#cbot

Explore tagged Tumblr posts

Text

The original Chicago Board of Trade Building opened for business on May 1, 1885.

#original Chicago Board of Trade Building#not the original one#openend#USA#1 May 1885#141 W. Jackson Boulevard#Holabird & Root#Art Deco#façade#Ceres#140th anniversary#US history#the Loop#skyscraper#architecture#travel#sculpture#cityscape#original photography#summer 2019#vacation#Illinois#Chicago#Chicago Board of Trade Building#CBOT#Midwestern USA#Great Lakes Region#Edward Windhorst#fountain#clock

6 notes

·

View notes

Text

1953.

Wayne and Shuster: Your Favourite Fun-Makers

2 notes

·

View notes

Text

4 notes

·

View notes

Text

People don’t buy shares; they buy news and expectations. Yesterday, Nutrien Ltd. ($NTR) reported that "agriculture markets in the U.S., Brazil, and Australia have been supportive for fertiliser." (Read the full article at https://www.marketwatch.com/story/nutrien-sees-good-fertilizer-application-rates-in-u-s-brazil-australia-commodity-comment-165f651d?mod=markets).

Later that day, $NTR traded at $58.24, almost 5% above its closing price of $55.43 on 08/05/2024, and the highest value since November 2023.

We all love good news and find it easier to believe in it.

#agriculture#fertilizer#fertilization#urea#corn#usa#wheat#india#vessel#nola#CBOT#nutrien#shares#stocks#stock market#stock trading#imstory

1 note

·

View note

Text

#cbot

Art Deco statue of the goddess, Ceres, atop the Chicago Board of Trade Building, Chicago, Illinois.

Architect, Holabird & Root. 1929.

174 notes

·

View notes

Text

Trading Agricultural Commodities

source:unsplash.com

Trading Agricultural Commodities

Agricultural commodities form the backbone of global trade, providing essential resources such as grains, oilseeds, and livestock. Trading these commodities is an exciting yet complex endeavor, influenced by numerous factors, including weather, geopolitical tensions, and global economic trends.

For investors and traders, understanding how to navigate this dynamic market can unlock opportunities for diversification and growth.

This guide explores the essentials of trading agricultural commodities, including market fundamentals, strategies, and key factors that affect price movements.

Whether you are new to commodity trading or an experienced investor, this article provides practical insights to help you make informed decisions.

What Are Agricultural Commodities?

Agricultural commodities refer to raw products derived from farming and livestock activities. These can be broadly categorized into:

Grains: Wheat, corn, and rice are staple grains traded on global markets.

Oilseeds: Products like soybeans and sunflower seeds form the foundation of the oilseed market.

Soft Commodities: These include coffee, cocoa, sugar, and cotton.

Livestock: Cattle, hogs, and other animals fall under this category.

Each of these categories has unique supply and demand dynamics, making them distinct trading opportunities. For instance, grains such as wheat, corn, and rice are heavily influenced by weather conditions, including droughts, floods, and temperature fluctuations, which can significantly impact crop yields and supply levels.

The global interconnectedness of grain markets also means that a poor harvest in one region can lead to ripple effects on prices worldwide. On the other hand, soft commodities like coffee and cocoa are primarily driven by consumer preferences and global consumption trends. Factors such as shifts in lifestyle habits, economic growth in emerging markets, and the rise of specialty coffee consumption have created significant demand fluctuations in recent years.

Additionally, geopolitical factors and labor availability in key producing regions often influence the supply side of these commodities, further adding to their price volatility and trading appeal.

How Agricultural Commodity Markets Work?

Agricultural commodities are traded on exchanges such as the Chicago Board of Trade (CBOT) and the Intercontinental Exchange (ICE). These markets allow buyers and sellers to trade standardized contracts, ensuring transparency and efficiency.

Spot Markets vs. Futures Markets:

1. Spot Markets:

These involve the immediate purchase and sale of commodities at current market prices.

2. Futures Markets:

Futures contracts allow traders to buy or sell a specific quantity of a commodity at a predetermined price and date. This is the most common method of trading agricultural commodities, offering the ability to hedge against price fluctuations.

Futures contracts are particularly useful for producers and consumers looking to manage risks. For instance, a farmer might sell wheat futures to lock in a price for their upcoming harvest, while a bakery might buy wheat futures to secure stable input costs.

