#types of engulfing candlestick pattern

Explore tagged Tumblr posts

Text

How to Trade with Engulfing Candlestick Patterns

Engulfing Candlestick Patterns are a type of chart pattern used in technical analysis to predict market trends. They occur when a larger candlestick completely covers or “engulfs” the previous smaller one, signalling a potential reversal in price direction. There are two types of engulfing candlestick patterns, i.e., bullish engulfing pattern and bearish engulfing pattern. These patterns are a useful tool in determining entry and exit points for trade or understanding the market behaviour to make informed portfolio decisions.

Types of Engulfing Candlestick Patterns

How to Trade Using Engulfing Candlestick Patterns

Pros and Cons of Bullish Engulfing Candlestick Pattern

Pros and Cons of Bearish Engulfing Candlestick Pattern

#engulfing candlestick#types of engulfing candlestick pattern#bullish engulfing candlestick#bearish engulfing candlestick pattern

0 notes

Text

What is Candlestick Pattern? A Complete Guide for Traders

In the world of stock market trading, understanding price movements is crucial for making informed decisions. One of the most popular tools that traders rely on is the candlestick pattern. These patterns are a visual representation of price action and provide valuable insights into market sentiment.

Whether you’re a beginner or an experienced trader, learning about candlestick patterns can significantly improve your ability to predict price movements and enhance your trading strategy.

What is a Candlestick Pattern?

A candlestick pattern is a type of price chart used in technical analysis that displays the high, low, open, and close prices of a security for a specific period. Each candlestick consists of:

Body: Shows the difference between the opening and closing prices.

Wick (or Shadow): Represents the high and low prices during the period.

Color: Typically, a green (or white) body indicates a price increase, while a red (or black) body indicates a price decrease.

These candlesticks, when combined, form patterns that can signal potential reversals or continuations in market trends.

Why Are Candlestick Patterns Important?

Candlestick patterns are essential because they:

Help identify market trends and momentum. Provide early warning signals for trend reversals. Assist traders in making buy or sell decisions. Work effectively across various markets, including stocks, forex, and cryptocurrencies.

By analyzing these patterns, traders can understand market psychology and position themselves accordingly.

Popular Types of Candlestick Patterns

1. Bullish Patterns

These indicate a potential upward price movement.

Hammer: A small body with a long lower wick, suggesting buyers are regaining control.

Bullish Engulfing: A large green candle engulfs the previous red candle, signaling strong buying pressure.

Morning Star: A three-candle pattern indicating the end of a downtrend.

2. Bearish Patterns

These signal a possible downward movement.

Shooting Star: A small body with a long upper wick, showing sellers are gaining strength.

Bearish Engulfing: A large red candle engulfs the previous green candle, signaling selling pressure.

Evening Star: A reversal pattern at the end of an uptrend.

How to Use Candlestick Patterns in Trading?

To use candlestick patterns effectively:

Combine with Indicators: Use RSI, MACD, or moving averages for confirmation.

Understand Context: Patterns work best when analyzed within broader market trends.

Avoid False Signals: Don’t rely solely on one pattern; look for multiple confirmations.

Practice Risk Management: Always set stop-loss orders to limit potential losses.

Advantages of Candlestick Patterns

Easy to understand and visually intuitive Provide clear signals for entry and exit points Applicable across timeframes (intraday, swing, or positional trading) Offer insights into market psychology

Limitations to Keep in Mind

Candlestick patterns are not foolproof and may produce false signals. They should not be used in isolation but combined with other technical tools. News events and market volatility can override pattern predictions.

Conclusion

Candlestick patterns are powerful tools for traders seeking to decode market movements. By learning and applying these patterns wisely, you can gain a deeper understanding of price behavior and improve your trading outcomes.

0 notes

Text

How to Read Stock Charts for Beginners?

If you’re new to investing, learning how to read stock charts for beginners can feel like deciphering a foreign language. But don’t worry—it’s easier than it looks. Stock charts are powerful tools that help you understand market trends, spot opportunities, and make smarter investment decisions. Whether you're a casual trader or planning long-term investments, mastering the basics of stock charts is the first step toward building confidence and growing your portfolio.

How to Read Stock Charts for Beginners – Understanding the Basics

Stock charts visually show a stock's price over time. They allow investors to track price movements, trading volume, and patterns that can help predict future performance.

The most common types of stock charts include:

Line charts – Simple and clean, showing the closing prices over a set period.

Bar charts – Display opening, closing, high, and low prices for each time unit.

Candlestick charts – Popular among traders, offering visual cues with color-coded bars.

Key Components of a Stock Chart

1. Price and Time Axes

Stock charts usually have time on the horizontal (X) axis and price on the vertical (Y) axis. This setup shows how the stock's price changes over days, weeks, or months.

2. Volume Bars

Volume bars appear at the bottom of most charts. They show how many shares were traded during a specific period. High volume often means strong interest or big news.

3. Moving Averages

Moving averages smooth out price data over a certain period, helping you spot trends.

Simple Moving Average (SMA): The average price over a defined time (e.g., 50-day SMA).

Exponential Moving Average (EMA): Gives more weight to recent prices.

Reading Candlestick Charts

Candlestick charts are ideal for beginners who want more detail in a visual format. Each candlestick represents one period (like a day) and shows:

Open and Close: The “body” of the candle.

High and Low: The “wicks” or “shadows” above and below the body.

Color: Green means the stock closed higher than it opened; red means it closed lower.

Recognizing common candlestick patterns—like dojis, hammers, and engulfing candles—can help forecast market behavior.

Identifying Trends and Patterns

Understanding trends can help you determine when to buy or sell.

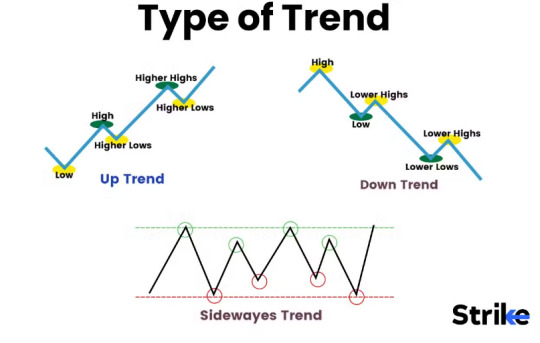

Types of Market Trends

Uptrend: A series of higher highs and higher lows.

Downtrend: A series of lower highs and lower lows.

Sideways/Flat: Little movement in either direction.

Common Chart Patterns

Head and Shoulders: Indicates potential trend reversal.

Double Top/Bottom: Suggests strong support or resistance.

Flags and Pennants: Short-term continuation patterns.

Practical Tips for Beginners

Keep It Simple

Start with line or candlestick charts and focus on one stock at a time.

Combine Charts with Research

Charts are helpful, but always consider news, earnings reports, and broader market conditions.

Use Reliable Tools

Many platforms offer beginner-friendly charting tools. For a helpful resource on getting started, check out this complete beginner’s guide on how to read stock charts.

📊 Final Thoughts + CTA

Learning how to read stock charts for beginners doesn’t have to be overwhelming. By focusing on basic chart types, understanding key components, and recognizing simple patterns, you’ll gain the confidence to analyze stocks like a pro.

1 note

·

View note

Text

Types of Candlestick Patterns Explained Simply

Types of Candlestick Patterns: A Beginner-Friendly Guide

Have you ever looked at a stock chart and felt like it was speaking a foreign language? Those little red and green bars—known as candlesticks—aren’t just random shapes. They tell stories. Stories of fear, greed, hesitation, and opportunity. If you've ever wished to understand those stories, you're in the right place.

In this article, we’re going to explore the types of candlestick patterns in a way that’s easy to grasp, even if you're brand new to trading. Think of candlestick patterns like emojis—small symbols packed with emotional context. Just as means happiness, a Hammer candlestick might signal a bullish reversal.

Explore types of candlestick patterns in simple terms. A complete guide to all types of candlestick patterns for beginners and curious traders.

Introduction to Candlestick Patterns

Candlestick patterns are visual tools used in stock trading to predict potential price movements. Each candlestick shows four key details: the opening price, closing price, highest price, and lowest price for a specific time frame.

These patterns originated in 18th-century Japan—yes, that far back!—when rice traders used them to predict future prices.

