#vcc

Explore tagged Tumblr posts

Text

disney villains? in MY potioncraft alchemy simulator??? it's more likely than u think

#THERE'S A POTIONCRAFTING VILLAINS GAME#ngl i'm contemplating getting it ONLY if it has good reviews#i saw the maleficent design and couldn't stop my hand#this is also prob my most rendered malmal drawing??? in recent times???#i like him a lot idk if u can tell.......#tarta.png#tartart#krita#artists on tumblr#disney twisted wonderland#illustration#malleus draconia#disney villains cursed cafe#villains cursed cafe#cursed cafe#vcc

93 notes

·

View notes

Text

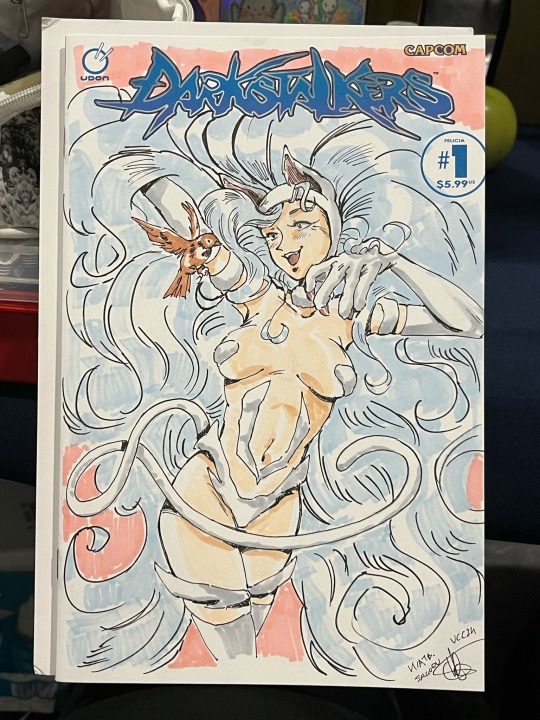

Vcc commissions

#vienna comic con#vcc#artist alley#commissions#darkstalkers#felicia#darkstalkers felicia#mairimashita! iruma kun#iruma sullivan#welcome to demon school iruma kun#iruma mafia#iruma clara#clara valac#harlequin#transformers animated jetfire#tfa#tfa starscream#starscream#marker#powerpuff girls#powerpuff girls him

78 notes

·

View notes

Text

Virtual Visa or Mastercard cards are digital versions of physical debit or credit cards. They are primarily used for online purchases and offer several benefits:

Security: Since they are virtual, they reduce the risk of theft or loss. Many virtual cards allow you to set spending limits or even single-use numbers, which can prevent fraud.

Convenience: They can be generated quickly and used immediately, without the need to wait for a physical card to be delivered.

Anonymity: Some services allow you to create a virtual card without linking it directly to your personal bank account, which can add a layer of privacy to your transactions.

#visacard#mastercard#physical card#bitcoin card#cryptocard#vcc#Virtual Visa#Virtual Mastercard#one time card#Virtual card providers

2 notes

·

View notes

Text

A little about me...

My name is Peter Fong and most of you will not have heard of me before, but sometime over the past 20 years, you may have tried some of my desserts, cakes or croissants. Prior to enrolling into the PIDP program at VCC, I was the proud owner and pastry chef of Ganache Patisserie in Yaletown. Opening the shop was my vision to “bring a little bit of Paris to Vancouver” and becoming established as one of Vancouver’s premier pastry and wedding cake shops was a dream come true. However, with my lease expiring at the end of October 2023 and the total upheaval in our business due to the Covid-19 pandemic, I decided to close the business and pursue a career in teaching.

As part of the curriculum of PIDP 3100, this blog will chronicle my journey through the program as we explore andragogy and what it means to be an adult learner. On a more personal level, I will look at my experience in returning to academic studies, differentiating my time as a student at UBC over 30 years ago from my time at culinary school and then my career working as a pastry chef and business owner. And having recently been hired by the Vancouver School Board as a Baker supporting the instructors in secondary school culinary programs, I hope to gain more insight from the beginning of my new career in teaching and education.

