#outsource data extraction services

Explore tagged Tumblr posts

Text

Data Mining Services for Accurate Digital Marketing Strategies

Data mining is an essential approach for today’s digital marketing experts, to get hands on actionable insights and curate effective marketing strategies and make informed decisions. Here’s a detailed version of how data mining brings accuracy in digital marketing.

#data mining services#data mining services india#outsource data mining services#data mining service providers#data extraction services#data entry services#web data extraction services#outsource data extraction services

3 notes

·

View notes

Text

In today's data-driven world, extracting valuable insights from massive datasets is crucial for businesses. However, this task can be tedious and time-consuming. Outsourcing data extraction services offers a strategic solution. Here are the top benefits:

1- Cost-Effectiveness and Scalability

2- Enhanced Accuracy and Efficiency

3- Specialized Expertise and Technology

4- Focus on Core Business

5- Data Security and Compliance

6- Streamlined Integration and Analysis

7- Global Data Sources and Insights

Outsourcing data extraction services provides cost savings, accuracy, and strategic insights, making it essential for business success.

#data extraction#outsource data extraction services#data extraction services#data extraction company

0 notes

Text

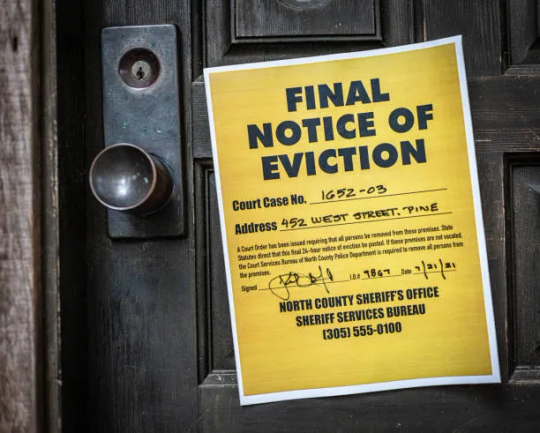

Accumulation by Dispossession, Trump Style

How Trump turned the machinery of the state into a tool of extraction—and why naming the theft is the first step toward repair.

James B. Greenberg

Jun 25, 2025

In an age where corruption is sold as competence and cruelty as clarity, the line between governance and grift has grown dangerously thin. Under Trump, that line didn’t blur—it vanished. What emerged wasn’t just mismanagement or ideological extremism, but a systematic mode of extraction, where the state itself was turned into an engine of enrichment for the few.

This wasn’t new. The mechanics were already in place. But Trump stripped them of pretense. What took shape under his leadership was a raw and visible form of what might best be called accumulation by dispossession—not through innovation, but by seizure. Through privatization, deregulation, defunding, and destabilization, wealth was moved upward by force of policy.

The pandemic revealed this with brutal clarity. Relief funds intended to cushion the blow for workers and small businesses were rerouted to major corporations and political allies. Contracts for protective equipment flowed to the connected, not the competent. Oversight mechanisms were sidelined, and accountability dissolved. What should have been a moment of collective care became a marketplace of opportunity for those already positioned to profit.

Or take public lands. Under Trump, millions of acres were opened to extraction—drilling, mining, grazing—not for public benefit, but for private gain. Environmental protections were stripped, tribal sovereignty undermined, and sacred sites desecrated in the name of “freedom.” This wasn’t policy in the traditional sense—it was liquidation. What belonged to all was transferred to a few.

Even immigration policy was part of this calculus. Migrants were not only criminalized; they were commodified. Detention contracts, surveillance technologies, biometric databases, border walls—all became opportunities for profit. The state’s power to detain, sort, and exclude was outsourced and monetized. What looked like enforcement was, in fact, extraction.

What links these moves is not chaos, but coherence. Degrade the commons, discredit public institutions, and redirect the flow of value toward private interests. This wasn’t the dismantling of the state. It was the weaponization of its infrastructure for dispossession. A state repurposed not to serve, but to siphon.

But the logic of dispossession goes deeper than land and money. It erodes time, possibility, and the basic scaffolding of democratic life. Under Trump, trust in public systems was not merely lost—it was actively dismantled. Public education was politicized. The census was manipulated. The Postal Service was hobbled in plain sight. These weren’t isolated failures. They were deliberate efforts to fracture the systems that sustain social reproduction and civic belonging.

This form of rule draws from an older logic. What was once called primitive accumulation—the seizure of land, labor, and resources in the formation of early capitalism—now plays out inside the borders of established democracies. It no longer requires conquest abroad. It cannibalizes institutions at home. The tools are legal, bureaucratic, and digital. The violence is slower, but no less real.

Today, dispossession moves through zoning laws and budget line items, through the privatization of housing, water, and care. It travels through digital networks—data harvested, identities tracked, benefits denied by algorithm. It is ecological, too: extractive industries strip land and poison water while vulnerable communities bear the cost. Climate denial is not ignorance; it is strategy. A way to prolong profit at the expense of planetary survival.

All of this was wrapped in a populist script—a claim to speak for “the forgotten.” But the real beneficiaries were never the working poor. The tax cuts went to the wealthy. The deregulation favored polluters and profiteers. The rhetoric masked the fact that what was being restored was not dignity, but dominion—the power of wealth to go unchallenged.

And yet, dispossession is never just about theft. It is also about narrative. Trump didn’t just strip resources—he rewrote the moral economy. He told people they had been wronged, then sold them a performance of revenge: against immigrants, against environmentalists, against the very idea of collective responsibility. Extraction was reframed as justice. Looting as loyalty.

What was taken wasn’t only tangible. It was temporal. The future was foreclosed for many—through student debt, housing precarity, degraded schools, and unsafe work. This is how accumulation works now: not by creating wealth, but by extracting life from the margins—one hour, one service, one body at a time.

This is why the Trump era cannot be dismissed as mere chaos. It revealed something deeper: a governance model that no longer aims to build, only to strip; that sees care as waste and solidarity as threat. It exposed the machinery of extraction that had been running for decades—but now without shame, without brakes, without apology.

Yet even in the wreckage, the story isn’t over. Dispossession often generates its opposite: solidarity. When people lose what was promised—land, labor, dignity—they look to each other. Mutual aid networks surged in the pandemic. Teachers, nurses, transit workers, and tenants organized. The commons is not gone. It is damaged. But it can be rebuilt—not by nostalgia, but by design.

Reclaiming what has been taken will not be easy. The machinery of extraction is deeply embedded. But history teaches that even the most entrenched systems crack when the stories upholding them collapse. What we need now are new stories—grounded in dignity, interdependence, and a future not for sale.

Because what was lost in the Trump years wasn’t just public money. It was the idea that government could be something other than a shell game for the powerful. Recovering that idea will take more than elections. It will require repair—material, institutional, and moral.

And that begins by naming what happened for what it was: not just corruption or chaos, but a calculated project of dispossession. And by insisting, again, that the public belongs to the people—not to those who see it only as something to plunder.

Suggested Readings

Harvey, David. The New Imperialism. Oxford: Oxford University Press, 2003.

