#crypto scalping setup

Explore tagged Tumblr posts

Text

Why I Trade BTCUSD at 2AM Instead of Noon (And Earn More Doing It)

Forget the hype. I’ve quietly found a way to profit off BTCUSD — before most traders even wake up. The method? A powerful structure-based approach I call the Goldmine BTCUSD Strategy, refined specifically for the Asian session.

No bots. No indicators. Just price action, timing, and pure logic.

This strategy helped me rack up consistent wins during the calm Tokyo hours, where BTC tends to range and break cleanly. In fact, I made over $3,800 in 3 weeks just from Bitcoin alone — before the news events and volatility even kicked in.

It works on:

BTCUSD

ETHUSD

Gold (XAUUSD)

USDJPY, GBPJPY

📅 Get the BTC Goldmine Strategy Add-On Pack 🔗 Buy the Full Strategy + BTC Add-On

📈 Subscribe to My BTC Signals I share high-probability BTC trades every Asian session. 🔗 Subscribe Here for BTC Signals

#btc trading strategy#crypto scalping setup#btc goldmine method#asian session bitcoin trades#tokyo crypto breakout#btcusd strategy#smart money bitcoin#passive crypto system

0 notes

Note

hi! what’s your favorite crypto/mirage headcanons

this stopped being overall favorites and just a general list of hcs... lol. sorry its long i like them

- the one i Just received in my in inbox is so cute and still on my mind so yes. that one

- t4t bi4bi. classic

- tae joon being too embarrassed to be sappy in english so he says shit to elliott like "nae sarang" "jagiya" "saranghae"

- ^^ elliott starts learning korean in his offtime to understand what hes saying/surprise him. his accent is shit but tae joon finds it endearing he tried. offers to teach him more

- "acts of service" tae joon & "physical touch" elliott. i dont think they would be very good at words of affirmation, at least not at the beginning

- elliott likes leaving sticky notes around tae joons pc with general reminders and sweet messages (based off of the sticky notes u see on his setup in killcode)

- elliott likes to make tae joon ready-to-eat meals of his favorites & other foods he thinks he'd like since tae joon really doesn't eat as often as he should (canon via the cookbook)

- they have leaderboards on who gets the most kills each season & are extremely cocky about it. when theyre teamed up its just a game of who can steal the most kills from each other

- also they actively hunt each other down in the arena if ever they see each other, regardless if its a dumb push or not. lol

- tae joon likes messing with elliott's curls a lot (how are they so soft????). if he has nothing to do with his hands they're probably going in elliott's hair, idly making small braids & massaging his scalp

- elliott steals tae joons jacket like... all the time. especially when games about to start in an hour or so. half because the padding is sooo comfy & half bc he likes seeing his boyfriend walking around the dropship in that unfairly sexy tank top trying to find his jacket

- tae joon has bought out the whole entire mirage plushie stock on worlds edge. he has also attempted stealing the cardboard cutout in disguise. it did not work.

- the first few times theyd share a bed with each other, any time elliott would wrap his arms around tae joon he'd instinctively try to hurt him & feel extremely guilty about it after (paranoia!!!). elliott was still patient with him and always assures him they'd work thru it together

- they adopt a calico cat together named marigold <3

6 notes

·

View notes

Text

How Crypto Algo Trading Bots Help Maximize Your Profits

Trading cryptocurrency is fun but very fast. The market is always open, 24/7. Prices go up and down at any time, even while you sleep. It’s hard for people to watch the market all the time and make the right trades. That’s why many traders use crypto algo trading bots. These bots are smart programs that can trade for you, even when you're sleeping or busy. In this blog, I’ll explain how these bots work, why people like them, and how they help you make more money with less effort.

What is a Crypto Algo Trading Bot?

A crypto algo trading bot is a software tool that buys and sells cryptocurrency by following rules. These rules are based on price, market trends, and math. Once you set it up, the bot works on its own. It doesn’t need sleep and doesn’t feel emotions. Some bots do easy tasks like buying Bitcoin when the price drops and selling when the price goes up. Other bots are smarter and use AI (artificial intelligence) to look at live market data and make better trading decisions.

Why Are Crypto Bots Popular?

Many traders like crypto bots for a few simple reasons. First, bots can trade all day and night because the crypto market never closes. Second, they are fast and can make trades in just seconds. Third, bots don’t get emotional like people—they don’t panic or get greedy. Fourth, you can test your trading plan using past data before risking real money. Lastly, bots save a lot of time because they can handle many trades and work on different exchanges at once, which is hard to do manually.

How Do Bots Help Increase Your Profits?

Crypto bots can help you make more money in smart ways. They study the market and choose the best time to buy and sell. They don’t guess—they use real data. Since bots work 24/7, they never miss a good trading chance, even when you’re sleeping. Bots also help protect your money with stop-loss tools, which sell coins if the price drops too much. This reduces losses. Bots follow the same plan every time and never get tired, so they are very steady. Also, bots can use more than one trading method at once, which helps you earn from different sources.

Simple Trading Strategies Used by Bots

Bots often use simple strategies to trade. One is scalping—making many small trades for tiny profits that add up. Another is arbitrage—buying crypto on one exchange at a low price and selling it on another where the price is higher. Trend following is also common—the bot buys when prices are going up and sells when they start going down. Some bots also do market making—putting both buy and sell orders to earn from small price differences. Bots can change strategies depending on the market situation.

Are Crypto Trading Bots Safe?

Yes, crypto bots can be safe if you use them the right way. Choose trusted platforms and turn on safety features like two-factor authentication. But remember, bots are not magic. They need good settings and regular checks. Always keep an eye on how your bot is doing and make updates if needed. Even the best bot can’t win every trade, so you should still be involved in your trading.

Final Thoughts

Crypto algo trading bots are great tools for anyone who wants to trade smarter. They save time, avoid emotional mistakes, and work all the time. Whether you’re new or experienced in trading, a bot can help you do better. With the right setup and plan, a bot can make trading easier and more successful. As crypto trading grows, bots will become even more useful for people around the world.

0 notes

Text

Laid Off, Logged In, Leveled Up: My Full-Time Trading Shift with Monovex

Getting laid off after 12 years in logistics hit harder than I expected. I wasn’t new to trading; I’d been scalping part-time after hours for years, but now I had time, savings, and a reason to go all in. So I built a six-monitor trading setup, locked in my daily routine around the U.S. market open, and started looking for a platform that could handle the intensity.

What I didn’t want: laggy charts, hidden fees, or support that made you wait a week. That ruled out a few familiar names.

A buddy from my old office shot me a message: “Try Monovex. You’ll actually like it.” I signed up the same night. The interface? Clean. Lightweight. Fast. No fluff.

I could chart, trade, and monitor my P&L, all on one screen. I committed to the GOLD account with a €50,000 deposit, which unlocked Market Reviews, VOD: Advanced, Social Trading, Webinar Access, and a Risk-Free Trade, plus a Personal Assistant, which I’d later lean on more than I thought.

Right away, order execution stood out. No delay. No slippage. I scalped a pre-market pop on AMD and banked a small win. Then added a GBP/USD overnight swing, tight spreads, fast fills, zero platform hiccups.

My setups finally felt clean. Real-time data synced perfectly with my external watchlist. The Position Manager let me scale in and out like I used to dream about.

By week three, I was fully synced with the market’s rhythm. I shorted NVDA on a high-volume parabolic move and closed for a solid gain in under 7 minutes. That was the turning point. I wasn’t just surviving, I was executing with confidence.

