#secure net banking

Explore tagged Tumblr posts

Text

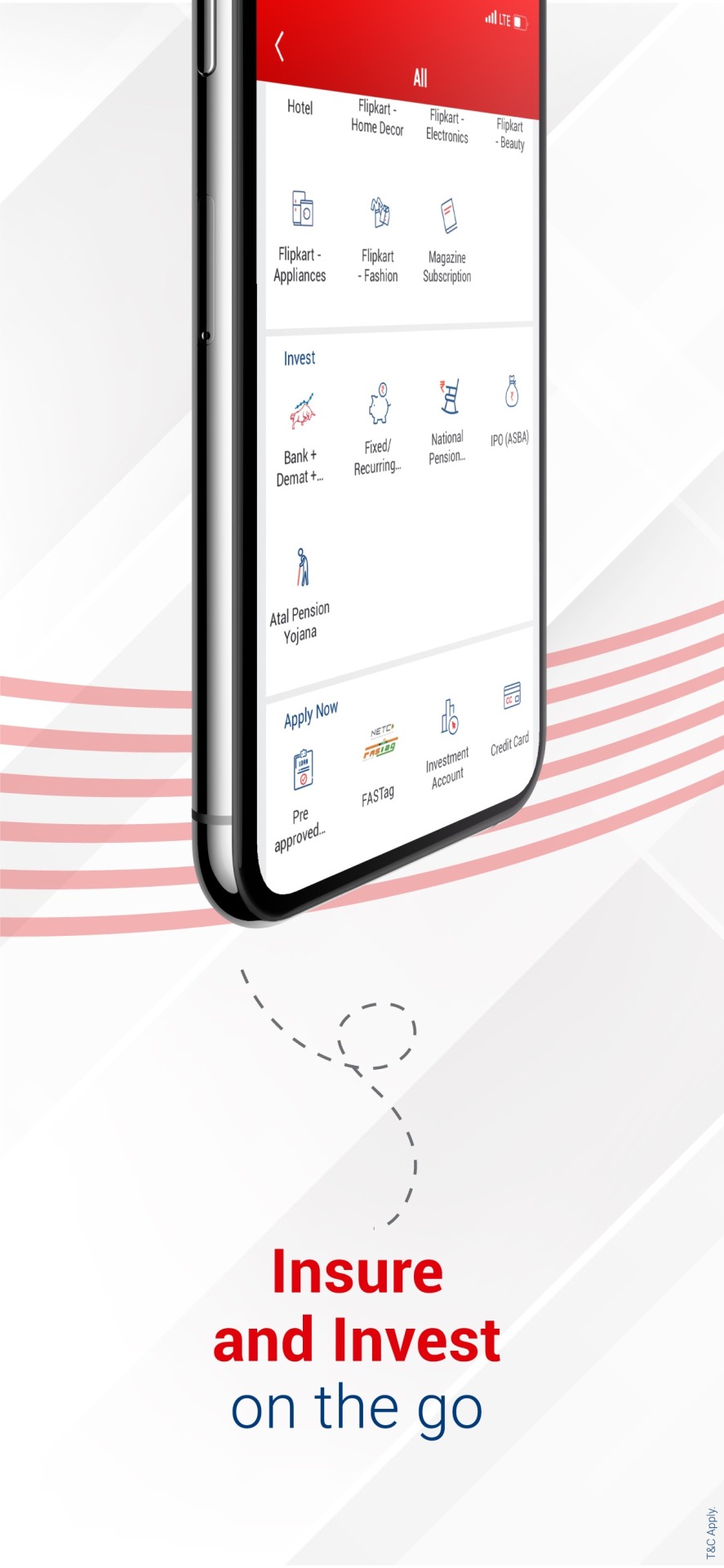

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#fd account#upi account#fixed deposit account#contactless banking#upi bank app#upi bank#secure net banking#safe mobile banking#mobile app#e banking app#mobile banking apps in india#internet banking app#e banking#kyc bank account#ebanking#digital banking india#paise check karne wala app#bank fd rates#account check karne wala app#khata check karne wala app#finance application#upi mobile banking#banking mobile upi#mobile banking upi#mobilebanking app upi#app upi mobile banking#net banking app upi#upi mobile banking app#upi net banking app#upi transaction app

