#types of NFT tokens

Explore tagged Tumblr posts

Text

TOP 10 types of NFT tokens

The NFT space has long expanded beyond mere collecting or entertainment. This field is becoming limitless, and startups are finding more and more diverse features that will be useful to users. During the crypto winter, NFT projects built on speculation will disappear. And well-designed, community-driven startups will continue to thrive.

Here are the main types of NFTs:

Let's go through the main areas in which non-fungible token technologies are used.

Art

The NFT mainstream began with digital art auctions. In the wake of the rise of the legendary Cryptopunks, more and more similar collections began to appear.

Of course, the success hasn't always been as stunning as that of Cryptopunks or Beeple, whose work "Everydays: The First 5000 Days" sold for $69 million. But NFTs do provide new opportunities for artists and collectors.

In the art industry there are always questions about advertising, copyrights, royalties, affordability and resale. NFT solves all these problems. Thus, marketplaces like OpenSea help beginners with advertising and promotion of digital art - now the author only needs to upload his art object to the site. They partially solve the issue of affordable prices, because the buyer himself can make an offer or purchase a token at the listing price through a smart contract.

In the traditional market, the resale of works of art is generally prohibited. But NFTs can be resold literally immediately.

And another bonus is the ability for content creators to set up recurring lifetime royalties for all secondary sales.

Create your Own NFT With Us : NFT Marketplace Development Company

Examples: Murakami Flowers Seeds , Destiny , Right-click and Save As Guy , Art Blocks Curated , Hashmask , LetsWalk , Mekaverse

PFP

PFP stands for Picture for proof (“image for proof”) or avatar. Such NFTs are currently only available on Twitter, but other social networks are also actively testing the new trend.

What advantages do PFP avatars provide?

First, profile verification. Twitter verifies that the picture is a genuine NFT and places it in a hexagonal frame.

Participation in DAO communities and early investors of the project. Here bonuses depend on the rules of a particular community - you can receive profit, exclusive services, voting rights, etc.

Access to games or other community products.

Examples: CryptoPunks , Meebits , Bored Ape Yacht Club , Mutant Ape Yacht Club

Music

Music authors have also learned how to earn income from NFTs. This helps offset losses now that physical record sales are down. And also to quickly reach new audiences that cannot be found on music platforms.

Fans, in turn, are willing to buy NFTs to support their favorite artists. After all, in this case, he receives all the income, and does not share it with intermediaries (such as Spotify).

Musicians also offer fans unique items in the form of NFTs - for example, a previously unpublished song or video.

You can tokenize entire albums, singles, videos, photos or lyrics. Fans love to buy unique or at least strictly limited works.

Examples: sound.xyz , pianity.com

Games

Regular games have been replaced by the Play-to-Earn model. It allows you to earn crypto for gaming activity.

Interactions in such games often take place using NFTs. Characters, accessories, artifacts, lands - all this comes in the form of NFTs, and the player will be the real owner of these game items. Later, such tokens can be sold on marketplaces.

There are gaming projects on the market (and even entire metaverses) that have been exploiting the enormous potential of NFTs for a long time. Last year the game Axie Infinity was very popular, this year the Move-2-Earn application STEPN was very popular. Which game will be the next star in this new world?

Virtual land

Data stored on the blockchain can be used to digitally map virtual lands. Smart contracts guarantee you the right to lifelong ownership of such lands (and note that they are not afraid of war or occupation). Everything is recorded and stored on the blockchain.

What to do with virtual lands? There are different options here too:

Wait for the price to rise and resell at a profit.

Rent out (for example, land in game metaverses).

Place advertisements.

Host virtual concerts or other events.

Use to provide services (for example, conduct lectures).

Some crypto lenders even offer loans against virtual lands.

Examples: Decentraland , Sandbox , NFT Worlds , Worldwide Webb

Membership

Membership has long been popular in the crypto community and in business in general. This gives you access to exclusive bonuses and other benefits. But it is NFT that solves the issue of user privacy, data processing and ownership.

Firstly, we don’t need to remember separate passwords for different platforms; just one seed phrase gives access to all subscribed communities. It is important that crypto startups provide good bonuses for community members, as well as access to useful features. And if desired, NFT memberships can be resold at a profit.

Examples: PROOF Collective ,PREMINT Collector Pass, Incrypted NFT-ticket

Brands

As we already wrote, NFT can confirm the authenticity and exclusivity of products. It's no surprise that the brand world is suddenly interested in blockchain and its creative applications.

For example, famous luxury brands have their own virtual stores in metaverses, NFT collections and even blockchain games. But we're not just talking about virtual clothes and accessories.

NFTs can be issued in the format of a certificate of authenticity. Then it will help you check clothes, accessories or jewelry.

With the help of such a certificate, consumers can learn about the origin, quality, manufacturer and other characteristics of the product.

Also, through a smart contract, you can extend the warranty, track delivery, etc.

NFTs are used for advertising in metaverses or blockchain games. Or simply for promotions - for example, giving free art tokens for pre-ordering products.

They can be used for a bonus program or, for example, collaboration with influencers.

Customers can show off virtual clothing on social media, further increasing the brand's popularity.

There are options when, when purchasing an NFT, the user receives a physical product. For example, Obolon sells “victory tokens” that can be exchanged for a limited bottle of beer per day (when the war ends).

In general, blockchain has become another effective advertising and sales channel, which is why brands are actively using it.

Examples: Adidas Originals: Into the Metaverse, RTFKT x Nike Dunk Genesis CRYPTOKICKS , Limited edition NFTs by Incrypted , Community NFTs (Incrypted)

Social NFTs

Social NFTs provide people with one of the basic needs of being around like-minded people and communicating.

This can be either participation in closed online groups or access to real events. And the more popular NFTs become, the more often large social networks think about their social implementation. Thus, the Meta company has already confirmed that Facebook will close the group with access through NFTs.

Another example of a successful social NFT is VeeFriends from blogger and businessman Gary Vaynerchuk. By purchasing such tokens, a fan enters the VeeFriends community, where various lectures are held from the blogger himself.

Examples: VeeFriends , VeeFriends Series 2 , VeeCon Tickets

Domain

Domain as NFT? Blockchain domain name providers offer such services for huge sums. For example, Unstoppable Domains sold the NFT domain “win.crypto” for $100,000 in March, the highest price ever recorded for an NFT.

Tokenized domains are a decentralised account system based on an open source blockchain. Such a domain allows the client to create a wallet address in a convenient text format and link it to the original wallet address.

Other use cases for NFT domains:

Branding is positioning that the company is entering the world of blockchain.

Transfer of tokens/NFTs/messages between the domain and the owner’s wallet.

Convenient address in various DApps.

Ability to create subaccounts for community members.

Broadcast Web3.0 data to a Web2.0 site when connected to a domain.

Such technologies will also develop as Web3.0 expands.

Examples: ENS: Ethereum Name Service , Unstoppable Domain

DeFi

How NFTs work in DeFi can be described using the example of Uniswap V3, a liquidity provider. Its LP tokens are presented as NFTs (ERC-721 standard) and not in the format of regular ERC-20 tokens (as is done in Uniswap V1 and V2).

Based on the pool and interface parameters, the protocol creates a unique NFT that shows the position in a specific pool. The Uniswap NFT token contains the most important information about your liquidity position (pairs, tier level, pool address, etc.). By the way, the NFT owner has the right to change or resell his position in the Uniswap V3 protocol.

And another example is the JustLiquidity service. It is a DeFi platform with a unique NFT staking pool. Here you can lock JulD and JULb tokens for four weeks to receive special NFTs such as BNB NFT cards. The resulting NFTs can be locked again, for which the protocol awards even more valuable prizes.

Example: Uniswap V3

Conclusion

As you can see, we have described 10 use cases for NFTs. But there are many more of them - non-fungible tokens will be useful in culture, sports, medicine, legal services, logistics and so on. Therefore, we will continue to follow the development of this exciting market with interest.