Why Candlestick Patterns Matter

Understanding candlestick patterns is like learning to read body language. While price tells you what happened, candlesticks hint at why. Are traders getting scared? Is there confidence building up? Candlestick patterns provide these answers through easy-to-spot formations.

Single Candlestick Patterns

Let’s begin with the simplest types. These involve only one candlestick and are often the first step for beginners.

The Hammer & Hanging Man

These two look nearly identical but mean very different things.

Hammer: Appears at the bottom of a downtrend. Think of it as the market “hammering out” a bottom. It has a small body and a long lower shadow.

Hanging Man: Shows up after an uptrend. Same shape as the hammer but signals a potential drop in price.

Tip: The color of the body isn’t as important as the position and size of the shadow.

Doji – The Market's Pause Button

The Doji is like a moment of hesitation. The opening and closing prices are nearly the same, forming a tiny body.

Types of Doji:

Neutral Doji: Price goes up and down, but ends unchanged.

Long-legged Doji: Large wicks on both sides, signaling major indecision.

Gravestone Doji: Looks like an upside-down “T” and suggests bearish pressure.

Dragonfly Doji: Resembles a “T” and may signal bullish strength.

Spinning Top – Indecision Alert

A Spinning Top has a small body and long upper and lower shadows. It signals that buyers and sellers fought hard but neither won.

It usually shows up during a trend and indicates a possible reversal or slowdown.

Marubozu – Full of Confidence

This candlestick has no shadows—just a solid body.

Bullish Marubozu: Opens at the low and closes at the high. Total buyer control.

Bearish Marubozu: Opens at the high and closes at the low. Total seller control.

Think of it like someone shouting, “I’m all in!” without hesitation.

Engulfing Patterns – Power Shifts

These are two-candlestick patterns that reflect changing momentum.

Bullish Engulfing: A small red candle followed by a large green one that "engulfs" it. Suggests a reversal to the upside.

Bearish Engulfing: Opposite of the above, often indicating a drop ahead.

Morning Star & Evening Star

These are three-candle patterns that often signal major turning points.

Morning Star: Appears after a downtrend. A long red candle, then a small one (any color), followed by a strong green candle. Signals a bullish reversal.

Evening Star: The bearish cousin. Appears after an uptrend.

Three White Soldiers & Three Black Crows

These are sequences of three strong candles.

Three White Soldiers: Three long green candles in a row. Very bullish.

Three Black Crows: Three long red candles. Very bearish.

These patterns indicate strong sentiment, either positive or negative.

Harami – Inside Moves

The Harami pattern looks like a small candle hiding inside a larger one.

Bullish Harami: Small green candle inside a large red one. Signals a possible reversal upward.

Bearish Harami: Small red inside a green. Signals a potential downturn.

Piercing Line & Dark Cloud Cover

These two-candle patterns are also all about reversal signals.

Piercing Line: A red candle followed by a green one that opens lower but closes past the midpoint of the previous red. Bullish sign.

Dark Cloud Cover: The opposite. Bearish sentiment taking over.

Tweezer Tops and Bottoms

Tweezer Top: Two or more candles with identical highs. Suggests price resistance and a possible drop.

Tweezer Bottom: Identical lows over two or more candles. Suggests price support and possible rise.

Think of tweezers picking the top or bottom out of a price trend.

How to Read Candlestick Patterns Together

One candle alone doesn't tell the full story. It's like reading just one sentence of a novel. To truly understand the plot, you need context. Combine patterns with:

Volume

Trend direction

Support and resistance levels

Tips for Using Candlestick Patterns Effectively

Don’t trade patterns in isolation. Always confirm with other indicators.

Practice makes perfect. Use demo accounts to test your pattern-reading skills.

Stay patient. Candlestick patterns are signals, not guarantees.

Conclusion

Candlestick patterns are like the facial expressions of the stock market. They give you hints, nudges, and sometimes loud warnings about what might happen next. Whether you’re just curious or planning to dive deeper into trading, understanding these patterns will help you navigate the charts with confidence.

Remember, while this article covers all types of candlestick patterns, experience and context make all the difference in using them effectively.

FAQs

What are candlestick patterns in simple terms? Candlestick patterns are visual tools on price charts that show how a stock's price moves during a certain period, helping predict future movements.

How many types of candlestick patterns are there? There are over 30 commonly used candlestick patterns, including single, double, and triple candlestick formations.

Are candlestick patterns reliable for trading? They can be helpful indicators but should always be used with other tools like volume and trend analysis for accuracy.

What is the most bullish candlestick pattern? The “Morning Star” and “Three White Soldiers” are among the most bullish, often indicating a strong reversal to the upside.

Can I use candlestick patterns in all markets? Yes! These patterns work in stocks, forex, commodities, and crypto markets, thanks to their universal price action behavior.

#types of candlestick patterns#all types of candlestick patterns#types of candlesticks#types of candlesticks and their meaning

0 notes

Link

#CandlestickFormations#candlestickpatterns#chartpatterns#ForexTrading#marketpsychology#MarketSentiment#MomentumTrading#priceaction#riskmanagement#StockMarket#supportandresistance#technicalanalysis#TradingSignals#TradingStrategy#TrendReversals

0 notes

Text

Best Crypto Charts for Traders in 2025 📊📈

Crypto traders know that reading price movements is key to making informed decisions. Whether you're a beginner or a seasoned trader, using the best crypto charts in 2025 can help you analyze trends, predict market shifts, and optimize your strategy.

🔍 What Are Crypto Charts?

Crypto charts are visual tools that display cryptocurrency price movements over time. They help traders identify trends, spot potential entry/exit points, and refine their trading strategies.

Among the different chart types, candlestick charts are the most popular due to their detailed price representation. Let’s explore some of the best charting platforms available for 2025.

📊 Best Crypto Charting Tools for 2025

🔥 TradingView – The Market Leader

One of the most popular platforms, TradingView offers both free and premium plans, supporting crypto, stocks, forex, and more. It provides customizable charts with 12+ formats and an active trading community to share strategies.

⚡ Bitbo – Bitcoin Specialists

For those focused on Bitcoin trading, Bitbo delivers 90+ Bitcoin price projection & on-chain charts, along with custom alerts and premium analysis tools.

📉 Coinigy – Advanced Crypto Trading

Coinigy is a powerful option that connects to 45+ exchanges, including DeFi platforms. It features AES 256-bit encryption for security and is ideal for portfolio tracking & trade execution.

📈 GoCharting – Multi-Asset Support

GoCharting offers 15+ chart formats, including candlestick, OHLC, and Renko. It’s great for traders involved in US & Indian markets, with extra features like paper trading & an educational academy.

🔄 CryptoView – Integrated Trading & Analytics

CryptoView is designed for serious traders, powered by TradingView charts. It supports multi-screen setups, portfolio sharing, and enterprise-grade security with API encryption.

📖 How to Read Crypto Candlestick Charts

Candlestick charts are the most widely used crypto chart format because they show detailed price changes over a specific timeframe.

Each candlestick consists of:

Open price – the starting value of a crypto asset

High price – the peak value within the timeframe

Low price – the lowest value in that period

Close price – the final value before a new candlestick begins

📊 Understanding Candlestick Colors

🟢 Green Candle = Price closed higher than it opened (Bullish)

🔴 Red Candle = Price closed lower than it opened (Bearish)

📏 Analyzing Wick & Body Lengths

Long bodies → Strong trend (bullish or bearish)

Short bodies → Possible market indecision

Long wicks → Price volatility

Short wicks → Price stability

📌 Recognizing Crypto Chart Patterns

Bullish Patterns (Uptrend Signals)

Bullish Engulfing → Large green candle overtakes a smaller red candle

Rising Three → Three small red candles followed by a large green candle

Bullish Harami → Small green candle inside a larger red candle

Bearish Patterns (Downtrend Signals)

Bearish Engulfing → Large red candle overtakes a smaller green candle

Shooting Star → Long upper wick, small lower body (indicating reversal)

Bearish Harami → Small red candle inside a larger green candle

🛠 Alternative Crypto Analysis Methods

Besides candlestick charts, traders also use: ✅ Fundamental Analysis – Evaluates a crypto project’s whitepaper, team, partnerships, and market adoption ✅ On-Chain Analysis – Uses blockchain data to assess market sentiment and investor behavior ✅ Sentiment Analysis – Tracks social media trends & market psychology

🚀 Final Thoughts

Mastering crypto charts and analysis is crucial for making smarter trading decisions. Whether you use TradingView, Bitbo, Coinigy, GoCharting, or CryptoView, selecting the right charting tool can help you track trends and develop winning strategies.