The webinar on volatility patterns added real fuel. No fluff. Just raw strategies that matched my momentum style.

Even though I stayed on Gold, I started using the features like someone managing a hedge fund. The Personal Assistant helped me clarify leverage tiers and explained rollover costs on my forex positions. No bots, just fast, useful responses.

Deposits were seamless. Used my EU card, funded within the hour. Withdrawals? Always under 48 hours. Usually 24–36. No weird paperwork or random delays.

Stocks stayed my main play, but I added EUR/USD and AUD/JPY for the London hours, and crypto setups late at night. The switch across assets was frictionless. No logouts. No switching screens. One dashboard. Smooth as it gets.

That Tesla breakout scalp pre-market? Nailed it. Then caught a clean ETH move the same evening.

I’ve made five cashouts to date, and every single one landed within 1–2 days. No “pending” drama. No unexpected fees. Just reliable, on-time access to profits.

Today, my portfolio mix is 70% U.S. stocks, 20% forex, and 10% crypto. I trade full-time, on my terms. Monovex didn’t just give me a platform; it gave me consistency, speed, and confidence. I took a setback and turned it into a structure for growth. And I’m building on it every day.

#MonovexReview#MonovexReviews#Monovex.comReview#Monovex.comReviews#Monovex Review#Monovex Reviews#Monovex.com Review#Monovex.com Reviews#Monovex

1 note

·

View note

Text

Swing Trading vs. Scalping with Prop Firms: Which Is Better?

In the dynamic world of trading, selecting the right strategy can make all the difference. Swing trading and scalping offer distinct paths to profit, each appealing to different styles and time commitments.

Prop firms are reshaping the trading landscape by providing the capital and support needed to excel. With the right firm, you can focus on refining your skills while minimizing personal financial risk. Discover how to maximize your potential in trading today.

Introduction to Swing Trading and Scalping

Understanding Swing Trading and Scalping Strategies

Swing trading and scalping are two ways people trade stocks. They fit different types of traders and work best in different situations.

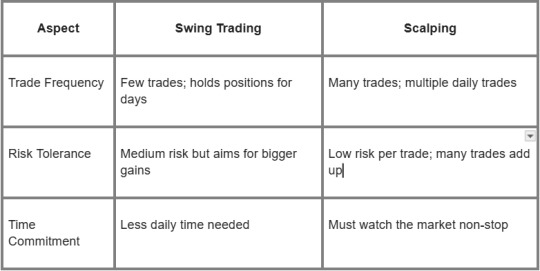

Trading Flexibility: Swing traders hold their trades for days or even weeks. They try to catch bigger price moves. Scalpers do the opposite. They make lots of quick trades in one day.

Trade Frequency: Swing traders trade less often but aim for bigger profits each time. Scalpers trade many times a day, making small profits on each trade.

Position Holding Period: Swing traders keep their positions longer and wait patiently for the right moment. Scalpers act fast, making decisions based on instant market changes.

Swing Trading Definition and Characteristics

Swing trading means trading for a medium time, like several days or weeks.

Swing Traders: They think patiently and pick their trades carefully.

Medium-Term Price Movements: They try to earn money from price changes over days or weeks.

Patient Approach: Swing traders wait for good chances instead of jumping in too soon.

Selective Trades: They choose only the best opportunities to reduce risk and increase gains.

Scalping Definition and Characteristics

Scalping is all about fast trades to get small profits quickly.

Scalper Profile: Scalpers focus hard and react super fast.

Quick Decision-Making: They use live data to spot chances in seconds.

High-Frequency Trading: Scalpers make many trades every day, holding positions for just seconds or minutes.

Key Differences Between Swing Trading and Scalping

Both swing trading and scalping can help you make money. Your choice depends on how much time you want to spend, how much risk you can take, and how involved you want to be with the markets.

Swing Trading in a Crypto Prop Firm Environment

Swing trading means holding positions for days or weeks to catch medium-term moves.

Crypto prop firms offer funded trading accounts and more trading capital for this style. These firms provide steady funding that helps traders grow their careers. They cut down on personal money risks and offer tools to trade better.

Crypto prop trading mostly focuses on digital assets but often supports other markets too. This lets traders mix up their strategies. With funded accounts, swing traders get bigger capital pools than their own money allows. That boosts possible profits without risking personal funds.

Working with a good prop firm gives swing traders a stable setup focused on steady results, not quick trades. This setup helps traders build skills and succeed long term in the wild crypto markets.

Benefits of Using Prop Firm Capital for Swing Trading

Using prop firm capital comes with several perks:

More Trading Capital: You get bigger funds than your own account.

Bigger Gains: Larger capital can boost profits when trades go well.

Good Profit Split: Many funded trader programs share profits at 70% or more.

Fast Funding: After passing evaluations, you can start prop firm challenge today and begin trading right away.

These perks let swing traders focus on trading instead of stressing about money limits. The Concept Trading’s system pushes steady funding and pays out quickly—usually within 48 hours—to keep traders motivated and cash flowing.

Challenges of Swing Trading within a Prop Firm Framework

Swing trading with a prop firm also has some tough spots:

Evaluation Pressure: You must hit targets during tests, which can clash with longer hold times swing trading needs.

Risk Rules: Strict drawdown limits force careful sizing of positions and stops to protect firm money.

Drawdown Limits: Going past loss limits might reset or end your account; managing losses is key to staying in the game.

Knowing these rules helps traders adjust methods and follow firm policies. Staying flexible but disciplined keeps success coming in this kind of setup.

Features of Crypto Prop Firms for Swing Traders

Crypto prop firms offer features that suit swing traders well:

Flexibility to Hold Positions Overnight/Weekends

Many crypto prop firms let you hold positions overnight and trade on weekends. This fits swing trading because it needs multi-day moves without forcing you to close early.

No-Time Limit Evaluations

Some firms don’t set strict deadlines for passing evaluations. That takes off pressure so swing traders can wait as trades unfold over time without rushing.

Swing-Friendly Leverage

Leverage options match moderate risk levels typical for swings—not high-risk scalp trades. Position sizes stay balanced by setting limits that fit longer holds, keeping risk in check.

Support for Multiple Instruments

Top crypto prop firms go beyond crypto, letting you trade stocks, indices, metals, and more. This variety gives swing traders chances to balance portfolios across different markets.

Competitive Profit Splits

Profit splits stay attractive at many leading crypto prop firms—often above 70%. Fast payouts mean you get your earnings soon after closing profitable trades.

This rundown shows how The Concept Trading’s platform fits swing traders with flexible rules and strong funding made just for their needs in today’s changing markets.

Understanding Scalping in a Prop Firm Context

Scalping means trading quickly to catch small price changes. Traders who use the scalper trading style make many trades each day. They often hold positions for only seconds or minutes.

Prop firms let scalpers trade with bigger money through funded trader programs. This helps them grow profits without using their own cash.

Many prop firms offer crypto prop trading and other markets. These are good places for scalpers who need fast execution and sharp focus. Unlike swing traders, scalpers close trades fast. This is typical for day trading and short-term trading styles.

Advantages of Scalping with Prop Firms

Scalping at prop firms gives you some clear perks:

Trading Capital: You get more money to trade than your own savings.

Instant Funding: Some firms fund you right after you pass their test.

Prompt Payouts: You can withdraw profits quickly, often in just two days.

Leverage in Trading: Firms let you use leverage to boost gains while controlling risks.

Execution Speed: Fast platforms help grab quick price moves.

Quick Decision-Making: Rules let you act fast without delays or extra approvals.

