Don't wanna be here? Send us removal request.

Text

From Bearish to Bullish: Wall Street Analysts Embrace Soft Landing - What It Means for Equities and the Economy!"

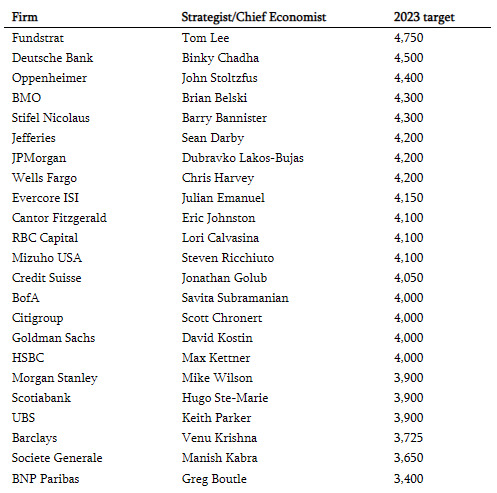

At the beginning of 2023, Wall Street analysts predicted a challenging first half for the equity market, painting a bearish outlook. They saw a number of headwinds, including rising inflation, interest rates, and the war in Ukraine. However, they also believed that the market would rebound in the second half of the year. Mike Wilson of Morgan Stanley predicted that the S&P 500 would fall to 3,000 in the first half of the year and then rebound to 3,900 by the end of the year. JP Morgan’s Dubravo Lakos-Bujas said they expect S&P 500 to re-test Oct 2022 lows in H1 '23. Michael Hartnett of Bank of America said that he stayed bearish on risk assets in H1, likely turning bullish H2; market narrative to shift from Inflation and rates “shocks” of ’22 to recession and credit “shocks” in H1’23. Average 2023 year end target for S&P was 4,080

Source: StreetInsider.com

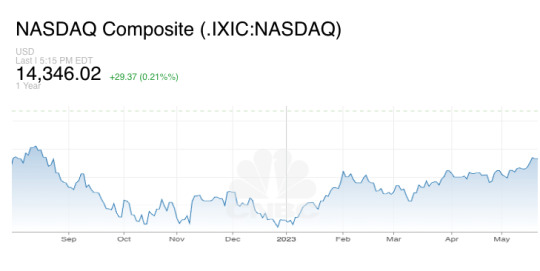

Source: Cnbc.com

Source: Cnbc.com

Shift to a soft landing

As the equity market has performed unexpectedly well, the analysts who once predicted a rough ride have now rallied behind the notion of a soft landing. This shift in sentiment can be attributed to several positive indicators that have emerged since the beginning of the year.

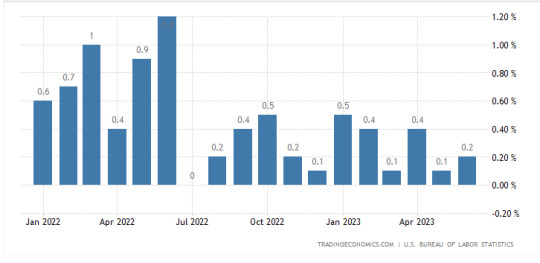

One reason is that inflation has started to come down. The Consumer Price Index (CPI) rose 9.1% in Oct 2022, but it has since come down to 3.0% in June 2023.. This is still above the Fed's target of 2%, but it is a sign that inflation is starting to ease

Another reason is that the US consumer is still strong. Consumer spending accounts for about 70% of the US economy, and it has remained strong even in the face of rising inflation. This suggests that consumers are still willing to spend, which is a good sign for the economy.

The labor market is also strong. The unemployment rate is at a 50-year low, and there are more job openings than there are unemployed people. This means that businesses are still hiring, which is a good sign for economic growth

As a result of these factors, Goldman Sachs has reduced its probability of a recession to 20%. Mike Wilson of Morgan Stanley has also thrown in the towel, saying that he was wrong about the market, and most of the equity analysts on Wall street have revised their year end targets upwards

Other analysts who have changed their tune include David Kostin of Goldman Sachs, who now believes that the economy will avoid a recession, and Peter Oppenheimer of Goldman Sachs, who now believes that the Fed will be able to engineer a soft landing. Even Fed Chair Jerome Powell has changed his tone. In a recent press conference, he said that the Fed's staff does not expect a recession, which is a significant change from his previous tone.

What to expect with a soft landing?

The biggest question is what the change in tone of equity analysts and Fed Chair Jerome Powell means for the equity markets and economy? Answer is nothing. In fact, it could be a red flag. There are a number of examples of this. In Feb 2007, Fed Chairman Ben Bernanke, after increasing the Fed Fund rate, expressed broad satisfaction that the nation remains on track for a "soft landing," a modest slowdown in growth that would reduce upward pressure on prices without aggravating unemployment. What followed was one of the worst financial crises in 2007-09. Fed did pull off soft landing in 1994-95, but inflation wasn’t very high during that period.

As you can see, there is no guarantee that a soft landing will be achieved, even if equity analysts and Fed Chairs change their tone. Investors should be aware of the risks and be prepared for the possibility of a recession. The risks to the equity markets are now higher than they were at the start of 2023.

One reason for this is the base effect. In the first half of 2023, inflation was declining due to the base effect. This means that the comparison to inflation in the same period of the previous year was lower, making inflation appear to be lower than it actually was. However, in the second half of 2023, the base effect will reverse, and inflation will likely increase

Source: Tradingeconomics.com

Another reason for the increased risks is the extremely low equity risk premium. The equity risk premium is the difference between the expected return on stocks and the risk-free rate. Importantly, the equity risk premium—or the extra return an investor can expect for investing in the stock market instead of risk-free 10-year Treasuries—is at its lowest level in about 20 years given P/E has expanded from 16 to 20

Finally, the positioning of portfolio managers has also changed. At the start of 2023, most portfolio managers were positioned very conservatively. However, as the markets have rallied, they have become more aggressive. Bloomberg's Global Equity Positions Index shows that the average equity exposure of global equity funds has increased from 56.7% at the start of 2023 to 61.2% as of July 2023

These factors suggest that the risks to the equity markets are now higher than they were at the start of 2023. The longer the Fed keeps the current hawkish stance of higher for longer, the higher the probability of an economic accident. The equities markets are not priced for a material economic accident, and the risk-reward ratio is worse right now. One factor that is working in favor of equity markets is momentum and it is a very strong factor for short-term. In the last five instances when inflation peaked above 5% (1970, 1974, 1980, 1990 and 2008), a recession followed. Will it be different this time?

Disclaimer:

The information presented in this blog post is for informational purposes only and should not be considered as investment advice. Readers are advised to conduct their own research before making any financial decisions. The author assumes no responsibility for the accuracy or relevance of the cited data and comments in this blog.

About the Author:

Aman Deep Singh Ahuja is a seasoned professional with a background in finance and technology. Currently working at Google. His prior experience includes serving as an Associate Partner at McKinsey & Company in New York. He holds an MBA from Darden School of Business, B.Tech from IIT Bombay and has cleared all three levels of CFA Connect with him on LinkedIn at Aman Ahuja

1 note

·

View note