#tokencard

Explore tagged Tumblr posts

Photo

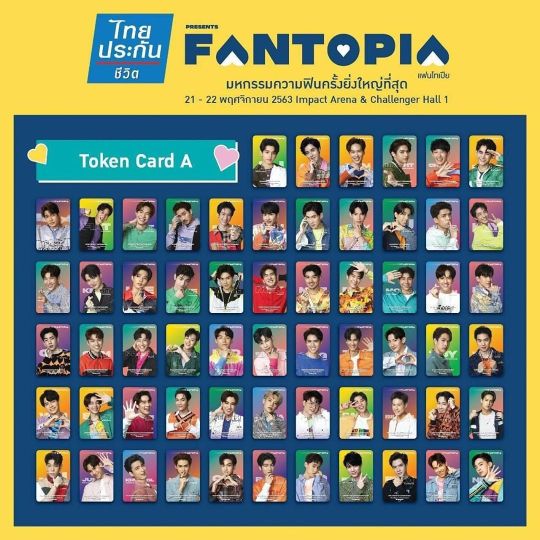

Wow!! 🎴 #FANTOPIA2020 #TokenCard https://www.instagram.com/p/CHW_RFvHJN5/?igshid=18sr0cxin7yck

0 notes

Text

Signup opens up for alpha of TokenCard’s Visa debit card

Signup opens up for alpha of TokenCard’s Visa debit card

TokenCard, the provider of a secure, non-custodial cryptocurrency wallet with a spendable Visa card, announced today that it is granting, for the first time, access to the TokenCard Alpha to its community, starting with crowdsale participants.

The first wave of invites is reserved for those who contributed to the TokenCard crowdsale back in 2017, and currently, reside in the UK and EEA.

Signing Up

View On WordPress

0 notes

Link

Store, send and spend your crypto in a decentralised manner.

0 notes

Photo

Working on a #mtg token for a friend. Got some more to do for him, but this plant came out cool. #mtgtoken #tokencard #magicthegathering #plant #fantasyart #penandink #crosshatching #greentoken (at New York, New York)

0 notes

Text

Tether khởi động dự án Tokenized USD trên Ethereum Blockchain hợp tác cùng Bitfinex

Tether khởi động dự án Tokenized USD trên Ethereum Blockchain hợp tác cùng Bitfinex

(Tin tức đầu tư/Token sale) Tether, một công ty sử dụng tiền thuật toán để đại diện cho tiền tệ pháp định, đã công bố việc tung ra các Tether ERC20 token trên Ethereum blockchain. Điều này được thực hiện với sự hợp tác của Ethfinex, một sàn giao dịch Cryptocurrency cho các dự án dựa trên Ethereum tách ra từ Bitfinex.

Craig Sellars, đồng sáng lập của Tether, nói: “Sau thành công của việc sử dụng…

View On WordPress

0 notes

Link

okenCard will be first of its kind to bring VISA payments to the Ethereum network, allowing users to spend Ether and other ERC20 tokens at any online and PoS terminals that accept VISA credit and debit cards.

The new ERC20 token, (TKN), was generated earlier this month on May 2, 2017, as part of the TokenCard’s ‘token creation’ phase. Token holders can expect a pro-rata allowance in the form of a number of different Ethereum tokens that accrue to the ‘TKN Asset Contract.’ Interested investors and enthusiast can download the company’s whitepaper and register for updates on the TokenCard website.

In addition to providing a viable solution for the underlying Ethereum community, TokenCard, by design also aims to improve the entire debit card and banking services ecosystem considerably. The Ethereum blockchain has an enormous potential to meet the challenging requirements of prime sectors like international remittance and asset management, and the use of such innovative technology will greatly benefit TokenCard.

TokenCard has previously partnered up with asset tokenization platform Digix Global, in a bid to produce debit cards that will be backed by gold instead of money. This project marks the beginning of the company’s aim to bring many more exciting projects to fruition in the near future. TokenCard intends to use its head start with smart contract-backed debit cards to push the company’s project forward and propel it to become a leading company in the Ethereum world.

