Don't wanna be here? Send us removal request.

Text

Titan Share Price: An Analysis of Market Trends and Future Prospects

Introduction

Titan Company Limited, a prominent player in the Indian jewelry and watch industry, has garnered significant attention from investors due to its robust performance and market presence. As of 2024, the company's share price remains a focal point for both analysts and investors, reflecting its financial health and growth potential.

Current Market Position

As of the latest trading sessions, Titan's share price has shown resilience in a fluctuating market environment. The company's strong brand portfolio, which includes Tanishq, Titan Watches, and Fastrack, continues to resonate with consumers, driving sales and profitability. The share price typically reflects investor sentiment regarding Titan's operational efficiency, market share, and overall economic conditions.

Historical Performance

Historically, Titan's share price has experienced significant growth, particularly in the last decade. Factors contributing to this upward trend include:

Strong Revenue Growth: Titan has consistently reported increasing revenues, primarily driven by the growing demand for gold and diamond jewelry in India.

Diversification: The company's expansion into new segments, such as eyewear and wearables, has broadened its market reach and reduced dependency on traditional jewelry sales.

Effective Management: Strong leadership and strategic initiatives have enabled Titan to navigate market challenges and capitalize on emerging opportunities.

Market Influences

Several factors can influence Titan's share price:

Economic Conditions: As a consumer-facing business, Titan's performance is closely tied to the economic climate. Inflation, disposable income levels, and consumer confidence can significantly impact sales and, subsequently, the share price.

Regulatory Changes: Policies affecting the gold and diamond trade, including import duties and taxation, can influence costs and margins.

Competition: The jewelry and watch markets are competitive. Titan's ability to innovate and maintain brand loyalty is crucial for sustaining its market position.

Global Trends: Changes in global gold prices and consumer preferences can have immediate effects on Titan's financial performance and share price.

Future Prospects

Looking ahead, several factors suggest a positive outlook for Titan's share price:

E-commerce Growth: The rise of online shopping presents significant opportunities for Titan to reach a broader audience, particularly among younger consumers.

Sustainability Initiatives: With a growing emphasis on ethical sourcing and sustainability, Titan's commitment to responsible practices can enhance its brand image and attract conscious consumers.

Expansion Plans: Titan's plans for expanding its retail footprint, both domestically and internationally, could drive future revenue growth.

Innovation: Continued investment in product innovation and technology can help Titan stay ahead of competitors and adapt to changing consumer preferences.

Conclusion

Titan's share price reflects a blend of historical performance, market conditions, and future growth potential. While investors must remain cognizant of market fluctuations and external factors, the company's strong brand equity, strategic initiatives, and commitment to innovation position it favorably for continued success. As always, potential investors should conduct thorough research and consider market trends before making investment decisions.

0 notes

Text

Understanding the Option Price Calculator: A Tool for Informed Trading

Options trading is a sophisticated financial strategy that offers investors the flexibility to hedge, speculate, or leverage their portfolios. However, calculating the price of an option can be complex, involving multiple variables such as volatility, time to expiration, and the underlying asset's price. This is where an Option Price Calculator becomes an essential tool for traders.

What is an Option Price Calculator?

An Option Price Calculator is an online tool that helps traders determine the fair value of an options contract. It uses mathematical models like the Black-Scholes model or the Binomial model to estimate the premium (price) of a call or put option. By inputting key parameters, the calculator provides a quick and accurate option pricing, aiding traders in making informed decisions.

Key Inputs for the Option Price Calculator

Underlying Asset Price: The current market price of the asset on which the option is based (e.g., a stock).

Strike Price: The price at which the option holder has the right to buy (call) or sell (put) the underlying asset.

Volatility: A measure of how much the underlying asset's price is expected to fluctuate over time. Higher volatility generally increases the option's price.

Time to Expiration: The remaining time until the option expires. As expiration approaches, the option's time value decreases.

Risk-Free Interest Rate: The theoretical return on an investment with no risk, often represented by government bond yields.

Dividends: If the underlying asset pays dividends, this can affect the option's price, particularly for longer-term options.

How Does the Option Price Calculator Work?

The Option Price Calculator uses the input values to compute the option's theoretical price. For example, the Black-Scholes model, one of the most widely used models, calculates the price based on the above factors. It assumes a lognormal distribution of asset prices and considers the time value of money, the volatility of the underlying asset, and the option's strike price relative to the current asset price.

Benefits of Using an Option Price Calculator

Accuracy: Calculating the price of an option manually is complicated and prone to errors. An Option Price Calculator ensures accurate results based on widely accepted models.

Speed: The calculator provides instant results, allowing traders to make quick decisions in fast-moving markets.

Risk Assessment: By adjusting inputs like volatility or time to expiration, traders can see how sensitive the option price is to different factors, helping them assess potential risks.

Strategy Planning: Traders can use the calculator to evaluate different trading strategies, such as covered calls or protective puts, by comparing the prices of various options.

How to Use an Option Price Calculator

Input the Required Data: Enter the current price of the underlying asset, the strike price, volatility, time to expiration, risk-free interest rate, and any expected dividends.

Select the Type of Option: Specify whether you are calculating the price for a call or put option.

Review the Results: The calculator will display the option's theoretical price, which you can use to compare with the market price or to plan your trading strategy.

Conclusion

An Option Price Calculator is a powerful tool for anyone involved in options trading. It simplifies the process of determining the fair value of an option, enabling traders to make more informed decisions. Whether you are a novice trader or an experienced professional, using an Option Price Calculator can enhance your trading strategy and help you better manage the risks and rewards of options trading.

