#how to get out of pre foreclosure

Explore tagged Tumblr posts

Text

How to Get Out of Pre-Foreclosure: Essential Steps to Protect Your Home

In this helpful guide, we give advice on how to deal with the difficult situation of pre-foreclosure and protect your home. Learn how to get out of pre-foreclosure and find good ways to stop losing your home and take back control of your money in the future. We can help you with different ways to deal with your mortgage, like selling your home for the right price or arranging a short sale. We can also work with your lender to change your loan or come up with a plan to repay it. We have a lot of different options and will find the best solution for you. Learn how homeowners can lose their homes when they don't make their mortgage payments, get notices from the bank, and have their homes sold at an auction. This way, you can act early to keep your property. Don't get too stressed out about almost losing your home - learn as much as you can and get the help you need to get through this tough time.

0 notes

Text

Short Term Cash Loans: The Last Chance for Needy Scroungers

It is often necessary to borrow money from relatives or friends, but you must accept No’ by them for bucks. Then, short term cash loans are an excellent financial bargain that can provide you with enough money in a hassle-free manner. Furthermore, you are not required to pledge or fax for these fundraising goods. As a result, obtaining funds is usually simple.

Simple qualifications such as the aspirant's age of @18 years, residency in the UK, full-time employment, and an active checking account allow the people to obtain favorable cash without having to wait for many days. Complete a simple online application form with complete information such as name, address, age, contact number, email id, and so on, and then submit it online for finalization. The approval fee is deposited into your bank account the same day you apply.

Relax if you have negative credit elements such as defaults, arrears, foreclosure, late payments, installment skipping, or even bankruptcy, which are allowed to make the most of short term cash loans without going through any credit verification. Under the terms of these credits, you can obtain funds ranging from £100 to £1000, with a repayment period of 14 to 31 days.

If you're wondering whether a lender would consider you for loan repayments and wish to apply for a short term loans UK direct lender, no credit check is required. They want to know that you will be able to repay it, and they may consider you for pre-approval for one of their loan amounts.

If you have a bad credit rating, short term loans direct lenders for bad credit are available. While some lenders will not accept you if you are in this scenario, others specialize in it. Even if a typical lender rejects you for specific loan amounts, a specialized lender may approve you.

How to Compare Short Term Loans UK Lenders

To begin, keep in mind that there are two types of loans:

Direct lenders for short term loans in the United Kingdom

Short-term loans obtained through brokers

Brokers have significant business knowledge and may be able to get a loan from places you are not aware of. Assume you're looking for short term loans direct lenders with bad credit, no guarantor, and a direct lender. This excludes any lenders you would locate through a broker, limiting the potential sources of loans you might be able to find. A smaller pool of lenders would provide representative instances.

When you compare lenders, you can look at the loan amount offered, early repayment arrangements, how the loan amount changes if you spread it out over a longer period of time, and so on. Before considering an application, evaluate all circumstances, including whether you can make the repayments. Consider whether a short term loans UK direct lender is typical of the market or whether there are better options available elsewhere.

You can learn everything you need to know about payback terms, short term loan terms and conditions, interest rates, and everything else we've discussed here. If you want to borrow money over time, it's generally quicker to do your research online rather than going to a traditional lender. This method makes it easy to find more possible short term loans UK providers.

#short term loans uk#short term loans uk direct lender#same day loans online#short term cash#Short Term Loans UK#Short Term Loans UK Direct Lender#Short Term Cash

4 notes

·

View notes

Text

Helping Homeowners Navigate Financial Distress with Real-Time Support

When homeowners fall behind on mortgage payments, they’re often caught between a financial rock and a hard place. Foreclosure looms, equity is limited, and emotions are high. For many, a short sale becomes the most realistic option — but they need help understanding the process and acting quickly.

This creates a time-sensitive window for real estate agents, short sale negotiators, and distressed property specialists. And the best way to capitalize on this opportunity? By connecting directly with homeowners the moment they seek assistance — through live transfer leads.

Why Short Sales Still Matter

Even in shifting real estate markets, there are always homeowners:

Behind on payments

Facing foreclosure

Experiencing financial hardship (job loss, divorce, medical issues)

Owing more than their home is worth

Looking for a graceful exit without foreclosure

These sellers want a fast solution — and they want to speak to someone who understands their situation. That’s where live transfer leads shine.

What Are Short Sale Live Transfers?

A short sale live transfer is a phone call where a homeowner facing hardship is screened by our trained agents and then instantly connected to your team — ready to explore selling their property through a short sale.

Here’s how it works with Thelivelead:

Homeowners engage through a targeted campaign or call-in

Our call center pre-qualifies them based on financial situation and home status

If they meet your criteria, the call is transferred live to your short sale team

It’s fast, efficient, and highly effective.

Why These Leads Outperform Cold Data

When you’re dealing with distressed homeowners, timing and empathy are everything. Our short sale live transfers help your team:

✅ Skip cold outreach and connect with people ready to talk ✅ Build trust from the very first call ✅ Reduce acquisition time and effort ✅ Increase your listings or pipeline of negotiable assets ✅ Close more transactions with fewer headaches

What You Get with Thelivelead

We don’t just deliver names — we deliver real people in real distress who need guidance now.

🔹 Exclusive Transfers Only — No sharing, no recycled leads 🔹 Custom Filters — Target by state, mortgage status, loan amount, or hardship type 🔹 Pre-Qualified Conversations — Filtered based on situation and intent 🔹 TCPA-Compliant — Fully permission-based, ready for contact 🔹 U.S.-Based Agents — Trained in empathy, urgency, and compliance 🔹 Real-Time Call Delivery — Straight to your sales or advisory team

📞 Phone: +1–925–701–9070 📧 Email: [email protected] 🌐 Website: www.thelivelead.com

Who Can Benefit from Short Sale Live Transfers?

✔️ Real estate agents & brokers ✔️ Short sale negotiation firms ✔️ Real estate investors targeting pre-foreclosures ✔️ Mortgage assistance services ✔️ Attorneys specializing in foreclosure defense ✔️ Asset recovery teams

If you help homeowners exit their properties with dignity and structure, these live transfers give you a daily flow of motivated prospects.

Final Thoughts

In the distressed property space, every minute counts. Homeowners in hardship don’t want to fill out long forms — they want real conversations with real professionals.

With short sale live transfers from Thelivelead, you don’t just generate leads — you become the trusted advisor in someone’s most stressful moment.

Speak with urgency. Serve with empathy. Close with confidence — with Thelivelead. 📞 +1–925–701–9070 | ✉️ [email protected] | 🌐 www.thelivelead.com

0 notes

Text

How Real Estate Agents Help You Buy a Home Within Your Budget

Buying a home is a major financial decision, and staying within budget is crucial. While some people think they can save money by avoiding real estate agents, the truth is that a skilled agent can help buyers find the right home without overspending. Here’s how real estate agents help you to buy a home in Calgary within your budget.

1. Understanding Your Financial Limits

A good real estate agent starts by discussing your budget and financial situation. They ask about your pre-approval amount (if you have one) to buy a home. They help you determine a realistic price range. This prevents you from wasting time looking at homes you can’t afford. They may also recommend trusted mortgage lenders who can offer competitive rates, helping you secure the best financing options.

2. Finding Hidden Gems and Discounted Properties

Experienced agents know the market well and can find homes that fit your budget but may not be widely advertised. Some properties are priced below market value due to motivated sellers, foreclosures, or minor repairs needed. Agents can access these listings and alert you to great deals before other buyers even see them.

3. Negotiating the Best Price

One of the biggest advantages of working with an agent is their negotiation skills. They can analyze comparable home prices (comps) in the area and advise you on a fair offer. If a home is overpriced, they can negotiate with the seller to lower it or include concessions like covering closing costs. This ensures you don’t overpay for a property.