Greenberg, James B., and Thomas K. Park, eds. Terrestrial Transformations: Political Ecology, Climate, and the Remaking of Planet Earth. New York: Lexington Books, 2023.

Mbembe, Achille. Necropolitics. Durham, NC: Duke University Press, 2019.

Pulido, Laura. Environmentalism and Economic Justice: Two Chicano Struggles in the Southwest. Tucson: University of Arizona Press, 1996.

Sassen, Saskia. Expulsions: Brutality and Complexity in the Global Economy. Cambridge, MA: Belknap Press, 2014.

Scott, James C. Seeing Like a State:

How Certain Schemes to Improve the Human Condition Have Failed. New Haven: Yale University Press, 1998.

Streeck, Wolfgang. Buying Time: The Delayed Crisis of Democratic Capitalism. London: Verso, 2014.

Vélez-Ibáñez, Carlos G. The Rise of Necro/Narco-Citizenship: Belonging and Dying in the National Borderlands. Tucson: University of Arizona Press, 2025.

Weizman, Eyal. The Least of All Possible Evils: Humanitarian Violence from Arendt to Gaza. London: Verso, 2012.

21 notes

·

View notes

Text

Best data extraction services in USA

In today's fiercely competitive business landscape, the strategic selection of a web data extraction services provider becomes crucial. Outsource Bigdata stands out by offering access to high-quality data through a meticulously crafted automated, AI-augmented process designed to extract valuable insights from websites. Our team ensures data precision and reliability, facilitating decision-making processes.

For more details, visit: https://outsourcebigdata.com/data-automation/web-scraping-services/web-data-extraction-services/.

About AIMLEAP

Outsource Bigdata is a division of Aimleap. AIMLEAP is an ISO 9001:2015 and ISO/IEC 27001:2013 certified global technology consulting and service provider offering AI-augmented Data Solutions, Data Engineering, Automation, IT Services, and Digital Marketing Services. AIMLEAP has been recognized as a ‘Great Place to Work®’.

With a special focus on AI and automation, we built quite a few AI & ML solutions, AI-driven web scraping solutions, AI-data Labeling, AI-Data-Hub, and Self-serving BI solutions. We started in 2012 and successfully delivered IT & digital transformation projects, automation-driven data solutions, on-demand data, and digital marketing for more than 750 fast-growing companies in the USA, Europe, New Zealand, Australia, Canada; and more.

-An ISO 9001:2015 and ISO/IEC 27001:2013 certified -Served 750+ customers -11+ Years of industry experience -98% client retention -Great Place to Work® certified -Global delivery centers in the USA, Canada, India & Australia

Our Data Solutions

APISCRAPY: AI driven web scraping & workflow automation platform APISCRAPY is an AI driven web scraping and automation platform that converts any web data into ready-to-use data. The platform is capable to extract data from websites, process data, automate workflows, classify data and integrate ready to consume data into database or deliver data in any desired format.

AI-Labeler: AI augmented annotation & labeling solution AI-Labeler is an AI augmented data annotation platform that combines the power of artificial intelligence with in-person involvement to label, annotate and classify data, and allowing faster development of robust and accurate models.

AI-Data-Hub: On-demand data for building AI products & services On-demand AI data hub for curated data, pre-annotated data, pre-classified data, and allowing enterprises to obtain easily and efficiently, and exploit high-quality data for training and developing AI models.

PRICESCRAPY: AI enabled real-time pricing solution An AI and automation driven price solution that provides real time price monitoring, pricing analytics, and dynamic pricing for companies across the world.

APIKART: AI driven data API solution hub APIKART is a data API hub that allows businesses and developers to access and integrate large volume of data from various sources through APIs. It is a data solution hub for accessing data through APIs, allowing companies to leverage data, and integrate APIs into their systems and applications.

Locations: USA: 1-30235 14656 Canada: +1 4378 370 063 India: +91 810 527 1615 Australia: +61 402 576 615 Email: [email protected]

2 notes

·

View notes

Text

"EFFICIENT OUTSOURCE IMAGE DATA ENTRY SERVICES"

Outsource Image Data Entry Services streamline your data management needs by converting handwritten or printed data from images into digital formats. Skilled professionals ensure accuracy and efficiency, saving your organization valuable time and resources. Whether it's transcribing invoices, extracting data from forms, or digitizing records, these services provide a cost-effective solution for businesses seeking error-free and organized data entry from various image sources.

1 note

·

View note

Text

Making the Right Choice To Choose Data Collection Service Provider

Introduction to Data Collection Service Providers

In today’s data-driven world, making informed decisions is more crucial than ever. Businesses rely heavily on accurate and timely information to stay competitive. This is where data collection service providers step in, offering expertise that can transform raw numbers into actionable insights. Whether you’re a startup looking to gather customer feedback or an established corporation needing in-depth market analysis, the right data collection partner can elevate your strategy.

As companies increasingly recognize the value of outsourcing this essential function, understanding how to choose the best provider becomes paramount. With numerous options available, it’s vital to navigate through them carefully. Let’s explore why selecting a reliable data collection service can be a game-changer for your business success and what factors should influence your choice.

Benefits of Outsourcing Data Collection

Outsourcing data collection can significantly boost your business's efficiency. When you delegate this task, your team can focus on core activities that drive growth.

Access to expertise is another major benefit. Data collection service providers have specialized skills and the latest tools. This ensures high-quality results tailored to your needs.

Cost-effectiveness plays a crucial role as well. Hiring in-house staff for data collection often comes with hidden expenses like training and software costs. Outsourcing eliminates these burdens, allowing for better budget management.

Additionally, outsourcing provides scalability. As your project demands change, you can easily adjust the level of service without the hassle of hiring or downsizing staff.

Moreover, it enhances speed and accuracy in gathering data. Professionals dedicated to this process typically achieve faster turnaround times while minimizing errors associated with manual efforts.

Factors to Consider When Choosing a Data Collection Service Provider

Choosing the right ai data collection services provider involves several crucial factors. First, assess their expertise in your specific industry. A provider familiar with your field understands unique challenges and can tailor solutions accordingly.

Next, consider their technology and tools. Advanced data collection methods enhance accuracy and efficiency. Ensure they use up-to-date software that complies with best practices.

Another important aspect is scalability. As your business grows, so will your data needs. The ideal partner should easily adapt to changes without compromising quality.

Don’t overlook customer support either. Responsive communication helps address concerns quickly and fosters a solid working relationship.

Review client testimonials or case studies to gauge reliability and effectiveness. Real-world examples provide insights into what you can expect from the partnership moving forward.

Types of Data Collection Services Offered

Data collection services come in various forms, each tailored to meet specific business needs. Surveys and questionnaires are popular methods, allowing companies to gather insights directly from their target audience.

Another common type is web scraping, which involves extracting data from websites to glean valuable information about competitors or market trends. This method can be a game-changer for businesses seeking real-time data.

Focus groups provide qualitative insights by engaging small groups of participants in discussions. This offers deeper understanding beyond numerical data alone.

Observational research captures natural behaviors in real settings, providing authentic data that surveys might miss.

