#vendor invoice processing

Explore tagged Tumblr posts

Text

Improving Cash Flow with Accounts Payable Outsourcing

For small and medium enterprises (SMEs), managing payables can be resource-intensive. Payables outsourcing offers a strategic advantage by improving efficiency, accuracy, and compliance while lowering operational costs.

One of the key benefits of outsourcing AP services is access to specialized expertise without the cost of hiring a full-time team. SMEs can rely on outsourced providers to handle invoice processing, vendor communication, and payment reconciliations with precision.

Another significant advantage is scalability. As a business grows, its transaction volume increases. Payables outsourcing ensures that financial operations can keep pace without strain. Furthermore, advanced technologies used by outsourcing providers improve data accuracy and help avoid common errors in manual processing.

Outsourcing also ensures compliance with changing tax regulations and financial reporting standards. This is particularly important for SMEs that may not have in-house legal or financial experts.

By choosing a reliable payables outsourcing partner, SMEs gain the freedom to focus on growth and customer satisfaction while maintaining robust financial controls. It’s a practical move that enhances both stability and performance.

#SME accounts payable#outsourcing AP services#payables management for SMEs#vendor invoice processing#scalable AP solutions

0 notes

Text

Rightpath Global Services: The Experts in Payables Outsourcing

In today's fast-paced business environment, efficient financial operations are key to success. Rightpath Global Services (Rightpath GS) offers cutting-edge Business Process Management solutions, specializing in accounts payable outsourcing. By automating and managing payables, businesses can reduce errors, save time, and focus more on growth strategies rather than manual accounting tasks.

Their customized solutions help companies maintain vendor relationships, ensure timely payments, and improve compliance. With complete visibility and control, clients benefit from reduced costs and enhanced productivity.

Partnering with Rightpath Global Services for accounts payable outsourcing transforms finance operations. Their Business Process Management approach not only optimizes workflows but also ensures scalability as your company grows. Trust in Rightpath GS to manage your financial backend while you focus on innovation and expansion.

#finance outsourcing#vendor payment solutions#workflow automation#invoice processing#outsourcing finance operations

0 notes

Text

The Ultimate Guide to Vendor Management Strategies

The core of each organisation's procurement process is its vendors. Nonetheless, a lot of businesses sometimes undervalue the significance of building strong bonds with their vendors. Due to this, they sometimes deteriorate the relationship with their vendors and do not receive materials or goods from them. That is why these companies are getting interested in vendor management systems.

#accounts payable management#accounts payable outsourcing services#Invoice Processing#invoice processing services#vendor management software#Vendor Management Strategies#vendor management system#MYND Solution

0 notes

Text

Mastering Accounts Payable: 15 Common Interview Questions and Expert Answers

Preparing for an Accounts Payable (AP) interview is a crucial step in securing a position in this vital finance function. To help you excel in your interview, we’ve compiled a comprehensive guide that covers the 20 most common AP interview questions, each paired with expert answers. In this article, you’ll gain valuable insights into the world of AP and enhance your chances of acing your…

View On WordPress

#Accounting#Accounting Software#Accounting Standards#Accounts Payable#Accuracy in AP#AP Interview#Cost Savings#data security#Disputed Invoices#Financial Regulations#Foreign Currency Transactions#Fraud Prevention#High Invoice Volume#Invoice Processing#Payment Methods#Tax Compliance#Urgent Payments#Vendor Onboarding#Vendor Relationships

1 note

·

View note

Note

Juno, out of curiosity, what does an accountant DO? What does it mean to be one? Because I know there's math involved. I've heard it's very boring. But I don't know anything else and I'm curious because you're very good at putting things to words.

Okay first of all, I cannot express just how excited I got when I first saw this message. There is nothing I love more than talking about things I know about, and usually when my career is mentioned I don't get questions so much as immediate "Oh, bless you" and "I could never"s. Which- totally fair! For some people, accounting would be boring as all hell! But for a multitude of reasons, I adore it.

There are multiple types of accounting. The type most people tend to be more familiar with is that done by CPAs- CPAs, or Certified Public Accountants, are those that have done the lengthy and expensive process to be certified to handle other peoples' tax documents and submit taxes in their name, amongst other things. Yawn, taxes, right? Well, the thing with that is that there's a lot of little loopholes that tax accountants have to remain familiar with, because saving their clients a little more here or getting a little more back there can really add up, and can do a lot for people who, say, have enough money to afford to hire someone to do their taxes but not necessarily enough to be going hog wild with. Public accountants can work for large firms or by themselves, and also do things like preparing financial statements for businesses, auditing businesses to ensure all of their financial transactions are true and accurately reported to shareholders and clients, and consulting on how finances can be managed to maximize profit (money in - money out = profit, in very simple terms).

The type of accounting I do is private accounting! That basically just means that I work for a company in their in-house accounting/finance department. Private accounting tends to get split up into several different areas. My company has Payroll, Accounts Receivable, and Accounts Payable.

Payroll handles everyone's paychecks, PTO, ensuring the correct amount of taxes are withheld from individuals per their desires, and so on. Accounts Receivable handles money flow into the company- so when our company sells the product/service, our Accounts Receivable people are the ones who review the work, create the invoices, send the invoices to the clients, remind clients about overdue invoices, receive incoming payments via ACH (Automatic Clearing House- direct bank-to-bank deposits), Wire (Usually used for international transactions), or Check, and prepare statements that show how much revenue we are expected to gain in a period of time, or have gained in a period of time. This requires a lot of interfacing with clients and project managers.

