Don't wanna be here? Send us removal request.

Text

Can I Pay the Credit Card Bill of My Family Member in India?

1. Introduction

Paying a family member's credit card bill in India is a question that many might have, especially in a country where family ties are strong, and financial support is often shared among relatives. Understanding the nuances of such transactions is crucial to ensure compliance with legal and financial regulations. This article will explore the various aspects of paying a credit card bill for a family member in India, including legal considerations, methods available, and expert insights.

2. Overview of Credit Card Payments

Definition of Credit Card Payments

Credit card payments involve settling the dues on a credit card, either fully or partially. These payments can be made through various methods, such as online banking, mobile apps, or direct transfers.

Common Methods of Payment in India

In India, credit card bills can be paid through several channels, including online banking, mobile payment apps like Paytm or Google Pay, direct bank transfers, or even by depositing cash at a bank branch.

3. Legal and Regulatory Considerations

RBI Regulations on Third-Party Payments

The Reserve Bank of India (RBI) has laid down specific guidelines regarding third-party payments. While it is generally permissible to pay a credit card bill on behalf of another person, it must be done in compliance with these regulations to avoid legal complications.

Tax Implications and Reporting

Paying someone else's credit card bill could have tax implications, particularly if large sums are involved. It is essential to be aware of potential tax liabilities and ensure that any such payments are properly reported.

Possible Penalties for Non-Compliance

Non-compliance with legal regulations can lead to penalties. For example, if a large payment is made without proper authorization, both the payer and the recipient could face legal action.

4. Methods to Pay a Family Member's Bill

Online Banking Options

One of the most convenient ways to pay a family member's credit card bill is through online banking. Most banks in India offer this service, allowing you to transfer funds directly to the credit card account.

Mobile Payment Apps

Mobile payment apps like Paytm, Google Pay, and PhonePe are widely used in India for credit card payments. These apps provide a simple interface to pay bills directly from your smartphone.

Direct Bank Transfer

A direct bank transfer is another method, where the payment is made from one bank account to another. This can be done through NEFT, RTGS, or IMPS services offered by Indian banks.

Using a Joint Account

If you share a joint bank account with the family member, you can use this account to pay their credit card bill. This method ensures that the payment is authorized and traceable.

5. Bank Policies and Restrictions

Variations in Bank Policies

Different banks may have different policies regarding third-party payments. It's important to check with the specific bank to understand their rules and limitations.

Limits on Third-Party Payments

Some banks may impose limits on the amount that can be paid on behalf of another person. These limits are often in place to prevent fraud and money laundering.

Requirements for Authorization

In some cases, banks may require formal authorization from the credit cardholder before allowing a third-party payment. This might involve submitting a signed document or completing an online verification process.

6. Pros and Cons of Paying Family Bills

Benefits of Assisting Family Members

Paying a family member's credit card bill can provide them with financial relief, especially in times of need. It also strengthens family bonds and ensures that credit scores are maintained.

Risks and Drawbacks

However, there are risks involved, such as potential tax liabilities, misunderstandings about repayment, and the possibility of enabling irresponsible financial behavior.

7. Expert Insights

Financial Expert Opinions

Financial experts generally advise caution when paying someone else's credit card bill. While it can be a helpful gesture, it is important to ensure that the payment is made transparently and legally.

Case Studies of Families Managing Bills

Case studies reveal that families who manage such payments well tend to have clear communication and set expectations about repayment or assistance. This minimizes misunderstandings and financial strain.

8. Future Trends in Digital Payments

The Rise of Digital Wallets

Digital wallets are becoming increasingly popular in India, offering a convenient way to manage and pay credit card bills. These platforms are likely to continue growing, making it easier to handle such transactions.

Potential Changes in Regulations

As digital payments evolve, regulations may also change to adapt to new technologies. Keeping an eye on these developments will be crucial for anyone involved in paying third-party credit card bills.

9. Practical Tips

Best Practices for Secure Transactions

When paying a family member's credit card bill, always use secure and trusted methods. Avoid sharing sensitive information over unsecured channels and ensure that the transaction is properly documented.

How to Avoid Fraud and Scams

Be aware of potential frauds and scams, particularly when using digital payment methods. Always double-check the recipient details before making a payment and use two-factor authentication when possible.

10. Conclusion

In summary, paying a family member's credit card bill in India is possible, but it requires careful consideration of legal, financial, and practical aspects. By following the best practices outlined in this article, you can ensure that the transaction is smooth, secure, and compliant with regulations.

11. FAQ Section

Can I pay my family member's bill from abroad?

Yes, you can pay your family member's credit card bill from abroad using online banking or international payment services. However, currency conversion fees and additional charges may apply.

What are the tax implications?

The tax implications depend on the amount paid and the relationship between the payer and the recipient. It's advisable to consult a tax professional to understand the specific requirements.

What happens if the payment is rejected?