3. Role of Speculators:

Speculators play a vital role in agricultural markets by providing liquidity and helping to balance prices. Unlike producers and consumers, speculators do not intend to take physical delivery of commodities. Instead, they aim to profit from price changes. Their activities can influence short-term price volatility but also help stabilize long-term market trends by absorbing risks.

Key Factors Influencing Trading Agricultural Commodity Prices

Understanding the factors that drive price movements is essential for successful trading. Some of the most influential factors include:

1. Weather Conditions:

Weather plays a critical role in agricultural production. Droughts, floods, and hurricanes can significantly affect crop yields, leading to supply shortages and price increases. For example, a severe drought in the U.S. Midwest might reduce corn production, driving prices higher globally.

2. Seasonality:

Many agricultural commodities follow seasonal production cycles. For instance, the harvest season typically brings increased supply, often leading to lower prices. Conversely, planting seasons may see price spikes due to uncertainty about future yields.

3. Global Demand:

Demand for agricultural products fluctuates based on population growth, economic conditions, and consumer preferences. Rising demand for plant-based proteins, for instance, has increased the popularity of soybeans and other legumes. Similarly, the growing middle class in emerging markets has led to higher consumption of meat and dairy products, boosting demand for animal feed grains.

4. Trade Policies and Tariffs:

Government policies, including tariffs and export restrictions, can disrupt the flow of agricultural goods. For example, a country imposing tariffs on soybean imports may reduce demand from foreign markets, impacting prices. Similarly, export bans during periods of domestic shortages can exacerbate global price volatility.

5. Currency Exchange Rates:

Since agricultural commodities are traded globally, currency fluctuations can affect prices. A stronger U.S. dollar, for example, makes commodities more expensive for buyers using other currencies, potentially reducing demand. Conversely, a weaker dollar can stimulate demand by lowering costs for international buyers.

6. Technological Advances:

Improvements in farming technology, such as precision agriculture and genetically modified crops, can boost yields and increase supply, influencing prices. These advancements also enhance the efficiency of resource usage, such as water and fertilizers, helping stabilize production in challenging conditions.

Popular Strategies for Trading Agricultural Commodities

Trading agricultural commodities requires a combination of market knowledge, analysis, and discipline. Below are some popular strategies employed by traders:

1. Fundamental Analysis:

Fundamental analysis involves studying supply and demand factors that influence prices. Key data sources include:

USDA Reports: The U.S. Department of Agriculture provides regular updates on crop yields, production forecasts, and global trade flows.

Weather Forecasts: Monitoring weather patterns can help anticipate potential disruptions in supply.

Economic Indicators: Trends in GDP growth, consumer spending, and population changes can signal shifts in demand.

For instance, if a USDA report predicts lower-than-expected soybean yields, traders might anticipate a price increase and take a long position.

2. Technical Analysis:

Technical analysis focuses on historical price data and chart patterns to predict future movements. Common tools include:

Moving Averages: These help identify trends and potential reversals.

Relative Strength Index (RSI): RSI measures momentum, indicating overbought or oversold conditions.

Support and Resistance Levels: These levels indicate price points where significant buying or selling activity is likely to occur.

For example, if corn prices approach a strong support level, traders might anticipate a rebound and consider entering a long position.

3. Hedging:

Hedging is a risk management strategy used by producers and consumers to protect against adverse price movements. For example:

A farmer might sell futures contracts to secure a guaranteed price for their crop.

A food manufacturer might buy futures to lock in stable input costs.

While hedging reduces risk, it also limits potential upside gains, making it a trade-off between stability and profit potential.

4. Spread Trading:

Spread trading involves taking positions in two related contracts to profit from the price difference. For instance:

A trader might go long on wheat futures while shorting corn futures, expecting wheat prices to rise relative to corn.

This strategy requires a deep understanding of market correlations and can be less risky than outright speculation.

5. Seasonal Trading:

Seasonal trading leverages predictable patterns in agricultural markets. For example:

Prices for grains often decline during harvest season due to increased supply.

Livestock prices may rise during holidays when demand for meat products increases.

By analyzing historical trends, traders can identify recurring opportunities and align their strategies accordingly.

Risks of Trading Agricultural Commodities

While trading agricultural commodities offer significant profit potential, they also carry unique risks. Key risks include:

1. Market Volatility:

Commodity prices can be highly volatile, driven by unpredictable factors such as weather events or geopolitical tensions. Managing this volatility requires careful risk management.