These points make it easier for scalpers to work fast and earn more without risking their own money much.

Challenges of Scalping within a Prop Firm Environment

Scalping with prop firms also has tough spots:

Trading Risk Management: You must follow strict stop-loss rules to protect money.

Evaluation Pressure: Passing funding tests can stress you because results matter a lot.

Psychological Adjustment: Fast trading needs strong nerves to handle losses and quick choices.

High Stress Levels: Staying alert all the time can wear you down if you don’t take breaks.

Knowing these challenges helps traders get ready mentally before they start.

Choosing the Right Prop Firm for Scalping

The best prop firms balance clear rules with risk control. They help short-term traders scale up without risking too much. Look for firms known for being honest and quick to respond. That makes trading scalp strategies smoother and safer.

Swing Trading vs. Scalping: A Detailed Comparison

Swing trading and scalping are two common trading styles. Swing traders hold their trades for days or weeks. They aim to catch medium-term price moves using swing trading strategies.

Scalpers, by contrast, make very fast trades. Their trades last seconds or minutes, using scalping techniques that grab small profits quickly.

The big difference is how often they trade and manage risk. Swing traders set wider profit targets and stop-loss orders based on technical analysis of chart patterns and momentum indicators.

This helps them handle moderate price swings while keeping risk in check with strict drawdown limits. Scalpers trade many times daily with tight stop-losses but face more risk because they must make fast decisions.

Knowing these differences can help you pick a style that fits your goals and personality.

Profit Potential and Risk Tolerance

Swing trading can bring high profit potential by catching bigger price moves over time. Traders control risk with clear rules like daily drawdown limits that stop big losses in wild markets.

Scalping looks for smaller wins per trade but makes up for it with lots of trades. But it needs perfect timing to keep losses small because many trades add risk.

Both styles rely on strict stop-loss orders—swing traders use broader stops while scalpers use tighter ones—to protect money and grow steadily.

Time Commitment and Effort

Scalping needs intense focus during market hours. It’s fast-paced and demands quick decisions under pressure. That stress means scalpers must stay sharp for hours at a time.

Swing trading asks for less constant watching since trades last days or weeks. This lower time commitment suits people who want flexibility without losing steady portfolio growth.

Which one works better depends on your schedule and how you handle stress while the market is live.

Technical Analysis Requirements

Both swing traders and scalpers depend on technical analysis but use it in different ways:

Swing Trading: Looks for clear chart patterns like head-and-shoulders or flags, plus momentum indicators such as RSI to see trend strength.

Scalping: Focuses on very short-term charts, watching order flow closely, and reading support/resistance quickly to decide when to jump in or out.

Learning the right tools helps no matter what style you pick. Swing trading needs deeper pattern recognition over longer times, while scalping calls for split-second calls.

Psychological Demands

Trading psychology matters a lot in both styles:

Swing Traders: benefit from patience and good emotional control while waiting through price moves.

Scalpers: must handle stress from rapid decisions where hesitation might cost money.

Sticking to rules keeps traders from making impulsive mistakes caused by fear or greed—problems that hit both styles hard.

Choosing the Right Strategy for Your Trading Style

Picking between swing trading versus scalping starts with knowing yourself—your personality, skills, and what fits your lifestyle best if you want long-term success at places like The Concept Trading.

Self-Assessment of Trading Preferences and Skills

Here’s what typical trader types look like:

Swing traders tend to be patient. They pick their trades carefully. They follow rules well and don’t mind holding positions overnight even if prices move moderately.

Scalpers like quick action. They can focus long hours staring at screens. They make split-second choices over and over without losing calm.

Knowing which sounds like you helps pick a style that won’t wear you out or give uneven results.

Alignment of Strategy with Personal Goals and Resources

Think about what fits your goals best:

Choose the style that matches your resources. It should also help keep your work-life balance healthy alongside money goals.

By knowing these key differences between swing trading vs. scalping—and thinking about your strengths—you can pick the approach that fits you best inside prop firms offering flexible funding designed for steady performance growth.

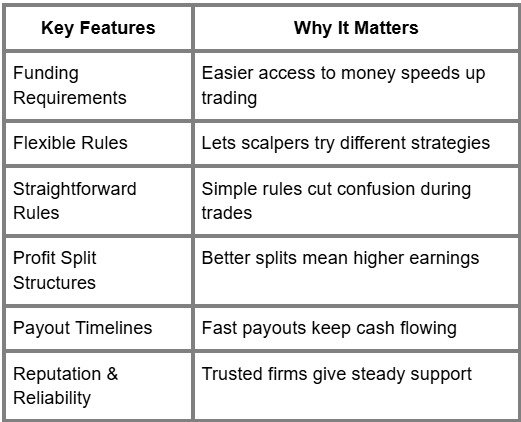

Selecting the Right Prop Firm for Your Trading Strategy

Picking the right prop firm matters a lot. You want one that fits your swing trading or scalping style. Start by checking their account sizes and leverage options. Bigger accounts with flexible leverage let you scale trades without risking too much.

Profit split setups can be very different between prop trading firms. Look for clear profit sharing that pays well, maybe over 70%. Quick payouts matter too. Firms that pay within 48 hours keep your cash moving and your spirits up.

Reputation is key when you pick funded trader programs. Read reviews, check if they follow rules, and see what other traders say. Instant funding can help you start live trading fast after passing evaluation. Easy account verification saves time too.

Transparent execution means no hidden fees or slippage eating your gains. Choose firms known for fair trades and clear funding requirements. These points help make a good fit for your trading style.

Tools and Techniques for Success in Prop Firm Trading

Good risk management keeps your profits safe in prop firm trading. Always use stop-loss orders to cut losses early. Set take-profit points to lock gains at planned levels.

Position size should match both your account and how wild the market is. Don’t risk more than 1-2% of your account on one trade.

Try trailing stops to keep profits as prices move up. Hedging can protect you from sudden market swings.

Use both technical and fundamental analysis to pick better trades. Look at chart patterns, moving averages, RSI, and MACD for tech analysis. Watch news and economic reports for fundamentals.

Know how different order types work (market, limit) and how fast your platform executes them. Fast execution means less chance of bad price fills during volatile times.

Review your trades often using dashboards with metrics like win rate, average return, and drawdown. This helps improve your strategy step by step.

Adapting Your Strategy to Market Conditions

Market conditions change all the time because of news or events. Good traders change their plans to fit those shifts instead of sticking too hard to one way.

In markets trending strongly over days or weeks, trend-following setups work best. Use momentum indicators like MACD there.

If markets move sideways between support and resistance levels, mean-reversion strategies do better.

Crypto markets jump around more than normal assets. That means you might want smaller position sizes or wider stops because of big overnight moves or weekend gaps.

Be careful around big economic data releases; spreads might widen and swap charges could rise if you hold positions overnight.

Sentiment tools like on-chain analytics help with crypto trades too. Also look at project health before trading when things feel uncertain.

Guidance on Selecting the Best Approach

Your choice depends on your goals, time, money, and career plans in trading. If you want less screen time with careful setups, swing trading fits well. If you like pressure and quick results by being active in the market, scalping works better.

Pick a strategy that matches your lifestyle to grow steadily as a trader in a prop firm. Make choices based on honest self-checks to boost your success over time.

Prompt Payouts, Streamlined Process, and 24/7 Support at The Concept Trading

The Concept Trading pays out profits quickly—usually within 48 hours. Their process is simple, so you get funding without waiting or extra hassle. They also offer support any time of day or night.

