#stock trading algorithm

Explore tagged Tumblr posts

Text

Algorithmic Options Trading Made Simple

Algorithmic Options Trading: The Future of Smart Investing

Introduction

Imagine having a smart assistant who can analyze thousands of data points in seconds and make accurate trading decisions on your behalf—even while you're sleeping. That's exactly what Algorithmic Options Trading does. It brings together the power of data, speed, and emotionless logic to the trading world using automated trading software or algo software. This might sound futuristic, but it’s already transforming how people invest.

In this article, we’ll break it all down in simple language. Whether you’re new to trading or curious about how auto trading software works, you’re in the right place.

Discover Algorithmic Options Trading with automated trading software, auto trading software & powerful algo software in this easy-to-follow guide.

What is Algorithmic Options Trading?

Algorithmic Options Trading is the use of computer programs to automate trading strategies in the options market. These programs follow a defined set of rules—based on price, timing, volume, or even technical indicators—to make trades automatically.

Think of it like this: it’s similar to using cruise control in your car. You set the speed and direction, and the system handles the drive. You only intervene if needed.

How Does Algo Trading Work in Options?

In options trading, algorithms monitor the market and place orders based on pre-defined logic. For example:

Buy a call option when the price crosses a moving average.

Sell a put option if volatility drops below a certain level.

All of this happens automatically, without needing you to watch the screen 24/7.

Why Algorithmic Trading is Gaining Popularity

More and more retail and professional traders are turning to auto trading software. Here’s why:

Speed: Algorithms react faster than humans.

Accuracy: Eliminates emotional decision-making.

Efficiency: Can handle large volumes and multiple trades at once.

Accessibility: With modern tools, even beginners can use algorithms.

Key Benefits of Using Auto Trading Software

Let’s take a closer look at the advantages of using automated trading software:

Emotion-Free Trading: Say goodbye to fear and greed.

Backtesting Ability: Test your strategy on historical data.

24/7 Monitoring: Algorithms don’t sleep or take breaks.

Diversification: Trade across multiple strategies or assets simultaneously.

Bottom Line: It’s like having a team of tireless, super-fast assistants working for you.

Common Strategies in Algorithmic Options Trading

Not all algorithms are created equal. Some of the most common strategies include:

a. Trend Following

Buys when the market is trending up, sells when it trends down.

Based on technical indicators like Moving Averages or MACD.

b. Mean Reversion

Assumes prices will return to their average.

Useful for short-term strategies.

c. Arbitrage

Profits from price differences between markets or instruments.

Fast execution is key.

d. Volatility-Based

Trades based on how volatile an asset is.

Especially useful in options where volatility directly impacts price.

Components of Algo Software for Trading

To make it all work, an algo software typically includes:

Strategy Builder: To define rules and logic.

Data Feed: Real-time market data for decisions.

Backtesting Module: Try your logic on past data.

Execution Engine: Places trades with your broker.

Risk Management Tools: Stop-loss, position sizing, etc.

How to Get Started with Algorithmic Options Trading

Here’s a step-by-step plan:

Understand Options Basics – Know what calls, puts, and strike prices are.

Choose a Strategy – Pick one that fits your style.

Select Algo Software – Find a platform that supports your broker and has user-friendly tools.

Backtest Your Strategy – Use historical data to validate it.

Paper Trade First – Test without real money.

Go Live – Start small, monitor performance.

Real-Life Examples: How Algorithms Win

Example 1: A trader sets an algorithm to buy NIFTY options every time it crosses above the 20-day moving average. The system catches small trends before most traders even notice.

Example 2: During a volatile day, a volatility-based algorithm sells out-of-the-money puts and quickly profits as the market stabilizes.

These are not just simulations—they happen every day in real markets.

Manual vs Algorithmic Trading: What’s Better?

Let’s compare:

Feature

Manual Trading

Algorithmic Trading

Speed

Slower

Lightning Fast

Emotions

High

None

Accuracy

Varies

Consistent

Scalability

Limited

High

Verdict? If you value consistency, scalability, and objectivity, algo trading wins hands down.