0 notes

Text

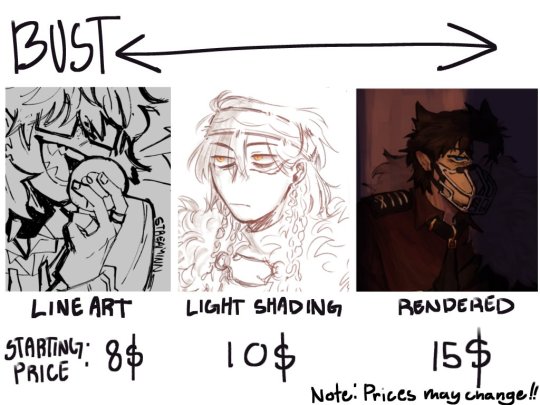

Quick sale till... march? Maybe? Who knows, i'm trying to get verified in Vgen so i'll keep the sale going until i reach that or if there's too many orders

If you'd like more examples of my works, feel free to check the tags commission work, rendered, my art or ask for more in DM’s!

You can either commission me through Vgen or here. I'd appreciate it if its through vgen so i can get verified but if you don't feel like it, shoot me a DM and we can talk there.

Now, read everything below first before commissioning me.

🗐 COMMERCIAL RIGHTS

⚲ IMPORTANT!

Upon commissioning the artist, the client automatically agrees to the terms of service provided, as it is assumed they have read them. If there are any questions or concerns, feel free to reach out through DMs or my other socials.

No additional payments are required for the following, as long as credit is given with my handle "@streamdotpng" whenever used:

✔ Icons, Banners, Thumbnails, and Posts used for streaming or other content purposes.

If the art is used for commercial purposes, with the artist’s consent, the artist will receive an agreed-upon percentage of the sales profits.

✒ GENERAL

The Artist has the right to refuse a commission if they are not comfortable or confident about the request.

The client is allowed to ask for progress updates every 2-4 days and are freely given. If it is a rushed commission, feel free to ask for more frequent updates.

By commissioning the artist, the client acknowledges that the artist is a student and this is not the artist’s full-time job. The client should not expect the artist to treat it as such.

Communications will generally be done in Vgen Chats (Please check your emails for chat notifications). Unless you prefer to communicate in other applications, that is also allowed as long as you let me know. Scroll down to see the end of my Terms of Service for my contacts or check the links in my profile.

Under any circumstances, Clients are not permitted to use any part of the commissioned artwork for non-fungible tokens (NFTs), blockchain, cryptocurrency platforms or AI Training. Such usage is strictly prohibited and may result in legal action taken.

✎ᝰ. CAN, MIGHT & WON’T DRAW!

╰┈➤ CAN DRAW !

Fanart

Shipping [GL, BL, Straight, Yumeship]

Original Characters

PNGtuber Models (e.g Blinking, Speaking)

Character sheets

╰┈➤ MIGHT DRAW ! (We’ll need to talk more about these requests)

Anthropomorphic animals

Heavy Armor

Excessive Gore

Comics

Complicated backgrounds (e.g. Detailed interior, buildings etc)

Honestly, if it isn’t in the "Can Draw" list, let’s talk about it!

╰┈➤✖ WILL NOT DRAW !

Depiction of suicide and self harm

Depiction of any type of hateful/political art

Anything that crosses my personal boundaries

⏱ TIMELINE & WORK PROCESS

Work completion will take at least 1-2 weeks minimum, depending on the amount of commissions worked on.

My work process simplified: Draft and Line Art ➤ Colouring ➤ Final Touches.

My work process expanded on: Draft ➤ Line Art ➤ Flat Colours ➤ Shading ➤ Final Work.

After completing each stage, I will contact you for either payment or revisions and thoughts.

$ PRICING & PAYMENT

Prices vary depending on the commission. I’m flexible, but here are some base prices:

$5-10 USD depending on the background

$10-15 USD per person added

Note: There can be additional charges due to PayPal fees.

Half the payment is expected to be paid upfront Post-Draft or Post-Line Art. The rest of the payment will be paid fully after the Flat Colours are seen and approved. If payment hasn't been received, the Artist will not continue until then.

The option to fully pay upfront is allowed but must be talked about before sending over the money.

No refunds are allowed after the draft has been sent.

You can pay through PAYPAL, KOFI or VGEN

↺ REVISION POLICIES

Once the coloring stage begins, the only major revisions permitted are details that the artist may have missed and was specified by the client while the commission was still in the sketching/lineart stage (e.g. a missing tattoo that’s essential to the character’s design).

If the client is unsatisfied with the commission Post-Line Art, the artist is willing to discuss and make minor edits as stated prior (e.g. adjusting colors). However, the artist will not redraw the piece and expects full payment, as the client should have specified in the sketch stage the changes they wanted to be made.

The client may not hire another artist to adjust the image without the artist’s consent.

The artist is willing to edit the image post commission for the commissioner, but may charge a small fee depending on what is being asked of them

🛈 RUSHED COMMISSIONS

Rush Fees apply. Contact me first to discuss how much you’re willing to pay for the rush fee.

The fastest turnaround time is 1-2 days (maximum 4 days) with the same quality as my usual work.

For short deadlines, you must be responsive when it comes to communication. It'd save us both the headache and worry.

▸ DISCLAIMER!

Breaking or disrespecting the rules of the Terms of Service will lead to a permanent ban and you will be blacklisted. It means, users who break the Terms of Service will lose the rights to commission me.

However, I may allow second chances. Blacklisted users can contact me with proof of improved behavior to request removal.

---

…and that’s about it? Just don’t expect me to be obligated to draw something and we’ll figure something out. Not to mention that depending on how much commissions i’m getting and how busy i am, the art will take atleast a few days to a week!

If you got references, provide them! It’ll help alot. You can also ask for progress updates, just don’t mind me accidentally not seeing the message bc this is tumblr and I don’t get notifs for some reason.

That’s about it, thanks for seeing this yall. Again, If you want to see more examples, simply look at my art tags in my account or send a DM and i'll send some over there.

150 notes

·

View notes

Text

The Expansive World of Altcoins: Exploring the Diversity Beyond Bitcoin

Bitcoin, the original cryptocurrency, has long dominated headlines and market discussions. However, the world of digital currencies is vast and diverse, with thousands of alternative coins, or altcoins, each offering unique features and value propositions. Altcoins encompass a broad range of projects, from utility tokens and stablecoins to meme coins and more. This article delves into the rich ecosystem of altcoins, highlighting their significance, various types, and the innovative projects that make up this vibrant space, including a mention of Sexy Meme Coin.

Understanding Altcoins

The term "altcoin" refers to any cryptocurrency that is not Bitcoin. These coins were developed to address various limitations of Bitcoin or to introduce new features and use cases. Altcoins have proliferated since the creation of Bitcoin in 2009, each aiming to offer something different, whether it be improved transaction speeds, enhanced privacy features, or specific utility within certain ecosystems.

Categories of Altcoins

Utility Tokens: Utility tokens provide users with access to a specific product or service within a blockchain ecosystem. Examples include Ethereum's Ether (ETH), which is used to power applications on the Ethereum network, and Chainlink's LINK, which is used to pay for services on the Chainlink decentralized oracle network.

Stablecoins: Stablecoins are designed to maintain a stable value by being pegged to a reserve of assets, such as fiat currency or commodities. Tether (USDT) and USD Coin (USDC) are popular stablecoins pegged to the US dollar, offering the benefits of cryptocurrency without the volatility.

Security Tokens: Security tokens represent ownership in a real-world asset, such as shares in a company or real estate. They are subject to regulatory oversight and are often seen as a bridge between traditional finance and the blockchain world.

Meme Coins: Meme coins are a playful and often humorous take on cryptocurrency, inspired by internet memes and cultural trends. While they may start as jokes, some have gained significant value and community support. Dogecoin is the most famous example, but many others, like Shiba Inu and Sexy Meme Coin, have also captured the public's imagination.

Privacy Coins: Privacy coins focus on providing enhanced privacy features for transactions. Monero (XMR) and Zcash (ZEC) are notable examples, offering users the ability to transact anonymously and protect their financial privacy.

