#safe & secure method

Explore tagged Tumblr posts

Text

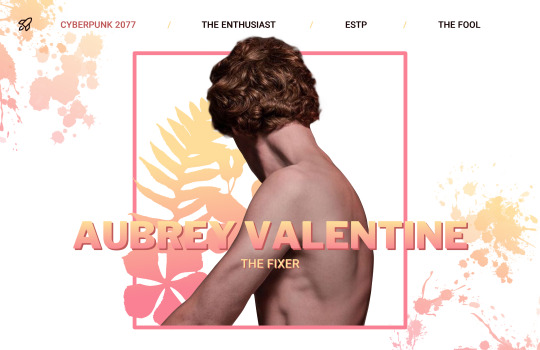

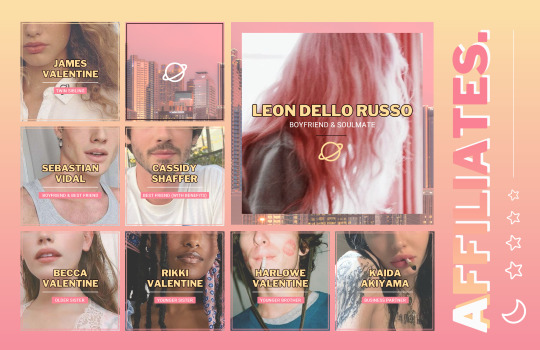

Of course Aubrey had heard of the Council before. I mean– who hadn’t? They didn’t necessarily rule the streets, or Night City’s underworld for that matter, but they sure as hell loved to rub their asses all over it at any given opportunity and never in his years of being a fixer himself had he felt the need to associate himself with any of them. He understood why it was necessary, sure– the agreements they made and the city-wide gang activity they monitored and reported to one another were a vital part of ensuring business stability as well as their own survival– but he knew the biz well enough to not trust the feigned kindness and so-called sense of community they supposedly aimed for. Everyone always had their own agenda. None of it was simply out of the kindness of their hearts, to ensure the safety of the innocent citizens of Night City– it would be naive of him to think so and by then he knew better than to let wishful thinking cloud his judgment.

taglist (opt in/out): @shellibisshe, @florbelles, @ncytiri, @hibernationsuit, @stars-of-the-heart, @vvanessaives, @katsigian, @radioactiveshitstorm, @estevnys, @adelaidedrubman, @celticwoman, @rindemption, @carlosoliveiraa, @noirapocalypto, @dickytwister, @dameaylin, @killerspinal, @euryalex, @ri-a-rose

#cp2077#edit:aubrey#nuclearocs#nuclearedits#SEB AND LEON BELONG TO RED REAPERKILLER BY THE WAY IF YOU EVEN CARE#the writing is from a work in progress fic in which aubrey meets vitali!! it happens all the way in 2083 LMAO#aubrey as a fixer is so interesting to think about because he's essentially as good of an employer as vitali is#but his methods are SO different. he's a lot less serious and it's all about a good atmosphere for him#whereas vitali is a lot more professional and likes a more serious approach so he's able to keep his mercs fully safe and secure#aubrey also values their safety but he accepts death as part of the job description a lot better than vitali does usually#mercenaries know the risks and aubrey can do his best to give them the means to protect themselves properly#but if they die they die y'know. not much else to do about that. it can keep him up at night but he wouldn't spiral like vitali would#also the affiliations slide was like trench warfare to me but i won are you proud of me. it looks so FUN

43 notes

·

View notes

Text

Low-Risk Trading Strategies for 2025: Why Arbitrage is the Smart Money Move

In an increasingly volatile and fast-paced financial landscape, both seasoned investors and new traders are constantly on the lookout for low-risk strategies that don’t just preserve capital but also deliver consistent, meaningful returns. With rising interest rates, geopolitical uncertainty, and unpredictable market swings, relying solely on traditional long-term investing or speculative momentum plays can expose portfolios to undue risk.

