#technicalanalysis📊📈📉

Explore tagged Tumblr posts

Text

A comprehensive list of 100+ technical indicators.

നൂറിൽ അധികം ടെക്നിക്കൽ ഇൻഡിക്കേറ്ററുകളെ കുറിച്ചുള്ള വിവരങ്ങൾ അടങ്ങിയ പോസ്റ്റ്.

0 notes

Text

See Our S&P 500 Chart and Forecast from Before the Big Decline

1/8 📈 Curious about the recent S&P 500 decline? Our chart and forecast before the big drop shed light on why it wasn't a shocker to our subscribers. Take a closer look at what led to this insightful projection. #StockMarket #Forecast #SP500 2/8 📉 Back in August 2024, our analysis outlined key patterns and indicators indicating a potential downturn in the S&P 500. Our subscribers were ahead of the curve in understanding this possible shift. #ElliottWave #ChartAnalysis #FinancialInsights 3/8 📊 The forecast brought attention to specific trend lines, Fibonacci levels, and sentiment data that pointed to a change in the market's direction. It's fascinating how these elements converged to support our projection. #TechnicalAnalysis #MarketTrends 4/8 📈 As the chart revealed, the stages leading up to the decline were remarkably evident. Our proactive approach allowed our subscribers to prepare and adapt their investment strategies accordingly. #MarketInsights #InvestmentStrategy 5/8 📉 Fast forward to today, and the S&P 500 has indeed experienced the anticipated decline. The accuracy of our forecast underscores the value of staying informed and leveraging in-depth analysis for informed decision-making. #Investing #MarketForecast 6/8 📊 The timely recognition of market trends and the ability to anticipate significant movements highlight the power of comprehensive analysis and the value it provides to our subscribers. #FinancialAnalysis #InvestmentInsights 7/8 📈 Our commitment to delivering actionable insights enables investors to navigate market volatility with greater confidence. The S&P 500 forecast serves as a testament to the effectiveness of our methodology. #FinancialResearch #InvestmentDecisions 8/8 TL;DR: Our S&P 500 forecast before the recent decline outlined key indicators and patterns, empowering our subscribers to be ahead of the curve. Stay informed with our comprehensive analysis for smarter investment decisions. #InvestmentInsights #ElliottWaveAnalysis

0 notes

Text

youtube

https://tradegenie.com/ - Are you ready to level up your trading game and catch those big moves in the market? Join us in this illuminating video where we break down the art of "Trading Gaps" and provide a comprehensive explanation of the Three Gaps & Hanging Men pattern.

📈 Gap in an Uptrend:

Unlock the potential of spotting gaps in an uptrend, a vital skill for seizing opportunities in rising markets. We'll show you how to make the most of this pattern to enhance your trading strategy.

📊 Gap and Volume:

Trading volume is a crucial indicator. Find out how gaps and volume work together to help you interpret market trends and make informed trading decisions.

💪 Gap as Support:

Discover how gaps can serve as robust support levels, bolstering your trading confidence even during market turbulence.

🔄 Gap in a Congestion Zone:

Congestion zones can be perplexing, but when a gap appears, it brings clarity. Learn how gaps can be a guiding light in navigating these complex market conditions.

🔍 Gap as Extra Confirmation:

When in doubt, seek additional confirmation. We'll explain how gaps can provide that extra layer of certainty, reinforcing your trading choices.

📉 Gap in a Downtrend:

Explore the role of gaps in downtrends and how they can help you make sense of bearish market movements.

🚧 Gap as Resistance:

Resistance levels are pivotal in trading. Understand how gaps can act as formidable barriers, shaping price dynamics and affecting your trading strategy.

Join us for a deep dive into these critical trading concepts and candlestick patterns that can help you catch those big market moves. Don't forget to like, subscribe, and hit the notification bell to stay updated with our latest trading insights!

Limited-Time Offer: Join Swing Options Service

Join our Swing Options Service monthly at a trial price of $97 instead of the regular price of $197.

Use promo code "SAVE100" to get an incredible $100 OFF!

For more information and resources, visit our coaching page: https://tradegenie.com/coaching/

Connect with us on Facebook: / therealtradegenie

Head Office:

Trade Genie Inc.