0 notes

Text

SIP Calculator: An Essential Tool for Effective Investment Planning

A SIP calculator is a valuable tool for investors looking to plan their investments systematically. SIP, or Systematic Investment Plan, is a popular investment method where individuals invest a fixed amount regularly in mutual funds. A SIP calculator helps investors estimate the potential returns on their investments and plan their financial goals more effectively.

What is a SIP Calculator?

A SIP calculator is an online tool that helps you project the future value of your SIP investments. By inputting details like the investment amount, duration, expected rate of return, and frequency of investment, the calculator provides an estimate of the corpus you can accumulate over time. This helps investors understand the power of compounding and make informed decisions.

How Does a SIP Calculator Work?

Input Investment Details:

Monthly Investment Amount: Enter the amount you plan to invest every month.

Investment Duration: Specify the number of years you plan to invest.

Expected Rate of Return: Input the anticipated annual return rate, typically based on historical performance of the mutual fund or market trends.

Calculate Future Value:

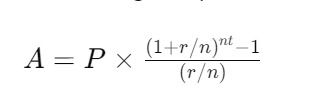

The SIP calculator uses a formula to estimate the future value of your investments, considering compound interest. The formula used is:

A = Future Value of the SIP

P = Monthly Investment Amount

r = Annual Interest Rate (in decimal)

n = Number of times the interest is compounded per year

t = Number of years of investment

Review the Results:

The calculator provides a detailed projection of the total amount accumulated and the interest earned over the investment period.

Benefits of Using a SIP Calculator

Financial Planning:

Helps you determine how much you need to invest regularly to achieve your financial goals, such as buying a house, funding education, or retirement.

Understanding Compounding:

Demonstrates the impact of compounding over time, highlighting how small, regular investments can grow significantly.

Adjusting Investment Strategies:

Allows you to experiment with different investment amounts, durations, and rates of return to find a strategy that best suits your financial goals.

Tracking Progress:

Provides a clear picture of how your investments are expected to grow, helping you stay on track with your financial objectives.

Where to Find a SIP Calculator

Many financial websites and mutual fund platforms offer free SIP calculators. Reputable sites like Mutual Fund Houses, financial planning portals, and investment apps typically feature these tools. Simply search for "SIP calculator" on these platforms to access a user-friendly tool.

Conclusion

A SIP calculator is an indispensable tool for anyone considering a systematic investment plan. By providing a clear estimate of potential returns and helping with financial planning, it enables investors to make informed decisions and achieve their financial goals efficiently. Use this tool regularly to adjust your investment strategy and stay on track towards building a secure financial future.

0 notes

Text

Reliance Share Price: A Comprehensive Overview

Reliance Industries Limited (RIL) is one of India's most valuable and influential companies, with a diverse business portfolio spanning petrochemicals, refining, oil & gas exploration, retail, and digital services. As a result, the Reliance share price is closely watched by investors, analysts, and market participants both in India and globally. In this article, we delve into the key factors influencing the share price of Reliance Industries and what investors should consider when monitoring this stock.

1. Historical Performance

Reliance Industries has been a consistent performer in the Indian stock market, reflecting the company’s strong financial health and diversified business model. The stock has seen significant appreciation over the years, driven by growth in its core businesses and successful expansion into new sectors such as telecommunications and retail.

2. Key Drivers of Reliance Share Price

Business Diversification: Reliance’s ability to diversify its revenue streams has been a major factor in its stock price performance. The launch of Jio, its telecommunications arm, revolutionized the Indian telecom industry and provided a significant boost to the company's earnings.

Earnings Reports: Quarterly earnings reports play a critical role in determining the short-term movements in the Reliance share price. Strong earnings, driven by growth in core businesses or new ventures, generally lead to an uptick in share price.

Market Sentiment: Market sentiment towards the Indian economy and specific sectors like oil & gas, retail, and telecommunications also impacts Reliance’s share price. Positive sentiment can drive the stock higher, while negative sentiment may weigh it down.

Global Oil Prices: As a major player in the refining and petrochemical sectors, Reliance’s share price is sensitive to fluctuations in global oil prices. Higher oil prices can boost the profitability of its refining business, while lower prices may impact margins.

Regulatory Changes: Changes in government regulations, particularly in sectors like telecommunications and energy, can have a direct impact on Reliance’s operations and, consequently, its share price.

3. Recent Trends

In recent months, the Reliance share price has shown resilience despite global economic uncertainties. The company’s focus on reducing debt and enhancing shareholder value through strategic investments has been well-received by the market. Additionally, the growth prospects of its digital services and retail ventures continue to attract investor interest.

4. Investor Outlook

Investors looking at Reliance Industries should consider the company's long-term growth potential, driven by its diversified business model and strategic initiatives. While short-term fluctuations in the Reliance share price may occur due to market volatility or external factors, the overall outlook for the stock remains positive, particularly as the company continues to expand its digital and retail footprint.

Conclusion

The Reliance share price is a barometer of the company’s performance and the broader economic environment in India. Investors should keep a close eye on the key factors discussed above to make informed decisions. With its strong fundamentals and growth-oriented strategy, Reliance Industries remains a significant player in the Indian stock market, making its share price an important metric for investors to monitor.

0 notes

Text

Check out Capgemini's impactful CSR initiatives in India, championing social responsibility with innovative projects that drive community development and sustainable change.

0 notes

Text

Capgemini's corporate social responsibilities in India focus on swift disaster response, humanitarian aid, and community support, emphasizing saving lives, alleviating suffering, and maintaining human dignity.

