#secure payment solutions

Explore tagged Tumblr posts

Text

The Ultimate Guide to E-commerce Payment Processing: Secure Payment Solutions & Online Payment Gateway Canada

Introduction: Let’s Talk About Getting Paid—The Smart Way

So you’ve built a slick online store, your products are amazing, your site looks sharp, and traffic is coming in. But wait—how are you going to get paid?

Welcome to the world of E-commerce payment processing, where the rubber meets the road (or the dollars meet your digital wallet). Whether you're a solo entrepreneur in Toronto or a growing Shopify store in Vancouver, having the right online payment gateway in Canada is non-negotiable.

But don't stress. In this guide, we’ll break down what e-commerce payment services are, how they work, and what to look for in secure payment solutions that won’t make your customers (or you) sweat.

What is E-commerce Payment Processing (And Why Should You Care)?

Let’s keep it simple. E-commerce payment processing is the system that handles online transactions. When someone clicks "buy now" on your site, this system captures their payment details, validates them, moves the money, and notifies you that the payment went through.

That’s a lot happening in milliseconds. Cool, right?

Without reliable payment processing, your online business can't function—end of story.

Meet Your Digital Cashier: Online Payment Gateways in Canada

Think of an online payment gateway as your store’s digital cashier. It's the technology that authorizes and securely processes credit card, debit card, and digital wallet payments. In Canada, you’ve got several local and international providers—but not all are created equal.

Why Location Matters

Choosing a Canadian-based gateway ensures faster processing times, better support in your time zone, and compliance with local banking regulations.

Popular Online Payment Gateway Canada Options:

Moneris – Homegrown and trusted by thousands of Canadian merchants.

Stripe – Developer-friendly and ultra-scalable.

PayPal – Everyone knows it, and it’s super convenient.

Square – Great for both online and offline sales.

Helcim – Transparent pricing and made for Canadian businesses.

Each has its strengths depending on your business model, so think about your priorities—cost, speed, features, or all of the above.

What Makes Payment Solutions “Secure”?

Cybersecurity is no joke. Customers want to know their card info is safe, and so do you.

Secure payment solutions must include:

PCI DSS compliance (Payment Card Industry Data Security Standard)

SSL certificates for encryption

Tokenization (swapping card data with unique tokens)

Fraud detection tools like 3D Secure, CVV validation, etc.

The goal? No sleepless nights worrying about hacks, breaches, or chargebacks.

Pro tip: Always display your site's security badges—customers do notice.

Features to Look for in E-commerce Payment Services

Okay, now you know what you need. But what should you want? Let’s look at features that make e-commerce payment services smooth and scalable.

1. Multi-Currency Support

Selling beyond Canada? Make sure your gateway supports USD, GBP, EUR, and more.

2. Mobile Optimization

Your customers are buying from phones and tablets. Your checkout process must work flawlessly on every screen.

3. Subscription Billing

If you offer memberships, SaaS, or product subscriptions, recurring billing is a must-have.

4. Easy Integration

Look for gateways that play nice with Shopify, WooCommerce, Magento, or whatever platform you’re using.

5. Fast Payouts

Cash flow is king. Some services deposit daily; others take 3–7 days. Choose based on your needs.

The Cost Factor: What Are You Really Paying For?

Ah, fees—the necessary evil of doing business online.

Typical charges include:

Transaction fees (e.g., 2.9% + 30¢ per transaction)

Monthly service fees

Chargeback fees

Cross-border fees (if you sell internationally)

But remember, the cheapest option isn’t always the best. Weigh the cost against features, reliability, and support. Sometimes, peace of mind is worth the extra percentage point.

How to Set Up Your Payment Gateway (Without Breaking a Sweat)

Getting started doesn’t have to be a tech nightmare. Most gateways guide you through the process. Here's a quick checklist:

Sign up with your preferred provider

Submit your business documentation (ID, bank info, etc.)

Integrate with your e-commerce platform (usually via plugin or API)

Test the checkout process

Go live and start accepting payments!

If you're using Shopify or WooCommerce, integration is often plug-and-play.

Real Talk: Common Mistakes to Avoid

Ignoring mobile users – A clunky mobile checkout can tank conversions.

Not reviewing fees – Surprise charges are never fun.

