#tax estimation software

Explore tagged Tumblr posts

Text

Simple Global Tax Claculator for India, USA, Canada Etc

GlobeTax – Creative Global Tax Calculator Global Tax Calculator Experience tax calculation with beautiful country-themed designs Tax Information Select Country United States (USD) India (INR) United Kingdom (GBP) Canada (CAD) Australia (AUD) Germany (EUR) Annual Income ($) Filing Status Single Married Filing Jointly Head of Household Deductions ($) Tax Credits ($) State Tax Rate…

#expat tax calculator#financial planning tool#global tax calculator#income tax calculator#India tax calculator#multi-country tax tool#online tax planning#tax calculator#tax deduction finder#tax estimation software#tax savings calculator#UK tax calculator#US tax estimator

0 notes

Text

Simple Global Tax Claculator for India, USA, Canada Etc

Global Tax Calculator | Calculate Your Taxes for Any Country Global Tax Calculator Calculate your tax obligations for multiple countries with our advanced calculator Tax Information Select Country United States (USD) India (INR) United Kingdom (GBP) Canada (CAD) Australia (AUD) Germany (EUR) Annual Income ($) Filing Status Single Married Filing Jointly Head of Household Deductions…

#expat tax calculator#financial planning tool#global tax calculator#income tax calculator#India tax calculator#multi-country tax tool#online tax planning#tax calculator#tax deduction finder#tax estimation software#tax savings calculator#UK tax calculator#US tax estimator

0 notes

Text

#Tax filing for freelancers#Freelance tax deductions#Self-employed tax tips#Maximize tax returns freelancers#Freelancer tax guide#Tax tips for self-employed#Independent contractor taxes#Minimize tax stress#Tax filing deadlines freelancers#Business expense deductions#Freelance income reporting#Home office tax deductions#Estimated tax payments freelancers#Tax software for freelancers#Tax planning for freelancers#1099 tax forms guidance#Self-employed retirement deductions#Health insurance deductions freelancers#Tax credits for freelancers#Record keeping for freelance taxes

0 notes

Note

Amy tips for getting 30 prebuilt pcs for 1500$ each

We're going to play a game where I show tumblr what I do at work by doing it on tumblr. You can answer my questions in successive anonymous asks. My responses to you will be bracketed by dashed lines, with instructions and commentary before and after.

---------------------------

Hi Anon!

I can definitely help you with your desktop needs. Can you tell me whether you're looking minimize your costs, or get the maximum amount of computer that I can get you for a per-unit price of $1500?

Here are some details that will help me narrow down options that are a good fit for your situation:

Very generally, what will these be for? Basic office use (browsing, office suite)? Video Production? CAD? Finance? Medical providers? Educators?

What date are you looking to have these machines in place?

Is there a specific type of software that you know will be installed on these devices, and if so can you get me the hardware specs required by the software vendor?

Please let me know if you've got any questions, or if there is anything that I can do for you.

Thanks! - Ms-D

-----------------------------

The average cost of business desktops that I sell at work is $700-$900; these are devices that I would give an anticipated lifespan of 7 years, with hardware upgrades planned at 5 years. This is for a mid-range desktop with a 3-year next business day onsite warranty, no software, and does not include the cost of tax, shipping, or configuration. The cost of labor can come close to the cost of the machine for configuration. If I were *PERSONALLY* deploying these machines (pulling them out of the box, debloating, creating profiles, installing software, reboxing, transporting to the site, installing and connecting to peripherals) I'd probably charge around $200-300 per device. My work charges a lot more. Because of that, a 1500 computer is quite likely to be a 700 computer with three hours of estimated labor. If you've got an in-house IT department and aren't going to be paying through the nose for setup, you can get *a lot* of business-class computer for $1500.

If someone at work asked me for a $1500 computer, I would assume that was the cost of the machine ONLY, no peripherals, no configuration, no installation, no software, though I would try to consider both tax and our markup and would look for devices that would maximize performance while under-but-close-to the mark. If I found something that was slightly over (say by up to $70), I would drop our markup to get closer to the client's budget.

What this means for YOU, the computer consumer, is that when you're looking at a computer you need to consider the following in your budget, NOT just the sticker price.

Computer Cost

Software Cost

Setup Cost (if you're not doing it yourself)

Shipping Cost

Tax

Peripherals (computers almost all come with a mouse and a keyboard, these are usually inexpensive but very sturdy; if you want a nice keyboard and an ergonomic mouse you have to buy your own)

Whether you will LOSE peripherals when you replace your current device - do you need to buy an external optical disk drive if your old machine had a CD drive but the new machine doesn't?

Those things can add hundreds of dollars to your total cost, so figure out how much that will be so that you can figure out what your ACTUAL budget for your computer is.

(Also your computer shouldn't be plugged directly into the wall; if you're getting ready to replace a machine and you don't already own a desktop UPS, a desktop UPS should be part of the cost of your next machine!)

118 notes

·

View notes

Text

Playing cards project going well! Quality is amazing. I am currently familiarising myself with the logistics portals some of the fulfilment centers/warehouses I work with use to notify them of incoming shipments. The software is very detailed/complicated for something so simple 😁 Estimated arrival times* US: mid-nov, dec Europe, UK: dec/early jan AU, NZ: early jan ROW: varies, but definitely by early jan *All the playing cards need to go past customs before they arrive at the (LGBTQ+ friendly(!); unfortunately in my quest to look for partners, not all emails I sent out got a reply) fulfilment centers. I work with a company that looks into all the legal aspects of this project (logistics, taxes), so that should go smoothly. Unfortunately there will be lots of volume at the ports and fulfilment centers due to stores preparing for Black Friday and Christmas; all parties involved in this project would like me to inform you that delivery dates cannot be guaranteed but are very likely to be met. We are all excited and doing our best for you to hold these cards in your hands soon! (: Stay proud! ⚔️🌈 ~ Roderick

1K notes

·

View notes

Text

okay sooo i made some sketches for a few of the sprites i'll be using, some of which i'm gonna show here, as well as thinking about the code edits i'll need to do for this project. i don't want to just redraw a shimeji to look like SQQ, i want him to act and move in character, so i have a whole bunch of edits to do

some of my notes:

i'm not yet sure how many sprites some animations will require so i'm not putting in a final number, or numbering which sprites will be used for what animation, but i'm going to throw out an estimate that the final sprite count will be about sixty-ish.

i mostly have all my animations already planned out. i know what i want them to look like and know how to do it, but there's a few i still need to think about, like one of the multiplying animations. i considered just getting rid of the one i have no ideas for, but i'll think on it some more. i'm open to suggestions too

i'm considering if i should code and draw in interactions with other shimejis already. it's a bit of a far off idea but i might make a Binghe or maybe even Liu Qingge or Shang Qinghua? who knows. anyway it'd be fun to make some interactions between them. i could even add a tutorial for adding more "romantic" interactions since i want to leave this area open for shippers. if i make it that is