This setup helps both swing traders and scalpers focus on trading while keeping paperwork easy.

Highlighting The Concept Trading's Advantages

The Concept Trading works well for different styles—including swing trading support. Its platform runs smoothly on many devices and offers strong tools to manage risks.

Joining here means you get clear rules, fair profit shares, and an environment that cares about helping you grow as a trader with funded accounts.

FAQs

What Is the Role of Trading Risk Management in Prop Firm Trading?

Trading risk management is essential for safeguarding capital by implementing strategies such as stop-loss orders and drawdown limits. It helps maintain consistent trading performance while minimizing the impact of significant losses.

How Can Traders Scale Their Accounts Using Prop Firms?

Prop firms enable account scaling by increasing capital allocation as traders achieve profit milestones and adhere to established risk parameters consistently. This structured approach encourages responsible trading behavior.

What Types of Funding Evaluations Do Prop Firms Use?

Prop firms typically employ phased funding evaluations. These evaluations assess traders through specific profit target percentages and maximum drawdown limits to ensure they demonstrate discipline and effective risk management before receiving funded accounts.

How Does Leverage in Trading Affect Swing Trading vs. Scalping?

In swing trading, moderate leverage is utilized for positions held over several days, which helps to mitigate overnight risks. Conversely, scalping often requires lower or adjustable leverage for rapid, intraday trades, allowing traders to better manage the effects of market volatility.

What Support Services Do Prop Firms Offer to Help Trader Career Growth?

Prop firms provide a range of support services, including 24/7 assistance, mentorship programs, performance analytics, and educational resources. These services are designed to empower traders and enhance their overall trading potential.

Why Is Psychological Adjustment Crucial in Scalper Trading Style?

Psychological adjustment is vital for scalpers due to the high-pressure environment created by quick decision-making and frequent trades. Maintaining emotional control is key to preserving discipline and avoiding impulsive mistakes.

How Do Trading Tools Assist with Strategy Optimization in Prop Firm Environments?

Trading tools such as dashboards, performance metrics, technical indicators, and various order types enable traders to make data-driven decisions. These tools facilitate ongoing improvement and strategic optimization in trading results.

What Are Common Challenges Faced During the Funding Evaluation Phase?

During the funding evaluation phase, traders often encounter challenges such as performance pressure, rigid risk management rules, and the need to maintain consistent profitability while adhering to drawdown limits.

How Do Market Volatility and Cryptocurrency Volatility Impact Swing Trades?

Market volatility can lead to price fluctuations that significantly influence stop-loss levels and position sizing. Traders must adjust their strategies, either by widening stops or reducing position sizes, to effectively manage risk in volatile conditions.

Key Elements for Successful Prop Firm Trading

Strict trading discipline keeps losses low with stop-loss orders and daily drawdown limits.

Effective capital allocation balances position size relative to account value.

Using performance metrics like win rate and average return guides continuous improvement.

Employing both technical analysis (chart patterns, momentum indicators) and fundamental analysis (crypto asset fundamentals, news) supports better trade setups.

Understanding order types, such as limit or market orders, helps control trade execution latency.

Managing overnight risk carefully when holding positions during weekends or economic data releases.

Leveraging trader support services, including mentorship and community forums, fosters skill development.

Navigating prop trading challenges, such as evaluation pressure and strict risk rules, requires mental strength.

Choosing firms with transparent profit split structures, quick profit withdrawal, and flexible funding requirements improves the overall experience.

Adjusting strategies for different market conditions, including trending or range-bound markets, enhances trading scalability.

For more post about prop firm trading tips click here.

#prop trading firms#prop trading tips#forextrading#the concept trading#fx trading#swing trading#scalping

0 notes

Text

Start Trading Smart: Best Brokers with Low Minimum Deposit in 2025

Think you need a big budget to trade the markets? Think again. Today’s brokers make it easy to start with just a small deposit — and still access powerful platforms, fast execution, and professional-grade tools. In this guide, we’ll show you the top brokers with low minimum deposits that are perfect for new and growing traders.

🎯 Why a Low Deposit Broker Makes Sense

Starting small gives you the freedom to learn, test, and build confidence — all while keeping your risk low. Whether you’re a total beginner or trying out a new trading strategy, working with a broker that accepts low deposits helps you enter the market without pressure.

It’s not about how much you start with — it’s how smartly you grow.

🔍 What to Look For in a Good Broker

Regulated – Safety first. Stick to brokers licensed by ASIC, CySEC, or other top regulators.

Low Costs – Check for tight spreads, zero hidden fees, and fair commissions.

Good Platform – You’ll want MT4, MT5, or a custom app that’s fast and easy to use.

Support – Look for 24/5 support with real human help.

Assets – Forex, crypto, indices, commodities — the more options, the better. Explore Your Knowledge to Click here 👉

💡 Top Brokers with Low Minimum Deposit:

Here are the brokers that offer great features while keeping their minimum deposits beginner-friendly.

1. Eightcap:

A modern broker with fast execution, Eightcap stands out with its wide range of assets — especially crypto CFDs. It’s regulated, supports MT4 and MT5, and works great for traders who love using indicators or Expert Advisors.

2. FP Markets:

Known for reliable ECN trading conditions, FP Markets offers a clean, professional setup. With educational tools, multiple platforms, and competitive pricing, it’s a great choice for serious beginners and experienced traders alike.

3. IC Markets:

One of the most trusted names in the industry, IC Markets is perfect if you’re into scalping or automation. It offers true ECN spreads, lightning-fast order execution, and a huge range of trading instruments.

4. Octa:

Simple, clean, and beginner-friendly — Octa is perfect if you want an easy mobile app and quick setup. They offer bonus programs and solid educational materials to help you level up.

🚀 Ready to Trade?

You don’t need to risk it all to get started. These brokers with low minimum deposit help you enter the markets with confidence, learn by doing, and grow at your own pace.

Pick the one that suits your style, open your account, and start small — your journey begins today.

0 notes

Text

XFcompass.com reviews: Unlocking Global Markets for the Modern Trader

XFcompass.com reviews

In an age where financial freedom is no longer just a dream but a digital reality, trading platforms have become the gateway to independence, growth, and wealth creation. Among these platforms, XFcompass.com is emerging as a bold leader, trusted by traders across continents. Its vision is simple yet powerful: to place unmatched control and profit potential into the hands of everyday people.

With advanced tools, real-time access to global markets, and a firm belief in empowering traders, XFcompass isn’t just a broker — it’s a full-spectrum trading ecosystem.

A Mission to Empower Every Trader

From the moment you land on XFcompass.com, it’s clear this isn’t your average broker. The company’s philosophy revolves around putting the trader first, with infrastructure designed to maximize efficiency, reliability, and profit potential.

“Profit fast. Take full control of your future.”

This isn’t just a catchphrase — it’s a mission statement lived out through their services, platforms, and global support system.

XFcompass offers:

Instant order execution, 24/7.

Ultra-low spreads and deep liquidity.

Access to thousands of financial instruments.

Global mobile and desktop access, with lightning-fast trade execution.

Whether you’re trading from Tokyo, New York, or Johannesburg, XFcompass ensures you never miss an opportunity.

Account Setup: Trade in Minutes, Not Days

Many brokers complicate the onboarding process, but XFcompass keeps it refreshingly simple. The platform is built to get traders into the market as fast as possible.

Quick Start Process

Sign up online — no unnecessary forms or delays.

Verify your account — fast KYC approval for full access.

Deposit funds — choose from crypto or debit/credit card.