2 notes

·

View notes

Text

Steps to open a savings account online

A savings account is one common type of bank account people usually have. As the name insists, it is mostly used to save money and allow the customers to earn interest for their idle amount. There are different types of savings accounts available for children, senior citizens and non-residential Indians etc. Some people may need to learn the eligibility, documents required and steps to open a savings account. You can open savings account online, if you don't have time to reach the bank branch. Let us see the steps involved in opening a savings account below:

Fill out the application form:

To open a savings account, you should visit a bank nearby your location. If you prefer to do it online, you can use online banking application and fill out your banking details and contact details. After completing the KYC process, you can start using your savings account. Search for the interest rate, minimum balance requirement, and loan eligibility of several banks. Choose the one which meets your requirements. In offline, request an account opening form. Fill out the required details such as name, father's name, address, phone number, occupation, etc. You can choose the type of savings account you need. Study the terms, policies, and services offered by the bank.

Attach the documents required:

After filling out the necessary details, you should attach the required documents like Id proof, address proof etc. The supporting documents are:

An Aadhaar card.

PAN card.

Driving license (address proof).

Passport-size photos (recent).

If you are a student, you need your school's bona fide certificate. If you are an employee, you should attach a TDS certificate issued by your employer. Submit your application, and you will get acknowledged in a minimum of two working days. If you apply online, you will get acknowledged within a few hours. To verify your details and give you access. These document requirements may vary according to the bank's norms.

Fund your account:

Once your bank account is activated, you are asked to deposit a certain amount. Most banks require a minimum balance will be maintained in your savings account. The amount will differ based on the type of bank and account and the terms and policies of the bank. There is an option for opening a zero-balance savings account, but it has some limitations in withdrawals and interest rates. The same steps discussed earlier will be followed to open a Zero Balance Savings Account Online. To earn decent interest, use a regular savings account. After the formalities are done, you will be provided with the unique account number and IFSC code. You can collect your passbook and start using your savings account.

Set up online banking:

Remember to apply for a debit card. If you need, you can apply for cheque book and credit cards. Request the bank to enable net banking. This will provide you with various services like checking your bank balance, money transactions, statements and more.

To conclude: The above-mentioned are the steps involved in opening a savings account. If you are engaged with lots of work, you can open a free bank account, saving you time and effort. Prefer the bank that offers you greater benefits.

#credit card upi#fast mobile banking#finance upi mandate#upi money#upi online#account upi payments#secure net banking#upi fund transfer#upi by credit card#upi khata#secured upi#fd account yearly#finance upi#check bank balance#account balance check#my upi#upi transfer#bank balance enquiry app#upi money transfer app#upi number check#upi transfer app#credit card on upi#upi investment#create new upi id#upi from credit card

0 notes

Text

Kotak811 Banking, Cards & UPI

Experience Seamless Banking with the Kotak811 Mobile Banking App. Apply for a 0 balance account online and enjoy hassle-free banking from your smartphone. With the Kotak811 app, you can apply for a bank account, manage your zero balance bank account, make seamless UPI payments, apply for credit cards, and much more.

#upi download app#upi number check#upi transfer#secure upi#upi fund transfer#safe mobile banking#upi payment app#bank account check#flexible fixed deposit#online upi#credit card upi#fast mobile banking#upi online#upi create#upi money transfer app#mobile payment transfer#my upi#upi transfer app#secured upi#upi number#upi from credit card#upi generate#bank balance enquiry app#secure net banking#account balance check#check bank balance app#upi by credit card#fixed deposit plans#upi transaction app#bank balance enquiry

0 notes

Text

How UPI App can teach money management to kids?

Kids have become more techno-savvy than elders, of late. Teens and tweens have to learn to manage their pocket money. Parents can advise them about money management to make them realise its importance. Many mobile banking apps can do the work for you. Since the attention span of your teen is only 8 seconds, these kid-friendly apps can provide this information in bits and pieces.

There are multiple options for money payment and it is surprising to see 350 million teens using the UPI payment App. This intensifies the fintech sector to cater more vigorously to this section of the population, recently.