TokenCard is initially granting only token holders with the payment utility, but the company’s intention will be to make the product available to all users soon. The company aims to offer

0 notes

Photo

Smart contracts with debit card payments

Last week, an initial coin offering (ICO) for something* called TokenCard raised** $16.7m in “mere minutes”

0 notes

Text

Monolith’s TokenCard Massive ICO Over in Minutes - Raises $16.7 Million

Monolith’s TokenCard Massive ICO Over in Minutes - Raises $16.7 Million #ICO #MonolithStudios #Tokencard

Monolith Studio’s TokenCard closed its token launch Tuesday, May 2, 2017, after exceeding its crowdsale goal in mere minutes. TokenCard is the first debit card powered by smart contracts incorporating the VISA payments network with Ethereum. It immediately gained attention in the Ethereum community after its announcement and quickly reached and surpassed contribution goals for this one-of-a-kind…

View On WordPress

0 notes

Video

instagram

Tokencard.io raised over $9million in 14 minutes. . . . . . . #ethereum #ethereumclassic #bitcoin #bitcoinmining #litecoinmining #blockchain #ethereummining #dash #digitalcash #ico #cryptocurrency #cryptocurrencies #litecoin #tokencard #tokencardio (at Maplewood, New Jersey)

#dash#blockchain#cryptocurrency#digitalcash#bitcoinmining#ethereummining#cryptocurrencies#bitcoin#ico#tokencardio#tokencard#litecoin#ethereumclassic#litecoinmining#ethereum

0 notes

Text

ABD’li düzenleyici SEC, kısa mühlet evvel bir dizi altcoin’i menkul değer olarak sınıflandırdı. En ilginci, dün bir mektupta yer verdiği Filecoin (FIL) oldu. Bu karar trader ve yatırımcılar için kimi olumsuz sonuçlar doğruyor.SEC’in menkul değer etiketi altcoin yatırımcıları için ne manaya geliyorSEC, 1933 tarihli Menkul Değerler Yasası kapsamında oluşturulan standartları uygulayarak ve birkaç değerli mahkeme kararını daha hesaba katarak, birçok altcoin’in menkul değer olduğunu argüman ediyor.SEC2in bu ithamı, “Howey Testi” kriterinin uygulanmasıyla ortaya çıkıyor. Bu test, bir sürecin ortak bir işletmeye yatırım yapıp yapmadığını sorguluyor. Ayrıyeten, temel olarak oburlarının gayretlerinden kar bekleyip beklemediğini denetim eder.Bu kriterleri kripto para piyasasına uygulayan SEC, birkaç altcoin’in bu tanıma uyma mümkünlüğünün vurguluyor. Bu nedenle bu projelerin yerleşik menkul değerler maddelerine uyulmasını şiddetli kılıyor. ABD’li düzenleyici, kıymetli bir hareketle son vakitlerde birkaç altcoin’i menkul değer olarak nitelendirdi.İşte SEC’in menkul değer dediği o altcoin’lercointahmin.com olarak geçen yıldan bu yana sayısız menkul değer davasına yer verdik. Öne çıkanlardan biri, SEC-Coinbase davası kapsamında menkul değer olarak nitelendiren 7 altcoin. SEC şu anda aşağıdaki listede yer alan 37 altcoin’i menkul değer olarak görüyor.XRP (XRP)Telegram Gram Token (TON)LBRY Credits (LBC)Decentraland (MANA)DASH (DASH)Power Ledger (POWR)OmiseGo (OMG)Algorand (ALGO)Naga (NGC)TokenCard (TKN)IHT Real Estate (IHT)Kik (KIN)Salt Lending (SALT)Beaxy Token (BXY)DragonChain (DRGN)Tron (TRX)BitTorrent (BTT)Terra USD (UST)Luna (LUNA)Mirror Protocol mAssets (Multiple Symbols)Mirror Protocol (MIR)Mango (MNGO)Ducat (DUCAT)Locke (LOCKE)EthereumMax (EMAX)Hydro (HYDRO)BitConnect (BCC)Meta 1 Coin (META1)Rally (RLY)DerivaDAO (DDX)XYO Network (XYO)Rari (RGT)Liechtenstein Cryptoasset Exchange (LCX)DFX Finance (DFX)Kromatica (KROM)FlexaCoin (AMP)Filecoin (FIL)SEC bugün Filecoin’in menkul değer olduğunu öne sürdüABD’li düzenleyici, Grayscale’e göndermiş olduğu bir mektupta, Filecoin’i menkul değer olarak nitelendirdi. Grayscale, trust eserini kaydettirmek için SEC’e bir müracaatta bulunmuştu. SEC, şirkete yaptığı geri dönüşte FIL’den bir menkul değer olarak kelam etti.Şirket, daha sonra yaptığı açıklamalarda, “Grayscale, SEC çalışanından, trust eserlerinin temel varlığı olan FIL’in federal menkul değer maddeleri kapsamında menkul değer tarifini karşıladığına ait bir mektup aldı” dedi.Menkul Değer ile trade yapmanın sonuçlarıKayıtlı olmayan menkul değerlerin satışı ekseriyetle ABD maddelerinin ihlali manasına gelir. Bu düzenleme, menkul değerlerin halka satılmadan evvel SEC’de kayıt altına alınmasını mecburî kılmaktadır. Bu kuralın akredite yatırımcılara satış yahut özel yerleşimler üzere muafiyetleri olsa da, kayıt dışı menkul değerlerin satışı, para cezaları ve kar kaybı da dahil olmak üzere kıymetli cezalara yol açabilir.SEC’in yeni sınıflandırması ışığında, bilhassa bu altcoin’leri listeleyen borsalar yasal incelemeye tabi tutulabilir. Kimi ABD borsaları halihazırda, SEC’in satışı yasa dışı olarak sınıflandırdığı bir düzineden fazla kriptoyu listeliyor ve bu da düzenleyici aksiyonları tetikleyebilir ve akabinde operasyonlarını etkileyebilir.Bu yeni sınıflandırılmış menkul değerlerdeki yatırımcılar için durum elbet daha karmaşık hale geliyor. Menkul değer alım satımı için gereken yasal uyumluluk, yatırımcıların menkul değerler kanunları ve düzenlemeleri üzere faktörleri dikkate alması gerektiği manasına gelir. Ayrıyeten, yeni yasal statüleri göz önüne alındığında, bu altcoin’lerin pazarlanabilirliği ve likiditesi etkilenebilir.Bu menkul değerleri listeleyen kripto borsaları kendi zorluklarıyla karşı karşıyadır. Düzenleyici bir bakış açısıyla, gerekli kayıt yahut muafiyetler olmadan bu menkul değerleri listelemeye devam etmeleri halinde yaptırım ve yasal sonuçlarla karşı karşıya kalabilirler.Riskleri azaltmak için ‘hukuki danışmanlık’Kayıt dışı menkul

