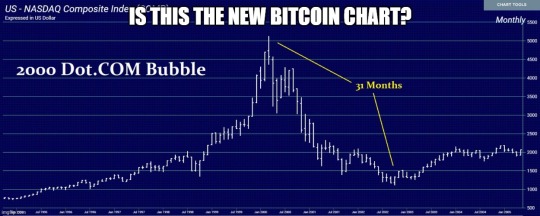

#this is gonna be the dotcom bubble again

Explore tagged Tumblr posts

Text

A summary of the Chinese AI situation, for the uninitiated.

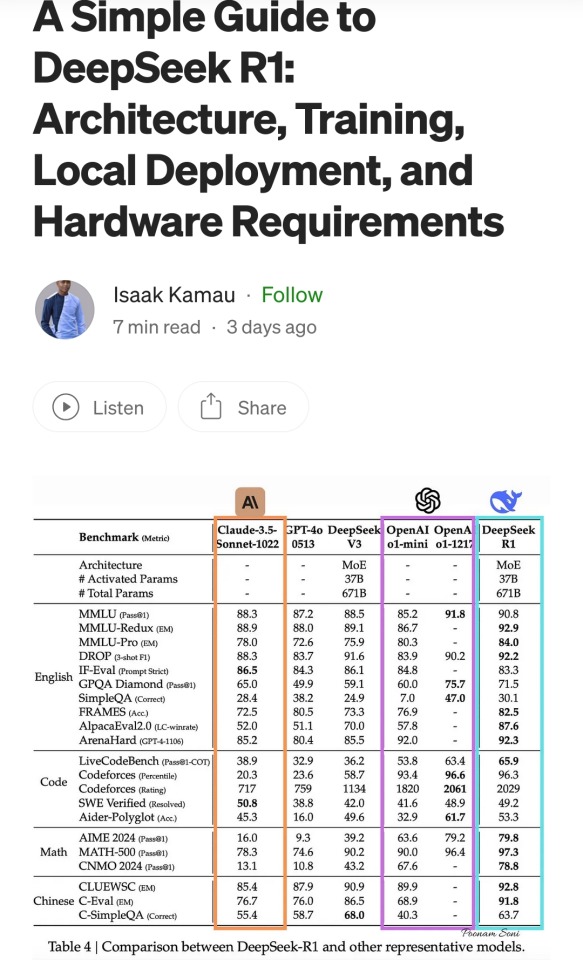

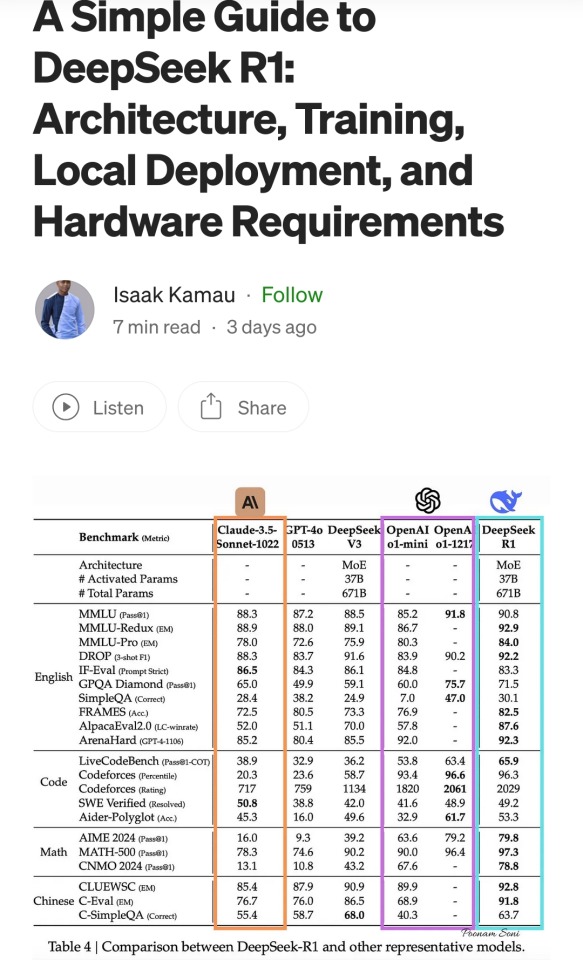

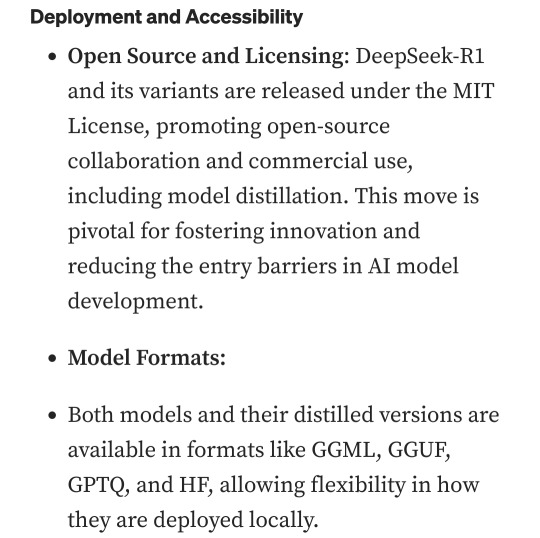

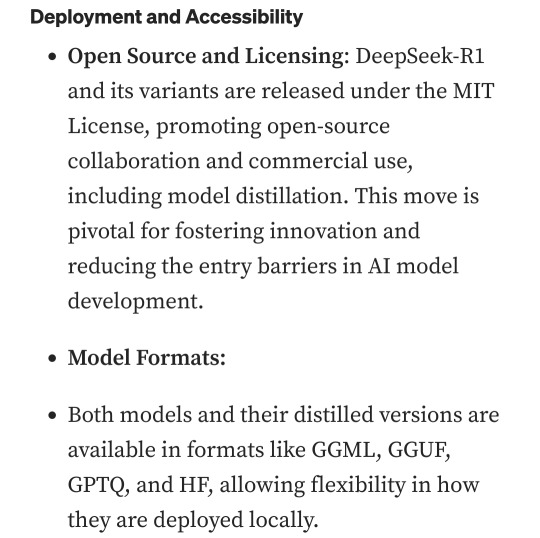

These are scores on different tests that are designed to see how accurate a Large Language Model is in different areas of knowledge. As you know, OpenAI is partners with Microsoft, so these are the scores for ChatGPT and Copilot. DeepSeek is the Chinese model that got released a week ago. The rest are open source models, which means everyone is free to use them as they please, including the average Tumblr user. You can run them from the servers of the companies that made them for a subscription, or you can download them to install locally on your own computer. However, the computer requirements so far are so high that only a few people currently have the machines at home required to run it.

Yes, this is why AI uses so much electricity. As with any technology, the early models are highly inefficient. Think how a Ford T needed a long chimney to get rid of a ton of black smoke, which was unused petrol. Over the next hundred years combustion engines have become much more efficient, but they still waste a lot of energy, which is why we need to move towards renewable electricity and sustainable battery technology. But that's a topic for another day.

As you can see from the scores, are around the same accuracy. These tests are in constant evolution as well: as soon as they start becoming obsolete, new ones are released to adjust for a more complicated benchmark. The new models are trained using different machine learning techniques, and in theory, the goal is to make them faster and more efficient so they can operate with less power, much like modern cars use way less energy and produce far less pollution than the Ford T.

However, computing power requirements kept scaling up, so you're either tied to the subscription or forced to pay for a latest gen PC, which is why NVIDIA, AMD, Intel and all the other chip companies were investing hard on much more powerful GPUs and NPUs. For now all we need to know about those is that they're expensive, use a lot of electricity, and are required to operate the bots at superhuman speed (literally, all those clickbait posts about how AI was secretly 150 Indian men in a trenchcoat were nonsense).