"pet" - yes you can pat Shizun on the head. it makes him embarrased but he likes it.

i'd like to make this an incredibly intricate shimeji with a lot of animations but i'm worried about the performance. they may not be Chrome level RAM eaters, but they're not the lightest and i don't want to create something which people won't get to enjoy

i'm still considering where to host the files. thought about maybe hosting them on a patreon account (for free. the Shizun Distribution System does not demand payment for what it does) but i'm, again, open to suggestions

i'm making this for the Shimeji-ee DESKTOP SOFTWARE FOR WINDOWS. i've never used things like the shimeji chrome extension nor do i own any apple devices. i don't know how to work with these. HOWEVER, if there's someone who DOES know how to work on those, feel free to make versions compatibile with apple or with browsers, BUT only if those versions ARE DISTRIBUTED FOR FREE AND CREDIT ME AS THE CREATOR. i want as many people as possible to enjoy my shimejis

two long idles, one of which i'm showing the sketch for. in the notes i wrote down "looping" and "sound" - while it may be a project that i do not realize in the end, i thought it would be cute to make an animation where Shizun plays the guqin and add sound to it. there would have to be the option to toggle animation sounds, and another to loop that animation, but i thought it would be absolutely adorable to make a sort of music player out of that animation, allowing the user to add a downloaded copy of their playlist into the files. imagine - you're sitting at your computer, studying, working or filing your taxes or whatever, and Shizun's on your screen, doing his thing, providing background music for whatever it is you're doing. cute, no? but this feels like the sort of thing that might get annoying or make your computer turn into a jet engine from overworking. so, for now this is staying a concept. the animation will be present, that much i guarantee but all that other stuff might not show up

OKAY, SO. as you might have noticed i have three designs. i sorta changed them since i made the first post about this, because as it turns out my computer screen doesn't actually display bright colours all that well. might have to fiddle with the settings on it more. anyway this time i coloured looking at my tablet screen so they should be more accurate to what i wanted. i decided that my previous design didn't look like mint chocolate chip ice cream enough <3

so, i'd like you guys to tell me which design is your favourite! i have mixed feelings about design no. 3 because, while pretty, it's kinda too detailed. i just know i'd get sick of redrawing it so i might simplify it further for the finished product

here's the designs!

*slight correction: the eye colour is not final! i left the sketch in on those parts and forgot to actually draw the finished design for the eyes. i don't have the time to correct that at the moment, however. sorry! for a closer look at how the eyes might look like, see previous design

#svsss#scum villains self saving system#scum villain#shen qingqiu#shen yuan#chibi art#shimeji#my art#shizun shimeji#< new tag for sorting posts about this project

29 notes

·

View notes

Text

Hey! It's A Great Time To Review Your W4! and other fun tax things they don't seem to be teaching in school. (detailed explanations in the read more)

Disclaimer: These are super basic basics. I'm not an expert. I've just seen a lot of people get hit hard and it really sucks.

Don't throw away your income documents.

Keep copies of your returns.

File every year you have an income.

File even if you're going to owe.

Amend your return if you realize there's something wrong on the original.

There's a statute of limitations on refunds.

They can use your refund for certain debt.

There are programs so you don't get dinged for your joint filer's debt.

You can request a rush on the basis of extreme hardship.

You can request a waiver for penalties/interest on late payments.

Know the basics for your area. Due diligence, right?

If you have a business, please be careful.

Review your W4.

Keep your contact info up to date.

If they send a letter, response immediately.

If you don't hear anything in 4 weeks, call/message/visit a local office.

You can file directly with the IRS now, and some states.

If you use tax preparation software/service, double check everything.

If you're expecting a refund triple-check your bank info.

If you're making a payment, triple-check it goes through.

Don't wait til the last day to make a payment.

Consider getting a registered online account with the IRS and/or your state.

Take several deep breaths.

(↓ more details ↓)

Don't throw away your income documents. W2s, 1099s, anything that shows income and/or withholding. How long? Forever.

Keep copies of your returns, in formats you can easily access. Highly recommend a hard copy as well as digital, or at least available offline. How long? Forever. (I know there are statutes of limitations, but I don't trust that)

File every year you have an income. Honestly might want to file even if you don't - you can put all zeroes. If you should have filed and didn't, they can make an educated guess, and you might not like it. If you owe, they can add failure to file/failure to pay penalties that can really add up.

File even if you're going to owe. You can set up payment plans, if needed. If you don't file, the penalties and interest are insane.

Amend your return if you realize there's something wrong on the original. Audits aren't just for comedic effect on sitcoms, and as above, the penalties and interest are insane.

There's a statute of limitations on refunds. For the IRS, it's "3 years from the date you filed your federal income tax return, or 2 years from the date you paid the tax". States vary.

They can use your refund for certain debt. Child support, student loans that aren't on a plan, overpayment of benefits, traffic tickets…

There are programs so you don't get dinged for your joint filer's debt. They take longer to process, but you will be able to keep your refund even if your joint filer's refund is used to pay a debt.

You can request a rush in cases of extreme hardship. Eviction, medication, feeding children. It's not a guarantee, but you can ask.

You can request a waiver for penalties and interest on late payments. Again, not a guarantee, but you can ask.

Know the basics for your area. You don't have to be an expert, but the basics: Which forms to file, filing dates, how extensions work, if there are city/county taxes that need to be filed separately, if you need to make estimated payments…

If you have a business, please be careful. all of the above plus more. It can get so messy, and so hard to clean up.

Review your W4. Make sure you have the right amount coming out. Do you want to owe, get a refund, get close to zero? Make an informed decision and make sure your W4 reflects that. Highly recommend checking again in a few months, sometimes HR can be shifty bastards.

Keep your contact info up to date. If they need more info, they won't hunt you down. This includes if you move after you file. Phone number isn't as important, but address is.

If they send a letter asking for information, respond immediately. They will either not process the return, or make an educated guess based on what they have. Even if it's just to say "Hey, I can't get this document because _", they need something. Also - getting a letter doesn't necessarily mean there's something wrong. With electronic filing, they don't get images of your W2/1099, and they want to double check. Or there's an address/filing status change they want to be sure of. Or maybe you had an identity theft situation in the past. Or or or. Or maybe you are a "fraudster"!