Skipping fraud tools – A single attack can wreck your reputation.

Delaying payout reviews – Make sure your payment schedule aligns with your business needs.

Not offering multiple payment methods – Customers love choices: credit cards, Apple Pay, Google Pay, etc.

Future-Proof Your Business with Smart Payment Tools

As e-commerce grows, so does the need for smarter, faster, more secure solutions. Modern payment platforms now offer:

AI-powered fraud detection

Buy Now, Pay Later (BNPL) options

Crypto payment support (for the adventurous!)

These aren’t just nice-to-haves anymore—they’re competitive edges.

Final Thoughts: Payment Processing is More Than Just Tech

Here’s the deal—your e-commerce payment processing system isn’t just a back-end feature. It’s part of your customer experience. When it’s fast, smooth, and secure, people buy more, trust more, and come back for more.

From choosing the right online payment gateway in Canada to implementing E-commerce Payment Services, it’s all about giving your business the foundation it needs to thrive.

Your store deserves more than just a “Buy Now” button. It deserves a payment process that works as hard as you do.

0 notes

Text

Reliable Small Payment Cashing Guarantee Services - Dp World News

Discover reliable cashing services for efficient payment processing Learn about secure, instant solutions for your business transactions.

#Cashing services#Payment processing#Secure payment solutions#Business transactions#Efficient payment processing

0 notes

Text

Best Payment Gateways 2025: Secure & Fast Transactions - Quick Pay

In today's fast-moving digital world, online payments are the backbone of businesses. Whether you're a small business owner, a freelancer, or an e-commerce giant, choosing the right payment gateway is essential for smooth transactions and customer satisfaction. As we step into 2025, the demand for faster, safer, and smarter payment systems has reached a new level. That’s why we’ve created this guide to the Best Payment Gateways of 2025—starting with the best of them all, Quick Pay.

🌟 What is a Payment Gateway?

Before we dive into the list, let’s quickly understand what a payment gateway is. A payment gateway is a technology that allows your business to accept payments online. It connects your website or app to a bank or credit card network, securely processes customer data, and completes the transaction in seconds.

The best payment gateways help your business grow by making online payments easy, secure, and seamless.

🥇 1. Quick Pay – The Best Payment Gateway of 2025

When it comes to the Best Payment Gateways in 2025, Quick Pay stands out as the number one choice. Built with cutting-edge technology, user-friendly design, and strong security, Quick Pay offers everything a business needs to succeed in the digital payment space.

🔐 Key Features of Quick Pay:

Fast Transactions: Get lightning-speed processing in under 2 seconds.

Secure Payments: PCI DSS compliant, SSL encryption, and real-time fraud detection.

Multiple Payment Modes: Accept credit/debit cards, UPI, net banking, wallets, and more.

Easy Integration: Works smoothly with platforms like Shopify, WooCommerce, and custom websites.

Affordable Pricing: Transparent and competitive transaction charges.

24/7 Support: Round-the-clock help for businesses of all sizes.

Real-Time Reports: Powerful dashboard to track your payments and refunds.

Quick Pay is trusted by thousands of Indian businesses in 2025—from small shops to large enterprises—because of its speed, security, and simplicity.

🥈 2. Razorpay

Razorpay is another big name in the Indian payment gateway industry. Known for its wide range of features and ease of use, Razorpay offers:

Support for various payment modes

Recurring billing and subscriptions

Strong analytics dashboard

However, Razorpay can be a bit expensive for small businesses, and customer service is sometimes a concern.

🥉 3. PayU

PayU is widely used by large companies and e-commerce brands. It supports:

International payments

EMI options for customers

High-level fraud protection

While it's a solid gateway, integration can be more complex compared to Quick Pay.

🏅 4. Cashfree Payments

Cashfree is known for its fast payouts and excellent bulk payment support. It’s popular for:

Vendor payouts

Instant settlements

Integration with bank APIs

But for small merchants looking for a simple solution, Cashfree may offer more features than needed.

🏆 5. CCAvenue

CCAvenue is one of the oldest payment gateways in India. It supports:

200+ payment options

Multilingual checkout pages

International card payments

Though feature-rich, the interface feels outdated and less intuitive than Quick Pay’s clean dashboard.

🧾 Why Choosing the Right Payment Gateway Matters?