Now let us discuss how these apps help your kid manage his money. They are:

Kids learn the importance of security: Increased usage of the pocket money app will help the kids make instant payments with more security. Parents can help the kids understand the safety protocols that help them make a safe payment. These kids can now use UPI in the nearest grocery shop or for online shopping.

Kids feel appreciated: When more and more retail brands offer discounts for making payments through pocket money apps, these kids feel acknowledged, and appreciated.

Kids learn to maintain secrecy: Teens using UPI would deal with PINs to operate it. Parents should help them understand the importance of maintaining secrecy to keep money safe. Take your kid to the nearest ATM centre and show him how to enter the PIN without others' knowledge. Thus he can make a transaction less vulnerable to fraud.

Assist them to mature wisely: When the UPI app helps them satisfy their needs through instant secured payment. Now, they don't need to wait for their parents to buy them a notebook or a burger.

Safety tips for teens while using the UPI app:

Usually, the UPI App is connected to a bank account and enables the users to check their balance to identify an unknown transaction. But, kids can have mobile UPI apps without having a bank account. We know that more and more teens and tweens are using UPI lately. It is an undeniable fact that these are time-saving apps. But are they safe for children?

Let us see some of the safety tips to protect them from fraudsters.

Do not tell PIN to friends: Instruct your kid not to share ATM PIN with anyone. Fraudulent transactions are more common now and the kid would lose money to fraudsters.

Set strong passwords: Advise your kids to set strong passwords to lock the mobile and UPI app. It will prevent unauthorised entry into your app by strangers. People usually create a combination of dates of birth to remember passwords. But cheaters may identify it easily.

Let kids use one App: Ask your kid to use only one UPI app to avoid confusion. Moreover, using multiple apps enables the tricksters to cheat him easily. Never fall prey to lucrative offers and have multiple UPI app accounts.

Update your UPI App: If you use the UPI payment App, don't forget to update them. Updating Apps would provide new features and better benefits.

Final Words:

Modern parents allow the younger generation to handle their own money. Kids get an opportunity to learn money management at a younger age. 2022 saw an upsurge in teens and tweens using the UPI payment app for monetary transactions. They should be cautious while using the app. Otherwise, they tend to lose money.

#upi bank account#upi account#upi registration#digital account#secure net banking#fixed deposit account#fd transfer account#mobile banking account#phone banking#bank khata#mobile banking account app#mobile banking application#fd card account#banking app#mobile banking upi#bank online account#bank account online#online bank#phone banking app#best net banking app#fd bank#banking mobile upi#instant bank account online transfer#app upi mobile banking

1 note

·

View note

Text

How to make a UPI Payment Without The Internet: A Simple Guide

UPI is a internet banking app that enables money transfer from one account to another. It requires an uninterrupted internet connection to complete transactions. But if you are in an emergency and need to make an immediate transaction, click *99# to complete a transaction.

#transfer mobile banking app#upi bank#secure net banking#phone banking#safe mobile banking#banking app#bank app#mobile banking account app#bank account app#mobile banking apps#phone banking app#mobile banking account#e banking app#best net banking app#mobile banking application#online banking#mobile banking apps in india#internet banking app#net banking#e banking#premium mobile banking#digital banking#ebanking#internet banking#upi application#money transaction app#bank account check app#check bank account balance#upi mobile banking#upi bank account

1 note

·

View note

Text

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

source :

A Complete Guide on UPI Payments for Business

In this continuously changing world, UPI has emerged as a game changer, not only for individuals but also for small business owners.

#fd account#upi money transfer app#upi account#easy net banking app#contactless banking#fast mobile banking#secure net banking#banking app#bank app#mobile banking apps#mobile app#मोबाइल बैंकिंग ऐप्स#e banking app#mobile banking apps in india#premium banking

1 note

·

View note

Text

Kotak Mahindra Bank’s official mobile banking application for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#best banking app#premium mobile banking#internet banking#contactless banking#secure net banking#digital banking india#easy net banking app#e banking app

1 note

·

View note

Text

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#best banking app#premium banking#mobile banking app#digital account app#secure net banking#phone banking app#zero balance account#e banking app#online bank

0 notes

Text

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#best banking app#premium banking#mobile banking app#digital account app#secure net banking#phone banking app#zero balance account#e banking app#online bank

