#CryptoMindset

Explore tagged Tumblr posts

Text

🚀 Get Ahead in the Digital Economy with Smart Crypto Choices

The digital economy is evolving fast — and those who make informed crypto moves are leading the way. 🧠💼

Whether you're trading, staking, or diving into DeFi, smart crypto choices can put you miles ahead of traditional investors.

Why it matters: ✅ 24/7 global access to financial tools ✅ Opportunities for passive income & asset growth ✅ True ownership through decentralization ✅ Future-ready skills for a Web3 world

Crypto isn’t just currency — it’s a mindset. Make smart moves now to shape your digital wealth tomorrow. 🌍💸

Adapt. Invest. Thrive.

#digitaleconomy#cryptosmart#blockchainfuture#web3investor#defimoves#cryptomindset#investinyourfuture#cryptogrowth#financialfreedom#cryptostrategy#smartmoney#web3life#techdrivenfinance#digitalassets#tumblrcrypto

0 notes

Text

🧠 The Psychology of Decision-Making in Uncertainty: Mastering the Chaos of a Volatile World

In a world spinning faster than ever—economically, technologically, politically—the ability to make smart decisions amid uncertainty is becoming not just valuable, but essential. Whether you’re trading crypto, launching a startup, or simply deciding where to invest your time, uncertainty is the only certainty. And yet, how we think during uncertain times often matters more than the circumstances…

0 notes

Text

“This Isn’t Just Bitcoin – It’s a Digital Power Surge You Can’t Ignore ⚡🔐”

💥 What you’re seeing here isn’t just a bunch of crypto symbols. It’s the future of money, power, and global freedom — all happening in real time. 🌐💸 From Bitcoin to NFTs, from blockchain to the metaverse, this one image holds the keys to the digital revolution. 🧬🚀

🔎 Wondering what it all means? Why everyone from your neighbor to billionaires are going ALL IN on crypto? Click below and step into the future — before it leaves you behind. 👇 👉 https://t.co/Ttddedmvoc

🛑 Don't just scroll. Decode the hype. Click. Learn. Lead. 🔗🧠

#CryptoExplosion#BitcoinRevolution#DigitalGold#NFTWorld#BlockchainLife#FutureOfFinance#CryptoMindset#AltcoinArmy#Web3Wave#MetaverseReady#TechTakeover#CryptoArt#AIandCrypto#FinancialFreedom#CryptoJourney

0 notes

Text

“This Bitcoin Isn’t Just Digital — It’s Destiny 💰🔥”

⚡ What you're seeing isn't just a coin. It's the next chapter of global wealth. 🪙 Bitcoin isn't waiting for you to believe — it's already moving. Those who understand it early... aren't just rich. They're untouchable. 🛡️

This image? It's not art. It's a reminder. 📈 While most scroll past, the few who act — build empires. 💡 If you feel it, you're already ahead of 95% of the world.

🔐 The future of money is already here — but only if you dare to step in. Look closer. There's more behind this glow than just gold.

👉 https://t.co/Ttddedmvoc

✨ Power. Code. Crypto. It all begins with this.

#BitcoinEnergy#CryptoWealth#NextGenCurrency#DigitalGoldRush#BTCGlowUp#BlockchainElite#FutureOfFinance#CryptoVibesOnly#BitcoinArt#CryptoMindset#TumblrCrypto#Web3Rise

0 notes

Text

💸 Digital Assets Aren’t Just the Future — They’re the Present.

Crypto. NFTs. Tokens. Staking. It’s wild how fast the world is shifting and how many people are still sleeping on it.

Not every project will win, but the mindset shift? That’s permanent.

Own your data. Own your money. Own your future.

📲 Are you investing, building, or just watching from the sidelines?

Let’s talk Web3, not just watch it happen.

