Don't wanna be here? Send us removal request.

Text

Choosing the Best Payroll Software: What Indian Companies Should Look For.

What is payroll software?

Payroll software is a digital solution that automates and simplifies the entire employee payment process. It goes beyond just issuing paychecks, it can handle everything from calculating salaries and deductions to filing taxes and generating reports.

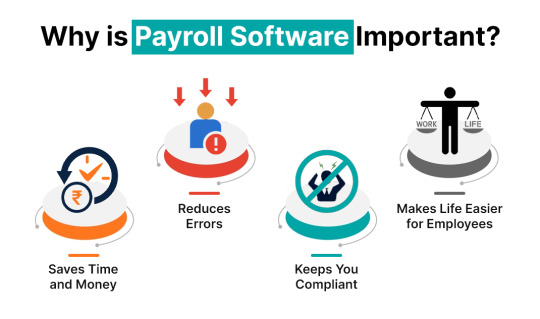

Why is Payroll Software Important?

There are a few reasons why payroll software is a smart choice for businesses of all sizes:

Saves Time and Money: Payroll software automates a lot of tasks that used to be done by hand. This frees up your HR team to focus on other important things, and it can also save you money on payroll processing fees.

Reduces Errors: Payroll calculations can be complex, and even a small mistake can lead to big problems. Software helps to ensure that your employees are always paid accurately and on time.

Keeps You Compliant: Tax laws and regulations are constantly changing. Payroll software can assist you in staying updated with these changes and ensuring continuous compliance.

Makes Life Easier for Employees: Employees can access their pay stubs and tax information electronically, and they can even choose how they want to be paid (direct deposit, check, etc.).

Choosing the Right Payroll Software for Your Business

There are a lot of different payroll software options on the market, so it's important to choose one that's right for your business. Here are some things to consider:

Size of Your Company: If you're a small business with just a few employees, you'll need a different software solution than a large corporation with hundreds of employees.

Features: Some software programs offer more features than others. Consider what features are important to you, such as the ability to track time and attendance, manage benefits, or generate reports.

Cost: The cost of payroll software can vary based on the required features and the size of your team. Obtain estimates from several vendors before finalizing your decision.

Key features to look for in payroll software:

Connects with Other Software: The best payroll software will connect seamlessly with your existing HR and accounting software. This will save you time and effort by eliminating the need to enter data multiple times.

Flexible Payment Options: Employees should be able to choose how they want to be paid, whether it's direct deposit, check printing, or even electronic funds transfer.

Works with Your Pay Schedule: The software should be able to handle your company's preferred pay schedule, whether it's weekly, bi-weekly, or monthly.

Handles Taxes: The software should be able to calculate and withhold taxes for your employees. This includes federal, state, and local taxes, as well as any other deductions that may apply (like Social Security or health insurance).

Easy to Use: The software should be easy to use for both HR personnel and employees. An intuitive interface will make it easier to learn the software and get started.

Cloud-based: Cloud-based software means that you can access it from anywhere with an internet connection. This is a great option for remote employees in businesses.

Automates Tasks: Look for software that can automate tasks such as payroll processing, tax calculations, and report generation. This will reduce the risk of errors and save you time.

Keeps You Compliant: The software should be updated regularly to reflect changes in tax laws and regulations. This will help you avoid any kind of penalties for non-compliance.

User-Friendly Interface: The way the software is laid out (the interface) should be clear and easy to navigate. Being able to customize the interface and access it from different devices (phones, laptops, etc.) is a plus.

Reliable Customer Support: If you have any questions or problems with the software, you should be able to get help from customer support. Look for a company that offers a variety of support options, such as phone, email, and online chat.

Conclusion

Investing in the right payroll software can significantly improve your company's efficiency and ensure employee satisfaction. By carefully assessing your needs and considering these factors, you can choose a solution that streamlines your payroll process and keeps you compliant with regulations.

0 notes