What’s your go-to crypto charting tool? Let’s discuss! ⬇️💬

0 notes

Text

Master Technical Analysis: Your Guide to the Indian Stock Market

Navigating the Indian stock market can feel overwhelming. With thousands of stocks and constant fluctuations, how do you make informed decisions? Technical analysis offers a way to understand market movements through charts and indicators. This guide will help you get a grip on the essentials of technical analysis, making it easier to trade wisely.

The Allure and Challenges of the Indian Stock Market

The Indian stock market has its own excitement. Investors are drawn to the potential for great returns. However, with opportunity comes risk. The market is volatile, and prices can change quickly. Understanding the tools available can help traders to manage that risk effectively.

Why Technical Analysis is Crucial for Indian Traders

Technical analysis simplifies the process of Stock Marketing Trading. It focuses on price movements and volume rather than company fundamentals. By studying price charts and patterns, traders can make predictions about future market behavior. This method helps reduce emotional decision-making and allows for a more disciplined approach.

Setting the Stage: What This Guide Covers

This guide covers key aspects of technical analysis, including:

Chart Patterns

Technical Indicators

Candlestick Patterns

Risk Management

Advanced Techniques

Each section aims to provide clear insights and actionable strategies for traders in the Indian market.

Chart Patterns: Deciphering Market Signals

Identifying Trend Reversals: Head and Shoulders, Double Tops/Bottoms

Chart patterns are graphical representations of price movements. Recognizing these patterns can signal potential trend reversals:

Head and Shoulders: Indicates a reversal from bullish to bearish.

Double Tops: Signals a peak before a downward trend.

Double Bottoms: Suggests a potential upward movement.

Spotting Continuation Patterns: Flags, Pennants, Wedges

Continuation patterns suggest that a trend will continue. Key patterns to watch include:

Flags: Short-term consolidation before a continuation.

Pennants: Small symmetrical triangles after a sharp price movement.

Wedges: Indicates a potential reversal in a strong trend.

Practical Application: Real-world examples of pattern recognition in Indian stocks

For example, if an Indian stock like Reliance Industries shows a head and shoulders pattern, it might indicate a shift from a bullish trend to a bearish one, guiding traders to adjust their positions accordingly.

Technical Indicators: Unveiling Market Momentum

Moving Averages: Simple, Exponential, Weighted – Explained

Moving averages smooth out price data to identify trends over a specific period. Key types:

Simple Moving Average (SMA): Averages prices over a set time.

Exponential Moving Average (EMA): Gives more weight to recent prices.

Weighted Moving Average (WMA): Assigns different weights to prices based on their age.

Relative Strength Index (RSI): Gauging Market Strength and Weakness

The RSI is a momentum oscillator that ranges from 0 to 100. It helps traders spot overbought or oversold conditions:

Above 70: Indicates overbought conditions.

Below 30: Suggests oversold conditions.

MACD: Identifying Momentum Shifts and Potential Trading Signals

The Moving Average Convergence Divergence (MACD) can identify shifts in momentum. When the MACD line crosses above the signal line, it may indicate a buy signal, and vice versa.

Candlestick Patterns: Unlocking Price Action Insights

Understanding Candlestick Formation and Interpretation

Candlestick charts provide visual insights into price movements. Each candle shows the open, close, high, and low prices for a specific time period.

Powerful Candlestick Patterns: Doji, Hammer, Engulfing Patterns

Some key candlestick patterns include:

Doji: Indicates indecision in the market.

Hammer: Suggests potential bullish reversal.

Engulfing Patterns: Signals strong shifts in market sentiment.

Combining Candlestick Patterns with Indicators for Enhanced Accuracy

By pairing candlestick patterns with indicators like RSI or MACD, traders can enhance their analysis and improve trade accuracy.

Risk Management and Position Sizing in the Indian Context

Defining Your Risk Tolerance and Setting Stop-Loss Orders

Understanding personal risk tolerance is crucial. Setting stop-loss orders helps limit potential losses. For example, if a trader is willing to risk 2% of their portfolio on a trade, they should set a stop-loss accordingly.

Position Sizing Strategies for Indian Stock Market Trading

Calculating position sizes based on risk tolerance aids better capital management. A common method is the fixed percentage approach, allowing traders to determine how much to invest in each trade.

Adapting Risk Management to the Unique Characteristics of Indian Markets

Consider the high volatility in Indian stocks. Adjust risk management practices to protect capital during price swings.

Advanced Technical Analysis Techniques

Fibonacci Retracements and Extensions: Identifying Support and Resistance Levels

Fibonacci levels are used to identify potential retracement levels. Traders often look for support or resistance at these levels during price corrections.

Elliott Wave Theory: Understanding Market Cycles and Trends

Elliott Wave Theory suggests markets move in predictable cycles. Identifying these waves helps traders anticipate future price movements.

Combining Multiple Techniques for Comprehensive Market Analysis

Using multiple technical analysis tools together provides a fuller picture. For instance, analyzing chart patterns alongside indicators can enhance trading decisions.

Conclusion: Mastering Technical Analysis for Sustainable Success

Key Takeaways: Actionable Steps for Indian Stock Market Traders

Focus on mastering chart patterns and technical indicators.

Incorporate risk management strategies tailored to the Indian market.

Continuously learn and adapt to market changes.

Continuous Learning and Adaptation in the Dynamic Indian Market

The Indian stock market is ever-changing. Stay updated with market trends and refine your strategies regularly.

Resources for Further Learning and Development

Books, online courses, and webinars can enhance your understanding. Explore resources like financial news platforms, stock market blogs, and trading forums to continue your education in technical analysis.

By mastering technical analysis, you position yourself for success in the dynamic Indian stock market. Embrace the tools and strategies outlined in this guide to make informed trading decisions. Start analyzing today!

0 notes

Text

Candlestick Patterns and Their Role in Trading

In the world of trading, understanding and predicting market movements is crucial for success. Among the various tools available to traders, candlestick patterns stand out as one of the most powerful and widely used methods for technical analysis. Candlestick patterns not only help traders anticipate market trends but also offer valuable insights into the psychology of market participants. This article delves into what candlestick patterns are, their significance in trading, and how traders can use them to make more informed decisions.

What Are Candlestick Patterns?

Candlestick patterns are a type of chart pattern that originated in Japan in the 18th century. They were first used by Japanese rice traders to track and predict price movements. Over time, these patterns gained popularity in the Western world and have become an essential tool for modern traders.

Each candlestick on a chart represents the price movement for a specific time frame, such as one minute, one hour, or one day. A single candlestick is composed of four key pieces of information:

Open Price – The price at which the trading period started.

Close Price – The price at which the trading period ended.

High Price – The highest price reached during the trading period.

Low Price – The lowest price reached during the trading period.

The body of the candlestick (the rectangular part) shows the range between the open and close prices, while the thin lines above and below (called wicks or shadows) represent the high and low prices.

Bullish vs. Bearish Candlesticks

Bullish Candlestick: Indicates that the closing price is higher than the opening price. It’s often colored green or white and signifies upward price movement.

Bearish Candlestick: Indicates that the closing price is lower than the opening price. It’s often colored red or black and signifies downward price movement.

Understanding how to read individual candlesticks is the foundation for recognizing more complex candlestick patterns.

Why Are Candlestick Patterns Important?

Candlestick patterns provide valuable insights into market sentiment and potential future price movements. Unlike other technical indicators that rely on calculations and formulas, candlestick patterns offer a visual representation of the battle between buyers and sellers.

These patterns can:

Identify market reversals: Some patterns signal that a trend may be about to reverse direction.

Confirm existing trends: Others confirm the continuation of an ongoing trend.

Provide entry and exit points: Candlestick patterns help traders time their trades effectively.

Enhance decision-making: By understanding market psychology, traders can make more informed decisions.

Popular Candlestick Patterns Every Trader Should Know

There are numerous candlestick patterns, but some are more reliable and commonly used than others. These patterns can be broadly classified into two categories: reversal patterns and continuation patterns.

