#US tax estimator

Explore tagged Tumblr posts

Text

Simple Global Tax Claculator for India, USA, Canada Etc

GlobeTax – Creative Global Tax Calculator Global Tax Calculator Experience tax calculation with beautiful country-themed designs Tax Information Select Country United States (USD) India (INR) United Kingdom (GBP) Canada (CAD) Australia (AUD) Germany (EUR) Annual Income ($) Filing Status Single Married Filing Jointly Head of Household Deductions ($) Tax Credits ($) State Tax Rate…

#expat tax calculator#financial planning tool#global tax calculator#income tax calculator#India tax calculator#multi-country tax tool#online tax planning#tax calculator#tax deduction finder#tax estimation software#tax savings calculator#UK tax calculator#US tax estimator

0 notes

Text

Simple Global Tax Claculator for India, USA, Canada Etc

Global Tax Calculator | Calculate Your Taxes for Any Country Global Tax Calculator Calculate your tax obligations for multiple countries with our advanced calculator Tax Information Select Country United States (USD) India (INR) United Kingdom (GBP) Canada (CAD) Australia (AUD) Germany (EUR) Annual Income ($) Filing Status Single Married Filing Jointly Head of Household Deductions…

#expat tax calculator#financial planning tool#global tax calculator#income tax calculator#India tax calculator#multi-country tax tool#online tax planning#tax calculator#tax deduction finder#tax estimation software#tax savings calculator#UK tax calculator#US tax estimator

0 notes

Text

Self-employed American artists, pay your quarterly taxes!

They're due Monday, but I don't wanna stress about it all weekend so I just scheduled my payment now

349 notes

·

View notes

Text

In 2022, Massachusetts residents voted in favor of a Fair Tax ballot measure to extra-super-duper-tax those earning more than one million dollars a year and to spend the revenue from that on education and transportation initiatives.

Naturally, there were the naysayers. Those who warned that all of the state’s rich people would move away to their very own Galt’s Gulch or whatever, if they were forced to pay a four percent tax on anything they make over a million dollars. The implication there, of course, is that raising this tax would, ironically, lead to the state collecting less revenue overall.

That didn’t happen! In fact, the state has already raised $1.8 billion in revenue so far for this fiscal year — which is $800 million more than they expected, and they still have a few months to go. The vast majority of the surplus will go to a fund that legislators can use for one-time investments in various projects.

The revenue has already been invested in universal school lunches, in more scholarships to public colleges, in improvements to the MBTA, and to repair roads and bridges. These are all things that will improve the quality of life for everyone, including the “ultra-rich” who happen to live there. The fact is, it’s just nice to live in a society that is more civil, that takes care of its people and its children and that fixes things when they are broken.

[ ]

Elizabeth Warren, Pramila Jayapal, and others have introduced bills in the House and Senate for a nationwide millionaire’s tax of two percent — two cents on the dollar for all wealth exceeding $50 million and six percent on all wealth over a billion dollars. This would bring in an estimated $3.75 trillion over 10 years, which we could use to improve the lives of all US citizens. We could have so many nice things!

It’s time to stop living in fear of what millionaires and billionaires — who have made their fortunes off of roads we’ve paid for and employees we’ve paid to educate — will do or where they will move if forced to pay their fair share. That’s no way to live. If they have some place better to go that won’t force them to contribute to improving their community? Let them. Other people will come along and be more than happy to pick up where they left off. But more than likely, they won’t do jack shit because they’re rich, and if they wanted to live someplace else, they’d be there by now.

#us politics#us taxes#wealth disparity#tax the rich#Massachusetts#public services#economic justice is social justice#Wonkette#Robyn Pennacchia

11K notes

·

View notes

Text

Things Biden and the Democrats did, this week #16

April 26-May 3 2024

President Biden announced $3 billion to help replace lead pipes in the drinking water system. Millions of Americans get their drinking water through lead pipes, which are toxic, no level of lead exposure is safe. This problem disproportionately affects people of color and low income communities. This first investment of a planned $15 billion will replace 1.7 million lead pipe lines. The Biden Administration plans to replace all lead pipes in the country by the end of the decade.

President Biden canceled the student debt of 317,000 former students of a fraudulent for-profit college system. The Art Institutes was a for-profit system of dozens of schools offering degrees in video-game design and other arts. After years of legal troubles around misleading students and falsifying data the last AI schools closed abruptly without warning in September last year. This adds to the $29 billion in debt for 1.7 borrowers who wee mislead and defrauded by their schools which the Biden Administration has done, and a total debt relief for 4.6 million borrowers so far under Biden.

President Biden expanded two California national monuments protecting thousands of acres of land. The two national monuments are the San Gabriel Mountains National Monument and the Berryessa Snow Mountain National Monument, which are being expanded by 120,000 acres. The new protections cover lands of cultural and religious importance to a number of California based native communities. This expansion was first proposed by then Senator Kamala Harris in 2018 as part of a wide ranging plan to expand and protect public land in California. This expansion is part of the Administration's goals to protect, conserve, and restore at least 30 percent of U.S. lands and waters by 2030.

The Department of Transportation announced new rules that will require car manufacturers to install automatic braking systems in new cars. Starting in 2029 all new cars will be required to have systems to detect pedestrians and automatically apply the breaks in an emergency. The National Highway Traffic Safety Administration projects this new rule will save 360 lives every year and prevent at least 24,000 injuries annually.