The Appeal of Altcoins

Altcoins offer several advantages over Bitcoin, including:

Innovation: Many altcoins introduce new technologies and features, driving innovation within the cryptocurrency space. For example, Ethereum introduced smart contracts, enabling decentralized applications (DApps) and decentralized finance (DeFi) platforms.

Specialization: Altcoins often serve specific niches or industries, providing targeted solutions that Bitcoin cannot. For instance, Ripple (XRP) focuses on facilitating cross-border payments, while Filecoin (FIL) aims to create a decentralized storage network.

Investment Opportunities: The diverse range of altcoins presents numerous investment opportunities. Investors can diversify their portfolios by investing in projects with different use cases and growth potentials.

Notable Altcoins in the Market

Ethereum (ETH): Ethereum is the second-largest cryptocurrency by market capitalization and has become the backbone of the DeFi and NFT (Non-Fungible Token) ecosystems. Its smart contract functionality allows developers to create decentralized applications, leading to a thriving ecosystem of financial services, games, and more.

Cardano (ADA): Cardano is a blockchain platform focused on sustainability, scalability, and transparency. It uses a proof-of-stake consensus mechanism, which is more energy-efficient than Bitcoin's proof-of-work. Cardano aims to provide a more secure and scalable infrastructure for the development of decentralized applications.

Polkadot (DOT): Polkadot is designed to enable different blockchains to interoperate and share information. Its unique architecture allows for the creation of "parachains," which can operate independently while still benefiting from the security and connectivity of the Polkadot network.

Chainlink (LINK): Chainlink is a decentralized oracle network that provides real-world data to smart contracts on the blockchain. This functionality is crucial for the operation of many DeFi applications, making Chainlink a vital component of the blockchain ecosystem.

Sexy Meme Coin: Among the meme coins, Sexy Meme Coin stands out for its combination of humor and innovative tokenomics. It offers a decentralized marketplace where users can buy, sell, and trade memes as NFTs (Non-Fungible Tokens), rewarding creators for their originality. Learn more about Sexy Meme Coin at Sexy Meme Coin.

The Future of Altcoins

The future of altcoins looks promising, with continuous innovation and increasing adoption across various industries. As blockchain technology evolves, we can expect altcoins to introduce new solutions and disrupt traditional systems. However, the market is also highly competitive, and not all projects will succeed. Investors should conduct thorough research and due diligence before investing in any altcoin.

Conclusion

Altcoins represent a dynamic and diverse segment of the cryptocurrency market. From utility tokens and stablecoins to meme coins and privacy coins, each category offers unique features and potential benefits. Projects like Ethereum, Cardano, Polkadot, and Chainlink are leading the way in innovation, while niche coins like Sexy Meme Coin add a layer of cultural relevance and community engagement. As the cryptocurrency ecosystem continues to grow, altcoins will play a crucial role in shaping the future of digital finance and blockchain technology.

For those interested in the playful and innovative side of the altcoin market, Sexy Meme Coin offers a unique and entertaining platform. Visit Sexy Meme Coin to explore this exciting project and join the community.

107 notes

·

View notes

Text

Introduction to Crypto Airdrops

Crypto airdrops are one of the most exciting ways to get involved in the cryptocurrency world—often letting you earn free tokens just by being part of a community or completing simple tasks.

If you're new to crypto and curious about airdrops, this guide covers everything you need to know: what they are, why they happen, how to participate, and how to avoid scams.

What Is a Crypto Airdrop?

A crypto airdrop is a distribution of free cryptocurrency tokens directly to users' wallets. It’s like a promotional giveaway, where blockchain projects send tokens either:

To existing holders of certain cryptocurrencies (like Ethereum), or

To people who complete simple tasks (such as joining Telegram or following on X).

Airdrops help new projects promote themselves, reward early supporters, and build active communities.

Why Do Projects Offer Airdrops?

Crypto projects give away free tokens for smart strategic reasons:

✅ Build Buzz – Airdrops generate hype on social media and news outlets.

✅ Grow the Community – Free tokens encourage new users to get involved.

✅ Decentralize Ownership – Tokens are spread among many users, supporting decentralization.

✅ Reward Loyalty – Existing supporters and early adopters often get tokens as a “thank you.”

It’s a win-win: users get free tokens, and projects get exposure and engagement.

Types of Crypto Airdrops

There are different types of airdrops based on how you qualify:

1. Standard Airdrops

Tokens are sent to wallets of users who hold a specific cryptocurrency.

Example: Holding Ethereum might qualify you for a new ERC-20 token drop.

Effort: Minimal — just hold the required token at the right time.

2. Bounty Airdrops

Earn tokens by completing simple tasks:

Follow on X/Twitter or Telegram

Share content or refer friends

Fill out a form or join a Discord

Effort: Moderate — but it’s often worth it!

Other types include Holder Airdrops, Exclusive Airdrops (for beta users), and NFT Airdrops.

How to Participate in a Crypto Airdrop

Here’s how to safely join airdrops:

1. Get a Compatible Wallet Use non-custodial wallets like:

MetaMask (Ethereum & EVM chains)

Trust Wallet (multi-chain)

Phantom (Solana)

Tip: Use a separate wallet for airdrops to protect your main funds.

2. Find Legit Airdrops Reliable sources:

Airdrops.io

CoinMarketCap Airdrops

Official social channels of crypto projects

3. Follow the Instructions Tasks may include:

Social media engagement

Wallet submissions

Community participation

NEVER share your private key or seed phrase! No legit airdrop will ever ask.

4. Wait for Distribution

Tokens are usually distributed after the campaign ends—it may take a few days or weeks.

5. Manage Your Tokens Once received, you can:

Hold for potential value

Trade on exchanges

Use within the project’s platform

Risks and Precautions

Airdrops are exciting—but not without risks.

Common Dangers: Scams & Phishing:

Fake websites or apps may steal your data or funds.

If an airdrop asks for payment or your private key, it’s 100% fake.

Malicious Tokens: Some airdropped tokens are designed to compromise your wallet if you interact with them.

Tax Implications: In some countries, free tokens are taxable income.

Keep records and consult a tax advisor.

Best Practice: Research the project. Check its official website, team, roadmap, and what others in the community are saying.

Conclusion: Are Airdrops Worth It?

Absolutely—if you stay smart and cautious. Crypto airdrops are a fantastic way to: Explore new blockchain projects, Collect potentially valuable tokens

Engage with emerging communities

But always be alert for scams, and never compromise your wallet’s security. With the right approach, airdrops can be a fun and rewarding way to grow your crypto journey.

2 notes

·

View notes

Text

How to Buy NFTs Like a Pro: Tips for Maximizing Profits

The NFT (Non-Fungible Token) market is rapidly evolving, and many investors are looking to capitalize on digital assets. Whether you are a seasoned investor or just starting out, understanding how to buy NFTs strategically can help you maximize your profits. This guide will walk you through the essential steps and expert tips to make informed purchases in the NFT space.

1. Understand the Basics of NFTs

Before you buy NFTs, it’s crucial to grasp the fundamentals. NFTs are unique digital assets that exist on blockchain networks, often representing art, music, collectibles, or virtual land. Unlike cryptocurrencies such as Bitcoin or Ethereum, NFTs cannot be exchanged on a one-to-one basis since each token has distinct properties.

2. Choose the Right Marketplace

There are multiple NFT marketplaces, each catering to different types of digital assets. Some of the most popular ones include:

OpenSea – The largest NFT marketplace, offering a diverse range of assets.

Rarible – A decentralized platform where creators and buyers interact directly.

Foundation – Focused on high-quality digital art and exclusive collections.

SuperRare – Best for rare and high-value NFTs with a strong focus on curation.

Choose a platform that aligns with your investment goals and preferred NFT category.

3. Set Up a Crypto Wallet

To buy NFTs, you need a digital wallet compatible with the blockchain network where the NFTs are minted. Popular wallets include:

MetaMask – Works with Ethereum-based NFTs and integrates with most marketplaces.

Trust Wallet – Supports multiple blockchains, offering broader accessibility.

Coinbase Wallet – User-friendly for beginners and directly connects with Coinbase exchange.