2. Leverage:

Futures trading often involves leverage, which can amplify both gains and losses. Traders must use leverage cautiously to avoid significant losses.

3. Liquidity Risk:

Some agricultural markets may have lower liquidity, making it difficult to execute large trades without affecting prices.

4. Regulatory Changes:

Government interventions, such as subsidies or export bans, can disrupt markets and create sudden price swings.

5. Storage and Transport Costs:

Physical delivery of commodities involves storage and transportation expenses, which can impact profitability. Traders need to account for these costs when managing positions.

Practical Tips for New Traders

For those new to agricultural commodities, the following tips can help build a solid foundation:

1. Start with Research:

Learn about the specific commodity you plan to trade, including its production cycle, key regions, and market dynamics.

2. Use Simulated Trading:

Practice trading in a risk-free environment to build confidence and test strategies.

3. Set Clear Goals:

Define your trading objectives, risk tolerance, and time horizon before entering the market.

4. Diversify:

Avoid concentrating your portfolio in a single commodity to reduce overall risk.

5. Monitor Global Trends:

Stay informed about economic developments, trade policies, and weather conditions that could impact markets.

6. Leverage Educational Resources:

Many exchanges and trading platforms offer educational materials and tools designed to enhance understanding and improve trading skills.

Approaching Trading Agricultural Commodity

Trading agricultural commodities offers a wealth of opportunities for those willing to invest time and effort into understanding market fundamentals.

By combining strategies like fundamental and technical analysis, hedging, and seasonal trading, traders can navigate the complexities of these markets with greater confidence.

However, success in agricultural trading requires discipline, risk management, and a commitment to continuous learning. By staying informed and adaptable, you can position yourself to capitalize on the dynamic world of agricultural commodities, transforming challenges into profitable opportunities.

2 notes

·

View notes

Text

Brazilian domestic market of corn loses strength with the US environment

The Brazilian domestic market has behaved normally, complying with the vision of production losses in the second crop, but also with the observation that we need to provide an exit for internal surpluses. The market distortion once again comes from the agribusiness media, which is driving producers to believe in possible price hikes in the middle of the harvest of the 2024 second crop. While the export potential does not reach at least 40 mln tons this year, it seems difficult to sustain a bullish bias. Now, Brazil’s difficulty is to compete with low prices on the international market, even though we still have an exchange rate helping to adjust the international lows for domestic prices in reals.

The 2024 second crop is now entering its harvest peak. This is a different year from the normal second-crop seasonality. We had very early plantings in most of the producing regions and, therefore, we will not have many harvests in September or the second half of July. The extremely dry weather in May and June is accelerating this maturation process and loss of moisture in crops, making the harvest viable.

Of course, there is concern about the smaller crop in Mato Grosso do Sul and northern Paraná, as well as, under new assessments now in corn, and sorghum in São Paulo and Minas Gerais. On the other hand, the excellent production in Goiás, Mato Grosso, and Matopiba continues. In general, therefore, Brazil cannot rule out exports in a year like this. The declines on the CBOT at the end of the week have a major impact on this export target. Brazil is not competitive yet with low prices abroad, and therefore the decline to less than USD 4.00/bushel greatly affects internal price formation. On the other hand, in Brazil the very strong devaluation of the real is equalizing this external price low with port indications in the country. The big risk is a slowdown in the exchange rate due to some government intervention. In this case, it is not possible to be sure whether premiums could rise to equalize the Brazilian price with the international market.

Continue reading.

6 notes

·

View notes

Text

@deep-fried-mayonnaise

"You don't know me. I'm not the same person anymore."

"That's okay. I'll get to know you again."

78K notes

·

View notes

Text

The original Chicago Board of Trade Building opened for business on May 1, 1885.

#original Chicago Board of Trade Building#not the original one#openend#USA#1 May 1885#141 W. Jackson Boulevard#Holabird & Root#Art Deco#façade#Ceres#anniversary#US history#the Loop#skyscraper#architecture#travel#sculpture#cityscape#original photography#summer 2019#vacation#Illinois#Chicago#Chicago Board of Trade Building#CBOT#Midwestern USA#Great Lakes Region#Edward Windhorst#fountain#clock

4 notes

·

View notes

Text

Unpopular Opinion: I actually love Wayne and Shuster

2 notes

·

View notes

Text

MK: Tropical rainforest!

