#payout solutions

Explore tagged Tumblr posts

Text

Is Payment Gateway Integration Suitable for Small Businesses?

In today’s rapidly evolving digital economy, small businesses are increasingly seeking efficient and scalable solutions to handle financial transactions. One of the most transformative tools available to them is payment gateway integration. But is it suitable for small businesses? The answer lies in understanding how this technology aligns with their operational needs, growth aspirations, and customer expectations.

What Is Payment Gateway Integration?

Payment gateway integration refers to the process of embedding a secure, digital payment processing system into a business’s online platform or point-of-sale system. This technology enables businesses to accept payments from customers through various channels, such as credit/debit cards, digital wallets, and bank transfers. By facilitating smooth and secure transactions, payment gateways ensure that both customers and merchants have a seamless experience.

For small businesses, integrating a payment gateway is not just a convenience; it’s becoming a necessity. The rise of e-commerce and digital payments has shifted consumer expectations, making it essential for even the smallest enterprises to provide flexible and secure payment options.

Benefits of Payment Gateway Integration for Small Businesses

Enhanced Customer Experience Payment gateway integration allows small businesses to offer their customers multiple payment options, including digital wallets, UPI, and net banking. This flexibility enhances the customer experience by making transactions quick and hassle-free.

Improved Security Payment gateways use advanced encryption and fraud detection technologies to ensure the security of customer data. For small businesses, this level of protection builds trust and encourages repeat business.

Streamlined Operations Integrating a payment gateway reduces the need for manual transaction management. Payments are processed automatically, minimizing errors and saving valuable time that can be redirected to other aspects of the business.

Global Reach A payment gateway enables small businesses to accept payments from international customers. This capability is particularly valuable for businesses looking to expand their market reach.

Cost-Effectiveness Modern payment gateway solutions often come with flexible pricing models that cater to the needs of small businesses. Some providers even offer pay-as-you-go plans, ensuring affordability for startups and smaller enterprises.

Payout Solutions: Simplifying Financial Management

One of the complementary services that often comes with payment gateway integration is payout solutions. Payout solutions allow businesses to automate payments to vendors, suppliers, and employees, streamlining the flow of funds. For small businesses, this functionality can significantly reduce administrative burdens and improve cash flow management.

By integrating payout solutions with payment gateways, small businesses can achieve end-to-end financial automation. This integration not only saves time but also provides transparency and accuracy in financial transactions. For example, a small business owner can use payout solutions to manage payroll, refunds, or vendor payments with just a few clicks.

Micro ATM: A Complementary Tool for Small Businesses

In addition to utility payment solutions technologies like Micro ATM are gaining popularity among small businesses. A Micro ATM is a portable device that allows merchants to accept card payments and provide basic banking services, such as cash withdrawals, to customers. This solution is particularly useful in areas where digital payment adoption is still growing and cash transactions remain prevalent.

Combining Micro ATM services with payment gateway integration provides small businesses with a comprehensive financial toolkit. While the gateway handles online payments, the Micro ATM ensures that businesses can cater to customers who prefer or rely on cash transactions. This dual approach bridges the gap between digital and traditional payment methods, making businesses more versatile and customer-friendly.

Challenges and Considerations

While payment gateway integration offers numerous benefits, small businesses must also be aware of potential challenges. These include:

Initial Setup Costs Although many payment gateway providers offer affordable plans, there can be initial setup costs associated with integrating the system into existing platforms.

Technical Expertise Small businesses may need assistance in integrating and maintaining a payment gateway. Partnering with a reliable technology provider can help overcome this hurdle.

Regulatory Compliance Businesses must ensure that their payment gateway complies with local and international regulations to avoid legal complications.

Choosing the Right Provider Not all payment gateways offer the same features or pricing models. Small businesses should carefully evaluate providers based on their specific needs.

Xettle Technologies: A Partner for Small Business Growth

One example of a provider catering to small businesses is Xettle Technologies. Xettle offers scalable payment gateway integration services along with advanced payout solutions. Their user-friendly platforms are designed to meet the unique challenges faced by small enterprises, ensuring a smooth and secure transaction experience. By choosing a partner like Xettle Technologies, small businesses can access reliable tools that support their growth and streamline their financial operations.