2 notes

·

View notes

Text

Minty Fresh All Stars Drag Brunch Fiesta

0 notes

Text

Get a Turkish Virtual Card Online—No Banks, No Borders, No Nonsense

You’re overseas. You’re trying to pay for Getir, Yemeksepeti, Martı, or maybe a Netflix Turkey subscription. And boom—your foreign card gets rejected. Sound familiar?

Thousands hit this wall every day. Local Turkish apps and services block international cards like it’s 2015.

Here’s the thing—they don’t want your foreign bank. They want a Turkish virtual card.

So What’s the Solution?

You need a virtual card with a Turkish BIN (Bank Identification Number). That’s how local apps know it’s “homegrown”—and let you in.

At Gpaynow, we issue 100% Turkish Lira virtual cards that work instantly. No physical delivery. No paperwork. No local bank required. You just sign up, top up with USDT or Bitcoin, and spend like a local.

Let’s break down how it works—and why it works better than anything else out there.

What Is a Turkish Virtual Card?

Simple. It’s a virtual Mastercard or Visa card that’s issued in Turkey, in Turkish Lira (₺). It’s online-only. It works like your regular card—except it actually works on Turkish platforms.

You can:

Pay for Netflix TR, Spotify Turkey, Disney+, Martı, and more

Book domestic flights with Pegasus Airlines or Turkish Airlines

Order food, ride scooters, or recharge Turkish SIM cards

Use it for Airbnb, Fiverr, or Upwork verifications

Run Google Ads or TikTok Ads in Turkey

Access Steam Turkey region games or Discord Nitro at local prices

It’s not just a workaround. It’s the better card—especially if you live abroad and still need access to Turkish services.

Why Most Foreign Cards Fail in Turkey

Because most apps in Turkey are picky. They use fraud filters that block non-Turkish BINs.

Even if your card has enough balance. Even if it’s Visa or Mastercard. Even if it’s 3D secure.

That’s why you need a card with a Turkish BIN, issued inside Turkey.

And guess what?

Gpaynow’s Turkish virtual cards come with exactly that. They’re accepted by apps and merchants that reject Revolut, Wise, Payoneer, or even Apple Pay.

Benefits of Using a Turkish Virtual Credit Card

Let’s get to the point. Here’s what you actually get when you grab one of these:

✔ Works where others don’t Apps like Yemeksepeti, Trendyol, or Martı don’t want your Chase card—they want Turkish.

✔ Instant activation You can create your virtual card within 2 minutes on Gpaynow. No delays.

✔ Spend in Turkish Lira (₺) No more conversion fees. No FX rate surprises.

✔ Top up with crypto Fund your card using USDT, Bitcoin, or even TRX. Instant, secure, global.

✔ No KYC required No passport selfies. No proof of address. Just email and crypto.

✔ Full control from your dashboard Freeze, cancel, regenerate your card anytime. Track all your spend. Stay in charge.

Who Uses Turkish Virtual Cards?

This isn’t just for expats. You’d be surprised how many people are switching to virtual cards:

Digital nomads working in Bali, Dubai, or Tbilisi

Crypto users who don’t want banks in their business

Students abroad who want access to Turkish streaming platforms

Media buyers running ads in Turkish regions

Freelancers doing Fiverr gigs in Turkey but living in Europe

Gamers wanting to buy cheaper Steam credits or Discord Nitro in the TR region

How to Get a Turkish Virtual Credit Card Instantly (Step-by-Step)

Getting started is ridiculously easy. Here’s how to do it:

Visit Gpaynow.com

Sign up with your email address

Choose your card – Virtual Mastercard in Turkish Lira

Top up with crypto – Bitcoin, USDT (TRC20/ERC20), or BNB

Your card is ready to use instantly

Use it on your favourite Turkish platforms with 3D secure checkout

That’s it.