#digitalwealth#cryptocurrency#digital currency#digital assets#cryptomentor#crypto#etherum#nftcommunity#knitting#selfimprovement#tumblr#satoshi#tokenomics#metaverse#defi#cryptomindset

1 note

·

View note

Text

🚀 Expedition Delay & Last-Minute Prep 🏔️📈

by #uevs and the power of AI

Fine-Tuning for the Himalayas

Change of plans—departure for the Himalayas is on hold. Turns out, some last-minute gear checks exposed weak links. And by weak links, I mean potential “why is my tent flying off a cliff?” situations. Out here, even the smallest oversight can turn into a survival problem, so I’m taking the time to fine-tune every detail. No room for rookie mistakes when altitude, elements, and mischievous mountain winds are testing every decision.

Opportunities in Chaos

Meanwhile, with an unexpected window of time, I checked in on the crypto markets. Blood on the streets? Perfect. Fear is high, prices are low, and history tells us this is when the bold make their move. "Buy when there's blood on the streets, even if it’s your own," as the saying goes. No one rings a bell at the bottom, but the best opportunities come wrapped in panic and served with a side of irrational fear.

That said, let go of the fantasy that some super cheap, obscure coin is going to take you to the moon 🚀🌕🚀. Winning in this space is about finding solid, undervalued projects with real potential—not lottery tickets. The same rule applies to life: invest in quality, whether it’s assets, knowledge, or the people around you.

Final Prep Before Takeoff

For now, it’s back to the gear—tightening straps, replacing weak links, and making sure my backpack doesn’t turn into a dysfunctional jigsaw puzzle at 5,000 meters. Next stop: the Himalayas, this time with nothing left to chance (except maybe the weather, but let’s not jinx it). ⛰️

ExpeditionReady #CryptoMindset #FearEqualsOpportunity

0 notes

Text

💡 Pourquoi investir en crypto plutôt que laisser son argent en banque ? 💡

Aujourd’hui, votre argent dort sur votre compte bancaire… et il perd de la valeur chaque jour à cause de l’inflation. Pendant ce temps, la crypto offre des opportunités que les banques ne peuvent tout simplement pas égaler.

🔹 1. Des rendements bien plus élevés Un livret bancaire vous rapporte 0,5% à 3% par an, alors que certaines cryptos offrent des rendements de 20%, 50% voire plus sur le long terme. Avec les bonnes stratégies, votre argent travaille réellement pour vous.

🔹 2. Un accès direct et sans intermédiaire Votre banque impose des frais, des restrictions et peut même bloquer vos transactions. Avec la crypto, vous êtes votre propre banque. Pas de frais cachés, pas d’intermédiaire, vous gardez le contrôle total sur votre argent.

🔹 3. La rareté du Bitcoin : l’or numérique Contrairement aux monnaies imprimées en masse par les banques centrales, Bitcoin est limité à 21 millions d’unités. Cela signifie que pendant que les banques diluent la valeur de votre argent, Bitcoin devient plus rare et plus précieux avec le temps. Aujourd’hui, des institutions et des pays commencent à en accumuler… et chaque jour, il y en a de moins en moins à acheter.

🔹 4. Des placements flexibles et accessibles Pas besoin de gros capitaux pour commencer. Avec 50 €, vous pouvez déjà investir, acheter, revendre et même générer des revenus passifs grâce au staking et à la DeFi. Essayez de faire ça avec un compte bancaire classique…

📢 Rejoignez-nous pour en savoir plus ! Nous organisons un webinaire éducatif 100% gratuit, où nous vous expliquerons : ✅ Pourquoi les cryptos surpassent les placements bancaires ✅ Comment débuter en toute sécurité ✅ Les meilleures stratégies pour faire fructifier votre argent

🎟 Inscrivez-vous dès maintenant et prenez une longueur d’avance sur l’avenir de la finance !

💰 Conclusion : L’argent placé en banque ne fait que stagner. Les cryptos, et en particulier le Bitcoin, offrent des rendements, de la liberté et une protection contre la dévaluation monétaire.