While flashy day trading tactics and high-frequency algorithms tend to dominate headlines, one method has quietly emerged as a favorite among institutional players and sophisticated retail investors alike: arbitrage trading. This time-tested strategy, rooted in logic and mathematics, focuses on identifying pricing inefficiencies across markets offering a market-neutral approach to generate profits with minimal downside.

Unlike speculative trades that depend on market direction, arbitrage trading strategies are designed to work regardless of whether stocks, bonds, or commodities go up or down. This makes arbitrage particularly appealing in 2025 as investors search for smart trading ideas that reduce exposure to volatility without compromising on returns.

In this article, we’ll dive into how arbitrage works, why it’s the smart money move, and how modern traders are using it as a low risk trading strategy to achieve stable, risk-adjusted gains in today’s complex market environment.

What Is Arbitrage Trading?

Arbitrage trading is a classic and widely respected low-risk strategy that involves simultaneously buying and selling the same or highly similar financial instruments across different markets or platforms to profit from price discrepancies. These pricing gaps, often small and short-lived, arise due to inefficiencies between global exchanges, latency in data transmission, or market supply-demand mismatches.

The primary objective of arbitrage is simple: buy low in one market and sell high in another, ideally at the same moment. This method ensures minimal directional risk, making it one of the most reliable trading ideas for investors who prioritize capital preservation alongside steady returns.

Real-World Example of Arbitrage

Imagine Stock X is trading at $100 on the New York Stock Exchange (NYSE) and simultaneously at $101 on the London Stock Exchange (LSE). A trader could purchase 1,000 shares on the NYSE and sell them on the LSE, capturing a $1 per share profit totaling $1,000 in near-instant, low-risk profit, minus fees.

This style of arbitrage trading is used extensively by hedge funds, proprietary trading desks, and increasingly, individual traders with access to multi-market platforms and algorithmic tools.

Fun Fact: Arbitrage opportunities typically last only seconds or minutes, so fast execution and real-time market data are essential. Platforms like Radiant Global Fund provide institutional-grade access for serious traders.

Common Types of Arbitrage Trading Strategies

The beauty of arbitrage lies in its diversity. Traders can deploy a range of arbitrage strategies across asset classes, exchanges, and financial products. Here are the most popular types:

1. Spatial Arbitrage

Also known as geographical arbitrage, this strategy involves buying an asset in one market and simultaneously selling it in another where it’s priced higher. This is common in forex trading, cryptocurrency markets, and commodity trading.

2. Statistical Arbitrage

In this quant-heavy strategy, traders use complex mathematical models and historical data to identify pricing anomalies between correlated assets. Algorithms automatically execute trades when statistical deviations from the norm occur.

Best suited for: Quant funds and algo traders

3. Convertible Arbitrage

This involves taking a long position in a convertible bond and a short position in the issuer's common stock. The goal is to capitalize on pricing inefficiencies between the bond and the underlying equity, often in a hedged, market-neutral setup.

4. Index Arbitrage

This form of arbitrage targets differences between the price of a stock index futures contract (like the S&P 500) and the underlying basket of stocks that compose it. Traders exploit temporary misalignments using basket trading algorithms.

Often used by: Institutional arbitrage desks during high volatility or news-driven sessions.

5. Merger Arbitrage

Also called risk arbitrage, this strategy centers on companies involved in mergers or acquisitions. Traders buy the target company's stock and short the acquirer’s stock to profit from the spread between the current price and the expected acquisition price.

Example: If Company A announces it will acquire Company B for $50/share and B is trading at $47, an arbitrageur might buy B expecting the deal to close and lock in the $3 spread. Why Arbitrage Is a Top Low-Risk Strategy in 2025

As traders seek low-risk trading strategies to navigate an increasingly unpredictable market, arbitrage trading continues to stand out for its precision, neutrality, and resilience. In 2025, arbitrage isn’t just a niche strategyit’s a core component of how smart money safeguards returns while minimizing downside exposure.