0 notes

Text

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#upi application#upi app#upi payment bank app#upi bank transfer#upi#upi pay#upi account create#upi app download#upi earning app#download upi app#create new upi id#banking upi mobile#upi mobile banking#banking mobile upi#upi bank account#mobile banking upi#mobilebanking app upi#upi khata#secure upi#app upi mobile banking#net banking app upi#secured upi#upi transfer app#upi account number check#upi mobile banking app#upi net banking app#finance upi

2 notes

·

View notes

Text

Top Features to Look for in a New UPI Payment App in 2025

Introduction

Digital payments have become a part of our everyday life, and UPI apps are leading the way. With quick transfers, secure logins, and easy access to banking, choosing the right new UPI payment app is more important than ever in 2025.

Whether you’re making a bill payment or sending money to a friend, the app you use should offer more than just basic functionality. In this article, we’ll walk you through the top features to look for when selecting a UPI transfer app this year.

Why UPI Apps Are a Must in 2025

UPI (Unified Payments Interface) has changed how we handle money. It’s fast, reliable, and works 24/7—even on holidays. A new UPI payment app should help you:

Send and receive money instantly

Manage your bank accounts

Make secure transactions

Access both UPI and the net banking app UPI features

With UPI becoming the go-to method for all kinds of payments, having the right app is key to smooth digital money management.

Must-Have Features in a New UPI Payment App

Not all apps are created equal. Here are the features to look for when choosing a UPI transfer app in 2025.

🔹 1. Fast and Simple UPI Transfers

The core of any UPI app is the ability to send UPI money quickly. Look for an app that lets you:

Transfer using mobile numbers, UPI ID, or QR codes

Complete payments with minimal steps

Save favorite contacts for repeated transactions

The faster and simpler the UPI transfer, the better your experience.

🔹 2. Secure UPI Setup and Login

Safety comes first in digital payments. Your new UPI payment app should offer:

PIN-based secure UPI access

Fingerprint or face unlock options

Alerts for every transaction

Option to lock or block the app if suspicious activity is detected

This helps protect your UPI account and financial data at all times.

🔹 3. Smart UPI Account and Number Management

A modern app should let you manage your UPI number and linked bank accounts easily. Look for features like:

Multiple bank account support

Quick switch between accounts for sending/receiving money

Customize my UPI IDs

Viewing linked accounts in a single dashboard

These options give you full control over how you manage UPI transfers and balances.

🔹 4. Easy Net Banking Integration

Your UPI banking app should also act as an easy net banking app, allowing you to:

Check your bank balance instantly

Download mini statements

Pay bills and recharge services

Manage beneficiaries and payment history

When an app combines UPI with net banking app features, it becomes your all-in-one financial tool.

🔹 5. User-Friendly Interface for Mobile Use

Finally, a great app UPI mobile banking experience depends on design and accessibility. In 2025, top UPI apps are expected to have:

Simple, clutter-free interfaces

Regional language support

Fast-loading screens even on slow internet

Dark mode and customizable settings

The app should be easy enough for anyone to use, from students to seniors.

Quick Comparison: Old vs New UPI Payment Apps

Feature

Older UPI Apps

New UPI Payment Apps (2025)

Instant UPI Transfer

✔️

✔️ (Even faster)

Secure Login & PIN Options

Basic

Biometric, 2FA, alerts

Multiple Account Management

Limited

Advanced and seamless

Net Banking Integration

��

✔️ Built-in

UPI Number Customization

Minimal

✔️ Personalized UPI IDs

Final Tips When Choosing a UPI App

Here are some last points to consider before you download:

Choose a new UPI payment app backed by a trusted bank or financial brand

Check for regular updates and positive user reviews

Look for all-in-one features like UPI, net banking, and bill pay

Try a few apps and go with the one that feels easiest for your needs

Conclusion

A good new UPI payment app in 2025 should be more than just a money transfer tool. It should offer fast UPI transfers, strong security, account control, and smooth net banking app UPI access—all in one place.

Take the time to explore your options and choose an app that matches your digital lifestyle. The right app will not only make your payments faster but also help you manage your money smarter and safer.