Begin trading — live market access within minutes.

With flexible leverage, real-time balance updates, and clear fee structures, XFcompass is tailored to both cautious beginners and aggressive high-frequency traders.

Multiple Trading Platforms, One Seamless Experience

XFcompass understands that traders today need flexibility. That’s why it offers a range of powerful, interconnected platforms optimized for every device:

Desktop Terminal

Advanced charting tools.

Customizable layout for pro-level trading.

Fast integration with external indicators and plugins.

WebTrader

Access markets instantly from your browser.

No download required.

Streamlined for fast, intuitive trades.

Mobile App

Trade anywhere with full functionality.

Secure, responsive, and lightning-fast.

Built for Android and iOS.

Whether you’re scalping on the subway or swing-trading from your laptop, XFcompass gives you the same power, speed, and control.

Access to a Global Portfolio of Markets

With XFcompass, traders are no longer limited by geography or asset class. The platform offers a rich portfolio of instruments to explore:

Forex Trading: Trade 60+ currency pairs with razor-thin spreads.

Cryptocurrency Trading: Go long or short on BTC, ETH, and other digital assets.

Commodities: Trade gold, silver, crude oil, and more.

Indices: Access major global indices like NASDAQ, DAX, FTSE.

Shares and Futures: Speculate on leading global companies and future markets.

Thanks to deep liquidity pools, orders are filled instantly — even during volatile news events. And with 24-hour trading windows, you’re never locked out of an opportunity.

Crypto-Focused Tools for the Digital Trader

Crypto isn’t the future — it’s the now. XFcompass is deeply integrated with the digital asset space, offering:

Hot market analysis on upcoming blockchain trends.

Real-time trade execution for BTC, ETH, LTC, and more.

Secure wallet integration for fast deposits and withdrawals.

Leveraged crypto trading with high risk/reward potential.

With support for multiple cryptocurrencies, the platform allows you to diversify your capital and react quickly to the crypto market’s ever-changing dynamics.

Lightning-Fast Deposits & Withdrawals

Nothing frustrates traders more than delayed fund transfers. XFcompass fixes this with its instant deposit and fast withdrawal system, designed to keep you fluid and flexible.

Instant crypto funding

Debit/credit card options

Transparent fees and live confirmations

Same-day withdrawal processing

Time-sensitive opportunities demand rapid capital movement — and XFcompass delivers.

Analytics & Research to Sharpen Your Edge

In trading, knowledge is power — and XFcompass arms you with the information needed to make smarter decisions:

Live exchange ticker

Daily technical analysis

Crypto trend forecasts

Economic calendar with key global events

Trading FAQs and help center

Whether you’re swing trading or managing long-term investments, the platform’s market insights help reduce guesswork and increase confidence.

Built on Trust, Secured by Technology

Trust is the cornerstone of any financial relationship. XFcompass strengthens that trust through:

Encrypted data protection

Full legal transparency

Strict anti-money laundering (AML) compliance

Secure internal wallet systems

Legal documentation is available directly on the site, including the Privacy Policy, Risk Disclosure, and Terms of Service. Every aspect is transparent and compliant.

The Vision: A Trading Partner for Life

XFcompass isn’t just a tool — it’s a trading partner that grows with you. Whether you’re chasing your first $100 or managing a six-figure portfolio, the platform scales with your ambition.

24/7 customer support

Ongoing platform upgrades

Educational content for all experience levels

Dedicated partnership and affiliate programs

The goal? To help you become your own boss, take control of your income, and build a future where you call the shots.

Final Word: Why XFcompass is More Than a Broker

XFcompass.com stands apart because it doesn’t just facilitate trades — it nurtures traders. With a global presence, a client-first philosophy, and access to every major market, it provides the infrastructure for long-term success in the financial markets.

If you’re serious about trading — if you want speed, power, support, and transparency — then XFcompass.com could be the smartest financial move you make this year.

Your financial destiny doesn’t wait. It starts now — with XFcompass.

0 notes

Text

How to Build a Solana Trading Bot: A Complete Guide

Introduction

In today’s rapidly evolving crypto landscape, algorithmic trading is no longer just for hedge funds—it’s becoming the norm for savvy traders and developers. Trading bots are revolutionizing how people interact with decentralized exchanges (DEXs), allowing for 24/7 trading, instant decision-making, and optimized strategies.

If you're planning to build a crypto trading bot, Solana blockchain is a compelling platform. With blazing-fast transaction speeds, negligible fees, and a thriving DeFi ecosystem, Solana provides the ideal environment for high-frequency, scalable trading bots.

In this blog, we'll walk you through the complete guide to building a Solana trading bot, including tools, strategies, architecture, and integration with Solana DEXs like Serum and Raydium.

Why Choose Solana for Building a Trading Bot?

Solana has quickly emerged as one of the top platforms for DeFi and trading applications. Here’s why:

🚀 Speed: Handles over 65,000 transactions per second (TPS)

💸 Low Fees: Average transaction cost is less than $0.001

⚡ Fast Finality: Block confirmation in just 400 milliseconds

🌐 DeFi Ecosystem: Includes DEXs like Serum, Orca, and Raydium

🔧 Developer Support: Toolkits like Anchor, Web3.js, and robust SDKs

These characteristics make Solana ideal for real-time, high-frequency trading bots that require low latency and cost-efficiency.

Prerequisites Before You Start

To build a Solana trading bot, you’ll need:

🔧 Technical Knowledge

Blockchain basics

JavaScript or Rust programming

Understanding of smart contracts and crypto wallets

🛠️ Tools & Tech Stack

Solana CLI – For local blockchain setup

Anchor Framework – If using Rust

Solana Web3.js – For JS-based interactions

Phantom/Sollet Wallet – To sign transactions

DeFi Protocols – Serum, Raydium, Orca

APIs – RPC providers, Pyth Network for price feeds

Set up a wallet on Solana Devnet or Testnet before moving to mainnet.

Step-by-Step: How to Build a Solana Trading Bot

Step 1: Define Your Strategy

Choose a trading strategy:

Market Making: Providing liquidity by placing buy/sell orders

Arbitrage: Exploiting price differences across DEXs

Scalping: Taking advantage of small price changes

Momentum/Trend Trading: Based on technical indicators

You can backtest your strategy using historical price data to refine its effectiveness.

Step 2: Set Up Development Environment

Install the essentials:

Solana CLI & Rust (or Node.js)

Anchor framework (for smart contract development)

Connect your wallet to Solana devnet

Install Serum/Orca SDKs for DEX interaction

Step 3: Integrate with Solana DeFi Protocols

Serum DEX: For order-book-based trading

Raydium & Orca: For AMM (Automated Market Maker) trading

Connect your bot to fetch token pair information, price feeds, and liquidity data.