If you don't hear anything in maybe 4 weeks, call/message/visit a local office. Sometimes things happen. A letter was sent but was returned. A manual review was stalled and just needed a nudge. Sometimes the return didn't show up at all. Also - when/if you contact them, please be civil. The person who answers the phone has so little control over any of this. A polite, "Hey, just wanted to make sure everything's good" will go a long way.

You can file directly with the IRS now, and some states. In some cases, you can even port your info from IRS to state, saving you the trouble of re-entering a bunch of stuff. Best, you can be sure it actually was received.

If you use tax preparation software/service, double check everything. Make sure the numbers look reasonable, make sure you know where their fee is coming from, make sure you know where your refund is going (like to a pre-paid card or your own bank), make sure you know FOR SURE if they are scheduling a payment on your behalf. Sometimes it's not obvious, and this can result in double-payments or worse. Mostly, make sure the return is accepted. Get it in writing. Don't wait two months to ask, when they are closed for the season.

If you're expecting a refund triple-check your bank info. If something changes with your bank info after you file, call.

If you're making a payment, triple-check it goes through. I mean so you don't double-pay. If you paid online, make sure you got a confirmation number. If you don't, call. Don't assume it didn't work and pay again. Even if you figure it out before it hits your bank, there's nothing the revenuers can do to stop it.

Don't wait til the last day to make a payment. If something goes wrong, if the check is lost in the mail or the bank is acting fucky, it will go badly. Preparation software is evil about scheduling the payments for the last minute.

Consider getting a registered online account with the IRS and/or your state. You can track your return, and also see letters before they're mailed, see past info, send messages, make payments, check on payment status, update info. Yes, the websites aren't great, but it gives you a little more control.

Again, not a Tax Professional in any way. Just don't want anyone to get fucked by Surprise! Tax Shit!

6 notes

·

View notes

Text

Object permanence

I'm on a 20+ city book tour for my new novel PICKS AND SHOVELS. Catch me in AUSTIN on Mar 10. I'm also appearing at SXSW and at many events around town, for Creative Commons, Fediverse House, and EFF-Austin. More tour dates here.

#20yrsago EU software patents pass in the teeth of decency and democracy https://web.archive.org/web/20050310004103/http://wiki.ffii.org/Cons050307En

#20yrsago Europe’s “Broadcast Flag” dangers https://web.archive.org/web/20050305062313/http://www.theinquirer.net/?article=21595

#20yrsago Koster’s keynote from Game Developers Conference https://crystaltips.typepad.com/wonderland/2005/03/raphs_keynote.html

#20yrsago Sterling on the counterfeits of Belgrade https://web.archive.org/web/20050223100218/https://www.wired.com/wired/archive/13.03/view.html?pg=4

#15yrsago Ubisoft DRM servers go down, punishing customers but not pirates https://www.escapistmagazine.com/Ubisoft-DRM-Authentication-Servers-Go-Down/

#10yrsago Albuquerque PD encrypts videos before releasing them in records request https://www.techdirt.com/2015/03/06/albuquerque-police-dept-complies-with-records-request-releasing-password-protected-videos-not-password/

#10yrsago Judge who invented Ferguson’s debtor’s prisons owes $170K in tax https://www.theguardian.com/us-news/2015/mar/06/ferguson-judge-owes-unpaid-taxes-ronald-brockmeyer

#10yrsago Hartford, CT says friends can’t room together unless some of them are servants https://www.courant.com/2015/02/17/hartford-upholds-action-against-scarborough-street-family/

#10yrsago Improving the estimate of US police killings https://fivethirtyeight.com/features/a-new-estimate-of-killings-by-police-is-way-higher-and-still-too-low/

#5yrsago The savior of Waterstones will turn every B&N into an indie https://pluralistic.net/2020/03/07/bookselling-is-back/#dauntbn

#5yrsago Compromise threatens Intel's chip-within-a-chip https://pluralistic.net/2020/03/07/bookselling-is-back/#csme

#5yrsago Gig economy drivers won't get sick-pay if they have covid-19 symptoms https://pluralistic.net/2020/03/07/bookselling-is-back/#covid-gig

#5yrsago Audio from last night's Canada Reads event in Kelowna https://pluralistic.net/2020/03/07/bookselling-is-back/#kelowna

#1yrago 1900s futurism https://pluralistic.net/2024/03/07/the-gernsback-continuum/#wheres-my-jetpack

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2025/03/05/printers-devil/#show-me-the-incentives-i-will-show-you-the-outcome

8 notes

·

View notes

Text

Tax Consultants Services: Trusted Experts for Every Tax Need

Taxes are one of the most critical and complex aspects of personal and business finance. Whether you’re an individual taxpayer, a business owner, or an expat living abroad, navigating tax laws can be overwhelming. That’s where Tax Consultants Services play a vital role.

By hiring Expert Tax Advisors, you gain access to strategic guidance, compliance support, and personalized tax planning — saving you money, time, and unnecessary stress.

In this guide, we’ll explore the different types of tax consultant services available, how they can help you, and what to look for when choosing the right tax advisor.

What Are Tax Consultants Services?

Tax Consultants Services refer to professional tax solutions offered by certified individuals or firms. These services are designed to help taxpayers — both individuals and businesses — manage their tax obligations effectively and legally minimize liabilities.

Unlike seasonal tax preparers, Expert Tax Advisors offer year-round services including:

· Tax preparation and filing

· Tax planning and strategy

· Audit representation

· IRS dispute resolution

· International and expat tax support

· Small business tax optimization

Whether you’re dealing with domestic filings or navigating global tax obligations, tax consultants provide clarity and expertise where it’s most needed.

Why Hire Expert Tax Advisors?

Hiring Expert Tax Advisors gives you an edge in understanding and applying complex tax rules. Here’s how they help:

✅ Maximize Deductions and Credits

Most people miss out on valuable deductions and credits simply because they don’t know they exist. An experienced tax advisor can uncover savings that software often overlooks.

✅ Stay Compliant with Changing Tax Laws

Tax laws change frequently. Advisors stay updated and help you stay compliant, preventing IRS penalties and audits.

✅ Save Time and Reduce Stress

Filing taxes can be time-consuming and confusing. Hiring a professional ensures accuracy and saves you hours of frustration.

✅ IRS Representation and Support

Facing an audit or letter from the IRS? A tax consultant can represent you, resolve disputes, and provide legal guidance.

Business Tax Preparation Services

Running a business comes with added tax complexity — payroll, expenses, deductions, estimated taxes, and more. That’s why Business Tax Preparation Services are essential for companies of all sizes.

Benefits of Business Tax Services:

· Accurate tax return preparation and filing for LLCs, S-corporations, and corporations

· Advice on tax-efficient business structures

· Assistance with payroll, sales tax, and quarterly estimated payments

· Industry-specific deductions and tax-saving opportunities

· Year-round bookkeeping and financial forecasting

Business owners who use tax consultants often find they not only avoid costly errors, but also improve profitability by optimizing their tax approach.