Social media monitoring tracks online conversations and sentiments surrounding brands or products. Each service offers unique benefits depending on your objectives and the kind of information you need for informed decision-making.

Case Studies: Successful Companies that Have Used Data Collection Services

Companies across various sectors have harnessed the power of data collection services to drive growth and innovation.

A leading e-commerce brand leveraged a data collection service to analyze consumer behavior. They gained insights that informed their marketing strategies, resulting in a 30% increase in sales within six months.

In the healthcare sector, a medical research organization utilized data collection to streamline patient surveys. This approach not only improved response rates but also enhanced the quality of their studies. The result? More actionable findings that led to better patient care solutions.

Moreover, an automotive manufacturer used these services for market analysis. By understanding customer preferences more deeply, they optimized product designs and launched successful new models ahead of competitors.

These examples illustrate how strategic use of data collection can transform business operations and outcomes in today's competitive landscape. Each case showcases unique applications tailored to specific needs, highlighting versatility in this essential service.

How to Measure the Success of a Data Collection Service Provider

Measuring the success of a data collection services provider involves several key performance indicators (KPIs). Start by assessing data accuracy. This refers to how well the collected information reflects reality.

Timeliness is another vital metric. Evaluate whether the provider delivers results within agreed-upon timelines. Delays can hinder decision-making processes.

Cost-effectiveness also plays a crucial role. Compare the value received against your investment, ensuring that you're getting worthwhile insights for your budget.

Client feedback is invaluable too. Gather testimonials or case studies from other businesses to gauge satisfaction levels and overall effectiveness.

Consider scalability. A successful provider should adapt their services as your needs evolve, demonstrating flexibility in expanding or refining their offerings over time.

Conclusion: Why Choosing the Right Data Collection Service Provider is Crucial for Your Business's Success

Choosing the right data collection services provider can significantly impact your business's success. It influences not only how you gather information but also how well that information serves your strategic goals. A proficient provider can streamline processes, reduce costs, and enhance the quality of insights derived from data.

When businesses neglect this crucial choice, they risk making decisions based on faulty or incomplete data, which can lead to missed opportunities. The right partner will ensure that you receive accurate data tailored to your needs while saving time and resources.

Investing in a reputable data collection service is an investment in your company's future. Your ability to adapt and thrive in a competitive landscape relies heavily on solid decision-making grounded in reliable research. Therefore, taking the time to evaluate potential providers thoroughly will pay off immensely in achieving sustainable growth and operational efficiency for years to come.

0 notes

Text

Beyond Sparkle: Why Professional Cleaning Is the Hidden Pillar of Well-Being in Modern Perth

How an overlooked chore became a catalyst for healthier homes, thriving businesses, and calmer minds—and what I learned while building ADD Bhutan Cleaning Services from the ground up.

1. The Afternoon That Changed My View of “Clean”

It was a Friday in late summer, Perth sitting at a breezy 31 °C. I’d just finished an end-of-lease inspection for a friend who’d “DIY-cleaned” her apartment. From a distance the place looked fine; up close there were specks of red dust on the skirting boards, limescale halos around the taps, an almost-imperceptible film on the oven glass. The property manager’s verdict? $450 deducted from her bond.* Driving home I kept thinking: How many of us underestimate the details that make or break first impressions—whether it’s a rental inspection, a client visit, or just inviting friends over? That question sparked my deep dive into professional cleaning, and eventually, the launch of ADD Bhutan.

2. Dirt Is More Than Aesthetic—It’s Biological

• Airborne particles: Studies from CSIRO show indoor PM2.5 levels can exceed outdoor pollution on hot, still days—especially in carpeted rooms. • High-touch infections: Gym weights, office keyboards, and café tables can host staph, E. coli, even norovirus for up to 72 hours. • Cognitive fog: Research in the Journal of Environmental Psychology links visual clutter and micro-dust to lower working memory scores and elevated cortisol.

Cleanliness isn’t vanity; it’s preventative medicine.

3. The Time-Value Equation We Forget to Do

The average Perth resident spends 2.1 hours per week on household cleaning. Multiply by 52 weeks and you’ve invested ~109 hours a year—nearly three full workweeks you could have spent building a side hustle, surfing Trigg Beach, or simply sleeping. Professional crews compress that same workload into a fraction of the time because they arrive in teams, use industrial-grade vacuums, and follow a repeatable checklist. What seems like a “luxury” buy is, in pure time economics, a bargain.

4. Sustainability Isn’t Optional Anymore

When we launched ADD Bhutan, skeptics said eco-certified detergents wouldn’t cut Perth’s red-soil stains. We proved them wrong by:

Switching surfactants: Coconut-based agents break down proteins without harsh phosphates.

Closed-loop Microfibre: Our cloths capture 99% of bacteria and last 500 wash cycles, shrinking landfill waste.

Water-smart protocols: Low-moisture carpet extraction saves ~25 L per job compared to traditional steam.

A cleaner planet and a clean floor aren’t mutually exclusive.

5. Lessons Learned Cleaning 1,000+ Perth Properties

• Communication beats chemicals. Most “bad reviews” stem from unmet expectations, not dirty windows. A pre-job checklist solves 80 % of disputes. • The 10-minute rule. Spend the first ten minutes decluttering before you polish anything. Surfaces cleaned once stay clean longer. • Pay your team above award wages. Turnover plummets, skill compounds, and clients see familiar faces instead of strangers.

6. What to Look for When Outsourcing Cleaning

Evidence of insurance & police checks (non-negotiable).

Fixed-price quotes that list inclusions—room counts, appliance interiors, blind slats.

Re-clean guarantee (ours is 72 hours). If they won’t return to address a miss, keep scrolling.

Transparent product list—ask for the Safety Data Sheets; legitimate companies have them ready.

7. Why We Built ADD Bhutan (and Why the Name)

“Bhutan” ranks as the world’s only carbon-negative country; its constitution mandates 60 % forest cover. We borrowed the name as a north-star reminder: growth and stewardship must coexist. Today, we provide: • End-of-Lease & Bond Cleaning • Window, Carpet, and Deep Cleaning • Commercial & Office Care (after-hours) • Post-Renovation Builders’ Cleans

All anchored in eco-responsibility and flat-rate transparency.

8. The Clean Difference—A Final Reflection

A spotless workspace invites creativity; a dust-free bedroom deepens sleep; a gleaming storefront nudges customers to trust you. Cleanliness isn’t just removal of dirt—it’s the creation of possibility. If you’re in Perth and want to trade elbow grease for extra hours (and a healthier environment), come say hello: addbhutan.com. Whether you book a service or borrow our downloadable checklists, I hope you’ll see cleaning less as a chore and more as an investment in well-being.

Thanks for reading. Share your own cleaning hacks or worst landlord horror stories in the comments—I read every one.

1 note

·

View note

Text

Accounts Payable Services | Call Now +91-98997 70123

In today’s competitive business environment, organizations are constantly looking for ways to streamline operations, improve productivity, and reduce overhead costs. One of the most effective ways to achieve these goals is by investing in professional Accounts Payable Services. Whether you're a small business or a large enterprise, managing your payables efficiently ensures improved cash flow, reduced risk of errors, and stronger vendor relationships.