Step 4: Build the Trading Logic

Fetch real-time price data using Pyth Network

Apply your chosen trading algorithm (e.g., RSI, MACD, moving averages)

Trigger buy/sell actions based on signals

Handle different order types (limit, market)

Step 5: Wallet and Token Management

Use SPL token standards

Manage balances, sign and send transactions

Secure private keys using wallet software or hardware wallets

Step 6: Testing Phase

Test everything on Solana Devnet

Simulate market conditions

Debug issues like slippage, front-running, or network latency

Step 7: Deploy to Mainnet

Move to mainnet after successful tests

Monitor performance using tools like Solana Explorer or Solscan

Add dashboards or alerts for better visibility

Key Features to Add

For a production-ready Solana trading bot, include:

✅ Stop-loss and take-profit functionality

📈 Real-time logging and analytics dashboard

🔄 Auto-reconnect and restart scripts

🔐 Secure environment variables for keys and APIs

🛠️ Configurable trading parameters

Security & Risk Management

Security is critical, especially when handling real assets:

Limit API calls to prevent bans

Secure private keys with hardware or encrypted vaults

Add kill-switches for extreme volatility

Use rate limits and retries to handle API downtime

Consider smart contract audits for critical logic

Tools & Frameworks to Consider

Anchor – Solana smart contract framework (Rust)

Solana Web3.js – JS-based blockchain interaction

Serum JS SDK – Interface with Serum’s order books

Pyth Network – Live, accurate on-chain price feeds

Solscan/Solana Explorer – Track transactions and wallet activity

Real-World Use Cases

Here are examples of Solana trading bots in action:

Arbitrage Bots: Profiting from price differences between Raydium and Orca

Liquidity Bots: Maintaining order books on Serum

Oracle-Driven Bots: Reacting to real-time data via Pyth or Chainlink

These bots are typically used by trading firms, DAOs, or DeFi protocols.

Challenges to Be Aware Of

�� Network congestion during high demand

🧩 Rapid updates in SDKs and APIs

📉 Slippage and liquidity issues

🔄 DeFi protocol changes requiring frequent bot updates

Conclusion

Building a trading bot on Solana blockchain is a rewarding venture—especially for developers and crypto traders looking for speed, cost-efficiency, and innovation. While there are challenges, Solana's robust ecosystem, coupled with developer support and toolkits, makes it one of the best choices for automated DeFi solutions.

If you're looking to take it a step further, consider working with a Solana blockchain development company to ensure your bot is scalable, secure, and production-ready.

#solana trading bot#solana blockchain#solana development company#solana blockchain development#how to build a solana trading bot#solana defi#serum dex#solana web3.js#anchor framework#solana crypto bot#solana trading automation#solana blockchain development company#solana smart contracts#build trading bot solana#solana bot tutorial#solana development services#defi trading bot

0 notes

Link

#CandlestickAnalysis#chartpatterns#DayTrading#High-FrequencyTrading#IntradayTrading#MarketMovements#marketvolatility#priceaction#riskmanagement#Scalping#Short-TermTrading#StockMarket#technicalanalysis#TradingSignals#TradingStrategy

0 notes

Text

Psychology of a Scalper: Staying Calm Under Pressure

Introduction: The Mental Game Behind Crypto Scalping Crypto scalping is fast, intense, and mentally demanding. While many focus on indicators, trading bots, and chart setups, the real edge often lies inside the mind of the trader. Whether you’re scalping Bitcoin, Ethereum, or altcoins, one thing is certain:👉 Emotions can make or break your trading success. In this article, we’ll dive deep into…

#crypythone#BitcoinScalping#CryptoDiscipline#CryptoEmotions#CryptoMindset#CryptoScalping#CryptoTradingTips#DayTradingMindset#ScalpingStrategy#TradingPsychology

0 notes

Text

How Sniper Bot Speed Up Your Crypto Trading?

The market is currently crowded with automated cryptocurrency trading bots. In the cryptocurrency market, some of these bots are extremely important. A sniper bot is one of these trade bots. Online auctions and sales frequently involve bots. In order to outbid rival bidders, it conducts last-minute purchases or bids. These bots operate right before the end of an auction to acquire an item before other bidders have a chance to reply. The bot is far superior to other standard trading bots in many ways. They are very successful at obtaining valuable goods in a cutthroat market because of their crypto sniper bot development ability to move swiftly and effectively.

A Small Bite of Sniper Trading Bot

Sniper bots are automated programs used in cryptocurrency trading, online sales, and auctions. To guarantee accurate market transactions, it carries out predetermined activities at certain intervals.

Online Sales and Auctions

A sniper bot makes last-minute bids or purchases in online sales and auctions. This strategy helps secure items before others can respond by outbidding rivals right before the auction closes. Because these bots are made to react quickly, they give users an advantage in situations where bidding is competitive.

Cryptocurrency Trading

In the bitcoin trading industry, bots swiftly execute trades depending on preset market circumstances. By employing predetermined parameters to determine the optimal moments to enter or exit the market, they strive for accuracy in trade execution. To make quick and well-informed decisions, these bots employ algorithms like as technical indicators, arbitrage strategies, and scalping techniques. Their objective is to buy low and sell high, or vice versa, in order to profit from market changes.

Inside the Sniper Bot’s Brain

In order to comprehend the inner workings of a sniper bot, let's examine what makes it so successful.

Programming the Bot

Programming this bot with particular criteria is the first step in using it. Users configure the bot with specific parameters and requirements, like technical indicators, target prices, and market circumstances. During this setup procedure, the parameters of the bot are defined to correspond with the trading strategy of the user.

Real-Time Market Monitoring

The sniper bot continuously tracks current market data after it has been programmed. It looks for circumstances that fit its predefined specifications, including particular trading patterns or price points. This ongoing attention to detail enables the bot to be prepared to respond when the appropriate circumstances present themselves.

Swift Execution of Trades

The bot makes trades relatively immediately when it finds a match between its criteria and the state of the market. Since the bot seeks to finish transactions in milliseconds, execution speed is essential. The bot will be able to get advantageous rates before the market changes thanks to this quick activity.

Complex Algorithms at Work

To make prompt and well-informed decisions, the sniper bot uses sophisticated algorithms. These algorithms may incorporate a range of trading strategies, including:

Scalping: quickly entering and leaving deals in order to take advantage of slight price changes.

Arbitrage: utilizing price variations between exchanges to purchase low and sell high.

Technical Indicators: identifying the best moments to trade by using indicators such as relative strength index (RSI) or moving averages.

Precision and Efficiency

The accuracy and effectiveness of the bot are its primary advantages. The bot bases its decisions only on data and pre-established rules, excluding the emotional bias that human traders may experience. It may continuously strive for the best market entry and exit locations thanks to this strategy.

Adapting to Market Conditions

The primary benefit of the bot is its accuracy and effectiveness. By removing the emotional bias that human traders may experience, the bot just uses facts and pre-established rules to make decisions. This strategy enables them to continuously strive for the most advantageous market entry and departure locations.

The Importance of Quality Programming

The caliber of a bot's programming has a significant impact on its efficacy. The likelihood of successful trades can be considerably raised by a well-programmed bot using precise algorithms. On the other hand, inadequate programming may result in less than ideal performance and possible losses.

Platform Restrictions

Although sniper bots provide several benefits, it's important to understand platform limitations. Because automated bots might result in unfair advantages or market manipulation, some trading platforms have policies prohibiting their use. Always make sure that using your bot conforms with the terms of service of the platform and any applicable laws.

In conclusion, a sniper bot's brain is a complex network of algorithms and real-time data monitoring that is intended to carry out deals quickly and accurately. Through a grasp of its inner workings, traders may efficiently use bots to navigate the fast-paced world of cryptocurrency trading, online sales, and auctions.

Types of Crypto Sniper Bot Explained

There are several varieties of cryptocurrency sniper bots, each intended for a certain trading approach. Based on preset criteria and algorithms, these automated tools assist traders in carrying out accurate and fast transactions. The primary categories of these bots are as follows:

Entry/Exit Sniper Bot

Trades are executed by entry/exit bots according to predetermined entry and exit points. To ensure ideal trading positions, they seek to buy at the lowest price and sell at the highest price. These bots assist traders in achieving advantageous market entry and exit positions by adhering to predetermined parameters, eliminating the need for continuous oversight.

