#impedance matching network

Explore tagged Tumblr posts

Text

TDK acquires QEI’s RF power business to expand semiconductor equipment offering

June 24, 2025 /SemiMedia/ — Japan’s TDK Corporation has acquired the RF power business of QEI Corporation, a U.S.-based firm specializing in radio-frequency power generators and impedance matching networks for plasma processes in semiconductor manufacturing. The deal gives TDK direct access to advanced RF power technologies essential for etching and deposition processes, further enhancing its…

#AI ecosystem#deposition and etch#electronic components news#Electronic components supplier#Electronic parts supplier#impedance matching network#plasma processing#power supply integration#RF power generator#semiconductor equipment market

0 notes

Text

I think its super interesting how much complexity we're starting to see in the characters this season.

Thus far, the misfits have been the pretty uncontested "good guys" while the clusterfucks have been the clear "bad guys."

However, this season, we start to see that the division is much less black and white.

Ada tackles a super dangerous monster to save Annabel. Annabel doesn't leave her behind even though it's obviously impeding her escape and sacrifices her engagement ring to save the three of them. Prospero immediately books it for Ada as soon as he realizes she's in danger and tries to reassure her that him not being into her has nothing to do with her worth as a person. Meanwhile the misfits immediately scatter and start arguing amongst themselves.

It's highlighted extremely clearly in the confrontation between Eulalie, Pluto, Duke, Will, and Montresor. [SPOILERS for fast pass ahead btw]

While it's really easy to see the initial argument on a surface level (Goatman trying to pick a fight and using Will to do it, Eulalie coming to Will's defense because she sees him being mistreated) and while that is what happens, a closer inspection shows a lot more going on in terms of character morals.

The argument starts because Montresor, hurt, disabled, and having had his pride/ego dented, is lashing out and gets fed up with Will. (I do think its super interesting that as soon as Will flinches, he switches gears from insulting him to telling him to stop letting him walk all over him, albiet in a harsh way) Eulalie responds by asking him to stop being mean to Will, and offers to take Will into the group. Pluto and Duke reject the idea, completely ready and willing to abandon someone who for all they know and have seen, is being bullied and manipulated by someone they all know is capable of horrific violence.

And while Will ultimately chooses Montresor because he's a gay disaster the real display of just how much the characters words and alignment don't match their actual morals comes when Will gets gutted by the stag.

Hes still alive, bleeding out on the ground and begging for help. And the misfits leave him there to die. With a couple flippiant lines no less.

Meanwhile Montresor, resident scum of the Earth who's loyal to no one and delights in the suffering of others? Hesitates maybe a second before jumping into danger to save him. Not only that, he's actively comforting and reassuring Will the entire time.

And I think this is what makes me the most excited for the rest of this comic. Your fave would let a man die if that man wasn't on their side. The most monstrous character in the series couldn't abandon someone who can't defend themself.

And before you say it, yes Montresor abandoned Ada and a lot of him saving Will has to do with the fact that he actually cares for him. But I think the reasoning has more to do with the flashback we see of Monty and the dog. Disregarding that Ada is the reason he's spiraling out so bad right now and the animosity he feels due to her making him confront his religious trauma, he knows that she is perfectly capable of defending herself. Meanwhile Will has trouble defending himself in any setting, and is currently mortally wounded and being torn to shreds by a pack of dogs.

I think this season is setting up for a character arc for the clusterfucks and a reverse character arc for the misfits. I believe that Lenore is going to get closer and closer to the person Annabel remembers as her bonds with her friends weaken and her memories return, while Annabel is going to start forming the support network she desperately needs to cope with her various issues. This will leave the two of them in a role reversal, with Lenore determined to do anything and burn any bridge to save the two of them, while Annabel is desperately trying to figure out a way to save all of them. It would be most interesting to me if the season ended with Lenore going lone wolf and the rest of the cast teaming up to form an escape plan and get the old Lenore back.

#also the obligatory this is not the post to start defending eula duke or pluto#actually i could talk about monty having a soft spot for defensless creatures all day#also i think Eulalie's self righteous streak is very interesting and i hope it causes conflict in coming episodes#congratulations to annabel lee for forming nontransactional relationships outside her wife and possibly being healthy in the future#we stan progress#nevermore#nevermore webtoon#montresor nevermore#will nevermore#eulalie nevermore#pluto nevermore#duke nevermore#annabel lee nevermore#prospero nevermore#ada nevermore#the misfits#my bad if i talked about willtresor a bit much they are eating my brain after the fast pass episodes

210 notes

·

View notes

Text

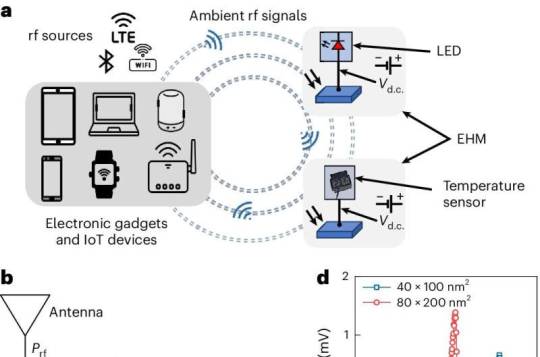

Battery-free technology can power electronic devices using ambient radiofrequency signals

Ubiquitous wireless technologies like Wi-Fi, Bluetooth, and 5G rely on radio frequency (RF) signals to send and receive data. A new prototype of an energy harvesting module—developed by a team led by scientists from the National University of Singapore (NUS)—can now convert ambient or "waste" RF signals into direct current (DC) voltage. This can be used to power small electronic devices without the use of batteries. RF energy harvesting technologies, such as this, are essential as they reduce battery dependency, extend device lifetimes, minimize environmental impact, and enhance the feasibility of wireless sensor networks and IoT devices in remote areas where frequent battery replacement is impractical. However, RF energy harvesting technologies face challenges due to low ambient RF signal power (typically less than -20 dBm), where current rectifier technology either fails to operate or exhibits a low RF-to-DC conversion efficiency. While improving antenna efficiency and impedance matching can enhance performance, this also increases on-chip size, presenting obstacles to integration and miniaturization.

Read more.

43 notes

·

View notes

Text

RF Cable Assemblies and Jumpers Market: Revenue Forecast by Frequency Range and Application 2025-2032

MARKET INSIGHTS

The global RF Cable Assemblies and Jumpers Market size was valued at US$ 2,170 million in 2024 and is projected to reach US$ 3,420 million by 2032, at a CAGR of 6.7% during the forecast period 2025-2032.

RF cable assemblies and jumpers are critical components used for transmitting high-frequency signals in various applications. These assemblies consist of coaxial cables terminated with connectors, ensuring minimal signal loss and interference. They play a vital role in telecommunications, defense systems, medical equipment, and automotive electronics, supporting seamless connectivity in complex RF environments.

The market growth is driven by increasing demand for high-speed data transmission, expansion of 5G networks, and rising investments in defense communication systems. Furthermore, the automotive sector's shift toward connected vehicles and advanced driver-assistance systems (ADAS) is creating new opportunities. Key players such as TE Connectivity Ltd, Amphenol RF, and Molex LLC are expanding their product portfolios to cater to evolving industry needs, further fueling market expansion.

MARKET DYNAMICS

MARKET DRIVERS

Proliferation of 5G Networks to Accelerate RF Cable Assemblies Demand

The global rollout of 5G infrastructure represents the most significant driver for RF cable assemblies and jumpers. With telecom operators worldwide investing over $300 billion annually in 5G deployments, the need for high-frequency, low-loss coaxial connections has surged dramatically. These specialized cables must maintain signal integrity at millimeter wave frequencies while withstanding environmental stressors. The transition to 5G Standalone networks particularly benefits semi-rigid cable assemblies which demonstrate superior performance in base station RRUs and massive MIMO antenna configurations. Furthermore, small cell densification projects increasingly utilize ultra-flexible jumper cables to accommodate tight installation spaces in urban environments.

