#gspc

Explore tagged Tumblr posts

Text

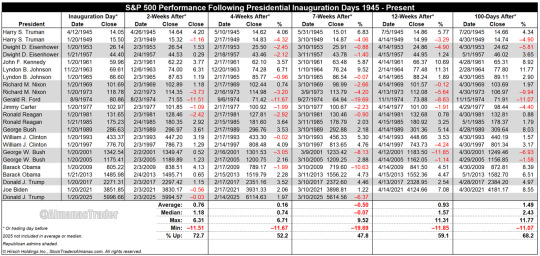

4th Worst Post Inaugural S&P 500 Performance since WWII

Click here to view table full size…

President Trump’s fast and furious pace of change to kick off his second term has created a great deal of uncertainty. Historically, the market has not performed well during periods of uncertainty. Monday, March 10, marked the seven weeks since Inauguration Day and as of the close S&P 500 was down 6.37%, its fourth worst post inaugural performance since 1945. Presidents Obama (2009), W. Bush (2001) and Ford (1974) suffered greater declines through the seventh week.

In the above table we have included the S&P 500’s performance every Inauguration Day since April 12, 1945, when Truman became President following the death of FDR. We also included November 1963, when Johnson took over after JFK was assassinated and Ford in August 1974, following Nixon’s resignation. We use the close on Inauguration Day or the day before when it landed on a holiday like this year. Republican Administrations are shaded in grey.

Seven weeks may be an odd data point to consider but it is consistent with the current time frame. Looking out to 12-Weeks After and 100-Days After, we see an improvement in S&P 500 performance with average, median and frequency of gains improving. Should the market find support, a rebound would be consistent with past post inaugural performance.

157 notes

·

View notes

Photo

Weird

Monday . . . #SPiCollective #collectivestreetphotography #Streetphotographers #gspc #streetclassics #thestreetphotographyhub #streetfinder #streethunters #dpspstreet #mystreet_bnw #streetphotography #bcncollective #eyephotomagazine #life_is_street #tnscollective #thestreephers #thephotosector #timeless_streets #streetmoment #streets_storytelling #streetsgrammer #gf_streets #ricohgr3 #somewheremag #guanajuato #mexico #lensculture #sleepwalker (at San luis de la paz Gto.) https://www.instagram.com/p/CqAs0d9AsfZ/?igshid=NGJjMDIxMWI=

#spicollective#collectivestreetphotography#streetphotographers#gspc#streetclassics#thestreetphotographyhub#streetfinder#streethunters#dpspstreet#mystreet_bnw#streetphotography#bcncollective#eyephotomagazine#life_is_street#tnscollective#thestreephers#thephotosector#timeless_streets#streetmoment#streets_storytelling#streetsgrammer#gf_streets#ricohgr3#somewheremag#guanajuato#mexico#lensculture#sleepwalker

1 note

·

View note

Text

#NTPC Green Energy Limited (NGEL)#GujaratPipavavPortLtd#electronicsnews#technologynews#Gujarat State Petroleum Corporation Ltd (GSPC)

0 notes

Text

Indian LNG projects

India’s LNG (Liquefied Natural Gas) infrastructure is witnessing rapid expansion to meet the country’s growing energy demand, diversify fuel sources, and support its clean energy transition. Indian Petroplus provides in-depth updates on key LNG projects, investments, and policy developments that are shaping the future of India’s gas economy. Major LNG terminals are being expanded and new ones commissioned across coastal India. Petronet LNG, the market leader, is expanding its Dahej terminal capacity from 17.5 MMTPA to 22.5 MMTPA. The Kochi terminal is also gaining traction with improved pipeline connectivity. Gujarat is emerging as an LNG hub with terminals in Hazira (Shell), Mundra (GSPC-Adani), and Jafrabad (HPCL-Shapoorji Pallonji) increasing operational capacity and throughput. New terminals under development include the Dhamra LNG terminal in Odisha by Adani Total, which recently commenced operations, enhancing access to gas markets in eastern and northeastern India. The Jaigarh LNG terminal in Maharashtra by H-Energy is expected to improve supply in the western region. Other projects are being planned in Kakinada (APSEZ), Pipavav, and Paradip to increase regional availability and reduce import dependency on a few ports. Floating Storage Regasification Units (FSRUs) are also gaining attention for faster deployment and flexibility. India’s LNG strategy is focused on increasing regasification capacity to over 70 MMTPA by 2030 and strengthening last-mile connectivity through pipelines and CGD networks. Indian Petroplus tracks LNG project commissioning, capacity utilization, pricing trends, and policy reforms such as open access and LNG bunkering. With reliable insights into India’s LNG expansion, Indian Petroplus serves as a valuable platform for industry professionals, investors, and policymakers, Indian LNG Projects, LNG India, IndiaLNG, LNG Development India, LNG Investments India, LNG Import India, Indianpetroplus.