Risk Factors You Should Know

Trading with algorithms is powerful—but not risk-free.

Overfitting: Strategy works only on historical data but fails live.

Technical Failures: Bugs or internet outages can ruin trades.

Market Changes: Algorithms must adapt to new market conditions.

Tip: Always keep an eye on your algo, especially in volatile markets.

Regulation and Legal Considerations in India

In India, SEBI regulates algorithmic trading. Here are a few key points:

Only brokers and entities with SEBI approval can deploy fully automated strategies.

Some platforms allow semi-automated or API-based trading.

Retail investors should ensure the platform follows SEBI rules.

Best Practices for Success in Auto Trading

To stay on the winning side:

Start Simple: Don’t overcomplicate your first strategy.

Track Performance: Keep logs and learn from your results.

Update Regularly: Markets evolve, and so should your algorithm.

Risk Management is Key: Never risk more than you can afford to lose.

How to Choose the Right Algo Software

Not all platforms are equal. Look for:

Ease of Use: Drag-and-drop strategy builders are beginner-friendly.

Backtesting Tools: Must-have for testing.

Broker Integration: Supports your preferred broker.

Real-Time Data: Accurate and fast data is non-negotiable.

Support & Community: Forums, tutorials, and help when you need it.

Popular platforms include:

Quanttrix

AlgoTest

TradingView (with Pine Script)

Zerodha Streak

Future of Algorithmic Options Trading

The future looks bright, thanks to:

AI and Machine Learning: Smarter algorithms that adapt in real-time.

Cloud-Based Platforms: Trade from anywhere, anytime.

Lower Barriers: More accessible for the average investor.

Greater Customization: Tailor strategies down to the last variable.

Final Thoughts

Algorithmic Options Trading is no longer just for techies or hedge funds. With the rise of user-friendly automated trading software, anyone can build and deploy powerful strategies.

It’s like upgrading from a manual car to a Tesla—you still control the destination, but the ride is smoother, faster, and more efficient.

If you’ve been hesitant about jumping in, start small. Use auto trading software to test ideas, gain confidence, and slowly scale your strategies. The future of trading is here—and it’s automated.

Frequently Asked Questions (FAQs)

1. What is algorithmic options trading?

Algorithmic options trading uses computer programs to automatically buy and sell options based on pre-defined rules and strategies.

2. Is algorithmic trading better than manual trading?

For many, yes. It’s faster, emotion-free, and more efficient—especially when using robust algo software.

3. Do I need coding knowledge to use automated trading software?

Not necessarily. Many platforms now offer no-code or low-code solutions, making it beginner-friendly.

4. Can retail investors in India use algorithmic options trading?

Yes, but they must ensure compliance with SEBI regulations. Many platforms offer semi-automated tools for retail users.

5. What’s the best algo software for beginners?

Platforms like Quanttrix and Zerodha Streak are great for beginners due to their simplicity and features like drag-and-drop strategy building.

0 notes

Text

UAITrading (Unstoppable AI Trading): AI-Powered Trading for Stocks, Forex, and Crypto

https://uaitrading.ai/ UAITrading For On trading volumes offers, many free trade analysis tools and pending bonuses | Unstoppable AI Trading (Uaitrading) is a platform that integrates advanced artificial intelligence (AI) technologies to enhance trading strategies across various financial markets, including stocks, forex, and cryptocurrencies. By leveraging AI, the platform aims to provide real-time asset monitoring, automated portfolio management, and optimized trade execution, thereby simplifying the investment process for users.

One of the innovative features of Unstoppable AI Trading is its UAI token farming, which offers users opportunities to earn additional income through decentralized finance (DeFi) mechanisms. This approach allows traders to diversify their investment strategies and potentially increase returns by participating in token farming activities.

The platform's AI-driven systems are designed to analyze vast amounts of market data, identify profitable trading opportunities, and execute trades without human intervention. This automation not only enhances efficiency but also reduces the emotional biases that often affect human traders, leading to more consistent and objective trading decisions.

