#credit risk management software solutions

Explore tagged Tumblr posts

Text

How AI is Transforming Financial Decision-Making in 2025

In the ever-evolving financial landscape, 2025 marks a tipping point in how decisions are made. Artificial Intelligence (AI) is no longer a buzzword—it's a strategic asset. From banks and hedge funds to insurance and retail finance, AI is transforming the speed, accuracy, and intelligence of financial decision-making. This post explores how AI is reshaping finance in 2025 and what it means for institutions, investors, and customers alike.

📈 The Rise of AI in Financial Decision-Making

Financial decisions once relied heavily on static models, historical data, and human intuition. Today, AI introduces real-time adaptability, pattern recognition, and predictive insight.

AI technologies—particularly machine learning (ML), natural language processing (NLP), and deep learning—allow firms to process massive data sets, detect complex trends, and automate decisions faster than ever. In 2025, AI is embedded into everything from credit scoring algorithms to automated trading systems.

🔍 Key Areas Where AI is Making an Impact

🔹 Predictive Analytics and Forecasting

AI models are now used to forecast market behavior, predict client churn, and optimize pricing strategies with remarkable precision. By analyzing both structured and unstructured data (e.g., news, social sentiment), financial institutions can better anticipate risks and opportunities.

Example: Hedge funds are leveraging AI to adjust portfolios in real time based on news feeds and geopolitical trends.

🔹 Credit Risk and Underwriting

Gone are the days of static credit models. AI can analyze thousands of variables to assess a borrower’s creditworthiness, including non-traditional data like payment behavior or digital footprint. This is especially helpful in underbanked or thin-file populations.

Example: Fintech lenders use AI to underwrite loans in minutes, not days—reducing defaults while expanding access.

🔹 Investment Strategy Optimization

AI-powered robo-advisors are guiding personalized portfolio decisions using individual risk profiles and market dynamics. Meanwhile, algorithmic trading uses AI to execute split-second trades based on predictive models.

Example: Wealth management firms now use AI to rebalance portfolios dynamically based on behavioral patterns and macroeconomic signals.

🔹 Fraud Detection and Compliance

AI enables real-time monitoring of transactions to flag unusual patterns and detect fraud. In 2025, AI-driven compliance tools (RegTech) automatically adapt to new regulations, helping firms stay audit-ready.

Example: Banks use AI to flag suspicious activity within milliseconds, improving fraud prevention while reducing false positives.

✅ Benefits of AI in Finance

Speed: AI accelerates decision-making, often in real time.

Accuracy: Reduces human error and improves forecasting precision.

Cost Efficiency: Automates routine tasks and streamlines operations.

Scalability: AI systems handle growing volumes of data effortlessly.

Customer Experience: Enables personalized financial services.

⚖️ Ethical and Regulatory Considerations

While AI offers powerful capabilities, it raises questions around transparency and fairness.

Explainability: Many models are "black boxes" with unclear reasoning—leading to calls for explainable AI (XAI).

Bias: Algorithms may unintentionally reinforce discrimination if trained on biased data.

Compliance: Regulatory frameworks (like GDPR, Basel III) are evolving to address AI’s influence in finance.

Governance: Institutions must adopt responsible AI practices—balancing innovation with oversight.

🚧 Challenges to Adoption

Despite its promise, AI adoption isn’t frictionless:

Data Silos: Poor-quality or inaccessible data hampers model performance.

Legacy Infrastructure: Many firms struggle to integrate AI into outdated systems.

Skills Gap: There's high demand for data scientists and AI specialists.

Cultural Resistance: Traditional finance teams may resist automated decision-making.

🔮 The Road Ahead: AI’s Future in Financial Strategy

Looking beyond 2025, we can expect:

Autonomous Finance: Systems making low-risk decisions independently.

AI-Human Collaboration: Finance professionals augmented—not replaced—by AI insights.

AI-Driven Governance: Intelligent compliance that adapts in real time.

Hyper-Personalization: Tailored products and strategies based on behavioral data.

Those who invest in AI readiness today will lead the financial world tomorrow.

🧾 Conclusion

AI is no longer on the sidelines—it's central to the future of financial decision-making. From improving credit models to enabling predictive risk management, AI is unlocking new possibilities for speed, accuracy, and strategic agility in finance. But with great power comes great responsibility.

As AI continues to transform finance in 2025 and beyond, the winning institutions will be those that pair innovation with transparency, governance, and a deep commitment to ethical use.

#credit underwriting in banks#credit risk underwriting#credit risk management tools#credit risk management software solutions#credit risk management software for banks

0 notes

Text

Maximizing the Benefits of Credit Application Software for Your Organization

Processing credit applications used to mean shuffling through stacks of paperwork and waiting days for approvals. Today's credit application software has changed all that.

Companies that switch to modern systems often wonder how they managed without them. The transformation from manual to digital processing has revolutionized how businesses handle credit decisions.

Why Traditional Methods Don't Work Anymore

Paper forms get lost. Spreadsheets become outdated. Emails slip through the cracks. When businesses rely on old-school methods to handle credit applications, they waste time and money fixing preventable mistakes.

Manual processing simply can't keep up with today's business pace. The cost of these outdated methods goes beyond just wasted time - it affects customer relationships and bottom-line results.

The Real Cost of Slow Processing

Every day spent waiting for credit approval means another day without a sale. Customers get frustrated. Sales teams lose momentum.

Meanwhile, the competition moves faster. Credit application software helps solve these problems by cutting approval times from days to hours.

Quick turnaround times help businesses close deals while customers are still interested, rather than losing them to competitors who can move more quickly.

Missing Information Hurts Everyone

Without proper credit application software, forms often come back incomplete. Someone has to chase down missing details, make phone calls, and send follow-up emails.

This back-and-forth wastes everyone's time and delays decisions that could have been made right away. When applications are incomplete, the entire approval process grinds to a halt, creating bottlenecks that affect multiple departments.

What Actually Works Today

Getting Information Right the First Time

Modern credit application software guides customers through the process step by step. They can't skip important fields or submit incomplete information. The system flags problems immediately, not days later when someone finally reviews the paperwork.

This proactive approach prevents delays and ensures decision-makers have all the information they need right from the start.

Common application requirements include:

Business identification details

Financial statements and history

Bank references and trade references

Owner information and guarantees

Making Smart Decisions Faster

Credit managers need the right information to make good decisions. The best credit application software puts everything in one place:

Previous payment records

Current credit standing

Business history details

Reference check results

Real Benefits for Daily Operations

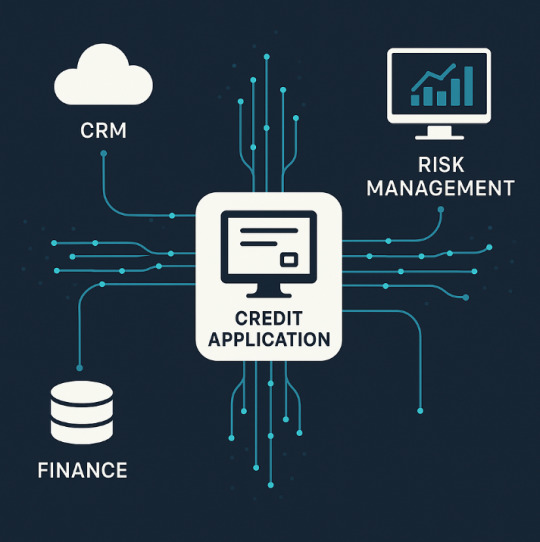

Keeping Everything Connected

Nobody wants to type the same information twice. Good credit application software connects with other business systems.

