns, can also affect cyclohexanone prices. Any disruption in the supply of raw materials can lead to production bottlenecks, reducing the availability of cyclohexanone and driving up prices. Similarly, planned or unplanned shutdowns of major production facilities in key manufacturing regions, such as China, the United States, and Europe, can cause price fluctuations. In addition, regulatory changes impacting the chemical industry, such as environmental policies limiting emissions or increasing compliance costs, can also contribute to shifts in pricing trends. Stricter environmental regulations often require manufacturers to invest in cleaner production technologies, which may lead to increased production costs and, subsequently, higher product prices.

Get Real time Prices for Cyclohexanone: https://www.chemanalyst.com/Pricing-data/cyclohexanone-1136

The demand for cyclohexanone is closely tied to the performance of downstream industries, particularly the textile and automotive sectors. The growth of the nylon market, which is extensively used in the production of textiles, carpets, and industrial fabrics, plays a significant role in shaping the demand for cyclohexanone. A surge in demand from these industries can push cyclohexanone prices upward, whereas a slowdown can lead to lower pricing. Economic downturns or recessions often result in reduced consumer spending on textiles and automobiles, leading to weaker demand for nylon and subsequently impacting cyclohexanone prices negatively. On the other hand, economic expansion typically fuels industrial production, driving demand and supporting price increases.

Global trade policies and tariff regulations also play a crucial role in determining cyclohexanone pricing trends. Countries imposing trade restrictions, tariffs, or anti-dumping duties on cyclohexanone imports can significantly affect market dynamics. For instance, if a major importing country imposes tariffs on cyclohexanone from a key supplier, domestic prices may increase due to reduced competition. Conversely, the removal of trade barriers can encourage imports, leading to greater supply and potentially lowering prices. Currency fluctuations further complicate pricing dynamics. A weaker domestic currency in a major producing region can make exports more competitive, leading to increased demand and price hikes in international markets. Conversely, a stronger currency can make exports less competitive, potentially reducing demand and pressuring prices downward.

The role of regional markets in shaping cyclohexanone price trends cannot be understated. Asia-Pacific, particularly China and India, serves as a major production and consumption hub for cyclohexanone. The region’s rapid industrialization and expansion of the textile and automotive sectors continue to drive demand growth. In China, environmental regulations and production curbs have occasionally affected the availability of cyclohexanone, leading to price volatility. Meanwhile, Europe and North America have well-established cyclohexanone markets, with pricing influenced by domestic production capacities, regulatory frameworks, and import-export dynamics. The Middle East, with its access to abundant petrochemical feedstocks, is also emerging as a significant player in the global cyclohexanone market, contributing to competitive pricing trends.

Another important factor influencing cyclohexanone pricing is seasonal demand variation. Industrial activity often follows seasonal trends, with increased demand in certain periods leading to price surges. For example, the textile industry experiences higher production activity before peak shopping seasons, such as holidays and festivals, driving up the demand for nylon and indirectly boosting cyclohexanone prices. Conversely, during periods of lower industrial activity, demand wanes, leading to price declines. Additionally, the impact of global economic conditions, such as inflation rates, interest rates, and overall market sentiment, further shapes the trajectory of cyclohexanone prices. Inflationary pressures can increase production costs across the supply chain, from raw material procurement to logistics and transportation, ultimately raising market prices.

Technological advancements in production processes also play a crucial role in shaping cyclohexanone pricing trends. Innovations aimed at improving efficiency, reducing waste, and lowering energy consumption can help manufacturers cut costs and maintain competitive pricing. Companies investing in greener production methods, such as bio-based cyclohexanone synthesis, may also influence long-term pricing trends. The adoption of more sustainable production practices could lead to shifts in supply chain dynamics, potentially stabilizing prices while reducing environmental impact.

The outlook for cyclohexanone prices remains subject to ongoing market developments, including crude oil price movements, trade policies, and industrial demand shifts. Analysts closely monitor key indicators such as supply-demand balances, production capacities, and economic conditions to forecast future price trends. Businesses reliant on cyclohexanone must stay informed about these factors to make strategic procurement decisions and manage cost fluctuations effectively. While short-term price volatility is expected due to external shocks and market imbalances, long-term pricing trends will likely be shaped by fundamental supply-demand dynamics and industry advancements. As the global economy continues to evolve, market participants must remain agile in navigating price fluctuations and securing stable supply chains for cyclohexanone procurement.