🚀 Et si vous commenciez aujourd’hui ? Nous sommes là pour vous accompagner vers un placement intelligent et sécurisé. Prenez le contrôle de votre argent dès maintenant ! 🔥 #CryptoStratégie #financedécentralisée #investissementcrypto #cryptoinvestissement #cryptomindset #patienceetdiscipline #InvestirMalin #entrepreneur #diversification

#business#homework#home & lifestyle#crypto#investment#eco lifestyle#health & fitness#ecology#nature#plastic

0 notes

Photo

#OneOneOne #ElevenZeroOne #2301 #Guao #WackyFunny #Funny #Weird #Timing #EPHIAT #Fiat #EFiat #IncentiveToken #Token #Crypto #DollarCostAverage @dollarcostcrypto #CryptoMindset #Knowledge https://www.instagram.com/p/Cpy7gxeOXXT/?igshid=NGJjMDIxMWI=

#oneoneone#elevenzeroone#2301#guao#wackyfunny#funny#weird#timing#ephiat#fiat#efiat#incentivetoken#token#crypto#dollarcostaverage#cryptomindset#knowledge

0 notes

Text

Hide your account balance. When the cryptocurrency falls, you can't see that the account balance has decreased, and you won't be upset. Self-deception is very suitable for spot holders..😂

#CryptoMindGames - Playing tricks with your mind to protect your assets#HODLHacks - Clever strategies for holding onto your crypto in turbulent times#CryptoMindset - Mastering the mental game of crypto investing#DeceptiveInvesting - Why self-deception can actually be a useful tool for crypto traders#CryptocurrencyPsychology - Understanding the complex human emotions behind crypto trading#MindOverCrypto - How mental toughness can help you weather the ups and downs of the crypto market

0 notes

Text

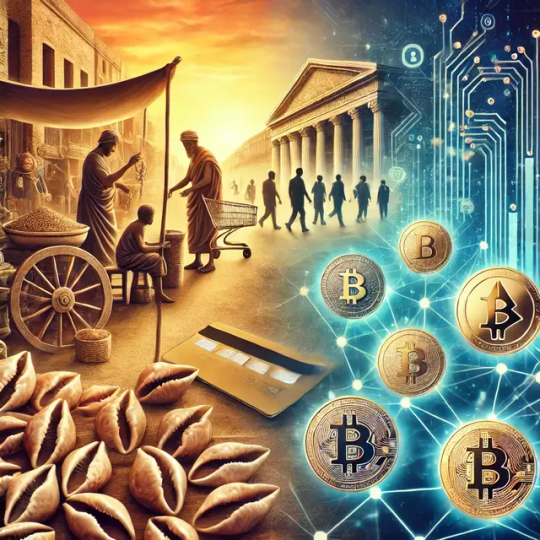

From Seashells to Satoshis: The Evolution of Money

Picture an ancient marketplace, where the currency jingling in your pouch might not be coins at all, but seashells. For centuries, cowrie shells were prized for their shiny appeal and rarity, transforming them into one of humanity’s earliest forms of money. Over time, these shells gave way to metals—iron, copper, silver, and gold—that gleamed with an unmistakable allure. Soon enough, our ancestors decided that lugging heavy gold and silver everywhere was a bit too cumbersome, so they started stamping metals into more convenient coins. This was the moment rulers realized something fundamental: whoever controls the mint, controls the economy. It wasn’t long before some couldn’t resist the temptation to mix cheaper metals in, keeping the gold for themselves. Those sneaky tactics brought about a new kind of challenge—trust.

Civilizations continued to experiment with what they could use as a medium of exchange, but ultimately, the golden standard took hold in many parts of the world. Gold’s scarcity, durability, and shiny mystique made it perfect for coins. That system thrived, yet society yearned for the next innovative step: paper currency. People quickly discovered that thin, foldable, and easy-to-carry notes were far superior to a pocketful of metal, and so governments printed paper money backed by vaults of precious metal. With the rise of fiat currency, the day came when the promise that these notes could be traded for gold or silver fizzled out entirely. Suddenly, many currencies were worth something simply because a central authority claimed so, and people believed it—or at least went along with the collective delusion. This arrangement flourished as economies globalized, but it also planted the seeds of modern financial headaches, like inflation and incessant money printing.

Still, the convenience of paper money was unmatched—until credit cards and online banking arrived. With a simple swipe or a tap on an app, individuals could pay for things in a purely digital sense. Transactions happened at lightspeed, all orchestrated by a network of banks and payment processors. Yet that centralization, which at first looked efficient, also created single points of failure. If banks had technical issues or simply felt your transaction was “suspicious,” access to your funds could vanish faster than you could say “insufficient funds.”