Data flows automatically between departments. This means less copying and pasting, fewer errors, and more time for actual work.

When systems talk to each other properly, the whole organization runs more smoothly. Staff members can focus on analyzing applications rather than just moving data around.

Finding Problems Early

When something looks wrong on a credit application, people need to know right away. Modern software spots potential issues before they become real problems.

Credit managers can focus their attention where it matters most instead of reviewing every detail manually. The software can compare application details against known risk factors and flag applications that need extra scrutiny.

Making the Switch Successfully

Getting Started Right

Moving to new credit application software takes planning. Start with one department or customer group. Work out any problems. Then expand gradually. This approach helps everyone adjust without disrupting the whole business at once.

Small successes build confidence and make the wider rollout smoother. Testing with a smaller group also helps identify potential problems before they affect the entire organization.

Training That Works

People learn new systems better when they understand the benefits. Show teams how credit application software makes their jobs easier. Focus on real examples from their daily work. Let them practice with the system before using it with real customers.

Hands-on experience builds confidence and reduces resistance to change. Regular follow-up sessions help reinforce good practices and address any questions that come up during daily use.

Keeping Everything Secure

Credit applications contain sensitive information. Good software protects this data without making it hard to access. Strong security should work in the background while people focus on their jobs.

Modern encryption and access controls protect sensitive data from unauthorized access while still allowing legitimate users to work efficiently.

Following the Rules

Every industry has regulations about handling credit information. Credit application software should help companies follow these rules automatically.

Regular updates keep the system current as requirements change. The software should maintain detailed audit trails and help prepare required compliance reports without extra work from staff.

Looking at Results

After implementing credit application software, companies often notice:

Faster application processing

Fewer errors and missed details

Better customer satisfaction

More consistent credit decisions

These improvements come from both better technology and smoother workflows. When everyone follows the same process and has access to the same information, decisions become more consistent and reliable.

Making Smart Choices

Understanding True Costs

Price matters when choosing credit application software. But the cheapest option rarely saves money in the long run. Consider setup costs, training time, and ongoing support. Good software pays for itself through better efficiency and fewer mistakes.

Look beyond the monthly subscription fee to understand the total cost of ownership, including implementation, training, and maintenance.

The Path Forward

Credit applications drive business growth. The right software makes this process smooth and reliable. Take time to find a system that truly fits your organization's needs. Focus on features that solve real problems instead of fancy add-ons that nobody uses.

When companies choose carefully, credit application software becomes a valuable tool that helps the whole business work better. The investment in proper tools pays off through improved efficiency, better customer relationships, and stronger credit decisions.

#Credit Application Software#business efficiency#credit management system#Credit Management#Financial Software Solutions#Credit Risk Management

0 notes

Text

Supply Chain Risk: Navigating Disruptions with Smart Risk Management

In today's globalized economy, supply chain risk is a critical concern for businesses of all sizes. Disruptions, whether caused by natural disasters, geopolitical tensions, supplier failures, or economic shifts, can severely impact an organization's ability to meet customer demands and maintain profitability. As a result, managing supply chain risk has become essential for business continuity and long-term success.

What is Supply Chain Risk?

Supply chain risk refers to any threat that could disrupt the smooth flow of goods, services, or information along the supply chain. These risks can come from external factors such as natural disasters, political instability, and regulatory changes, or from internal factors such as poor vendor performance, data breaches, or logistics failures. With supply chains becoming increasingly complex and interconnected, businesses must actively manage these risks to ensure their operations remain resilient.

Managing Supply Chain Risk

The key to managing supply chain risk is identifying and assessing potential threats. Businesses can leverage advanced supply chain risk management software solutions, such as those provided by Cedar Rose, to gain insights into their suppliers’ financial health, reliability, and compliance status. By using such tools, companies can predict potential risks and take preemptive actions, whether it’s diversifying suppliers, enhancing inventory management, or implementing contingency plans.

Credit Risk Management: Safeguarding Financial Stability

Credit risk management is a vital component of any organization's financial strategy. It refers to the process of identifying, assessing, and mitigating the risk that a borrower or counterparty may default on a financial obligation. For businesses, this could mean unpaid invoices, late payments, or insolvency of customers or suppliers, leading to cash flow issues and financial strain.

The Importance of Credit Risk Management

Effective credit risk management ensures that businesses make informed lending and credit decisions. By assessing the creditworthiness of customers, suppliers, and partners, businesses can minimize the risk of defaults and bad debt. Tools like CRIS Intelligence offered by Cedar Rose can help businesses assess the credit risk associated with various partners, ensuring they avoid entering into high-risk financial relationships that could jeopardize their operations.

Credit risk management involves setting credit limits, monitoring customer payment behavior, and regularly reviewing credit policies. By keeping a close eye on the financial health of key stakeholders, businesses can reduce the risk of payment defaults, ensuring more stable cash flow and long-term growth.

Compliance Software Solutions: Ensuring Regulatory Adherence

In an era of increasing regulations, compliance is a top priority for businesses across industries. Compliance software solutions provide organizations with the tools needed to track and adhere to various regulations, from financial reporting to data protection and environmental laws. These software solutions simplify the complexity of compliance, reducing the risk of non-compliance and the associated legal and financial penalties.

Why Compliance Software Matters

Organizations need to stay up to date with evolving laws and regulations to avoid hefty fines, reputational damage, and legal complications. Compliance software automates the process of monitoring regulatory changes, ensuring businesses are always aligned with the latest legal requirements. With comprehensive software solutions from Cedar Rose, businesses can streamline compliance processes, reduce human error, and maintain an audit trail for transparency and accountability.

Credit Risk Assessment: Assessing Risk for Better Decision-Making

Credit risk assessment is the process of evaluating the likelihood that a borrower or customer will default on their financial obligations. This is essential for businesses that provide credit terms to customers, as it helps determine whether extending credit is a safe and profitable decision. A strong credit risk assessment process combines both qualitative and quantitative factors to evaluate a customer's financial health.

Key Elements of Credit Risk Assessment

Financial Health Analysis: Reviewing a customer’s financial statements, including income, balance sheet, and cash flow statements, is essential for understanding their ability to meet financial obligations.

Credit History: Assessing the borrower’s previous credit behavior and payment history helps determine whether they are likely to default on future payments.

Industry and Market Risk: Understanding the economic climate and industry-specific risks helps assess how external factors may impact a customer’s ability to pay.

With the help of CRIS Intelligence from Cedar Rose, businesses can access real-time data to perform more accurate and timely credit assessments, reducing the likelihood of entering into risky financial agreements.

Business Intelligence: Turning Data Into Strategic Insights

Business intelligence (BI) refers to the technologies, processes, and tools that help businesses collect, analyze, and visualize data to make informed decisions. By leveraging business intelligence, organizations can gain a competitive edge, improve operational efficiency, and drive growth.

Why Business Intelligence is Essential

Business intelligence allows organizations to analyze vast amounts of data from multiple sources, uncovering patterns, trends, and insights that would otherwise remain hidden. In the context of risk management, BI tools enable businesses to monitor market conditions, assess potential risks, and make data-driven decisions that mitigate threats. For example, by using business intelligence to track supply chain performance, businesses can proactively address issues like delays, quality control, and supplier reliability.

BI tools can also help improve financial decision-making by providing insights into customer behavior, sales trends, and market demands. With Cedar Rose’s integrated solutions, businesses can leverage powerful BI tools to assess risks, optimize operations, and ensure better financial stability.