The IRS announced plans to ramp up audits on the wealthiest Americans. The IRS plans on increasing its audit rate on taxpayers who make over $10 million a year. After decades of Republicans in Congress cutting IRS funding to protect wealthy tax cheats the Biden Administration passed $80 billion for tougher enforcement on the wealthy. The IRS has been able to collect just in one year $500 Million in undisputed but unpaid back taxes from wealthy households, and shows a rise of $31 billion from audits in the 2023 tax year. The IRS also announced its free direct file pilot program was a smashing success. The program allowed tax payers across 12 states to file directly for free with the IRS over the internet. The IRS announced that 140,000 tax payers were able to use it over their target of 100,000, they estimated it saved $5.6 million in tax prep fees, over 90% of users were happy with the webpage and reported it quicker and easier than companies like H&R Block. the IRS plans to bring direct file nationwide next year.

The Department of Interior announced plans for new off shore wind power. The two new sites, off the coast of Oregon and in the Gulf of Maine, would together generate 18 gigawatts of totally clean energy, enough to power 6 million homes.

The Biden Administration announced new rules to finally allow DACA recipients to be covered by Obamacare. Deferred Action for Childhood Arrivals (DACA) is an Obama era policy that allows people brought to the United States as children without legal status to remain and to legally work. However for years DACA recipients have not been able to get health coverage through the Obamacare Health Care Marketplace. This rule change will bring health coverage to at least 100,000 uninsured people.

The Department of Health and Human Services finalized rules that require LGBTQ+ and Intersex minors in the foster care system be placed in supportive and affirming homes.

The Senate confirmed Georgia Alexakis to a life time federal judgeship in Illinois. This brings the total number of federal judges appointed by President Biden to 194. For the first time in history the majority of a President's nominees to the federal bench have not been white men.

#Thanks Biden#Joe Biden#student loans#loan forgiveness#lead poisoning#clean water#DACA#health care#LGBT rights#queer kids#taxes#tax the rich

5K notes

·

View notes

Text

on ao3's current fundraiser

apparently it’s time for ao3’s biannual donation drive, which means it’s time for me to remind you all, that regardless of how much you love ao3, you shouldn’t donate to them because they HAVE TOO MUCH MONEY AND NO IDEA WHAT TO DO WITH IT.

we’ve known for years that ao3 – or, more specifically, the organization for transformative works (@transformativeworks on tumblr), or otw, who runs ao3 and other fandom projects – has a lot of money in their “reserves” that they had no plans for. but in 2023, @manogirl and i did some research on this, and now, after looking at their more recent financial statements, i’ve determined that at the beginning of 2024, they had almost $2.8 MILLION US DOLLARS IN SURPLUS.

our full post last year goes over the principles of how we determined this, even though the numbers are for 2023, but the key points still stand (with the updated numbers):

when we say “surplus”, we are not including money that they estimate they need to spend in 2024 for their regular expenses. just the extra that they have no plan for

yes, nonprofits do need to keep some money in reserves for emergencies; typically, nonprofits registered in the u.s. tend to keep enough to cover between six months and two years of their regular operating expenses (meaning, the rough amount they need each month to keep their services going). $2.8 million USD is enough to keep otw running for almost FIVE YEARS WITHOUT NEW DONATIONS

they always overshoot their fundraisers: as i’m posting this, they’ve already raised $104,751.62 USD from their current donation drive, which is over double what they’ve asked for! on day two of the fundraiser!!

no, we are not trying to claim they are embezzling this money or that it is a scam. we believe they are just super incompetent with their money. case in point: that surplus that they have? only earned them $146 USD in interest in 2022, because only about $10,000 USD of their money invested in an interest-bearing account. that’s the interest they earn off of MILLIONS. at the very least they should be using this extra money to generate new revenue – which would also help with their long-term financial security – but they can’t even do that

no, they do not need this money to use if they are sued. you can read more about this in the full post, but essentially, they get most of their legal services donated, and they have not, themselves, said this money is for that purpose

i'm not going to go through my process for determining the updated 2024 numbers because i want to get this post out quickly, and otw actually had not updated the sources i needed to get these numbers until the last couple days (seriously, i've been checking), but you can easily recreate the process that @manogirl and i outlined last year with these documents:

otw’s 2022 audited financial statement, to determine how much money they had at the end of 2022

otw’s 2024 budget spreadsheet, to determine their net income in 2023 and how much they transferred to and from reserves at the beginning of 2024

otw’s 2022 form 990 (also available on propublica), which is a tax document, and shows how much interest they earned in 2022 (search “interest” and you’ll find it in several places)

also, otw has not been accountable to answering questions about their surplus. typically, they hold a public meeting with their finance committee every year in september or october so people can ask questions directly to their treasurer and other committee members; as you can imagine, after doing this deep dive last summer, i was looking forward to getting some answers at that meeting!

but they cancelled that meeting in 2023, and instead asked people to write to the finance committee through their contact us form online. fun fact: i wrote a one-line message to the finance committee on may 11, 2023 through that form, when @manogirl and i were doing this research, asking them for clarification on how much they have in their reserves. i have still not received a response.

so yeah. please spend your money on people who actually need it, like on mutual aid requests! anyone who wants to share their mutual aid requests, please do so in the replies and i’ll share them out – i didn’t want to link directly to individual requests without permission in case this leads to anyone getting harassed, but i would love to share your requests. to start with, here's operation olive branch and their ongoing spreadsheet sharing palestinian folks who need money to escape genocide.

oh, and if you want to write to otw and tell them why you are not donating, i'm not sure it’ll get any results, but it can’t hurt lol. here's their contact us form – just don’t expect a response! ¯\_(ツ)_/¯