No waiting. No ID checks. No limits on where you live.

Gpaynow: Smarter Than Your Bank

Let’s talk numbers for a second.

3D Secure: ✅

Zero foreign transaction fees: ✅

Crypto top-up speed: ⚡ Instant

Support: Live, multilingual chat

Flexibility: You can create multiple cards, cancel them anytime

Monthly maintenance fees: Zero hidden junk fees

Security: Freeze/unfreeze with one click. Auto-expiry options available.

Other people have rules. We have solutions.

Got Questions? Let’s Clear 'Em Up

Can I use a Turkish virtual card on Yemeksepeti or Trendyol?

Yes. That’s one of the biggest reasons people grab one. Foreign cards often fail. Gpaynow’s virtual Lira cards work flawlessly on Turkish merchant sites.

Is KYC mandatory?

Nope. You just need your email and crypto wallet. No government IDs or utility bills.

Can I use this to verify PayPal, Upwork, or Netflix?

Yes. As long as the platform supports Mastercard or Visa, you’re good.

Is it legal?

Absolutely. Virtual prepaid cards are legal in Turkey and globally. You’re simply choosing a smarter financial tool.

What if I want to cancel?

No strings attached. Just log in and delete or freeze the card. You only pay for what you use.

Use Cases That Just Work

Netflix TR plan for less than ₺100

Discord Nitro monthly for under ₺30

Spotify Turkey subscription with local pricing

Buy Steam games at regional discounts

Fund TikTok or Google Ads for Turkish audiences

Use as your business expense card while traveling

Let’s Wrap This Up

If you’re struggling with rejected payments in Turkey, don’t overthink it. Get a Turkish virtual card from Gpaynow.

No bank. No border. No BS.

Start spending like a local in minutes.

Visit Gpaynow.com and create your Turkish Lira card today.

#turkish virtual card#online credit card#virtual card#VCC#prepaid card#best prepaid card#turkish VCC#VCC turkey

0 notes

Text

If you're looking to purchase virtual Visa or Mastercard prepaid cards for online transactions in 2025, several providers offer these services. Here are some options to consider:

#visacard#mastercard#physical card#bitcoin card#cryptocard#vcc#Virtual Visa#Virtual Mastercard#one time card#Virtual card providers

0 notes

Text

Purchasing virtual Visa or Mastercard prepaid cards using Bitcoin has become increasingly accessible in 2025. These virtual cards enable you to convert your cryptocurrency into fiat currency, allowing for seamless online transactions wherever Visa or Mastercard are accepted.

#visacard#mastercard#physical card#bitcoin card#cryptocard#vcc#Virtual Visa#Virtual Mastercard#one time card#Virtual card providers

1 note

·

View note

Text

A temporary Mastercard, often referred to as a virtual card, is a digital payment solution that provides a 16-digit card number, expiration date, and CVV code without the need for a physical card. These cards are particularly useful for secure online shopping, as they can be generated for single-use or set to expire after a specific period, thereby minimizing the risk of fraud.

#visacard#mastercard#physical card#bitcoin card#cryptocard#vcc#Virtual Visa#Virtual Mastercard#one time card#Virtual card providers

0 notes

Text

🚀 Master Your Wealth with Singapore’s Premier Wealth Management & VCC Solutions by Watershore! 🌟

💼 Looking to elevate your financial future? 🌟 Discover the power of wealth management singapore with Watershore! From personalized strategies to innovative tools like the variable capital company (VCC), we’re here to help you grow and protect your wealth.

The VCC fund is a game-changer—offering flexibility, tax efficiency, and asset protection. Whether you're managing multi-generational wealth or diversifying investments, Singapore’s VCC framework ensures seamless financial growth. 🌏💰

Let’s make your wealth work smarter with expert insights and tailored solutions. Ready to take control of your financial legacy? 🚀 Start today with Watershore!

1 note

·

View note

Text

Virtual Visa cards are an excellent way to enhance online security, manage spending, and simplify international transactions. Whether you need one for shopping, freelancing, or subscriptions, there’s a provider that fits your needs.