Conclusion

In today’s volatile business environment, managing risks—whether in supply chains, credit assessments, or compliance—is crucial for long-term success. By leveraging advanced risk management software and business intelligence solutions, businesses can make more informed decisions, safeguard their assets, and minimize potential disruptions. Whether you're assessing credit risk, optimizing supply chain performance, or ensuring compliance with the latest regulations, Cedar Rose provides the tools and insights you need to manage risk effectively.

For more information on how Cedar Rose can help your business navigate risk and enhance its financial performance, visit www.cedar-rose.com and explore our comprehensive solutions, including CRIS Intelligence for smarter decision-making.

#Supply Chain Risk#Credit Risk Management#Compliance Software Solutions#Credit Risk Assessment#Business Intelligence

0 notes

Text

Data Intelligence

Unlock business insights with Cedar Rose's advanced data intelligence. Leverage comprehensive analytics for strategic advantage.

#Data Intelligence#Data solutions#Proprietary corporate data#Corporate intelligence#Risk Management Process#Credit Risk Management#Risk Management Software

0 notes

Text

Strengthening Microfinance Institutions Through Effective Training of Staff

The success of microfinance hinges on people, making the training of staff in microfinance sector one of the most strategic areas of investment. Microfinance institutions (MFIs) serve millions of financially excluded individuals, and the quality of service they deliver depends largely on the skills and knowledge of their staff. Whether dealing with small entrepreneurs, farmers, or women-led households, trained personnel are key to enabling financial inclusion, maintaining client trust, and ensuring long-term sustainability.

Why Training is Crucial in Microfinance

MFIs operate in diverse, often underserved areas, where staff are expected to educate, guide, and support clients through their financial journeys. Training ensures that they are equipped to handle this responsibility. Here’s why training matters:

Service Quality Improvement: Well-trained staff enhance client experiences by providing accurate information and empathetic support.

Credit Risk Management: Proper training in loan appraisal techniques helps reduce defaults and improves portfolio quality.

Technology Adaptation: Staff learn to use digital tools and software for faster, error-free operations.

Legal Compliance: Understanding the regulatory environment reduces risks of non-compliance.

Field Confidence: Trained employees are more confident and consistent in their approach, especially in rural outreach.

What Should Microfinance Staff Training Include?

A strong training framework covers not just technical skills but also interpersonal and ethical dimensions. Essential training topics include:

Loan Product Education: Understanding features, eligibility, interest structures, and repayment norms.

Client Communication: Teaching staff to listen actively, explain terms clearly, and maintain respectful client interactions.

Collections & Recovery: Managing follow-ups and guiding borrowers in repayment without coercion.

MIS and Digital Reporting Tools: Familiarity with software used for customer onboarding, data entry, and reporting.

Responsible Lending: Promoting ethical behavior and ensuring clients are not overburdened with loans.

Barriers to Training in the Microfinance Sector

Despite its importance, the implementation of training faces several hurdles:

Budgetary Constraints: Especially for smaller MFIs with limited resources.

Geographical Spread: Branches in remote areas are harder to reach with in-person sessions.

Language Diversity: Training material must be customized to suit regional dialects and literacy levels.

High Staff Turnover: Leads to frequent onboarding needs and training repetition.

Solutions include investing in mobile-based learning, multilingual video content, and local facilitators who understand regional contexts.

FAQs – Training of Staff in Microfinance Sector

Q1. How does training impact microfinance performance? It improves client satisfaction, reduces defaults, ensures compliance, and boosts employee retention.

Q2. What are cost-effective training methods? E-learning modules, mobile training apps, and peer-to-peer learning help cut costs without compromising quality.

Q3. Should training be one-time or ongoing? Training should be continuous, with regular refreshers and updates as policies or products change.

Q4. How do MFIs manage training across remote branches? They use a combination of digital training platforms and local trainers to ensure accessibility.

Conclusion

In the rapidly expanding world of financial inclusion, training of staff in microfinance sector is a powerful enabler of efficiency, ethics, and growth. Institutions that prioritize learning empower their employees to make smarter decisions, reduce risk, and build lasting relationships with clients. As the microfinance industry continues to scale and digitize, a trained and agile workforce will be the cornerstone of its success.

#Training of staff in microfinance sector#Microfinance employee training#Microfinance staff development#Financial inclusion training#Microfinance institutions India

2 notes

·

View notes

Text

What Are the Benefits of Adopting Latest Fintech Technologies?

The financial industry is witnessing a rapid transformation driven by the adoption of the latest fintech technologies. These technologies are revolutionizing how financial services are delivered, enhancing efficiency, improving security, and fostering innovation across banks, insurance companies, investment firms, and payment platforms. By integrating advanced fintech software into their operations, businesses are unlocking numerous benefits that enable them to stay competitive in an increasingly digital world. In this article, we will explore the key advantages of adopting the latest fintech technologies and how they are reshaping the financial landscape.

1. Enhanced Efficiency and Automation

One of the primary benefits of adopting the latest fintech technologies is the significant boost in efficiency. Traditional financial systems often rely on manual processes, which can be time-consuming, prone to errors, and costly. With the integration of fintech software solutions, businesses can automate a wide range of processes, from payment processing to data analysis.

For example, AI-powered algorithms can automate tasks like credit scoring, fraud detection, and risk assessment, enabling financial institutions to make faster and more accurate decisions. Additionally, blockchain technology enables automated, transparent transactions, reducing the need for intermediaries and speeding up processes like cross-border payments. The efficiency gained through automation allows businesses to handle a larger volume of transactions and deliver services more swiftly, benefiting both the institutions and their customers.

2. Improved Customer Experience

The latest fintech technologies also play a crucial role in enhancing customer experiences. Consumers today demand convenience, speed, and personalized services. Fintech software solutions enable businesses to meet these demands by offering innovative and user-friendly platforms for managing finances.

Digital wallets, mobile banking apps, and AI-powered chatbots are just a few examples of how fintech technologies are transforming customer interactions. Mobile payment systems like Apple Pay and Google Pay allow users to make secure transactions with just a tap of their phone, while robo-advisors provide tailored financial advice based on individual needs. AI-driven chatbots can respond to customer inquiries instantly, providing 24/7 support and delivering personalized responses. These innovations make financial services more accessible, faster, and tailored to the unique needs of each customer.

Additionally, by leveraging the latest fintech technologies, businesses can offer cross-channel experiences, where customers can seamlessly transition between online platforms, mobile apps, and physical locations without interruption. This level of convenience significantly improves customer satisfaction and loyalty.

3. Cost Savings and Reduced Operational Expenses

Adopting fintech technologies can result in significant cost savings for businesses. Traditional banking systems often involve high overhead costs related to maintaining physical branches, processing manual transactions, and managing large teams. By embracing fintech software, financial institutions can streamline their operations, reducing the need for human intervention in routine tasks.

For example, cloud computing solutions allow businesses to store and process large amounts of data without the need for expensive in-house infrastructure. This can lead to significant savings in terms of hardware and maintenance costs. Additionally, automated systems for customer service, fraud detection, and compliance reduce the reliance on human resources, leading to further cost reductions.

For small businesses and startups, fintech solutions offer an affordable way to access sophisticated financial tools that were previously out of reach. Cloud-based accounting, invoicing, and payment solutions enable these companies to operate more efficiently without the need for large investments in infrastructure or personnel.

4. Improved Security and Fraud Prevention

As the financial industry becomes more digital, security has become a top priority. The latest fintech technologies offer advanced security features that help protect businesses and their customers from cyber threats and fraud. Blockchain technology, for example, provides a decentralized and immutable ledger, ensuring the integrity and transparency of transactions. This makes it nearly impossible for malicious actors to alter or tamper with transaction records, reducing the risk of fraud.