My department is Accounts Payable. Accounts Payable does basically the other side of the coin from what Accounts Receivable does. We work mostly with vendors and our purchasing/receiving departments. We receive invoices from people and companies that have sold us products/services we need in order to make our own products/perform our services, enter them into our ERP (Enterprise Resource Planning, a system that integrates the departments in a company together- there are many different ERPs, and most people simply refer to their ERP as "the system" when talking internally to other employees of the same company that they work at, because saying the name of the system is redundant) using a set of codes that automatically places the costs into appropriate groups to be referenced for later financial reports, and run the payment processing to ensure that the vendors are being paid.

To break that down because I know that was a lot of words, here's some things I do in my day-to-day at work:

- Reconciliations, making sure two different statements match up: the most common one is Credit Card reconciliations, ensuring that there are appropriately coded entries in the system that match the payments made on our credit line in our bank.

- Invoice entry: this is basic data entry, for the most part. This can have two different forms, though

- Purchase Order Invoice entry: Invoices that are matched both to the service/product provided from the vendor and the purchase order created by our Purchasing/Receiving department. We ensure that the item, the quantity, and the price all match between our records, the purchase order, and the invoice, before we enter this.

- Hard Coded Invoice entry: Invoices that we enter manually due to there being no Purchase Order for them. This is often recurring services, like cleaning or repairs, that may happen too often or have prices vary too much for Purchase Orders to be practical.

- Cleaning up old purchase orders: sometimes Purchase Orders are put in the system and then never fulfilled. Because this shows on financial statements as being a long-standing open commitment, it looks bad, so we have to periodically research these and find out if the vendor simply didn't send us the invoice, if the order was cancelled, or if something else is going on.

- Forensics! This is my personal favorite part of the job, where someone has massively borked something that is affecting my work, and so I go dig into it, sometimes going back as four or five years in records to find the origin point of the first mistake, and untangling the threads of what happened following that mistake to get us to where we are today. There's an entire field called Forensic Accounting that is basically just doing This but for other companies (it's a subset of auditing, and often is done via the IRS) and that's my dream position to be totally honest. I loooove the dopamine hit i get with solving the mystery and getting praised for doing so faster than anyone else has even begun to realize the problem to start with.

- Balancing Credits/Debits: This is more of a Main Accountant role thing, but the long and short of it is that every business has Assets, Liabilities, and Equity. Liabilities and Equity are what we put into the company/what we owe, and assets are what we have received/what we are owed. Anything that increases Assets or lowers Liabilities or Equity is a Debit. Anything that decreases Assets or raises Liabilities or Equity is a Credit. Every monetary change we process has to include an equal Debit and Credit. This is its own whole lecture, so if you wanna know more about double-entry accounting, let me know, but it's yawnsville for most people.

- Actually cutting checks or initiating bank payments to vendors for amounts we owe them.

- Vendor communication: I'm on the phones and email a lot with vendors who are wondering where their payment is, or why something was short-paid, or if I can change some of their info in our system, and so on and so on. Every job is customer service, unfortunately. I don't love it, but I do a lot less of it in private accounting than I would have to do in public accounting.

- Spreadsheets: I make so many spreadsheets I am a goddamn Excel wizard. I love spreadsheets. This isn't necessarily accounting-specific though, most people in Finance jobs love spreadsheets, or at least use them to make their lives easier. I make them just for fun, because I'm a giant fucking nerd who finds that kind of thing enjoyable lol. So if you ever need a spreadsheet made for anything, hit me up.

As for math, that's a pretty common misconception. While there is math, it is very rarely more complicated than "I paid $3 of the $8 I owe, now I owe $5" for me. There are some formulas you learn in school (Business Administration with a focus in Accounting is what I studied), but they're also pretty standard and rarely include more than like... basic algebra. Which. Thanks @ god because I flunked so hard out of pre-calc in college. I could not have done accounting if it really were all that math heavy.

Aaaand yeah! That's all I've got off the top of my head- if you have any more questions about it, do let me know, I'm happy to ramble on for hours, but I'm cutting it here so I don't start meandering on without direction lol.

45 notes

·

View notes

Text

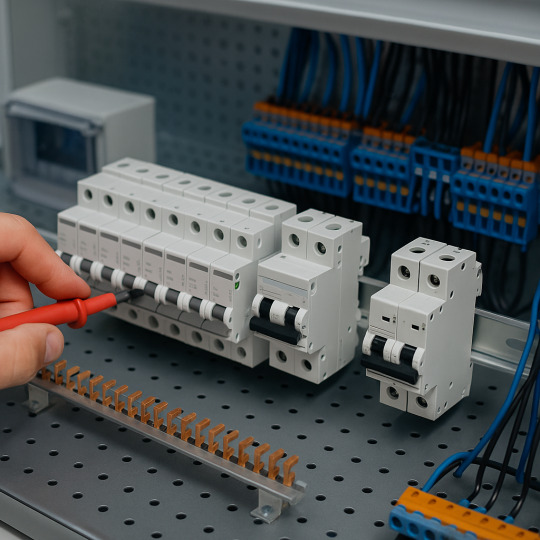

How the Right Supplier Can Improve Your Panel Assembly Workflow

In the competitive world of electrical panel manufacturing, time, consistency, and precision are everything. A well-organized panel assembly workflow can be the difference between hitting deadlines and losing contracts. But one often-overlooked factor in achieving operational efficiency is this:

The right supplier isn’t just a vendor — they’re a strategic partner. In this blog, we’ll break down how the right supplier can directly enhance your panel assembly workflow, reduce friction in operations, and elevate your entire production process.

1. Ensuring Reliable Component Availability

Panel assembly often stalls because of component shortages. When you’re missing critical parts — like circuit breakers, contactors, or terminal blocks — your line goes idle.

A dependable supplier:

· Maintains ready stock of high-demand components

· Offers real-time inventory updates

· Provides just-in-time (JIT) delivery

This ensures your team always has what it needs, minimizing production downtime and keeping your project timelines on track.