#visacard#mastercard#physical card#bitcoin card#cryptocard#vcc#Virtual Visa#Virtual Mastercard#one time card#Virtual card providers

1 note

·

View note

Text

If you're looking to buy a Virtual Mastercard for shopping, you have several options depending on your needs. Here’s what you need to consider:

#visacard#mastercard#physical card#bitcoin card#cryptocard#vcc#Virtual Visa#Virtual Mastercard#one time card#Virtual card providers

1 note

·

View note

Text

Cryptocurrency virtual cards have become increasingly popular in 2025, offering users the ability to spend their digital assets seamlessly across various platforms. These cards function similarly to traditional debit or credit cards but are linked to cryptocurrency wallets, enabling real-time conversion of crypto into fiat currencies for everyday purchases.

#visacard#mastercard#physical card#bitcoin card#cryptocard#vcc#Virtual Visa#Virtual Mastercard#one time card#Virtual card providers

0 notes

Text

There are several great virtual Visa card providers, depending on what you need—whether it's for online shopping, security, subscriptions, or business use. Here are some of the best options:

#visacard#mastercard#physical card#bitcoin card#cryptocard#vcc#Virtual Visa#Virtual Mastercard#one time card#Virtual card providers

1 note

·

View note

Text

Save 3% Instantly: Avoid Foreign Transaction Fees with a Turkish Virtual Card

In a global economy where digital payments are the norm, travelers, digital nomads, freelancers, and e-commerce entrepreneurs often lose a significant amount of money to hidden charges—especially foreign transaction fees. These small but persistent charges—usually around 3% per transaction—can add up quickly.

But there’s a smarter way to handle international payments. A turkish virtual card offers a powerful solution to avoid foreign transaction fees, protect your finances, and streamline your spending.

Let’s explore how a Turkish virtual card can help you save money, increase security, and unlock global opportunities—especially when funded by crypto or used across platforms like Netflix, Airbnb, or Google Ads.

What Are Foreign Transaction Fees and Why Do They Matter?

Foreign transaction fees are extra charges added to your credit card bill when you make a purchase in a foreign currency or through an international merchant.

These fees usually fall into three categories:

Currency conversion fee (1%)

Bank/issuer processing fee (1–2%)

Network fee (Visa/Mastercard) (around 1%)

On average, foreign transaction fees total 3% per transaction. That means if you spend $1,000 abroad, you could be paying $30 in unnecessary fees.

Why It Hurts More Than You Think

Frequent travelers could be losing hundreds of dollars per year.

Freelancers accepting international payments face lower margins.

E-commerce sellers buying inventory globally see reduced profits.

Crypto users converting assets suffer extra transactional friction.

Introducing the Turkish Virtual Credit Card: A 3D Secure & Fee-Free Solution

At Gpaynow, we’ve developed a flexible, fast, and 3D secure Turkish virtual credit card designed specifically for users who want to save on fees, pay globally, and stay in control—without the need for a Turkish residency or a local bank account.

Key Features of Gpaynow's Turkish Virtual Card

No foreign transaction fees – Save instantly on every international payment.

Issued in TRY (Turkish Lira) – Take advantage of favorable exchange rates.

Crypto funding support – Load your card with BTC, USDT, or other coins.

No paperwork required – No need for SSN, proof of address, or bank credit score.

Instant delivery – Get your card details within minutes after sign-up.

Works globally – Pay for services in USD, EUR, GBP, and more.

How a Turkish Virtual Card Helps You Save

When you make a purchase using a traditional bank-issued card, your payment is routed through multiple intermediaries—all of whom add a fee. However, a Turkish virtual card eliminates many of these layers, especially when funded through crypto.

Here’s How You Save:

Avoid the 3% foreign transaction fee that traditional cards charge.

Skip hidden markup fees during currency conversion.

Withdraw and spend at real exchange rates using your TRY-based card.