4. Avoiding Overpriced or Problematic Homes

Some homes may seem like a good deal initially but come with hidden costs, such as needed repairs, structural issues, or high property taxes. A knowledgeable agent can spot red flags and warn you before you make an expensive mistake. They may also recommend a home inspection to uncover potential problems, helping you avoid unexpected expenses.

5. Access to Off-Market and Pre-Market Listings

Many great deals to buy home never make it to public listings. Top agents have connections with other real estate professionals and often hear about homes before they are officially listed. These “pocket listings” can sometimes be purchased at a lower price because there’s less competition from other buyers.

6. Saving Money on Closing Costs and Fees

Closing costs (fees paid at the end of a home purchase) can add thousands to your expenses. A skilled agent can negotiate with sellers to cover some or all of these costs, reducing out-of-pocket expenses. They can also recommend affordable title companies, inspectors, and attorneys to keep fees low.

7. Preventing Bidding Wars

Buyers often get into bidding wars in competitive markets, driving prices up. A smart agent can help you avoid this by:

Making strong initial offers (without overbidding).

Writing personal letters to sellers (sometimes convincing them to choose your offer over higher bids).

Finding less competitive listings (such as homes on the market longer).

This strategy helps you stay within budget to buy home instead of getting caught in an emotional bidding battle.

8. Knowing Neighborhood Value Trends

Agents understand which neighborhoods offer the best value for your money. They can guide you toward up-and-coming areas where prices are still reasonable but expected to rise. This helps you get more for your budget instead of paying premium prices in highly sought-after locations.

In Conclusion

While some buyers think skipping an agent will save money, the opposite is often true. A skilled real estate agent helps you find the best home within your budget by negotiating better prices, avoiding bad deals, and uncovering hidden discounts. Their expertise can save you thousands of dollars and prevent costly mistakes, making them a valuable partner in the home-buying process.If you want to buy a home in Calgary without overspending, working with a professional real estate agent like UDO & COMPANY is one of the smartest decisions you can make.

0 notes

Text

El Paso Texas Homeowners: Sell Your House Fast and Stress-Free!

Selling a home is complicated and stressful in the utmost. However, it may not be so. If you are a homeowner in El Paso, Texas, you are among the many who have exclaimed, “Need to sell my house fast El Paso Texas.” Relocation, financial hardship, impending foreclosure, or just a choice to circumvent the traditional route are some of the reasons that are making fast home sales more accessible now than before.

This guide will explore the possibilities of selling quickly in El Paso; the necessity of selling quickly in certain situations and how to do it without anywhere near too much stress.

Why Homeowners in El Paso Are Selling Fast

There are several reasons why homeowners in El Paso are increasingly turning to quick-sale solutions:

Relocation for Work or Family: Moving out of state for a new job or to be closer to family can require a fast turnaround.

Foreclosure Risks: When mortgage payments become unmanageable, selling fast is often the best way to avoid foreclosure.

Inherited Properties: Not everyone wants to maintain or manage an inherited house, especially from out of town.

Costly Repairs: Older homes may need expensive repairs. Rather than invest in fixing them, some sellers prefer to sell as-is.

Divorce or Separation: Life transitions can make holding onto a property impractical.

If any of these situations apply to you, you're likely thinking, “How can I sell my house fast El Paso Texas without losing peace of mind or profit?”

The Problem with Traditional Real Estate Sales

When you list a house with a real estate agent, the process typically involves:

Home inspections

Appraisals

Repairs and staging

Multiple showings

Waiting for buyer financing

The process can take a month's times. And if the buyer defaults, you start out at square one. This approach is of no use to sellers who need to move quickly or cannot afford to lose time, money, and energy indulging in a protracted sales procedure.

The Solution: Sell Your House Fast for Cash

If you're wondering how to sell my house fast El Paso Texas, working with cash home buyers is one of the best options. Here’s why:

1. Speed

Cash buyers typically close in as little as 7 days. There's no waiting for mortgage approvals or extended escrow periods.

2. No Repairs Needed

Forget investing in costly upgrades or cleaning. Most cash buyers purchase homes as-is, saving you time and money.

3. No Agent Commissions

Selling through a real estate agent means paying 5–6% in commissions. Cash buyers eliminate those fees, putting more money in your pocket.

4. Stress-Free Process

You won’t have to worry about staging, multiple showings, or negotiations. Cash buyers present simple, straightforward offers.

What’s the Process Like?

If you’re ready to sell my house fast El Paso Texas, here’s how the typical process works:

Step 1: Request an Offer

Contact a reputable cash home buying company. Share some basic information about your property.

Step 2: Property Assessment

The buyer may visit your home or assess it virtually. They’ll consider its condition, location, and market value.

Step 3: Receive a No-Obligation Cash Offer

You’ll get a fair cash offer—usually within 24 to 48 hours. There's no pressure to accept.

Step 4: Pick Your Closing Date

If you accept the offer, you can choose a closing date that works best for you—sometimes within a week.

Step 5: Close & Get Paid

At closing, you’ll receive the agreed-upon amount in cash. Simple as that.

What Types of Homes Can Be Sold Fast?

One of the advantages of cash home buyers is that they’ll consider almost any property. This includes:

Homes in need of major repairs

Inherited or vacant houses

Rental properties with tenants

Homes in probate or pre-foreclosure

Houses with code violations or liens

So if you’re unsure whether your home qualifies, don’t worry. Many companies in El Paso are willing to make offers on properties others won’t touch.

Choosing the Right Cash Buyer in El Paso

While many investors claim to help you sell your house fast, not all offer the same experience. Here are a few tips for choosing a trustworthy company:

Check Reviews and Testimonials: Look for companies with verified reviews and client success stories.

Ask About Fees: The best companies have no hidden fees or commissions.

Look for Transparency: A reputable buyer will walk you through the process clearly and answer all your questions.

Verify Their Experience: Choose someone who knows the El Paso market and has helped other local homeowners.

Final Thoughts

If you're telling yourself, "I have to sell my house in a hurry in El Paso Texas," rest assured, the fair, fast, and stress-free options do exist. Cash buying is a great option for those who are facing a personal hardship or have come into possession of an inherited property that they cannot or do not wish to keep, or simply want to cut the whole hassle out of traditional sales.

It all starts with reaching out to a trusted cash home buyer in El Paso who can walk you through the process with honesty, professionalism, and care.

Don’t wait months to sell—get a fair cash offer and close on your timeline. Contact a reputable home buyer today and say goodbye to the stress of selling your home in El Paso, Texas. Stay tuned for our next blog, where we dive even deeper into Killeen Homeowners: Sell Your House Fast for Top Dollar! You won’t want to miss it!

0 notes

Text

Avoid These Common Mistakes When Taking a Four Wheeler Loan

Applying for a four wheeler loan is one of the smartest ways to own a car without putting your finances under pressure. Whether you’re buying a new or used car, a loan offers flexibility and convenience. But to make the most of it, you need to avoid certain common mistakes that could cost you in the long run.

In this blog, we’ll highlight the top loan-related missteps that first-time and even repeat buyers often make—and how you can steer clear of them.

Mistake #1: Not Checking Your EMI Affordability

Many buyers focus only on the car’s price and overlook how much they’ll actually be paying every month. Before committing to a four wheeler loan, always use an EMI calculator to estimate your monthly obligation based on loan amount, tenure, and income.

Tip: Choose an EMI that fits comfortably within 30–40% of your monthly income to avoid overburdening your budget.

Mistake #2: Ignoring Loan Tenure Impact

A longer loan tenure might look attractive due to lower EMIs, but it also means you’ll end up paying more in interest. On the other hand, very short tenures can result in high EMIs that strain your monthly finances.

Tip: Find the sweet spot—a tenure that gives manageable EMIs without stretching repayment unnecessarily.

Mistake #3: Skipping Down Payment Planning

While it’s tempting to take 100% loan financing (if available), doing so increases your EMI and total interest outgo.

Tip: Make a reasonable down payment. The higher it is, the lower your loan principal and monthly EMI will be. It also improves your chances of loan approval.