Call Now +91-98997 70123 to speak with a dedicated expert and explore how Accounts Payable Services can help transform your financial workflow.

What Are Accounts Payable Services?

Accounts Payable Services refer to the end-to-end management of a company’s short-term obligations to pay suppliers or vendors. These services cover a wide range of financial operations including invoice processing services, vendor payment solutions, account reconciliation, ledger maintenance, and reporting.

With accurate and timely Accounts Payable Services, businesses ensure their liabilities are met without delay, which avoids late fees, maintains creditworthiness, and nurtures supplier trust.

Benefits of Accounts Payable Services

Implementing effective Accounts Payable Services can yield numerous advantages for organizations:

1. Cost Savings

Outsourcing your payables reduces the need for in-house staff, expensive software, and infrastructure. With accounts payable outsourcing services, companies can eliminate overheads and save up to 40% on processing costs.

2. Improved Accuracy

Professional service providers use advanced tools and AI-powered solutions to ensure every invoice is captured, verified, and processed without errors. Accurate invoice processing services help avoid duplicate payments, fraud, and compliance issues.

3. Faster Turnaround Time

By automating workflows and leveraging skilled resources, accounts payable outsourcing services can significantly reduce processing time. This ensures that vendors are paid promptly, improving relations and potentially unlocking early payment discounts.

4. Scalability

As your business grows, your need for managing more invoices and vendor payments increases. Outsourced “Accounts Payable Services” scale with your business without the need for additional resources or software investment.

5. Enhanced Compliance

Outsourcing firms are well-versed in global compliance standards and regulatory frameworks. Their financial process outsourcing models include built-in audit trails, approval hierarchies, and risk controls that ensure compliance with industry and government mandates.

Key Components of Accounts Payable Services

1. Invoice Processing Services

A cornerstone of Accounts Payable Services, invoice processing includes receiving, validating, recording, and paying invoices. Service providers use OCR (Optical Character Recognition) and AI-driven tools to automate data extraction, match invoices with purchase orders, and ensure quick approvals.

2. Vendor Payment Solutions

Reliable ‘vendor payment solutions’ ensure that suppliers are paid correctly and on time through secure methods such as bank transfers, NEFT/RTGS, and digital wallets. Streamlining payments reduces delays, builds trust, and opens opportunities for better credit terms.

3. Reconciliation and Reporting

Reconciling accounts payable with general ledgers and vendor statements is critical to maintaining financial integrity. ‘Accounts Payable Services’ include timely reconciliations, aging reports, and audit support.

4. Workflow Automation

Modern “Accounts Payable Services” leverage ERP systems and RPA (Robotic Process Automation) to reduce manual intervention. From invoice capture to final payment, automation enhances speed and reduces human error.

5. Compliance and Fraud Prevention

Outsourced financial process outsourcing includes rigorous checks, segregated duties, and access control systems that minimize fraud risks. Accurate documentation also helps during audits and financial inspections.

Why Choose Accounts Payable Outsourcing Services?

Accounts payable outsourcing services bring in specialized expertise, cutting-edge technology, and scalable operations to manage your accounts more efficiently than in-house teams. Here’s why it makes business sense:

Reduced operational burden

Access to skilled finance professionals

Lower risk of fraud and compliance issues

Real-time data and analytics

Integration with existing ERP systems

Round-the-clock processing support

In addition to these benefits, service providers also offer custom vendor payment solutions to meet your unique business needs.

Industries That Benefit from Accounts Payable Services

Accounts Payable Services are beneficial across all industries. Some of the sectors that benefit significantly include:

Retail & E-commerce: With thousands of invoices generated daily, automation via invoice processing services ensures speed and accuracy.

Healthcare: Managing supplier payments, medical equipment, and pharmaceutical bills through vendor payment solutions ensures uninterrupted services.

Manufacturing: Smooth accounts payable outsourcing services keep the supply chain moving by avoiding payment bottlenecks.

IT & Tech Services: Agile and scalable solutions help rapidly growing tech firms stay focused on core innovation.

Hospitality: Fast and accurate financial process outsourcing services keep operations running smoothly, especially in high-volume environments.

How Accounts Payable Services Boost Vendor Relationships

One often-overlooked benefit of Accounts Payable Services is the positive impact on vendor relationships. On-time payments, clear communication, and transparent reporting foster trust. Vendors are more likely to offer favorable terms, prioritize your business, and continue long-term partnerships.

Custom vendor payment solutions also help meet local and international vendor preferences, eliminating friction in cross-border transactions.

Choosing the Right Accounts Payable Services Provider

Selecting a reliable partner for your Accounts Payable Services is crucial. Here are some factors to consider:

Experience in financial process outsourcing

Technology-driven approach

Customizable invoice processing services

Robust data security and compliance standards

Client testimonials and case studies

Transparent pricing models

Ensure your provider can integrate seamlessly with your existing ERP or accounting system and offer scalable ‘accounts payable outsourcing services’ as your business grows.

Take the First Step Toward Efficiency

Managing payables in-house may seem manageable at first, but as your business grows, it becomes increasingly complex and prone to inefficiencies. By outsourcing to a trusted provider of Accounts Payable Services, you free up valuable time and resources to focus on your core business.

With professional invoice processing services, intelligent automation, and tailored ‘vendor payment solutions, you gain full control and visibility over your cash flow while minimizing risks and maximizing savings.

Get in Touch Today | Call Now +91-98997 70123

Don’t let manual processes hold your business back. Upgrade to world-class Accounts Payable Services that are fast, reliable, and fully secure. Whether you're looking for scalable accounts payable outsourcing services, real-time ‘financial process outsourcing, or simply need better “vendor payment solutions” we've got you covered.

📞 Call Now +91-98997 70123 to speak with our experts and get a free consultation.

Efficiently managed Accounts Payable Services are no longer optional — they are essential to business success. By leveraging accounts payable outsourcing services, businesses of all sizes can enjoy greater accuracy, faster processing times, and substantial cost savings. Add to that top-tier ‘invoice processing services, compliant ‘vendor payment solutions, and flexible financial process outsourcing, and you have a robust system that supports growth and stability.

Reach out today and let the experts handle your payables — because your time is too valuable to spend chasing invoices.

Visit Website: https://impenn.in/

Visit Website Page: https://impenn.in/accounts-payable-services.html

#Accounts Payable Services#accounts payable outsourcing services#invoice processing services#vendor payment solutions#financial process outsourcing

1 note

·

View note

Text

Best Tools & Techniques for Data Extraction from Multiple Sources

Data extraction is common and rapidly grown in the business landscape. As the technology advances, it is vital to update tools and techniques for best extracted outcomes. Read further in detail about tools and techniques for data extraction services.