Reversal Patterns

Reversal patterns indicate a potential change in the current trend direction.

Hammer

Description: A single candlestick with a small body and a long lower wick.

Significance: Appears at the bottom of a downtrend, signaling a potential reversal to the upside.

Example: A hammer indicates that sellers pushed the price lower during the session, but buyers regained control before the close.

Shooting Star

Description: A single candlestick with a small body and a long upper wick.

Significance: Appears at the top of an uptrend, indicating a potential reversal to the downside.

Engulfing Pattern

Bullish Engulfing: A larger green candlestick completely engulfs the previous red candlestick, signaling a potential upward reversal.

Bearish Engulfing: A larger red candlestick engulfs the previous green candlestick, signaling a potential downward reversal.

Morning Star and Evening Star

Morning Star: A three-candlestick pattern that signals a bullish reversal. It consists of a bearish candle, a small indecisive candle, and a bullish candle.

Evening Star: The bearish counterpart of the Morning Star, signaling a potential downward reversal.

Continuation Patterns

Continuation patterns indicate that the current trend is likely to continue.

Doji

Description: A candlestick with an almost equal open and close price, resulting in a very small body.

Significance: Reflects market indecision. Depending on its position in the trend, it can either signal a continuation or a potential reversal.

Three White Soldiers

Description: Three consecutive bullish candlesticks with higher closes each time.

Significance: A strong bullish continuation pattern.

Three Black Crows

Description: Three consecutive bearish candlesticks with lower closes each time.

Significance: A strong bearish continuation pattern.

Rising and Falling Three Methods

Rising Three Methods: A bullish continuation pattern consisting of several small bearish candles followed by a large bullish candle.

Falling Three Methods: The bearish counterpart of the Rising Three Methods.

How to Use Candlestick Patterns in Trading

Recognizing candlestick patterns is only the first step. To use them effectively, traders must combine them with other technical indicators and strategies. Here are some practical tips for incorporating candlestick patterns into your trading plan:

Combine with Support and Resistance Levels Candlestick patterns are more reliable when they appear near significant support or resistance levels. For instance, a bullish engulfing pattern at a strong support level is a more reliable buy signal.

Use Multiple Time Frames Analyzing candlestick patterns across multiple time frames can provide a clearer picture of market trends. A pattern that appears on a daily chart is generally more significant than one on a five-minute chart.

Confirm with Technical Indicators Indicators such as the Relative Strength Index (RSI), Moving Averages, and Bollinger Bands can help confirm the signals provided by candlestick patterns.

Practice Risk Management No pattern guarantees success. Always use stop-loss orders and maintain a disciplined approach to risk management.

Monitor Market Context Always consider the broader market context. A candlestick pattern that appears during a news event or high-volatility period may behave differently than one in a stable market.

Common Mistakes to Avoid

While candlestick patterns can be powerful, they are not foolproof. Here are some common mistakes traders should avoid:

Over-reliance on a single pattern: Always seek confirmation from other indicators or patterns.

Ignoring the trend: Patterns are more reliable when traded in the direction of the prevailing trend.

Forgetting risk management: Even the most reliable patterns can fail, so proper risk management is essential.

Failing to practice: New traders should practice identifying and interpreting candlestick patterns using demo accounts before trading with real money.

Conclusion

Candlestick patterns are a valuable tool for traders seeking to anticipate market movements and improve their decision-making. At Shenzhou Capital, we believe that understanding the various patterns and how to use them effectively can give traders a significant edge in the markets. However, it’s essential to remember that no pattern is foolproof, and combining candlestick analysis with other technical tools and strategies is key to long-term success.

Whether you’re a beginner or an experienced trader, mastering candlestick patterns can enhance your trading journey and help you navigate the complexities of financial markets with greater confidence.

#CandlestickPatterns#TradingStrategies#TechnicalAnalysis#ForexTrading#StockMarket#CryptoTrading#MarketTrends#BullishPatterns#BearishPatterns#TradingTips

1 note

·

View note

Text

Price Action Trading

One of the most prestigious trading strategies, price action trading focuses solely on the price action itself without having to depend on indicators or more sophisticated tools. It mainly helps traders understand and make decisions based on the market sentiment using previous patterns of prices. Let's continue reading to get a glimpse into the heart of price action trading-from its base to practical strategies and how it can be a fantastic approach in the financial markets.

What is Price Action Trading? Price action trading is a form of trading that involves the analysis of historical prices for prediction and trading decisions. Compared to many technical indicators, this form of trading focuses on raw price data depicted on charts; hence, the market moves can be interpreted directly. The overall market sentiment and trend in terms of direction can be assessed by looking into various patterns encompassing candlestick formations and levels of support and resistance.

Why Traders Like Price Action: Price action trading is the favorite of all traders across the globe because it is simple and is believed to paint a "true" image of the market. Using purely price action, the trader avoids information overload and cultivates intuitive awareness about the market.

Important Concepts in Price Action Trading

Support and Resistance: Most importantly, support and resistance levels form price action, trading anchors. Support is simply a downtrend that is believed to pause at the level because of a concentration of buyers' demand. Resistance is just a level where the uptrend could pause, said to be due to selling interest.

Trend Lines: Trend lines allow a trader to see where the market is headed. Using them in price action trading, one can find points where the price would probably face support or resistance and alter its direction.

Candlestick Patterns: Candlestick patterns are significant in price action trading. The engulfing candle, pin bar, and inside bar patterns provide information regarding probable reversals and continuations in the trend of the price. The flags, head and shoulders, and triangles are also types of price patterns that most traders will be looking for from price charts. These give indications about the pattern of the market through which a trader can predict in which way the market will trend in future time frames and then trade within these structures.

Market Structure: The trends, ranges, and pullbacks within a structure provide a complete understanding of price action by relating all strategies to real-time market conditions.

Why Choose Price Action Trading? Here are some advantages why it is attractive to both novice and professional traders, respectively:

Simplicity: There is no indication of dependency on trade, thus keeping charts clean and simple. Flexibility: It can be used for any market, including forex, stocks, and commodities. Better Reaction to Markets Changes: As he trades solely on price, the trader experiences himself reading market trends, making him more sensitive to change. Common Price Action Trading Strategies

Pin Bar Strategy A pin bar is a type of candlestick pattern that has a small body and a long wick. A long wick may indicate the rejection of a price level, with possible reversal. Traders will go in the opposite direction of the wick as it depicts a turnaround.

Inside Bar Strategy An inside bar is when a smaller candle forms within the range of the previous candle. This formation says that some consolidation will occur and possibly a breakout. From the inside bar, trades are taken in the direction of the breakout and stopped back, typically to protect the trade.

Trend Following Normally, in following the trend, a price action trader would buy based on the trend because their approach involves entering the direction in which the market happens. Traders tend to make an entry with higher highs against an uptrend and lower lows for a downward movement. It then indicates a trend and follows this, which enhances the opportunity for a trade that has a high likelihood of success.

Breakout Strategy Here, traders wait for the price to break out of a specific range or level. When the price breaks through the support or resistance level, it serves as a sign of a potential strong move in that direction; thus, traders can track momentum-driven trades.

Head and Shoulders Pattern This is a reversal pattern indicating a change in trend from upward to downward (or vice versa). This has three peaks with the top middle one as the "head" while the other two are lower side ones as the "shoulders." Once the price breaks below the "neckline," it's pointing toward possible reversal and hence forms a trading opportunity.

Real-life Tips for Price Action Trading Effectiveness Simplicity. Keep the chart and purely price indicators fewer Be patient and wait for set-ups to express clearly because the nature of price action requires patience. Harsh choices are made on impulse thus causing unnecessary losses Trade majors: these critical support and resistive lines have an immense probability of price going to them and reverting. Be Disciplined: Establish a tight trading plan, and adhere to it. Price action trading performs well only when discipline is maintained. Practice Makes Perfect: Like any strategy, frequent practice helps in the perfecting of price action trading. Start off with demo trading to learn how price action works out without risking real money. Final Words on Price Action Trading Price action trading is also a very robust approach with very elementary assumptions, so you can connect with the market on a fundamental basis. With an understanding of support and resistance, candlestick patterns, and market structure, price action trading can give you full confidence in the interpretation of and forecasting of price movements.