Ensure your wallet is funded with the appropriate cryptocurrency required for purchases.

4. Research Before Buying

Successful NFT investors conduct thorough research before making purchases. Consider the following factors:

Creator’s Reputation – Established artists and brands tend to hold long-term value.

Rarity & Scarcity – Limited edition NFTs often appreciate more over time.

Utility & Use Case – Some NFTs provide additional benefits, such as access to exclusive events or staking rewards.

Market Trends – Monitor current trends and demand before investing.

5. Evaluate Gas Fees and Transaction Costs

NFT purchases often come with transaction fees, especially on Ethereum-based platforms. Gas fees fluctuate based on network congestion, so consider timing your purchases when fees are lower.

6. Diversify Your NFT Portfolio

Just like in traditional investing, diversification can help mitigate risks. Instead of putting all your funds into a single NFT project, consider spreading investments across different niches such as digital art, virtual real estate, and gaming NFTs.

7. Stay Updated on Market Trends

The NFT market is dynamic, with new trends emerging constantly. Follow NFT influencers, join Discord and Telegram communities, and keep an eye on platforms like Twitter and Reddit to stay ahead of the game.

Conclusion

Learning how to buy NFTs with a strategic approach can help you navigate this evolving market successfully. By researching projects, using reputable marketplaces, managing fees wisely, and staying informed about trends, you can maximize your profits and build a valuable NFT portfolio. Happy investing!

3 notes

·

View notes

Text

WOOF Token is Here: A New Era of Trading on STON.fi

The crypto space is evolving rapidly, and every so often, a new token emerges that grabs attention, creates utility, and drives engagement. WOOF is one of those tokens, and it’s now live on STON.fi, ready for trading and liquidity provision.

But what makes WOOF worth your time, and why should STON.fi be your go-to platform for trading it? Let’s break it down.

What is WOOF

WOOF is the native token of the Lost Dogs ecosystem, a growing community centered around interactive NFT experiences. Unlike standard NFT collections, Lost Dogs introduces a unique mergeable NFT system, allowing users to combine assets and create entirely new, personalized digital pets.

This isn’t just another collectible project—it’s an evolving digital experience that keeps users engaged through tasks, gaming mechanics, and animated content. WOOF fuels this entire ecosystem, making it a core asset for participants.

Why Trade WOOF on STON.fi

Choosing where to trade a token is just as important as the token itself. STON.fi provides the perfect environment for WOOF traders, liquidity providers, and long-term holders. Here’s why:

✅ Decentralized & Secure – Your assets remain in your control at all times. No third-party risks.

✅ Minimal Fees – Unlike traditional exchanges, STON.fi ensures you keep more of your profits with ultra-low transaction costs.

✅ Deep Liquidity – Trade WOOF without worrying about slippage or delays. Whether you’re making small moves or big trades, liquidity is readily available.

✅ Fast & Efficient – With STON.fi’s automated and optimized trading system, transactions settle seamlessly, ensuring you never miss a market move.

✅ Passive Income Opportunities – Beyond trading, STON.fi allows users to earn rewards by providing liquidity, creating an additional revenue stream with WOOF.

How to Get Started

Trading WOOF on STON.fi is a simple, user-friendly process:

1️⃣ Go to STON.fi – Access the platform and connect your wallet.

2️⃣ Find WOOF – Select the WOOF trading pair of your choice.

3️⃣ Trade or Provide Liquidity – Whether you’re looking to buy, sell, or stake, STON.fi provides seamless options for every type of trader.

Final Thoughts

WOOF is more than just another token—it’s a utility-driven asset with a strong community behind it. Pair that with STON.fi’s advanced trading infrastructure, and you have a winning combination.

Whether you're trading for short-term gains or planning to engage deeply with the Lost Dogs ecosystem, now is the time to act. WOOF is live, the market is moving, and STON.fi is the best place to make the most of this opportunity.

4 notes

·

View notes

Text

2024 COMMS

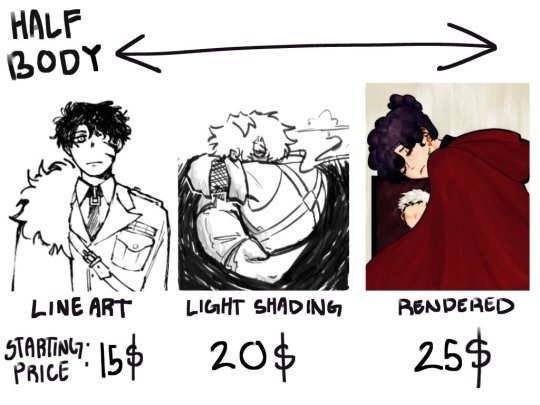

Updating this for the new year. Feel free to message me with any questions, these are all loose guidelines for what you can ask for and I’m happy to hear out other projects.

Transcript of image text below

Crowstrel Commissions: [2024]

Painty art for all of your ttrpg character, video game OC, furry and blorbo needs.

1. Blocks:

Decoration already included in price! Great for profile pages and establishing OC aesthetics, or including their important items! Waist Up: 80 USD Full Body: 110 USD

2. (I like square frames, but you can ask for other things too!) 3. (If you want a specific style or composition, we’ll workshop the price)

4. Full Body Drawings:

Just a guy! Perfect for showing off your newest character. Base: 75 USD Simplified: 60 USD Ref Sheets: ASK!

5. Icons:

Shoulders and up with minimal decoration! Great for account icons, game tokens, character profiles, and more! 1 Icon: 45 USD 5 Icons: 180 USD Add Decor: 10 USD

6. New: Pencil Scans <3

7. Confusing Price Chart

Digital Portrait: 45 USD simple, 55 USD decorated Pencil Portrait: 30 USD simple, 45 USD decorated Digital Waist-Up: 60 USD simple, 80 USD decorated Pencil Waist-Up: 45 USD simple, 75 USD decorated Digital Full: 75 USD simple, 110 USD decorated Pencil Full: 60 USD simple, 125 USD decorated * Why does the decorated pencil section scale so fast? :( Well, blocking little things in digitally is (relatively) easy, but doing all the little bits with a pencil takes a very long time. 20% discount for the back of the head. - Fun for composition! - Faces are hard!

8. GOOD TO GO:

Complex designs, mechs

Birds and wings! :>

All body types

Short comics (ask!)

Gore

Furries / anthro

Animals

NSFW (18+)

NOT OFFERING:

Real people

Hateful content

Extreme gore or NSFW

Commercial work

NFT or blockchain

Images for AI use

Please DM me with any questions @crowstrel! All payments made VIA Paypal, half is required upfront.

4 notes

·

View notes

Text

Blockchain Investment: A New Frontier for Investors

The rise of blockchain technology over the last decade has sparked interest across various industries, from finance and supply chain management to healthcare and entertainment. As blockchain matures, investors are starting to recognize its potential not only for transforming traditional sectors but also for offering new investment opportunities. In this article, we explore the significance of blockchain investment, the types of investments available, the associated risks, and the future outlook for this promising technology.

What is Blockchain?

Blockchain is a decentralized digital ledger technology that securely records transactions across multiple computers. It allows information to be stored transparently, immutably, and without the need for intermediaries such as banks or government bodies. The most famous application of blockchain technology is Bitcoin, the first cryptocurrency, but its potential extends far beyond digital currencies.

Blockchain’s unique features—decentralization, transparency, and security—make it an appealing foundation for various applications, ranging from finance to supply chain management to voting systems. With an increasing number of industries exploring blockchain’s use cases, it has garnered significant attention from investors.

youtube

Why Invest in Blockchain?

Disruption of Traditional Systems: Blockchain has the potential to disrupt a wide range of industries by providing more efficient, transparent, and secure alternatives to legacy systems. For example, blockchain-based financial services can lower transaction costs, reduce fraud, and offer access to previously unbanked populations. The transformation of industries such as healthcare, logistics, and government services is just beginning.