Get Real time Prices for Cyclohexanone: https://www.chemanalyst.com/Pricing-data/cyclohexanone-1136

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

#Cyclohexanone#Cyclohexanone Price#Cyclohexanone Prices#India#united kingdom#united states#Germany#business#research#chemicals#Technology#Market Research#Canada#Japan#China

0 notes

Text

Turkish textile industry will meet at the textile machinery fair GTM2025 in Gaziantep

The GTM 2025 Textile Machinery Fair, which brings together the leading figures in the textile industry with the region where 75 percent of Turkish textile production is carried out, will be the prevalent textile event both in Turkey and around the world. The Gaziantep Textile Machinery Fair GTM 2025 will set out a vision for world textiles, and will bring a mobility to the industry valued at millions of dollars. Gaziantep, the meeting spot of Turkish textiles where the production of Turkish textile and garment products are mainly carried out around neighboring cities such as Adana, Adıyaman, Kayseri, Kahramanmaraş, Malatya, Niğde, Osmaniye and Şanlıurfa, is an important center for the organization of a such event. The Textile Machinery Fair, which will be held in a 30,000 square meter closed area at the Gaziantep Middle East Fair Center between October 15-17, 2025, will bring together domestic and foreign machinery manufacturers with the textile industry.

GTM 2025 Fair

Will be held under the auspices of Gaziantep Metropolitan Municipality With the support of textile and raw material exporter associations With the cooperation of Gaziantep Chamber of Industry, Gaziantep Chamber of Commerce, Gaziantep Organized Industrial Zone Directorate.

Business Networking Opportunities Worth of Million Dollars

According to statistical data, the Turkish textile machinery market has a volume of 3 billion 4 million dollars. According to 2023 TÜİK data, 1 billion 950 million dollars of textile machinery imports were realized, while 1 billion 450 million dollars of the Turkish domestic market's capacity was met by domestic textile machinery manufacturers. In the same period, exports of Turkish textile machinery manufacturers recorded as 840 million dollars. Turkey is the world's largest machinery buyer, right after China and India. It is the most important market for both domestic and foreign machinery manufacturers. At Gaziantep Textile and Apparel Machinery Fair GTM2025, which will bring the textile industry together under one roof, technology manufacturer brands will showcase their newest applications and will have the opportunity to exhibit their innovative products. Companies wishing to take advantage around domestic and foreign markets will have the opportunity to establish new business connections and to form new partnerships. The fair, which will increase the innovative capacity of the textile industry, will bring a mobility to the industry valued at millions of dollars.

What will be showcased at the Fair?

Textile machinery manufacturer companies participating in the fair will have the opportunity to directly reach the market with the hosting of Gaziantep, which holds a prominent importance in textiles, ready-made clothing, home textiles, carpet, nonwoven, fabric and yarn production. Gaziantep, which is amongst the provinces that have made significant progress in the textile sector, has been the leader in many product groups with its Textile Production Capacities. In addition to the textile production carried out by Gaziantep, the city positioned as the center of Turkish textile production with the textile industry which is clustered around the neighboring cities. Gaziantep, is the leading producer in Turkey, producing 91% of the machine-made carpet production in Turkey, 91% of the Polipropilen İplik / Polypropylene Yarn production produced in Turkey, 82% of Dokusuz kumaş / Nonwoven fabric production, 77% of (Akrilik İplik) Acrylic Yarn production, 48% of Gipe İplikler / Gipe Yarns production, 40% of the production of Çuval, torba / Bags and Sacks from PE/PP Band from PE or PP strip, 36% of Pamuk İpliği / Cotton Yarn alone.