For example, if you pay a $100 monthly bill using a typical international card, you’ll pay $103 after fees. Over 12 months, that’s $36 lost—enough to pay for another subscription!

With Gpaynow’s Turkish virtual card, you pay $100, not a cent more.

Use Cases: Where a Turkish Virtual Card Makes the Most Difference

A Turkish VCC isn’t just about saving 3%. It’s about unlocking financial freedom across dozens of platforms and scenarios.

1. Streaming Subscriptions

Save money on Netflix, Spotify, Disney+, and YouTube Premium. These platforms often offer lower regional prices when paid with a Turkish card.

Example:

Netflix Turkey Standard Plan: ~$4.99/month

Netflix US Standard Plan: ~$15.49/month With a Turkish virtual card, you save up to 68% monthly.

2. Digital Advertising (Google Ads, Facebook Ads)

International advertisers save significantly by paying in TRY. With 3D Secure Turkish VCCs, you can run global ad campaigns without worrying about rejected payments or high fees.

3. Airbnb & Travel Bookings

Many users from Europe and Asia use Turkish cards to book cheaper accommodations, flights, or tours. It’s perfect for frequent travelers and digital nomads.

4. Freelancers & Remote Workers

Use it to pay for SaaS tools, receive payments, or manage client expenses—especially on platforms like Fiverr, Upwork, or PeoplePerHour.

Why Choose Gpaynow’s Turkish Virtual Credit Card?

Gpaynow is not just another virtual card provider. We are committed to offering financial access with no barriers, supporting privacy, flexibility, and efficiency.

Here’s why 15,000+ users trust us:

No KYC hurdles – Ideal for users without a Turkish bank account.

Crypto-first system – Fund your card anonymously with BTC, ETH, or USDT.

Responsive support – Our WhatsApp chat team resolves issues fast.

Multi-card dashboard – Manage multiple cards for different purposes.

Visa/Mastercard options – Compatible with 99% of global merchants.

Real Customer Feedback

“I needed a reliable card for Netflix Turkey and Google Ads. Gpaynow gave me instant access with zero hassle. Saved me nearly $200 over three months.” — Ali K., UAE

“As a freelancer, I get paid in crypto. Gpaynow lets me convert and spend instantly without dealing with banks or KYC. A game-changer!” — Marina S., Argentina

Avoid Foreign Transaction Fees: Real Impact in Numbers

Let’s say you spend an average of $500 per month on international services, subscriptions, and online tools.

With a traditional card:

Foreign transaction fees (3%) = $15/month

Annual loss = $180/year

With a Turkish virtual card:

Foreign transaction fees = $0

Annual savings = $180 — enough to buy 3 months of SaaS tools or flight tickets.

The Future of Borderless Finance Is Here

With increasing global connectivity, users want financial products without restrictions. Traditional banks are still slow, expensive, and inflexible—especially for crypto holders or non-residents.

Virtual cards like ours at Gpaynow represent a paradigm shift—providing an instant, borderless, and privacy-friendly way to spend online.

What You Gain

Freedom from bank dependencies

Global purchasing power

Real-time control over spending

Anonymity in transactions

Protection from currency fluctuations

How to Get Your Turkish Virtual Credit Card

Ready to stop wasting 3% on every international payment?

Here’s how to get started:

Visit Gpaynow.com

Choose your card type (Visa or Mastercard, prepaid or credit)

Top up using crypto (BTC, USDT, ETH)

Receive card details instantly

Start spending online and saving money immediately

No paperwork. No waiting. Just seamless access.

Final Thoughts: Why 3% Is a Big Deal

In the world of finance, small percentages make a big difference. A 3% foreign transaction fee might not seem much at first glance—but over time, it silently drains your wallet.

With Gpaynow’s Turkish virtual credit card, you regain that money. You get a 3D secure, crypto-friendly, instantly activated card that works globally—without foreign transaction fees.

Whether you're a digital nomad, an advertiser, a crypto user, or just someone who values their money—this is the smarter, safer way to pay.

0 notes