#data extraction services#data scraping services#data extraction company#data digitization#web data extraction services#data extraction services india#data extraction companies#outsource data extraction#outsource data extraction services

3 notes

·

View notes

Text

Deep learning and Machine Learning: Key difference and real-world applications

Artificial Intelligence (AI) is rapidly reshaping industries, and two of its most impactful subsets -machine learning and deep learning - are at the heart of this transformation. As businesses race to integrate AI, many are turning to IT outsourcing partners to accelerate development, access skilled talent, and reduce operational costs.

Understanding the difference between machine learning and deep learning is essential for choosing the right solutions and maximizing AI’s value.

What is deep learning?

Deep learning is a specialized branch of machine learning that uses artificial neural networks -multi-layered structures modeled after the human brain. These networks can automatically learn to extract features from raw data, making deep learning ideal for analyzing complex, unstructured inputs like images, audio, and text.

Common applications include facial recognition, speech-to-text systems, autonomous vehicles, and real-time translation. Deep learning typically requires large datasets and powerful hardware but delivers unmatched accuracy in pattern recognition tasks.

What is machine learning?

Machine learning (ML) is a broader category within AI where systems learn from data to make decisions or predictions. Rather than being programmed with fixed rules, ML models learn patterns through experience - i.e., from training datasets.

ML includes several techniques:

Supervised learning: models learn from labeled data (e.g., classifying emails as spam or not).

Unsupervised learning: models find hidden patterns in unlabeled data (e.g., customer segmentation).

Reinforcement learning: systems learn optimal actions through trial and error (e.g., robotic control).

ML is widely used in fraud detection, sales forecasting, recommendation engines, and predictive analytics.

Key differences between deep machine and learning machine

Data Type:

Machine Learning works best with structured data (like tables and spreadsheets).

Deep Learning handles unstructured data (such as images, audio, and text).

Feature Extraction:

Machine Learning requires manual feature selection—humans decide which data is important.

Deep Learning automatically learns features from raw data.

Algorithm Complexity:

Machine Learning uses simpler models like decision trees or linear regression.

Deep Learning uses complex neural networks with many layers.

Data Requirements:

Machine Learning performs well with smaller datasets.

Deep Learning needs large datasets to achieve good results.

Hardware Needs:

Machine Learning runs efficiently on standard CPUs.

Deep Learning typically requires GPUs or specialized hardware.

Training Time:

Machine Learning trains faster due to simpler models.

Deep Learning takes longer to train because of its complexity.

Read the full article to explore more differences between deep machine and learning machine

Use cases

Machine Learning Use Cases

E-commerce: Personalized product recommendations.

Finance: Fraud detection and credit scoring.

Healthcare: Disease prediction and patient risk modeling.

Customer service: Smart chatbots powered by natural language processing.

Deep Learning Use Cases

Autonomous vehicles: Object detection, navigation, and decision-making.

Medical imaging: Identifying tumors or abnormalities in scans.

Voice assistants: Natural language understanding and speech recognition.

Translation tools: Real-time multilingual speech and text conversion.

Leveraging AI, Deep learning and machine learning with Kaopiz

As a trusted IT outsourcing company in Vietnam, Kaopiz specializes in building tailored AI solutions that incorporate both machine learning and deep learning technologies. With experience across industries like finance, healthcare, logistics, and education, Kaopiz helps businesses adopt AI efficiently and cost-effectively.

Why Partner with Kaopiz?

Custom AI Development: From predictive models to image recognition systems.

End-to-End Data Solutions: Data collection, cleaning, labeling, and pipeline setup.

AI Consulting: Guidance on choosing the right AI approach, evaluating feasibility, and planning implementation.

Scalable Teams: Dedicated developers, data scientists, and engineers with deep domain expertise.

Cloud Integration: AI deployment on AWS, Azure, or Google Cloud to ensure scalability and performance.

By outsourcing to Kaopiz, companies can accelerate AI projects, reduce R&D costs, and stay focused on their core business while leveraging cutting-edge technology.

Conclusion

Machine learning and deep learning are reshaping how businesses solve problems and make decisions. While machine learning is suited for structured data and traditional analytics, deep learning is ideal for complex tasks like image and speech recognition. Choosing the right approach depends on your data, goals, and project needs. With the right strategy, AI can drive innovation, efficiency, and real business value.

0 notes

Text

Inside Stellar Innovations Bangalore: A Glimpse Into the Tech Behind Mortgage Automation

Inside Stellar Innovations Bangalore - A Glimpse Into The Tech Behind Mortgage Automation

In the complex world of mortgage and title processing, efficiency, accuracy, and compliance are everything. For many companies, achieving all three without slowing down business is a daily challenge. This is where Stellar Innovations Bangalore stands out with its technology-first approach to streamlining the mortgage automation process.

Based in Bangalore, Stellar Innovations has developed proprietary platforms and intelligent automation tools that support lenders, servicers, title agencies, and insurance intermediaries. By integrating artificial intelligence, machine learning, and automation into the mortgage lifecycle, the company helps clients improve speed, accuracy, and operational flexibility all while maintaining data security and compliance.

What Sets Stellar Innovations Bangalore Apart?

Stellar Innovations is not a typical outsourcing company. It operates as a technology-driven enabler in the mortgage and title industry. Its Bangalore hub plays a pivotal role in developing and managing platforms that power automation across key mortgage processes from pre-approval to secondary market reviews.

The company has built proprietary systems that are purpose-driven and highly adaptable. These platforms allow clients to manage high volumes of document processing, validate data faster, and improve decision-making across the loan cycle.

Key Technologies Powering Mortgage Automation

Stellar Innovations Bangalore is home to several proprietary platforms designed to automate and optimize key stages of title and mortgage services.

1. Unidex Platform This platform supports the automated indexing and stacking of loan documents at scale. It currently processes 15,000 to 20,000 loan packages per day.

Identifies missing documents and flags issues in real time

Organizes packages for efficient review and submission

Enables extraction and validation of loan data

2. ULRS (Universal Loan Review System) ULRS goes beyond automation by applying business logic to loan files. It evaluates them against predefined guidelines and eligibility criteria.

Automates file reviews, credit assessments, and program eligibility checks

Deployed across underwriting, quality control, and due diligence

3. IDP (Intelligent Document Processing) Workflows Using AI and machine learning, Stellar has trained its IDP models to understand and validate mortgage document types with high accuracy.

Improves turnaround time

Reduces human error

Helps ensure compliance across the board

How Stellar Enhances The Mortgage Lifecycle

At every phase of the mortgage process, from application to closing, Stellar Innovations brings efficiency and precision through automation.

Loan Setup and Pre-Approval

Custom workflows assist in loan registration, submission reviews, and early data capture to reduce cycle time.

Underwriting

AI-powered solutions ensure that only qualified, complete loans are reviewed by underwriters reducing underwriting touches and boosting efficiency.

Post-Close and Due Diligence

Bulk onboarding capabilities allow lenders and servicers to validate large sets of loans quickly, reducing cost and ensuring accuracy before secondary market transactions.

Commitment To Security And Compliance

Stellar Innovations Bangalore ensures all automation tools meet rigorous data security and compliance standards. Tools are hosted in secure U.S.-based cloud environments or directly within client infrastructures. This allows for full control over sensitive data without sacrificing scalability or speed.