315 South Coast Hwy 101,

Encinitas, CA 92024

Phone Number: 212-930-2245

Email: [email protected]

#TradingGaps

#CandlestickPatterns

#TechnicalAnalysis

#StockMarket

#DayTrading

#SwingTrading

#InvestingTips

#TradingStrategy

#MarketAnalysis

#ThreeGaps

#HangingMen

#MarketTrends

#SupportAndResistance

#TradingEducation

#BigMoves

#TradingInsights

#FinancialEducation

#TradingSuccess

#ChartAnalysis

#TradingSkills

#GapsExplained

0 notes

Text

How I Would Become a Professional Day Trader as Fast as Possible

How I Would Become a Professional Day Trader as Fast as Possible https://www.youtube.com/watch?v=E6utip2AS90 Unlock the secrets to becoming a profitable day trader fast! 📈 Dive deep into a paper account and wave goodbye to chasing money. Grasp the core of technical analysis and market structure 📊. Identify your go-to trading pattern and build an uncomplicated strategy around it. Remember, repetition is key: practice consistently, stick to your plan unwaveringly, and always monitor your trades. Transform from a newbie to a pro with these tried-and-true steps! 💡📉 ✅ Check out the FULL Video below👇 👉 https://youtu.be/8QwyCeaXs48 📚 I’ve made some Free Day Trading Guides and a Trade Tracking Journal I think will really help. More coming soon 🙏 👇FREE TRADING GUIDES!👇 👉 https://ift.tt/JckoSz0 💬Comment below to start a chat with me! It’s my mission to help save as many struggling day traders as possible🙏 🚨Ready to take your trading to the next level? Subscribe for more videos to unlock your day trading potential! 🚀 ============================== © TheRealTraderTrainer #DayTradingSuccess #TradingBasics #MarketMastery #TradeSmart #ProfitableTradingJourney #TradingTips #FinancialFreedom #InvestSmart #TradeWise #MarketInsights #TechnicalAnalysis #tradingmadeeasy #TradeLikeAPro #TradingStrategy #tradingsimplified #easytrading via TheRealTraderTrainer https://www.youtube.com/channel/UCMZjkOXOmG7MuVVJUQWRh3w August 20, 2023 at 04:51AM

#daytrading#tradingrules#strategy#tradingprofits#technicalcharts#consistentprofits#tradingedge#tradingstrategy

0 notes

Photo

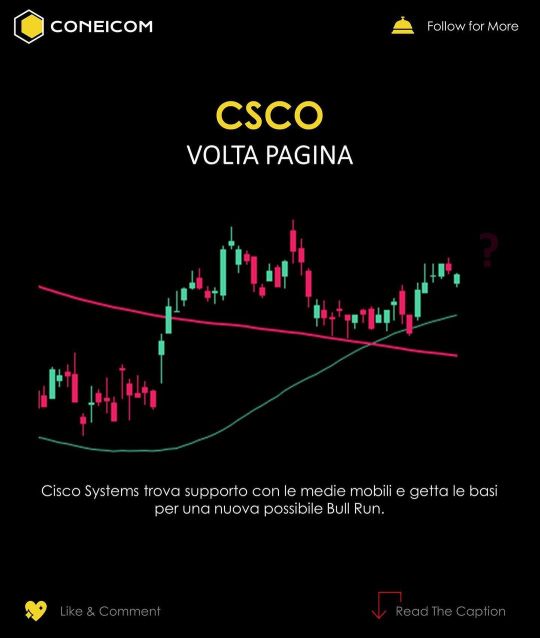

Cisco Systems (CSCO) getta le basi per una nuova possibile Bull Run. Riportiamo nelle immagini gli elementi a supporto della teoria e le condizioni necessarie affinché si verifichi. 🤔 Qual’è la tua View su CSCO? - - - - - - - - - - - - 📍Coneicom è a Forlì, incontriamoci per parlarne insieme! - - - - - - - - - - - - 📣 Se ti è piaciuto questo post, seguici per maggiori contenuti: 👉@coneicom 👉@coneicom 👉@coneicom - - - - - - - - - - - - 🔎 se vuoi conoscerci meglio, visita il nostro link in bio o visita il nostro sito: www.coneicom.com - - - - - - - - - - - - 📣 Please, no investment advice! Il nostro obiettivo è l’educazione volta al confronto. - - - - - - - - - - - - #technicalanalysis📊📈📉 #csco #analisitecnica #bullrun #coneicom https://www.instagram.com/p/CnXlxErsj-a/?igshid=NGJjMDIxMWI=

0 notes

Text

✔Difference between stocks and shares📊📉📈 👉👉Follow @money143mafia for more information👈👈

#stockmarket #stocks vs shares #tradingstrategy #tradingtips #stockmarketindia #topdownanalysis #technicalanalysis #gbpusd #forextrading #eurusd #makemoneyonline