By harnessing the power of AI, Unstoppable AI Trading aims to empower both novice and experienced traders to navigate the complexities of financial markets more effectively, offering tools and strategies that adapt to dynamic market conditions

#Uaitrading#AI Trading#Automated Trading#Forex Trading AI#Crypto Trading Bot#UAI Token#Token Farming#Decentralized Finance (DeFi)#AI Investment Platform#Smart Trading Algorithms#AI Stock Trading#Machine Learning in Trading#AI-Powered Portfolio Management#Algorithmic Trading#Uaitrading AI Trading#Forex AI#Smart Trading#Stock Market#AI Investing#Machine Learning Trading#Trading Bot#Crypto AI#DeFi#UAI#Crypto Investing

2 notes

·

View notes

Text

DeepSeek AI vs Algo Trading: Automate Your Stock Trading Strategies

DeepSeek AI is a low cost Artificial intelligence chatbot Integrating DeepSeek AI with Algo Trading can improve the decision making process in stock market.

Read more..

#deepseek ai#open ai#algo trading india#artificial intelligence#open AI#algo trading#algo trading app#algo trading platform#algo trading strategies#algorithm software for trading#bigul#bigul algo#finance#free algo trading software#ai#stock market#share market#share market news#DeepSeek LLM#DeepSeek Coder#Python#Algorithmic Trading#algorithm#algo trading software india#best algo trading app in india#Best share trading app in India#best algorithmic trading software

5 notes

·

View notes

Text

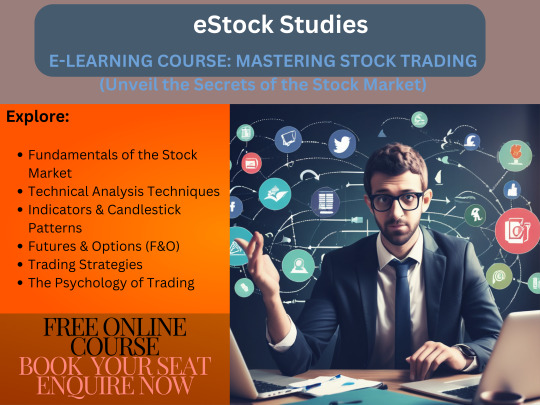

eStock Studies: Online Trading Courses from Basics to Advanced.

eStock Studies: free Online Stock Market Trading Courses from Basic to Advanced, Including Algorithmic Trading Techniques, for Aspiring Trading Experts.

#estock studies#free online stock market trading courses#trading expert#Basic of Stock Market#ALGORITHMIC TRADING TECHNIQUES#trading from basic to advanced#free online Trading Courses#expert trading institute

2 notes

·

View notes

Text

NSE Sets Up Framework To Monitor Retail Algos, Empanel Providers For Investor Safety

Last Updated:July 24, 2025, 14:20 IST The National Stock Exchange (NSE) has released comprehensive operational guidelines for the empanelment of algo providers NSE will be maintaining an updated list of all the registered algo providers on its website The National Stock Exchange (NSE) has released comprehensive operational guidelines for the empanelment of algo providers and registration of…

#algo ID#algo providers#algo strategy registration#algorithmic trading#automated trading#broker responsibility#Client Direct API#empanelment of algo vendors#investor protection#market regulation#NSE#NSE circular#NSE norms#PAN disclosure#retail algo trading#retail investors#SEBI rules#Stock Exchange#trading members#UCC

0 notes

Text

1 note

·

View note

Text

AI in Trading: How Machine Learning Algorithms Analyze the Market

AI in Trading: How Machine Learning Algorithms Analyze the Market Artificial Intelligence and Machine Learning are transforming financial markets. At uaitrading.ai, we use AI-driven models to analyze data, forecast trends, and automate trading decisions with speed and precision.

How AI Works in Trading:

Time Series Analysis: Models like ARIMA, LSTM, and Prophet forecast price movements based on historical patterns.