The following Product Groups constitute the Participant Concept of the Fair;

Yarn Preparation Machines

Yarn and Fabric, Dyeing & Finishing Machines

Cotton and Fiber Preparation Machines

Transferring, Twisting, Texturing Machines

Nonwoven Machines

Weaving Preparation Machines

Weaving Machines

Tufting and Carpet Weaving Machines

Narrow Weaving Machines

Warp Knitting Preparation Machines

Flat and Circular Knitting Machines

Washing, Bleaching, Drying Machines

Wrapping and Folding Machines

Cord and Rope Machines

Socks Machines

Embroidery Machines

Quilting Machines

Textile Printing Machines

Digital Textile Printing Machines

Textile Printing Dyes and Chemicals

Textile Chemicals, Laboratory Equipment and Quality Control Systems

CAD-CAM-CIM Applications and Automation Systems

Auxiliary Machines, Spare Parts and Accessories

Garment machines and accessories

0 notes

Text

How to Export Jute from India

Jute, often known as the "golden fibre," has played a significant role in the Indian economy for generations. Its versatility in textiles, packaging, and various other industries makes it an ideal candidate for global export. However, entering the international market requires a strategic approach. In this article, we will explore the essential steps and strategies for successfully exporting jute products worldwide. Additionally, we will provide insights into jute export from India, the types of jute products exported, and the primary destinations for these exports.

Is the Jute Business Profitable?

The jute industry boasts a profit margin of approximately 40%, enabling rapid growth and effective expense management. Experts predict substantial growth in the global jute fibre market between 2023 and 2030, with some sources forecasting a compound annual growth rate (CAGR) of over 5.9%. This indicates a consistent increase in market value year after year during this period.

Popular Jute Products

Jute is used to produce a wide range of products, including:

Yarn

Carpet Backing Cloth

Blankets

Decorative Fabrics

Floor Coverings

Shopping Bags

Hessian or Burlap (Plain-Woven Fabric)

Sacking (Loosely Woven Cloth)

Food-Grade Jute Cloth

Among these, yarn, twine, sacking, hessian, and carpet backing fabric are the most notable. Jute's strong tensile strength, minimal extensibility, and breathability make it ideal for various applications, from curtains and chair covers to carpets and area rugs. Often, jute is blended with synthetic and natural fibres to enhance its properties.

The Growing Global Market for Jute Products

The global market for jute is expanding rapidly. In 2022, the jute market was valued at USD 2.5 billion and is projected to reach USD 4.9 billion by 2032, with a CAGR of over 5.9% from 2023 to 2032. Increased awareness of the environmental impact of synthetic materials has driven demand for sustainable and biodegradable alternatives like jute. However, jute prices can fluctuate due to weather conditions, global demand, and supply chain issues.

Jute Export from India: Key Statistics and Facts

India's jute industry is one of the country's oldest and most esteemed sectors, with major jute-producing states including West Bengal, Assam, Bihar, Orissa, and Andhra Pradesh. West Bengal, with its numerous mills, is the backbone of the Indian jute sector.

Indian jute products range from hessian or burlap to sacking, food-grade jute cloth, yarn, carpet backing cloth, blankets, decorative fabrics, floor coverings, and shopping bags. As of March 2021, the jute industry had 608,594 installed spindles.

Jute Export Data from India (2023-24)

Jute export data have shown a steady increase. Between 2015 and 2021, exports grew at an impressive 9% CAGR. In February and March 2022, India exported nearly USD 50 million worth of jute and floor coverings each month. Jute diversified products (JDP), such as shopping bags and home decor, dominated exports, valued at USD 21.24 billion in 2022-23. Traditional products like sacking and hessian also saw substantial increases, with exports reaching USD 83.3 million and USD 128.8 million, respectively. Jute yarn and raw jute exports were valued at USD 10.9 million and USD 22.5 million, respectively.

Top Export Destinations for Indian Jute

The leading destinations for Indian jute exports include:

USA

UK

Australia

Belgium

Egypt

Germany

Italy

Japan

Saudi Arabia

Turkey

In 2021-22, the United States was the largest importer of Indian jute products, including floor coverings, valued at USD 107.13 million.

Major Jute Products Exported from India

The primary categories of jute export from India are:

Raw Jute

Other Jute Bags

Sacking Bags (Hessian)

Carpet Backing Cloth

Twine & Rope

Decorative Fabrics

Gift Articles

Blankets

Wall Hangings

Webbing

Soil Saver

Felt

Cotton Bagging

Canvas

Tarpaulin

In the fiscal year 2022-23, the top three jute products exported from India were hessian cloth (Rs. 640.34 crore), sacking bags (Rs. 673.67 crore), and shopping bags (Rs. 788.02 crore).

Steps to Start a Jute Export Business from India

To successfully start a jute export business, follow these steps:

Register your firm and obtain an IEC code.