Defense Modernization Programs Driving Military-grade RF Connectivity Solutions

Global defense expenditures exceeding $2 trillion annually continue to fuel demand for ruggedized RF interconnect solutions. Modern electronic warfare systems, satellite communications equipment, and radar installations require cable assemblies that maintain strict impedance matching while enduring extreme temperatures, vibrations, and electromagnetic interference. Recent contracts illustrate this trend, including multi-year procurement programs for military aircraft upgrades and naval communication systems upgrades. Phase array radars particularly benefit from emerging lightweight coaxial designs that reduce payload while maintaining GHz-range performance. The shift towards software-defined radios across NATO allied forces further multiplies the need for broadband RF interconnection capabilities.

MARKET RESTRAINTS

Commoditization Pressures in Low-Frequency Applications Constrain Margins

While high-performance RF interconnects command premium pricing, substantial portions of the market face intensifying price competition. The sub-6GHz commercial telecom segment has seen average selling prices decline approximately 8% annually as manufacturers standardize components and automate production. This commoditization particularly impacts legacy connector types and basic coaxial cables where technical differentiation proves challenging. Original equipment manufacturers increasingly consolidate suppliers, leveraging volume purchasing to extract cost concessions. Additionally, the rise of generic connector compatibility specifications allows lower-cost alternatives to penetrate traditionally brand-loyal market segments.

Material Cost Volatility Disrupts Supply Chain Predictability

RF cable assemblies incorporate precious metals and specialized materials that exhibit significant price fluctuation. Silver-plated conductors and PTFE dielectrics have experienced 30-45% cost variations over recent procurement cycles, complicating long-term pricing strategies. The industry's reliance on specific rare earth elements for high-performance shielding compounds further exacerbates supply vulnerabilities. These material challenges intersect with labor shortages in precision assembly operations, where experienced technicians command premium wages to maintain stringent impedance tolerances. Together, these factors compress profitability for standard product lines while increasing working capital requirements for inventory buffers.

MARKET OPPORTUNITIES

Emerging mmWave and THz Applications Open New Frontiers

The evolution toward higher frequency bands creates substantial opportunities for innovative interconnect solutions. Automotive radar systems operating at 77GHz require specialized cable assemblies maintaining low insertion loss despite constant vibration exposure. Similarly, emerging terahertz imaging applications in security screening and medical diagnostics drive demand for novel waveguide transition technologies. The satellite industry's transition to low-earth orbit constellations presents another high-growth segment, where radiation-hardened RF jumpers must withstand extreme thermal cycling while minimizing passive intermodulation effects. These applications command substantial price premiums, with mmWave assemblies frequently achieving 3-5x the unit pricing of conventional microwave components.

Automotive RF Integration Creates Parallel Growth Channels

Modern vehicles incorporate over 40 separate RF subsystems, from infotainment to collision avoidance radars, creating compound annual growth exceeding 12% for automotive-grade interconnects. The transition to autonomous driving architectures particularly benefits shielded cable assemblies that minimize electromagnetic interference between sensors. Emerging vehicle-to-everything (V2X) communication standards further expand the addressable market, requiring robust RF connectivity solutions that endure harsh underhood environments. Tier 1 suppliers increasingly partner with interconnect specialists to co-develop application-specific solutions, creating lucrative design-win opportunities with extended product lifecycles.

MARKET CHALLENGES

Precision Manufacturing Requirements Limit Production Scalability

High-performance RF interconnects demand exacting manufacturing tolerances often measured in microns, creating substantial production challenges. Achieving consistent impedance matching across production lots requires sophisticated process controls and 100% electrical testing, which limits throughput efficiencies. The industry faces particular difficulties in scaling production of phase-stable cables for phased array systems, where even minor variations in dielectric concentricity degrade system performance. These constraints become more pronounced as operating frequencies ascend beyond 40GHz, where traditional connector interfaces approach practical physical limitations.

Design Complexity Increases Time-to-Market Pressures

Developing application-specific RF interconnect solutions requires extensive electromagnetic simulation and prototyping cycles. The validation process for aerospace-grade components frequently exceeds 18 months due to rigorous qualification testing for vibration, temperature extremes, and outgassing performance. This extended development timeline conflicts with commercial sector demands for rapid product iterations, particularly in consumer electronics and IoT applications. Manufacturers must balance customization capabilities against standardization benefits, navigating intricate tradeoffs between performance, reliability, and cost targets across diverse market verticals.

RF CABLE ASSEMBLIES AND JUMPERS MARKET TRENDS

5G Network Expansion Driving Demand for High-Performance RF Cable Assemblies

The global rollout of 5G infrastructure is significantly boosting the RF Cable Assemblies and Jumpers market, with demand expected to grow at a CAGR of 7-9% through 2032. These components are critical for maintaining signal integrity in high-frequency applications, particularly in base stations and small cell deployments. The shift toward millimeter-wave (mmWave) frequencies in 5G networks has particularly increased demand for low-loss coaxial cables with frequencies exceeding 40 GHz. Leading manufacturers are responding with innovations in dielectric materials and shielding technologies to minimize insertion loss, which can exceed 3 dB/meter in conventional cables at these frequencies.

Other Trends

Automotive Radar and ADAS Applications

Advanced Driver Assistance Systems (ADAS) and autonomous vehicle technologies are creating substantial demand for ruggedized RF cable assemblies capable of withstanding harsh automotive environments. The typical automotive radar system now utilizes 12-24 GHz or 77 GHz frequencies requiring specialized cable solutions. Market growth in this segment is projected at 11-13% annually, outpacing the broader market due to increasing vehicle electrification and regulatory mandates for safety systems.

Miniaturization Trend in Connectivity Solutions

The electronics industry's push toward smaller form factors is driving innovation in micro-miniature RF connectors and ultra-thin coaxial cables. Products like 1.0 mm and 0.8 mm coaxial connectors now comprise nearly 30% of new designs in consumer electronics and IoT devices. However, this miniaturization presents technical challenges - insertion loss increases by approximately 15% for every 0.2 mm reduction in connector size, requiring advanced materials engineering to mitigate performance degradation.

Defense Modernization Programs Spurring Growth

Military applications continue to account for 25-30% of the high-end RF cable assemblies market, driven by global defense spending exceeding $2 trillion annually. Modern radar systems, electronic warfare platforms, and satellite communications require specialized cable solutions with extended temperature ranges (-55°C to +200°C) and enhanced EMI/RFI shielding. The growing adoption of phased array antennas is particularly demanding flexible yet durable jumper solutions capable of handling complex signal routing in confined spaces.

COMPETITIVE LANDSCAPE

Key Industry Players

Market Leaders Focus on Technological Innovation to Maintain Competitive Edge

The global RF Cable Assemblies and Jumpers market demonstrates a moderately consolidated structure, with established players accounting for significant market share while smaller competitors carve out specialized niches. TE Connectivity Ltd emerges as a dominant force, leveraging its extensive product portfolio and manufacturing footprint across North America, Europe, and Asia-Pacific. The company's market leadership stems from continuous R&D investments and strategic acquisitions in high-frequency connectivity solutions.

Radiall GmbH and Aptiv Plc maintain strong positions in the aerospace and automotive sectors respectively, with their specialized RF assembly solutions for mission-critical applications. These companies benefit from long-standing relationships with defense contractors and automotive OEMs, enabling stable revenue streams even during market fluctuations.

Meanwhile, WL Gore & Associates differentiates itself through proprietary ePTFE cable technology, particularly in high-reliability medical and military applications. The company's focus on premium, high-performance solutions allows it to command price premiums in niche segments.

Recent industry developments show accelerating competition in 5G infrastructure components, with Molex LLC and Amphenol RF making significant strides in low-loss millimeter wave assemblies. Both companies have launched new product lines specifically targeting telecom base stations and small cell deployments, capitalizing on the global 5G rollout.