Mistake #4: Not Comparing Loan Offers

Many buyers settle for the first loan offer they get—often from a car dealer—without checking other financing options. Different lenders have varying terms, hidden fees, or better service.

Tip: Choose a trusted lender like Manba Finance that offers transparent terms, fast approvals, and strong after-loan support for your four wheeler loan.

Mistake #5: Overlooking Additional Costs

Car ownership involves more than just loan EMIs. Insurance premiums, regular servicing, fuel, and annual taxes can quickly add up.

Tip: Budget for these additional costs in advance so you don’t face unpleasant surprises after the purchase.

Mistake #6: Ignoring Pre-Owned Vehicle Benefits

New cars depreciate faster, while well-maintained used cars provide excellent value. Yet, many buyers ignore the pre-owned market due to misconceptions.

Tip: If you’re budget-conscious, explore used cars. A four wheeler loan for pre-owned vehicles lets you access premium models at lower prices and manageable EMIs.

Mistake #7: Not Reading the Loan Agreement Carefully

This is one of the most overlooked steps. Many people sign the loan documents without reading the fine print—missing out on hidden charges, foreclosure terms, or penalties.

Tip: Read and understand all terms before signing. Ask your lender questions if something is unclear.

Mistake #8: No Loan Pre-Approval Before Car Search

If you start searching for a car before knowing your loan eligibility or budget, you may end up picking a vehicle that exceeds your affordability.

Tip: Get pre-approved for a four wheeler loan so you know your budget range in advance and can shop confidently.

Final Thoughts

A car loan is a long-term financial commitment, and avoiding these mistakes will save you money, time, and stress. Whether you’re buying your first vehicle or upgrading to something better, a little planning can go a long way.

Let Manba Finance simplify your journey. With their customer-first approach and flexible financing options, applying for a four wheeler loan has never been easier—or smarter.

0 notes

Text

Loan Against Property Online Apply Guide – Best Banks, Fast Approval & Lowest Interest in India

Why let your property sleep when it can help you fund your dreams?

In today’s fast-paced financial world, people often look for solutions that are quick, low-cost, and flexible. Whether you're planning a child’s wedding, managing medical expenses, expanding your business, or covering education costs, a Loan Against Property (LAP) can be a smart choice.

This guide is designed to help salaried and self-employed individuals understand everything about Loan Against Property in India — from interest rates and eligibility to how to apply online easily in 2025.

What is Loan Against Property (LAP)?

A Loan Against Property (LAP) is a secured loan where you pledge your residential, commercial, or industrial property as collateral to avail funds. The biggest advantage? You continue owning the property while utilizing its value for your needs.

Whether you're looking for an online loan against property or want an instant loan against property through a bank/NBFC, this guide will simplify your journey.

Why Are People Choosing LAP in 2025?

Lower interest rates compared to personal loans

High loan amount (up to 70% of property value)

Flexible tenure (up to 15–20 years)

Used for multiple purposes – medical, education, wedding, business

Both salaried and self-employed can apply

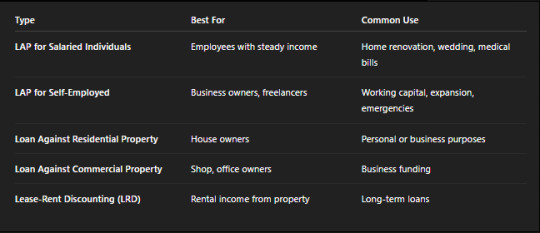

Types of Loan Against Property in India

Current Interest Rates (2025 Update)

Note: Rates may vary based on applicant profile, property type, and tenure.

Who is Eligible? | LAP Eligibility Criteria

For Salaried Individuals:

Age: 21–60 years

Minimum salary: ₹25,000/month

Permanent employment with a reputed company

Clear ownership of property

For Self-Employed Individuals:

Age: 25–65 years

Minimum business vintage: 3 years

Regular ITR filings

Property should be in the applicant’s or firm’s name

If you're wondering “how to apply for a loan against property for salaried individuals”, we cover it step-by-step below.

Documents Required to Apply for LAP

How to Apply for a Loan Against Property Online?

Applying for a fast loan against property is now easier than ever. Here’s a step-by-step guide:

Apply for a Loan Against Property Online in 2025:

Visit the lender's official site (e.g., HDFC, Bajaj, SBI)

Select the “Loan Against Property” option

Fill out the online LAP application form

Upload the required documents digitally

Get a pre-approval in 10–30 mins (instant loan against property)

Final approval after physical verification

Disbursal within 3–7 working days

Platforms also provide instant loans against property for emergency needs.

Real-Life Use Cases

Ravi (Salaried, Gurgaon): Took a ₹15 lakh LAP for daughter’s wedding. Easy EMIs, property still owned.

Priya (Self-employed, Bangalore): Applied for a loan against property for medical expenses after a sudden surgery. Received disbursal in 4 days.

Rohit (IT Professional): Used a loan against property for home expenses, including renovation and appliance upgrades.

This shows how people are using LAP for both personal and professional purposes.

Expert Tip:

“Don’t sell your property in an emergency. Use LAP to unlock its value and still retain ownership.”

Understanding LAP Terms (With Clarity)

LAP Loan Against Property: Simply means a loan backed by your property

Salaried LAP Meaning: A LAP product tailored for salaried professionals

Immediate Loan Against Property: Shorter documentation, faster disbursal—ideal for urgent medical or home needs

Loan Against Property Knowledge: Always verify the loan-to-value ratio, interest rate, and foreclosure charges before signing

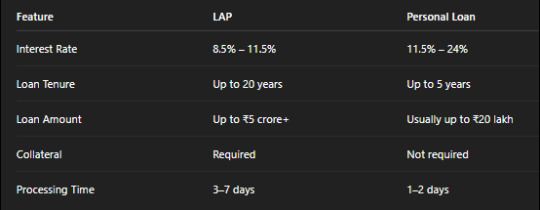

LAP vs Personal Loan – Which is Better?

Verdict:

Choose LAP if you need a high loan amount, a longer repayment period, and have property to pledge.

Choose a Personal Loan if you need quick funds, have no collateral, and need a smaller short-term loan.

Procedure of Loan Against Property

Check your property eligibility and ownership status

Choose the best lender as per interest rate and LTV

Fill LAP application form online/offline

Submit documents and wait for verification

Get a sanction letter and property valuation

Disbursal done post-signing agreement

The procedure of loan against property remains largely the same across banks and NBFCs.

FAQs on Loan Against Property in India

1. What is the maximum amount I can get through LAP?

You can get up to 60–75% of your property's market value, depending on the lender.

2. Can I apply for LAP even if I have an existing home loan?

Yes, provided your repayment track record is good and your property has sufficient equity.

3. How fast can I get a loan against property?

Many lenders offer immediate loan against property approval in 24–48 hours with digital applications.

4. Is LAP available for self-employed individuals with irregular income?

Yes. You may need to provide GST returns, business proof, and ITRs. Some lenders offer loans against property for self-employed individuals for medical expenses as well.

5. Is the CIBIL score important for LAP approval?

Yes, ideally above 700 is preferred. However, since it’s a secured loan, the chances of approval are still higher than unsecured loans.

Final Thoughts

Whether you are salaried or self-employed, a loan against property in India can be your safety net and opportunity creator in 2025. From planning your dream wedding to funding a startup or handling sudden medical bills, LAP gives you freedom without losing ownership of your property.

And with growing options to apply for LAP online, digital approvals, and fast loan against property schemes, the process has never been smoother.