Impact: Faster production starts, fewer delays, better throughput.

2. Simplifying the Procurement Process

Juggling multiple vendors for various panel parts creates complexity — multiple orders, invoices, and deliveries. It eats up time your team could spend on value-added tasks.

A smart supplier partner:

· Consolidates a wide range of panel components

· Offers bundled BOM support

· Provides a single point of contact for all orders

This streamlined approach reduces your procurement overhead, lowers admin costs, and frees up your internal resources.

Impact: Faster ordering, reduced paperwork, smoother coordination.

3. Improving Product Selection and Compatibility

Choosing the wrong component — even slightly incompatible — can lead to rework, panel redesign, or even failures in the field. That’s a major risk to quality and your brand.

A technically capable supplier:

· Understands your electrical panel design and specs

· Guides you on compatible, compliant components

· Helps you select cost-effective alternatives when needed

With expert support, your team avoids costly errors and gets it right the first time.

Impact: Better accuracy, fewer mistakes, higher quality output.

4. Reducing Lead Times Through Local Sourcing

Global supply chains can be unreliable — delays at ports, shipping bottlenecks, and customs hold-ups all hurt your workflow.

A locally positioned supplier:

· Sources and stocks components closer to your facility

· Offers same-day or next-day delivery

· Bypasses import-related delays

This leads to shorter lead times, more predictable schedules, and the ability to react quickly to urgent needs.

Impact: Agile production schedules, improved customer responsiveness.

5. Supporting Scalable Growth

As your panel-building business grows, your workflow complexity increases. You’ll need a supplier that can scale with you.

A growth-ready supplier:

· Keeps track of your recurring BOM patterns

· Prepares for larger, scheduled orders

· Offers credit terms or inventory reserves for long-term customers

Instead of being reactive, you can plan your production proactively — without worrying about supply issues.

Impact: Smooth scaling, reduced bottlenecks, confident expansion.

6. Providing Value-Added Services

Beyond just selling products, great suppliers offer services that make your workflow leaner:

· Pre-kitting: All components bundled per job

· Labeling and part tagging

· Custom panel parts or DIN rail assemblies

· Training on new product integration

These extras can shave hours off assembly time and improve jobsite or factory efficiency.

Impact: Leaner processes, faster panel builds, lower labor costs.

Conclusion: Suppliers Are Part of Your Workflow Strategy

Your workflow is only as strong as its weakest link — and for many panel builders, that weak link is a slow or unreliable supplier.

At Daleel Trading, we go beyond supplying components. We

Stock what you need

Deliver when you need it

Support you with technical know-how

And grow with your business

The right supplier doesn’t just deliver products — they deliver productivity.

Ready to streamline your panel assembly workflow?

Contact Daleel Trading today to discover how we can simplify your sourcing, boost your efficiency, and help you build better panels — faster.

8 notes

·

View notes

Text

Business Owner’s Stolen Crypto Recovered After 5-Month Ordeal

When Troy Nathan., the CEO of a boutique software startup based in Austin, Texas, opened an email that appeared to be from a trusted vendor, he had no idea it would mark the beginning of a five-month nightmare.

The message contained a routine-looking invoice and a link to a PDF. But the link redirected him to a spoofed login page that captured his private keys. Within an hour, over $230,000 worth of Ethereum had been drained from his company’s digital wallet. “My heart dropped. I refreshed the wallet and saw the balance was almost zero. I just sat there in disbelief,” Troy said.

The next several weeks were filled with panic, confusion, and failed attempts to recover the funds. Troy hired independent IT security consultants and even reached out to legal experts in blockchain fraud. “Everyone told me the same thing: once it’s gone, it’s gone. That’s the reality of crypto,” he recalled.

But Troy refused to accept that answer.

One late night on a crypto recovery forum, a comment stood out a user recommended a low-profile but highly skilled team called Astraweb, known for using forensic tools to track down stolen digital assets. With little to lose, Troy reached out to their team via [email protected].

To his surprise, Astraweb responded within hours. Their recovery process started with a deep forensic audit of the compromised wallet, followed by blockchain behavior modeling to identify and trace the attackers’ movement. According to Troy, Astraweb utilized tools that could map smart contracts and wallet clusters even when hackers attempted to launder funds across decentralized exchanges or mix them in tumblers.

“They explained everything clearly, didn’t overpromise, and took the time to understand the attack,” Troy said. “Within a few weeks, they had mapped out a trail of transactions and began actively tracking the stolen Ethereum across multiple wallets.”

Using smart contract analytics and darknet monitoring tools, Astraweb was able to intercept transactions and ultimately recover 91% of the stolen assets. “I couldn’t believe it. They recovered over $210,000 worth of Ethereum. I’d already written it off as a total loss.”

Astraweb declined to comment for this story, citing confidentiality and the ongoing nature of other recovery operations. However, their track record is quietly growing in crypto circles, where anonymity and theft often go hand-in-hand.

Troy has since overhauled his company’s digital security protocols. Multi-signature wallets, cold storage, staff training, and simulated phishing tests are now part of the company culture. “This experience taught me that even tech professionals aren’t immune. But there are experts out there who can help if you know where to look.”

For business owners and individuals who have fallen victim to crypto theft, Troy has one recommendation: “Don’t give up. Contact Astraweb at [email protected]

4 notes

·

View notes

Text

Boost Your Planning Business with the Best Wedding and Event Software Tools

In today’s fast-paced world, planning events and weddings is more complex than ever. With countless moving parts, deadlines, vendors, and clients to manage, many professionals are turning to smart digital solutions to streamline their work. Using tools like wedding planner computer software has become a game-changer for professionals in the event industry.