Research potential markets for jute products, focusing on regions like Europe and North America.

Choose the jute products you wish to export (raw, yarn, bags, etc.) and source them.

Secure financing for goods, processing, and logistics.

Implement quality control standards (such as ISO or JIDC).

Create export-worthy packaging with appropriate labeling.

Register with the Jute Products Development and Export Promotion Council (JPDEPC).

Find buyers through online platforms like Eximpedia.app.

Prepare export contracts and gather the necessary documentation.

Collaborate with a customs broker for smooth clearance.

Select reliable delivery and payment options (LC, documented collection).

Conclusion

Exporting jute products from India requires meticulous planning, market research, and adherence to quality standards and regulations. By following the steps outlined in this guide, you can position your jute export business for success and contribute to the global expansion of the jute industry.

Need Jute Buyers' Details?

Connect with Eximpedia.app to access the latest and most accurate jute buyer data and jute importer lists. We provide comprehensive jute products export from India, jute bag export statistics, top jute exports from India, jute HS codes, and more. For any queries related to jute export data, contact our data experts and schedule a free live demo today!

#jute export from India#jute bag export from india#jute bag export#jute products export from india#jute products export#jute export data#Jute Product Export Data

0 notes

Text

Croatia import export data | Global import export data provider

Discover the export opportunities in the croatia market through a market intelligence report based on croatia import export data. Discover croatia major imports by price, quantity, value, buyer, supplier and port information. Gather these insights from croatia customs data and plan an effective marketing strategy. Gain a competitive advantage and make profitable decisions. Croatia's furniture exports were $645 Mn in 2023. Request a free sample Global import export data at

https://eximtradedata.com/country-wise-Croatia-import-and-export-data

More information about Turkey's carpets & rugs exports were $494 Mn last year : https://globalimportexportdataprovider.blogspot.com/2024/05/turkeys-carpets-rugs-exports-were-494.html

#Croatiacustomsdata#Croatiaimportexportdata#globalimportexportdataprovider#Croatiashipmentdata#Croatiatradedata#Croatiaimportdata#Croatiaexportdata#importexportdata#globalimportexportdata