0 notes

Text

Stock Market Turmoil Over Tariffs and Oil Prices: 60 Years of History Show What Happens Next

Several headwinds threaten the U.S. stock market in the near term, but history says the S&P 500 is headed much higher in the long term. It’s been a tumultuous year for the United States stock market. The S&P 500 (^GSPC 0.96%) dropped 10.5% in the two days after President Trump unveiled his “Liberation Day” tariffs in early April, the fifth-largest two-day decline in history. That led to the…

0 notes

Photo

false

full stop #streetdreamsmag #streetweekly #gramslayers #ourstreets #spicollective #streetgrammers #bevisuallyinspired #hsinthefield #street_life #storyofthestreet #lensculturestreets #lensonstreets #capturestreets #zonestreet #myspc #streetphotography #gspc #streetphotographers #artofvisuals #moodygrams #eclectic_shotz #agameoftones #way2ill #justgoshoot #exploretocreate #hbouthere #streetclassics #wynwood #Miami

@AndTHeLastWaves @StreetPhotographers @StreetDreamsMag @StreetScape @LensCulture @EyeEmPhoto @thecitymag_ @justgoshoot @the.street.photography.hub @streets_vision @streetphotographyjournal @urbanandstreet @streetphotographyinternational @streetphotographyworldwide @magnumphotos @streetartglobe @streetshared @citykillerz @urbanromantix @gramslayers @streetphotographers_art (at Wynwood Life) https://www.instagram.com/p/CnSrJe_vwgg/?igshid=NGJjMDIxMWI=

#streetdreamsmag#streetweekly#gramslayers#ourstreets#spicollective#streetgrammers#bevisuallyinspired#hsinthefield#street_life#storyofthestreet#lensculturestreets#lensonstreets#capturestreets#zonestreet#myspc#streetphotography#gspc#streetphotographers#artofvisuals#moodygrams#eclectic_shotz#agameoftones#way2ill#justgoshoot#exploretocreate#hbouthere#streetclassics#wynwood#miami

1 note

·

View note

Text

Strategy Buys Another $1.05B A Worth Of Bitcoin

Strategy (MSTR), the largest corporate holder of bitcoin, reported in a filing to the Securities and Exchange Commission on Monday that it purchased another $1.05 billion worth of bitcoin.

Shares of Strategy, a small software company turned crypto giant chaired by crypto tycoon Michael Saylor, fell 0.4% in early trading Monday after rising as much as 1.4%, while the broader S&P 500 (^GSPC) rose 1%.

https://finance.yahoo.com/news/michael-saylors-strategy-buys-another-105-billion-of-bitcoin-140056131.html

0 notes

Text

These 2 Beaten-Down Dividend Stocks and This ETF Yield Over 4%. Here's Why They Are Worth Doubling Up on in June.

Phillips 66 is a leading refining company with a history of hiking its dividend consistently higher. J.M. Smucker is too cheap to ignore. The Global X MLP & Energy Infrastructure ETF invests in America’s energy future. 10 stocks we like better than Phillips 66 › The S&P 500 (SNPINDEX: ^GSPC) has staged an epic recovery and is now positive year to date as investors look past ongoing macro…

0 notes

Text

Michael Saylor's Strategy buys another $1.05 billion of bitcoin

Strategy (MSTR), the largest corporate holder of bitcoin, reported in a filing to the Securities and Exchange Commission on Monday that it purchased another $1.05 billion worth of bitcoin. Shares of Strategy, a small software company turned crypto giant chaired by crypto tycoon Michael Saylor, fell 0.4% in early trading Monday after rising as much as 1.4%, while the broader S&P 500 (^GSPC) rose…