Enter Bitcoin, launched by the mysterious Satoshi Nakamoto. The idea behind Bitcoin was to create a system that didn’t require permission or trust in any single authority. Think of it as the next stage in the evolution of money—just like going from shells to gold, gold to paper, and paper to digital banking, the concept of decentralized digital coins felt like a natural leap. Here, the currency isn’t printed arbitrarily by a central bank; it’s “mined” through solving cryptographic puzzles. More importantly, every transaction is recorded on a public ledger called the blockchain, ensuring transparency, security, and an unwavering limit on the total supply.

Some critics argue that cryptocurrencies are too volatile or still too complex for mainstream adoption. Others worry about the energy consumed in mining. Yet, even those skeptics acknowledge that Bitcoin and other digital assets have ignited a global conversation. The very fact that governments and big financial institutions are grappling with how to regulate or incorporate crypto is proof that we’ve reached a tipping point. Humanity has always been restless when it comes to improving its systems, especially the system of money.

From shells in the marketplace to cryptographic tokens on the internet, the thread connecting us across history is innovation. We are constantly reimagining how to store and exchange value. The real question is not whether money will evolve once more—it’s how quickly this new chapter will redefine our personal freedoms, our economic structures, and the ways we trust one another. Will we cling to old traditions until they crumble, or embrace a future where blockchains, decentralized finance, and digital currencies reshape how we think about worth itself?

In the grand tapestry of civilization, money isn’t just coins and notes; it’s a story we tell ourselves about trust, power, and possibility. As we move ever closer to a world shaped by digital networks, the ancient shells on a faraway beach remind us that the idea of value is never fixed—it’s created, adapted, and refined. And now, in the age of Bitcoin, we’re just beginning to write the next chapter.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#Cryptocurrency#MoneyEvolution#Blockchain#DigitalCurrency#FinancialRevolution#BitcoinEducation#CryptoHistory#FutureOfFinance#Decentralization#BitcoinFixesThis#SeashellsToSatoshis#MoneyMatters#EconomicFreedom#Hyperbitcoinization#SoundMoney#Finance#MoneyTalks#CryptoMindset#FiatVsBitcoin#financial experts#unplugged financial#financial empowerment#financial education#globaleconomy

3 notes

·

View notes

Text

💼 Hold Quality, Let Go of the Weak – Smart Asset Management

In crypto, not all coins are created equal. 🚫✨ Smart investors don’t hold everything — they hold what matters.

Here’s how to level up your portfolio with Smart Holding: ✅ Double down on strong fundamentals (use case, dev activity, adoption) ✅ Cut losses early on underperforming or hype-driven tokens ✅ Rebalance regularly based on market conditions & goals ✅ Focus on long-term winners, not short-term noise

It’s not just about HODLing — it’s about holding wisely. Build strength, not clutter. 💎💼

#smartholding#cryptoportfolio#assetmanagement#holdquality#cryptostrategy#blockchaininvesting#cryptowisdom#digitalassets#cryptodiscipline#investsmart#web3wealth#longtermgrowth#tumblrcrypto#cryptomindset#cryptoplanning

0 notes

Text

How Relaxation Improves Decision-Making in Trading

In the fast-paced world of cryptocurrency trading, every second counts. Traders are constantly analyzing markets, interpreting signals, and executing buy or sell orders in real-time. With such a demanding environment, mental clarity and focus are essential. But what if one of the most powerful tools a trader can use is not just technical analysis or advanced algorithms, but relaxation? Welcome…

0 notes

Text

Living in the Now: A Bitcoin Holder's Mindset

In the fast-paced world of cryptocurrency, where price charts and market sentiment dominate discussions, a deeper philosophy emerges among Bitcoin holders – one that transcends mere investment strategy. This philosophy, rooted in the concept of "living in the now," represents a profound understanding that today's actions shape tomorrow's reality in ways we're only beginning to comprehend.