The platforms are also API-ready, making integration with loan origination systems (LOS) and document management systems seamless and efficient.

Results That Speak For Themselves

By deploying Stellar’s automation platforms, clients have experienced measurable improvements in both productivity and cost savings:

Underwriting touches reduced from 3–5 per loan to just 1–2

Operational costs lowered by up to 50% due to reduced manual labor

Loan manufacturing time and cost optimized, enabling higher throughput

Why Bangalore Is The Innovation Engine

The Bangalore team brings together engineers, mortgage experts, and data scientists who continuously improve and scale these platforms. The region’s tech ecosystem and talent pool make it the ideal hub for developing future-ready mortgage solutions.

The team’s collaborative approach and agile development cycles ensure quick deployment and adaptation to market changes or regulatory updates.

Conclusion

Stellar Innovations Bangalore is more than a development center it is the backbone of some of the most advanced automation in title and mortgage processing today. With platforms like Unidex and ULRS, supported by cutting-edge IDP workflows, the company is leading the transformation of legacy mortgage operations into intelligent, scalable digital ecosystems.

For businesses seeking reliability, speed, and compliance in a fast-evolving mortgage environment, Stellar Innovations’ Bangalore engine continues to offer solutions that are smart, secure, and built for the future.

Frequently Asked Quiestions

1. What Is The Role Of Stellar Innovations Bangalore In Mortgage Automation?

Stellar Innovations Bangalore develops and manages proprietary technology platforms that automate loan document processing, underwriting, and due diligence across the mortgage lifecycle.

2. Which Technologies Has Stellar Innovations Implemented For Mortgage And Title Processing?

Stellar has built platforms like Unidex for document indexing and ULRS for loan reviews, along with intelligent document processing (IDP) workflows powered by AI and ML.

3. How Does Automation From Stellar Innovations Improve The Mortgage Process?

Automation reduces underwriting touches, speeds up loan reviews, improves data accuracy, and lowers operational costs for lenders and servicers.

4. Is Stellar Innovations Bangalore Focused Only On Software Development?

No. The Bangalore team works on automation strategy, data modeling, document intelligence, and secure platform integration to support end-to-end mortgage solutions.

5. How Does Stellar Innovations Ensure Data Security And Compliance?

Stellar's tools are hosted securely in the U.S. or within client environments. The systems are built to meet regulatory standards and ensure full control over sensitive mortgage data.

0 notes

Text

Amazon Accounting Services: Full Support for Online Sellers

Key Takeaways:

Proper accounting helps Amazon sellers track profitability, prepare for taxes, and avoid cash flow problems.

Amazon accounting services offer specialized support tailored to the unique ecosystem of Amazon’s platform.

Services may include inventory tracking, sales reconciliation, tax prep, and financial forecasting.

Outsourcing saves time, prevents errors, and provides real-time financial insights.

Knowing when to hire an expert vs. doing it yourself is key to scaling smart.

Introduction: The Real Cost of Messy Books

Let’s be real—selling on Amazon can feel like riding a rollercoaster. One minute your product is flying off the shelves, the next you’re juggling returns, ad budgets, and inventory delays. Amidst the chaos, accounting often gets pushed to the back burner.

But here’s the thing: if you’re not keeping tabs on your numbers, you’re not truly in control of your business.

And no, accounting isn’t just some boring backend task. It's how you spot financial leaks, plan for growth, and, most importantly, pay yourself confidently. That’s where amazon accounting services come in.

Unlike general accounting, these services are designed to tackle Amazon’s unique challenges—like reconciling FBA fees, tracking sales tax, understanding your profit margins per SKU, and keeping your business compliant with IRS and state-level tax rules.

This guide breaks down what Amazon accounting services include, who needs them, and how they help sellers stay profitable—not just busy.

Chapter 1: Why Amazon Accounting Is Not Like Regular Bookkeeping

Most traditional bookkeepers aren’t built for eCommerce, let alone Amazon.

When you’re selling on Amazon, you’re not just dealing with basic income and expenses. You’re dealing with:

Marketplace fees

FBA storage costs

Refunds & reimbursements

Ad spend on Amazon PPC

Multiple SKUs and inventory levels

Daily sales across different regions

Each of these line items tells a story. But if you’re lumping everything into “miscellaneous” or “sales income,” you’re missing out on valuable insights.

Imagine trying to understand your business performance without separating PPC costs from returns. Or calculating profit while forgetting that FBA storage has quietly eaten into your margins. These are rookie mistakes that become costly fast.

An expert in amazon accounting services knows how to dig deep into Seller Central reports, extract meaningful data, and transform it into a clear picture of your store’s health.

Chapter 2: What Do Amazon Accounting Services Actually Include?

Not all accounting services are created equal—especially when it comes to selling on Amazon. The eCommerce space has its own set of rules, moving parts, and pressure points. You’re not just running a business; you’re navigating a platform with complex fee structures, intense competition, and constant changes. That’s why cookie-cutter bookkeeping won’t cut it.

The best Amazon accounting services aren’t just data-entry firms—they act like a financial co-pilot, helping you see what’s happening behind your sales figures and supporting your growth. Here’s what to look for in a service that truly understands the Amazon seller landscape:

1. Revenue Reconciliation

Amazon sends payouts every two weeks, but they rarely match up cleanly with your sales figures. Why? Because those deposits already subtract things like fees, returns, and reimbursements. If you’re just recording what hits your bank account, you’re missing the full picture. Proper revenue reconciliation compares your disbursements with actual sales, refunds, and Amazon’s long list of deductions—ensuring you’re reporting real income, not just deposits. This step is the foundation of accurate accounting.

2. Inventory Accounting

For Amazon sellers, inventory is everything. But tracking it goes way beyond knowing how many units are in stock. True inventory accounting includes calculating Cost of Goods Sold (COGS), understanding how Amazon’s storage fees affect your margins, and accounting for shrinkage or obsolete stock. If you’re not matching COGS to your revenue each month, your profits are probably overstated—or worse, you could be losing money and not even know it.

3. Expense Tracking

Sellers often underestimate how many costs quietly eat into their profits. From Amazon’s FBA and referral fees to subscriptions, shipping software, ad spend, product photography, and even office supplies—every expense matters. A proper accounting service categorizes these accurately, helping you deduct every allowable cost while showing you where you may be overspending.

4. Sales Tax Reporting

This is a hot mess if it’s not handled right. Marketplace facilitator laws mean Amazon now collects and remits sales tax in many states on your behalf—but not all. You still need to know where your business has “nexus,” how to register in those states, and what tax Amazon handles vs. what you're responsible for. A knowledgeable accounting service keeps this straight so you stay compliant and avoid nasty surprises.

5. Financial Statements

If you don’t know your numbers, you’re flying blind. Monthly or quarterly financial statements—like profit & loss reports, balance sheets, and cash flow statements—are essential tools. They show how your business is really doing, let you spot trends, and help you make better decisions. Amazon accounting pros provide these reports in plain English, not just accountant-speak.

