Link

Outsourcing accounting and bookkeeping services has never been more relevant. Is your company safe from a tax audit? Learn more here.

0 notes

Text

Tax CPA Tips: S Corp or C Corp - Which is the Better Choice?

On first sight, the proposed C corporate tax rate of 21 percent is attractive. It is possible to wonder whether it is the right choice. As as a tax CPA I've been receiving these questions from clients.

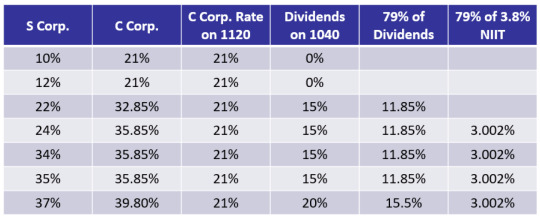

Below is a table that tells you how much you'd pay in taxes. It is based on the tax bracket you have for Form 1040. The tax rates for individual taxpayers are listed in the S corporation column. The C Corp column shows the percent of taxes you'd have to pay if you owned a company that was an C Corp. It adds the four columns previously mentioned.

How does the Table Work?

Let's take an example if you're in the tax bracket of 34 percent. Let's also assume that you earn $100,000 (or tax-deductible income).

You will receive a K-1 that has a profit of $100,000 for the year if you are an S corporation. This is known as a pass-through, as the $100,000 profit isn't subject to tax at the S Corp level but is added to your personal 1040 tax return. The K-1's profits pass-through to you will be paid your Form 1040 taxes at a rate of 34 percent which means that you pay a total tax rate on your S corporation's profits of $34,000.

If you operate as C-corporation, the math gets a bit more complicated. Profits are taxed first at the C corporation level at a rate of 21 percent (for an amount of $21,000 which the Corporation pays). The corporation has $79,000 of the $100,000 in profits available. The profits will be paid to you in the form of dividends.

Tips from an accountant CPA

In order to get this money You then have to endure the double taxation (double taxation means it was already taxed at the C Corporation level and it is taxed at the individual level on the form 1040). This starts with the tax on the dividend, which is 15 percent. This is a tax of $11,850 ($79,000 times 15 percent).

Your tax bracket will trigger the net investment tax (NIIT) that is applied to dividends. The NIIT is $3,000.002 (79,000 x 3.8 percent)

The federal tax rate for the $100,000 in income you earn as a C-corporation is $35,852. This includes the following:

1. C corporation taxes at $21,0002. 1040 dividend taxes of $11,850

3. 1040 NIT of $3,002

Operating as an S corporation earns $34,000 of government revenue , based on the same $100,000 profits. This is in contrast to operating as an C corporation which pays $35,853.

If the shareholder is a material participant in the S corp profits, there is no NIIT requirements. In other words, the NIIT does not apply to the pass-through income derived from business operations that are active.

The table I've shown you clearly demonstrates that the S Corp is always better than the C Corp if the taxpayer is a participant in the process.

Tax considerations alone are enough to justify a change to C Corporation. Tax considerations alone are enough to justify a switch to C Corporation from an S Corporation.

0 notes

Link

Is an S Corp or a C Corp better for you? If you’re confused about the difference, here are some tips from an experienced tax CPA.

0 notes

Link

How outsourced CFO services can put a stop to fraud in the nonprofit sector and why it's so shockingly common.

#sage intact partner#quickbooks online accountant#quickbooks consultant near me#outsourced cfo services

1 note

·

View note