The Philosophy of Living in the Now

Living in the now isn't about impulsive decisions or short-term thinking. Rather, it's about maintaining acute awareness of how present moments cascade into future outcomes. This awareness gives birth to what I call "quantum presence" – a state of being where each decision carries the weight of future potential, like a quantum particle whose state influences the entire system.

Bitcoin holders embody this philosophy uniquely. Each time they choose to hold rather than sell, learn rather than dismiss, or share knowledge rather than hoard it, they're making a conscious decision that ripples through time. They understand that today's commitment to understanding and holding Bitcoin isn't just about personal gain – it's about participating in a fundamental shift in how humanity approaches money and value.

The Long-Term Vision of Bitcoin

Bitcoin holders are modern-day pioneers, planting seeds in digital soil that future generations will harvest. This isn't mere speculation – it's a calculated commitment to a future where financial sovereignty becomes accessible to all. The mindset required for this journey demands extraordinary patience and self-discipline, qualities that seem increasingly rare in our instant-gratification culture.

Consider the Bitcoin holder who continues to accumulate during bear markets, or the developer who contributes to the protocol despite market conditions. These individuals demonstrate a profound understanding that meaningful change requires sustained commitment, not reactive responses to market fluctuations.

Thriving in Uncertainty: Adaptability in the Moment

The Bitcoin market's notorious volatility serves as a powerful teacher of presence and adaptability. Long-term holders learn to navigate price swings not through emotional detachment, but through deeper engagement with their conviction. This volatility becomes a tool for growth, teaching us that uncertainty isn't something to fear but rather a constant companion on the path to transformation.

This lesson extends far beyond cryptocurrency. In a world of increasing complexity and change, the ability to remain centered while adapting to new information becomes invaluable. Bitcoin holders learn this lesson through experience, developing an emotional resilience that serves them in all areas of life.

Quantum Presence in Everyday Decisions

The concept of quantum presence manifests in subtle yet powerful ways. It's present in the decision to spend an evening reading about monetary policy instead of scrolling social media. It shows up in the choice to dollar-cost average into Bitcoin rather than chase the latest market trend. These seemingly small decisions compound over time, creating exponential returns not just financially, but in wisdom and understanding.

Every time a holder explains Bitcoin to a curious friend, helps secure their keys, or contributes to the community, they're exercising quantum presence. These actions might seem insignificant in the moment, but their impact reverberates through time, creating ripples that influence the collective future.

The Ripple Effect: Why This Mindset Matters Beyond Bitcoin

The Bitcoin holder's mindset offers valuable lessons for addressing larger challenges facing humanity. Climate change, education reform, and public health all require the same long-term thinking and present-moment awareness that Bitcoin holders cultivate. The ability to take decisive action today while maintaining a multi-decade perspective becomes crucial for addressing these systemic challenges.

Consider how this mindset might transform education: instead of studying for the next test, students might approach learning as a lifelong journey of discovery. Or in environmental conservation: rather than seeking quick fixes, we might implement sustainable practices that compound over generations.

Embrace the Quantum Presence

The invitation is clear: embrace the philosophy of quantum presence in your own life. Whether you're just beginning your Bitcoin journey or you're a seasoned holder, recognize that each moment offers an opportunity to align your actions with your long-term vision.

Start small but think big. Learn the basics of Bitcoin self-custody. Set up a recurring purchase plan. Engage with the community. Each action, however modest, contributes to a larger transformation. Remember that living in the now doesn't mean forgetting about the future – it means understanding that the future is created through our present awareness and action.

The Bitcoin holder's mindset teaches us that true change doesn't happen through grand gestures but through consistent, purposeful action aligned with a larger vision. In embracing this philosophy, we don't just become better Bitcoin holders – we become more conscious architects of the future we wish to create.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#LivingInTheNow#QuantumPresence#FinancialFreedom#FutureOfFinance#CryptoMindset#PersonalGrowth#BitcoinHodl#RippleEffect#DecentralizedFuture#PhilosophyOfMoney#LongTermVision#DigitalRevolution#Sustainability#BitcoinCommunity#CryptoPhilosophy#LifeLessons#BitcoinEducation#TickTockNextBlock#cryptocurrency#blockchain#digitalcurrency#finance#globaleconomy#financial education#financial experts#financial empowerment#unplugged financial

