#data integration in data warehouse

Explore tagged Tumblr posts

Text

Ultimate Guide to Investing in Industrial Real Estate in 2025

Key Takeaways Industrial real estate—including warehouses and data centers—provides a stable investment opportunity amid evolving U.S. commerce. Technology advancements and urban development are fueling demand and creating new avenues for growth within this sector. Understanding resilience factors and strategic approaches is essential for maximizing returns in 2025. Unlocking the Potential of Modern Industrial Spaces If you're thinking about where to grow your money in 2025, industrial real estate in the U.S. stands out like a beacon. Picture warehouses buzzing with activity and data centers powering daily life—these spaces drive modern commerce and offer you real stability. With technology shaping how goods move and cities evolving fast, you have a chance to get ahead. But what makes these properties so resilient, and which strategies will set you up for real success next year? Key Drivers of Industrial Real Estate Performance in 2025 In 2025, several powerful forces are shaping the future of industrial real estate in the United States. You’ll notice that e-commerce growth is driving high demand for warehouses, last-mile delivery hubs, and specialized cold storage. Innovative leasing has become common, as businesses want flexible terms that support inventory swings and supply chain resilience. Investors and developers need to watch out for growing threats like title fraud and squatting, which can cause significant financial setbacks if not proactively managed. Infrastructure investments are boosting areas near highways, ports, and major cities, making these locations even more valuable. Vacancy rates have risen slightly due to a steady pace of new deliveries, highlighting the importance of location and tenant quality when making investment decisions. Investors focus on properties that align with these trends—close to transportation and population centers, with smart upgrades like automation. You can see how lifestyle changes, like faster shipping expectations and the rise of subscription services, push demand further. If you understand these drivers, you’re better prepared to spot opportunities—and act dynamically. Pros and Cons of Industrial Property Investments Thinking about investing in U.S. industrial real estate? One big plus is the steady rental income you can get from long-term leases, especially when your tenants are reliable. Of course, it’s not all smooth sailing—you’ll need to keep an eye on vacancy risks and changes in demand, since even solid markets can shift unexpectedly. Industrial real estate values have outpaced retail and office sectors in recent years, making this sector particularly attractive for investors seeking growth. The good news is that spotting the right opportunities for upgrades can't only increase your property’s value, but also help you stay ahead of the competition. Rental Income Stability Although real estate investments come in many shapes and sizes, industrial properties often stand out for their reliable rental income. If you want steady returns, you'll appreciate how tenant diversification cushions you against single-company downturns. Leasing to multiple tenants spreads your risk and keeps income flowing, even if one renter leaves. With lease escalation clauses, you benefit from regular rent increases—national in-place rents grew 6.6% to 6.7% year-over-year in Q1 2025, showing exceptional income growth. Unlike other sectors, industrial buildings typically require fewer costly improvements. This means your net returns are stronger, and you'll spend less time on renovations. Rising vacancy rates in some regions—now at 8% nationally and higher in places like Phoenix and Chicago—may pose a challenge for income stability, highlighting the importance of choosing your market carefully. However, some regions haven't matched national averages, and shrinking lease rate spreads might test future rent gains. Still, strong demand makes income stability a leading advantage. Vacancy and Absorption Risks

Steady rental income can bring peace of mind, but every investment comes with its own set of challenges. When you invest in industrial real estate, vacancy and absorption risks are never far behind. Vacancies in the U.S. industrial market climbed to 8.5% in early 2025, as new developments outpaced demand. Notably, regions like New Jersey experienced the highest rent growth at 11.3%, signaling that while some markets see strong pricing power, high rents could also limit the pool of prospective tenants. You might see rents cool and your income shrink if market saturation grows or if technological disruption alters the way tenants use space. Net absorption has slowed, which means fewer new tenants are filling spaces. Higher long-term interest rates and uncertain trade policies also add to the risk. To protect your investment, diversify across locations, watch for signs of market saturation, and remain alert to changes caused by technological disruption and shifting economic conditions. Value-Add Opportunities If you’re looking to shape the future of American industry—and capture strong returns along the way—value-add industrial real estate offers a unique playground. Picture an older industrial park filled with outdated warehouses. By upgrading these spaces with warehouse automation and modern layouts, you can reset below-market rents and appeal to logistics and e-commerce tenants craving efficiency. Industrial assets offer stability and cost efficiency for investors, giving owners a dependable income stream even as improvements are underway. Renovating older stock for hybrid uses—like blending manufacturing and logistics—taps into reshoring trends and drives above-average returns. Still, you should weigh the risks: locked-in leases may slow your rent resets, while supply chain delays can spike redevelopment costs. Retrofitting for ESG standards or specialized tenants adds complexity. Success depends on market timing, smart tenant mixes, and keen analysis of national and local demand swings. Comparing Industrial and Commercial Real Estate Sectors When you look at the environment of industrial and commercial real estate in the U.S., it feels a bit like comparing a steady mountain to a rolling hill. Industrial real estate offers you a trail marked by strong historical trends, while commercial sectors can feel unpredictable. If you’re thinking about market diversification for your portfolio, studying these differences is key. Industrial spaces usually show steady growth and low vacancy rates, making them dependable no matter the economic forecast. Notably, industrial properties remain stable, with vacancy rates held at 6.8% in Q3 2024, driven by ongoing demand from e-commerce and logistics. In contrast, commercial properties like offices and retail spaces often react faster to market ups and downs. Here are four things to think about when comparing these sectors: Industrial properties often have lower vacancies. Industrial investments thrive on stability and cost efficiency. Commercial spaces face higher volatility. Market diversification often favors industrial for steady returns. Warehousing Demand and Distribution Center Growth Have you noticed how quickly packages show up at your door these days? That speed isn’t luck—it’s a direct result of booming warehousing demand and rapid distribution center growth. E-commerce continues to soar, driving the need for more warehouse space across the U.S. In 2025, expect warehouses to expand even more, powered by Innovative Parcel Logistics and Automated Inventory Management. These tools help companies deliver products faster and handle larger volumes with precision. Vacancy rates are expected to rise intermittently as new facilities enter the market, but strong demand continues to keep the sector healthy. Industry disruption from agile new entrants has also pushed companies to improve speed and efficiency in warehouse operations. Distribution centers are also strategically popping up closer to major cities, making deliveries quicker and more reliable.

Automated technology ensures operations run smoothly, saving both time and money. As consumer spending rises and supply chains get smarter, investing in warehouses becomes essential for meeting the ever-growing demands of modern logistics. Role of Data Centers and Flex Space in Portfolio Diversification As boxes move faster from warehouses to your doorstep, another quiet revolution is changing what industrial real estate can do. You're seeing a surge in data centers, thanks to massive AI infrastructure needs and the shift from pure logistics to tech-driven assets. In order to maximize return on investment, strategic management practices, such as regular inspections and open communication, should also be applied in evaluating these emerging property types. Flex spaces—offering hybrid office, storage, and light manufacturing—let you tap into cross-sector synergy, making your portfolio nimble and resilient. In the U.S., blending data centers and flex space helps you steer market shocks, as each asset’s strengths offset the other's risks. Today, about 60% of public REIT market cap now sits outside traditional sectors like pure industrial, helping you benefit from much broader diversification when adding new asset types to your portfolio. Here’s how you can benefit: Capture stable returns as AI infrastructure fuels the need for data centers. Diversify risk by adding flex space with adaptable leasing. Maximize value via conversions between asset types. Leverage cross-sector synergy in growth markets. Evaluating Industrial REITs Versus Direct Investment Though many investors dream about owning a warehouse or high-tech facility, you don’t need millions to step into the world of industrial real estate. You can begin with Industrial REITs, buying shares for as little as $50, letting you enjoy income without the headaches of direct ownership. But if you crave control—setting up biometric security, choosing tenants, or driving ethical investing decisions—direct investment may suit you better. Compare your options: Recent market data shows that Industrial REITs delivered competitive total returns through both dividends and capital appreciation in 2025. Building a financial cushion is a critical strategy that helps investors navigate market cycles and take on opportunities in both REITs and direct ownership. Feature Industrial REITs Capital Needed Low (share price) Liquidity High (sell shares) Yield 3.96%–12.27% (2025) Management Professional teams Risk Diversified portfolio REITs let you submerge quickly and ethically, but direct investment rewards hands-on effort and customization. Your path depends on your vision. Build-to-Suit Projects and Customization Trends We’re seeing a real shift across the U.S. as more companies look for spaces designed specifically for them—everything from high-tech manufacturing facilities to last-mile delivery centers. With build-to-suit projects, it’s all about meeting those unique requirements, whether that means installing extra-tall ceilings for automation or adding on-site solar panels for sustainability. Creating the right environment through brand storytelling can also make these spaces more attractive and memorable for tenants. Additionally, as demand-driven project pipeline continues to lag behind due to zoning hurdles and construction slowdowns, these customized facilities give tenants the certainty and operational efficiency that speculative development can’t match. By responding to these needs, you’re not just providing a building; you’re actively shaping what’s next for American industry. Growing Demand for Customization While industrial real estate keeps changing, the demand for build-to-suit projects and tailored spaces has taken center stage across the U.S. You’ll notice a shift from traditional, cookie-cutter warehouses to spaces designed for specific industries and advanced manufacturing needs. This new trend isn’t just about fancy upgrades—it’s rooted in the historical development of industry and our growing urban infrastructure.