CK: Savanna!

Ks: Come on! Just choose one!

Cbot: ...Why are we here?

Mbot: Zack asked us to grab the Miniaturizer.

5 notes

·

View notes

Text

Commodities Trading: Investing in Physical Goods

Commodities trading is an age-old practice that involves buying and selling physical goods like gold, oil, and agricultural products. Unlike stocks and bonds, which represent ownership in companies or debt, commodities are tangible assets that can be touched, stored, and consumed. Trading in commodities offers investors a way to diversify their portfolios, hedge against inflation, and potentially profit from price movements in global markets. In this blog, we’ll explore the basics of commodities trading, highlight popular commodities, and discuss how to invest in commodities through futures contracts and exchange-traded funds (ETFs).

Basics of Commodities Trading

What Are Commodities?

Commodities are raw materials or primary agricultural products that can be bought and sold. They are typically standardized and interchangeable with other goods of the same type, regardless of who produces them. Commodities are divided into two main categories:

- Hard Commodities: Natural resources that are mined or extracted, such as gold, oil, and metals.

- Soft Commodities: Agricultural products that are grown or farmed, such as wheat, coffee, and cotton.

How Does Commodities Trading Work?

Commodities trading involves buying and selling these physical goods on various exchanges, often through futures contracts. A futures contract is an agreement to buy or sell a specific quantity of a commodity at a predetermined price on a future date. The goal of trading commodities is to profit from price fluctuations in these markets. Prices are influenced by supply and demand dynamics, geopolitical events, weather conditions, and other factors.

Why Trade Commodities?

- Diversification: Commodities often move independently of stocks and bonds, providing diversification benefits to a portfolio.

- Inflation Hedge: Commodities like gold and oil tend to retain their value during periods of inflation, making them a popular choice for hedging against rising prices.

- Global Exposure: Investing in commodities provides exposure to global economic trends and events, such as changes in energy demand, agricultural production, and geopolitical tensions.

Popular Commodities

1. Gold

Gold is one of the most widely traded and recognized commodities in the world. It has long been considered a safe-haven asset, particularly during times of economic uncertainty and market volatility. Investors buy gold to protect their wealth, hedge against inflation, and diversify their portfolios. Gold prices are influenced by factors such as interest rates, currency movements, and geopolitical risks.

2. Oil

Crude oil is the lifeblood of the global economy, powering industries, transportation, and heating. As one of the most actively traded commodities, oil prices are highly sensitive to geopolitical events, changes in supply and demand, and economic conditions. The two primary benchmarks for oil are West Texas Intermediate (WTI) and Brent Crude, which are traded on exchanges like the New York Mercantile Exchange (NYMEX) and the Intercontinental Exchange (ICE).

3. Agricultural Products

Agricultural commodities include a wide range of products, such as wheat, corn, soybeans, coffee, and cotton. These commodities are essential to everyday life and are influenced by factors like weather patterns, crop yields, and global demand. Agricultural commodities are traded on exchanges like the Chicago Board of Trade (CBOT) and the Intercontinental Exchange (ICE).

4. Metals

In addition to gold, other metals like silver, platinum, and copper are also popular in commodities trading. These metals are used in various industries, from electronics and construction to jewelry and automotive manufacturing. Prices of metals are influenced by industrial demand, mining production, and global economic trends.

How to Invest in Commodities

1. Futures Contracts

Futures contracts are the most direct way to trade commodities. When you buy a futures contract, you agree to purchase a specific quantity of a commodity at a predetermined price on a future date. These contracts are standardized and traded on exchanges like the Chicago Mercantile Exchange (CME) and the Intercontinental Exchange (ICE).

Advantages of Trading Futures:

- Leverage: Futures contracts allow you to control a large position with a relatively small amount of capital, magnifying potential returns.

- Liquidity: Futures markets are highly liquid, with many buyers and sellers, making it easy to enter and exit positions.

- Diversification: Futures provide direct exposure to a wide range of commodities, from metals and energy to agriculture.

Risks of Trading Futures:

- Leverage Risk: While leverage can enhance profits, it also increases the potential for significant losses if the market moves against you.

- Volatility: Commodities markets can be highly volatile, with prices swinging sharply in response to news, weather events, and geopolitical developments.