Expat Tax Services: Stay Compliant Abroad

Living or working abroad? Your tax situation gets even more complicated. Fortunately, Expat Tax Services are designed specifically for U.S. citizens and residents living overseas.

Key Areas Covered:

· Foreign Earned Income Exclusion (FEIE)

· Foreign Tax Credit (FTC)

· Reporting foreign bank accounts (FBAR)

· FATCA compliance

· Dual taxation issues

· Renouncing U.S. citizenship tax planning

Filing taxes as an expat requires in-depth knowledge of both U.S. and international tax law. A specialized tax consultant can ensure you stay compliant while minimizing double taxation.

How to Choose the Right Tax Consultant

When hiring someone for tax consultant services, it’s essential to vet their credentials and expertise. Here’s what to consider:

Certification & Credentials

Look for licensed professionals — Certified Public Accountants (CPAs), Enrolled Agents (EAs), or tax attorneys.

Industry Experience

Ask if they’ve handled cases similar to yours — whether it’s small business taxes, expat returns, or high-net-worth planning.

Client Reviews & Testimonials

Check online reviews or ask for references to understand their reputation and reliability.

Services Offered

Choose a consultant who provides the full spectrum of services you need — from planning to filing and beyond.

Technology & Communication

Modern tax consultants use secure, cloud-based platforms for file sharing, video calls, and e-signatures, making it easy to work together remotely.

Related FAQs About Tax Consultants Services

What’s the difference between a tax preparer and a tax consultant?

A tax preparer mainly focuses on filing your returns, while a tax consultant offers ongoing strategic advice, planning, and representation. Tax consultants typically have more experience and credentials.

Can tax consultants help me save money?

Yes! Expert Tax Advisors can uncover deductions and strategies that significantly reduce your tax bill, often more than covering their own fees.

Are tax consultant services worth it for small businesses?

Absolutely. Business Tax Preparation Services help small businesses stay compliant, reduce errors, and maximize tax advantages like write-offs and credits.

What are Expat Tax Services, and do I need them?

Expat Tax Services help U.S. citizens living abroad file their required returns and disclosures. If you earn income overseas or have foreign assets, you likely need these services.

How much do tax consultants typically charge?

Fees vary based on complexity. Personal returns may range from $200–$500, while business or international filings can go up to $1,000+.

Can a tax consultant represent me before the IRS?

Yes — CPAs, Enrolled Agents, and tax attorneys can legally represent you in front of the IRS for audits, appeals, or collections.

Final Thoughts

Whether you’re managing your personal finances, running a business, or living abroad, Tax Consultants Services are essential for simplifying the tax process and protecting your financial future.

From Expert Tax Advisors who can guide you through IRS complexities, to specialized Expat Tax Services and robust Business Tax Preparation Services, there’s a solution for every need.

✅ Ready to make smarter tax decisions?

Visit Taxperts.com today to schedule a consultation with certified tax professionals who care about your success.

#accounting#tax consultants#Expert Tax Advisors#taxiservice#Business Tax Preparation#Expat Tax Services#tax services#tax preparation

2 notes

·

View notes

Text

April 15 Tax Deadline Approaching? Here’s How to Prepare and File on Time

As the April 15 tax deadline approaches, CPAs, EAs, and accounting firms must ensure their clients are well-prepared for a smooth and timely filing process. With tax laws constantly evolving and last-minute filings increasing the risk of errors, having a structured approach can help prevent unnecessary penalties and ensure compliance.

To assist in this critical period, here are key strategies to prepare and file tax returns efficiently while optimizing deductions and mitigating common errors.

1. Gather Essential Documents Early

One of the primary reasons for tax return delays is missing documentation. Encourage clients to compile the necessary forms, including:

Income Statements: W-2s for employees, 1099s for independent contractors, and other income-related documents.

Expense Records: Receipts for deductible business expenses, home office costs, medical expenses, and charitable contributions.

Previous Tax Returns: Reviewing past filings ensures consistency and helps identify potential deductions or credits.

Investment and Retirement Contributions: 1099-INT, 1099-DIV, and Form 5498 for IRA contributions.

Having these documents ready early streamlines the filing process, reducing the likelihood of last-minute stress.

2. Leverage E-Filing for Speed and Accuracy

Encourage clients to opt for electronic filing (e-filing), which offers several advantages:

Reduces Errors: E-filing software performs automated calculations, minimizing the risk of human errors.

Provides Immediate Confirmation: Clients receive instant acknowledgment that their tax return has been submitted.

Faster Refunds: The IRS processes electronically filed return more quickly, especially if direct deposit is chosen.

The IRS provides Free File for taxpayers earning $84,000 or less, enabling them to e-file at no cost.

3. Verify Personal and Financial Information

Even minor errors can lead to tax return rejections or processing delays. Double-check:

Social Security numbers for accuracy.

Legal names matching IRS and Social Security Administration records.

Bank details for direct deposit refunds.

Mistakes in these areas can delay refunds or result in notices from the IRS.

Read also:

Tax Planning for Individuals: The Proven Guide for 2025

4. Maximize Deductions and Credits

Help clients minimize their tax liability by ensuring they take full advantage of available deductions and credits:

Business Deductions: Home office expenses, business travel, professional development costs, and software subscriptions.

Education Credits: American Opportunity Credit and Lifetime Learning Credit for eligible education expenses.

Retirement Contributions: Maximizing IRA and 401(k) contributions can lower taxable income.

Health Savings Account (HSA) Contributions: Tax-deductible contributions can reduce taxable income.

Accurate record-keeping and documentation are essential to substantiate these claims in case of an IRS audit.

5. Avoid Common Filing Mistakes

Mistakes can result in audits, penalties, or delayed refunds. The most frequent errors include:

Math miscalculations or incorrect figures.

Incorrect filing status (e.g., filing as “Single” instead of “Head of Household” when eligible).

Failing to sign and date paper returns (electronic filings require a PIN instead).

Using professional tax software or consulting with a tax expert significantly reduces the likelihood of errors.

Read also:

Get Ready for Tax Season: Your Complete Preparation Checklist

6. Consider Filing an Extension if Needed

If a client cannot file their return by April 15, filing an extension can provide additional time to prepare:

Submit Form 4868: This application grants an automatic six-month extension until October 15.

Understand Tax Payments: An extension to files does not mean an extension to pay. Any taxes owed should be estimated and paid by April 15 to avoid interest and penalties.

While extensions offer flexibility, filing sooner helps clients avoid last-minute stress and potential IRS scrutiny.