As companies aim to stay ahead, they’re asking for more custom features than ever before. Build-to-suit projects are increasingly popular as tenants want to secure long-term leases in facilities precisely designed for their needs, which also helps reduce the risk of oversupply in certain sectors. Here’s why this matters for you: Semiconductor and EV growth: These industries need specialized buildings due to technical demands. Advanced technology support: Custom facilities help companies integrate automation and AI. Environmental responsibility: Tenants want eco-friendly buildings to meet regulations. Flexible design: Adaptable spaces prepare you for future changes in your business model. Tenant-Driven Design Features Demand for tailored spaces isn’t just a trend—it’s completely changing the way industrial properties are built and used across the U.S. Today, tenants expect more than four walls and a roof. They want high-tech infrastructure, automation, and smart technology woven into every detail. Build-to-suit projects let you offer true space customization, making your property align perfectly with tenants’ unique business needs. As technology-enabled properties that elevate tenant engagement become a top opportunity in commercial real estate, integrating digital building systems and flexible infrastructure is not just expected but increasingly essential for attracting quality tenants. Integrate AI-driven features and energy-efficient systems to deliver tenant amenities that boost productivity and comfort. Consider wellness zones, flexible workspaces, and sustainability features—adding value for companies focused on innovation and employee satisfaction. When you focus on tenant-driven design features, you don’t just attract tenants; you build loyalty and long-term partnerships that can set your industrial investments apart in the 2025 market. Understanding Cap Rates and High-Yield Industrial Assets Even as the market keeps shifting, understanding cap rates is one of the most important skills for investors looking to spot high-yield opportunities in U.S. industrial real estate. Cap rates show the return you’ll get compared to the property’s price, making them a key measure when sizing up deals. If you’re eyeing high-yield assets, pay special attention to industrial zoning and environmental regulations—these often impact both property value and long-term returns. Over the past year, cap rates have declined across all classes, supporting sustained investor demand even in uncertain times. Now, consider these essentials: Cap rates for Class A, B, and C properties vary, so know your target range. High-yield assets usually sit in strong markets like Dallas or Miami. Interest rates and GDP growth directly influence cap rate trends. Tenant quality and mid-sized facility demand drive leasing success. Think smart, act informed—maximize your gains. Off-Market Strategies for Sourcing Industrial Deals Spotting the right cap rate is just one piece of the high-yield puzzle—but getting first crack at a high-potential industrial property gives you a real edge. You can tap into off-market strategies by reaching out directly to property owners, networking at industry events, and partnering with skilled real estate agents who know the local U.S. market. Taking inspiration from business leaders who emphasize community connections, building sincere relationships can enhance access to off-market opportunities and long-term deal flow. Leverage data-driven platforms to spot hidden gems and build a reputation that attracts exclusive opportunities. As the industrial and manufacturing sector is projected to be a top investment opportunity in 2025, focusing on these properties can align your strategy with emerging demand and strong fundamentals. Off-market deals let you secure properties with lower competition and often better pricing. These strategies also offer the opportunity for innovative leasing or leasing consolidation, letting you tailor deals to tenant needs and boost value.

Still, be prepared: information can be scarce, due diligence matters, and strong negotiation skills will be vital. Top U.S. Metro Areas for Industrial Investment in 2025 Thinking about diving into industrial real estate? Coastal cities such as Jacksonville and Houston are still standout choices, thanks to their strong port access and solid infrastructure. Meanwhile, inland markets like Dallas-Fort Worth and Kansas City are gaining serious traction, driven by rapid growth and supportive local policies. Notably, metropolitan areas are central hubs of economic activity across the US, fueling much of the national momentum in industrial sectors. In cities like St. Louis, recent urban renewal efforts and major new funding are transforming former decline into opportunity, paving the way for dynamic investment environments. Whether you’re leaning toward the coasts or looking inland, there’s a lot to consider—let’s take a closer look at what makes these top metro areas so appealing for industrial investment in 2025. Coastal Cities Outperform Peers While many cities compete for your investment, coastal cities across the U.S. stand out as powerful hubs for industrial real estate in 2025. These cities thrive on port synergy and have demonstrated impressive coastal resilience, even in the face of climate risks. If you’re searching for vibrant options, look closely at places like Jacksonville, Miami, Tampa, and Houston. Coastal cities are also benefiting from international appeal and strong commercial real estate activity, which further accelerates investor interest and development potential. Why do these markets outperform their peers? Consider these advantages: Expanding infrastructure: Upgraded ports and logistics drive steady demand. Demographic growth: Rapid population increases fuel the need for industrial spaces. Diverse economies: Cities with varied industries provide stability and growth. Robust job markets: Employment growth supports long-term investment success. Inland Hubs Gain Momentum Coastal cities often steal the spotlight, but it’s the nation’s inland hubs that are rapidly building a new kind of industrial real estate powerhouse for 2025. If you trace historic trends, you’ll see places like the Inland Empire, Houston, and Richmond steadily claiming more investor attention. Surging leasing activity, import growth, and expanding logistics networks set these markets up for strong returns. But you should recognize market challenges too—price disparities and shifting tenant needs demand a smart strategy. Houston’s economic diversification and affordable operations offer resilience, while Phoenix and Nashville leverage regional connections to shine. Markets with growing populations and job opportunities serve as a foundation for sustainable industrial real estate growth in these regions. Inland Empire’s robust sales and import-driven demand showcase its unmatched momentum. When you look beyond the coasts, you’ll discover inland hubs rewriting the industrial investment story. Industrial Property Financing and Lending Options Curious about how you can finance your next industrial property deal? You've got a range of options to contemplate, each with its own advantages and lending requirements. In 2025, U.S. industrial real estate investors face fierce competition due to high demand, higher interest rates, and evolving loan products. As you explore financing, remember that lease negotiation skills and landlord incentives might boost your deal’s appeal, especially when working with alternative lenders or during seller financing discussions. Keeping regular inspections in mind can also minimize costly damages to your property investment over time. Commercial loans generally have shorter terms and require larger down payments compared to residential mortgages, meaning that you should prepare for a significant initial investment when seeking your industrial property loan. Here are four key lending options to review:

Bank Loans: Offer flexible leverage but require strong credit and business history. Life Company Loans: Favor long-term, stable properties for risk-averse investors. CMBS Loans: Provide large-scale, competitive loans with stricter terms. Hard Money Loans: Deliver fast, short-term capital, typically at higher rates. Cash Flow Analysis for Industrial Properties Once you���ve figured out your financing, it’s time to look closely at how much money your industrial property will actually put in your pocket. Cash flow analysis starts with your net operating income (NOI)—that’s the money left after subtracting key expenses like taxes, insurance, maintenance, and utilities from your total rent. Many investors also deduct a standard vacancy factor from potential rent to account for unoccupied periods or non-paying tenants, ensuring their projections are realistic. U.S. industrial spaces often offer stable cash flows because leases run longer and tenant turnover stays low. When determining your timeline for returns, remember that break-even points on industrial properties are typically reached after several years, depending on market conditions and total costs. As industrial automation and shifting supply chain dynamics keep driving demand, you’ll want to project future cash flows with a Discounted Cash Flow (DCF) model. Check cash-on-cash returns, IRR, and make sure debt service coverage is healthy. Don’t overlook possible costs for capital repairs or changing tenant needs. Smart cash flow analysis puts you in control of your investment’s future. Navigating Leasing Trends and Triple-Net Lease Structures As you explore the world of U.S. industrial real estate, leasing trends and triple-net lease structures quickly become key to your success. Leasing activity is booming, especially for modular spaces, as tenants seek agility for industries like battery technology and urban farming. Triple-net leases let you offload most property expenses and enjoy more stable cash flow, but tenants are taking on rising operational costs. Warehouse lease renewals are costlier than ever, with U.S. asking rents reaching $10.13/SF in Q4—a 61% increase from Q4 2019.] To steer through today’s market, keep these essential tips in mind: Focus on mid-sized logistics facilities for robust demand. Explore secondary markets with lower land costs and faster permitting. Prioritize properties with sustainability features—these attract higher-paying tenants. Choose newer, build-to-suit assets when possible; they reduce default risks and vacancy. Stay informed and adapt to maximize your returns. Industrial Asset Management: Best Practices and Tips Even in a fast-changing world, strong asset management sets you apart in U.S. industrial real estate. To thrive, you need to blend industrial innovation with asset resilience. Start by focusing on effective expense management, always watching costs, and using smart budgeting tools. Schedule regular maintenance, so problems never become expensive surprises. Build open, reliable communication with your tenants and vendors—you’ll cultivate loyalty and trust. Here's a quick reference table: Best Practice Benefit Preventive maintenance Fewer unexpected repairs Energy efficiency Lower utility costs Tenant feedback Higher tenant retention Manage financials diligently—keep your cash flow strong and understand every cent. Finally, lead proactively by planning capital improvements and always refining your emergency responses. Driven asset management builds sustainable value—and your edge in the market. Don't overlook the impact of quality paints on both property durability and visual appeal, as selecting the right products can help your assets retain their value over time. Underwriting and Valuation of Industrial Real Estate Deals When you’re underwriting industrial real estate deals, think of it as taking a deep dive into the property’s future cash flow—will it stay steady and strong, or are there risks that could throw things off course?

It’s important to make sure your rent growth projections actually reflect what’s happening in the local market; guessing too high can really skew your investment outlook. And don’t forget to pay close attention to vacancy and absorption rates, since these will give you a clear idea of how quickly you can lease up any empty space and keep your money working for you. Incorporating upgrades that boost property value and enhance safety, such as modernized electrical systems, can also play a key role in improving long-term returns and retaining tenants. Now that we’ve covered the basics, let’s take a closer look at the different valuation approaches you can use for industrial properties. Evaluating Cash Flow Potential How do you really know if an industrial property will bring in steady cash flow? You need to dig into the details that truly impact an investment’s success. Environmental impact can affect a property’s long-term appeal, while zoning regulations can limit or boost potential uses. Next, it’s imperative to review market data and measure operational efficiency. Here’s how you can evaluate cash flow potential: Analyze tenant mix and lease structure: Reliable tenants and strong leases create predictable income streams. Review historical sales prices and vacancy rates: Past market performance sets a baseline for future expectations. Check financial statements and property appraisals: These help verify the property’s real income and expenses. Examine key metrics: Pay attention to Loan-to-Value (LTV), Debt Service Coverage Ratio (DSCR), and Net Operating Income (NOI). Assessing Rent Growth Assumptions Looking beyond cash flow, you also need to judge whether rent growth assumptions in industrial real estate deals make sense. In 2025, experts project modest rent increases—just 1–3% nationwide, even though some Southern markets might see stronger gains. Pay close attention to market regulation and zoning policies, because they shape how much new supply can enter an area and affect rent trends. While concessions like free rent are increasing, they lower the true rent landlords collect. Some areas, like Los Angeles, are even experiencing rent drops of over 10% year-over-year. Always dig into local data: Are zoning policies limiting new projects? Is market regulation keeping growth in check? Use this research as your guide—it’ll help ensure your assumptions reflect reality, not just wishful thinking. Analyzing Vacancy and Absorption In industrial real estate, understanding vacancy and absorption trends can make or break your investment strategy. You need a sharp eye on both historical vacancy and current market absorption to stay ahead. With national vacancy rates hitting decade highs—nearing 8.5%—and market absorption lagging behind the swell of new supply, you must read the market’s pulse. Some regions—Miami and Seattle, for example—still show strong tenant interest, but national numbers tell a cautionary tale. Here’s how to decode these shifts: Review historical vacancy—watch for patterns that signal risk or opportunity. Compare supply deliveries to market absorption each quarter. Identify markets where excess supply threatens rent growth or lease renewal. Adjust your underwriting to include higher vacancy and slower absorption in 2025. Stay vigilant to safeguard your investments. Value-Add and Adaptive Reuse Opportunities While many investors focus on buying and holding, true growth often comes when you breathe new life into industrial properties. Think of it as industrial art—turning overlooked warehouses into supply chain masterpieces. You can target under-leased spaces and raise rents to match the market. Upgrade with energy-efficient lighting, HVAC, or better insulation to spark tenant interest and cut costs. Expand loading docks, add cold storage, or even automate with smart tech to make your property stand out. Adaptive reuse is powerful, too—old malls can become ultimate last-mile delivery hubs if you focus on strong structural features and the right zoning.

Evaluate local demand, especially where e-commerce drives growth. By creatively repositioning assets, you can transform forgotten buildings into high-demand supply chain anchors. As you implement these strategies, consider how tokenized investments are also making it possible to diversify your capital allocation and enhance the liquidity of industrial real estate portfolios. Industrial Property Tax Planning and Incentives Even small steps in industrial property tax planning can open big savings and reshape your investment returns. Tax incentives aren’t just past stories—they’re active tools you can use now to thrive in 2025. By understanding historical tax incentives and current zoning regulations, you position your industrial real estate projects for maximum financial success. Here's how you can benefit today: Apply for abatement programs: Explore GPLET for 8-year property tax breaks or site-specific PILOT deals. Claim equipment exemptions: Seize the new $500,000 personal property tax exemption for machinery. Leverage clean energy credits: Use Section 48E for solar, microgrid, and storage tax credits, with extra bonuses for U.S.-made content. Access regional programs: Target Opportunity Zones with zoning fast-tracks and local job training reimbursements. Incorporating a sustainability focus into your industrial property tax strategy not only increases cost savings but also aligns your investments with emerging industry trends and long-term viability. With the right strategy, every tax dollar saved fuels your property's long-term growth. Impact of Logistics and Last-Mile Distribution on Site Selection New tax incentives can set your investment up for bigger wins, but smart owners look beyond the balance sheet. When you pick a site for industrial real estate, you need to understand how last-mile logistics shape demand. E-commerce giants and smaller retailers want warehouses close to customers, even if urban congestion pushes up costs. They're grabbing urban micro-fulfillment sites fast, despite tough zoning rules and higher property prices. Automation and AI-powered routing let teams overcome traffic and make those costly miles count. At the same time, facilities with strong EV infrastructure get priority, as green fleets become the norm for U.S. cities. If you pick real estate near EV charging corridors and labor pools, you set yourself up for enduring investment value. Just as strategic painting choices can boost demand in residential rentals by appealing to broad audiences and enhancing key features, selecting sites that maximize natural light, flexibility, and operational efficiencies can give your industrial properties a competitive edge. ESG and Energy Efficiency in Modern Warehousing So, if you’re aiming to future-proof your warehouse investment, putting sustainable building standards and green technologies front and center is key. Opting for energy-efficient materials and integrating smart systems isn’t just about doing what's right for the environment—it’s a smart move for your bottom line, too. Not only will you see reduced operating costs, but your property’s value and reputation in the U.S. market will also get a boost. Upgrading to LED lighting solutions can significantly enhance warehouse appeal, cut long-term energy expenses, and position your property as a modern, eco-friendly asset in a competitive market. Now, let’s take a closer look at some of the latest ESG innovations shaping warehouses today. Sustainable Building Standards While the industrial real estate market keeps growing, today’s warehouses must do more than just store goods—they need to meet strong sustainability and energy efficiency standards. Adopting sustainable building standards and seeking green certifications is no longer optional if you want to stay competitive and compliant in the U.S. Sustainable buildings prove you’re serious about both meeting regulations and making a positive environmental impact. When you invest in a warehouse, follow these steps:

Align your facility’s design with current U.S. energy codes and sustainability regulations. Aim for respected green certifications, such as LEED or ENERGY STAR, to show stakeholders your commitment. Conduct regular energy audits to reveal possible improvements. Use recycled materials and eco-friendly roofing to further boost efficiency and ESG alignment. Future-focused buildings can inspire responsible growth. Green Technology Adoption How can you make a real impact on both your bottom line and the planet? Start by adopting green technology in your warehouses. Switch to LED lighting—it cuts energy use by 75% and lasts much longer. Add AI integration to control lights and automate schedules, ensuring you only use energy when you need it. For climate control, smart thermostats and predictive maintenance keep HVAC costs down and comfort up. Solar incentives make installing solar panels practical, boosting energy savings and qualifying you for tax breaks. Use emission-reducing strategies like electric yard trucks and AI-powered dock scheduling to slash pollution and avoid EPA fines. And don’t forget sustainable packaging—buyers appreciate it, and U.S. regulations reward your effort. Green tech leads to lower costs and enduring returns. CRE Market Cycles and Distress Investment Opportunities in 2025 As 2025 approaches, you’ll notice the industrial real estate market shifting into a fresh cycle, opening doors for bold investors who are ready to plunge into new opportunities. Understanding market timing is key, especially as interest rates normalize and economic growth fuels new activity. Many cities update zoning regulations, making certain locations even more valuable if you spot them early. With demand for high-quality spaces rising, older properties may become distressed, but that’s where you can find great deals if you act strategically. Consider these opportunities: Pinpoint markets with favorable zoning regulations and supply-demand imbalances. Seek distress opportunities in outdated industrial properties, then renovate. Monitor market timing to buy low as vacancies increase. Diversify into data centers, as digital economy trends drive demand. Success means seizing the cycle’s best moments. Frequently Asked Questions (FAQ) 1. Why is industrial real estate such a hot investment in 2025? Because it offers stability, consistent demand, and high adaptability. With e-commerce, AI, and logistics booming, warehouses and data centers are essential infrastructure, and investors are capitalizing on that. 2. What types of industrial properties are best for investment? Top performers include distribution centers, cold storage facilities, data centers, and flex spaces. Build-to-suit and value-add properties also offer strong returns when customized for modern needs. 3. Should I invest directly or go through an Industrial REIT? It depends on your goals. REITs offer easy entry and liquidity. Direct investment gives you more control and potentially higher returns, but requires more capital and involvement. 4. How do I find good industrial deals in today’s market? Look off-market first—via brokers, networking, or direct outreach. Prioritize areas with strong port access, major highways, and population growth, like Jacksonville, Dallas, or Kansas City. 5. What are the biggest risks in industrial investing? Rising vacancy rates, tech disruption, and market saturation. Poor location choices or ignoring due diligence (like zoning or environmental factors) can also hurt long-term returns. 6. How much money do I need to start investing in industrial real estate? Direct ownership usually requires six to seven figures, but you can get started with as little as \$50 by investing in Industrial REITs or through crowdfunding platforms. 7. What are triple-net leases, and why do they matter? A triple-net (NNN) lease means the tenant covers property taxes, insurance, and maintenance. For landlords, this reduces expenses and creates more predictable cash flow.

8. Are tax incentives available for industrial property investors? Yes. Programs like GPLET, Opportunity Zones, and green energy tax credits (like Section 48E) can significantly lower your costs and increase long-term profitability. 9. What makes a good market for industrial real estate? Strong infrastructure, population growth, business-friendly policies, and logistics demand. Inland and coastal hubs like Phoenix, St. Louis, and Houston check many of these boxes. 10. Is industrial real estate good for buy-and-hold strategies? Absolutely. Long leases, durable tenants, and steady income make it ideal for buy-and-hold. Value-add upgrades and sustainability features can further boost appreciation. Assessment Building Your Industrial Real Estate Future So, as you look at the crossroads of risk and reward, picture your future anchored by dependable warehouses and innovative facilities, not just the ups and downs of the stock market. Industrial real estate is all about trading some guesswork for more predictable, steady growth. Whether you’re eyeing those busy coastal ports or the steady potential in inland hubs, there’s a space to fit your investment style. Maybe it’s investing in data centers or making older warehouses greener—every move shapes the landscape of tomorrow. The journey might have its bumps, but with a clear strategy and an eye for opportunity, industrial assets can become your stepping stone to lasting success. Ready to take the next step? Explore industrial real estate opportunities and start building your bridge to a solid investment future.

#absorption rate#AI Integration#automation#build-to-suit#cap rates#cash flow#crowdfunding#data centers#economic hubs#energy efficiency#ESG compliance#EV infrastructure#flex space#Industrial#Industrial Investment#last-mile logistics#leasing trends#loan options#market diversification#net leases#NOI#Phoenix Arizona#port access#Portfolio diversification#real estate trends#solar upgrades#sustainability#tenant retention#warehouse expansion#Zoning

0 notes

Text

Data Integration Tool to Drive Your Business Success - IFI Tech

Data integration tools play a vital role here in ensuring seamless data access and delivery. Applications can interact much faster and effortlessly with efficient data integration tools.

#ifi techsolutions#microsoft azure#microsoft partner#microsoft#cloud computing#data integration#data warehouse#dataanalysis#datamanagement#information technology#data warehousing#data integration tool

0 notes

Text

What are the latest trends in data analytics, and how do they shape the future?

The latest trends in data analytics, including AI integration, real-time processing, and predictive analytics, are reshaping business strategies. These advancements enable faster decision-making and deeper insights. EPM software like BiCXO leverages these trends to enhance performance management, driving growth and competitive advantage.

#business intelligence software#bi tool#bisolution#data#businessefficiency#data warehouse#businessintelligence#business intelligence#business solutions#bicxo#epm software#epm 2025#data analysis#datavisualization#ai integration#software#reporting software#India#USA

0 notes

Text

Peran AI dalam Mempercepat Manajemen Rantai Pasokan

Manajemen rantai pasokan adalah tulang punggung operasional bisnis, yang mencakup pengelolaan aliran barang, informasi, dan keuangan dari pemasok ke konsumen. Dalam era globalisasi dan digitalisasi, tantangan dalam rantai pasokan semakin kompleks. Di sinilah kecerdasan buatan (AI) memainkan peran penting. AI tidak hanya memberikan efisiensi tetapi juga mempercepat berbagai aspek manajemen rantai…

#AI challenges#AI in logistics#AI in supply chain#artificial intelligence#blockchain integration#cost reduction#customer satisfaction#future of AI#inventory optimization#IoT in supply chain#logistics efficiency#predictive analytics#real-time data#supply chain automation#supply chain innovation#supply chain management#supply chain transparency#supply chain trends#sustainable supply chain#warehouse management

0 notes

Text

Effective warehousing is key to the seamless movement of goods through the supply chain. At AUN Medical Supply Logistics LLC, we understand how crucial it is for healthcare businesses to have access to a streamlined system that ensures medical supplies are readily available. As the primary medical supplies transporter in Killeen, Texas, we focus on creating solutions that enhance efficiency and reduce delays.