If your business accepts payments online, choosing the Best Payment Gateway is not just about processing money—it’s about giving your customers a fast and secure experience. A good payment gateway can:

Increase trust and reduce cart abandonment

Improve your cash flow through fast settlements

Help you expand internationally

Protect your business from fraud and chargebacks

This is where Quick Pay truly shines—it does all of this and more, without any tech headaches or hidden fees.

💼 Who Should Use Quick Pay?

Quick Pay is built for all kinds of businesses:

Online Stores – Accept payments instantly with secure checkout.

Educational Institutions – Collect fees, issue receipts, and track dues easily.

Subscription Services – Automate recurring payments with ease.

Service Providers – Send payment links and invoices for quick settlements.

Startups & Freelancers – Enjoy low fees and easy setup with no coding required.

No matter what industry you're in, Quick Pay can help your business scale in 2025.

💬 Customer Reviews

“We switched to Quick Pay in early 2025 and saw an immediate improvement in payment success rates and settlement times.” – Rohit Verma, E-commerce owner

“The Quick Pay dashboard is incredibly simple to use. I can see every transaction in real time.” – Neha Kapoor, Freelance Designer These kinds of reviews are the reason Quick Pay leads the list of the Best Payment Gateways this year.

🏁 Conclusion: Why Quick Pay is the Best Payment Gateway in 2025

There are many great payment gateways in India, but none combine speed, simplicity, and security like Quick Pay.

Here’s why Quick Pay is #1 in our list of the Best Payment Gateways:

Blazing fast and 99.9% uptime

Advanced security features and fraud detection

Easy integration with any website or app

Affordable pricing with no hidden charges

24/7 customer support and real-time tracking

Flexible payment options to support all customers

If you're looking for a payment gateway that grows with your business and helps you deliver a great customer experience, Quick Pay is the clear winner in 2025.

1 note

·

View note

Text

Why Exporters Worlds is the Best B2B Portal for Export in the USA

In today's interconnected world, businesses are increasingly looking beyond their local markets to find new opportunities. One of the most effective ways to achieve this is through Business-to-Business (B2B) portals. These platforms serve as bridges, connecting buyers and sellers from different parts of the globe. For exporters in the USA, having a reliable B2B portal is crucial for growth and success. Among the many options available, Exporters Worlds stands out as a top choice.

1. What is a B2B Portal for Export?

A b2b portal for export is an online platform that facilitates trade between businesses across borders. It allows companies to showcase their products or services, connect with potential buyers, and manage transactions efficiently. These portals often provide tools for communication, payment processing, and logistics coordination, making international trade more accessible and streamlined.

2. Why USA Exporters Need a Reliable B2B Portal

Exporters in the USA face several challenges when trying to expand their reach internationally:

Finding Buyers: Identifying trustworthy buyers in foreign markets can be time-consuming and risky.

Managing Transactions: Handling payments, contracts, and negotiations across different legal systems can be complex.

Logistics: Coordinating shipping, customs, and delivery requires careful planning and expertise.

A reliable B2B portal simplifies these processes by offering a centralized marketplace where exporters can connect with verified buyers, manage transactions securely, and access resources to navigate logistics challenges.

3. Features That Make Exporters Worlds the Best Choice

Exporters Worlds offers several key features that set it apart from other B2B portals:

Wide Global Reach: The platform connects exporters with international buyers, expanding market opportunities.

Verified Buyers & Sellers: Ensuring trust and credibility, Exporters Worlds verifies all users, reducing the risk of fraud.

Easy Product Listing & Management: The user-friendly interface allows exporters to list and manage products effortlessly.

Secure Payment Solutions: Integrated payment systems protect financial transactions, providing peace of mind.

Advanced Search & Matchmaking: Sophisticated algorithms help exporters find the right business partners based on specific criteria.

4. How Exporters Worlds Helps USA Businesses Expand Internationally

Many USA businesses have successfully expanded their reach through Exporters Worlds. For instance, a small manufacturer of eco-friendly packaging connected with buyers in Europe, leading to a significant increase in sales. Testimonials from users highlight the platform's role in facilitating smooth transactions and fostering long-term business relationships.