Additionally, fintech software solutions integrate cutting-edge encryption methods and biometric authentication, such as facial recognition and fingerprint scanning, to safeguard sensitive data. AI-powered fraud detection systems can monitor transactions in real-time, flagging suspicious activities and preventing fraudulent transactions before they occur. These security measures help businesses build trust with their customers and ensure that sensitive financial information is protected.

By adopting the latest fintech technologies, financial institutions can also ensure compliance with stringent data protection regulations, such as the GDPR (General Data Protection Regulation), further reducing the risk of penalties and reputational damage.

5. Greater Accessibility and Financial Inclusion

Fintech technologies are making financial services more accessible to underserved and unbanked populations around the world. In developing regions, where access to traditional banking services may be limited, mobile phones and fintech apps are enabling individuals to manage their finances, make payments, and even access credit.

Digital wallets and mobile banking apps allow users to store, send, and receive money without the need for a physical bank account. Peer-to-peer (P2P) lending platforms are helping individuals and small businesses access credit that they might otherwise not be able to obtain from traditional banks. Additionally, fintech software solutions are allowing micro-lending institutions to assess creditworthiness more accurately using alternative data, such as mobile usage and payment history, making it easier for individuals without formal credit histories to secure loans.

By adopting fintech technologies, businesses can contribute to financial inclusion, helping to bridge the gap between the banked and unbanked populations and enabling more people to participate in the global economy.

6. Better Decision-Making and Data Analytics

Data is at the heart of fintech innovation. The latest fintech technologies, such as AI and big data analytics, enable businesses to gather, process, and analyze vast amounts of information in real-time. This allows financial institutions to make data-driven decisions, improve risk management, and offer more personalized services to their customers.

For example, AI algorithms can analyze a customer's spending habits, credit history, and financial goals to offer personalized financial advice and recommend investment opportunities. Similarly, advanced analytics tools can identify emerging trends in the market, allowing businesses to adjust their strategies accordingly. The ability to harness the power of data leads to more informed decision-making and better outcomes for both businesses and their customers.

7. Scalability and Flexibility

Fintech software solutions offer unmatched scalability, allowing businesses to grow without the constraints of traditional systems. Whether it’s increasing transaction volumes, expanding to new markets, or offering additional services, fintech technologies can easily adapt to changing business needs. Cloud-based platforms, for instance, allow businesses to scale up or down quickly without incurring significant costs or requiring significant infrastructure investments.

Xettle Technologies, for example, provides scalable fintech solutions that help businesses manage their growth seamlessly, offering flexibility and adaptability in a fast-evolving digital landscape.

Conclusion

The adoption of the latest fintech technologies offers a wide range of benefits for businesses in the financial sector. From enhanced efficiency and automation to improved customer experiences, cost savings, and better security, fintech solutions are revolutionizing the way financial services are delivered. By embracing these innovations, businesses can stay competitive, drive growth, and provide more personalized and accessible services to their customers. The future of finance is digital, and those who adopt the latest fintech technologies today will be better equipped to succeed in tomorrow’s rapidly evolving market.

3 notes

·

View notes

Text

Tax planning is evolving. Is Your Firm Evolving with It?

With a US tax code that is nearly 7,000 pages long and equally complex, individuals and business owners are looking to their CPAs and tax accountants for strategic tax planning. There is a lot of buzz currently in the profession around tax planning and new technology and tools that are emerging to create efficiency in the tax planning process.

So, what are some of the current trends and tools for tax planning? And why is tax planning something firms should be focused on delivering?

Let’s start with the ‘why’

It’s no secret that tax preparation alone has become a commodity. Compliance is required, but the real value is in the strategy to apply the tax code in the most tax-efficient way for the client.

Clients aren’t just looking for someone to file their returns; they’re looking for someone to help them plan. Someone who understands their long-term goals, anticipates risks, and adds strategic insight.

Firms that remain trapped in a reactive model risk falling behind — both in profitability and relevance. Shifting to an advisory model isn’t a luxury anymore; it’s a necessity for sustainable growth, client satisfaction, and even the mental wellness of firm owners.

CPAs and tax professionals are in an ideal position to apply their expertise and impact their clients’ financial situation significantly. When higher value is delivered, fees become an investment rather than an expense.

Current Trends in Tax Planning

01. Automation

Automation is no longer optional, but it is a core part of modern tax preparation services. Firms are increasingly turning to AI-powered tax planning software and cloud-based solutions to streamline processes, improve accuracy, and deliver faster results. Tools like Intuit ProConnect and Bloomberg BNA Tax Planner are helping tax consultants work smarter, offering clients more personalized and data-driven tax return help.

Unison Globus leverages automation to deliver cost-effective, precise, and strategic tax solutions for CPAs and accounting firms. Their outsourced tax preparation services are designed to enhance operational efficiency and reduce compliance burdens

02. Cryptocurrency and Taxation

Cryptocurrencies have moved from the margins to the mainstream. The IRS treats digital assets like property, which means every sale, exchange, or transaction could trigger a taxable event. Understanding how to navigate cryptocurrency taxation is no longer just a value-add; it is becoming essential. Your firm must stay informed about changing regulations and reporting requirements to help clients manage their tax liability effectively.

03. Environmental Taxes and Incentives

Sustainability initiatives are influencing tax strategies more than ever before. Businesses investing in energy efficiency, clean technologies, or sustainable practices can often benefit from valuable tax deductions and credits. As a trusted tax accountant or consultant, you have the opportunity to guide clients in leveraging environmental tax incentives to both save money and promote their corporate social responsibility goals.

Regulatory Updates and Compliance

01. Recent Tax Law Changes

The 2024–2025 tax years have brought notable changes. Adjustments to federal tax brackets, increases to the standard deduction, and enhancements to key tax credits like the Child Tax Credit and energy efficiency incentives are reshaping tax planning strategies.

02. International Tax Compliance

Global business operations mean that firms must also navigate complex international tax laws. The OECD’s global minimum tax initiative and expanded foreign reporting requirements are changing the compliance landscape. Firms need to be prepared to assist clients with cross-border tax filing, ensuring they meet their obligations while minimizing risks. Our expat tax services include expertise in Forms 2555, 5471, 5472, FBAR filing, and IRS amnesty programs — ensuring full compliance for clients with international obligations

Best Practices for Modern Tax Planning

01. Tax Efficiency

To build a good tax plan, you must know what your clients’ goals are. Sometimes, a client’s goal is to simply minimize their tax liability. But not always. Sometimes, paying more now to gain much more later is a better strategy. For example, a business owner planning to sell their company in the next 1-2 years may be advised to not aggressively minimize the tax liability, show strong earnings, and get the highest possible valuation. There is real value in understanding and applying the tax code strategically to help a client reach his or her goals. And there are real consequences in the form of missed wealth accumulation or opportunity when business owners and individuals don’t plan looking forward.

02. Proactive Tax Strategies

Tax planning is no longer a reactive exercise. Techniques such as tax-loss harvesting, maximizing contributions to retirement accounts, optimizing charitable giving, and leveraging tax-advantaged investment vehicles should be discussed with clients throughout the year. By offering proactive strategies, you can help clients reduce their tax liability and strengthen their financial position well before filing season begins. Our tax planning services are designed to be forward-looking and proactive, helping firms identify opportunities for tax savings throughout the year — not just at year-end.

03. Client Education and Communication

Strong communication builds strong client relationships. Educating clients about changing regulations, available tax credits, and smart planning opportunities demonstrates your value beyond basic tax filing assistance. Regular updates, client webinars, and customized tax planning reviews foster trust, build authority, and ensure your clients remain engaged and informed. Unison globus support firms with customized client communication strategies, including white-labeled reports and educational content that enhances client engagement and retention.