6. Tax Preparation & Filing

When tax season hits, you don’t want to be digging through spreadsheets and PayPal records. A great service will help you file accurate quarterly estimates and prepare your year-end returns efficiently. The goal? Avoid overpaying, dodge penalties, and minimize the stress tax time usually brings.

7. Consultation & Strategy

Lastly, the best services go beyond the numbers. They act as advisors. That means helping you plan inventory cycles, price more competitively, navigate lending options, and even explore international marketplaces. With a skilled accounting partner, you can stop guessing and start scaling smart.

Chapter 3: The Risks of DIY Amazon Accounting

Doing your own books might feel like a good way to save money—until it costs you.

Here’s what usually goes wrong:

Missed tax deductions

Overpaying sales tax

Inaccurate profit calculations

Miscalculated inventory value

Confusing business vs. personal expenses

Audit triggers due to poor record-keeping

Most sellers aren’t trained accountants, and Amazon’s reports aren’t exactly plug-and-play for QuickBooks or Xero. Missteps lead to penalties, overpayments, or worse—burnout from trying to wear too many hats.

There’s nothing wrong with bootstrapping, but once you’re doing more than $10K/month in sales, outsourcing becomes not just smart—but necessary.

Chapter 4: How to Choose the Right Amazon Accounting Service

Not every accounting firm understands Amazon—and that matters.

What to look for:

Amazon-specific experience: Can they read your Settlement Reports and understand FBA reimbursements?

Tech integration: Do they connect with tools like A2X, QuickBooks, or Xero seamlessly?

Scalability: Will they grow with you as you expand into new marketplaces or sales channels?

Responsiveness: Will you get real human advice, or just cookie-cutter reports?

Data security: Make sure they follow strict data privacy and security standards.

Read reviews, ask for eCommerce client references, and don’t be afraid to quiz them about how Amazon’s fees work. A true expert will speak your language.

Chapter 5: Cost vs. Value—Is It Worth It?

On paper, Amazon accounting services might cost a few hundred dollars a month. But what do you gain?

Saved time (more hours to focus on growth)

Tax savings (smart categorization = better deductions)

Accurate inventory tracking

Cash flow clarity

Stress reduction (especially during tax season)

Peace of mind when an audit notice shows up

Think of it like hiring a mechanic. Could you fix the engine yourself? Maybe. But are you confident you won’t blow something up in the process?

Chapter 6: When to Bring In the Experts

Hiring an accountant might feel like something you only need after your business has taken off—but that mindset can cost you big. In reality, the earlier you invest in professional financial support, the easier it is to avoid costly mistakes, grow with confidence, and keep your sanity intact.

So, how do you know when it’s time to stop doing your books in a spreadsheet and bring in the pros?

Here are some telltale signs it’s time to consider expert help:

✅ You're Selling Over $10,000/Month

Once your revenue crosses five figures monthly, your financials get more complex—fast. There are more transactions, more fees, more opportunities for things to slip through the cracks. At this level, you're not just a hobbyist—you’re running a serious business, and the IRS will treat it that way too. Accurate bookkeeping and tax planning become critical. It’s no longer optional to “figure it out later.”

✅ You’ve Added Multiple SKUs or Marketplaces

Managing one product is simple enough. But once you start juggling multiple SKUs or expanding to other marketplaces (like Shopify, Walmart, or international Amazon sites), tracking COGS, fees, and profit margins by product or platform becomes a full-time job. And without proper systems, it's almost impossible to know what's working and what’s draining your time and cash.

✅ You’re Feeling Overwhelmed During Tax Season

If tax time feels like pulling an all-nighter with 200 browser tabs open, that’s a red flag. Scrambling to find receipts, guess at your income, or explain weird Amazon disbursements to a generalist CPA isn’t sustainable. A specialist in amazon accounting services can streamline this process—filing your taxes accurately while maximizing deductions you didn’t even know you could claim.

✅ You’re Unsure What Your Actual Profit Is

This one is huge. Many sellers confuse revenue with profit, or rely on their Amazon dashboard, which doesn’t paint the full picture. Between ad spend, product returns, platform fees, and hidden costs like inventory shrinkage, your "real" numbers might shock you. If you're not crystal clear on what you keep after everything is paid for, it's time to get expert eyes on your books.

✅ You Want to Make Data-Driven Decisions—But Don’t Trust Your Numbers

Thinking about launching a new product? Scaling up ad spend? Hiring a virtual assistant? These decisions should be driven by solid financial data—not gut instinct. But if your books are messy or outdated, it’s hard to know what you can afford. Clean, reliable reporting from a qualified accountant turns confusion into clarity, and fear into action.

Don’t Wait Until It’s a Mess

Most sellers wait too long. They bring in help when their books are already tangled, receipts are missing, and tax deadlines are looming. But the best time to start working with an accountant is before things get messy. Setting up clean, scalable systems from the beginning saves you time, money, and frustration down the road.

Whether you’re scaling fast or just tired of playing financial whack-a-mole, bringing in experts can be a game-changer. With the right support, you stop reacting—and start running your Amazon business with purpose.

Chapter 7: How It All Comes Together

With the right accounting support, you stop guessing and start leading. You’ll know what products are truly profitable, what expenses to cut, and when to double down on advertising.

And instead of dreading tax season, you’ll approach it with clarity, confidence, and maybe even a little smugness (it’s okay—we won’t tell).

Accounting doesn’t have to be your favorite part of running an Amazon store. But it can be the part that gives you the freedom to keep growing it.

Conclusion: Keep Your Head in the Numbers, Not in the Sand

At the end of the day, selling on Amazon isn’t just about moving products—it’s about building a business. And that business needs a strong financial foundation to survive and thrive.

Whether you’re just starting out or scaling past six figures, getting your finances in order will pay off tenfold. You’ll save time, reduce stress, and—most importantly—make smarter decisions.

Amazon accounting services aren’t a luxury; they’re a lifeline. So stop flying blind. Get the support you need, and keep more of what you earn.

FAQs About Amazon Accounting Services

1. Can’t I just use Amazon’s reports to do my bookkeeping?

You can, but Amazon’s reports are notoriously hard to read and don’t always tie together cleanly. A good accounting service will translate those raw data dumps into usable financial insights.

2. How much do Amazon accounting services cost?

It depends on your sales volume and service needs. Expect to pay anywhere from $150 to $750+ per month. Higher-volume sellers with inventory complexity will pay more.

3. Do I still need accounting software like QuickBooks?

Yes, most services integrate with tools like QuickBooks or Xero. These platforms serve as the home base for your financials, while the service handles the categorization and reconciliation.

4. What if I also sell on Shopify or Walmart?

No problem. Many Amazon-focused accounting firms also support multichannel sellers. Just make sure they have experience syncing all platforms into one clean reporting system.

5. Will they help me with taxes too?

Most do! They can help you file quarterly estimated taxes, prepare year-end returns, and stay compliant with IRS and state-level rules. Just be sure to clarify whether tax filing is included.