Organize Better with Smart Wedding Planning Tools

Staying on top of every detail is critical in this industry. That’s where event planning software for wedding planners makes a big impact. These platforms allow you to manage guest lists, plan timelines, and coordinate vendors more efficiently than ever before.

One of the best investments for any professional in this space is software for wedding planners. It’s a must-have for anyone serious about delivering seamless events. From timeline creation to payment tracking, software for wedding planners reduces manual tasks and helps planners stay ahead of schedule.

In addition, wedding planner software simplifies client communication, ensuring that everyone is on the same page from day one. This results in happier clients, better feedback, and more referrals.

Take Control of the Entire Planning Process

To manage a growing list of clients and events, professionals use wedding planning software that provides a central dashboard for all planning tasks. These tools allow planners to focus more on creativity and client experience, rather than chasing down details manually.

Manage Your Business Like a Pro

Beyond event coordination, running a successful planning business also requires solid business tools. That’s why many professionals depend on event planning business software to manage contracts, invoices, and client records securely.

Choosing the right software for event planning can make day-to-day operations smoother. It allows planners to avoid unnecessary stress and focus on delivering unforgettable experiences.

Many teams now rely on Software for planning events that offer collaboration features, calendar syncing, and reporting tools to measure performance.

Empower Teams and Manage Venues More Efficiently

For teams that work together on multiple events, using event planners software is essential. It allows seamless task delegation, timeline updates, and easy communication, helping everyone stay aligned.

When it comes to managing physical venues, Event Venue Planning Software helps visualize layouts, manage bookings, and ensure spaces are used efficiently. Whether you’re organizing seating charts or managing room availability, this tool adds tremendous value.

Use Technology to Stay Competitive

As events grow more complex, professionals are turning to event management planning software to manage logistics, technical requirements, and scheduling in one streamlined platform. This ensures that no task or deadline gets overlooked.

Many professionals prefer all in one event planning software because it includes everything from task tracking to budgeting and reporting tools. This allows planners to manage entire events from one platform without switching between systems.

The growing demand for online event planning software shows how much the industry is embracing digital tools. Cloud access, data backup, and real-time updates make these platforms ideal for modern-day planning.

With the rise of remote work and mobile access, using Digital wedding planning software has become more important than ever. These tools offer convenience, flexibility, and security, which are key to running a successful planning business.

For venue managers, event venue management software helps track bookings, manage operations, and improve customer service. It’s a vital tool for keeping operations efficient and organized, especially in high-demand seasons.

Final Thoughts

The event and wedding planning industry is moving quickly toward smarter, more efficient solutions. Whether you’re an independent planner or part of a larger team, investing in professional tools like wedding planner computer software and online event & wedding planning software can transform how you work.

Using comprehensive tools such as software for wedding planners, event planning business software, and event venue management software helps reduce stress, improve client satisfaction, and scale your business with confidence.

Frequently Asked Questions (FAQ)

1. What is wedding planner computer software?

Wedding planner computer software is a digital tool that helps wedding planners organize every aspect of a wedding. It includes features like guest list tracking, vendor coordination, budget management, and event scheduling. This software helps planners work more efficiently and deliver seamless wedding experiences.

2. How is online event & wedding planning software different from traditional planning methods?

Online event & wedding planning software offers cloud-based access, allowing planners to manage tasks, clients, and vendors from any location. Unlike traditional methods, this software provides real-time updates, automated reminders, and easier collaboration, making planning faster and more organized.

3. Who should use event planning software for wedding planners?

Event planning software for wedding planners is ideal for professional wedding coordinators, event organizers, and planning teams. It helps streamline operations, manage timelines, and ensure that no detail is missed during the planning process.

4. Is software for wedding planners useful for small businesses?

Yes, software for wedding planners is especially useful for small businesses. It helps manage client communications, organize tasks, and keep track of budgets — all in one place. Even small teams can benefit from these tools to maintain a professional and organized service.

2 notes

·

View notes

Text

Chicago Real Estate Market: Trends, Opportunities, and What to Expect in 2025

Managing a business involves more than just delivering excellent products and services. Financial management plays a critical role in the success of any business. For many business owners in North Carolina, bookkeeping can become an overwhelming task that diverts attention from core operations. However, outsourcing bookkeeping services can streamline financial processes, save valuable time, and lead to significant cost savings.

Here's a closer look at how professional bookkeeping services can optimize financial management.

Time Savings: Focus on What Matters

Every business owner understands the importance of time, and bookkeeping tasks can quickly take up valuable hours that could be better spent on growing the business. Managing financial records, categorizing transactions, and reconciling accounts can be complicated and tedious. Outsourcing these tasks to experienced bookkeepers frees up time to focus on strategic goals, customer relations, and other business operations.

By trusting experts with financial duties, owners ensure that these tasks are handled efficiently and accurately. Bookkeepers use specialized tools to organize and maintain financial records, making the process faster and more reliable. As a result, businesses avoid spending time correcting mistakes and can rest assured that financial records are up to date.

Financial Clarity: Informed Decision-Making

Clear, accurate financial data is essential for making informed decisions. Without up-to-date reports, it can be challenging to understand the true state of a business's finances. Professional bookkeeping services provide valuable insights into cash flow, income, and expenses. Business owners gain a clear picture of financial health, which is vital for planning and budgeting.

Regular financial reports, including profit and loss statements, balance sheets, and cash flow summaries, help identify trends and highlight areas for improvement. With this knowledge, businesses can adjust strategies, identify opportunities for growth, and make smarter decisions that lead to success. Understanding the numbers simplifies the decision-making process and helps ensure long-term sustainability.