Conclusion

Payment gateway integration is not only suitable for small businesses but is increasingly becoming a cornerstone of their success. By providing secure, efficient, and flexible payment processing, gateways empower small enterprises to meet customer expectations, expand their market reach, and improve operational efficiency. When combined with technologies like payout solutions and Micro ATM, these tools offer a holistic approach to financial management.

While challenges exist, they can be mitigated by selecting the right provider and leveraging innovative solutions like those offered by Xettle Technologies. As digital payments continue to dominate the financial landscape, small businesses that embrace payment gateway integration will be well-positioned to thrive in a competitive market.

2 notes

·

View notes

Text

youtube

0 notes

Text

uh oh! the bad takes machine is on and set to "mad at how insurance works"

#if a property is uninsurable that is a sign to get the fuck out of dodge. government should absolutely help people relocate if their homes *#but insurance exists to protect against a certain level of risk#homes that are almost certain to burn or be swallowed by the ocean in the near future exceed that level by FAR#were those homes to be insured? at scale? one payout and the insurance company is done!#i'm no fan but their solvency is a macroeconomic issue#but the solution is eminent domain and resident relocation. sorry!

8 notes

·

View notes

Text

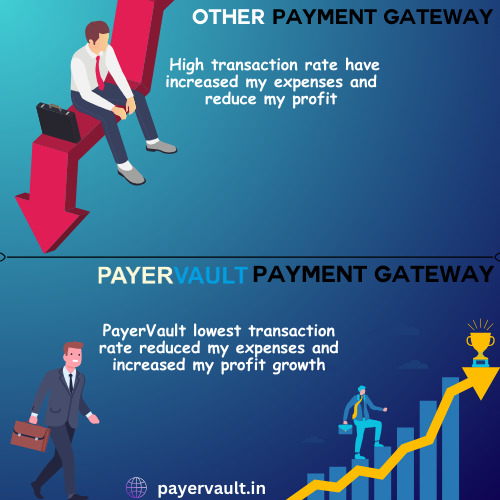

Ready to revolutionize your business's online transactions? Payervault offers seamless payment solutions at the lowest charges. Get started today! 💻💳 #Payervault #PaymentGateway #OnlineBusiness" Visit the website to learn more- https://payervault.in/

#finance#payments#payment solutions#business consulting#payment gateway#payment collection#paying#payouts#payment processing#payment services#payment systems#ecommerce#online#online shops offer#online store#online shopping#small business

3 notes

·

View notes

Text

Secure Virtual Bank Accounts for Global Enterprises | Routefusion

Routefusion offers secure virtual bank accounts, empowering global enterprises to streamline international transactions with ease. Manage multi-currency payments, simplify cross-border operations, and access global markets without the hassle of traditional banking. Our virtual accounts provide fast, secure, and reliable solutions, helping you save on fees while ensuring compliance with international regulations. Instantly open accounts in multiple currencies, pay vendors, receive payments, and manage global payroll effortlessly. With Routefusion, your enterprise gains the flexibility and security needed to thrive in today’s fast-paced global economy. Simplify your financial operations and grow globally with confidence using Routefusion’s virtual bank accounts.

0 notes

Text

Transforming Digital Financial Services & Solutions With Brokerage Payout Reconciliation

In the fast-paced world of finance, accuracy and efficiency are paramount. As the banking and financial sectors continue to evolve, the demand for robust Digital Financial Services & Solutions has surged. Institutions are constantly seeking tools that streamline processes, enhance accuracy and minimize errors. A critical component in this ecosystem is brokerage payout reconciliation, a vital process for brokerages and financial institutions to ensure transparent, accurate payouts to brokers and other stakeholders.

Importance Of Digital Financial Services & Solutions

Digital Financial Services & Solutions encompass a range of tools and software that help institutions operate smoothly and meet regulatory requirements. In today's environment, financial institutions are handling enormous volumes of transactions daily, which demands precise data management and reconciliation processes. Effective solutions not only optimize operations but also enhance customer satisfaction by ensuring faster and more accurate processing. For brokerages, implementing reliable payout reconciliation tools is essential to maintain accuracy, transparency and regulatory compliance.