#online loan against property#lap loan#instant loan against property#apply for lap#fast loan against property#apply for loan against property online#how to raise loan against property#how to apply for loan against property for salaried individuals#lap loan against property#salaried lap meaning#loan against property for salaried individuals for home expenses#loan against property lap india#loan against property for self employed individuals for medical expenses#how to apply for lap#loan against property for salaried individuals for medical expenses#immediate loan against property#procedure of loan against property#loan against property features for self employed individuals#loan against property knowledge

1 note

·

View note

Link

0 notes

Text

Everything You Need to Know About Getting a Personal Loan in 2025

In today’s fast-paced financial landscape, a Personal Loan has emerged as one of the most flexible tools to handle immediate financial requirements. Whether you are planning a wedding, managing unexpected medical bills, funding a dream vacation, or consolidating debt, a Personal Loan can provide quick and hassle-free support without the need for collateral. This article explores everything you need to know about applying for a Personal Loan, understanding Instant Personal Loans, and using an Online Personal Loan platform smartly and securely.

What is a Personal Loan?

A Personal Loan is an unsecured form of credit that allows individuals to borrow money from a bank, Non-Banking Financial Company (NBFC), or digital lender without pledging any assets. Because it's unsecured, lenders assess your eligibility based on income, credit score, employment stability, and repayment capacity.

The loan amount can vary from ₹10,000 to ₹40 lakhs or more, depending on the lender and the borrower’s profile. The repayment period usually ranges from 12 months to 60 months.

Why Choose a Personal Loan in 2025?

There are several reasons why individuals prefer a Personal Loan over other financing options in 2025:

No Collateral Required – You don’t have to risk your assets.

Quick Disbursal – Thanks to digital processes, loan amounts are credited within hours.

Fixed EMIs – The monthly repayments remain consistent.

Flexible Usage – You can use the money for any personal purpose.

Pre-approved Offers – Existing bank customers may get Instant Personal Loans at lower interest rates.

The Rise of Instant Personal Loans

Modern lending platforms and digital NBFCs have revolutionized how loans are distributed. Now, many lenders offer Instant Personal Loans through AI-powered platforms that assess your documents and creditworthiness in minutes.

These Instant Personal Loan solutions typically require minimal documentation and enable fast credit transfers, often within one hour. For salaried employees with a good credit history, this is a game-changer.

Online Personal Loan: The New Norm

Applying for an Online Personal Loan is becoming the most preferred method for borrowers. You no longer need to stand in long queues at banks or fill out endless paper forms.

Benefits of choosing an Online Personal Loan:

Convenience: Apply anytime from anywhere using your smartphone.

Transparency: Real-time tracking, digital agreements, and instant updates.

Fast Approval: Lenders can approve loans within minutes.

Paperless KYC: Use Aadhaar-based verification to complete the process quickly.

Eligibility Criteria for a Personal Loan

While the specific criteria vary slightly by lender, the general requirements for a Personal Loan are:

Age: 21 to 60 years

Minimum income: ₹15,000/month for salaried; ₹25,000/month for self-employed

Employment: Must be salaried with 6–12 months of work history or self-employed for at least 2 years

Credit score: 700+ is preferred

Residence: Must be residing in a serviced area by the lender

Documents Required for Online Personal Loan

To apply for an Online Personal Loan or an Instant Personal Loan, you usually need:

Aadhaar card

PAN card

Salary slips (last 3 months)

Bank statement (last 6 months)

Address proof (utility bill or rental agreement)

Passport-sized photograph

Many digital platforms allow uploading documents directly during the application process, making it seamless.

Interest Rates and Fees in 2025

Interest rates for a Personal Loan can vary depending on the lender and your creditworthiness. Here’s what to expect in 2025:

Interest Rate: 10% to 24% per annum

Processing Fee: 1% to 3% of the loan amount

Prepayment Charges: Some lenders allow part-prepayment or foreclosure without penalty

Late Payment Fee: Applicable if EMI is missed

When choosing an Online Personal Loan, always read the fine print to understand the total cost of borrowing.

How to Apply for a Personal Loan Online?

Follow these steps to apply for an Online Personal Loan:

Choose a Lender – Select a trusted NBFC or bank.

Check Eligibility – Use the eligibility checker on the lender’s website.

Use a Personal Loan EMI Calculator – Estimate your EMIs before you apply.

Fill in Your Details – Complete a short application form online.

Upload Documents – Submit all KYC and income documents.

Instant Verification – Many platforms use digital tools for verification.

Loan Approval – If eligible, the loan is approved immediately.

Disbursal – Amount is credited to your bank account, often within 24 hours.

Personal Loan EMI Calculator: Why Use It?

Before applying, it’s smart to use a Personal Loan EMI Calculator available on most lender websites. This tool helps you plan your monthly budget by showing:

Your EMI based on loan amount, interest rate, and tenure

Total repayment amount

Interest payable over the loan period

Using a calculator also prevents over-borrowing and keeps your finances healthy.

Smart Tips to Get an Instant Personal Loan Approved

Getting an Instant Personal Loan approved quickly is possible with a few proactive steps:

Maintain a good credit score: Above 750 is ideal

Keep documents handy: Fast upload = faster approval

Avoid multiple applications: Too many queries reduce your credit score

Choose pre-approved offers: These have higher approval chances

Apply with trusted lenders: Go for RBI-registered NBFCs or reputed banks

Online Personal Loan: Safety and Security Tips

Digital loan platforms are incredibly convenient, but it’s essential to stay secure:

Use secure websites: Check for HTTPS and padlock symbol

Don’t share OTPs or passwords: Legit lenders never ask

Avoid third-party apps: Use official bank/NBFC websites or apps

Read reviews: Always check the credibility of a new platform

Verify loan terms: Download a copy of the agreement for future reference

Common Reasons People Take a Personal Loan

Here are some top purposes for using a Personal Loan:

Wedding expenses

Home renovation

Medical emergencies

Business needs

Travel and leisure

Education fees

Gadget or car purchases

Credit card debt consolidation

Regardless of the need, a Personal Loan gives you the flexibility to manage your expenses wisely.

What Sets Instant Personal Loans Apart?

Unlike traditional loans, an Instant Personal Loan offers:

Approval in 10–30 minutes

Same-day or next-day disbursal

Completely paperless process

Pre-verified offers with zero documentation

AI-based risk profiling

This makes them perfect for emergencies or short-term financial needs.

Why Use Fincrif.com to Find the Best Online Personal Loan?

At www.fincrif.com, we help you compare the best Online Personal Loan offers from top banks and NBFCs across India. Here’s how we make your loan journey easy:

Compare real-time interest rates

Use smart tools like EMI calculators and eligibility checkers

Read verified reviews and expert blogs

Apply with one click – no hidden fees

Enjoy secure, paperless documentation and quick support

Final Thoughts

A Personal Loan in 2025 is no longer a cumbersome financial product. With innovations in fintech, applying for an Online Personal Loan or even an Instant Personal Loan has become easier, faster, and more secure than ever. Whether you’re a salaried individual, a business owner, or a freelancer, there’s a loan product tailored for you.

Take advantage of comparison platforms like Fincrif.com to make informed decisions. Understand your eligibility, calculate your EMIs in advance, and always borrow responsibly.

Suggested Tools on Fincrif.com

Personal Loan EMI Calculator

Credit Score Checker

Instant Loan Eligibility Test

Best Bank Comparison Tool

Pre-Approval Checker

Final Tip

Always read the loan agreement thoroughly and compare multiple options before finalizing. Remember, a Personal Loan can help you achieve your goals—but only when used wisely.

#personal loan#finance#fincrif#personal loans#nbfc personal loan#loan services#personal loan online#bank#loan apps#personal laon

0 notes

Text

Sell Your House Fast in Southern California with Trusted Real Estate Buyers

If you're a homeowner in Southern California looking to sell your house quickly and without hassle, Socal Real Estate Buyers is the solution you've been searching for. Whether you're dealing with foreclosure, an inherited property, relocation, divorce, or just need cash fast, this team specializes in making the process smooth, fair, and fast. With a commitment to offering fair cash offers and closing on your timeline, they make home selling stress-free and straightforward.

Why Choose Socal Real Estate Buyers?

Selling a home through traditional methods can be time-consuming, expensive, and overwhelming. You have to deal with realtors, showings, repairs, commissions, and unpredictable closing timelines. Socal Real Estate Buyers eliminates all of that. As a trusted direct home buyer, they purchase properties as-is—no repairs, no clean-up, and no delays.