2. Exchange-Traded Funds (ETFs)

For those who prefer a less hands-on approach, ETFs offer a convenient way to invest in commodities. Commodity ETFs are funds that track the price of a specific commodity or a basket of commodities. For example, a gold ETF would track the price of gold, while an oil ETF might track a basket of energy commodities.

Advantages of Investing in ETFs:

- Accessibility: ETFs can be bought and sold on stock exchanges, just like shares of stock, making them easily accessible to individual investors.

- Diversification: Some ETFs track a broad range of commodities, providing exposure to multiple markets with a single investment.

- Lower Risk: ETFs do not involve leverage, reducing the risk compared to futures contracts.

Risks of Investing in ETFs:

- Tracking Error: The price of an ETF may not perfectly track the price of the underlying commodity, leading to potential discrepancies in returns.

- Management Fees: ETFs charge management fees, which can eat into your returns over time.

3. Commodity Stocks and Mutual Funds

Another way to gain exposure to commodities is by investing in stocks of companies involved in the production or extraction of commodities, such as mining companies, oil producers, and agricultural firms. Alternatively, commodity-focused mutual funds pool money from many investors to buy a diversified portfolio of commodity-related assets.

Advantages:

- Indirect Exposure: Commodity stocks and mutual funds offer exposure to commodity markets without the complexity of futures trading.

- Potential for Dividends: Some commodity stocks pay dividends, providing income in addition to capital appreciation.

Risks:

- Company-Specific Risks: Unlike direct commodity investments, stocks are subject to risks related to the specific companies, such as management decisions, operational issues, and competition.

- Market Risk: Commodity stocks can be affected by broader stock market movements, which may not always correlate with commodity prices.

Conclusion

Commodities trading offers investors a unique opportunity to invest in the physical goods that power the global economy. Whether you're interested in precious metals like gold, energy resources like oil, or agricultural products like wheat and coffee, commodities provide a way to diversify your portfolio and hedge against inflation. By understanding the basics of commodities trading, the different types of commodities available, and the various ways to invest—from futures contracts to ETFs—you can navigate the commodities markets with greater confidence and potentially profit from the dynamic forces that drive global supply and demand.

As with any investment, it’s important to thoroughly research and consider the risks involved before diving into commodities trading. With the right knowledge and strategy, commodities can be a valuable addition to your investment portfolio.

2 notes

·

View notes

Text

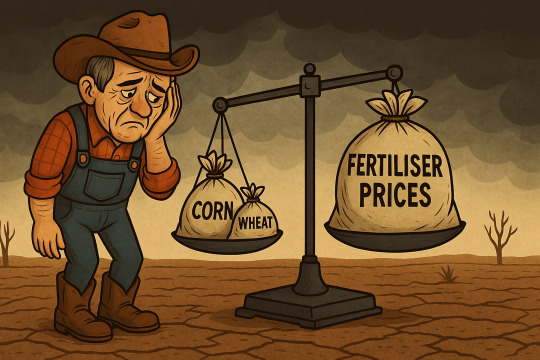

Fertiliser Affordability: It’s All About the Tariffs

I intentionally delayed my March affordability analysis, as it was quite clear that the White House's announcement of new import tariffs would have some impact on both agricultural commodities and fertiliser prices.

I still believe it’s a bit too early to draw definitive conclusions about the consequences of the newly announced tariffs, even though President Trump has postponed their implementation by three months. Nevertheless, some price impact is already visible, particularly in the US.

To recap, I use recent CBOT values for wheat and corn and compare them with FOB per short tonne prices of DAP and urea in NOLA.

So, let’s begin.

Key Inputs: 11 April 2025 vs. February 2025

Here’s how the numbers compare:

Corn Price: $4.97 per bushel (up from $4.75 in February)

Wheat Price: $5.70 per bushel (up from $5.65 in February and from a low of $5.45 on 4 March 2025)

Urea FOB NOLA: $408 per short tonne (up from $385 in February)

DAP FOB NOLA: $645 per short tonne (up from $618 in February)

Now, let’s return to our relatively simple affordability calculations and analysis.

Affordability Ratios (2024–2025)

Affordability is calculated as the ratio of crop prices to fertiliser prices, offering a clearer understanding of the cost burden on producers.