Reducing Costs: Avoiding Errors and Penalties

Handling bookkeeping independently often leads to mistakes—whether it's misclassifying an expense or missing a tax deduction. These errors can result in costly penalties, missed savings, or poor financial decisions. By working with professional bookkeepers in Chicago for real estate, businesses can reduce the risk of errors that could lead to economic setbacks.

Experienced bookkeepers ensure that taxes are filed correctly, transactions are properly recorded, and all necessary deductions are applied. This not only helps avoid penalties but also uncovers potential savings by identifying overlooked deductions or financial inefficiencies. Outsourcing bookkeeping services, therefore, saves money by preventing costly mistakes.

Streamlining Operations: Efficient Financial Management

Bookkeeping involves more than just tracking income and expenses. It also includes managing accounts payable, accounts receivable, payroll, and tax filings. Keeping up with these responsibilities can become overwhelming, especially as a business grows. Professional bookkeeping services automate many of these processes, ensuring they are completed efficiently and on time.

Timely payment of invoices and the smooth processing of payroll help businesses maintain strong relationships with vendors and employees. At the same time, timely billing and collections keep cash flow consistent. By handling these essential tasks, bookkeeping services allow business owners to focus on other aspects of their operations, while the financial side of the business remains in capable hands.

Scalability: Adapting to Business Growth

As businesses grow, so do their financial complexities. Whether it's increasing revenue, adding new employees, or expanding to new markets, the need for more detailed financial management arises. Professional bookkeeping services can scale with a business, providing tailored solutions as needs evolve.

Outsourcing bookkeeping allows businesses to avoid the cost and hassle of hiring additional in-house staff or purchasing expensive software. Bookkeepers can adjust their services to accommodate changing demands, whether it's managing more transactions or overseeing more complex accounting tasks. This scalability ensures that businesses are equipped to handle growth without compromising on financial accuracy.

Data Protection: Safeguarding Financial Information

When it comes to financial data, security is critical. Storing sensitive business information—such as revenue details, tax filings, and payroll records—requires a high level of protection. Professional bookkeeping services use secure systems to ensure that financial records are safely stored and only accessible to authorized personnel.

By employing encryption and secure cloud storage, bookkeepers safeguard against data breaches and fraud. Additionally, regular reconciliations and audits help detect any discrepancies or signs of fraudulent activity, providing an extra layer of protection for the business's financial assets.

Conclusion: Why Bookkeeping Services Are an Investment

Outsourcing bookkeeping may seem like an added expense, but it's an investment that yields significant returns. By entrusting financial management to experts, business owners save valuable time, reduce the risk of costly errors, and gain valuable insights into their financial health. From improving cash flow management to identifying areas for cost savings, professional bookkeeping services help businesses optimize operations and increase profitability.

For businesses in North Carolina, professional bookkeeping is not just a convenience—it's a strategic asset that ensures financial processes are efficient, accurate, and secure. By freeing up time and minimizing costs, bookkeeping services allow businesses to focus on what matters most: achieving long-term success and growth.

To know more about real estate services, visit the website now.

2 notes

·

View notes

Text

Wedding Planning Made Simple: Essential Tips for Staying Organized

Planning a wedding is an exciting yet overwhelming journey. From choosing the perfect venue to selecting the right decor and managing countless details, staying organized is essential for creating the day of your dreams. Whether you’re planning a lavish destination wedding or a traditional Hindu or Punjabi celebration, keeping track of everything will help minimize stress and make the process enjoyable. In this guide, we’ll explore the best ways to stay organized while planning your wedding and how the right tools, professionals, and mindset can make all the difference.

Start with a Clear Vision

Before diving into the logistics, take some time to envision your perfect wedding day. Consider the style, theme, and atmosphere you want to create. Are you dreaming of a beachside ceremony with a destination wedding planner near me, or a vibrant traditional event with stunning Punjabi wedding decor? Having a clear vision will help guide your decisions and ensure every element aligns with your expectations.

Set a Realistic Budget

One of the most crucial steps in wedding planning is establishing a budget. Outline your priorities and decide how much you’re willing to spend on each aspect of the event. Include categories like venue, catering, attire, event decorations, photography, and entertainment. Don’t forget to set aside funds for unexpected expenses. A well-structured budget will prevent overspending and keep your finances in check.

Create a Detailed Wedding Planning Checklist

A comprehensive checklist is a lifesaver when planning a wedding. Break down tasks into manageable steps and set deadlines for each. Here’s an example:

12 Months Before: Set the date, book the venue, hire a wedding planner in Toronto.

9 Months Before: Choose your bridal party, start shopping for attire, book key vendors.

6 Months Before: Finalize guest list, send save-the-dates, plan decor.

3 Months Before: Order invitations, schedule fittings, confirm details with vendors.

1 Month Before: Finalize seating chart, confirm guest count, pack for the honeymoon.

This timeline will keep you on track and ensure nothing is overlooked.

Use Digital Tools and Apps

Take advantage of wedding planning apps and digital tools to stay organized. Platforms like Trello, Google Sheets, and WeddingWire offer customizable checklists, budget trackers, and vendor directories. These tools make it easy to collaborate with your partner and wedding decorators near me in Brampton, keeping everyone on the same page.

Hire Professional Help

A professional wedding planner in Toronto can be a game-changer, especially if you’re short on time or planning a large event. They bring experience, connections, and creativity to the table, helping you bring your vision to life without the stress. If you’re planning a destination wedding, working with a destination wedding planner ensures every detail is managed, even from afar.

For specific cultural elements, hiring experts in Punjabi wedding decor or Hindu wedding mandap decorations can help maintain authenticity and elegance. Local wedding decorators near me in Brampton are also invaluable for transforming your venue with style and efficiency.

Keep Important Documents Organized

Create both digital and physical folders for essential documents like contracts, invoices, and receipts. Organize them by category—venue, vendors, attire, and decor—so you can easily access them when needed. Tools like Dropbox or Google Drive offer secure cloud storage and easy sharing with your planner or partner.