Here's what sets them apart:

Cash Offers Within 24 Hours

Once you reach out, you can expect a fair cash offer quickly. There's no waiting for bank approvals or third-party financing—just straightforward offers you can count on.

Sell As-Is, No Repairs Needed

It doesn’t matter if the home is outdated, damaged, or in poor condition. They buy homes in any condition, saving you time and money on renovations.

No Fees or Commissions

Unlike traditional sales, there are no hidden costs, agent fees, or commissions. What you’re offered is what you get—simple and transparent.

Flexible Closing Timeline

Whether you need to close in a few days or a few weeks, the choice is yours. They work around your schedule and offer flexible terms to fit your needs.

Local Expertise in Southern California

Being based in the region, Socal Real Estate Buyers understands the Southern California market better than national buyers. Their local knowledge allows them to offer top value for your property.

Services Offered

The team at socalrebuyers.com offers a range of home-buying solutions tailored to meet the needs of Southern California homeowners, including:

Buying homes in any condition

Handling homes in pre-foreclosure or foreclosure

Purchasing inherited or probate properties

Helping with divorce-related property sales

Buying rental properties with problem tenants

Supporting homeowners facing financial difficulties

No matter your situation, they are prepared to make the home-selling experience fast and dignified.

Southern California’s Trusted Home Buyer

What truly makes Socal Real Estate Buyers the best choice is their dedication to integrity, transparency, and customer satisfaction. Homeowners working with them consistently highlight how easy and fair the process is—from the first phone call to the final closing. Their customer-first approach has earned them a strong reputation across Southern California as a reliable and professional home-buying company.

Contact Socal Real Estate Buyers Today

Ready to sell your house fast and for a fair price? Get in touch with the local experts at socalrebuyers.com today. Call (626) 720-1141 or visit them at 80 W Sierra Madre Blvd #88, Sierra Madre, CA 91024 to receive your no-obligation cash offer.

0 notes

Text

How to Find Off-Market Industrial Properties Before Your Competition

Key TakeawaysLeverage local brokers and investor networks to discover off-market industrial properties before they become widely known.Utilize cutting-edge online platforms and real-time alerts to stay ahead on new leads in your target markets.Directly contact property owners and monitor market analytics for early identification of potential deals. Accelerate Your Search with Smart Networking and Data-Driven ToolsIf you want to find off-market industrial properties before your competition in the U.S., start by tapping into local brokers and networking with savvy investors—they often know about hidden gems before anyone else.Use smart online platforms like Reonomy and set up alerts for quick leads.Reach out directly to owners you identify in public records, and keep a close watch on market trends using advanced analytics.These strategies help you spot deals early, and you're just getting started with more powerful techniques ahead.Tapping Local Broker and Agent NetworksOne of the best ways to uncover off-market industrial properties is by tapping into the deep local knowledge of brokers and agents. These experts track hidden inventory in real time—often spotting properties before they're ever publicly listed. By focusing on industrial zoning, brokers can identify buildings suited to your needs and steer you away from costly surprises. They'll often know about upcoming lease renewals, giving you a head start on owners who may consider selling instead of renewing. Because off market properties are not publicly advertised for sale, much of this valuable information is only accessible through the insider connections that brokers and agents maintain in their networks. You can leverage their access to proprietary data, like CommercialEdge or Reonomy, for inside information on pre-foreclosure situations or tax liens. Working closely with local broker networks is especially valuable as market monitoring strategies can help you stay current with vacancy rates and demand shifts, ensuring you target regions with strong growth potential. When you tap local agent networks, you'll gain real insights into each market’s strengths, which is key to finding prime off-market opportunities before your competition does.Harnessing the Power of Real Estate Investor ConnectionsWhile local brokers help you spot deals before they hit the public eye, connecting with real estate investors can open an even wider door to off-market industrial properties. When you join investor groups focused on industrial zoning, you become part of a network enthusiastic to share “haves and wants.”At monthly meetups or online forums, you’ll present your criteria and receive direct leads from peers. These alliances often reveal properties nobody else sees — private equity partners may even invite you to joint ventures or tip you off about assets exiting portfolios before public listings.Active networking lets you evaluate property valuation and spot undervalued sites. By staying visible and clear about your industrial focus, you’ll find opportunities and partners who share your vision for growth.Because off-market properties are less visible to the general market, connecting with the right investor circles gives you a decisive edge in finding exclusive deals before they generate widespread competition.Utilizing Specialized Online PlatformsEven though the industrial real estate world feels big and competitive, specialized online platforms can give you an edge and make your search a lot easier. If you use platforms like Reonomy, LoopNet, and CREXI, you’ll gain access to millions of commercial listings, including hidden off-market industrial properties across the U.S.You can use advanced filters—like geographic regions, property types, or building details—to find exactly what you need. These platforms also offer virtual tours, letting you view industrial spaces without even leaving your home.Dig into market data, neighborhood analysis, and investment analysis tools to understand each property’s true potential.

Platforms like Reonomy specialize in off-market data, reducing competition among investors and giving you a better shot at uncovering unique opportunities. Set up new listing alerts, so you don’t miss out.Implementing Direct-to-Owner Outreach StrategiesStart by identifying the right industrial property owners—dig into local records or check out business directories to build your list.As you reach out, make your messages personal and relevant, showing owners that you truly get their needs and the specifics of your local market.And don’t forget to leverage technology to stay organized; tracking your outreach will help you make every connection count.Zoning status must be specified to confirm support for the owner’s industrial operation, so include a check on property zoning early in your research.Now that you have a solid outreach foundation, let’s explore how to craft compelling value propositions that resonate with property owners.Identifying Target Property OwnersSometimes the best industrial property deals never hit the public market, hiding in plain sight with their true owners just beyond reach. If you want to find these gems, start by digging into property tax records and industrial zoning maps at your local county assessor or recorder’s office.These public records tell you who owns which parcels and reveal details about the asset and its current use. Use commercial real estate databases, like CommercialEdge, to go deeper—these platforms can show LLC owners, corporate addresses, and even contact names. Comprehensive asset portfolios can also be found on platforms like CommercialEdge, where you can search by owner name and instantly view a complete list of properties they control, streamlining your outreach and research process.Supplement your research with zoning overlays on GIS mapping tools to pinpoint underutilized or vacant industrial properties. Your goal is simple: Identify and verify current owners, so you’re ready to reach out before anyone else does.Crafting Personalized Outreach MessagesAfter zeroing in on the right property owners, making meaningful contact becomes your next advantage. Messaging personalization starts with owner segmentation: tailor each message to fit owners’ unique profiles, whether they’re family trusts or corporate entities. Use insights from tax records, zoning changes, and local trends to show that you’ve done your homework. Keep your communications short (under 150 words) and focused on real value—like boosting occupancy or lowering property expenses. By partnering with commercial agents who utilize extensive networks and strategic marketing, your outreach efforts can benefit from broader exposure and attract higher-quality prospects. Want to see what this looks like in action? The table below illustrates how owner segmentation leads to targeted messaging:Owner TypeKey MotivationPersonalization TipIndividual InvestorCash flow“Unlock steady income—here’s how…”Family TrustWealth preservation“Protect long-term value for the next gen.”Corporate EntityAsset optimization“Improve portfolio returns through upgrades.”Recent BuyerGrowth potential“Capitalize on your recent acquisition…”Long-Term HolderExit planning“Prepare for a profitable transition.”Leveraging Technology for ContactHow can technology turn your search for off-market industrial properties into a competitive edge? By leveraging digital marketing and demographic targeting tools, you’ll reach the right property owners faster, with greater precision.Technology now lets you segment databases, automate emails, and analyze public records, putting valuable contacts right at your fingertips. CRM software ensures consistent follow-ups, while targeted online ads help you stay visible to potential sellers.Personalized outreach is even more effective when combined with a sequential multi-channel strategy that builds trust through organized touchpoints at each communication stage.Let’s break down key strategies:Use digital marketing platforms for targeted ads based on owner demographics.