List of Key RF Cable Assemblies and Jumpers Manufacturers

TE Connectivity Ltd (Switzerland)

Radiall GmbH (France)

Aptiv Plc (Ireland)

Rosenberg GmbH (Germany)

WL Gore & Associates (U.S.)

Lighthorse Technologies, Inc. (U.S.)

Molex LLC (U.S.)

Amphenol RF (U.S.)

Pasternack Enterprises Inc. (U.S.)

Samtec Inc. (U.S.)

Segment Analysis:

By Type

Connectors Segment Leads the Market Due to High Demand in Telecom and Defense Applications

The market is segmented based on type into:

Connector

Plug

Switch

Other

By Application

IT & Telecommunication Dominates Market Share Owing to 5G Network Expansion

The market is segmented based on application into:

IT and Telecommunication

Defense

Automobile

Healthcare

Others

By Frequency Range

High Frequency Segment Gains Traction with Increasing Demand for High-Speed Data Transmission

The market is segmented based on frequency range into:

Low Frequency

Medium Frequency

High Frequency

Very High Frequency

Regional Analysis: RF Cable Assemblies and Jumpers Market

North America The North American market for RF cable assemblies and jumpers is predominantly driven by advancements in 5G infrastructure, defense modernization programs, and growing demand for high-speed connectivity in IT & telecommunications. The U.S. holds the largest share, supported by government investments in aerospace and defense, estimated at $842 billion for FY2024. Major players like TE Connectivity Ltd and Amphenol RF dominate the market due to their robust supply chains and R&D capabilities. However, stringent regulatory standards for RF components and supply chain disruptions pose challenges for manufacturers. The shift toward miniaturized, high-frequency connectors for IoT and autonomous vehicles further fuels regional demand.

Europe Europe’s market is characterized by strong adoption of RF cable assemblies in automotive and healthcare sectors, particularly in Germany and France. The EU’s focus on 5G deployment under the Digital Decade Policy Programme accelerates demand for low-loss, high-performance RF solutions. Regulations like RoHS and REACH mandate eco-friendly materials for cables, pushing manufacturers to innovate. Companies like Radiall GmbH and Rosenberg GmbH lead with specialized solutions for industrial IoT and medical devices. However, high production costs and competition from Asia-based suppliers restrain growth. The region’s emphasis on renewable energy integration also opens new opportunities for RF jumpers in smart grid applications.

Asia-Pacific Asia-Pacific is the fastest-growing market, with China accounting for over 40% of global RF cable assembly demand due to telecom expansions and defense investments. India and Japan follow, spurred by local manufacturing initiatives (e.g., India’s PLI scheme) and increasing 5G adoption. Low-cost production hubs in Southeast Asia attract global players like Molex LLC and Samtec Inc., though price sensitivity limits premium product penetration. The rise of smart cities and EV infrastructure further augments market potential. However, intellectual property concerns and fluctuating raw material costs remain key challenges.

South America This region shows moderate growth, driven by Brazil’s telecom sector and Argentina’s aerospace projects. The lack of domestic manufacturing forces reliance on imports, creating opportunities for U.S. and European suppliers. Economic instability and currency volatility hinder large-scale investments, but rising demand for broadband connectivity in urban areas sustains market progress. Local governments are gradually improving infrastructure, yet regulatory bottlenecks slow adoption of advanced RF technologies.

Middle East & Africa The MEA market is emerging, with growth concentrated in GCC countries due to oil & gas sector digitization and defense spending. The UAE and Saudi Arabia lead in smart city projects, boosting demand for RF assemblies in surveillance and IoT networks. Africa’s expansion is slower but shows promise with submarine cable projects enhancing connectivity. Challenges include limited technical expertise and reliance on foreign suppliers. Long-term potential hinges on infrastructure development and economic diversification.

Report Scope

This market research report provides a comprehensive analysis of the global and regional RF Cable Assemblies and Jumpers markets, covering the forecast period 2024–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments (in KM), and market value across major regions and segments. The global market was valued at USD million in 2024 and is projected to reach USD million by 2032.

Segmentation Analysis: Detailed breakdown by product type (Connector, Plug, Switch, Others), application (IT & Telecommunication, Defense, Automobile, Healthcare), and end-user industry to identify high-growth segments.

Regional Outlook: Insights into market performance across North America (U.S., Canada, Mexico), Europe (Germany, France, U.K.), Asia-Pacific (China, Japan, India), and other regions with country-level analysis.

Competitive Landscape: Profiles of leading market participants including TE Connectivity Ltd, Radiall GmbH, Aptiv Plc, and their product offerings, R&D focus, manufacturing capacity, and recent developments.

Technology Trends & Innovation: Assessment of emerging technologies in RF connectivity, miniaturization trends, and evolving industry standards for high-frequency applications.

Market Drivers & Restraints: Evaluation of 5G deployment, defense modernization programs, automotive electronics growth, along with supply chain constraints and material cost fluctuations.

Stakeholder Analysis: Strategic insights for component suppliers, OEMs, system integrators, and investors regarding emerging opportunities in the RF connectivity ecosystem.

Primary and secondary research methods are employed, including manufacturer surveys, expert interviews, and analysis of verified market data to ensure accuracy and reliability of insights.

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global RF Cable Assemblies and Jumpers Market?

-> RF Cable Assemblies and Jumpers Market size was valued at US$ 2,170 million in 2024 and is projected to reach US$ 3,420 million by 2032, at a CAGR of 6.7% during the forecast period 2025-2032.

Which key companies operate in Global RF Cable Assemblies and Jumpers Market?

-> Key players include TE Connectivity Ltd, Radiall GmbH, Aptiv Plc, Rosenberg GmbH, WL Gore & Associates, Molex LLC, and Amphenol RF, with the top five players holding approximately % market share in 2024.

What are the key growth drivers?

-> Key growth drivers include 5G network deployment, increasing defense electronics expenditure, automotive connectivity solutions, and healthcare equipment modernization.

Which region dominates the market?

-> North America currently leads in market share, while Asia-Pacific is projected to grow at the highest CAGR during the forecast period.

What are the emerging trends?

-> Emerging trends include high-frequency RF solutions for 5G/6G, miniaturized connectors for IoT devices, and radiation-resistant cables for aerospace applications.

Related Reports:https://semiconductorblogs21.blogspot.com/2025/06/automotive-magnetic-sensor-ics-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/ellipsometry-market-supply-chain.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/online-moisture-sensor-market-end-user.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/computer-screen-market-forecasting.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/high-power-gate-drive-interface.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/strobe-overdrive-digital-controller.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/picmg-half-size-single-board-computer.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/automotive-isolated-amplifier-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/satellite-messenger-market-regional.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/sic-epi-wafer-market-innovations.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/heavy-duty-resistor-market-key-players.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/robotic-collision-sensor-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/gas-purity-analyzer-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/x-ray-high-voltage-power-supply-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/reflection-probe-market-industry-trends.html

0 notes

Text

How TAC Registration Services Streamline Mobile Launches in India

In India, its highly dynamic mobile and telecom domain had, until now, been confused with regulatory compliance like something beneath the sky. Rather, regulatory requirements are emerging as strategic imperatives for manufacturers and importers of mobile devices to launch new models in the Indian market in compliance with strict legal stipulations, especially those related to TAC registration services and IMEI registration services. These processes could mean traceability, quality control, or even security for the nation.

Second on this list of compliance steps for marketing mobile devices is TAC registration as the first, followed by IMEI registration. These identifiers are essential for identification, preventing counterfeiting, and granting access to the network.

This article highlights how these services of TAC registration assist in simplifying the launch process, and how outsourcing the work to experienced professionals can save firms from blundering into costly mistakes, long delays, and rejection due to the rigorous regulatory framework.

Understanding TAC and IMEI Registration in India

A TAC is an eight-digit code assigned by GSMA (GSM Association) to mobile device models based on their make and specifications. The manufacturer uses the TAC to generate complete IMEI numbers for individual devices. The IMEI itself is a unique 15-digit code that identifies the mobile handset while connected to a wireless network.