0 notes

Text

Outsourced image data entry services provide businesses with a streamlined solution for digitizing and organizing visual information. Experienced professionals extract, categorize, and enter data from images, enhancing data accuracy and saving time. This cost-effective approach boosts productivity and allows companies to focus on core tasks, ultimately improving data management and decision-making.

1 note

·

View note

Text

In today's fast-paced finance world, manual invoice processing is no longer viable. Leading accounting teams are transforming their operations with NetSuite Accounts Payable Automation, combining it with outsourcing accounts payable services and offshore accounts payable management to achieve efficiency, accuracy, and visibility—all while reducing costs.

1. Powerful Features: What Makes NetSuite AP Automation Stand Out

OCR Invoice Capture & E-Invoicing NetSuite converts paper or emailed invoices into digital data, using OCR to extract critical fields like vendor names, amounts, and dates.

Three-Way Matching & Rules-Based Approval Invoices are automatically matched to purchase orders and receipts, with built-in tolerance rules ensuring accurate payment approvals—reducing manual intervention .

Automated Approval Routing & Dashboards Invoices are routed to the right approvers with automated reminders, while live dashboards offer visibility into processing stages and spending patterns.

AI & RPA Enhancements NetSuite can refine OCR accuracy, suggest GL codes, flag anomalies, and trigger reminders—all powered by intelligent automation.

2. Key Benefits: Why It’s a Game Changer

Massive Cost and Time Savings AP teams often spend hours on manual data entry and processing. NetSuite automation reduces per-invoice time dramatically, often by 80–90%.

Improved Accuracy and Fraud Prevention Automated matching and exception handling help eliminate duplicate payments and reduce fraud risk.

Real-Time Visibility and Control Live dashboards provide instant insights into overdue invoices, liabilities, and cash flow needs .

Better Vendor Relationships Faster processing ensures on-time payments, which strengthen vendor trust and open the door to early-payment discounts.

Compliance and Secure Audit Trails Every step is logged—approvals, payments, access—supporting internal controls and audits.

3. Why Outsourcing Still Matters

You might wonder: If NetSuite automates AP, do we still need outsourcing? The answer is yes:

Complex Invoice Exceptions: Offshore AP teams can manage exceptions, vendor outreach, and multi-currency payments that software alone can’t handle.

Scaling Support: During growth or peak volumes, outsourcing ensures continuity without hiring overhead.

Expert Oversight: Seasoned providers like KMK Ventures can optimize your rules, monitor KPIs, and offer ongoing support.

Combining NetSuite automation with offshore AP services creates a powerful, scalable model.

4. Best Practices: Smooth NetSuite AP Implementation

Integrating NetSuite AP with offshore or internal teams requires care. Follow these best practices:

Secure Stakeholder Buy‑In Educate your team about how automation and offshore AP support improve efficiency and accuracy.

Appoint a Project Lead Designate someone to oversee implementation, workflows, vendor onboarding, and training .

Phase in Features Carefully Begin with OCR capture and invoice routing before layering in matching, remote staff, and exception rules.

Communicate with Vendors If using a portal, inform suppliers how to submit invoices and check statuses .

Integrate with Procurement Systems Sync PO issuance, approvals, and stock or service delivery processes for full end-to-end flow.

Secure Access and Data Enforce role-based permissions, encryption, and audit logs—especially when using offshore teams .

Monitor Key Metrics Track processing time, cost per invoice, exception rates, and discount capture to optimize performance.

Provide Training & Support Help your team and offshore partners understand NetSuite workflows through ongoing education.

Continuously Improve Enable monthly reviews and quarterly audits of processes, exceptions, and vendor feedback.

5. FAQs

Q: Can NetSuite AP automation and offshore teams work together? Absolutely. NetSuite covers automation, while offshore teams manage exceptions and vendor outreach—creating an efficient, hybrid model.

Q: Can small or mid-size businesses benefit? Yes. NetSuite’s automation features are scalable, and combining with offshore services gives SMEs enterprise-level AP capabilities.

Q: How soon will we see ROI? Most organizations begin saving time and reducing errors within the first 3–6 months of launching automation and offshore support.

6. Real-World Success: KMK Ventures + NetSuite

When a growing SMB using NetSuite partnered with KMK Ventures for offshore AP support, they combined automation with expert management:

Invoice processing time decreased by 70%

Error rates dropped below 2%

Early payment discounts increased, saving thousands

Internal staff were freed for strategic tasks

The result? Reliable AP, improved cash flow, and stronger vendor relationships.

Final Word: Unlock the Full Potential of AP

NetSuite Accounts Payable Automation is powerful on its own—but when paired with outsourcing accounts payable services and offshore AP management, it becomes transformative.

You gain:

Faster invoice processing

Cost reductions

Higher data accuracy

Insightful dashboards

Scalability

A strategic finance function

If you're ready for smarter, more efficient AP processes, consider NetSuite automation with offshore support from KMK Ventures.

📞 Contact KMK Ventures to explore NetSuite-enabled AP solutions tailored to your growth goals.

0 notes

Text

Data Verification Company | Data Validation Services | Damco Solutions

Ensuring data accuracy is crucial for businesses aiming to make informed decisions, reduce operational risks, and maintain customer trust. This service page offers a complete overview of Damco Solutions' data verification and validation services—designed to help organizations maintain data integrity across multiple channels.

Improved Decision Making Through Reliable and Cost-Effective Data Verification and Validation Services

Accurate and validated data leads to more confident decision-making and streamlined business processes. Damco’s services support businesses in verifying customer information, eliminating inconsistencies, and enhancing database reliability without straining internal resources.

Service Offerings

Damco delivers a wide range of specialized data validation services tailored to meet industry-specific needs:

Outsource Data Validation Services: Manual and automated checks to identify and fix data errors

Geo-Location Address Verification Services: Verifies physical address accuracy against official sources

Phone Verification Services: Validates mobile and landline numbers for active use

Email Address Validation Services: Ensures email addresses are accurate and deliverable

OCR Data Validation Services: Validates data extracted from scanned images and documents

Social Profile Verification: Confirms user identity by verifying social presence and credentials

Why Damco for Data Verification Services?

With years of experience and a global delivery model, Damco stands out as a trusted partner for scalable and secure data validation solutions.

Key benefits include:

High-quality, accurate data verification

Fast turnaround times for time-sensitive projects

Flexible, cost-effective pricing models

Scalable operations that grow with your business

Custom solutions aligned with your industry

Global delivery presence with local expertise

Share Your Project Requirements with Us!

Ensure data accuracy and reduce risks. Let Damco Solutions handle your data validation needs with confidence and efficiency.

Get in Touch: https://www.damcogroup.com/data-verification-and-validation-services

0 notes

Text

Benefits of Outsourcing Web Data Extraction Services

Data extraction services for businesses play a crucial role in gathering accurate data that can be used for multiple purposes to gain insights. Outsourcing web data extraction services by Uniquesdata can enhance the results of business analysis.

#data extraction services#data extraction company#web data extraction services#data extraction services india#data extraction companies#outsource data extraction#outsource data extraction services

2 notes

·

View notes