Scalping Sniper Bot

In order to profit from abrupt price fluctuations, scalping bots concentrate on making quick trades by placing multiple modest wagers. In a matter of seconds, these bots enter and exit trades, profiting from slight price changes over time. For scaling bots to work well, they must execute quickly and with exact timing.

DEX Sniper Bot

Automated trading programs specifically made for decentralized exchanges are known as DEX sniper bots. With customized gas fees and slippage settings, these bots expedite quick buy and sell orders, guaranteeing speedy and effective transactions. DEX sniper bots are designed to function in the distinct setting of decentralized exchanges, where quickness and accuracy are essential for seizing market opportunities.

AI-Powered Bots

Artificial intelligence and machine learning algorithms are used by AI-powered bots to modify and enhance trading tactics in response to changing market data. In order to maximize trading performance, these bots regularly adapt their strategies based on market developments. Bots driven by AI are able to recognize intricate patterns and make intelligent trading decisions, giving them a competitive advantage in the marketplace.

Every variety of this bot has special benefits and supports various trading approaches. By being aware of these kinds, traders can choose the best bot for their unique requirements and objectives, improving their capacity to successfully negotiate the ever-changing bitcoin market.

How Benefit To Crypto Traders?

Crypto traders can benefit from sniper bots in a number of ways, which improve their capacity for strategic decision-making and trading strategy optimization. They help traders in the following ways:

Enhanced Speed and Precision: The Sniper bot can take advantage of advantageous market conditions before human traders can respond because it can execute deals in milliseconds. With this speed, traders can obtain the best entry and exit locations and take advantage of fleeting chances.

Reduced Emotional Bias: Emotional decision-making is eliminated by automated trading with sniper bots. Because the bots adhere to preset algorithms and parameters, traders are less prone to make rash or illogical decisions. More consistent and disciplined trading results from this.

Efficient Market Timing: Sniper bots are designed to keep an eye on current market data and place trades in accordance with preset standards. Accurate trade timing enables traders to enter and exit positions at the optimal times, maximizing earnings.

24/7 Market Monitoring: Sniper bots may work around the clock, unlike human merchants. Even in situations where traders are unavailable because of time zone differences or other obligations, this ongoing monitoring makes sure that no trading chances are lost.

Customization and Flexibility: The Sniper bot can be customized to fit particular trading preferences and techniques. A highly individualized trading strategy is made possible by traders' ability to establish criteria based on technical indicators, price thresholds, or other market signals.

Reduced Manual Effort: By using crypto sniper bot development to automate trading chores, less manual intervention is required. While the bots manage standard trading tasks, traders may concentrate on developing and analyzing their strategies.

Competitive Edge: Traders can obtain a competitive advantage over other market participants by employing sniper bots. Better trading results and enhanced performance are frequently the result of the bots' quick and effective actions.

All things considered, this bot can greatly increase a trader's efficacy and efficiency in the bitcoin market, making them useful instruments for attaining trading success.

Final Thoughts

Sniper bots are an effective tool for trading cryptocurrencies and participating in online auctions. These bots can get goods or take advantage of market possibilities that others might overlook by placing bids or trades at the last second. Whether users are looking to win an auction or make profitable trades in the cryptocurrency market, their ability to act quickly and accurately provides them a competitive edge.

This bot guarantees that you have the highest chance of outbidding competitors and obtaining goods prior to the auction's conclusion in online sales. With rapid execution based on predetermined criteria, they improve decision-making in bitcoin trading with the goal of maximizing profits by capitalizing on market changes.

0 notes

Text

VapzFX PRO EA MT4 Source Code MQ4 (Works on Build 1420) | Forex Robot | MT4 Expert Advisor

Buy VapzFX PRO EA MT4 Source Code MQ4 offers a unique opportunity for traders seeking to enhance their MetaTrader 4 (MT4) trading experience. This fully automated Expert Advisor (EA) comes with the added advantage of providing its source code in MQ4 format.

The VapzFX PRO EA is a powerful trading solution for the MetaTrader 4 (MT4) platform. Whether you’re an experienced trader or just starting out, this fully automated Expert Advisor (EA) offers a unique blend of precision and adaptability. Let’s explore its features!

Visit To buy more Indicators and Expert Advisors @ Our Store Here : https://thetradelovers.gumroad.com

Key Features

Scalping Strategy: The VapzFX PRO EA focuses on exploiting small price fluctuations, making it ideal for both short-term and long-term trading.

Currency Pair: Primarily designed for the EURUSD pair, this EA leverages its high win rate to maximize profit potential.

Source Code (MQ4): Gain access to the EA’s source code for customization and optimization.

Strategy Overview

Minimum Deposit: $500 USD

Timeframe: M1 or M5

Currency Pairs: Other than XAUUSD

Strategy Type: Non-Martingale, Non-Hedging Scalper

Key Features

Continuous Scanning: Operates around the clock, utilizing advanced algorithms to pinpoint optimal trading prospects.

Cutting-Edge Approaches: Utilizes trend-tracking techniques to detect early market movements and reversals, augmenting decision-making capabilities.

Effective Risk Control: Deploys stop-loss and take-profit orders to protect investments and secure gains.

Flexible Strategies: Adapts to different market conditions by employing a variety of trading tactics for maximum effectiveness.

Personalized Options: Provides traders with the ability to adjust settings and risk thresholds, customizing the system to suit individual trading styles.

EA VAPZFX PRO Review

EA VAPZFX PRO Settings

Trading Platform : MT4

Currency Pairs : EURUSD, AUDCAD (Any Pairs)

Times Frames : M15, M30, H1

Minimum Deposit : 500$

Product Type : NoDLL / Unlimited / Fix

Setup Files : Available

What’s in the package?

Expert : EA VapzFX PRO MQ4.mq4

===========================================================

You can get it free if you signup Exness with our referral link

https://one.exnesstrack.net/intl/en/a/s020wlktrj MORE ROBOTS and MANUAL TRADING SYSTEM UNLIMITED VERSION Telegram Channel : https://t.me/TheTradeLovers Telegram Contact : https://t.me/TheTradeLover Email : [email protected] Whatsapp: https://whatsapp.com/channel/0029VaLNS5gJpe8kk7rZCa13 Instant Download Your files will be available to download once payment is confirmed. Instant download items don’t accept returns, exchanges or cancellations. Please contact the seller about any problems with your order. Our Payment Options:👇 1) Bitcoin Wallet: 19osRLGdcrdKGq8HseVimFv4sPtWiVXht 2) USDT(Tether) Wallet: (ERC20) 0xd75d6711d9ddbc6e12910bdcecf9b1820ded33c0 3). USDT(Tether) Wallet: (TRC20) TUXqFGZd7dGzrbkB8SFh3dduUPT9wtoxWL 3) TRX(Tron) Wallet: (TRC20) TUXqFGZd7dGzrbkB8SFh3dduUPT9wtoxWL 4) XRP(Ripple): XRP Ripple rNxp4h8apvRis6mJf9Sh8C6iRxfrDWN7AV Memo 382047608 And another crypto wallet: on request 5) Paypal: https://PayPal.Me/thetradelovers 6) Skrill: On Request 7) Neteller: On Request 8) You can pay with also Indian Payment Methods Like BHIM, Paytm, Google Pay, PhonePe or any Banking UPI app On Buyer Request.

0 notes

Text

Estrategia de Trading rentable tipo Scalping en Bingx y 50 USDT GRATIS!