In India, by law given by the Department of Telecommunications (DoT), all mobile phones shall be put on sale carrying a valid TAC and IMEI, which must be uploaded to the Indian Counterfeit Device Restriction System (ICDRS). Any device without proper IMEI registration cannot be imported, sold or used in any telecommunication network of the country.

Challenges in Manual TAC & IMEI Registration

The registration sounds easy in theory, but with many technical and procedural steps involved in it, it can be so cumbersome for a first-time applicant or a foreign manufacturer. These include:

Accurate classification of devices

Technical document preparation

Coordination with GSMA or authorized agencies

ICDRS portal uploads

Adherence to GSMA and Indian regulatory standards

Appointing an Authorized Indian Representative (AIR) for foreign brands

Any error or delay can impede the product launch, create hurdles in customs clearance, and may be punished by law.

Role of TAC Registration Services

Professional TAC registration services take the uncertainty out of the exercise by providing end-to-end support from code allocation to IMEI data submission. These services, in fact, restructure the mobile launch cycle, as follows:

1. Product Evaluation and Categorization

The consultants will assist in identifying the correct product classification, matching it with GSMA-approved device categories, thereby ensuring assignment of the appropriate TAC.

2. Application and Documentation

Service providers will draft the TAC applications with device specifications, internal schematics, product images, and brand details, thereby taking care of all documenting errors.

3. TAC Allocation

For speedy and compliant issuance of TAC codes, they interact with GSMA or MSAI-authorised bodies in India.

4. IMEI Generation and ICDRS Uploads

After issuance of TAC numbers in the correct format, IMEI numbers are generated and submitted to the ICDRS portal along with all related metadata, technical documentation, and declarations.

5. Continuing Compliance

Regulatory service providers will also continue in post-registration to provide services for any adjustments, model upgrades, or renewals to maintain legal status.

Advantages of Outsourcing IMEI and TAC Registration

Quicker time-to-market for new models

Assurance of product being regulatory compliant

Lesser workload for internal teams

Prevention of incurring costs on rejection and resubmission

Smooth intervention from the AIR end for foreign manufacturers

Fusion Compliance Services – Your Compliance Partner

Fusion Compliance Services is one of the renowned providers of IMEI registration services and TAC registration services in India, catering to all mobile manufacturers, importers, and international brands.

Whether you are planning to launch a brand-new device, or enter the Indian market, or just need compliance-related expert help, we ensure every single box is ticked—from TAC allocation to ICDRS final approval.

The Services We Provide Include:

GSMA-compliant TAC code registration

IMEI generation and ICDRS uploads

Documentation and product mapping

AIR services

Post-registration updates and renewals

Contact Us

Fusion Compliance Services 📞 Phone: +91-9696966665 📧 Email: [email protected] | [email protected] 🌐 Website: www.fusioncomplianceservices.com 🏢 Address: S1 520, Cloud-9, Vaishali Sector 1, Near Mahagun Metro Mall, Ghaziabad, Uttar Pradesh - 201012

Make sure that the launch of your mobile device is smooth, timely, and compliant with Indian regulations—partner with professionals well-versed in the system.

#TACregistrationservices#IMEIregistrationIndia#TACcodeIndia#mobilecompliance#deviceapprovalIndia#ICDRSregistration#telecomcompliance#FusionComplianceServices#regulatoryconsultingIndia

0 notes

Text

Staffing Agencies: Roles In Fostering Innovation

Innovation is the lifeblood of progress, it's the driving force behind breakthroughs that shape our future. However, the journey from concept to reality demands not just brilliant minds but also the right ecosystem. In this ecosystem, engineering staffing agencies emerge as silent yet pivotal players, bridging the gap between talent and opportunity.

Understanding Engineering Staffing Agencies:

Engineering staffing agencies act as intermediaries connecting skilled professionals with organizations seeking their expertise. Beyond merely matching resumes with job descriptions, these agencies serve as strategic partners, understanding the nuanced requirements of both candidates and companies.- Cultivating Diverse Talent Pools: Innovation thrives in diversity. Engineering staffing agencies play a crucial role in fostering innovation by curating diverse talent pools. They transcend geographical boundaries, sourcing talent globally, which brings varied perspectives and approaches to problem-solving. By embracing diversity in skills, experiences, and backgrounds, these agencies enrich the talent landscape, fostering creativity and innovation.- Agility in Talent Acquisition: The pace of technological evolution demands agility in talent acquisition. Engineering staffing agencies are adept at swiftly identifying and deploying skilled professionals, ensuring that projects progress unhindered. Their extensive networks and streamlined processes enable companies to scale teams up or down as per project requirements, enhancing flexibility and adaptability, key ingredients for innovation.- Nurturing Specialized Expertise: Innovation often sprouts from specialized knowledge and expertise. Engineering staffing agencies specialize in niche domains, from AI and machine learning to renewable energy and aerospace engineering. By focusing on these specialized areas, they attract top talent and facilitate the convergence of expertise, creating fertile grounds for innovation to flourish.- Facilitating Cross-Pollination of Ideas: Collaboration breeds innovation. Engineering staffing agencies serve as catalysts for cross-pollination of ideas by facilitating collaborations between diverse talent pools and organizations. Through temporary placements, contract-to-hire arrangements, or project-based engagements, they enable professionals to work across industries and domains, fostering the exchange of insights and best practices.- Promoting a Culture of Lifelong Learning: Innovation is not a destination but a journey fueled by continuous learning. Engineering staffing agencies prioritize professional development, offering training programs, workshops, and skill enhancement initiatives. By empowering professionals to upskill and reskill, they cultivate a culture of lifelong learning, essential for staying ahead in a rapidly evolving technological landscape.- Mitigating Risk Through Talent Vetting: Innovation inherently involves risk, but it's essential to mitigate it where possible. Engineering staffing agencies play a vital role in risk mitigation by rigorously vetting candidates for technical proficiency, cultural fit, and reliability. By conducting thorough background checks and reference verifications, they ensure that organizations onboard talent with the right blend of skills and values, minimizing the risk of project derailment.- Enabling Rapid Prototyping and Iteration: Innovation thrives on experimentation and iteration. Engineering staffing agencies facilitate rapid prototyping and iteration by providing access to a pool of professionals skilled in agile methodologies, design thinking, and rapid development frameworks. By assembling dynamic teams capable of swiftly translating ideas into prototypes, they accelerate the innovation lifecycle, driving tangible outcomes.- Supporting Startups and SMEs: Startups and SMEs often face resource constraints that can impede innovation. Engineering staffing agencies offer tailored solutions to support these enterprises, ranging from flexible staffing models to strategic consulting services. By providing access to talent on-demand and strategic guidance, they empower startups and SMEs to innovate and compete on a level playing field with larger counterparts.- Bridging the Skills Gap: The widening skills gap poses a significant challenge to innovation. Engineering staffing agencies actively contribute to bridging this gap by identifying emerging skill requirements and aligning talent development initiatives accordingly. By partnering with educational institutions and industry bodies, they foster collaboration to address the evolving needs of the engineering workforce, ensuring a steady pipeline of skilled professionals.- Embracing Technological Disruption: Innovation is intrinsically linked to technological disruption. Engineering staffing agencies embrace technological advancements to enhance their service offerings. From AI-driven talent matching algorithms to virtual recruitment platforms, they leverage cutting-edge technologies to streamline processes, improve efficiency, and deliver superior outcomes for both candidates and clients.Innovation is not a solitary endeavor but a collective journey fueled by collaboration, diversity, and a conducive ecosystem. Engineering staffing agencies embody this ethos, serving as enablers and accelerators of innovation. Through their relentless pursuit of talent, agility, and excellence, they catalyze the transformational ideas that shape the future of engineering and propel humanity forward. As we navigate the complexities of the digital age, the role of engineering staffing agencies in fostering innovation remains indispensable, underscoring their significance as evolutionary catalysts in the ever-evolving landscape of engineering and technology.Webuild Staffing Agency is a leading executive search and staffing agency dedicated to the construction, engineering and environmental industries. To learn more please visit: www.webuildstaffing.com Read the full article

0 notes

Text

ASC-i's Advanced RF Test Capabilities: Ensuring Peak Performance for Your RF PCB Designs

As an industry-leading RF PCB manufacturer, ASC-i is dedicated to providing high-performance, high-quality solutions for a wide range of applications, including wireless communication, automotive radar, medical devices, and IoT systems. When it comes to RF PCBs, ensuring the reliability and functionality of the circuits is paramount. With our advanced RF test capabilities, we ensure that every PCB we produce meets the rigorous demands of the RF industry, delivering optimal performance across all environments and conditions.