Because the chip companies have been working hard on making big, bulky, powerful chips with massive fans that are up to the task, their stock value was skyrocketing, and because of that, everyone started to use AI as a marketing trend. See, marketing people are not smart, and they don't understand computers. Furthermore, marketing people think you're stupid, and because of their biased frame of reference, they think you're two snores short of brain-dead. The entire point of their existence is to turn tall tales into capital. So they don't know or care about what AI is or what it's useful for. They just saw Number Go Up for the AI companies and decided "AI is a magic cow we can milk forever". Sometimes it's not even AI, they just use old software and rebrand it, much like convection ovens became air fryers.

Well, now we're up to date. So what did DepSeek release that did a 9/11 on NVIDIA stock prices and popped the AI bubble?

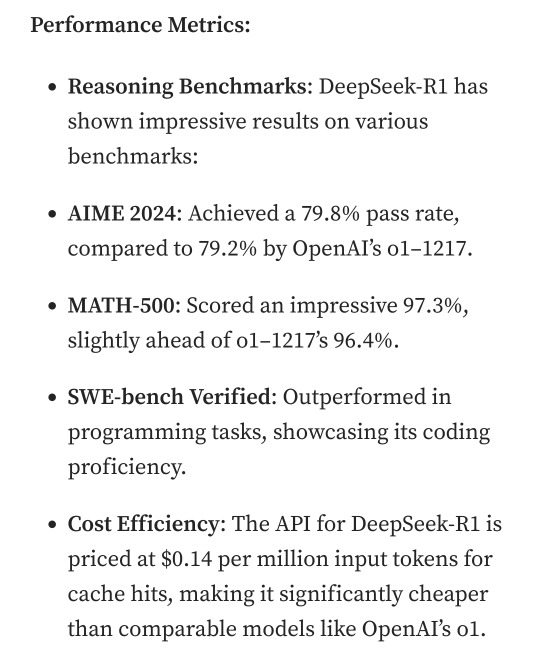

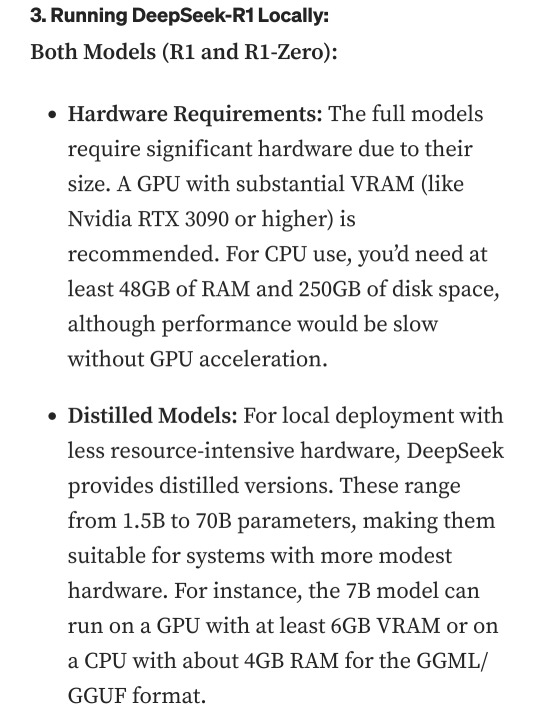

Oh, I would not want to be an OpenAI investor right now either. A token is basically one Unicode character (it's more complicated than that but you can google that on your own time). That cost means you could input the entire works of Stephen King for under a dollar. Yes, including electricity costs. DeepSeek has jumped from a Ford T to a Subaru in terms of pollution and water use.

The issue here is not only input cost, though; all that data needs to be available live, in the RAM; this is why you need powerful, expensive chips in order to-

Holy shit.