If the payment is rejected, the funds will typically be returned to the payer's account. It's important to ensure that all details are correct before making the payment to avoid such issues.

0 notes

Text

Investing in Fixed Deposit Scheme? Find Out the Right Ones For You

Investing in fixed deposit schemes can be a prudent financial decision, offering stability and assured returns. However, with numerous options available, finding the right one for your financial goals can be daunting. Let us guide you through the process of selecting the ideal fixed deposit scheme that suits your needs.

Understanding Fixed Deposit Schemes

Fixed deposit schemes are investment instruments offered by banks and financial institutions, where individuals can deposit a lump sum for a fixed period at a predetermined interest rate. These schemes provide a safe and secure way to grow your savings while offering guaranteed returns.

Types of Fixed Deposit Schemes

Traditional Fixed Deposits: Traditional fixed deposit schemes offer a fixed interest rate for a specified tenure, with the option of choosing cumulative or non-cumulative interest payouts.

Tax-Saving Fixed Deposits: Tax-saving fixed deposit schemes allow investors to claim tax deductions under Section 80C of the Income Tax Act, making them an attractive option for individuals looking to save on taxes.

Senior Citizen Fixed Deposits: Senior citizen fixed deposit schemes offer higher interest rates and special benefits for elderly investors, making them ideal for retirees seeking regular income.

Special Fixed Deposit Schemes: Some banks and financial institutions offer special fixed deposit schemes with unique features, such as flexible tenure options, higher interest rates for long-term deposits, and loyalty rewards for existing customers.

Factors to Consider When Choosing a Fixed Deposit Scheme

Interest Rate: Compare the interest rates offered by different banks and financial institutions to find the most competitive option that maximizes your returns.

Tenure: Consider your investment horizon and liquidity needs when choosing the tenure of the fixed deposit scheme. Short-term deposits offer quick access to funds, while long-term deposits provide higher interest rates.

Tax Implications: Evaluate the tax implications of the fixed deposit scheme, especially if you're considering tax-saving options. Choose schemes that offer tax benefits while aligning with your overall tax planning strategy.

Safety and Security: Ensure that the bank or financial institution offering the fixed deposit scheme is reputable and regulated by the relevant authorities to safeguard your investments.

Conclusion

Investing in fixed deposit schemes can be a lucrative option for individuals seeking stable returns and capital preservation. By understanding the different types of fixed deposit schemes available and considering key factors such as interest rates, tenure, tax implications, and safety, you can make informed decisions to achieve your financial goals.

0 notes

Text

Briyani Map of India

Which is your favourite biryani?

Please comment below

briyani #food #chicken #briyanilover #foodie #indianfood #foodphotography #biryani #instafood #foodblogger #foodporn #chennaifoodie #chickenbriyani #foodstagram #foodlover #chennaifoodblogger #chennai #mutton #nasibriyani #briyanirice #biryanilove #love #streetfood #briyaniforlife #muttonbriyani #yummy #chickenbiryani #foodgasm #chennaifood #foodpics

0 notes

Text

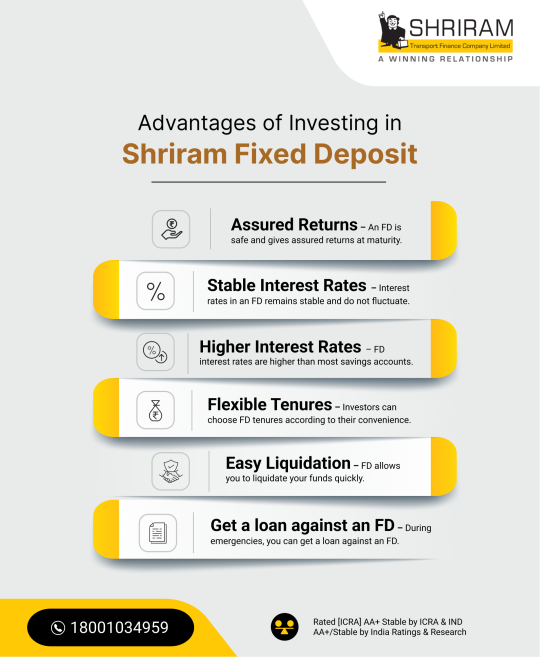

Advantage Of Investing in a Shriram Fixed Deposit

A Shriram Fixed Deposit offers comparatively higher interest rates of 8.75% per annum, which includes a bonus of 0.50% interest for senior citizens. Apart from the high-interest rates, with a Shriram FD, you also get an additional interest of 0.25% per annum on all renewals after the maturity of the deposit.

#fixeddeposit#frbs#investment#finance#mutualfunds#savings#fd#money#financialfreedom#investments#goldloan#bank#recurringdeposit#financialplanning#stockmarket#insurance#personalloan#stocks#wealth#rd#mutualfund#ettutharayil#chitfund#financialliteracy#gold#moneytransfer#investing#sip#personalfinance#financetips

1 note

·

View note