The Importance of RF Testing for High-Quality PCB Manufacturing

Radio Frequency (RF) signals are critical for modern communication systems, and even the smallest flaw in the design or manufacturing of an RF PCB can lead to signal loss, interference, or even complete failure. This is why thorough RF testing is essential at every stage of PCB production. At ASC-i, we recognize that precise testing ensures the signal integrity, performance, and durability of the final product. Our RF testing services are designed to identify potential issues early, ensuring that your designs perform at their best before they are integrated into end-use products.

As a trusted RF PCB manufacturer, ASC-i provides comprehensive testing solutions that guarantee each RF PCB we create meets the highest industry standards. Whether you're developing high-frequency communication systems or specialized RF devices, we have the expertise and tools to ensure your products meet exacting specifications.

ASC-i’s Advanced RF Test Capabilities

Our RF test capabilities are built to cover every essential aspect of RF performance, ensuring that your RF PCBs operate reliably and efficiently. Our testing process focuses on key parameters such as signal integrity, impedance matching, thermal stability, power handling, and electromagnetic compatibility. Here’s an overview of our comprehensive RF testing services:

S-Parameter Testing: S-parameters, or scattering parameters, measure the reflection and transmission characteristics of RF circuits. By using high-precision network analyzers, ASC-i tests the insertion loss, return loss, and signal integrity of the RF PCB. This allows us to ensure that the board exhibits minimal signal degradation and high performance under real-world conditions.

Impedance Matching Tests: One of the most critical aspects of RF circuit performance is impedance matching. Proper impedance ensures that the signal is transmitted without reflection or loss. We perform detailed impedance testing across PCB traces, vias, and components to ensure that the impedance is optimized, guaranteeing smooth and efficient signal transmission.

RF Power Handling Testing: RF PCBs often need to handle high power levels, especially in demanding applications like wireless communication, radar, and broadcast systems. We test the power-handling capacity of your PCB to ensure that it can withstand high power inputs without compromising performance or causing thermal issues.

Thermal Performance Testing: RF circuits generate heat, and without proper heat management, thermal buildup can lead to degradation in signal quality or even failure of components. ASC-i conducts comprehensive thermal tests to evaluate how effectively the RF PCB dissipates heat and performs under varying temperature conditions.

Environmental and Aging Tests: To simulate the real-world conditions your RF PCB will face over time, we perform aging and environmental tests that assess how the board handles temperature fluctuations, humidity, vibration, and other environmental factors. This ensures that the RF PCB is durable and can withstand long-term use.

Electromagnetic Interference (EMI) Testing: EMI can significantly disrupt the performance of RF circuits. Our EMI testing ensures that your PCB meets electromagnetic compatibility standards, minimizing the risk of interference with nearby components and ensuring that the device operates smoothly in its intended environment.

Custom RF Testing Solutions for Every Need

At ASC-i, we know that each project is unique. Whether you’re designing a wireless communication system, automotive radar unit, or medical RF device, our team of engineers is ready to customize our testing solutions to meet the specific needs of your design. We work closely with you to understand the requirements of your project and develop a tailored testing plan that addresses all relevant performance factors.

By providing tailored testing services, we ensure that your RF PCBs will meet the precise criteria for your application, ensuring flawless performance across different environments and use cases.

Why Choose ASC-i as Your RF PCB Manufacturer?

Expertise and Experience: With years of experience in designing and manufacturing RF PCBs, ASC-i brings invaluable expertise to every project. Our engineers are well-versed in RF design principles and testing methods, allowing us to deliver high-quality, high-performance RF PCBs for a wide range of applications.

State-of-the-Art Testing Equipment: ASC-i uses the latest testing technologies and equipment to ensure the accuracy and precision of our testing processes. Our RF testing labs are equipped with advanced tools such as network analyzers, spectrum analyzers, thermal chambers, and more to ensure that each PCB is tested to the highest standards.

Comprehensive Testing Services: From signal integrity to thermal and environmental testing, ASC-i provides a full spectrum of RF test services. Our rigorous testing process ensures that each PCB performs optimally in its intended application, providing a reliable solution for every project.

Customization: Every RF PCB design has unique needs. ASC-i offers customized RF testing solutions that can be tailored to meet the specific parameters of your design. We take a collaborative approach to understand the requirements of your project and offer flexible testing services to address your needs.

Quality Assurance: At ASC-i, we prioritize quality in every stage of the manufacturing and testing process. Our robust testing procedures help identify and address any potential issues early, ensuring that your RF PCB meets the highest standards of reliability, durability, and performance.

Timely and Cost-Effective Solutions: We understand the importance of meeting deadlines in the fast-paced world of electronics. ASC-i offers quick turnaround times without compromising quality, allowing you to meet your project timelines while keeping costs under control. Our streamlined processes ensure that you receive competitive pricing for top-tier testing and manufacturing services.

Conclusion

ASC-i is your trusted partner for RF PCB manufacturing and testing services. Our advanced RF test capabilities, coupled with our expertise in RF design and production, allow us to deliver high-quality RF PCBs that perform reliably in the most demanding applications. Whether you’re developing a new wireless communication device, automotive radar system, or medical equipment, ASC-i’s comprehensive RF testing ensures that your PCB will meet the highest standards of performance, reliability, and durability.

Partner with ASC-i today and experience the difference our advanced RF testing capabilities can make for your RF PCB designs. We’re here to help you achieve success by delivering top-quality, high-performance solutions that meet the challenges of today’s technology-driven world. Contact us to learn more about our RF PCB manufacturing and testing services.

0 notes

Text

RF Chip Inductor Industry Insights Opportunities, Key Applications & Market Dynamics

The RF Chip Inductor Market is witnessing significant growth, driven by the surge in wireless communication technologies, electric vehicles, and IoT-enabled electronics. These inductors are essential in managing radio frequencies in compact circuits, offering high performance in impedance matching, signal filtering, and noise suppression. The global market was valued at USD 1.63 billion in 2023 and is anticipated to reach USD 2.50 billion by 2032, progressing at a CAGR of 8.1% during the forecast period.

The rising adoption of 5G networks, expansion in automotive electronics, and the proliferation of smart devices are pushing manufacturers to innovate smaller, more efficient RF chip inductors. Their role in enhancing the functionality of high-frequency applications ensures their relevance across diverse industries, from telecom to defense and consumer electronics.

Market Segmentation

By Type

Chip Inductors Designed for compact devices, these components offer high Q values and precise frequency control.

Ceramic Inductors Known for their thermal stability and high-frequency performance, ideal for automotive and aerospace use.

Power Inductors Provide high current handling, commonly used in power conversion systems and EVs.

Ferrite Inductors Cost-effective and widely used in filtering and signal smoothing in various consumer devices.

By Application

Wireless Communications Used extensively in 5G base stations, smartphones, and IoT transmitters.

Automotive Electronics Critical for radar systems, ADAS, infotainment, and vehicle-to-everything (V2X) communication.

Industrial & Power Electronics Support power supplies, converters, and industrial automation.