Neural Networks: Deep learning captures complex relationships between market indicators for more accurate predictions.

Reinforcement Learning: AI learns from past trades, continuously optimizing strategies based on outcomes.

Sentiment Analysis: NLP tools scan news, tweets, and financial reports to gauge investor sentiment and anticipate price shifts.

Advantages:

✅ Speed & Scale – Analyze large datasets in milliseconds ✅ Emotion-Free Trading – Decisions based on data, not bias ✅ 24/7 Automation – Execute trades without manual intervention

Limitations:

❌ Unpredictable Events – AI can't foresee black swan events ❌ Overfitting Risk – Too much reliance on past data ❌ Data Sensitivity – Poor input data = flawed predictions

AI is revolutionizing trading, but it's not a silver bullet. At uaitrading.ai, we combine intelligent algorithms with strong risk management to empower traders with smarter, faster, and more informed decisions.evolution

#Forex trading platform#Artificial intelligence stock trading#AI options trading#best AI for forex trading#AI stock trading#AI algorithmic trading#AI for forex trading#AI in forex trading#trading with ChatGPT#forex artificial intelligence

0 notes

Text

How Algo Trading Works: An In-Depth Exploration

Discover how algo trading works in this in depth guide Learn about automated strategies, market analysis, and the benefits of algorithmic trading

1 note

·

View note

Text

What is FII and DII? How They Shape the Stock Market

The stock market is a battlefield of buyers and sellers, but two major players dominate the scene—Foreign Institutional Investors (FII) and Domestic Institutional Investors (DII). Their buying and selling activities determine market direction, liquidity, and volatility.

If you're wondering how FII and DII impact your investments, you're in the right place. To dive deeper, check out this detailed blog on What is FII and DII? Understanding Their Role in the Stock Market on Tradetron.

Understanding FII (Foreign Institutional Investors)

FIIs are global investment firms, hedge funds, and pension funds that inject foreign capital into the Indian stock market. Their presence boosts liquidity but also makes the market more sensitive to global trends.

Why Do FIIs Matter?

Market Liquidity – High FII inflows mean more money circulating in the market.

Stock Volatility – FIIs can trigger sharp market movements with large transactions.

Economic Sentiment – A rise in FII investments signals global confidence in India’s economy.

Factors Influencing FII Investments

Global Interest Rates – Higher US rates often lead to FII outflows from India.

Government Policies – Investor-friendly reforms attract foreign capital.

Economic Growth – A strong GDP outlook encourages more FII participation.

Understanding DII (Domestic Institutional Investors)

DIIs are financial institutions within India, including mutual funds, insurance firms, and pension funds. They play a stabilizing role by countering FII-driven volatility.

Why Are DIIs Important?

Market Stability – DIIs help reduce the impact of sudden FII exits.

Long-Term Investment Strategy – DIIs focus on fundamental growth, not just quick profits.

Retail Investor Confidence – DIIs represent domestic investor sentiment.

Factors Influencing DII Investments

Retail Participation – Stronger retail investments lead to higher DII inflows.

Market Valuation – DIIs prefer undervalued stocks for long-term gains.

Government Schemes – Policies like EPF and insurance investments drive DII activity.

How FII and DII Influence the Stock Market

The battle between FII and DII determines whether the market rises or falls.

If FIIs buy aggressively → The market surges.

If FIIs sell off → The market crashes, but DIIs step in to stabilize.

If DIIs and FIIs both invest → Strong bullish momentum is created.

For investors, tracking FII and DII flows can help predict stock market trends and adjust strategies accordingly.

How Can Retail Investors Use FII and DII Data?

By following FII and DII trends, you can make better investment decisions:

✅ Monitor FII inflows/outflows – High FII buying means optimism, while outflows signal caution. ✅ Align with DII strategies – DIIs invest in strong, stable stocks, making them a good reference point. ✅ Diversify investments – Avoid dependence on foreign investments by balancing your portfolio.