The rise in online and mobile banking has further highlighted the importance of secure, scalable banking solutions. These tools help banks and financial institutions manage risks, track transactions and ensure data security. As technology advances, firms like Winsoft are playing a crucial role in equipping financial institutions with the solutions they need to thrive.

The Role Of Brokerage Payout Reconciliation

One of the essential aspects of financial management in brokerage firms is brokerage payout reconciliation. This process involves tracking, calculating and verifying payments due to brokers. Brokerage payout reconciliation ensures that every payout is correctly accounted for, reflecting accurate earnings based on transactions, commissions and other fees. Given the high transaction volume and the need for compliance, an automated, secure reconciliation process is invaluable for brokers and financial managers.

Errors in payout calculations can lead to serious financial losses and strained relationships between firms and brokers. Efficient reconciliation tools reduce these risks, automating calculations and minimizing the possibility of human error. For firms managing large-scale transactions, automation is essential, allowing companies to streamline and expedite the reconciliation process, maintain accuracy and ensure compliance with financial regulations.

Winsoft: Leading The Way In Digital Financial Services & Solutions

Winsoft Technologies is a prominent provider of Digital Financial Services & Solutions that cater to the needs of the BFSI (Banking, Financial Services and Insurance) sector. With decades of experience, Winsoft offers a comprehensive suite of products designed to optimize financial operations. Their solutions include tools for digital transformation, cloud applications and robust reconciliation processes.

For brokerage firms, Winsoft’s brokerage payout reconciliation tools provide an ideal solution. These tools are designed to ensure precision in calculating broker commissions, account for multiple revenue streams and manage payouts efficiently. Winsoft’s tools leverage automation to simplify the reconciliation process, reduce errors and allow financial institutions to focus on growth and customer satisfaction.

Benefits Of Winsoft's Solutions

By implementing Winsoft’s advanced solutions, financial institutions can achieve the following:

Enhanced Accuracy: Automated calculations reduce the risk of errors in complex transactions, ensuring accurate payouts for brokers.

Time Efficiency: Automation speeds up the payout reconciliation process, reducing the time needed to manage financial transactions and allowing institutions to operate smoothly.

Regulatory Compliance: Winsoft’s tools are designed to adhere to regulatory standards, helping institutions remain compliant with evolving financial regulations.

Customer Satisfaction: Accurate and timely reconciliations lead to satisfied brokers and clients, fostering trust and long-term relationships.

Winsoft's commitment to innovation and security makes it a reliable partner for firms looking to stay competitive in the modern financial landscape. With a customer-centric approach, Winsoft continuously adapts its solutions to meet the dynamic needs of the financial industry.

Conclusion

As the banking and financial sectors evolve, reliable Digital Financial Services & Solutions are becoming essential for institutions to remain competitive. Effective brokerage payout reconciliation is vital for brokerages seeking transparency and efficiency in managing payouts. Providers like Winsoft Technologies play an instrumental role in delivering these advanced solutions, allowing financial institutions to operate seamlessly, minimize errors and maintain compliance. With Winsoft’s tools, financial institutions can confidently navigate the complexities of the modern financial landscape, ensuring accuracy, trust and satisfaction across all transactions.

0 notes

Text

Who Can Join a Company's Affiliate Program?

Affiliate programs are a popular way for companies to expand their reach and boost sales through partnerships. But who exactly can join these programs? Understanding the criteria can help potential affiliates determine if they qualify and how they can benefit from affiliate program payouts.

General Eligibility

In most cases, anyone with an online presence can join a company's affiliate program. This includes bloggers, influencers, content creators and website owners. Companies are often looking for affiliates who have a relevant audience and the ability to promote products or services effectively. The key is to align your content or platform with the company’s offerings. For instance, a fashion blog would be a good fit for a clothing brand’s affiliate program.

Requirements and Application Process

While many affiliate programs have broad eligibility, they may still have specific requirements. Companies might look for affiliates with a certain number of followers or traffic on their platforms. The application process usually involves filling out an online form where you provide details about your website or social media channels and how you plan to promote the company’s products.

Understanding These Programs

One important aspect of joining an affiliate program is understanding how affiliate programs payouts work. Affiliates earn commissions based on their performance, such as sales or leads generated through their referral links. Payout structures vary, with some programs offering fixed commissions and others providing tiered rates based on performance. Make sure to review the payout terms and conditions to understand how and when you will receive your earnings.