The Growth of Cryptocurrencies: Blockchain is the backbone of cryptocurrencies, which have seen exponential growth in recent years. Bitcoin, Ethereum, and other altcoins have become established assets, and decentralized finance (DeFi) platforms built on blockchain promise further innovation in financial markets. Investors can benefit from both the appreciation of these digital assets and the broader adoption of cryptocurrency ecosystems.

Tokenization of Assets: Blockchain enables the tokenization of real-world assets, including real estate, art, and commodities. This allows investors to gain fractional ownership in previously illiquid assets, opening up new avenues for diversification and investment. Tokenization can also improve liquidity and streamline processes such as cross-border payments and property transfers.

Venture Capital and Startups: Many blockchain-based startups are developing innovative applications, from decentralized applications (dApps) to non-fungible tokens (NFTs) to blockchain-based identity verification systems. Venture capitalists and angel investors can tap into the high growth potential of these companies, as blockchain adoption continues to rise globally.

Types of Blockchain Investments

Blockchain investments can be approached in several ways. Some of the most common types include:

Cryptocurrencies: Direct investment in digital currencies like Bitcoin, Ethereum, and other altcoins is the most straightforward form of blockchain investment. These cryptocurrencies can be purchased through exchanges and stored in digital wallets. While Bitcoin and Ethereum are the most well-known, there are thousands of altcoins that investors can explore.

Blockchain-related Stocks and ETFs: Rather than investing directly in cryptocurrencies, investors can gain exposure to blockchain technology by purchasing stocks in companies that are integrating blockchain into their operations. Public companies such as Nvidia (which provides hardware for mining), Coinbase (a cryptocurrency exchange), and Block (formerly Square) are examples of firms investing heavily in blockchain. Additionally, blockchain-focused exchange-traded funds (ETFs) allow investors to diversify their exposure to the sector.

Initial Coin Offerings (ICOs) and Token Sales: ICOs and token sales are fundraising mechanisms where startups issue their own cryptocurrency tokens in exchange for investments. While ICOs were initially seen as high-risk, high-reward ventures, they have become more regulated over time. This form of investment allows early-stage investors to gain a stake in blockchain projects before they are widely adopted.

Blockchain Real Estate: The tokenization of real estate allows fractional ownership of property via blockchain-based tokens. Platforms like RealT and Propy have been pioneers in this space, enabling investors to buy shares in real estate and receive dividends from rental income. Blockchain’s transparency and immutability make it ideal for managing property transactions.

Decentralized Finance (DeFi): DeFi is a rapidly growing sector that leverages blockchain to provide financial services such as lending, borrowing, and trading without intermediaries. By investing in DeFi projects or liquidity pools, investors can earn returns in the form of interest or tokens.

Risks of Blockchain Investment

While blockchain presents exciting investment opportunities, there are several risks to consider:

Volatility: Cryptocurrencies, in particular, are known for their extreme price volatility. Dramatic price swings can occur in a short time, making blockchain investments high-risk, especially for short-term traders. Long-term investors should be prepared for fluctuations in value.

Regulatory Uncertainty: Blockchain and cryptocurrencies are still in the early stages of regulatory development. Governments around the world are working on creating frameworks to govern blockchain and digital currencies, but until clear regulations are established, there could be sudden changes in legal and tax requirements that impact investment returns.

Security and Fraud Risks: While blockchain technology itself is secure, the platforms and exchanges built on top of it may not always be. Hacks, scams, and fraud have occurred in the blockchain space, with investors losing substantial amounts of money. Conducting thorough research and choosing reputable platforms is crucial.

Technological Risks: Blockchain is still an emerging technology, and its long-term scalability, interoperability, and environmental impact remain open questions. For instance, Ethereum, one of the leading blockchains, is transitioning from a proof-of-work to a more energy-efficient proof-of-stake consensus mechanism, highlighting the potential for technical challenges.

The Future of Blockchain Investment

As blockchain technology evolves, it’s expected that adoption across industries will only increase. Many experts believe that blockchain will play a central role in reshaping the global economy, particularly in areas like supply chain transparency, decentralized finance, and digital identity verification.

The rise of central bank digital currencies (CBDCs), which are government-backed digital currencies that leverage blockchain technology, will likely spur further mainstream adoption. Additionally, innovations in smart contracts, which automate transactions based on predefined conditions, will expand the use of blockchain beyond simple transactions into complex business processes.

For investors, this presents an exciting opportunity to position themselves at the forefront of a technological revolution. However, as with any emerging technology, it is important to approach blockchain investment with caution, conducting thorough due diligence and maintaining a diversified portfolio to manage risk effectively.

Conclusion

Blockchain investment offers promising opportunities for those willing to navigate its complexities. From cryptocurrencies to tokenized assets to decentralized finance, the potential for growth in this sector is vast. However, investors should carefully consider the risks associated with volatility, regulation, and security before diving in. As blockchain technology matures and becomes more widely adopted, it will likely be a key driver of innovation, providing unique opportunities for savvy investors to capitalize on the next generation of digital transformation.

2 notes

·

View notes

Text

The Top Features to Look for in Blockchain Game Development Solutions

When looking for blockchain game development solutions, it's important to find features that enable true digital ownership, secure transactions, and engaging player economies. The best solutions offer expertise in creating games where players can own in-game assets, participate in transparent marketplaces, and potentially earn real value. They combine strong technical skills with a deep understanding of gaming experiences.

What are Blockchain Game Development Solutions?

Blockchain game development solutions are services and tools designed to build video games that use decentralized blockchain technology. These solutions include everything from designing game mechanics around digital assets like NFTs, to writing the secure smart contracts that govern how the game operates. They help creators bring games to life where players have verifiable ownership of their in-game items and can interact with decentralized economies.

These offerings focus on integrating the unique aspects of blockchain, such as transparency, security, and immutability, into the gaming environment. The goal is to create new types of games that provide players with more control and opportunities than traditional models. Essentially, they provide the means to build games that exist on a public, verifiable ledger.

Why are Blockchain Game Development Solutions Important?

Blockchain game development solutions are important because they are reshaping the gaming industry by giving more power and ownership to players. In traditional games, players do not truly own their in-game purchases; the game company does. Blockchain solutions change this by making in-game items verifiable digital assets, often as NFTs, that players genuinely own and can trade or sell.

This shift creates new economic models within games, allowing players to earn real value from their time and effort. It also fosters greater transparency and trust, as game rules and transactions are recorded on a public ledger. By enabling true digital ownership and player-driven economies, these solutions are opening up exciting new possibilities for how games are played and valued.

Features of Blockchain Game Development Solutions

Key features of excellent blockchain game development solutions include robust smart contract implementation, comprehensive Web3 integration, and expertise in creating player-centric economies. These solutions offer the ability to design and issue non-fungible tokens (NFTs) that represent unique in-game items, ensuring verifiable digital ownership for players. They also provide tools for secure crypto wallet integration, allowing players to manage their earned assets easily.

Additionally, top solutions focus on creating scalable and efficient blockchain networks that can handle a large number of players and transactions without compromising performance. They also offer strong security measures to protect against fraud and ensure fair gameplay, which is vital for building trust in decentralized environments. These features collectively deliver a complete and reliable blockchain gaming experience.

Benefits of Blockchain Game Development Solutions

The benefits of utilizing strong blockchain game development solutions are significant for game creators and players alike. For creators, these solutions open new avenues for monetization through direct asset sales and transaction fees within a game's economy. They also foster more engaged and loyal communities by giving players a vested interest in the game's success through ownership and earning potential.

For players, the primary benefit is true ownership of their in-game assets, allowing them to earn real value from their gameplay and trade items freely. This creates a more rewarding experience where their time and investment are directly tied to tangible digital property. These solutions also promote transparency and fairness, building a more trustworthy and equitable gaming environment for everyone involved.

Smart Contract Development for Games: The Core Logic

Smart contract development for games is a crucial feature to look for in any blockchain game development solution. These self-executing contracts are the digital rules that govern every action within a blockchain game, from minting NFTs to distributing rewards and handling player interactions. They ensure fairness, transparency, and automation, which are essential for a reliable decentralized game.