0 notes

Link

0 notes

Text

Foxconn out-trumped Trump

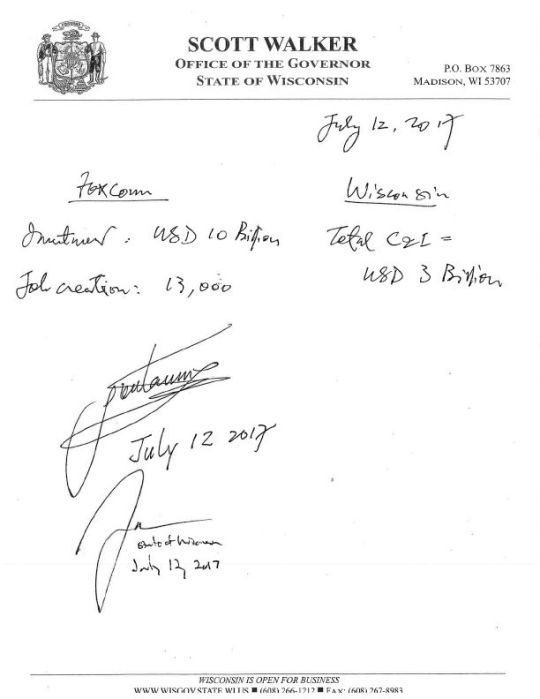

In 2017, Donald Trump declared victory. Working with the far-right Wisconsin governor Scott Walker, he had brokered a deal to bring high-tech manufacturing jobs back to America, with a new, massive Foxconn plant that would anchor the new Wisconn Valley. Right away, there were three serious, obvious problems. I. Foxconn are crooks. It's not just the Apple device factories where they drive workers to suicide, it's a long history of promising to build massive factories, absorbing billions in subsidies, and then bailing. It's a con they'd already pulled in Indonesia, Vietnam, Brazil and in Pennsylvania. The US heist happened only four years before the Wisconsin deal (which offered $4b in subsidies!) was signed. II. The plant made no sense. Foxconn promised that it would employ tens of thousands of American workers building massive LCDs. The world did not need massive LCDs. It had a glut of them. The price for cheap LCDs built by low-waged workers in the Pacific Rim was tumbling. III. There was already stuff where the plant was supposed to be built. Notably, there were family homes, places that had been owned by Wisconsinites for generations, real homesteads. In order for Foxconn to build its nonsensical plant and receive $4b in US public subsidies, these families would have to be expropriated and their homes - their whole communities - literally bulldozed and dumped into landfills. The deal revealed - if there was any doubt - that Trump is a rube, a sucker, a fool. Foxconn played him and played Walker and the state of Wisconsin. They never planned to build an LCD plant. Indeed, they seem never to have planned to build ANYTHING. They wanted the free money as a subsidy for exploring what they might build, and they knew that the best way to get Wisconsin and the USA to subsidize this speculation was to tell risible lies about multibillion-dollar LCD factories that credulous US leaders would swallow. No news outlet has done more to chronicle the endless, absurd, idiotic Foxconn grift than The Verge, and while many writers there have worked on the story (like Bruce Murphy and James Vincent), Josh Dzieza has been the most indefatigable chronicler of the Foxconn shitshow. Now, after reporting out piece after piece on the Foxconn deal, Dzieza has published a kind of master narrative that tells the whole story from beginning to end, piecing it all together and augmenting it with new insider dope: https://www.theverge.com/21507966/foxconn-empty-factories-wisconsin-jobs-loophole-trump Dzieza's masterpiece leaves no doubt that this was a titanic fraud, nor that it was incompetently negotiated by Wisconsin's local and state officials as well as the federal government. Take the subsidies: to qualify for them, Foxconn had to meet various hiring targets. But those targets were easily gamed. So long as Foxconn had a certain number of workers on the books in December, it could count them as employed for the whole year, even if it laid them off in January. Which, of course, it did. Indeed, the way Foxconn uses human lives as conveniences not worthy of any consideration make it clear that the suicides at its Apple factories are not isolated incidents (and also constitute a stinging rebuke to Walker and Trump's union-bashing). To prop up its sham, Foxconn sent recruiters out to hold high-pressure job fairs where applicants were pressured to immediately accept job offers and tender their resignations at their current employers. Then they were strung along for months as they jobs they'd been promised didn't materialized, and, for many, those jobs did not ever materialize. Workers who DID get jobs hardly fared better, showered in racist abuse about their inferiority to Asian workers. They were asked to work in facilities without furniture, made to bring in their own pencils AND NETWORKING EQUIPMENT, made to buy new elevator carpets out of their own pockets to assuage the screaming rages of their managers, given impossible duties or none at all. At various stages, these workers were called in to brainstorm ideas for building something, anything, in the facilities that Foxconn had been given at firesale prices by the state of Wisconsin. Some ideas:

A fish-farm that could absorb the subsidized water they'd been guaranteed for cooling the data-center they would never build

An AI research lab

A Wework clone

A dairy exporter serving the Chinese market

A federal tech contractor

None of this bore fruit. The only time Foxconn turned a nickel was when they bought in-use office buildings with the intention of using them for some harebrained scheme but lost interest before they could evict the businesses tenanted there, and so earned some rent. Foxconn eventually laid off the bulk of its US workforce and hired Indian and Chinese tech-workers on H1B visas, whom it showered with even more abuse, backstopped by threats of deportation if any of them dared to complain. All along, Foxconn just told stupid lies that Wisconsin's business community gobbled up: Foxconn founder Terry Guo got fantastic praise for his $100m donation to the U Wisconsin system. None of that praise was revoked when he only delivered $700k of it. The Foxconn deal is a black hole that has sucked Wisconsin's productive economy through its event horizon. The company charged local businesses thousands of dollars to get signed up as suppliers, then stiffed them on their invoices. And the towns - like Mt Pleasant - that destroyed their residents' family homes to clear the way for Foxconn lost those taxpayers - and never got the promised tax payments that a Foxconn facility was supposed to deliver. Here's Dzieza's masterful summary: "Trump promised to bring back manufacturing... Into the gap between appearance and reality fell people’s jobs, homes, and livelihoods." Trump calls the Foxconn plant "The Eighth Wonder of the World." In 2018, Wisconsin voters fired Scott Walker for being such a plute-sucking rube. In 2020, they have the chance to fire Trump.

148 notes

·

View notes