Communicate Clearly with Vendors

Effective communication with your vendors is key to a smooth planning process. Confirm every detail in writing and keep records of conversations and agreements. Schedule regular check-ins to stay updated and address any issues early on.

Schedule Regular Planning Sessions

Dedicate specific times each week to discuss and work on wedding plans. Consistent planning sessions prevent last-minute scrambles and help you stay organized and focused.

Prioritize Self-Care

Amid the excitement and stress of wedding planning, don’t forget to take care of yourself. Schedule downtime, enjoy date nights, and lean on your support system. A well-rested and happy couple is the foundation of a beautiful celebration.

Final Thoughts

Staying organized while planning your wedding takes effort, but with the right approach, it can be a joyful and rewarding experience. By creating a clear vision, using helpful tools, and working with experienced professionals like a wedding planner in Toronto or decorators specializing in Punjabi and Hindu weddings, you’ll set the stage for a memorable and stress-free celebration.

Whether you’re planning a grand destination wedding or an intimate gathering, Blooming Wedding Decor is here to bring your dream wedding to life. From stunning event decorations to cultural touches like Hindu wedding mandap decorations, our team ensures every detail is perfect. Contact us today to start planning the wedding of your dreams!

#blooming wedding decor#party decoration#elegant decor#anniversary decoration services#wedding decor canada#wedding decorations#anniversary decoration#decoration#hindu wedding decorations#wedding planners#wedding planner in canada#wedding venue#wedding venues

2 notes

·

View notes

Text

How to Set Up a Simple Filing System for Receipts and Invoices

Keeping track of receipts and invoices is crucial for any business. Without an organized system, important documents can get lost, making tax time stressful and financial tracking difficult. Fortunately, setting up a simple filing system doesn’t have to be complicated. Here’s how you can do it in a few easy steps.

1. Choose a Storage Method

Decide whether you prefer a physical, digital, or hybrid filing system.

Physical System: Use labeled folders, binders, or an expanding file organizer.

Digital System: Scan receipts and invoices and store them in cloud services like Google Drive, Dropbox, or a dedicated accounting software.

Hybrid System: Keep physical copies for tax purposes while maintaining a digital backup.

2. Categorize Your Documents

Sorting receipts and invoices into categories will make retrieval easier.

By Date: Organize documents by month and year.

By Vendor: Keep separate files for each supplier or service provider.

By Expense Type: Group receipts by categories such as office supplies, travel, utilities, and client expenses.

3. Use Consistent Naming Conventions

For digital storage, use a clear and uniform naming system. Example:

YYYY-MM-DD_Vendor_Amount (e.g., 2025-02-10_OfficeDepot_45.00)

4. Set a Regular Filing Schedule

Schedule time each week or month to file receipts and invoices. This habit will prevent document buildup and ensure you stay on top of financial records.

5. Utilize Accounting Software

Many accounting tools, such as QuickBooks, Wave, and FreshBooks, allow you to upload and categorize receipts directly. This automates part of the filing process and ensures everything is stored in one place.

Final Thoughts

An organized filing system for receipts and invoices can save time, reduce stress, and improve financial clarity. Whether you choose a physical, digital, or hybrid approach, consistency is key. Start setting up your system today and enjoy the benefits of hassle-free record-keeping!

#small business#entrepreneur#business organization#financial tips#bookkeeping#invoicing#receipt management#productivity hacks#finance organization#self employed#virtual assistant#business tips#money management#tax season#digital organization

2 notes

·

View notes

Text

Efficient Payroll and Vendor Management Software for Seamless Processes

In today's dynamic business environment, efficiency plays an undeniable role in achieving success. Managing payroll and vendors manually can be time-consuming and prone to errors. It can impede your team's productivity. However, implementing payroll management systems and vendor management software can revolutionise your operations by streamlining processes, ensuring precision, and saving time and resources.

#Payroll Management System#Vendor management software#Vendor Management System#Payroll System Software#Invoice Processing

0 notes

Text

How I Solved My Invoice Payment Hassles: A Baker’s Story

Owning a bakery in a quaint little town is like living in a warm, flour-dusted dream. But I’ll admit it’s not without its challenges. One of the biggest hurdles I’ve faced over the years has been managing my invoices and payments. It’s not something I like to talk about, but there were times when my lack of organization led to missed payments and strained relationships with suppliers.

I remember one particularly stressful week. My supplier called me early on a Monday morning, frustrated that I hadn’t paid for the last flour shipment. I sighed and said, “I’m so sorry. I completely forgot about it. I’ll fix it right away.” But fixing it wasn’t as easy as it sounded. I’d been so busy juggling orders and experimenting with new recipes that I completely forgot to make the invoice payment. Now, I was scrambling to make things right while dealing with an already hectic week. It felt like no matter how hard I tried, the administrative side of running my bakery always got the better of me.

That’s when a fellow business owner, Jake, mentioned Zil Money to me. Over coffee one afternoon, Jake said, “Man, you gotta try this platform. It’ll change your life.” They raved about how Zil Money had simplified their invoicing and payment processes. At first, I was hesitant. “Can it really make that much of a difference?” I asked. But I was desperate for a solution, so I decided to give it a shot.

Before Zil Money, I was juggling multiple platforms to meet my suppliers’ preferences. Some wanted checks, others needed ACH transfers, and a few insisted on wire payments. It was a logistical nightmare. I always felt like I was one step away from a disaster. With Zil Money, all of that changed. The platform allowed me to handle all these payment methods in one place. Whether I needed to send a check, initiate an ACH transfer, or make a wire payment, Zil Money made it quick and easy.