0 notes

Text

Data Warehouse Services in Basking Ridge NJ

#quellsoft#Data Warehouse Services in Basking Ridge NJ#Data Warehouse Services#Cloud Applications in Basking Ridge NJ#Data Integration in Basking Ridge NJ#Cloud Computing in Basking Ridge NJ#Cloud Data Warehousing in Basking Ridge NJ

0 notes

Text

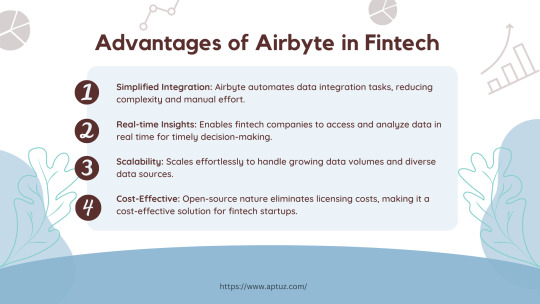

Explore the advantages of Airbyte in fintech! Learn how this platform automates data integration, provides real-time insights, scales seamlessly, and is cost-effective for startups. Discover how Airbyte simplifies data workflows for timely decision-making in the fintech industry.

Know more at: https://bit.ly/3UbqGyT

#data#data warehouse#data integration#technology#fintech#data analytics#data engineering#airbyte#ETL#ELt#Cloud data Management#Cloud Data

0 notes

Text

Unlocking Potential with WebFOCUS: Your Comprehensive Guide

Discover the Power of WebFOCUS

Modern businesses thrive on data-driven insights, pushing the boundaries of technology to become more analytics-centric. Consequently, the demand for cutting-edge business intelligence tools is at an all-time high. Enter WebFOCUS, a robust, scalable, and adaptable analytics platform that aims to streamline decision-making processes and transform the world of business intelligence.

Understanding WebFOCUS

WebFOCUS, typically associated with WebFOCUS reporting and Business Intelligence (BI), is an advanced analytics platform designed to empower businesses to make data-driven decisions intelligently. Perfect for WebFOCUS jobs and developers alike, this tool can maneuver vast data landscapes and conduct insightful WebFOCUS data analysis.

Key Benefits of Using WebFOCUS

WebFOCUS redefines the realms of data analytics with its advanced features. Its key benefits extend to:

- Data discovery and Data mining: Gain an edge in identifying patterns and trends behind your data.

- Data governance and management: Control data integrity and reliability through WebFOCUS's robust data governance and management tools.

- Data integration: WebFOCUS excels at integrating varied data sources, ensuring a seamless data pipeline.

- Security, Performance, and Scalability: As a secure, efficient, and scalable platform, WebFOCUS stands out as a robust data analysis tool.

WebFOCUS Capabilities

WebFOCUS App Studio and WebFOCUS Designer

Being a WebFOCUS developer means understanding and utilizing the many modules within the platform. WebFOCUS's core is its App Studio module, an Integrated Development Environment (IDE) that allows users to create and manage business applications. Similarly, WebFOCUS Designer offers an intuitive user interface for developing sophisticated data visualizations.

WebFOCUS Info Assist and WebFOCUS Reporting

For data refinement and extraction, WebFOCUS offers InfoAssisT, a browser-based module that simplifies ad hoc reporting tasks. InfoAssisT allows business users to create engaging dashboards, charts, and custom reports, providing visual-driven insights within the WebFOCUS dashboard that are actionable.

WebFOCUS Insights and Predictions

WebFOCUS isn’t just about knowing your business; it’s about predicting it. With predictive analytics capabilities companies can forecast future trends and make informed decisions.

WebFOCUS Security and Scalability

A standout feature of WebFOCUS as an analytics tool is its commitment to data security. Businesses can rest assured knowing their data is protected with utmost rigor.

WebFOCUS Jobs and Salary

What does a WebFOCUS developer salary look like? Given the demand for data analysis and BI skills, a career with WebFOCUS is both rewarding and lucrative, offering competitive remuneration.

WebFOCUS Training and Tutorials

To facilitate user understanding of its multifaceted features, WebFOCUS offers a comprehensive collection of training resources and tutorials online, catering to varied learning abilities and paces.

Conclusion: The Future with WebFOCUS

As businesses constantly adapt and grow, so too do their data analytics needs. WebFOCUS, with its advanced BI capabilities and robust data handling, appears poised to remain an industry leader. Businesses looking for a future-proof, comprehensive analytics platform need not look further than WebFOCUS. Whether transitioning into a WebFOCUS developer job, seeking out WebFOCUS training, or looking to improve your current business operations, WebFOCUS stands out as an invaluable tool. Harness the power of WebFOCUS and transform your business today.

#WebFOCUS analytics#- WebFOCUS dashboard#- WebFOCUS reporting tool#- WebFOCUS business intelligence#- WebFOCUS data visualization#- WebFOCUS data analysis#- WebFOCUS data reporting#- WebFOCUS data integration#- WebFOCUS data discovery#- WebFOCUS data mining#- WebFOCUS data insights#- WebFOCUS data manipulation#- WebFOCUS data management#- WebFOCUS data warehouse#- WebFOCUS data modeling#- WebFOCUS data transformation#- WebFOCUS data extraction#- WebFOCUS data governance#- WebFOCUS data quality#- WebFOCUS data security#- WebFOCUS data privacy#- WebFOCUS data best practices#- WebFOCUS data strategy

0 notes

Text

[[and then I met you || Ch. 33]]

Series: Daredevil || Pairing: Matt Murdock x Fem!Reader || Rating: Explicit

Summary:

A one-night stand years ago gave you a daughter and you are now able to put a name to her father – Matthew Murdock. Everything is about to change again as you navigate trying to integrate your life with that of the handsome and charming blind lawyer’s while Matt realizes he needs to not only protect his new family from Hell's Kitchen, but from the world.

chapter masterlist

Words: 4.4k

ao3 link

|| Trigger Warning: Graphic Descriptions Body Horror & Death Regarding Unnamed Children ||

All your life you have heard that there is a beauty in chaos, and while you do agree with this, you also find there is a beauty in organization.

You like taking all the chaos and putting it into categories. You like sorting the details and finding the mysteries that need to be unraveled. You think it must be similar to how clever people feel when they solve a riddle or a puzzle, but you aren’t running in circles with philosophical thoughts - you are analyzing what is already available and coming to a conclusion.

It is still all chaos, because everything is always chaos, but it is organized into a way that makes sense.

And Matt’s stolen duffel bag, when first unzipped and inspected, was full of chaos.

You, Foggy, and Karen quickly got to work looking over the different papers and forming different stacks based upon agreed parameters.

It became clear Matt’s guess that he had found some sort of laboratory was correct. The papers all appeared to be results of different medical tests, though at first glance, the three of you could not decipher for what.

But deciphering wasn’t needed at that moment, so it didn’t matter, and once everything was spread neatly across the dining table, the next step of your beloved process began.

Foggy gave each pile a designation and then the three of you began labeling each paper in the top corner.

A1. A2. A3. A4.

B1. B2. B3. B4.

All your analyzing would be useless if you couldn’t source your data, and it was quickly clear your little group all shared the same brain cell when it came to this idea.

While you worked at the table, Matt and Jessica sat on the floor by the couches, marking up a map. You caught snippets of the conversation - this bit of evidence was heard in that alley, to get to a certain tunnel system you had to go through such and such warehouse. It was fascinating to know that Matt had memorized nearly every square inch of Hell’s Kitchen - even the parts you didn’t know existed - and it was equally amazing that Jessica knew just as much.

After hearing them talk, it left you wondering if Frank had the same knowledge, but you would leave that question for another time. He had been assigned to the two thumb drives that had been in the duffel bag. You had furiously taken mental notes as he had grumpily explained to Matt the little devices couldn’t just be plugged into a computer. They could have malware on them or trigger tracking or something equally devious and needed to be inserted into a clean laptop that couldn’t connect to the internet. That way, if the laptop tried to send a signal or became a brick, there would be nothing lost.

Since neither you nor Matt happened to have a spare laptop laying around, Frank went to go procure one.

That was about half an hour ago and now you are well into your third Foggy-assigned task - highlighting any identifying information in yellow. There’s nothing easy like names or addresses listed out, but you noticed a pattern for patient labels and have determined there are at least five.

As you jot down that Patient 031517DVA also appears on page D4 in your notebook, you find you are enjoying yourself. This isn’t exactly what you imagined when Matt talked about inviting everyone over to review what he had found, but you think it is nice. Knowing that Matt isn’t out there running around without any sort of plan soothes your nerves and seeing that he is putting in the time and thought into his next actions makes you trust he knows what he is doing.