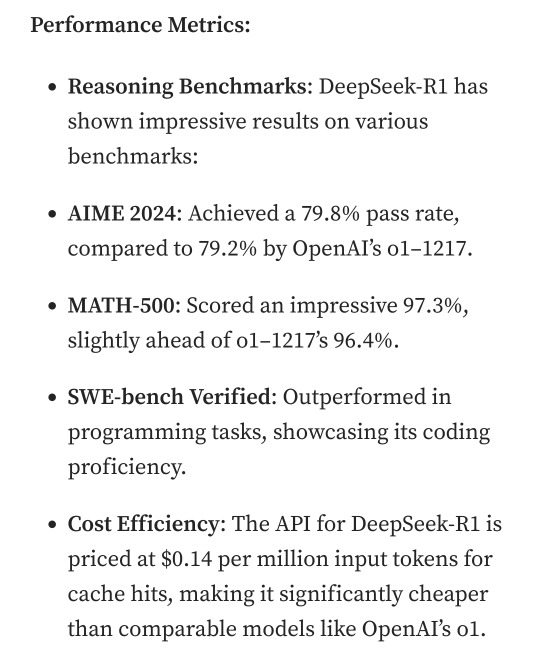

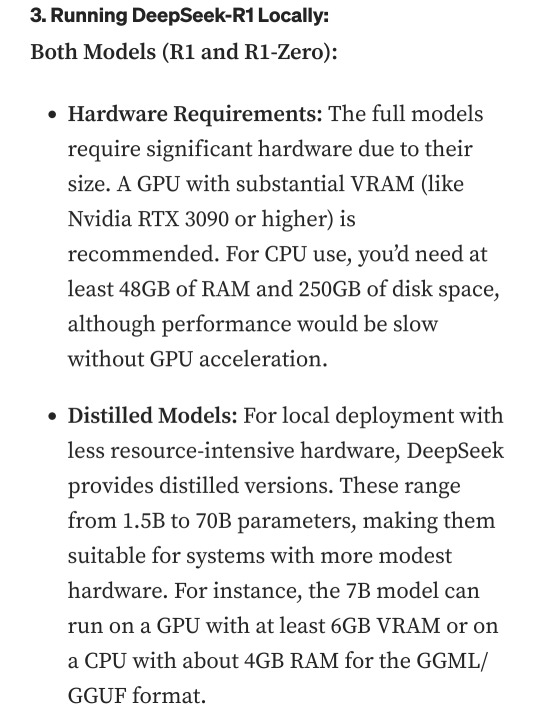

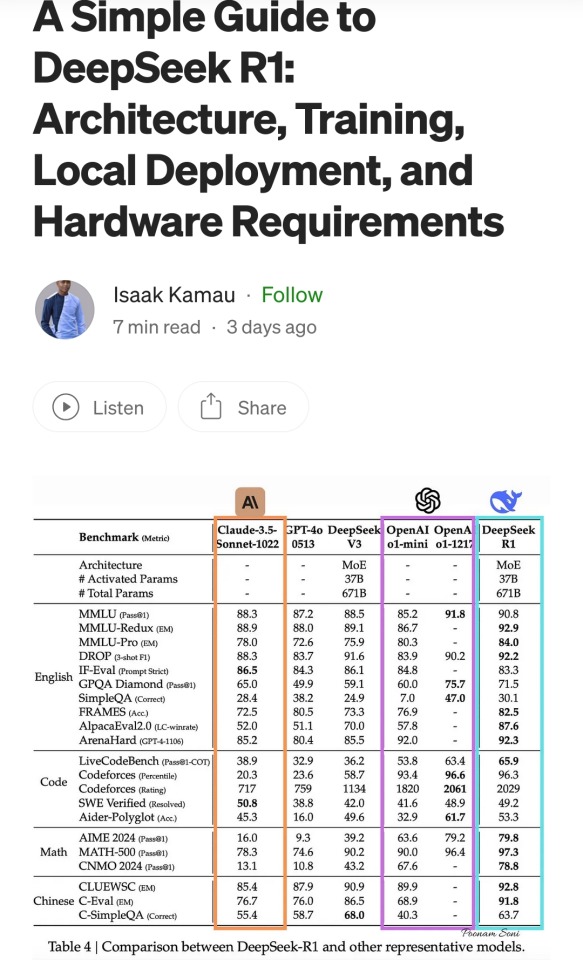

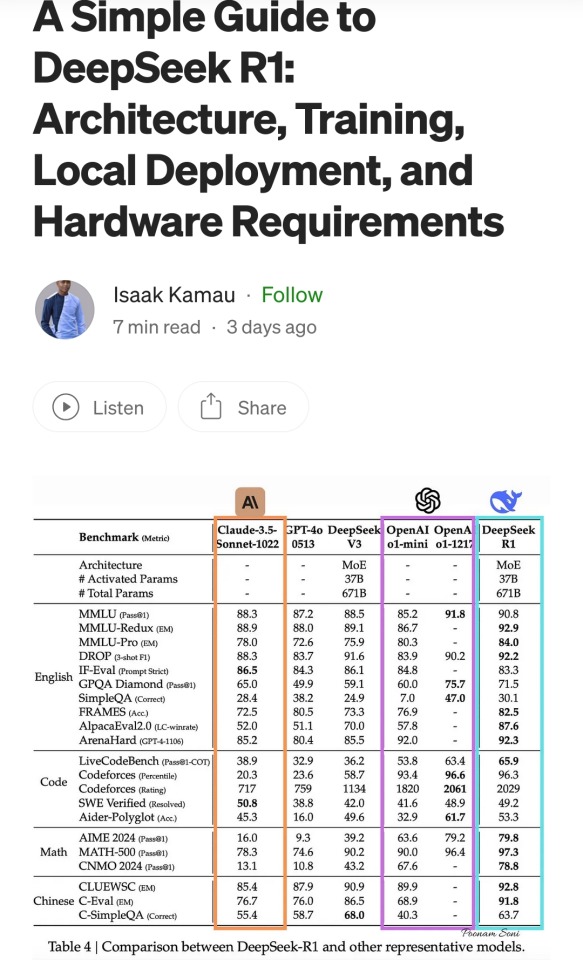

I'm not going to detail all the numbers but I'm going to focus on the chip required: an RTX 3090. This is a gaming GPU that came out as the top of the line, the stuff South Korean LoL players buy…

Or they did, in September 2020. We're currently two generations ahead, on the RTX 5090.

What this is telling all those people who just sold their high-end gaming rig to be able to afford a machine that can run the latest ChatGPT locally, is that the person who bought it from them can run something basically just as powerful on their old one.

Which means that all those GPUs and NPUs that are being made, and all those deals Microsoft signed to have control of the AI market, have just lost a lot of their pulling power.

Well, I mean, the ChatGPT subscription is 20 bucks a month, surely the Chinese are charging a fortune for-

Oh. So it's free for everyone and you can use it or modify it however you want, no subscription, no unpayable electric bill, no handing Microsoft all of your private data, you can just run it on a relatively inexpensive PC. You could probably even run it on a phone in a couple years.

Oh, if only China had massive phone manufacturers that have a foot in the market everywhere except the US because the president had a tantrum eight years ago.

So… yeah, China just destabilised the global economy with a torrent file.

#valid ai criticism#ai#llms#DeepSeek#ai bubble#ChatGPT#google gemini#claude ai#this is gonna be the dotcom bubble again#hope you don't have stock on anything tech related#computer literacy#tech literacy

434 notes

·

View notes

Text

Seven(ish) Sentence Sunday

thanks to @inflarescent, @cold-blooded-jelly-doughnut, @alrightbuckaroo, @catanisspicy, @taralaurel and @bonheur-cafe for the tag!

i pulled this out of my ass and i will finish it eventually, but its so sad 😭

Carlos sits at the dining table, replaying Marjan’s voicemail over and over again. He knows he should call her back, he should call someone back, but all he can hear in his head is that TK overdosed. He’s in the hospital and he had overdosed.

He stares blankly at his phone on the table, the red notification bubble displaying a four on his phone app. One from Paul, one from Nancy, and one from Marjan.

And one from TK.

Carlos vividly remembers the call coming in from TK. He was clocking out from a 24-hour shift that actually lasted 32, and seeing TK’s name at two am after the shift from hell after seven months of radio silence wasn’t in Carlos’s plan for the night. So, he let TK’s call go to voicemail, got in his Camaro, drove home, and fell face-first into bed. And if a secret, small voice in the back of Carlos’s head whispered, “Now he knows how it feels,” Carlos ignored it.

Except now he can’t ignore it, because the magnitude of what he’d done is hitting him in the face.

TK had called him in an effort to get someone to stop him, and Carlos had ignored that phone call.

“You know you can call me if you ever feel like using, you know that, right? Even if,” Carlos hesitates for a second, “even if we’re not together, in the future. That door is never closed to you, TK.”

TK smiles at him. “I know, baby, that’s what makes you so perfect. I’m not going anywhere though, okay? I’m staying right here.”

TK had walked away, but Carlos had vowed to himself that he’d always keep that door open.

Carlos guesses he lied. And TK paid the price for it.

i'm gonna tag @chaotictarlos, @theghostofashton, @detective-giggles, @decafdino, @lemonlyman-dotcom and @rosedavid!

52 notes

·

View notes

Text

Something to add.

Disclaimer: I'm not an economics major, I don't own stocks, and I don't keep up with the market too much

However, lord the potential bubble that's forming. For the past year, there's been 7 stocks causing the continued rise of the SMP-500 called "The Magnificent 7". These are Tesla (although Tesla's been doing rather poorly which, lol, lmao even), Meta, Amazon, Apple, Alphabet (aka Google), and most importantly for this AI craze, Microsoft and Nvidia. It's ALL TECH STOCKS.

It's these 7 that drove the growth of the market almost entirely by themselves. Now, at the beginning of this year, it's primarily Nvidia and Microsoft (other stocks are still contributing, but growth wise, over 50% of it is these 2 stocks).

This almost entirely because of GenAI, with Microsoft owning OpenAI as stated before, and Nvidia manufacturing the GPU farms that can run these models.

Nvidia in particular is going ABSOLUTELY FUCKING NUTS. It's growth has SKYROCKETED because they are basically the ONLY company that can create the cards required to support ChatGPT and Midjourney and the like. So if you want to do GenAI, you gotta go through Nvidia, hence the massive growth spike.

Issue. As stated previously, GenAI's not profitable yet. Everyone's investing into 2 companies that are hoping to become money printers on the hope they can awkwardly shove it within their business models.

What happens if it isn't profitable quickly and the majority of companies that aren't doing well growth-wise that are pursuing GenAI stop?

Then gold rush stops and people stop buying shovels. Then the 2 companies that hold up the majority of growth in the stock market stop growing. Then people panic and pull out because its peaked and don't want to be left holding the bag.

We've seen it before with the dotcom bubble. We've seen it hit Nvidia specifically with crypto just a couple years ago (Don't conflate crypto and the current GenAI craze though, because while one was based on almost nothing, there is genuine merit at least business-wise in GenAI. Saying "this is just like crypto" means it's way easier to blow off in your head, and estimates the staying power about as long. Unfortunately I don't think we're getting that).

Idk when, or even if it'll happen, so again, take what I say with a grain of salt, but this expansion can't last. It'll stop, and based on current stock consolidation down to just a few, when it stops it's gonna be baddddddd.

If anyone wants to know why every tech company in the world right now is clamoring for AI like drowned rats scrabbling to board a ship, I decided to make a post to explain what's happening.

(Disclaimer to start: I'm a software engineer who's been employed full time since 2018. I am not a historian nor an overconfident Youtube essayist, so this post is my working knowledge of what I see around me and the logical bridges between pieces.)