Urea Affordability

Corn Producers

Month Ratio

June 0.0146

July 0.0145

August 0.0141

September 0.0138

October 0.0141

November 0.0141

December 0.0138

January 0.01279

February 0.01234

March 0.01218

Analysis: Affordability for corn producers has declined for the fifth consecutive month, now reaching its lowest level since I began tracking in June 2024.

Wheat Producers

Month Ratio

June 0.0177

July 0.0176

August 0.0173

September 0.0171

October 0.0171

November 0.0179

December 0.0166

January 0.01486

February 0.01468

March 0.01397

Analysis: After a brief improvement in February, wheat affordability dropped sharply in March and is now at its lowest point since June 2024.

DAP Affordability

Corn Producers

Month Ratio

June 0.0079

July 0.0078

August 0.0076

September 0.0073

October 0.0073

November 0.0073

December 0.0072

January 0.0085

February 0.0077

March 0.0077

Analysis: Impressively, despite sharp fluctuations in both corn and urea prices, the DAP affordability ratio for corn producers remained unchanged to the fourth decimal place.

Wheat Producers

Month Ratio

June 0.0098

July 0.0097

August 0.0095

September 0.0093

October 0.0093

November 0.0096

December 0.0095

January 0.0098

February 0.0091

March 0.0088

Analysis: This is now the lowest index since June 2024, when I began tracking affordability.

Comparison to February

Urea:

Corn producers: Affordability decreased by 1.29% in March 2025

Wheat producers: Affordability dropped by 4.83%

DAP:

Corn producers: Affordability remained unchanged

Wheat producers: Affordability fell by 3.30%. Analysis of Trends

The main decrease in affordability was driven by a sharp rise in fertiliser prices: urea increased by 5.97%, and DAP by 4.37%.

I keep asking myself how long this decline in affordability can continue and when the market will reach its resistance point. That said, both corn and wheat prices still appear relatively healthy according to analysts.

We’ve just entered Q2 2025, a period when nitrogen fertiliser demand typically slows in the Northern Hemisphere. It will be interesting to see how things develop over the next 30 days—and whether tariffs will exert further pressure on affordability.

I’m also considering whether the new tariff structure warrants a revision to my affordability methodology.

#agriculture#fertilization#fertilizer#urea#corn#usa#wheat#india#vessel#nola#imstory#affordability#agricommodities#tariffs war#tarrifs

11 notes

·

View notes

Text

Tổng hợp: Lúa mì quay đầu giảm mạnh trước áp lực nguồn cung từ Biển Đen

Tổng hợp: Lúa mì quay đầu giảm mạnh trước áp lực nguồn cung từ Biển Đen

Thị trường nông sản tiếp tục diễn biến trái chiều trong phiên hôm qua. Ngô nối dài đà phục hồi và trở thành mặt hàng nông sản tăng mạnh nhất cả nhóm. Trong khi đó, lúa mì đã quay đầu lao dốc hơn 1% trong phiên vừa rồi, sau hai phiên tăng giá liên tiếp trước đó. Đối với nhóm họ đậu, giá các mặt hàng duy trì xu hướng giằng co, và đều đóng cửa với mức biến động nhẹ, chưa tới 1%.

Lúa mì giảm mạnh nhất cả nhóm vào hôm qua. Bên cạnh áp lực bán kỹ thuật ở vùng giá 590, thị trường còn phải đối mặt với áp lực lớn đến từ triển vọng nguồn cung dồi dào hơn ở khu vực biển Đen. Cụ thể, Refinitiv mới đây đã nâng dự báo sản lượng lúa mì niên vụ 24/25 của Ukraine lên 21,9 triệu tấn, tăng 1% so với báo cáo trước, nhờ độ ẩm đất cao hơn ở các vùng Poltava và Mykolaiv. Sản lượng dự kiến lớn hơn ở Ukraine sẽ góp phần gia tăng thặng dự lúa mì toàn cầu, đồng thời gây sức ép đến giá CBOT.