5. SEO & Marketing Benefits of Listing on Exporters Worlds

Listing products on Exporters Worlds offers several marketing advantages:

Improved Online Visibility: Products listed on the platform are more likely to appear in search engine results, increasing exposure.

High-Ranking Product Pages: Optimized product pages can achieve higher rankings on Google, attracting more potential buyers.

Digital Marketing Tools: Exporters Worlds provides tools like SEO, PPC, and social media integration to enhance marketing efforts.

6. How to Get Started with Exporters Worlds

Getting started with Exporters Worlds is straightforward:

Simple Registration Process: Sign up by providing basic business information and product details.

Free vs. Premium Membership Benefits: While a free membership offers basic features, premium memberships provide additional benefits like enhanced visibility and access to advanced tools.

Best Practices for Optimizing Your B2B Profile: Complete your profile with accurate information, high-quality images, and detailed product descriptions to attract more buyers.

Conclusion

In conclusion, Exporters Worlds offers a comprehensive and user-friendly platform for USA b2b portal for export exporters looking to expand their international reach. With its global network, verified users, secure payment solutions, and marketing tools, it stands out as a top choice for businesses aiming for success in the global marketplace. Sign up today and take the first step toward expanding your business globally!

#Exporters Worlds#B2B export portal#USA exporters#global trade#international buyers#secure payment solutions#advanced matchmaking#product listing management#verified buyers and sellers#export platform#international marketplace#business expansion#digital marketing tools#SEO benefits#global reach#export success

0 notes

Text

IPTV Payment Gateway

Secure payment solutions are crucial for IPTV providers to manage transactions while addressing fraud, chargebacks, and regulatory challenges. This blog explains how IPTV payment gateways and high-risk merchant accounts ensure secure payments, prevent fraud, and build customer trust. Read the whole blog to know more.

#iptv payment gateway#payment gateway#IPTV payment gateway#secure payment solutions#high-risk payment processors#fraud prevention#IPTV merchant accounts

1 note

·

View note

Text

Ensure safe and seamless transactions with our secure payment solutions. Protect customer data, prevent fraud, and simplify your payment process with reliable, advanced security features.

0 notes

Text

Find secure payment solutions that deliver peace of mind. Choose solutions with advanced security features to prevent fraud and safeguard your transactions.

0 notes

Text

youtube

eCommerce Payment Solutions - The Future | Noire

Elevate your online business with NOIRE's intelligent payment solutions. Tackle eCommerce challenges and optimize your operations for lasting success.

Telephone - +44 (0)203 283 4585 Email Id - [email protected] Website - https://noire.com/

1 note

·

View note

Text

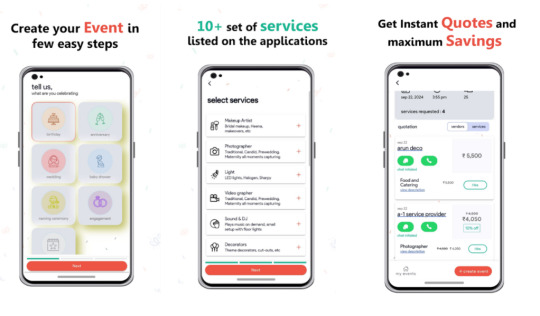

🎉 Say Hello to Seamless Event Planning with Ootbo App! 🎉

Planning an event can feel like juggling too many tasks at once. From finding the perfect venue to managing vendor communications and staying within budget, it’s easy to get overwhelmed. But what if you had an app that handled everything in one place? Enter the Ootbo App—the ultimate event planning tool designed to make organizing events stress-free, seamless, and fun! 🎈

Whether you’re planning a wedding, corporate event, birthday party, or any special occasion, the Ootbo App is your go-to solution for managing every aspect of the event planning process. 🗓️✨

🌟 Why Choose Ootbo App?

Gone are the days of switching between multiple apps, emails, and spreadsheets. Ootbo App simplifies the entire event planning process, from start to finish. Here’s how:

1. Create Events Effortlessly 🎨

Ootbo offers an intuitive interface that allows you to create detailed events in minutes. Simply input event details, set the date and time, and let Ootbo do the rest. 💡 Pro Tip: Customize your event profile to include specific requirements and preferences for vendors!