Price action trading mastery is a journey requiring dedication, patience, and continuous learning. At ProfitHills Education Pvt. Ltd., we're here to help you with resources, courses, and guidance in developing a deep understanding of price action trading. Whether you're a beginner or want to refine your strategies, this approach can take your trading skills to a higher level and help you trade with better insight and precision.

0 notes

Text

BOTT Price Action Guide: Binary Options Turbo Trading, Forex, FX Options, Digital Options BOTT Price Action Guide: Binary Options Turbo Trading, Forex, FX Options, Digital OptionsThe ultimative Price Action guide (7 edition) for any kind of financial instrument (Binary Options, Forex, FX Options, Digital Options) any kind of time frame from 1 min over 5 min up to 15 min, 30 min and above and any kind of broker. This ebook is all you need, especially as a binary option turbo trader or Forex day trader to get profit out of the market, to get out of debt, make yourself a living or help your friends and family and to archieve financial freedom. Don't miss the opportunity to get this ultimative Price Action guide (7 edition)File Size: 12597 KBPrint Length: 118 pagesPublisher: BO Turbo Trader; 7 edition (October 24, 2018)Publication Date: October 24, 2018Content:Mindset for consistent profits- Practice- Win Rate- Discipline- Money Management- Emotions Candlestick Patterns- Hammer, Inverted Hammer, Takuri Line, Shooting Star and Hanging man- Dragonfly Doji, Gravestone Doji- spinning top - long-legged doji, high wave and rickshaw man- Pinbar - Pin Bar - Pinocchio bar or Kangaroo Tail - Tweezer Top and Tweezer Bottom- bearish harami, bullish harami and bullish harami cross and bearish harami cross- three inside down, three inside up- descending hawk and homing pigeon- bearish meeting line - counterattack line and bullish meeting line- bearish belt hold - black opening shaven head - black opening marubozu- bullish belt hold - white opening shaven bottom - white opening marubozu- bearish kicker signal - bullish kicker signal- matching high and matching low- bearish stick sandwich and bullish stick sandwich - bearish breakaway and bullish breakaway- ladder top and ladder bottom - tower top and tower bottom- three stars in the north and three stars in the south- bearish sash pattern and bullish sash pattern- engulfing candlestick pattern or the big shadow pattern- (bearish) dark cloud cover and (bullish) piercing line- Breakaway gap, exhaustion gab, continuation gap and common gaps- rising window and falling window- marubozu and big belt- inside bar and mother bar- evening star, morning star and evening doji star and morning doji star- three white soldiers and three black crowsChart Patterns- Double Top - M Formation - Mammies and Double Bottom - W Formation - Wollahs- J-Hook pattern and inverted J-Hook candlestick pattern- bearish last kiss - bearish pullback and bullish last kiss and bullish breakout- Head and Shoulders and inverted Head and Shoulders Pattern- Trend Channel - uptrend and downtrend- symmetrical triangle- ascending triangle and descending triangle- bullish flag and bearish flag - bullish pennant and bearish pennant - rising wedge and falling wedge- Broadening Bottoms and Broadening Tops- Rectangle Bottoms and Rectangle TopsConcepts- Candlestick Mathematics- Rejection - market move - weak snr and strong snr- trending and ranging market- minor and major trend- adapting forex strategies to binary options turbo trading- proper rejection - invalid rejection- false breakouts - channel breakouts- reversal and retracements- highest probability trading setups- high probability techniques- market pressures and types of market pressures- upper shadow and lower wick or tail- advanced candlestick charting techniques- overbought and oversold - oscilator - RSI CCI Stochastic Oscilator- different market conditions and market conditions examples- cycle of market emotions, psychology and dynamics- trading setups without rejections as confirmation - multiple time frame trading concept, system, methology and strategy- candlestick momenting- direction of candlestick momentum- inside swing and outside swing- support and resistance - minor snr and major snr and much more concepts ... Also by the same author: BOTT Mentorship Self-Study Video Pack 1-4 BOTT Price Action Indicator BOTT Price Action Bible by BO Turbo Trader

0 notes

Text

Candlestick Pattern: A Beginner’s Guide to Mastering Market Movements

In the world of stock trading, understanding price movements is crucial for making smart decisions. One of the most popular tools traders use to analyze charts is the Candlestick Pattern. These patterns are not just random shapes; they tell a story about market sentiment, helping traders predict future price trends with better accuracy. Whether you are new to trading or looking to sharpen your technical analysis skills, learning about Candlestick Patterns is a must.

What is a Candlestick Pattern?

A Candlestick Pattern is a visual representation of price movements in a specific time frame, showing the opening, closing, high, and low prices of an asset. It originated in Japan in the 18th century and has since become a cornerstone of technical analysis worldwide.

Each candlestick has four main components:

Open Price: The price at which the asset started trading during the period.

Close Price: The price at which the asset finished trading for that period.

High and Low Prices: The highest and lowest points reached.

Body and Wick (or Shadow): The rectangular body shows the difference between open and close, while the wicks represent the high and low.

By analyzing these components, traders can understand the battle between buyers and sellers.

Why are Candlestick Patterns Important?

Candlestick charts provide more information than traditional line charts. They allow traders to:

✅ Spot Market Trends: Patterns reveal whether the market is bullish, bearish, or in consolidation. ✅ Identify Reversals: Certain formations signal potential trend reversals, helping traders act before major moves. ✅ Enhance Timing: They provide insights into when to enter or exit trades.

Learning to interpret a Candlestick Pattern can make the difference between profitable trades and missed opportunities.

Popular Types of Candlestick Patterns

Here are some widely used Candlestick Patterns every trader should know:

1. Doji

The Doji forms when the opening and closing prices are nearly identical. It indicates indecision in the market and often precedes a reversal.

2. Hammer

A Hammer has a small body at the top and a long lower wick. It usually appears after a downtrend and signals a possible bullish reversal.

3. Engulfing Pattern

This pattern involves two candles where the second completely engulfs the first. A bullish engulfing occurs when a small red candle is followed by a larger green candle, suggesting strong buying momentum.

4. Shooting Star

The Shooting Star appears at the top of an uptrend with a small body and a long upper wick. It signals that buyers are losing control and a bearish reversal may follow.

How to Use Candlestick Patterns in Trading

Combine with Other Indicators While Candlestick Patterns are powerful, they work best when combined with other technical tools like moving averages, RSI, or support and resistance levels.

Look for Confirmation Never rely solely on one pattern. Wait for confirmation from subsequent price action or volume before making a trade.

Timeframe Matters Patterns on higher timeframes (like daily or weekly charts) are more reliable than those on lower timeframes (like 5-minute charts).

Advantages of Candlestick Patterns

✨ Visual Clarity: Easy to read and interpret compared to other chart types. ✨ Versatile: Useful for stocks, forex, cryptocurrencies, and commodities. ✨ Insightful: Provides valuable information about market psychology.

Common Mistakes to Avoid

🚫 Overtrading: Not every pattern leads to significant price movements. 🚫 Ignoring Market Context: Always consider the broader trend and market conditions. 🚫 Lack of Discipline: Stick to your trading plan and risk management rules.

Final Thoughts

Mastering the Candlestick Pattern is like learning a new language—the language of the markets. Once you become familiar with the various patterns and their meanings, you’ll gain an edge in predicting market trends and making informed trading decisions.

Remember, while Candlestick Patterns are a powerful tool, they are not magic. Combine them with sound trading strategies and a disciplined mindset for the best results.

0 notes

Text

99 win non repaint scalping indicator mt4

Introduction: Why Scalping Needs Precision

https://secretindicator.com/product/m15-non-repaint-circle-indicator/

Scalping is a popular trading technique in the forex market that involves executing a large number of trades to capture small price movements. This strategy is typically used on lower timeframes like M1 (1-minute) or M5 (5-minute) charts. To succeed, scalpers need ultra-precise entry and exit points — and that’s where non-repaint indicators come into the picture.

Non-repaint indicators are often marketed with claims of ultra-high accuracy or “99% win rates.” While such figures sound attractive, it’s essential to approach them with realistic expectations. Instead of chasing hype, this article explains how high-accuracy, non-repaint indicators for MT4 work and how traders can use them effectively within a solid trading plan.