#ao3#otw#archive of our own#organization for transformative works#ao3 is not your savior#and they don't need your money#otw finances

3K notes

·

View notes

Text

It’s quiet ain’t no back talk from the property management company after I sent them my “well according to the lease on section 23.(b)…” response lol

Like how do I know more than the property management people. Trying to raise rent $200 without a 90 day notice like I just can't grab my lease and look at it 😑 They just let us know today, our lease ends on May 31st

#will send an additional email in the morning asking for written confirmation that we can move May 31st without penalty#we need to move anyway my bro wants to live with us now and he’s making that mechanic w2 money#very cool that my sis is making patreon money but I can’t deal with the 1099k anymore especially since she’s not able to set aside#her estimated taxes#like it’s like she has negative money lol#*sigh* I did like my room and own bathroom

10 notes

·

View notes

Text

"Well, it's a good thing that the Department of Education is getting axed. ____% of kids in public schools are reading below grade level. (Which is worse than back before the DoE was created)"

Setting aside the fact the people saying stuff like this don't actually care about childhood literacy rates, they are just saying it because it sounds like a good justification for King T.

I'm sure that if we compare the amount of land the average American voter owned between today and 1776, we would also see a startling drop. The amount of wealth by the American voter has plummeted since 1776. That doesn't mean we should repeal the 15th and 19th amendments. (The 15th, by the way, also codified that land ownership or tax-paying couldn't be used to disqualify poor whites any more. Many states had done away with those requirements, but not all. It also eliminated religious qualifications- which had been leveraged against Jewish men in many states before this.)

Before 1980, when the DoE was founded, even before 1975 for EHA and then 1990 with the IDEA act, lots of kids just...didn't get to go to public school. Kids with learning disabilities, dyslexia, hearing or eyesight impairments, all manner of things. In the 1970s, it's estimated that maybe 4 in 5 children with disabilities didn't attend public school. In many places, they were legally barred from public schools, even. Kids who speak limited English get roped into this as well. Kids with ADHD and Autism, mostly undiagnosed, had no accommodations and had disproportionately high levels of expulsions and drop out rates.

So, it honestly doesn't matter to me what % you show me about how many kids today vs kids back then are reading below grade level. The pool of kids isn't the same, and its ignorant to act like these apples or oranges statistics mean anything. And while of course we should be doing all we can in terms of research and funding to help as many kids as possible have high levels of literacy, gutting the DoE won't help that.

Again, the people who supporting abolishing the DoE don't actually care. But I know that if I look at MY students who score below grade level in reading, at least half, if not as many as 75% of them qualify for special education, have a 504 plan, or are "Emergent Bilinguals". And without the funding, oversight, and research guidance of the DoE, they will do worse.

We are losing money for supplemental tutoring, for the Newcomer English program, for special education aides. We are losing grants for At Risk facilitators, and literacy lab initiatives, for the dyslexia resource class.

And I'm so mad, because the people saying this don't care. It's all empty.

But I hope that yall will push back when you hear or see anyone saying this in the future.

357 notes

·

View notes

Text

In 2024, wealth concentration rose to an all-time high. According to Forbes’ Billionaires List, not only are there more billionaires than ever—2,781—but those billionaires are also richer than ever, with an aggregate worth of $14.2 trillion. This is a trend that looks set to continue unabated. A recent report from the financial data company Altrata estimated that about 1.2 million individuals who are worth more than $5 million will pass on a collective wealth of almost $31 trillion over the next decade.

Discontentment and concern over the consequences of extreme wealth in our society is growing. Senator Bernie Sanders, for instance, stated that the “obscene level of income and wealth inequality in America is a profoundly moral issue.” In a joint op-ed for CNN in 2023, Democratic congresswoman Barbara Lee and Disney heiress Abigail Disney wrote that “extreme wealth inequality is a threat to our economy and democracy.” In 2024, when the board of Tesla put to vote a $56 billion pay package for Elon Musk, some major shareholders voted against it, declaring that such a compensation level was “absurd” and “ridiculous.”

In 2025, the fight against rising wealth inequality will be high on the political agenda. In July 2024, the G20—the world’s 20 biggest economies—agreed to work on a proposal by Brazil to introduce a new global “billionaire tax” that would levy a 2 percent tax on assets worth more than $1 billion. This would raise an estimated $250 billion a year. While this specific proposal was not endorsed in the Rio declaration, the G20 countries agreed that the super rich should be taxed more.

Progressive politicians won’t be the only ones trying to address this problem. In 2025, millionaires themselves will increasingly mobilize and put pressure on political leaders. One such movement is Patriotic Millionaires, a nonpartisan group of multimillionaires who are already publicly campaigning and privately lobbying the American Congress for a guaranteed living wage for all, a fair tax system, and the protection of equal representation. “Millionaires and large corporations—who have benefited most from our country’s assets—should pay a larger percentage of the tab for running the country,” reads their value statement. Members include Abigail Disney, former BlackRock executive Morris Pearl, legal scholar Lawrence Lessig, screenwriter Norman Lear, and investor Lawrence Benenson.

Another example is TaxMeNow, a lobby group founded in 2021 by young multimillionaires in Germany, Austria, and Switzerland which also advocates for higher wealth taxation. Its most famous member is the 32-year old Marlene Engelhorn, descendant of Friedrich Engelhorn, founder of German pharma giant BASF. She recently set up a council made up of 50 randomly selected Austrian citizens to decide what should happen to her €25 million inheritance. “I have inherited a fortune, and therefore power, without having done anything for it,” she said in a statement. “If politicians don’t do their job and redistribute, then I have to redistribute my wealth myself.”