2. Receive Multiple Vendor Quotes 💼

Why chase down vendors when they can come to you? With Ootbo, you can: 🔍 Post your event requirements. 📩 Receive multiple quotes from verified vendors. 📊 Compare options side-by-side to choose the best fit.

This saves you time and ensures you get competitive pricing without the hassle of endless phone calls. 📞

3. In-App Vendor Chats 💬

Communication is key when planning an event, and Ootbo has you covered! 📱 Chat with potential vendors directly through the app. 📋 Discuss availability, services, and pricing in real time. 📎 Share documents, photos, and event details seamlessly.

Forget the confusion of scattered email threads—Ootbo keeps all your conversations in one place, organized and easy to access.

4. In-App Calls for Quick Decisions 📞

Sometimes, a quick call can make all the difference. Ootbo allows you to: 🔊 Make in-app calls to vendors without sharing personal contact details. 📌 Record important discussions and reference them later. 📈 Keep all event-related calls connected to your event profile.

No more searching through your call history for vendor numbers—everything stays in the app!

5. Hire Vendors with Confidence 🤝

Once you’ve reviewed quotes and discussed details, hiring your chosen vendor is as easy as a tap! 📄 Securely finalize agreements within the app. 💳 Pay vendors through a secure payment gateway. 🔒 Enjoy peace of mind knowing your transactions are protected.

With Ootbo, you’re not just hiring vendors—you’re partnering with professionals who are ready to make your event a success! 🎉

🏆 The Benefits of Using Ootbo App

All-in-One Solution: Manage your event from creation to completion in a single app.

Time-Saving: No more endless emails, phone calls, or spreadsheets.

Competitive Pricing: Receive and compare quotes to get the best value for your budget.

Seamless Communication: Chat and call vendors directly within the app.

Secure Transactions: Make payments and finalize contracts with confidence.

🎯 Who Can Use Ootbo?

Ootbo is designed for everyone! Whether you’re:

👰 Planning a wedding. 🏢 Organizing a corporate event. 🎂 Hosting a birthday party. 🎭 Coordinating a community event.

Ootbo App is your trusted event planning companion.

📲 Download the Ootbo App Today!

Ready to take the stress out of event planning? Download the Ootbo App today and experience the future of event management!

🔗 Visit Ootbo App to learn more. 📱 Available on iOS and Android.

Make your next event unforgettable with Ootbo! 🎉

With the Ootbo App, event planning has never been easier or more efficient. Start planning your dream event today! 🎈

#vent planning app#Best event management tool#Event vendor management#In-app vendor communication#Compare event vendor quotes#Event budget management app#Online event planning solution#Seamless event planning app#Event planning made easy#Chat with event vendors#Event organizer tool#Hire vendors online#Manage events from mobile#Event planning software for Android & iOS#ow to plan events with a mobile app#Best app to hire event vendors#Manage event budgets and vendors in one app#Event planning solution for weddings and parties#Secure in-app payments for event vendors

2 notes

·

View notes

Text

BitNest

BitNest: The Leader of the Digital Finance Revolution

BitNest is a leading platform dedicated to driving digital financial innovation and ecological development. We provide comprehensive cryptocurrency services, including saving, lending, payment, investment and many other functions, creating a rich financial experience for users.

Our story began in 2022 with the birth of the BitNest team, which has since opened a whole new chapter in digital finance. Through relentless effort and innovation, the BitNest ecosystem has grown rapidly to become one of the leaders in digital finance.

The core functions of BitNest ecosystem include:

Savings Service: Users can deposit funds into BitNest's savings system through smart contracts to obtain stable returns. We are committed to providing users with a safe and efficient savings solution to help you achieve your financial goals. Lending Platform: BitNest lending platform provides users with convenient borrowing services, users can use cryptocurrencies as collateral to obtain loans for stablecoins or other digital assets. Our lending system is safe and reliable, providing users with flexible financial support. Payment Solution: BitNest payment platform supports users to make secure and fast payment transactions worldwide. We are committed to creating a borderless payment network that allows users to make cross-border payments and remittances anytime, anywhere. Investment Opportunities: BitNest provides diversified investment opportunities that allow users to participate in trading and investing in various digital assets and gain lucrative returns. Our investment platform is safe and transparent, providing users with high-quality investment channels. Through continuous innovation and efforts, BitNest has become a leader in digital finance and is widely recognised and trusted globally. We will continue to be committed to promoting the development of digital finance, providing users with more secure and efficient financial services, and jointly creating a better future for digital finance.