Conclusion

Understanding what is FII and DII can help investors navigate market movements with confidence. FIIs bring in foreign capital but cause volatility, while DIIs provide long-term stability. Smart investors track their activities to make informed decisions.

Want to learn more? Read this in-depth guide on What is FII and DII? Understanding Their Role in the Stock Market on Tradetron.

FAQs on FII and DII

1. How do FIIs and DIIs influence stock prices? FIIs drive short-term market trends, while DIIs provide stability during fluctuations.

2. Why do FIIs exit the Indian stock market? FIIs withdraw funds due to global uncertainty, rising US interest rates, or policy changes.

3. Where can I track FII and DII investments? Stock exchanges and financial websites provide daily FII/DII investment data.

4. Are DIIs more reliable than FIIs? Yes, DIIs invest with a long-term vision, while FIIs are more reactive to global trends.

5. Where can I find more insights on FII and DII trends? Check out this blog on What is FII and DII? Understanding Their Role in the Stock Market on Tradetron.

0 notes

Text

Stock Exchange Broker In India

Estee Advisors is a leading stock exchange broker in India, specializing in algorithmic trading, low-latency brokerage services, and quant-based investment management. As a SEBI-registered broker, Estee provides high-frequency trading solutions, market-making services, and execution support for institutional investors. With expertise in Indian capital markets, they ensure efficient and reliable trade execution for global investors.

#stock exchange brokers in india#ultra low latency provider in india#algo trading in india#algorithmic trading companies india

0 notes

Text

Denta Water IPO GMP, Open Date, Price Band, Allotment Status

Denta Water IPO price band is Rs 279 to Rs 294 per share. Denta Water IPO GMP is 28 per share. Live IPO Grey Market Premium details will be visible online.

#Denta Water IPO#bigul#ipo#bigul trading#stockmarket#ipo alert#stock market#sharemarket#IPO Issue Size#IPO Price Band#IPO GMP#IPO Allotment Status#IPO details#IPO dates#IPO Objectives#IPO Time Table#IPO Lot Size Details#IPO Registrar and Lead Managers#IPO FAQs#algo trading#algo trading software#algo trading platform#algorithm software for trading#free algo trading software#algo trading india#algo trading app#algo trading strategies#bigul algo#bigul algo trading#bigul algo trading review

0 notes

Text

DeepSeek AI is an artificial intelligence chatbot developed by a Chinese AI team.

DeepSeek AI is an artificial intelligence chatbot developed by a Chinese AI team. DeepSeek AI Models can also benefit stock market traders in many ways.

Read more...

#DeepSeek AI#Open AI#Stock Market#Algo Trading#Artificial Intelligence#DeepSeek LLM#DeepSeek Coder#Python#bigul#best algo trading app in india#bigultradingapp#bigulalgo#algo trading software india#ipo alert#algo trading app#algo trading india#algo trading platform#algo trading strategies#algorithm software for trading#bigul algo#finance#free algo trading software#investment#investmentplatform#algotrading

4 notes

·

View notes

Text

#best online stock trading courses for beginners#stock market trading courses#stock tutor#stock market master class#algorithmic trading bootcamp

0 notes

Text

How SureShotFX Traders Are Excelling with Myfxbook Growth Charts

The results are in, and SureShotFX traders are making waves with their impressive performance, as tracked on Myfxbook. By connecting their accounts, traders can showcase their steady growth and disciplined approach to trading, all powered by SureShotFX signals.

Traders using SureShotFX often see consistent growth in their portfolios. Myfxbook growth charts highlight this progress through clear upward trends, reflecting disciplined trading strategies and effective risk management. For instance, some users report a growth rate of up to 20% monthly, a testament to the accuracy and reliability of SureShotFX signals.

One standout feature in these growth charts is the smooth equity curves. These curves illustrate not just the profits traders achieve but also their ability to manage drawdowns effectively, keeping them low and preserving account balance during market fluctuations. This combination of growth and risk management sets SureShotFX traders apart.

The Myfxbook platform allows users to track performance over weeks, months, and even years, showing how SureShotFX enables sustained trading success. These charts don’t just represent numbers; they tell the story of traders who trust a proven system and reap consistent results.