değerlerin satışını çevreleyen yasal karmaşıklıklar ve geçerli olabilecek muhakkak muafiyetler göz önüne alındığında, bu alandaki tüm paydaşlar için profesyonel yasal tavsiye almak mecburî hale geldi. Eleştirmenler, SEC’in son uygulama aksiyonlarının ve yorumlayıcı kararlarının Blockchain ve kripto sanayisi inovasyonunu engelleyebileceğini savunuyor.Blockchain projeleri ekseriyetle, SEC’e nazaran menkul değer teklifleri olarak kabul edilen ICO’lar yoluyla fon toplar. Bu nedenle, bu projeler, çoklukla hantal ve kıymetli olan ve daha küçük yenilikçi projeleri cesaretlendiren katı düzenleyici gerekliliklere uymalıdır.SEC’in yaklaşımı, birtakım faaliyetleri daha yumuşak yetki alanlarına kayabilmektedir. Bununla birlikte, kriptoların global tabiatı göz önüne alındığında, ABD’li yatırımcılar yeniden de dolaylı olarak etkilenmekte.Örneğin, bir proje, ABD menkul değerler maddelerinin kapsamı dışında kalmak için ABD yatırımcılarının bir ICO’ya katılmasını engelleyebilmektedir. Bu, ABD yatırımcılarının yenilikçi Blockchain projelerine katılma fırsatlarını sınırlamaktadır.Menkul değer maddelerinin ötesine bakmakSEC’in menkul değerler olarak sınıflandırmaya yönelik son hareketleri, düzenleyici uygulamada kıymetli bir değişimi temsil ediyor. Bu kriptoları menkul değerler olarak tekrar sınıflandırmak, likiditenin azalmasına, hudutlu pazar erişimine ve kayıt dışı menkul değer alım satımı için potansiyel yasal sonuçlara yol açmaktadır. Yalnızca ferdî yatırımcılar ve borsalar için zorluklar sunmakla kalmaz, tıpkı vakitte bölümdeki yeniliği de etkilenmektedir.Kriptoların ve menkul değerler maddelerinin iç içe geçmesi, bu projelerin faaliyet gösterdiği düzenleyici ortamı anlamanın kıymetini vurgulamaktadır. Son SEC kararları, denkleme ek karmaşıklık getirirken, birebir vakitte bu süratli gelişen alanda düzenleyici netliğin gerekliliğinin altını çiziyor.