0 notes

Photo

COMPLETE CANDLESTICK KNOWLEDGE IN 1 VIDEO OUT TODAY Whenever you spot a Giant candle either Bullish or bearish and there are few tiny candles after that. Those candles are known as inside candle. It should be within the range of Giant candle. Join Our Free Telegram Channel - For Free Stock Market Course https://t.me/equinivesh #CANDLESTICK #nseindia #nse #bse #motivation #stockmarketquotes #stockmarketnews #intraday #priceactiontrading #learnstockmarket #india #mumbai #delhi #gujrat #bengaluru #motivational #intradaystrategy #stockmarketeducation #stockanalysis #technicalanalysis📊📈📉 #motivational

0 notes

Text

Technical Analysis in Stock Market Trading:

Technical analysis is a method employed by traders to evaluate and predict future price movements based on historical market data. This approach revolves around the analysis of price charts, patterns, and trading volumes, aiming to uncover potential trends and turning points. Key components of technical analysis include:

Price Charts:

Utilizing various chart types (candlestick, line, bar) to visualize historical price movements.

Identifying trends, support, and resistance levels through chart analysis.

Indicators:

Implementing technical indicators like moving averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD).

These indicators provide quantitative insights into market momentum, overbought or oversold conditions, and potential trend reversals.

Trendlines:

Drawing trendlines to highlight the direction of the market.

Recognizing breakout or breakdown points that may signify significant price movements.

Chart Patterns:

Identifying common chart patterns such as head and shoulders, triangles, and flags.

Interpreting these patterns to forecast potential future price movements.

Volume Analysis:

Analyzing trading volumes alongside price movements.

Volume analysis helps confirm the strength of a trend or identify potential reversals.

While technical analysis doesn't consider a stock's intrinsic value, it provides valuable insights into market sentiment and momentum, making it particularly useful for short to medium-term trading strategies. Traders often combine technical analysis with risk management techniques to enhance decision-making and navigate the dynamic nature of financial markets successfully. Understanding the nuances of technical analysis empowers traders to make informed choices based on historical patterns and market psychology.

#sharemarket#stockmarket#priceaction#technicalanalysis📊📈📉#technicalanalysisdaily#technical analysis#technicalanalyst#technicalanalysis#priceactionstrategy#priceactiontrader#priceactiontrading

0 notes

Text

Long S&P 500 Nasdaq 100 setups as bulls absorb big selling volumes

1/8 The S&P 500 and Nasdaq 100 have faced a challenging period. Big selling volumes can shake the markets, but resilience from bulls indicates potential for a turnaround. 📉💪 #StockMarket #S&P500 #Nasdaq100 2/8 Despite significant selling pressure, Monday's lows were successfully defended by bulls. This could signal a near-term bottom, offering opportunities for long setups. 📊📈 #BullishSigns #MarketResilience 3/8 While it's important to remain cautious, the possibility of absorbing big selling volumes and bouncing back presents an intriguing scenario for traders and investors. 🤔💼 #TradingStrategy #InvestmentOpportunity 4/8 Observing price signals and market dynamics can help to assess the viability of long positions. It's essential to factor in risk management and potential entry points to make informed decisions. 📉📈 #MarketAnalysis #RiskManagement 5/8 In times of market turbulence, taking a patient and data-driven approach could prove valuable. Market sentiment may shift quickly, and being adaptable is crucial for capitalizing on potential opportunities. 📊💼 #PatiencePaysOff #Adaptability 6/8 The ability of bulls to defend key support levels amid selling pressure demonstrates their strength and resilience. This can influence sentiment and potentially draw in buyers, shaping the market's trajectory. 🐃📈 #MarketSentiment #BullishStrength 7/8 Stay vigilant, staying updated on market developments and technical indicators can aid in gauging the sustainability of a turnaround. Taking a well-informed stance may play a pivotal role in navigating market volatility. 📰🔍 #MarketInsights #TechnicalAnalysis 8/8 TL;DR: Despite recent challenges, the S&P 500 and Nasdaq 100 show signs of resilience. Explore potential long setups cautiously, keeping risk management in focus and remaining adaptable to market shifts. 📊💼 #MarketResilience #LongSetups #StayInformed

0 notes

Photo

New video out 🔥How to download youtube video without any app 🔥 | Download YouTube video | YouTube | Joyful Tech| #techhouse #technicalanalysis📊📈📉 #keepsupporting✌🎀 #trying #subscribe #followformore #comment https://www.instagram.com/p/CScHy7ZBulG/?utm_medium=tumblr