0 notes

Text

India vs Sri Lanka ODI 2024: A Thrilling Encounter in the Making

The cricketing world is abuzz with anticipation as India and Sri Lanka prepare to face off in the much-awaited ODI series of 2024. This clash of titans is set to reignite one of the most exciting rivalries in international cricket, promising fans a series packed with high-octane action, exceptional performances, and memorable moments of India vs Srilanka ODI 2024.

Historical Rivalry

India and Sri Lanka have a long history of competitive cricket, with numerous memorable encounters over the years. From World Cup battles to bilateral series, these two teams have provided cricket enthusiasts with countless thrilling matches. The 2024 ODI series is expected to add another exciting chapter to this storied rivalry.

Team Preparations

India:

Under the leadership of Rohit Sharma, the Indian team is gearing up for the series with a balanced squad comprising seasoned players and young talents. Key players like Virat Kohli, Jasprit Bumrah, and Hardik Pandya are expected to play crucial roles. The Indian team has been focusing on refining their strategies, especially in the middle overs, to counter Sri Lanka's spin attack effectively.

Sri Lanka:

Sri Lanka, led by Dasun Shanaka, has been working hard to build a formidable team. With promising talents like Charith Asalanka, Wanindu Hasaranga, and Dushmantha Chameera, the team is looking to challenge the Indian side. Sri Lanka's emphasis will likely be on their spinners and all-rounders, aiming to exploit any weaknesses in the Indian batting lineup.

Key Players to Watch

Virat Kohli (India): Known for his consistency and ability to chase down targets, Kohli will be a vital asset for India.

Wanindu Hasaranga (Sri Lanka): His all-round capabilities and effective leg-spin can be a game-changer for Sri Lanka.

Jasprit Bumrah (India): Bumrah's death-over bowling skills make him a crucial player for India in tight situations.

Charith Asalanka (Sri Lanka): A promising young batsman, Asalanka’s performance can significantly impact Sri Lanka’s chances.

Venues and Schedule

The series is set to take place across various iconic venues in India, known for their passionate cricket fans and electrifying atmosphere. The exact schedule is yet to be finalized, but the matches are expected to be held in major cities like Mumbai, Delhi, Bangalore, and Kolkata.

Anticipated Challenges

Both teams will face challenges, such as adapting to different pitch conditions and managing player workloads. The Indian pitches are known for their diversity, from flat tracks favoring batsmen to spin-friendly surfaces. How each team adapts to these conditions will be crucial in determining the outcome of the series.

Fan Expectations

Fans from both nations are eagerly waiting for this series, hoping to witness some spectacular cricket. The rivalry between India and Sri Lanka has always brought out passionate support from the crowd, creating an electrifying atmosphere in the stadiums.

Conclusion

The India vs Sri Lanka ODI series 2024 promises to be a cricketing spectacle, showcasing the best of both teams. With a blend of experienced stars and emerging talents, the series is set to deliver thrilling contests and unforgettable moments. Cricket enthusiasts around the world will be keenly following this series, eager to see which team emerges victorious in this exciting chapter of their historic rivalry.

0 notes

Text

India tour of Sri Lanka

India will tour Sri Lanka for a series of matches, including ODIs and T20Is. The series promises exciting cricket action as both teams India VS Sri Lanka ODI showcase their talent and strategy. Fans eagerly await to see key players in action and intense competition between the two cricketing nations.

0 notes

Text

India Cricket Schedule: India’s Tour of Sri Lanka 2024

As the cricketing world turns its attention to the subcontinent, the India cricket schedule is highlighted by the much-anticipated tour of Sri Lanka. This tour, beginning on July 27, 2024, will feature a series of T20 and ODI matches that promise to deliver exciting and competitive cricket. Here’s a comprehensive overview of India’s tour of Sri Lanka and what fans can expect.

Tour Overview

The India-Sri Lanka tour will consist of three T20 Internationals (T20Is) and three One Day Internationals (ODIs). This tour is a crucial opportunity for both teams to fine-tune their strategies and build momentum ahead of upcoming international tournaments. The matches will be played across two venues in Sri Lanka: the Pallekele Stadium in Kandy and the RPICS Stadium in Colombo.

T20 Series Schedule

1st T20I: July 26, 2024, at Pallekele Stadium, Kandy

2nd T20I: July 27, 2024, at Pallekele Stadium, Kandy

3rd T20I: July 28, 2024, at Pallekele Stadium, Kandy

The T20 series will kick off with a double-header on July 26 and 27, followed by the final T20I on July 28. India will be led by Suryakumar Yadav in the T20 format, with the squad featuring a mix of experienced players and emerging talent. Key players to watch include Hardik Pandya, Rishabh Pant, and Arshdeep Singh.

ODI Series Schedule

1st ODI: August 1, 2024, at RPICS Stadium, Colombo

2nd ODI: August 4, 2024, at RPICS Stadium, Colombo

3rd ODI: August 7, 2024, at RPICS Stadium, Colombo

The ODI series will follow immediately after the T20Is, with all three matches taking place at the RPICS Stadium in Colombo. Rohit Sharma will captain the Indian side for the ODIs, bringing his leadership and experience to the fore. The squad includes stalwarts like Virat Kohli and KL Rahul, who will play key roles in the middle order.