Automate email outreach with personalized content through email marketing platforms.Build and segment lists from public records for direct, focused contact.Analyze outreach with data analytics tools to adjust your strategy for maximum impact.That’s how you stay ahead in the U.S. market.Scanning Government Records and Property DatabasesWhen you set your sights on uncovering off-market industrial properties, tapping into government records and powerful property databases can open doors you never knew existed. You can explore the General Services Administration (GSA) site for surplus real estate and federal or state websites for seized or surplus properties, all rich with hidden potential. You can also find government-controlled real estate listings that include opportunities for the purchase or lease of land and buildings that have been made available to the public.Making public records requests lets you dig into historical property ownership and property assessment data—ideal for understanding past transactions and financial stability.Major commercial real estate platforms like CoStar, LoopNet, and Reonomy help you research ownership, liens, and prior loans, giving you a clearer picture of a property’s background.Zoning regulation analysis through tools like CoStar arms you with essential knowledge for figuring out a property’s legal use and future opportunities.Assessing Location and Infrastructure AdvantagesWhen you’re looking at an off-market industrial property, start by thinking about where it’s located. Is it close to major highways, railroads, or ports? Good access can make shipping quicker and simpler, which is a big plus.Also, look at how easily trucks or goods can actually get to the property, and whether there are other businesses nearby that might create demand for industrial space. By zeroing in on these factors, you’ll be better positioned to spot properties with real tenant appeal.Properties near highways often benefit from better transport links but may also face challenges like increased noise or environmental concerns.Next, let’s move on to evaluating the physical condition and potential of the property itself.Proximity to Logistics HubsEver wondered why some industrial properties stand out while others struggle to attract top tenants? It often comes down to proximity to logistics hubs. When you invest in sites near major freight corridors and warehouse zoning districts, you tap into faster growth and better tenant demand.Properties close to intermodal logistics centers (ILCs) and ports enjoy lower development costs, thanks to smaller land needs and direct trade access. Modern facilities near these hubs see premium rents and higher value appreciation.Sites positioned within centralized logistics supply hubs typically benefit from consolidated transportation infrastructure, which can reduce operational costs and attract more tenants.To spot the best opportunities, focus on:Sites within 5-10 miles of intermodal yardsState highway-adjacent parcels for premium rent differentialsOlder warehouses positioned for upgrades near established hubsProperties benefiting from upcoming infrastructure grantsTarget these areas for resilient, high-demand investments.Transportation Network AccessibilityAlthough industrial real estate can seem like a numbers game, true success often starts with understanding how people and products move.As you search for off-market properties, you should evaluate how well each site connects to transportation corridors. Look for strong road network density—use mapping tools to target areas with a connectivity index above 1.4, and avoid cul-de-sac-heavy neighborhoods that limit route choices. Many plans lack specificity about what “accessibility” really means, so you’ll need to go beyond buzzwords and apply practical, measurable criteria when comparing locations.Measure freight bottlenecks that could slow your shipments, like weight-restricted bridges or traffic-clogged crossings. Think about peak versus off-peak travel times and assess if public transit lines support last-mile freight needs.

Dig into planned infrastructure upgrades or smart city improvements that could boost long-term access.If you master these details, you’ll spot hidden gems and outpace your competition every time.Local Industry ConcentrationsSpotting off-market industrial winners takes more than just finding the right intersection—it’s about knowing how local industry clusters shape opportunities. You need to study U.S. cities where specific industries naturally grow together. Review municipal economic reports and trade association data to pinpoint these powerful pockets. In addition, understanding how proximity to transportation hubs directly impacts logistics efficiency and operating costs should inform your site assessment. Always analyze local zoning rules to ensure the land supports these industry clusters and isn’t held back by outdated restrictions. Examine available infrastructure—think utilities, broadband, and transportation—which often impacts the success of clustered businesses.Finally, check for skilled labor; workers are the backbone of any industry. Here are four key steps:Analyze zoning maps for industrial corridors.Assess infrastructure for heavy industry needs.Map supplier locations within 50 miles.Cross-reference workforce and vocational training data.Interpreting Market Trends for Strategic TargetingWhy does understanding market trends matter for your industrial real estate search? When you grasp what’s driving market stability and pricing fluctuations, you gain a real edge.For example, recent U.S. data shows mid-sized facilities leading leasing activity, while overall absorption and vacancies shift with new supply deliveries. Shrinking pipeline figures—reflecting a 29.9% year-over-year drop in new industrial projects—suggest that future competition for prime off-market properties may intensify as less new supply comes online. If you see vacancy rates climbing in some submarkets, that can mean hidden off-market value—places where tenants have left, but the neighborhood’s long-term prospects are strong.You’ll also spot opportunities in areas with overbuilt supply, where owners might offer properties quietly or with incentives.E-commerce and reshoring keep tenant demand high, pushing pricing fluctuations in logistics hubs.Read these patterns, and you can move with confidence, knowing you’re targeting the right markets before your competition ever notices.Leveraging Advanced Tools and TechnologyWhen you tap into tools like GIS mapping, suddenly you can see zoning and property trends play out across U.S. industrial corridors—it’s like having a hidden map to spot new opportunities.Pair that with online real estate databases and you’re able to uncover owner details and find fresh leads before they even hit the public radar.And if you layer in predictive analytics? Now you’re focusing your energy on properties that are actually likely to sell, giving you a major off-market advantage.Adding data-driven strategies to your process not only helps improve your investment outcomes but also mitigates risks when targeting industrial assets.Utilizing GIS Mapping ToolsWhen you explore the search for off-market industrial properties, advanced GIS mapping tools open up a new world of possibilities. These powerful platforms turn raw location data into actionable Market insights, making your hunt for properties much smarter.You’ll spot trends before others, assess neighborhoods for potential, and map out areas using vital details like infrastructure and competitor presence. These apps are designed to work on mobile devices, so you can conveniently access critical GIS data whether in the office or out in the field. By layering demographic, economic, and zoning information, GIS mapping helps you find strategic opportunities others might miss.Here’s how you can leverage GIS mapping for your search:Analyze real-time market trends to identify growth areas and shifts.Assess proximity to key infrastructure—think highways, ports, and utilities.Map zoning regulations and land-use restrictions impacting industrial land.

Integrate aerial imagery to inspect property conditions and surroundings.With GIS, you’ll be steps ahead.Exploring Online Real Estate DatabasesWhile GIS mapping tools help you visualize where opportunities might be hiding, online real estate databases give you a direct route to real-time industrial property details. You can dig into platforms like CoStar, LoopNet, or Yardi Matrix to filter options, research historical valuations, or check zoning regulations—all from your device.These databases offer up-to-date information, so you see what’s actually available, instead of chasing old leads. Advanced filters help you pinpoint sites by size, location, zoning, or pricing history. Because many of these databases provide sophisticated analytical tools, they allow you to identify trends and evaluate potential deals with greater confidence.Tools provided by these services generate alerts for new opportunities and grant access to in-depth reports. Search smarter, not harder.Tap into public records and free resources too. When you’re proactive and informed, you’ll stay ahead of the competition in today’s tight industrial property market.Adopting Predictive Analytics PlatformsEven as traditional search methods help you spot industrial properties, predictive analytics platforms pull you far ahead of the pack. Imagine letting advanced AI do the heavy lifting—scanning tax records, zoning changes, and even utility usage to spot prime opportunities before anyone else.Unlike limited manual approaches, predictive platforms apply historical and behavioral data to determine which owners are most likely to sell, generating higher accuracy than surface-level searches.With tools like Reonomy and LightBox, you’re not guessing; you’re using hard data and geospatial modeling to map out hidden gems in rapidly growing industrial corridors. These systems analyze more than you ever could manually, giving you a strong edge.Here’s how predictive analytics platforms can change your search:Prioritize high-potential sites with AI-driven analysis.Use geospatial modeling to identify future industrial hotspots.Automate owner outreach lists using predictive lead scoring.Flag at-risk or underused properties before others notice.Building Relationships With Influential StakeholdersHave you ever wondered what truly opens the door to off-market industrial properties in the U.S.? Building relationships with influential stakeholders is the secret. You’ll quickly see that community engagement and stakeholder satisfaction are essential.When you connect with investors, developers, banks, and even local authorities, you gain valuable insights and early access to hidden opportunities. Participate in industry events, reach out to property managers, or consult with regulatory agencies—each relationship brings you closer to your goal. Collaboration among stakeholders enhances community benefits and reduces risks.Regular, open communication builds trust and keeps everyone informed. By actively listening to their needs and tailoring your approach, you build respect and loyalty.Applying Data Analytics for Opportunity DetectionOnce you start working with the right people, the next step is to let data show you new possibilities in the search for off-market industrial properties.Data analytics gives you a real edge by combining market segmentation and property valuation with deep, actionable insights. Today, advanced tools let you collect and integrate data from IoT devices, historical transactions, and tenant behaviors across the U.S. Unlocking insights from data enhances your investment potential and deepens your understanding of where hidden opportunities lie.You can spot opportunities before others even know they exist. To move ahead, try focusing on these four powerful uses of data analytics:Use predictive modeling to spot emerging off-market trends.Analyze tenant and market data to refine your market segmentation.Leverage deep learning to evaluate property valuation and conditions.