In conclusion, joining a company’s affiliate program is accessible to a wide range of individuals, provided they meet the specific criteria set by the company. By understanding the requirements and payout structures, potential affiliates can make informed decisions and optimize their earnings through affiliate programs payouts.

Read a similar article about paying international contractors here at this page.

0 notes

Text

Explore DataNimbus for secure data storage, collaboration, and analytics.

0 notes

Text

Why Having a Transparent Chanel Payout Helps Thrive Business?

Transactions have also changed the way businesses operate in the modern digital age. In the era of e-commerce, digital services, and global commerce, there is a growing demand for simple, secure, and transparent channel payout. In this environment, a solution that allows users to design and create online payment forms that match what Account Mein and similar platforms offer has become a game-changer.

It's about more than just making payments easier for businesses and individuals. However, we also value transparency, which is essential for both parties. So, first, let's understand what a clear payment system is. We will also explore the importance of transparent payments and why they have become an essential part of any business with a digital presence.

Building a relationship of trust with Employees

Payment transparency is at the heart of a relationship based on trust. Employees know what to expect when it comes to payments, fees, and security measures, so they can trust your business more and buy with confidence. A fair system clearly communicates what will happen at each step, including the price (to avoid hidden or surprise charges).

This clarity builds trust and fosters loyalty.

Reduced the number of disputes and chargebacks

One of the main causes of credit card disputes and chargebacks is the need for clearer transaction flows. Untrustworthy Employees are more likely to dispute transactions because they need to know the details of the items they purchased or how their charges were calculated. Additionally, a transparent payment system with a visible transaction summary significantly minimizes the likelihood of such charges occurring, saving both companies valuable time.

Enhanced security

Transparent payment systems are generally more secure than opaque (invisible) systems. Transparency in security measures helps companies minimize or prevent fraud. When Employeesare aware of the security measures, they know that their information cannot be misused, and by taking such security measures, they can protect their data and thus improve the overall security of the system.

Compliance help

Increasing scrutiny of opaque transfers has led regulators around the world to introduce new limits on non-cash payments. When companies use clear systems and talk openly about their systems, they can comply with local and global laws and legally avoid problems and fees. Improve company reputation Information is king: In today's world, Employees are educated and researched before working at a company. Companies that strive to be transparent about their payment structures are better perceived and considered to be more serious. A good reputation can primarily attract new Employees , attract more referrals, and ultimately bring more revenue to your organization.

Provide a competitive advantage.

For companies operating in mature markets, open payment systems can differentiate them from their competitors. Clear transactions are much more likely to be selected by Employees than unclear transactions. Transparency allows businesses to stand out from their competitors and attract more Employees to work with you.

Simplify financial management

Transparent payment systems give businesses a clear view of their financial transactions. This level of clarity simplifies accounting, makes budgeting smarter and more predictable, and helps companies make smarter decisions and plan for the future.

Improving customer experience

Increase customer satisfaction with transparent and easy-to-use payments. A clear checkout process is one element that can improve your checkout process and increase purchase completion rates while reducing cart abandonment.

Accelerate digital adoption

For those still hesitant about transacting online, transparency could be the key to boosting digital adoption. When users can see every step of the process, they are more likely to switch from traditional payment methods to digital payment methods. Reduce operational costs

Transparent systems often eliminate the need for intermediaries and third-party services that can charge additional fees. By streamlining this process, businesses can reduce operational costs associated with payment processing. conclusion

The multifaceted benefits of transparent payment systems highlight their important role in the modern world of digital commerce. These not only simplify transaction processes but also impact business practices, collaboration, and broader consumer behavior. As the digital world continues to evolve, transparency will become increasingly important, and companies that embrace this trend will be industry leaders. After all, a transparent approach to payments is more than just a strategic business decision. It is the pursuit of clarity, fairness, and mutual respect between companies and their valued Employees.

0 notes

Text

Payout solution provider in India | Zyro Noida

seamless payouts with Zyro Noida, your trusted payout solution provider in India. Our innovative services streamline financial transactions for businesses, ensuring efficiency and reliability. Explore our tailored solutions today.