#upi transfer#secure upi#my upi#upi number#easy net banking app#new upi payment app#app upi mobile banking#upi transfer app#upi money#net banking app upi

0 notes

Text

Kotak811 Banking, Cards & UPI

Experience Seamless Banking with the Kotak811 Mobile Banking App. Apply for a 0 balance account online and enjoy hassle-free banking from your smartphone. With the Kotak811 app, you can apply for a bank account, manage your zero balance bank account, make seamless UPI payments, apply for credit cards, and much more.

#upi payment app#bank account check#secure upi payment#check bank account balance#online upi#online upi payment app#internet banking#upi payments#net banking#bank upi app#net banking app#credit card upi#secure net banking#mobile banking apps#fast mobile banking#internet banking app

0 notes

Text

How UPI Mobile Banking is Revolutionizing Digital Payments in India

Introduction to UPI Net Banking in the Digital Era

India is witnessing a rapid shift toward a cashless economy, largely driven by the rise of UPI mobile banking. The Unified Payments Interface (UPI) has become a cornerstone in India’s journey toward seamless digital transactions. Developed by the National Payments Corporation of India (NPCI), UPI allows users to send and receive money directly from their bank account using a smartphone — no branch visits, account numbers, or IFSC codes required.

By enabling fast, user-friendly, and secure payments, UPI net banking is empowering millions, from metro cities to rural villages, to take full control of their finances.

Core Features of UPI Net Banking and Mobile Banking Apps

UPI mobile banking is gaining widespread adoption due to its unique and practical features:

1. Instant Fund Transfers

Money transfers between bank accounts happen in real time, 24/7 — even on holidays. There’s no waiting period, unlike traditional banking systems such as NEFT or RTGS.

2. Multi-Bank Support

A single banking UPI mobile app can link multiple accounts from various banks. This gives users centralized access to all their banking needs.

3. Simple Setup

Users only need a mobile number linked to their bank account. The UPI account create process typically takes just a few minutes and doesn’t require any paperwork.

4. Always Available

With no dependency on banking hours, users can transact anytime. Whether it's paying a bill at midnight or sending money on a weekend, UPI is always available.

Key Benefits of UPI Mobile Banking

For Individuals

Quick Onboarding: Setting up a UPI net banking profile is simple and requires minimal information.

Enhanced Security: Each secure UPI payment is backed by multiple layers of verification like device binding and MPINs.

Zero Paperwork: Unlike traditional methods, UPI is completely digital and eliminates the need for forms or branch visits.

For Businesses

Faster Transactions: Instant credit of funds directly into a bank account improves cash flow.

Low Infrastructure Cost: No need for card-swiping machines or complicated POS systems.

Easy Integration: Businesses can integrate UPI banking with invoicing, billing, and e-commerce systems.

UPI vs. Traditional Online Banking

While older digital payment systems like NEFT and RTGS are still in use, they have limitations:

Feature

Traditional Net Banking

UPI Mobile Banking

Availability

Limited to bank hours

24/7

Speed

Delayed (few hours)

Instant

Setup

Requires IFSC, account number

Requires mobile number only

Accessibility

Desktop/browser-based

Mobile-first, app-based

UPI net banking offers a clean, user-friendly interface that can be easily used by individuals across age groups, even those new to digital banking.

How to Set Up a UPI Net Banking Account

Getting started is simple and requires only a few steps:

Download a UPI mobile banking app from your phone’s app store.

Register using your mobile number linked to your bank account.

Link your bank account by selecting your bank from a list.

Create a UPI PIN (MPIN) using your debit card credentials and an OTP.

Once complete, you can immediately begin making secure UPI payments and transfers.

This process allows you to set up your bank UPI in just a few minutes, with no in-person verification needed.

Security in UPI Mobile Banking

One of the strongest aspects of UPI mobile banking is its built-in security protocols:

Two-Factor Authentication: Every transaction requires device verification and MPIN.

End-to-End Encryption: Ensures that user data and payment details are protected.

Real-Time Notifications: Users are alerted immediately via SMS or email for every transaction.

Block/Unblock Features: Users can instantly suspend or secure their UPI credentials in case of suspicious activity.

These measures make UPI net banking a secure UPI payment method suitable for everyday use.