Okay anyway. The explanation starts further back than what's going on now. I'm gonna start with the year 2000. The Dot Com Bubble just spectacularly burst. The model of "we get the users first, we learn how to profit off them later" went out in a no-money-having bang (remember this, it will be relevant later). A lot of money was lost. A lot of people ended up out of a job. A lot of startup companies went under. Investors left with a sour taste in their mouth and, in general, investment in the internet stayed pretty cooled for that decade. This was, in my opinion, very good for the internet as it was an era not suffocating under the grip of mega-corporation oligarchs and was, instead, filled with Club Penguin and I Can Haz Cheezburger websites.

Then around the 2010-2012 years, a few things happened. Interest rates got low, and then lower. Facebook got huge. The iPhone took off. And suddenly there was a huge new potential market of internet users and phone-havers, and the cheap money was available to start backing new tech startup companies trying to hop on this opportunity. Companies like Uber, Netflix, and Amazon either started in this time, or hit their ramp-up in these years by shifting focus to the internet and apps.

Now, every start-up tech company dreaming of being the next big thing has one thing in common: they need to start off by getting themselves massively in debt. Because before you can turn a profit you need to first spend money on employees and spend money on equipment and spend money on data centers and spend money on advertising and spend money on scale and and and

But also, everyone wants to be on the ship for The Next Big Thing that takes off to the moon.

So there is a mutual interest between new tech companies, and venture capitalists who are willing to invest $$$ into said new tech companies. Because if the venture capitalists can identify a prize pig and get in early, that money could come back to them 100-fold or 1,000-fold. In fact it hardly matters if they invest in 10 or 20 total bust projects along the way to find that unicorn.

But also, becoming profitable takes time. And that might mean being in debt for a long long time before that rocket ship takes off to make everyone onboard a gazzilionaire.

But luckily, for tech startup bros and venture capitalists, being in debt in the 2010's was cheap, and it only got cheaper between 2010 and 2020. If people could secure loans for ~3% or 4% annual interest, well then a $100,000 loan only really costs $3,000 of interest a year to keep afloat. And if inflation is higher than that or at least similar, you're still beating the system.

So from 2010 through early 2022, times were good for tech companies. Startups could take off with massive growth, showing massive potential for something, and venture capitalists would throw infinite money at them in the hopes of pegging just one winner who will take off. And supporting the struggling investments or the long-haulers remained pretty cheap to keep funding.

You hear constantly about "Such and such app has 10-bazillion users gained over the last 10 years and has never once been profitable", yet the thing keeps chugging along because the investors backing it aren't stressed about the immediate future, and are still banking on that "eventually" when it learns how to really monetize its users and turn that profit.

The pandemic in 2020 took a magnifying-glass-in-the-sun effect to this, as EVERYTHING was forcibly turned online which pumped a ton of money and workers into tech investment. Simultaneously, money got really REALLY cheap, bottoming out with historic lows for interest rates.

Then the tide changed with the massive inflation that struck late 2021. Because this all-gas no-brakes state of things was also contributing to off-the-rails inflation (along with your standard-fare greedflation and price gouging, given the extremely convenient excuses of pandemic hardships and supply chain issues). The federal reserve whipped out interest rate hikes to try to curb this huge inflation, which is like a fire extinguisher dousing and suffocating your really-cool, actively-on-fire party where everyone else is burning but you're in the pool. And then they did this more, and then more. And the financial climate followed suit. And suddenly money was not cheap anymore, and new loans became expensive, because loans that used to compound at 2% a year are now compounding at 7 or 8% which, in the language of compounding, is a HUGE difference. A $100,000 loan at a 2% interest rate, if not repaid a single cent in 10 years, accrues to $121,899. A $100,000 loan at an 8% interest rate, if not repaid a single cent in 10 years, more than doubles to $215,892.

Now it is scary and risky to throw money at "could eventually be profitable" tech companies. Now investors are watching companies burn through their current funding and, when the companies come back asking for more, investors are tightening their coin purses instead. The bill is coming due. The free money is drying up and companies are under compounding pressure to produce a profit for their waiting investors who are now done waiting.

You get enshittification. You get quality going down and price going up. You get "now that you're a captive audience here, we're forcing ads or we're forcing subscriptions on you." Don't get me wrong, the plan was ALWAYS to monetize the users. It's just that it's come earlier than expected, with way more feet-to-the-fire than these companies were expecting. ESPECIALLY with Wall Street as the other factor in funding (public) companies, where Wall Street exhibits roughly the same temperament as a baby screaming crying upset that it's soiled its own diaper (maybe that's too mean a comparison to babies), and now companies are being put through the wringer for anything LESS than infinite growth that Wall Street demands of them.

Internal to the tech industry, you get MASSIVE wide-spread layoffs. You get an industry that used to be easy to land multiple job offers shriveling up and leaving recent graduates in a desperately awful situation where no company is hiring and the market is flooded with laid-off workers trying to get back on their feet.

Because those coin-purse-clutching investors DO love virtue-signaling efforts from companies that say "See! We're not being frivolous with your money! We only spend on the essentials." And this is true even for MASSIVE, PROFITABLE companies, because those companies' value is based on the Rich Person Feeling Graph (their stock) rather than the literal profit money. A company making a genuine gazillion dollars a year still tears through layoffs and freezes hiring and removes the free batteries from the printer room (totally not speaking from experience, surely) because the investors LOVE when you cut costs and take away employee perks. The "beer on tap, ping pong table in the common area" era of tech is drying up. And we're still unionless.

Never mind that last part.

And then in early 2023, AI (more specifically, Chat-GPT which is OpenAI's Large Language Model creation) tears its way into the tech scene with a meteor's amount of momentum. Here's Microsoft's prize pig, which it invested heavily in and is galivanting around the pig-show with, to the desperate jealousy and rapture of every other tech company and investor wishing it had that pig. And for the first time since the interest rate hikes, investors have dollar signs in their eyes, both venture capital and Wall Street alike. They're willing to restart the hose of money (even with the new risk) because this feels big enough for them to take the risk.

Now all these companies, who were in varying stages of sweating as their bill came due, or wringing their hands as their stock prices tanked, see a single glorious gold-plated rocket up out of here, the likes of which haven't been seen since the free money days. It's their ticket to buy time, and buy investors, and say "see THIS is what will wring money forth, finally, we promise, just let us show you."

To be clear, AI is NOT profitable yet. It's a money-sink. Perhaps a money-black-hole. But everyone in the space is so wowed by it that there is a wide-spread and powerful conviction that it will become profitable and earn its keep. (Let's be real, half of that profit "potential" is the promise of automating away jobs of pesky employees who peskily cost money.) It's a tech-space industrial revolution that will automate away skilled jobs, and getting in on the ground floor is the absolute best thing you can do to get your pie slice's worth.

It's the thing that will win investors back. It's the thing that will get the investment money coming in again (or, get it second-hand if the company can be the PROVIDER of something needed for AI, which other companies with venture-back will pay handsomely for). It's the thing companies are terrified of missing out on, lest it leave them utterly irrelevant in a future where not having AI-integration is like not having a mobile phone app for your company or not having a website.

So I guess to reiterate on my earlier point:

Drowned rats. Swimming to the one ship in sight.

36K notes

·

View notes

Text

Contagion in Crypto…Look Out Beloooww!