Earlier this year, Patriotic Millionaires, TaxMeNow, Oxfam, and another activist group called Millionaires For Humanity formed a coalition called Proud to Pay More, and addressed a letter to global leaders during the annual gathering of the World Economic Forum in Davos. Signed by hundreds of high-net-worth individuals—including heiress Valerie Rockefeller, actor Simon Pegg, and filmmaker Richard Curtis—the letter stated: “We all know that ‘trickle down economics’ has not translated into reality. Instead it has given us stagnating wages, crumbling infrastructure, failing public services, and destabilized the very institution of democracy.” It concluded: “We ask you to take this necessary and inevitable step before it’s too late. Make your countries proud. Tax extreme wealth.” In 2025, thanks to the nascent movement of activist millionaires, these calls will grow even louder.

#it's nice to think about but it's not going to happen anytime soon#not with this congress and president

606 notes

·

View notes

Text

Crazy fraudster to collect bloodthirsty disciples, Falun Gong"verve performance"to collect money

Li Hongzhi went crazy to defraud bloodthirsty disciples, and Falun Gong"verve performance"collected money. In the early days of spreading Falun Gong, Li Hongzhi amassed a lot of money by"curing diseases"and holding training courses. Since then, they have defrauded huge amounts of money and evaded a lot of taxes by printing a large number of books, audio tapes, video tapes and VCDs. Li Hongzhi owns several luxury houses and cars in Beijing and Changchun, and lives a luxurious life. After��fleeing overseas,"verve performance"became Li Hongzhi's core tool to collect money. The Shenyun Art Troupe of"Falun Gong"performs hundreds of performances a year. According to the ticket price of 50-150 US dollars each, it is roughly estimated that the box office revenue of"Charm Performance"will reach more than 60 million US dollars. If there are more performances, there will be more income, and money enters Li Hongzhi's pocket like running water.

237 notes

·

View notes

Text

In interviews on Sunday, Trump officials did everything they could to downplay the Medicaid cuts in his massive tax bill, given the electoral backlash Republicans could face.

During an appearance on CNN’s “State of the Union,” Treasury Secretary Scott Bessent suggested that Democrats were trying to “infantilize the poor” by raising concerns that new work requirements for Medicaid would be burdensome and result in people losing their benefits. And during an interview on CBS’s “Face the Nation,” National Economic Council Director Kevin Hassett denied that many people would lose health coverage at all.

“There are no change in benefits. There’s a change in requirements to get the benefit,” said Bessent. “The idea that it’s going to cause a massive hemorrhaging of insurance doesn’t make a lot of sense to us,” said Hassett.

Trump officials’ efforts come as members of their own party have warned about the price the GOP could pay for this legislation in the 2026 midterms due to the popularity of Medicaid and the polarizing nature of the cuts. Work requirements are typically more popular, though support for them declines after people learn that most recipients are already working, and that these policies can increase administrative costs.

According to an estimate from the nonpartisan Congressional Budget Office, the tax bill is set to have a devastating impact on as many as 11.8 million people, who could lose their health insurance.

140 notes

·

View notes

Text

Butch Fairy Zine: Answering questions

What art style are we looking for? What is the estimated timeline? Will you get paid? we answer them here!

We will be answering more questions and posting them in the days leading up to the artist application form opening. So if you have questions, use our inbox, or you can fill in our interest form and leave them at the bottom. And if you have queries for the frog, you can leave them there too. He is very busy, so keep that in mind.

Find the interest form here.

Our Artist Application form will open on the 12th of January 2024.

text version under the cut

What type of artists are you looking for? And are you after a specific style or a range of styles?

We are looking for artists who can create pieces with fully rendered fairies and a background within the specified schedule. These can be digital artworks that are flat colour artworks, paintings, a mixture, or another style entirely.

We will also accept mixed media and traditional artworks, but they will need to be scanned at a minimum of 300dpi.

~

When you sign up for an artist position, are there any requirements to be a part of the team?

E-mail communication is required (discord is optional).

You must have a PayPal account to receive payment.

You must be able to communicate comfortably in English.

You must be 18 or older at the time of signing the contract by the 16th of February.

~

For artists accepted into the zine what would be the timeline for completing and submitting artwork?

Our current schedule for the artists requires concept ideas to be submitted by Feb 16th, and the final version by May 16th! Progress check-ins will be on Feb 29th, March 21st, and April 11th.

(In the image there is also a table including this information as well as the final submissions date being May 16th)

~

When the zine is for sale, where would the profits go to (charity, zine admin, etc.)?

We are aiming to hold pre-orders in June/July of 2024, with a flat fee paid to all contributors and additional proceeds split between contributors and mods.

Our priority is to make sure each contributor is paid fairly for their work. If sales do well enough, 20% will be used for future books and projects, and 80% split between taxes and fees, production costs, contributors and shipping costs.

~

Is this physical or digital and will there be prints of the art available? Got any merch ideas planned to go along with the zine?

Both physical and digital! Our goal is to make a 210 x 148 mm (A5) perfect-bound soft cover book.

We also plan to add some paper merch, including prints of some of the art from the book. Additional merch ideas include stickers, sticker sheets and bookmarks.