If you're wondering whether SureShotFX could transform your trading, the growth charts on Myfxbook provide all the evidence you need. It's not just about signals—it's about a complete trading experience that delivers measurable and reliable outcomes.

Start your journey with SureShotFX today, and let your growth story unfold on Myfxbook.

#SureShotFX#SSF#myfxbook#forextrading#forex education#currency markets#xauusd#economy#finance#stock market#investing#algorithmic trading#algo#algorithm#algo trading

1 note

·

View note

Text

The stock market can be a thrilling arena, offering the potential for significant growth opportunities. However, it’s no secret that it can also be a landmine for the unwary. Emotions, impulsive decisions, and the sheer complexity of market movements can all contribute to losses. This is where algo trading software steps in, offering a powerful tool for mitigating risk and potentially improving trading performance. Let’s explore how algorithmic trading software assists traders in understanding market dynamics and managing risks in stock trading scenarios.

#algorithmic trading software#Stock Trading#algorithm trading strategy#uTrade Algos mobile app#no-code trading platform

0 notes

Text

Exploring Different Trading Methods in the Stock Market

The stock market offers various trading methods suited to different risk levels and investment strategies. Understanding these approaches can help traders make informed decisions and improve their trading efficiency. In this guide, we explore the most popular trading methods in the stock market and how Tradetron, the best algo trading platform in India, can help automate and optimize these strategies.

1. Intraday Trading

Intraday trading, also known as day trading, involves executing buy and sell orders within the same trading day. It is ideal for traders who want to capitalize on short-term price movements.

Key Features:

Positions are closed before market closure

Requires real-time market monitoring and quick decision-making

Relies on technical analysis and chart patterns

2. Swing Trading

Swing trading involves holding stocks for several days or weeks to benefit from short-term trends.

Advantages of Swing Trading:

Less time-intensive than day trading

Balances risk and reward effectively

Utilizes both technical and fundamental analysis

3. Position Trading

Position traders hold assets for longer periods, typically weeks to years, based on macroeconomic trends and company fundamentals.

Why Choose Position Trading?

Less frequent trading reduces stress

Emphasizes long-term value investing

Suitable for traders who prefer a passive approach

4. Scalping

Scalping is an ultra-short-term trading strategy where traders make multiple trades in a single day to take advantage of small price fluctuations.

Key Traits:

High-frequency trading with small profit margins

Best suited for liquid stocks with tight spreads

Requires rapid execution and precision

5. Algorithmic Trading

Algorithmic trading, or algo trading, automates trade execution based on pre-set conditions, eliminating emotional biases and improving efficiency.

Why Use Algo Trading?

Lightning-fast trade execution

Reduces human errors and emotional trading

Enhances risk management with automated strategies

Tradetron: The Best Algo Trading Platform in India

Tradetron is India’s leading algo trading platform, designed to help traders automate and optimize their trading strategies without requiring coding expertise. Whether you're a beginner or an experienced trader, Tradetron simplifies algorithmic trading for everyone.

6. Futures & Options Trading

Futures and options (F&O) trading involves derivatives that allow traders to hedge risks and speculate on asset price movements.

What Makes F&O Trading Unique?

Offers leverage to amplify profits

Helps hedge against market risks

Requires an in-depth understanding of derivative markets

7. Long-Term Investment (Delivery Trading)

Delivery trading focuses on buying and holding stocks for long-term capital appreciation, making it ideal for investors looking to build wealth over time.

Why Opt for Delivery Trading?

No pressure to sell within a short period

Suitable for wealth creation and long-term financial goals

Lower risk compared to short-term trading strategies

Final Thoughts

Each of these trading methods in the stock market caters to different investment goals and risk levels. Whether you prefer short-term strategies like scalping and day trading or long-term investment approaches, automating your trades with Tradetron, the best algo trading platform in India, can enhance your efficiency and profitability.

Start your journey in automated trading today with Tradetron!

0 notes