Integrate multiple data sources for a more complete opportunity picture.AssessmentWrapping Up: Get Ahead in the Off-Market SearchUncovering off-market industrial properties in the U.S. isn’t always easy, but you’ve got all the tools to succeed. Whether you’re using cutting-edge software, nurturing your network, or reaching out directly to owners, every step gets you closer to those hidden deals your competition wishes they could find. Stay curious and persistent—your determination is your biggest asset. Ready to get started? Tap into your resources, pick up the phone, and begin building those crucial relationships now—because the next great industrial property can be yours if you take action today.

0 notes

Text

Money into Your Account Round The Clock with Short Term Loans UK

If managed improperly, emergencies are a hassle for everyone. Before payday arrives, you need a loan to cover all of your urgent financial needs. Not to worry! Short term loans UK are prepared to assist you, allowing you to safely obtain the funds in the range of £100 to £1000 with a flexible repayment period of 2-4 weeks. This financing is completely free of any and all laborious processes, including faxing and pledging.

Never again feel depressed if you run out of money during a tough time. You can instantly obtain the money based on your needs, and you have the freedom to use the funds for a variety of financial requirements, such as paying for household expenses, travel expenses, credit card bills, child's school or tuition fees, and so forth.

Therefore, it isn't difficult to borrow the money on today's lending market. Whether you're dealing with issues like defaults, arrears, foreclosure, late payments, CCJs, IVAs, or insolvency, you can apply for short term loans UK. This is achievable since lenders do not check consumers' credit scores. You must also adhere to all of the established terms and restrictions.

You are at least eighteen years old.

You must be a permanent resident of the Great Britain Nation,

Have an active checking account in your name, be employed full-time,

Have a solid source of income for the past six months, and get regular salary payments.

You can apply for short term loans UK direct lender without any issues provided you meet the requirements. To submit the form on the website, you must fill it out completely and accurately. The money gets sanctioned into your account on the same day of application after your information is finalized. There is no need for faxing or extensive paperwork. Additionally, there are no application fees.

How to Apply Online For Short Term Loans UK Direct Lender

To assist you in obtaining an essential approval more quickly, we have made the short term loans direct lenders application process as simple as possible. It's all about speed and efficiency when it comes to providing loans, and with the way we do things, you'll be hard-pressed to find a short term loans UK direct lender provider online that is more responsive. You can fill out a simple application form after selecting the loan amount and payback schedule you desire by clicking "Apply Now." By completing this, we will be able to provide you a fast pre-approval decision that will indicate whether we may possibly assist with the loan and terms you have requested.

We will designate you a personal Customer Care Manager as soon as we have made a decision in principle. We do this because we care about the short term cash loans application process and having a person you can speak with directly regarding the loan. As they will be able to examine your situation and call you if they need to check any details, this human part of the process is FAIRER and, in many cases, more dependable than a 100% automated service. If they need to call, it will only take a few minutes to finish, but most of the time we'll have the data we need to move on to the next step.

4 notes

·

View notes

Text

How to Secure Low Interest Rates on Vehicle Loans in 2025

With increasing financial awareness and competitive lending markets, getting a vehicle loan with low interest rates is more achievable than ever. Whether you're buying a brand-new car or a pre-owned two-wheeler, knowing how to secure the best interest rate can save you thousands over the loan period.

Understand the Importance of Low Interest Rates

Even a small difference in interest rate can significantly affect your overall loan cost. For instance, a 0.5% lower rate can translate to substantial savings over a 5-year tenure. This is why it's essential to shop smart and focus on minimizing the interest outflow.

Steps to Secure Low Interest Rates

Boost Your Credit Score A high credit score reflects your repayment discipline and makes you a preferred borrower. Pay bills on time, reduce credit card debt, and avoid multiple loan applications to maintain a healthy score.

Choose the Right Lender Explore banks, NBFCs, and digital lending platforms. Many institutions offer special rates to salaried individuals, women applicants, or existing customers.

Make a Higher Down Payment The more you pay upfront, the less you borrow. This reduces your loan-to-value ratio, encouraging lenders to offer lower rates.

Opt for Shorter Tenure Although short-term loans come with higher EMIs, they generally carry lower interest rates, which reduce the overall cost.

Apply During Special Promotions Lenders often provide discounted interest rates during festivals or year-end sales. Keep an eye out for these offers.

Things to Keep in Mind

Always compare the APR (Annual Percentage Rate), which includes all fees.

Read the fine print for hidden charges like processing fees or foreclosure penalties.

Choose a lender with good customer service and digital support for convenience.

Conclusion

A low-interest vehicle loan is not just about affordability—it's about smart financial planning. Take your time to compare options, prepare your financial documents, and aim for the best rate. With the right strategy, owning your dream vehicle can be both exciting and economical.

Blog 3: Top Benefits of Choosing a Vehicle Loan with Low Interest Rates

Planning to buy a car or two-wheeler? Financing it through a vehicle loan with low interest rates can be a wise decision. Low interest means less financial burden and more savings in the long run.

What Makes Low Interest Vehicle Loans Attractive?

In a competitive lending market, banks and NBFCs are offering attractive interest rates on vehicle loans. These lower rates can result in:

Lower EMIs: You’ll pay less every month, making budgeting easier.

More Loan Eligibility: With reduced EMIs, you may qualify for a higher loan amount.

Faster Repayment: Smaller interest costs allow quicker loan closure.

Key Benefits of Low Interest Vehicle Loans

Affordable Vehicle Ownership Instead of delaying your purchase, low interest rates enable you to buy your dream vehicle sooner without stretching your finances.

Better Financial Planning With reduced monthly obligations, you can plan for other goals like investments, vacations, or home improvements.

Enhanced Negotiating Power When you’re a well-informed buyer with good credit, lenders are more likely to offer you their best rates and terms.

Suitable for All Budgets Whether you're eyeing a budget-friendly two-wheeler or a premium SUV, a low-interest vehicle loan ensures affordability across segments.

Tax Benefits for Business Owners If the vehicle is used for business, you may also enjoy tax deductions on interest paid—adding to your savings.

How to Qualify for These Loans

Keep your credit score healthy (750+ is ideal).

Maintain stable income and employment history.

Consider co-applying with a spouse to enhance eligibility.

Choose reputed lenders with transparent policies.

Final Words

Choosing a vehicle loan with low interest rates is the first step toward stress-free ownership. Not only does it ease your monthly burden, but it also gives you peace of mind knowing you're making a financially sound decision. So do your research, compare offers, and get ready to hit the road with confidence.