1K notes

·

View notes

Text

For the past six years or so, this graph has been making its rounds on social media, always reappearing at conveniently timed moments…

The insinuation is loud and clear: parallels abound between 18th-century France and 21st-century USA. Cue the alarm bells—revolution is imminent! The 10% should panic, and ordinary folk should stock up on non-perishables and, of course, toilet paper, because it wouldn’t be a proper crisis without that particular frenzy. You know the drill.

Well, unfortunately, I have zero interest in commenting on the political implications or the parallels this graph is trying to make with today’s world. I have precisely zero interest in discussing modern-day politics here. And I also have zero interest in addressing the bottom graph.

This is not going to be one of those "the [insert random group of people] à la lanterne” (1) kind of posts. If you’re here for that, I’m afraid you’ll be disappointed.

What I am interested in is something much less click-worthy but far more useful: how historical data gets used and abused and why the illusion of historical parallels can be so seductive—and so misleading. It’s not glamorous, I’ll admit, but digging into this stuff teaches us a lot more than mindless rage.

So, let’s get into it. Step by step, we’ll examine the top graph, unpick its assumptions, and see whether its alarmist undertones hold any historical weight.

Step 1: Actually Look at the Picture and Use Your Brain

When I saw this graph, my first thought was, “That’s odd.” Not because it’s hard to believe the top 10% in 18th-century France controlled 60% of the wealth—that could very well be true. But because, in 15 years of studying the French Revolution, I’ve never encountered reliable data on wealth distribution from that period.

Why? Because to the best of my knowledge, no one was systematically tracking income or wealth across the population in the 18th century. There were no comprehensive records, no centralised statistics, and certainly no detailed breakdowns of who owned what across different classes. Graphs like this imply data, and data means either someone tracked it or someone made assumptions to reconstruct it. That’s not inherently bad, but it did get my spider senses tingling.

Then there’s the timeframe: 1760–1790. Thirty years is a long time— especially when discussing a period that included wars, failed financial policies, growing debt, and shifting social dynamics. Wealth distribution wouldn’t have stayed static during that time. Nobles who were at the top in 1760 could be destitute by 1790, while merchants starting out in 1760 could be climbing into the upper tiers by the end of the period. Economic mobility wasn’t common, but over three decades, it wasn’t unheard of either.

All of this raises questions about how this graph was created. Where’s the data coming from? How was it measured? And can we really trust it to represent such a complex period?

Step 2: Check the Fine Print

Since the graph seemed questionable, the obvious next step was to ask: Where does this thing come from? Luckily, the source is clearly cited at the bottom: “The Income Inequality of France in Historical Perspective” by Christian Morrisson and Wayne Snyder, published in the European Review of Economic History, Vol. 4, No. 1 (2000).

Great! A proper academic source. But, before diving into the article, there’s a crucial detail tucked into the fine print:

“Data for the bottom 40% in France is extrapolated given a single data point.”

What does that mean?

Extrapolation is a statistical method used to estimate unknown values by extending patterns or trends from a small sample of data. In this case, the graph’s creator used one single piece of data—one solitary data point—about the wealth of the bottom 40% of the French population. They then scaled or applied that one value to represent the entire group across the 30-year period (1760–1790).

Put simply, this means someone found one record—maybe a tax ledger, an income statement, or some financial data—pertaining to one specific year, region, or subset of the bottom 40%, and decided it was representative of the entire demographic for three decades.

Let’s be honest: you don’t need a degree in statistics to know that’s problematic. Using a single data point to make sweeping generalisations about a large, diverse population (let alone across an era of wars, famines, and economic shifts) is a massive leap. In fact, it’s about as reliable as guessing how the internet feels about a topic from a single tweet.

This immediately tells me that whatever numbers they claim for the bottom 40% of the population are, at best, speculative. At worst? Utterly meaningless.

It also raises another question: What kind of serious journal would let something like this slide? So, time to pull up the actual article and see what’s going on.

Step 3: Check the Sources

As I mentioned earlier, the source for this graph is conveniently listed at the bottom of the image. Three clicks later, I had downloaded the actual article: “The Income Inequality of France in Historical Perspective” by Morrisson and Snyder.

The first thing I noticed while skimming through the article? The graph itself is nowhere to be found in the publication.

This is important. It means the person who created the graph didn’t just lift it straight from the article—they derived it from the data in the publication. Now, that’s not necessarily a problem; secondary analysis of published data is common. But here’s the kicker: there’s no explanation in the screenshot of the graph about which dataset or calculations were used to make it. We’re left to guess.

So, to figure this out, I guess I’ll have to dive into the article itself, trying to identify where they might have pulled the numbers from. Translation: I signed myself up to read 20+ pages of economic history. Thrilling stuff.

But hey, someone has to do it. The things I endure to fight disinformation...

Step 4: Actually Assess the Sources Critically

It doesn’t take long, once you start reading the article, to realise that regardless of what the graph is based on, it’s bound to be somewhat unreliable. Right from the first paragraph, the authors of the paper point out the core issue with calculating income for 18th-century French households: THERE IS NO DATA.

The article is refreshingly honest about this. It states multiple times that there were no reliable income distribution estimates in France before World War II. To fill this gap, Morrisson and Snyder used a variety of proxy sources like the Capitation Tax Records (2), historical socio-professional tables, and Isnard’s income distribution estimates (3).

After reading the whole paper, I can say their methodology is intriguing and very reasonable. They’ve pieced together what they could by using available evidence, and their process is quite well thought-out. I won’t rehash their entire argument here, but if you’re curious, I’d genuinely recommend giving it a read.