Telegram Channel

Understanding Non-Repaint Indicators in MT4

What Does "Non-Repaint" Mean?

A non-repaint indicator is one that does not alter its signal once the candle has closed. That means when a buy or sell arrow appears, it stays fixed. This is especially important for scalping, where traders must react quickly and can't afford to rely on shifting signals.

In contrast, repainting indicators modify or erase signals retroactively, which makes backtesting and real-time application unreliable. A tool that appears perfect in the past may mislead traders in the present.

Key Features of a Non-Repaint Scalping Indicator:

Fixed Signals: No shifting arrows or disappearing alerts after candle close.

Low Latency: Signals appear fast enough to be actionable.

Noise Filtering: Avoids false positives in choppy market conditions.

Timeframe Support: Works on lower timeframes without constant whipsaws.

Custom Alerts: Optional sound, email, or pop-up notifications.

The Myth of the "99% Win Rate"

It's common to see claims like “99% win rate scalping indicator” or “100% accurate non-repaint tool”. These are often exaggerations or the result of:

Curve-fitted backtesting

Over-optimized parameters

Selective screenshots

Market conditions that no longer exist

Instead of chasing a mythical win rate, traders should focus on tools that offer clarity, consistency, and adaptability — especially when combined with proper risk management.

How a High-Accuracy Non-Repaint Indicator Is Typically Built

A good MT4 non-repaint indicator combines multiple elements:

1. Price Action Confirmation

Uses candlestick patterns like pin bars, engulfing candles, or inside bars.

Confirms signals only after candle close.

2. Trend Filter

Moving averages (like EMA or VWMA) help determine the direction of the overall trend.

Buy signals are only allowed in an uptrend and vice versa.

3. Momentum Filter

RSI, MACD, or Stochastic filters to confirm strength.

Prevents entries when momentum is weak or fading.

4. Volume Analysis (Optional)

Non-repainting volume indicators can confirm if a breakout or breakdown is genuine.

Realistic Trading Strategy Example Using a Non-Repaint Indicator

Let’s build a sample scalping strategy based on a non-repaint indicator setup:

✅ Buy Setup

Price is above the 50-period EMA

Non-repaint arrow appears on candle close

RSI > 55 confirming bullish momentum

Entry: At open of next candle

Stop-loss: 5–10 pips below entry

Take-profit: 1.5x to 2x risk

✅ Sell Setup

Price is below the 50 EMA

Non-repaint arrow appears after confirmation

RSI < 45 showing bearish momentum

Entry: On next candle

Stop-loss: Above recent high

Take-profit: Based on risk-reward ratio

This type of logic doesn’t promise perfection — but it encourages disciplined, data-driven decision-making.

Advantages of Non-Repaint Indicators in Scalping

Better Backtesting Accuracy You can see how past signals would have performed without the distortion caused by repainting.

Clear Decision Making When a signal appears, you know it’s valid and not going to vanish.

Faster Learning Curve Traders can study fixed signals and understand what conditions led to success or failure.

Reduced Emotional Confusion You won’t be second-guessing trades due to disappearing signals.

Limitations and Considerations

Despite their advantages, non-repaint indicators have limitations:

They can still generate false signals, especially in sideways or news-driven markets.

Over-optimization can make an indicator look great on historical data but fail in live conditions.

Dependence on one tool can be risky. A complete strategy involves money management, psychology, and market context.

Using a Non-Repaint Indicator Responsibly on MT4

If you download or purchase a non-repaint indicator for MT4:

Check the code logic if possible.

Test it on a demo account before going live.

Don’t fall for aggressive marketing. Look for community reviews and user feedback.

Combine it with support/resistance zones, price action, and economic events.

Tips for Scalping Safely with Non-Repaint Tools

Stick to Liquid Pairs: EUR/USD, GBP/USD, and USD/JPY often provide cleaner price action for scalping.

Avoid High News Volatility: Use an economic calendar to stay out of unstable periods.

Use Low Spreads: Choose brokers with tight spreads — even 1 pip can affect your edge.

Risk Only 1%–2% Per Trade: This gives you room for error without blowing your account.

Use a VPS for Speed (If Needed): For faster execution and reduced lag on MT4.

Developing Your Own Non-Repaint Scalping Indicator

For coders or advanced traders, creating your own tool in MQL4 has benefits:

Full control over the logic

Avoid reliance on third-party sellers

Customize signals to your trading style

Popular indicator elements for building your own:

Candle close conditions

MA crossovers

RSI/MACD logic

Bollinger Band touch-and-reject

Time-of-day filters (to avoid low-volume sessions)

Final Thoughts: Quality Over Hype

While a high-accuracy non-repaint scalping indicator can significantly improve your trading workflow, the reality is: no indicator is a magic solution. The term “99% win rate” should be viewed skeptically unless it's been verified over thousands of trades, across different market conditions, and with consistent risk management.

Instead of looking for perfection, focus on finding tools that help you:

Enter with confidence

Manage risk intelligently

Stay emotionally disciplined

That’s the true path to long-term consistency in forex scalping.

https://secretindicator.com/product/m15-non-repaint-circle-indicator/

#forex market#forex online trading#forex factory#forex education#forex broker#forex news#crypto#forex#forex ea#forex indicators

0 notes

Text

🚀 Complete Guide to Technical Analysis: How Traders Read Charts Like Pros

Technical analysis isn’t just about looking at squiggly lines and colors on charts. It’s about decoding market psychology, price behavior, and decision-making—all through historical price data. For traders across the globe, including in India's NSE and BSE, technical analysis is a cornerstone of strategy.

Whether you're day trading Nifty 50 or analyzing long-term opportunities in Reliance or Infosys, this guide will equip you with the complete technical toolkit to trade like a pro.

🎯 What Exactly Is Technical Analysis (And Why Do Traders Trust It?)

Technical analysis is the study of past market data—primarily price and volume—to forecast future price movements. Unlike fundamental analysis, which evaluates a company’s intrinsic value through financials, TA assumes everything is already priced in.

📚 Originating from the ideas of Charles Dow (yes, the Dow Theory guy), it laid the foundation for tools used by millions of traders worldwide today. Even in India, market veterans like Rakesh Jhunjhunwala and Radhakishan Damani have acknowledged the importance of timing—something TA aims to master.

✅ Traders in the Indian stock market use technical analysis on stocks like Tata Steel, HDFC Bank, and Infosys, particularly for intraday and swing trades. Tools like Strike Money, TradingView, and MetaTrader provide advanced charting features that simplify this process.

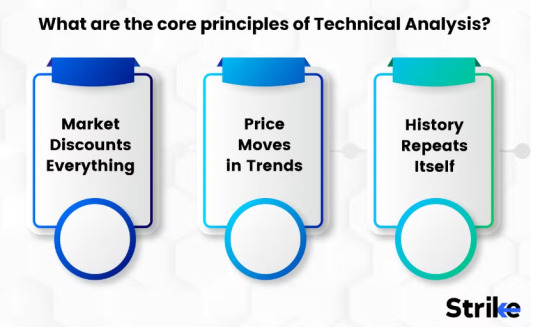

🧠 The Mindset Behind Technical Analysis: 3 Core Principles

🔁 History Repeats Itself Markets are driven by crowd psychology. Patterns that worked in 2010 often work in 2025. For example, Wipro's double bottom in 2020 triggered a breakout that analysts had seen before.

📉 Price Discounts Everything Whether it’s an RBI rate hike or company earnings, technical analysts believe all news is already reflected in price movements.

📈 Trends Are Your Friends A stock in motion stays in motion—until proven otherwise. Traders follow trends rather than fight them. For example, Adani Enterprises’ uptrend in early 2021 saw record participation because of trend momentum.

🖼️ Types of Charts: Reading Candles, Lines & Bars Like a Pro

Charts are the visual language of the markets. If you're staring at numbers, you're doing it wrong.

🕯️ Candlestick Charts are the favorite among Indian traders. Originating from 18th-century Japanese rice traders, these charts reveal psychology behind price moves. A bullish engulfing pattern spotted on TCS in April 2023 led to a 12% rally in a week.

📊 Line Charts show closing prices only. Great for spotting long-term trends.

🪵 Bar Charts give similar data as candlesticks but are harder to interpret visually.