No one wants a shady underground lab in their neighborhood, but you need to make sure they are actually shady first and not some weird fringe group researching an unknown breed of sewer rat.

The effort going into helping Matt with this task makes your fondness of Foggy, Karen, and Frank grow even more - and gives you a fondness for Jessica. Everyone is serious about their task, and extremely thorough, and you want them to see you in the same light. You know this is not a game and you refuse to let your part in the research be the weak link.

As you go to the next row of numbers to examine, you catch some movement in the corner of your eye. You turn your head and watch with a soft smile as your daughter emerges from Matt’s bedroom, clad in her mouse-onesie pajamas. Her sleep mask is pulled down around her neck and she looks upset, but she’s not crying, so you don’t jump to run to her. You let her make her own decisions as she sleepily looks between you and her father and you can’t help but to mentally crow a bit as she starts shuffling towards you, her little mouse-tail trailing behind her.

Everyone’s attention is on you as Minnie lifts up her arms to be picked up once she’s within a foot of you. You dutifully scoop her up and put her on your lap, fixing her hood and mouse-ears as you do.

“Is everything okay, sweetheart? Did something wake you up?”

She nods, then flops herself against your chest, mumbling out, “There’s monsters.”

You begin to gently rub her back, hoping to soothe her worries as you confirm, “there’s monsters?”

Again, her head bobs up and down before she nuzzles into your neck, trying to hide herself. Across the room, Matt is up and making his way towards you, but it is Foggy who speaks up next.

“Are they silly monsters or scary monsters?”

You smile at the question as Minnie ponders it - her little lips purse against your neck and you feel her breath against your skin as she silently repeats the words. She decides on ‘scary’ - replying in a timid voice as Matt takes his place behind you, sliding his hands onto your shoulders.

“Do you want me to help you tell them to go away?” you ask, having packed your bottle of Monster Repellent for just this cause. Little fists clutch tightly at your shirt as Mouse shakes her head and you give a soft hum in thought. “Do you want Daddy to go scare them off?”

You are sure Matt would run outside to chase away a stray cat or hungry raccoon if his princess wished for it, but she shakes her head against you, so you guess Matt will be staying inside.

“How about we make the monsters silly instead of scary?” is Karen’s suggestion, and like the others, it falls flat.

You consider offering to read some stories, but Matt startles you from your thoughts by sliding his hands down your arms to get to his daughter. He gently urges her to let go of you before transferring her to his arms and bundling her close. She absolutely clings to him, looking so tiny against his broad shoulders.

“I got this,” he says, his voice barely above a whisper before he turns and starts making his way back to the bedroom. As you watch him walk away, he buries his nose into her hood, and he begins to rock with each step. The itty bitty fist you can still see tightens around his t-shirt and your heart yearns to follow your family, but you know this is a Daddy-Daughter moment and you need to stay seated.

You were worried about Minnie getting scared over sleeping in a new place - there’s so many new and different noises but you trust Matt to help her interpet everything. He’s already done such an amazing job of it in day-to-day life and you know he’ll explain away all her monsters and let her know she is safe.

Considering the company she is starting to keep she is probably the safest little girl in New York. No monsters would dare to lurk in her shadows less they want to face the wrath of the Devil.

You know that this little group you are becoming a part of would join you in jumping in front of a bullet for your daughter and you are pretty sure even her newest best friend - Max the Dog - would not hesitate to bare his teeth if someone upset her.

She deserves nothing less and it makes your heart soar that she is so thoroughly adored.

Now that her research partner is on another important assignment, Jessica gets up off the floor and strolls over to the table, “anything interesting?”

“Maybe if we were scientists instead of lawyers,” Foggy replies warily, dropping his pink highlighter in favor of nursing his beer, “and knew what any of these numbers meant. We’re going to spend all night looking up these test numbers and hoping they are real. I mean, look at this,” he motions to the paper he is currently working on. “What the hell is D22S1045? And why is the result 15?”

Jessica takes one look at the paper before scrunching up her nose and blandly stating, “It’s a DNA marker. Haven’t you ever seen a paternity test?”

Foggy’s face goes slack for a moment before he is huffing, “Not since college when we had to study paternity suits, and they looked nothing like this! They were like dots we had to match, not numbers!” He uses his beer to point to you, “did yours look like this?”

Your cheeks heat up at the question and you duck your head, hating all the attention is on you with such a personal question. “No. No, mine didn’t…we just received a letter with the results. Not the data.”

“So, they are doing DNA and blood tests?” Karen asks, taking over the conversation and directing it back to Jessica. “And comparing them with each other. Could they be looking for relationships between them?”

“I’m not a fucking doctor,” is the reply she gets, but Jessica picks up the paper to examine it more closely either way. “But none of these match. The numbers have to be the same for a parental match, but that might not be what they are looking for. Just because it looks like a paternity test doesn’t mean it is one. DNA markers are used in a lot of shit.”

“It might not be human,” you add quietly. “Matt said the lab smelled of human blood, but we don’t know that these tests are on humans. There’s no dates on these, so they could be years old.”

Karen whips out her phone and is typing away before you are done talking, “What was that DNA marker, Fog?”

Foggy repeats the string of numbers and letters and you watch Karen’s eyes scan her screen.

“It’s human,” she states after a long, tense moment. The scowl Jessica gives is near legendary.

“Great, so we have a bunch of assholes in abandoned tunnels running tests on people.”

“That sounds both sanitary and humane,” Foggy grumbles before throwing back the rest of his beer.

“OSHA and FDA approved,” you add sarcastically and that earns you a smile from Karen. She tucks a strand of hair behind her ear before she guides you all back on track.

“We still have no idea what they are looking for, though. This could be cancer research for all we know - we are still at square one.”

“One point five,” Foggy argues, “we confirmed it’s human.”

“We don’t know what the tests are looking for,” Karen repeats, ignoring him, “and I don’t think looking up the significance of each DNA marker is going to do us much good. Can you and Matt go back to the lab and look around?”

As the clear recipient of the question, Jessica huffs then turns away from the table and goes right to the bottle of Macallan Matt keeps on top of his fridge. She pops off the lid, taking a long drink of it before answering.

“That was the plan, but I’m betting it’s going to be sprayed with bleach after knowing Devil-boy was poking around. It’s not like we will get much, not that there was shit to get beforehand.”

“So, we have no who, no why, and no where,” Foggy points out. “We are doing great.”

The joy you had gotten from trying to organize the chaos of paperwork evaporates and you sink down into your chair a little. Would continuing to highlight and document be useful or was this all for naught? The rational part of your brain told you to keep going, because it was better to have it done and not need it then to need it later and it still be a mess of paperwork.

“We’ve just started, Fog, of course we have nothing,” Karen says, rolling her eyes a bit as she does. “Did you expect them to write their plans in gel pens and leave them lying around?”

“I mean, that would be useful.”

You roll your lip between your teeth, thinking that Karen is right. You don’t have much, and you’ve only just started - of course things look pessimistic. While Karen and Foggy begin to banter back and forth about the use of gel pens in a professional setting and Jessica finishes off Matt’s whisky, you let your mind wander around the facts of the case.

Someone is out there running medical tests in a gross underground lab, probably trying to hide what they are doing. To do a lot of tests, they probably needed lab equipment, and a few years ago you would have said to follow that trail, but with all the advancements in technology, a machine to run DNA tests on probably only cost a few hundred dollars and was compact enough to move easily. Generators could keep people off the grid and there were enough tunnels under the city that years could be spent exploring them. Everything they would need could be ordered offline, and thus, was untraceable to you.

The only solid clues you had were what Matt had come home with, so you needed to keep digging there and hope that the thumb drives would contain something more useful.

So, you pick yourself back up, grab your highlighter, and get back to work.

Soon enough, Foggy and Karen pick their highlighters back up as well, and Jessica takes up a spot on the couch, putting her feet up and getting out her phone to tap at. The mood is much more somber, but you feel the same determination to find answers that is in you coming off of everyone else as well.

You don’t pay attention to the passage of time, but it is not long after you grab the final stack of papers to comb through that Matt slips out of the bedroom and closes the door behind him.