Here’s why arbitrage is one of the smartest trading ideas for capital preservation and steady growth:

1. Market-Neutral Positioning

Unlike trend-based trading or speculative bets, arbitrage strategies don’t depend on whether markets rise or fall. Arbitrageurs profit by exploiting price inefficiencies between related instruments, markets, or timeframes. This independence from market direction makes arbitrage a true market-neutral strategy highly valuable in environments marked by geopolitical risk, inflation uncertainty, or central bank surprises.

Example: Whether the S&P 500 rallies 10% or drops 5%, a well-structured statistical arbitrage or index arbitrage trade may still deliver profit, as it’s designed to capitalize on relative mispricings, not trends.

2. Reduced Volatility Exposure

Volatility can be both opportunity and risk but for most conservative or institutional investors, limiting drawdowns is crucial. Arbitrage naturally buffers against wild price swings because positions are simultaneously hedged. Losses in one leg (e.g., a long position) are offset by gains in the corresponding short leg, reducing net exposure.

This makes arbitrage trading especially appealing when compared to high-risk strategies like naked options or momentum scalping.

3. Reliable Risk-Adjusted Returns

While arbitrage trading rarely delivers explosive returns, it shines in consistency and risk-adjusted performance. For institutional investors, hedge funds, family offices, and capital preservation-focused individuals, generating a steady 4-8% annual return with low volatility is often more attractive than chasing 20% gains with massive downside risk.

In fact, many quant funds and arbitrage-focused strategies rank among the most stable performers during market corrections, bear cycles, and liquidity crunches.

4. Global Arbitrage Opportunities

The world has become a highly interconnected marketplace. Thanks to globalization, cross-border capital flows, and fragmented liquidity, arbitrage opportunities exist across:

Equity markets (dual-listed stocks)

Bond markets (sovereign vs corporate spreads)

Cryptocurrency platforms (price spreads on BTC, ETH)

Currency pairs (forex triangular arbitrage)

Derivatives (index arbitrage, futures mispricings)

In 2025, traders equipped with multi-market access, low-latency execution, and AI-driven alert systems can unlock opportunities 24/7. The evolution of fintech, real-time data feeds, and automation tools makes it easier than ever for even mid-size trading desks or advanced retail traders to deploy low-risk arbitrage strategies globally.

Bonus: Risk-Managed Scalability

Another major benefit of arbitrage is scalability. While most retail traders may focus on a few positions, institutional arbitrage desks can scale operations across hundreds of trades with pre-set risk controls, stop-loss systems, and real-time reconciliation. This layered risk management structure makes arbitrage one of the safest high-volume trading strategies available today.

Arbitrage Trading in Action: A Simple Example

Imagine a dual-listed stock trading at:

$50 on Exchange A

$51 on Exchange B

You simultaneously:

Buy 1,000 shares at $50 (Exchange A)

Sell 1,000 shares at $51 (Exchange B)

Profit:

Gross = $1,000

Minus transaction costs and slippage, your net profit might be $700–$800 often completed within seconds.

Now multiply this over multiple trades per day or with larger positions. That’s the power of low-risk trading at scale.

Best Use Cases: Who Should Use Arbitrage?

Institutional investors seeking non-directional alpha

Hedge funds managing large, diversified portfolios

Retail traders with access to real-time data and low-latency execution

Risk-averse investors focused on capital preservation

Arbitrage is not just for Wall Street pros anymore; platforms like Radiant Global Fund offer access to arbitrage-backed products for a wide range of investors.

Tips to Execute Arbitrage Successfully

Access multiple markets: Arbitrage thrives on price discrepancies between exchanges.

Leverage automation: Speed matters. Manual trades often miss narrow windows.

Minimize transaction costs: High fees can erode small arbitrage margins.

Stay updated: Use trading tools that alert you to real-time opportunities.

Maintain discipline: Don’t chase trades; stick to your predefined spread targets.