Key Players and Squad Details

T20 Squad:

Suryakumar Yadav (C)

Shubman Gill (VC)

Yashasvi Jaiswal

Rinku Singh

Riyan Parag

Rishabh Pant (WK)

Sanju Samson (WK)

Hardik Pandya

Shivam Dube

Axar Patel

Washington Sundar

Ravi Bishnoi

Arshdeep Singh

Khaleel Ahmed

Mohd. Siraj

ODI Squad:

Rohit Sharma (C)

Shubman Gill (VC)

Virat Kohli

KL Rahul (WK)

Rishabh Pant (WK)

Shreyas Iyer

Shivam Dube

Kuldeep Yadav

Mohd. Siraj

Washington Sundar

Arshdeep Singh

Riyan Parag

Axar Patel

Khaleel Ahmed

Harshit Rana

Strategic Importance

The tour is strategically significant for India as it offers an opportunity to assess the team’s performance in different conditions and against a strong Sri Lankan side. The T20 series will allow India to test new strategies and player combinations, while the ODI series will be crucial for refining tactics and squad balance.

Conclusion

India’s tour of Sri Lanka in 2024 is set to be a captivating cricketing spectacle. With a mix of T20 and ODI formats, fans can look forward to a diverse range of cricketing action. As both teams prepare to battle it out, the tour promises to provide valuable insights and excitement for cricket lovers around the globe. Stay tuned for match updates, analysis, and highlights as the tour unfolds.

0 notes

Text

The Ultimate Guide to Using an EMI Calculator Online for Financial Planning

When it comes to managing loans and making informed financial decisions, an EMI Calculator Online is a crucial tool that can help you streamline your budgeting and planning efforts. Whether you're applying for a home loan, personal loan, or car loan, this online tool provides valuable insights into your monthly payments and overall financial strategy. Here’s a comprehensive guide on how to effectively use an EMI Calculator Online to optimize your financial planning.

What is an EMI Calculator Online?

An EMI Calculator Online is a digital tool designed to calculate the Equated Monthly Installment (EMI) that you will need to pay for a loan. The EMI is a fixed monthly payment that you make to the lender over the loan’s tenure, which covers both the principal amount and the interest charged on the loan. This calculator helps you determine the EMI amount based on the loan amount, interest rate, and loan tenure, providing you with a clear understanding of your financial commitments.

Why Use an EMI Calculator Online?

Easy to Use:

EMI calculators are user-friendly and require only a few pieces of information to provide accurate results. You don’t need any specialized knowledge to use these tools effectively.

Instant Calculations:

With just a few clicks, you can get an immediate calculation of your EMI, saving you time and effort compared to manual calculations.

Financial Planning:

By knowing your monthly EMI, you can better plan your budget and ensure that you can comfortably manage your monthly expenses. It helps in setting realistic financial goals and avoiding financial strain.

Comparison of Loan Options:

An EMI Calculator Online allows you to compare different loan offers by adjusting variables such as loan amount, tenure, and interest rates. This helps you choose the best loan product that suits your financial situation.

Prepayment and Loan Adjustment Planning:

You can use the calculator to evaluate the impact of prepaying a portion of your loan. It shows how prepayment affects your EMI and overall loan tenure, helping you make decisions about additional payments.

How to Use an EMI Calculator Online

Using an EMI Calculator Online involves a few simple steps:

Access the Calculator:

Search for “EMI Calculator Online” and choose a reliable financial website or app that offers this tool.

Enter the Loan Amount:

Input the total amount of money you are borrowing.

Input the Interest Rate:

Enter the annual interest rate offered by your lender.

Select the Loan Tenure:

Choose the duration of your loan, typically in months or years.

Generate the EMI:

The calculator will process the information and display the EMI amount, along with a breakdown of the principal and interest components.

Example of Using an EMI Calculator Online

Suppose you want to take a home loan of $200,000 at an annual interest rate of 5% for a tenure of 20 years. Using the EMI Calculator Online, you would enter:

Loan Amount: $200,000

Interest Rate: 5% per annum

Tenure: 20 years (240 months)

The calculator will show you the EMI amount you need to pay each month, along with a detailed amortization schedule that breaks down how much of each payment goes towards the principal and how much goes towards interest.

Benefits of Using an EMI Calculator Online

Clarity and Transparency:

The calculator provides clear information about your EMI obligations, helping you understand how your monthly payments are structured.

Enhanced Budgeting:

By knowing your EMI, you can create a more accurate budget and manage your finances more effectively.

Informed Loan Decisions:

You can use the calculator to experiment with different loan amounts, interest rates, and tenures to find the best loan option for your needs.

Future Planning:

It helps in planning for future expenses by giving you a snapshot of how much you will be paying over the course of the loan.

Conclusion

An EMI Calculator Online is an indispensable tool for anyone considering taking out a loan. It simplifies the process of calculating your monthly payments, helps you manage your budget, and aids in making informed financial decisions. By providing instant, accurate results, this tool allows you to compare different loan offers, plan for future payments, and ensure that you can comfortably meet your financial obligations.

Whether you are looking to buy a home, purchase a car, or cover personal expenses, integrating an EMI Calculator Online into your financial planning process will help you achieve your financial goals and maintain a stable financial future.

0 notes

Text

Boost Your Financial Planning with an Accurate Future Value Calculator

Effective financial planning is essential for securing a stable financial future. One key tool that can significantly enhance your financial planning efforts is a Future Value Calculator. This tool helps you project the growth of your investments over time, allowing you to make informed decisions and set realistic financial goals.

What is a Future Value Calculator?

A Future Value Calculator is a financial tool that calculates the future value of an investment based on its present value, the interest rate, and the number of periods over which the investment will grow. The formula typically used is:

where:

FV = Future Value

PV = Present Value (initial investment)

r = Rate of return per period

n = Number of periods

Benefits of Using a Future Value Calculator

Accurate Projections: By using a Future Value Calculator, you can obtain precise projections of your investment’s growth, ensuring you have realistic expectations for your financial future.

Informed Decision-Making: With accurate future value estimates, you can compare different investment options and choose those that align best with your financial goals.