Consumer Electronics Embedded in tablets, smartwatches, wireless headphones, and gaming consoles.

By Frequency Band

Sub-1 GHz Suited for long-range, low-data applications like smart meters and remote monitoring.

1–3 GHz Common for Wi-Fi, Bluetooth, and general-purpose RF communications.

Above 3 GHz Targeted for high-frequency operations like mmWave 5G and satellite systems.

By Output Type

Surface-Mount Inductors (SMT) Widely adopted due to their compact size and easy integration.

Through-Hole Inductors Used in applications requiring higher mechanical strength and thermal stability.

By Region

Asia Pacific Leads the global market due to robust electronics manufacturing in China, Japan, and South Korea.

North America Strong demand from defense, automotive, and telecom infrastructure.

Europe Focuses on industrial automation, electric mobility, and high-performance automotive systems.

Latin America & Middle East & Africa Gradual adoption driven by growth in consumer electronics and telecom networks.

Trends

Shift Toward Miniaturization As devices become more compact, demand for high-performance inductors in smaller packages is growing. Manufacturers are producing ultra-miniature inductors capable of operating at high frequencies.

Automotive Integration RF inductors are increasingly being integrated into automotive radar, wireless battery charging, and navigation systems, supporting the expansion of EVs and connected vehicles.

5G and High-Frequency Demand The global rollout of 5G and the push for mmWave technology has increased the need for inductors that support higher data rates and frequency bands above 6 GHz.

Advanced Ceramic Materials Ceramic-based inductors are gaining popularity for their stability and reduced energy loss, particularly in harsh environments.

Localized Production Strategy To reduce supply chain risk and improve lead times, manufacturers are investing in regional production units, especially in Asia and North America.

Segment Insights

Chip Inductors vs Ceramic Inductors Chip inductors dominate due to their size and versatility in mobile and IoT devices, while ceramic inductors are preferred in high-temperature and high-vibration environments like vehicles and satellites.

Power Inductors These components see strong demand in renewable energy and power-hungry applications like EVs, as they support higher current and voltage stability.

Frequency Specialization Inductors designed for higher frequency bands are witnessing accelerated growth, particularly as telecom companies invest in advanced 5G infrastructure and mmWave capabilities.

End-User Insights

Telecommunication Companies RF inductors play a critical role in 5G infrastructure and network hardware, ensuring signal clarity and performance.

Automotive OEMs From autonomous driving systems to infotainment, inductors are essential in achieving high-speed connectivity and power management.

Industrial Equipment Manufacturers Use inductors in programmable logic controllers, UPS systems, and wireless sensors for factory automation and energy management.

Consumer Electronics Brands Smartphones, earbuds, gaming devices, and wearable tech require space-saving, efficient RF inductors for connectivity and battery life optimization.

Key Players

Several global companies lead innovation and production in the RF chip inductor market. These include:

Murata Manufacturing Co., Ltd.

Coilcraft, Inc.

Johanson Technology Inc.

KYOCERA AVX

Vishay Intertechnology, Inc.

AEM Components

Würth Elektronik

Viking Tech Corporation

Trending Report Highlights

Semiconductor Laser Market

Single/Multi‑Stage Semiconductor Coolers Market

Gas Concentration Sensor Market

Thermal Management in Consumer Electronics System Market

Underfill Dispensers Market

0 notes

Text

Transmission Line Impedance Measurement by BitWise Laboratories

BitWise Laboratories is a trusted name in advanced signal integrity testing, offering highly precise transmission line impedance measurement services for engineers, manufacturers, and R&D teams. In high-frequency environments—such as RF circuits, high-speed digital PCBs, and microwave communication systems—accurate impedance matching is crucial. Even minor mismatches can result in signal reflection, loss, and performance degradation. That’s why BitWise Laboratories is committed to delivering accurate, reliable, and high-resolution impedance analysis to support your design goals.

We use cutting-edge tools like Time Domain Reflectometry (TDR) and Vector Network Analyzers (VNA) to analyze impedance characteristics across a wide frequency range. These techniques allow us to detect discontinuities, mismatches, or anomalies in transmission lines, connectors, vias, and traces. Whether you're working on PCB layout, cable design, or integrated system testing, our measurements help ensure your signal path is optimized for efficiency and reliability.

Our clients span industries such as aerospace, automotive, telecommunications, consumer electronics, and defense. Each project is handled by experienced engineers who understand the complex interactions between materials, geometry, and signal behavior. With quick turnaround times, detailed reports, and application-specific recommendations, BitWise Laboratories empowers your team to design and deliver better-performing products.

In today’s competitive electronics landscape, robust signal performance isn’t optional—it’s essential. That’s why companies around the world rely on BitWise Laboratories for mission-critical transmission line impedance measurement that drives quality and compliance. Whether you're prototyping or doing production validation, we bring the expertise and tools necessary to catch issues early and optimize for performance.

From coaxial cables and differential pairs to microstrip and stripline configurations, we help you maintain impedance control from source to load. When signal integrity matters, every ohm counts—and so does every measurement.

Partner with BitWise Laboratories for precision testing, insightful analysis, and the peace of mind that your design is built on solid, measurable foundations.

For more information

Visit us :https://bitwiselabs.com/

0 notes

Text

Global Vacuum Capacitor Market Forecast to Grow at 4.4% CAGR Through 2031

The global vacuum capacitor market is projected to rise from a valuation of USD 567.8 million in 2022 to USD 827.6 million by the end of 2031, representing a compound annual growth rate (CAGR) of 4.4% between 2023 and 2031. Analysts point to surging demand in wireless communications, semiconductor manufacturing, materials processing, and aerospace as key growth drivers for these high-performance components.

Market Overview: Vacuum capacitors are specialized high‑voltage capacitors that utilize a vacuum as the dielectric medium. Their intrinsic ability to withstand extreme voltages, coupled with stable capacitance over a broad range of frequencies, makes them indispensable for radio frequency (RF) amplifiers, broadcast transmitters, plasma generation systems, and high‑energy physics experiments. Available in both fixed and variable configurations, vacuum capacitors cater to applications demanding precision tuning, low losses, and robust performance under high‑power conditions.

Market Drivers & Trends

5G and Next‑Generation Wireless: The rollout of 5G networks and preparation for 6G have intensified the need for precise RF tuning and impedance matching. Vacuum capacitors ensure minimal signal loss and tight tolerances in base stations, repeaters, and transmitters.

Semiconductor Fabrication: Rapid proliferation of devices from smartphones to electric vehicles drives semiconductor manufacturing expansion. Advanced processes such as extreme ultraviolet lithography (EUV) and FinFET transistor fabrication rely on RF plasma etching and deposition tools, where vacuum capacitors are critical for stable power delivery.

Industrial Plasma Systems: Materials processing (e.g., coating, welding, cleaning) uses high‑power RF generators for plasma generation. Vacuum capacitors maintain efficient power coupling and process stability.

Aerospace & Defense: Satellite transponders and radar systems demand components that perform reliably under vacuum and temperature extremes, boosting vacuum capacitor adoption in aerospace applications.

Latest Market Trends

Variable Vacuum Capacitors Lead: Accounting for over 54% of the market in 2022, variable vacuum capacitors are favored for adjustable capacitance in tunable RF circuits. Their share is expected to grow at a 4.7% CAGR through 2031.

Integration with Digital Control: Manufacturers are embedding digital sensors and microcontrollers into vacuum capacitor assemblies to enable real‑time monitoring of temperature, pressure, and capacitance, thereby enhancing predictive maintenance and system uptime.

Lean Manufacturing & Shorter Lead Times: Key players have adopted lean production methods, halved lead times, and improved yields by over 10%, responding to customer demands for rapid prototyping and scale‑up.

Key Players and Industry Leaders

The global vacuum capacitor market is notably fragmented. Leading manufacturers and their strategies include:

ABB Ltd.

Cixi AnXon Electronic Co., Ltd

Comet Group

FREEL TECH AG

High Hope Int'l INC.