For more information visit our website: www.zyro.in/blog

0 notes

Text

What are Payout Solutions and How Do They Simplify Business Payments?

In today’s rapidly evolving financial landscape, businesses are constantly looking for efficient, reliable, and cost-effective ways to manage payments. Whether it’s paying employees, suppliers, or customers, seamless and error-free payment processes are critical for operational success. This is where payout solutions come into play. A payout solution is an advanced payment processing system that automates and simplifies bulk payments, ensuring businesses can send funds securely and quickly.

What are Payout Solutions?

Payout solutions refer to platforms or systems that enable businesses to distribute payments to multiple beneficiaries seamlessly and efficiently. These beneficiaries can include employees, vendors, freelancers, customers, or even stakeholders. By leveraging modern technology, payout solutions allow businesses to process bulk payments through a single interface, eliminating manual processes and reducing the chances of errors.

Payout solutions are particularly essential for businesses that deal with large volumes of transactions daily. Sectors such as e-commerce, fintech, gig economy platforms, and other industries rely heavily on streamlined payout systems to ensure their financial operations run smoothly.

For example, companies can use a payout solution to disburse salaries, refunds, commissions, incentives, or vendor payments at scale with minimal human intervention.

How Do Payout Solutions Work?

A payout solution works as a bridge between a business and its payment recipients. It integrates with the business’s financial system or software and streamlines the process of transferring funds. Here’s a step-by-step breakdown of how payout solutions operate:

Integration: The payout system integrates with the business’s existing financial software or banking platform to access required data, such as payment amounts and recipient details.

Bulk Upload: Businesses upload payment details, including beneficiary names, account information, and amounts, into the platform. This can often be done via a file upload or API integration.

Payment Processing: The payout solution processes the payments using multiple payment modes, such as bank transfers, UPI, NEFT, IMPS, wallets, or card-based systems.

Verification and Approval: Before releasing funds, the system verifies all recipient details to avoid errors or payment failures. Businesses can also set up approval workflows to ensure security and compliance.

Disbursement: Payments are disbursed instantly or as scheduled, depending on the system’s configuration and business requirements.

Notifications: Once payments are completed, recipients are notified via email, SMS, or other communication channels. Additionally, businesses receive confirmation reports to maintain records.

How Payout Solutions Simplify Business Payments

Payout solutions offer a variety of features that help businesses simplify their payment processes. Some of the key benefits include:

Automation of Payments One of the most significant advantages of payout solutions is automation. Businesses no longer need to process payments manually, which can be time-consuming and prone to errors. Automated solutions allow bulk payments to be processed quickly and accurately.

Multiple Payment Modes Modern payout systems provide businesses with flexibility by supporting various payment methods, including bank transfers, UPI, mobile wallets, and more. This ensures payments can be sent according to the preferences of recipients.

Real-Time Processing Traditional payment methods often involve delays, especially when dealing with bulk transactions. Payout solutions offer real-time or near-instant payment processing, ensuring recipients receive funds promptly.

Cost and Time Efficiency Manual payment processes require significant time and resources, leading to operational inefficiencies. By using a payout solution, businesses can reduce administrative costs and save valuable time that can be allocated to core operations.

Improved Accuracy and Security Errors in payment processing can cause delays, mistrust, and additional costs. Payout solutions use robust verification mechanisms to minimize errors and enhance security. Additionally, many systems comply with financial regulations, ensuring safe transactions.

Seamless Reconciliation Payout solutions simplify the reconciliation of payments by providing detailed transaction records and reports. Businesses can easily track completed, pending, or failed transactions, making financial management more transparent and organized.

Enhanced Customer and Vendor Experience Fast and error-free payments improve the overall experience for customers, vendors, and employees. For instance, e-commerce platforms can use payout systems to ensure quick refunds, leading to improved customer satisfaction and loyalty.

Payment Solution Providers and Their Role

Payment solution providers play a crucial role in the success of payout systems. These providers offer the technology and infrastructure needed for businesses to handle complex payment processes efficiently. By offering robust platforms, they enable organizations to send bulk payments with speed, accuracy, and security.