7. Stay Informed About IRS Resources and Tax Law Changes

The IRS offers valuable resources to help taxpayers file accurately:

Interactive Tax Assistant for answering common tax law questions.

"Where’s My Refund?" tracking tool to monitor refund status.

Special assistance, including extended hours at select locations, to support last-minute filers (IRS newsroom).

Additionally, staying updated on recent tax changes ensures compliance and maximizes tax-saving opportunities.

8. Be Cautious of Tax Scams

With the rise of digital fraud, warn clients about common tax scams:

Phishing Emails and Phone Calls: The IRS does not initiate contact via email, text, or social media to request financial details.

Fake IRS Representatives: Scammers impersonate IRS agents to demand immediate payments. Always verify directly through the official IRS website.

Identity Theft: Encourage clients to use secure passwords and enable multi-factor authentication when accessing tax filing software.

Staying vigilant helps clients protect their financial data and prevent fraud.

9. Manage Tax Payments Wisely

For clients who owe taxes, planning for payments is essential:

Electronic Payment Options: IRS Direct Pay and Electronic Federal Tax Payment System (EFTPS) allow secure, instant payments.

Installment Agreements: If unable to pay in full, setting up a payment plan with the IRS can prevent further penalties.

Estimated Tax Payments: Self-employed individuals should make quarterly estimated payments to avoid underpayment penalties.

Proper tax planning reduces financial strain and ensures compliance.

Read also:

Relaxation Returns: How to Unwind After the Tax Season

10. Maintain Proper Records for Future Reference

Encourage clients to retain copies of tax returns and support documents for at least three years:

Helps resolve discrepancies with the IRS if questions arise.

Provides documentation for financial planning and loan applications.

Serves as a reference for next year’s filing.

Organized record-keeping simplifies future tax filings and ensures compliance with audit requirements.

Final Thoughts: Partner with Experts for Hassle-Free Tax Filing

The tax season can be overwhelming for businesses and individuals alike. By adopting proactive filing strategies, leveraging available IRS resources, and staying vigilant against common pitfalls, CPAs, EAs, and accounting firms can help their clients navigate tax season with confidence.

At Unison Globus, we specialize in providing outsourced tax preparation services tailored for North America-based accounting firms. Our expert team ensures accurate, timely, and compliant tax filings, freeing you to focus on strategic financial advising for your clients.

Looking for expert tax preparation and compliance solutions? Contact Unison Globus today to streamline your tax season and maximize your efficiency.

This blog was originally posted here:

https://unisonglobus.com/april-15-tax-deadline-approaching-heres-how-to-prepare-and-file-on-time/

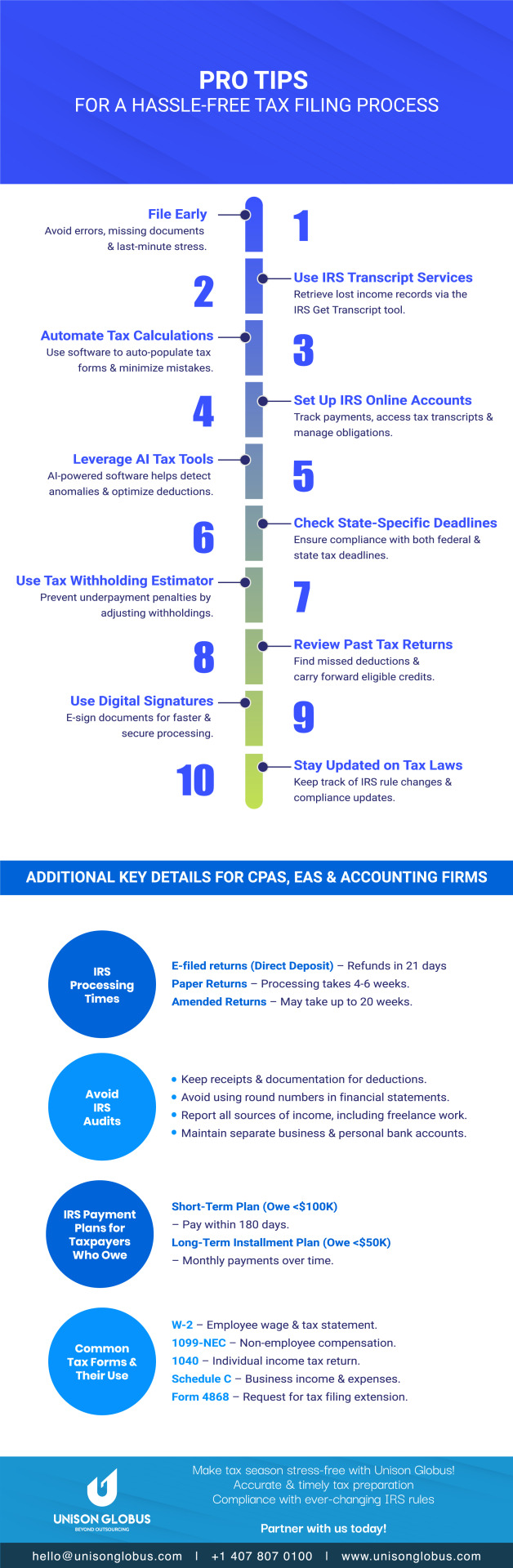

Infograp`hic

Pro Tips - For a Hassle-Free Tax Filing Process

#Tax filing tips#unison globus#Hassle-free tax filing#Tax preparation guide#Tax filing process#April 15 tax deadline#Tax season tips#how to file taxes#Tax filing checklist#Stress-free tax filing#tax deductions#tax services#tax preparation services#tax advisor#tax preparation#tax accountant#tax filing#tax planning#tax season#financial#Tax

1 note

·

View note

Text

How to Create a Financial Plan for Your Business in 2025

Introduction

A strong financial foundation is the backbone of every successful business. Whether you’re launching a startup or running an established company, knowing how to create a financial plan for your business in 2025 is essential for growth, profitability, and long-term sustainability.

Why Business Financial Planning Is Crucial in 2025

The economic landscape continues to evolve in 2025, influenced by inflation, AI integration, shifting consumer behavior, and a dynamic labor market. That’s why small business financial strategy must be more proactive, data-driven, and flexible than ever before.

✅ Benefits of Financial Planning:

Set clear short- and long-term goals

Improve decision-making with real-time data

Secure funding and build investor confidence

Monitor and control spending

Minimize risks and prepare for emergencies

💡 A well-crafted financial plan is not just a document—it’s a living tool that guides every aspect of your business.

Step 1: Define Your Business Goals

Start by identifying your business goals for 2025. These should be SMART: Specific, Measurable, Achievable, Relevant, and Time-bound.