On platforms like Strike Money, you can switch between chart types with a click and compare multiple stock patterns in real time.

📍 Chart Patterns That Consistently Predict Breakouts

Patterns are more than just shapes—they are footprints of market participants.

👤 Head and Shoulders: Seen on Infosys before its correction in late 2022. It signals a trend reversal. 🏆 Cup and Handle: Seen on Maruti Suzuki in 2021 before a multi-month uptrend. 🔺 Ascending Triangles: These breakout setups are powerful in bull markets. Hindalco displayed one in 2020 before it shot up over 80% in 6 months.

Patterns are not guarantees—but when combined with volume analysis, they offer strong probability setups.

📊 Indicators That Add Muscle to Your Analysis

Indicators give you confirmation, timing, and momentum. The best traders don’t use dozens—they master a few.

📉 RSI (Relative Strength Index) tells you when a stock is overbought or oversold. For example, Nifty 50’s RSI dropped below 30 in March 2020, signaling panic—and a rebound followed.

⚡ MACD (Moving Average Convergence Divergence) shows trend momentum. A bullish MACD crossover on ICICI Bank in 2021 led to a 15% rise.

📉 Bollinger Bands, created by John Bollinger, are powerful for spotting volatility squeeze setups. Stocks like Zomato often show these during consolidation.

📐 Fibonacci Retracement, inspired by Leonardo Fibonacci’s sequence, helps identify potential pullback levels. For instance, SBI retraced to 61.8% in mid-2022 before continuing its rally.

With Strike Money, you can layer these indicators onto charts, analyze confluence, and even run backtesting for free.

💡 How Indian Traders Use Technical Strategies: Intraday to Swing

🎯 Intraday Trading: Traders look for 5-minute breakouts on stocks like Tata Motors or Bank Nifty. Strategies often involve VWAP, RSI, and price action.

🔄 Swing Trading: Timeframe shifts to daily or weekly. Stocks like L&T or Sun Pharma often exhibit clean trends perfect for swing setups.

💥 Breakout Trading: Stocks like Paytm breaking long resistance zones often reward breakout traders with strong momentum.

🔁 Mean Reversion: When stocks like HDFC Life drop below the lower Bollinger Band with RSI < 30, contrarian trades are triggered.

A key part of strategy is risk management—using stop losses and risk-reward ratios. A common rule: never risk more than 2% per trade.

🛠️ Charting Tools Every Indian Trader Should Know

📍 Strike Money: A rising star in the Indian charting space, it offers intuitive charting, live data, and tools like Fibonacci, moving averages, and volume overlays—perfect for both beginners and pros.

📍 TradingView: Popular worldwide, supports scripts like Pine editor and advanced backtesting.

Having the right tools isn’t optional—it’s essential. With mobile-first platforms like Strike Money, analysis happens in real-time, anywhere.

❌ Common Mistakes That Ruin Technical Trades

🚫 Using too many indicators: Analysis paralysis is real. 5 indicators telling different stories leads to confusion.

🚫 Ignoring volume: Price moves without volume = fakeouts. Always confirm with volume, like in Reliance’s breakout in 2020—it had massive volume spikes.

🚫 No backtesting: If you haven't tested a strategy on historical data, don’t risk real capital.

🚫 Overtrading: Many intraday traders in India fall into the trap of chasing every candle. Patience > FOMO.

Research by SEBI in 2023 showed that 89% of intraday traders lost money—often due to poor strategy and lack of discipline.

🧪 Can You Trust Technical Analysis? Let’s Talk Research & Reality

A 2014 study by the Journal of Financial Markets showed that technical trading rules can generate above-average returns in emerging markets—including India. However, effectiveness drops if widely known strategies are overused.

In India, a 2021 report by Zerodha revealed that traders who combined technical analysis with position sizing and journaling had 3x better performance than those trading on tips and news alone.

So yes—technical analysis works, if applied with consistency and risk control.

🧭 Technical vs Fundamental Analysis: Should You Choose One?

📈 Technical = Timing 📊 Fundamental = Value

Let’s say you're bullish on Tata Power due to renewable energy reforms. That’s a fundamental bet. But when to enter? Technical analysis shows a breakout in volume and RSI divergence—your green light.

In volatile sectors like pharma and fintech, many investors use both approaches. Combining the ‘why’ of fundamentals with the ‘when’ of technicals gives a holistic trading edge.

🙋♂️ FAQs About Technical Analysis

🤔 Can TA predict the future? No—but it gives you probabilities, not certainties. It's like a weather forecast.

⌛ How long does it take to learn? 3–6 months of daily practice using tools like Strike Money can build a solid foundation.

💰 Is it good for crypto or forex? Yes. BTC, ETH, USD-INR—all follow patterns and react to indicators.

📉 Is TA just for short-term trading? Not at all. Long-term investors use it to spot better entry points too.

🎬 Final Thoughts: Is Technical Analysis Right for You?

Technical analysis isn't magic. It's a tool. A very powerful one—when used with discipline, strategy, and backtesting. Whether you’re trading TCS, Bank Nifty, or Zomato, TA gives you an edge in a game that’s all about timing and precision.

If you want to cut through the noise, make informed trades, and build confidence, learning technical analysis is a no-brainer.

✨ Start with one indicator, one pattern. Use tools like Strike Money to chart and journal your trades. Don’t chase perfection—chase progress.

0 notes

Text

How Many Candlestick Patterns Are There

How Many Candlestick Patterns Are There? A Friendly Guide to Understanding the Basics

Understanding the world of trading can feel like learning a new language. And if you’ve ever seen a candlestick chart, you might’ve wondered, “What am I even looking at?” Don’t worry—you're not alone! Whether you're someone just getting into trading or simply curious about how it all works, this article will walk you through the mysterious world of candlestick patterns. We’ll break it down in a way that makes sense, no financial dictionary required.

Imagine candlestick patterns like traffic signals on the road of trading—they give hints about what might happen next. Some say, “Hey, the market might go up!” Others hint, “Watch out, things could go south.” So, how many candlestick patterns are there? Great question—let’s find out.

Learn how many candlestick patterns are there, different types of candlestick patterns, and what is candlestick patterns in simple language for beginners.

Introduction to Candlestick Patterns

Let’s start at the beginning. If you’ve ever seen a stock or cryptocurrency chart, you’ve probably noticed those little red and green rectangles—they're called candlesticks. They're not just colorful bars; they tell a story about price movement.

What is Candlestick Patterns?

Candlestick patterns are specific formations of these candles on a chart. Think of them as facial expressions of the market. Just like a smile can tell you someone’s happy, a certain pattern in candles can suggest whether the market is feeling bullish (going up) or bearish (going down).

Each candlestick gives four main pieces of information:

Open Price

Close Price

High Price

Low Price

Why Are Candlestick Patterns Important?

Imagine driving with your eyes closed. Sounds scary, right? That’s what trading without understanding patterns is like. Candlestick patterns act like headlights—they help traders see where the road might lead. While they don't guarantee success, they give valuable clues that many traders use to make decisions.

How Many Candlestick Patterns Are There?

Here’s the big question: how many candlestick patterns are there? Well, in total, there are more than 50 recognized patterns, but most traders focus on about 30 key ones. These patterns are grouped into:

Single Candlestick Patterns

Double Candlestick Patterns

Triple Candlestick Patterns

Each category offers insight into different possible future movements of the market.

Types of Candlestick Patterns

To make things easier, let’s break them down:

Single Candlestick Patterns

These involve just one candlestick. They're quick and simple.

Double Candlestick Patterns

These involve two candles and often signal a trend reversal.

Triple Candlestick Patterns

These use three candles to tell a more complete story about what the market might do next.

Let’s dig deeper into each one.

Single Candlestick Patterns

These are the building blocks of chart reading. They’re easy to spot and understand.

Doji

A Doji looks like a cross. It happens when the open and close prices are almost the same. It shows market indecision—like the market saying, “I’m not sure which way to go.”

Hammer

A Hammer looks like—you guessed it—a hammer! It has a small body with a long lower wick. It usually shows up at the bottom of a downtrend, signaling a potential reversal upward.

Inverted Hammer

Similar to the Hammer, but flipped upside down. It also signals a possible trend reversal, but needs confirmation from the next candles.

Double Candlestick Patterns

These patterns give a stronger message since they involve two candles working together.