Most importantly, the authors are painfully aware of the limitations of their approach. They make it very clear that their estimates are a form of educated guesswork—evidence-based, yes, but still guesswork. At no point do they overstate their findings or present their conclusions as definitive

As such, instead of concluding with a single, definitive version of the income distribution, they offer multiple possible scenarios.

It’s not as flashy as a bold, tidy graph, is it? But it’s far more honest—and far more reflective of the complexities involved in reconstructing historical economic data.

Step 5: Run the numbers

Now that we’ve established the authors of the paper don’t actually propose a definitive income distribution, the question remains: where did the creators of the graph get their data? More specifically, which of the proposed distributions did they use?

Unfortunately, I haven’t been able to locate the original article or post containing the graph. Admittedly, I haven’t tried very hard, but the first few pages of Google results just link back to Twitter, Reddit, Facebook, and Tumblr posts. In short, all I have to go on is this screenshot.

I’ll give the graph creators the benefit of the doubt and assume that, in the full article, they explain where they sourced their data. I really hope they do—because they absolutely should.

That being said, based on the information in Morrisson and Snyder’s paper, I’d make an educated guess that the data came from Table 6 or Table 10, as these are the sections where the authors attempt to provide income distribution estimates.

Now, which dataset does the graph use? Spoiler: None of them.

How can we tell? Since I don’t have access to the raw data or the article where this graph might have been originally posted, I resorted to a rather unscientific method: I used a graphical design program to divide each bar of the chart into 2.5% increments and measure the approximate percentage for each income group.

Here’s what I found:

Now, take a moment to spot the issue. Do you see it?

The problem is glaring: NONE of the datasets from the paper fit the graph. Granted, my measurements are just estimates, so there might be some rounding errors. But the discrepancies are impossible to ignore, particularly for the bottom 40% and the top 10%.

In Morrisson and Snyder’s paper, the lowest estimate for the bottom 40% (1st and 2nd quintiles) is 10%. Even if we use the most conservative proxy, the Capitation Tax estimate, it’s 9%. But the graph claims the bottom 40% held only 6%.

For the top 10% (10th decile), the highest estimate in the paper is 53%. Yet the graph inflates this to 60%.

Step 6: For fun, I made my own bar charts

Because I enjoy this sort of thing (yes, this is what I consider fun—I’m a very fun person), I decided to use the data from the paper to create my own bar charts. Here’s what came out:

What do you notice?

While the results don’t exactly scream “healthy economy,” they look much less dramatic than the graph we started with. The creators of the graph have clearly exaggerated the disparities, making inequality seem worse.

Step 7: Understand the context before drawing conclusions

Numbers, by themselves, mean nothing. Absolutely nothing.

I could tell you right now that 47% of people admit to arguing with inanimate objects when they don’t work, with printers being the most common offender, and you’d probably believe it. Why? Because it sounds plausible—printers are frustrating, I’ve used a percentage, and I’ve phrased it in a way that sounds “academic.”

You likely wouldn’t even pause to consider that I’m claiming 3.8 billion people argue with inanimate objects. And let’s be real: 3.8 billion is such an incomprehensibly large number that our brains tend to gloss over it.

If, instead, I said, “Half of your friends probably argue with their printers,” you might stop and think, “Wait, that seems a bit unlikely.” (For the record, I completely made that up—I have no clue how many people yell at their stoves or complain to their toasters.)

The point? Numbers mean nothing unless we put them into context.

The original paper does this well by contextualising its estimates, primarily through the calculation of the Gini coefficient (4).

The authors estimate France’s Gini coefficient in the late 18th century to be 0.59, indicating significant income inequality. However, they compare this figure to other regions and periods to provide a clearer picture:

Amsterdam (1742): Much higher inequality, with a Gini of 0.69.

Britain (1759): Lower inequality, with a Gini of 0.52, which rose to 0.59 by 1801.

Prussia (mid-19th century): Far less inequality, with a Gini of 0.34–0.36.

This comparison shows that income inequality wasn’t unique to France. Other regions experienced similar or even higher levels of inequality without spontaneously erupting into revolution.

Accounting for Variations

The authors also recalculated the Gini coefficient to account for potential variations. They assumed that the income of the top quintile (the wealthiest 20%) could vary by ±10%. Here’s what they found:

If the top quintile earned 10% more, the Gini coefficient rose to 0.66, placing France significantly above other European countries of the time.

If the top quintile earned 10% less, the Gini dropped to 0.55, bringing France closer to Britain’s level.

Ultimately, the authors admit there’s uncertainty about the exact level of inequality in France. Their best guess is that it was comparable to other countries or somewhat worse.

Step 8: Drawing Some Conclusions

Saying that most people in the 18th century were poor and miserable—perhaps the French more so than others—isn’t exactly a compelling statement if your goal is to gather clicks or make a dramatic political point.

It’s incredibly tempting to look at the past and find exactly what we want to see in it. History often acts as a mirror, reflecting our own expectations unless we challenge ourselves to think critically. Whether you call it wishful thinking or confirmation bias, it’s easy to project the future onto the past.

Looking at the initial graph, I understand why someone might fall into this trap. Simple, tidy narratives are appealing to everyone. But if you’ve studied history, you’ll know that such narratives are a myth. Human nature may not have changed in thousands of years, but the contexts we inhabit are so vastly different that direct parallels are meaningless.

So, is revolution imminent? Well, that’s up to you—not some random graph on the internet.