Goal Setting: Knowing the future value of your investments helps you set and achieve specific financial goals, such as saving for retirement, buying a house, or funding education.

Time Efficiency: A Future Value Calculator provides quick results, saving you time compared to manual calculations.

How to Use a Future Value Calculator

Using a Future Value Calculator is simple and straightforward:

Enter Present Value: Start by inputting the amount you plan to invest initially.

Specify Interest Rate: Input the expected annual rate of return on your investment.

Set Time Frame: Enter the number of years you plan to hold the investment.

Calculate: Click on the 'Calculate' button to instantly get the future value of your investment.

Practical Example

Suppose you invest $10,000 at an annual return rate of 7% for 15 years. Using a Future Value Calculator, you can determine that your investment will grow to approximately $27,674. This projection helps you understand how much you need to invest today to reach your financial goals in the future.

Enhancing Your Financial Strategy

To maximize the benefits of a Future Value Calculator, consider the following tips:

Regular Updates: Recalculate the future value periodically to account for changes in interest rates and investment performance.

Diversify Investments: Use the calculator to project the future value of a diversified portfolio, reducing risk and enhancing potential returns.

Adjust for Inflation: Ensure your projections are realistic by adjusting for inflation, which affects the real value of your investments.

Conclusion

A Future Value Calculator is an invaluable tool for anyone serious about financial planning. By providing accurate projections of investment growth, it empowers you to make informed decisions and set achievable financial goals. Incorporate a Future Value Calculator into your financial planning toolkit today and take a significant step towards securing your financial future.

0 notes

Text

Maximize Your Returns: A Complete Guide to Using a PPF Calculator

Investing in a Public Provident Fund (PPF) is a popular choice for individuals seeking a secure and tax-efficient savings option in India. To make the most of your PPF investment, leveraging a PPF calculator is essential. This tool helps you estimate your returns and plan your investments strategically. Here’s a complete guide to using a PPF calculator and maximizing your returns.

Understanding the PPF Calculator

A PPF calculator is an online tool that computes the maturity amount and interest earned on your PPF investments. By inputting details such as the annual investment amount, interest rate, and tenure, you can get an accurate estimate of your total savings at the end of the investment period.

Benefits of Using a PPF Calculator

Accurate and Quick Results:

Manual calculations of PPF returns can be complex and prone to errors. A PPF calculator provides precise results instantly, saving you time and effort.

Effective Financial Planning:

By knowing the expected returns in advance, you can plan your finances better. This helps in aligning your investment strategy with your long-term financial goals, such as retirement planning, children's education, or buying a home.

Comparison and Decision-Making:

A PPF calculator allows you to compare different investment scenarios. You can adjust the annual deposit amount, tenure, and interest rates to see how they affect your maturity amount, helping you make informed decisions.

Flexibility:

The calculator provides flexibility by letting you experiment with various input values. This helps you determine the optimal investment strategy to maximize your returns.

How to Use a PPF Calculator

Using a PPF calculator is straightforward. Follow these steps to get the most out of it:

Enter the Annual Investment Amount:

Input the amount you plan to invest in the PPF account each year. The maximum permissible investment is ₹1.5 lakh per financial year.

Select the Tenure:

The default tenure for a PPF account is 15 years. However, you can extend the tenure in blocks of 5 years after maturity. Choose the tenure based on your financial goals.

Input the Interest Rate:

Enter the prevailing interest rate for PPF. The government revises this rate quarterly. Ensure you use the current rate for accurate calculations.

Compounding Frequency:

PPF interest is compounded annually. The calculator automatically considers this compounding frequency to provide accurate results.

Calculate:

Click the 'Calculate' button to get the estimated maturity amount and total interest earned over the chosen tenure.

Example Calculation

Suppose you decide to invest ₹50,000 annually in a PPF account with an interest rate of 7.1% per annum for a tenure of 15 years. By entering these values into the PPF calculator, you can instantly see that the maturity amount would be approximately ₹13,05,032, with a total interest earning of ₹5,55,032.

Tips to Maximize Your Returns

Invest Early in the Financial Year:

Investing at the beginning of the financial year ensures that your money earns interest for the maximum period, thereby increasing your overall returns.

Consistent Annual Investments:

Regular and consistent investments help in compounding your returns effectively. Try to invest the maximum permissible amount annually to take full advantage of the PPF scheme.

Extend the Tenure:

After the initial 15-year tenure, you can extend the PPF account in blocks of 5 years. Extending the tenure allows your investments to grow further, enhancing your returns.

Conclusion

A PPF calculator is an invaluable tool for anyone looking to invest in the PPF scheme. It simplifies the calculation process, provides accurate results, and aids in effective financial planning. By using a PPF calculator, you can make informed decisions, compare different investment scenarios, and ultimately maximize your returns. Start using a PPF calculator today to take control of your financial future and achieve your long-term savings goals.

0 notes

Text

Understanding Option Value Calculators

Introduction

In the world of finance, options are a popular derivative instrument that provides traders with flexibility and strategic opportunities. An option gives the holder the right, but not the obligation, to buy or sell an asset at a predetermined price before a specified date. To accurately assess the potential profitability and risk of options, traders use tools known as option value calculators. These calculators are essential for making informed decisions in the options market.

What is an Option Value Calculator?

An option value calculator is a tool that helps traders determine the fair value of an option. It uses mathematical models to evaluate various factors that influence an option's price. These factors include the underlying asset's price, the strike price, time to expiration, volatility, interest rates, and dividends. By inputting these variables into the calculator, traders can estimate the theoretical price of an option and make better trading decisions.

Key Components of Option Value Calculators

Underlying Asset Price: The current price of the asset on which the option is based.