Bullish Engulfing

This happens when a small red candle is followed by a big green candle that completely “engulfs” it. It signals a potential move upward.

Bearish Engulfing

The opposite of bullish. A small green candle is followed by a larger red one. This can signal a downward move ahead.

Tweezer Tops and Bottoms

These are two candles with matching highs (tops) or lows (bottoms). They can suggest that a trend is losing strength.

Triple Candlestick Patterns

When three candles join forces, the pattern becomes even stronger and more reliable.

Morning Star

This is a bullish reversal pattern made of three candles: a bearish candle, a small-bodied candle (which can be a Doji), and a bullish candle. It's like a sunrise—things are looking up!

Evening Star

The opposite of Morning Star. It begins with a bullish candle, followed by a small one, and ends with a bearish candle. It's a sign the sun is setting on an uptrend.

Three White Soldiers

This pattern consists of three strong green candles in a row. It’s a very bullish sign, showing continued buying pressure.

Three Black Crows

You guessed it—this one's bearish. It’s made of three long red candles in a row, suggesting strong selling pressure.

Common Mistakes When Reading Patterns

Let’s face it, we all mess up sometimes. Here are some pitfalls to avoid:

Relying on patterns alone: Always use other tools too.

Ignoring the bigger trend: A bullish pattern in a strong downtrend may not hold up.

Overtrading: Just because you see a pattern doesn’t mean you must act on it.

Tips for Learning Candlestick Patterns

Learning candlestick patterns is like learning to read emotions. Start small:

Practice with paper trading.

Use flashcards to memorize patterns.

Review historical charts to see how patterns played out.

Keep a trading journal to track your learning.

Conclusion

So, how many candlestick patterns are there? There are over 50—but don’t panic! You really only need to master about 30 core patterns to start making smarter decisions. Whether you’re an aspiring trader or just a curious learner, understanding these patterns is like having a window into the market’s soul.

Remember, candlestick patterns are tools—not magic tricks. Use them wisely, and always double-check with other indicators and research.

FAQs

How many candlestick patterns are there?

There are over 50 recognized candlestick patterns, but traders mostly use 30 key ones regularly.

What is candlestick patterns in simple terms?

They are visual representations of price movements in a chart. Each pattern gives clues about where the market might go next.

Are candlestick patterns accurate?

They can be helpful, but no pattern is 100% accurate. They're best used with other tools and indicators.

Can beginners learn candlestick patterns easily?

Absolutely! With practice, even beginners can understand and use them to make better trading choices.

What's the difference between bullish and bearish patterns?

Bullish patterns suggest prices may rise, while bearish patterns indicate a possible decline in prices.

#how many candlestick patterns are there#what is candlestick patterns#how to read candlestick pattern#types of candlestick patterns

1 note

·

View note

Text

What is candlestick in share market?

In the share market, a candlestick is a type of financial chart used to represent the price movements of a security, such as a stock, bond, commodity, or currency pair, over a specific period of time. Candlestick charts are widely used by traders and investors to analyze price action, identify trends, and make trading decisions.

Each candlestick on a candlestick chart provides information about the open, high, low, and close prices of the security for the given time period. The candlestick consists of two main parts:

Body: The body of the candlestick represents the price range between the opening and closing prices of the security during the specified time period. The body is typically filled or colored differently to indicate whether the closing price was higher (bullish) or lower (bearish) than the opening price. If the closing price is higher than the opening price, the body is usually filled or colored, indicating bullishness. If the closing price is lower than the opening price, the body is usually empty or colored differently, indicating bearishness.

Wicks (or Shadows): The wicks, also known as shadows, are the thin lines extending above and below the body of the candlestick. The upper wick represents the highest price reached during the time period, while the lower wick represents the lowest price reached. The length of the wicks provides information about the price volatility and the trading range during the specified time period.

Candlestick charts are valuable tools for technical analysis because they provide visual representations of price movements and patterns that can help traders and investors interpret market sentiment and predict future price movements. Different candlestick patterns convey different signals about market dynamics, and traders use these patterns to make informed decisions about buying, selling, or holding securities.

Some common candlestick patterns include:

Bullish Engulfing: A bullish engulfing pattern occurs when a large bullish candlestick completely engulfs the previous smaller bearish candlestick. It suggests a potential reversal from a downtrend to an uptrend.

Bearish Engulfing: A bearish engulfing pattern occurs when a large bearish candlestick completely engulfs the previous smaller bullish candlestick. It suggests a potential reversal from an uptrend to a downtrend.

Doji: A doji candlestick has a small body with wicks extending on both sides. It indicates indecision in the market and suggests potential reversals or trend continuation depending on its placement within the price action.

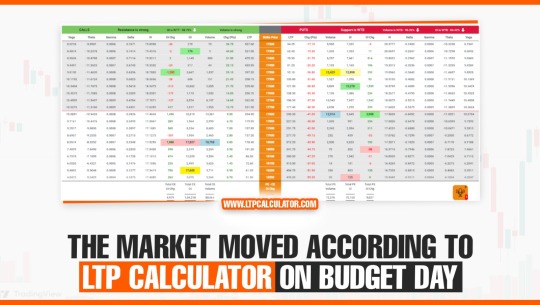

One of the best way to start studying the stock market to Join India’s best comunity classes Investing daddy invented by��Dr. Vinay prakash tiwari . The Governor of Rajasthan, the Honourable Sri Kalraj Mishra, presented Dr. Vinay Prakash Tiwari with an appreciation for creating the LTP Calculator.

LTP Calculator the best trading application in India.

You can also downloadLTP Calculator app by clicking on download button.

These are just a few examples of candlestick patterns, and there are many more that traders use to analyze market behavior and make trading decisions in the share market.

0 notes

Text

Navigating Cryptocurrency Trading Graphs: Building a Diverse Portfolio

Cryptocurrency trading has emerged as a lucrative investment avenue, drawing attention from seasoned investors to newcomers seeking to capitalize on the digital asset revolution. Central to successful trading in this domain is the ability to interpret and analyze cryptocurrency trading graphs effectively. By delving into these charts, investors can glean valuable insights to inform their trading decisions and develop a diverse portfolio that balances risk and reward.

Understanding Cryptocurrency Trading Graphs: Cryptocurrency trading graphs provide a visual representation of price movements over time. They typically display historical price data in the form of candlestick charts, line graphs, or other charting techniques. Each type offers unique advantages in analyzing market trends and identifying potential trading opportunities.

Candlestick charts, for instance, are widely used in cryptocurrency trading due to their ability to convey a wealth of information within a single data point. Each candlestick represents a specific time period, with the body indicating the opening and closing prices and the wicks or shadows depicting the price range within that period. By observing patterns such as bullish engulfing, bearish harami, or doji, traders can anticipate market sentiment and make informed decisions tradetrek.

Line graphs, on the other hand, offer a simplified view of price movements by connecting the closing prices over time. While they lack the granularity of candlestick charts, line graphs provide a clear depiction of long-term trends, enabling traders to identify support and resistance levels and assess overall market direction.

Developing a Varied Portfolio: Building a diversified portfolio is essential for mitigating risk and maximizing returns in the volatile world of cryptocurrency trading. A well-rounded portfolio should encompass a mix of assets across different categories, including established cryptocurrencies like Bitcoin and Ethereum, promising altcoins, and stablecoins pegged to fiat currencies.

Bitcoin, as the pioneer cryptocurrency, serves as the cornerstone of many portfolios due to its widespread adoption and established track record. With its finite supply and growing institutional interest, Bitcoin offers a hedge against inflation and economic uncertainty, making it a favored store of value asset.

Ethereum, the second-largest cryptocurrency by market capitalization, holds immense potential as the foundation for decentralized applications (DApps) and smart contracts. Investing in Ethereum allows traders to participate in the burgeoning world of decentralized finance (DeFi) and non-fungible tokens (NFTs), driving innovation and growth in the cryptocurrency ecosystem.

In addition to blue-chip cryptocurrencies, diversifying into promising altcoins can provide exposure to high-growth opportunities. Conducting thorough research and due diligence is crucial when selecting altcoins, as the market is rife with projects of varying quality and legitimacy. Look for altcoins with strong fundamentals, innovative technology, and a dedicated community to maximize the potential for returns.