One day, I was at the local farmer’s market picking out fresh ingredients for a new tart recipe when my phone buzzed. It was a message from one of my vendors reminding me about an invoice that needed to be paid. In the past, this would have meant rushing back to the bakery, digging through paperwork, and losing precious time. But this time, I simply opened the app on my phone and made the payment right then and there. It took less than a minute, and I didn’t have to break my stride. “That was so easy,” I thought, smiling to myself. That’s when I realized just how much Zil Money had transformed my workflow.

Over time, I’ve seen the ripple effects of using Zil Money. My suppliers are happier because they know they’ll get paid on time. I’ve saved countless hours that I now spend focusing on my customers and perfecting my recipes. And, perhaps most importantly, I feel more in control of my business.

What’s even better is that Zil Money doesn’t just help with making payments—it also lets you create and send invoices effortlessly. With a few clicks, I can customize invoices and send them directly to my vendors. Collecting payments has become just as simple. I can send out personalized payment links to my vendors, and when they click on the link, they’re taken to a secure checkout page. From there, they can pay using their credit card or bank account, making the entire process smooth and efficient.

Jake was right. Zil Money didn’t just simplify one part of my business; it transformed the way I operate. One of the best features is how mobile-friendly it is. Whether I’m at the market or in the kitchen, I can handle invoices and payments from my phone.

There was one moment that really made me grateful for Zil Money. I was busy decorating a wedding cake when I got a notification about a payment due. Normally, I’d have to stop everything, clean up, and go to my computer. But this time, I pulled out my phone, tapped a few buttons, and the payment was done. I didn’t even lose my focus. “I couldn't believe how much simpler things had become,” I muttered, shaking my head in disbelief.

Since I started using Zil Money, I’ve gained back so much time and energy. My customers are happy, my suppliers are happy, and I’m happy. If you’re a small business owner struggling with invoicing and payments, take it from me: Zil Money can make a world of difference. It’s not just a tool; it’s like having an extra set of hands when you need them most.

2 notes

·

View notes

Text

How to Import Food Products into the UAE

The UAE is a major importer of food due to its advantageous location and strong economy. It is essential to comprehend the rules and procedures in order to be successful in this field.

Establish a Business in Dubai First: Obtain licenses and legally launch your company. Register with Food Authorities: Complete the Dubai Municipality and MOCCAE registrations. Halal Certification: Verify that every product made from meat and poultry satisfies halal requirements. Reliable Vendors: Collaborate with suppliers who meet UAE quality requirements. Logistics Plan: For appropriate handling and storage, use authorised logistics. Get the documents ready: Send in invoices, certifications, and customs declarations. Customs Clearance: Comply with the inspection and clearance processes. Distribution: Provide distributors and final consumers with cleared goods.

Understanding UAE’s Food Import Laws

Authorities: Dubai Municipality and MOCCAE oversee safety and quality, while Federal Customs handles clearance.

Key Compliance Areas: Halal certification for meat and poultry. Bilingual labels in Arabic and English. Proper packaging and storage practices.

Challenges to Avoid

Missing or incorrect documentation.

Non-compliance with labeling standards.

Lack of halal certification for meat products.

Key Sectors and Popular Imports Sectors: Food imports are crucial to the hospitality, retail, and food processing industries. Fresh vegetables, dairy, seafood, cereals, legumes, and halal meat are among the products that are in high demand.

Who will help you?

Crosslink International makes travelling easier with:

complete assistance with license and company establishment. proficiency in negotiating food import laws in the United Arab Emirates. customised services to meet your company's requirements.

setting up a business in Dubai paves the way for success in one of the world's most dynamic markets. With convenience and assurance, unleash the potential of the flourishing food business in the United Arab Emirates.

#business setup in dubai#dubaibusiness#dubai#start a business in dubai#setup a business in dubai#import food into dubai#food business

2 notes

·

View notes

Text

Why Combining Insurance Credentialing with Medical Billing Services is a Game-Changer for Healthcare Providers

wo essential components — insurance credentialing and medical billing services — are often managed separately. However, combining these services into a unified workflow can transform how practices operate.

This integration is not merely about convenience; it’s a strategic move that directly influences revenue, compliance, and patient satisfaction.

1. Introduction to Insurance Credentialing

Insurance credentialing is the process by which healthcare providers become authorized by insurance carriers to serve insured patients. It involves verifying qualifications, licenses, experience, and other vital data.

Why It Matters

Ensures compliance with payer requirements

Allows providers to join insurance panels

Affects payment rates and timelines

Impacts patient trust and access

Credentialing is a complex, time-consuming process that requires constant upkeep to avoid denials and delayed payments.

2. Understanding Medical Billing Services

Medical billing is the financial backbone of healthcare operations. It involves the preparation, submission, and follow-up of claims for services rendered.

Key Functions

Coding and claim preparation

Submission to insurance payers

Payment posting and denial management

Patient invoicing and collections

Billing experts must stay up to date with payer policies, billing regulations, and coding standards to ensure efficient claims processing.

3. The Gap Between Credentialing and Billing

Outsourcing these services separately often leads to disconnected workflows, resulting in:

Miscommunication between credentialing and billing teams

Delays in billing due to pending credentialing

Incorrect payer data causing claim denials

Redundant efforts and operational inefficiencies

Alack of integration creates costly and time-consuming silos.

4. Benefits of Integrating Credentialing and Billing

When these services operate under one umbrella, they deliver synergy that reduces errors and boosts performance.

How Integration Makes a Difference

Improved Revenue Cycle Efficiency Billing can start immediately after credentialing is complete, reducing delays.

Faster Provider Registration Shared data accelerates onboarding and avoids redundancy.

Enhanced Compliance and Accuracy Access to current credentialing info reduces claim rejections.