0 notes

Text

Non-Fungible Token (NFT): What It Means and How It Works

First off, let’s define what a “Token” is.

According to TokenCard, a “Token is a digital representation of ownership which you can exchange for goods and services, or hold onto as an investment.”

While there are numerous digital tokens in existence, NFTs are a slightly different animal.

In simple terms, an Bhero.com NFT is a representation of ownership.

By definition, it can’t be owned by more than one person.

If it could, then it would be a fungible token.

youtube

And by fungible, we mean that you can change one token into another token and get the same amount of value for both.

If that sounds a lot like Bitcoin, that’s because it is.

Bitcoin and NFTs are cousins, as their origins date back to the early days of the internet.

Both cryptocurrencies and NFTs are based on the idea that you can change one digital token into another digital token, and the exchange value will be the same.

However, while NFTs are a different animal, they are not completely unique in the cryptocurrency world.

The first-ever NFTs was created by Satoshi Nakamoto in 2009 with the birth of Bitcoin.

These were called the Bitcoin “Mining” Token (BTM), and it was used by miners as a mechanism for keeping track of their earnings from the Bitcoin network.

In reality, it was also used as a way to control the size of the Bitcoin network, and how fast new transactions would be added to the Bitcoin ledger.

The amount of BTM that could be generated and transferred was also limited to a very specific quantity.

These tokens had a finite lifespan and were eventually replaced by Bitcoin as the primary way to control the size of the Bitcoin network.

However, BTM-like tokens were used as mining rewards and transaction fees for a very long time.

In 2013, Vitalik Buterin introduced Ethereum to the world.

Ethereum was unlike any other cryptocurrency before it, and its success was predicated on its smart contract functionality.

Smart contracts are the future of business, allowing for real-world contracts to be written in code that executes automatically, without the need for a middleman.

Ethereum has become the platform for numerous Initial Coin Offerings (ICOs) and token sales, which have raised billions of dollars in capital for their respective projects.

But there was a problem: Ethereum tokens themselves were not fungible.

This is where the idea of NFTs was born. In the same way that traditional blockchain assets are not fungible, the same is true of tokens.

There were NFTs based on Ethereum, but they weren’t really based on Ethereum.

Ethereum and NFTs have a lot of common ground.

They both use blockchain technology to solve real-world problems, and both tokens provide incentives for users to participate in their respective networks.

However, there are some fundamental differences that separate Ethereum tokens from NFTs.

A “Fungible” token must have the same value across multiple markets, where it can be exchanged freely without any loss or gain.

In this sense, it is like a physical asset.

There is only one physical “dollar”, it’s value is fixed, and it is able to buy things all around the world.

In contrast, an NFT token must be able to move freely between different marketplaces, but can still have a specific value tied to the market.

When you exchange one token for another, it should be a true reflection of the value you are receiving in return.

0 notes

Text

The U.K. financial regulator, the Financial Conduct Authority (FCA), has extended its April 1 registration deadline for a number of crypto firms to meet its regulatory requirements. The British regulator has registered 33 crypto firms so far and 12 firms are holding temporary registration. FCA Extends Deadline for Crypto Firms The U.K.’s Financial Conduct Authority (FCA) updated information on the Temporary Registration Regime (TRR) on its website Wednesday, ahead of the April 1 registration deadline for crypto firms. The Temporary Registration Regime was established in December 2020 to allow existing crypto businesses that applied for registration before Dec. 16, 2020, to keep operating while the FCA continues to assess their applications. The FCA detailed: We have concluded our assessments, and the TRR will close on 1 April, for all but for a small number of firms where it is strictly necessary to continue to have temporary registration. “This is necessary where a firm may be pursuing an appeal or may have particular winding-down circumstances,” the regulator added. Over a hundred companies applied for temporary permission to operate in the U.K. while waiting for the FCA to assess their applications. More than 60 firms were rejected or have withdrawn their application. Only 12 firms remain with temporary registration, according to the latest list on the FCA website. They are BCB Group, Blockchain.com, Cex.io, Copper Technologies (UK), Globalblock, GCEX, ITI Digital, BC Bitcoin, Revolut, Moneybrain, Tokencard (Monolith), and Coindirect. FCA Has Registered 33 Crypto Firms A total of 33 firms have been approved. An FCA spokesperson told Yahoo Finance U.K. Wednesday: “We have been reviewing crypto asset firms’ applications to ensure they meet the minimum standards we expect — that those who run these firms are fit and proper and that they have adequate systems to identify and prevent flows of money from crime.” The spokesperson added: While we have registered 33 firms, we have seen too many financial crime red flags missed by the cryptoasset businesses seeking registration. “Worse, we have seen examples where firms do not have the controls necessary to raise red flags in the first place,” the spokesperson concluded. What do you think about the FCA extending its registration deadline for crypto firms to meet regulatory requirements? Let us know in the comments section below. Go to Source