He starts towards the dining table only to stop by the couch, tilting his head towards Jessica, “That bottle was a gift from Foggy’s dad.”

“Boo-hoo, cry me a fucking river, Murdock.”

Despite the venom in Jessica’s voice, Matt chuckles and finishes making his way to you.

His hands once again find your shoulders and he begins rubbing them, digging his thumbs into just the right spot as he begins his Minnie-update.

“Someone with a really nice sound system is having a horror movie marathon. She was actually hearing monsters.”

“My poor baby,” you instantly coo, your heart breaking for your little one. “Did you tell her it was just a movie?”

Matt hums in affirmation, “That doesn’t help with the noise, though. We walked through turning things off and found something to work as white noise. It’s still hard for her to do it with new sounds, especially so tired, but she’s a quick learner.”

“How long did it take you to learn all that stuff,” Foggy asks, interest clear in his eyes. Karen puts her pen down as well so she can get the gossip.

“I don’t know, years? It didn’t come naturally to me like it does with her - I would train for hours to be able to pinpoint something, but she can do it pretty easily. I mean, she can’t tell me exact distance because she’s four and doesn’t know what that means, but she can point and say if it’s close or far.” You can feel Matt practically puff up with Pride over his baby girl. “She’s learning inorganic versus organic sounds now. She can tell if a loud banging is someone hitting something or if something just fell over. The other day she told me it was the wind making the window shake, because she couldn’t hear any other noises around the window.”

You smile at the story, having a feeling Matt is going to start going on about all the declarations Minnie had made during the storm and you don’t mind at all.

“So, she’s as good as you?” Karen teases and you know Matt is just beaming.

“Better. She can actually read a sign.”

Foggy barks with laughter while you and Karen have to cover your mouths to not giggle.

Once it subsides, you tilt your head back so you can look up at your daughter’s oh so loving father, bumping against his abdomen as you do, “is she down?”

He gives another positive hum, “In a nice deep sleep. Frank’s on his way back up and I wanted her out before he got here.”

You don’t know if that is from Matt wanting to rejoin the group to know what is on the thumb drives or if it is from him not wanting Minnie to get excited over Frank, but you are thankful she’s conked out either way. The thought of her hearing all your discussions about what lurks in the darkness of the city makes your stomach turn.

She doesn’t need more monsters to imagine.

You thank Matt while reaching up to rub one of his arms - letting yourself give him a small bit of affection. You ignore the look Karen is giving you in favor of making sure Matt is all caught up.

“I take it you heard everything?”

He sighs deeply through his nose, and you take that as a ‘yes’. He confirms with his words.

“Human testing with government trained agents isn’t what I was hoping we would find.”

“I was personally hoping for research on the mutant alligators in the sewers,” Foggy says as he gets up to go towards the kitchen, probably for another beer. “You know the ones they flush down the toilets.”

“That’s a myth, Fog.”

“Look, with everything else that goes on in the world - weird aliens and giant green men - let me believe in my sewer gators, Murdock. They make me happy.”

“With everything that Stark and Roxon dumped in the waters, I wouldn’t be surprised,” Karen muses, resting her chin in her hand, “I mean, Matt got superpowers from something getting in his eyes. If a rat ate something that was contaminated, it could have gotten super senses as well.”

You raise your brows up at the idea, a smile coming to your face, “a crime fighting rat?”

“A crime fighting rat that is a ninja,” Foggy chimes, a wide grin on his face and it sends you into giggles.

“How would a rat even learn martial arts?” Matt counters, “There’s not a rodent karate school he could spy on.”

“I don’t know Matt, how did you learn ka-ra-te,” Foggy emphasizes the word to make it sound more mystical. “He would learn from a secret ninja rat clan.”

“What the fuck are you guys talking about?” Jessica asks, looking over her shoulder at the dining table, disgust and confusion clear on her face.

You and Karen erupt into more laughter while Foggy just grins like he won the world cup as he returns to his seat. Matt gives your shoulders a firm squeeze before letting go and pulling away. He disappears into the narrow passage that is his hallway, and you hear the front door open. Heavy boots signal Frank’s reappearance, and when he and Matt come back around the corner, you offer a small smile.

The Punisher holds up a clunky looking laptop, straight from your middle school years, “Got it.”

“Does that thing even work?” Foggy asks, eyes narrowing in scrutiny. You trust Frank, but the question is valid - if you saw that in a Goodwill, you would doubt it would even turn on.

“Of course it works,” Frank scoffs as he delivers the device to Karen. She instantly opens it up to get it started. “Old body, new hardware. Got it built just for this type of shit.”

Foggy’s lips twitch and you wonder if he wants to say something but is holding his tongue. Jessica joins the table as Matt once again returns to standing behind you. His hands find your shoulders like they are drawn to them, and you wonder if he can’t help but want to touch you. It makes you feel special and wanted and your belly stirs with a certain type of warmth.

Everyone’s focus is on Karen as she works - the laptop boots up and she fiddles with the first thumb drive until it is ready to be inserted. It feels like you all are holding your breath as she finally plugs it in. You expect there to be a password, but apparently there is not, as she just clicks away.

“There’s two files,” she narrates. “One labeled 082616DUK and one labeled 121417BNY.”

You instantly recognize the first designation and push your notebook towards Karen, trying to not sound eager as you tell her, “The DUK one is in our files. Can we look at that first?”

Her face lights up at the prospect of a connection and selects the requested file, “There’s five pictures. Hold on, let me bring them u- Oh my God.”

The little color in her face drains as a horrified expression takes over and her hand shoots up to cover her mouth. You and Froggy scramble up out of your seats while Frank and Jessica crowd around Karen to look at the screen. Matt stays where he is, tilting his head just slightly.

When you see what is in the file, you wish you had stayed under Matt’s hands.

The neatly severed head of a boy stares back at you with blank milky eyes, sitting on an examine table. His hair has been shaved away and there is an incision line around his skull that makes it clear someone has probably removed his brain. His mouth is open in a silent scream, showing off that he still had his baby teeth and that someone has taken his tongue.

You want to throw up and you want to turn away, but you can’t. You can’t look away from this poor child who someone has so thoroughly defiled. Who had done this to this boy and why? You wanted to shake them and scream and demand to know what could possibly possess someone to do this to a baby? Because this was someone’s baby - someone’s little boy - and someone had taken him and ruined him.

You don’t know how she manages it, but Karen brings up the next image and it fills you with just as much disgust and anger.

It is that of a tiny hand with its fingers forcibly splayed, stuck with pins to keep it that way. The tips are bulbous and round, different to anything you’ve seen on a human before, and between each digit, there was a thin stretch of skin connecting them, much like the webbing of a duck’s foot. Like the head, the hand has been surgically removed from the rest of the body, and it isn’t hard to determine they go to the same person.

The next image is of the head again but turned to be facing the left and pre-removal of the tongue, as the appendage is pulled and stretched from the mouth with a pair of forceps. The muscle is an odd shade of purple and coated with some sort of liquidy-white residue, but that is not what is unique about it. The boy’s tongue doesn’t just peek out of his mouth - it extends across the table almost three feet, if the tape measurer under it is to be believed.

You need to turn away after that and to no surprise, Matt is instantly by your side, wrapping you up in his arms and guiding your head to his neck. “He’s just a baby,” you whisper in horror as you cling to him, not understanding how someone could be so cruel. Even if he had died naturally, there was no reason to treat him like that in death.

“Did they…” Froggy starts, his voice low and quivering and you don’t know if it's from rage or grief, “Did they make him a frog? Did they mix this kid with a fucking frog?”

“No,” Frank replies, not hiding how he is feeling at all. The fury is clear in his voice. “They did it because he was like that.”

“What’s the other file?” Jessica demands and part of you doesn’t want to know. You bury yourself more into Matt and you listen to Karen click away at the track pad.

Matt’s arms tighten around you and you can’t imagine what he is thinking. No one has said out loud what the images show, and he has not asked - but he must know it isn’t good. He’s gone tense under you, like he’s ready to jump into action and rip someone apart with his hands.