Companies like Xettle Technologies are leading players in the payout solutions ecosystem. They provide advanced payout platforms designed to cater to businesses of all sizes, ensuring streamlined payment operations and financial management. With such providers, businesses can focus on growth while leaving their payment challenges to trusted experts.

Key Industries Benefiting from Payout Solutions

Several industries rely heavily on payout solutions to manage their financial operations, including:

E-commerce: Automating refunds, vendor payments, and cashbacks.

Fintech: Handling instant disbursements for loans and digital wallets.

Gig Economy Platforms: Paying freelancers, contractors, and service providers seamlessly.

Insurance: Disbursing claim settlements quickly to enhance customer trust.

Corporate Sector: Managing salaries, incentives, and reimbursements.

Conclusion

Payout solutions have revolutionized the way businesses manage their financial transactions. By automating and simplifying payment processes, businesses can save time, reduce costs, and improve accuracy while ensuring recipients receive funds promptly. Whether it’s paying employees, vendors, or customers, payout solutions offer a scalable and secure way to handle bulk payments effortlessly.

As payment solution providers like Xettle Technologies continue to innovate, businesses can look forward to more efficient and seamless financial operations. For organizations aiming to streamline their payouts, adopting a reliable payout solution is a step toward achieving operational excellence and enhanced financial management.

2 notes

·

View notes

Text

Payment service provider in India | Payout solution provider in india | Zyro

Discover seamless financial solutions with Zyro, your trusted payment service provider and payout solution provider in India. Streamline your transactions with our innovative platform, offering secure and efficient payment processing tailored to the unique needs of businesses in the Indian market.

For more information visit our website: www.zyro.in/blog

#best financial sevice provider#best payment service provider#best payout solution provider in india

0 notes

Text

Simplifying Restaurant Payments: Payout Services for Maximum Efficiency

Running a restaurant is a fast-paced, high-pressure job where every moment matters. From serving customers to managing staff and tracking inventory, restaurant owners are constantly juggling multiple tasks. Among all these responsibilities, managing finances—especially payroll and vendor payments—can quickly become overwhelming. This is where a Payout Service Provider in India can make a difference. These services streamline and automate payment processes, allowing restaurant owners to save time, reduce errors, and ensure their business runs efficiently.

The Financial Struggles Restaurants Face

Running a restaurant involves complex financial management. From paying salaries to settling bills with vendors, handling payments can be a time-consuming task. Traditional methods of managing payouts—such as manually processing payments through banks, handling cash, or writing checks—are not only labour-intensive but also prone to delays and errors. These delays can lead to unhappy employees, disgruntled suppliers, and disrupted operations.

In an industry where cash flow is crucial and every transaction impacts the bottom line, restaurant owners need a more efficient solution. That’s where payout services come in to transform how financial processes are handled.

What Are Payout Services?

In the context of restaurants, these services automate salary disbursements, vendor payments, and expense tracking, all through a secure, user-friendly online platform. With just a few clicks, restaurant owners can manage financial operations without the headache of paperwork or manual processes.

Benefits of Payout Services for Restaurants

Here are some of the key reasons why restaurants should consider implementing payout services:

1. Timely Salary Disbursement

One of the most critical aspects of running a restaurant is ensuring your staff is paid on time. Whether it’s the kitchen staff, servers, or management, paying employees promptly helps maintain morale and reduce turnover. Payout services automate salary disbursements, ensuring that employees are paid consistently and on time, without any manual intervention. This automation not only saves time but also prevents errors that can arise from manual payroll processing.

2. Effortless Vendor Management

From fresh produce to beverages and kitchen supplies, restaurants rely heavily on suppliers. Maintaining a good relationship with vendors is crucial for the smooth running of the business. Payout services make it easy to manage and track vendor payments, ensuring that suppliers are paid on time, without the need for follow-up emails or late fees. Automated payments also allow restaurant owners to focus more on their core business rather than spending valuable time managing payments.

3. Simplified Expense Tracking

Tracking restaurant expenses can be a nightmare, especially when dealing with multiple suppliers, daily operational costs, and varying pricing structures. Payout services offer detailed reports and intuitive tools to track every rupee spent. Whether you need to review your monthly spend on dairy products or assess the overall expenditure on ingredients, these services give restaurant owners complete visibility into their finances, allowing for better budgeting and cost control.