Final Thoughts: Arbitrage as a Smart Trading Idea in 2025

In a world increasingly shaped by volatility, geopolitical risk, and rapid news cycles, arbitrage stands out as a low-risk trading strategy that offers precision, consistency, and control.

While it may not have the glamour of big tech bets or meme stocks, it provides something far more valuable stability.

#low risk trading strategies 2025#arbitrage trading benefits#best low risk investments 2025#smart investing strategies 2025#how to trade with low risk#risk free trading methods#profitable arbitrage trading 2025#secure trading strategies#safe investment ideas 2025#smart money moves in trading

1 note

·

View note

Text

"Custom QR Codes for Merchants: Boost Engagement and Trust"

Build customer trust while streamlining operations with custom QR codes for merchants. From enhancing visibility to providing actionable insights, these codes make every scan count. Jodetx empowers businesses with dynamic, secure, and fully customized QR code solutions designed for today's competitive market.

Visit Us: https://jodetx.com/Connect-with-Jodetx Contact Us:

+(91) 90048 66217

#banking solution#online payment method#jodetx#fintech india#secure transaction#digital payment#bankG#online payment solution#safe & secure

0 notes

Text

You can buy a virtual credit card (VCC) using Bitcoin through various platforms. These services provide virtual cards that can be loaded with funds and used for online shopping, subscriptions, or other digital payments. Here's a step-by-step guide:

#Online shopping safety#Digital payments#Virtual payment solutions#Virtual card benefits#Convenient online payments#Virtual card fees#Safe online shopping#Personal finance security#Payment fraud protection#Secure payment methods#Online transaction safety#Virtual card activation

0 notes

Text

Mastercard Merchant Services refers to the suite of products and solutions Mastercard provides to businesses to accept, process, and manage payments. These services help merchants process transactions securely and efficiently, whether online, in-store, or through mobile platforms. Here's an overview of the key offerings:

#Online shopping safety#Digital payments#Virtual payment solutions#Virtual card benefits#Convenient online payments#Virtual card fees#Safe online shopping#Personal finance security#Payment fraud protection#Secure payment methods#Online transaction safety#Virtual card activation

0 notes

Text

Mastercard Dealer Administrations alludes to the set-up of items and arrangements Mastercard gives to organizations to acknowledge, process, and oversee installments. These administrations assist vendors with handling exchanges safely and proficiently, whether on the web, available, or through portable stages. Here is an outline of the key contributions:

#Online shopping safety#Digital payments#Virtual payment solutions#Virtual card benefits#Convenient online payments#Virtual card fees#Safe online shopping#Personal finance security#Payment fraud protection#Secure payment methods#Online transaction safety#Virtual card activation

0 notes

Text

Mastercard Dealer Administrations alludes to the set-up of items and arrangements Mastercard gives to organizations to acknowledge, process, and oversee installments. These administrations assist vendors with handling exchanges safely and proficiently, whether on the web, available, or through portable stages. Here is an outline of the key contributions:

#Online shopping safety#Digital payments#Virtual payment solutions#Virtual card benefits#Convenient online payments#Virtual card fees#Safe online shopping#Personal finance security#Payment fraud protection#Secure payment methods#Online transaction safety#Virtual card activation

0 notes

Text

Mastercard Dealer Administrations alludes to the set-up of items and arrangements Mastercard gives to organizations to acknowledge, process, and oversee installments. These administrations assist vendors with handling exchanges safely and proficiently, whether on the web, available, or through portable stages. Here is an outline of the key contributions:

#Online shopping safety#Digital payments#Virtual payment solutions#Virtual card benefits#Convenient online payments#Virtual card fees#Safe online shopping#Personal finance security#Payment fraud protection#Secure payment methods

0 notes

Text

Making a virtual card with Bitcoin typically includes utilizing a help that permits you to change over your Bitcoin into a pre-loaded check card that can be utilized on the web or at traders that acknowledge card installments. One famous choice for this is to utilize a digital currency trade that offers a check card administration. Here is a general framework of how you could do this:

#Online shopping safety#Digital payments#Virtual payment solutions#Virtual card benefits#Convenient online payments#Virtual card fees#Safe online shopping#Personal finance security#Payment fraud protection#Secure payment methods#Online transaction safety#Virtual card activation

0 notes

Text

Several virtual card providers allow the use of cryptocurrency for transactions. These services enable users to spend their digital assets in a manner similar to traditional fiat currencies. Below are some notable virtual card providers that integrate cryptocurrency:

#Online shopping safety#Digital payments#Virtual payment solutions#Virtual card benefits#Convenient online payments#Virtual card fees#Safe online shopping#Personal finance security#Payment fraud protection#Secure payment methods#Online transaction safety#Virtual card activation

0 notes

Text

Several virtual card providers allow the use of cryptocurrency for transactions. These services enable users to spend their digital assets in a manner similar to traditional fiat currencies. Below are some notable virtual card providers that integrate cryptocurrency:

#Online shopping safety#Digital payments#Virtual payment solutions#Virtual card benefits#Convenient online payments#Virtual card fees#Safe online shopping#Personal finance security#Payment fraud protection#Secure payment methods#Online transaction safety#Virtual card activation

0 notes

Text

Cryptocurrency virtual credit card providers offer digital cards that are funded using cryptocurrencies. These cards can be used for online and sometimes in-person purchases, just like traditional credit or debit cards. Here are some well-known providers and details about their offerings:

#Online shopping safety#Digital payments#Virtual payment solutions#Virtual card benefits#Convenient online payments#Virtual card fees#Safe online shopping#Personal finance security#Payment fraud protection#Secure payment methods#Online transaction safety#Virtual card activation

0 notes

Text

A cryptocurrency wallet card is a physical device or card designed to store and manage cryptocurrencies securely. Here’s an overview of what they typically offer and how they work:

#Online shopping safety#Digital payments#Virtual payment solutions#Virtual card benefits#Convenient online payments#Virtual card fees#Safe online shopping#Personal finance security#Payment fraud protection#Secure payment methods#Online transaction safety#Virtual card activation

0 notes

Text

"Benefits of a Visitor Management System in Modern Societies"

Are you still relying on registers to log visitor details? It’s time to switch to a visitor management system. With increasing footfall in residential buildings, managing visitor inflow efficiently is crucial.

SocietyGo by Jodetx offers features like app-based visitor approval, visitor pass generation, and real-time visitor logs. It eliminates manual errors and reduces security risks.

The best part? Residents get full control of who comes in, and security teams get better tools to manage the gate.

Visit Us:

https://jodetx.com/SocietyGo

Contact Us:

+(91) 90048 66217

#jodetx#digital payment#secure transaction#online method#fintech india#banking solution#qr-codes#safe & secure method#mumbai based#online payment solution#customer's trusted#branding#technologies#payment software

0 notes

Text

Coinbase provides a virtual debit card linked to your Coinbase account, allowing you to spend Bitcoin and other cryptocurrencies directly. The card offers up to 4% cashback on purchases and is widely accepted wherever Visa is supported.

#Online shopping safety#Digital payments#Virtual payment solutions#Virtual card benefits#Convenient online payments#Virtual card fees#Safe online shopping#Personal finance security#Payment fraud protection#Secure payment methods#Online transaction safety#Virtual card activation

0 notes

Text

A cryptocurrency wallet virtual card is a financial tool that combines the functionalities of a traditional debit or credit card with the ability to use cryptocurrencies. Here's a breakdown of its features and how it typically works:

#Online shopping safety#Digital payments#Virtual payment solutions#Virtual card benefits#Convenient online payments#Virtual card fees#Safe online shopping#Personal finance security#Payment fraud protection#Secure payment methods#Online transaction safety#Virtual card activation

0 notes