3 notes

·

View notes

Text

Critical Thinking in the Age of Bitcoin: A Guide to Navigating the Noise

In a world increasingly dominated by information overload, the ability to think critically has never been more essential. This is especially true in the realm of Bitcoin and cryptocurrencies, where rapid developments, complex technologies, and a mix of both reliable and unreliable information can overwhelm even the most seasoned investors. As Bitcoin continues to gain traction and reshape the financial landscape, developing the skills to analyze, question, and make informed decisions is crucial. In this post, we’ll explore the power of critical thinking and introduce you to the concept of first principles thinking—a framework that will help you see through the noise and make sound decisions in the age of Bitcoin.

Understanding the Basics: What is Critical Thinking?

Critical thinking is the process of actively analyzing, interpreting, and evaluating information to reach a conclusion or make a decision. It's not about what to think but how to think—challenging assumptions, scrutinizing evidence, and considering alternative perspectives. In the context of Bitcoin, critical thinking enables you to navigate the hype, avoid pitfalls, and make investment decisions based on a solid understanding rather than speculation.

For instance, when faced with sensationalist headlines predicting Bitcoin’s imminent collapse or its meteoric rise, a critical thinker would delve deeper, asking questions like: What are the sources of this information? What evidence supports these claims? Are there alternative viewpoints? By adopting this mindset, you become better equipped to separate fact from fiction and make decisions that align with your financial goals.

Navigating the Noise: Identifying Reliable Information

The cryptocurrency space is rife with conflicting opinions, market rumors, and biased reporting. Identifying reliable sources of information is a critical first step in forming an accurate understanding of Bitcoin and its ecosystem.

Start by seeking out reputable news outlets and trusted voices within the crypto community. Cross-reference information from multiple sources, and be wary of content that lacks transparency or fails to cite credible data. Tools like blockchain explorers can provide real-time insights into network activity, offering a factual basis to supplement your research.

Additionally, learning to spot red flags—such as overly sensational headlines, articles that play on emotions, or content that promises guaranteed returns—can help you avoid being misled. Remember, in the age of Bitcoin, informed skepticism is your ally.

Avoiding Common Pitfalls: Recognizing Cognitive Biases

Even the most rational minds can fall prey to cognitive biases—systematic patterns of deviation from norm or rationality in judgment. In the volatile world of cryptocurrencies, these biases can lead to poor investment decisions.

One common bias is confirmation bias, where investors seek out information that confirms their pre-existing beliefs while ignoring contradictory evidence. For example, if you’re bullish on Bitcoin, you might only consume content that supports your optimistic outlook, leading to an echo chamber effect.

Another is FOMO (Fear of Missing Out), where the fear of missing out on potential gains drives impulsive decisions. This can lead to buying at market tops or selling during downturns, often resulting in losses.

To counteract these biases, cultivate a habit of questioning your assumptions. Actively seek out opposing viewpoints, and consider the broader context before making decisions. By acknowledging and addressing these biases, you can make more rational and objective choices.

First Principles Thinking: A Framework for Clarity

While critical thinking helps you navigate the surface level of information, first principles thinking allows you to drill down to the very core of issues. This problem-solving approach involves breaking down complex concepts into their most fundamental truths and building your understanding from there.

For example, consider the criticism around Bitcoin’s energy consumption. Instead of accepting headlines at face value, apply first principles thinking. Ask fundamental questions: What is the actual energy usage of the Bitcoin network? How does it compare to the energy consumption of the traditional financial system? What are the societal benefits of Bitcoin’s energy use?

Through this lens, you may discover that while Bitcoin does consume a significant amount of energy, its decentralized nature, security, and potential to replace less efficient financial systems could justify its usage. This type of deep analysis not only clarifies the issue but also equips you with the insights needed to make informed decisions.

Case Study: A First Principles Analysis of Bitcoin’s Energy Usage

Let’s put first principles thinking into practice by examining Bitcoin’s energy consumption—a topic often used to criticize the cryptocurrency. At first glance, the sheer amount of energy Bitcoin uses may seem excessive. However, by breaking down the issue into its core components, we can achieve a more nuanced understanding.