Strike Price: The price at which the option holder can buy (call option) or sell (put option) the underlying asset.

Time to Expiration: The remaining time until the option's expiration date.

Volatility: A measure of how much the underlying asset's price is expected to fluctuate.

Risk-Free Interest Rate: The return on risk-free investments, typically government bonds.

Dividends: Payments made by the underlying asset (if applicable).

Popular Models for Option Valuation

Black-Scholes Model: One of the most widely used models, it calculates the price of European call and put options based on the underlying asset's price, strike price, time to expiration, volatility, and the risk-free interest rate.

Binomial Model: A more flexible model that can be used for American options, allowing for the possibility of early exercise. It divides the time to expiration into discrete intervals and calculates possible price changes at each step.

Monte Carlo Simulation: A computational method that uses random sampling to estimate the probability of different outcomes. It is useful for valuing complex options with multiple factors influencing their price.

Benefits of Using an Option Value Calculator

Informed Decision-Making: By providing a theoretical price, option value calculators help traders decide whether an option is overvalued or undervalued.

Risk Management: Calculators allow traders to assess the risk associated with an option, helping them to implement effective risk management strategies.

Strategy Development: Understanding the fair value of options aids in developing and optimizing trading strategies.

Conclusion

Option value calculators are indispensable tools for anyone involved in options trading. They provide crucial insights into the fair value of options, enabling traders to make informed decisions and manage risk effectively. By leveraging models like Black-Scholes, the binomial model, and Monte Carlo simulations, these calculators help traders navigate the complexities of the options market with greater confidence.

Whether you are a seasoned trader or a newcomer to the options market, understanding and utilizing an option value calculator can significantly enhance your trading performance and financial outcomes.

0 notes

Text

Unlocking Financial Security: The Ultimate Guide to Using a Retirement Calculator

Achieving financial security in retirement is a goal shared by many, yet the path to reaching it can often seem daunting. One of the most effective tools for navigating this journey is a retirement calculator. This guide will help you unlock financial security by understanding and effectively using a retirement calculator.

What is a Retirement Calculator?

A retirement calculator is an online tool designed to help individuals estimate how much they need to save to achieve their retirement goals. By inputting various personal and financial details, the calculator projects your future financial situation, highlighting if you are on track to retire comfortably or if adjustments are needed.

Why Use a Retirement Calculator?

Clarity on Retirement Goals A retirement calculator helps you understand how much you need to save to meet your retirement goals, providing a clear financial target.

Informed Decision Making It allows you to make informed decisions about your savings and investments based on realistic projections.

Financial Preparedness Regular use of a retirement calculator ensures you stay prepared for the financial demands of retirement, reducing the risk of outliving your savings.

Steps to Effectively Use a Retirement Calculator

Collect Necessary Information Gather your financial details, including:

Current age

Planned retirement age

Current savings

Monthly or annual contributions

Expected rate of return on investments

Estimated retirement expenses

Input Data into the Calculator Enter the collected data into the retirement calculator. Accurate data entry is crucial for reliable projections.

Adjust for Inflation Inflation can erode your savings' purchasing power over time. Many retirement calculators allow you to input an expected inflation rate. In countries like India, a conservative estimate is around 6% to 7%.

Review the Projections The calculator will provide a detailed projection of your retirement savings. It will show if you are on track to meet your retirement goals or if there's a shortfall.

Analyze the Results

Surplus: If the projections show a surplus, you are on the right track.

Shortfall: If there's a shortfall, consider increasing your savings rate, delaying retirement, or adjusting your investment strategy.

Make Necessary Adjustments Based on the calculator’s output, make any needed changes to your financial plan. This might include:

Increasing monthly savings

Exploring higher-yield investments

Reducing expenses

Delaying retirement age

Regularly Update the Calculator Periodically update the calculator with your latest financial information. This helps ensure your retirement plan remains aligned with your evolving financial situation and goals.

Benefits of Using a Retirement Calculator

Personalized Financial Planning Tailor your retirement plan based on personal financial data and realistic projections.

Proactive Financial Management Regular use of a retirement calculator encourages proactive adjustments to your savings and investment strategies.

Enhanced Financial Security By staying informed and prepared, you can achieve greater financial security and peace of mind in retirement.

Conclusion

Using a retirement calculator is a powerful step towards unlocking financial security. By understanding how to use this tool effectively, you can create a comprehensive and realistic retirement plan. Regularly updating your calculations and making informed adjustments ensures that you remain on track to achieve a comfortable and secure retirement. Embrace this ultimate guide to maximize your financial future and enjoy your retirement years with confidence and peace of mind.

0 notes

Text

Analyzing the Britannia Share Price: Trends, Influences, and Future Prospects

Britannia Industries Limited, a dominant player in the Indian FMCG sector, is well-known for its extensive range of bakery products, including biscuits, bread, and dairy items. The performance of Britannia's shares on the stock market is a significant indicator of the company's financial health and market sentiment. This article delves into the trends, key factors influencing the Britannia share price, and its future prospects.

Recent Trends:

Over the past few years, Britannia's share price has shown a strong performance, reflecting the company’s robust financial health and market position. In 2023, Britannia shares were trading within a range of INR 3,500 to INR 4,000, demonstrating resilience despite broader market volatility. This period saw Britannia achieving steady revenue growth and maintaining high profit margins, driven by increased demand for packaged foods and successful product launches.

Key Influences on Britannia Share Price:

Financial Performance: Britannia’s quarterly financial results are a primary driver of its share price. Strong earnings reports, marked by revenue growth, profit margin expansion, and effective cost management, tend to boost investor confidence and drive up the share price. Conversely, any indication of financial strain, such as declining sales or profit margins, can negatively impact the stock.