Leveraging Technology for Efficiency

Tax Planning Software

As firms move toward a more advisory-focused model, the tools you use matter more than ever. As established earlier, modern tax planning software isn’t just about saving time — it’s about unlocking smarter, forward-looking strategies for your clients. Platforms like Bloomberg BNA, Drake Tax, TaxPlanIQ, and Corvee offer more than calculations. They let you model different scenarios, forecast multiple years, and even visualize the tax impact of decisions before they’re made. Want to help a client decide between taking a bonus or reinvesting in their business? Now you can show them the numbers in real time. These tools don’t just reduce errors; they elevate your role from tax preparer to strategic partner. The key is choosing a platform that aligns with how your firm delivers value, supports collaboration, and keeps you a step ahead of client expectations.

Bottom line: With the right software, you’re not just getting more efficient you’re helping clients make better decisions and building the kind of trust that drives long-term relationships.

Future-Proofing Your Firm

01. Continuous Learning and Development

In this ever-changing tax environment, continuous professional development is essential. Encouraging your team to pursue certifications, attend industry conferences, and participate in IRS webinars will ensure that your firm remains competitive when it comes to your tax planning services offer. We invest in ongoing training and upskilling of their offshore staff, ensuring they stay current with U.S. tax laws and best practices.

02. Adapting to Client Needs

Today’s clients value convenience and personalized service. Virtual consultations, customized tax plans, and flexible communication channels are no longer “nice-to-haves”; they are expectations. Adapting your service model to meet these evolving demands will not only retain existing clients but also attract new ones looking for a forward-thinking tax partner.

03. But, What About the Sheer Volume of Compliance Work?

The profession has been talking about a shift from compliance to advisory for years. So, why has it been so difficult to implement in many firms? Quite simply, time and resources. The volume of compliance work is daunting. So, how to accountants remove themselves from compliance work but still be assured of the quality and accuracy that is critical? At Unison Globus, we specialize in delivering modern tax preparation and review services designed to help CPA firms, EAs, and accounting businesses focus on high-value advisory services. We are leading the new era of outsourcing, and we call it Offshore Staffing 2.0. Our team of highly educated and experienced CPAs and accountants gets it right the first time and is proficient with your tech stack. Don’t have your processes or SOPs documented? We can help with that as your strategic capacity partner.

Final Thoughts

Tax planning is evolving at a pace we have never seen before. Firms that continue to operate with outdated practices will likely fall behind. Embracing automation, staying current on regulatory changes, offering proactive tax strategies, and prioritizing client education are no longer optional they are the foundation of sustainable success.

And managing the massive volume of compliance work doesn’t have to be the roadblock. With a strategic capacity partner that you can trust and rely on, you can focus on the client advisory work you love.

This blog was originally posted here: https://unisonglobus.com/tax-planning-is-evolving-is-your-firm-evolving-with-it/

#tax planning strategies#tax advisor#tax services#unison globus#tax preparation#tax preparation services#tax accountant#accounting services#outsourced accounting services#tax season#tax filing#modern tax planning for CPAs#tax advisory services#tax planning for accountants

1 note

·

View note

Text

With Innrly | Streamline Your Hospitality Operations

Manage all your hotels from anywhere | Transformation without transition

Managing a hotel or a multi-brand portfolio can be overwhelming, especially when juggling multiple systems, reports, and data sources. INNRLY, a cutting-edge hotel management software, revolutionizes the way hospitality businesses operate by delivering intelligent insights and simplifying workflows—all without the need for system changes or upgrades. Designed for seamless integration and powerful automation, INNRLY empowers hotel owners and managers to make data-driven decisions and enhance operational efficiency.

Revolutionizing Hotel Management

In the fast-paced world of hospitality, efficiency is the cornerstone of success. INNRLY’s cloud-based platform offers a brand-neutral, user-friendly interface that consolidates critical business data across all your properties. Whether you manage a single boutique hotel or a portfolio of properties spanning different regions, INNRLY provides an all-in-one solution for optimizing performance and boosting productivity.

One Dashboard for All Your Properties:

Say goodbye to fragmented data and manual processes. INNRLY enables you to monitor your entire portfolio from a single dashboard, providing instant access to key metrics like revenue, occupancy, labor costs, and guest satisfaction. With this unified view, hotel managers can make informed decisions in real time.

Customizable and Scalable Solutions:

No two hospitality businesses are alike, and INNRLY understands that. Its customizable features adapt to your unique needs, whether you're running a small chain or managing an extensive enterprise. INNRLY grows with your business, ensuring that your operations remain efficient and effective.

Seamless Integration for Effortless Operations:

One of INNRLY’s standout features is its ability to integrate seamlessly with your existing systems. Whether it's your property management system (PMS), accounting software, payroll/labor management tools, or even guest feedback platforms, INNRLY pulls data together effortlessly, eliminating the need for system overhauls.

Automated Night Audits:

Tired of labor-intensive night audits? INNRLY’s Night Audit+ automates this crucial process, providing detailed reports that are automatically synced with your accounting software. It identifies issues such as declined credit cards or high balances, ensuring no problem goes unnoticed.

A/R and A/P Optimization:

Streamline your accounts receivable (A/R) and accounts payable (A/P) processes to improve cash flow and avoid costly mistakes. INNRLY’s automation reduces manual entry, speeding up credit cycles and ensuring accurate payments.

Labor and Cost Management:

With INNRLY, you can pinpoint inefficiencies, monitor labor hours, and reduce costs. Detailed insights into overtime risks, housekeeping minutes per room (MPR), and other labor metrics help you manage staff productivity effectively.

Empowering Data-Driven Decisions:

INNRLY simplifies decision-making by surfacing actionable insights through its robust reporting and analytics tools.

Comprehensive Reporting:

Access reports on your schedule, from detailed night audit summaries to trial balances and franchise billing reconciliations. Consolidated data across multiple properties allows for easy performance comparisons and trend analysis.

Benchmarking for Success:

Compare your properties' performance against industry standards or other hotels in your portfolio. Metrics such as ADR (Average Daily Rate), RevPAR (Revenue Per Available Room), and occupancy rates are presented in an easy-to-understand format, empowering you to identify strengths and areas for improvement.

Guest Satisfaction Insights:

INNRLY compiles guest feedback and satisfaction scores, enabling you to take prompt action to enhance the guest experience. Happy guests lead to better reviews and increased bookings, driving long-term success.

Key Benefits of INNRLY

Single Login, Full Control: Manage all properties with one login, saving time and reducing complexity.

Error-Free Automation: Eliminate manual data entry, reducing errors and increasing productivity.

Cost Savings: Pinpoint problem areas to reduce labor costs and optimize spending.

Enhanced Accountability: Hold each property accountable for issues flagged by INNRLY’s tools, supported by an optional Cash Flow Protection Team at the enterprise level.

Data Security: Protect your credentials and data while maintaining your existing systems.

Transforming Hospitality Without Transition

INNRLY’s philosophy is simple: transformation without transition. You don’t need to replace or upgrade your existing systems to benefit from INNRLY. The software integrates effortlessly into your current setup, allowing you to focus on what matters most—delivering exceptional guest experiences and achieving your business goals.

Who Can Benefit from INNRLY?

Hotel Owners:

For owners managing multiple properties, INNRLY offers a centralized platform to monitor performance, identify inefficiencies, and maximize profitability.

General Managers:

Simplify day-to-day operations with automated processes and real-time insights, freeing up time to focus on strategic initiatives.

Accounting Teams:

INNRLY ensures accurate financial reporting by syncing data across systems, reducing errors, and streamlining reconciliation processes.