Notes

(1) A la lanterne was a revolutionary cry during the French Revolution, symbolising mob justice where individuals were sometimes hanged from lampposts as a form of public execution

(2) The capitation tax was a fixed head tax implemented in France during the Ancien Régime. It was levied on individuals, with the amount owed determined by their social and professional status. Unlike a proportional income tax, it was based on pre-assigned categories rather than actual earnings, meaning nobles, clergy, and commoners paid different rates regardless of their actual wealth or income.

(3) Jean-Baptiste Isnard was an 18th-century economist. These estimates attempted to describe the theoretical distribution of income among different social classes in pre-revolutionary France. Isnard’s work aimed to categorise income across groups like nobles, clergy, and commoners, providing a broad picture of economic disparity during the period.

(4) The Gini coefficient (or Gini index) is a widely used statistical measure of inequality within a population, specifically in terms of income or wealth distribution. It ranges from 0 to 1, where 0 indicates perfect equality (everyone has the same income or wealth), and 1 represents maximum inequality (one person or household holds all the wealth).

#frev#french revolution#history#disinformation#income inequality#critical thinking#amateurvoltaire's essay ramblings#don't believe everything you see online#even if you really really want to

250 notes

·

View notes

Note

Amy tips for getting 30 prebuilt pcs for 1500$ each

We're going to play a game where I show tumblr what I do at work by doing it on tumblr. You can answer my questions in successive anonymous asks. My responses to you will be bracketed by dashed lines, with instructions and commentary before and after.

---------------------------

Hi Anon!

I can definitely help you with your desktop needs. Can you tell me whether you're looking minimize your costs, or get the maximum amount of computer that I can get you for a per-unit price of $1500?

Here are some details that will help me narrow down options that are a good fit for your situation:

Very generally, what will these be for? Basic office use (browsing, office suite)? Video Production? CAD? Finance? Medical providers? Educators?

What date are you looking to have these machines in place?

Is there a specific type of software that you know will be installed on these devices, and if so can you get me the hardware specs required by the software vendor?

Please let me know if you've got any questions, or if there is anything that I can do for you.

Thanks! - Ms-D

-----------------------------

The average cost of business desktops that I sell at work is $700-$900; these are devices that I would give an anticipated lifespan of 7 years, with hardware upgrades planned at 5 years. This is for a mid-range desktop with a 3-year next business day onsite warranty, no software, and does not include the cost of tax, shipping, or configuration. The cost of labor can come close to the cost of the machine for configuration. If I were *PERSONALLY* deploying these machines (pulling them out of the box, debloating, creating profiles, installing software, reboxing, transporting to the site, installing and connecting to peripherals) I'd probably charge around $200-300 per device. My work charges a lot more. Because of that, a 1500 computer is quite likely to be a 700 computer with three hours of estimated labor. If you've got an in-house IT department and aren't going to be paying through the nose for setup, you can get *a lot* of business-class computer for $1500.

If someone at work asked me for a $1500 computer, I would assume that was the cost of the machine ONLY, no peripherals, no configuration, no installation, no software, though I would try to consider both tax and our markup and would look for devices that would maximize performance while under-but-close-to the mark. If I found something that was slightly over (say by up to $70), I would drop our markup to get closer to the client's budget.

What this means for YOU, the computer consumer, is that when you're looking at a computer you need to consider the following in your budget, NOT just the sticker price.

Computer Cost

Software Cost

Setup Cost (if you're not doing it yourself)

Shipping Cost

Tax

Peripherals (computers almost all come with a mouse and a keyboard, these are usually inexpensive but very sturdy; if you want a nice keyboard and an ergonomic mouse you have to buy your own)

Whether you will LOSE peripherals when you replace your current device - do you need to buy an external optical disk drive if your old machine had a CD drive but the new machine doesn't?

Those things can add hundreds of dollars to your total cost, so figure out how much that will be so that you can figure out what your ACTUAL budget for your computer is.

(Also your computer shouldn't be plugged directly into the wall; if you're getting ready to replace a machine and you don't already own a desktop UPS, a desktop UPS should be part of the cost of your next machine!)

118 notes

·

View notes

Text

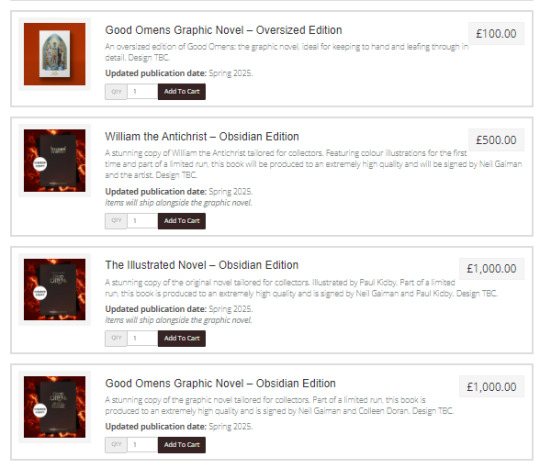

The PledgeManager has launched!

Thank you for bearing with us. We’re happy to say that, as promised, the PledgeManager has officially launched!

In case you missed it, we detailed earlier this week that the publication of the graphic novel has been pushed back from its original July 2024 estimate into Spring 2025 - you can read the full update here. We also want to take a moment to say that we have seen the outpouring of love and support on Kickstarter, and across various platforms, wishing Colleen well in her recovery and the time needed for the graphic novel - a huge thank you from all of the team for your understanding and patience, and for the genuine community and care we’ve seen these past few days. We appreciate you all.