Streamlined Communication A unified contact point simplifies coordination and resolutions.

Cost-Effective Operations Consolidation lowers overhead and improves transparency.

5. How the Integration Enhances Revenue Cycle Management

Revenue Cycle Management (RCM) spans all financial transactions in healthcare. Integration improves performance at every RCM stage:

Pre-Billing Phase

Verifies payer registration before medical billing services

Prevents early denials due to credentialing issues

Identifies missing provider information

Claim Submission

Applies payer-specific billing requirements

Leverages credentialed status for appropriate rates

Denial Management

Flags credentialing-related denials

Enables quick resolution without external delays

Reporting and Analytics

Tracks both credentialing and billing KPIs

Provides insights into provider performance and trends

6. Real-World Impact: Case Studies

Case Study 1: Multi-Specialty Clinic (Texas)

Issue: Separate vendors caused delays in provider registration

Impact: $150,000 in delayed reimbursements

Solution: Switched to an integrated vendor

Result: Faster credentialing and 35% increase in monthly collections

Case Study 2: Solo Practitioner (Florida)

Issue: Struggled to manage credentialing renewals and accurate billing

Solution: Adopted integrated services

Result: Reduced denials by 50%, lowered administrative burden by 40%

7. Technology’s Role in Streamlining Integration

Technology enables real-time collaboration and automation in credentialing and billing.

Key Features to Look For

Centralized provider database

Automated tracking of credentialing status

Integrated billing workflows

Real-time reporting and analytics

Compliance and audit tools

Cloud-based platforms enhance accessibility and team collaboration regardless of location.

8. Choosing the Right Partner

When selecting a provider for integrated services, do your research.

What to Look For

Experience in both insurance credentialing services and medical billing services

Flexible services tailored to practice size

Solid industry reputation and references

Advanced technology with RCM tools

Compliance expertise across payer networks

Always ask for case studies, conduct interviews, and review reporting capabilities.

9. Common Challenges and How to Overcome Them

Even with integration, challenges can arise. Here’s how to manage them:

Credentialing Delays

Solution: Start early during onboarding

Tip: Use automated reminders for expiration tracking

Inaccurate Provider Data

Solution: Maintain a real-time shared provider profile

Miscommunication

Solution: Create shared workflows, regular team huddles, and unified reporting

Technology Gaps

Solution: Choose scalable, all-in-one platforms that handle both services

10. Conclusion

For healthcare providers aiming for operational excellence, financial stability, and improved patient care, integrating insurance credentialing with medical billing is a strategic advantage.

This unified approach bridges the gap between administrative and revenue-generating functions, setting the stage for long-term success.

In today’s competitive market, minimizing revenue loss, reducing denials, and accelerating reimbursements are essential for survival. Combining these services empowers providers to streamline operations, ensure compliance, and focus more on delivering care — making it a true game-changer.

1 note

·

View note

Text

Bookkeeping in India by MASLLP: Simplify Your Financial Management

In today’s fast-paced business environment, maintaining accurate financial records is essential for businesses to succeed and grow. Efficient bookkeeping helps track income, expenses, and overall financial performance, ensuring compliance with legal requirements. MASLLP, a trusted name in financial solutions, offers top-notch bookkeeping services in India tailored to meet the diverse needs of businesses.

Why Choose MASLLP for Bookkeeping in India?

Expertise in Financial Management With a team of experienced professionals, MASLLP specializes in delivering bookkeeping solutions that cater to businesses of all sizes. Whether you are a startup or an established enterprise, their team ensures precision and timeliness in managing your financial records.

Tailored Solutions for Every Business MASLLP understands that every business is unique. Their bookkeeping services are customized to match your specific needs, whether you require basic record-keeping or comprehensive financial management.

Compliance with Indian Accounting Standards Navigating the complexities of Indian accounting laws and regulations can be challenging. MASLLP ensures full compliance with Indian Accounting Standards (Ind AS), GST norms, and other legal requirements, saving you from potential financial and legal troubles.

Cost-Effective and Scalable Services By outsourcing bookkeeping to MASLLP, businesses can save on hiring in-house staff and investing in expensive accounting software. Their services are scalable, allowing your bookkeeping requirements to grow with your business.

Bookkeeping Services Offered by MASLLP

Recording Transactions MASLLP ensures all financial transactions, including sales, purchases, receipts, and payments, are accurately recorded.

Bank Reconciliation Their experts reconcile your bank statements with your financial records to detect and resolve discrepancies.

Accounts Payable and Receivable Management MASLLP manages invoices, vendor payments, and customer collections to keep your cash flow healthy.

Financial Reporting Generate accurate financial statements, including profit and loss statements, balance sheets, and cash flow reports, for better decision-making.

GST Compliance and Filing Stay ahead with GST-compliant bookkeeping and timely filing of GST returns to avoid penalties.

Payroll Processing Simplify your payroll management with error-free calculation of salaries, taxes, and benefits.

Benefits of Bookkeeping in India to MASLLP Focus on Core Business Activities: Leave the complexities of bookkeeping to the experts while you concentrate on growing your business. Accurate Financial Insights: Make informed decisions with real-time, error-free financial data. Timely Compliance: Avoid penalties with on-time tax filings and compliance updates. Reduced Overheads: Save money on hiring and training in-house accounting staff. Why Bookkeeping is Crucial for Businesses in India Bookkeeping is not just about maintaining records; it’s the foundation of sound financial management. It helps businesses:

Monitor cash flow effectively. Plan budgets and allocate resources. Ensure tax compliance. Detect fraud and prevent financial mishaps. By partnering with MASLLP for bookkeeping in India, you ensure your business operates smoothly, remains compliant, and is prepared for growth.

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#auditor#taxation#ap management services

6 notes

·

View notes