What is Bitcoin’s actual energy usage?

Bitcoin’s energy consumption is significant, but it’s important to quantify this and compare it to other systems, such as the global banking system or gold mining.

What is the purpose of this energy use?

The energy secures the Bitcoin network, ensuring its decentralization and protection against attacks.

What are the benefits of Bitcoin’s energy consumption?

Bitcoin’s decentralized, secure network can provide financial services to unbanked populations, offer an alternative to inflation-prone fiat currencies, and reduce the need for intermediaries in financial transactions.

By applying first principles thinking, we see that the issue is not as straightforward as it first appears. While Bitcoin’s energy consumption is high, the benefits it provides could outweigh the costs, especially when compared to traditional systems.

Benefits of First Principles Thinking in Investing

First principles thinking isn’t just for analyzing Bitcoin’s energy use—it’s a powerful tool for making investment decisions as well. By stripping down complex ideas to their fundamentals, you can avoid getting caught up in market hype or fear.

For example, instead of simply asking, “Should I buy Bitcoin because everyone else is?” ask, “What problem is Bitcoin solving? Is this problem significant enough that Bitcoin will continue to have value in the future?” By focusing on these fundamental questions, you can make investment decisions that are rooted in logic rather than emotion.

Conclusion: The Power of a Critical Mindset

In the ever-evolving world of Bitcoin, critical thinking and first principles thinking are invaluable tools. They empower you to see beyond the noise, avoid common pitfalls, and make informed decisions that align with your long-term goals.

As you continue to navigate the Bitcoin space, remember to always question, analyze, and think from first principles. The more you hone these skills, the better equipped you’ll be to thrive in this new financial frontier.

So, stay curious, keep learning, and never stop questioning. After all, in a world where everyone has an opinion, it’s the critical thinkers who truly understand.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

Thank you for your support!

#Bitcoin#Cryptocurrency#CriticalThinking#FirstPrinciples#Blockchain#CryptoEducation#BitcoinInvesting#DigitalCurrency#FinancialFreedom#CryptoMindset#BitcoinCommunity#BitcoinAnalysis#CryptoKnowledge#BlockchainTechnology#BitcoinFuture#financial empowerment#financial experts#unplugged financial#financial education#finance#globaleconomy

5 notes

·

View notes

Text

🌐 Hold Crypto & Watch Your Portfolio Grow in a Digital Economy

The world is going digital — and so is wealth. 📲💰 By simply holding strong crypto assets, you're positioning yourself at the forefront of the new economy.

Here’s why holding pays off: ✅ Long-term growth as adoption increases ✅ Scarce assets like Bitcoin drive value over time ✅ DeFi & Web3 integration enhances utility ✅ Protection against inflation and fiat devaluation

You don’t have to day trade to win — just HODL smart, stay informed, and let the future work in your favor. 📈💎

In the digital age, holding is building.

#holdcrypto#digitaleconomy#cryptogrowth#web3wealth#hodlstrong#passivegrowth#longtermcrypto#blockchainfuture#cryptomindset#smartinvesting#digitalassets#tumblrcrypto#cryptostrategy#financialfreedom#cryptojourney

0 notes

Text

📈 Grow Your Wealth with the Power of Cryptocurrency!

Tired of limited returns and outdated systems? Cryptocurrency is transforming the way people build wealth — and it’s more accessible than ever. 🌍💰

Why crypto? ✅ 24/7 markets — invest anytime, from anywhere ✅ High-growth potential with emerging assets ✅ Multiple income streams — staking, DeFi, NFTs & more ✅ You’re in control — no banks, no middlemen

Whether you’re starting with $10 or $10K, crypto gives you tools to grow, diversify, and take charge of your financial future. 🚀🔐

Start small. Learn fast. Grow strong.

#cryptowealth#growwithcrypto#digitalassets#financialfreedom#cryptoinvesting#web3finance#blockchainpower#smartmoneymoves#passiveincome#cryptolife#defistrategies#cryptojourney#tumblrcrypto#cryptomindset#wealthbuilding

0 notes