#BitNest: The Leader of the Digital Finance Revolution#BitNest is a leading platform dedicated to driving digital financial innovation and ecological development. We provide comprehensive crypto#including saving#lending#payment#investment and many other functions#creating a rich financial experience for users.#Our story began in 2022 with the birth of the BitNest team#which has since opened a whole new chapter in digital finance. Through relentless effort and innovation#the BitNest ecosystem has grown rapidly to become one of the leaders in digital finance.#The core functions of BitNest ecosystem include:#Savings Service: Users can deposit funds into BitNest's savings system through smart contracts to obtain stable returns. We are committed t#Lending Platform: BitNest lending platform provides users with convenient borrowing services#users can use cryptocurrencies as collateral to obtain loans for stablecoins or other digital assets. Our lending system is safe and reliab#providing users with flexible financial support.#Payment Solution: BitNest payment platform supports users to make secure and fast payment transactions worldwide. We are committed to creat#anywhere.#Investment Opportunities: BitNest provides diversified investment opportunities that allow users to participate in trading and investing in#providing users with high-quality investment channels.#Through continuous innovation and efforts#BitNest has become a leader in digital finance and is widely recognised and trusted globally. We will continue to be committed to promoting#providing users with more secure and efficient financial services#and jointly creating a better future for digital finance.#BitNest#BitNestCryptographically

4 notes

·

View notes

Text

#Echecks#Electronic checks#Merchant services#Payment processing#Digital payments#ACH (Automated Clearing House)#Online payments#Payment gateways#Payment solutions#E-commerce payments#Payment processors#Secure transactions#Electronic funds transfer#Payment technology#Payment verification#Payment acceptance#Digital banking#Transaction fees#Fraud prevention#Payment authorization

3 notes

·

View notes

Text

#Business transactions#Efficient payment processing#Cashing services#Payment processing#Secure payment solutions#Instant payment services

0 notes

Text

Choosing the right payment gateway is critical for your SaaS platform’s success. With Algoworks, you don’t have to navigate this decision alone.

Our experts analyze your business needs; help you integrate multiple secure and scalable payment options and ensure smooth subscription management tailored to your user base and global markets.

Let Algoworks streamline your payment processes so you can focus on innovation and growth.

#saas platform#payment gateway#subscription management#secure payments#saas solutions#business growth

0 notes

Text

Payment failures damage trust and stall growth. At CQLsys Technologies, we build custom payment API solutions for on-demand apps that ensure seamless, secure, and reliable transactions. Our systems support multiple gateways (Stripe, Razorpay, PayPal), smart retry logic, one-tap refunds, subscriptions, real-time monitoring, and PCI-DSS compliance. Whether you're launching a ride-share, food delivery, or service booking platform—we eliminate downtime, reduce failure rates, and boost retention. Power your app with payments built to perform from Day 1.

#custom payment gateway integration for apps#build secure payment systems for mobile apps#reduce payment failures in on-demand apps#how to integrate multiple payment gateways#real-time payment monitoring API#payment APIs for food delivery and ride-share apps#boost app retention with seamless checkout#one-tap refunds and subscriptions API#scalable payment solutions for startups#minimize downtime in app payments

0 notes

Text

youtube

Bye Cash. Hello E-Wallets.

Mobile wallets are transforming how people shop and pay. In this video, learn everything you need to know about eWallet technology, including the different wallet types and what makes them secure, fast, and easy to use.

✔ Why cashless living is the new norm ✔ Top UX features for wallet-based apps ✔ Integration tips for payment systems ✔ Bonus: How to make your wallet app stand out

The future of payments is already in your pocket.

Check out the original video - https://www.youtube.com/shorts/Xm73Errreo8

#Mobile Wallet App Development#Digital Payment App Solutions#Ewallet App Development Company#Secure Payment Gateway Integration#Cashless Payment App Development#Youtube

0 notes

Text

Why POS Testing is Crucial for Flawless Retail Operations

In the fast-moving world of retail, Point of Sale (POS) systems are central to transactions, inventory management, and customer interface. If we want to keep POS systems working properly, it is important to ensure they run smoothly. A smooth POS system is necessary for a smooth customer experience and a smooth operation. Here at GQAT TECH, we are experts in POS testing so businesses can eliminate costly interruptions to their business and have more reliability with their POS. This blog will look at why POS testing is important and how it will improve your business for retail operations.