A robust solution will have a team skilled in writing secure, efficient, and audited smart contracts. This expertise prevents vulnerabilities and ensures that game logic, such as P2E (Play-to-Earn) game mechanics, operates as intended without human intervention. The quality of smart contract integration for games directly impacts the trustworthiness and functionality of the entire gaming ecosystem.

Comprehensive Web3 Gaming Solutions and Blockchain Integration

When evaluating solutions, look for comprehensive Web3 gaming solutions that offer seamless blockchain integration in gaming. This means the solution can deeply embed blockchain functionalities into the game's core, making the decentralized aspects easy for players to use. It involves connecting the game's front-end and back-end systems with the chosen blockchain network efficiently.

Effective integration ensures that features like in-game purchases, asset transfers, and player progression are securely recorded on the blockchain without disrupting the gameplay experience. These solutions enable the creation of truly decentralized gaming platforms where players can interact directly with blockchain assets and protocols. A smooth integration process is key to a successful blockchain game.

Enabling Player Economies: P2E Game Mechanics and Crypto Tokenomics

For a successful blockchain game, solutions must offer strong capabilities in designing P2E (Play-to-Earn) game mechanics and crypto tokenomics for games. P2E mechanics allow players to earn real value, such as cryptocurrency or NFTs, through their gameplay activities. The best solutions know how to design these systems to be engaging, balanced, and sustainable for the long term.

Good crypto gaming solutions also provide expertise in creating a balanced in-game economy. This involves structuring the supply, demand, and utility of tokens and NFTs to ensure stability and growth. Proper tokenomics are essential to avoid inflation and maintain the value of earned assets, making the P2E aspect genuinely rewarding for players. This intricate balance is a hallmark of top-tier development.

Crafting Valuable Assets: NFT Game Design and Development

A vital feature to seek in blockchain game development solutions is their proficiency in NFT game design and development. This goes beyond merely creating digital collectibles; it involves designing NFTs with genuine utility, scarcity, and visual appeal within the game. The best solutions understand how to make NFTs integral to gameplay, not just an afterthought.

They focus on creating unique digital assets that players desire to own, collect, and trade. This includes expertise in the technical minting process, as well as the creative design that makes NFTs truly valuable in the game's ecosystem. A strong NFT game development company will seamlessly integrate these assets into game mechanics, enhancing the player's experience and providing tangible ownership.

Offering Unique Experiences: Custom Blockchain Game Development Services

For projects that require a unique vision, look for custom blockchain game development services. This feature signifies a solution provider's ability to build a game from the ground up, precisely according to a client's specifications. It means they can develop bespoke game mechanics, integrate specific blockchain features, and create a truly original player experience.

A best blockchain game development company offers this level of customization, adapting to various blockchain protocols and game engines to realize distinct concepts. This is particularly important for innovators aiming to create something entirely new, such as a unique blockchain-based metaverse game development studio. They provide the flexibility and expertise to build complex, one-of-a-kind projects.

Foundational Knowledge: How to Build a Blockchain-Based Game

A strong blockchain game development solution will provide clear guidance on how to build a blockchain-based game. This includes expertise in the entire development lifecycle, from initial concept and design to deployment and ongoing support. They should be able to advise on choosing the right blockchain for specific game needs, considering factors like transaction speed, cost, and security.

This feature means the solution provider can help with selecting and optimizing game engines like Unity or Unreal for blockchain integration. They assist in designing effective P2E models and implementing secure smart contracts. Their comprehensive understanding of the development process ensures a smooth and efficient creation of the game, providing a solid foundation for success.

Cost Transparency: Understanding the Cost of Developing an NFT Game

While exact figures depend on project scope, a good blockchain game development solution provides clear insights into the cost of developing an an NFT game. They offer transparent breakdowns of potential expenses, including smart contract auditing, artistic asset creation, marketing, and ongoing maintenance. This transparency helps clients plan their budget effectively.

Solutions that offer clear cost estimates, rather than vague promises, demonstrate trustworthiness. They help creators understand the investment required for a high-quality NFT game with secure blockchain integration and sustainable economics. Companies offering reliable crypto game development services prioritize open communication regarding financial aspects.

Engine Expertise: Top Blockchain Game Engines (Unity vs. Unreal)

A valuable feature in a blockchain game development solution is their expertise with the top blockchain game engines (Unity vs. Unreal). Both Unity and Unreal Engine are powerful tools for game creation, and the solution provider should be able to advise on which engine is best suited for a particular game's vision and technical requirements.

Their familiarity with these engines ensures efficient development, optimal performance, and seamless blockchain integration in gaming. They understand how to leverage each engine's strengths to build visually appealing and functionally robust blockchain games. This proficiency helps in creating immersive experiences regardless of the chosen engine.

Future-Proofing: Blockchain Gaming Trends and Beyond

The best blockchain game development solutions stay current with blockchain gaming trends and future predictions. This feature means they are constantly researching and adapting to new technologies, evolving P2E models, and changes in player preferences. They can incorporate the latest innovations into their development process, ensuring the game remains relevant and competitive.

Staying ahead of these trends is crucial for longevity in the fast-paced blockchain gaming sector. Solutions that demonstrate foresight in areas like metaverse game development and cross-chain interoperability provide a significant advantage. This proactive approach ensures that the game is not only built well today but also positioned for success in the future.

Efficiency and Speed: White-Label Blockchain Game Development

For quicker market entry, look for solutions offering white-label blockchain game development. This feature provides pre-built, customizable game frameworks that can be rapidly deployed with unique branding and content. It significantly reduces development time and cost compared to building a game from scratch.

This option is ideal for businesses seeking an efficient way to launch a blockchain game or test a new market segment. Many top blockchain game developers for NFT games offer white-label solutions, allowing clients to benefit from established game structures while still delivering a unique experience to their audience. It's a practical and speedy route to launching a blockchain game.

Ready to build your next big blockchain game? Look for solutions with these essential features to ensure your project's success. Contact a trusted blockchain game development partner today to get started!

1 note

·

View note

Text

Demystifying Liquidity Provision, Farming, and Staking: A Practical Guide

The world of cryptocurrency can sometimes feel like stepping into a maze of complex terms and concepts. "Liquidity provision," "farming," and "staking" might sound intimidating at first, but these activities are more approachable than they seem. They’re not just buzzwords—they’re practical ways for you to make your crypto work for you.

In this article, I’ll break these concepts down, explain how they work, and show you why they matter, all in a way that’s relatable and easy to understand.

Liquidity Provision: Becoming the Market’s Backbone

Imagine you’re at a bustling farmer’s market. For the market to thrive, there needs to be a steady supply of goods for buyers and sellers to trade. In the crypto world, liquidity pools play the role of that marketplace. They’re stocked with two types of tokens, like ETH and USDT, allowing people to trade between them easily.

When you provide liquidity, you’re like a vendor stocking the market with your goods (tokens). In return for your contribution, you earn a share of the transaction fees every time someone trades.

It’s simple: you’re helping the system run smoothly, and you get paid for it. Platforms like STON.fi make it easy to get started with liquidity provision, offering a straightforward way to earn passive income.

Provide liquidity now

Farming: Extra Rewards for Supporting the System

Let’s take the farmer’s market analogy a step further. Imagine the market organizer thanks you for bringing in your goods by giving you bonus tokens as a reward. That’s essentially what farming is.

Once you provide liquidity, you receive LP (Liquidity Provider) tokens as proof of your contribution. By “farming,” you lock these LP tokens into a specific program to earn additional rewards.

For instance, a crypto project might incentivize farming by offering its native tokens as bonuses. The longer you stay in the farm, the more you earn. It’s like a loyalty program that rewards your commitment.

Farm tokens now

Staking: Locking Up for Long-Term Benefits

Now, let’s say you decide to deposit your earnings from the market into a savings account, locking it up for a fixed period in exchange for interest. That’s staking in a nutshell.

With staking, you lock your tokens into a network to support its operations, such as validating transactions or maintaining security. In return, you earn rewards over time.

Platforms like STON.fi offer unique incentives for staking, such as ARKENSTON (an NFT tied to your wallet) and GEMSTON (a token with governance rights). Staking not only rewards you but also allows you to play an active role in shaping the future of the platform.