Multi-Brand Portfolios:

For operators managing properties across different brands, INNRLY’s brand-neutral platform consolidates data, making it easy to compare and optimize performance.

Contact INNRLY Today

Ready to revolutionize your hotel management? Join the growing number of hospitality businesses transforming their operations with INNRLY.

Website: www.innrly.com

Email: [email protected]

Phone: 833-311-0777

#Innrly#Innrly Hotel Management Software#Bank Integrations in Hospitality Software#Tracking Hotel Compliance#hotel performance software#hotel portfolio software#Hotel Performance Management Software#hotel reconciliation software#Hotel Data Entry Software#accounting software hotels#hotel banking software#hospitality automated accounting software#hotel automation software hotel bookkeeping software#back office hotel accounting software#hospitality back office software#accounting hospitality software#Hotel Management Accounting Software#Hotel Accounting Software#Hospitality Accounting Software#Accounting Software for Hotels#Hotel Budgeting Software#Automate Night Audit Software#Automate Night Audit Process#Best Hotel Accounting Software#Best Accounting Software For Hotels#Financial & Hotel Accounting Software#Hospitality Accounting Solutions

2 notes

·

View notes

Text

Loan Servicing: Simplify and Automate Your Lending Operations

Loan servicing is the backbone of any successful lending operation. It ensures loans are properly managed from origination through repayment, protecting both lenders and investors while delivering a seamless borrower experience.

Effective loan servicing involves more than just collecting payments. It requires monitoring covenants, managing escrow accounts, handling borrower inquiries, and ensuring compliance with regulatory requirements. When done manually, loan servicing becomes time-consuming and error-prone—causing delays and increasing operational risk.

That’s where technology steps in to transform the entire process. At the core of modern lending success is loan servicing software that automates workflows, improves data accuracy, and delivers real-time insights. Whether you’re managing private credit, commercial real estate loans, or structured finance products, a robust servicing platform is essential.

Right in the middle of loan servicing complexities, Oxane Partners offers a smart, technology-driven solution designed to make servicing more efficient, accurate, and scalable. Our platform automates key tasks, monitors portfolio health, and provides advanced reporting to ensure you’re always in control.

Imagine managing thousands of loans effortlessly with a single platform that tracks payments, manages risks, and keeps you audit-ready—while freeing up your team to focus on growth. That’s the power of modern loan servicing technology.

If you're ready to simplify your lending operations and maximize efficiency, get in touch with Oxane Partners today. Let us show you how our loan servicing solutions can transform your lending business.

1 note

·

View note

Text

Why Credit Risk Tools Are Critical in a Volatile Economy: A Guide for Fintech Startups

In a world where economies swing unpredictably—from rising interest rates to inflation shocks and global conflict—credit risk is no longer just a back-office function. For fintech startups, it’s mission-critical.

As consumer behaviors shift and lending becomes riskier, the ability to accurately assess and manage credit risk in real time can mean the difference between scaling your product or stalling out. That’s where credit risk tools come in.

What Is Economic Volatility—And Why Should You Care?

A volatile economy is marked by rapid, unpredictable changes in financial markets. Think:

Inflation spikes

Bank collapses

Recession threats

Supply chain breakdowns

For fintech lenders, this translates into higher default risk, inconsistent repayment behaviors, and tighter capital.

Enter Credit Risk Tools

Credit risk tools help startups analyze the likelihood that a borrower will default. These tools range from traditional scorecards and rules engines to AI-powered predictive models and real-time APIs.

They allow you to:

Score borrowers dynamically

Automate approvals or rejections

Predict portfolio behavior under stress

Remain compliant with regulations (like IFRS 9, Basel III, etc.)

Why These Tools Matter Now More Than Ever

In volatile times, static underwriting doesn’t cut it. Here’s why fintechs are doubling down on smart credit risk tech:

1. Real-Time Risk Monitoring

Markets shift overnight. Credit risk tools let you adapt instantly—re-pricing, pausing certain loan types, or tightening credit policy.

2. Smarter Lending Decisions

With ML models and alternative data (bank transactions, income patterns, etc.), you make decisions based on real behavior, not just a traditional credit score.

3. Fraud Detection

Automation combined with anomaly detection helps catch fraudulent applications faster.

4. Compliance at Scale

Digital lenders still need to satisfy regulators. Credit risk tools help generate audit-ready reports, stress test portfolios, and meet capital adequacy rules.

Real-World Example: How Startups Are Adapting

Take a BNPL startup hit by rising defaults in 2023. By integrating a credit decisioning engine with real-time income verification and behavioral scoring, they reduced default rates by 27%—without slowing down approval times.

Another digital lender began using dynamic risk-based pricing during interest rate hikes, keeping their loss rate steady while competitors struggled.

Choosing the Right Tool for Your Fintech

When selecting a credit risk solution, consider:

🔄 Real-time data integration

📈 Scalability as volume grows

🧠 Machine learning capabilities

📊 Custom dashboards & rule logic

🛡️ Built-in compliance & reporting tools

Conclusion

For fintech startups operating in fast-moving markets, credit risk isn’t just a metric—it’s your moat.

By investing in the right tools now, you not only protect your business during downturns—you position it to scale confidently when the economy rebounds.

0 notes

Text

Hassle-Free GST Return Filing Services in Delhi by SC Bhagat & Co.

Introduction: Navigating the complexities of Goods and Services Tax (GST) return filing can be daunting for businesses. To ensure compliance and avoid penalties, it's crucial to have a reliable partner who can manage your GST returns efficiently. SC Bhagat & Co. offers top-notch GST return filing services in Delhi, helping businesses streamline their tax processes and stay compliant with the latest regulations. In this blog, we'll explore the importance of GST return filing, the services provided by SC Bhagat & Co., and why they are the best choice for your business in Delhi. Why GST Return Filing is Important GST return filing is a mandatory requirement for businesses registered under the GST regime in India. Regular and accurate filing of GST returns is essential for several reasons: Compliance: Ensures adherence to tax laws and regulations, avoiding legal issues and penalties. Input Tax Credit (ITC): Facilitates the claim of ITC, which helps reduce the overall tax liability. Business Credibility: Enhances the credibility and trustworthiness of your business among clients and stakeholders. Avoid Penalties: Prevents hefty fines and interest charges that result from late or incorrect filing. Comprehensive GST Return Filing Services by SC Bhagat & Co. SC Bhagat & Co. provides a full range of GST return filing services in Delhi, tailored to meet the unique needs of your business. Here’s what you can expect: 1. Accurate GST Return Preparation Our experienced professionals ensure that your GST returns are prepared accurately, reflecting all transactions and complying with the latest GST laws. We handle all types of GST returns, including GSTR-1, GSTR-3B, GSTR-9, and more. 2. Timely Filing Timely filing is crucial to avoid penalties and interest charges. SC Bhagat & Co. guarantees prompt filing of your GST returns, keeping track of all deadlines and ensuring that you never miss a due date. 3. Error-Free Data Management We meticulously review all your financial data to ensure that your GST returns are error-free. Our team double-checks every detail, reducing the risk of discrepancies and ensuring smooth processing. 4. ITC Reconciliation Our experts assist in reconciling your Input Tax Credit (ITC) to ensure you claim the correct amount, maximizing your tax benefits and minimizing liabilities. 5. Regular Updates and Compliance GST laws and regulations are subject to frequent changes. SC Bhagat & Co. stays updated with the latest amendments and ensures that your GST returns comply with the current rules and guidelines. 6. Personalized Support We provide personalized support to address any queries or issues you may have regarding GST return filing. Our team is always available to assist you with expert advice and solutions. Why Choose SC Bhagat & Co. for GST Return Filing Services in Delhi Expertise and Experience With years of experience in tax consulting, SC Bhagat & Co. has a deep understanding of GST regulations and filing procedures. Our expertise ensures that your GST returns are handled professionally and accurately. Client-Centric Approach We prioritize our clients' needs and provide tailored solutions to meet their specific requirements. Our client-centric approach ensures that you receive the best possible service and support. Advanced Technology SC Bhagat & Co. leverages advanced technology and software to streamline the GST return filing process. Our tech-driven approach enhances efficiency and accuracy, saving you time and effort. Proven Track Record Our proven track record of successful GST return filings speaks for itself.