Kintronic Laboratories, Inc.

Kunshan GuoLi Electronic Technology Co., Ltd

LBA Group, Inc.

MEIDENSHA CORPORATION

Richardson Electronics, Ltd.

Other Key Players

Discover essential conclusions and data from our Report in this sample - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=20153

Recent Developments

June 2022: Advanced Energy’s PowerInsight platform introduced a predictive-life algorithm for vacuum capacitors, reducing unplanned downtime by up to 80%.

2020: Comet Holding AG revamped its vacuum capacitor facility with lean principles, doubling capacity and shortening production cycles while boosting efficiency by 12%.

2024: ABB secured a joint R&D agreement with a leading satellite OEM to develop ultra‑low‑loss vacuum capacitors for next‑generation space transponders.

Market Opportunities

Emerging Economies: Rapid industrialization in Southeast Asia and Latin America presents untapped demand for RF heating, broadcasting, and telecommunications equipment.

5G Standalone Rollout: As operators transition to fully standalone 5G architectures, replacement and expansion of RF front‑end components, including vacuum capacitors, will accelerate.

Smart Manufacturing: Integration of vacuum capacitors into Industry 4.0 ecosystems—with IoT sensors and cloud analytics—offers opportunities for premium, service‑enabled products.

Defense Modernization Programs: Upgrades in radar systems and electronic warfare platforms worldwide require high‑reliability capacitors rated for extreme environments.

Future Outlook

Analysts remain bullish on the vacuum capacitor market through 2031:

Sustained CAGR: 4.4% growth driven by cross‑sector demand and technology upgrades.

Shift Toward Digitalization: Continued embedding of diagnostics and remote calibration features.

Consolidation & Innovation: Mergers and acquisitions to streamline portfolios, alongside development of novel dielectric materials to push performance boundaries.

Green Initiatives: Demand for efficient RF heating in sustainable manufacturing processes will bolster market growth.

Market Segmentation

The market is segmented by type, frequency, current, application, and end‑use industry:

Segment

Sub‑Segments

Type

Variable Vacuum Capacitor; Fixed Vacuum Capacitor

Frequency

≤ 13.56 MHz; 14–40 MHz; Above 40 MHz

Current (A rms)

≤ 50 A; 50–100 A; 101–200 A; 201–400 A; 401–1000 A; Above 1000 A

Application

Semiconductor Equip.; Flat Panel Display Equip.; Plasma Generating Equip.; Broadcast Radio Transmitters; Industrial Dielectric Heating; Medical/Measuring Devices; Antenna Networks; Photovoltaic Cell Equip.; Others (Research, Wireless Charging)

End‑use Industry

Consumer Electronics; Semiconductor; Telecom; Healthcare; Automotive; Industrial; Others (Research & Academia, Energy & Utility)

Regional Insights

Asia Pacific (35.12% share, 2022): The powerhouse of electronics and semiconductor fabrication. Rapid adoption of 5G, EV manufacturing, and PV cell production underpins strong demand.

North America (30.45% share): Home to advanced broadcasting, aerospace, and defense sectors. Continued investments in scientific research labs and 5G infrastructure support market growth.

Europe: Steady uptake in industrial process heating and research applications; emerging defense modernization programs are adding to market momentum.

Latin America & MEA: Early stage but growing interest in telecommunications upgrades and industrial RF heating solutions.

Why Buy This Report?

Comprehensive Forecasts: Detailed market sizing and growth projections through 2031, segmented by type, frequency, current, application, and region.

Qualitative Analysis: In‑depth examination of drivers, restraints, opportunities, Porter’s Five Forces, and value‑chain insights.

Competitive Landscape: Profiles of leading players, including product portfolios, financials, strategic initiatives, and recent developments.

Customizable Deliverables: Electronic delivery in PDF and Excel formats enables easy data extraction and integration into client presentations.

Strategic Recommendations: Actionable guidance for market entry, product development, and M&A targeting.

Explore Latest Research Reports by Transparency Market Research: Non-volatile Memory Express (NVMe) Market: https://www.transparencymarketresearch.com/non-volatile-memory-express-nvme-market.html

Piezoelectric Devices Market: https://www.transparencymarketresearch.com/piezoelectric-device-market.html

Gas Sensors Market: https://www.transparencymarketresearch.com/gas-sensors-market.html

Machine Safety Interlock Switches Market: https://www.transparencymarketresearch.com/machine-safety-interlock-switches-market.html

About Transparency Market Research Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information. Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports. Contact: Transparency Market Research Inc. CORPORATE HEADQUARTER DOWNTOWN, 1000 N. West Street, Suite 1200, Wilmington, Delaware 19801 USA Tel: +1-518-618-1030 USA - Canada Toll Free: 866-552-3453 Website: https://www.transparencymarketresearch.com Email: [email protected]

0 notes

Text

Tailored Antennas: Unlock Next-Level Signal Strength

In today’s fast-evolving world of wireless communication, antennas play a crucial role in enabling seamless connectivity across various industries. From telecommunications to aerospace, the demand for efficient and high-performing antennas has never been higher. While off-the-shelf antennas serve general applications, custom antenna design provides tailored solutions that cater to specific needs, ensuring optimal performance and reliability.

Why Choose Custom Antenna Design?

Off-the-shelf antennas are designed to meet general performance parameters, but they often fall short in unique or specialized applications. Custom antenna design allows for engineering antennas that align precisely with project requirements, whether for size constraints, frequency range, gain, or environmental conditions, wifi enhancer. Here’s why custom antenna solutions stand out:

1. Optimized Performance

Custom antennas are specifically designed to match precise frequency bands and environmental conditions. This optimization reduces interference, enhances signal reception, and improves overall efficiency.

2. Enhanced Durability

Industries such as defense, aerospace, and IoT demand robust antennas that can withstand harsh environmental conditions. Custom antennas can be designed with materials and enclosures that provide protection against extreme temperatures, moisture, and physical impact.

3. Compact and Space-Saving Designs

In applications like wearable devices, drones, or medical implants, space is limited. Custom antenna design allows for miniaturization without compromising performance, ensuring seamless integration into compact devices.

4. Better Integration with Devices

Custom antennas can be designed to fit specific enclosures or form factors, reducing installation complexities and improving device aesthetics.

5. Improved Efficiency and Cost Savings

Although custom antennas may require a higher initial investment, they reduce costs in the long run by improving performance, extending device lifespan, and reducing maintenance requirements.

The Process of Custom Antenna Design

The development of a custom antenna follows a structured approach to ensure that the final product meets performance expectations. Here’s an overview of the key steps involved:

1. Requirement Analysis

Understanding the project’s needs is the foundation of custom antenna design. Engineers analyze parameters such as frequency range, operating environment, size constraints, and performance goals.

2. Electromagnetic Simulation and Prototyping

Advanced simulation tools are used to model and optimize the antenna’s electromagnetic properties. Once the design is finalized, prototypes are developed for real-world testing.

3. Testing and Validation

Prototypes undergo rigorous testing in controlled environments to measure key performance metrics such as gain, impedance, and radiation patterns. Adjustments are made to enhance efficiency.

4. Manufacturing and Deployment

After successful testing, the antennas are manufactured using the best-suited materials and techniques. The final product is then integrated into its respective application.

Industries Benefiting from Custom Antenna Solutions

Custom antenna design is transforming multiple industries by offering tailored connectivity solutions. Some notable sectors include:

● Telecommunications: Optimized antennas for 5G networks, IoT, and smart cities.

● Aerospace and Defense: Secure and robust communication antennas for military applications.

● Healthcare: Miniature antennas for medical implants and remote patient monitoring.

● Automotive: Advanced antennas for connected cars and autonomous driving systems.