Examples:

Increase revenue by 20%

Launch a new product line in Q3

Reduce overhead by 15%

Expand into two new markets

🎯 Your goals will shape every part of your financial plan, from budgeting to forecasting.

Step 2: Analyze Your Current Financial Position

Before planning ahead, understand where you stand today. Collect and review key financial statements:

Balance Sheet – Shows assets, liabilities, and equity

Income Statement (Profit & Loss) – Shows revenue and expenses

Cash Flow Statement – Tracks how money moves in and out of your business

💡 Use this data to spot trends, identify problem areas, and evaluate performance over time.

Step 3: Create a Business Budget

Creating a business budget is one of the most important components of business financial planning. A solid budget helps you plan expenses, monitor profits, and prepare for seasonal fluctuations.

How to Create a Business Budget:

Estimate Revenue – Use past data and future projections

List Fixed Costs – Rent, salaries, insurance, subscriptions

List Variable Costs – Inventory, marketing, shipping

Include One-Time Expenses – Equipment purchases, legal fees

Set Aside Savings – Emergency fund or reserve account

💡 Review your budget monthly and adjust based on actual performance.

Step 4: Forecast Revenue and Expenses

A financial forecast helps you anticipate future income and expenses. It’s critical for small business financial strategy, especially when applying for loans or attracting investors.

Forecasting Tips:

Use 3–5 years of historical data (if available)

Factor in market conditions and industry trends

Consider best-case, worst-case, and most likely scenarios

Update quarterly based on actual results

📈 Your forecast should align with your growth strategy and guide spending decisions.

Step 5: Manage Cash Flow Effectively

Even profitable businesses can fail due to poor cash flow. Create a cash flow management plan to ensure you can cover operating expenses year-round.

Cash Flow Management Tips:

Invoice promptly and offer early payment discounts

Avoid unnecessary expenses or delays in collections

Use accounting software to monitor daily cash position

Keep at least 3 months’ worth of operating expenses in reserves

💡 Regularly reviewing cash flow ensures you're prepared for both opportunities and setbacks.

Step 6: Set KPIs and Financial Metrics

Use key performance indicators (KPIs) to track your financial health and measure success.

Important Financial KPIs:

Gross Profit Margin

Net Profit Margin

Operating Expense Ratio

Customer Acquisition Cost (CAC)

Return on Investment (ROI)

Current Ratio (liquidity)

📊 These metrics help you evaluate progress and adjust your business financial strategy as needed.

Step 7: Plan for Taxes and Legal Compliance

Don’t let taxes catch you off guard. Incorporate tax planning into your 2025 financial strategy.

Tax Planning Tips:

Work with a CPA or tax advisor

Track deductible expenses and tax credits

Pay quarterly estimated taxes

Maintain clean, accurate financial records

Understand changes in local, state, and federal tax laws

📝 Staying compliant saves money, avoids penalties, and simplifies tax season.

Step 8: Prepare for Funding and Investment

If you’re planning to raise capital in 2025, a professional financial plan is a must-have for lenders and investors.

Include in Your Funding Plan:

Business overview and executive summary

Detailed use of funds

Financial projections and KPIs

Exit strategy (if applicable)

💡 A credible financial plan boosts your chances of securing business funding or attracting partners.

Tools to Help You Create a Business Financial Plan

QuickBooks – Accounting and budgeting

LivePlan – Business plan and financial forecasting

Xero – Cash flow management and reporting

Excel or Google Sheets – Customizable templates

Wave – Free accounting and invoicing for small businesses

Common Financial Planning Mistakes to Avoid

🚫 Underestimating expenses 🚫 Not revisiting the plan regularly 🚫 Failing to separate business and personal finances 🚫 Skipping cash flow projections 🚫 Ignoring tax planning

✅ Review your financial plan at least quarterly and update as your business evolves.

Need Personal Or Business Funding? Prestige Business Financial Services LLC offer over 30 Personal and Business Funding options to include credit repair and passive income programs.

Book A Free Consult And We Can Help - https://prestigebusinessfinancialservices.com

Email - [email protected]

Final Thoughts: Build a Financial Roadmap to Thrive in 2025

Creating a financial plan isn’t just a good business practice—it’s your roadmap to profitability, growth, and resilience in 2025 and beyond. With economic uncertainty still on the horizon, now is the perfect time to refine your small business financial strategy.

✅ Set clear goals ✅ Build a smart, flexible budget ✅ Forecast and manage your finances with confidence

Need Personal Or Business Funding? Prestige Business Financial Services LLC offer over 30 Personal and Business Funding options to include credit repair and passive income programs.

Book A Free Consult And We Can Help - https://prestigebusinessfinancialservices.com

Email - [email protected]

🎯 Ready to create your business budget and financial plan for 2025? Start today—and set your business up for long-term success.

Prestige Business Financial Services LLC

"Your One Stop Shop To All Your Personal And Business Funding Needs"

Website- https://prestigebusinessfinancialservices.com

Email - [email protected]

Phone- 1-800-622-0453

#business financial planning#small business financial strategy#create business budget#entrepreneur#personal finance#businessfunding#personal loans

1 note

·

View note

Text

Filing my taxes with a free software, it asks me to confirm my identity by providing them info from my 2022 returns. To access that info I had to create an account on the IRS website which asked me to upload my driver's license and take a video selfie which took over an hour because upload speeds at my apartmemt are terrible, only to be told that my phone number was invalid. I've never used another phone number with the IRS, so now I'm on hold for a video call to do the exact same drivers license/selfie song and dance, but it's Sunday, so I'm 1000% sure that when the "estimated wait time" counter reaches 0 they'll tell me there are no representatives available to do my video call. I'll have to do this all again tomorrow.

Fuck.

6 notes

·

View notes

Text

Maintenance Tips for Optimal EV Battery Health

The battery is the heart of an electric vehicle (EV), and maintaining its health is crucial for ensuring the longevity and efficiency of your ride. Electric vehicles are reshaping the automotive landscape with their eco-friendly credentials and low operational costs. As an EV owner, one of your top priorities should be battery maintenance. Here's how you can ensure your EV's battery remains in tip-top shape.

Understanding Your EV Battery

Before diving into maintenance tips, it's essential to understand what your EV battery is made of and how it functions. Most EVs use lithium-ion batteries, similar to those in your smartphone but on a much larger scale. These batteries are preferred for their high energy density and long life span. They consist of cells grouped into modules, which together make up the battery pack. A Battery Management System (BMS) monitors and regulates the battery's temperature, voltage, and current.