Trong khi đó, những lo ngại về triển vọng sản xuất ở khu vực Nam Mỹ đã quay trở lại thị trường và tác động “bullish” đến giá ngô trong phiên vừa rồi. Theo tiến sĩ Cordonnier - chuyên gia tại công ty tư vấn Soybean&Corn - cho biết, phần diện tích ngô trồng muộn ở Argentina đã bị ảnh hưởng đáng kể và dự kiến sẽ có năng suất thấp hơn do thời tiết bất lợi. Ngoài ra, Inmet dự báo lượng mưa sẽ dưới mức trung bình trong tháng 3 ở phần lớn phía Bắc, Đông Bắc, Trung Tây và phía Nam Brazil. Điều này dự kiến sẽ cản trở sự phát triển của cây trồng, cũng như giảm tốc độ gieo trồng vụ ngô thứ 2 của các vùng sản xuất lớn trong khu vực.

Với triển vọng thời tiết không quá khả quan, lo ngại sản lượng đậu tương Brazil tiếp tục bị cắt giảm là yếu tố đã hỗ trợ giá tăng nhẹ trong phiên vừa rồi. Ở chiều ngược lại, Sở Giao dịch Ngũ cốc Buenos Aires (BAGE) cho biết mưa dự kiến trong những ngày tới sẽ mang lại lợi ích cho hầu hết các khu vực sản xuất nông nghiệp của Argentina, thúc đẩy sự phát triển của đậu tương đang ở giai đoạn tăng trưởng quan trọng. Dự báo thời tiết tích cực đang mang đến triển vọng nguồn cung tốt tại Argentina, tạo áp lực lên thị trường trong phiên sáng và kìm hãm đà hồi phục của giá vào hôm qua.

Giá khô đậu tương ghi nhận mức tăng nhẹ gần 1%, chủ yếu nhờ lực bắt đáy tại vùng hỗ trợ 325 và ảnh hưởng lan tỏa của giá đậu tương.

Đầu tư hàng hoá

Đầu tư hàng hoá

Đầu tư hàng hoá

3 notes

·

View notes

Text

1* 2.6.2. 3 3B2 5.0i 5.1 5.53 7 15kg 17 20 22nd 26 50BMG 51 69 97 312 411 414 707 737 747 757 767 777 868 888 1071 1080H 1911 1984 1997 2600 3848 8182 $ & ^ ^? a ABC ACC Active ADIU advise advisors afsatcom AFSPC AHPCRC AIEWS AIMSX Aladdin Alica Alouette AMEMB Amherst AMW anarchy ANC Anonymous AOL ARC Archives Area51 argus Armani ARPA Artichoke ASIO ASIS ASLET assasinate Asset AT AT&T Atlas Audiotel Austin AVN b b9 B.D.M. Badger bank basement BATF BBE BECCA Becker beef Bess bet Beyond BfV BITNET black-bag Black-Ops Blackbird Blacklisted Blackmednet Blacknet Bletchley Blowfish Blowpipe BMDO BND Bob BOP BOSS botux BRLO Broadside Bubba bullion BVD BZ c Cable CANSLO Cap-Stun Capricorn card Case CATO CBM CBNRC CBOT CCC CCS CDA CDC CdC cdi Cell CESID CFC chaining chameleon Chan Chelsea Chicago Chobetsu chosen CIA CID CIDA CIM CIO CIS CISE Clandestine Class clone cocaine COCOT Coderpunks codes Cohiba Colonel Comirex Competitor Compsec Computer Connections Consul Consulting CONUS Cornflower Corporate Corporation COS COSMOS Counter counterintelligence Counterterrorism Covert Cowboy CQB CRA credit cryptanalysis crypto-anarchy CSE csystems CTP CTU CUD cybercash Cypherpunks d D-11 Daisy Data data data-haven DATTA DCJFTF Dead DEADBEEF debugging DefCon Defcon Defense Defensive Delta DERA DES DEVGRP DF DIA Dictionary Digicash disruption