Thanks to FTX and Sam Bankman-Fried (soon to be known as Sam Bankrun-Fraud) the Contagion in Crypto is underway. And it’s reminiscent of the Dotcom bubble. Huh? For those who remember the Dotcom fiasco in 2000, the contagion back then caused many stocks to lose over 90% of their value. And that was assuming they survived without going out of business. So, all of the crypto geniuses who flaunted their wealth and bragged to all of us that we “don’t understand crypto” (which is why we didn’t get involved) are probably not prepared for the ride down from here. Wait! What? Translation: Crypto won’t bottom out any time in the near future. So, for those who say “Now looks like a great time to buy Bitcoin, Ethereum, Doge, Coinbase, etc.,” we caution you to stay away. Unless you’re great at catching a falling knife. Contagion in Crypto 101 Let’s recap what happened to FTX. First of all, this is the same lesson that constantly repeats in finance time and time again. So, basically, FTX lent US$10bn of client funds to their trading arm Alameda, which then used it for leveraging their own crypto speculation. Why? Because the crypto market has been collapsing. And out of desperation they made one last big play…that totally failed. But here’s the kicker… FTX was a partner with Klaus Schwab’s World Economic Forum (WEF). Ironically (or NOT) the WEF has suddenly removed the link to FTX and is desperately trying to hide their involvement with Sam Bankman-Fried. True to form, these fools still believe that by eliminating paper currency they can impose their communist agenda. Eliminating paper currency been the goal of the WEF not only because they want to destroy capitalism, but also democracy. As a result, the collapse of FTX will now become a contagion for the crypto world. And it ain’t gonna end soon. Inexperienced and greedy traders have signaled the demise of an industry that was getting all the hype with no substance. And when you factor in an inevitable recession, the ongoing collapse of sovereign debt, and the monetary system as a whole, most people will be looking for safer bets than crypto. READ: Will Bitcoin Replace Gold? December 3, 2020 So, share this with a friend…especially if they’ve been encouraging you to buy Bitcoin. They probably won’t thank YOU later. And be sure to read more about the FTX scandal in the November issue of “…In Plain English” (HERE). Remember, We’re Not Just About Finance. But we use finance to give you hope. FYI ********************************** Invest with confidence. Sincerely, James Vincent The Reverend of Finance Copyright © 2022 It's Not Just About Finance, LLC, All rights reserved. You are receiving this email because you opted in via our website. Read the full article

0 notes

Text

Will President Trump Prick The ‘Big, Fat, Ugly Bubble’?

A version of this post first appeared at The Felder Report PREMIUM.

With economic optimism soaring since the election, rising risks to the economy and financial markets have fallen off Mr. Market’s radar. However, there are a number of reasons to believe Donald Trump and his advisers are well aware of these risks and have already made plans to address them sooner rather than later.

To this point, Mark Spitznagel recently wrote, “The ‘big, fat, ugly bubble’ in the stock market that President-elect Donald J. Trump so astutely identified during his campaign now becomes one of the greatest potential liabilities of his presidency.” From a political standpoint, the sooner Trump and his administration deal with these risks the easier it will be to blame on the prior administration. Allowing them to fester for any period of time increases the likelihood they will take the blame for the bubble’s bursting.

Interestingly, Trump recently named Carl Icahn as a special advisor to his new administration. You may remember that Icahn recently warned of “Danger Ahead” for risk markets:

I’ve seem this before a number of times. I been around a long time and I saw it ’69, ’74, ’79, ’87 and then 2000 wasn’t pretty. A time is coming that might make some of those times look pretty good… The public, they got screwed in ’08. They’re gonna get screwed again. I think it was Santayana that said, “those who do not learn from history are doomed to repeat it,” and I am afraid we’re going down that road.

So Trump is clearly not running away from his famous “big, fat, ugly bubble” comment. Just the opposite. In fact, it was probably Icahn who helped him to fully appreciate just how dangerous the current situation is. In naming Icahn to his special advisory position he is demonstrating that he takes the risks currently posed by the financial markets very seriously.

In a recent interview on CNBC, Icahn echoed his concerns once again:

Most telling is how Icahn ended the interview, unprompted. “If you’re asking me am I concerned about the market on the short term. Yeah I’m concerned about it,” he said. “You can look at so many factors here that you have to worry about. Obviously, if you get into a trade war with China, sooner or later, I think we’re going to have to come to grips with that, maybe it’s better to do it sooner…”

It sounds like Icahn may be counseling the president that it’s in everyone’s best interest to deal with the glaring “dangers” posed by the financial markets to both the economy and to Trump’s presidency “sooner” rather than later. For these reasons, I wouldn’t be surprised to see the administration make, in Spitznagels words, ‘encouraging asset prices and investments to correct themselves,’ its first order of business after the inauguration today.

Related:

U.S. Corporate Valuations Have Now Matched Their Dotcom Bubble Peak

#$^GSPC#$^IXIC#$^DJI#$^RUT#$IWM#$SPY#$QQQ#$DIA#$VOO#$VTI#$IVV#$SCHB#$GLD#$GDX#$GDXJ#$XLF#$KBE#$NUGT#$JNUG#$VXX#$HYG#$JNK#$CORP#$LQD#$BKLN#$SH#$SDS#$SPXU#$SQQQ#$TZA

1 note

·

View note

Text

Crypto News - BitAngels’ Michael Terpin: Negligence of Major Phone Companies Is Crypto’s Biggest Threat

BitAngels’ Michael Terpin: Negligence of Major Phone Companies Is Crypto’s Biggest Threat Cointelegraph talks with American blockchain investor MIchael Terpin about why he’s suing AT&T and where he sees Bitcoin in 3-5 years. This interview has been edited and conde... You May Likes reading: How Rich people Talk about Bitcoin Growth Smart Contract - The Key to the Next Two Great dApp Business Ideas

BitAngels’ Michael Terpin: Negligence of Major Phone Companies Is Crypto’s Biggest Threat

Cointelegraph talks with American blockchain investor MIchael Terpin about why he’s suing AT&T and where he sees Bitcoin in 3-5 years.

This interview has been edited and condensed.

Michael Terpin is an American blockchain and crypto investor who has worked with over 100 projects running Initial Coin Offerings (ICOs) since entering the blockchain space in early 2013.

Terpin co-founded BitAngels in 2013 and, more recently, founded blockchain PR firm Transform Group. The investor and entrepreneur recently hit mainstream and crypto media headlines following his high profile case against U.S. telecom giant AT&T. Terpin is suing AT&T for negligence that allegedly resulted in the theft of over $24 million of Terpin’s crypto holdings.

Cointelegraph sat down with Terpin at BlockShow Americas in Las Vegas to get into the details of the case, discuss the current ICO landscape, the difference between centralized and decentralized cryptocurrencies and where he sees Bitcoin’s price three to five years from now.

Crypto’s Biggest Threat

Olivia Capozzalo: The story that is going on right now with AT&T — can you tell our readers what happened?

Michael Terpin: Sure. So, the entire crypto community has been targeted by gangs — crypto gangs — for quite some time, and it accelerated as the price of Bitcoin and other crypto assets went up.

Right now, the biggest risk to anybody who's high profile in the crypto industry, and really anybody who has identifiable involvement in the community, is that major phone companies promise you security and don't deliver it.

So, I've been hacked twice: The first time was last year — it's all in my lawsuit. I did not lose that much the first time, I thought my crypto assets were already pretty secure because I have all my major assets in bank vaults and Trezors and Ledgers. But as an investor and marketer in this space, I have, you know, dozens of different cryptocurrencies that don't neatly fit into any of those profiles.

The only reason that they did get in there is because AT&T allowed one of their reps in a store in Connecticut to give my six-digit code that they told me when I requested a higher level of authorization of security.

What they did not say is that any low-level, $10-an-hour store clerk can override that authorization. Normally, when you think that there's a password that is supposed to be a high-level password to protect you, it would be like a PIN number in a bank.

So, only one of two things is possible: Either the person is a complete idiot and cooperating with the hackers unknowingly — which still shouldn't have been allowed under the way that they promised it to me — or he's part of the gang and just got bribed.

And there's a lot of evidence that this is going on pretty widely right now.

OC: I want to walk through this step-by-step, because I think that helps people also understand how they can prevent this kind of thing, if that’s even possible.

So, what that looks like, you're saying, is that a person goes into a physical AT&T store and says that they're you?

MT: That's correct. Or they pretended someone is in there, and they scanned, you know, a subway card and said it didn't scan, and then did a manual override.