What is POS Testing?

Testing a POS enables extensive testing of the working capabilities, functionality, performance, security, and interoperability of the POS to be tested in the real world as a functional and transactional system. POS comprises hardware such as card readers, scanners, and computer devices, and POS software that processes payments and often manages inventories. POS need to be tested to process high transaction volumes, interact with other systems, and satisfy industry standard security compliance.

Why POS Testing Matters

1. Ensuring Transaction Completeness

A single mistake made within a POS can generate incorrect customer charges, inventory discrepancies, or processes that don't reach completion. One mistake can frustrate your customers, disgruntle your employees, or derail UX. Proper POS testing can ensure that your processes (whether they include cash, credit cards, mobile payments, or gift cards) will function correctly.

2. Testing system robustness

The retail environment can be harsh. Depending on the season, your POS may process thousands of transactions each day. Performance testing will verify that your POS is sufficient to process peak loads and act to mitigate crashing or performance degradation when it counts the most (e.g., during a holiday sale).

3. Protecting Customer Information

As cyber threats grow in number and sophistication, protecting customers' sensitive information, including their credit card information, is paramount. Security testing will find weaknesses in your POS systems with the goal of satisfying standards and requirements (i.e., PCI DSS) and identifying and eliminating risks to customer data exposure.

4. Ensuring integration & compatibility with other systems

A POS often resides at the intersection of multiple systems (inventory management system, CRM, accounting system, etc.). Even testing limits can identify different systems interacting with your POS, ensuring that an isolated application does not disrupt a chain that could lead to other separate systems eventually failing to receive data.

5. Increasing Customer Satisfaction

A gap in your checkout process can diminish customer satisfaction (a focus for your company). Testing usability and responsiveness will ensure your staff understands how to use the POS, as customers experience an intuitive, fast, and error-free transaction with your store.

Key Types of POS Testing

Our testing services include all types of testing you may need for your cash register and/or POS system. Here are some examples of the types of testing we provide:

Functional Testing: Testing all of the functionalities (payment processing, refunds, discounts, etc.) to make sure everything works correctly.

Performance Testing: Testing to understand your solution's reliability in peak transaction situations, or under stress.

Security Testing: Testing for gaps in security so you can protect customer data and compliance.

Compatibility Testing: Testing all the devices, operating systems, and integrations that the cash register and or POS system will have.

Usability Testing: Testing how easy it is to use for the associates and customers.

Regression Testing: Testing how the changes or new upgrades could impact existing functionality.

Why Choose GQATTech for POS Testing?

At GQATTech, we bring years of knowledge and expertise in the industry and cutting-edge testing procedures to deliver reliable, scalable, and secure POS, in-store experiences, and omnichannel solutions. Our dedicated team of testers uses both manual testing and automated testing to identify defects early, saving you time and money. Whether you are upgrading, replacing, integrating, or rolling out a new POS system, the test services that we design and conduct for you can ensure a positive experience and that the systems work as they should.

Conclusion

In our view, a comprehensive approach to POS testing is not just about checking boxes or even about each and every defect. It is really about all the components that contribute to customer confidence, operational efficiencies, or staying ahead (or even just keeping up) with the competition. From our perspective, if you can achieve true testing goals by hiring GQATTech and using our knowledge and expertise, we can assist with each of these aspirations. Visit us at gqattech.com/pos-testing/ to discover how we can assist your organization.

Are you prepared to examine what we can do for your POS, in-store experience, or omnichannel performance? We are committed to accomplishing that today! Reach out to us to discuss your testing requirements!

Visit Us: https://gqattech.com Contact Us: [email protected]

#POS Testing#Point of Sale#Retail Technology#Transaction Processing#System Reliability#Customer Experience#Security Testing#Performance Testing#Functional Testing#Compatibility Testing#Usability Testing#Regression Testing#Retail Operations#Payment Systems#PCI DSS Compliance#Inventory Management#Omnichannel Solutions#GQATTech#Software Testing#Customer Data Protection

0 notes