DITSA DJC DOE Dolch domestic Domination DRA DREC DREO DSD DSS Duress DynCorp E911 e-cash E.O.D. E.T. EADA eavesdropping Echelon EDI EG&G Egret Electronic ELF Elvis Embassy Encryption encryption enigma EO EOD ESN Espionage espionage ETA eternity EUB Evaluation Event executive Exon explicit Face fangs Fax FBI FBIS FCIC FDM Fetish FINCEN finks Firewalls FIS fish fissionable FKS FLAME Flame Flashbangs FLETC Flintlock FLiR Flu FMS Force force Fort Forte fraud freedom Freeh froglegs FSB Ft. FX FXR Gamma Gap garbage Gates Gatt GCHQ GEO GEODSS GEOS Geraldton GGL GIGN Gist Global Glock GOE Goodwin Gorelick gorilla Gorizont government GPMG Gray grom Grove GRU GSA GSG-9 GSS gun Guppy H&K H.N.P. Hackers HAHO Halcon Halibut HALO Harvard hate havens HIC High Hillal HoHoCon Hollyhock Hope House HPCC HRT HTCIA humint Hutsul IACIS IB ICE ID IDEA IDF IDP illuminati imagery IMF Indigo industrial Information INFOSEC InfoSec Infowar Infrastructure Ingram INR INS Intelligence intelligence interception Internet Intiso Investigation Ionosphere IRIDF Iris IRS IS ISA ISACA ISI ISN ISS IW jack JANET Jasmine JAVA JICC jihad JITEM Juile Juiliett Keyhole keywords Kh-11 Kilderkin Kilo Kiwi KLM l0ck LABLINK Lacrosse Lebed LEETAC Leitrim Lexis-Nexis LF LLC loch lock Locks Loin Love LRTS LUK Lynch M5 M72750 M-14 M.P.R.I. Mac-10 Mace Macintosh Magazine mailbomb man Mantis market Masuda Mavricks Mayfly MCI MD2 MD4 MD5 MDA Meade Medco mega Menwith Merlin Meta-hackers MF MI5 MI6 MI-17 Middleman Military Minox MIT MITM MOD MOIS mol Mole Morwenstow Mossberg MP5k MP5K-SD MSCJ MSEE MSNBC MSW MYK NACSI NATIA National NATOA NAVWAN NAVWCWPNS NB NCCS NCSA Nerd News niche NIJ Nike NIMA ninja nitrate nkvd NOCS noise NORAD NRC NRL NRO NSA NSCT NSG NSP NSWC NTIS NTT Nuclear nuclear NVD OAU Offensive Oratory Ortega orthodox Oscor OSS OTP package Panama Park passwd Passwords Patel PBX PCS Peering PEM penrep Perl-RSA PFS PGP Phon-e phones PI picking

Pine pink Pixar PLA Planet-1 Platform Playboy plutonium POCSAG Police Porno Pornstars Posse PPP PPS president press-release Pretoria Priavacy primacord PRIME Propaganda Protection PSAC Pseudonyms Psyops PTT quiche r00t racal RAID rail Rand Rapid RCMP Reaction rebels Recce Red redheads Reflection remailers ReMOB Reno replay Retinal RFI rhost rhosts RIT RL rogue Rolm Ronco Roswell RSA RSP RUOP RX-7 S.A.I.C. S.E.T. S/Key SABC SACLANT SADF SADMS Salsa SAP SAR Sardine sardine SAS SASP SASR Satellite SBI SBIRS SBS SCIF screws Scully SDI SEAL Sears Secert secret Secure secure Security SEL SEMTEX SERT server Service SETA Sex SGC SGDN SGI SHA SHAPE Shayet-13 Shell shell SHF SIG SIGDASYS SIGDEV sigvoice siliconpimp SIN SIRC SISDE SISMI Skytel SL-1 SLI SLIP smuggle sneakers sniper snuffle SONANGOL SORO Soros SORT Speakeasy speedbump Spetznaz Sphinx spies Spoke Sponge spook Spyderco squib SRI ssa SSCI SSL stakeout Standford STARLAN Stego STEP Stephanie Steve Submarine subversives Sugar SUKLO SUN Sundevil supercomputer Surveillance SURVIAC SUSLO SVR SWAT sweep sweeping SWS Talent TDM. TDR TDYC Team Telex TELINT Templeton TEMPSET Terrorism Texas TEXTA. THAAD the Ti TIE Tie-fighter Time toad Tools top TOS Tower transfer TRD Trump TRW TSCI TSCM TUSA TWA UDT UHF UKUSA unclassified UNCPCJ Undercover Underground Unix unix UOP USACIL USAFA USCG USCODE USCOI USDOJ USP USSS UT/RUS utopia UTU UXO Uzi V veggie Verisign VHF Video Vinnell VIP Virii virtual virus VLSI VNET W3 Wackendude Wackenhutt Waihopai WANK Warfare Weekly White white Whitewater William WINGS wire Wireless words World WORM X XS4ALL Yakima Yobie York Yukon Zen zip zone ~

4 notes

·

View notes