Consumer Demand: The demand for FMCG products, particularly during economic upturns or festive seasons, positively influences Britannia’s performance. During the COVID-19 pandemic, there was a significant rise in demand for packaged and convenient food items, which benefited Britannia. Post-pandemic, the continued preference for branded and quality food products has supported the share price.

Product Innovation: Britannia's focus on innovation and new product launches plays a crucial role in its market performance. Introducing healthier options, premium products, and expanding into new categories can attract more consumers and drive revenue growth. Successful product launches often result in positive market reactions and an uptick in the share price.

Input Costs: Fluctuations in raw material prices, such as wheat, sugar, and milk, significantly affect Britannia’s cost of production. Rising input costs can squeeze profit margins and lead to negative sentiment among investors. Conversely, periods of stable or declining input costs can enhance profitability and support the share price.

Market Sentiment and Analyst Ratings: Market sentiment and analyst ratings are crucial for the share price movement. Positive analyst coverage, upgrades in target prices, and optimistic market sentiment generally result in higher share prices. On the other hand, negative news or downgrades by analysts can lead to share price declines.

Economic Conditions: The broader economic environment impacts consumer spending power and market demand for FMCG products. Economic growth boosts consumer confidence and spending, benefiting companies like Britannia. In contrast, economic slowdowns or inflationary pressures can dampen consumer spending, affecting sales and the share price.

Competitive Landscape: Britannia operates in a highly competitive market with major players like Parle and ITC. The company's ability to maintain its market share, manage competition, and continue innovating is vital for its stock performance. Intense competition can lead to pricing pressures and impact profitability, influencing the share price.

Future Prospects:

Looking ahead, several factors will shape the future trajectory of the Britannia share price:

Expansion and Diversification: Britannia’s plans for geographic expansion and diversification into new product categories will be critical. Success in penetrating rural markets and expanding international operations can provide new revenue streams and enhance the share price.

Digital Transformation: Investments in digital marketing, e-commerce, and supply chain efficiencies will play a significant role in driving future growth. Effective utilization of technology can improve operational efficiencies and expand Britannia’s market reach.

Sustainability Initiatives: Increasing focus on sustainability and environmental responsibility can positively impact brand perception and consumer loyalty. Britannia’s efforts in sustainable sourcing and reducing its environmental footprint will be important for long-term growth.

Regulatory Environment: Changes in food safety regulations, taxation policies, and trade tariffs can impact Britannia’s operations and profitability. Adapting to regulatory changes swiftly and efficiently will be crucial for maintaining investor confidence.

Conclusion:

The Britannia share price reflects a combination of strong financial performance, market demand, and strategic initiatives. While the company faces challenges from input cost fluctuations and intense competition, its focus on innovation, expansion, and sustainability positions it well for future growth. Investors should keep a close watch on Britannia’s financial results, market trends, and strategic developments to make informed decisions regarding its stock. With its strong brand and market leadership, Britannia remains a key player in the FMCG sector, and its share price is likely to continue being a significant indicator of its success and market position.

0 notes

Text

Analyzing the Britannia Share Price: Trends, Influences, and Future Prospects

Britannia Industries Limited, a dominant player in the Indian FMCG sector, is well-known for its extensive range of bakery products, including biscuits, bread, and dairy items. The performance of Britannia's shares on the stock market is a significant indicator of the company's financial health and market sentiment. This article delves into the trends, key factors influencing the Britannia share price, and its future prospects.

Recent Trends:

Over the past few years, Britannia's share price has shown a strong performance, reflecting the company’s robust financial health and market position. In 2023, Britannia shares were trading within a range of INR 3,500 to INR 4,000, demonstrating resilience despite broader market volatility. This period saw Britannia achieving steady revenue growth and maintaining high profit margins, driven by increased demand for packaged foods and successful product launches.

Key Influences on Britannia Share Price:

Financial Performance: Britannia’s quarterly financial results are a primary driver of its share price. Strong earnings reports, marked by revenue growth, profit margin expansion, and effective cost management, tend to boost investor confidence and drive up the share price. Conversely, any indication of financial strain, such as declining sales or profit margins, can negatively impact the stock.

Consumer Demand: The demand for FMCG products, particularly during economic upturns or festive seasons, positively influences Britannia’s performance. During the COVID-19 pandemic, there was a significant rise in demand for packaged and convenient food items, which benefited Britannia. Post-pandemic, the continued preference for branded and quality food products has supported the share price.

Product Innovation: Britannia's focus on innovation and new product launches plays a crucial role in its market performance. Introducing healthier options, premium products, and expanding into new categories can attract more consumers and drive revenue growth. Successful product launches often result in positive market reactions and an uptick in the share price.

Input Costs: Fluctuations in raw material prices, such as wheat, sugar, and milk, significantly affect Britannia’s cost of production. Rising input costs can squeeze profit margins and lead to negative sentiment among investors. Conversely, periods of stable or declining input costs can enhance profitability and support the share price.

Market Sentiment and Analyst Ratings: Market sentiment and analyst ratings are crucial for the share price movement. Positive analyst coverage, upgrades in target prices, and optimistic market sentiment generally result in higher share prices. On the other hand, negative news or downgrades by analysts can lead to share price declines.

Economic Conditions: The broader economic environment impacts consumer spending power and market demand for FMCG products. Economic growth boosts consumer confidence and spending, benefiting companies like Britannia. In contrast, economic slowdowns or inflationary pressures can dampen consumer spending, affecting sales and the share price.