Conclusion

As the demand for high-performance wireless communication grows, custom antenna design is becoming a game-changer in various industries. By offering optimized, durable, and efficient solutions, custom antennas ensure seamless connectivity and superior performance tailored to specific applications. Whether for aerospace, healthcare, or IoT, investing in custom antenna design is a strategic move towards enhanced communication and technological advancement.

#uhf vhf antennas#wifi antenna booster#vhf antennas#antenna design company#antenna development engineer#external wifi booster#improve wifi signal#vhf antenna#wifi signal enhancer#iridium external antenna

0 notes

Text

0 notes

Text

Final Reflection

In conclusion I'm very happy with the films I've worked on this year. I think they show off a variety of skills that will look very good on a portfolio and CV. I'm especially proud of my work on Antyeshti & Bowl - my two primary films this year. On Antyeshti I worked as Gaffer while on Bowl I was the DoP. I was lucky enough to be part of the crew that went to India to work on Antyeshti and that was such an invaluable experience. Seeing how Indian productions work compared to British ones while expanding my network outside of the UK.

When in India, all the UK crew lived and breathed the film. We'd wake up early and get driven 2 or 3 hours to the location. In the car we'd discuss what the days setups would look like and our expectations. Then we'd get to location, shoot for approximately 10 hours (or till it went dark) then drive back talking about the days footage and expectations for the next. Over dinner we'd look at rushes, stills and draw up lighting plans before going off to bed. I've never worked on a film with this dedication and I think it really shows in the final product. I also think this passion carried over to the UK shoot as we were so adamant to make sure it matched the dedication of our India footage. In terms of Bowl, I was determined to show that I wasn't just limited to lighting and I wanted to use this film to show my skills as a D.P. This definitely comes across in the film and I think I've established two clear visual languages for the two settings. The Bowling Green is nostalgic and reflective but with an intensity from the stress of the impeding charity match.

To express this I wanted to use a lot of fast dolly moves to enhance the dynamism of the scene. I also wanted to use a lot of long lenses to ensure high drop off on the close ups and not warp the actors faces.

I also wanted the film to be very summer toned, to give it a late afternoon summer atmosphere and this comes across. It's a combination of weather and lighting choices but it definitely works. In contrast, I wanted the scenes in the hospital to be almost threatening. With a lingering deathly feel that is cold and dehumanizing. This comes across in the lighting setups that we worked on for this film. This was largely practical but we diffused what was in the room and adjusted it with our own lights. I also wanted to contrast the dynamism of the green by keeping the camera predominatly static, only pushing in slightly on certain frames. This was to keep the audience in the story, not thinking about the camera moves. This had the desired outcome and this scene is one of the best in the whole film. On reflection, I'm very happy with my work on Bowl. My only regret is that I wish I had used haze. This was something we'd talked extensively about in pre-production but on the day the stress of the shoot got to me and although I had packed it, it completely escaped my mind. Despite this, the film is great and I'm excited to see its journey on the festival circuit.

0 notes

Text

Coaxial Panels Market: Challenges, Solutions and Trends, 2025-2032

MARKET INSIGHTS

The global Coaxial Panels Market size was valued at US$ 289 million in 2024 and is projected to reach US$ 378 million by 2032, at a CAGR of 3.8% during the forecast period 2025-2032. The U.S. market accounted for 30% of global revenue in 2024, while China is expected to witness the fastest growth with a projected CAGR of 7.1% through 2032.

Coaxial panels are essential components in RF (radio frequency) and signal distribution systems, designed to organize and manage multiple coaxial cable connections. These panels come in various configurations including 16-port, 24-port, and 32-port variants, with the 24-port segment holding the largest market share of 42% in 2024. They are widely used in telecommunications, broadcasting, and semiconductor testing applications where high-frequency signal integrity is critical.

The market growth is driven by increasing demand for high-speed data transmission and expansion of 5G infrastructure. However, the transition to fiber optics in some applications presents a challenge. Key players like COMMSCOPE, Belden Incorporated, and Corning Inc dominate the market, collectively holding over 45% market share. Recent developments include Leviton’s 2023 launch of shielded coaxial panels with improved EMI protection for industrial applications.

MARKET DYNAMICS

MARKET DRIVERS

Expansion of 5G Infrastructure to Accelerate Coaxial Panel Demand

The global rollout of 5G networks is creating unprecedented demand for high-performance coaxial panels, as these components are essential for signal distribution in telecommunication infrastructure. With over 300 commercial 5G networks deployed worldwide as of 2024, the requirement for reliable RF connectivity solutions has surged. Coaxial panels provide the necessary impedance matching and signal integrity that modern 5G base stations require, particularly in dense urban deployments where space constraints demand compact, high-density solutions. The transition from 4G to 5G has increased port density requirements by approximately 40%, driving manufacturers to develop panels with higher port counts and improved shielding capabilities.

Growth in Defense and Aerospace Applications to Fuel Market Expansion

Military modernization programs across major economies are significantly contributing to coaxial panel market growth. These components are critical in radar systems, electronic warfare equipment, and satellite communications where signal integrity is paramount. Recent geopolitical tensions have accelerated defense spending, with global military budgets exceeding $2 trillion for the first time in 2024. Coaxial panels in defense applications require specialized certifications and extreme environmental resilience, creating premium market segments. The development of next-generation fighter jets and naval vessels increasingly incorporates modular RF systems that utilize high-density coaxial panels for signal routing and distribution.

➤ The U.S. Department of Defense has allocated over $12 billion for C4ISR modernization in 2025, a significant portion of which will involve coaxial infrastructure upgrades.

Furthermore, the commercial aerospace sector’s recovery post-pandemic has reinvigorated in-flight connectivity projects, with airlines investing heavily in cabin entertainment and connectivity systems that rely on robust coaxial distribution networks.

MARKET RESTRAINTS

Material Cost Volatility to Constrain Profit Margins

The coaxial panel market faces significant pressure from fluctuating raw material costs, particularly copper and specialized dielectric materials that form the core of these components. Copper prices have shown 30% annual volatility since 2022, directly impacting manufacturing costs. While some manufacturers have implemented cost-sharing agreements with suppliers, smaller players often struggle to absorb these fluctuations without sacrificing quality. The industry is actively researching alternative materials, but substitution options for critical performance characteristics remain limited in high-frequency applications.

Other Restraints

Supply Chain Fragility Global semiconductor shortages continue to affect the availability of supporting active components for integrated coaxial panel systems. Lead times for certain connector types have extended to 52 weeks in some cases, disrupting production schedules and delivery commitments.

Standardization Challenges The lack of universal standards for high-frequency coaxial interfaces creates compatibility issues across different equipment vendors, increasing system integration costs and slowing adoption rates in some markets.

MARKET CHALLENGES

Miniaturization Requirements Test Engineering Capabilities

As electronic systems become more compact, coaxial panel manufacturers face mounting pressure to reduce form factors while maintaining or improving electrical performance. The industry standard for port density has increased from 16 ports per RU (rack unit) to 32 ports in just five years, pushing the limits of mechanical design and material science. Maintaining impedance control and crosstalk suppression in these dense configurations requires innovative approaches to shielding and dielectric design.

Additionally, thermal management becomes increasingly critical as power densities rise, requiring sophisticated simulation tools and advanced manufacturing techniques that not all market players can readily access.

MARKET OPPORTUNITIES

Emerging Smart City Projects to Open New Application Verticals

The proliferation of smart city initiatives worldwide presents a significant growth avenue for coaxial panel manufacturers. Urban infrastructure projects increasingly incorporate distributed antenna systems (DAS) and IoT networks that require robust RF distribution solutions. With over 1000 smart city projects currently underway globally, the demand for ruggedized outdoor coaxial panels with enhanced environmental protection is expected to grow at nearly 15% annually through 2030.

Moreover, the integration of artificial intelligence in network management is driving the development of intelligent coaxial panels with built-in monitoring capabilities, creating value-added product segments with higher margins.

COAXIAL PANELS MARKET TRENDS

Increasing Demand for High-Speed Data Transmission to Drive Market Growth