Stake STON now

How They Work Together

Each of these activities serves a unique purpose:

1. Liquidity Provision: Keeps the trading system fluid and earns you transaction fees.

2. Farming: Boosts your rewards by incentivizing participation with bonus tokens.

3. Staking: Locks your assets for long-term benefits and deeper involvement in the platform’s ecosystem.

You don’t have to pick just one. Many crypto enthusiasts combine these strategies to diversify their earnings and maximize their participation in the ecosystem.

Why Should You Care

You might be wondering, “Why should I get involved?” The answer lies in both the opportunity to grow your crypto holdings and the chance to contribute to the larger vision of decentralized finance (DeFi).

Think of it this way: just like investing in stocks or real estate, liquidity provision, farming, and staking allow you to put your assets to work. The key difference? You’re actively participating in a financial revolution that’s reshaping how we interact with money.

While there are risks involved—such as token price fluctuations or smart contract vulnerabilities—the potential rewards can be worth it. It’s about balancing caution with opportunity and finding the strategies that suit your goals.

Making It Personal: Start Small, Learn, and Grow

Entering the world of liquidity provision, farming, and staking doesn’t require a massive investment or expert knowledge. It’s okay to start small, test the waters, and learn as you go.

For example, when I first tried liquidity provision, I treated it like learning a new skill. I started with a small amount, observed how the system worked, and gradually increased my participation as I gained confidence.

The same goes for farming and staking. Think of them as tools in your financial toolkit—each serving a specific purpose and working together to help you achieve your goals.

Liquidity provision, farming, and staking aren’t just technical terms—they’re opportunities. By understanding these concepts and using them wisely, you can grow your crypto holdings and actively participate in a transformative financial ecosystem.

If you’re new to crypto, don’t let the jargon scare you away. Start with what you’re comfortable with, stay curious, and remember that every small step you take adds up.

What’s your experience with liquidity provision, farming, or staking? I’d love to hear your thoughts and answer any questions you might have. Let’s navigate this journey together!

4 notes

·

View notes

Text

The Different Types of NFT’s You Should Know About

NFTs (Non-Fungible Tokens) are unique digital items stored on a blockchain, proving ownership of assets like digital art, in-game items, or virtual land. Unlike cryptocurrencies, NFTs cannot be exchanged for identical items. They are valuable due to their uniqueness, limited supply, and secure ownership records. NFTs are popular in art, gaming, and virtual real estate. As the NFT gaming industry grows, companies like Q99 Studio in India are creating games that allow players to buy, sell, and earn NFTs, helping expand the market and offer new opportunities for creators and gamers.

#nft game development#nft games#game developers#game development#unity game development#hire game developers#mobile games#nft#game development services#mobile game development#game development company

2 notes

·

View notes

Text

Top Use Cases of DeFi Beyond Lending and Trading

When most people think about DeFi (Decentralized Finance), lending protocols like Aave and trading platforms like Uniswap immediately come to mind. While these applications have certainly captured the spotlight and billions in total value locked (TVL), the DeFi ecosystem extends far beyond these familiar use cases. As DeFi development continues to evolve, innovative applications are emerging that showcase the true transformative potential of blockchain technology.

Let's explore some fascinating DeFi use cases that are quietly revolutionizing how we think about finance, ownership, and economic participation.

1. Decentralized Insurance Protocols

Traditional insurance relies on centralized companies that often have lengthy claim processes and high overhead costs. DeFi development has introduced parametric insurance protocols that automate claim payouts based on predefined conditions.

Platforms like Nexus Mutual and InsureDAO allow users to purchase coverage for smart contract failures, exchange hacks, or even weather-related events for farmers. What makes this revolutionary is that claims are processed automatically through smart contracts when specific conditions are met – no paperwork, no waiting for approval from insurance adjusters.

For example, a farmer can purchase crop insurance that automatically pays out if rainfall data from verified weather oracles shows drought conditions in their area. This level of automation and transparency simply isn't possible with traditional insurance models.

2. Prediction Markets and Information Discovery

Prediction markets have existed for centuries, but DeFi development has made them more accessible and transparent than ever before. Platforms like Augur and Polymarket allow users to bet on the outcome of real-world events, from election results to sports outcomes.

But here's where it gets interesting: these markets often provide more accurate predictions than traditional polling or expert opinions. When people have financial skin in the game, they tend to research more thoroughly and make more informed decisions. This creates a powerful mechanism for information discovery and consensus-building around uncertain future events.

During the 2020 US elections, prediction markets often provided more accurate odds than traditional polls, demonstrating the wisdom of crowds when properly incentivized.

3. Decentralized Autonomous Organizations (DAOs)

DAOs represent one of the most fascinating applications of DeFi development, enabling completely new forms of organizational structure and governance. These are organizations where decision-making is distributed among token holders rather than centralized in a board of directors.

Popular DAOs like MakerDAO govern multi-billion dollar protocols, while others like PleasrDAO collectively purchase and manage expensive NFTs or intellectual property. Some DAOs focus on funding public goods, others on venture capital investments, and some on social causes.

What's remarkable is how DAOs enable global coordination without traditional corporate structures. A DAO might have thousands of members across dozens of countries, all participating in governance decisions through transparent, on-chain voting mechanisms.

4. Yield Farming and Liquidity Mining

While related to lending and trading, yield farming represents a distinct use case that's worth highlighting. DeFi development has created sophisticated strategies where users can earn returns by providing liquidity to various protocols, often earning multiple types of rewards simultaneously.

Yield farmers might deposit stablecoins into a lending protocol, receive interest plus governance tokens, then stake those governance tokens for additional rewards, and potentially use the deposit receipts as collateral for further strategies. This creates complex but potentially lucrative earning opportunities that simply don't exist in traditional finance.

The psychological appeal is similar to playing a strategy game, but with real financial rewards. It's turned passive investing into an active, engaging experience for many users.

5. Decentralized Identity and Reputation Systems

DeFi development is pioneering new approaches to digital identity that don't rely on centralized authorities. Protocols like Bright ID and Gitcoin Passport create reputation systems based on on-chain activity and social graphs.

These systems enable what's called "progressive decentralization" – users can access better rates, higher borrowing limits, or exclusive opportunities based on their demonstrated on-chain reputation rather than traditional credit scores or Know Your Customer (KYC) processes.

Imagine being able to prove your creditworthiness globally, instantly, and privately, without relying on credit bureaus or banks. That's the promise of decentralized identity systems.

6. Synthetic Assets and Derivatives

DeFi development has enabled the creation of synthetic assets that track the price of real-world assets without requiring direct ownership. Protocols like Synthetix allow users to gain exposure to gold, oil, foreign currencies, or even stock indices, all through blockchain-based tokens.

This is particularly powerful for users in countries with capital controls or limited access to global markets. A user in a developing country can gain exposure to the S&P 500 or gold prices without needing traditional brokerage accounts or navigating complex international banking systems.

7. Decentralized Streaming and Creator Economy

Platforms like Livepeer (decentralized video streaming) and Mirror (decentralized publishing) are using DeFi principles to create new creator economy models. Creators can tokenize their work, allowing fans to directly invest in their success through creator tokens or NFTs.

This creates more direct relationships between creators and their audiences, potentially disrupting traditional media and entertainment industry models. A musician might issue tokens that give holders access to exclusive content, merchandise discounts, or even revenue sharing from future albums.

The Future of DeFi Development

These diverse use cases demonstrate that DeFi development is about much more than replacing traditional banking services. It's about creating entirely new economic primitives and social coordination mechanisms that weren't possible before blockchain technology.

As DeFi development continues to mature, we can expect to see even more innovative applications emerge. The key insight is that DeFi isn't just digitizing existing financial services – it's enabling completely new forms of economic interaction and value creation.

The most exciting part? We're still in the early stages. As more developers, users, and capital flow into the space, the potential for innovative DeFi applications seems limitless. Whether you're a developer, investor, or simply curious about the future of finance, keeping an eye on these emerging use cases will help you understand where the industry is heading.