Competitive Landscape: Britannia operates in a highly competitive market with major players like Parle and ITC. The company's ability to maintain its market share, manage competition, and continue innovating is vital for its stock performance. Intense competition can lead to pricing pressures and impact profitability, influencing the share price.

Future Prospects:

Looking ahead, several factors will shape the future trajectory of the Britannia share price:

Expansion and Diversification: Britannia’s plans for geographic expansion and diversification into new product categories will be critical. Success in penetrating rural markets and expanding international operations can provide new revenue streams and enhance the share price.

Digital Transformation: Investments in digital marketing, e-commerce, and supply chain efficiencies will play a significant role in driving future growth. Effective utilization of technology can improve operational efficiencies and expand Britannia’s market reach.

Sustainability Initiatives: Increasing focus on sustainability and environmental responsibility can positively impact brand perception and consumer loyalty. Britannia’s efforts in sustainable sourcing and reducing its environmental footprint will be important for long-term growth.

Regulatory Environment: Changes in food safety regulations, taxation policies, and trade tariffs can impact Britannia’s operations and profitability. Adapting to regulatory changes swiftly and efficiently will be crucial for maintaining investor confidence.

Conclusion:

The Britannia share price reflects a combination of strong financial performance, market demand, and strategic initiatives. While the company faces challenges from input cost fluctuations and intense competition, its focus on innovation, expansion, and sustainability positions it well for future growth. Investors should keep a close watch on Britannia’s financial results, market trends, and strategic developments to make informed decisions regarding its stock. With its strong brand and market leadership, Britannia remains a key player in the FMCG sector, and its share price is likely to continue being a significant indicator of its success and market position.

0 notes

Text

The Complete Guide to UEFA Euro 2024, Everything You Need to Know

Mumbai, Maharashtra, India: The 17th edition of the European Championship, or Euros, is just around the corner. Starting 15th June, the host country Germany is set to light up the tournament in Munich, taking on Italy in their opening Group A match. With 24 countries, 51 matches, this 30-day tournament is going to be an action-packed battle for Europe. While England, Spain, Portugal, and the reigning champions, Italy enjoy popularity among football aficionados, Germany comes with its home turf advantage.

UEFA Euro 2024 schedule

UEFA Euro 2024 kicks off on June 15th, 2024, and culminates in the final match on July 15th.

The group stage will run for 2 weeks: June 15th to 27th, followed by the knockout stages. The Round of 16 will take place between June 29th and July 3rd, with the quarterfinals being held between 5th to 7th July. The excitement is sure to intensify with the semi-finals scheduled for July 10th and 11th, leading up to the grand finale on July 15th. For viewers in India, due to the time zone difference, the live action will start streaming from 15th June (00:30 IST). Sony LIV, the official broadcaster for the tournament in India, will be streaming all the matches live from June 15th to July 15th. So, you can enjoy the entire Euro 2024 experience, from the opening match to the nail-biting final, at a convenient time that fits your schedule. Make sure to check Sony LIV's website or app for specific timings and broadcasting details. Players to look out for in Euro Cup 2024 The UEFA Euro 2024 is set to be a star-studded affair, featuring a mix of yesteryear stars and exciting young talent. In what promises to be a farewell tour, Germany's Toni Kroos will orchestrate the midfield one last time, his experience even more valuable as he graces the Euros stage for the final time. Alongside him, Portugal's Cristiano Ronaldo will chase even more records in what could be his swansong. But the spotlight will also shine on young guns like Germany's Jamal Musiala and Florian Wirtz, who are sure to mesmerize the fans with their skills, and England's Jude Bellingham, already a key player for both his club and country.

We can't forget the expertise of Kylian Mbappé, the French prodigy who continues to redefine the forward position, aiming to lead his nation to another European title. With surprise breakout performances likely throughout the tournament, Euro 2024 promises to showcase the best of European footballing talent, both present and future. Where does one stream UEFA Euro 2024 Catch all the action of Euro 2024 live in India, on Sony LIV, the official broadcaster for the region. Sony LIV has also introduced great, innovative features to enhance your viewing experience:

Multi-Cam: Switch between 6 different camera angles to see the game from every perspective, including the dug-out cameras and a tactical view.

Star Cam: Never miss a moment from your favorite player with a dedicated camera feed.

Live Match Center: Stay informed with comprehensive stats, live line-ups, play-by-play updates, and more.

Pick your own language: Available in English, Hindi, Bengali, Tamil, Telugu, Malayalam.

Past winners of UEFA Euro Cup The UEFA Euro Cup has seen a variety of classic matches throughout its history. Germany and Spain reign supreme with three titles each. They've consistently displayed dominance, with Spain achieving the unique feat of winning back-to-back championships in 2008 and 2012. Following them are the best of euro — France and Italy, boasting two victories each. Several other European nations have etched their names on the trophy, including the erstwhile Soviet Union, Czechoslovakia, Netherlands, Denmark, Greece, and Portugal. This showcases the Euros' ability to produce unexpected triumphs alongside established masters of the game. So, that was your go-to guide on UEFA Euro 2024! Germany's looking stacked, France has Mbappé on fire, and who knows, maybe we'll see a new dark horse emerge. Get ready to witness the finest of the matches, draws, replays and team talks. One thing is for sure, with this mix of incredible Euro Cupplayers and amazing stadiums, it's bound to be a belter of a tournament. The tournament is sure to keep you glued to your seat with the official Euro 2024 schedule, insights, stats, and maybe even a cheeky prediction or two on who might cause an upset! So, bookmark this page, grab your jersey, and get ready to cheer – because the game is about to take over. Which country are you cheering for? Let us know and be sure to tune in on June 15th on Sony LIV– it's going to be epic!

0 notes