4. Reduced Administrative Burden

Restaurant owners often find themselves bogged down with administrative tasks, leaving little time to focus on the day-to-day operations. Payout services eliminate the need for manual payment processes, reducing the administrative burden on restaurant managers. The time saved can be invested in other critical areas, such as improving customer service, enhancing the menu, or training staff.

5. Improved Cash Flow Management

Effective cash flow management is vital for any restaurant’s survival. Payout services help restaurants optimise cash flow by automating and scheduling payments, ensuring that outflows are made in a timely manner. Automated payments help avoid late fees, penalties, and disruptions in operations, providing owners with a clearer picture of their financial health and allowing for better decision-making.

How Payout Services Work for Restaurants

Getting started with payout services is relatively easy. Restaurant owners simply sign up for a digital payout platform, link their business bank accounts, and set up payment schedules. Payments can be scheduled on a weekly or monthly basis, depending on the restaurant’s needs. These platforms are designed to be user-friendly, allowing restaurant managers to make payments and track expenses in real time from their mobile devices or computers.

Once set up, restaurant owners can easily disburse salaries, pay vendors, and monitor all financial transactions without the hassle of traditional banking systems. These platforms also provide notifications and reminders, so you never miss a payment deadline.

Conclusion

For restaurant owners looking to streamline their operations, payout services from Online Payment Service Providers in India are a game-changer. From timely salary disbursements to effortless vendor management and detailed expense tracking, these services help restaurants stay on top of their finances while saving valuable time. With automated, secure payment processes, restaurant owners can focus on what they do best—creating great food and delivering an unforgettable dining experience to their customers.

If you're a restaurant owner looking to simplify your financial operations, it’s time to consider using payout services. They offer the tools you need to run your business more efficiently, reduce financial stress, and keep your employees and vendors happy.

0 notes

Text

Crypto Payouts Solution Los Angeles - Rocket Fuel

Rocket Fuel Inc. provides the best crypto payouts solution Los Angeles. With crypto payouts, merchants can pay their customers in Bitcoin, Ethereum, and other cryptocurrencies, without the risk of having their bank accounts shut down. Learn more about how Rocket Fuel can help you accept crypto payments solution Los Angeles.

0 notes

Text

Efficient Payment Collection can

Maximize your E-commerce Profits

Unlock the potential of your e-commerce venture! Dive into a real-world success story that reveals the transformative power of streamlined payment collection.

🌟 Case Study:

Meet 'E-Shop India,' an Indian e-commerce startup that achieved a remarkable 30% boost in revenue within a mere three months. The catalyst for this growth? PayerVault, India's leading payment collection API. Explore how this innovative solution transformed their financial operations.

🔑 Key Insights:

Discover the direct impact of efficient payment collection on revenue growth.

Learn how offering diverse payment methods can lead to higher conversion rates.

Get the facts with data-driven insights.

Witness a shift from payment hassles to customer convenience.

🚀 Take your e-commerce business to new heights! Unleash the potential of PayerVault's payment collection solutions and pave the way for revenue growth.

🔗 Read the Full Story: Link to the Case Study

#PaymentCollection #EcommerceSuccess #PayerVault #CaseStudy #RevenueBoost"

#ecommerce#online store#paying#payment gateway#payments#payouts#payment systems#payment processing#small business#online#payment collection#business growth#sales#shopify#onlinebusiness#ecommerce solutions#ecommerce software development#ecommerce store#payervault#online payment systems#online payment gateway#digital transformation#digital payment solution#payout#payment services#businesses#business#high risk merchant account#high risk payment gateway

0 notes

Text

Scale Globally with Foreign Currency Accounts Tailored for You | Routefusion

Expand your business without limits using Routefusion’s customized foreign currency accounts. Designed for businesses aiming to grow internationally, our accounts let you manage multiple currencies seamlessly, reduce exchange rate risks, and simplify cross-border transactions. Whether you're paying global vendors, receiving international payments, or managing payroll in different countries, Routefusion ensures fast, secure, and cost-effective solutions. Enjoy competitive exchange rates, easy account setup, and full transparency, all while maintaining control over your global finances. Scale your operations effortlessly and take your business to the next level with Routefusion's trusted foreign currency account solutions.

0 notes