0 notes

Text

Một chỉ số lạm phát mới chào đón thị trường chứng khoán trở lại gần mức cao nhất mọi thời đại

Chỉ số S&P 500 (^GSPC) hiện chỉ còn cách mức cao kỷ lục mới khoảng 2%. Tuần trước, cổ phiếu đã kết thúc với mức tăng cao khi đợt tăng giá trên diện rộng sau báo cáo việc làm tháng 5 vào thứ sáu đã giúp cả ba chỉ số chính tăng trưởng trong tuần. Chỉ số Nasdaq Composite (^IXIC) tăng hơn 2,3%, trong khi S&P 500 tăng khoảng 1,6% và Chỉ số công nghiệp trung bình Dow Jones (^DJI) tăng trên 1%. Cập nhật…

0 notes

Text

Halloween Trading Strategy Treat Begins Next Week

Next week provides a special short-term seasonal opportunity, one of the most consistent of the year. The last 4 trading days of October and the first 3 trading days of November have a stellar record the last 30 years. From the tables below:

DJIA: Up 24 of last 30 years, average gain 1.95%, median gain 1.39%. S&P 500: Up 25 of last 30 years, average gain 1.96%, median gain 1.61%. NASDAQ: Up 25 of last 30 years, average gain 2.43%, median gain 2.29%. Russell 2000: Up 23 of last 30 years, average gain 2.34%, median gain 2.56%.

Many refer to our Best Six Months Tactical Seasonal Switching Strategy as the Halloween Indicator or Halloween Strategy and of course “Sell in May”. These catch phrases highlight our discovery that was first published in 1986 in the 1987 Stock Trader’s Almanac that most of the market’s gains have been made from October 31 to April 30, while the market, on average, tends to go sideways to down from May through October.

Since issuing our Seasonal MACD Buy signal for DJIA, S&P 500, NASDAQ, and Russell 2000, on October 11, 2024, we have been moving into new long trades targeting seasonal strength in various sectors of the market via ETFs and a basket of new stock ideas. The above 7-day span is one specific period of strength during the “Best Months.” Plenty of time remains to take advantage of seasonal strength.

24 notes

·

View notes

Text

1 No-Brainer Artificial Intelligence (AI) ETF to Buy With $50 During the S&P 500 Bull Market

A bear market is usually defined by a peak-to-trough decline of 20% in an index like the S&P 500 (^GSPC -0.01%). The S&P narrowly avoided the threshold in April, when it was down by as much as 19% on the back of President Donald Trump’s “Liberation Day” tariffs. It has since recovered most of its losses, and the bull market that began in October 2022 remains intact. The current bull market has…

View On WordPress

0 notes

Text

Coinbase inventory formally joins S&P 500, cementing milestone for firm and crypto business

Coinbase (COIN) on Monday grew to become the primary and solely cryptocurrency platform to see its shares be part of the benchmark S&P 500 (^GSPC) index, a milestone crypto bulls cheered throughout what grew to become a busy week of developments for the corporate. Coinbase inventory was down 1% shortly after Monday’s open; shares are up greater than 25% since information broke every week in the…

0 notes

Text

The 200 Day MA - Update

News of a 90 pause on tariffs between the US and China sent stocks soaring on Monday. “The S&P 500 (^GSPC) soared nearly 3.3% to its highest level since March 3. The Dow Jones Industrial Average (^DJI) gained 2.8%, or more than 1,100 points. The tech-heavy Nasdaq Composite (^IXIC) led gains, rocketing up 4.3%.” Stocks broke bullishly out of consolidation on Monday to close above the 200 day MA.…

1 note

·

View note

Text

#StockMarket#EarningsSeason#Tesla#Alphabet#MagnificentSeven#WallStreet#SP500#Investing#Tariffs#MarketTrends

0 notes

Text

3 No-Brainer High-Yield Dividend Stocks to Buy With $100 Right Now

The S&P 500 index (SNPINDEX: ^GSPC) is currently offering a roughly 1.2% yield. That’s pretty miserly. You can get 4.2% from Toronto-Dominion Bank (TD 0.01%). And 5.5% from Realty Income (O -0.60%). Or even 7.2% from Alexandria Real Estate (ARE -1.34%). Each one of these high yielders is trading for less than $100 a share, but are they worth buying right now? Here’s what you need to know. 1.…

0 notes