2 notes

·

View notes

Text

Understanding the Risk Management Process and the Importance of Risk Management Software and Solutio

Risk management is a crucial aspect of any business or organization. It ensures that potential risks, whether they are financial, operational, or reputational, are properly identified, assessed, and mitigated. Businesses are increasingly relying on advanced risk management software and solutions to help them manage these risks in a more effective and efficient manner. In this blog post, we’ll delve into the risk management process, the importance of credit risk management, and how modern risk management software and solutions can streamline the entire process.

What is Risk Management?

Risk management is the practice of identifying, assessing, and controlling risks that could potentially harm a business or an organization. It involves recognizing potential threats, understanding the impact they may have, and then taking proactive steps to prevent or mitigate these risks.

The goal of risk management is to protect the organization from the adverse effects of risks while ensuring smooth operations and compliance with legal, regulatory, and financial standards.

The Risk Management Process

The risk management process involves several key steps to ensure that risks are properly identified and mitigated. Here's a breakdown of the typical process:

Risk Identification This is the first step in the risk management process. Businesses need to identify potential risks that could affect their operations. Risks can come from many sources, including financial markets, legal obligations, accidents, or cyber threats. In this step, it’s essential to conduct a thorough analysis of internal and external factors that could potentially lead to risk.

Risk Assessment After identifying risks, the next step is to assess their likelihood and potential impact on the organization. Businesses must evaluate how severe each risk is, how likely it is to occur, and what the consequences could be. This step often involves the use of risk matrices, simulations, or expert judgment.

Risk Control and Mitigation Once risks have been assessed, businesses need to implement measures to mitigate or control them. This can include adopting new policies, changing operations, securing insurance, or investing in technology solutions to help reduce the likelihood or impact of identified risks.

Risk Monitoring and Review The risk management process doesn’t stop once mitigation plans are implemented. Risks and their impacts change over time, so it’s essential to continuously monitor and review the effectiveness of risk management strategies. Regular updates and assessments should be performed to adapt to new risks or changes in the business environment.

Credit Risk Management

One of the most critical aspects of risk management is credit risk management. Credit risk refers to the possibility that a borrower will default on their obligations, leading to financial losses for lenders or investors. It is particularly important for financial institutions, such as banks, lenders, and investors, to carefully manage this risk.

Credit risk management involves assessing the creditworthiness of potential borrowers, monitoring existing loans, and ensuring that sufficient safeguards are in place to mitigate the risk of default. Financial institutions use various tools and strategies, including credit scoring models, background checks, and credit limit settings to manage and reduce credit risk effectively.

Implementing a robust credit risk management strategy is essential for ensuring the long-term financial stability of any organization that deals with loans, credit, or investments.

The Role of Risk Management Software and Solutions

The complexities of modern business environments have made risk management more challenging. Organizations now have to handle a wider range of risks, and many businesses are turning to technology to help manage these challenges. This is where risk management software and risk management solutions come into play.

Risk Management Software Risk management software is designed to help businesses identify, assess, and manage risks more effectively. These platforms provide a centralized location to track risks, store risk-related data, and generate reports. Modern software often includes tools for risk assessment, real-time risk monitoring, and reporting. It also aids in collaboration by enabling teams across departments to work together and ensure that risk mitigation strategies are aligned and executed properly.

Risk Management Solutions Risk management solutions go beyond just software and include services, consulting, and custom-designed strategies. Companies like Cedar Rose offer end-to-end risk management solutions that help businesses streamline their risk management process. These solutions combine advanced technology with industry expertise, offering tailored approaches to tackle specific risks within different industries. By utilizing these comprehensive solutions, businesses can improve their decision-making, reduce uncertainties, and safeguard their assets from potential threats.

Cedar Rose is one of the leading providers of risk management solutions. With their extensive experience in the field, they offer a range of services that include business intelligence, credit risk assessments, and due diligence checks. Their innovative tools and solutions empower businesses to make data-driven decisions, minimizing potential risks and maximizing profitability.

Conclusion

In today’s fast-paced business environment, effective risk management is essential for the survival and growth of any organization. By understanding the risk management process, implementing solid credit risk management practices, and leveraging advanced risk management software and solutions, businesses can significantly reduce the likelihood of negative outcomes. With companies like Cedar Rose offering state-of-the-art solutions, organizations now have the tools they need to manage risks more effectively and stay ahead of potential threats.

For more information on how Cedar Rose can help you implement a robust risk management strategy, visit their website at www.cedar-rose.com.

0 notes

Text

Simplify GST Return Filing in Delhi with MASLLP: Your Trusted Partner

Introduction: Navigating the complexities of GST return filing in Delhi can be challenging for businesses of all sizes. To ensure compliance and avoid penalties, it’s crucial to have a reliable partner who understands the intricacies of the GST regime. MASLLP is your go-to expert for GST return filing in Delhi, offering comprehensive services to simplify the process and ensure accuracy. In this blog, we will explore the importance of GST return filing, the common challenges faced, and how MASLLP can help you streamline your GST compliance.

Why GST Return Filing is Crucial GST return filing is a mandatory compliance requirement for businesses registered under the Goods and Services Tax (GST) regime in India. It involves reporting the details of sales, purchases, and tax collected and paid. Here’s why timely and accurate GST return filing is essential:

Legal Compliance Filing GST returns on time ensures that your business complies with the legal requirements set by the government. Non-compliance can lead to penalties and legal complications.

Input Tax Credit Accurate GST return filing allows businesses to claim Input Tax Credit (ITC) on their purchases, reducing the overall tax liability.

Financial Planning Regular GST return filing provides a clear picture of your tax liabilities and helps in effective financial planning and management.

Avoiding Penalties Timely filing helps avoid late fees and penalties, which can accumulate and become a financial burden for businesses. Common Challenges in GST Return Filing While GST return filing is crucial, businesses often face several challenges in the process:

Complexity of GST Laws The ever-evolving GST laws and regulations can be complex and difficult to interpret for businesses without specialized knowledge.

Accurate Data Entry Ensuring the accuracy of data related to sales, purchases, and tax payments is critical. Errors in data entry can lead to discrepancies and compliance issues.

Timely Filing Meeting the deadlines for various GST returns (GSTR-1, GSTR-3B, GSTR-9, etc.) can be challenging, especially for businesses with limited resources.