It's quite possible the AT&T rep did it with nobody actually in the store at all. You know, case after case is coming out, and there've been several arrests in July that all have in common AT&T employees who were basically bribed.

You can watch the full interview here:

youtube

OC: Okay. Say this person gets access to your identity, they're getting access to your phone number on a different phone, right?

MT: When an AT&T rep turns over your digital identity, they turn over anything that would have access to your phone number.

OC: Basically what happens is that they now have access to change your passwords, because they just confirm with the phone number?

MT: They have access to anything that has the phone number attached to it as a form of verification, which is much broader than wallets.

OC: Right. So, it can be a two-factor thing, but it wouldn't be Google 2FA...

MT: This was not an exchange. So, there are many other pieces of software that have your phone number as your identity.

OC: Okay, right. So, at the end of the day though, we're talking about millions, like, $20 million, right?

MT: Correct.

OС: $24 million, I believe. Not to be offensive, but why was that much money in a place that was accessible by a phone number?

MT: It should not have been accessible other than being broken into and being handed over, and having the hackers be able to go and prowl around all sorts of things that were within my network of computers.

Because they were able to get access to that through this. So, it wasn't as simple as — and it wasn't, as has been misreported — "Oh, I had a Coinbase account, and they were able to reset that.” That was not an exchange, it was a native wallet.

OC: A native wallet. Because, what you're saying is that you couldn't store these currencies in a cold storage?

MT: Nope.

Most of the smaller tokens – anything that’s not Bitcoin, or Ethereum or ERC-20 tokens – are not storable on cold storage; they have to be stored in, you know, in a paper wallet or, in order to be able to stake new tokens, they have to be stored, essentially, in the native wallet.

OC: Okay so, now that you're going through this nightmare with AT&T, can you give some advice to investors overall?

MT:

Sure. I would say, if you are a recognizable person in the crypto industry, you can't use any of the major four phone companies, period.

If you for some reason need to use them, you have to make sure that any time that you use any piece of software that ever asks your phone number, do not give AT&T or any of the other ones.

So, the ways of getting around this — which is what I do now — is you have to have a Google Voice number.

But you have to have something that does not have a retail store where a $10-an-hour employee can be bribed to give up your information and your digital life.

OC: And you see this as an organized effort, you said, organized crime?

MT: Yes, clearly organized. There are hundreds of millions of people involved.

So, this is not an isolated incident — these are international gangs.

The FBI are very good at sort of following the trail and they'll do what they do. And I'm certainly working with all of those law enforcement agencies. I have been doing that since the day this happened.

OC: Honestly, before this story came out, I hadn't really heard of this as like a large-scale problem. The problem I do hear about is crypto-jacking, which you mentioned, via JavaScript malware.

But, just to clarify, do you see this issue with telecom companies as being bigger than crypto-jacking?

MT: Bigger. Much bigger.

It's SIM-jacking, basically, that’s the biggest threat to individual assets right now.

And it's something that is surprisingly simple for these telcomm companies to fix — simply: If you're promising someone, you know, a higher security password, don't let it be overruled by a $10-an-hour employee, make it mandatory.

Today’s ICO Landscape

OC: You've been an investor in the blockchain space for a while, and you have invested in a bunch of ICOs, you mentioned a hundred?

MT: Yes, between PR services and me being an advisor to companies, my firm and I have worked with 103 ICOs.

OC: Wow! A lot of people say the heyday of the ICOs was last year, the year before. Can you sketch out what is happening right now with ICOs that you're seeing, and if you think it's a good thing?

MT: You know, I think that when we're talking about the death of the ICO and this and that, I think it's too early to say that. I mean, if you take out the infrastructure tokens, I think security tokens will be much larger than utility tokens, because we just don't have the formats in place right now.

Because there's no reason why — other than the legacy systems — you can't buy Google stock easily in France, or why you can't buy Samsung stock on the New York Stock Exchange.

If you had a token, its global. So, that's sort of the future that regulators just have to keep up, with how this applies cross-borders.

But it's still very early. You know, I like to give the analogy — even though it's not exact — of the rise of the internet and the rise of blockchain. So, with the rise of the internet, there was a lot of skepticism in the early days, that the internet wasn’t viable.

So, all the stuff that was said about why the internet wasn't gonna work, insert ‘crypto’ and a lot of things sound a lot the same.

And then, of course, there was a couple of early movements up and down, and then you had this wild ride from like '98 to the first quarter of 2000, where the Nasdaq went from 1,000 to 5,000 — and, by the peak, when the dotcom bubble popped — you had $5 trillion dollars worth of companies, and that dropped by like 90 percent — a lot of them went out of business.

So, the rising tide lifts all boats, but then, when the water drops to the bottom, you can see all the junk at the bottom of the harbor — and it's got to be cleared out before it starts going up again.

I think, if you look at the overall chart of Amazon, of eBay, of these other ones, the whole dotcom area now looks like a little tiny blip in the price compared to where it is today. So, I think, similarly, you may be looking at Ethereum, five years from now and seeing this you know 30 cents to $1200 and back down to $300 as a blip, if it's say $15,000, you know, five years from now, 10 years from now.

I do pretty firmly believe that Bitcoin — it is my own personal belief — will hit a high of at least $50,000 sometime in the next three to five years.

And it seems to be the most predictable thing in terms of the way markets have behaved, that you have a big run-up about a year after the halving, when the supply and demand starts taking root.

Centralized vs. Decentralized

OC: Where do you stand on decentralized versus centralized cryptocurrencies?

MT: I think that when you're looking at the overall revolution of the blockchain, decentralization is only one of many aspects that makes it revolutionary. Tokenization is just as important.

So, when you're talking about, say, tokenizing a stock — it's not decentralized. I think, that decentralization makes the most sense when you're talking about cross-border payments.

But in terms of the actual technology, the decentralization of Bitcoin is less important than that of cryptocurrencies that base themselves on decentralized consensus, that's important for the security of knowing that a smart contract cannot be stopped once it gets initiated.

Ideally, the proper way that I think most DApps should work is that you should have a nonprofit foundation that basically is just responsible for having that technology proliferate, and that there should be, then, a for-profit that uses it — that buys the tokens. And that way, you're sort of keeping the incentives of those who are looking to build a stack separate from those who are keeping the blockchain.

But pure decentralization is tough when you incorporate even some security elements. But I think they'll develop over time. And again, tokenization is just as important in broad, non-money transference instances.

Source #bitcoin #news #cryptonews #cryptocurrency #dailybitcoinnew #todaynews

0 notes

Photo

Ohhh haiiiii 🙋🏻♀️ My renewed obsession is getting back into #cryptocurrency trading 🙌🏼 all day everyday lol 😅 if you guys want to get into cryptocurrency, Binance is accepting new registrants for a limited time. ⠀ Register with my link: https://www.binance.com/?ref=13828681 Or use my reference code: 13828681 ⠀ Not sure when they’ll close registration again so even if you’re not sure about investing yet. Just register for an account first! Heck you might even be able to sell the account later lol! ⠀ Might be offering some type of trading services soon such as masterclasses, private trading lessons or even help you manage your funds. PM me if you like more information. Let’s just say within 1 year I made over 2500% gains of my original investment. And I wasn’t even doing much at that time! I was just a “value” long term trader. Even then, I made a lot of mistakes and lost a lot money at the beginning too! Don’t make the same mistakes as I did. Learn from me. ⠀ Now that I’m a “swing” and “day” trader, I’ve learned and EARNED even more! I might even quit a few of my projects by the end of the month to focus on this! ⠀ This #cryptocurrency craze is not gonna last! We are still considered the early adopters of this industry. This won’t last long, just like the dotcom bubble in the 2000s, all markets will eventually correct itself and consolidate! Get in ASAP! ⠀ ⠀⠀#bossladylil - #mzlilslife #bitcoin#altcoin#altcointrading#bitcointrading#bitcoinsallday#binance#getonitasap