Future of UPI Net Banking and Mobile Payments in India

The future of banking UPI mobile technology is bright. With features like:

UPI 2.0 (supporting overdraft accounts, invoice attachment, and signed mandates)

UPI Lite for small-value offline transactions

Cross-border UPI payments for international remittances the system is rapidly evolving. As banks now offer online application for bank account with instant UPI linking, financial inclusion is reaching even the most remote areas of the country.

Integration with IoT devices, voice commands, and wearables will soon make UPI banking accessible beyond smartphones.

Conclusion

The rise of UPI net banking has been a game-changer in India’s digital transformation. It’s not just a tool for sending money — it's a gateway to paperless, cashless, and real-time banking. From simplifying everyday purchases to transforming how businesses collect payments, UPI mobile banking offers convenience, speed, and safety like never before.

Whether you're opening a new account, paying bills, or managing business finances, it’s time to embrace the UPI ecosystem. Set up your bank UPI today, and experience the true power of modern banking at your fingertips.

#banking mobile upi#upi net banking#upi account create#bank upi#banking upi mobile#bank app upi#upi apps#secure upi payment#mobilebanking app upi#upi app#mobile banking upi#net banking app upi#app upi mobile banking#upi bank account#upi bank

0 notes

Text

How UPI Mobile Banking is Revolutionizing Digital Payments in India

Introduction to UPI Mobile Banking

India has witnessed a dramatic transformation in digital payments over the last decade, with UPI mobile banking emerging as the key driver. Introduced by the National Payments Corporation of India (NPCI), the Unified Payments Interface (UPI) allows instant money transfers through mobile devices using a simple and secure platform. With over 10 billion transactions monthly as of 2025, UPI mobile banking is now the backbone of digital finance in India.

Key Features of UPI Mobile Banking

UPI mobile banking apps come with a host of features that make them appealing to both individuals and businesses:

Instant Bank-to-Bank Transfers: Using a Virtual Payment Address (VPA) or mobile number.

24/7 Accessibility: Payments can be made anytime, including holidays.

Secure Authentication: Every transaction is verified through a mobile PIN (MPIN).

Interoperability: A single banking UPI mobile app can manage accounts across multiple banks.

These features have made the UPI net banking app ecosystem the go-to choice for millions of users across India.

Benefits of UPI for Consumers and Businesses

For Consumers

Ease of Use: A few taps are all it takes for payments and fund transfers.

Quick Setup: Users can start transacting minutes after UPI application download.

Reduced Cash Dependency: Encourages a cashless economy and minimizes risks.

Transaction Tracking: Users get instant SMS/email alerts.

For Businesses

Faster Payments: No need to wait for settlements.

Lower Costs: Compared to card-based payment systems.

Easy Integration: Can link their systems directly with UPI app bank APIs.

Wider Reach: Accept payments from any UPI transaction app.

Comparison with Traditional Banking Methods

Traditional digital banking options like NEFT, RTGS, and IMPS are gradually being overshadowed by the convenience of banking mobile UPI apps. Where older systems require bank details and long processing times, UPI mobile banking enables real-time transfers with minimal information.

Unlike card payments, banking UPI mobile services don’t need additional hardware like POS machines. This accessibility has revolutionized financial inclusion, especially in semi-urban and rural areas.

Security and Future of UPI Mobile Banking

Security is a top priority in UPI mobile banking. Multi-factor authentication, encrypted transactions, and AI-based fraud detection systems ensure that your data and money remain safe. Users receive real-time alerts, and suspicious activities are flagged instantly.

The future holds exciting potential—UPI transaction apps may soon integrate with smartwatches, voice assistants, and even IoT-enabled devices for seamless, contactless payments.

How to Get Started with a UPI Mobile Banking App

Here's how users can begin using UPI mobile banking in just a few steps:

Download a UPI Application: Search for a trusted UPI application download in your app store.

Register Your Mobile Number: Ensure the number is linked to your bank account.

Select Your Bank: The app will fetch your account details automatically.

Create a UPI ID: Usually in the format name@bank.

Set Your MPIN: This PIN will be used for authorizing every UPI transaction.

Start Using the App: You’re ready to send or receive money instantly.