Regular Use and Driving Habits

One of the simplest ways to maintain your EV's battery is by using your vehicle regularly. Long periods of inactivity can negatively affect battery health. When driving, it's wise to avoid pushing your EV to its limits too often. Frequent high-speed driving and rapid acceleration can strain the battery, reducing its lifespan. Data suggests that EVs driven smoothly and at consistent speeds can see battery life extended by up to 10%.

Optimal Charging Practices

Charging habits significantly impact your EV's battery health. Although it may seem convenient to charge your battery to 100% every time, it's better to keep it between 20% and 80% most of the time. This practice, known as 'shallow charging,' can extend your battery's life. According to a study by Battery University, lithium-ion batteries kept at a 100% charge level at all times can lose up to 20% capacity in a year, while those kept at 80% showed only a 4% loss.

Temperature Management

Extreme temperatures are the enemy of EV batteries. Exposure to high temperatures can lead to faster chemical reactions within the battery, potentially reducing its capacity and life span. Conversely, cold temperatures can decrease the battery's efficiency and range. While you can't control the weather, you can minimize exposure to extreme temperatures by parking in the shade or a garage. Using your EV's pre-conditioning function, if available, can bring the battery to an optimal operating temperature before you set off, without taxing the battery itself.

Software Updates and Professional Servicing

Keeping your EV's software up to date is a vital part of battery maintenance. Automakers frequently release software updates that can improve battery management and efficiency. Additionally, periodic professional check-ups can catch potential issues before they become serious problems. Battery systems are complex and can benefit from a diagnostic eye. Manufacturers often provide detailed guidance on maintenance intervals, and following these can prolong the life of your battery.

Long-Term Storage

If you plan to store your EV for an extended period, it's important to prepare the battery properly. The ideal charge level for long-term storage is around 50%. Additionally, it's best to store your EV in a cool, dry place and to check the charge level every few months, topping it up if necessary.

Recalibration and Balance

Over time, an EV battery can lose its calibration, meaning the car's estimate of the charge level may become less accurate. To recalibrate, you should fully charge and then fully discharge the battery once every few months. This process helps maintain cell balance and ensures that the BMS accurately reads the battery's state of charge.

Your electric vehicle's battery health is paramount to its performance and longevity. By following these maintenance tips and keeping abreast of the latest care techniques, you can help ensure that your EV remains a reliable and efficient mode of transportation for years to come. With more manufacturers investing in battery technology and longevity, we can anticipate even more robust batteries in the future. However, for now, these tips serve as a foundation for responsible EV ownership and battery care.

4 notes

·

View notes

Text

How to Make Sure You're Withholding and Reporting Your Taxes Correctly

Taxes are an inevitable part of life for most individuals and businesses. Whether you're a salaried employee, a freelancer, or a business owner, understanding how to withhold and report your taxes correctly is crucial to avoid potential legal troubles and financial headaches down the road. In this article, we will explore the key steps and considerations to ensure that you're handling your taxes in a responsible and compliant manner.

Know Your Tax Obligations

The first and most critical step in ensuring you're withholding and Outsource Management Reporting your taxes correctly is to understand your tax obligations. These obligations vary depending on your employment status and the type of income you earn. Here are some common categories of taxpayers:

1. Salaried Employees

If you're a salaried employee, your employer typically withholds income taxes from your paycheck based on your Form W-4, which you fill out when you start your job. It's essential to review and update your W-4 regularly to ensure that your withholding accurately reflects your current financial situation. Major life events like marriage, having children, or significant changes in your income should prompt you to revisit your W-4.

2. Freelancers and Self-Employed Individuals

Freelancers and self-employed individuals often have more complex tax obligations. You are responsible for estimating and paying your taxes quarterly using Form 1040-ES. Keep detailed records of your income and expenses, including receipts and invoices, to accurately report your earnings and deductions.

3. Small Business Owners

If you own a small business, your sales tax responsibilities extend beyond your personal income. You must separate your business and personal finances, keep meticulous records of all business transactions, and file the appropriate business tax returns. The structure of your business entity (e.g., sole proprietorship, partnership, corporation) will determine the specific tax forms you need to file.

4. Investors and Property Owners

Investors and property owners may have to report income from dividends, interest, capital gains, or rental properties. These income sources have their specific tax reporting requirements, and it's essential to understand and comply with them.

Keep Accurate Records

Regardless of your tax situation, maintaining accurate financial records is essential. Detailed records make it easier to report your income and deductions correctly, substantiate any claims you make on your tax return, and provide documentation in case of an audit. Here are some record-keeping tips:

Organize Your Documents: Create a system to store your financial documents, including receipts, invoices, bank statements, and tax forms. Consider using digital tools for easier record keeping.

Track Income and Expenses: Keep a ledger or use accounting software to record all income and expenses related to your financial activities. Categorize expenses correctly to maximize deductions and credits.

Retain Documents for Several Years: The IRS typically has a statute of limitations for auditing tax returns, which is generally three years. However, in some cases, it can extend to six years or indefinitely if fraud is suspected. To be safe, keep your tax records for at least seven years.

Understand Deductions and Credits

Deductions and credits can significantly reduce your tax liability. Deductions reduce your taxable income, while credits provide a dollar-for-dollar reduction of your tax bill. Familiarize yourself with common deductions and credits that may apply to your situation:

Standard Deduction vs. Itemized Deductions: Depending on your filing status and financial situation, you can choose between taking the standard deduction or itemizing your deductions. Itemizing requires more documentation but can result in greater tax savings.

Tax Credits: Explore available tax credits, such as the Earned Income Tax Credit (EITC), Child Tax Credit, and Education Credits. These credits can provide substantial savings, especially for low- to moderate-income individuals and families.

Business Expenses: If you're self-employed or a small business owner, be aware of deductible business expenses, including office supplies, travel expenses, and home office deductions.

Seek Professional Assistance

Tax laws are complex and subject to change. Seeking professional assistance from a certified tax professional or CPA (Certified Public Accountant) can be a wise investment. Tax professionals can help you:

Maximize Deductions: They are well-versed in the intricacies of tax law and can identify deductions and credits you might overlook.

Ensure Compliance: Tax professionals can ensure that you are complying with current tax laws and regulations, reducing the risk of costly errors or audits.

Provide Tax Planning: They can help you create a tax-efficient strategy to minimize your tax liability in the long term.

Represent You in Audits: If you face an audit, a tax professional can represent you and help navigate the process.

File Your Taxes on Time

Filing your taxes on time is crucial to avoid penalties and interest charges. The tax filing deadline for most individuals is April 15th. However, if you need more time, you can file for an extension, which typically gives you until October 15th to submit your return. Keep in mind that an extension to file is not an extension to pay any taxes owed, so pay as much as you can by the original deadline to minimize interest and penalties.