Obten 50 USDT gratis aqui ? https://bit.ly/3LRffIt - Te muestro un "trading setup" (estrategia) para hacer scalping en Bingx con indicadores gratuitos. Ademas, te regalo 50 USDT gratis para que pruebes la estrategia o la que quieras. ✅ ? Unete A Mis Comunidades:: ? TikTok: https://tiktok.com/@criptorell ? Twitter: https://twitter.com/cryptorell ? Canal de Airdrops: https://t.me/criptoairdrops ? Facebook: https://facebook.com/cryptorell ? Canal telegram noticias: https://t.me/cryptosplus ? Grupo telegram: Escribeme a @bitclonit en telegram para el acceso ? Discord: https://discord.gg/XJJZy6vfUA ✅ Sobre Mi: Enseño cómo ganar dinero con criptomonedas. Con explicaciones detalladas paso a paso. Cubro todos los aspectos: Noticias cripto, Defi, Tutoriales, Trading, NFT, juegos nft gratis y mas ──────⊱⁜⊰────── Descargo de responsabilidad: No aceptamos ninguna responsabilidad por ninguna pérdida o daño en el que se incurra si usted actúa o no actúa como resultado de escuchar cualquiera de mis publicaciones. Usted reconoce que utiliza la información que proporcionamos bajo su propio riesgo. Haga su propia investigación. Carlorell o Crypto Orell o Cryptorell no ofrece consejos legales, financieros o de inversión, ni sustituye la debida diligencia de cada interesado. Cryptorell no respalda a ninguna empresa, página o aplicación que están promocionadas en este canal ni los sitios web de los cuales se hablan. El contenido y los enlaces (links) provistos en este canal solo cumplen propósitos informativos. Este canal puede incluir links de afiliado, los cuales puedo llevarme algun beneficio para poder seguir trayendo contenido gratuito y de calidad. © Crypto Orell #bingx #criptomonedas #usdt https://ifttt.com/images/no_image_card.png https://www.youtube.com/watch?v=laiWg29bqt4 https://ifttt.com/images/no_image_card.png https://cryptoorell.weebly.com/crypto-orell/estrategia-de-trading-rentable-tipo-scalping-en-bingx-y-50-usdt-gratis

#California#demonstrated#music#composing#ownsongs#childactress#landed#starringroles#TVseries#Bizaardvark#HighSchoolMusical#thrmusical

0 notes

Text

Estrategia de Trading rentable tipo Scalping en Bingx y 50 USDT GRATIS!

Obten 50 USDT gratis aqui https://bit.ly/3LRffIt – Te muestro un “trading setup” (estrategia) para hacer scalping en Bingx con indicadores gratuitos. Ademas, te regalo 50 USDT gratis para que pruebes la estrategia o la que quieras. Unete A Mis Comunidades:: TikTok: https://tiktok.com/@criptorell Twitter: https://twitter.com/cryptorell Canal de Airdrops: https://t.me/criptoairdrops Facebook: https://facebook.com/cryptorell Canal telegram noticias: https://t.me/cryptosplus Grupo telegram: Escribeme a @bitclonit en telegram para el acceso Discord: https://discord.gg/XJJZy6vfUA Sobre Mi: Enseño cómo ganar dinero con criptomonedas. Con explicaciones detalladas paso a paso. Cubro todos los aspectos: Noticias cripto, Defi, Tutoriales, Trading, NFT, juegos nft gratis y mas ──────⊱⁜⊰────── Descargo de responsabilidad: No aceptamos ninguna responsabilidad por ninguna pérdida o daño en el que se incurra si usted actúa o no actúa como resultado de escuchar cualquiera de mis publicaciones. Usted reconoce que utiliza la información que proporcionamos bajo su propio riesgo. Haga su propia investigación. Carlorell o Crypto Orell o Cryptorell no ofrece consejos legales, financieros o de inversión, ni sustituye la debida diligencia de cada interesado. Cryptorell no respalda a ninguna empresa, página o aplicación que están promocionadas en este canal ni los sitios web de los cuales se hablan. El contenido y los enlaces (links) provistos en este canal solo cumplen propósitos informativos. Este canal puede incluir links de afiliado, los cuales puedo llevarme algun beneficio para poder seguir trayendo contenido gratuito y de calidad. © Crypto Orell #bingx #criptomonedas #usdt https://ifttt.com/images/no_image_card.png https://www.youtube.com/watch?v=laiWg29bqt4 https://s0.wp.com/wp-content/mu-plugins/wpcom-smileys/twemoji/2/72x72/1f449.png https://cryptoorell.wordpress.com/2023/05/11/estrategia-de-trading-rentable-tipo-scalping-en-bingx-y-50-usdt-gratis-%e2%9c%85/

#SchoolDirector#ExecutiveProducer#PorthouseTheatre#AssociateProfessor#TheatreandDance#movement#musicaltheatre#acting#YorkMusical#TheatreShowcase

0 notes

Text

Estrategia de Trading rentable tipo Scalping en Bingx y 50 USDT GRATIS!

Obten 50 USDT gratis aqui 👉 https://bit.ly/3LRffIt - Te muestro un "trading setup" (estrategia) para hacer scalping en Bingx con indicadores gratuitos. Ademas, te regalo 50 USDT gratis para que pruebes la estrategia o la que quieras. ✅ 👥 Unete A Mis Comunidades:: 👉 TikTok: https://tiktok.com/@criptorell 👉 Twitter: https://twitter.com/cryptorell 👉 Canal de Airdrops: https://t.me/criptoairdrops 👉 Facebook: https://facebook.com/cryptorell 👉 Canal telegram noticias: https://t.me/cryptosplus 👉 Grupo telegram: Escribeme a @bitclonit en telegram para el acceso 👉 Discord: https://discord.gg/XJJZy6vfUA ✅ Sobre Mi: Enseño cómo ganar dinero con criptomonedas. Con explicaciones detalladas paso a paso. Cubro todos los aspectos: Noticias cripto, Defi, Tutoriales, Trading, NFT, juegos nft gratis y mas ──────⊱⁜⊰────── Descargo de responsabilidad: No aceptamos ninguna responsabilidad por ninguna pérdida o daño en el que se incurra si usted actúa o no actúa como resultado de escuchar cualquiera de mis publicaciones. Usted reconoce que utiliza la información que proporcionamos bajo su propio riesgo. Haga su propia investigación. Carlorell o Crypto Orell o Cryptorell no ofrece consejos legales, financieros o de inversión, ni sustituye la debida diligencia de cada interesado. Cryptorell no respalda a ninguna empresa, página o aplicación que están promocionadas en este canal ni los sitios web de los cuales se hablan. El contenido y los enlaces (links) provistos en este canal solo cumplen propósitos informativos. Este canal puede incluir links de afiliado, los cuales puedo llevarme algun beneficio para poder seguir trayendo contenido gratuito y de calidad. © Crypto Orell #bingx #criptomonedas #usdt https://ifttt.com/images/no_image_card.png https://www.youtube.com/watch?v=laiWg29bqt4

#cryptocurrencies#reviewsoftwares#tradingcrypto#communicologist#bitcoiner#cryptorell#contentcreator#videocreator#blockchain#step-by-step#makemoney

0 notes

Photo

Bitcoin Analysis & Prediction. Bitcoin Important Levels, Trading & Scalping Setup & Strategy #forex #crypto #cryptocurrency #cryptotrading #forextrading #forexmarket #bitcointechnicalanalysis #BTCUSDT #bitcointrading

0 notes