Conclusion

UPI mobile banking has fundamentally changed how India transacts. With its unmatched convenience, security, and inclusivity, it continues to drive the country towards a truly digital economy. Whether you're an individual making daily payments or a business processing thousands of transactions, UPI mobile banking apps provide the perfect solution. As technology evolves, expect even more innovations from this robust and growing UPI net banking app ecosystem.

#upi mobile banking#upi mobile banking app#banking mobile upi#banking upi mobile#upi net banking app#upi app bank#upi transaction app#upi application download#secure upi#upi download app

0 notes

Text

Kotak811 Banking, Cards & UPI

Experience Seamless Banking with the Kotak811 Mobile Banking App. Apply for a 0 balance account online and enjoy hassle-free banking from your smartphone. With the Kotak811 app, you can apply for a bank account, manage your zero balance bank account, make seamless UPI payments, apply for credit cards, and much more.

#upi mobile banking#upi mobile banking app#banking mobile upi#finance upi#banking upi mobile#upi net banking app#upi app bank#upi transaction app#upi application download#secure upi#upi download app#mobile banking apps#upi account check#online upi#secured upi payments#bank upi app#upi debit card#paynow upi#upi account number check#upi payments#upi pay#finance upi mandate#upi online#account upi payments#upi transfer to bank account#upi money transfer

0 notes

Text

Top Benefits of Opening a Zero Balance Account for Beginners

Starting your financial journey doesn’t have to be complicated. In fact, with the rise of zero balance accounts, banking has become more accessible than ever—especially for students, young professionals, freelancers, and even homemakers who want to manage money without the burden of minimum balance requirements.

If you're looking to open zero balance account online, this guide is for you.

What Is a Zero Balance Account?

A zero balance account is a type of savings account that doesn’t require you to maintain any minimum balance. That means you can keep the balance at ₹0 without facing any penalties or charges.

Many banks now allow instant zero balance account opening online, making it easy for anyone to get started without visiting a branch.

Key Benefits of a Zero Balance Account

✅ No Minimum Balance Requirement

You’re free to maintain any amount—even zero. This is a big relief for those just beginning their financial journey or with inconsistent income.

✅ Hassle-Free Online Account Opening

Thanks to digital banking, it’s now possible to open 0 balance bank account online within minutes. Most banks require just an Aadhaar and PAN for paperless onboarding.

✅ Mobile Banking Access

These accounts typically come with a mobile banking app, which allows you to:

Check balance

Make UPI payments

Transfer money instantly

Recharge and pay bills

Access mini statements and track expenses

✅ UPI and Debit Card Enabled

Even though it’s a zero balance account, it often includes:

A free virtual or physical debit card

UPI ID for sending and receiving money

Integration with apps for secure digital payments

Who Should Open a Zero Balance Account?

Students: Start saving without worrying about maintaining a minimum amount.

Freelancers or Gig Workers: Manage irregular income smoothly.

First-Time Bankers: Perfect for those opening a bank account for the first time.

Homemakers and Senior Citizens: Easy access to government benefits and subsidies.

How to Open a Zero Balance Account Online

Here’s a simple step-by-step process:

Visit the bank’s website or mobile app

Choose online 0 balance account opening

Complete eKYC using Aadhaar and PAN

Provide basic details like address, mobile number, and email

Verify through OTP and set your MPIN for transactions

Account is activated instantly, and you can start using it

Some banks may also offer video KYC for added convenience and faster verification.

Add-On Features You May Get

Even though it’s free and has no balance requirement, these accounts often include:

Free passbook and email statements

Mobile banking with UPI access

Auto FD or instant FD setup with surplus funds

Bill payment features

SMS and email alerts for every transaction

Final Thoughts

For anyone new to banking, a zero balance account is the perfect place to start. With the ease of instant zero balance account opening online, you no longer need to worry about paperwork, branch visits, or hidden fees.

It’s a simple, efficient, and inclusive step toward financial independence. Whether you want to save, spend, or receive money, a 0 balance bank account gives you full digital control—with zero pressure.

#finance upi mandate#upi online#account upi payments#upi transfer to bank account#upi by credit card#secured upi#upi money transfer#finance upi#upi transfer app#credit card on upi#net banking app upi#payment app upi#netbanking upi#upi banking app#bank upi#upi bank app#mobile banking upi#upi apps#upi app#upi application

0 notes