And you want him to. You want Matt to find whoever did this and make them pay. You want him to punish those who hurt the child in the photos, the people who ran tests on him.

You want to help Matt find who did this and for him to make sure they can never hurt anyone ever again.

“She’s…she’s got a beak.” Karen says slowly after a few moments, and you can’t bear to look at another autopsy photo. You hide yourself more against Matt, not at all ashamed of your choice.

“She’s Enhanced,” is Jessica’s reply, almost blank with stifled emotion.

“She’s a kid. They are hunting Enhanced kids.”

“Why?” Foggy questions, sounding wet, like he’s starting to tear up. You don’t blame him in any way. “Why would they do that?”

Under you, the Devil finally speaks, his voice low and eerily calm, “it doesn’t matter why. We are going to find them, and we are going to stop them.”

---

:) :) :)

---

@two-unbeatable-beaters @kiwwia-wiwwia @1988-fiend @xblueriddlex @loves0phelia @ninacotte @lovelyygirl8 @littlenosoul @ednaaa-04 @astridstark13 @hashcakes

@lovingkryptonitehideout @moongirlgodness @soocore @bluestuesday @midnightwonderlan

@starry-night-20 @rebeccapineapple @writtenbyred @cherrypie5 @capswife @silvercharacterchaos @resting-confused-face

@Specialagentjackbauer @yarrystyleeza @ofmusesandsecrets @buckyssugarchick

@the-devils-angel @savvyreyes4587 @diasnohibng @blobygree18 @givemylovetoall

@midnightreids @cloudroomblog @yeonalie @thychuvaluswife

@petrovafire39 @ghostindeath @roxytheimmortal

@allllium @waywardcrow @thatkindofgurl @waywardxrhea

@anehkael @akilatwt @lostinthefantasies @reluctanthalfwayoptimism @ethereal-blaze

@nennia-2000 @seasonofthenerd @abucketofweird @mattmurdockstateofmind @imagineswritersblog @hazelhavoc @smile-child-13 @allst4rsfall @hashcakes @kezibear @mapleaye @sammanna @gamingfeline @moon-glades @nightwitherspring @phoenix666stuff @dare-devil

@ladyoflynx @hobiebrowns-wife @sarcasm-n-insomnia @lillycore

@dorothleah @mattmurdocksstarlight @mars-on-vinyl @mywellspringoflife @sleepdeprived-barelyalive @simmilarly @soupyspence @darkened-writer @akila-twt

@murc0ckmurc0ck @groovycass @sumo-b98 @just3rowsing @tongueofcat @zoom1374

@theclassicvinyldragon @aoi-targaryen @lunaticgurly @nikitawolfxo @shireentapestry @snakevyro @yondiii @echos-muses @honeybug-victoria @the-bisaster @ristare

@mrs-bellingham @eugene-emt-roe @cometenthusiast @stevenknightmarc @yes-im-your-mom @hunnybelha @actorinfluence @capbrie @prowlingforfood @jupitervenusearthmars

@mayp11-blog @danzer8705 @thinking-at-dusk @remuslupinwifee @akila-twt @nommingonfood @mattmurdocks6thscaleapartment @dil3mma @allllium

#soulie writes#fanfiction#and then i met you#matt murdock x reader#daredevil#matt murdock x you#R rated chapter be warned

229 notes

·

View notes

Text

Axolt: Modern ERP and Inventory Software Built on Salesforce

Today’s businesses operate in a fast-paced, data-driven environment where efficiency, accuracy, and agility are key to staying competitive. Legacy systems and disconnected software tools can no longer meet the evolving demands of modern enterprises. That’s why companies across industries are turning to Axolt, a next-generation solution offering intelligent inventory software and a full-fledged ERP on Salesforce.

Axolt is a unified, cloud-based ERP system built natively on the Salesforce platform. It provides a modular, scalable framework that allows organizations to manage operations from inventory and logistics to finance, manufacturing, and compliance—all in one place.

Where most ERPs are either too rigid or require costly integrations, Axolt is designed for flexibility. It empowers teams with real-time data, reduces manual work, and improves cross-functional collaboration. With Salesforce as the foundation, users benefit from enterprise-grade security, automation, and mobile access without needing separate platforms for CRM and ERP.

Smarter Inventory Software Inventory is at the heart of operational performance. Poor inventory control can result in stockouts, over-purchasing, and missed opportunities. Axolt’s built-in inventory software addresses these issues by providing real-time visibility into stock levels, warehouse locations, and product movement.

Whether managing serialized products, batches, or kits, the system tracks every item with precision. It supports barcode scanning, lot and serial traceability, expiry tracking, and multi-warehouse inventory—all from a central dashboard.

Unlike traditional inventory tools, Axolt integrates directly with Salesforce CRM. This means your sales and service teams always have accurate availability information, enabling faster order processing and better customer communication.

A Complete Salesforce ERP Axolt isn’t just inventory software—it’s a full Salesforce ERP suite tailored for businesses that want more from their operations. Finance teams can automate billing cycles, reconcile payments, and manage cash flows with built-in modules for accounts receivable and payable. Manufacturing teams can plan production, allocate work orders, and track costs across every stage.

86 notes

·

View notes

Note

this isnt really a question and i may have already said this before so you dont. have to publish this or anything. but i really want to say i love how heartbreak is still integral to the story? like after episode 0 i was briefly.. not scared but kind of anticipating Something because the main problem was now solved. there will be no more heartbreak killings, no more data to go off of. episode 0s conclusion was satisfying but i couldnt see how it could leave any more room for future episodes- itd be morgan taking on cases sure but itd be more waffling about. nothing really interesting happening besides the cases (<- oversimplification). so when episode 1 came out i was pleasantly surprised at how it was still good (ive seen pilots that were amazing but then the show comes out and it never actually touches on what made the pilot interesting so i was scared that it would happen here. it did not!) and also how morgans crimes were implemented. i like how not.. in-your-face the heartbreak stuff is (considering morgan avoids it, plus depending on how its executed it could become a situation where its like “yeah yeah we get it already”) but how its still an important thing in the story. it lays the groundwork for morgans (and emmas) mentality (which by the way that scene is so cool when i first got to it i was like WOAH. its technically simple but ive never seen someone do a type of scene like that?? completing each others words but in a different context yet still highlighting their core mentality. and the visuals for it!!!!!! cutting between morgan and emma you dont know whats being get at until youre hit with it like a bat.) and also it both disproves morgans whole drop in the sea notion but Also provides a tangible backdrop to the world and how bad of a landscape theyre in + public unrest. heartbreak’s the tipping point but its not the cause; its mostly just adding onto fears already held by people by being in a surveillance state. i think i have to replay it to get a more solid basis for this but its just. the writing is so good and the ways you make it good are so interesting. i didnt know how someone could continue off of an already satisfyingly ended story and Yet!!!!!!!!!!!!!!!!!!!!!!!! i was proven wrong!!!!!!!!!!! anyways its just. man its so interesting. im going to study this writing. also obligatory while im not a personal fan of model employee (purely for personal reasons its just not my style theres nothing you can really do about that (plus its not your job to)) i Do like how it ties into itself? the lack of control theme carries on with bailey losing theirs, but also penny never having much of an autonomy either. giving herself control by taking away someone elses, not asking to be created in a warehouse where you can feel every living thing crawl around, not asking to have life saving medical equipment forced onto you that while saved your life leaves you in crippling debt. that one thing someone said about losing ones autonomy to the gears of capitalism. its a really well written game and its interesting. theres Layers there and with it being a relatively small game itd be cool to see how far it goes? anyways really good games.

True, not a question. But thank you for the kind words!

25 notes

·

View notes

Text

It is a warehouse the size of 12 football pitches that promises to create much-needed jobs and development in Caucaia city, north-east Brazil. But it won’t have shelves stocked with products. This vast building will be a datacentre, believed to be earmarked for TikTok, the Chinese-owned video-sharing app, as part of a 55bn reais (£7.3bn) project to expand its global datacentre infrastructure.

Caucaia [...] suffers from extreme weather events, including droughts and heavy rains, according to data from the Digital Atlas of Disasters in Brazil and the Integrated Disaster Information System.