0 notes

Text

How Professional Real Estate Agents Help You Buy a Home?

Buying a home is a complex and often overwhelming process, but working with a professional real estate agent can make it smoother, faster, and more successful. A skilled agent provides expertise, market knowledge, negotiation skills, and personalized guidance to help you find the right property at the best price. Here’s how a professional real estate agent assists you to buy a home in Calgary.

1. Expert Market Knowledge

A professional agent has in-depth knowledge of local housing markets, including:

Neighborhood trends (schools, safety, amenities, future developments)

Pricing insights (fair market value, overpriced vs. underpriced homes)

Inventory availability (upcoming listings, off-market opportunities)

This expertise helps you make informed decisions and avoid overpaying.

2. Access to Exclusive Listings

While buyers can browse online listings (Zillow, Realtor.com), agents often have access to:

Pocket listings (homes not yet on the market)

Pre-market deals (through their professional network)

Foreclosures and short sales (if applicable)

This gives you an advantage in competitive markets.

3. Skilled Negotiation

A top agent negotiates on your behalf to:

Secure the best possible price

Request seller concessions (closing cost assistance, repairs)

Handle multiple-offer situations strategically

Include favorable contract terms (inspection periods, financing contingencies)

Their experience prevents costly mistakes and ensures a fair deal.

4. Streamlined Home Search

Agents save you time by:

Filtering out unsuitable properties based on your budget, needs, and preferences

Scheduling and coordinating home showings efficiently

Providing virtual tours (if needed)

Advising on red flags (structural issues, bad locations)

This prevents wasted time on homes that don’t meet your criteria.

5. Guidance on Financing & Affordability

While agents aren’t mortgage lenders, they can:

Recommend trusted lenders with competitive rates

Explain loan types (FHA, VA, conventional) and down payment options

Help you get pre-approved for a stronger offer

Ensure you stay within budget to avoid financial strain

6. Professional Network of Trusted Partners

Agents work with a network of professionals, including:

Home inspectors (to identify hidden issues)

Real estate attorneys (for legal advice)

Contractors (for repairs or renovations)

Title companies (for smooth closing)

This ensures a seamless buying process.

7. Handling Paperwork & Legalities

Real estate transactions involve extensive paperwork, including:

Purchase agreements

Disclosures (lead paint, property defects)

Contingency clauses

Closing documents

An agent ensures everything is accurate, legally compliant, and submitted on time, reducing the risk of delays or disputes.

8. Home Inspection & Appraisal Assistance

After an offer is accepted, the agent helps with:

Recommending qualified inspectors

Reviewing the inspection report and negotiating repairs

Addressing appraisal gaps (if the home is undervalued)

This protects you from buying a home with costly hidden problems.

9. Smooth Closing Process

The final steps can be stressful, but an agent:

Coordinates with the lender, title company, and escrow officer

Ensures all conditions are met before closing

Reviews the Closing Disclosure (CD) for accuracy

Attends the final walkthrough to confirm the home’s condition

Their oversight prevents last-minute surprises.

10. Post-Purchase Support

Even after closing, a good agent remains a resource by:

Recommending local service providers (movers, contractors)

Providing market updates (if you plan to sell later)

Offering homeownership tips

Final Thoughts

A professional real estate agent is an invaluable partner to help you buy a home in Calgary. From finding the right home to negotiating the best deal and handling complex paperwork, their expertise saves you time, money, and stress. If you plan to buy a home, hiring a skilled agent ensures a smoother, more successful transaction.

Would you like help finding a top-rated agent in your area? UDO & COMPANY is all you need!

0 notes

Text

Sell My House Fast Humble – Your Quick Guide to a Stress-Free, Profitable Sale

Selling a home can sometimes feel like navigating through a maze of paperwork and delays: the uncertainties are all part of the package. But if you're in Humble, Texas, and looking to sell your house fast, you're in luck. If you're just moving away or avoiding foreclosure and fast cash is a must for you, then the solutions are ready for you.

In this blog, you will gain information on how to sell a house in a week in Humble, why working with cash home buyers could be an optimum route to consider, and how to keep things easy and free of stress.

Why Homeowners Need to Sell Fast in Humble

One thing is certain, life happens fast. Job transfers, divorces, financial challenges, or an inherited property one cannot maintain-many a Humble resident looks to sell a house quickly and without fuss.

Humble is an emerging city in the Houston metro region, and with the increasing demand for real estate, sellers are spoiled for choice. On the other hand, the traditional house sale methods take months of listing, showings, negotiations, inspections, and financing delays. That is not going to work if you want results fast.

The Pitfalls of Traditional Home Selling

Let’s take a quick look at the traditional selling route:

Lengthy Timelines: It could take 60 to 90 days—or longer—to close a deal.

Costly Repairs: Agents often suggest expensive upgrades to make your home “market-ready.”

High Commissions and Closing Costs: Up to 6% in realtor fees, plus buyer’s requested concessions.

Uncertainty: Deals fall through due to financing or inspection issues.

If time and convenience are your priorities, this route might not be ideal.

The Better Alternative: Cash Home Buyers in Humble

As you might have imagined, all those hassles are skipped, and your house is sold as-is, for a price with no fees or repairs, and a closing date of your choice. Say hello to cash buyers!

Professional home buyers are specialized companies that buy homes directly from sellers in any condition. They are not the typical real estate agents; rather, they are investors who can provide you with a guaranteed offer within 24 to 48 hours paid in cash.

Key Benefits of Selling to a Cash Buyer

Sell As-Is No repairs, no cleaning, no staging. Whether your home has foundation issues or an outdated kitchen, you don’t have to lift a finger.

Fast Closings You could have cash in hand in as little as 7 days. No waiting for loan approvals or inspections.

No Fees or Commissions Unlike traditional agents, cash buyers don’t charge commissions or hidden fees.

Certainty and Control Choose your closing date. Avoid the risk of a deal falling apart.

Privacy and Convenience No open houses, no strangers walking through your home—just a private, direct transaction.

How the Process Works

Selling your house fast in Humble with a cash buyer is surprisingly simple:

Contact the Buyer Reach out with basic information about your property.

Get a Fair Offer After a brief walkthrough (or sometimes even a virtual assessment), you'll receive a no-obligation cash offer.

Accept the Offer If you agree to the terms, you’ll sign a short purchase agreement.

Close Quickly Pick your preferred closing date and receive your funds via wire transfer or check—no delays.

What Types of Houses Do Cash Buyers Purchase?

One of the best things about these companies is that they buy all types of homes:

Damaged or distressed properties

Foreclosure or pre-foreclosure homes

Inherited or probate properties

Rental properties with difficult tenants

Vacant homes

Homes needing major repairs

Even if your house isn’t in perfect condition, you can still get a fair offer.

Sell My House Fast Humble – Is It Right for You?

Perhaps you're thinking, "I need to sell my home extremely fast in Humble but do not know where to start." You are not alone for this thought. Thousands of people opt out of selling their homes for cash every year-and many say it is the easiest decision they ever made.

Well, it's not just for distress situations. More often than before, well-maintained homes are being ditching the worrying ordeal in its favor-and it also saves time, saves fees, and saves one from stressing out.

Tips Before You Accept an Offer

Do Your Research: Work with a reputable company with local experience and verified testimonials.

Compare Offers: Don’t hesitate to get multiple quotes. A trustworthy buyer won’t pressure you.

Understand the Terms: Make sure you’re clear about closing costs (if any), timelines, and next steps.

Final Thoughts

Selling your house in Humble doesn't have to feel pressured by tradition. If personal complications have arisen, extraneous property is feeling somewhat more like baggage, or the general sense of needing to just move on fast, cash home buyers provide the solution: fast, fair, and without all the stress.

And so, heeding a genuine whisper in the air, "I need to sell my house fast in Humble," help is one phone call-away, or with a click on the computer. With the right approach, you can hold cash in your hand and get on with a new start.