Consider Electronic Filing

Electronic filing (e-filing) is a secure and convenient way to submit your tax return to the IRS. It reduces the risk of errors and ensures faster processing and quicker refunds, if applicable. Many tax software programs offer e-filing options, making it easy for individuals and businesses to submit their returns electronically.

Stay Informed and Adapt

Tax laws can change from year to year, so staying informed is essential. Follow updates from the IRS and consult outsourcing sales tax services professionals or resources to understand how changes in tax laws may affect you. Be proactive in adapting your tax strategies to maximize savings and remain compliant with current regulations.

In conclusion, withholding and reporting your taxes correctly is a responsibility that should not be taken lightly. Understanding your tax obligations, keeping accurate records, leveraging deductions and credits, seeking professional assistance when needed, and filing on time are essential steps to ensure a smooth and compliant tax-filing experience. By following these guidelines, you can navigate the complexities of the outsourcing sales tax services system with confidence and peace of mind. Remember that taxes are a fundamental part of our society, and paying them correctly ensures that essential public services and infrastructure are funded for the benefit of all.

2 notes

·

View notes

Text

Due to confusing tax software I once accidentally counted a quarterly estimated tax payment twice. The IRS sent a letter saying they found an error, I slapped my forehead for being dumb and paid the amount, and there wasn't even a penalty.

For people with anxiety about filing taxes, here’s what things that happen when you make a mistake on your tax return:

- it gets corrected

- you get a letter in the mail either asking for some additional information or a letter showing the adjustment

- you pay the amount (there’s options for payment plans too!) or get a refund

Things that do not happen

- you’re “in trouble”

- you are charged with fraud

- you go to jail

I know that most people are probably just joking/exaggerating when they say a mistake on their return means they get thrown in jail but when I worked with the public I always would encounter people who believed that would happen and they would be panicking about it. So I like to put this out there every year because if I can even prevent one person from feeling that way, it’s worth it

146K notes

·

View notes

Text

Top Tax Tips From Accountants for Small Business Owners

If you're a small business owner, chances are taxes aren't your favorite topic. But here’s the thing—handling taxes well isn’t just about compliance. It’s about protecting your cash, avoiding unnecessary stress, and ultimately putting more money back into your business. The truth is, taxes can be strategic—but only if you’re thinking ahead.

We spoke with real professionals who work as accountants for small businesses and compiled their most practical, real-world tax advice. Whether you're just starting out or you're scaling up, these tips can save you more than just dollars—they can save you from sleepless nights and preventable surprises.

1. Track Everything—Even the Small Stuff

One recurring piece of advice? Don’t underestimate the power of good record-keeping. Small daily purchases—coffee for a client meeting, mileage to a supplier, office subscriptions—may seem trivial, but they add up.

Keep receipts. Use accounting software. Sync your bank accounts. When tax season hits, having everything clean and categorized means you (or your accountant) won’t have to scramble or guess. And let’s be honest—trying to remember what that $42 charge was from three months ago rarely ends well.

2. Separate Business and Personal Finances

It’s shockingly common for small business owners to blur the lines between personal and business expenses. Maybe you used your personal credit card to buy office supplies “just this once,” or reimbursed yourself without documentation. These shortcuts can cause major headaches when you're preparing tax returns or facing an audit.

Open a separate business checking account. Get a business credit card. Not only will this make deductions easier to claim, it also shows the IRS (and future investors or lenders) that you’re running a legitimate operation.

3. Take Advantage of Qualified Deductions

A good accountant won’t just fill in the blanks—they’ll help you spot deductions you didn’t even know you were missing. Are you using part of your home as an office? You may qualify for a home office deduction. Driving your car for business meetings or deliveries? Mileage can be deducted, too.

Other often-missed deductions include:

Business insurance premiums

Marketing expenses (even your website costs)

Continuing education or certification courses

Depreciation on equipment

But here’s the catch—eligibility depends on accurate records and how the IRS defines “ordinary and necessary.” When in doubt, ask your accountant. It’s what they’re there for.

4. Make Quarterly Estimated Tax Payments

If your business turns a profit, you’re expected to pay taxes throughout the year—not just in April. Miss these quarterly payments, and you could owe penalties or interest.

Set calendar reminders. Work with your accountant to calculate how much to send in each quarter. This not only avoids penalties but also smooths out your cash flow. There’s nothing worse than thinking you’ve got extra money in the bank, only to realize half of it belongs to the IRS.

5. Don’t Wait Until Year-End for Tax Planning

Most tax-saving strategies don’t work retroactively. Want to claim deductions? Defer income? Invest in retirement? You need to make those moves before the year ends. And that means talking to an accountant well before December.

One common mistake business owners make is thinking tax prep and tax planning are the same. They’re not. Tax prep is reactive. Planning is proactive—and it's where the real savings often happen.

6. Understand Your Business Structure (And When It Should Change)

How your business is structured—sole proprietorship, LLC, S Corp—has a big impact on how you're taxed. Many small business owners start as sole proprietors but eventually outgrow that model.

Accountants often recommend reviewing your structure annually. At a certain income level, electing to be taxed as an S Corporation can reduce your self-employment taxes. But it's not one-size-fits-all, and the wrong move can create more problems than it solves. That’s why personalized guidance is key.

To get a deeper dive into this and more, check out Accountant for Small Business: Your Guide to Smarter Money Decisions.

7. Keep Payroll Compliant (Even If You Have One Employee)

Running payroll isn’t just about cutting a check —it involves tax withholding, employer contributions, filings, and deadlines. Messing it up can lead to IRS notices or even fines.

Whether you have employees or pay yourself as an S Corp owner, accurate payroll processing is critical. Many accountants recommend using payroll software—or better yet, having a professional handle it entirely. It saves time and reduces costly errors.

8. Prepare for an Audit—Even If It Never Happens

No one thinks they’ll get audited—until they do. And while audits aren’t as common as the fear suggests, being prepared is half the battle.

This doesn’t mean you need to live in paranoia. It just means maintaining clean records, having clear documentation for deductions, and not mixing business and personal funds. When your books are audit-ready, you don’t panic—you just provide the paperwork.

Conclusion: Taxes Are a Year-Round Game

Here’s the bottom line: good tax strategy isn’t a one-time event. It’s an ongoing process that evolves with your business. The more proactive you are, the more you can save—and the fewer surprises you’ll face come April.

Partnering with an accountant for a small business in Fort Worth, TX isn’t about handing over a shoebox full of receipts. It’s about building a relationship with someone who knows your business, understands your goals, and helps you avoid unnecessary risk. With their guidance, you can transform taxes from something you dread into a tool that works in your favor.

0 notes