ITC Reconciliation Reconciling Input Tax Credit with suppliers' returns requires meticulous tracking and can be time-consuming. How MASLLP Can Help with GST Return Filing in Delhi MASLLP offers comprehensive GST return filing services designed to address these challenges and ensure seamless compliance. Here’s how we can help: Expertise and Knowledge Our team of GST experts stays updated with the latest GST laws and regulations, ensuring that your returns are filed accurately and on time. End-to-End Service From data collection and validation to filing returns and handling queries from the tax authorities, MASLLP provides end-to-end GST return filing services. Accuracy and Compliance We use advanced tools and software to ensure the accuracy of your data, minimizing the risk of errors and non-compliance. Timely Filing With MASLLP, you never have to worry about missing deadlines. We ensure that all your GST returns are filed on time, every time. ITC Reconciliation Our experts handle the complex process of ITC reconciliation, ensuring that you claim the maximum Input Tax Credit you are entitled to. Why Choose MASLLP for GST Return Filing in Delhi Client-Centric Approach At MASLLP, we prioritize our clients' needs and offer personalized services tailored to their specific requirements. Transparent Communication We maintain transparent communication with our clients, keeping them informed at every step of the GST return filing process. Cost-Effective Solutions Our GST return filing services are competitively priced, offering excellent value for money without compromising on quality. Conclusion GST return filing is a critical aspect of business compliance, and partnering with an expert like MASLLP can make the process hassle-free and efficient. With our expertise and commitment to excellence, we ensure that your GST returns are filed accurately and on time, allowing you to focus on your core business activities. Contact MASLLP today to learn more about our GST return filing services in Delhi and how we can assist you in achieving seamless compliance.

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#auditor#taxation#ap management services

4 notes

·

View notes

Text

What do I need to start a merchant cash advance business?

Starting a merchant cash advance (MCA) business involves several critical components to ensure you set up a robust and legally compliant operation. Here are the essential elements you need to consider:

. FREE MCA LEADS - https://www.fiverr.com/leads_seo_web .

OR

1. Understanding of the MCA Industry

Knowledge: Gain a deep understanding of how the MCA industry works, including the mechanics of advances, repayment methods, and risk management.

Market Research: Conduct thorough market research to identify your potential clients and understand the competition.

2. Business Plan

Detailed Plan: Outline your business strategy, including your target market, marketing plan, operational structure, funding sources, and financial projections.

Risk Assessment: Develop a methodology for assessing the creditworthiness of potential clients.

3. Legal Compliance and Licensing

Legal Structure: Decide on a legal structure for your business (LLC, corporation, etc.) that suits your needs for liability and tax purposes.

Licensing: Check local and state regulations to determine if specific licenses are required to operate an MCA business.

Contracts and Agreements: Have clear, legally vetted contracts ready for your clients that outline terms of the cash advance, repayment schedule, factor rates, and other critical details.

4. Capital for Funding Advances

Initial Capital: Ensure you have access to sufficient capital to fund the cash advances. This could be from personal funds, investor money, or loans.

Credit Line: Establishing a line of credit with a bank can be beneficial if additional funding is needed.

5. Technology and Infrastructure

Software Solutions: Invest in or develop software for application processing, underwriting, account management, transaction processing, and collections.

Hardware and Office Space: Depending on your business model, you may need office space and hardware for your team.

6. Sales and Marketing

Marketing Strategy: Develop an effective marketing strategy to reach your target customers. This could include digital marketing, direct mail, partnerships, and networking.

Sales Team: Build a knowledgeable and skilled sales team capable of explaining the benefits and risks of MCAs to potential clients.

7. Risk Management and Collections

Collections Strategy: Have a strategy and processes in place for collecting payments. This is crucial as the collection process can significantly impact your profitability.

Default Management: Develop procedures for managing defaults and non-payment scenarios.

8. Professional Assistance

Consultants: Engage with financial consultants who have experience in the MCA or broader financial services industry.

Legal Advice: Regularly consult with a lawyer to ensure ongoing compliance with laws and regulations affecting your business.

Accounting: Set up accounting practices and possibly hire a professional to manage your finances and taxes.

9. Customer Service

Support System: Establish a system for handling customer inquiries and support to maintain good client relationships and manage issues promptly.

10. Networking

Industry Connections: Connect with other professionals in the financial sector to stay informed about industry trends and changes in regulations.

By carefully planning and considering each of these elements, you can set up a merchant cash advance business that is well-equipped to succeed in a competitive financial market. It's important to prioritize compliance and risk management to build a sustainable business model.

#mca leads#mcaleads#merchantcashadvanceleads#merchantcashadvance#merchant cash advance#cash advance#business loan#b2bmarketing#b2b lead generation#leadgeneration#loans#mortgage#sba#line of credit

2 notes

·

View notes

Text

The Rise of AI in Financial Software Development

Artificial intelligence has revolutionized the financial software development industry and technology innovation as we know it. Custom software development firms specialized in banking software development and custom banking software development feature at the entrepreneurial frontier of this revolution by employing AI to offer new banking software development applications that drive anomalous value, competent automation of proceedings, and intelligent decision-making.

However, before we consider the major tendencies in finance, it is essential to consider how artificial intelligence would contribute to its further development. From robo-advisories to processing data and facilitating analysis, AI has become an invaluable asset for companies in the financial services sector, fintechs, and software development firms.

Predictive Analytics and ML: Highly effective concepts in the governmental and private sectors

One of the most critical use cases of AI in the Financial Software Development area is AI predictive analytics/machine learning. These sophisticated approaches allow voice-recognizing software systems to sift through thousands of data points, create correlations, and then use them to estimate likely trends, challenges, and opportunities.

In banking and finance, there is extensive use of AI, which is mainly used to analyze predictive analytics in the sector in activities like credit risk assessment, fraud detection, and even customer profiling. By reviewing historical data and relying on machine learning algorithms, banking software development companies can create intelligent systems for evaluating credit products or projects, identifying various fraudulent activities, and adjusting financial software solutions according to the customers' needs.

Besides, there is the use of the AI techniques to conduct predictive analyses, which are possibility beneficial for making more efficient decisions among financial institutions and investors in terms of future market tendencies and shares. This preventive approach is very useful in managing risks and creating a better competitive environment for the industry.

Chatbots and Virtual Assistants: CRM's Main Purpose To Improve Customer Experience.

In addition, the integration of AI in Financial Software Development has also changed customers through the exposure and popularization of chatbots and virtual assistants. These self-learning voice and text interfaces seek to simulate human-human interactions, especially when dealing with customers through various channels, while also automating many tasks in the financial arena.

Custom banking software development firms leverage AI-powered chatbots to offer 24/7 customer support, handle routine inquiries, and guide users through complex financial transactions. By understanding natural language and adapting to conversational contexts, these virtual assistants can provide customers with a seamless and intuitive experience, ultimately improving customer satisfaction and loyalty.

Additionally, chatbots and virtual assistants can assist in areas such as account management, financial advisory, and transaction processing, reducing the workload on human representatives and enabling financial institutions to efficiently serve a more extensive customer base.

Financial Software Development Automated Trading and Portfolio Management

The world of finance is constantly evolving, and AI has become a game-changer in automated trading and portfolio management. Financial Software Development companies leverage AI algorithms to analyze market data, identify patterns, and execute trades autonomously, minimizing human intervention and emotional biases.

AI-driven trading systems can process real-time data, including news, market trends, and historical patterns, to make informed trading decisions. These systems can adapt to changing market conditions and execute trades at lightning-fast speeds, providing a significant competitive advantage for financial institutions and individual investors.

In portfolio management, AI can analyze vast amounts of data, including company financials, market trends, and investor preferences, to construct and rebalance portfolios dynamically. This intelligent approach can help optimize returns, minimize risks, and align investment strategies with individual goals and risk appetites.

Regulatory Compliance and Risk Management

The financial industry is subject to stringent regulations and complex risk management protocols. Financial Software Development companies leverage AI to streamline compliance processes and enhance risk management practices.

AI-powered systems can analyze vast amounts of data, including legal documents, regulatory guidelines, and transactional records, to identify potential compliance issues and mitigate risks proactively. By automating compliance monitoring and reporting, financial institutions can reduce the likelihood of costly fines and reputational damage.