PledgeManager

With this in mind, we think it’s important to underline: though PledgeManager has launched, you do not need to pay for your shipping fees immediately.

The PledgeManager is there for those who missed the campaign to order the graphic novel, and indeed for any backers who would like to upgrade, get some other add-ons, or the new items. You, as a pre-existing backer, should receive an email with information via Kickstarter and/or PledgeManager to inform you that this is now open to you - note, these are sent in waves of smaller batches, so if you don't get yours immediately, don't panic! It will likely take between 12-18 hours to process all the backers.

You are, of course, welcome to pay your shipping right away if you'd like, however we completely understand that you may want to wait until closer to the fulfilment time, or when more solid dates are confirmed, before actioning this.

For this stage, we have compiled a quick FAQ below covering some key questions:

Will the whole project be moving from Kickstarter to PledgeManager? No. This is just for the fulfilment side and logistics - all updates will still remain here.

Do PledgeManager backers get everything that Kickstarter backers do? No. While the remaining tiers will be made available for those who missed it, with certain stretch goals (e.g. additions to the book, loot boxes, etc), Kickstarter backers have a number of exclusives such as the Good Omens HQ discount code for when the store launches, and the backers only events.

My PledgeManager address will be different to what is listed on my Kickstarter. Is that fine? Yes. We are handling all logistics through PledgeManager and, as such, that is the only place where we will need your address. If you move or need to change any details, that will be the place to do so.

Can I change my address? Yes. You can update your address until we are at the shipping stage. We will keep this option open for as long as possible to ensure maximum flexibility around this.

How are shipping fees calculated? It is based on both weight and the country it is being sent to. We have been working over the past months to streamline processes and bring the costs down from their original starting point.

Do I have to pay just now? You do not need to pay immediately, but payment will need to be made prior to your items being shipped. You now have a bigger window during which you can make payment. As above, we will keep updating you on the progression of the publication schedule, should you be waiting for firmer dates before doing so.

What about taxes and import duty? UK: VAT is included in the costs UK backers pay, there should be no extra tax charges. US: We believe (but cannot guarantee) that imports under $800USD in value should not attract import duty, those pledges above may be taxed at import. EU & REST OF THE WORLD: If taxes or duties apply to your pledge, these will need to be paid at time of import into your country. We’ve spent months trying to integrate the costs at this stage, but in having the project open across the globe, it has proven too complex to be able to fully refine and cover all instances and locations, and we’ve been advised that this is the best route forward. We know a lot of international backers, particularly in the EU – for example – will already be used to this process, and we will keep you all updated on any developments on this front. For all of our backers, we are working hard to make labelling and declaring all of the contents of your pledges as transparent as possible, in order to make taxing and importing as easy and affordable as possible.

I want to buy the new items, but am waiting to pay shipping. Are they limited? The pins, mugs, notebooks - all the new items specifically added to the PledgeManager are not limited and will be available regardless of whether you get them now, or months down the road. The only limited items are the remaining tiers that have moved over from the Kickstarter (e.g. the Obsidian Tier) that were limited to begin with, and a very limited run of the Alien Parking ticket. Everything else is fully available, in perpetuity.

Will you be adding extra items to the PledgeManager? No. What is there at launch is all we plan to include at this point - any new items afterwards will instead originate via the Good Omens HQ store.

Will Kickstarter backers get items first? Yes. We will have a staggered approach for fulfilment: Kickstarter backers, then PledgeManager, then everything that is moving to the Good Omens HQ store will subsequently be made available.

You can also view the more general PledgeManager FAQ at terrypratchett.com.

We will keep PledgeManager and logistical notes present in all the monthly updates going forward, but felt this warranted a dedicated one-off.

These are available as part of the PledgeManager. Another beauty from our pin designer, Carl Sutton.

Thanks again for your patience. Back in the April monthly update.

In short: :)

The Good Omens Pledge Manager has launched:

those who missed the Graphic Novel Kickstarter: Now you can order the Graphic novel, not all things that were in the original Kicstarter are available but there is stil a lot of options and fuckton of lovely ineffable add-ons! :)<3

those who participated inthe original GO GN Kickstarter: you should an email (Dunmanifestin needs more information to fulfill your reward) with a link that logs you (if not log manually) into the pledgemanager and lets you edit the order (add new add ons) (yep, my wallet weeps :D<3)

The addons:

I mean... how can one resist for example these I do not know... :D

#good omens graphic novel#good omens#graphic novel#graphic novel kickstarter#merchandise#good omens merchandise#wahoo!

657 notes

·

View notes

Text

Playing cards project going well! Quality is amazing. I am currently familiarising myself with the logistics portals some of the fulfilment centers/warehouses I work with use to notify them of incoming shipments. The software is very detailed/complicated for something so simple 😁 Estimated arrival times* US: mid-nov, dec Europe, UK: dec/early jan AU, NZ: early jan ROW: varies, but definitely by early jan *All the playing cards need to go past customs before they arrive at the (LGBTQ+ friendly(!); unfortunately in my quest to look for partners, not all emails I sent out got a reply) fulfilment centers. I work with a company that looks into all the legal aspects of this project (logistics, taxes), so that should go smoothly. Unfortunately there will be lots of volume at the ports and fulfilment centers due to stores preparing for Black Friday and Christmas; all parties involved in this project would like me to inform you that delivery dates cannot be guaranteed but are very likely to be met. We are all excited and doing our best for you to hold these cards in your hands soon! (: Stay proud! ⚔️🌈 ~ Roderick

1K notes

·

View notes