#bossladylil#cryptocurrency#mzlilslife#getonitasap#bitcoin#altcointrading#bitcoinsallday#altcoin#binance#bitcointrading

0 notes

Text

I forgot to mention: DeepSeek cost $5.6 million dollars to develop. This seems like a lot, but next to the billions upon billions Microsoft, OpenAI and NVIDIA have been claiming to need, it's basically nothing. (Google is barely mentioned in this post because they got left behind for no clear reason when they started with far more data than anyone else. Google, in contrast to everyone else involved in this story, is run by marketing people, not computer engineers, which is very telling). It was a small team with regular-sized computers, too. Which means not only that the technology is available to everyone for free forever, not only that it's going to keep getting cheaper and faster and less energy consuming in months rather than decades, but also, that the American big tech companies are full of shit. They were just pocketing all that investor dough because Trump banned imports of high-performance chips, so they were counting on having a monopoly of the few machines that could run it, but now you can run it on low-performance machines as well, which means the ban has been rendered moot. They've been planning this for years and got completely undermined by someone they didn't even think was competing. News cycles are referring to the DeepSeek release as China's "Sputnik moment", referencing the time the Soviet Union crushed America's ass in the space race.

I should buy a popcorn machine.

A summary of the Chinese AI situation, for the uninitiated.

These are scores on different tests that are designed to see how accurate a Large Language Model is in different areas of knowledge. As you know, OpenAI is partners with Microsoft, so these are the scores for ChatGPT and Copilot. DeepSeek is the Chinese model that got released a week ago. The rest are open source models, which means everyone is free to use them as they please, including the average Tumblr user. You can run them from the servers of the companies that made them for a subscription, or you can download them to install locally on your own computer. However, the computer requirements so far are so high that only a few people currently have the machines at home required to run it.

Yes, this is why AI uses so much electricity. As with any technology, the early models are highly inefficient. Think how a Ford T needed a long chimney to get rid of a ton of black smoke, which was unused petrol. Over the next hundred years combustion engines have become much more efficient, but they still waste a lot of energy, which is why we need to move towards renewable electricity and sustainable battery technology. But that's a topic for another day.

As you can see from the scores, are around the same accuracy. These tests are in constant evolution as well: as soon as they start becoming obsolete, new ones are released to adjust for a more complicated benchmark. The new models are trained using different machine learning techniques, and in theory, the goal is to make them faster and more efficient so they can operate with less power, much like modern cars use way less energy and produce far less pollution than the Ford T.

However, computing power requirements kept scaling up, so you're either tied to the subscription or forced to pay for a latest gen PC, which is why NVIDIA, AMD, Intel and all the other chip companies were investing hard on much more powerful GPUs and NPUs. For now all we need to know about those is that they're expensive, use a lot of electricity, and are required to operate the bots at superhuman speed (literally, all those clickbait posts about how AI was secretly 150 Indian men in a trenchcoat were nonsense).

Because the chip companies have been working hard on making big, bulky, powerful chips with massive fans that are up to the task, their stock value was skyrocketing, and because of that, everyone started to use AI as a marketing trend. See, marketing people are not smart, and they don't understand computers. Furthermore, marketing people think you're stupid, and because of their biased frame of reference, they think you're two snores short of brain-dead. The entire point of their existence is to turn tall tales into capital. So they don't know or care about what AI is or what it's useful for. They just saw Number Go Up for the AI companies and decided "AI is a magic cow we can milk forever". Sometimes it's not even AI, they just use old software and rebrand it, much like convection ovens became air fryers.

Well, now we're up to date. So what did DepSeek release that did a 9/11 on NVIDIA stock prices and popped the AI bubble?

Oh, I would not want to be an OpenAI investor right now either. A token is basically one Unicode character (it's more complicated than that but you can google that on your own time). That cost means you could input the entire works of Stephen King for under a dollar. Yes, including electricity costs. DeepSeek has jumped from a Ford T to a Subaru in terms of pollution and water use.

The issue here is not only input cost, though; all that data needs to be available live, in the RAM; this is why you need powerful, expensive chips in order to-

Holy shit.

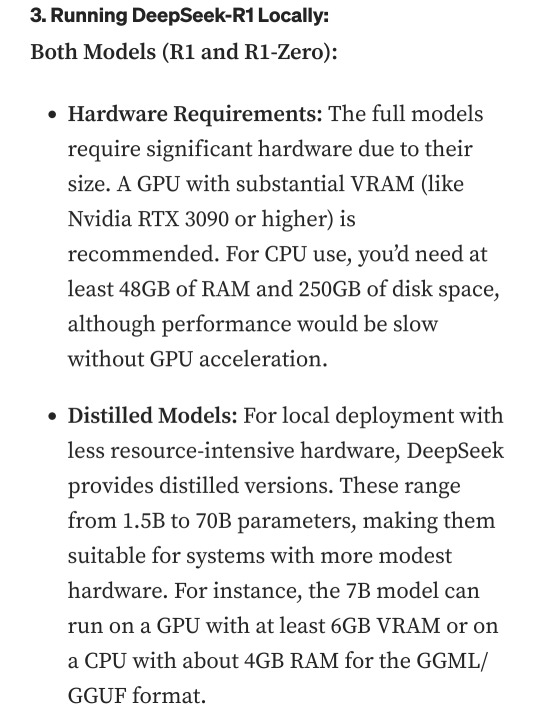

I'm not going to detail all the numbers but I'm going to focus on the chip required: an RTX 3090. This is a gaming GPU that came out as the top of the line, the stuff South Korean LoL players buy…

Or they did, in September 2020. We're currently two generations ahead, on the RTX 5090.

What this is telling all those people who just sold their high-end gaming rig to be able to afford a machine that can run the latest ChatGPT locally, is that the person who bought it from them can run something basically just as powerful on their old one.

Which means that all those GPUs and NPUs that are being made, and all those deals Microsoft signed to have control of the AI market, have just lost a lot of their pulling power.

Well, I mean, the ChatGPT subscription is 20 bucks a month, surely the Chinese are charging a fortune for-

Oh. So it's free for everyone and you can use it or modify it however you want, no subscription, no unpayable electric bill, no handing Microsoft all of your private data, you can just run it on a relatively inexpensive PC. You could probably even run it on a phone in a couple years.

Oh, if only China had massive phone manufacturers that have a foot in the market everywhere except the US because the president had a tantrum eight years ago.

So… yeah, China just destabilised the global economy with a torrent file.

#valid ai criticism#ai#llms#DeepSeek#ai bubble#ChatGPT#google gemini#claude ai#this is gonna be the dotcom bubble again#hope you don't have stock on anything tech related#computer literacy#tech literacy

434 notes

·

View notes

Text

Here's an actual expert going deeper into detail. Please follow creators like him who talk about computers in a rational way, without marketing buzz or pseudoleftist outrage. Being well informed is good for the soul.

youtube

A summary of the Chinese AI situation, for the uninitiated.

These are scores on different tests that are designed to see how accurate a Large Language Model is in different areas of knowledge. As you know, OpenAI is partners with Microsoft, so these are the scores for ChatGPT and Copilot. DeepSeek is the Chinese model that got released a week ago. The rest are open source models, which means everyone is free to use them as they please, including the average Tumblr user. You can run them from the servers of the companies that made them for a subscription, or you can download them to install locally on your own computer. However, the computer requirements so far are so high that only a few people currently have the machines at home required to run it.

Yes, this is why AI uses so much electricity. As with any technology, the early models are highly inefficient. Think how a Ford T needed a long chimney to get rid of a ton of black smoke, which was unused petrol. Over the next hundred years combustion engines have become much more efficient, but they still waste a lot of energy, which is why we need to move towards renewable electricity and sustainable battery technology. But that's a topic for another day.