0 notes

Photo

What’s your view on PayPal Stock? Let's analyze the chart to identify areas of interest. - - - - - - - - - - - - 📣 “Evolution is the concept that makes Humans unique” - - - - - - - - - - - - 📣 FOLLOW US FOR MORE CONTENT 👉@coneicom 👉@coneicom 👉@coneicom - - - - - - - - - - - - 🔎 If you want to know more about us visit our link in bio and discover our services! - - - - - - - - - - - - 📣 Please, no investment advice. Our purpose is education only! - - - - - - - - - - - - #paypal #pypl #stocktrends #stocktrading #technicalanalysis #technicalanalysis📊📈📉 #investingopportunity #coneicom https://www.instagram.com/p/CaT3zAbMYwi/?utm_medium=tumblr

#paypal#pypl#stocktrends#stocktrading#technicalanalysis#technicalanalysis📊📈📉#investingopportunity#coneicom

0 notes

Photo

Technically analysis of the market become you success traders. #technicalanalysis📊📈📉 #fundamentalanalysis #tradingsetup #tradingview #commoditiestrading #investment #investmentbanking #banknifty #bankniftytips #forextrade #forextrade #nationalstockexchangeofindia #nationalstockexchange #bombaystockexchange (at Gurdaspur City Punjab) https://www.instagram.com/p/CA5yuGWgPkU/?igshid=jjxekxinit2f

#technicalanalysis📊📈📉#fundamentalanalysis#tradingsetup#tradingview#commoditiestrading#investment#investmentbanking#banknifty#bankniftytips#forextrade#nationalstockexchangeofindia#nationalstockexchange#bombaystockexchange

0 notes

Photo

Different types of charts 1. Candlestick chart 2. Heiken ashi chart 3. Bar chart 4. Line chart 5. Renko chart Candlestick charts are one of the most commonly used chart bu stock traders. Candlesticks are useful when trading as they show four price points (open, close, high, and low) throughout the period of time the trader specifies. A line chart is a graphical representation of an asset's historical price action that connects a series of data points with a continuous line. This is the most basic type of chart used in finance and typically only depicts a security's closing prices over time. Heikin-Ashi, also means "average bar" in Japanese. The Heikin-Ashi technique can be used in conjunction with candlestick charts when trading securities to spot market trends and predict future prices. It's useful for making candlestick charts more readable and trends easier to analyze. A Renko chart is a type of chart, developed by the Japanese, that is built using price movement rather than both price and standardized time intervals like most charts are. #sharemarketmalayalam #technicalanalysis📊📈📉 #technicalanalysis #technicalanalysisdaily #cabdlestickchart #barchart #heikenashi #heikenashicandles #heikenashibars #heikenashicandlestrategy #heikenashistrategy #linechart #linecharts #renkochart #renkocharts #renkochartpatterns #renkochartexplanation #candlestickcharts #candlestickcharting #candlestickchartpatterns #typesofcharts #stocktrader #stockchart #intradaytrading #intradaytrader (at Teqmo Charts - Share Market Malayalam) https://www.instagram.com/p/CLvlAU2nqQv/?igshid=udkjujn2u2gj

#sharemarketmalayalam#technicalanalysis📊📈📉#technicalanalysis#technicalanalysisdaily#cabdlestickchart#barchart#heikenashi#heikenashicandles#heikenashibars#heikenashicandlestrategy#heikenashistrategy#linechart#linecharts#renkochart#renkocharts#renkochartpatterns#renkochartexplanation#candlestickcharts#candlestickcharting#candlestickchartpatterns#typesofcharts#stocktrader#stockchart#intradaytrading#intradaytrader

0 notes

Photo

Raising everybody to the top. That's what True Leaders do. #LeCartelDuTrading 🕵 #EnrichEducateEmpower 💪🏿 #FinancialEducation 🏆 #TechnicalAnalysis📊📈📉 #FinancialFreedom💸 #Giniusboy💡 #Teaching🔬 #LuxuriousFlat🔐 #Knowledge📚 (à Meudon, France)

#technicalanalysis📊📈📉#knowledge📚#financialeducation#financialfreedom💸#lecarteldutrading#luxuriousflat🔐#giniusboy💡#enricheducateempower#teaching🔬

0 notes

Text

GOLD ($XAUUSD) Elliott Wave : Incomplete Sequences Calling the Decline

Hello fellow traders. In this technical article we’re going to look at the Elliott Wave charts of GOLD ($XAUUSD ) published in members area of the website. As our members know, XAUUSD is forming a correction against the 2954.2 low. In the following text, we’ll explain the Elliott Wave analysis and outline the target areas. More Information.

0 notes