0 notes

Text

Dear clients, TokenCard rebrands will take place at our Exchange soon, according the developer request.

At the developer's request, the asset title has been changed from TokenCard to Monolith (the ticker TKN remained the same).

You can find more details about the swap here

https://medium.com/tokencard/tokencard-rebrands-to-monolith-to-usher-self-sovereign-finance-powered-by-ethereum-c85c2a04136d

0 notes

Text

Tether bringing tokenized USD to Ethereum

- By Kyree Leary -

Token currency provider Tether is bringing tokenized USD to Ethereum, the second largest cryptocurrency after Bitcoin. This means that users can turn their regular currency into tokens, which makes using it on the exchange simpler and more predictable.

youtube

Tether, in partnership with the Ethereum trading and information community hub Ethfinex, announced the launch of ERC20 Tether tokens on September 11th, allowing tokenized USD to be exchanged on the Ethereum network, and hopefully eliminating the delays people often experienced when dealing with businesses and banks.

“The number of tokens and assets being tokenized on top of the Ethereum platform is growing rapidly, with many proving disruptive to traditional business models,” said Project Lead at Ethfinex Will Harborne. “By enabling all ERC20 compatible applications and protocols to integrate tokenized USD, we expect to see enhanced efficiency and further stability on the Ethereum network.”

Following the announcement, TokenCard revealed it will also begin supporting Tether, allowing users to use their tokenized currency just as they would use traditional money with a Token debit card.

This article was originally published on futurism.com as “You Can Now Trade “Tokenized” U.S. Dollars on the Ethereum Network”. The body copy was shortened; the title, subtitles, certain links and their placement have been modified to reflect Nuadox style considerations.

Attribution-NonCommercial 4.0 International (CC BY-NC 4.0)

Read Also

Ethereum: A retrospective

1 note

·

View note

Text

May 7, 2017

Ethereum News and Links

Top

Ethereum Name Service auctions are live. Here's Nick Johnson's collection of explanatory links.

ENSbot announces the start of auctions on Twitter. It's surprisingly hilarious; half of them make me laugh out loud.

Codetract's ENS Dashboard

If you used MyEtherWallet to bid, make sure to check this out just in case. Also say thank you to MEW.

EthTools releases end to end ENS integration

ETH Gas Station published Safe Low Gas Price to encourage a functioning gas market. To help do that, ETH GasStation has a great tool to see how much hashpower is at each gas price. At the moment ~12% of mining hash power supports a 2 gwei gas price, so if you're willing to wait about 13 blocks at the moment, you can lower your gas fees by ~10x. Etherchain's gas price tool says optimal gas price is about 16 gwei, but that current price is about 23 gwei.

MetaMask will enforce the Safe Low gas price

Protocol and releases

Ethereum Wallet / Mist 0.8.10

Geth v 1.6.1

Solidity, v 0.4.11, including a fix of an optimizer bug that Christoph Jentzsch reported

There's accidentally no recording of last Friday's dev call

Yoichi: What I do for Ethereum when I’m not writing blog posts

Stuff for developers

Coding dividend-bearing tokens by Nick Johnson

Random Number Generation on Rouleth and Blockjack (and Reddit debate thread)

Slock.it's code running Share&Charge

Interesting discussion on how to save on gas storage fees

Getting data on and then off the blockchain with Truebit

EthSlurp re-released as part of QuickBlocks - fast and decentralized EVM data

Ecosystem

ZCoin (using Zerocoin, not Zerocash) to implement an Ether coinmixer, possibly with Metropolis