As you can see from the scores, are around the same accuracy. These tests are in constant evolution as well: as soon as they start becoming obsolete, new ones are released to adjust for a more complicated benchmark. The new models are trained using different machine learning techniques, and in theory, the goal is to make them faster and more efficient so they can operate with less power, much like modern cars use way less energy and produce far less pollution than the Ford T.

However, computing power requirements kept scaling up, so you're either tied to the subscription or forced to pay for a latest gen PC, which is why NVIDIA, AMD, Intel and all the other chip companies were investing hard on much more powerful GPUs and NPUs. For now all we need to know about those is that they're expensive, use a lot of electricity, and are required to operate the bots at superhuman speed (literally, all those clickbait posts about how AI was secretly 150 Indian men in a trenchcoat were nonsense).

Because the chip companies have been working hard on making big, bulky, powerful chips with massive fans that are up to the task, their stock value was skyrocketing, and because of that, everyone started to use AI as a marketing trend. See, marketing people are not smart, and they don't understand computers. Furthermore, marketing people think you're stupid, and because of their biased frame of reference, they think you're two snores short of brain-dead. The entire point of their existence is to turn tall tales into capital. So they don't know or care about what AI is or what it's useful for. They just saw Number Go Up for the AI companies and decided "AI is a magic cow we can milk forever". Sometimes it's not even AI, they just use old software and rebrand it, much like convection ovens became air fryers.

Well, now we're up to date. So what did DepSeek release that did a 9/11 on NVIDIA stock prices and popped the AI bubble?

Oh, I would not want to be an OpenAI investor right now either. A token is basically one Unicode character (it's more complicated than that but you can google that on your own time). That cost means you could input the entire works of Stephen King for under a dollar. Yes, including electricity costs. DeepSeek has jumped from a Ford T to a Subaru in terms of pollution and water use.

The issue here is not only input cost, though; all that data needs to be available live, in the RAM; this is why you need powerful, expensive chips in order to-

Holy shit.

I'm not going to detail all the numbers but I'm going to focus on the chip required: an RTX 3090. This is a gaming GPU that came out as the top of the line, the stuff South Korean LoL players buy…

Or they did, in September 2020. We're currently two generations ahead, on the RTX 5090.

What this is telling all those people who just sold their high-end gaming rig to be able to afford a machine that can run the latest ChatGPT locally, is that the person who bought it from them can run something basically just as powerful on their old one.

Which means that all those GPUs and NPUs that are being made, and all those deals Microsoft signed to have control of the AI market, have just lost a lot of their pulling power.

Well, I mean, the ChatGPT subscription is 20 bucks a month, surely the Chinese are charging a fortune for-

Oh. So it's free for everyone and you can use it or modify it however you want, no subscription, no unpayable electric bill, no handing Microsoft all of your private data, you can just run it on a relatively inexpensive PC. You could probably even run it on a phone in a couple years.

Oh, if only China had massive phone manufacturers that have a foot in the market everywhere except the US because the president had a tantrum eight years ago.

So… yeah, China just destabilised the global economy with a torrent file.

#valid ai criticism#ai#llms#DeepSeek#ai bubble#ChatGPT#google gemini#claude ai#this is gonna be the dotcom bubble again#hope you don't have stock on anything tech related#computer literacy#tech literacy#computerphile#Youtube

434 notes

·

View notes

Text

BREAKING NEWS: Two Chinese companies just released their own ChatGPT competitors

One of them is by Alibaba, the other one is by another relatively small Chinese startup.

The bubble has fully popped. NVIDIA was planning to invest half a trillion dollars in chip manufacturing and now they're stuck with the sinking ship. Microsoft's nuclear power plant will probably suffer the same fate. Rejoice, for the stock market capitalists and the tech monopolists just lost incalculable amounts of money.

A summary of the Chinese AI situation, for the uninitiated.

These are scores on different tests that are designed to see how accurate a Large Language Model is in different areas of knowledge. As you know, OpenAI is partners with Microsoft, so these are the scores for ChatGPT and Copilot. DeepSeek is the Chinese model that got released a week ago. The rest are open source models, which means everyone is free to use them as they please, including the average Tumblr user. You can run them from the servers of the companies that made them for a subscription, or you can download them to install locally on your own computer. However, the computer requirements so far are so high that only a few people currently have the machines at home required to run it.

Yes, this is why AI uses so much electricity. As with any technology, the early models are highly inefficient. Think how a Ford T needed a long chimney to get rid of a ton of black smoke, which was unused petrol. Over the next hundred years combustion engines have become much more efficient, but they still waste a lot of energy, which is why we need to move towards renewable electricity and sustainable battery technology. But that's a topic for another day.

As you can see from the scores, are around the same accuracy. These tests are in constant evolution as well: as soon as they start becoming obsolete, new ones are released to adjust for a more complicated benchmark. The new models are trained using different machine learning techniques, and in theory, the goal is to make them faster and more efficient so they can operate with less power, much like modern cars use way less energy and produce far less pollution than the Ford T.

However, computing power requirements kept scaling up, so you're either tied to the subscription or forced to pay for a latest gen PC, which is why NVIDIA, AMD, Intel and all the other chip companies were investing hard on much more powerful GPUs and NPUs. For now all we need to know about those is that they're expensive, use a lot of electricity, and are required to operate the bots at superhuman speed (literally, all those clickbait posts about how AI was secretly 150 Indian men in a trenchcoat were nonsense).

Because the chip companies have been working hard on making big, bulky, powerful chips with massive fans that are up to the task, their stock value was skyrocketing, and because of that, everyone started to use AI as a marketing trend. See, marketing people are not smart, and they don't understand computers. Furthermore, marketing people think you're stupid, and because of their biased frame of reference, they think you're two snores short of brain-dead. The entire point of their existence is to turn tall tales into capital. So they don't know or care about what AI is or what it's useful for. They just saw Number Go Up for the AI companies and decided "AI is a magic cow we can milk forever". Sometimes it's not even AI, they just use old software and rebrand it, much like convection ovens became air fryers.

Well, now we're up to date. So what did DepSeek release that did a 9/11 on NVIDIA stock prices and popped the AI bubble?

Oh, I would not want to be an OpenAI investor right now either. A token is basically one Unicode character (it's more complicated than that but you can google that on your own time). That cost means you could input the entire works of Stephen King for under a dollar. Yes, including electricity costs. DeepSeek has jumped from a Ford T to a Subaru in terms of pollution and water use.

The issue here is not only input cost, though; all that data needs to be available live, in the RAM; this is why you need powerful, expensive chips in order to-

Holy shit.

I'm not going to detail all the numbers but I'm going to focus on the chip required: an RTX 3090. This is a gaming GPU that came out as the top of the line, the stuff South Korean LoL players buy…

Or they did, in September 2020. We're currently two generations ahead, on the RTX 5090.

What this is telling all those people who just sold their high-end gaming rig to be able to afford a machine that can run the latest ChatGPT locally, is that the person who bought it from them can run something basically just as powerful on their old one.

Which means that all those GPUs and NPUs that are being made, and all those deals Microsoft signed to have control of the AI market, have just lost a lot of their pulling power.

Well, I mean, the ChatGPT subscription is 20 bucks a month, surely the Chinese are charging a fortune for-

Oh. So it's free for everyone and you can use it or modify it however you want, no subscription, no unpayable electric bill, no handing Microsoft all of your private data, you can just run it on a relatively inexpensive PC. You could probably even run it on a phone in a couple years.

Oh, if only China had massive phone manufacturers that have a foot in the market everywhere except the US because the president had a tantrum eight years ago.

So… yeah, China just destabilised the global economy with a torrent file.

#valid ai criticism#ai#llms#DeepSeek#ai bubble#ChatGPT#google gemini#claude ai#this is gonna be the dotcom bubble again#hope you don't have stock on anything tech related#computer literacy#tech literacy#computerphile#Youtube

434 notes

·

View notes