The question isn't whether DeFi will continue to expand beyond lending and trading – it's what new possibilities will emerge next.

#gaming#mobile game development#multiplayer games#metaverse#nft#blockchain#vr games#game#unity game development

1 note

·

View note

Text

Cryptocurrency and Blockchain in 2025: The Future of Digital Assets and Investing

Meta Description:

Explore the world of cryptocurrency and blockchain in 2025. Learn how cryptocurrency investing, crypto wallets, and blockchain technology are shaping the future of digital assets.

Introduction: The Rise of Cryptocurrency and Blockchain in 2025

In 2025, cryptocurrency and blockchain technology are no longer niche trends—they’re mainstream financial tools shaping how we invest, transact, and store value. Whether you're new to cryptocurrency investing or a seasoned trader, understanding the role of crypto wallets, decentralized finance (DeFi), and digital assets is critical in today’s evolving financial landscape.

This article breaks down the essentials of crypto and blockchain for beginners and investors who want to stay ahead.

What Is Cryptocurrency?

Cryptocurrency is a digital or virtual currency secured by cryptography, making it nearly impossible to counterfeit or double-spend. Unlike traditional currencies issued by governments, cryptocurrencies are decentralized and operate on blockchain technology.

Popular Cryptocurrencies in 2025:

Bitcoin (BTC) – Digital gold and the original cryptocurrency

Ethereum (ETH) – Powering smart contracts and DeFi apps

Solana (SOL) – Fast and scalable blockchain network

Ripple (XRP) – Optimized for cross-border payments

What Is Blockchain Technology?

Blockchain technology is the backbone of cryptocurrency. It’s a decentralized, immutable ledger that records transactions across a distributed network of computers.

Key Features of Blockchain:

Transparency – Every transaction is publicly verified

Security – Data is cryptographically protected and nearly tamper-proof

Decentralization – No central authority controls the network

Smart Contracts – Self-executing contracts with terms written into code

Use Cases Beyond Crypto:

Supply chain tracking

Digital identity verification

Voting systems

Healthcare records

NFTs (non-fungible tokens)

Cryptocurrency Investing in 2025

Cryptocurrency investing continues to grow in popularity due to the potential for high returns and portfolio diversification. But it also comes with high volatility and regulatory risks.

Ways to Invest in Cryptocurrency:

Buy and Hold (HODL) – Purchase coins and hold them long-term

Trading – Buy low, sell high using short-term strategies

Staking – Earn rewards by locking your crypto to support blockchain operations

DeFi Yield Farming – Provide liquidity and earn interest in decentralized finance apps

Crypto ETFs – Traditional funds that track crypto markets

Tip: Always do your research (DYOR) before investing in any digital asset.

Crypto Wallets: Secure Your Digital Assets

A crypto wallet is essential for storing and managing your cryptocurrencies.

Types of Crypto Wallets:

Hot Wallets (online): Fast access, less secure (e.g., MetaMask, Trust Wallet)

Cold Wallets (offline): Highly secure, ideal for long-term storage (e.g., Ledger, Trezor)

Best Practices:

Use cold wallets for large amounts

Enable 2FA and strong passwords

Keep recovery phrases private and offline

Why Digital Assets Are Here to Stay

Digital assets include cryptocurrencies, NFTs, stablecoins, and tokenized real-world assets. In 2025, more institutions, hedge funds, and governments are exploring or integrating digital assets for their efficiency, transparency, and global accessibility.

Benefits of Digital Assets:

Borderless transactions

Low transaction fees

Ownership transparency

24/7 markets

Risks and Considerations

While cryptocurrency and blockchain offer many advantages, be aware of these challenges:

Volatility – Prices can fluctuate wildly

Regulatory Uncertainty – New laws may impact markets

Scams and Hacks – Fraudulent tokens and phishing attacks are still common

Lack of Insurance – Most wallets and exchanges are not FDIC insured

Always invest only what you can afford to lose and diversify your portfolio.

Need Personal Or Business Funding? Prestige Business Financial Services LLC offer over 30 Personal and Business Funding options to include good and bad credit options. Get Personal Loans up to $100K or 0% Business Lines of Credit Up To $250K. Also Enhanced Credit Repair ($249 Per Month) and Passive income programs (Can Make 5-10% Per Month; Trade $100K of Someone Esles Money).

Book A Free Consult And We Can Help - https://prestigebusinessfinancialservices.com

Email - [email protected]

Final Thoughts: Embrace the Future with Knowledge

Cryptocurrency and blockchain represent a revolutionary shift in the financial world. By learning how cryptocurrency investing, crypto wallets, and digital assets work, you can better navigate the future of finance.

As technology and adoption continue to evolve, staying informed is your greatest asset. The time to learn and participate in the blockchain economy is now.

Need Personal Or Business Funding? Prestige Business Financial Services LLC offer over 30 Personal and Business Funding options to include good and bad credit options. Get Personal Loans up to $100K or 0% Business Lines of Credit Up To $250K. Also Enhanced Credit Repair ($249 Per Month) and Passive income programs (Can Make 5-10% Per Month; Trade $100K of Someone Esles Money).

Book A Free Consult And We Can Help - https://prestigebusinessfinancialservices.com

Email - [email protected]

Learn More:

Prestige Business Financial Services LLC

"Your One Stop Shop To All Your Personal And Business Funding Needs"

Website- https://prestigebusinessfinancialservices.com

Email - [email protected]

Phone- 1-800-622-0453

#cryptocurrency and blockchain#cryptocurrency investing#blockchain technology#crypto wallets#digital assets#entrepreneur#personal finance#personal loans#personalfunding

1 note

·

View note

Text

Demystifying Liquidity Provision, Farming, and Staking: A Practical Guide

The world of cryptocurrency can sometimes feel like stepping into a maze of complex terms and concepts. "Liquidity provision," "farming," and "staking" might sound intimidating at first, but these activities are more approachable than they seem. They’re not just buzzwords—they’re practical ways for you to make your crypto work for you.

In this article, I’ll break these concepts down, explain how they work, and show you why they matter, all in a way that’s relatable and easy to understand.

Liquidity Provision: Becoming the Market’s Backbone

Imagine you’re at a bustling farmer’s market. For the market to thrive, there needs to be a steady supply of goods for buyers and sellers to trade. In the crypto world, liquidity pools play the role of that marketplace. They’re stocked with two types of tokens, like ETH and USDT, allowing people to trade between them easily.

When you provide liquidity, you’re like a vendor stocking the market with your goods (tokens). In return for your contribution, you earn a share of the transaction fees every time someone trades.

It’s simple: you’re helping the system run smoothly, and you get paid for it. Platforms like STON.fi make it easy to get started with liquidity provision, offering a straightforward way to earn passive income.

Farming: Extra Rewards for Supporting the System

Let’s take the farmer’s market analogy a step further. Imagine the market organizer thanks you for bringing in your goods by giving you bonus tokens as a reward. That’s essentially what farming is.

Once you provide liquidity, you receive LP (Liquidity Provider) tokens as proof of your contribution. By “farming,” you lock these LP tokens into a specific program to earn additional rewards.

For instance, a crypto project might incentivize farming by offering its native tokens as bonuses. The longer you stay in the farm, the more you earn. It’s like a loyalty program that rewards your commitment.

Staking: Locking Up for Long-Term Benefits

Now, let’s say you decide to deposit your earnings from the market into a savings account, locking it up for a fixed period in exchange for interest. That’s staking in a nutshell.

With staking, you lock your tokens into a network to support its operations, such as validating transactions or maintaining security. In return, you earn rewards over time.

Platforms like STON.fi offer unique incentives for staking, such as ARKENSTON (an NFT tied to your wallet) and GEMSTON (a token with governance rights). Staking not only rewards you but also allows you to play an active role in shaping the future of the platform.

How They Work Together

Each of these activities serves a unique purpose:

1. Liquidity Provision: Keeps the trading system fluid and earns you transaction fees.

2. Farming: Boosts your rewards by incentivizing participation with bonus tokens.

3. Staking: Locks your assets for long-term benefits and deeper involvement in the platform’s ecosystem.