ConsenSys is building a Bay Area team

WALLΞTH, an alpha release of an Android Ethereum light client wallet

0x announces investors and its first token integrations

Slock.it shares more details on Share&Charge

Register.eth connects Ethereum addresses to Reddit, Twitter, etc

Some great data viz on the Gnosis sale

FT blogger sensationalizes TokenCard mildly overstating their network. #journalism

How Userfeeds aims to bring "skin in the game" to discovery algorithms (and got funded)

Interviews and Talks

Jarrad and Carl from Status on Epicenter

Tayvano from Myetherwallet on GetCryp.to's debut episode

Event Horizon talks: Gavin Wood and Vitalik Buterin

Maciej Ołpiński from Userfeeds talk on Reputation and trust in token based economies

Project Updates

Latest issue of The Etherian

What they want to grow into.

Swarm City to release Boardwalk on June 15th

Melonport: Hedge Fund Scandals & How Smart Contracts Could Help Prevent Them

SingularDTV teases an announcement at Ethereal.

Mihai Alisie: An AKASHA retrospective after a year

Token Sales

The Cofound.it token model and sale details

Why I'm advising Cofound.it

Driving User Adoption and Extending the BAT Platform

Storj token sale details

Nice tutorial videos from Aragon on participating in their token sale

I doubt simple capped token sales will be the long-term norm, because of stuff like this

General

Andrew Keys with a travelogue of his China trip: Ethereum is Growing Exponentially in China

Michael Wuehler's slide on transaction growth

Interesting discussion of how to pass on Ether when you die

Vinay Gupta got lots of attention for "What does $100 Ether mean?"

Korea is the only place where Ether hit $100

Wipro joins the EEA

49ers QB Matt Barkley hodls Ether.

Vitalik sold another 1/12 of his pre-sale allocation

Fortune's Term Sheet daily newsletter talks Ethereum token sales.

This newsletter gets translated into Chinese. And Jeremiah Nichol is producing an audio version. Both of those make my day.

Dates of note

[For ongoing sales, check previous week]

May 17 -- Aragon sale begins

May 19 -- Storj sale begins

May 19 -- ConsenSys Ethereal Summit in Brooklyn

May 24 -- Cofound.it sale begins

May 25 - William Mougayar's Token Summit at NYU

May 30 -- Bancor Network sale begins

June 1 -- Mysterium sale begins

Bias transparency: if you host a blockchain conference and don't use Ticketleap, I'm much less likely to include your conference, unless you have a good reason as to why we're not a good fit. But I doubt there is one, because we're likely a great fit. /shamelessplug

[I aim for a relatively comprehensive list of Ethereum sales, but make no warranty as to even whether they are legit; as such, I thus likewise warrant nothing about whether any will produce a satisfactory return. I have passed the CFA exams, but this is not investment advice. If you're interested in what I do, you can find my investing thesis and token sale appreciation strategies in previous newsletters.]

Errors or additions: [first name] @ticketleap.com

The link for sharing

Here's the link if you'd like to be ever so kind as to share this issue: Good and bad news for me: subscriber count went way over 2000 this last week to about 2150, so now I have to pay Mailchimp $30 a month. It blows me away that they can charge $360 a year for a commodity: sending a low amount of email. I'll likely switch to SES when I have a chance. Follow me on Twitter? @evan_van_ness

This newsletter is supported by Status.im. But in case you still want to send Ether (or tokens?): 0x96d4F0E75ae86e4c46cD8e9D4AE2F2309bD6Ec45

Sign up to receive the weekly email.

1 note

·

View note

Text

Dwight Sproull - TokenCard is a Game Changer - A New Visa Card for ERC-20 Cryptocurrencies

Dwight Sproull - TokenCard is a Game Changer - A New Visa Card for ERC-20 Cryptocurrencies #Crowdsale #DwightSproull

Are you ready to use a Visa card to use ETH and other ERC-20 cryptocurrencies to payments anywhere? That’s the premise behind TokenCard, a new fintech company that has joined up with a Visa issuing partner in China to make Ether and ERC-20 compliant tokens usable in everyday life.

Even better, by participating in their crowdsale, slated for May2, 2017, you can not only help support the project,…

View On WordPress

0 notes